MEMBERS ONLY

Moderna and Volatility Index Flashing a Warning

A warning does not necessarily have to become a full-blown sign to head for the exits. But it is, nevertheless, a warning.

The last time I saw a warning from VXX or the Volatility ETF, was in February. Granted, on February 5th, the title of my daily was "Volatility&...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation to Higher BETAs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I look at recent rotations in asset classes and sectors. Next, I present updated BETA values for sectors and compare cap-weighted vs equal-weight values. Finally, I then finish up the show with a pair trade review.

This video was originally broadcast on May 19th,...

READ MORE

MEMBERS ONLY

SEMICONDUCTORS LEAD TECH SECTOR HIGHER -- CHIPS LEADERS ARE NVIDIA, SKYWORKS, AND INTEL

by John Murphy,

Chief Technical Analyst, StockCharts.com

SEMIS LEAD TECH SPDR HIGHER... Technology is the day's strongest sector. Chart 1 shows the Technology Sector SPDR (XLK) rising today to the highest level in nearly three months. It's being led higher by semiconductors . Chart 2 shows the PHLX Semiconductor iShares (SOXX) moving above its...

READ MORE

MEMBERS ONLY

Three Key Steps To Becoming A Better Investor Or Trader

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've coached sports much of my life and there are two key elements to succeeding in athletics: practice and confidence. Raw talent and athleticism don't hurt either, of course. I don't care how good you might think you are, to excel in sports, or...

READ MORE

MEMBERS ONLY

Market Indicators: Swear By Them, or Swear At Them?

by Larry Williams,

Veteran Investor and Author

On this special episode of Real Trading with Larry Williams, Larry walks viewers through what he considers to be the best indicators, including technical and fundamental ones alike. Larry discusses their limitations and explains why they have them, then shows you the best ways that you can use them in...

READ MORE

MEMBERS ONLY

Stock Market Draft: T Minus One Day And Counting

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's the most exciting time of each quarter for EarningsBeats.com and its community members. We're one day away from the equivalent of the NFL Draft for equities. The beauty of our Stock Market Draft, however, is that no one else participates! We can literally select...

READ MORE

MEMBERS ONLY

This Aggressive Small Cap Stock Is Up 55% In Last 3 Months; More Upside Coming?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's been a very difficult environment for small caps ($SML) and mid caps ($MID) for quite awhile. We should take note of any stocks in these two asset classes that are moving higher because they're doing so completely against the grain. For instance, take a look...

READ MORE

MEMBERS ONLY

STOCKS SURGE ON VACCINE OPTIMISM -- MAJOR INDEXES NEAR TEST OF RECENT HIGHS -- SMALL STOCKS SURGE AS WELL -- CONSUMER CYCLICALS CLEAR 200-DAY LINE -- MODERNA SURGES ON VACCINE NEWS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS SURGE ON VACCINE OPTIMISM... A report that a vaccine developed by Moderna is showing positive results helped push stocks sharply higher today. Charts 1 and 2 show the Dow Industrials and S&P 500 gapping higher and in position to test their recent highs. The SPX may also...

READ MORE

MEMBERS ONLY

We Have A Raging Bull Market And Suffocating Bear Market Simultaneously; See The Difference

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One part of the U.S. stock market has been setting new highs and dragging other areas higher with it. Then we have groups reaching the depths of despair with little or no end in sight to their selling and misery. I've honestly never seen anything quite like...

READ MORE

MEMBERS ONLY

Anchors Away for this Small-Cap Stock

by Mary Ellen McGonagle,

President, MEM Investment Research

Summer is fast approaching and, with most states still in lockdown, it's expected that physical distancing measures may well but a damper on many people's plans.

There's one summer activity that's seen a distinct pickup, however, as those living near water can...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely to Continue Exhibiting Bearish Intent; RRG Shows This Sector Topping Out

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The past couple of days performed much along the anticipated lines as the markets, in general, continued to portray a bearish undertone and ended the weak on a negative note. After halting the pullback, the NIFTY has formed a lower top near 9900 levels and continued its slide, confirming the...

READ MORE

MEMBERS ONLY

Stock Indexes Stabilize

by John Murphy,

Chief Technical Analyst, StockCharts.com

After a weak start this morning, major stock indexes are stabilizing near some short-term support levels. Chart 1 shows the Dow Industrials finding support at its 50-day moving average and its mid-April intraday low at 22900. Chart 2 shows the S&P 500 holding support at 2797. So far,...

READ MORE

MEMBERS ONLY

STUNNING Results in Any Market

by John Hopkins,

President and Co-founder, EarningsBeats.com

When you stop to think about the overall environment we've all been working in these past few months, it's amazing to think there are some stocks that are at their all-time highs. Of course, whenever there is a crisis, there are stocks that benefit. This is...

READ MORE

MEMBERS ONLY

Historic Market Divergence - What Should You Trade? (+ Video)

Stanley Druckenmiller recently came out and said that the market has never been this disconnected from reality - and that the risk/reward has never been this bad.

In an article, a journalist synthesized Ray Dalio's thoughts and research on the state of currencies and the debt crisis....

READ MORE

MEMBERS ONLY

Is The Bullish Bias Back in the Markets?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV's The MEM Edge, Mary Ellen reviews the broader markets while highlighting specific areas that are poised to trade higher. She also follows up on stocks that have gapped up and the best way to take advantage as well as top stocks due...

READ MORE

MEMBERS ONLY

How To Catch Mid-Day Market Reversals

by Erin Swenlin,

Vice President, DecisionPoint.com

I received an email after trading on Wednesday 5/14 that included a great question about catching mid-day reversals:

"I struggle the most in days like today (5/14) where the market goes one way and then it changes direction. How do you identify when that is happening?

Your...

READ MORE

MEMBERS ONLY

Timing the S&P 500 Using the Bullish Percent Index

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

StockCharts calculates and publishes the Bullish Percent Indexes for several major indexes and sectors. Just search for the term $BP to find them because all the symbols begin with these three characters. These indicators are not part of my breadth models for broad market timing, but I do follow them,...

READ MORE

MEMBERS ONLY

STOCK INDEXES STABILIZE -- FINANCIALS REBOUND -- BANK INDEX TESTS MARCH LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES STABILIZE NEAR SUPPORT... After a weak start this morning, major stock indexes are stabilizing near some short-term support levels. Chart 1 shows the Dow Industrials finding support at its 50-day moving average and its mid-April intraday low at 22900. Chart 2 shows the S&P 500 holding...

READ MORE

MEMBERS ONLY

This Health Care Stock Only Needs to Break Resistance

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Inside the Health Care sector, IDXX is one of the stocks that stands out in a positive way.

Since mid-2019, IDXX has been bouncing against resistance around $290, but never managed to get to a clear break. The peak that was set in the week beginning 2/19 was the...

READ MORE

MEMBERS ONLY

DP Show: Selling Exhaustion or Initiation?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, after looking at the latest DP signal scoreboards, Carl and Erin discuss the recent deep dive in prices on the 10-minute bar chart and the implications shorter-term. A look at the bigger picture shows the very negative configuration of the indicators. Many parallels can be...

READ MORE

MEMBERS ONLY

Checking in with the Economic Modern Family

Last night, I wrote about the compression in the weekly gold chart. Today, gold closed green, but did not take out 162 (GLD) or the top of last week's trading range high.

This is super exciting to watch unfold. Will it clear? And, if so, how far can...

READ MORE

MEMBERS ONLY

S&P Struggling Below Its 200-Day MA; Watch Those Financials!

by Martin Pring,

President, Pring Research

Last week, I pointed out that the S&P Composite, despite the strong rally off the March low, had failed to touch an overbought condition. That presented a problem, since a security that is unable to reach an overstretched reading is usually suffering from some kind of a bear...

READ MORE

MEMBERS ONLY

Special Note: These 3 Charts Show Why You Should Choose NIFTY Next 50 over Small-Caps

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The global equity markets have seen the mother of all volatile times during the first five-and-a-half months of the year 2020. From the peak of early 2020, the key equity markets saw a sharp decline of over 35% in most cases. Following those lows, the stocks have also managed to...

READ MORE

MEMBERS ONLY

Indicators Don't Indicate, They Illustrate

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave gives a quick Bear Market Update, then moves on to indicators. He explains why he likes to call indicators "illustrators" and introduces you to some new Landry indicators that are coming to the StockCharts Advanced Charting Platform (ACP).

This video was...

READ MORE

MEMBERS ONLY

NASDAQ 100 Just Tested Big Short-Term Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Impulsive selling gripped the market yesterday afternoon for the first time in quite awhile and it came on the heels of a few warnings signs that I passed on to EarningsBeats.com members earlier this week. First, the accumulation/distribution line, which has been a HUGE friend of the bulls...

READ MORE

MEMBERS ONLY

STOCKS START THE DAY UNDER PRESSURE -- SMALL CAPS ARE LEADING THE DECLINE -- SO ARE FINANCIALS AND INDUSTRIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 500 WEAKEN... Stock prices are continuing the pullback that began yesterday afternoon. And some short-term support levels may soon be tested. Chart 1 shows the Dow Industrials slipping below their 20-day average (green line) and in position to test their early May low at 23400....

READ MORE

MEMBERS ONLY

Have You Seen That Small-Cap Growth Stocks are Picking Up Momentum?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

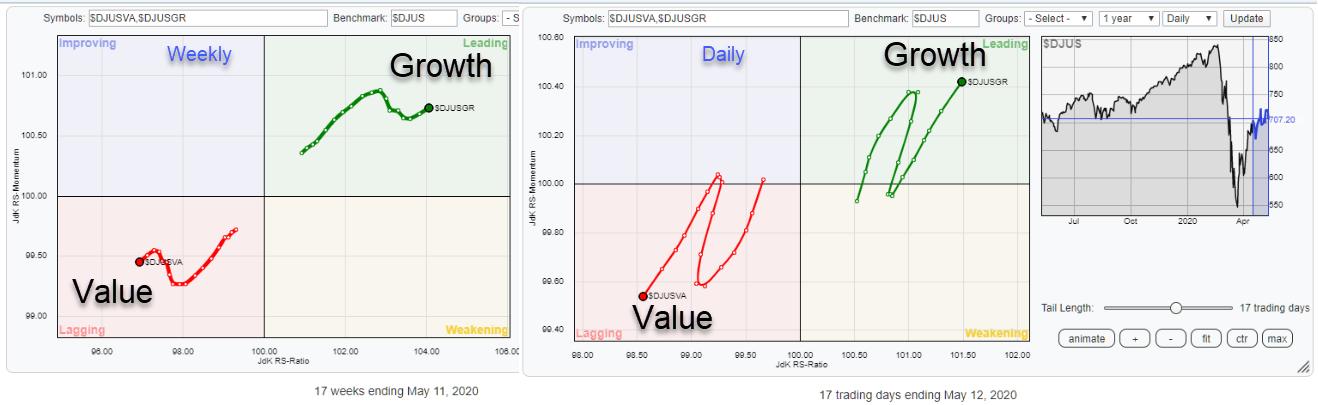

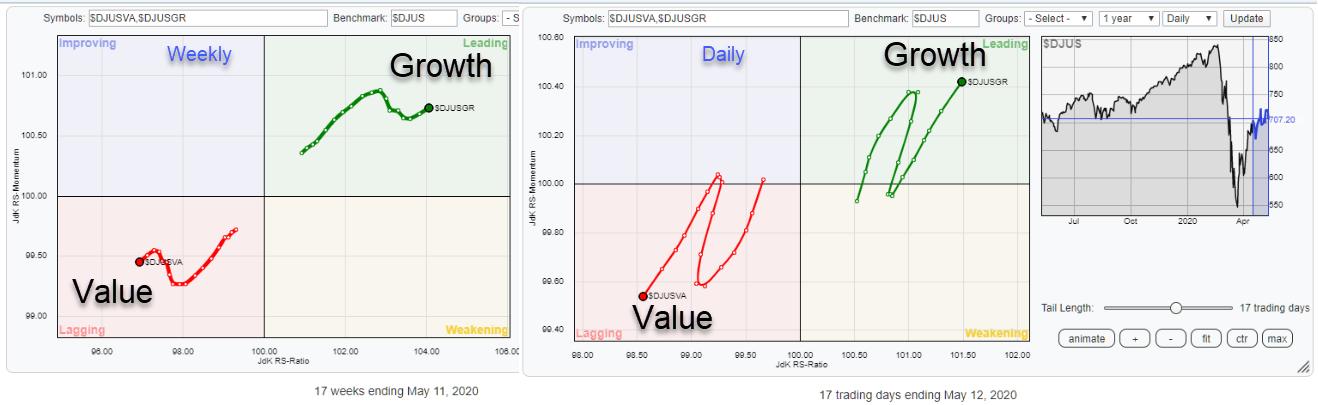

Growth-Value is a pre-defined group on the RRG page, showing the relative rotation for the Dow Jones Growth Index vs. Dow Jones Value Index, using the Dow Jones US index as the benchmark.

The last crossover for Value into the leading quadrant, and Growth into lagging, happened in November 2018....

READ MORE

MEMBERS ONLY

What is Compression? Four Inside Weeks in GLD

Compression is defined as the decrease in volume of any object or substance resulting from applied stress. Compression may be undergone by solids, liquids, and gases and by living systems.

And, apparently, by gold.

What is the applied stress in gold? First off, too many bears. Second, a relatively strong...

READ MORE

MEMBERS ONLY

Breadth Improves as Bear Market Rally Exhausts

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Most of my guests in recent weeks on The Final Barhave embraced the "we're due for a pullback" thesis. From the very bullish (S&P 3600) to the quite bearish (S&P 2000) and everyone in between, it seems most people feel that the...

READ MORE

MEMBERS ONLY

One for the Bears and One for the Bulls

by Carl Swenlin,

President and Founder, DecisionPoint.com

FOR THE BEARS . . .

This chart tracks the price of the individual S&P 500 component stocks relative to their 20EMA, 50EMA, and 200EMA. As price approaches the level of a prior top, I look for the indicators to make a lower top, which is a negative divergence. Such divergences...

READ MORE

MEMBERS ONLY

My Daily Five: Changing Tides In The S&P Groups, VTI At Key Price Levels, Breadth Improving and Offense Leading

by Grayson Roze,

Chief Strategist, StockCharts.com

What a way to start the week! Yesterday afternoon, I had the pleasure of hosting "Your Daily Five", our latest series on StockCharts TV where we bring you a concise, action-packed daily rundown of the five most important charts that you need to be watching. Weekdays at 1:...

READ MORE

MEMBERS ONLY

Sector Spotlight: Tops and Flops in Technology

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I highlight the Technology sector and picks some Tops and Flops that are worth keeping an eye on using RRG. In the second part of the show, I answers a question from the Mailbag and suggest a new pair trade idea.

This video was...

READ MORE

MEMBERS ONLY

How Daily and Weekly RRGs Are Aligned

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This article appeared in the Chartwatchers newsletter last weekend (5/9) but as it touches on one of the core interpretation basics for Relative Rotation Graphs I wanted to have it in the RRG-blog as well. So in case you missed this weekend's newsletter, here is your second...

READ MORE

MEMBERS ONLY

Seeing A Short Squeeze Unfold Presents Huge Opportunities; Add This One To Your Watch List

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One thing that this pandemic has caused - and few would disagree - is an inordinate amount of fear. An easy way to depict this is simply to look at the Volatility Index ($VIX) and the equity only put call ratio ($CPCE). When these two spike, it's a...

READ MORE

MEMBERS ONLY

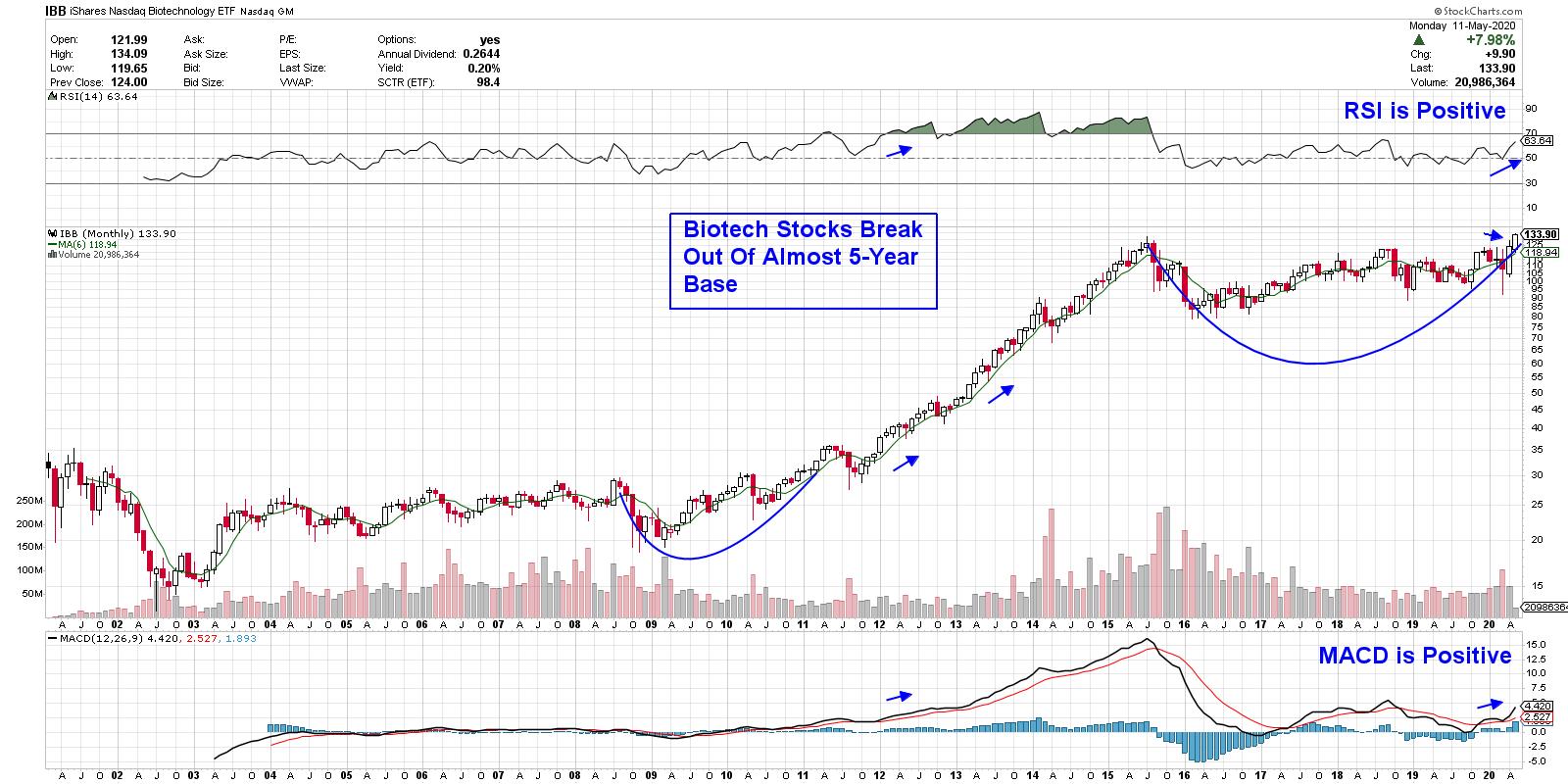

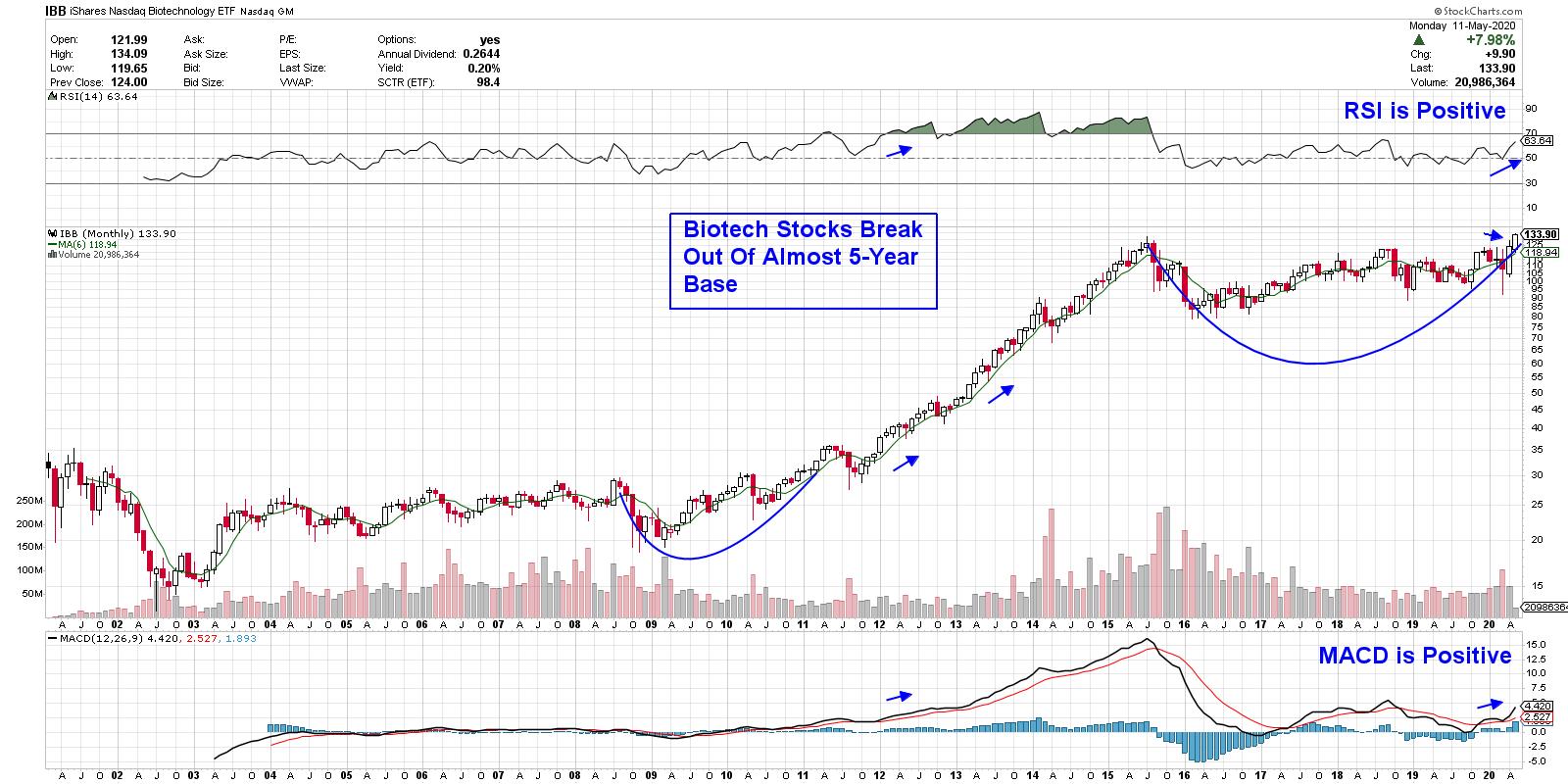

A Bullish Long-Term Shift Just Took Place in This Important Area of the Markets

by Mary Ellen McGonagle,

President, MEM Investment Research

A major group in the markets turned long-term bullish today, and I've been on the lookout for it for quite some time. The reason for my keen interest is that the stocks in this group currently began exhibiting characteristics that were very common to a period just before...

READ MORE

MEMBERS ONLY

Biotechnology Sector Rocks to All-Time Highs

A week ago, I wrote a blog article titled "The Beauty of the Biotechnology ETF Channel."I began by writing, "If there is one area to watch should the market have another run up, it is Biotechnology (IBB).

"The channel lines that are perfectly parallel, going...

READ MORE

MEMBERS ONLY

NASDAQ TURNS POSITIVE FOR YEAR -- S&P 500 MAY RETEST APRIL HIGH -- USING SCTR LINES TO RANK SECTORS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS RALLY ON BAD ECONOMIC NEWS... Last weekend's message suggested that the spring rally in stocks may have peaked. Judging from this week's strong price action, that doesn't appear to be the case. Stock prices have shown remarkable resilience in the face of very...

READ MORE

MEMBERS ONLY

Limit Your Trading Universe To This Group Of Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've run into multiple friends of late, socially-distanced of course, who keep asking me, "Aren't the airlines a great value now?" Ugh. Really? What business can you think of that (a) has lost 95% of its customers AND (b) has little hope of attracting...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Marks Important Technical Event; RRG Chart Shows Key Sectors Continuing to Lag

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets fared much along the expected lines over the past five sessions. In the previous weekly note, we had mentioned that if the NIFTY failed to move past the previous week's high, it might end up forming a lower top for itself. Things turned out on the...

READ MORE

MEMBERS ONLY

Strong April Seasonality Gives Way to May and June

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

When it comes to analysis and trading signals, seasonality is behind price action in the pecking order of importance. In general, seasonal patterns carry most weight when they jibe with the underlying trend. For example, bullish seasonal patterns in an uptrend can provide a tailwind. Nevertheless, price action is still...

READ MORE