MEMBERS ONLY

GOLD MINERS ETF NEARS UPSIDE BREAKOUT -- SEMICONDUCTERS LEAD TECH SECTOR LOWER -- FRIDAY'S SELLING SUGGESTS THAT OVERBOUGHT STOCK PULLBACK HAS PROBABY BEGUN

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD MINERS ETF NEARS UPSIDE BREAKOUT... With gold surging again today to another seven-year high, gold miners are having an even stronger day percentage-wise. And are nearing a major upside breakout. Chart 1 shows the VanEck Gold Miners ETF (GDX) trading 3% higher today and nearing a challenge of its...

READ MORE

MEMBERS ONLY

The Straightforward Secret To Outperforming The 11 Sector SPDR ETFs

by Gatis Roze,

Author, "Tensile Trading"

There is no shortage of academic papers to validate the paramount importance of accurate sector analysis in producing market beating results. My own three decades of experience confirms this. Simply put, SECTORS MATTER! I was recently given the opportunity to attend a presentation by sector guru and strategist Denise Chisholm...

READ MORE

MEMBERS ONLY

MEM Edge TV: Will High Growth Stocks Continue to Power Higher?

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews some earnings-driven dynamics that are providing bullish upside for some unusual groups. She also shares individual stocks that appear poised to trade higher, along with the best timeframe of chart for entry/exit points in these fast...

READ MORE

MEMBERS ONLY

DOLLAR SURGES TO NEARLY THREE-YEAR HIGH -- PLUNGING YEN HURTS JAPAN ISHARES -- WEAK EM CURRENCIES HURT EEM ISHARES --U.S. STOCKS LOOK VULNERABLE TO SOME PROFIT-TAKING

by John Murphy,

Chief Technical Analyst, StockCharts.com

U.S. DOLLAR INDEX BREAKS OUT TO THE UPSIDE... The strong rally that started in the dollar in January passed another technical milestone this week. The daily bars in Chart 1 show the U.S. Dollar Index rising above its September/October peaks in yesterday's trading to reach...

READ MORE

MEMBERS ONLY

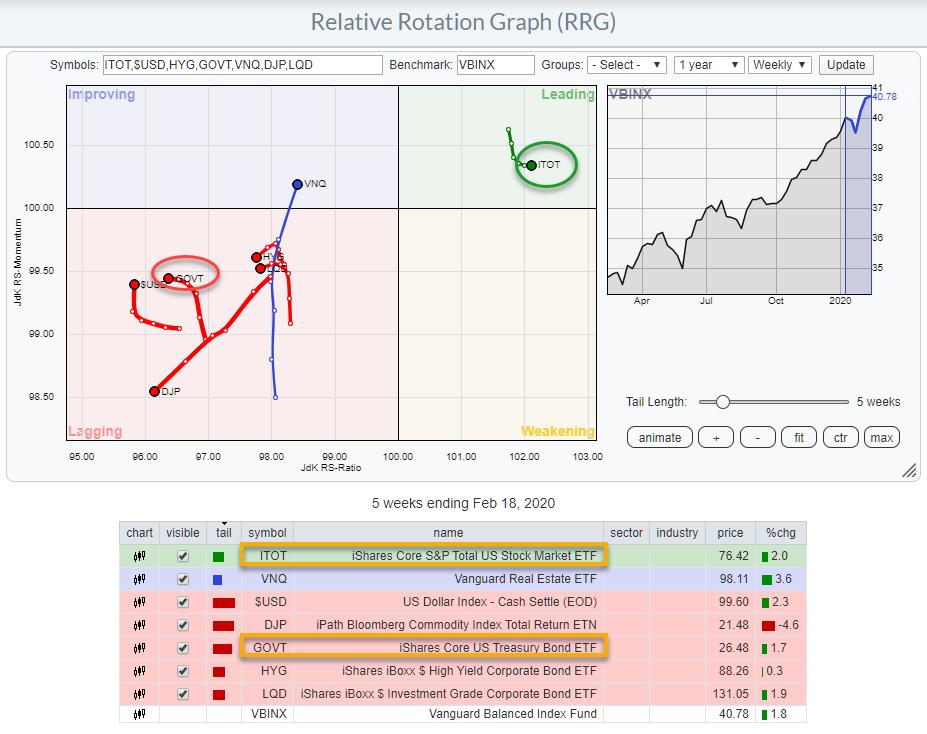

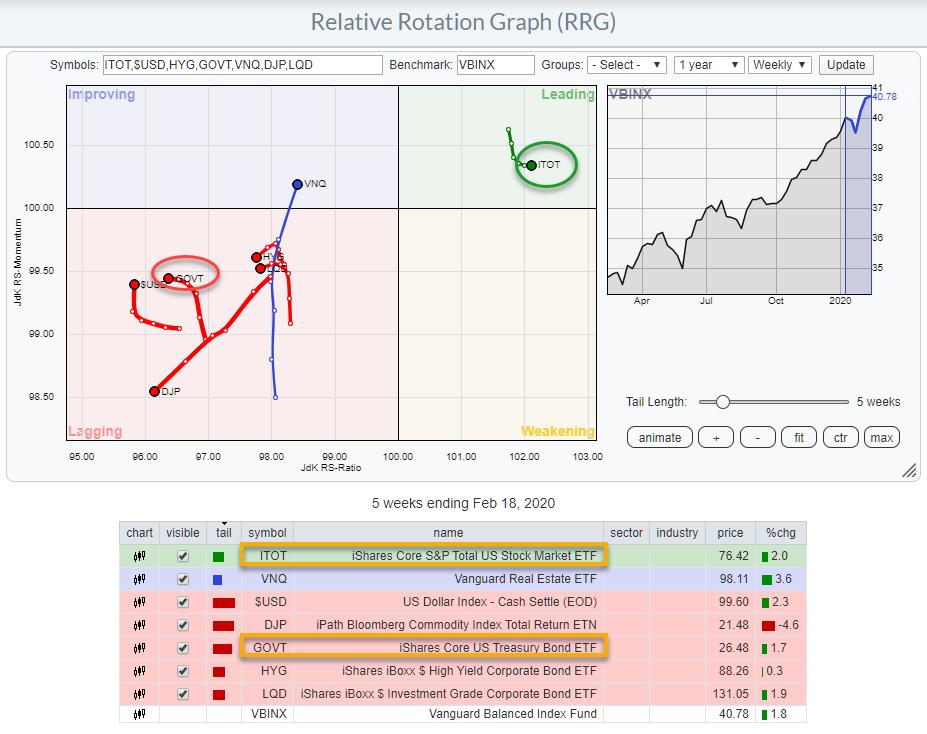

Two Changes to the Asset Allocation RRG Universe

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

People who follow the RRG Charts blog and my other articles in the ChartWatchers newsletter, as well as this Don't Ignore This Chart blog, will know that I like a top-down, structured approach to markets. The starting point for this approach is always the Asset Allocation universe, which...

READ MORE

MEMBERS ONLY

Getting Into Hot IPOs

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave talks all about how to get into hot IPOs early. As part of this, he presents the number one reason to trade IPOs and the ground rules for doing so.

This video was originally recorded on February 19th, 2020. Click anywhere on the...

READ MORE

MEMBERS ONLY

Has the Energy Sector Bottomed?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Today Energy (XLE) was the best performing of the eleven SPDR sectors we follow.

I have been watching the Energy Sector (XLE) for a few weeks, wondering if it was finally setting up for a rally. Price reached the bottom of a nine-month range, and the PMO bottomed, but that...

READ MORE

MEMBERS ONLY

Low Bond Yields May Not Be Around Much Longer

by Martin Pring,

President, Pring Research

* Secular Trend for the 20-Year Yield

* Lower Down Curve Yields Are Already in a Secular Bull

* Short-Term Oscillators Ready for Some Upside Action?

The coronavirus has triggered concerns about the recovery, which in turn has resulted in a sharp setback for yields. Falling yields are bullish for housing starts, which,...

READ MORE

MEMBERS ONLY

GOLD REACHES SEVEN-YEAR HIGH -- GOLD MINERS ARE ALSO TURNING UP -- NEWMONT GOLDCORP EXCEEDS 2016 HIGH -- BARRICK GOLD REACHES FOUR-YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD RESUMES UPTREND... My weekend message explained why falling bond yields, and an over-extended stock market, might be two of the reasons that investors have been buying gold since the start of the year. And they're doing so in the face of a rising dollar. The message also...

READ MORE

MEMBERS ONLY

Building A Solid Portfolio Starts With A Strong Foundation

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I write about this a lot. Putting a group of stocks together that have (a) beaten Wall Street revenue and EPS estimates in its latest quarter, (b) belong to one of the "favored" industry groups on Wall Street, and (c) show strong technicals, including bullish volume trends leads...

READ MORE

MEMBERS ONLY

This Stock Has Legendary Backing, High Growth and a Breakout On Volume.....

by Mary Ellen McGonagle,

President, MEM Investment Research

Retail Furnishing stocks have been a hot area as new home sales have continued to grow in this low interest rate environment. While most of these Home Furnishers have been expanding sales through online digital channels, there's been one high-growth company that's making a name for...

READ MORE

MEMBERS ONLY

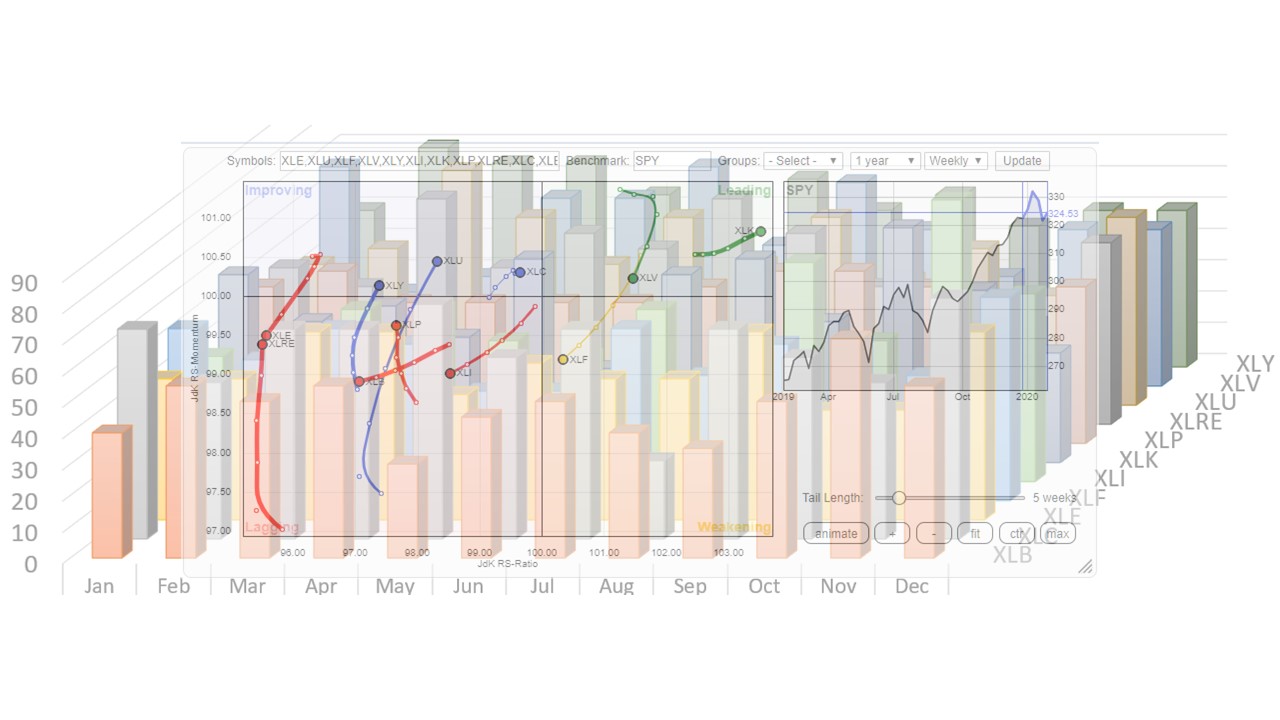

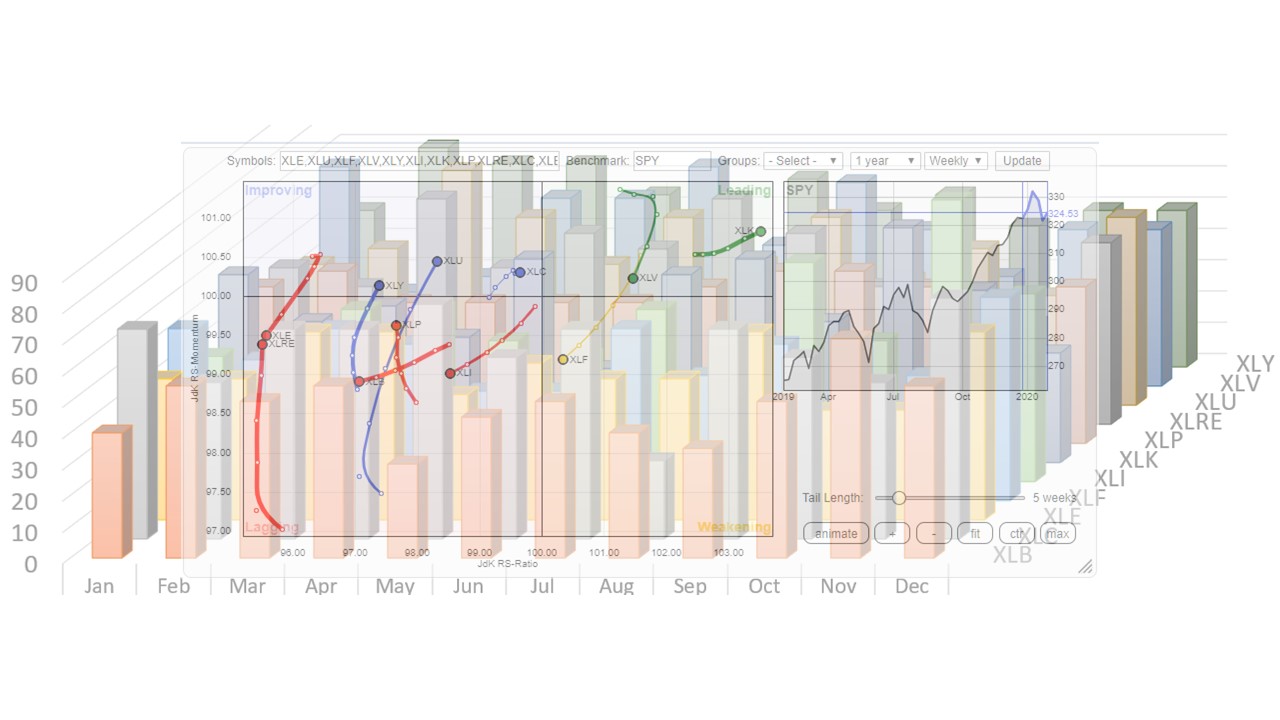

Sector Spotlight: (Re-)structuring the Asset Allocation Process

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV'sSector Spotlight, I cover a few questions that came in via the mailbag and used one of the questions to (re-)structure my asset allocation approach and visualize the investment pyramid.

This video was originally recorded on February 18th, 2020. Click anywhere on...

READ MORE

MEMBERS ONLY

With The First Pick In The U.S. Stock Market Draft, EarningsBeats.com Selects...

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've never really thought about it before, but putting together a portfolio is very similar to drafting NFL or NBA players. The idea in professional sports is to select someone who you believe will provide a major positive impact on your organization and to establish a winning tradition,...

READ MORE

MEMBERS ONLY

FALLING BOND YIELDS HAVE BEEN GIVING A BIG BOOST TO THE PRICE OF GOLD -- AND HELPED OFFSET IMPACT OF RISING DOLLAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

RELATIONSHIP BETWEEN GOLD AND THE DOLLAR... Last weekend's message explained that one of the side-effects of a rising U.S dollar is weaker commodity prices. And that's been the case so far this year as a four-month high in the U.S. Dollar Index has pushed...

READ MORE

MEMBERS ONLY

Applying the Dow Theory Principle of Confirmation to Measure Sector Participation

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Dow Theory applies the principle of confirmation to confirm primary trends. Charles Dow used the Dow Industrials and Dow Transports to confirm the primary trend for the broader market. The primary trend is up, and confirmed, when the Industrials and Transports both exceed their prior highs and record higher highs....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Vulnerable at Current Levels; RRG Chart Shows These Groups Doing Relatively Better

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week saw the markets consolidating in a 256-point move, as the headline index NIFTY50 ended flat with a negligible gain. After bouncing off from the 50-week MA in the earlier week, the NIFTY continued to trade near its critical zone of 12100-12225 throughout the week while making no...

READ MORE

MEMBERS ONLY

Select 5G Stocks Will Benefit From This Week's T-Mobile/Sprint Merger – Here are 3 Stocks Poised To Trade Higher

by Mary Ellen McGonagle,

President, MEM Investment Research

This week's federal court decision to allow the T-Mobile (TMUS)/Sprint (S) merger to go through has reignited select areas of the market that will be positively impacted by the boost in 5G adoption in the U.S.

This is because the judge who presided over the decision...

READ MORE

MEMBERS ONLY

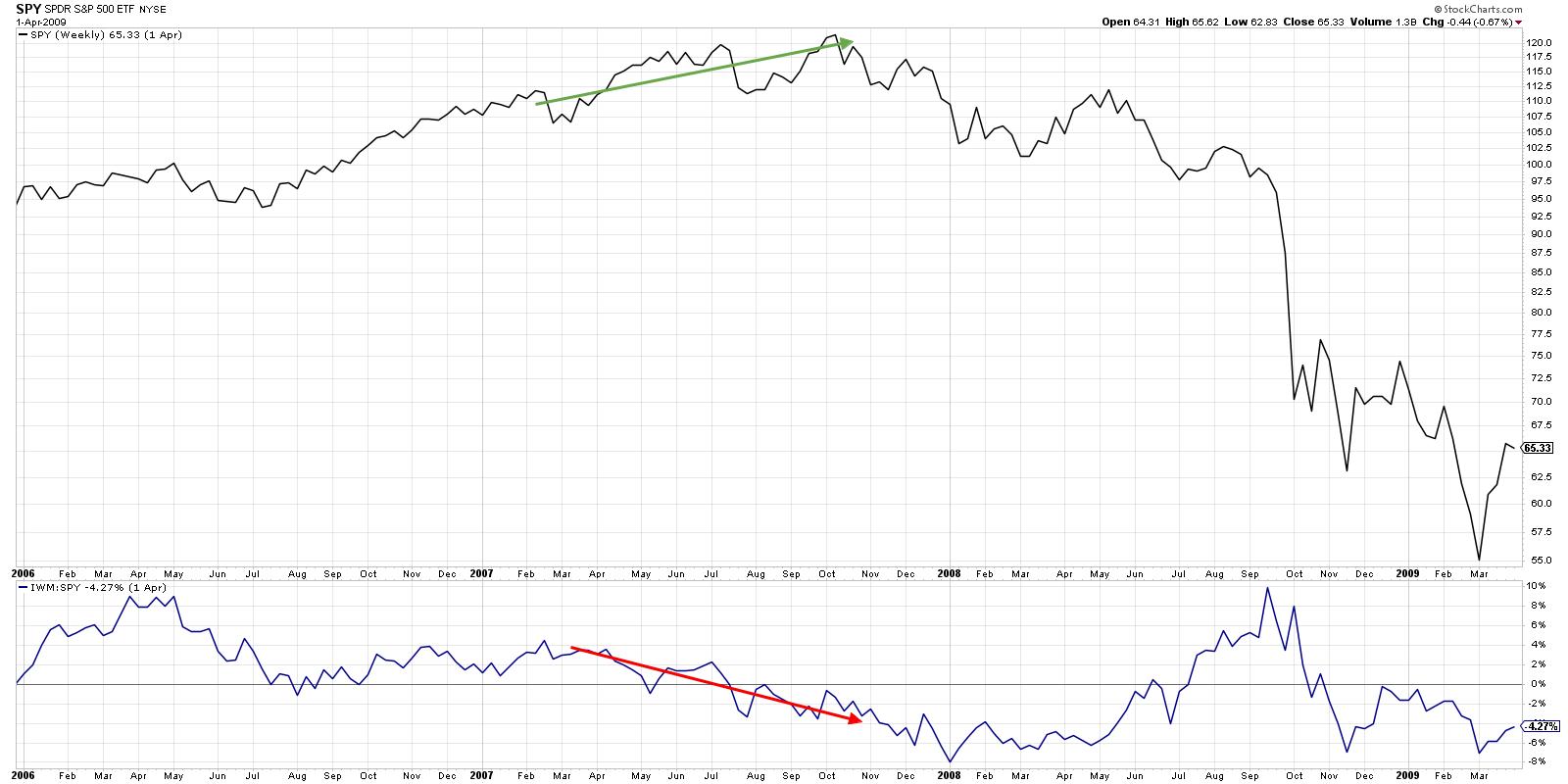

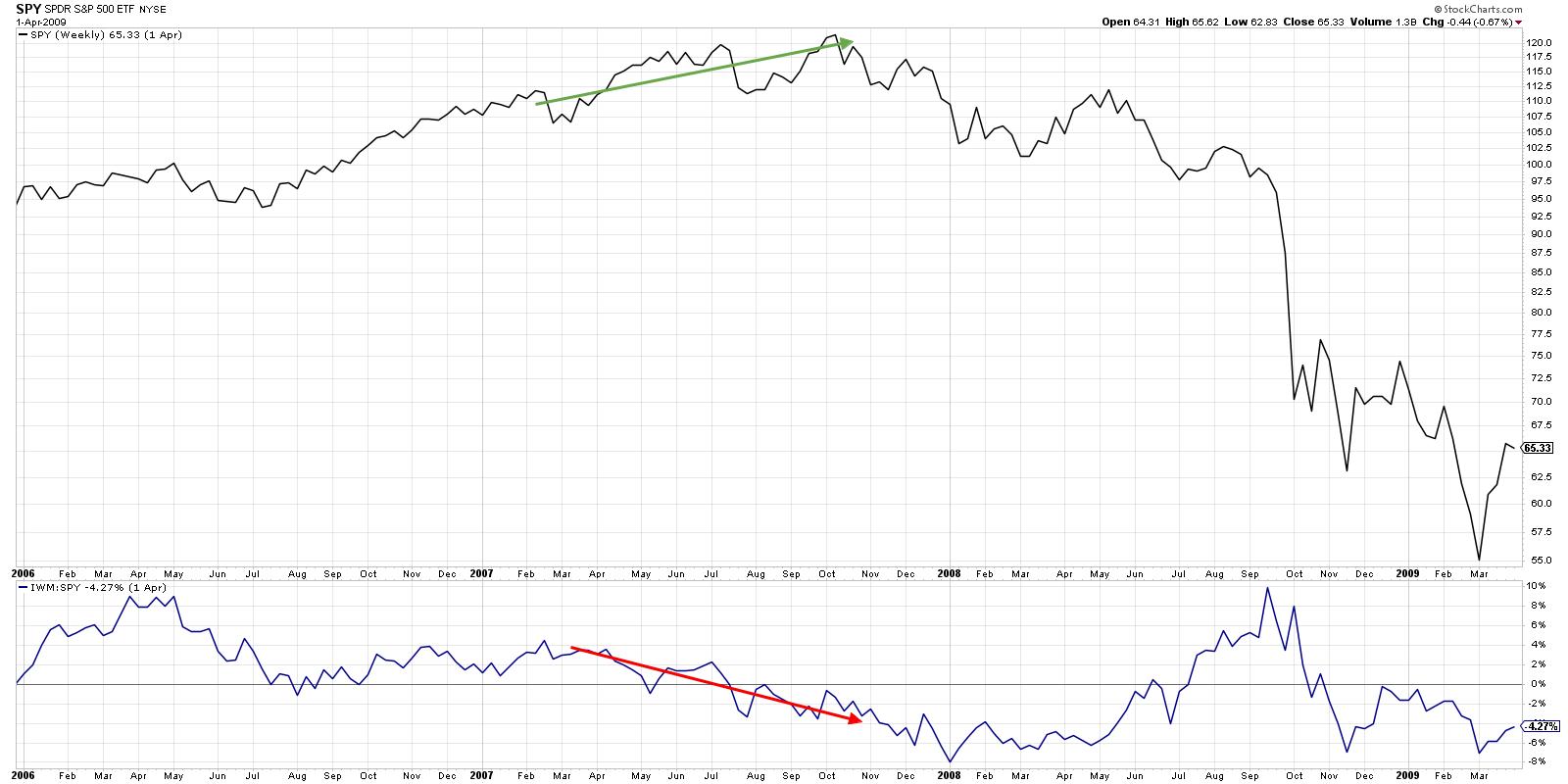

Struggling Small Caps

by David Keller,

President and Chief Strategist, Sierra Alpha Research

"How come small-caps aren't doing better when the market's making new highs?"

I've heard some version of this question many times over the last couple years, starting with the emergence of the FAANG trade. Once that subsided and the market resumed its...

READ MORE

MEMBERS ONLY

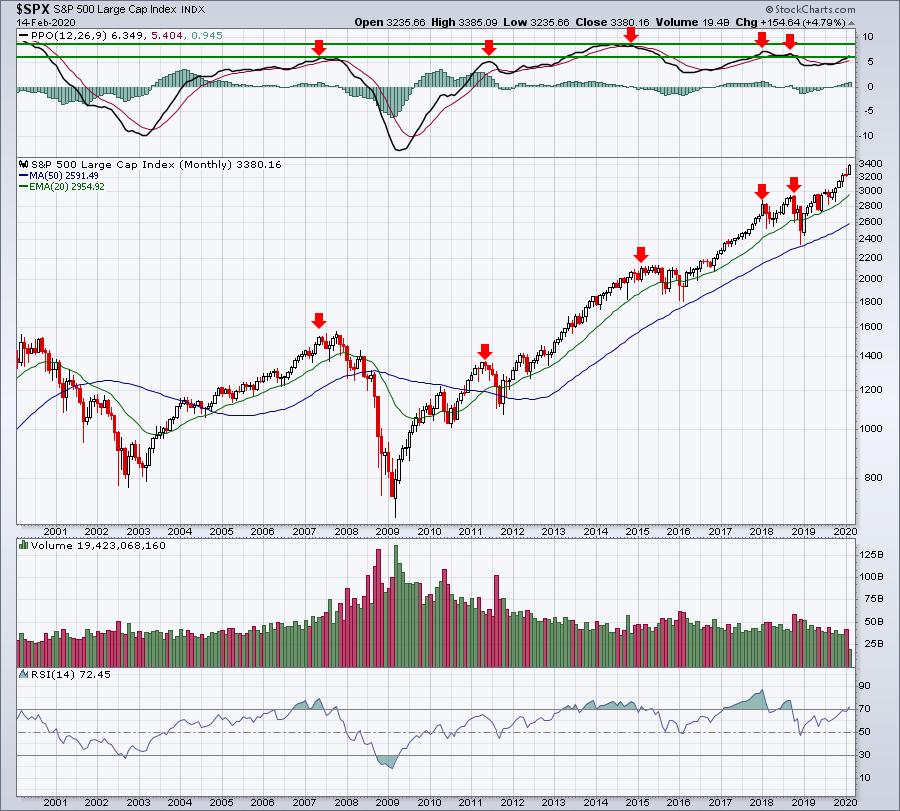

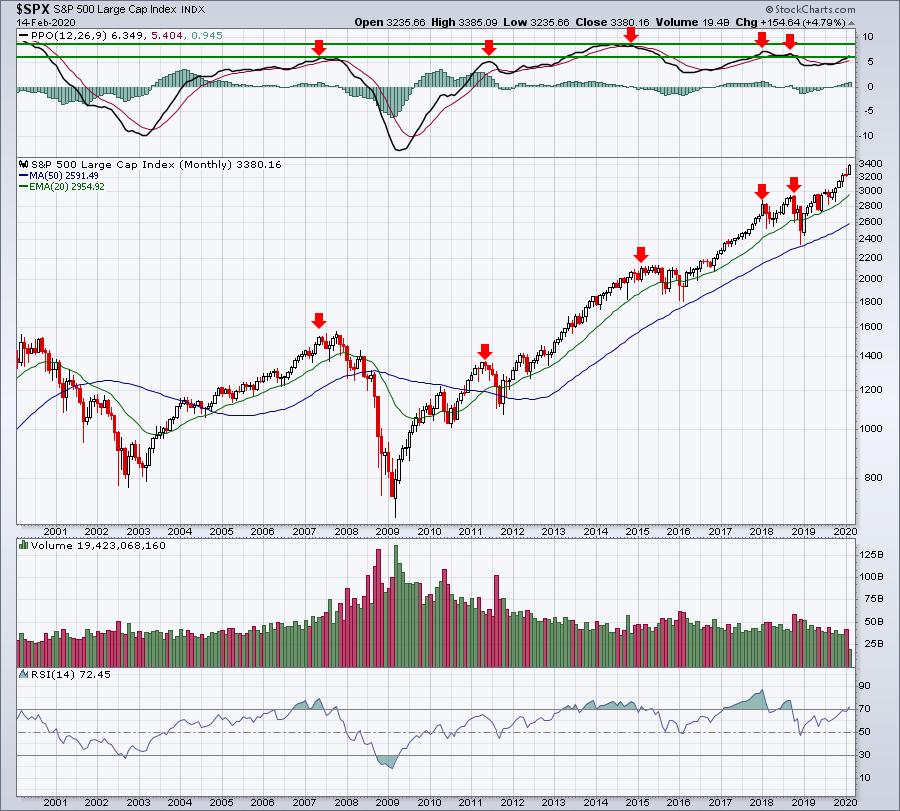

How High Might the S&P 500 Go? History Provides Us Clues

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Embrace this rally.

As far as bull markets go, this is truly the Perfect Storm. Never in my lifetime have I seen a stock market environment where we're experiencing modest growth, strong jobs, lower-than-target inflation, historically-low treasury yields and a Fed that honestly should cut rates again. If...

READ MORE

MEMBERS ONLY

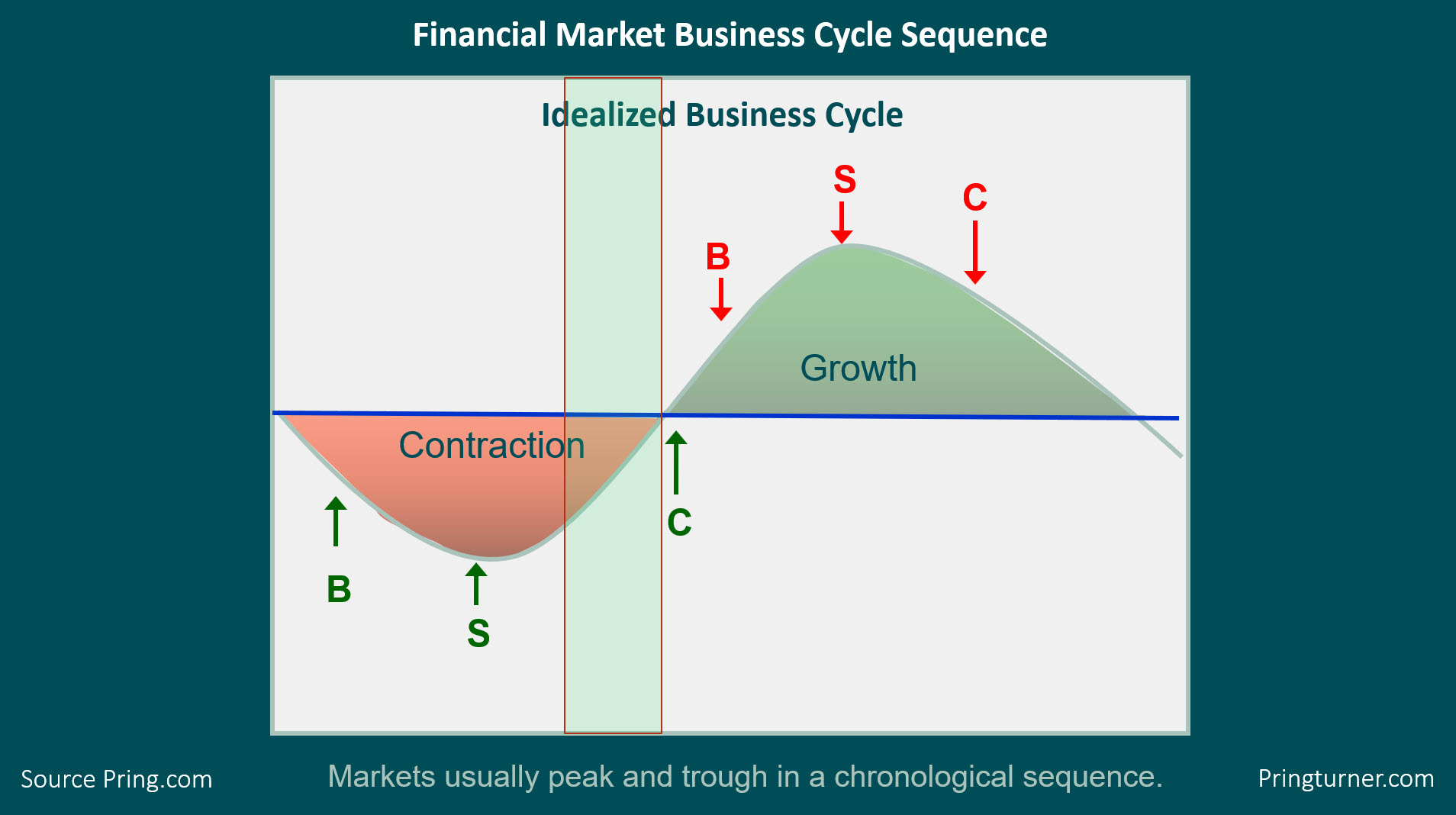

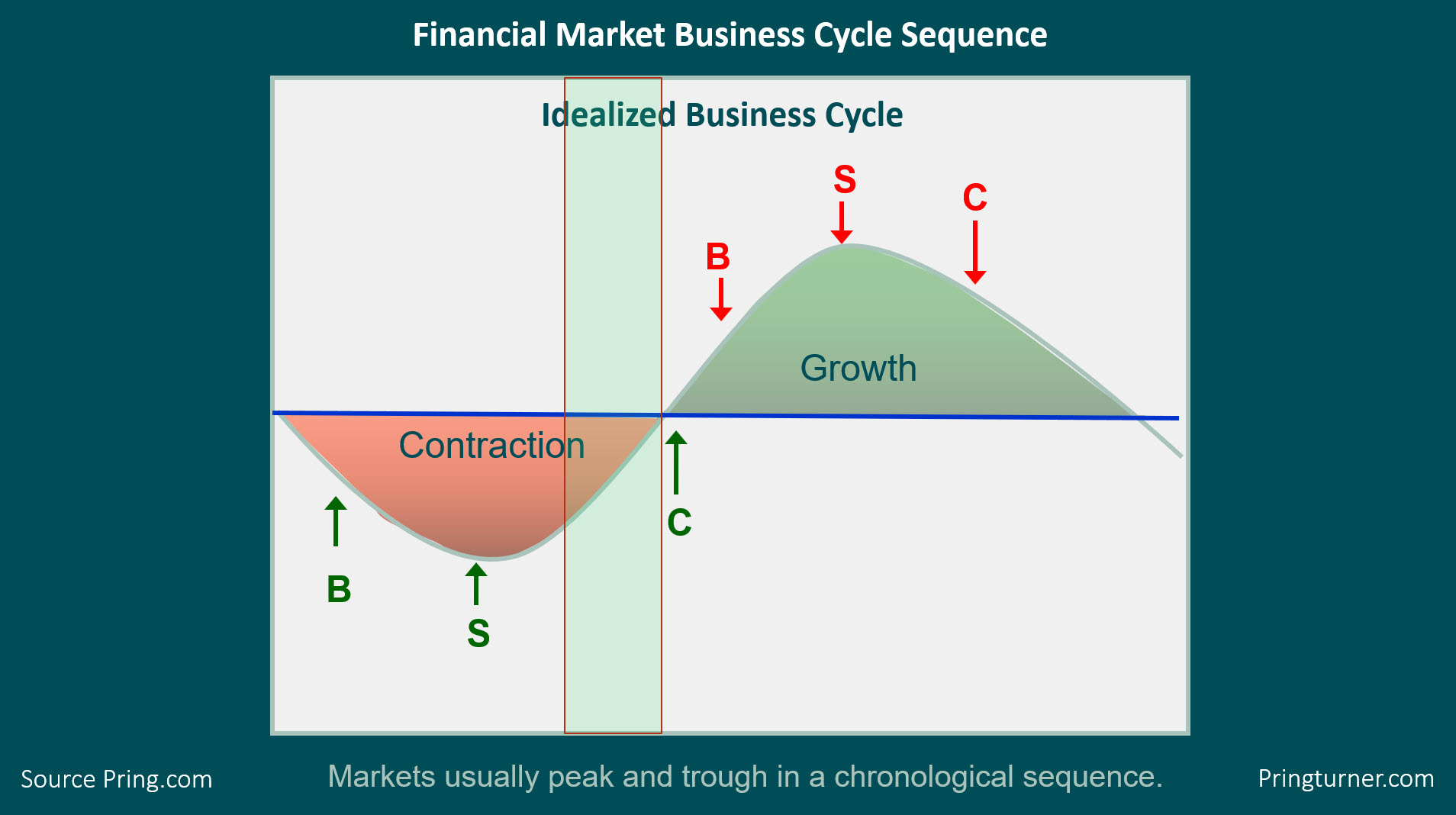

Commodities Remain on a Knife Edge

by Martin Pring,

President, Pring Research

Back in December, I wrote an articlepointing out that the business cycle was nothing more than a set series of chronological sequences. The importance of this observation, for investors, is that the primary trend peaks and troughs of bonds, stocks and commodities fit nicely into that chronology, as shown in...

READ MORE

MEMBERS ONLY

What's New: Symbol Summary, ChartList Reports, "Behind The Charts" And So Much More

by Grayson Roze,

Chief Strategist, StockCharts.com

As we were walking out of a meeting the other day, my good friend Dave Keller (our Chief Market Strategist here at StockCharts) said something that momentarily floored me. It made me stop what I was doing, zoom out mentally and really reflect on the past few months. Funniest part...

READ MORE

MEMBERS ONLY

LOWER YIELDS PUSH REITS AND UTILITIES TO RECORDS -- BANK SPDR MEETS SELLING AT 50-DAY LINE -- S&P 500 STILL LOOKS OVEREXTENDED -- WITH A SHORT-TERM NEGATIVE DIVERGENCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD CONTINUES TO WEAKEN... Treasury yields are down again today, and are losing some of the gains made over the last two weeks. The daily bars in Chart 1 show the 10-Year Treasury Yield losing 3 basis points today to 1.58%. The pennant-like shape of its sideways...

READ MORE

MEMBERS ONLY

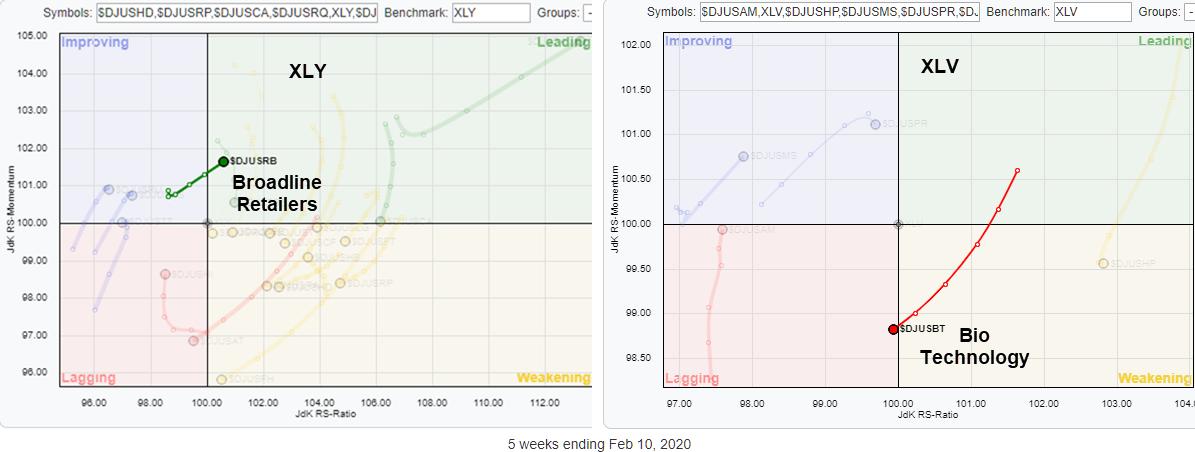

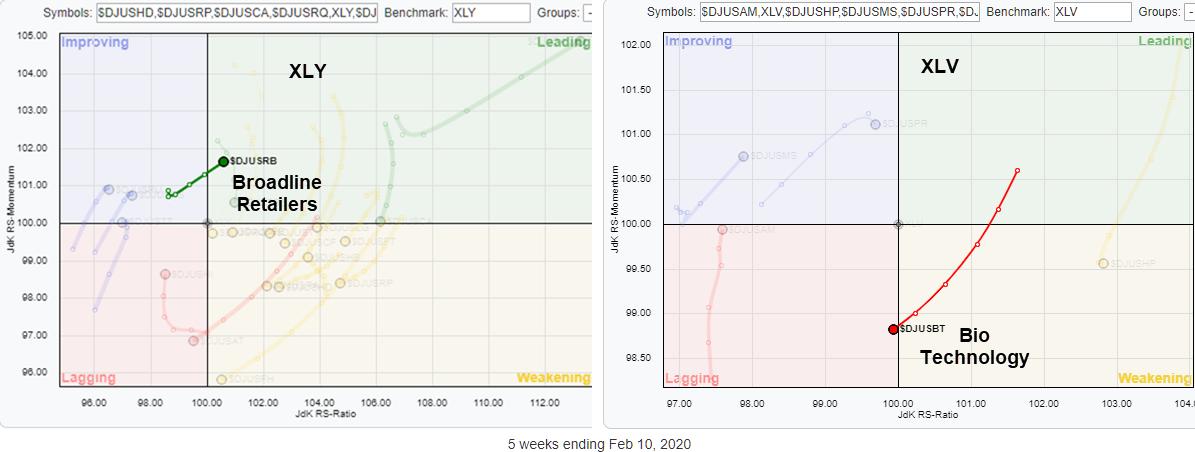

Picking Industries from Sectors with RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Two weeks ago, I wrote a ChartWatchers article titled "RRG Suggests Aggressive Trade Setup for XLY vs. XLV." In this article, I want to show you how you can take that idea one step further and, at the same time, answer a question on how you can easily...

READ MORE

MEMBERS ONLY

Commodities Remain on a Knife Edge

by Martin Pring,

President, Pring Research

* Where Are We in the Cycle?

* The Economy is Currently on the Side of the Bulls

* The Technical Position of the DB Commodity ETF is Precarious

Where Are We in the Cycle?

Back in December, I wrote an articlepointing out that the business cycle was nothing more than a set...

READ MORE

MEMBERS ONLY

Ready for a Bear?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The title of this article might make you believe that we are bearish on the market. If you have read some of the last 200+ articles in this blog, you know that we do not make forecasts or guess about the direction of the market; we follow our rules-based trend...

READ MORE

MEMBERS ONLY

Consumer Stock Ratio Breaks Out To Support Higher Prices Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Below is today's Daily Market Report that I send out to EarningsBeats.com members every day, usually between noon and 1pm EST. Enjoy!

Executive Market Summary

* Wall Street opened lower, but key indices are now flirting with positive territory

* January CPI indicated inflation remains modest

* The 10 year...

READ MORE

MEMBERS ONLY

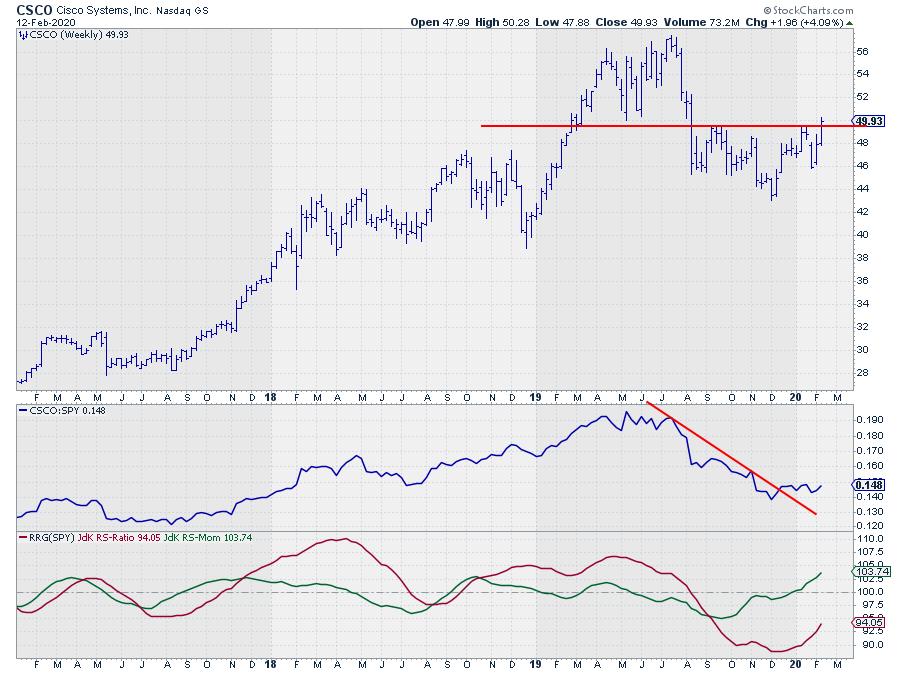

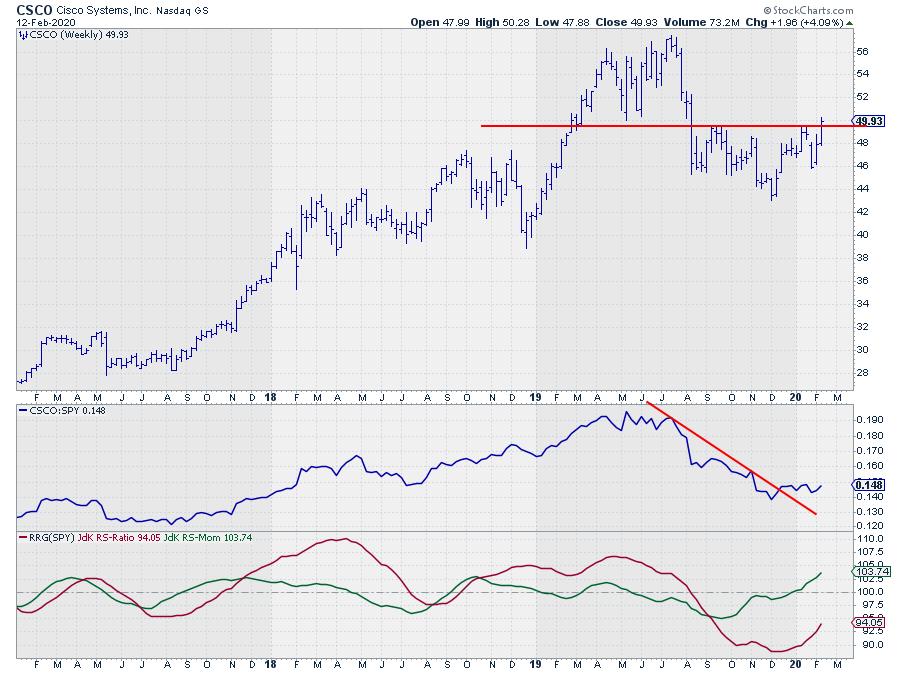

Opposite Rotations Suggest an Outperformance for CSCO over WMT in Coming Weeks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

CSCO peaked in the first half of 2019. The first time at $ 56.30 in April and then again in July at $ 57.40. A typical failure to convincingly break above a previous high. From July onward CSCO moved lower to a low around $ 43 at the start of December....

READ MORE

MEMBERS ONLY

Sector Spotlight: Adding an Extra Benchmark to Your RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV'sSector Spotlight, I discuss the current rotations for US sectors, then explain how to add a second(ary) benchmark to the RRG chart as a way of getting a more detailed analysis.

This video was originally recorded on February 11th, 2020. Click anywhere...

READ MORE

MEMBERS ONLY

Mystery Chart Follow-Up and IPOs

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave performs an in-depth follow-up on the Mystery Chart. Afterwards, he gives a short talk about IPOs.

This video was originally recorded on February 12th, 2020. Click anywhere on the Trading Simplified logo above or at this linkto see a larger version on YouTube....

READ MORE

MEMBERS ONLY

Mindset Matters: Why The Long Game Is My Only Option And How I'm A Better Trader For It

by Grayson Roze,

Chief Strategist, StockCharts.com

I just can't do it. I just can't bring myself to short stuff – the market, an individual stock, even something as seemingly harmless as an inverse ETF. I don't do it. I can't do it. I won't do it!

Yep,...

READ MORE

MEMBERS ONLY

RRG + Seasonality is a Very Powerful Combination!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

It's a Puzzle

Regular readers of the RRG blog and my contributions to DITC and the ChartWatchers newsletter, as well as watchers of Sector Spotlight, will probably be aware of my recent research exercises to combine RRG with seasonality.

The reason for doing that lies in my belief...

READ MORE

MEMBERS ONLY

BUYING OF GAMBLING, HOTELS, AND CRUISE LINES IS A SIGN THAT CORONAVIRUS THREAT MAY BE PASSING -- AMERICAN AIRLINES LEADS AIRLINES HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKETS LOOKING BEYOND CORONAVIRUS THREAT... Price action of the global financial markets over the past week strongly suggest that fears of the coronavirus are fading.Major U.S. stock indexes are trading at new records. Foreign stocks are being led higher by Asian emerging markets, with help from China. Crude...

READ MORE

MEMBERS ONLY

One of My Favorite Indicators

by Carl Swenlin,

President and Founder, DecisionPoint.com

An indicator that has become a favorite of mine is the Percentage of Stocks Above the 20EMA, because it is very straight forward and easily understood. Then a stock's price is above its 20EMA, it is a sign of strength, and, conversely, it is a sign of weakness...

READ MORE

MEMBERS ONLY

DP Show: Swenlin Perma-Bears? + Tesla: A Parabolic Tale

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin address a common question from many subscribers: "What will make you bullish?!". A viewer coins the expression "PermAware" for the Swenlin philosophy. In the vein, Carl gives his thoughts on divergences that have popped up, along with a...

READ MORE

MEMBERS ONLY

Lithium is Charged Up

by Bruce Fraser,

Industry-leading "Wyckoffian"

During the 4th quarter of 2019 Tesla came to life and leaped out of a multi-year trading range. Tesla's recent appreciation is likely indicating a period of robust business expansion for the electric automobile manufacturer (and battery producer). By some estimates there will be 15 new Electric Vehicles...

READ MORE

MEMBERS ONLY

The Next Big Breakout Is Happening Today

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've written about this industry group on many, many occasions, but up until today, we've simply seen a bunch of false hopes. Today is THE BREAKOUT. We gapped above resistance and, thus far, are adding to early gains. A strong afternoon would seal the deal -...

READ MORE

MEMBERS ONLY

This Hot IPO is Poised to Trade Higher - Even After Gapping Up on Strong Earnings

by Mary Ellen McGonagle,

President, MEM Investment Research

Bill.com (BILL) has been one of the better-performing IPOs to debut recently. The leading provider of cloud-based software that automates complex back-office financial operations popped more than 60% on its first day of trading two months ago.

Why all the hoopla? The company partners with 70 of the top...

READ MORE

MEMBERS ONLY

This Stock Looks Promising Over The Coming Days

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

VIPIND.IN - VIP Industries Limited

VIPIND.IN marked a peak near 641 in August 2018, formed a lower top 562 and saw a range-bound corrective move that took the stock to 342. The stock has attempted to form a base around that level - given the multiple pieces of...

READ MORE

MEMBERS ONLY

Perspective: That's What The Bull Market Naysayers Are Lacking

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I see so many comparisons to what was happening in 2007, as if the current market environment somehow should be compared to 2007. It shouldn't. 2007 was part of a 12-13 year secular bear market. 2020 is part of a lengthy secular bull market. The bullish boundaries of...

READ MORE

MEMBERS ONLY

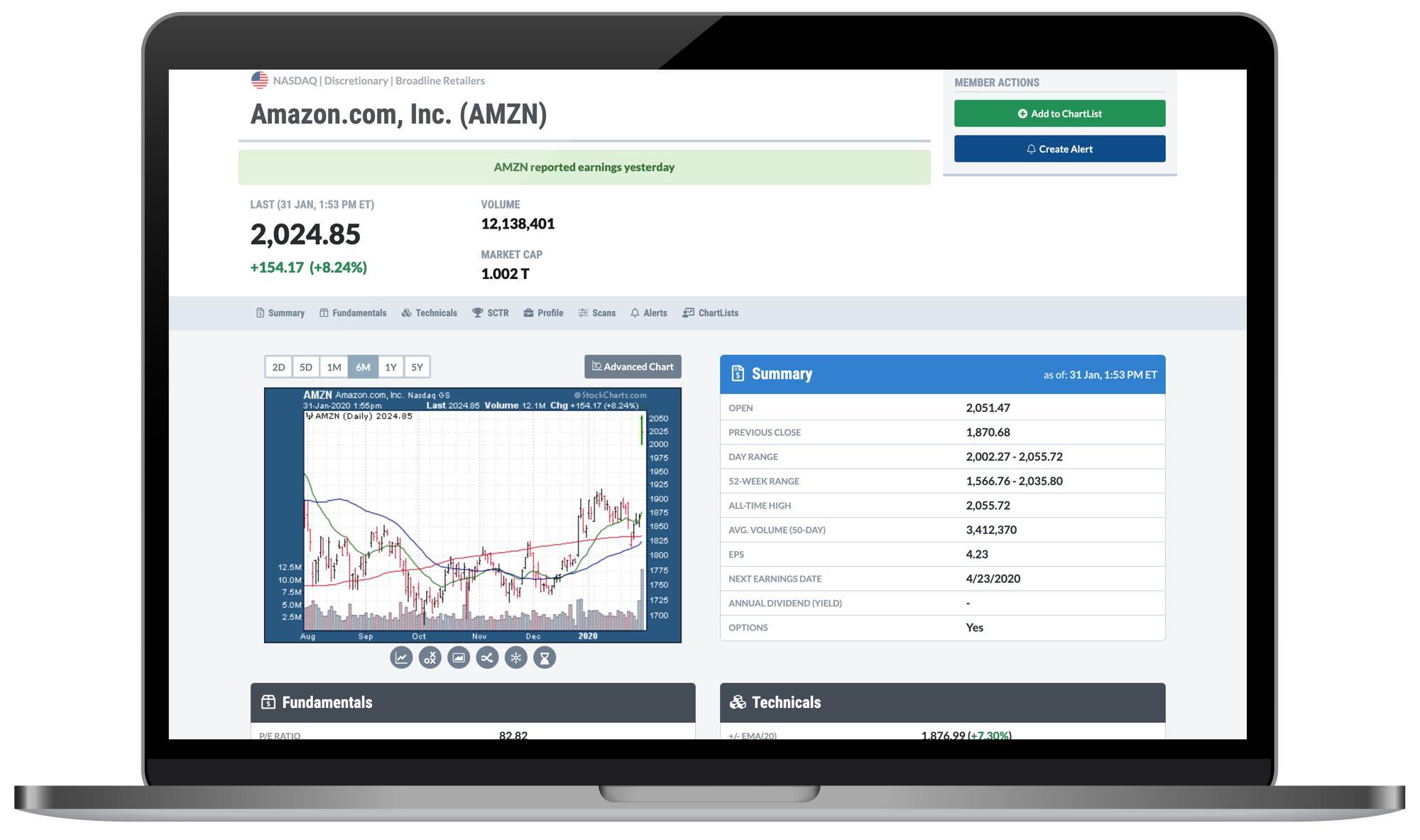

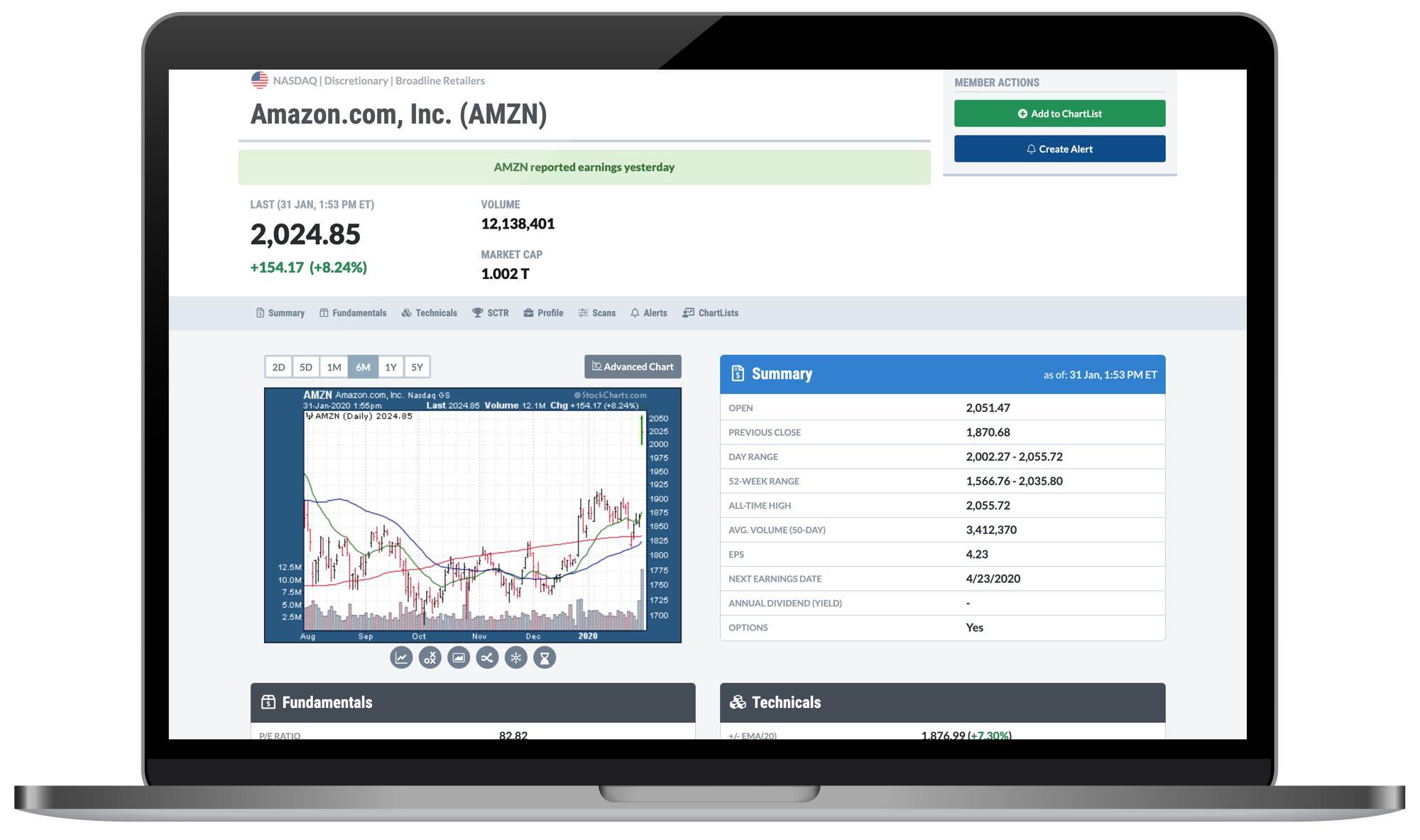

Removing the Amazon Effect from XLY - Plus the Mother of All Cup-with-Handle Patterns

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Amazon is by far the biggest component in the Consumer Discretionary SPDR and its recent breakout bodes well for the ETF. The new highs in XLY and AMZN this month, however, did not carry over to the Equal-weight Consumer Discretionary ETF (RCD). RCD removes the Amazon effect by treating all...

READ MORE