MEMBERS ONLY

DP Daily Diamonds - Energy Stocks Make an Appearance

by Erin Swenlin,

Vice President, DecisionPoint.com

Today was a mixed bag as far as today's Diamonds were concerned. I ran quite a few scans, but wasn't particularly excited about many of the results. I was persistent, however, and found a handful that do look very interesting. Notably, I have three Energy stocks...

READ MORE

MEMBERS ONLY

Small Cap Stocks Close To YTD Highs - Here's One Stock To Watch

by Mary Ellen McGonagle,

President, MEM Investment Research

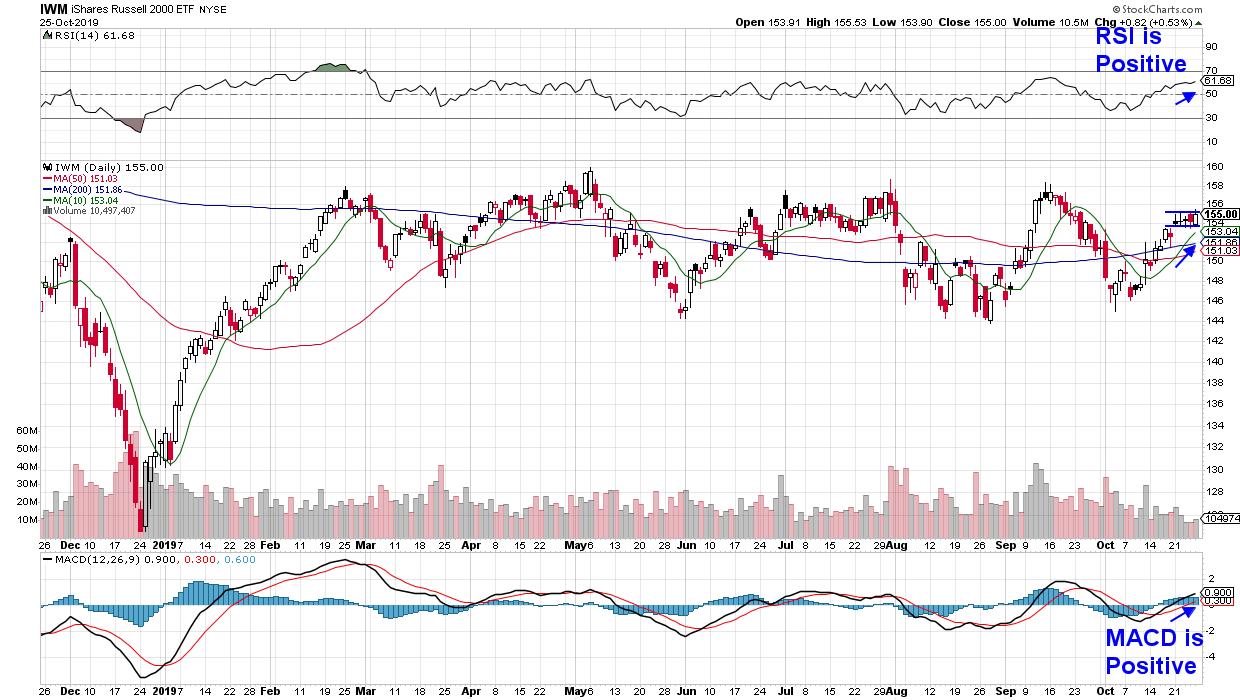

The Russell 2000 Small Cap Index is on the move and, while these smaller stocks can provide outsized returns, there's also an inherent volatility that one needs to be aware of before venturing into this asset class.

DAILY CHART OF LIFEVANTAGE CORP. (LFVN)

Let's take a...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-11-03

by Martin Pring,

President, Pring Research

The monthly Market Roundup video for November is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

DOW JOINS OTHER MAJOR STOCK INDEXES IN RECORD TERRITORY -- TRANSPORTATION STOCKS NEAR UPSIDE BREAKOUT -- SO DOES THE RUSSELL 2000 SMALL CAP ISHARES -- FINANCIAL SPDR HITS NEW RECORD -- WITH A LOT OF HELP FROM BANKS AND HIGHER BOND YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW JOINS OTHER MAJOR INDEXES IN RECORD TERRITORY...Chart 1 shows the Dow Industrials trading above their July high to put them in record territory. The Nasdaq and S&P 500 hit new records last week. Financials and materials are hitting new records today as well. Other leaders include...

READ MORE

MEMBERS ONLY

Understanding The Hints That Relative Strength Or Weakness Provides

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Here's today's EB Digest article that I sent to free subscribers close to 8am EST this morning. I just wanted to provide a sample of what you'll get if you SIGN UP.

Looking for a Negative Earnings Surprise

I've been providing a...

READ MORE

MEMBERS ONLY

Bearish Divergences Hindering A Clean Breakout; Fingers Crossed For The Coming Week

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

During a truncated week that began with a short Mahurut session, the markets ushered us into the new year on a buoyant note. In the previous weekly note, it was mentioned that the NIFTY's behavior against the price zone of 11700-11750 would be crucial to watch and that...

READ MORE

MEMBERS ONLY

NASDAQ JOINS S&P 500 IN RECORD TERRITORY -- HEALTHCARE AND TECHNOLOGY HIT NEW RECORDS -- FINANCIALS NEAR TEST OF EARLY 2018 HIGH -- INDUSTRIAL SPDR HITS NEW RECORD ON FRIDAY -- CATERPILLAR TURNS UP -- FOREIGN STOCK INDEX ACHIEVES BULLISH BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

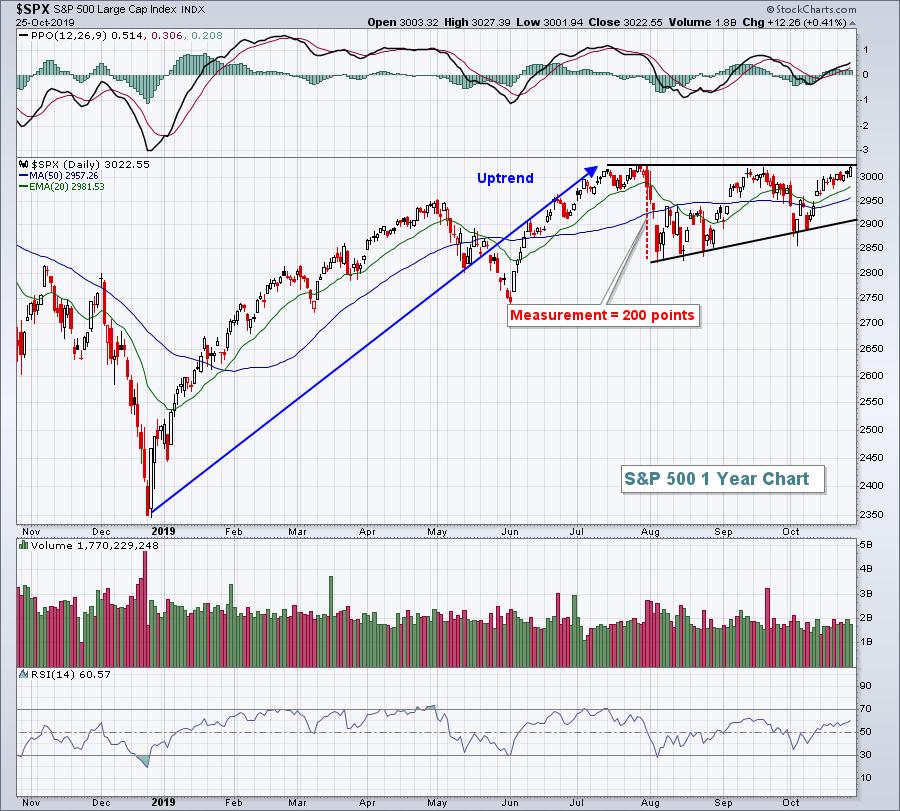

NASDAQ AND S&P 500 END IN RECORD TERRITORY...A strong jobs report on Friday (two days after the Fed cut rates for the third time this year) sent stock prices sharply higher. Chart 1 shows the S&P 500 hitting a new high on Friday for the...

READ MORE

MEMBERS ONLY

MEM Edge TV: Get Set for Next Week!

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen uncovers areas of the market that are poised to outperform. She also discusses how to get in front of the best candidates, as well as failed breakouts and what to look out for. This episode originally aired on...

READ MORE

MEMBERS ONLY

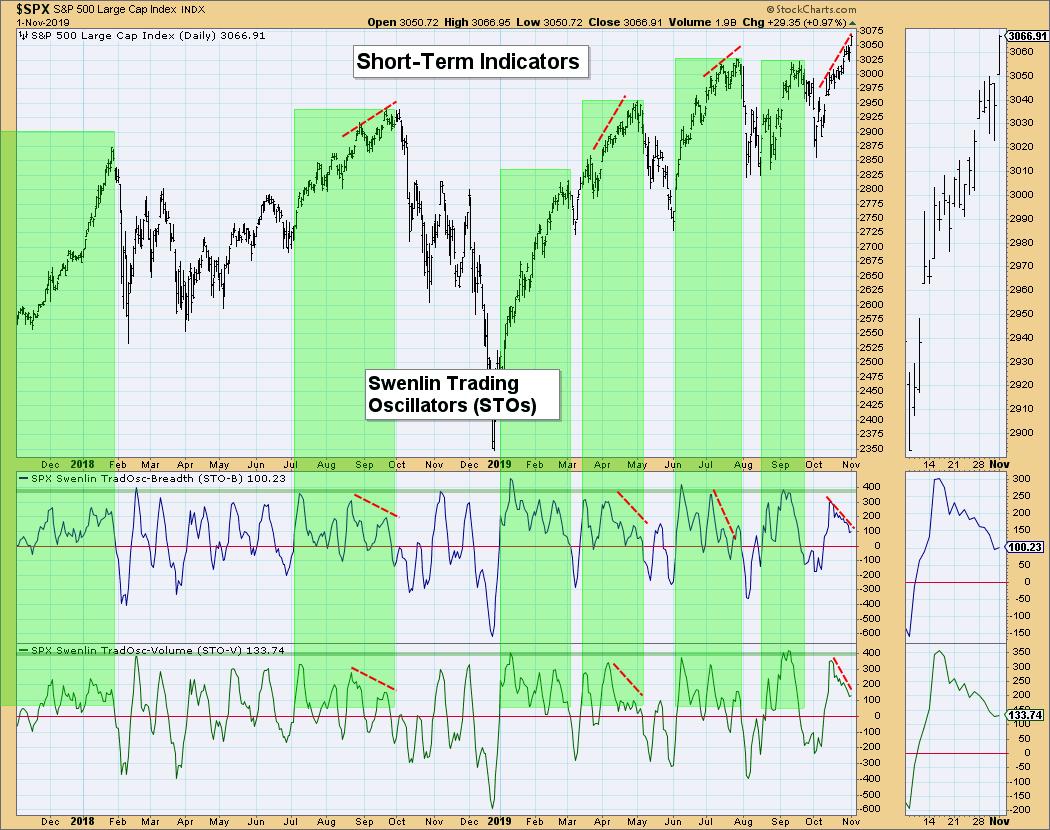

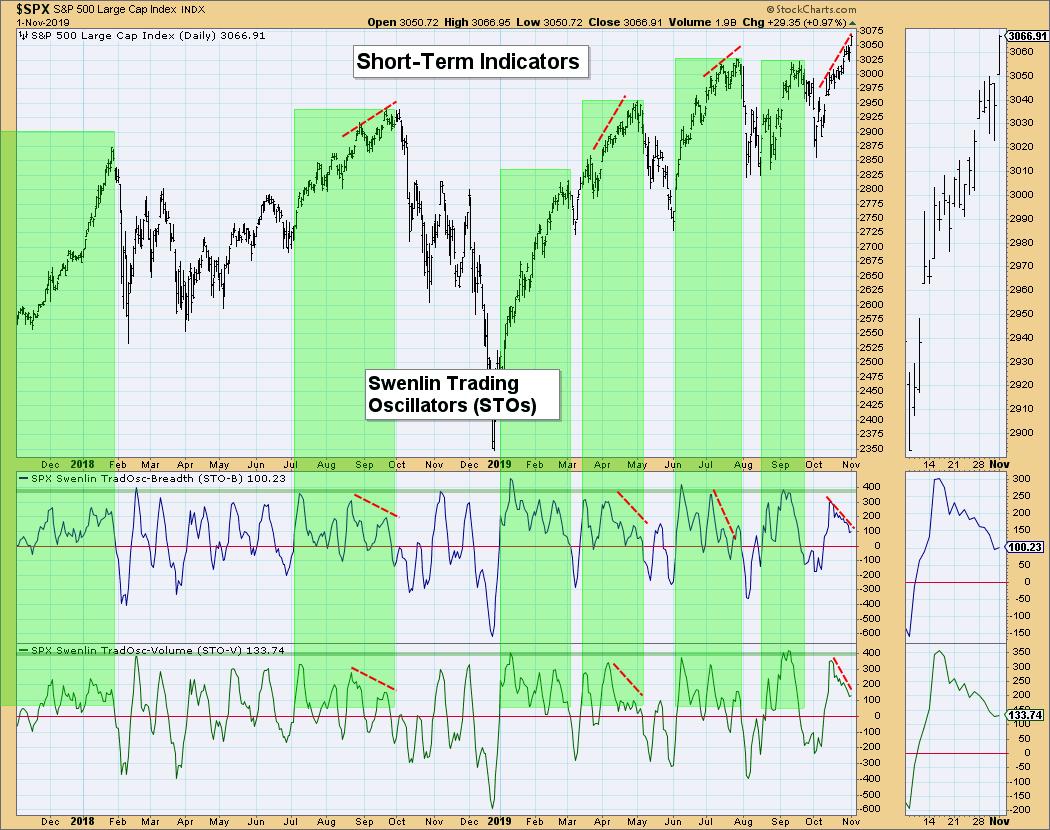

Swenlin Trading Oscillators Still Not Confirming All-Time Highs

by Erin Swenlin,

Vice President, DecisionPoint.com

Today saw fresh all-time highs hit on most of the broad market indexes. The weekly Price Momentum Oscillators (PMOs) just generated new Intermediate-Term BUY signals on all four DecisionPoint Scoreboard indexes (SPX, NDX, Dow and OEX). These signals are triggered when the weekly PMO crosses above its signal line on...

READ MORE

MEMBERS ONLY

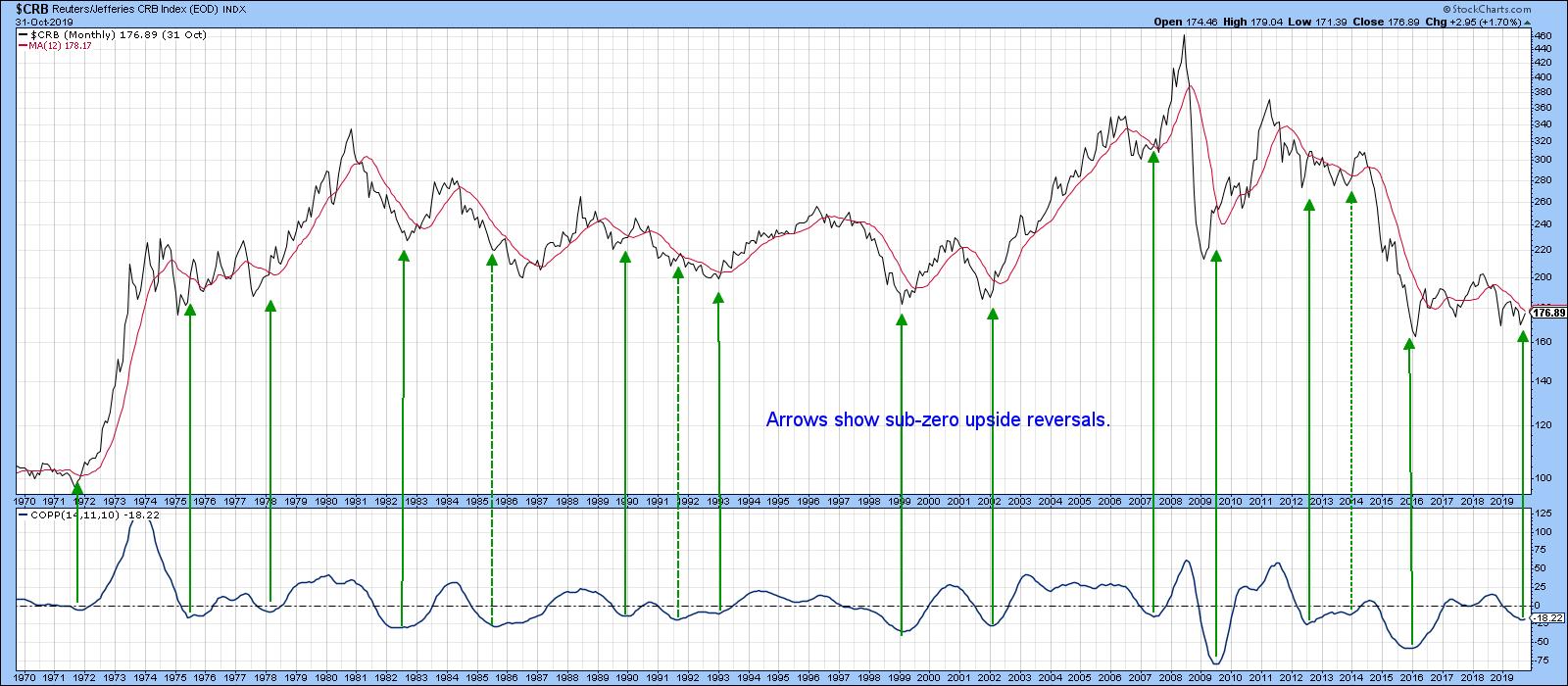

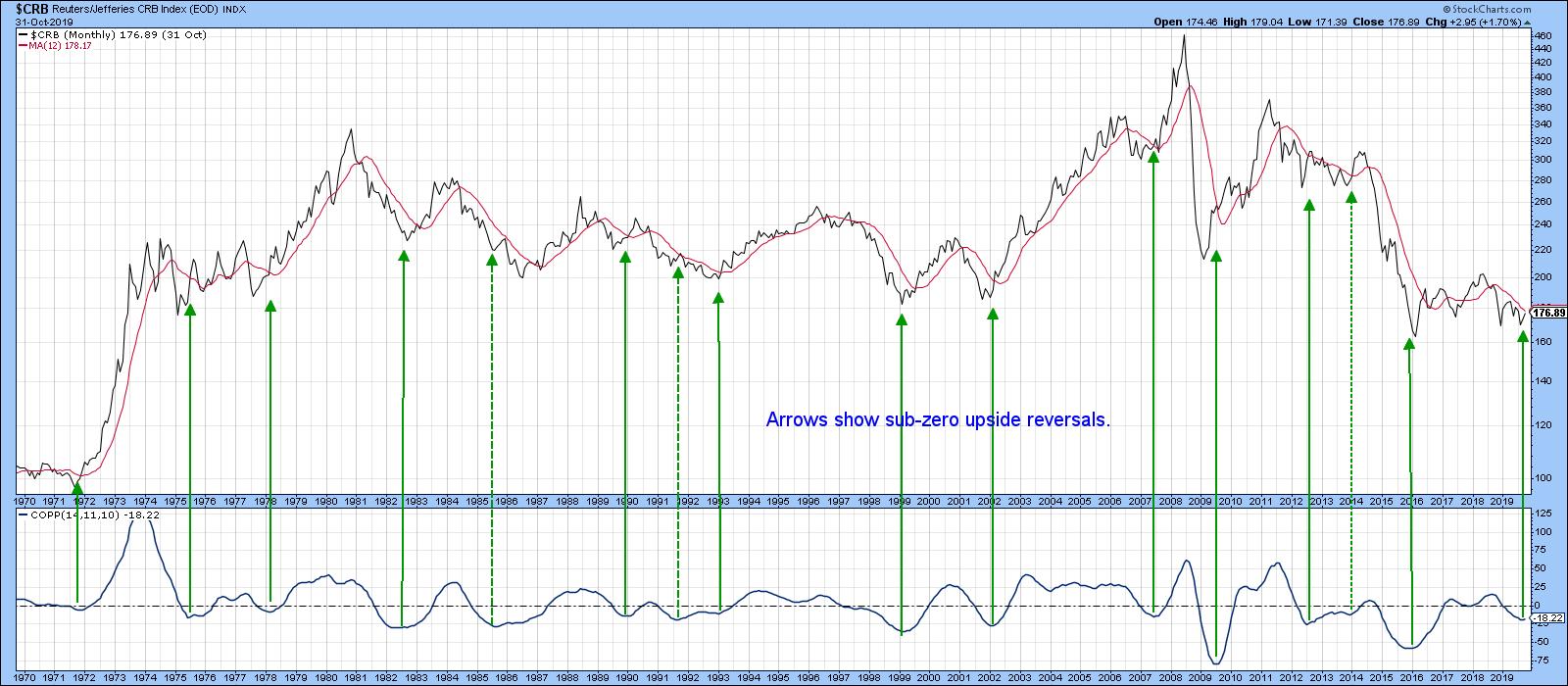

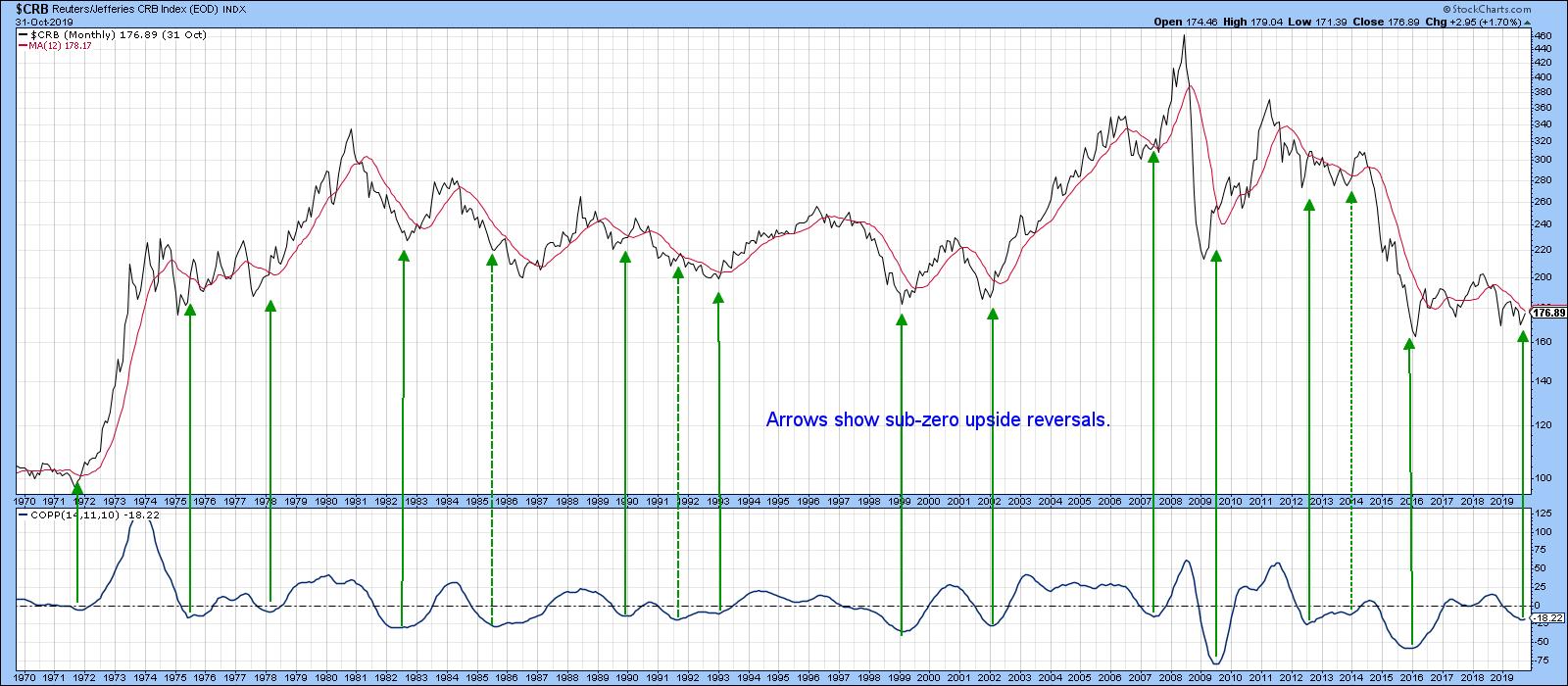

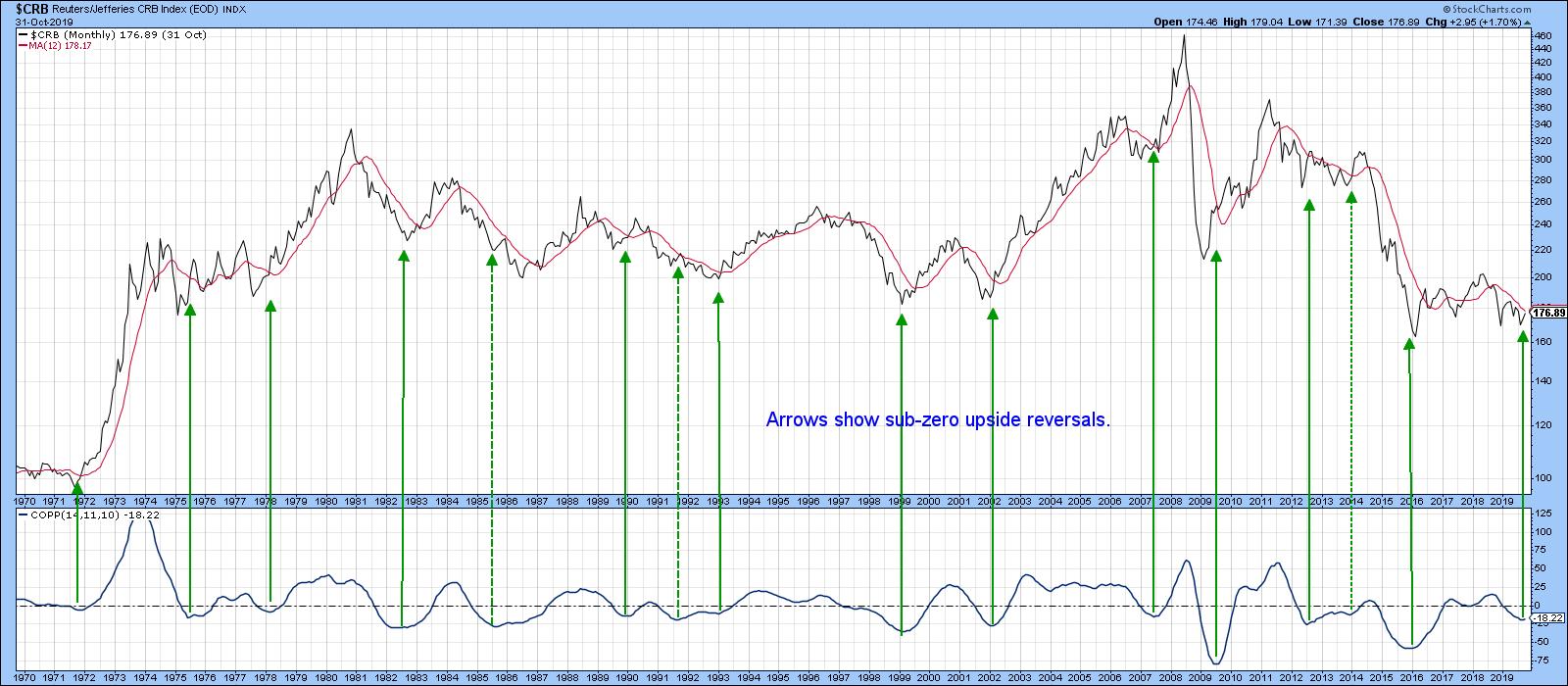

Stocks are in a Bear Market; What About Commodities?

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Friday, November 1st at 1:36pm ET.

At Pring Turner Capital, the registered investment advisory firm where I serve as investment strategist, our investment approachinvolves the proactive rotation of client's assets...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Choosing Between Conflicting Breadth Indicators

by Carl Swenlin,

President and Founder, DecisionPoint.com

The venerable Advance-Decline and Advance-Decline Volume Lines are confirming the rising price tops over the last ten months, which is reassuring for the bulls. Unfortunately, some other breadth indicators disagree.

Specifically, neither the SPX Silver Cross Index (percent of SPX stocks with 20EMA higher than 50EMA) or the SPX Golden...

READ MORE

MEMBERS ONLY

Do Not Ignore the Most Important Signal Heading Into an Earnings Report

by John Hopkins,

President and Co-founder, EarningsBeats.com

We are now deep into earnings season and, as we can see by the record highs in the NASDAQ and S&P, traders are mostly liking what they are hearing and seeing from companies who are reporting their numbers. We've seen some phenomenal moves in stocks -...

READ MORE

MEMBERS ONLY

How to Distinguish between Selective and Indiscriminate Advances

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq AD Line is not keeping pace with the Nasdaq Composite, but this is not bearish for the Nasdaq or the market as a whole. Note that the Nasdaq hit a new high in July and again on November 1st, even though the Nasdaq AD Line has been falling...

READ MORE

MEMBERS ONLY

Stocks Have Broken Out; What About Commodities?

by Martin Pring,

President, Pring Research

* Commodities are in a Bear Market

* The Stock Market May Be on the Verge of Signaling a Commodity Rally

* Short-Term Commodity Momentum

At Pring Turner Capital, the registered investment advisory firm where I serve as investment strategist, our investment approachinvolves the proactive rotation of client's assets around the...

READ MORE

MEMBERS ONLY

Your Shortcut to Stock Market Mastery: ChartPack Update #25 (Q3 / 2019)

by Grayson Roze,

Chief Strategist, StockCharts.com

by Gatis Roze,

Author, "Tensile Trading"

Investing is like a plumbing game. For this reason, the organization and organization of your ChartLists, along with your routines, matter big time! Figuring out where the funds are flowing and adjusting your piping system accordingly is the key objective. In this case, its money flow which is being piped...

READ MORE

MEMBERS ONLY

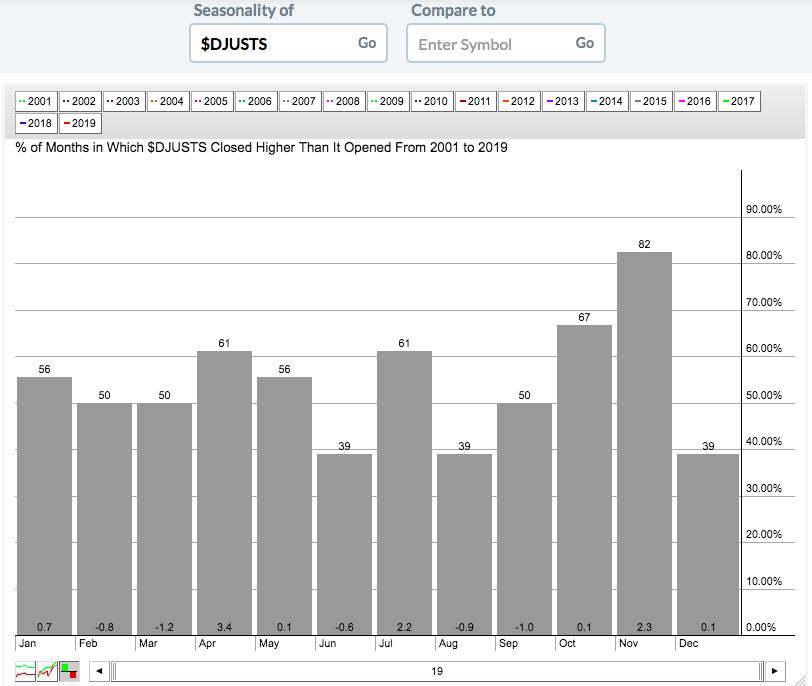

Take Your Relative Strength Analysis To The Next Level And Predict Earnings Reports

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

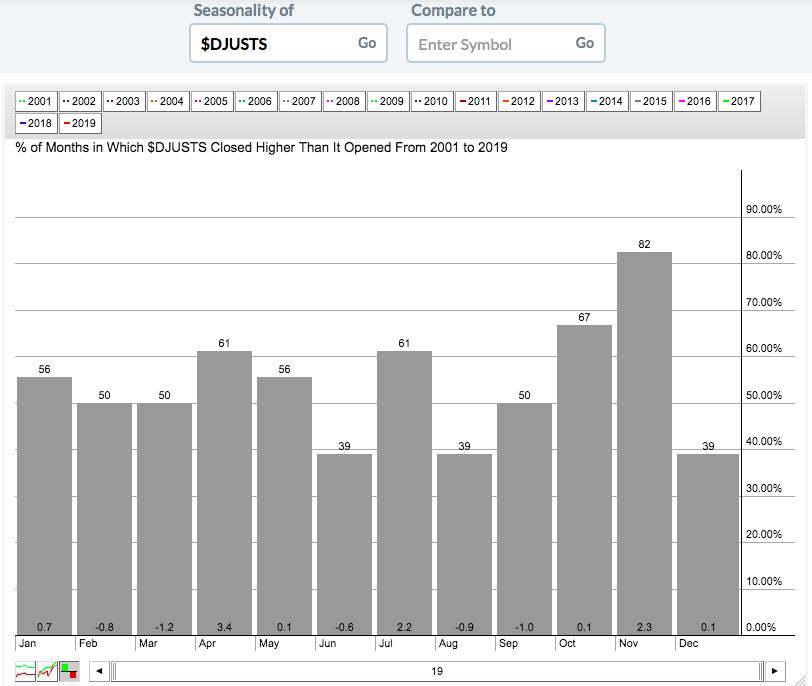

Ok, it might be a tad early to call it a leader, but transportation services ($DJUSTS) recently broke out to an 8 month relative high to the benchmark S&P 500. Money has been rotating there and we need to be aware of this relative strength. Before we look...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Trick or Treat? Treats (I Think)!

by Erin Swenlin,

Vice President, DecisionPoint.com

It was a spooky Halloween WealthWise Women show today and, as part of the program, we played "Trick or Treat?" with securities. One of the agreed upon "treats" was Merck (MRK), which came up in my scan today as well as hitting Mary Ellen McGonagle'...

READ MORE

MEMBERS ONLY

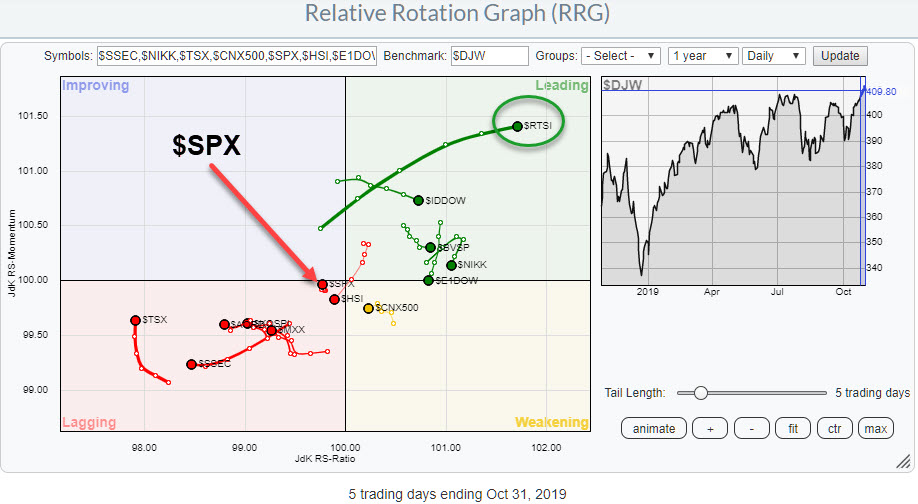

Rockin' Russia!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

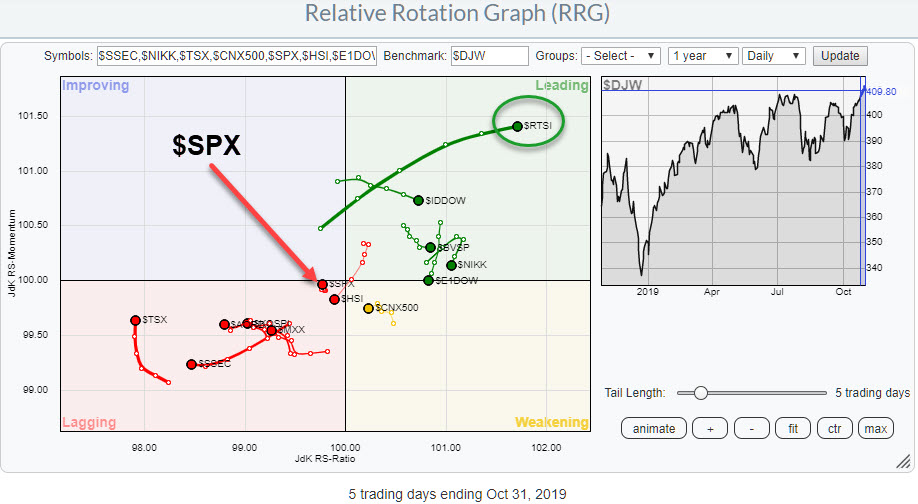

Despite the S&P 500 making new highs and looking strong on the charts, it is definitely not the strongest market in the world at the moment...

The RRG above shows the daily rotation for a universe of major stock market indexes around the world. The S&P...

READ MORE

MEMBERS ONLY

Drawdown

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

What is risk? The sterile laboratory of modern finance wants you to believe it is volatility. They say that volatility is defined as standard deviation. I have opposed that academic mentality often in these articles. If you use standard deviation it means you also believe the markets are random and...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Repeats? They Came Up on Today's Scans

by Erin Swenlin,

Vice President, DecisionPoint.com

I honestly don't keep track of all of the Diamonds that I present, but now and then I am sure that there are repeats. Three of today's Diamonds were reported to you in the past; obviously they've continued to perform or else they wouldn&...

READ MORE

MEMBERS ONLY

DP Alert Mid-Week: Extreme Negative Divergences on Short-Term Indicators

by Erin Swenlin,

Vice President, DecisionPoint.com

The market continues to reach new all-time highs, but DecisionPoint remains cautious. The negative divergences on our Swenlin Trading Oscillators (STOs) is concerning and tempers the euphoria of reaching those all-time highs. Volume has been under the annual average and the Silver and Gold Cross Indexes tell us that less...

READ MORE

MEMBERS ONLY

STOCKS AND BONDS CLOSE HIGHER ON DOVISH RATE CUT -- S&P 500 CLOSES AT NEW RECORD -- FALLING BOND YIELDS BOOST DIVIDEND-PAYING STOCKS AS BANKS PULL BACK -- DROP IN DOLLAR AND LOWER YIELDS BOOST GOLD -- VOLATILITY INDEX DROPS TO THREE-MONTH LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

FED RATE CUT AND DOVISH MESSAGE BOOST STOCK PRICES...The Fed lowered rates another quarter point today as expected, which was followed by a dovish sounding message from Mr. Powell. That pushed stock prices higher. Chart 1 shows the S&P 500 closing at another record high today. Chart...

READ MORE

MEMBERS ONLY

Don't Overlook These Two Boring Areas If Breakouts Occur

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Stock market rotation occurs on a small level each and every day, but longer-term "big picture" themes emerge and it's critical for us to spot them early in their development in order to take advantage and ensure a much better chance of outperforming the major indices....

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Mr. Softy (MSFT) Made the List

by Erin Swenlin,

Vice President, DecisionPoint.com

There were only three results on today's Diamond Scan, but I actually decided that all three passed muster. I ran a few other scans and Microsoft ("Mr. Softy" as Tom Bowley used to call it on MarketWatchers) made an appearance. I took a look at the...

READ MORE

MEMBERS ONLY

Mind The Gap - Record Number Of Stocks Gapping Up Following Earnings

by Mary Ellen McGonagle,

President, MEM Investment Research

It's been quite an earnings season so far with over 80% of companies that have reported, coming in ahead of analyst's estimates. Even more impressive has been investor's response to these upside surprises with a large number of stocks gapping up in price. Today...

READ MORE

MEMBERS ONLY

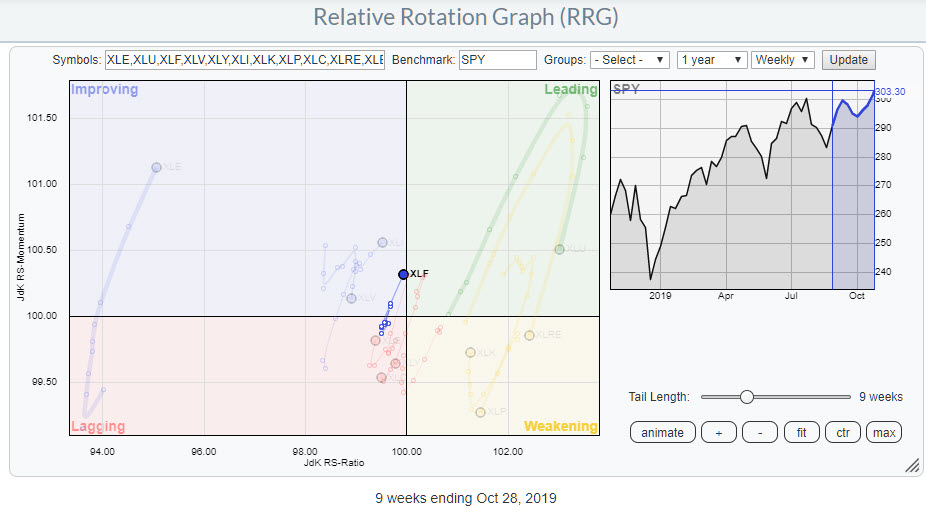

Banking Stocks Are Leading The Financial Sector Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

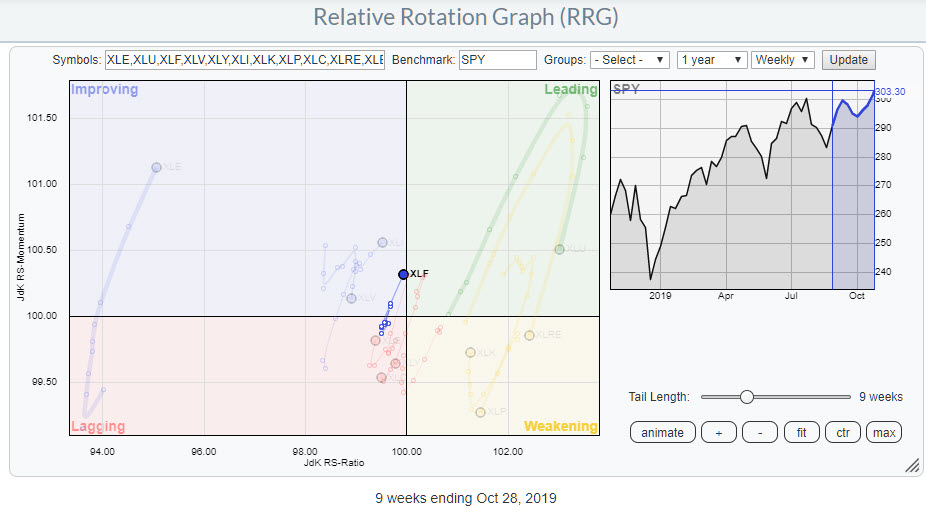

The Relative Rotation Graph for US sectors remains characterized by steep moves on the vertical (JdK RS-Momentum) axis. This is the Rate of Change metric for the underlying relative trends. Sharp moves in an almost vertical direction, up or down, indicate a sudden change of the underlying trend.

Looking at...

READ MORE

MEMBERS ONLY

HEALTH CARE SPDR NEARS RECORD HIGH -- XLV HAS GONE FROM MARKET LAGGARD TO LEADER IN LAST TWO MONTHS -- ALL GROUPS ARE PARTICIPATING -- STOCK LEADERS INCLUDE HCA HEALTHCARE, INCYTE, BECKTON DICKINSON, AND MERCK

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTH CARE SPDR NEARS RECORD HIGH...In a remarkable turnaround, the healthcare sector has gone from one of the year's worst performers to one of the strongest over the last couple of months. Chart 1 shows the Health Care SPDR (XLV) trading above its early July intra-day peak...

READ MORE

MEMBERS ONLY

Biotech ETF Makes a Statement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Biotech ETF (IBB) is making a bullish statement with recent developments in momentum, volume and trend. IBB is also outperforming its counter part, the Biotech SPDR (XBI), over the last two months.

The chart below shows IBB surging around 10% from the early October low to the current high....

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Only 4 Diamond Scan Results on Market All-Time Highs?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today was an exciting day as new all-time highs were hit on many of the broad market indexes. I was salivating waiting to see what my Diamond Scan results would be! To my surprise, I only had four results. Meanwhile, the bearish Diamond Dog Scan produced 8 results. So, on...

READ MORE

MEMBERS ONLY

DP Show: All-Time Highs - Where's the Breadth?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discussed the new all-time highs that broad markets accomplished today, but found that breadth was wanting. Volume was also suspect; a look at DP Short-Term indicators revealed serious negative divergences. Carl discussed wildfires and Generac Holdings (GNRC) and why it is prospering....

READ MORE

MEMBERS ONLY

MEM Edge TV: How to Trade Gaps Up on Earnings

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the hot areas of the market and which areas within them are bullish. She also examines the move into the Energy sector, discusses the stocks that reported earnings this past week and talks about how to trade...

READ MORE

MEMBERS ONLY

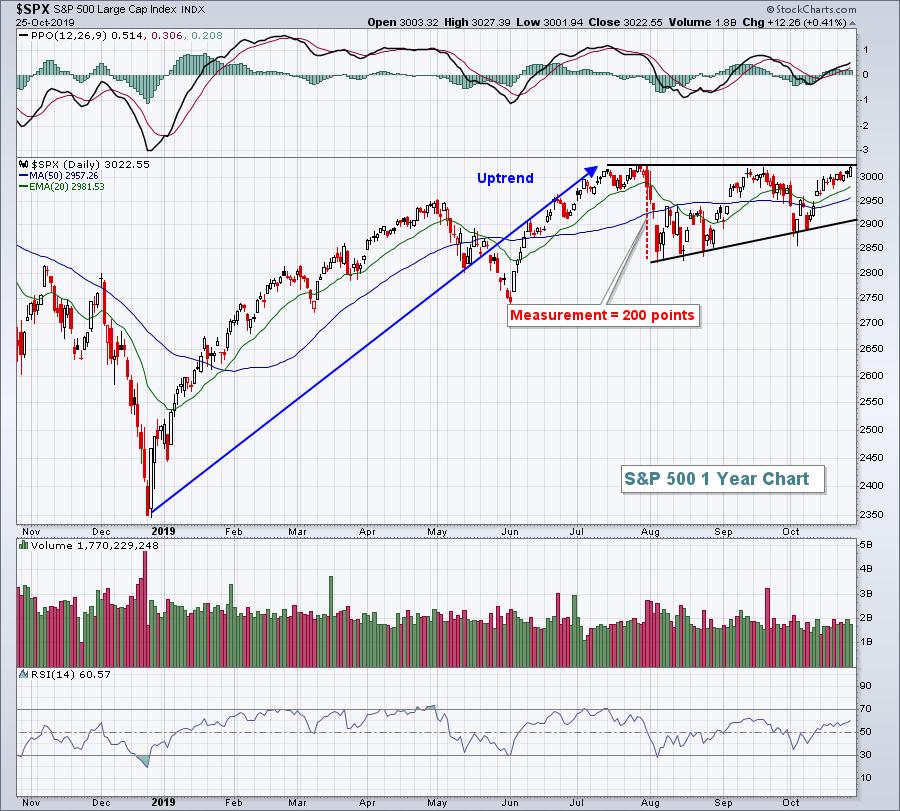

It's Happening! The Puzzle Pieces Are Coming Together, Get Ready Bulls!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Anyone who has followed my work for the past decade knows that I've remained steadfastly bullish despite all the negative media rants. Follow the charts. There is no recession. The economy will strengthen. We'll get a trade deal. Heck, even the Fed is finally on board...

READ MORE

MEMBERS ONLY

Special Note: What To Expect In Samvat 2076

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The year that ended today, with NIFTY closing at 11583.90, remained quite eventful for the Indian equity markets.

We traditionally wish a "Happy and Prosperous New Year," and the current year remains prosperous in a literal sense. On the last trading day of the current Samvat on...

READ MORE

MEMBERS ONLY

Coming Week Likely To See Limited Upsides; Overhead Levels Continue To Remain A Concern

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, we had mentioned the possibility of the NIFTY consolidating in a defined range while having a limited upside. Though it traded in line as anticipated, the NIFTY spent a significant part of the week resisting and consolidating near the 11700-level. While continuing to stay above...

READ MORE

MEMBERS ONLY

SECTOR RANKINGS SHOW MORE OPTIMISM -- ENERGY, TECHNOLOGY, INDUSTRIALS, FINANCIALS, AND MATERIALS LEAD MARKET HIGHER -- ALL WORLD STOCK ISHARES HIT NEW RECORD -- FOREIGN STOCK ISHARES ARE CLOSE TO AN UPSIDE BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

SECTOR LEADERS...Chart 1 shows the weekly ranking for the eleven stock market sectors.Nine of them closed up for the week with only two losers. That reflects a generally higher market with major stock indexes nearing new records. The rankings also reflect a generally upbeat mood on the market...

READ MORE

MEMBERS ONLY

Stock Market is Not Firing on All Cylinders

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The market as a whole is not firing on all cylinders, but that is not really important. What, then, is important?

We cannot expect a perfectly bullish stock market and rising tide that lifts all boats, as was the case in 2013 and 2017. Instead, we need to know which...

READ MORE

MEMBERS ONLY

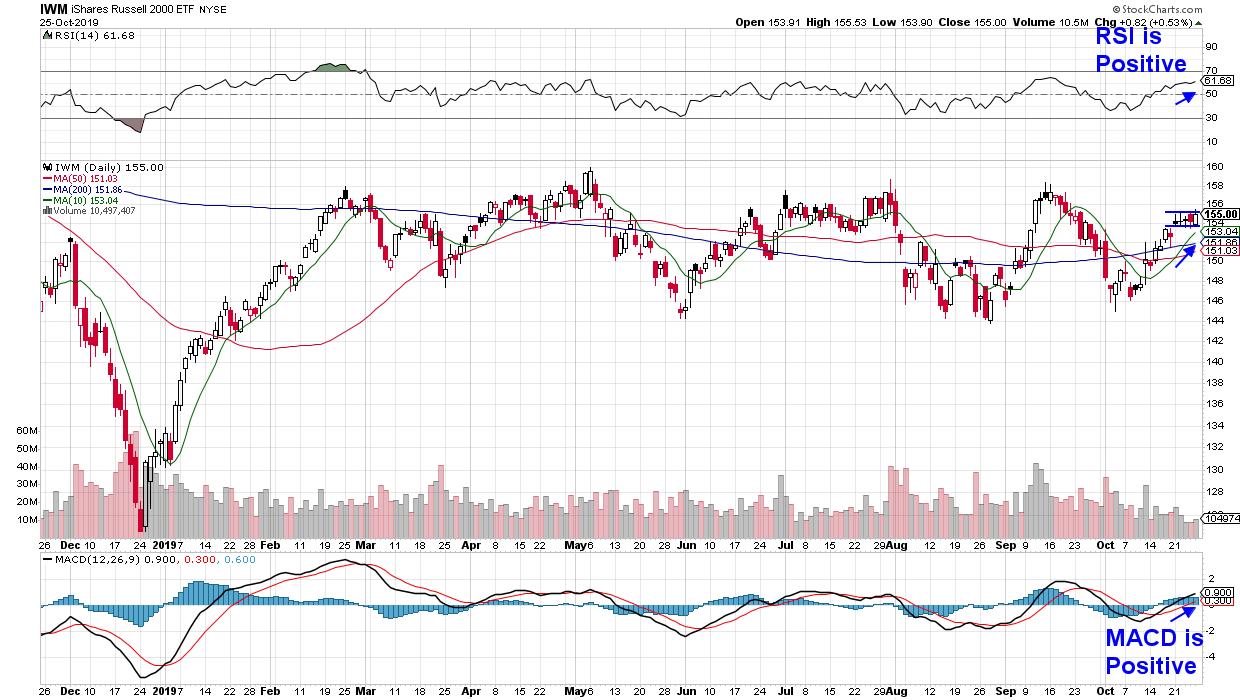

Small Cap Stocks Are Turning Positive And Tech Is Leading – 3 Small Tech Companies For Your Consideration

by Mary Ellen McGonagle,

President, MEM Investment Research

The Russell 2000 Index bullishly broke back above its key simple moving averages over a week ago and, as you can see in the chart below, this Index has been able to remain above this key area of support. And while it's not the first time this year...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Crash Coming?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Because of some recent articles I have seen, I decided to discuss the crashes in 1929 and 1987 on Monday's regular DecisionPoint show on StockCharts TV.

What I didn't cover during the show was how the chart patterns of those two iconic events compare to the...

READ MORE

MEMBERS ONLY

Separating Winners From Wannabes After Two Weeks Of Earnings Season

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

On each of the past two Mondays, I've hosted webinars that have highlighted stocks poised to trend higher with earnings results. It's a concept I discuss frequently and most of it has to do with relative strength. If Wall Street is accumulating, we need to take...

READ MORE

MEMBERS ONLY

A Steeper Yield Curve May Explain Recent Rotation into Financial Stocks

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, October 25th at 5:04pm ET.

A lot of positive groups rotations have taken place in the stock market over the past two months.We've seen new money moving into...

READ MORE