MEMBERS ONLY

2019 Lagging Industry Becoming Leader Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The aerospace industry ($DJUSAS) has recently caught fire once again and it's worth noting - not only from an absolute perspective, but also from a relative strength standpoint. Each pullback over the past 5-6 weeks has been met with buying at the 20 day EMA, a bullish development....

READ MORE

MEMBERS ONLY

State of the Stock Market - Meet the New Leaders, Same as the Old Leaders

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

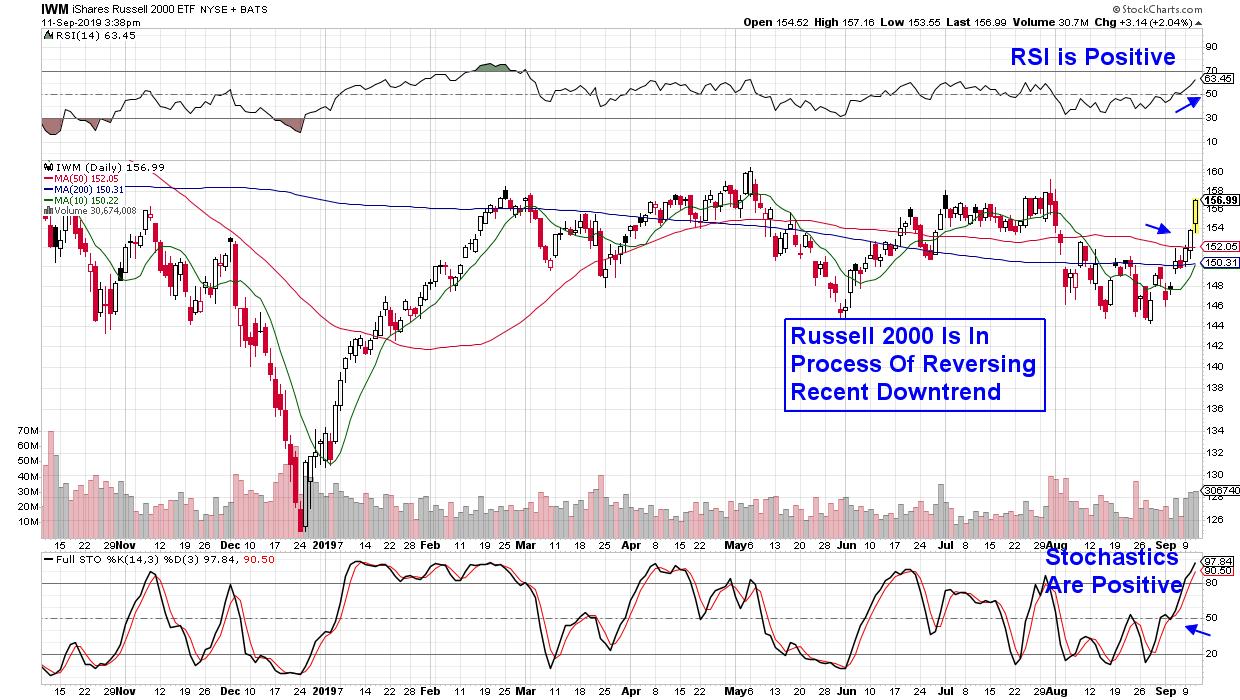

The resurgence of small-caps has been greatly exaggerated. Consider this. The S&P 500 SPDR (_SPY) bottomed on August 5th and broke above its August highs on September 5th. The Russell 2000 iShares (_IWM) bottomed on August 27th and broke above its August highs on September 10th. SPY bottomed...

READ MORE

MEMBERS ONLY

Microsoft Broke Out Today – Will Other Software Stocks Follow?

by Mary Ellen McGonagle,

President, MEM Investment Research

By all accounts, it was an incredible first half of the year for many growth areas of the market, before modest gains in July gave way to a dicey August. While September is up a healthy 2.75%, one formerly leading area of the markets has been left behind, leaving...

READ MORE

MEMBERS ONLY

DecisionPoint Daily Diamonds - The Long and Short of It

by Erin Swenlin,

Vice President, DecisionPoint.com

I discovered an interesting phenomenon today. When I ran my general Price Momentum Oscillator (PMO) scan, I got 19 results. That's more than we've seen the last few days, but then I decided I'd also run my Scan for Dogs, which is basically the...

READ MORE

MEMBERS ONLY

Ranking and Grouping Key ETFs - Tech-related ETFs Hit Moment of Truth, while Biotech ETFs Find Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After studying the charts in my core ETF list, I came up with eight groupings. The top three groups represent ETFs that are still in uptrends, while the bottom three groups represent ETFs that are in downtrends and lagging overall. The middle groups are in flux. Group 4 represents ETFs...

READ MORE

MEMBERS ONLY

MAJOR STOCK INDEXES ARE HEADED FOR TEST OF SUMMER HIGH -- STRONG TECH SECTOR IS PUTTING THE NASDAQ IN THE LEAD -- MICROSOFT HITS NEW RECORD TO LEAD MARKER HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES NEAR SUMMER HIGHS...Major U.S. stock indexes are trading higher today and approaching a test of their summer highs. Chart 1 shows the Dow Industrials continuing its bounce from yesterday afternoon and maintaining its bullish bias. Chart 2 shows the S&P 500 doing the...

READ MORE

MEMBERS ONLY

Post-Fed Action Provides Us MAJOR Clues....If You Know Where To Look

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I think most technicians would agree that stock market action into the close is generally much more important than stock market action just after the open. That is magnified even further when we have a major event take place intraday. Yesterday, we had a widely anticipated Fed meeting with growing...

READ MORE

MEMBERS ONLY

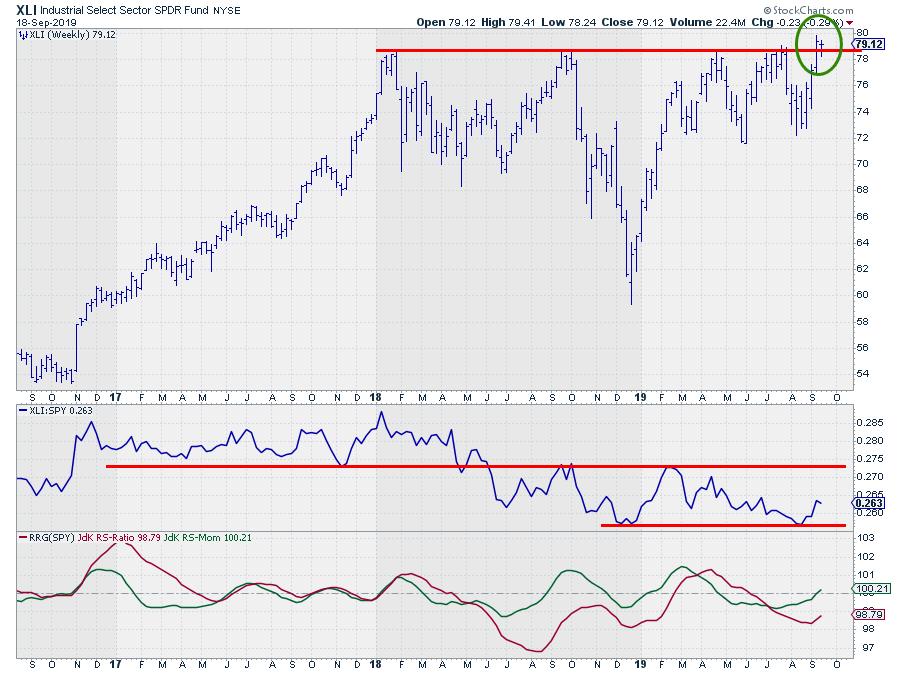

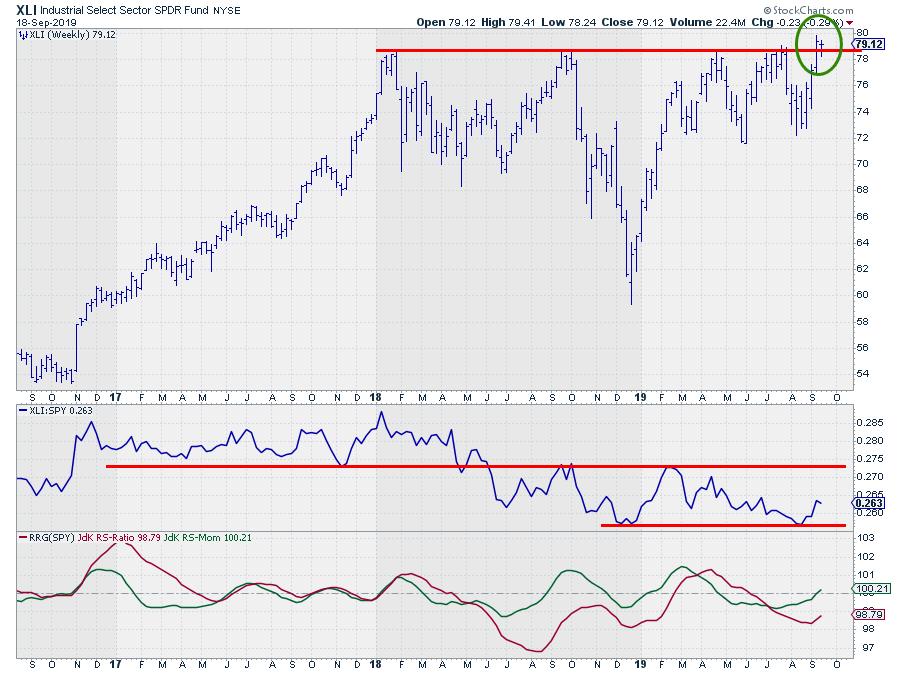

Here Is Another Sector Breaking To New Highs!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Today, I posted a Relative Rotation Graph for US sectors on my Twitter and Instagram feeds highlighting the clear split between some sectors now visible on the daily timeframe. One of these sectors is Industrials, which is traveling deeper into the leading quadrant at a stable, almost horizontal, relative momentum....

READ MORE

MEMBERS ONLY

DP Daily Diamonds - More Industrials and REITs (Including a Repeat)

by Erin Swenlin,

Vice President, DecisionPoint.com

The General Price Momentum Oscillator (PMO) scan threw 12 stocks at me today. We're still not seeing huge numbers coming in on these scans, which tells me to proceed with caution. Additionally, it's been interesting to see so many Industrials and REITs in the results. Today,...

READ MORE

MEMBERS ONLY

DP Alert: Overbought IT Indicators Suggest Rough Waters Ahead

by Erin Swenlin,

Vice President, DecisionPoint.com

The DecisionPoint indicators help give us some insight into the condition of the market. The present short-term indicator deterioration is bearish, and the very overbought readings on our ITBM and ITVM suggest lower prices ahead. Currently, the trend of the markets is bullish, with all three of our trend models...

READ MORE

MEMBERS ONLY

FED CUTS RATE A QUARTER POINT AS EXPECTED BUT APPEARS SPLIT ON FURTHER CUTS -- TWO-YEAR YIELD REBOUNDS WHILE 10-YEAR STABILIZES AFTER CUT -- STOCKS RECOVER FROM EARLIER LOSSES -- BANKS HAVE A STRONG DAY -- DOLLAR STRENGTHS AS COMMODITIES DROP

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS RECOVER EARLY LOSSES...Stocks recovered from initial selling after today's quarter point rate cut. Chart 1 shows the Dow Industrials ending 36 points (+0.13%) higher today to reverse earlier losses. The S&P 500 also closed modestly higher; while the Nasdaq ended modestly lower. Sector...

READ MORE

MEMBERS ONLY

Hold Your Breath, It's Fed Day!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm nervous. I believe the market has shown how nervous it's been as money quickly rotated from growth to value stocks ahead of today's Fed announcement. Here's a 10 year weekly look at the IWF:IWD ratio (Russell 1000 growth vs. value)...

READ MORE

MEMBERS ONLY

DecisionPoint Daily Diamonds - PMO Scan Pulls "Defensive" Stocks

by Erin Swenlin,

Vice President, DecisionPoint.com

My Price Momentum Oscillator (PMO) scan is still not providing too many choices; the ones that are appearing are in defensive categories. This always makes me suspicious of market conditions. Despite the SPX rising to new all-time highs, I'm only seeing around 8-11 results. I did get two...

READ MORE

MEMBERS ONLY

Moment-of-truth for Small-cap and Regional Bank ETFs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

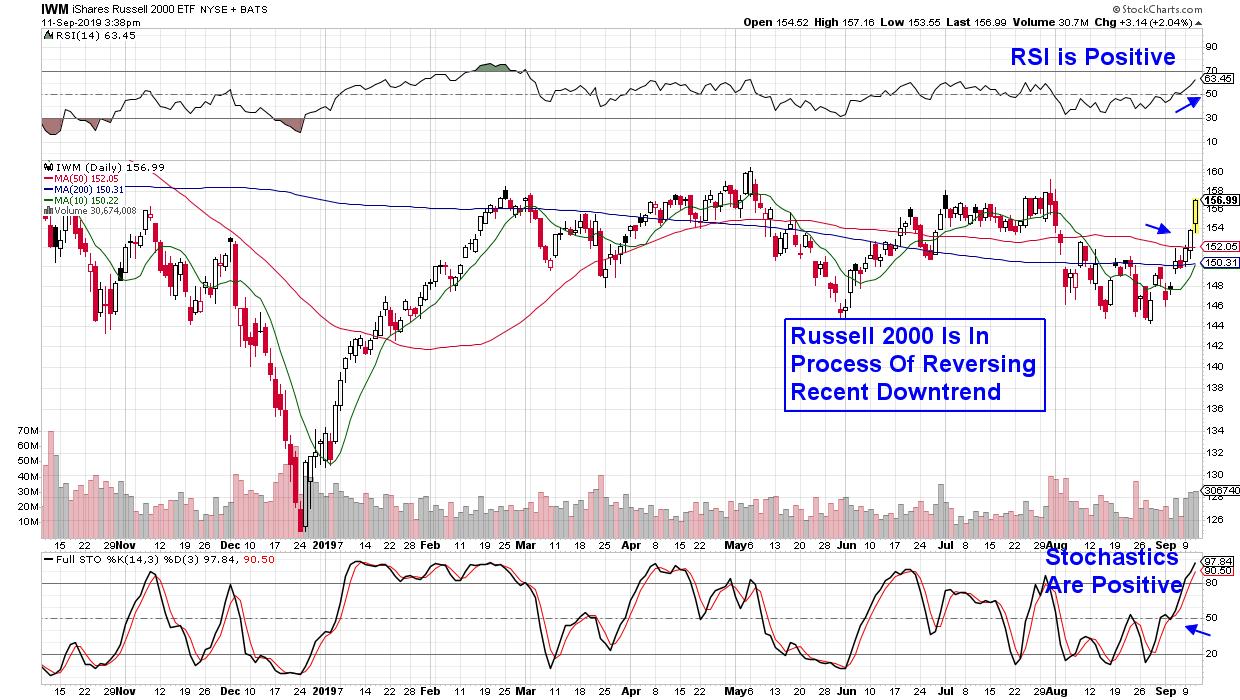

The S&P SmallCap iShares (IJR) and Russell 2000 iShares (IWM) are leading the market in September with 8.22% and 7.66% gains, respectively. As the PerfChart below shows, these gains are more than double the gains in the S&P 500 SPDR (SPY), Nasdaq 100 ETF...

READ MORE

MEMBERS ONLY

Crude Oil: The Long-Term View And The Fed's Role

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Crude oil ($WTIC) was certainly in the news on Monday after a drone strike crippled Saudi Arabian oil production by roughly 50%. The immediate reduction in global oil supply was felt via a 14.68% surge in price to $62.90 per barrel. Obviously, that's a one-time type...

READ MORE

MEMBERS ONLY

DecisionPoint Daily Diamonds - "Momentum Sleepers"

by Erin Swenlin,

Vice President, DecisionPoint.com

I've been running my "Momentum Sleepers" scan daily in the hopes of catching some stocks that are building momentum underneath the surface. These are mostly beat-down stocks, but volume and momentum are beginning to improve. I use a "speedy" Price Momentum Oscillator (PMO) and...

READ MORE

MEMBERS ONLY

Three Charts That Could Signal A Significant Extension To The Equity Rally

by Martin Pring,

President, Pring Research

* High Velocity of Short-Term Indicators Indicate Higher Prices

* Three Charts to Monitor for More Upside Potential

High Velocity of Short-Term Indicators Indicate Higher Prices

A couple of weeks ago, I cited some short-term indicators for the US stock market that struck me as being bullish. Several of these are now...

READ MORE

MEMBERS ONLY

ATTACK ON SAUDI OIL FACILITIES PUSHES CRUDE OIL AND ENERGY SHARES SHARPLY HIGHER -- CAUSING MINOR PROFIT-TAKING IN STOCKS -- FUEL-SENSITIVE AIRLINES DROP -- SMALL CAPS GAIN MORE GROUND -- BONDS AND GOLD REBOUND -- THE DJ US DEFENSE INDEX HITS A NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

CRUDE OIL AND ENERGY SHARES JUMP...As expected, the weekend attack on Saudi Arabia's oil facilities pushed the price of oil sharply higher today and in very heavy trading. Chart 1 shows the United States Oil Fund (USO) surging 12% to the highest level in four months. Energy...

READ MORE

MEMBERS ONLY

Is Now The Time For FedEx?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

FedEx Corp (FDX) will be reporting its latest quarterly results tomorrow after the closing bell. In late-August, FDX printed a bullish engulfing candle and it's been moving straight up ever since. It's now running into both gap and price resistance, however, so it needs a catalyst....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Holds The Crucial 100-Week MA; May Stay Vulnerable Unless It Moves Past This Zone

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week remained positive for the Indian equities as the benchmark index closed with week with net gains. The markets witnessed up-moves over the past couple of days, but those were fueled mostly by short-covering, which was triggered from the lower levels. The NIFTY successfully defended the critical support levels...

READ MORE

MEMBERS ONLY

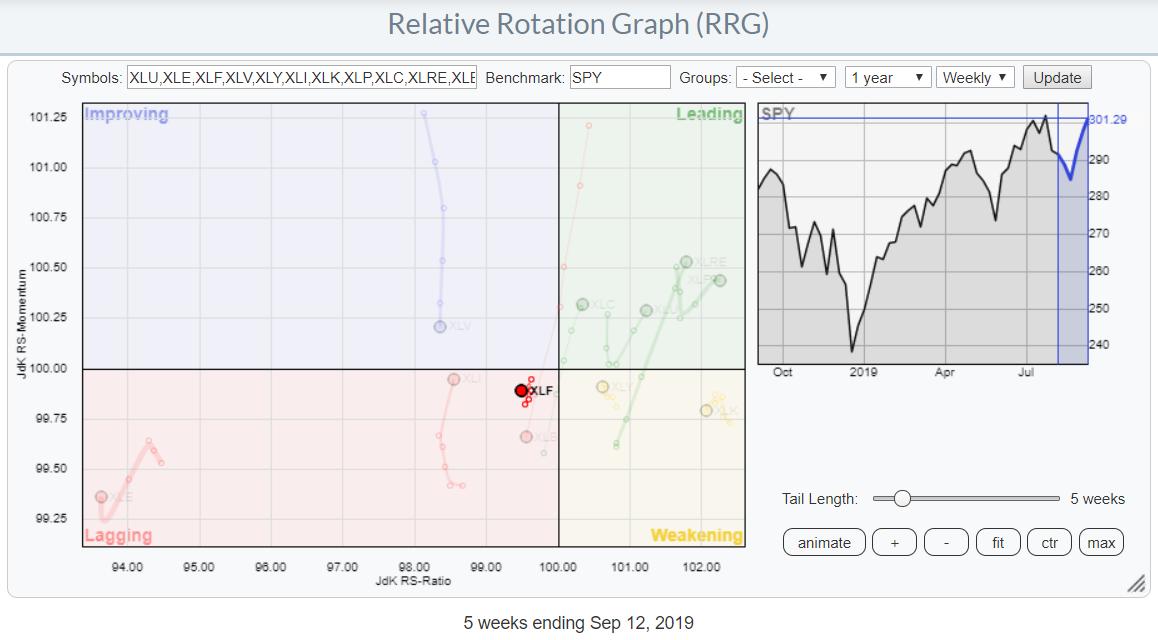

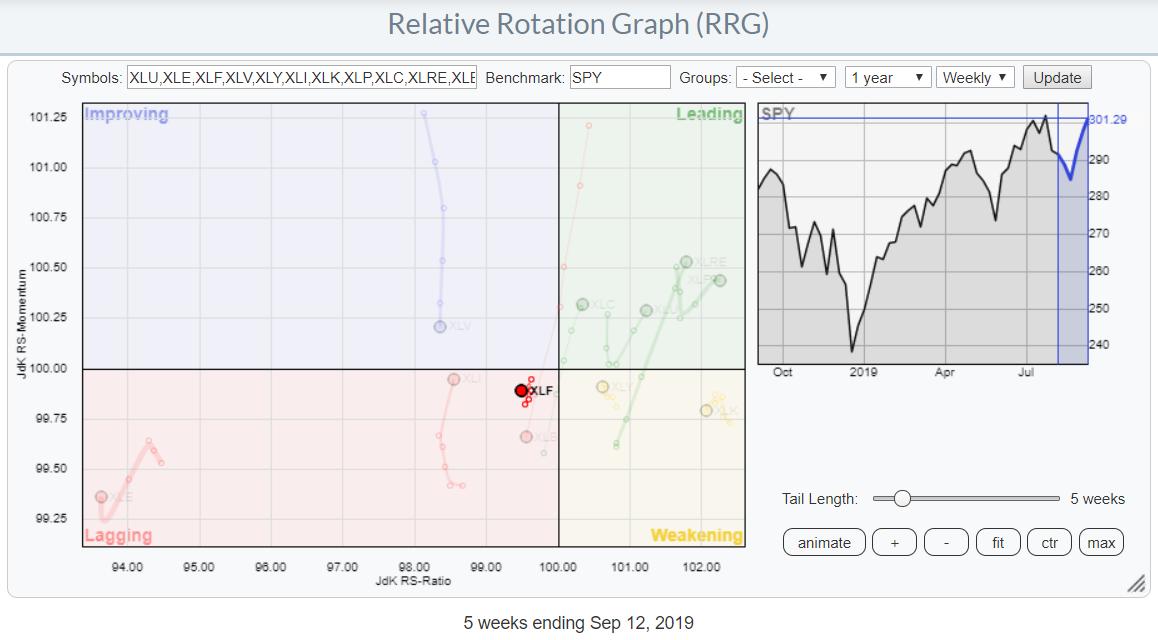

Are Recent Rotations within the Stock Market Bullish or Bearish?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are still plenty of strong uptrends out there in ETF land, but we are seeing a bit of rotation in the stock market. The Utilities SPDR (XLU), Real Estate SPDR (XLRE) and Consumer Staples SPDR (XLP) remain in uptrends, but they corrected the last six days as some out...

READ MORE

MEMBERS ONLY

SHARP REBOUND IN BOND YIELDS CONTRIBUTES TO ROTATION INTO VALUE STOCKS -- WITH SMALL CAP VALUE ISHARES IN THE LEAD -- STRONGER FINANCIALS AND INDUSTRIALS ARE MAIN REASONS WHY

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD BOUNCES OFF MAJOR CHART SUPPORT... My Wednesday message showed the 10-Year Treasury yield bouncing off major chart support at its 2012 and 2016 lows and in a very oversold condition. That made a rebound in bond yields more likely. The weekly bars in Chart 1 show the...

READ MORE

MEMBERS ONLY

Drive Off In These Profitable Stocks That Are Poised To Trade Higher

by Mary Ellen McGonagle,

President, MEM Investment Research

U.S. retail sales came in stronger than expected for the month of August and, while internet sales and home goods saw a pickup, the real boost in last month's retail numbers came from auto sales.

The Auto Retail industry is experiencing considerable changes in its operating environments...

READ MORE

MEMBERS ONLY

When Transports And Small Caps Talk, We MUST Listen

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've been adamant that we remain in a secular bull market, and I'm sticking to it. Yes, September scares me. The Fed petrifies me. And no more tweets, please! Oh, and let's not forget about the inverted yield curve (which isn't inverted...

READ MORE

MEMBERS ONLY

Daily Market Report - Friday, September 13, 2019

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note:

On Monday, September 16th, I will officially begin writing full-time at EarningsBeats.com as its Chief Market Strategist, returning to a role that I left in March 2015 when I joined StockCharts.com as a Sr. Technical Analyst. Below is a brief example of the type of information...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Yummy Flowers

by Erin Swenlin,

Vice President, DecisionPoint.com

Today, I ran a variety of scans, but the results are mostly from my "Bullish EMA - Mid-Range SCTR" scan, which nearly always gives me a lot of results. Today was no exception. I had 82 results! My other scans just weren't returning the set-ups I...

READ MORE

MEMBERS ONLY

Small Caps Surge and Reflect Rotation into Cheaper Parts of the Market

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Wednesday, September 11th at 5:14pm ET.

Smaller stocks were the stars of today's stock action. Previous messages have noted signs of improvement in the group which has lagged behind large...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Golden Cross and Silver Cross Indexes Not Confirming SPY Record High

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Thursday SPY hit an all-time intraday high, but it was not confirmed by some of our internal indicators. In particular I am referring to the *Golden Cross and **Silver Cross Indexes, both of which are well below their levels when the market made its last all-time high in July....

READ MORE

MEMBERS ONLY

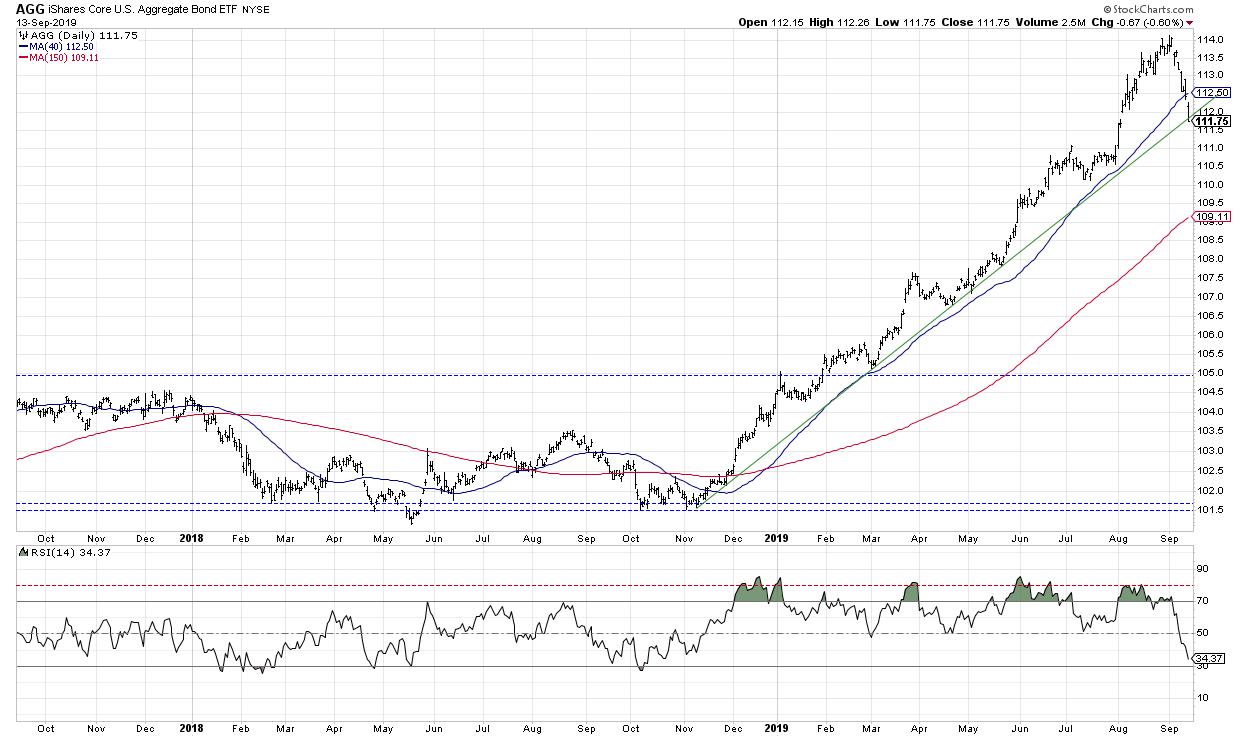

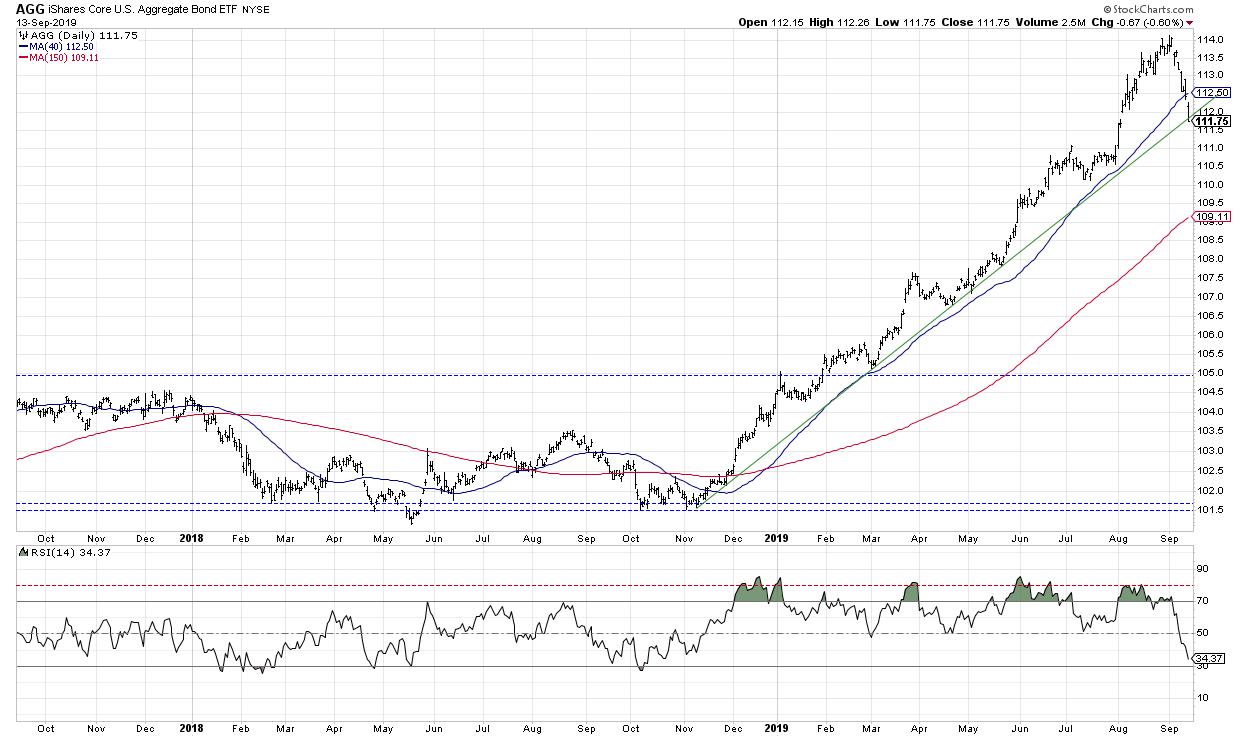

Sticking With Stocks Over Bonds

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I've written before about RSI and the difference between "good" overbought and "bad" overbought. In the future, we may see the bond prices of these past few weeks used as examples of how to interpret extreme overbought conditions. A review of the stock-to-bond ratio...

READ MORE

MEMBERS ONLY

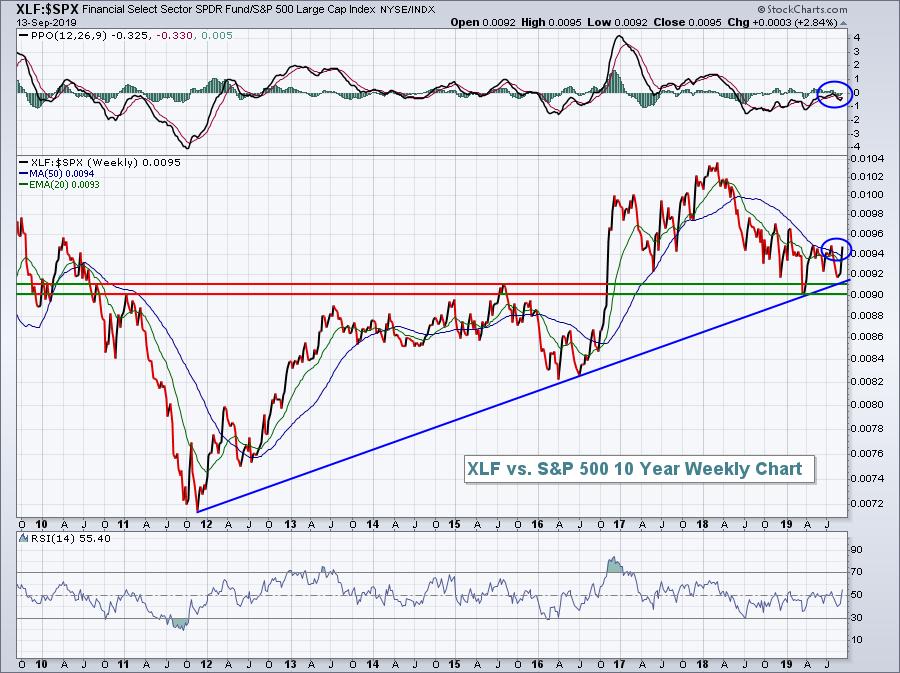

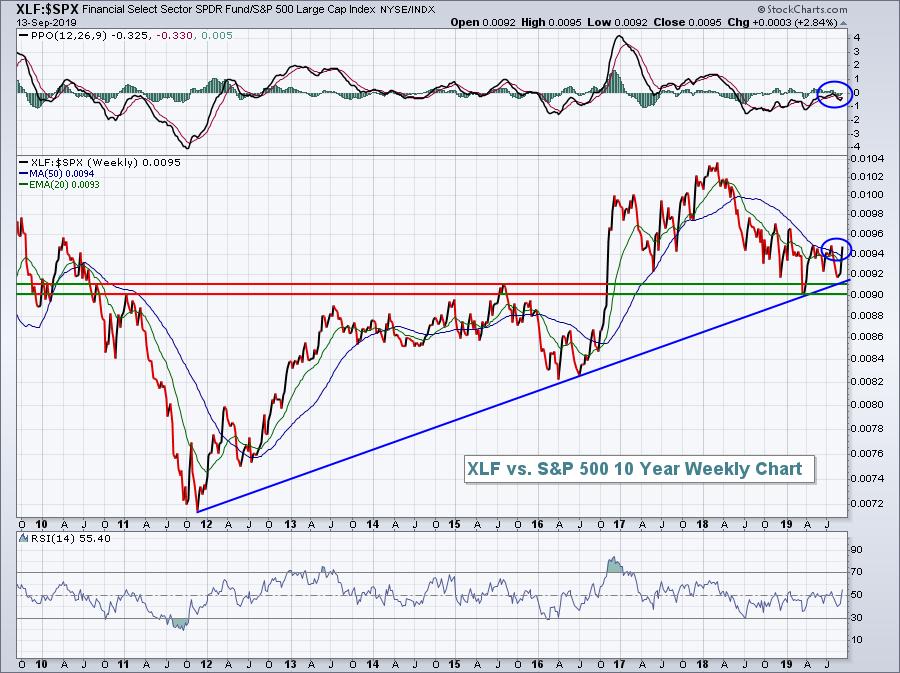

The Financial Sector is Improving, Leadership Role for JPM

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the weekly Relative Rotation Graph for US sectors, the Financial sector is positioned just inside the lagging quadrant, very close to the benchmark (center of the chart). It arrived here after a nearly vertical drop from the improving quadrant after failing to rotate into leading.

During the last five...

READ MORE

MEMBERS ONLY

Wall Street Rallies As We Near Record Highs Once Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 12, 2019

Apparently we're back in the "feel good" portion of the trade war as President Trump announced on Thursday that there would be a tariff delay, providing a "gesture of good will". Accordingly, global markets have rallied and...

READ MORE

MEMBERS ONLY

Index Breadth Model Improves as IWM Challenges Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

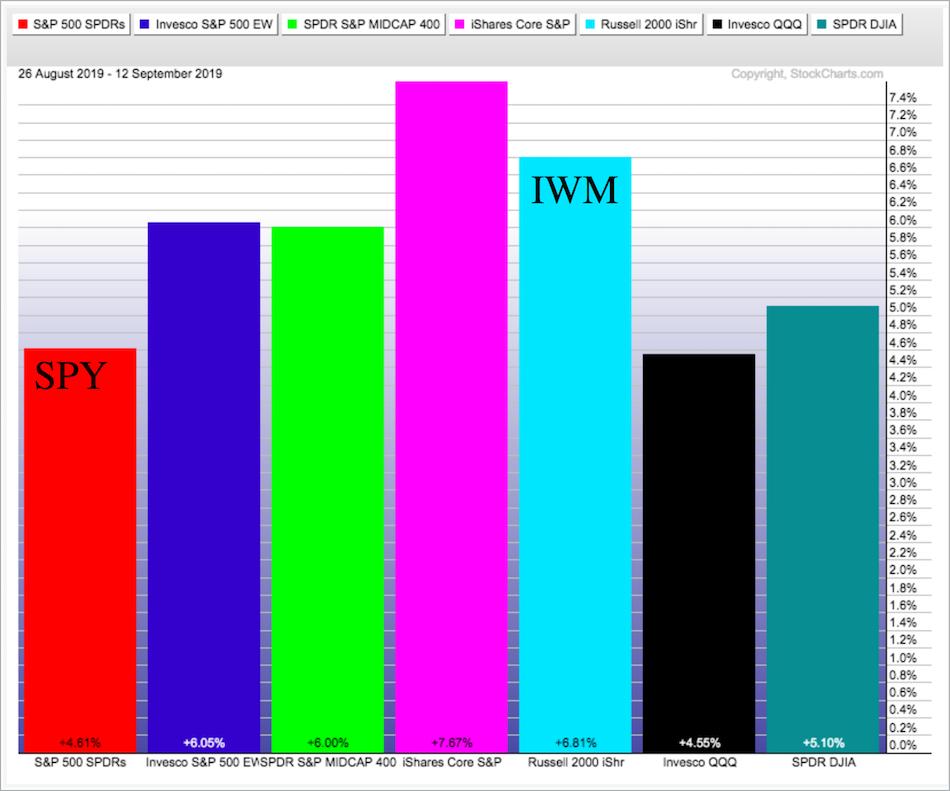

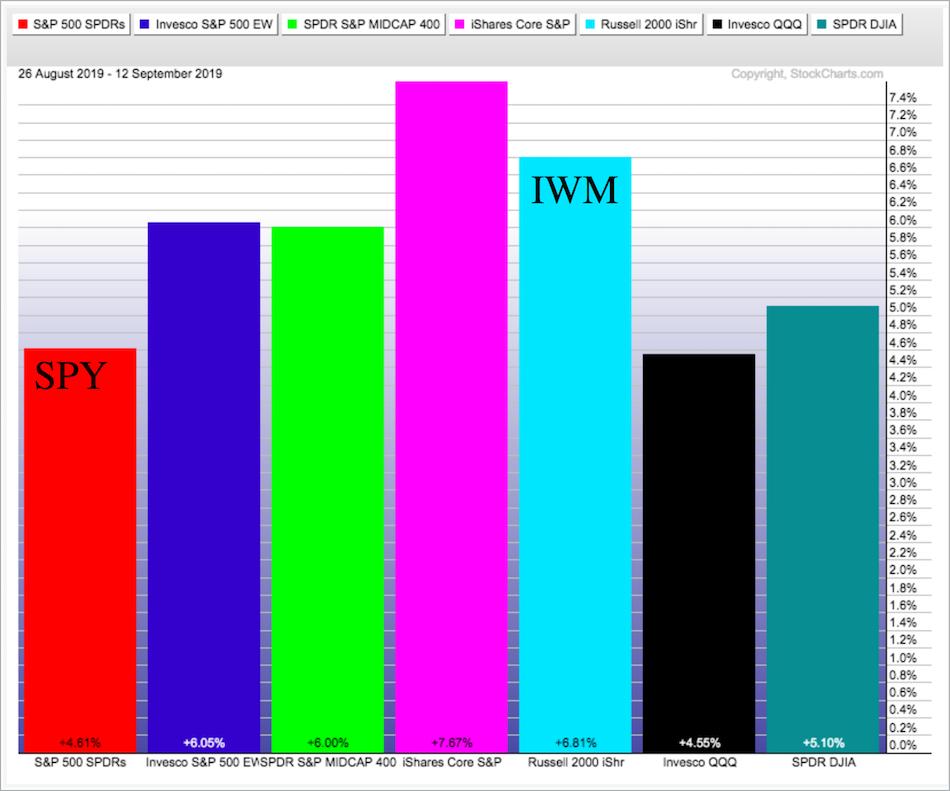

Stocks surged the last 12 days with small-caps leading the way higher. The Russell 2000 iShares (IWM) is up 6.8% and the S&P 500 SPDR (SPY) is up 4.6%. Even though small-caps are leading short-term, they are still lagging on the three and six month timeframes....

READ MORE

MEMBERS ONLY

DecisionPoint Daily Diamonds - Might Need Some Pullbacks

by Erin Swenlin,

Vice President, DecisionPoint.com

Today, I ran the WealthWise Women "Pink Line" scan, which uses the 50-SMA and a Chandelier Exit to determine entries and exits. Many times, these stocks will have "popped" on the day I get the results for this scan, so these all did have big moves...

READ MORE

MEMBERS ONLY

The Three Time Frames of Technical Analysis

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I'm often asked about how technical indicators work across different time frames. The short answer is "Yes, they work." The longer answer, which explains how you need to use the toolkit differently depending on your time frame, follows.

Many investors have a tendency to lock themselves...

READ MORE

MEMBERS ONLY

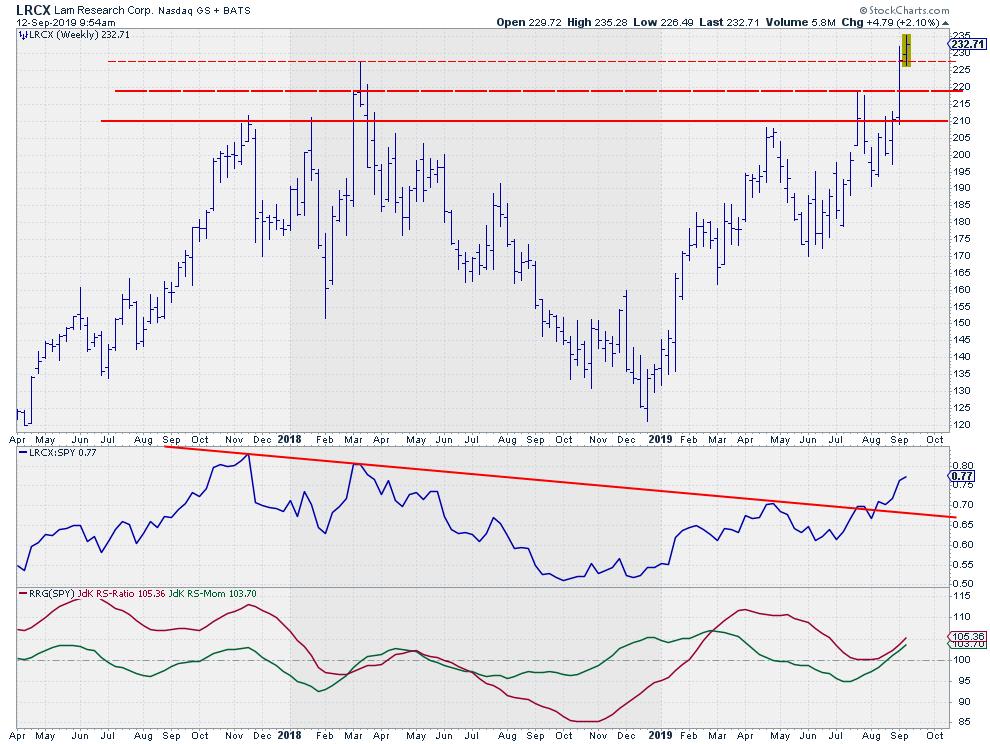

LRCX is Breaking To New Highs While Relative Strength is Picking Up

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

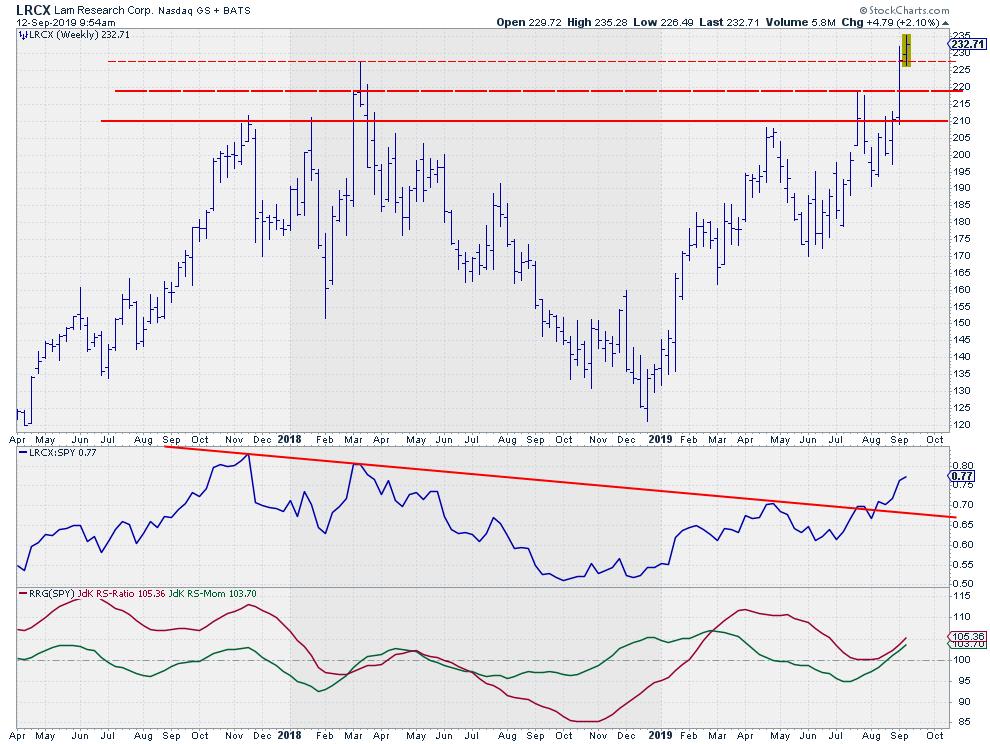

On the Relative Rotation Graph for technology stocks, LRCX stands out, with its relatively long tail and its push into the leading quadrant at a strong RRG-Heading. Such a rotation is more than enough reason to open up a regular chart for further investigation.

The chart above shows LRCX on...

READ MORE

MEMBERS ONLY

Industrials Challenging Resistance Again; Airlines Poised Strong Q4?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 11, 2019

On the 18th anniversary of 9/11, it was somewhat ironic that Boeing (BA, +3.51%) led the Dow Jones back above 27,000 and within 1% of its all-time high. Apple (AAPL, +3.05%) also performed quite well, with both stocks breaking...

READ MORE

MEMBERS ONLY

STOCK RALLY RESUMES AS MAJOR STOCK INDEXES DRAW CLOSER TO SUMMER HIGH -- BOEING, APPLE, AND CATERPILLAR LEAD DOW HIGHER -- THE INDUSTRIAL SPDR IS NEARING A MAJOR UPSIDE BREAKOUT TO RECORD HIGHS -- SMALL CAPS WERE THE DAY'S BIGGEST GAINERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES GAIN MORE GROUND... The stock upturn that started last week when major stock indexes cleared their August trading range and 50-day averages gained momentum today. All three major indexes hit the highest level in more than a month. Chart 1 shows the Dow Industrials gaining 227 points (+0....

READ MORE

MEMBERS ONLY

Small Caps Break Above Resistance – 4 Turnaround Candidates To Consider

by Mary Ellen McGonagle,

President, MEM Investment Research

This week's action in the markets is pointing to a shift in money flows out of high multiple Technology stocks and into recently down-and-out Small Caps, Financials and Cyclicals. While it's too early to determine if the shift will remain in place, in the near-term we...

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD IS BOUNCING OFF MAJOR SUPPORT -- BOND/STOCK RATIO ALSO RUNS INTO RESISTANCE AND HAS STARTED TO WEAKEN -- THAT WOULD FAVOR STOCKS OVER BONDS -- RECENT SECTOR ROTATIONS SHOW A SHIFT TO MORE ECONOMICALLY-SENSITIVE STOCK GROUPS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD IS TESTING MAJOR SUPPORT...Bond yields have been falling all over the world since the end of last year. Several foreign government bond yields have fallen deeply into negative territory and have helped pull Treasury yields lower. The 30-Year Treasury Yield recently fell to a new record...

READ MORE

MEMBERS ONLY

Energy And Transports Benefit From Rotating Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 10, 2019

We once again finished in bifurcated fashion on Tuesday with the small cap Russell 2000 ($RUT, +1.28%) and the Dow Jones ($INDU, +0.28%) leading the action, while the S&P 500 ($SPX, +0.03%) and the NASDAQ ($COMPQ, -0.04%...

READ MORE