MEMBERS ONLY

DP Daily Diamonds - Revisiting Carl's Scan

by Erin Swenlin,

Vice President, DecisionPoint.com

It was interesting to look at the results of the Diamond and Diamond Dog Scans today, where we had 16 bullish results and only 32 bearish results. If you recall, for the past few weeks, I've been seeing far more bearish results. I'm starting to track...

READ MORE

MEMBERS ONLY

A Breakout Won't Be Sustainable Without This

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've discussed this on many occasions, but bull market advances requires the rotation of dollars from the bond market. We can have money going into both stocks and bonds for a short period of time, but that generally won't work over a longer period of time....

READ MORE

MEMBERS ONLY

Here's ONE Thing I'm Looking For In Q4

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Ok, I'm being somewhat dramatic. I'm looking for several things. First of all, I'm quite bullish. It's hard to tell exactly how long this consolidation lasts, but I'm definitely nowhere near the camp that believes we're heading for...

READ MORE

MEMBERS ONLY

Answering Questions From the 1st Episode of Sector Spotlight.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week, on Tuesday 1st October I hosted the first episode of "Sector Spotlight".

Preparing for something new and then going into the first time hosting a live show was an exciting experience. The problem, at least for me, is that you do not really know how things...

READ MORE

MEMBERS ONLY

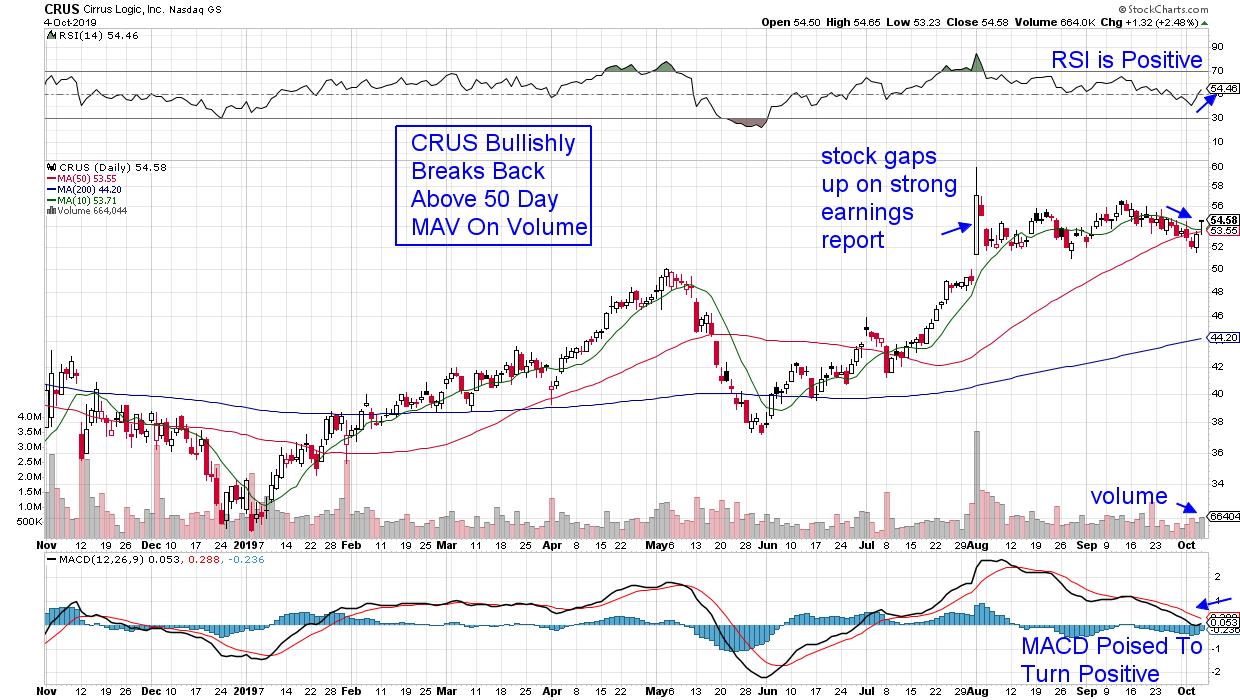

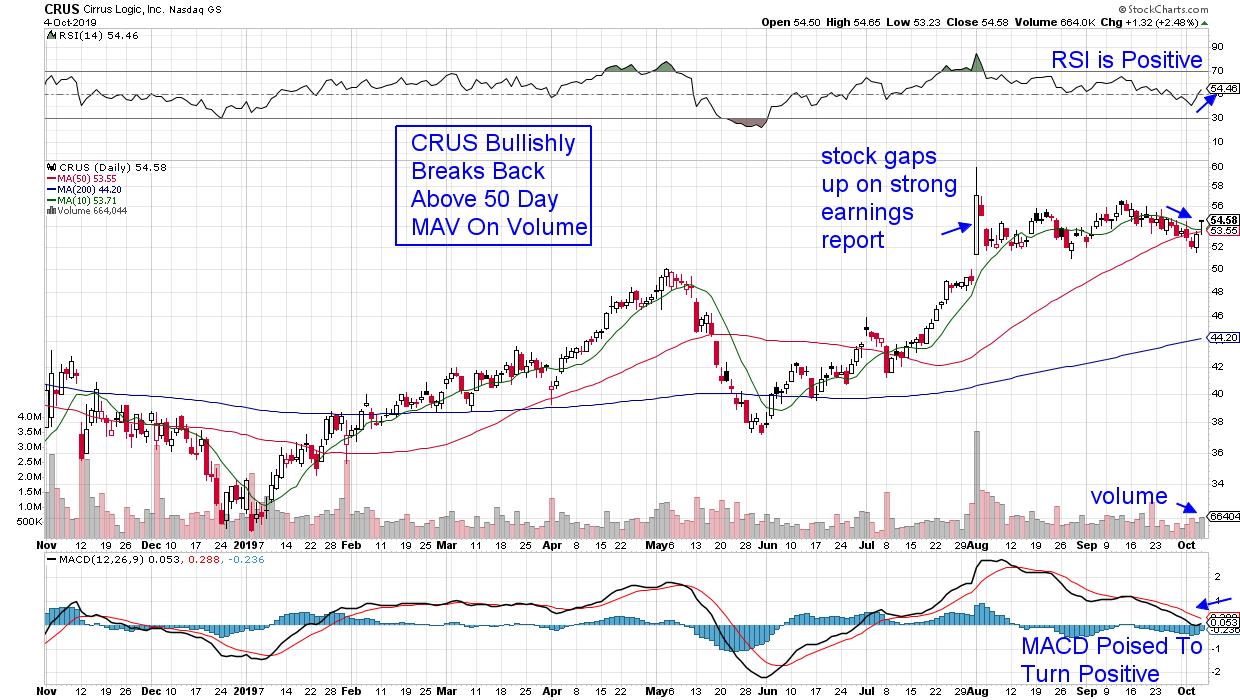

Apple Breaks Out On News - 3 Bullish Stocks That Stand To Benefit

by Mary Ellen McGonagle,

President, MEM Investment Research

News on Friday that Apple (AAPL) will be increasing iPhone 11 production by 8 million units (or about 10%) helped push the stock out of a 3-week base on volume. And while this bullish breakout sets AAPL up to trade higher should the market continue to rally, there are plenty...

READ MORE

MEMBERS ONLY

The Coming Week May Attempt A Technical Rebound, But Broader Setup Remains Weak; Watch These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, we had pointed out that the signs of exhaustion in the markets are visible; this week may see some profit-taking from higher levels. The past couple of days worked out much on the anticipated lines, but the profit-taking remained more intense than expected. The NIFTY...

READ MORE

MEMBERS ONLY

Q4: What's In Store For U.S. Equities?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

That's a great question and one that will be much easier to answer in 3 months. :-)

U.S. stocks have been through a lot over the past 21 months. Since topping in 2018, we've seen tremendous volatility, but there have been a few constants. For...

READ MORE

MEMBERS ONLY

State of the Stock Market - A Stock Picker's Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 and Nasdaq 100 remain in good shape, the Russell 2000 remains in bad shape and the S&P MidCap 400 is caught in the middle. I am not going to read too much into relative and absolute weakness in small-caps because the Russell 2000...

READ MORE

MEMBERS ONLY

Semiconductor ETFs Hold Up and Lead Tech - Plus 7 Semiconductor Stock Setups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Semiconductors are holding up relatively well over the last few weeks. While many stocks and ETFs broke their August lows, the Semiconductor SPDR (XSD) held its August low and the Semiconductor ETF (SOXX) did not even test its August lows. Today we will compare and contrast the two ETFs and...

READ MORE

MEMBERS ONLY

Q4 and Earnings Season Kick into High Gear. Get Ready!

by John Hopkins,

President and Co-founder, EarningsBeats.com

In just over a week, some of the largest banks will report their earnings including Citigroup, JP Morgan and Wells Fargo. When these financial behemoths report, I consider that the kickoff of Q3 earnings season. And when I think about the beginning of earnings season, my blood gets flowing thinking...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Double Top Abort?

by Carl Swenlin,

President and Founder, DecisionPoint.com

The market was treating my double top assessment pretty well, but on Friday price got back above the recently broken support; however, on the two-day rally SPX volume fell below the one-year average, failing to validate the advance. The daily PMO tried to turn up, but couldn't quite...

READ MORE

MEMBERS ONLY

Hail To The Sell-Side Savant: My Mentor

by Gatis Roze,

Author, "Tensile Trading"

I lost a mentor in September. Justin Mamis, who taught me how to formulate and engage my sell techniques, passed away at the age of 90. The lessons he taught me were the foundation for Stage Nine — the art of selling — in our book. I owe him an immeasurable debt...

READ MORE

MEMBERS ONLY

De-Fanging the FAANG Stocks - Bearish Patterns on Weekly Charts

by Erin Swenlin,

Vice President, DecisionPoint.com

About two weeks ago, my dad, Carl, pointed out that the FAANG stocks were forming some "impressive" bearish topping formations. I took a look and I have to agree. Despite a blow-out rally today, we both believe there is still trouble ahead. These charts in particular concern us,...

READ MORE

MEMBERS ONLY

Stock Indexes Try to Regain 50-Day Averages; The Nasdaq 100 QQQ Has Already Cleared Its Blue Line

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, September 4th at 3:11pm ET.

Stock prices are continuing the rebound that began with yesterday's upside reversal off their 200-day moving averages. And they're now trying to...

READ MORE

MEMBERS ONLY

Using New Highs and Lows to Track Trends in Two Timeframes

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today we are going to show how 52-week highs and lows can be used to track long-term and short-term trends in the S&P 500. Full disclosure: this is not the holy grail. It is one indicator that can be used in conjunction with others to keep you on...

READ MORE

MEMBERS ONLY

STOCK INDEXES TRY TO REGAIN 50-DAY AVERAGES -- THE NASDAQ 100 QQQ HAS ALREADY CLEARED ITS BLUE LINE -- SO HAS THE TECH SPDR WHICH IS LEADING STOCKS HIGHER TODAY -- APPLE NEARS NEW RECORD HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS BUILD ON YESTERDAY'S REBOUND OFF THEIR 200-DAY AVERAGES... Stock prices are continuing the rebound that began with yesterday's upside reversal off their 200-day moving averages. And they're now trying to clear some overhead resistance. Chart 1 shows the Dow Industrials entering an overhead...

READ MORE

MEMBERS ONLY

Stop The Insanity! We're Going Higher And Here's Why

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Before I talk about jobs, let's discuss the S&P 500. We're consolidating. In a secular bull market, that's fashionable. We went through this from 2014 through early 2016. This is simply the 2018/2019 version. Every downturn and we hear from the...

READ MORE

MEMBERS ONLY

STOCKS INDEXES SCORE UPSIDE REVERSAL NEAR AUGUST LOWS AND 200-DAY LINES -- TECHNOLOGY STOCKS LEAD NASDAQ REBOUND -- ALL ELEVEN SECTORS GAIN -- BUT STOCK INDEXES NEED MORE UPSIDE FOLLOW-THROUGH TO BUILD ON TODAY'S SUCCESSFUL TEST OF SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES BOUNCE OFF CHART SUPPORT... After trading sharply lower today, stocks reversed upward to score a potential upside reversal day. And they did it at some critical support levels. Chart 1 shows the Dow Industrials bouncing off their 200-day moving average and chart support near their August lows....

READ MORE

MEMBERS ONLY

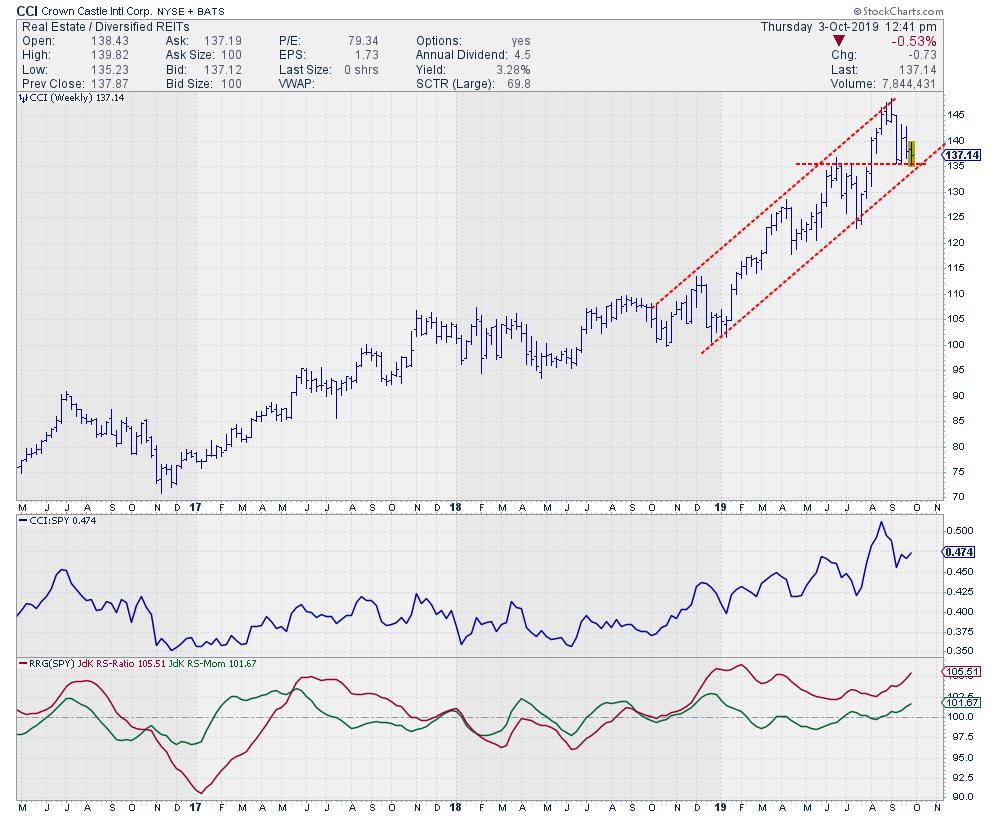

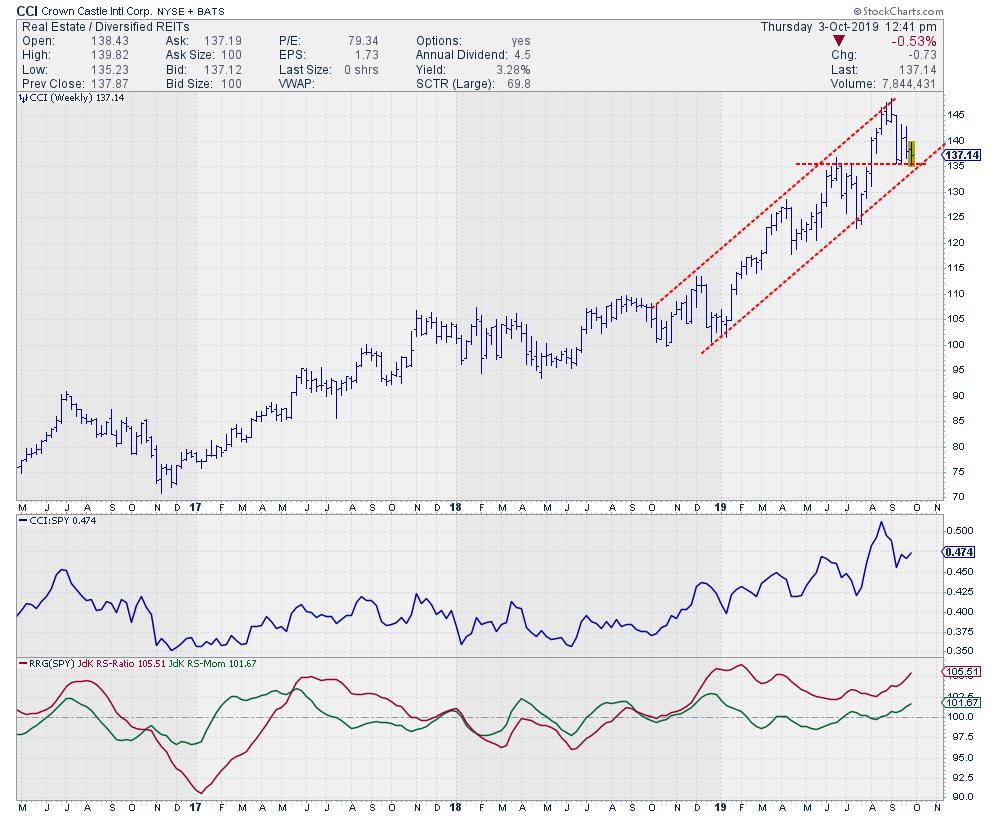

If You Are Looking To "Buy Dips" in Real Estate, Here is Your Dip For CCI!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This week is characterized by sinking stocks, at least in the first half of the week, as well as a stabilizing market (so far) on this Thursday. Situations like these lend themselves very well to search for stocks that "test support," especially when they are in a sector...

READ MORE

MEMBERS ONLY

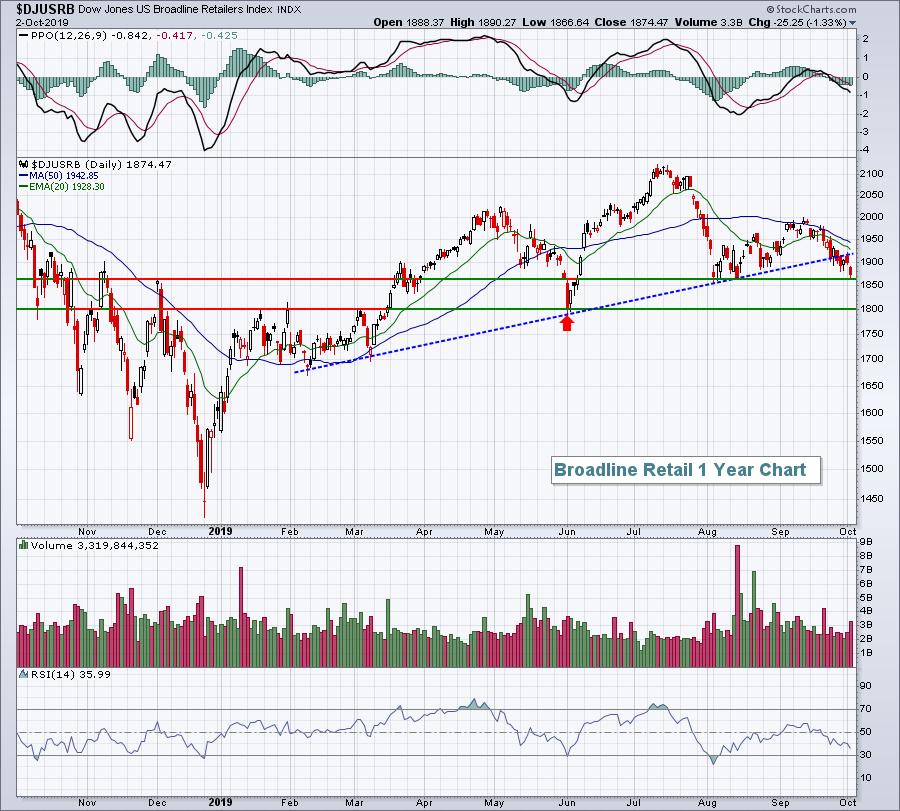

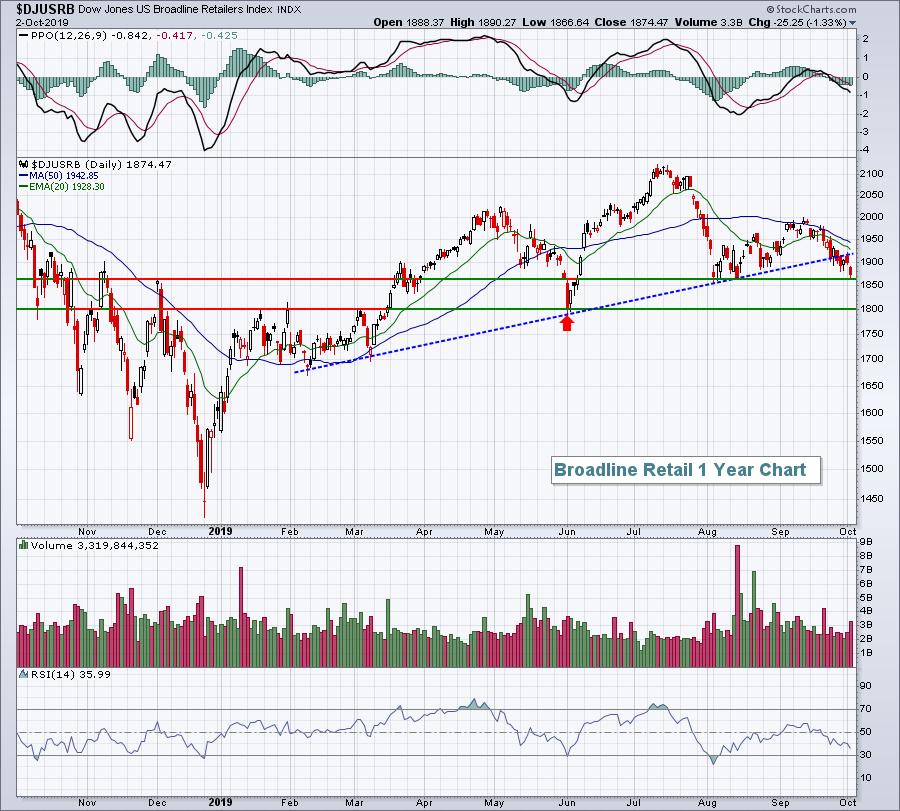

There Seems To Be No Bottom For This Broadline Retailer

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Broadline retail ($DJUSRB), once a Wall Street darling and bull market leader, has fallen upon hard times the past three months. While the S&P 500 recently moved up to challenge its all-time record high, the DJUSRB never came close. Its recent downtrend is now approaching key price support...

READ MORE

MEMBERS ONLY

Ranking and Grouping ETFs - SPY Consolidates, GLD Flies the Flag and SOXX Holds Strong

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

We will start with the S&P 500 SPDR (SPY) and the S&P 500 EW ETF (RSP), two versions of the same 500 or so stocks. These are the most important benchmarks to watch when it comes to the broader market. As such, I will use these...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Diamond Scan Exclusively Bonds - Shorting Opportunities Instead

by Erin Swenlin,

Vice President, DecisionPoint.com

I've seen this happen a few times. Today, I ran my Diamond PMO Scan and received 30 results that were ALL Bond ETFs. Rather than put those in, I decided, given the market environment, that I would give you some shorting opportunities. There were plenty to choose from...

READ MORE

MEMBERS ONLY

DP Alert Mid-Week: Golden Cross and Silver Cross Indexes Ugly Negative Crossovers

by Erin Swenlin,

Vice President, DecisionPoint.com

The newly minted "Golden Cross Index" and "Silver Cross Index" had negative crossovers today. I noticed that these negative crossovers tend to have serious consequences when the "stars" align on the Golden/Silver Cross Index and PMO indicators. This is in conjunction with all...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-10-02

by Martin Pring,

President, Pring Research

The monthly Market Roundup video for October is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

STOCK SELLING INTENSIFIES -- 50-DAY MOVING AVERAGES ARE BEING BROKEN -- A TEST OF SUMMER LOWS NOW APPEARS LIKELY

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES MAY BE HEADED FOR TEST OF SUMMER LOWS...Stock prices are undergoing more short-term technical damage. All three major stock indexes shown below have fallen decisively below their 50-day averages. Which raises the likelihood for a test of their August lows, and 200-day moving averages (red arrows)...

READ MORE

MEMBERS ONLY

Weak Manufacturing Spooks Wall Street, Sparking Selloff

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The September ISM manufacturing index fell from 49.1 in August to 47.8 this month, signaling a rather significant contraction. Export orders were much worse, posting 41.0, which was their third consecutive month of contraction. The report was released at 10am and, following a move lower heading into...

READ MORE

MEMBERS ONLY

Some Key Equal-Weight Sectors are Under Pressure

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks in the Industrials and Finance sectors were hit especially hard on Tuesday with XLI and XLF falling more than 2%. The Technology and Consumer Discretionary sectors held up better than the broader market by falling less than 1%. Nevertheless, these four offensive sectors were down on the day. The...

READ MORE

MEMBERS ONLY

Follow Up to Sunday Setups - When is the Rationale Invalidated?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Several of the Sunday Setups were hit hard on Tuesday as selling pressure hit the Finance, Industrials and Materials sectors quite hard. Five of the eleven stocks came from these sectors (PFG, USB, HON, FAST and PKG). Nine of the Eleven are down over the last two days. KMX and...

READ MORE

MEMBERS ONLY

STOCKS TURN LOWER ON WEAK MANUFACTURING DATA -- MAJOR STOCK INDEXES WEAKEN -- WEAKEST SECTORS ARE INDUSTRIALS, MATERIALS, ENERGY, AND FINANCIALS -- TRANSPORTS FALL BELOW 200-DAY LINE -- SO DOES RUSSELL 2000 -- ONLINE BROKERS TUMBLE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES ARE UNDER HEAVY SELLING PRESSURE...The weakest U.S. manufacturing number in ten years turned an early stock rebound into a bout of heavy selling. And the short-term stock picture continues to weaken. Chart 1 shows the Nasdaq Composite Index failing an early attempt to regain its 50-day...

READ MORE

MEMBERS ONLY

This Turnaround Candidate Is Hitting Its Stride!

by Mary Ellen McGonagle,

President, MEM Investment Research

When searching for downtrend reversal candidates, it's important to make sure that the stock's exhibiting bullish technical signals that point to an ability to sustain its new uptrend. It's also helps to make sure that the company is in a renewed period of growth...

READ MORE

MEMBERS ONLY

Medical Equipment Remains A Leader; 2 Stocks To Watch

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Medical equipment stocks ($DJUSAM) have been solid absolute and relative performers for the past 7 years with few exceptions, so it certainly seems worthwhile to stay on top of its relative strength leaders. One such leader in 2019 has been Avedro, Inc. (AVDR). After a wicked week last week, AVDR...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Real Estate is the Place Says the Diamond Scan

by Erin Swenlin,

Vice President, DecisionPoint.com

We certainly had an improvement in Diamond Scan results, as I saw 18 v 11 on Friday and only 90 on the Diamond Dog Scan. Also of interest, the Dogs that presented themselves showed minimal results for Utilities, Consumer Staples and Real Estate (a total of 9 of the 90)...

READ MORE

MEMBERS ONLY

When Contemplating Trades, Target The Leaders

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I know I speak of relative strength frequently, but it kinda makes common sense, doesn't it? In order to establish relative strength vs. your peers and the overall market, there has to be a lot of interest. When buying clothes, do you buy what's in style...

READ MORE

MEMBERS ONLY

Sunday Setups - 11 Stocks to Watch this Week

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After running some scans, scrolling through the charts and filtering the setups, I came up with a dozen stocks to watch for next week, and perhaps beyond. All are above their rising 200-day SMAs and in uptrends of some sort.

These stocks are also showing short-term relative strength. Eight of...

READ MORE

MEMBERS ONLY

Coming Week May See Consolidation With A Corrective Bias; Upsides May Stay Capped At Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Following the announcement of fiscal stimulus on Friday, the market extended its gains in the following week, but, at the same time, also consolidated at higher levels. After some more follow-up up moves in the first half of the week, the second half was spent in some volatile consolidation and...

READ MORE

MEMBERS ONLY

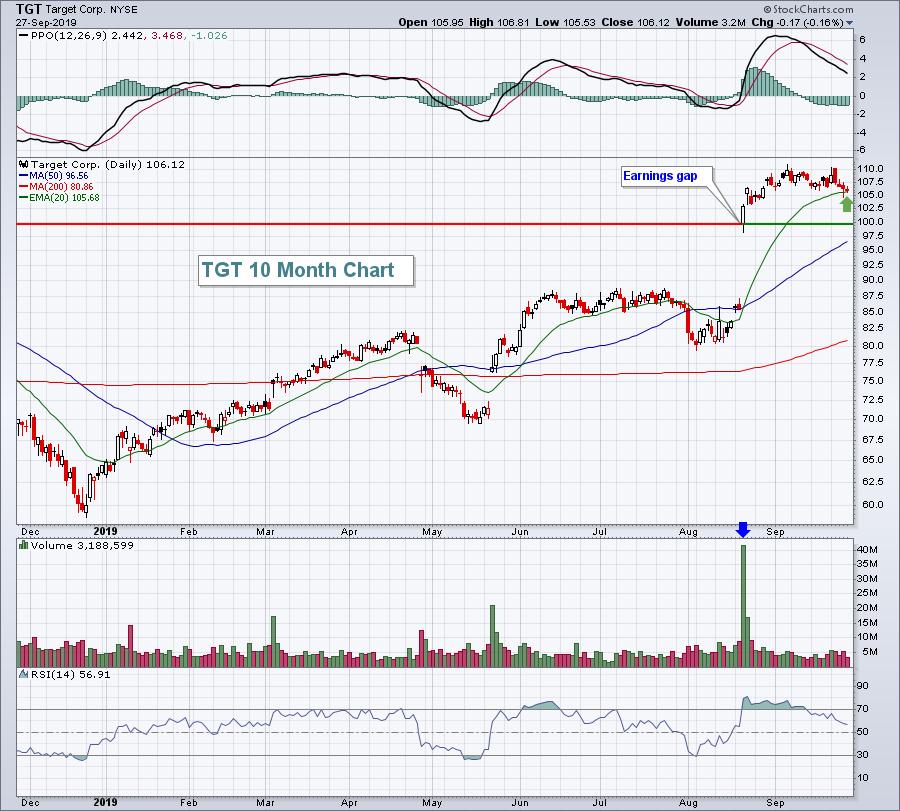

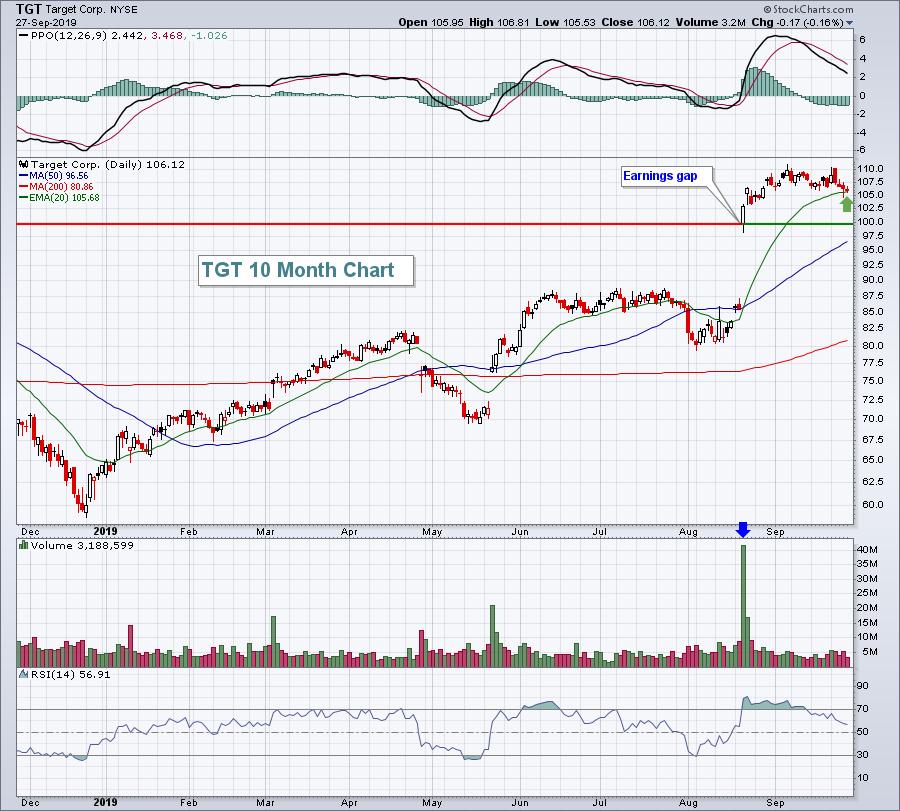

Earnings Gaps Provide Excellent Reward To Risk Trades

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Trading gaps from earnings is a big part of what I do. The reason is simple. When a company provides market participants new information, as a quarterly earnings report does, a new set of buyers and sellers emerge. Better-than-expected news will provide an immediate short-term boost in price, while bad...

READ MORE

MEMBERS ONLY

STOCK INDEXES PULL BACK FURTHER FROM SUMMER HIGH -- NASDAQ CONTINUES TO LOSE LEADERSHIP ROLE AS TECHNOLOGY SECTOR WEAKENS -- INTERNET STOCKS PULL COMMUNICATION SECTOR LOWER -- SELLING OF CHINESE STOCKS WAS A FACTOR -- BUT FACEBOOK ALSO HAD A BAD WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ ENDS BELOW ITS 50-DAY AVERAGE...While the three major U.S. stock indexes pulled back further from their July high, the Nasdaq was by far the weakest performer. Chart 1 shows the Nasdaq Composite Index ending the week well below its 50-day moving average (blue line). In addition, its...

READ MORE

MEMBERS ONLY

3 Breadth Indicators to Watch Next Week - SOXX Holds up Tech

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today I will expand and update the key breadth indicators for the S&P 500. Notably, I added two more early warning indicators to the mix. They have yet to trigger, but these added indicators will give us something to watch going forward.

I will also update the charts...

READ MORE

MEMBERS ONLY

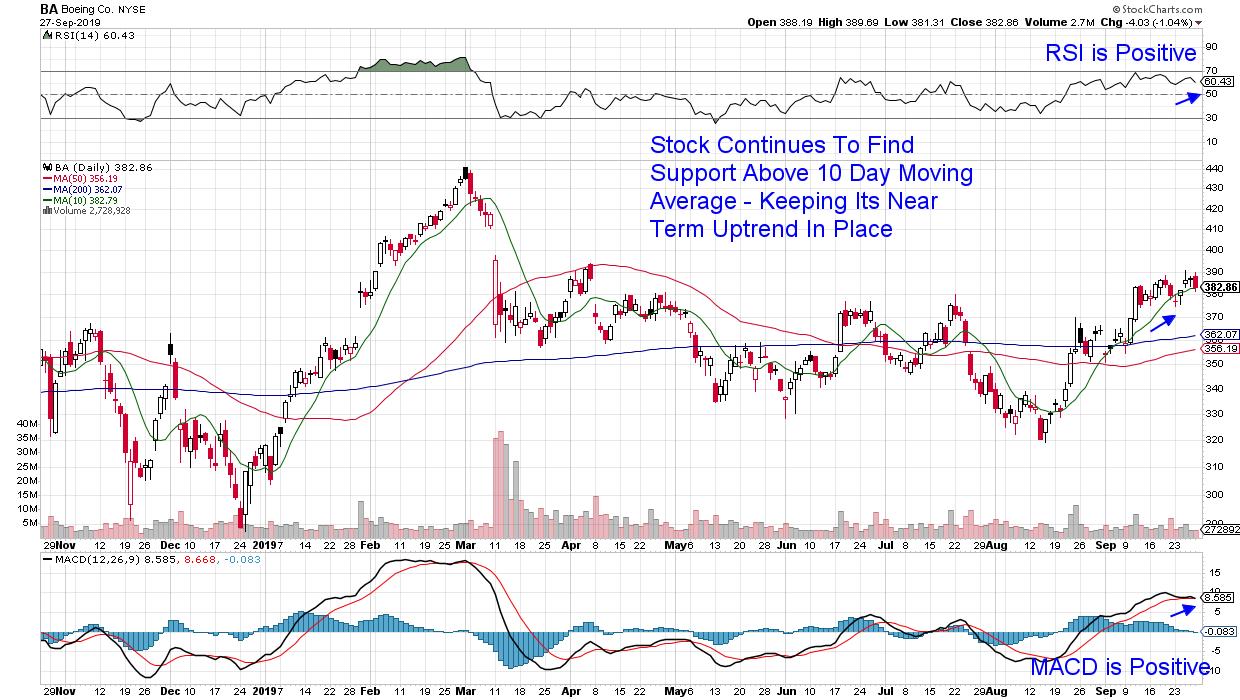

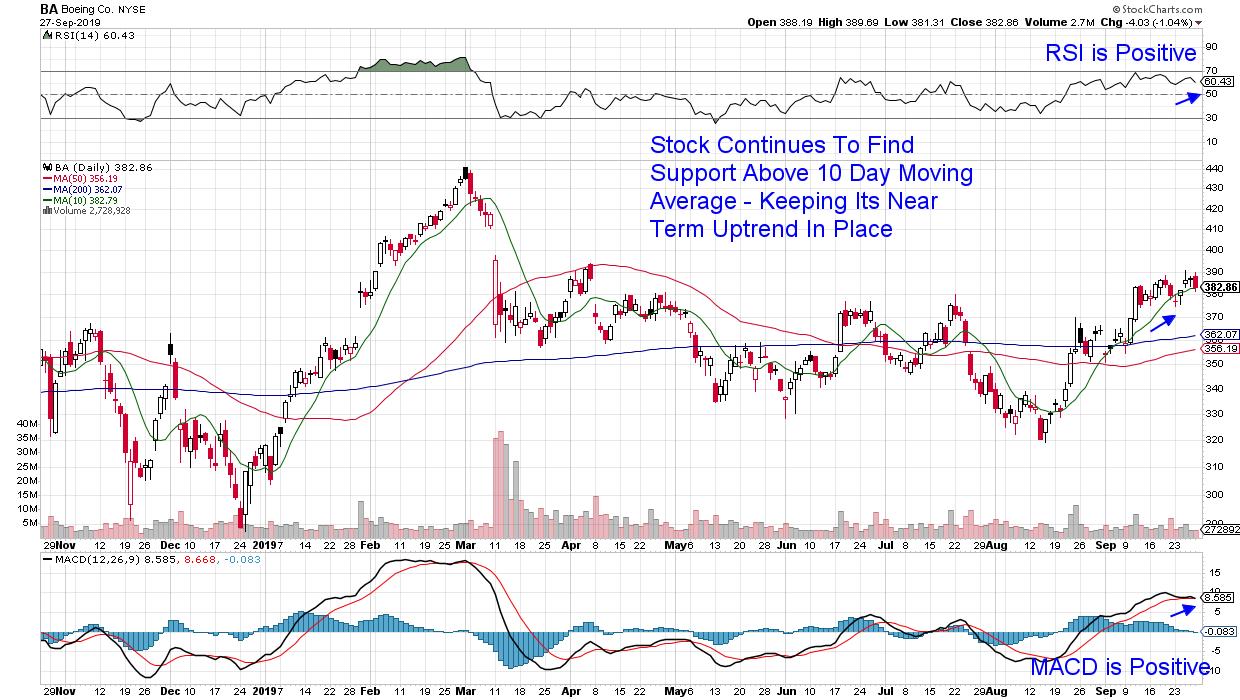

Yield Stocks With Growth Prospects: 3 Dow Stocks You Want To Be Aware Of

by Mary Ellen McGonagle,

President, MEM Investment Research

It was another bumpy week in the markets, as investors digested a barrage of political headlines which brought fear-induced selling to those areas most sensitive to the latest tweet. While the Tech-heavy Nasdaq was hardest hit, the Dow Jones Industrial Average held in surprisingly well last week, with several heavyweight...

READ MORE

MEMBERS ONLY

Financials Are About To Do Something They Haven't Done In Nearly 18 Months

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Financials (XLF) had been rather dormant for nearly 18 months - at least on a relative basis to the S&P 500 - but that is all about to change. While the group is certainly beginning to flex its collective muscle, the real confirming signal would likely be a...

READ MORE