MEMBERS ONLY

Sector Spotlight: BETA Helps You Find Sectors To Hide When Needed

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV'sSector Spotlight, I updated my spreadsheet for calculating the BETAs for all of the SPDR sectors. During the episode, I show users how to use this metric in combination with RRGs. This episode was originally recorded on January 28th, 2020.

Sector Spotlight airs...

READ MORE

MEMBERS ONLY

DP Show: New Signal Changes on Major Indexes - Cap-Weighted v. Equal-Weighted Analysis

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl reviewed some of his notes from last Friday's DecisionPoint Weekly Wrap (available at DecisionPoint.com), while Erin presents an update on the latest short-term SELL signals triggered with today's market action. Carl and Erin also discuss cap-weighting pitfalls and positives...

READ MORE

MEMBERS ONLY

STOCKS SELL OFF IN CONTINUATION OF LAST WEEK'S DEFENSIVE WARNINGS --

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES CONTINUE SELLING THAT STARTED LAST WEEK...The selling of stocks that started late last week intensified today. That shouldn't be too much of a surprise considering all the warnings given by the various markets as described in these messages. They include the plunge in Treasury yields...

READ MORE

MEMBERS ONLY

S&P 500 Channels 2018 and Opens a Box of Chocolates

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Signs of a correction were building for some time and it now appears that the long awaited corrective period is here. The S&P 500, in particular, is following the script from January 2018 quite closely. After a steady advance from October to December, signs of excess started appearing...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Has a Stiff Overhead Resistance to Deal With; RRG Chart Show Mid-Caps to Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After starting the week on a corrective note, the market recouped some of its losses on the last two trading days of the week. The last few days have remained volatile for the markets as the headline index NIFTY traded in a wider-than-usual range. The index oscillated in an over-340-point...

READ MORE

MEMBERS ONLY

Gold Miners on Fire!

by Erin Swenlin,

Vice President, DecisionPoint.com

Gold Miners have been on fire this week! Each Friday, I get a Weekly ChartList Report on the ETF Tracker ChartList that Carl and I have developed. If you would like it, you'll find it in the DP Trend and Condition ChartPack (free to Extra members and above!...

READ MORE

MEMBERS ONLY

MEM Edge TV: Is it Time to Exit the Markets?

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen discusses several ways to determine the market's health while reviewing a significant rotation that's taking place. She also analyzes the possible impact of the coronavirus and the importance of stocks that have reported strong...

READ MORE

MEMBERS ONLY

Consumer Discretionary SPDR Pulled Lower by Travel and Entertainment Stocks

by John Murphy,

Chief Technical Analyst, StockCharts.com

Yesterday's message showed bond yields falling (and bond prices rising) in a flight to the safety of government bonds. And further suggested that fears of the Chinese virus spreading was most likely behind that more defensive tone. Bond yields are falling even further today as that defensive mood...

READ MORE

MEMBERS ONLY

Ten Quotes on Extended Bull Markets

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I keep reminding viewers of my daily show, The Final Bar(new episodes every weekday at 4pm ET!), that extended bull markets can actually be a little frustrating. While a consistent uptrend in prices tends to be a good thing for long-term investors, two things present quite a challenge.

The...

READ MORE

MEMBERS ONLY

In a Volatile Market, Focus on the Best of the Best

by John Hopkins,

President and Co-founder, EarningsBeats.com

It's no secret that the market has reached frothy levels with virtually no relief since the beginning of October 2019. Thus, it makes sense that the VIX spiked on Friday, as it moved above all key technical intraday levels and many traders moved to the sidelines.

While the...

READ MORE

MEMBERS ONLY

A Moment of Truth for the Russell 2000 ETF

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Russell 2000 ETF (IWM) broke out of a pennant formation last week and then fell sharply this week. This puts price back in the pennant and near its make or break level.

Flags and pennants are short-term continuation patterns that form after a sharp move. Bullish versions represent the...

READ MORE

MEMBERS ONLY

Here's Where Your Profits Will Be In 2020: ChartPack Update #26 (Q4 / 2019)

by Grayson Roze,

Chief Strategist, StockCharts.com

by Gatis Roze,

Author, "Tensile Trading"

Free money! Get your free money here! All you have to do is be willing to get off the sofa and walk over to the corner of the house where you adjust your portfolio. It's literally that easy. That's how simple it was using the ChartPack...

READ MORE

MEMBERS ONLY

AIRLINES, CRUISE SHIPS, GAMBLING, AND HOTEL STOCKS LEAD MARKET LOWER AS CHINESE VIRUS SPREADS -- THAT COULD LEAD TO PROFIT-TAKING IN STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR PULLED LOWER BY TRAVEL AND ENTERTAINMENT STOCKS... Yesterday's message showed bond yields falling (and bond prices rising) in a flight to the safety of government bonds. And further suggested that fears of the Chinese virus spreading was most likely behind that more defensive tone. Bond...

READ MORE

MEMBERS ONLY

I Will Guarantee You The Upcoming Earnings Performance Of These 2 Giants

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If a company is likely to report strong results, Wall Street knows it. Analysts have met with management and discussed targets, competition, product strategies, margins, etc. If they like what they hear, they return to their offices and buy for themselves and clients. That's how it works. Astute...

READ MORE

MEMBERS ONLY

When the Inevitable Correction Comes, History Suggests It Won't Amount to Much

by Martin Pring,

President, Pring Research

One of the basic laws of technical analysis, which I have learned the hard way, is to be very careful about calling counter-cyclical short-term moves. The primary trend dominates everything. For example, if you are in a bear market and you see a short-term oversold condition, do not assume that...

READ MORE

MEMBERS ONLY

REBOUND IN BOND PRICES SHOWS FLIGHT TO SAFETY -- THAT'S ALSO BOOSTING REITS AND UTILITIES -- AND HOMEBUILDERS -- AND KEEPING BANKS ON THE DEFENSIVE -- GOLD MINERS REBOUND WHILE COPPER SHARES DROP

by John Murphy,

Chief Technical Analyst, StockCharts.com

TREASURY BOND YIELDS CONTINUE TO DROP... The drop in Treasury bond yields that started a month ago is continuing. And is nearing a test of some important support levels. The daily bars in Chart 1 show the 30-Year Treasury yield (TYX) having already broken a rising trendline drawn under its...

READ MORE

MEMBERS ONLY

EA Sports: It's In The Game...

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

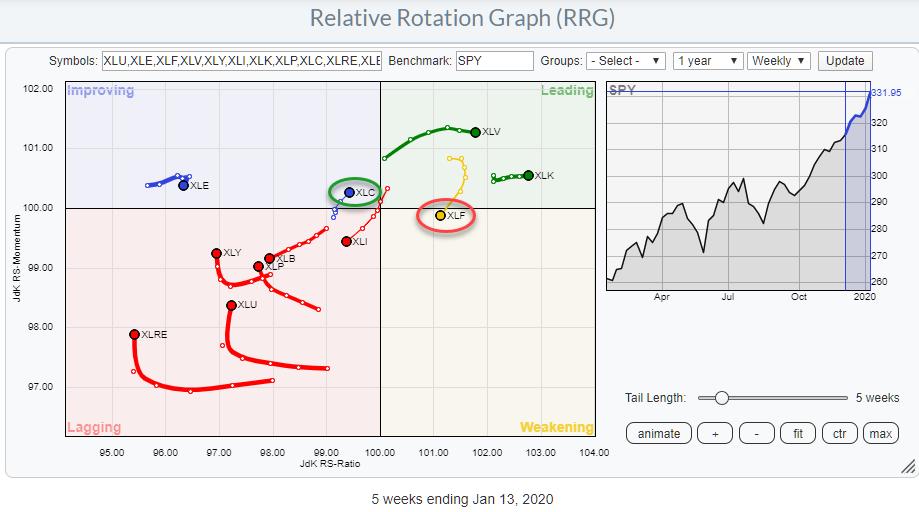

In a recent article in the RRG Blog titled "Is XLC taking over from XLK?", I identified the Communication Services sector as one of the potential new leading sectors in coming weeks. Currently, on the Relative Rotation Graph for US sectors, XLC is inside the improving quadrant, but...

READ MORE

MEMBERS ONLY

RRG Shows Money Rotating out of WBA into KO

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's episode of Sector Spotlight, I ran out of time to go over the pair trade idea that we usually have at the end of the show and I promised to write it up in an article. So here it is.

This idea was generated from...

READ MORE

MEMBERS ONLY

20 Trading Resolutions for 2020, Part 2

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave reveals the next group of his trading resolutions heading into 2020. Afterwards, he presents a new edition of "The Missed, The Best or the Worst Trade of the Week" and does some housekeeping. This video was originally recorded on January 22nd,...

READ MORE

MEMBERS ONLY

PRICE OF NATURAL GAS FALLS TO FOUR-YEAR LOW -- ETFS WITH NAT GAS EXPOSURE HAVE WEAKER YEAR -- THAT INCLUDES OIL & GAS EXPLORATION & PRODUCTION AND OIL SERVICES

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY STILL IN DECLINE... Despite today's snapback bounce in global stocks, one sector continues to weaken. And that's the energy sector. Chart 1 shows the Energy Sector SPDR (XLE) falling further below its 50- and 200-day moving averages today. And that's in a rising...

READ MORE

MEMBERS ONLY

XLE Whipsaws into LT Trend Model SELL Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

(This is an excerpt from today's DecisionPoint Alert report on DecisionPoint.com)

Today's giant drop in the Energy Sector (XLE) was enough to negate a very young Long-Term Trend Model (LTTM) BUY signal. That LTTM SELL signal was generated when the 50-EMA sunk below the 200-EMA....

READ MORE

MEMBERS ONLY

Sector Spotlight: Are RRGs "Useless" for Short-Term Trading?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV'sSector Spotlight, I analyze the current rotations for US sectors and answer two questions from the mailbag. For one of those questions, I discuss the use of RRGs in short-term trading. This video originally aired on January 21st, 2020.

During the last few...

READ MORE

MEMBERS ONLY

EB Daily Market Report - Tuesday, January 21, 2020

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Event

Below is a sample of the Daily Market Report that I sent to EarningsBeats.com members this afternoon.

Also, I'd like to extend an invite to everyone to join me at 4:30pm EST today as I will host our "Sneak Preview - Q4 Earnings&...

READ MORE

MEMBERS ONLY

Dow Jones Industrials. Out of Gas?

by Bruce Fraser,

Industry-leading "Wyckoffian"

In a number of cases we have studied classic Wyckoffian Overbought and Oversold conditions that emerge at the conclusion of a market move. Such a condition typically presents as Climactic action. Three or more unique events will often combine to setup exhaustion of a trend. Fulfilment of a Point and...

READ MORE

MEMBERS ONLY

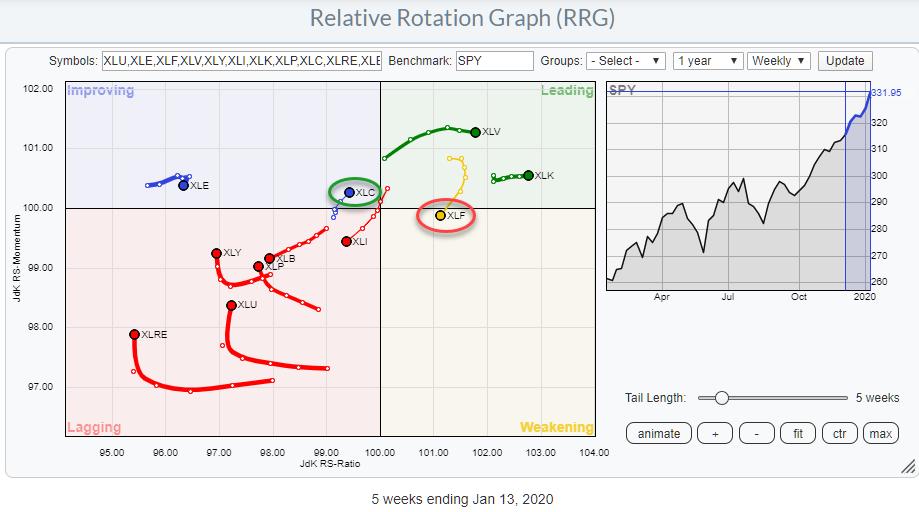

Is XLC taking over from XLF?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Here's a quick update for a rotation that caught my attention this morning.

Since the end of last year, XLF has started to give up on its leading role. JdK RS-Momentum started to decline and the tail began to roll over. Last week, XLF moved from the leading...

READ MORE

MEMBERS ONLY

And The FAANG Winner For 2020 Is?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I believe all 5 FAANG stocks - Facebook (FB), Apple (AAPL), Amazon (AMZN), Netflix (NFLX) and Alphabet (GOOGL) - will end 2020 higher than they started. The question is, how much higher? Which one is THE stock to own? If you asked me which company I believe is simply the...

READ MORE

MEMBERS ONLY

Despite Recent Underperformance, the Treasury Bond ETF (TLT) is Starting to Look Interesting

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The stock market started its latest run to infinity (and beyond) in mid August and the 20+ Yr Treasury Bond ETF (TLT) just happened to peak a week or so later. Stocks and bonds were largely on the same page from February to August as both moved higher. Correlation changed...

READ MORE

MEMBERS ONLY

NIFTY to Stay in a Defined Range; RRG Chart Points Towards this Sector Potentially Bottoming Out

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

With geopolitical tensions subsiding, the market had a quiet week as it continued to post a small amount of incremental gains. The trading range also remained capped due to the market oscillating in a capped range. While showing no volatility at all, the NIFTY made minor advancements on the higher...

READ MORE

MEMBERS ONLY

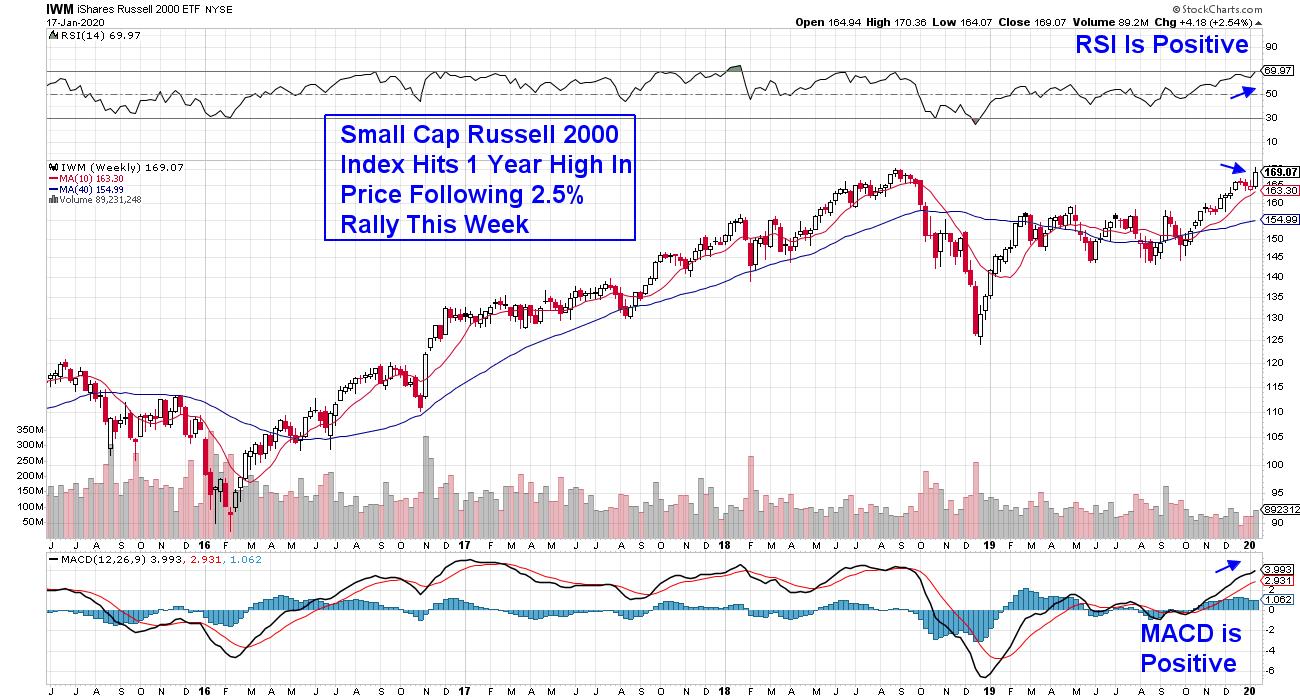

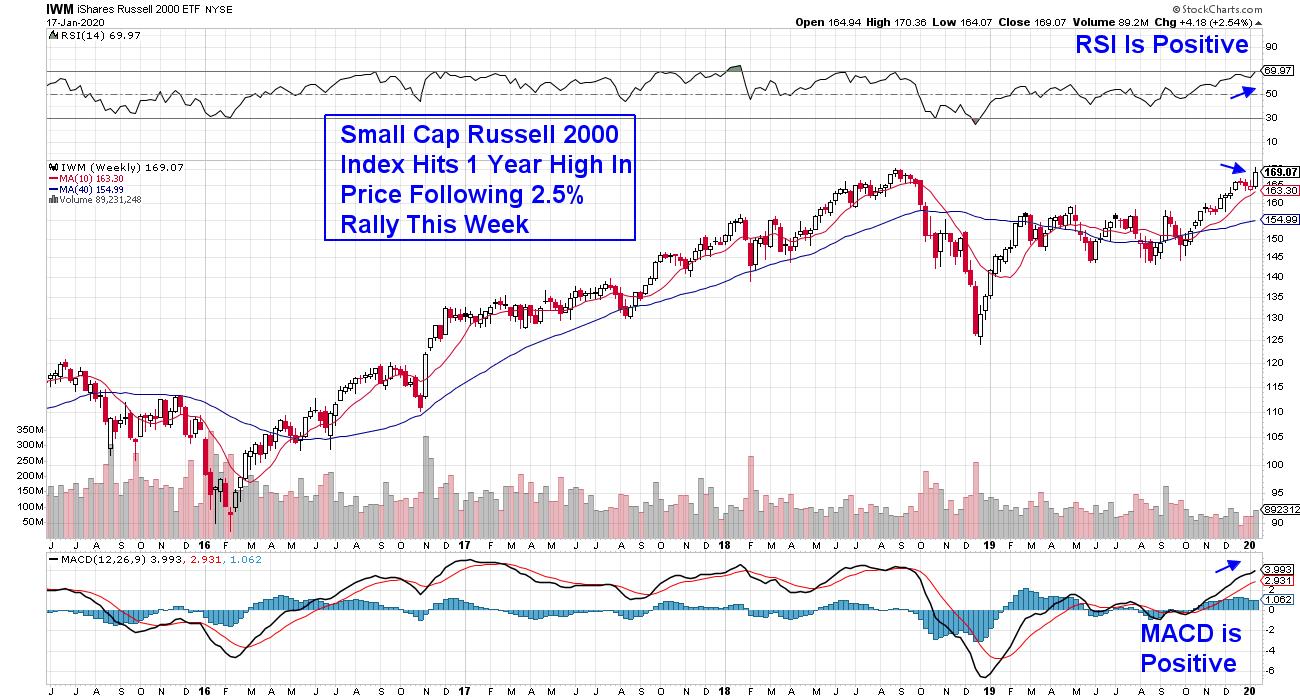

Are Small-Cap Stocks Ready for their Day in the Sun? 3 Stocks to Bank on if the Rally Continues

by Mary Ellen McGonagle,

President, MEM Investment Research

Last week, small-cap stocks were the highest performers, with the Russell 2000 gaining 2.5%. While the biggest gainers were upgraded Healthcare stocks following Wall Street's largest Medical conference, there were plenty of other areas that saw money flows signaling continued outperformance among these lower-market-cap companies.

With every...

READ MORE

MEMBERS ONLY

The Masses are Growing Too Bullish; I Smell a Short-Term Top

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

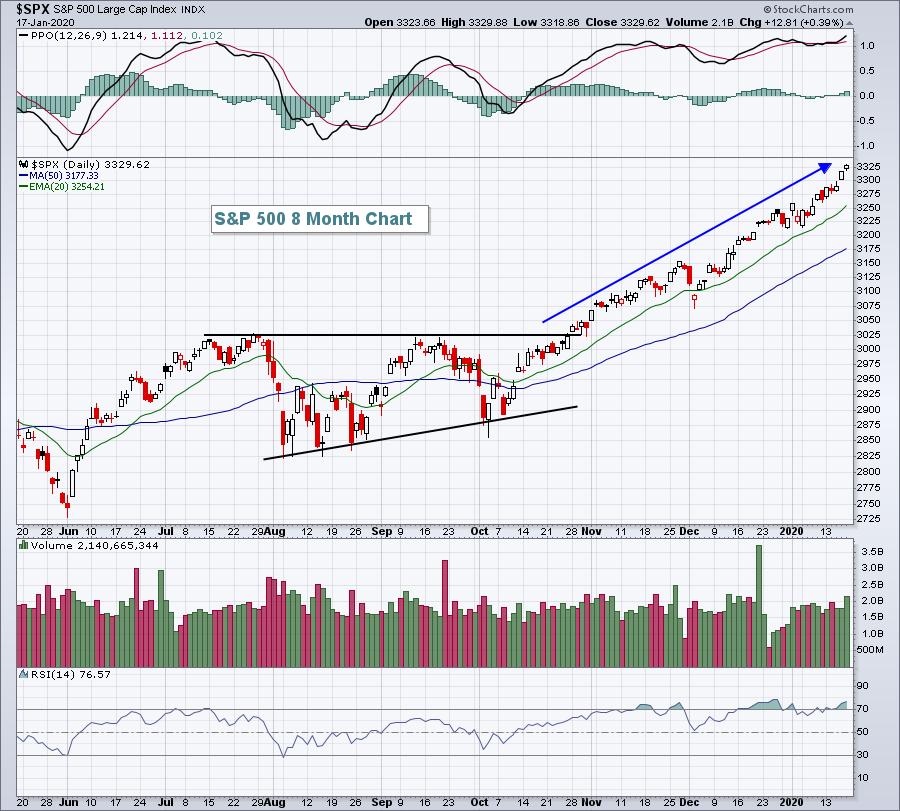

Calling tops in a secular bull market advance is not typically a wise thing to do, because it rarely works. But it's very difficult to ignore sentiment readings that border on the absurd. Three months ago, the S&P 500 broke out of a bullish ascending triangle...

READ MORE

MEMBERS ONLY

Dollar Index Reaches a Crucial Technical Juncture Point

by Martin Pring,

President, Pring Research

The Dollar Index has been rising in the last few sessions following its December decline, which has put it at a crucial technical juncture. Whichever way it breaks will have implications for commodities, gold and the relative performance of international equities to the US. A rising currency would have negative...

READ MORE

MEMBERS ONLY

Healthy Prognosis for Health Care

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While sectors like Technology of received much of the praise for leading the recent market upswing, the Health Care sector is comprised of a group of five industries that all have fairly attractive chart setups. (Earlier this week, on my daily closing bell show The Final Bar, I conducted a...

READ MORE

MEMBERS ONLY

MEM Edge TV: How to Play this Frothy Market

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares techniques that can help you successfully trade faster-moving stocks, as well as how to use clues from the 2018 "crash" to know when the uptrend has ended. She also reviews some news-driven areas of the...

READ MORE

MEMBERS ONLY

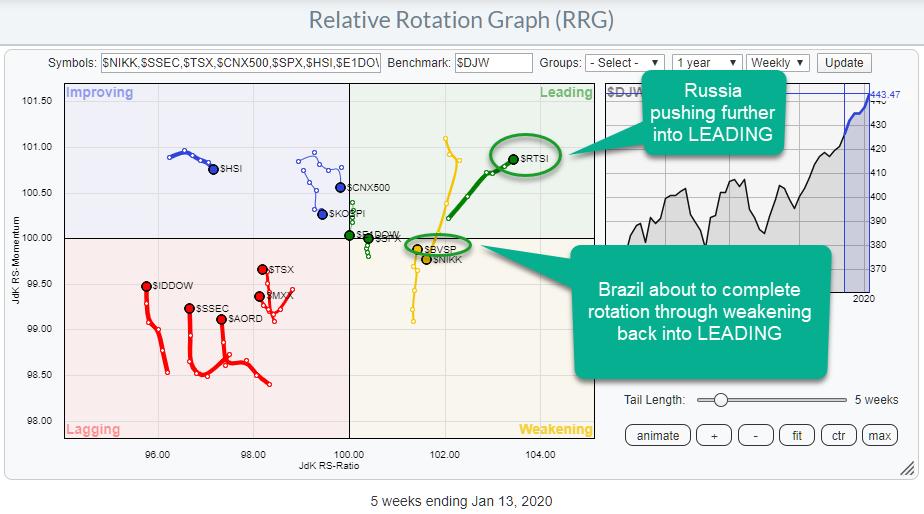

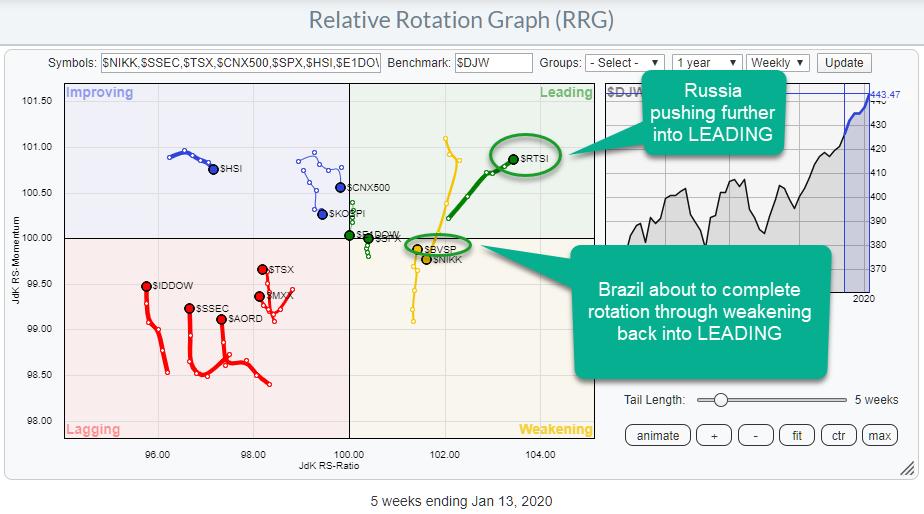

Brazil and Russia are Both Showing Promising Tails on Relative Rotation Graphs, But Russia Wins

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In my last article for the RRG blog, I wrote about the process of how to get from an idea, whether based on RRG analysis or something else, to a position in your portfolio. That post was geared towards the observation that Growth stocks are outperforming Value stocks and focused...

READ MORE

MEMBERS ONLY

Prepping For Another Very Strong Earnings Season

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In my last article, I discussed the possibility that we could see a short-term top form and many of those warning signs continue to persist. Of course, in a secular bull market advance, trying to predict short-term tops can be a constant disappointment as prices seemingly rise every single day....

READ MORE

MEMBERS ONLY

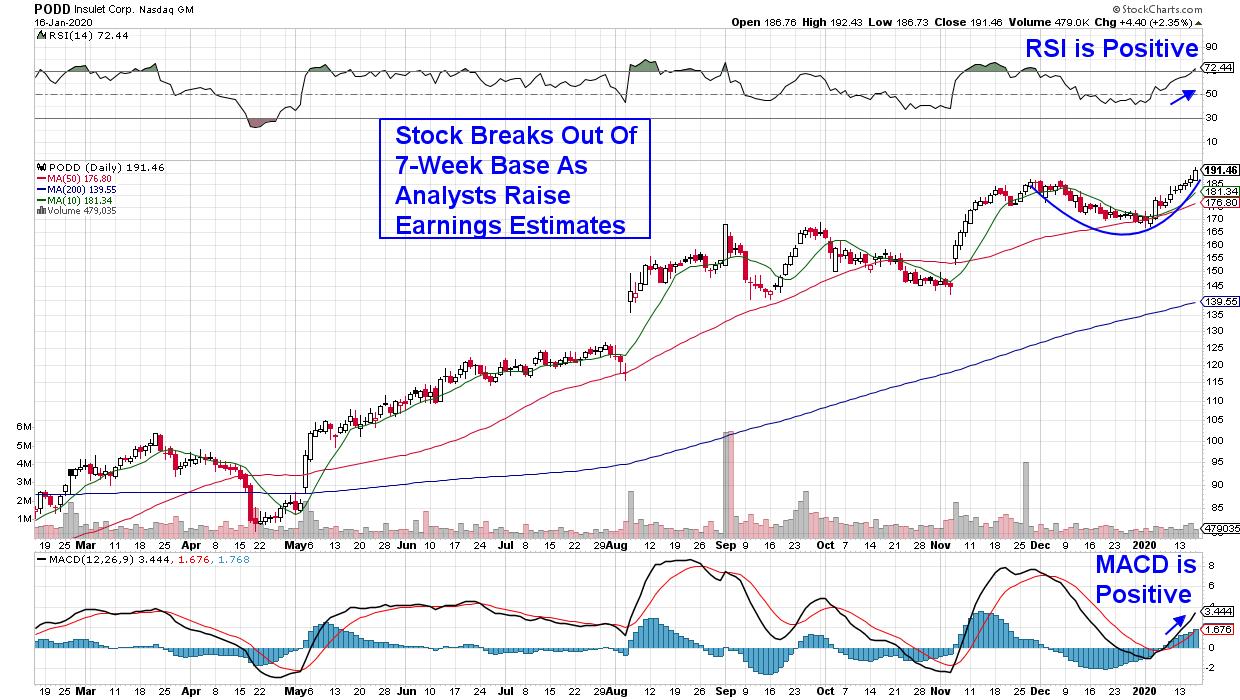

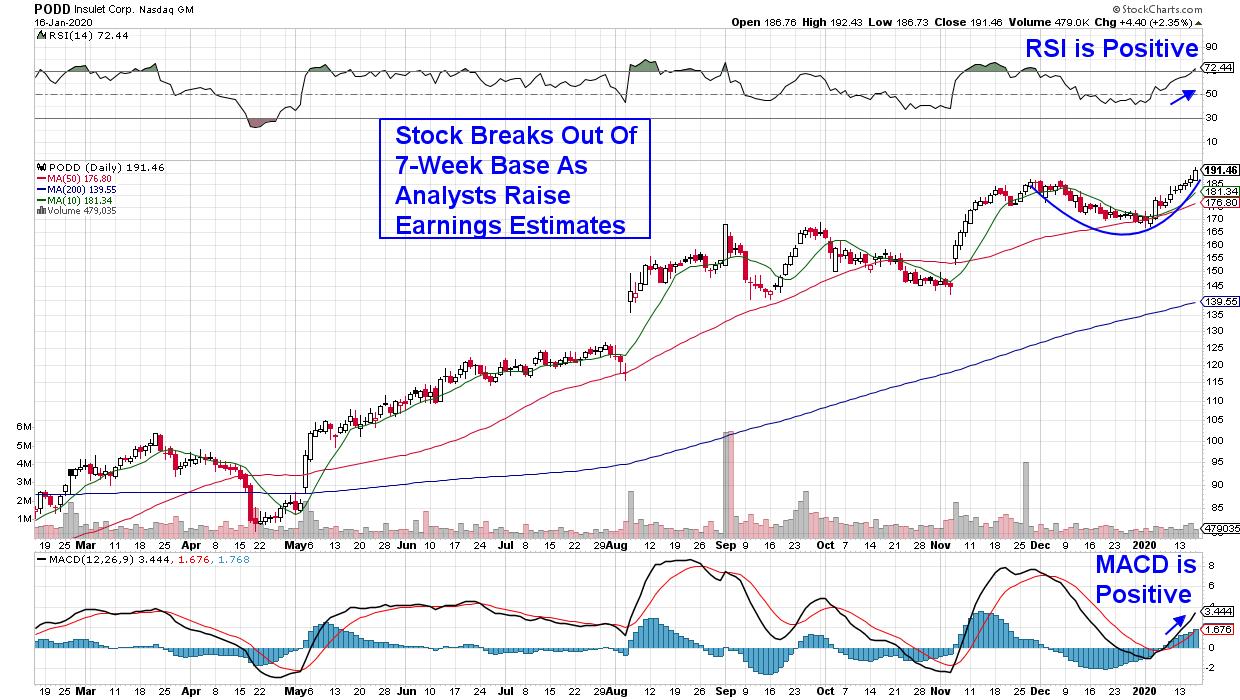

A Fresh Breakout Gives This Stock a Nice Shot in the Arm!

by Mary Ellen McGonagle,

President, MEM Investment Research

Insulet Corp. (PODD) had an exceptional year in 2019, as the stock powered to new highs on the heels of triple-digit growth during its first three earnings reports of the year. The insulin pump maker for diabetics peaked in price in December and has been consolidating ever since.

An increase...

READ MORE

MEMBERS ONLY

The Art of Forecasting

by Larry Williams,

Veteran Investor and Author

What is the future going to look like? In this special episode of Real Trading with Larry Williams, Larry presents the general roadmap for each market in 2020. His analysis takes into account the various seasonal influences (e.g. Christmas sales, production schedules, government action, etc.) and cycles (bond forecast,...

READ MORE

MEMBERS ONLY

SMALL CAPS AND TRANSPORTS LEAD TODAY'S RALLY -- RUSSELL 2000 iSHARES NEAR TEST OF 2018 PEAK -- RUSSELL 2000 GROWTH ISHARES HIT NEW RECORD -- WITH HELP FROM BIOTECHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSELL 2000 ISHARES NEAR NEW RECORD... Small cap stocks are having an unusually strong day today. And are nearing a potential new record. The weekly bars in Chart 1 show the Russell 2000 iShares (IWM) trading at the highest level in sixteen months; and nearing a test of its previous...

READ MORE

MEMBERS ONLY

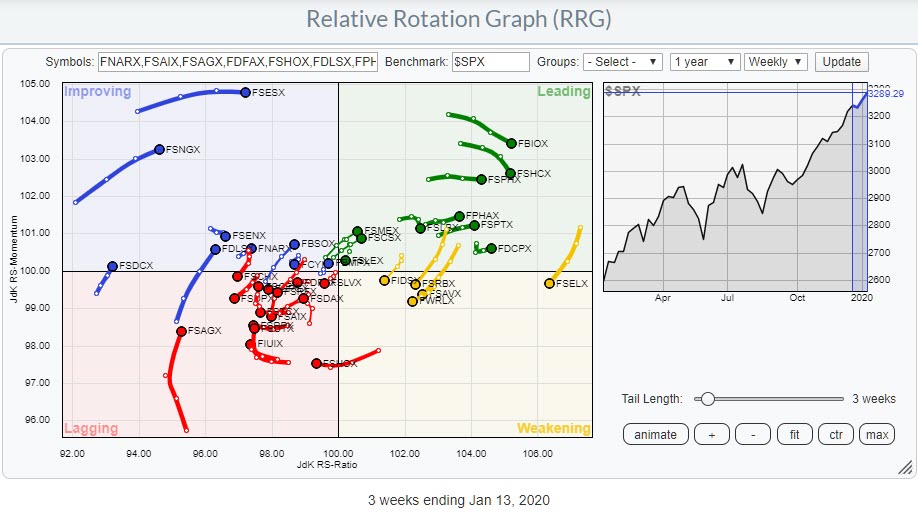

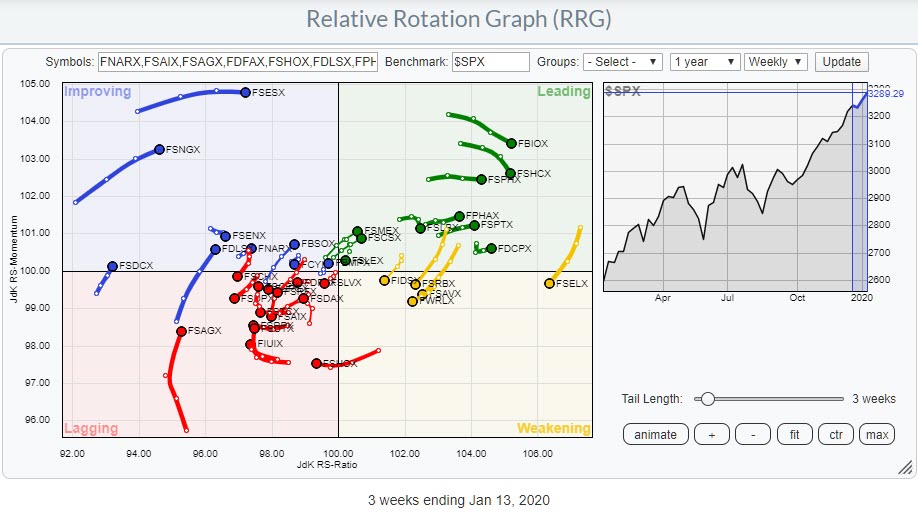

Are You Using Fidelity Funds in Your Portfolio? Here is the RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

If you are using Fidelity Funds, a Relative Rotation Graph showing the movement of all these funds can help you find the ones that are offering potential (for outperformance). The image above shows such a Relative Rotation Graph, holding 39 Fidelity Select funds.

Going over the funds on this chart,...

READ MORE

MEMBERS ONLY

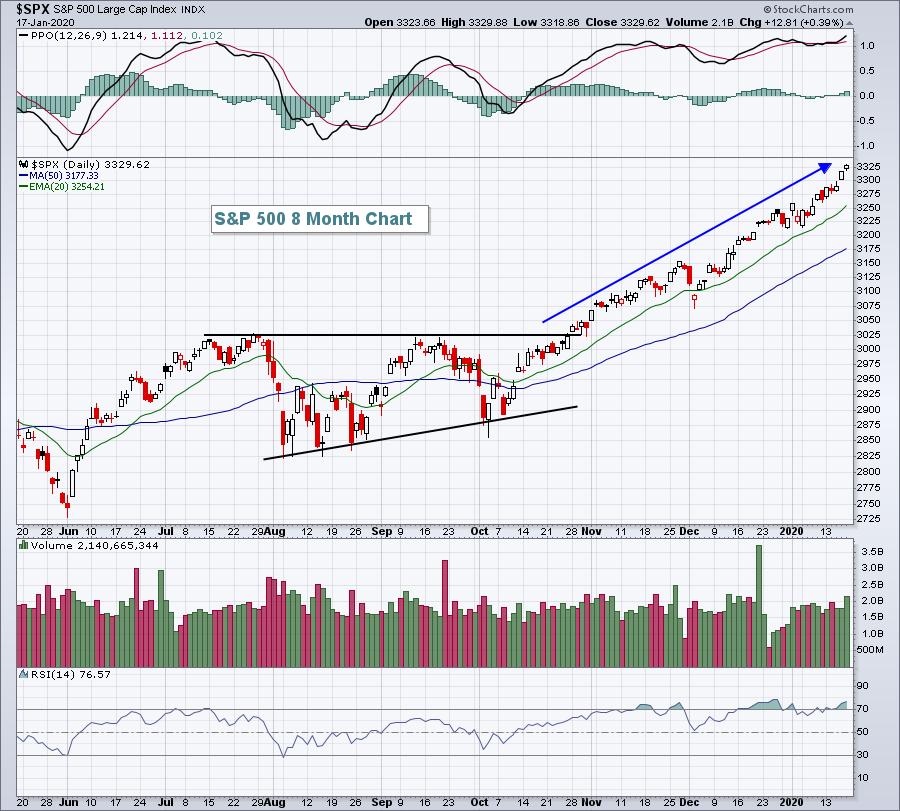

U.S. AND CHINA SIGN PHASE ONE OF TRADE DEAL -- MAJOR STOCK INDEXES HIT NEW RECORDS -- LOWER BOND YIELDS BOOST UTILITIES AND REITS -- BANKS HIT OVERHEAD RESISTANCE -- HOME CONSTRUCTION ISHARES HIT NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

SIGNING OF TRADE DEAL BOOSTS STOCKS... Stocks celebrated the U.S. and China signing phase one of their historic trade deal today with the three major stock indexes hitting another record high. Despite some late selling this afternoon, stock indexes ended in positive territory. Stock indexes are still dealing with...

READ MORE