MEMBERS ONLY

Bullish at a Time of Extreme Panic

by Larry Williams,

Veteran Investor and Author

On this special episode of Real Trading with Larry Williams, Larry explains why he believes the bull is about to roar back and put the bears to sleep. Based on nearly 60 years of market analysis and trading experience, Larry showcases the charts and indicators he's watching most...

READ MORE

MEMBERS ONLY

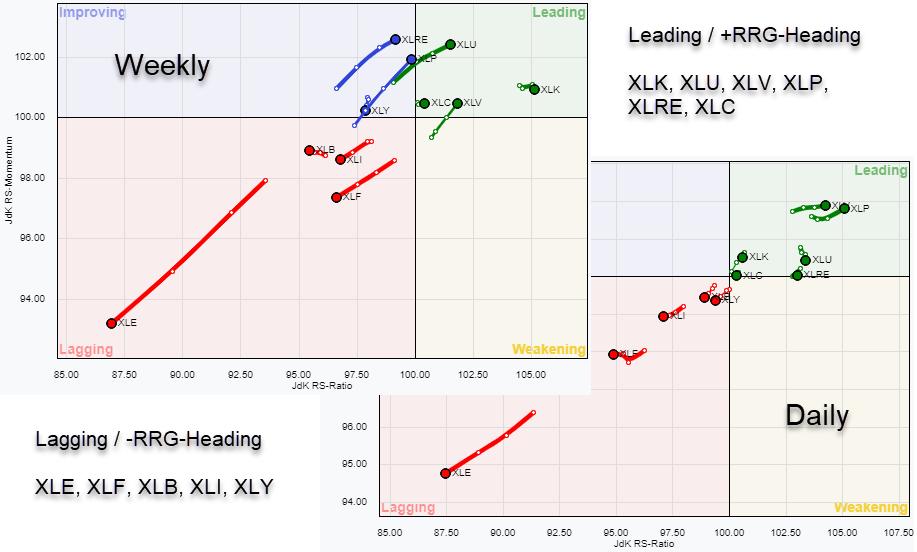

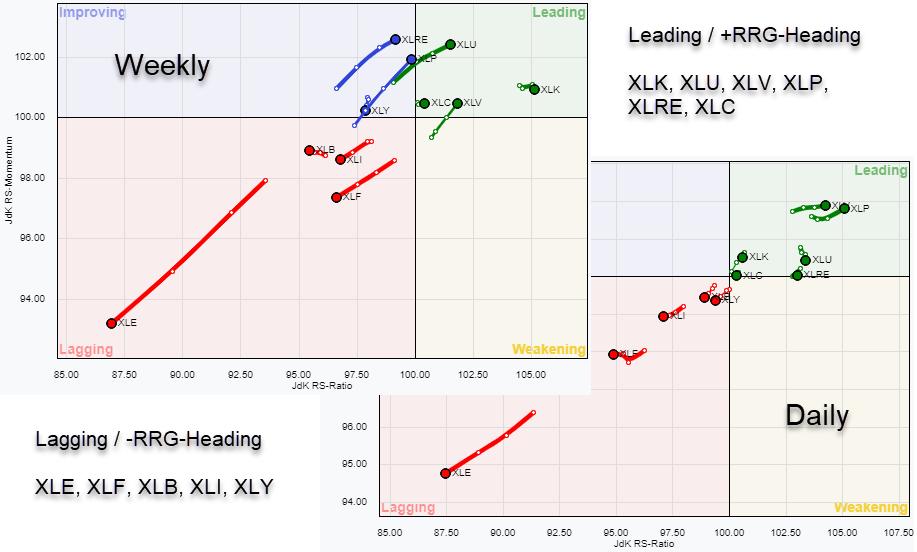

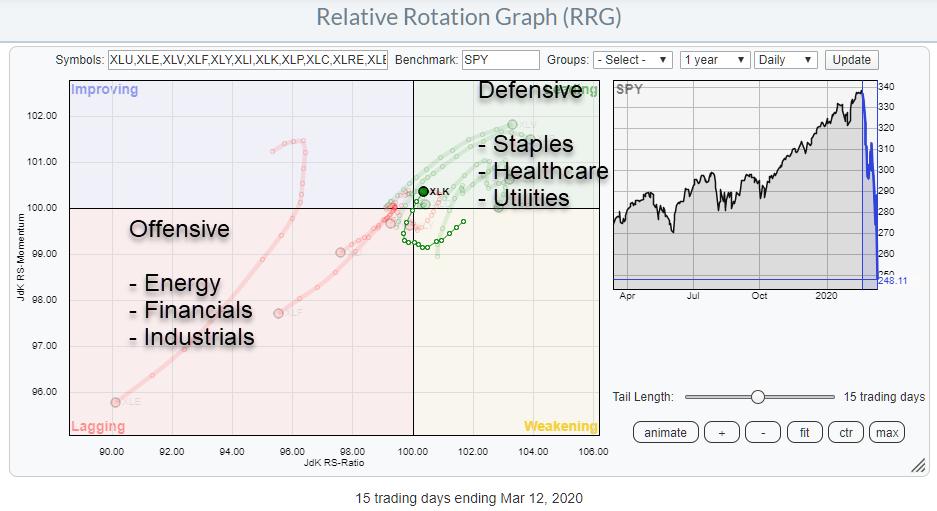

Sector Rotation in Sync On Daily and Weekly RRGs - What Does it Tell Us?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The US sector universe is split pretty much evenly around the benchmark SPY. That is normal. It is also split pretty distinctively in sectors that are inside the leading quadrant and/or traveling at a positive RRG-Heading, which means that they are in a relative uptrend vs. the market. Under...

READ MORE

MEMBERS ONLY

DP Show: Bear Market Implications - Real Estate Concerns

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss several topics including, of course, the bear market environment, along with global markets, broad markets and a few individual stocks you should see. Additionally, they analyze the implications of the Fed rate interest levels and the current and possible effects to...

READ MORE

MEMBERS ONLY

Bullish Divergences Can Be Hazardous to Your Portfolio

by David Keller,

President and Chief Strategist, Sierra Alpha Research

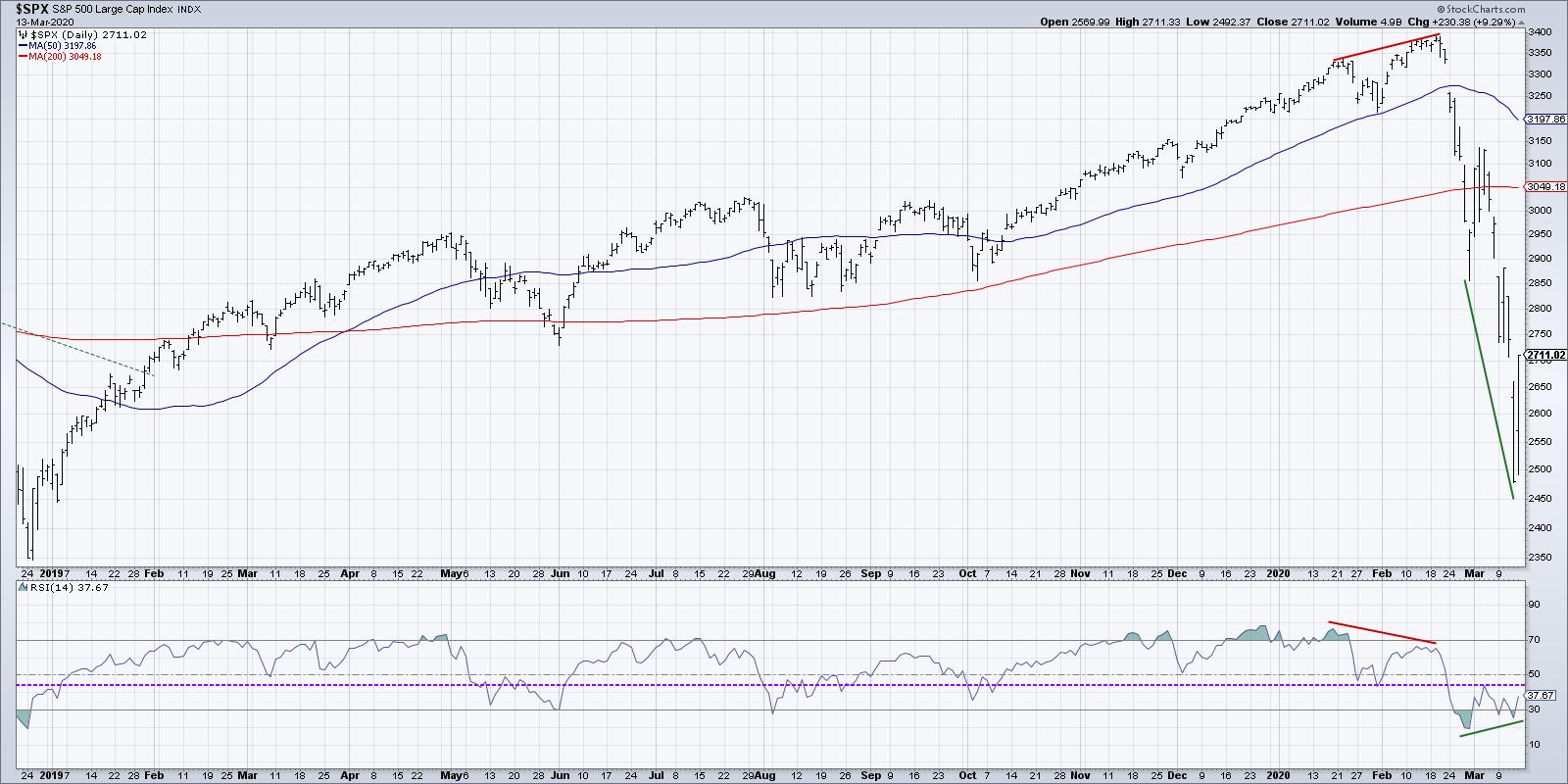

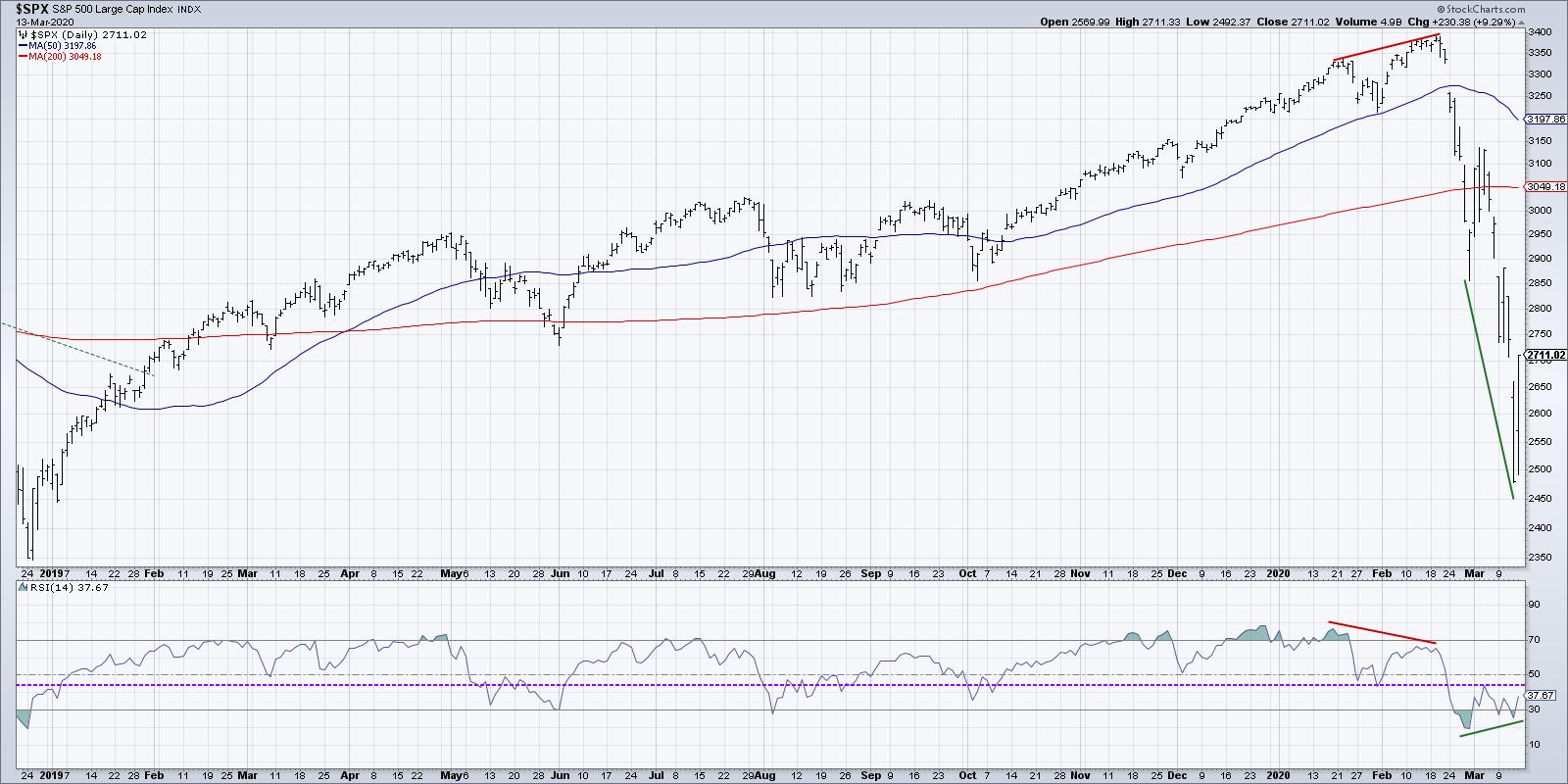

For this weekend's ChartWatchers newsletter, I shared some perspective on the bullish divergence appearing on the daily S&P 500 chart. It's worth noting that Monday's selloff pushed the S&P down to new lows, invalidating the bullish divergence.

As price continues...

READ MORE

MEMBERS ONLY

Random Thoughts: Thoughts on the Coronavirus, Plus More on Surviving and Prospering During a Bear Market

by Dave Landry,

Founder, Sentive Trading, LLC

Some Personal Thoughts on the Coronavirus

Everyone, especially those with an internet "mouthpiece," is holding themselves out as a professional. I am not one of them. Below is just my opinion. Feel free to skip down to the trading commentary portion of this piece if you feel that...

READ MORE

MEMBERS ONLY

Setting Expectations for Post-Crash Price Action

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

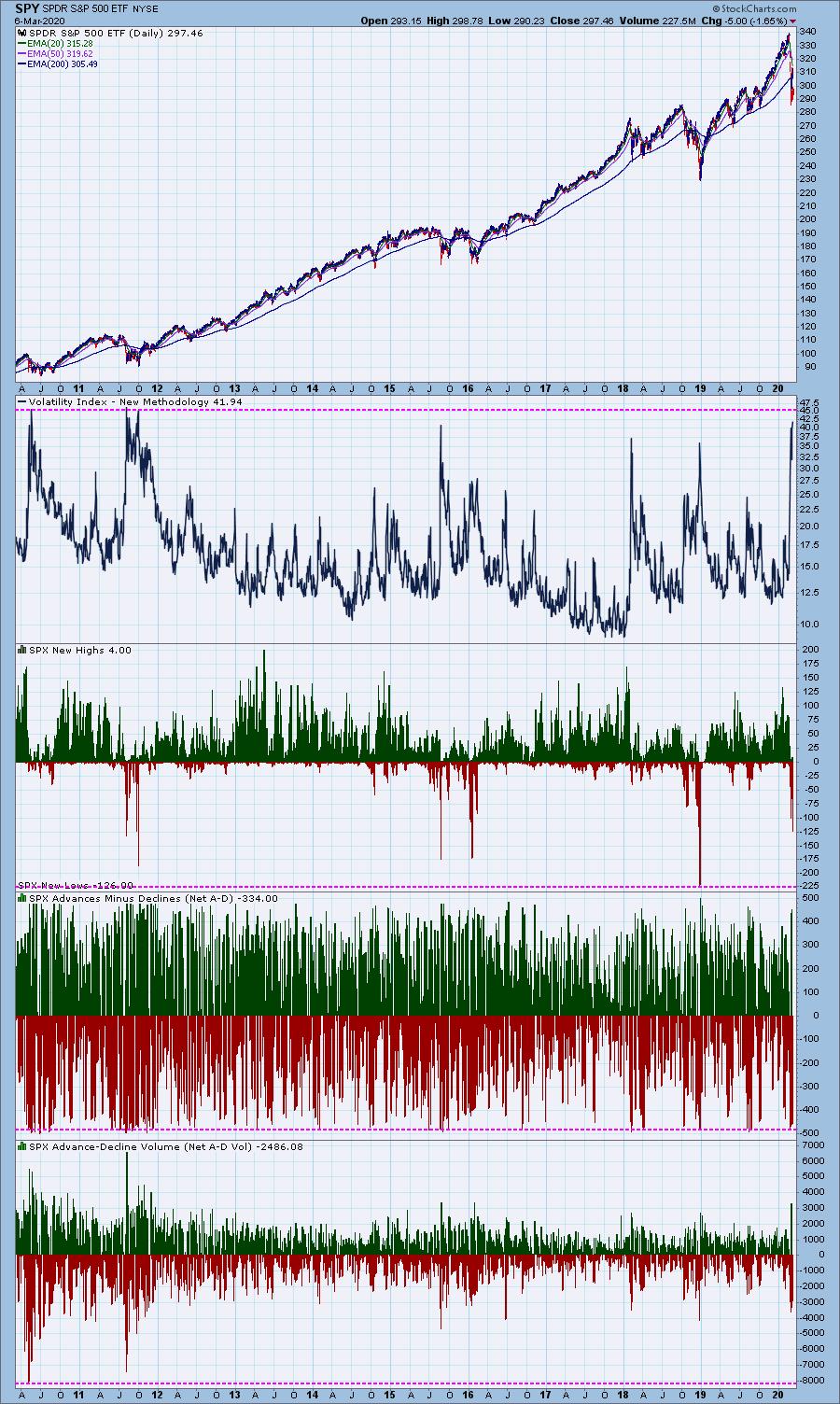

The S&P 500 moved from a 52-week high to a 52-week low with lightening speed over the last three weeks. To capture the sharpness of this decline, I am showing a chart with the 3-week Rate-of-Change in the indicator window. At -18.78%, this is the deepest three...

READ MORE

MEMBERS ONLY

THE DOW TESTS MAJOR LONG-TERM SUPPORT LINES -- BUT ANY REBOUND COULD MEET WITH NEW SELLING -- A BEAR MARKET HAS LIKELY BEGUN -- THE QUESTION IS HOW LONG AND HOW DEEP

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW DROPS INTO BEAR TERRITORY... Friday's strong rebound helped prevent a very bad week in stocks from getting worse. And it came at a good time. That's because of number of U.S. stock indexes are nearing tests of major long-term support lines. We'll...

READ MORE

MEMBERS ONLY

Special Note: Know Where NIFTY Stands from a Broader Perspective; What RRG Says About the Week Ahead

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After the violation of critical near-term support a week before, the Indian equities suffered their worst-ever weekly decline of the decade. In line with the global mayhem, the Indian stock markets also saw an equally sharp meltdown, going on to end well below the key moving average and slipping further...

READ MORE

MEMBERS ONLY

Is the State of Emergency a Sign of a Bottom?

by Martin Pring,

President, Pring Research

This week has seen U.S. administration fiscal proposals, as well as 1.5 trillion dollars in Fed support, aimed at limiting the economic damage from COVID-19. Friday saw a travel ban put into effect, along with a state of emergency. Unfortunately, these actions, just like the previous week'...

READ MORE

MEMBERS ONLY

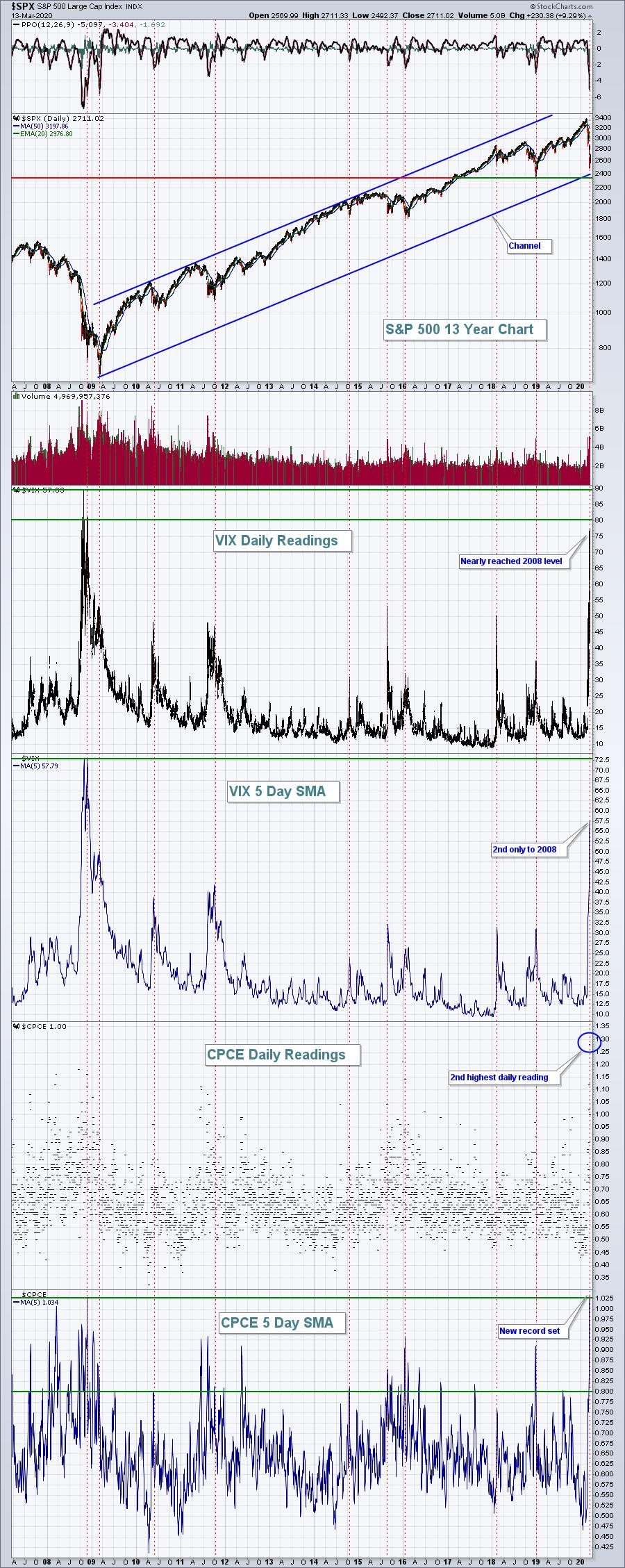

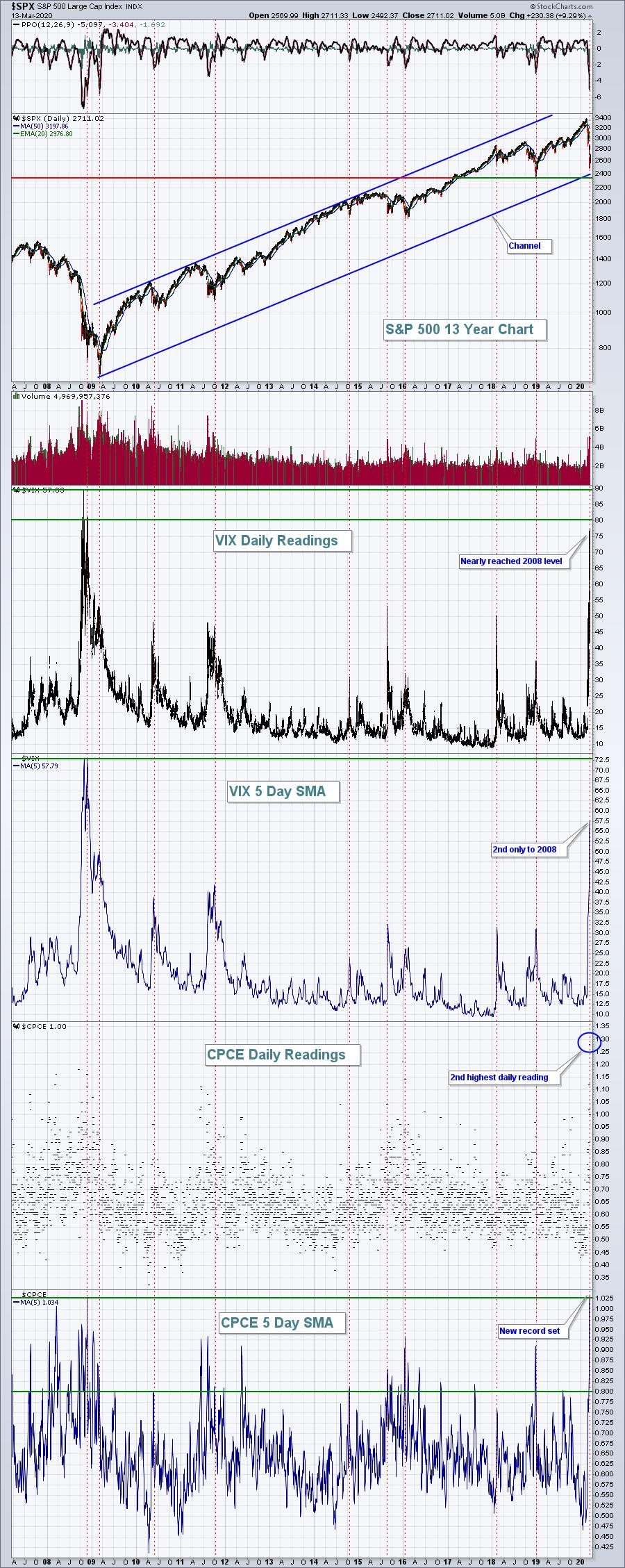

Extreme Bearish Sentiment Is Marking A Bottom

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The stock market has a mind of its own, so I never like to say that it MUST do one thing or another. But I'm firmly in the camp of this being a cyclical bear market, rather than a secular bear market. Historically, cyclical bear markets within secular...

READ MORE

MEMBERS ONLY

One Way to Help Ride Out the Bear Market

by Mary Ellen McGonagle,

President, MEM Investment Research

It was not a week for the faint of heart as the markets posted daily roller coaster type swings that had one day's action wiping out the prior day. The S&P 500 was down as much as 17% at one point before Friday's relief...

READ MORE

MEMBERS ONLY

Bullish Divergence Suggests Short-Term Upside

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Every Friday on my show The Final Bar, we answer viewer questions from throughout the past week. One of today's questions related to the potential bullish divergence on the S&P 500 using price and RSI. In this article, I'll share how I think about...

READ MORE

MEMBERS ONLY

Is It Time to Start Nibbling?

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the current market environment and how to use history as your guide. She also shares some recession-proof stocks that are holding up well in this tough environment.

This video was originally recorded on March 13th, 2020. Please...

READ MORE

MEMBERS ONLY

Is the State of Emergency a Sign of a Bottom?

by Martin Pring,

President, Pring Research

This week has seen U.S. administration fiscal proposals, as well as 1.5 trillion dollars in Fed support, aimed at limiting the economic damage from COVID-19. Friday saw a travel ban put into effect, along with a state of emergency. Unfortunately, these actions, just like the previous week'...

READ MORE

MEMBERS ONLY

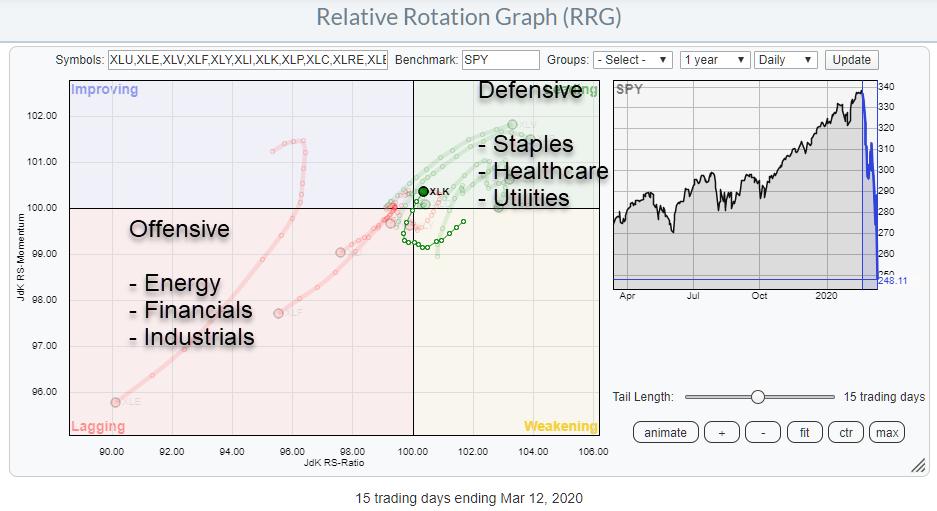

Technology Emerging as a Defensive Sector? Here are a Few Stocks to Watch

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The mayhem in the markets over the past three weeks has clearly caused a rotation out of the more offensive sectors towards defensive ones. The sectors with the clearest rotations are mentioned on the chart above.

One sector that I would have expected inside the lagging quadrant, or at least...

READ MORE

MEMBERS ONLY

Trend Following Was Ready, Were You?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

On February 13, 2020 we published an article called "Ready for a Bear?". On that day, the S&P 500 and Nasdaq Composite were closing near all-time highs, and 3 trading-days later on February 19, 2020, they both notched their peaks of this 11-year bull market cycle....

READ MORE

MEMBERS ONLY

Sentiment Has Now Reached EXTREME Levels And This It What It Means

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Trying to call bottoms is a difficult exercise, but human behavior can be quite predictable. Long-term investors are definitely long-term....as long as the market goes higher. But when we see the type of selling and panic that we've experienced these past few weeks, even the most disciplined...

READ MORE

MEMBERS ONLY

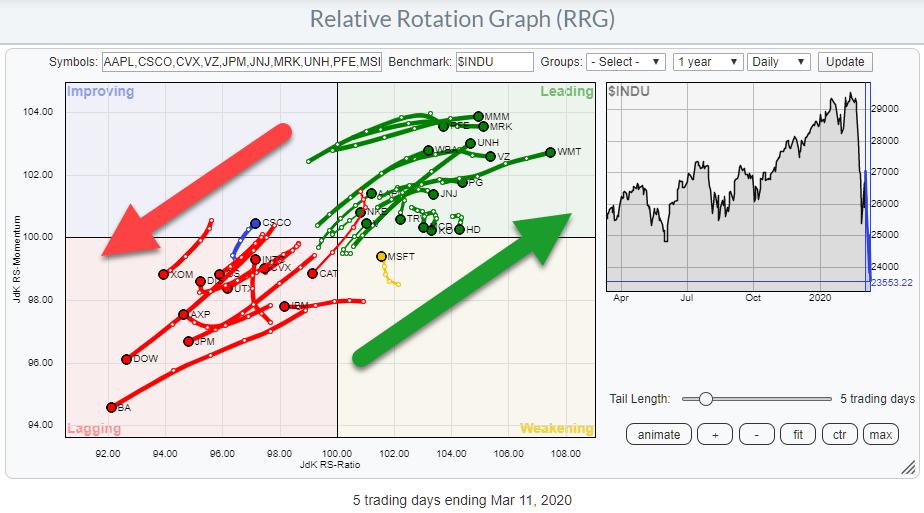

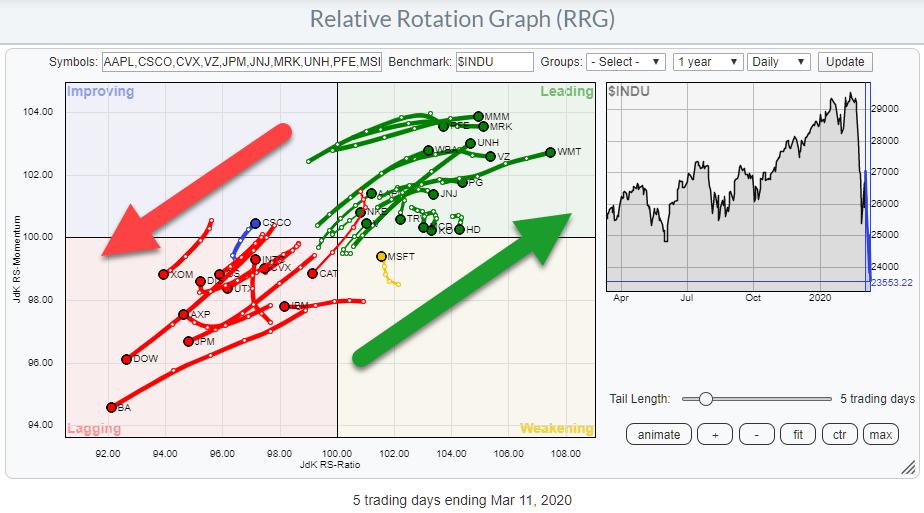

How's That for a Split Universe...?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for the DJ Industrial constituents shows a clear split between stocks in the leading quadrant vs. stocks inside the lagging quadrant, with only one inside weakening (MSFT) and one inside improving (CSCO).

A few stocks inside the leading quadrant are starting to roll over and a...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS ENTER BEAR MARKET -- FOREIGN STOCKS BREAK LONG-TERM SUPPORT LEVELS -- S&P 500 HEADING TOWARD SOME TESTS OF ITS OWN

by John Murphy,

Chief Technical Analyst, StockCharts.com

WORLD STOCK INDEX NEARS TEST OF LONG-TERM SUPPORT...The Dow Industrials entered a bear market yesterday when it closed more than -20% off its recent high. Another big global selloff today has put the world's stocks in a bear market as well. Which suggests that stocks in the...

READ MORE

MEMBERS ONLY

Surviving and Prospering During a Bear Market

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave talks about market timing and the need to find an objective measure to keep you on the right side of the market. Then, he goes into how to survive during a bear market through portfolio ebb and flow.

This video was originally recorded...

READ MORE

MEMBERS ONLY

Sector Spotlight: Markets Are All Over the Place

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

RRG can help you put things into an international perspective. In this edition of StockCharts TV'sSector Spotlight, I look at international stock markets through the RRG lens and comes up with two new pair trade ideas.

This video was originally recorded on March 10th, 2020. Please note the...

READ MORE

MEMBERS ONLY

Safe Havens Look Like They are Reversing; Stock Market Still Searching for a Low

by Martin Pring,

President, Pring Research

* Bonds and Yen Starting to Lose Safety Appeal?

* One Indicator That Has Returned to Financial Crisis Levels

Bonds and Yen Starting to Lose Safety Appeal?

The stock market has got the majority of the attention in the last couple of weeks because of its exceptional volatility. On the other hand,...

READ MORE

MEMBERS ONLY

Where Is Long-Term Support for Oil?

by Carl Swenlin,

President and Founder, DecisionPoint.com

We track crude oil using the ETF USO because it makes oil accessible for trading without having to get involved in future contracts; however, you will notice that USO has a slight downward bias when compared to $WTIC, the continuous contract dataset for tracking the futures price. The reason for...

READ MORE

MEMBERS ONLY

Use RRG to Help You Put Recent Developments into International Perspective

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

What a week ....

With stock markets flying all over the place, I always find it an enlightening exercise to take a step back and put things into a broader perspective. This can be done in multiple ways, including taking a longer-term approach, looking at different segments of the market via...

READ MORE

MEMBERS ONLY

DP Show: How Low Can It Go? Seven Sectors in Bear Markets

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss valuations following another brutal day in the markets, along with what they are projecting as possible lows in the markets. Seven sectors are in bear markets right now. Carl and Erin look at each sector and their indicators to demonstrate the...

READ MORE

MEMBERS ONLY

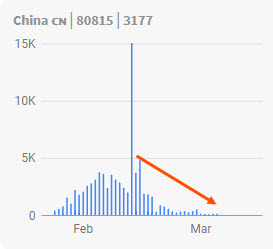

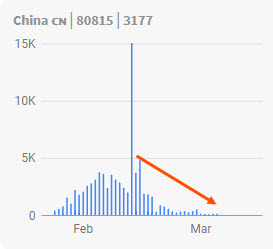

Market Tries to Hammer Out a Bottom As COVID-19 Tries to Hammer Out a Top

by Martin Pring,

President, Pring Research

* Revisiting the February 29 Hammer

* Hammering a Top for COVID-19

Revisiting the February 29 Hammer

On Friday, 29 February, I pointed out that the Wilshire 5,000 had formed a bullish hammer at a time when a couple of other short-term indicators had reached extreme levels, thereby suggesting a rally....

READ MORE

MEMBERS ONLY

RETEST OF RECENT LOWS TAKING PLACE -- FRIDAY'S LATE REBOUND IS MILDLY ENCOURAGING -- BUT MONTHLY INDICATORS WARN OF POSSIBLE TOP

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ HOLDS 200-DAY LINE... Let's start with some good news. Heading into the close yesterday afternoon (Friday), stocks were under heavy selling pressure. And the Nasdaq Composite Index was in danger of closing below its 200-day moving average for the first time since last spring. A late stock...

READ MORE

MEMBERS ONLY

Week Ahead: Avoid Chasing Technical Pullbacks, If Any; RRG Suggests Taking Refuge in These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The global scare of an economic slowdown following the outbreak of coronavirus saw the world markets taking a severe knock, and Indian equities were no exception. While trading on anticipated lines, the Indian equity markets saw a wide-ranging week wherein the headline index NIFTY moved in the range of 606...

READ MORE

MEMBERS ONLY

Stock Indexes Headed for Retest of Recent Low

by John Murphy,

Chief Technical Analyst, StockCharts.com

Another day of heavy selling has marked the end of this week's rebound, and a likely retest of last week's lows. Another plunge in bond yields to record lows and a 10% plunge in the price of oil are just two factors contributing to the stock...

READ MORE

MEMBERS ONLY

Solid Themes Emerging Within the Volatility

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews how to quickly get in front of areas that are withstanding the overall downward pressures and how to potentially trade them. She also showed how to use ETFs to capitalize on high-demand areas.

This video was originally...

READ MORE

MEMBERS ONLY

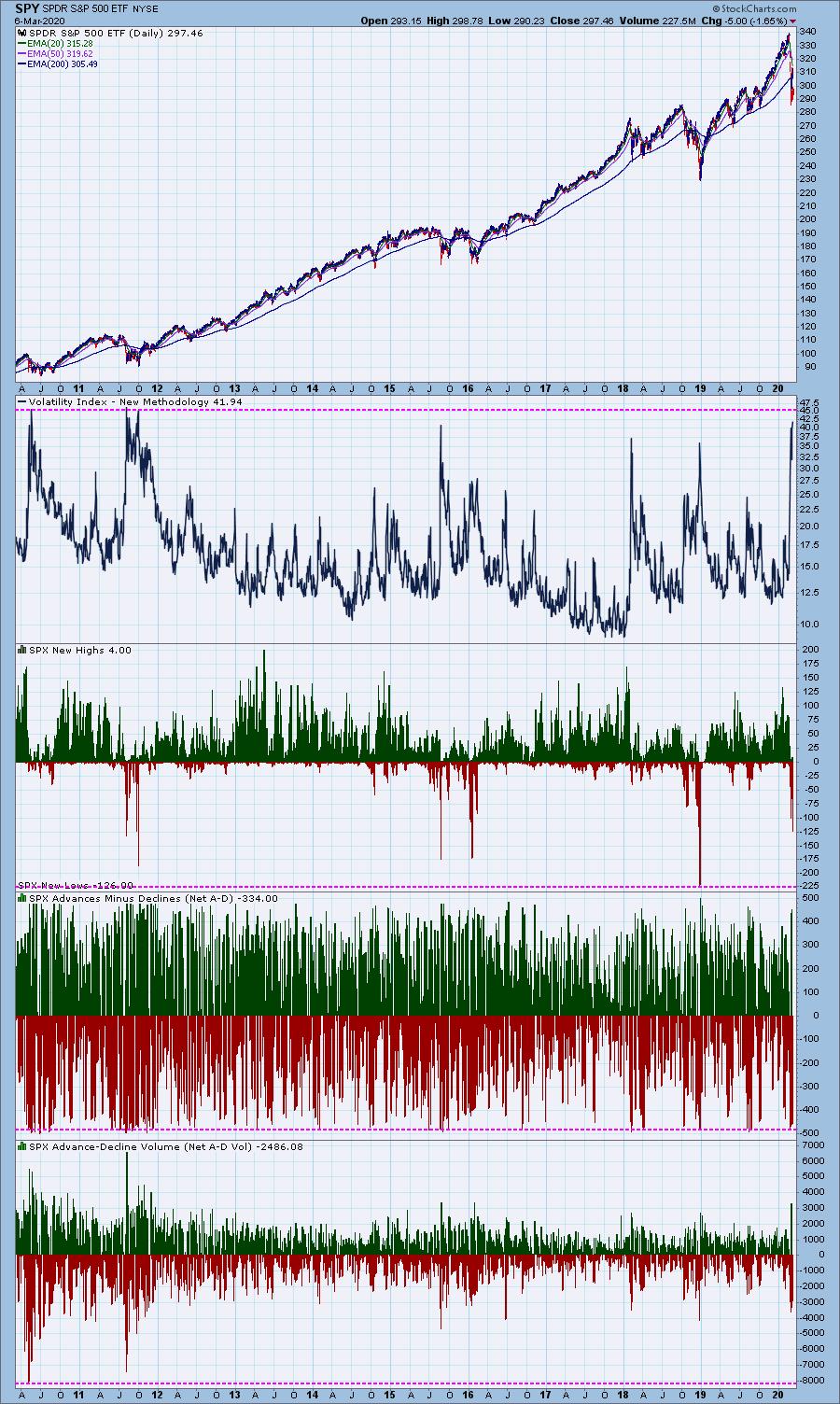

Are We Oversold Enough Yet?

by Erin Swenlin,

Vice President, DecisionPoint.com

Before I get started, I wanted to let everyone know that DecisionPoint.com "Charter Member" discounts end this weekend! If you've thought about subscribing, now would be the time! You'll find back issues (samples) of the DP Alert and Diamonds from last year in...

READ MORE

MEMBERS ONLY

Earnings Still Matter

by John Hopkins,

President and Co-founder, EarningsBeats.com

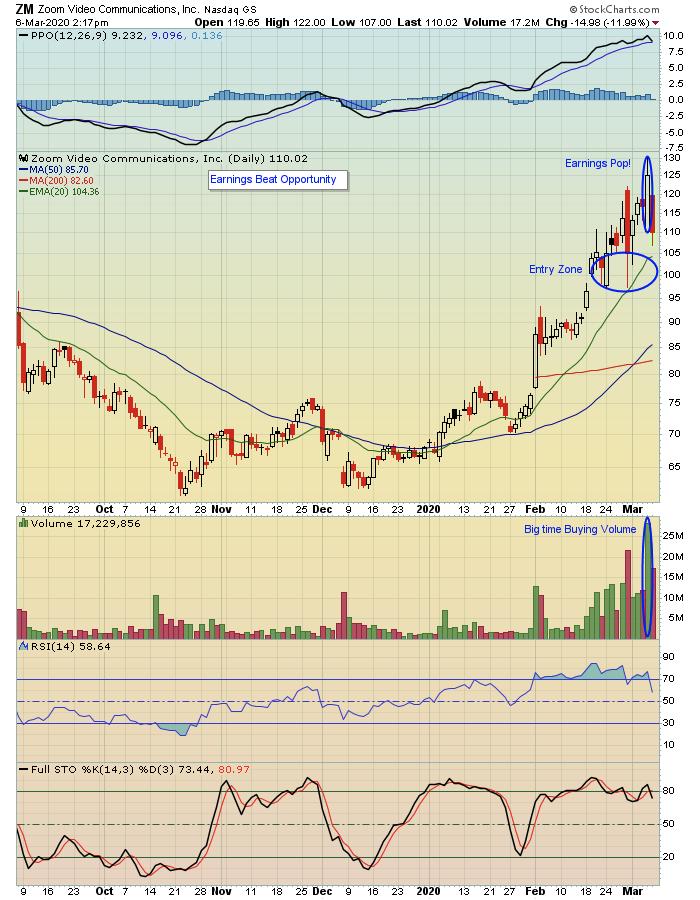

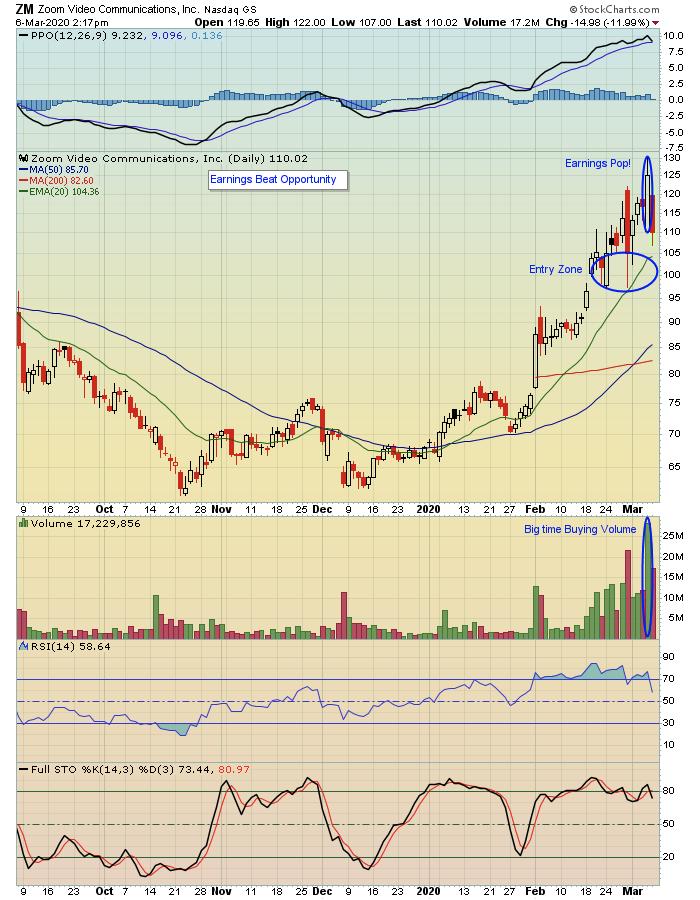

With the market in turmoil, many traders are in survival mode, never mind looking for new opportunities. Yet there are still companies reporting earnings that show the bottom line is still king.

As an example, take a look at the chart below on Zoom (ZM), a stock that reported its...

READ MORE

MEMBERS ONLY

When Bullish Retracement Zones and Support become Questionable

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Support levels and bullish retracement zones are questionable, at best, in bear market environments. Why? Because the path of least resistance is down in a bear market. As such, the odds that a support level holds or a bullish retracement zone leads to a reversal are greatly reduced. The odds...

READ MORE

MEMBERS ONLY

5 Essential Lessons Investors Should Learn From Robo-Analysts And Robo-Advisors

by Gatis Roze,

Author, "Tensile Trading"

Robots beat us at chess and are driving our cars now too. FinTech is invading Wall Street and Main Street too. To say that robo-analysts and robo-advisors (think Betterment.com) are stock market disruptors is an understatement on so many levels. Even so, we individual investors still have advantages, but...

READ MORE

MEMBERS ONLY

STOCK INDEXES HEADED FOR RETEST OF RECENT LOW -- NASDAQ THREATENING ITS 200-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

RETEST OF LAST WEEK'S LOWS APPEARS LIKELY... Another day of heavy selling has marked the end of this week's rebound, and a likely retest of last week's lows. Another plunge in bond yields to record lows and a 10% plunge in the price of...

READ MORE

MEMBERS ONLY

When Volatility ($VIX) Is This High, Wait For The Kitchen Sink

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Enjoying the ride? I've made a conscious decision to sit this wild ride out. I write a Daily Market Report (DMR) to our EarningsBeats.com members every day and last Tuesday (February 25th), I wrote the following (an excerpt):

"I'm bullish. I've remained...

READ MORE

MEMBERS ONLY

It's a Crucial Time for SPY and These Are Crucial Levels to Watch!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

When the market tanks, like it did from 24 February onwards, there is not much you can do anymore. You basically have to sit and wait and see which level(s) support or resistance are respected by the market. And the problem is, you will not know until a few...

READ MORE

MEMBERS ONLY

FALLING BOND YIELDS PUSH BANK INDEX TO NEW LOW -- AIRLINE INDEX FALLS TO THREE YEAR LOW -- CRUISE, GAMBLING, AND HOTELS CONTINUE TO SLIDE -- TODAY'S STOCK SELLING THREATENS REBOUND

by John Murphy,

Chief Technical Analyst, StockCharts.com

BANKS AND AIRLINES HIT NEW LOWS... Another record low in bond yields and a continuing flight to the safety of bonds (and gold) are helping put stock prices under heavy selling pressure today. The biggest sector losers are financials, energy, industrials, and cyclicals. It's not hard to understand...

READ MORE

MEMBERS ONLY

De-fense! Looking to Higher-Yielding Stocks as a Market Buffer

by Mary Ellen McGonagle,

President, MEM Investment Research

While last week's historically sharp drop in the markets was damaging to every area of the markets, what was most surprising was the hit that the normally-defensive Utility stocks endured. While not the worst performer for the week, this sector dropped more than the broader markets, with many...

READ MORE

MEMBERS ONLY

Interest Rate Compression -- Not A Good Look

by Carl Swenlin,

President and Founder, DecisionPoint.com

There is something different happening with interest rates. I don't know exactly what it means, but I definitely don't like how it looks. On the chart below, notice how in 2004 shorter-duration rates began to rise to where in 2006 long- and short-duration rates were compressed...

READ MORE