MEMBERS ONLY

Double Notch Upgrade Brings a Breakout to this Leading Stock

by Mary Ellen McGonagle,

President, MEM Investment Research

It's been quite a year for leading Semiconductor stocks, as demand for their chip technologies has been instrumental in pushing them higher. Today, Bank of America gave a "double notch" upgrade to Skyworks (SWKS), which means they moved the stock from Underperform to a Buy and...

READ MORE

MEMBERS ONLY

DP Alert Mid-Week: Bonds are Sporting TWO Bullish Chart Patterns with New BUY Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

The market is beginning to act "toppy" again and could be forming a bearish double-top. In the meantime, the Dollar is falling fast, Oil is hitting resistance, Gold is limping along and Bonds are looking particularly bullish right now. Indicators are perking up somewhat, but overall there are...

READ MORE

MEMBERS ONLY

Why vs. What - Trade Walkthroughs

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave gives his thoughts on proper stock selection and how to learn it, with a particular emphasis on considering the "why" of a trade over the "what." He also explains his personal approach to picking great stocks, including how to...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Remains Bullish

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I discuss the current sector rotation from a weekly and a daily perspective and take a closer look at Financials. A short-term pullback appears possible in the SPY.

This episode of Sector Spotlight originally aired on December 10th, 2019.

Sector...

READ MORE

MEMBERS ONLY

INDEX OF STOCKS TIED TO COPPER REACHES EIGHT-MONTH HIGH -- FREEPORT MCMORAN IS ONE OF MARKET'S STRONGEST STOCKS -- RISING NUCOR STOCK REFLECTS STRONGER STEEL STOCKS -- GLOBAL METALS & MINING ISHARES RISE TO FIVE-MONTH HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

COPPER STOCKS REACH EIGHT-MONTH HIGH... My weekend message suggested that copper and stocks tied to it might be bottoming. This week's strong action by both appears to be confirming that optimistic view. Copper closed at a five-month high yesterday (and is trading higher again today). Materials are today&...

READ MORE

MEMBERS ONLY

Two Drug Retailers That Could Be Very Compelling Buys

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It wasn't too long ago that no one wanted to own a drug retailer ($DJUSRD), but after the group pushed to 9 month absolute and relative highs, a few stocks in the group suddenly became fashionable once again. Perhaps the biggest turnaround came in the form of PetMed...

READ MORE

MEMBERS ONLY

Investing with the Trend

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This is a sales pitch for my latest and last book, Investing with the Trend. Instead of hearing from me, I have included a few actual reviews from readers. I basically tell people that I dumped 40+ years of experience in this book. There are many things in this book...

READ MORE

MEMBERS ONLY

DP Diamonds - Announcing Reader Request Thursdays

by Erin Swenlin,

Vice President, DecisionPoint.com

I've decided that, on Thursdays, I will take a look at some reader-requested "diamonds." With that in mind, I'm challenging my readers to find their own "diamonds in the rough" and send the symbol to me. I will pick five winners to...

READ MORE

MEMBERS ONLY

DP Show: NEW Sector ChartList + Carl Reviews Most-Active Stocks (AUD, MU and More)

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Erin unveils the new DecisionPoint Sector ChartList, which combines the Golden and Silver Cross Indexes, Stocks Above 20/50-EMAs and the SCTR! She then studies XLE, XLU, XLRE and XLK in detail. Meanwhile, Carl gives the lowdown on DP Indicator action, before analyzing some of...

READ MORE

MEMBERS ONLY

This ETF Will Likely Be A Great Stocking Stuffer

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The S&P 600 Small Cap Index ($SML) broke out again on Friday, closing above 1000 for the first time since October 9, 2018. Its all-time high close is 1098, so the index still has a lot of work to do. I believe this work is likely to be...

READ MORE

MEMBERS ONLY

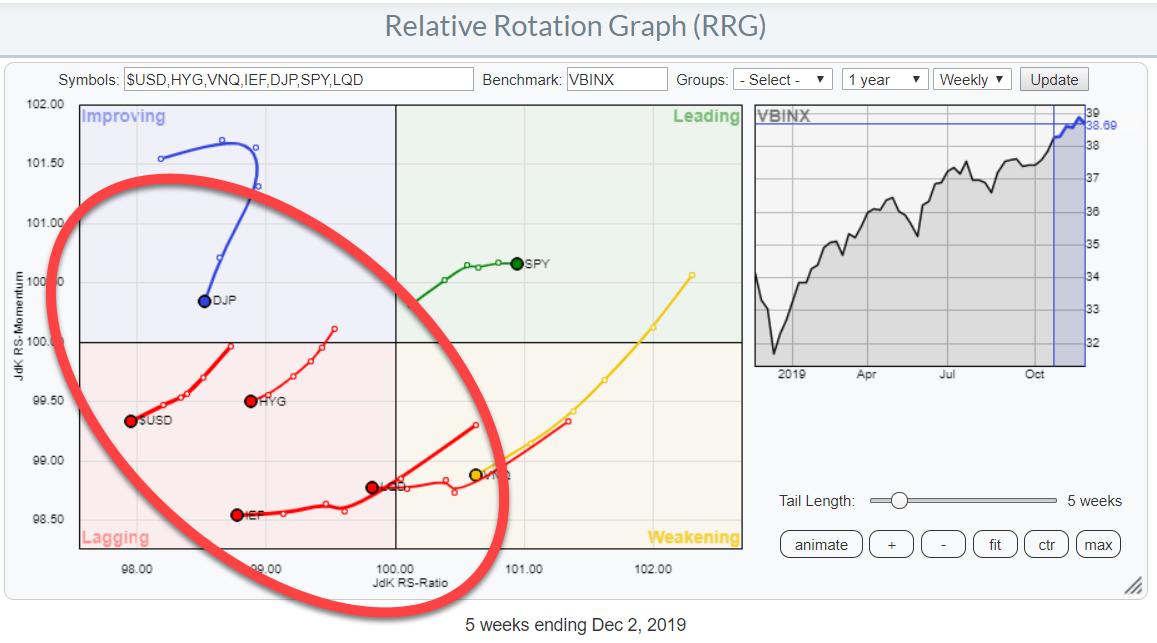

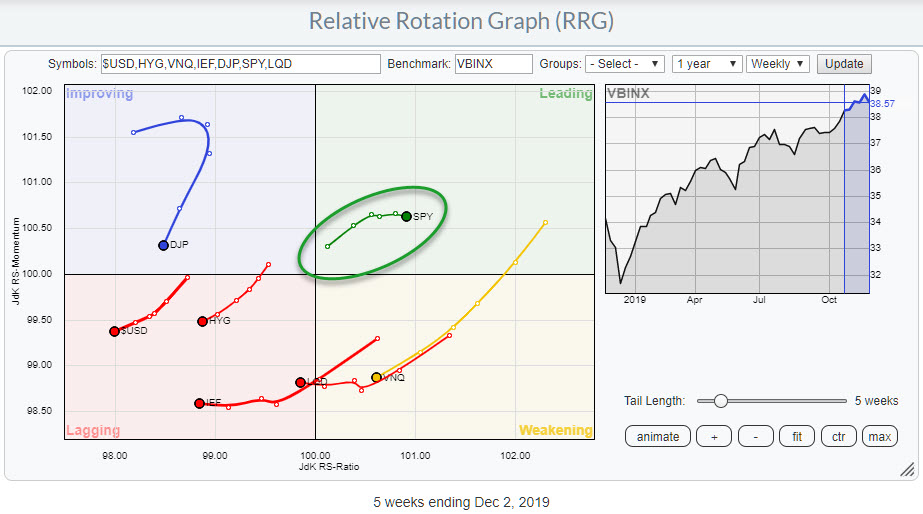

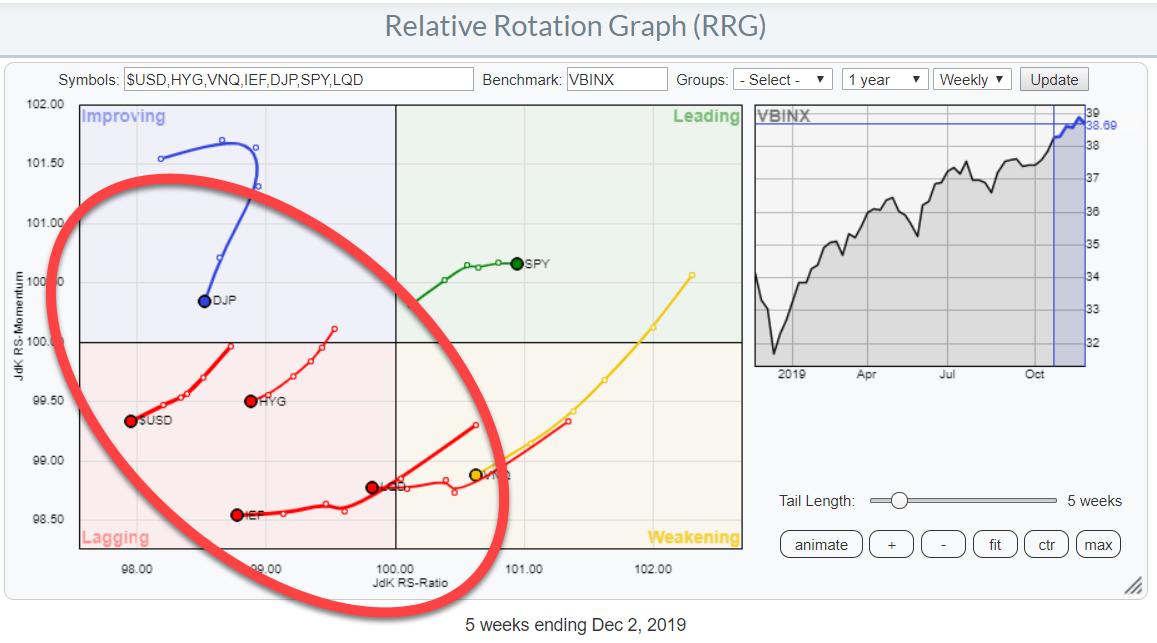

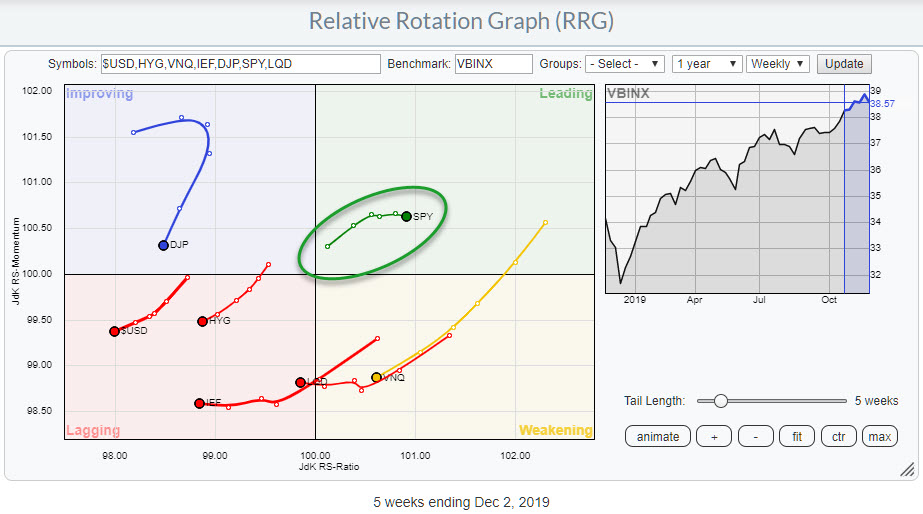

If a 100% Investment In Stocks is Too Much, Where Can You Find Diversification?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This article also appeared in our ChartWatchers newsletter (12/7).

Last Wednesday, I published an article in the RRG Charts blog titled "Stocks Remain The Only Asset Class Inside The Leading Quadrant Going into December". As the title suggests, that article primarily looks at the rotation for asset...

READ MORE

MEMBERS ONLY

COPPER AND GOLD HAVE BEEN TRENDING IN OPPOSITE DIRECTIONS ALL YEAR -- FALLING BOND YIELDS EARLIER IN THE YEAR FAVORED GOLD -- THE RECENT RISE IN THE 10-YEAR TREASURY YIELD FAVORS COPPER -- COPPER AND ITS MINERS MAY BE FORMING BOTTOMS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STRONG JOBS REPORT ON FRIDAY BOOSTED COPPER BUT HURT GOLD...Friday's impressive jobs report took a lot of traders by surprise resulting in strong buying of stocks; which was accompanied by selling of Treasury bonds and other safe havens like gold. Riskier assets gained which included copper prices....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Crucially Poised; RRG Shows Loss of Momentum Among a Few Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In contrast to the one that came before, this past week gave back all its gains while ending near the low point of the trading range. The markets were sitting on the verge of a breakout, but that did not amount to anything as the markets refused to break above...

READ MORE

MEMBERS ONLY

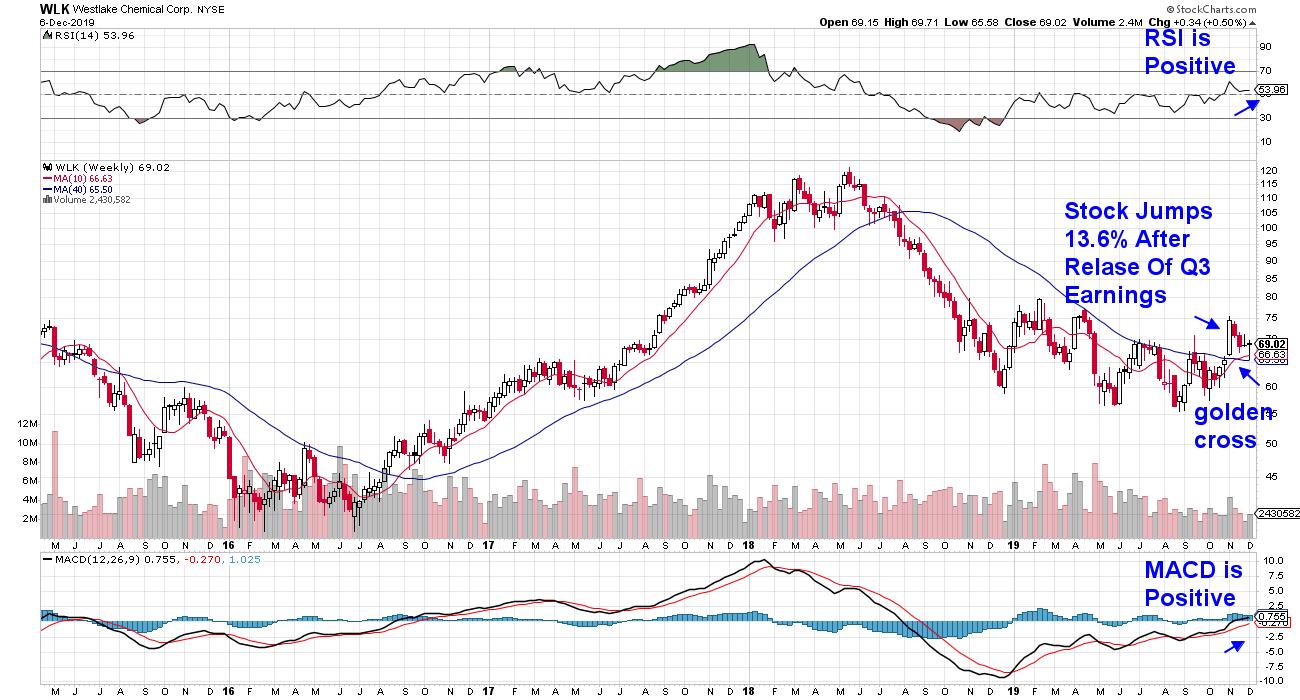

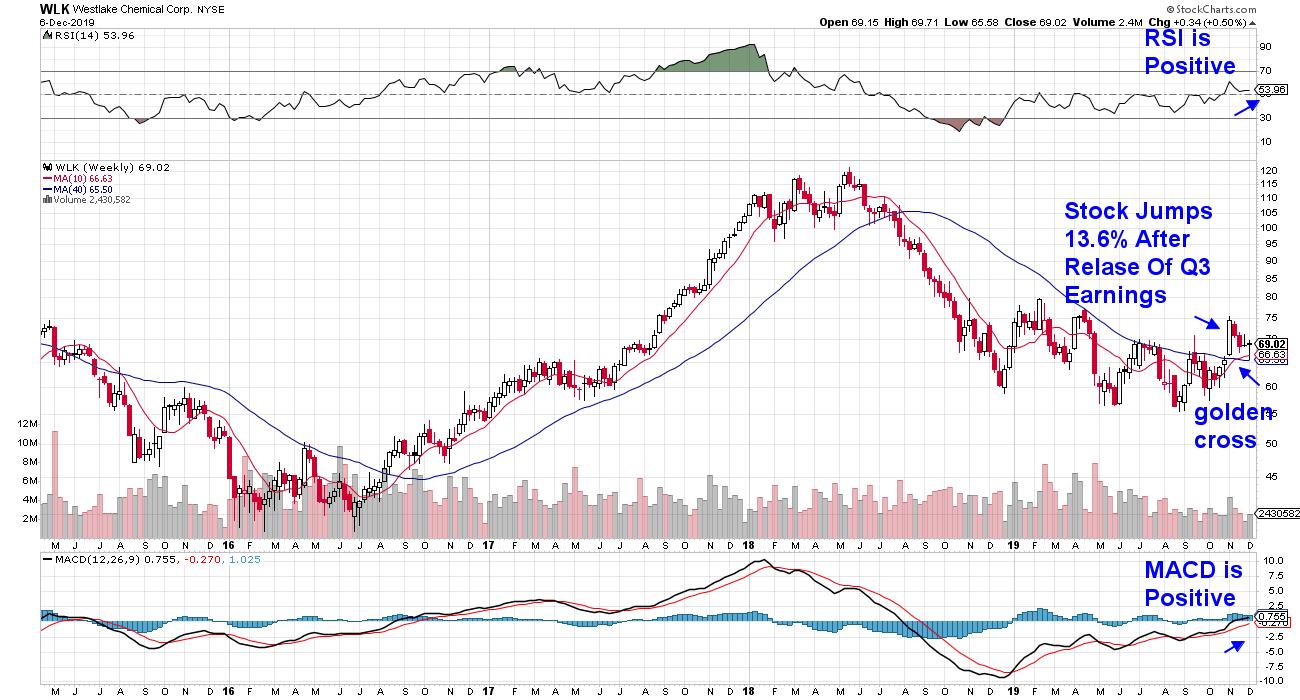

Goldman Sachs has A Laggard Stocks Strategy for Early 2020 - I've Highlighted Some of the Better-Looking Charts

by Mary Ellen McGonagle,

President, MEM Investment Research

For 17 years now, Goldman Sachs (GS) has been following a strategy at year-end of picking up battered stocks that have underperformed the markets and holding them into the first 3 months of the new year. This "laggard strategy" has outperformed the S&P 500 over 65%...

READ MORE

MEMBERS ONLY

To Profit from Trading, You Must Allow Trades to Come To You; Don't Chase

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One of the great features of our service at EarningsBeats.com is maintaining a Strong Earnings ChartList (SECL) for our members and running scans against it daily to identify trade setups. I do a lot of research every quarter, tracking those companies that beat Wall Street consensus estimates as to...

READ MORE

MEMBERS ONLY

MEM Edge TV: Benefitting From the Pullback in Leadership Stocks

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews stock candidates from leadership groups that pulled back last week and shares how you can screen for them. In addition, she shared top stocks from the rotation into Financials and discusses more big earnings still due to...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Participation Not Robust but Adequate for the Moment

by Carl Swenlin,

President and Founder, DecisionPoint.com

A good way to gauge participation in a particular market move is to check the percentage of stocks that are above their 20/50/200EMAs. The 20EMA indicator is short-term and most responsive, and we can see the deterioration that took place prior to some of the important price tops...

READ MORE

MEMBERS ONLY

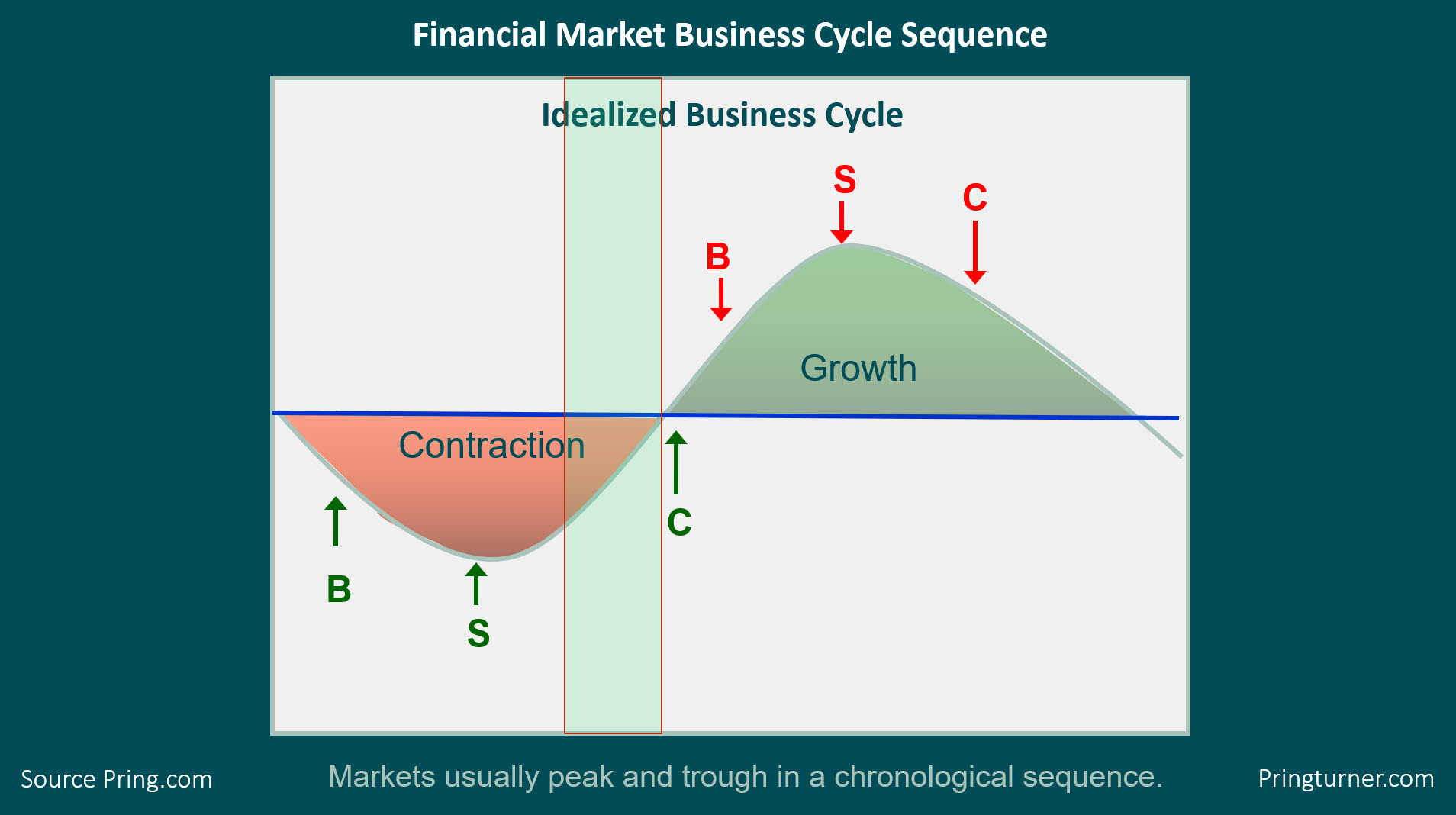

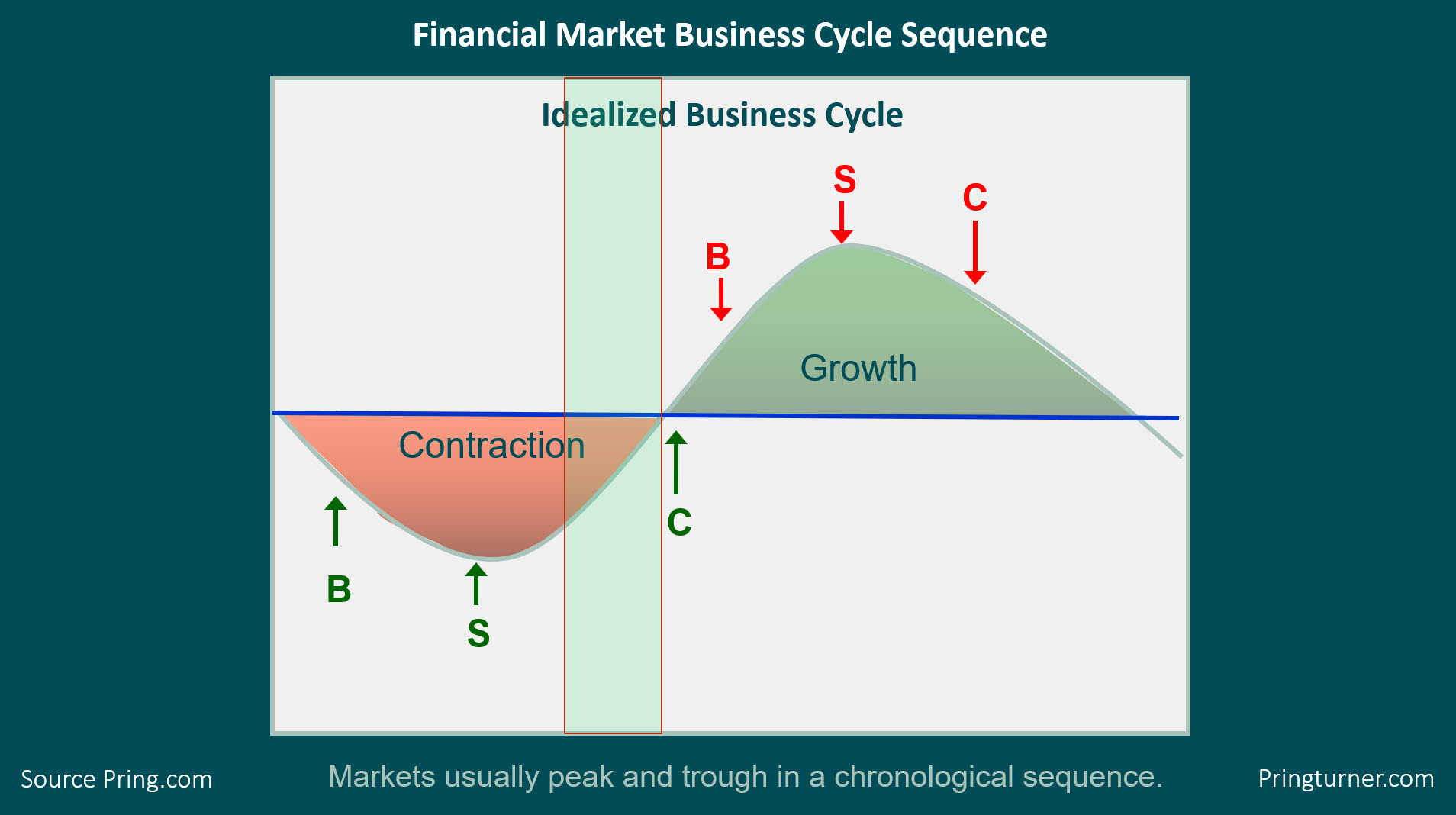

It's Time To Watch For A Bottom In Commodities

by Martin Pring,

President, Pring Research

In my Monthly Market Rounduplast week, I repeated a talk that I recently gave at the CMT Summit in Mumbai. The talk in question began with an outline of the approach we take at Pring Turner for our sub-advisory services and in the Intermarket Review, my monthly publication that analyses...

READ MORE

MEMBERS ONLY

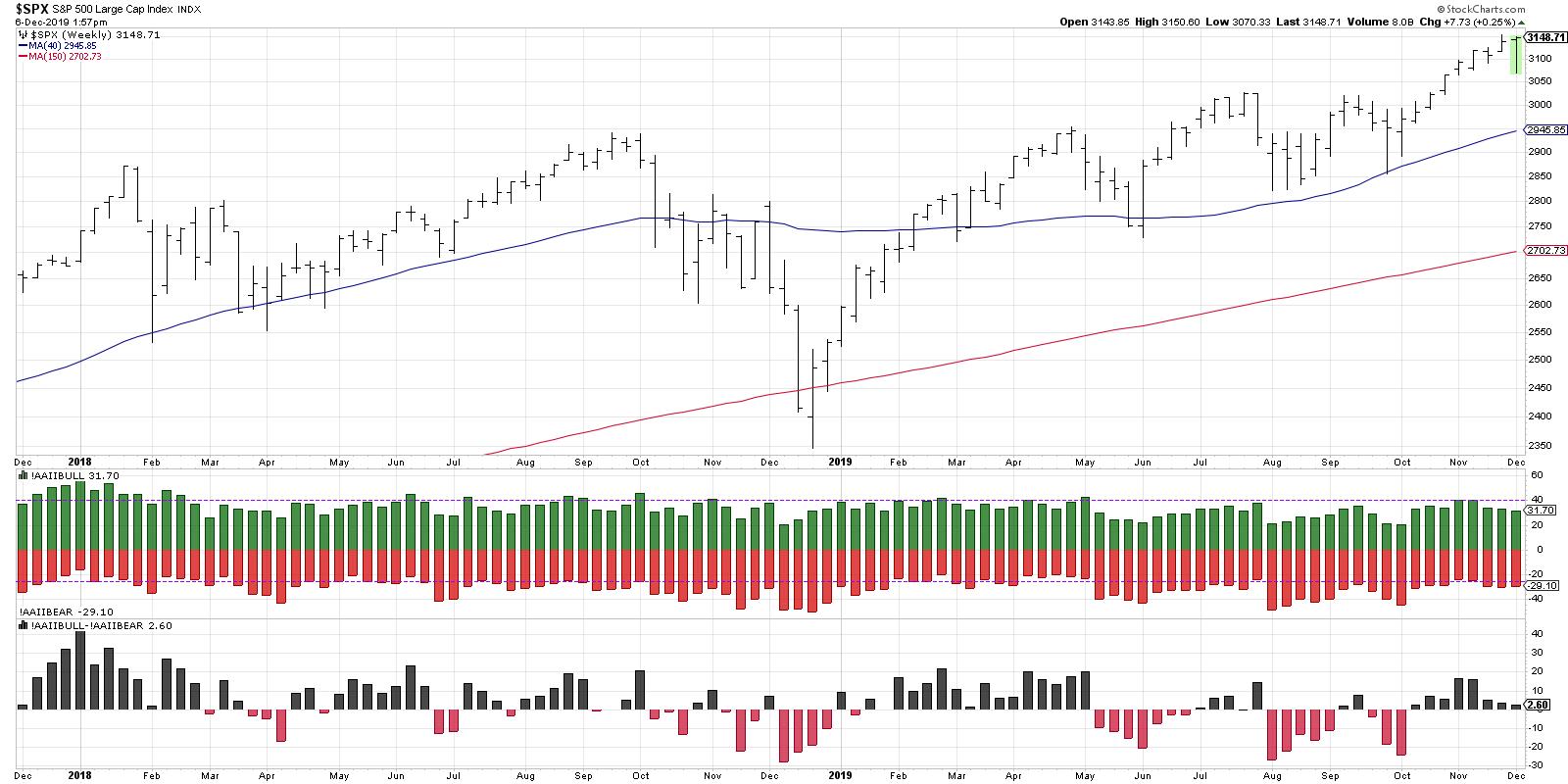

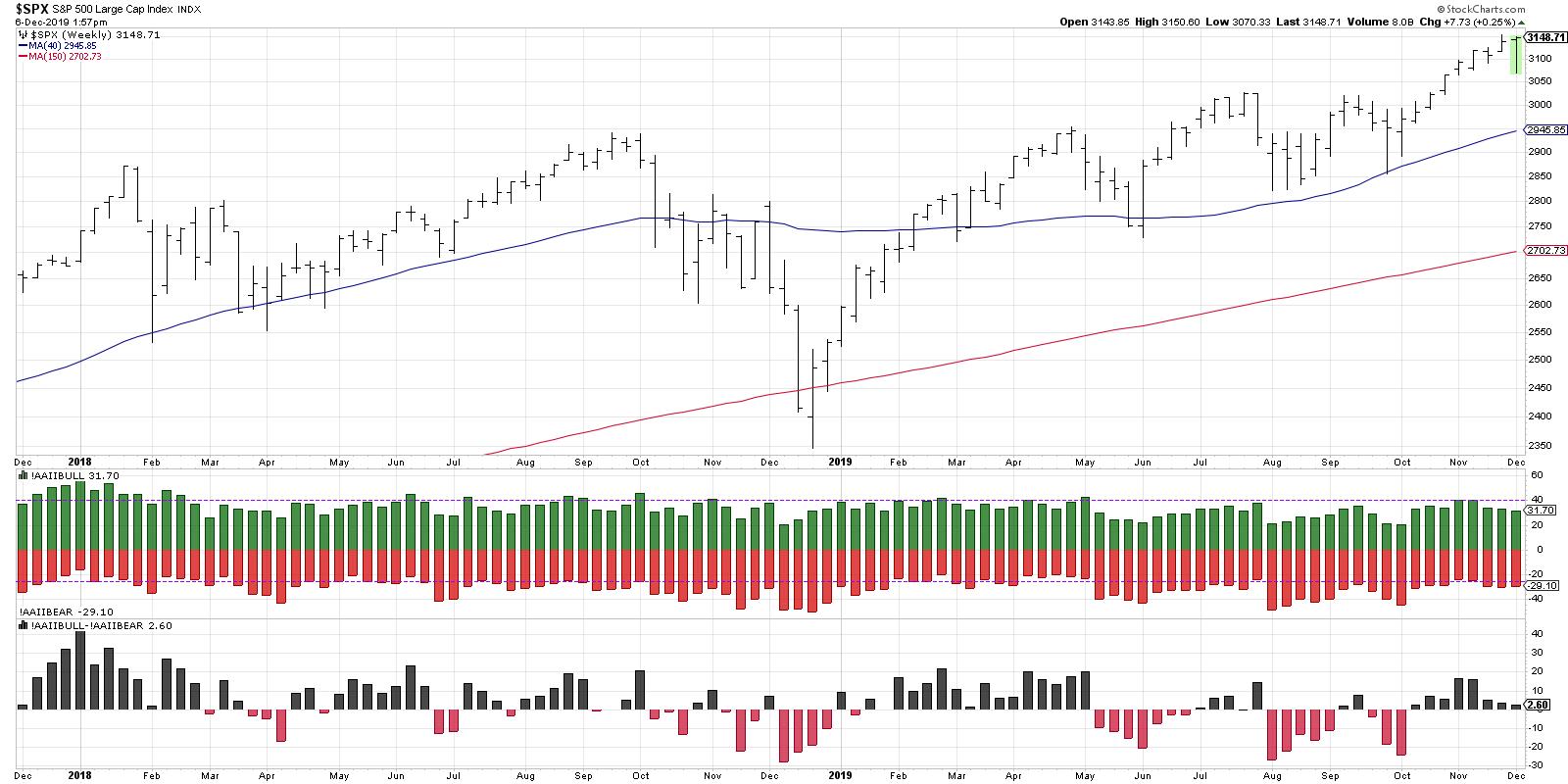

Stock Market Rallies Under Narrowing Sentiment

by David Keller,

President and Chief Strategist, Sierra Alpha Research

During an interview I took part in for a podcast this week, I was asked to define technical analysis. I immediately provided John Murphy's summary that technical analysis is the study of "market action" and is based on a visual analysis of price and sentiment.

After...

READ MORE

MEMBERS ONLY

It's Time To Watch For A Bottom In Commodities

by Martin Pring,

President, Pring Research

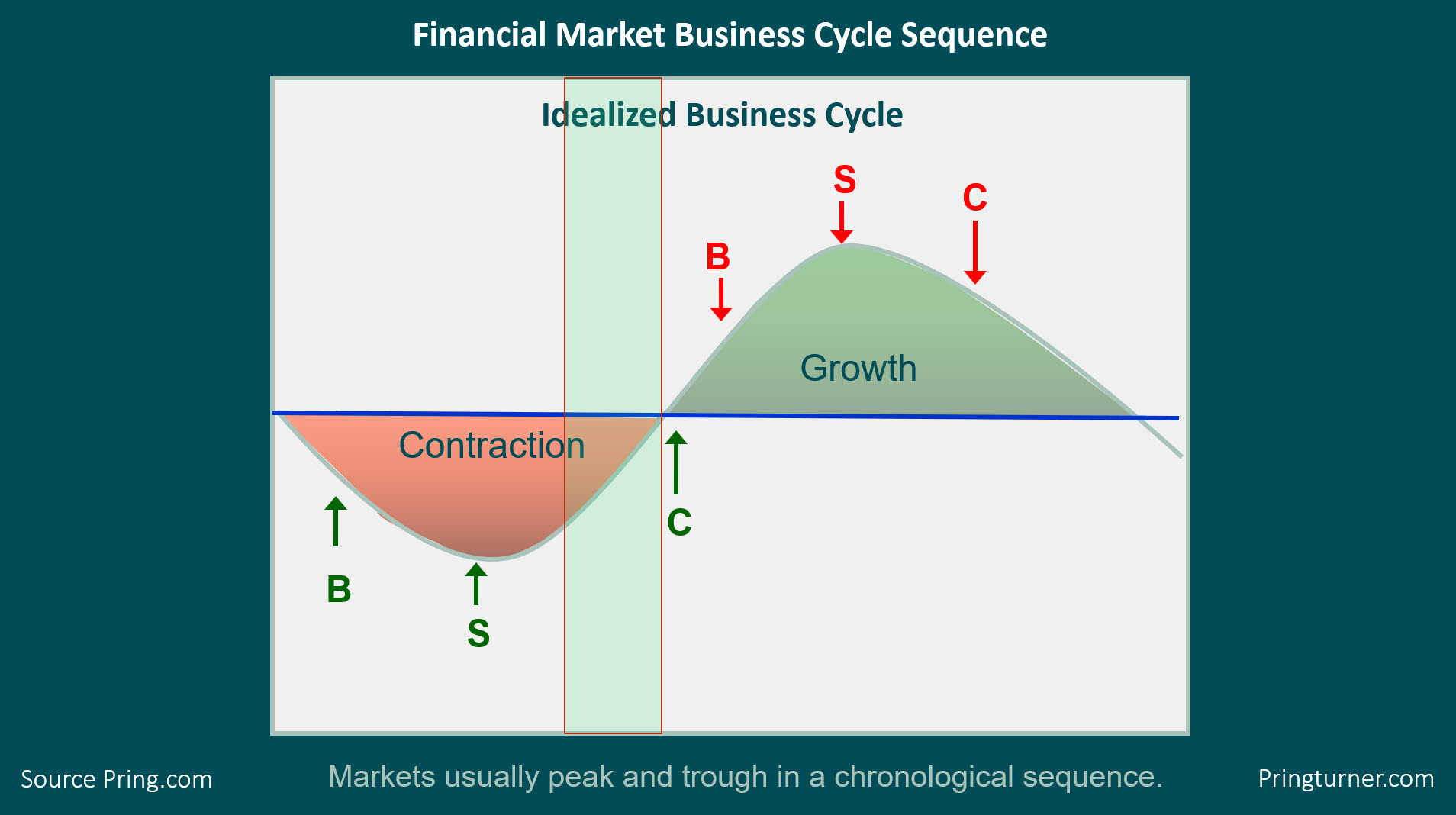

* The Markets and the Business Cycle

* Using Other Markets to Forecast Commodities

The Markets and the Business Cycle

In my Monthly Market Roundup last week, I repeated a talk that I recently gave at the CMT Summit in Mumbai. The talk in question began with an outline of the approach...

READ MORE

MEMBERS ONLY

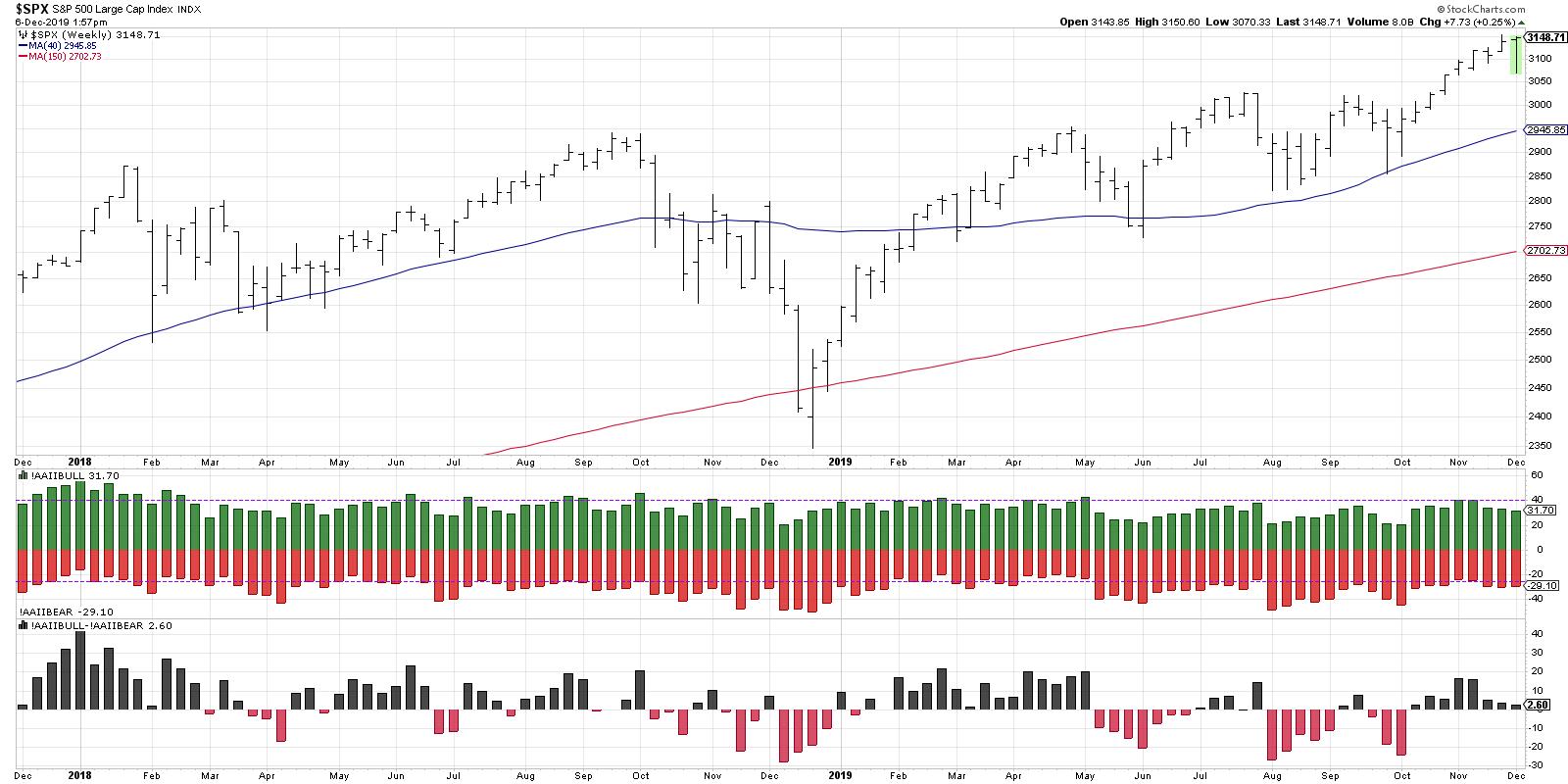

Stock Market Rallies Under Narrowing Sentiment

by David Keller,

President and Chief Strategist, Sierra Alpha Research

During an interview I took part in for a podcast this week, I was asked to define technical analysis. I immediately provided John Murphy's summary that technical analysis is the study of "market action" and is based on a visual analysis of price and sentiment.

After...

READ MORE

MEMBERS ONLY

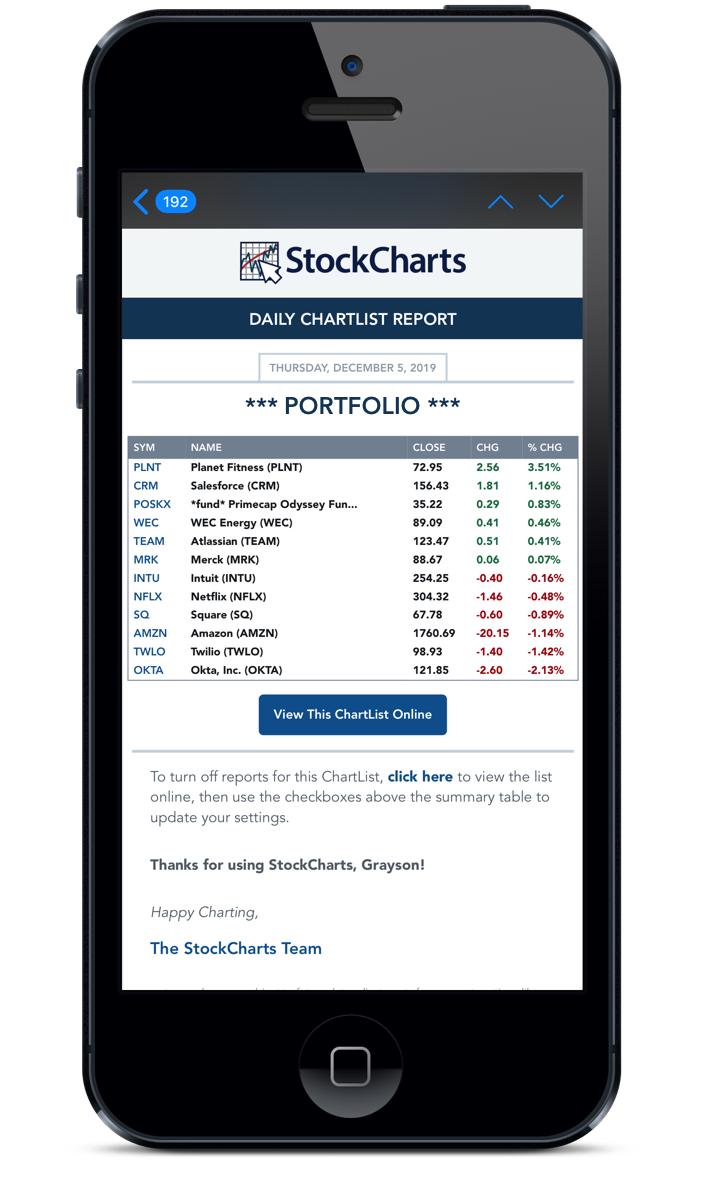

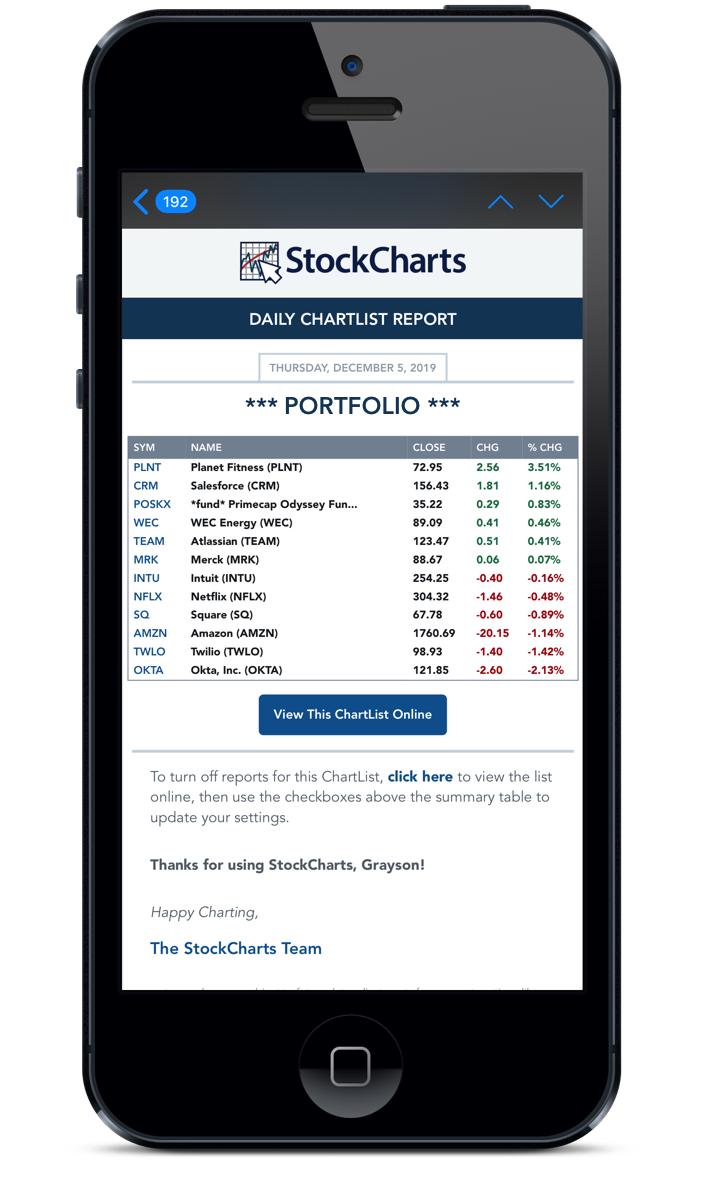

Introducing "ChartList Reports" - Daily and Weekly Performance Summaries Sent Right To Your Inbox

by Grayson Roze,

Chief Strategist, StockCharts.com

I'll let you in on a little secret. My favorite feature on StockCharts, hands down, is ChartLists. Second only to my charts themselves, ChartLists are the thing I rely on most heavily by far.

As an active investor, I use ChartLists throughout every stage of my process. I...

READ MORE

MEMBERS ONLY

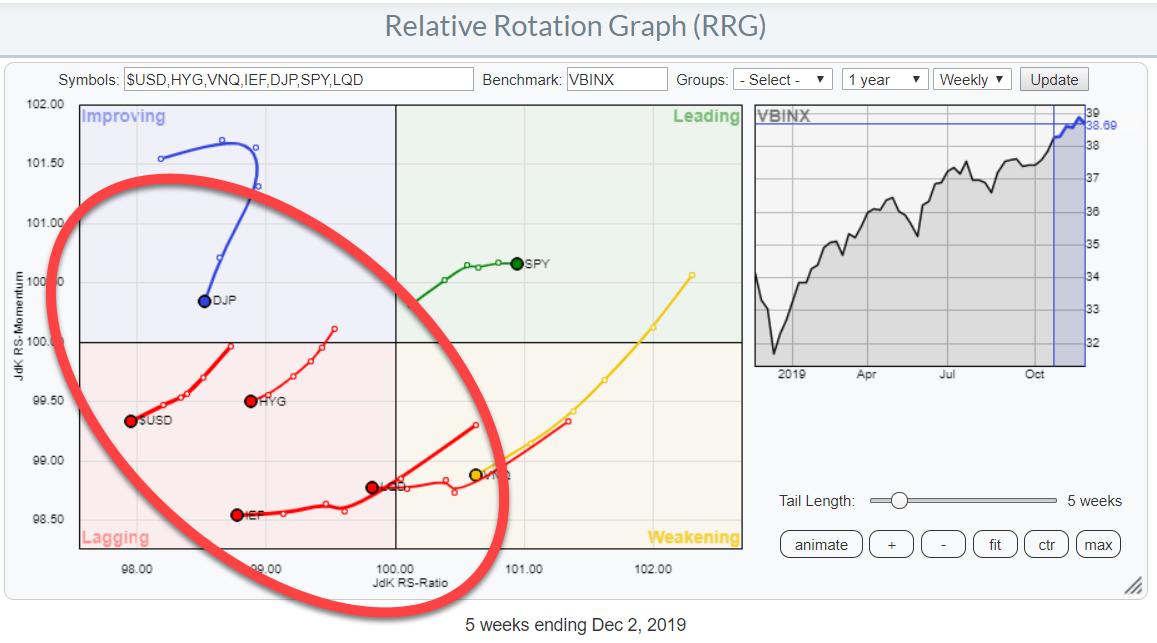

Where Should You Go if You Don't Want to be 100% Invested in Stocks?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last Wednesday, I published an article in the RRG blog titled "Stocks Remain The Only Asset Class Inside The Leading Quadrant Going into December". As the title suggests, that article is primarily looking at the rotation for asset classes, with an in-depth look into the long-term chart of...

READ MORE

MEMBERS ONLY

STOCKS JUMP ON STRONG JOBS REPORT -- RUSSELL 2000 ISHARES HIT NEW 52-WEEK HIGH -- ENERGY STOCKS BOUNCE WITH CRUDE OIL ON OPEC CUTS -- ALL SECTORS ARE GAINING WITH FINANCIALS AND HEALTHCARE HITTING NEW RECORDS -- T. ROWE PRICE HITS NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES JUMP ON STRONG JOBS REPORT... A strong November jobs report has stocks jumping today. The three charts below show the three major U.S stock indexes gapping higher today; and pushing them further above their 20-day moving averages. The erases the earlier setback seen on Tuesday. And the...

READ MORE

MEMBERS ONLY

Does A Bull Market Depend On Leadership From Growth Stocks? You Might Be Surprised

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

My favorite ratio to watch in order to gauge the market's appetite for growth stocks is the Russell 1000 Growth ETF vs. the Russell 1000 Value ETF (IWF:IWD). When this ratio is moving higher, we want our portfolio to be weighted more toward growth. When the opposite...

READ MORE

MEMBERS ONLY

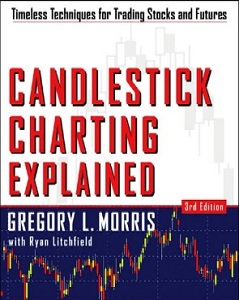

Candlestick Charting Explained

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

In 1988 I attended an MTA event at the Camelback Inn in Phoenix. At the conference there was a large contingent of Japanese traders present and they presented their charting techniques. It was the first time I had ever heard of "Hi Ashi," which is what the Japanese...

READ MORE

MEMBERS ONLY

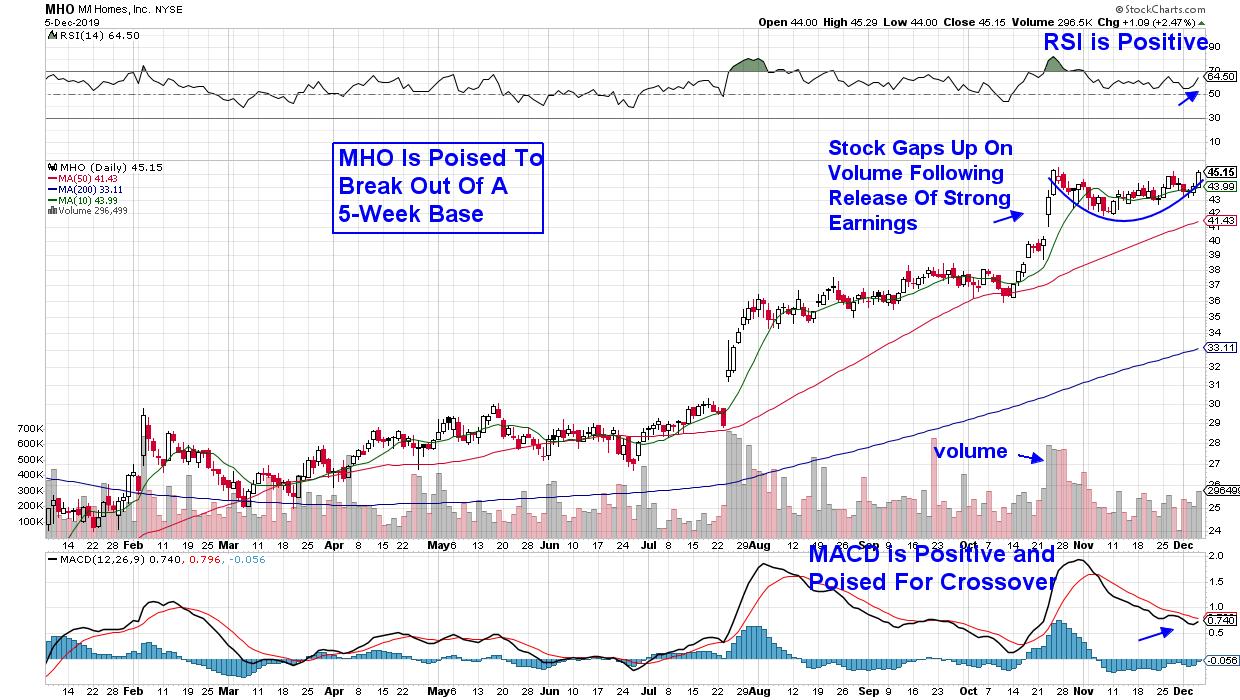

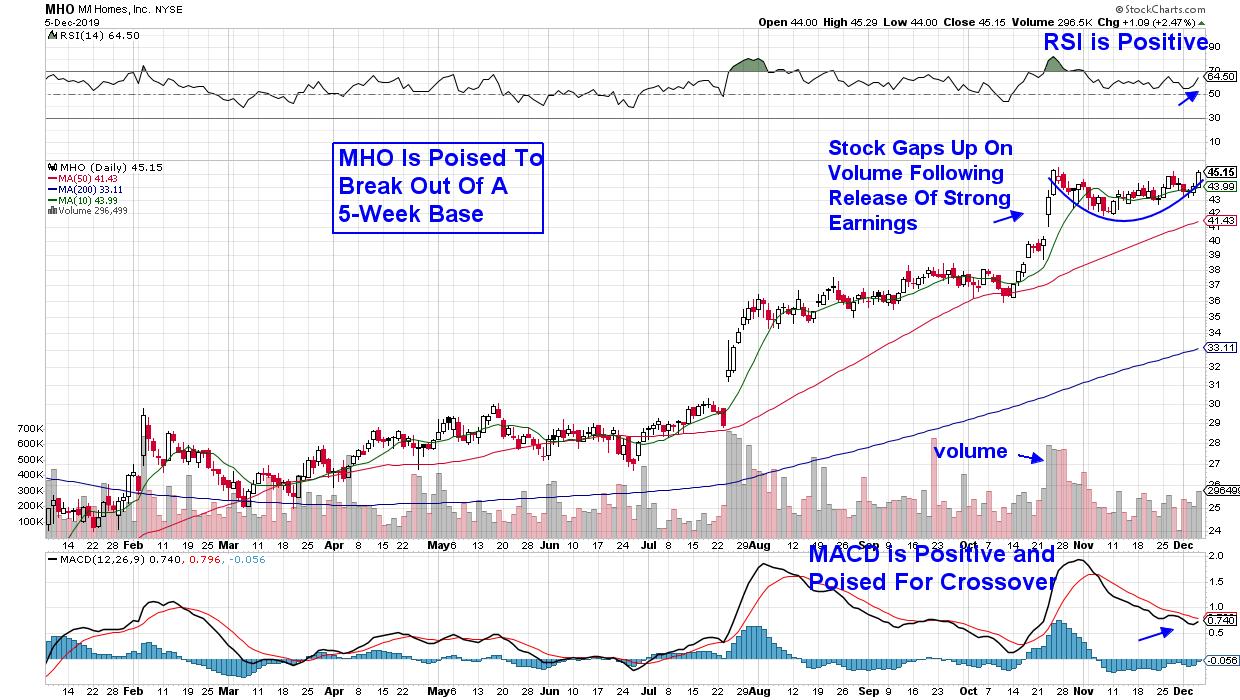

This Leading Stock's Pullback has Presented a Great Opportunity

by Mary Ellen McGonagle,

President, MEM Investment Research

Home Building stocks have had quite the year as a low interest rate environment, coupled with reduced inventory, has kept demand high for newly built homes. The resilient job market has also brought new buyers to the market. Many Home Builders were in strong uptrends until last month's...

READ MORE

MEMBERS ONLY

ASSET MANAGERS LEAD FINANCIALS HIGHER -- THAT INCLUDES NORTHERN TRUST AND BLACKROCK -- MATERIALS SPDR BOUNCES OFF CHART SUPPORT -- NEWMONT GOLDCORP AND FREEPORT MCMORAN LEAD IT HIGHER -- A WEAKER DOLLAR MAY BE BOOSTING COMMODITY MARKETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

ASSET MANAGERS LEAD FINANCIALS HIGHER...Financials continue to show new market leadership. Most attention in that sector, however, is usually paid to bank stocks which are its biggest part. Some other financial groups are also doing well. Like asset managers which have been the strongest part of the financial sector...

READ MORE

MEMBERS ONLY

Christmas Trades

by Larry Williams,

Veteran Investor and Author

In this engaging episode of Real Trading with Larry Williams, Larry takes a look at the Christmas Influence, looking at how the largest retail event of the year influences the markets. In addition, Larry talks the US Stock Market, Gold, bonds and Bitcoin (BTCUSD), before capping off by answering a...

READ MORE

MEMBERS ONLY

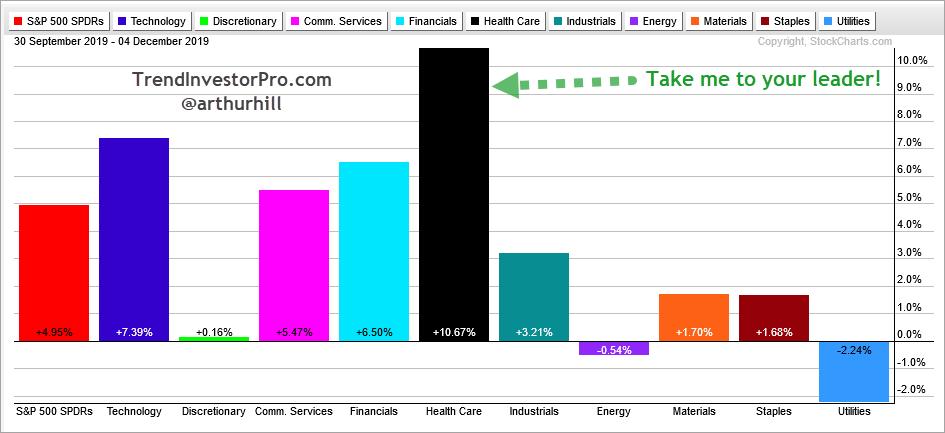

This Healthcare Stock Looks Poised to Play Catch Up with a Big Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

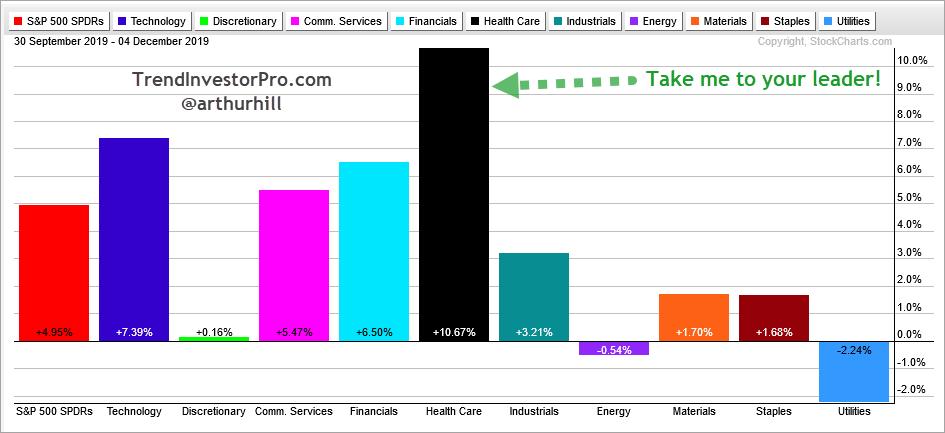

Chartists looking for winning stocks should start with leading sectors and industry groups. Having a sector or industry tailwind can greatly improve the odds for a winning trade or investment. Programming note: There is a special announcement at the end of this commentary.

Looking at the sector charts and sector...

READ MORE

MEMBERS ONLY

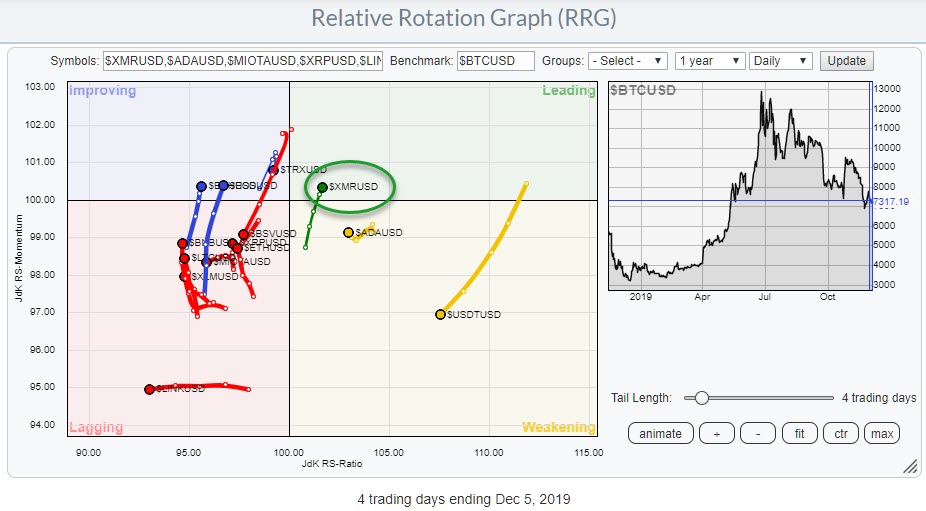

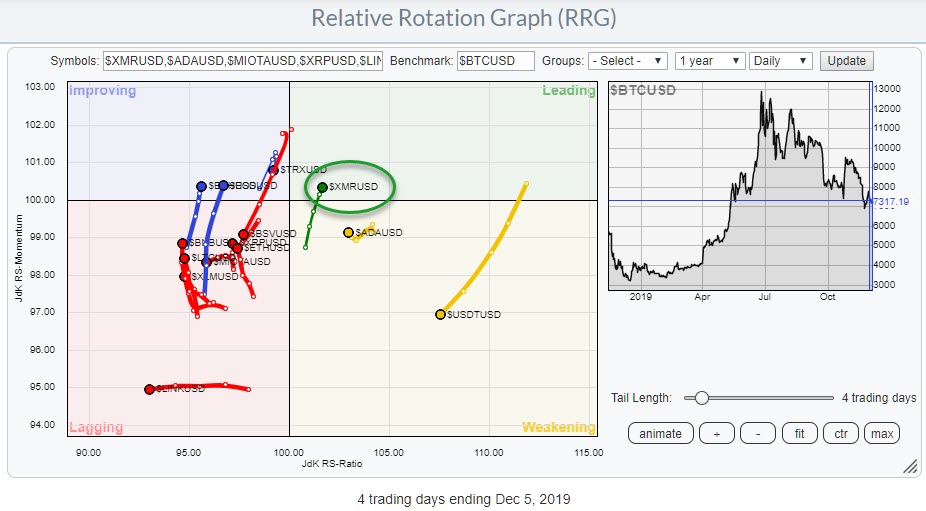

Keeping an Eye on Monero (XMR) as it Enters the Leading Quadrant on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This week is Crypto Week! Well, at least it is on StockCharts TV. Thus, I figured it would also be a good idea to once again bring to your attention to the fact that we can run RRG charts for cryptocurrencies as well.

As a quick reminder, you can find...

READ MORE

MEMBERS ONLY

Bitcoin: Is It Real? Should You Trade It?

by Dave Landry,

Founder, Sentive Trading, LLC

Are cryptos real? What does "real" even mean? In this edition of Trading Simplified, Dave gives his contribution to StockCharts TV's Crypto Week, delving into the questions surrounding trading cryptocurrencies, primarily Bitcoin ($BTCUSD). Afterwards, he presents the mother of all mystery chart reveals. This video originally...

READ MORE

MEMBERS ONLY

DP Diamonds: Momentum Sleepers

by Erin Swenlin,

Vice President, DecisionPoint.com

With today's rally pop, I decided to check my Momentum Sleepers Scan for possible diamonds in the rough. I found four from that scan and one from my Chart Breakouts Scan. The VIX and advance/declines suggest more upside in the very short term, but the rest of...

READ MORE

MEMBERS ONLY

DP Alert Mid-Week: ST PMO SELL Signal - On-Balance Volume (OBV) Positive Divergence

by Erin Swenlin,

Vice President, DecisionPoint.com

This week, we saw four new Short-Term Price Momentum Oscillator (PMO) SELL signals on the DP Scoreboards for all indexes. Last week, at month-end, we got two new Long-Term PMO BUY signals. Clearly short-term momentum has slowed, but, in the longer term, the picture isn't too pessimistic. I...

READ MORE

MEMBERS ONLY

Sector Spotlight: A Look At Monthly Sector Charts and Pair Trades

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of Sector Spotlight, I go over the completed monthly bars for asset classes and US sectors. Then, I present a new pair trade idea; for this video, I found one that comes from the Health Care sector.

This episode of Sector Spotlight originally aired on December 3rd,...

READ MORE

MEMBERS ONLY

STOCKS GAP HIGHER AND TRY TO REGAIN 20-DAY AVERAGE -- S&P 500 HAS ALSO BOUNCED OFF LOWER BOLLINGER BAND -- THOSE BANDS SHOW STOCKS PULLING BACK FROM OVERBOUGHT TERRITORY BUT STILL IN UPTRENDS -- LOWER BB VOLATILITY IS ALSO SUPPORTIVE TO STOCK PRICES

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES GAP HIGHER TODAY... After gapping lower yesterday, stocks are gapping higher today. The daily bars in Chart 1 show the S&P 500 also trying to regain its 20-day moving average (green line) that was violated yesterday. If this morning's gap to the upside holds...

READ MORE

MEMBERS ONLY

Based On The Charts, These 2 Stocks Could Explode With Earnings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I have found there are no guarantees when it comes to earnings and how a company will report. We can make educated guesses, though, especially when you consider that Wall Street has access to management teams before their "quiet period". A quiet period is simply the time from...

READ MORE

MEMBERS ONLY

Stocks Remain the Only Asset Class Inside the Leading Quadrant Going into December

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Asset allocation is the highest point in the investment decision pyramid. The decision to invest in Stocks or Bonds or other asset classes will have far more impact on the final return for an investor than the decision to select specific stocks.

Therefore, the Relative Rotation Graph showing the rotation...

READ MORE

MEMBERS ONLY

DecisionPoint Diamonds - Possible Shorts

by Erin Swenlin,

Vice President, DecisionPoint.com

Since I had zero results on the Diamond Price Momentum Oscillator (PMO) Scan, I decided to look at the results from my "Diamond Dog Scan", which is basically the mathematical reverse of the Diamond scan. When shorting, I always think "short-term;" at least in my experience,...

READ MORE

MEMBERS ONLY

STOCKS SELL OFF ON MORE TRADE TENSIONS -- SOME 20-DAY AVERAGES ARE BEING BROKEN -- DAY'S BIGGEST LOSERS ARE FINANCIALS, INDUSTRIALS, CYCLICALS, AND TECHS -- BIG DROP IN BOND YIELDS BOOSTS UTILITIES AND REITS -- BUT HURTS BANKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES UNDERGO PROFIT-TAKING... Increased trade tensions are contributing to profit-taking in stocks today. That and the fact that major stock indexes were already in overbought territory and vulnerable to short-term profit-taking. All three have fallen below their 20-day moving averages which could lead to a test of 50-day lines....

READ MORE