MEMBERS ONLY

Measuring Offensive vs Defensive Sectors Using BETA

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

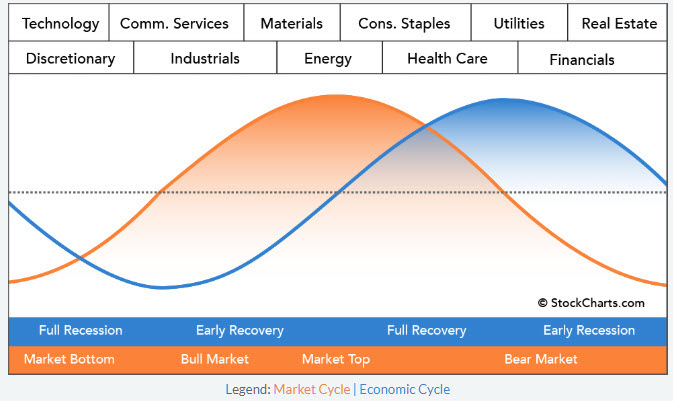

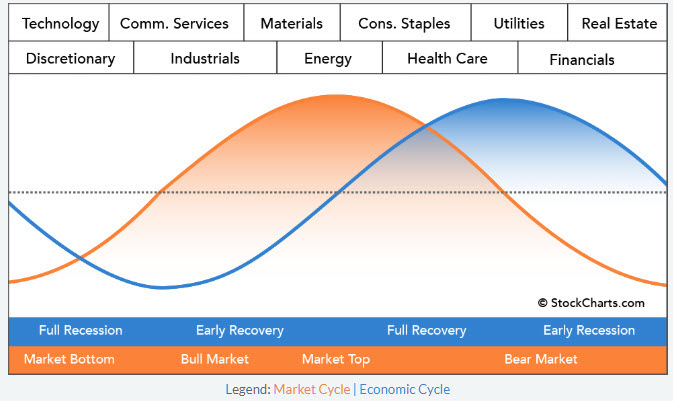

We, including myself, are always talking about offensive and defensive sectors, sector rotation from offensive to defensive, etc. Offensive sectors are the sectors that will do very well - and usually outperform - when the market goes up, while defensive sectors are the sectors that outperform when the market goes...

READ MORE

MEMBERS ONLY

DecisionPoint Diamonds - Home Builders Breaking Out

by Erin Swenlin,

Vice President, DecisionPoint.com

The "Chart Breakouts" Scan returned about nine different home builder stocks. I didn't care for all of them, but I did pick out three for your review. This scan generally pulls stocks that had monster days. Consequently, you may need to wait for a pullback to...

READ MORE

MEMBERS ONLY

DP Mid-Week Alert: Swenlin Trading Oscillators Leave Doubt About Reaching All-Time Highs

by Erin Swenlin,

Vice President, DecisionPoint.com

It's only Wednesday, but we've already had quite a few Scoreboard changes this week - BUY signals all around. The Scoreboards would suggest all-time highs should be no sweat, but the short-term indicators aren't on board with that analysis. The VIX is also beginning...

READ MORE

MEMBERS ONLY

British Pound Clears Its 200-day MA for an Initial Sign of a New Bull Market

by Martin Pring,

President, Pring Research

* Pound is in a Long-Term Secular Bear Market

* Crossing of the 200-Day Starts the Ball Rolling for a Primary Bull Market

* Pound Set to Break Against the Euro

Pound is in a Long-Term Secular Bear Market

Chart 1 shows that the British Pound has been in a secular bear market...

READ MORE

MEMBERS ONLY

DP Show: Indicators Don't Support All Time Highs

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

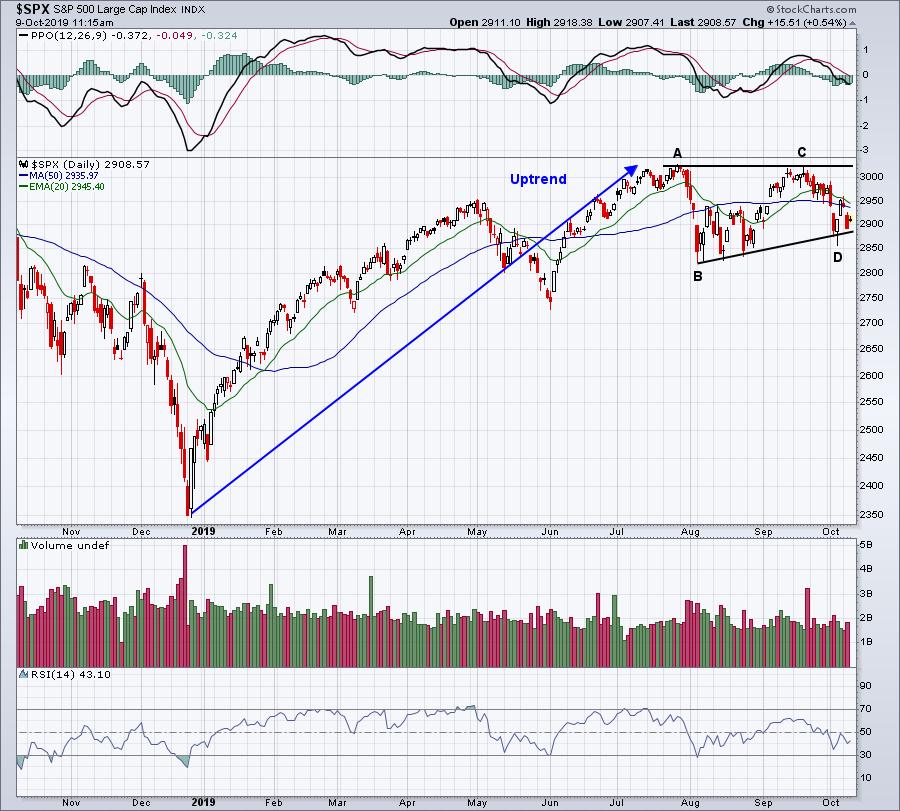

In this week's episode of DecisionPoint, Carl spent a few minutes analyzing a six-month chart of the SPX, after which Erin and Carl discussed the lack of support this recent rally is showing. Erin followed up with sentiment and DecisionPoint indicators, while Carl took his discussion of the...

READ MORE

MEMBERS ONLY

Uniquely Bullish Opportunity Emerges With This Week's Rally

by Mary Ellen McGonagle,

President, MEM Investment Research

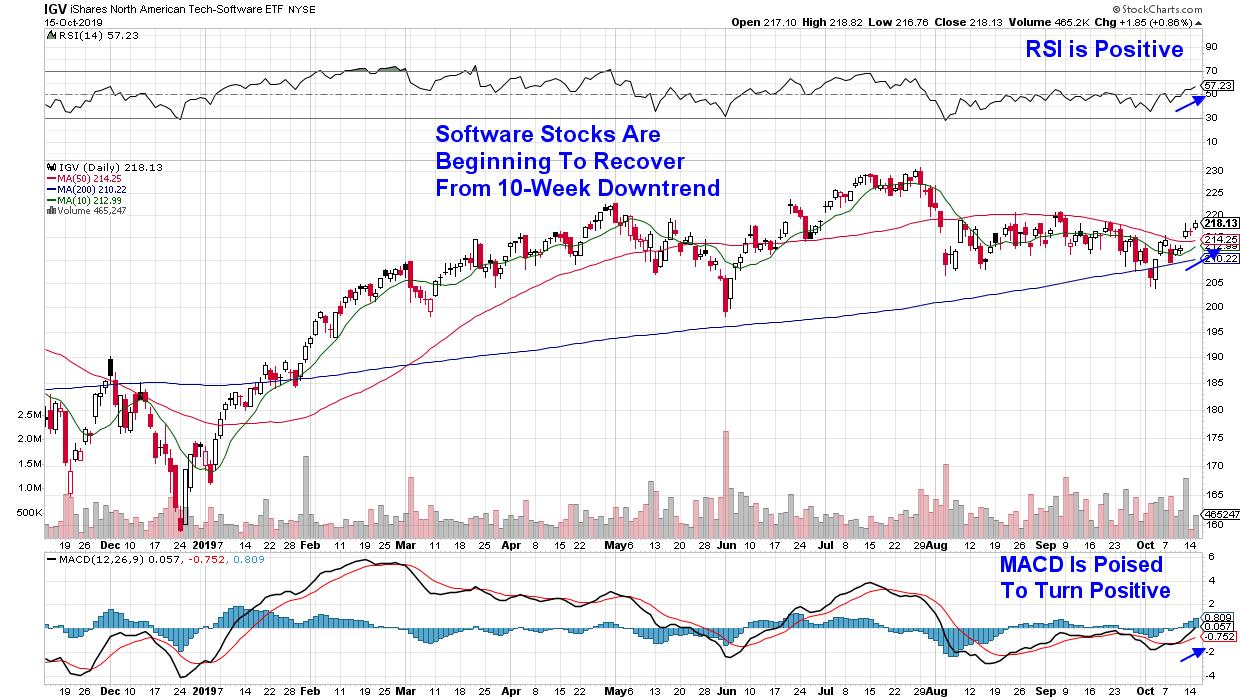

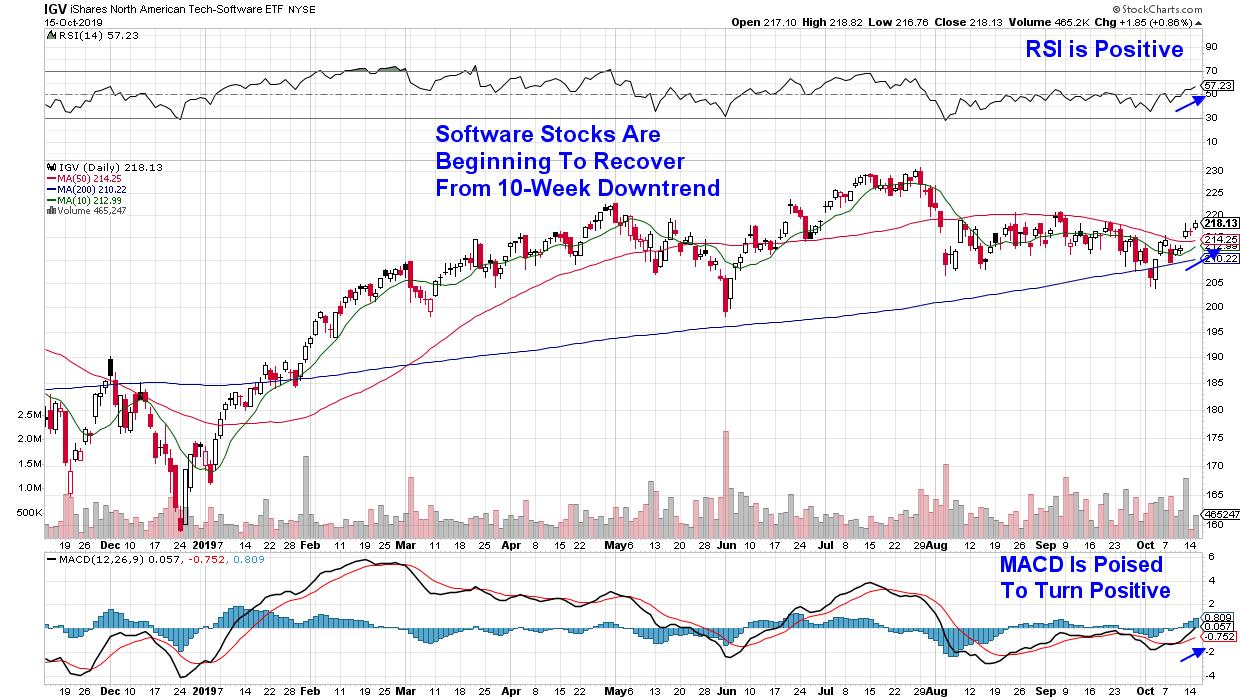

Software stocks peaked in late July after posting phenomenal year-to-date returns. The August dip in the markets hit this group particularly hard and, unlike other areas, it has been slow to recover.

The good news, as you can see below, is that these stocks are beginning to reverse their 10-week...

READ MORE

MEMBERS ONLY

DP Diamonds - These Stocks Look Good in All Timeframes with Great Seasonality Too!

by Erin Swenlin,

Vice President, DecisionPoint.com

Today, I had a plethora of results from my DP Diamond Scan - 83, to be exact! So it took me a bit longer to find today's diamonds, as I studied not only the daily and weekly charts but also seasonality in order to pare down to the...

READ MORE

MEMBERS ONLY

FACEBOOK AND GOOGLE LEAD COMMUNICATIONS TO ONE OF DAY'S STRONGEST SECTORS -- BOUNCING BOND YIELDS ARE PUSHING TREASURY BOND PRICES LOWER -- BUT HIGH YIELD BONDS ARE RISING

by John Murphy,

Chief Technical Analyst, StockCharts.com

COMMUNICATIONS SPDR HAS STRONG DAY...While healthcare and financials have been leading for most of the day, communication stocks have crept into second place in afternoon trading. Chart 1 shows the Communication Services SPDR (XLC) bouncing impressively off its 50-day average that it cleared just last week. It's...

READ MORE

MEMBERS ONLY

MAJOR STOCK INDEXES BUILD ON LAST WEEK'S GAINS -- HEALTHCARE PROVIDERS LEAD HEALTHCARE SPDR HIGHER LED BY UNITEDHEALTH -- RECORD HIGH BY JP MORGAN CHASE LEADS BANKS AND FINANCIALS HIGHER -- FALLING VIX ALSO SUPPORTS HIGHER STOCK PRICES

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES BUILD ON RECENT GAINS...After a modest pullback yesterday, major U.S. stock indexes are building on last week's trade-inspired gains. Chart 1 shows the Dow Industrials trading at the highest level of the month this morning. The Dow appears headed toward the top of...

READ MORE

MEMBERS ONLY

JP Morgan Chase (JPM) Banks A Huge Report

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

JPM did not disappoint Wall Street. The Street had been "banking" on a solid report, as evidenced by its solid relative performance to its banking peers and to the benchmark S&P 500. And wow did they get it! JPM reported revenues of $30.06 billion and...

READ MORE

MEMBERS ONLY

Trend Following Strategies

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Our rules-based trend following model is the foundation for three different money management strategies. This article will introduce you to two of them. Our model uses a weight-of-the-evidence approach to measure the strength of up-trends in the U.S. equity markets and is primarily focused on the Nasdaq Composite Index...

READ MORE

MEMBERS ONLY

DecisionPoint Diamonds - Daily and Weekly Charts of Three Diamonds in the Rough

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's Diamond Report, I decided to look at only three stocks as I want to discuss not only their daily charts, but their weekly charts as well. Seeing strength in both timeframes can provide the option to trade in the shorter term or in the longer term....

READ MORE

MEMBERS ONLY

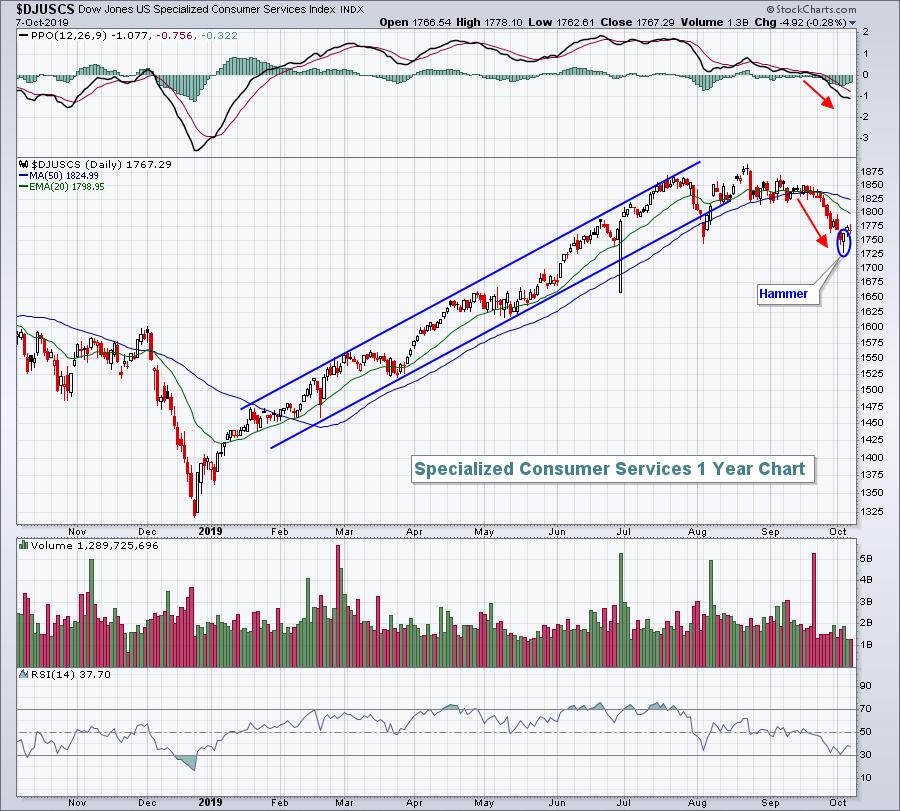

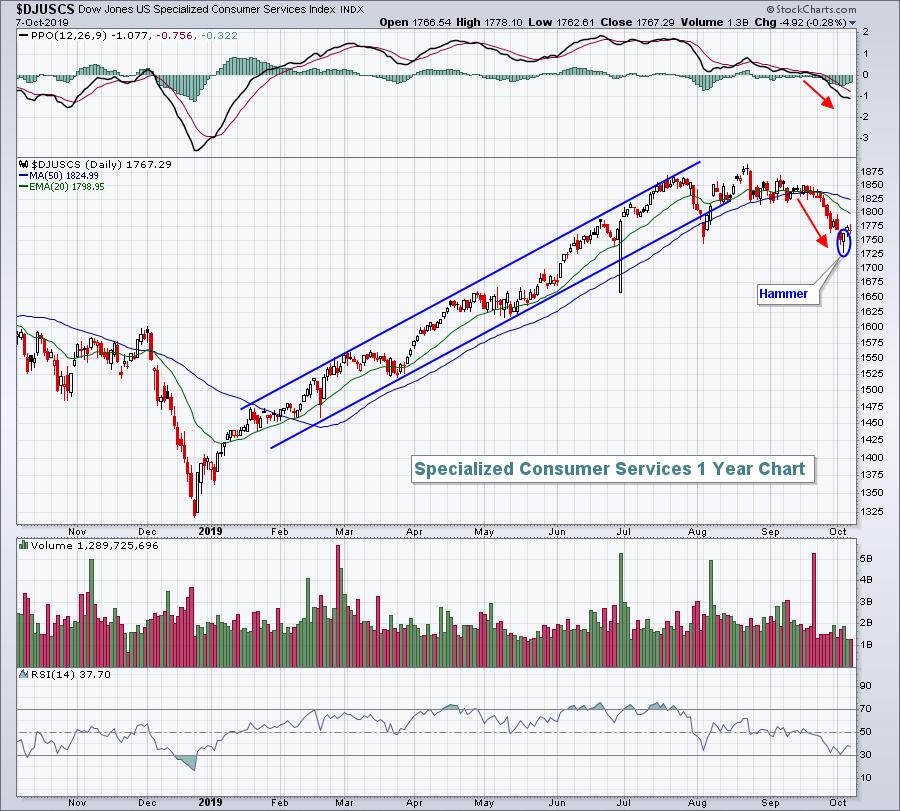

Consumer Discretionary Poised To Lead Market Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

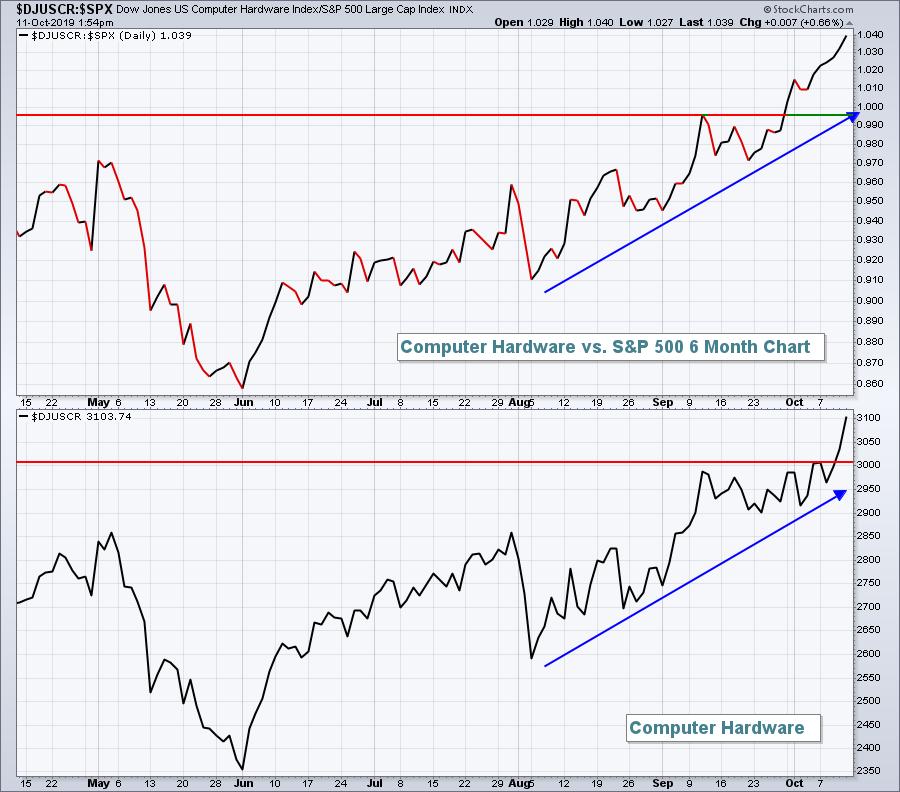

Last week, there were eight industry groups within consumer discretionary (XLY) that gained 2% or more, lead by the rapidly-improving apparel retailers ($DJUSRA), which gained 4.57% and broke out to 5 month absolute and relative highs:

The strength in the DJUSRA helped the XLY bounce off trendline support this...

READ MORE

MEMBERS ONLY

You Should Be Watching This Earnings Report On Tuesday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Every earnings season, there are a few key reports that I focus on. It could be that an industry group is beginning to show strength and a key component is reporting that could influence the direction of the group for the entire upcoming quarter. Or it could be that a...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Take A While To Establish A Confident Directional Bias; Upsides To Stay Capped

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

While trading in a broad range, the NIFTY struggled to find some base and managed to end the week with modest gains. The trading range of the NIFTY remained just moderately broad, but it oscillated quite a lot, infusing intraday volatility during the trading sessions. While holding on to its...

READ MORE

MEMBERS ONLY

Follow Through Day or Not?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Follow Through Day or Not? Stocks started Friday with a bang as the S&P 500 SPDR (SPY) gapped above 296 and held this gap throughout the day, despite a sell off in the final 30 minutes. Does this count as a "follow through" day? It is...

READ MORE

MEMBERS ONLY

Eight Stock Setups for the Coming Week

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It is time for another round of weekend stock setups. Last weekend I featured seven semiconductor stocks and these are performing well. Two weeks ago I featured a hodgepodge of stocks with mixed results.

The S&P 500 is trending higher, the Index and Sector Breadth Models are net...

READ MORE

MEMBERS ONLY

Markets Uptrend May Continue - Let The Leaders Reveal Themselves To You.

by Mary Ellen McGonagle,

President, MEM Investment Research

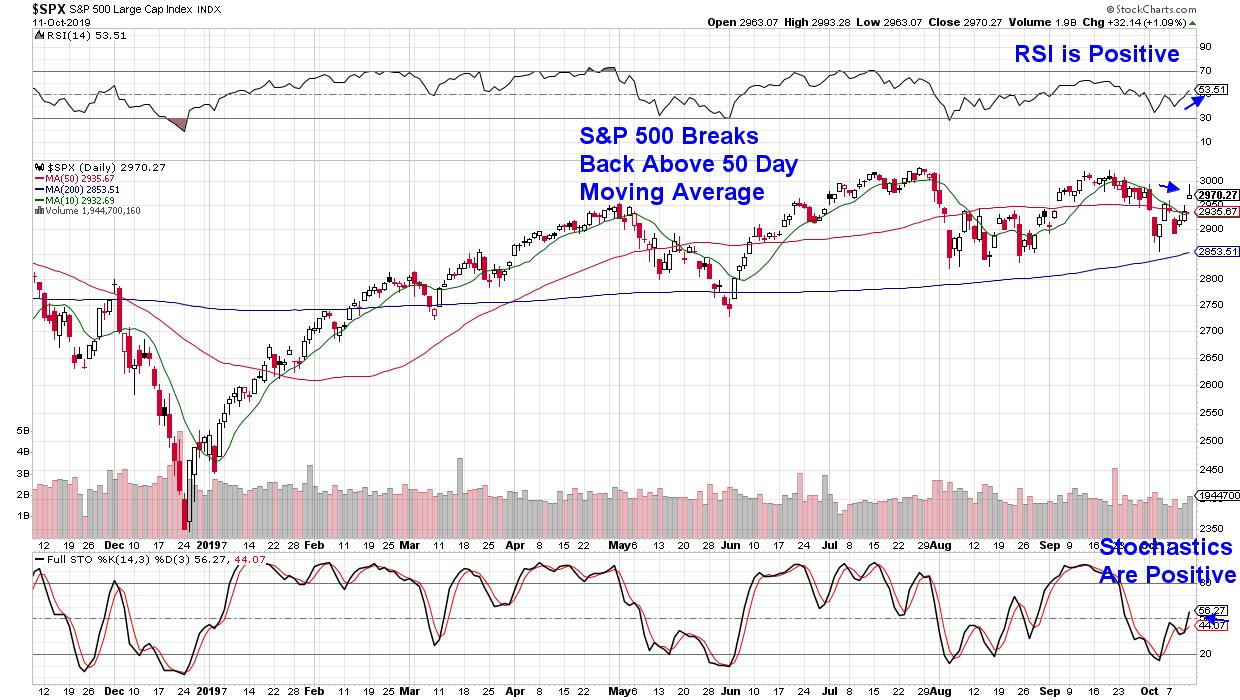

The markets closed out the week strong, with the S&P 500 jumping back above its key 50-day moving average on news of a partial US-China trade war deal. While constructive, we remain in a fragile period where the possibility of a phased trade deal may not be enough...

READ MORE

MEMBERS ONLY

Three Ways to Think About Relative Strength

by David Keller,

President and Chief Strategist, Sierra Alpha Research

We just completed our second week of The Final Bar, the new closing bell show on StockCharts TV. During our Friday mailbag segment, I was asked about how institutional investors think about relative strength.

To be honest, relative strength is of vital importance to institutions because, well, that is how...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Can't Fight the News

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I said, "There is a declining trend line drawn from the mid-September top. If that is taken out, I will pretty much give up on the double top idea." When I wrote that, I had in mind a solid, deliberate advance to new, all-time highs. What...

READ MORE

MEMBERS ONLY

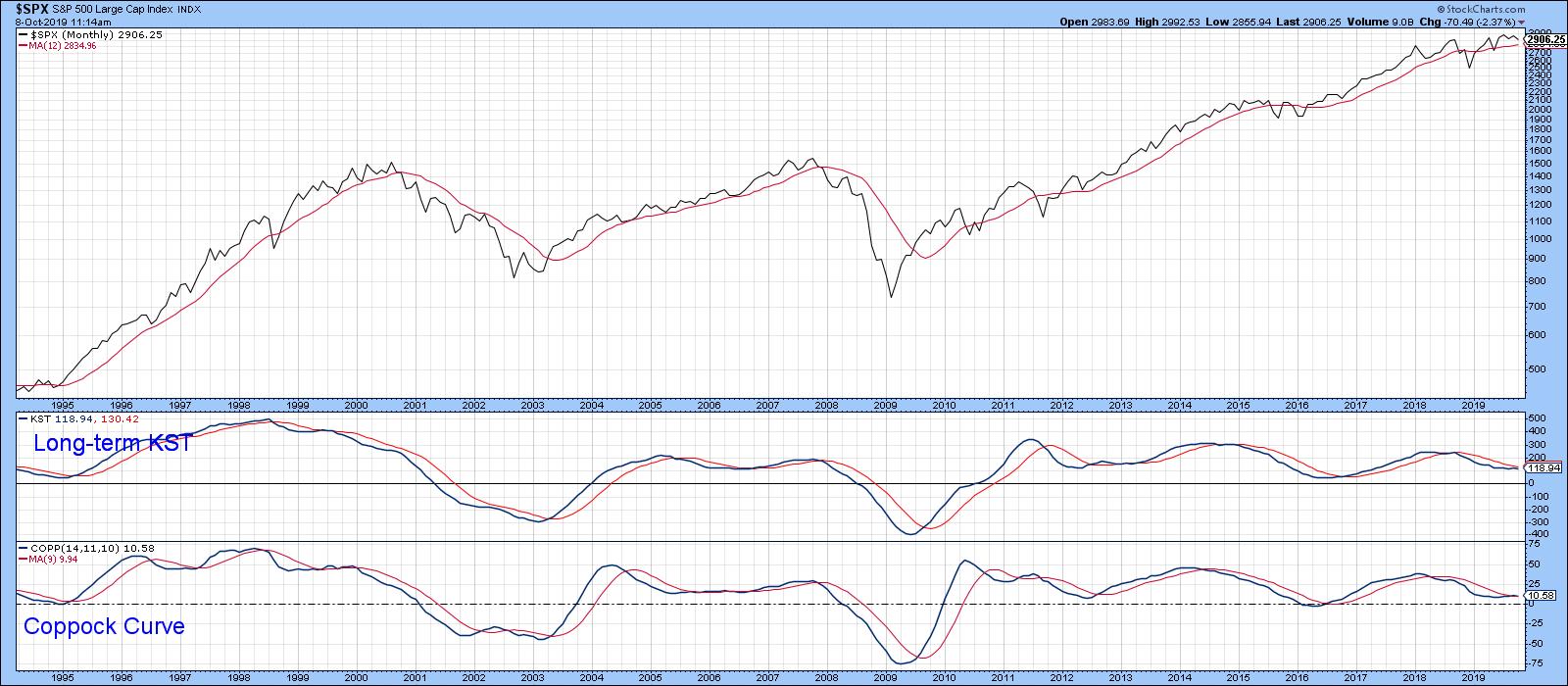

Short-Term Indicators Behave Differently in Bull and Bear Markets

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Tuesday, October 8th at 12:48pm ET.

Short-term oscillators behave differently depending on the direction of the primary trend. In bull markets, prices are very sensitive to oversold conditions and quickly bounce. We...

READ MORE

MEMBERS ONLY

STOCKS SOAR ON EXPECTED PARTIAL TRADE ACCORD BETWEEN U.S. AND CHINA -- INDUSTRIAL MINING SHARES LEAD MATERIALS HIGHER -- INDUSTRIALS, ENERGY, AND FINANCIALS ALSO LEAD -- BRITISH POUND HAS BIGGEST GAIN IN YEARS ON POSSIBLE BREXIT BREAKTHROUGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

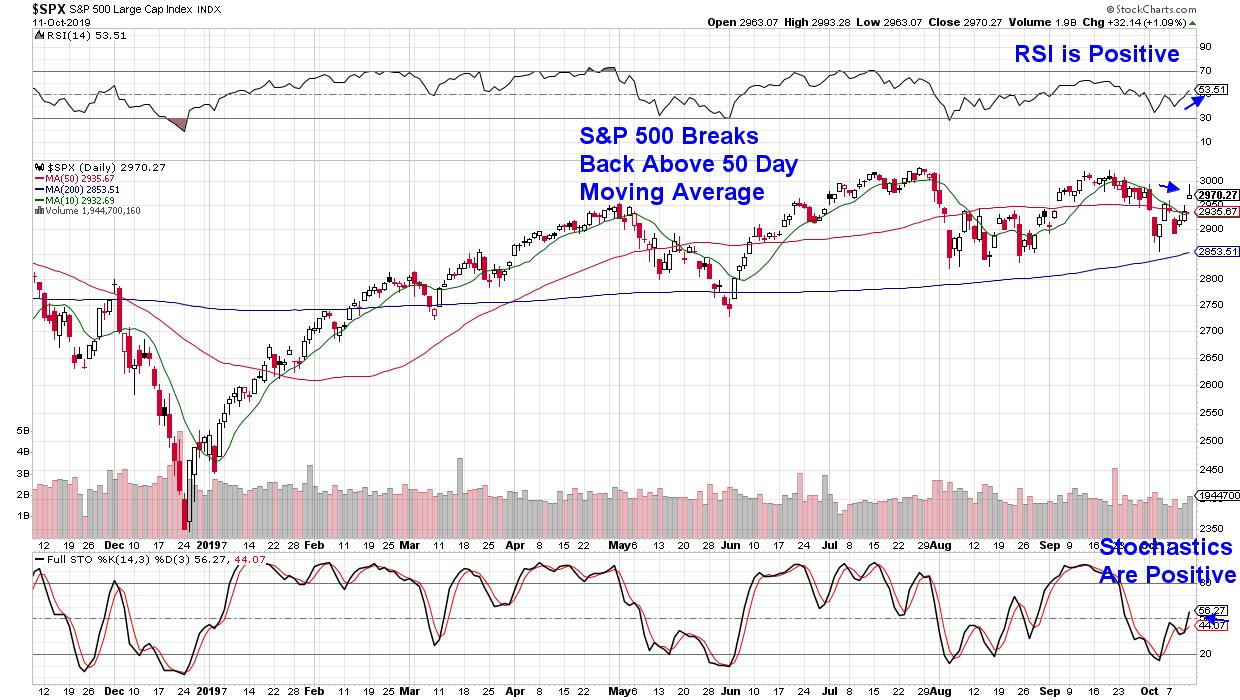

STOCK INDEXES SOAR ON TRADE HOPES...Stocks around the world are jumping sharply today on reports of a partial trade deal reached between the U.S. and China. Chart 1 shows the S&P 500 surging to the highest level this month to put it well above its 50-day...

READ MORE

MEMBERS ONLY

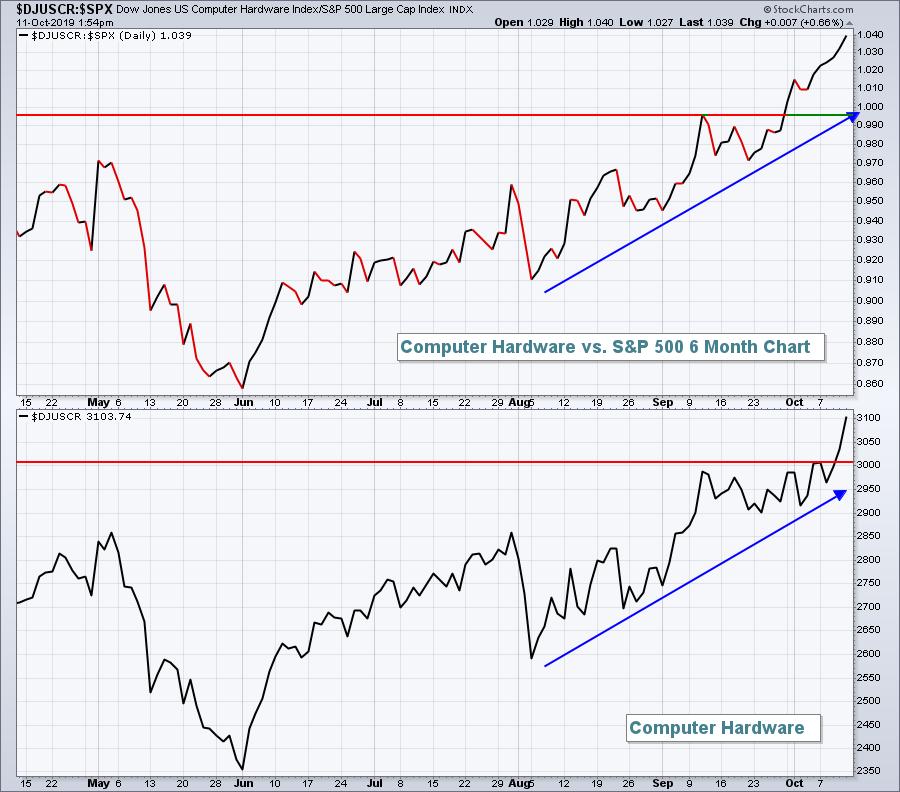

Industries Most Likely To Produce Blow Out Earnings Results

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Wall Street has placed its bets as we work our way into earnings season. It's very easy to see which groups are favored by big money - just look where that money has been going. Today, I'll give you my top 2 industry groups at the...

READ MORE

MEMBERS ONLY

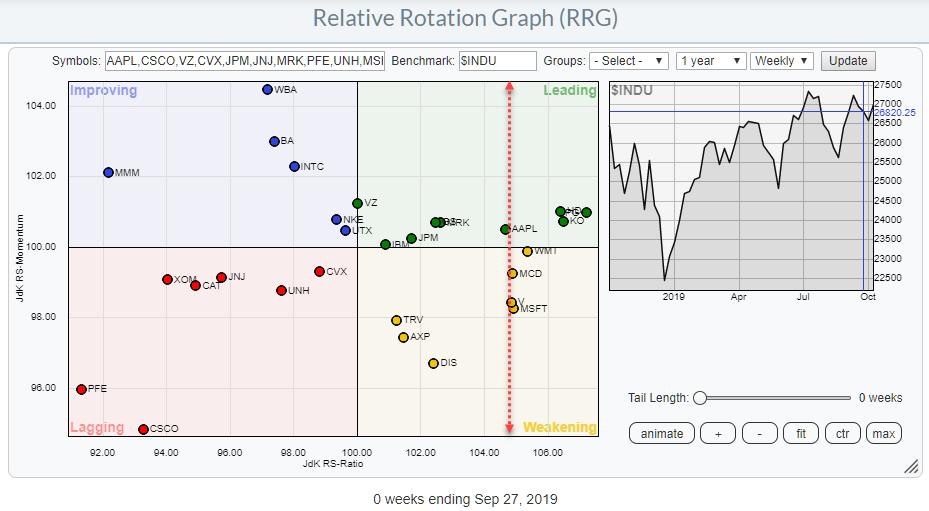

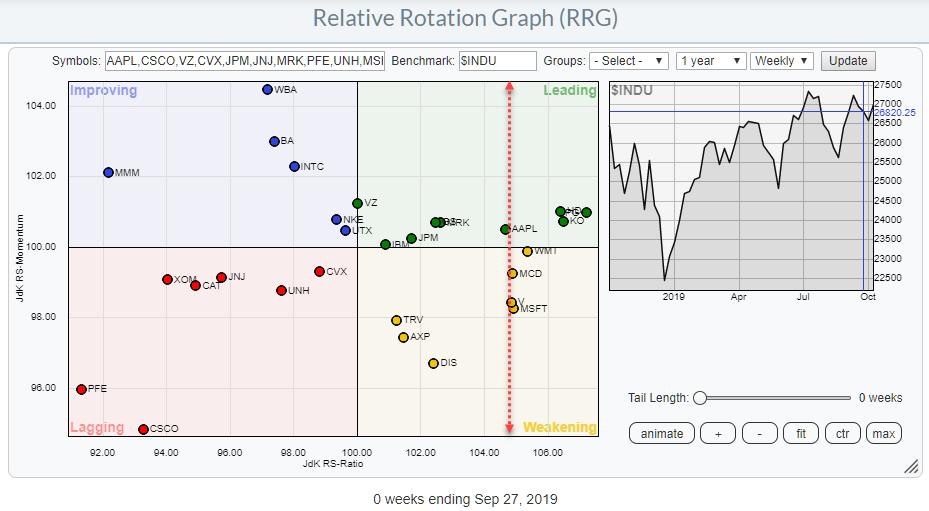

Buying the Top SIX Stocks in The DJ Industrials Index (on a Monthly Basis) Can Keep You Ahead Of The Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

What Is Our Track Record?

Ever since the launch of Relative Rotation Graphs on the Bloomberg professional terminal in 2011, some of the most frequently asked questions we've received have been "What's their track record", "How well do they perform?" and "...

READ MORE

MEMBERS ONLY

Banks Likely To Be Big Part Of Q4 Surge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Earnings season officially starts this morning, in my opinion, with quarterly results coming in from Citigroup (C). While C may provide the banking group a lift today, the bigger report comes on Tuesday when JP Morgan Chase (JPM) reports its numbers. Why is JPM more important? Because Wall Street has...

READ MORE

MEMBERS ONLY

State of the Stock Market - Key Assumptions Determine Probabilities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

My assumptions and biases are based on the bigger trend because it is the dominant force at work. When the trend is up, I view the cup as half full and expect more bullish resolutions than bearish resolutions. This means I favor bullish setups over bearish setups, successful support tests...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Glittering with Gold

by Erin Swenlin,

Vice President, DecisionPoint.com

In yesterday's DP Alert Mid-Week, I discussing the bullish prospects for Gold moving forward. Consequently, it was not surprising to see some Gold stocks on my various scans. I have a couple of these listed below, along with a semiconductor and solar company. The market is still quite...

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD IS BOUNCING TODAY -- LONG-TERM CHARTS SHOW TNX IN A LONG-TERM SUPPORT ZONE AND VERY OVERSOLD -- HIGHER BOND YIELDS ARE BOOSTING BANKS AND FINANCIAL STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR BOND YIELD IS BOUNCING OFF CHART SUPPORT...Global bond yields are bouncing today. The daily bars in Chart 1 show the 10-Year Treasury Yield rising 6 basis points to 1.65%. What makes that meaningful is that the TNX bounce is taking place from just above the previous low...

READ MORE

MEMBERS ONLY

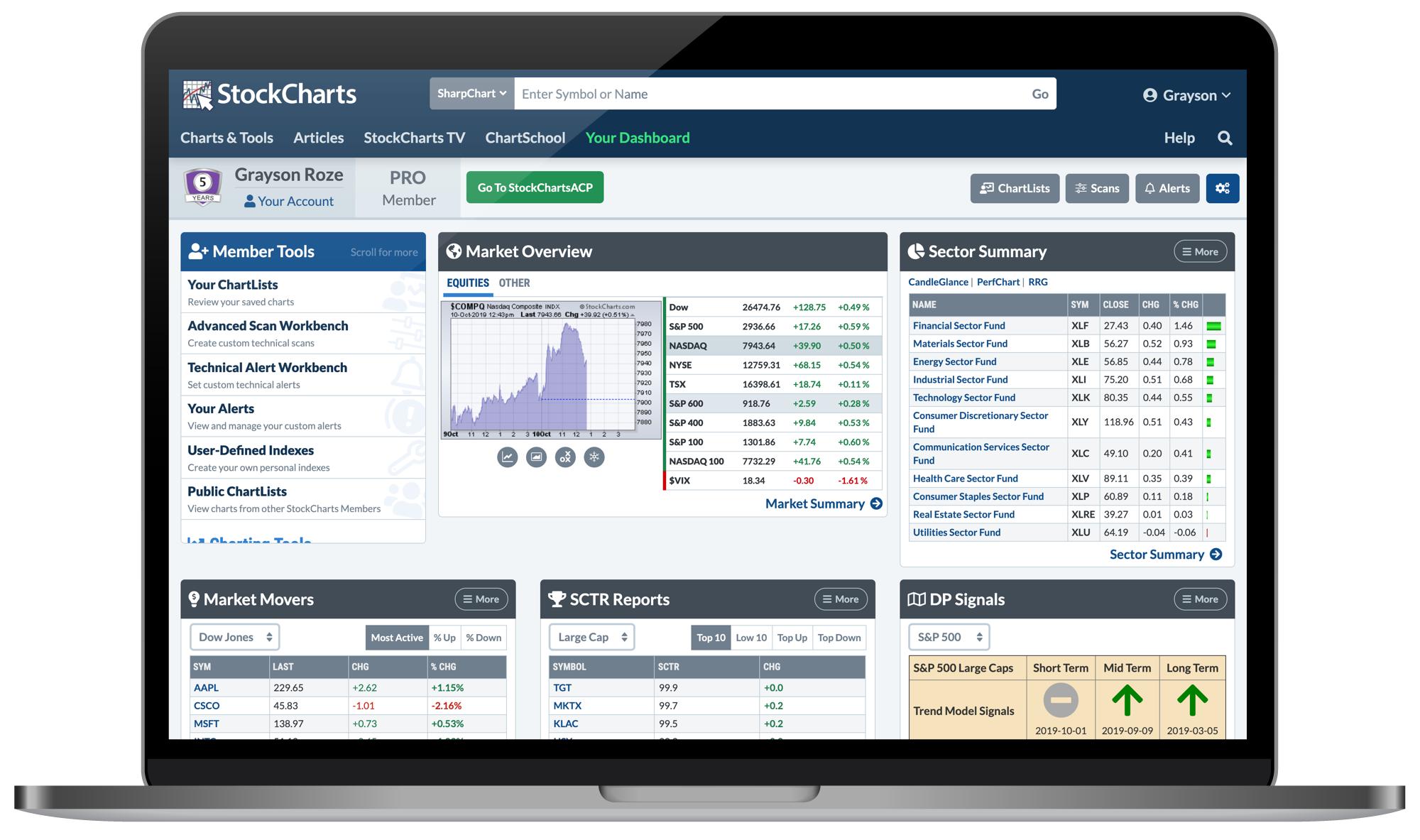

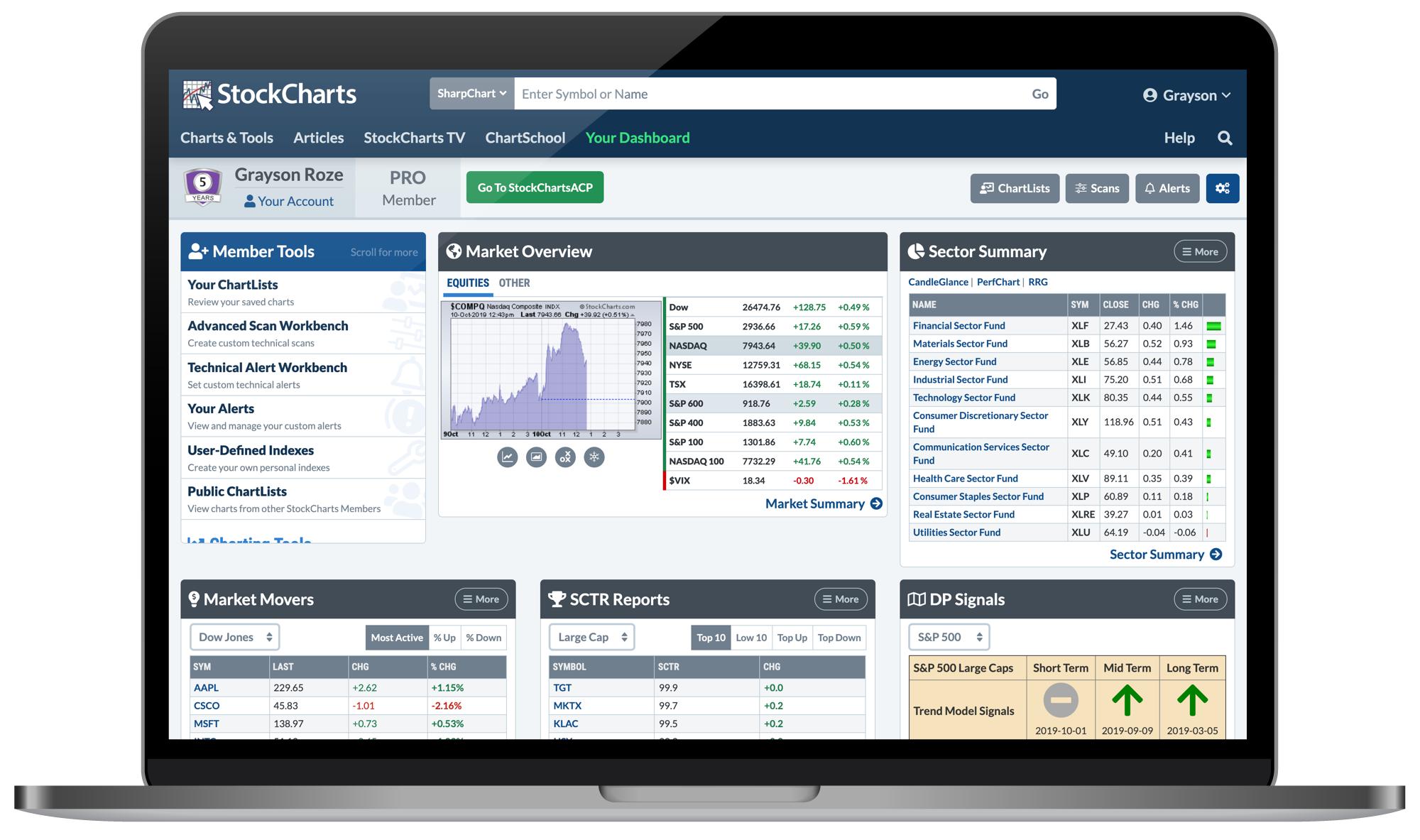

More Data, Better Charts, ChartList Actions and New Content: 5 Major Additions to Your StockCharts Dashboard

by Grayson Roze,

Chief Strategist, StockCharts.com

Hello Fellow ChartWatchers!

Earlier this week, we released another round of upgrades and additions to your StockCharts Dashboard. I've always referred to the Dashboard as "the heart and soul of your StockCharts account". Sure, it provides easy access to our many tools and features via the...

READ MORE

MEMBERS ONLY

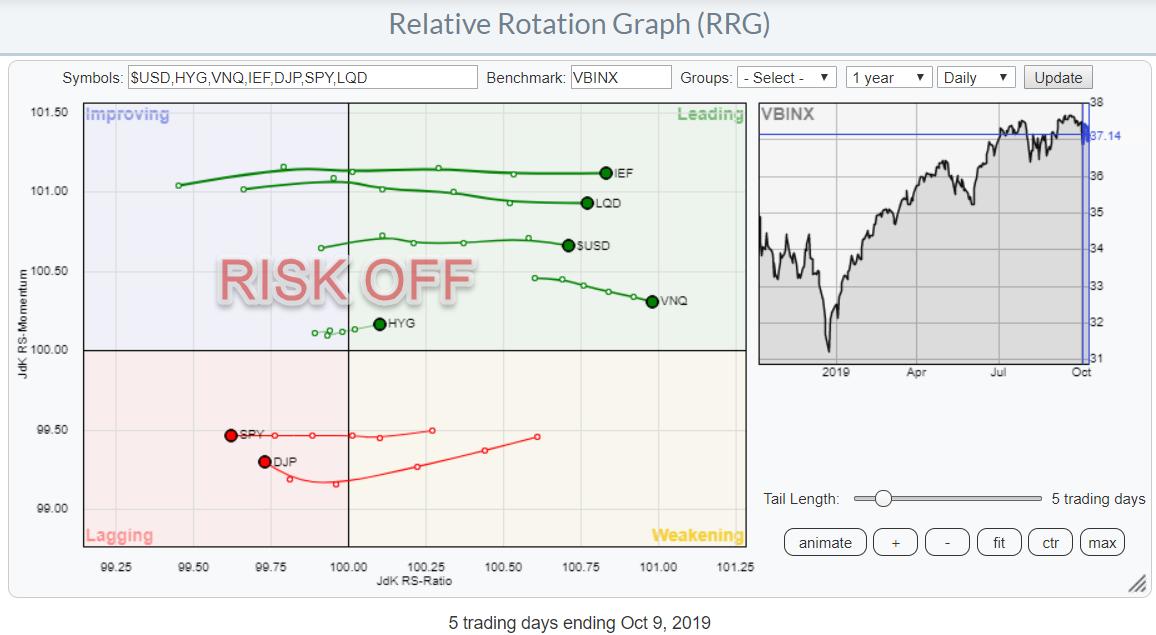

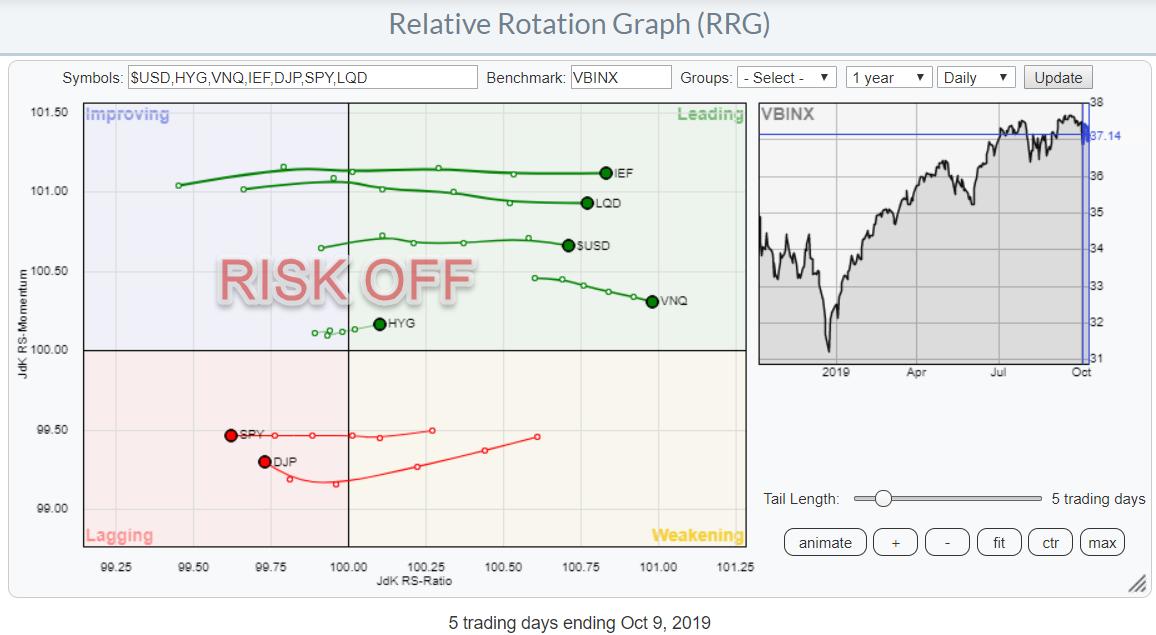

RRG Signals Risk-Off on Daily Chart

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The monthly charts for major markets like the S&P 500 Index are still in clear uptrends - that has not changed. But, in shorter timeframes, things have started to shift with regard to preference for asset classes.

In the first episode of my new StockCharts TV series Sector...

READ MORE

MEMBERS ONLY

Ranking and Grouping ETFs - Key Large-cap ETFs at Moment of Truth - Many More Downtrends than Uptrends

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The goal of this commentary is to cut through the day-to-day noise and focus on price action that actually matters. Noise can be in the form of news or random price fluctuations. Either way, we are often better off when we filter the noise and focus on what really matters....

READ MORE

MEMBERS ONLY

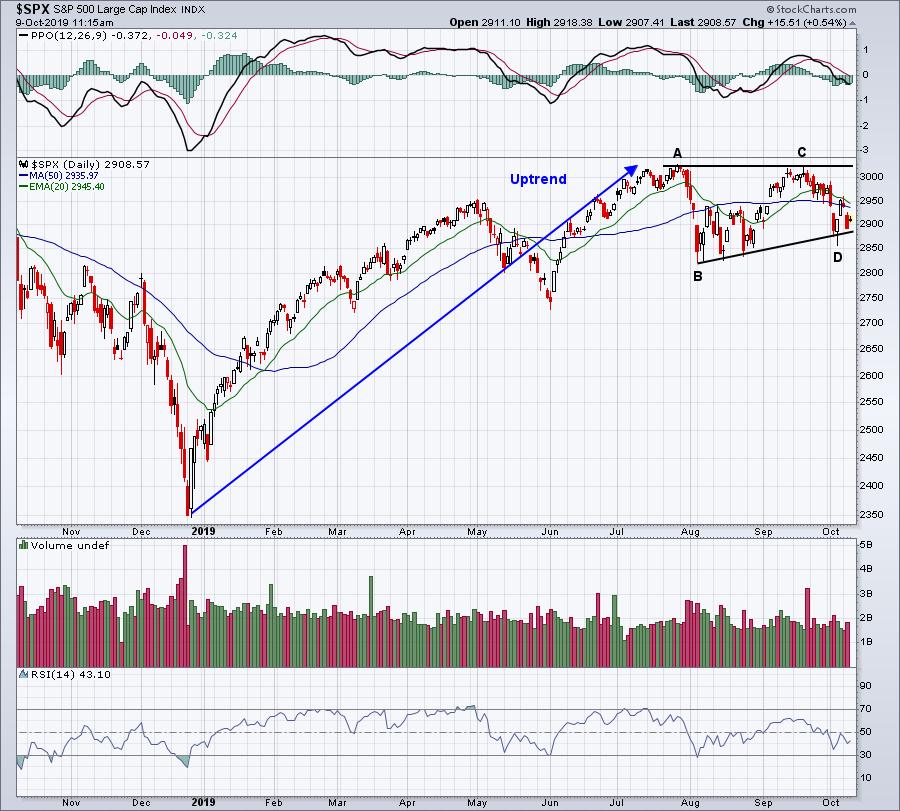

Daily Market Report - Wednesday, October 9, 2019

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

The following is the EB Daily Market Report for yesterday. It is sent out each day (usually between 11am and noon EST) to our members at EarningsBeats.com. It's one of several new products and services that we've unveiled over the past month. If you&...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Spotlight on Five REITs

by Erin Swenlin,

Vice President, DecisionPoint.com

The Diamond Scan presented only six candidates for review, one of which I wrote about yesterday (COST). I opted to run one of my less restrictive scans to see if there were a few hiding out there that my Diamond Scan doesn't normally pick out. That gave me...

READ MORE

MEMBERS ONLY

DP Alert Mid-Week: Bull Flag on Gold with Goldbugs Fueling the Fire

by Erin Swenlin,

Vice President, DecisionPoint.com

We had a great rally in the markets today, but the DP Scoreboards clearly tell the tale that problems remain. In fact, yesterday we got an Intermediate-Term Trend Model Neutral signal on the NDX - and we will see the same signals on the other three shortly. These signals are...

READ MORE

MEMBERS ONLY

STOCK INDEXES FLUCTUATE BETWEEN MOVING AVERAGE LINES AS TRADING RANGE CONTINUES -- TECH SECTOR SHOWS UPSIDE LEADERSHIP -- APPLIED MATERIALS AND LAM RESEARCH LEAD CHIPS HIGHER -- FINANCIALS NEED A BOOST FROM BOND YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES REMAIN IN TRADING RANGE...The three major U.S. stock indexes shown below remain in a sideways trading range between their 50-day moving averages on top and 200-day lines below. And they continue to trade between their July highs and August lows. While the short-term picture remains indecisive,...

READ MORE

MEMBERS ONLY

Can Banks Be The Catalyst For A Strong Quarter?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Technically-speaking, things are about to get very interesting for U.S. stocks. We've seen two economic reports out in the past two weeks that beg for at least a 25 basis point Fed rate cut. There was the weak ISM manufacturing data out last week and then yesterday...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Defensive Sectors Lead the Charge

by Erin Swenlin,

Vice President, DecisionPoint.com

I have decided to add my own (not yet charted) Diamond Index section as part of the Market Outlook section below. Basically, I will list the number of results that the Diamond Scan (formerly my General PMO Scan) returns, as well as the inverse Diamond Dog Scan. I then calculate...

READ MORE

MEMBERS ONLY

DP Show: Market Still Tenuous - Indicators Show Bearish Divergence

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's episode of DecisionPoint, Erin reviewed the major market indexes as well as the DecisionPoint indicators. Meanwhile, Carl added the Percent of Stocks Below their 20-EMA and the Silver Cross Index on our standard indicator charts. It made it quite clear that not all companies participated...

READ MORE

MEMBERS ONLY

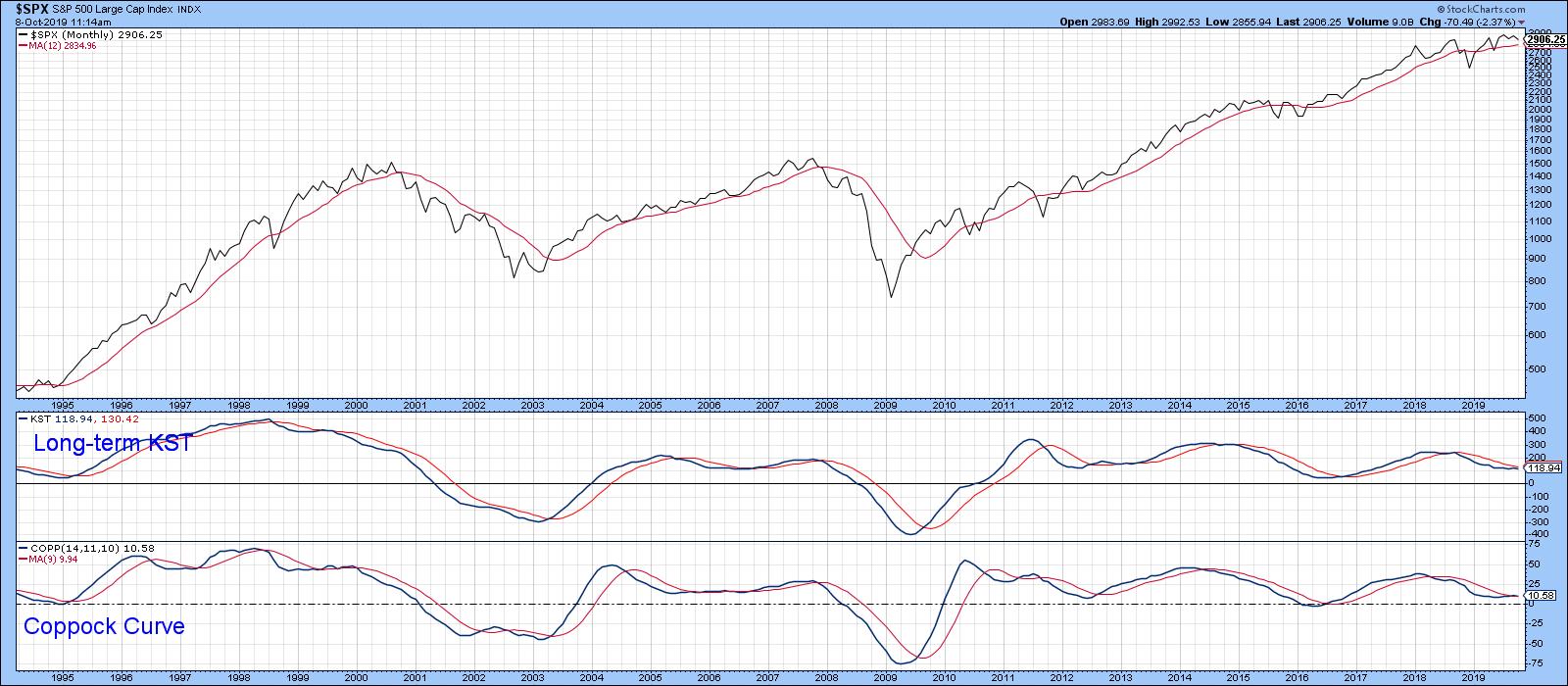

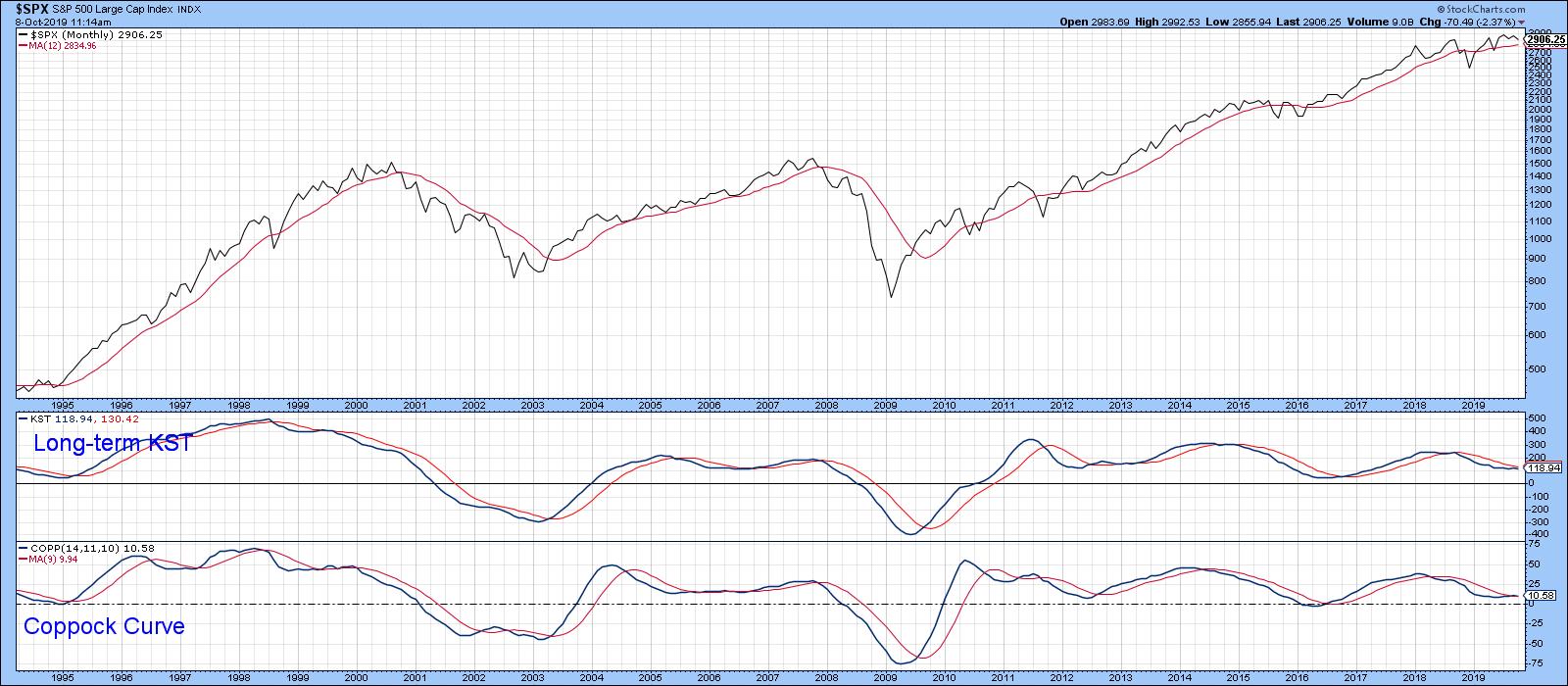

More Range-Bound Activity Ahead For US Equities?

by Martin Pring,

President, Pring Research

* Short-Term Indicators Behave Differently in Bull and Bear Markets

* Three Charts to Watch for a Potential Bearish Scenario

Short-Term Indicators Behave Differently in Bull and Bear Markets

Short-term oscillators behave differently depending on the direction of the primary trend. In bull markets, prices are very sensitive to oversold conditions and...

READ MORE

MEMBERS ONLY

Daily Charts vs. Weekly Charts: Which Are Better?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

That answer depends on your trading strategy quite honestly. Day traders likely don't care too much about technical indications on weekly charts whereas longer-term investors probably aren't going to grow too concerned by looking at charts day-to-day. Having said that, I put a lot more weight...

READ MORE