MEMBERS ONLY

A Breakout for this Healthcare/Technology Hybrid

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Some stocks fit nicely into sectors and industry groups. And some don't. Cerner (CERN) is part of the Health Care SPDR (XLV), but it is really a technology stock that serves the healthcare industry. Namely, Cerner provides information technology solutions for the healthcare industry. More importantly, the price...

READ MORE

MEMBERS ONLY

A Mystery Group Emerges To Lead Friday's Stock Market Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Event Today

Every quarter, I announce my Top 10 Stocks (equally-weighted) for my Model, Aggressive and Income portfolios. Today's the day! It all starts at 4:30pm EST. CLICK HERE for portfolio performance and registration information.

Market Recap for Friday, August 16, 2019

Industrials (XLI, +1.93%...

READ MORE

MEMBERS ONLY

The Truth About the Yield Curve, The Economy and The Stock Market

by Martin Pring,

President, Pring Research

* Yield Curve Inversion and Recessions

* Using the Economy to Forecast the Economy

* What Happens to the Stock Market after an Initial Inversion?

* Yield Curve Conclusion

* Catch a Falling Knife, Anyone?

By now, everyone and his dog is aware that the yield curve has inverted. An event such as this is...

READ MORE

MEMBERS ONLY

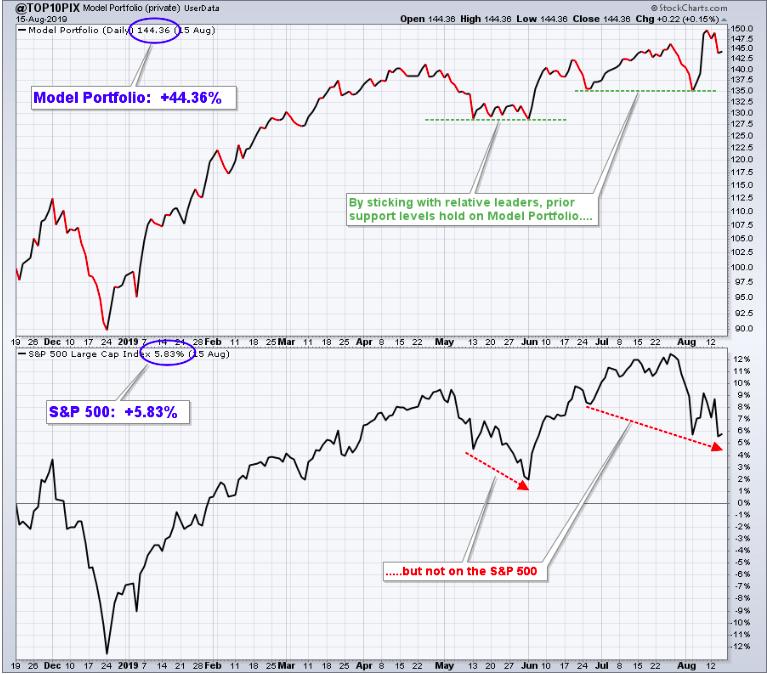

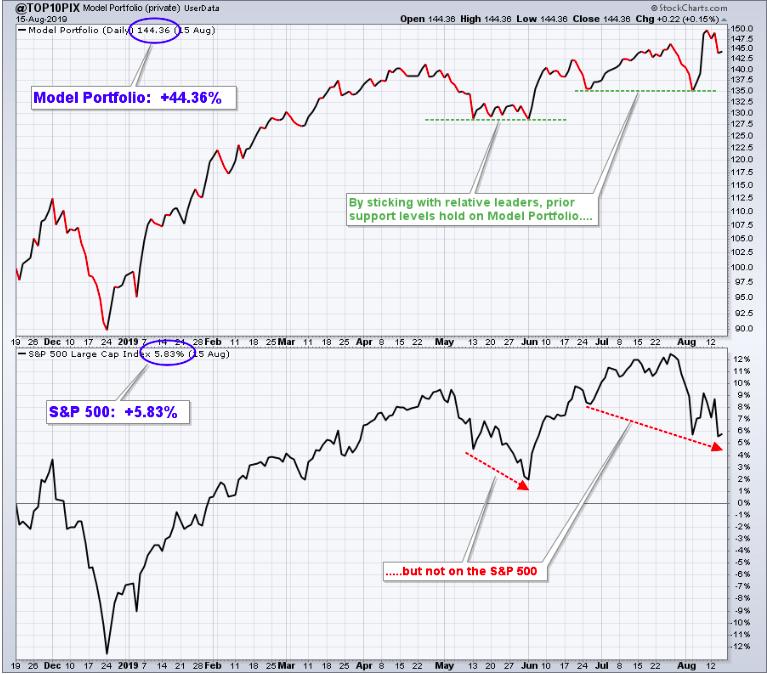

The Results Are In, Here Are The Winners And Losers

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Monday will mark the end of my third quarter of performance for the Model Portfolio. I've easily surpassed the benchmark S&P 500 in each quarter and this last quarter was certainly no exception. The average return of the 10 equal-weighted stocks in this portfolio was 12....

READ MORE

MEMBERS ONLY

Week Ahead: With Nifty Vulnerable At Higher Levels, These Sectors May Act As Safe Havens

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

With a 3-day working week, the markets moved along expected lines and stayed within a limited range. As anticipated, the NIFTY did not make any directional move, remaining within the 50-Week MA and 100-Week MA (as mentioned in our previous weekly note). After flirting with the 50-Week MA, which stands...

READ MORE

MEMBERS ONLY

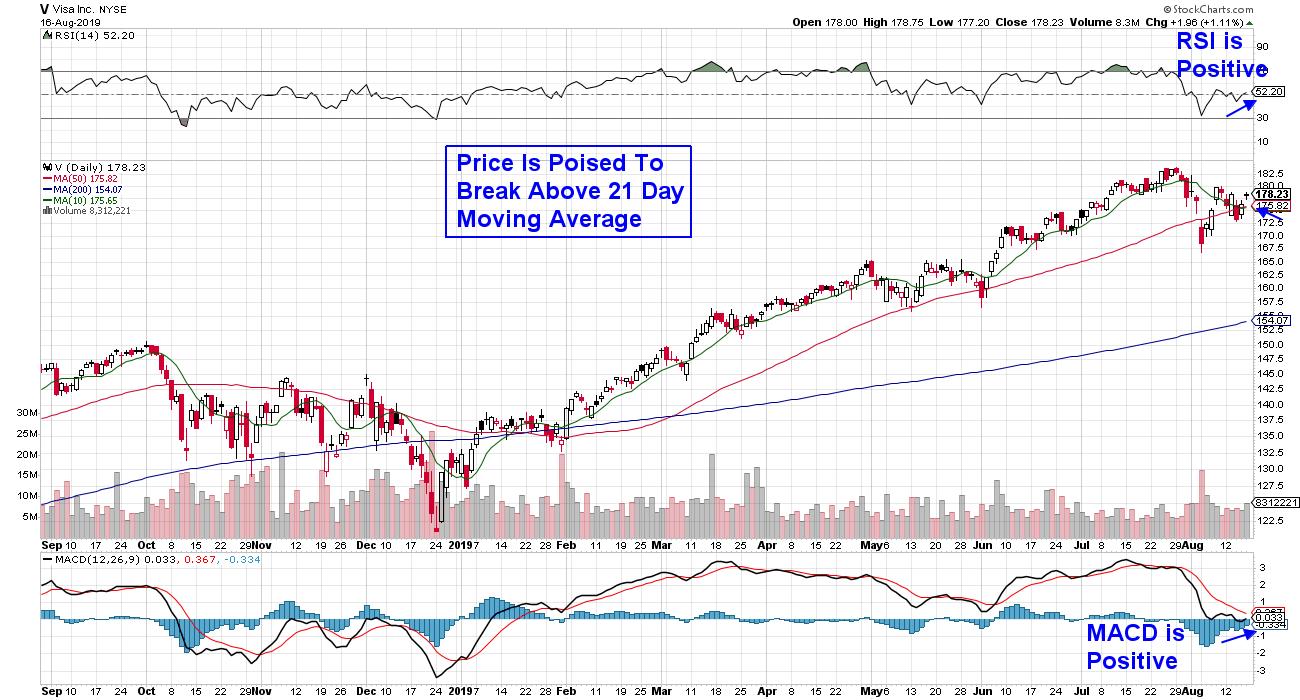

Preparing For Nice Returns - 3 Stocks For Your Watchlist

by Mary Ellen McGonagle,

President, MEM Investment Research

The volatility in the markets remains as investors continue to grapple with the latest global headline. With defensive areas of the market generally posting positive results, other areas are struggling to regain their footing following sharp selloffs.

Overall, cautiousness is still warranted, as the broader Indexes remain below key levels...

READ MORE

MEMBERS ONLY

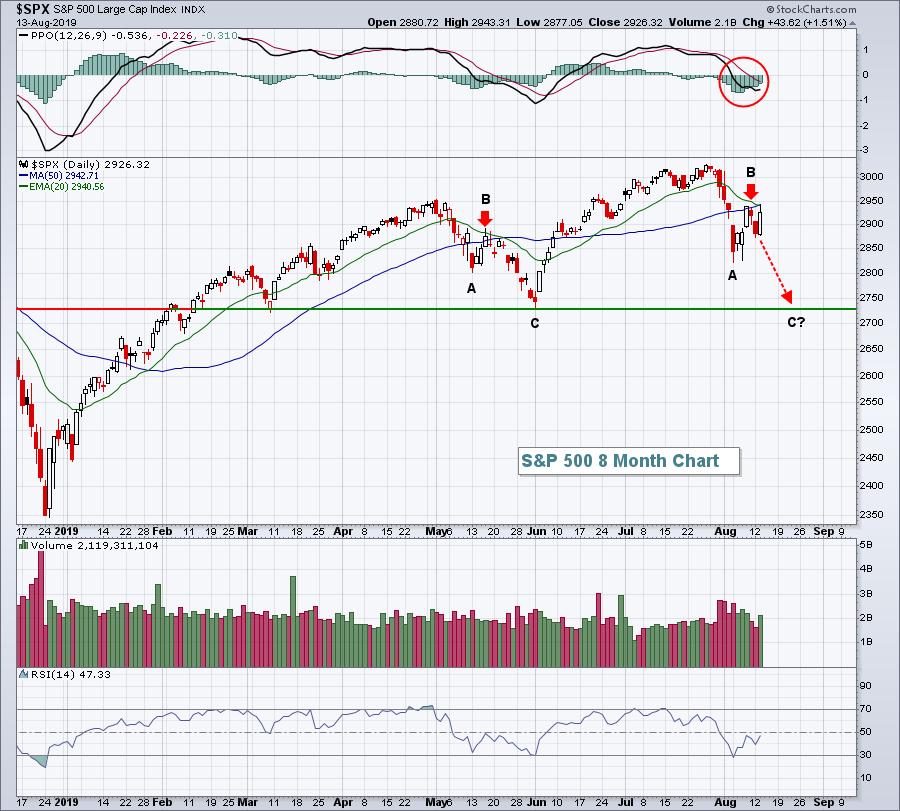

A Bounce, a Second Shoe or a Broadening Formation?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks rebounded on Friday with small-caps leading the way. The Russell 2000 surged 2.19%, while the S&P 500 advanced 1.44% and the Nasdaq 100 gained 1.59%. Despite these sizable rebounds, all three were down for the week and still down between 4.5% and 5....

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: All That Drama for a Net Change of Less Than One Percent for the Week

by Carl Swenlin,

President and Founder, DecisionPoint.com

On the last trading day of July the market (SPY) resolved a rising wedge pattern with the expected breakdown, and that began what has turned out to be a very turbulent August. (Note how the volume for almost every day has exceeded the one-year average.) After an initial decline of...

READ MORE

MEMBERS ONLY

Previous Bond Yield Inversions Saw Rising Commodities - This Time is Different

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Thursday, August 15th at 3:47pm ET.

Everyone's talking about inverted yield curves. The 10 year - 3 month yield curve turned negative a few months ago. The 10 year -...

READ MORE

MEMBERS ONLY

Relative Rotation Graphs Can Show You So Much More Than Just Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs, or "RRGs", were born while I was working as a sell-side analyst for an investment bank in Amsterdam, doing research and making calls on stocks and sectors. The clientele of the bank were all institutional investors, ranging from pension funds and endowments to hedge funds....

READ MORE

MEMBERS ONLY

Returning To My Roots At EarningsBeats.com

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Wow, it's been a great ride here at StockCharts.com!

I posted essentially this same article in my Trading Places blog a week ago, but I'm not sure how many of you follow me there. I want to make sure I reach out to everyone who...

READ MORE

MEMBERS ONLY

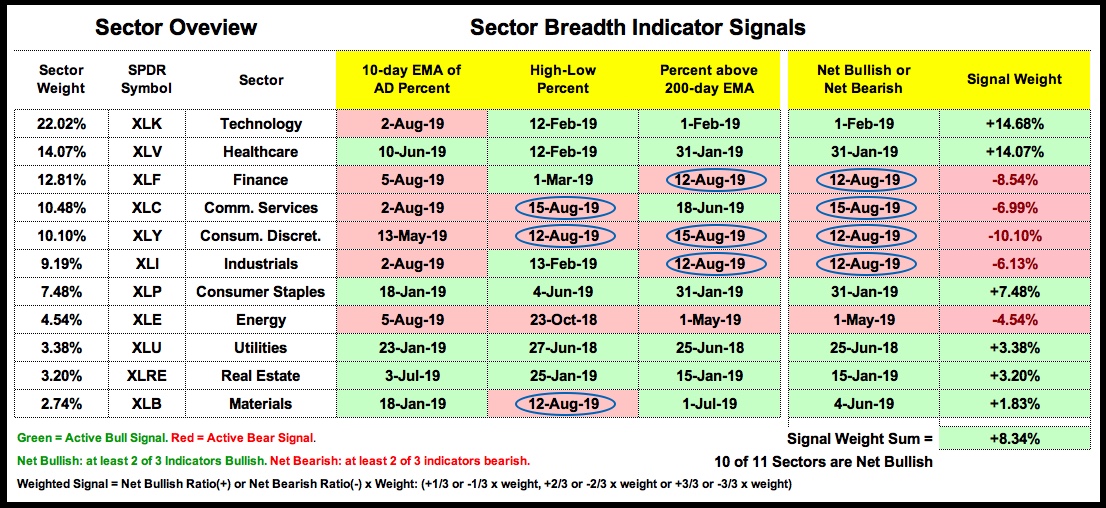

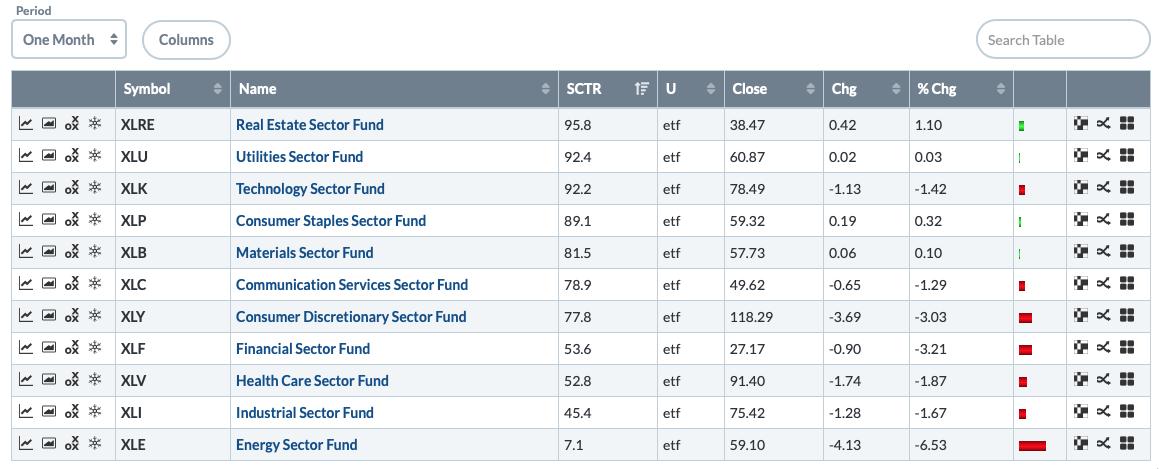

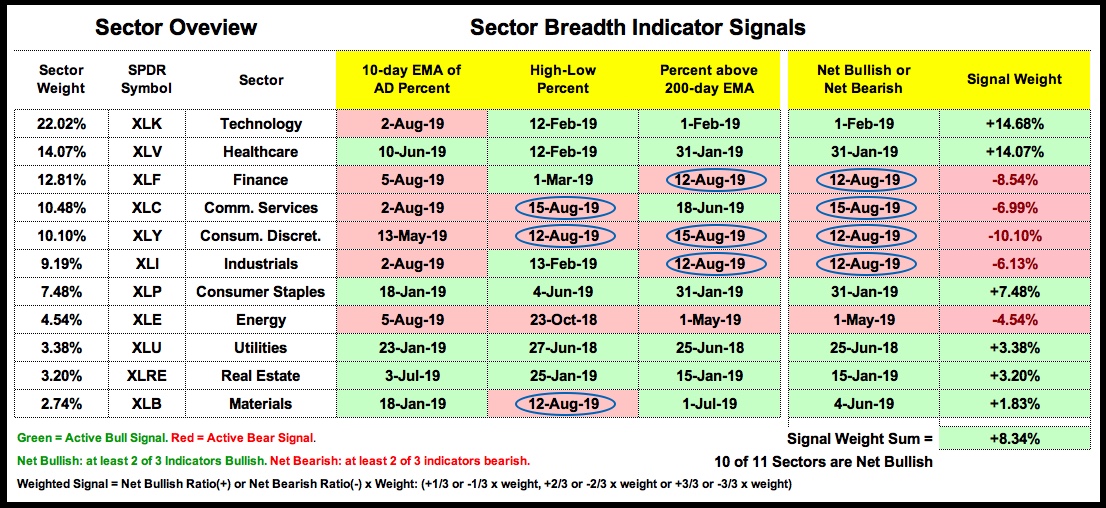

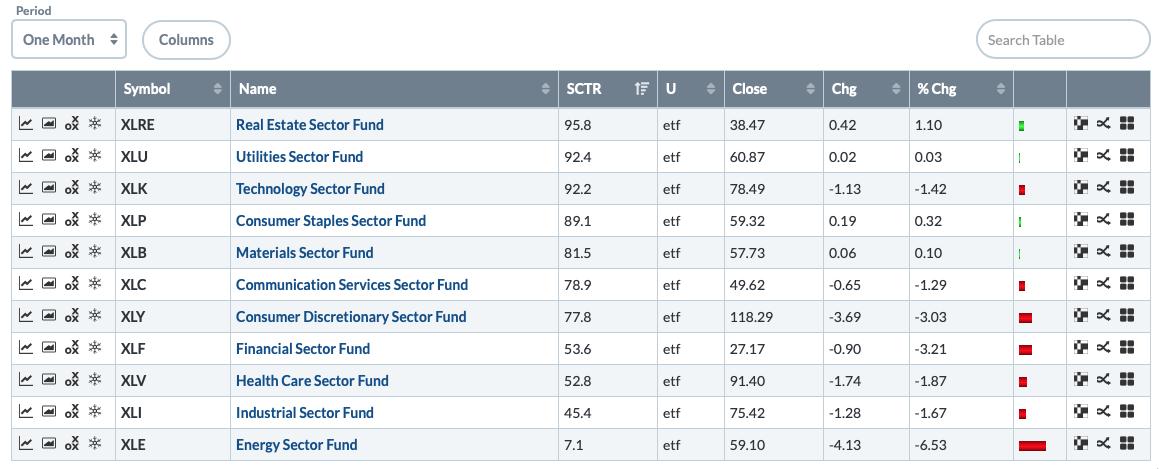

Ranking the 11 Sector SPDRs and Weighing the Breadth Evidence

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Sector Breadth Model Takes another Hit

Today I will rank and analyze the charts for the eleven sector SPDRs, but I will first cover the sector breadth table, which reflects the internal strength/weakness within each sector. Sometimes there is a discrepancy between the sector SPDR chart and the breadth...

READ MORE

MEMBERS ONLY

Why Looking At Germany Provides Us An S&P 500 Crystal Ball

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, August 15, 2019

There were a ton of economic reports out on Thursday, mostly positive, and that seemed to slow the onslaught of selling as our major indices finished mixed on the session. Walmart, Inc. (WMT, +6.11%) surged following better-than-expected earnings to lift the Dow...

READ MORE

MEMBERS ONLY

COMMODITY DECLINE SHOWS DEFLATIONARY TREND -- PREVIOUS BOND YIELD INVERSIONS SAW RISING COMMODITIES -- THIS TIME IS DIFFERENT

by John Murphy,

Chief Technical Analyst, StockCharts.com

DEFLATIONARY COMMODITY TREND... My earlier message today showed that bond yields and stocks have been trending in the same direction for most of the last two decades. It further explained that deflationary tendencies around the start of the new century changed the bond-stock relationship that existed prior to that. Plunging...

READ MORE

MEMBERS ONLY

BOND YIELDS AND STOCKS TRENDED IN OPPOSITE DIRECTIONS PRIOR TO 2000 -- BUT THEY'VE BEEN TRENDING IN THE SAME DIRECTION SINCE THEN ... THE EMERGENCE OF DEFLATION AROUND THE TURN OF THE CENTURY CHANGED THE BOND-STOCK RELATIONSHIP

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS AND STOCKS BEFORE 2000...A lot of attention is being given to what falling bond yields mean for the U.S. economy and stock market. I've written several books on intermarket analysis that explain the impact that bond yields have on the stock market (and eventually...

READ MORE

MEMBERS ONLY

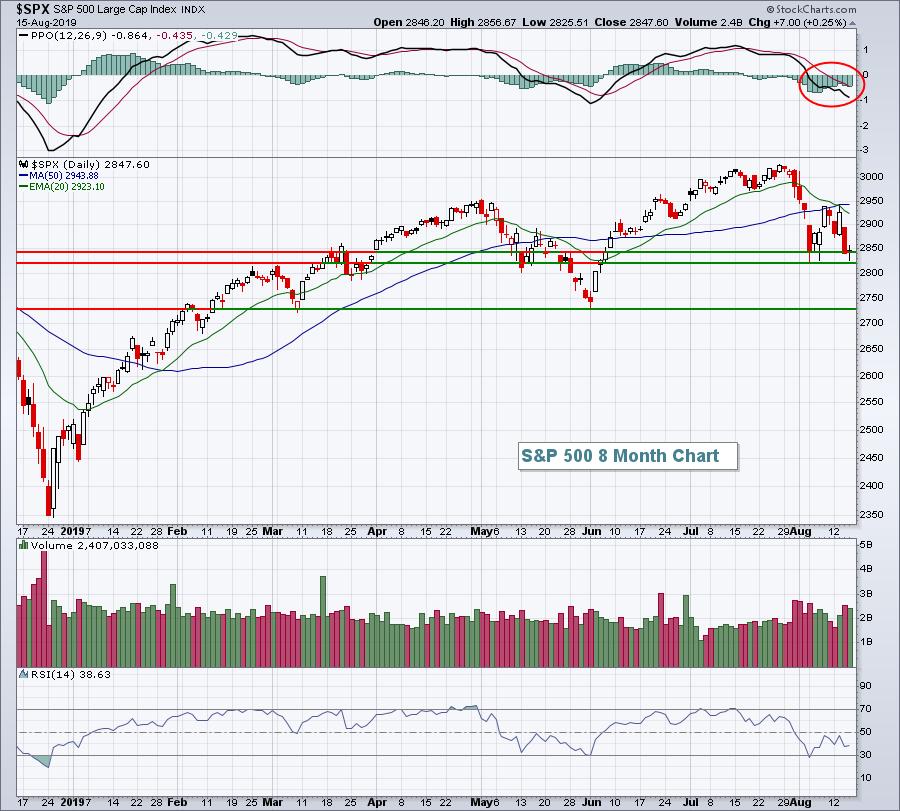

State of the Stock Market - Index and Sector Breadth Models Take Hits

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Watch for Rising Correlation

...The overall state of the stock market is the most important factor to consider when trading or investing in stocks. Broad market movements, by definition, affect most stocks. When the major stock indexes are trending lower, most stocks will also trend lower. Some will buck the...

READ MORE

MEMBERS ONLY

Futures Rally As Wall Street Tries To Show A Little "Sole"

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Event

I am hosting a HUGE event on Monday, August 19th at 4:30pm EST as I release my Top 10 Stocks for my Model, Aggressive and Income portfolios. Each of these portfolios has crushed the benchmark S&P 500 since their respective inceptions and for a mere...

READ MORE

MEMBERS ONLY

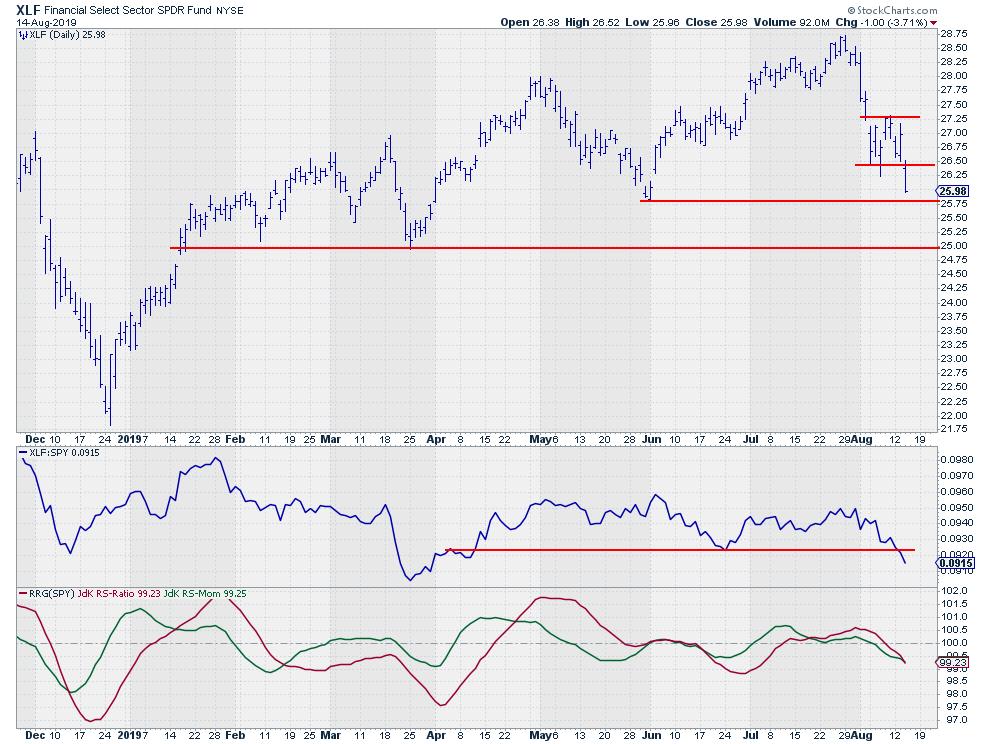

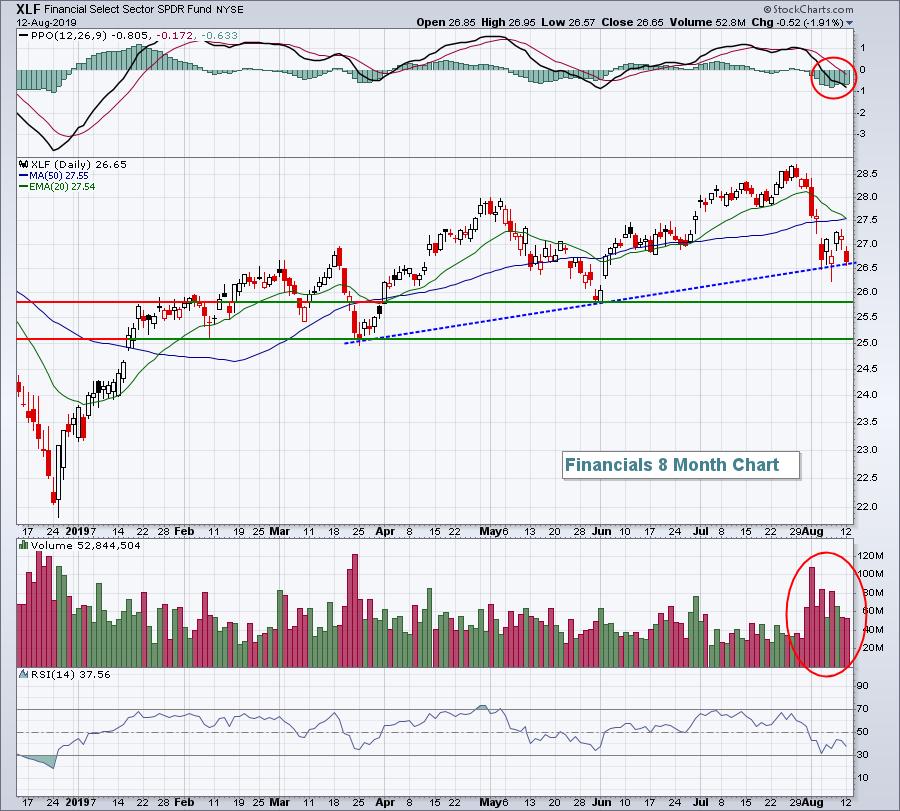

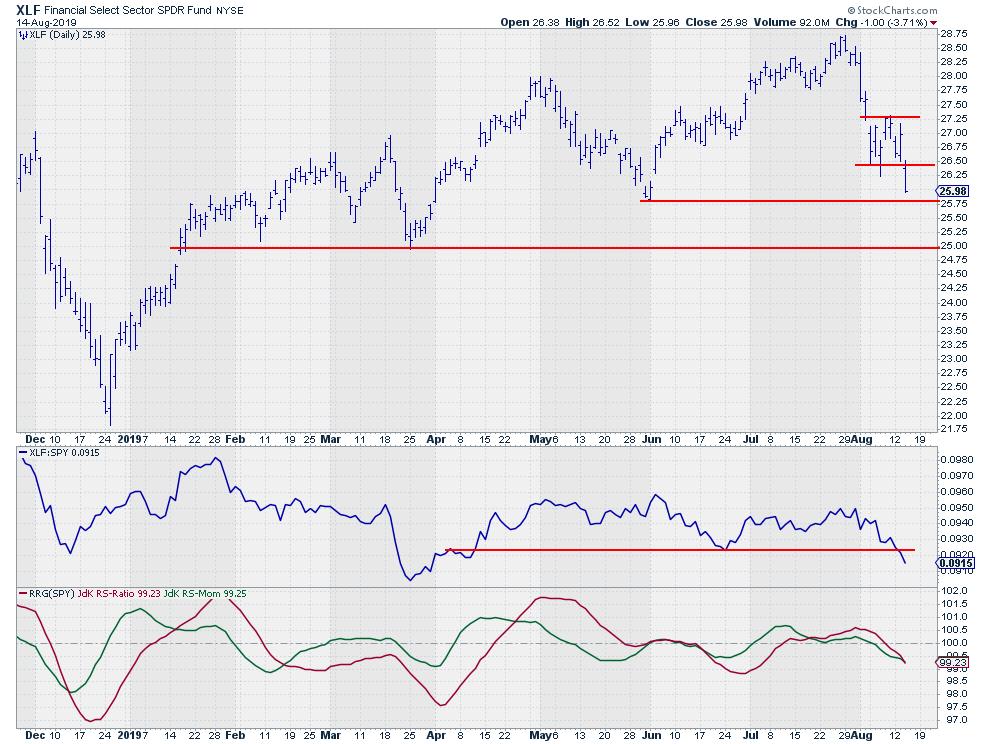

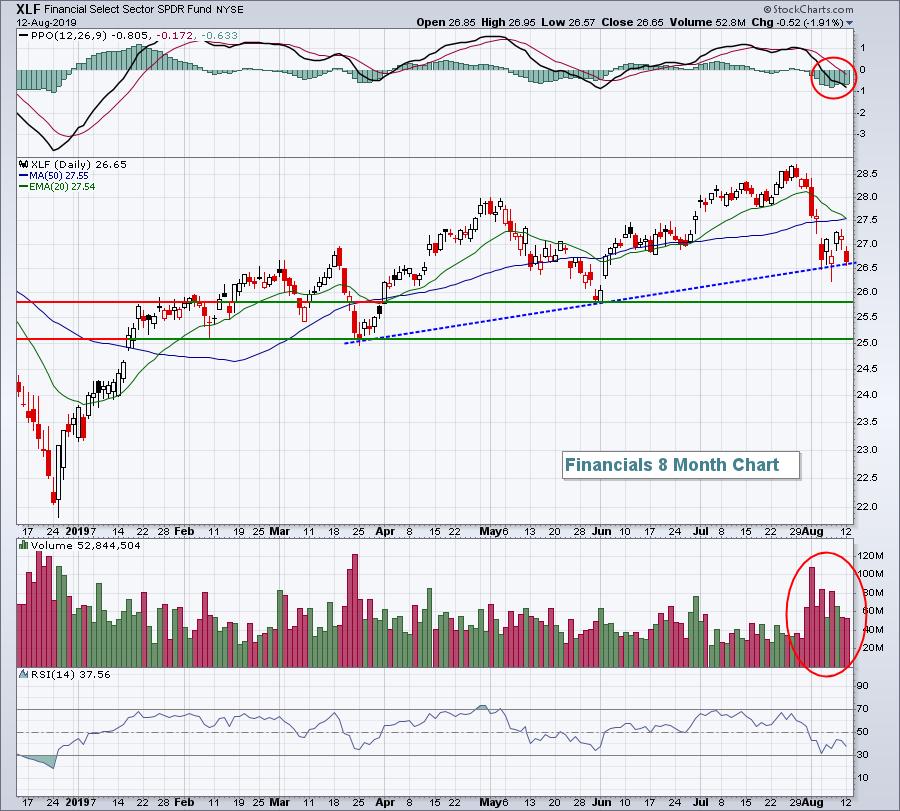

Financials Are Breaking (more) Support While Rotating Into the Lagging Quadrant On The RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph for US sectors, the tail on XLF, the Financials sector, caught my eye this morning. After a short stint through the leading quadrant, XLF had a sharp turn lower and entered the weakening quadrant, in which it spent only three days before rotating into lagging....

READ MORE

MEMBERS ONLY

DP Mid-Week: More Like a Dead Mouse Bounce - IT Neutral Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

The market has been flinging us around a lot this past week. I had been looking for a better bounce off the 200-EMA than we got; usually we use the term "dead cat" bounce, but in this case it was so small that I call it a "...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS UNDER HEAVY SELLING PRESSURE -- TEN-YEAR YIELD FALLS BELOW 2-YEAR -- RETEST OF 200-DAY AVERAGES APPEARS LIKELY

by John Murphy,

Chief Technical Analyst, StockCharts.com

MORE HEAVY STOCK SELLING...Global stocks are under heavy selling pressure again today. Bond yields continue to drop around the world. The ten-year Treasury yield dropped below the 2-year yield for the first time since 2007 which has created a second inversion of the yield curve. The 10-year yield fell...

READ MORE

MEMBERS ONLY

A Bearish Continuation Pattern Takes Shape in IWM

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Russell 2000 iShares (IWM) has been underperforming for some time now and remains the weakest of the major index ETFs. The chart below shows IWM forming a lower high from May to July and a lower low from March to May. Adding a couple of trend lines to these...

READ MORE

MEMBERS ONLY

Tuesday Was Nothing More Than A Bounce In A Market Downtrend

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, August 13, 2019

I received an email the other day after I discussed the rising volatility ($VIX) and likely move lower and it stated "Tom, I thought you were bullish. Why the bearish view now?". Let me address this because maybe some others are...

READ MORE

MEMBERS ONLY

Stock Market Time

by Bruce Fraser,

Industry-leading "Wyckoffian"

Recently the stock market indexes entered a period of extreme volatility. Seemingly random events sent the indexes into rapid declines. These unexpected events blindsided many traders and investors. Stops were hit on positions that only moments prior seemed to have a safe cushion of profit.

When markets become volatile and...

READ MORE

MEMBERS ONLY

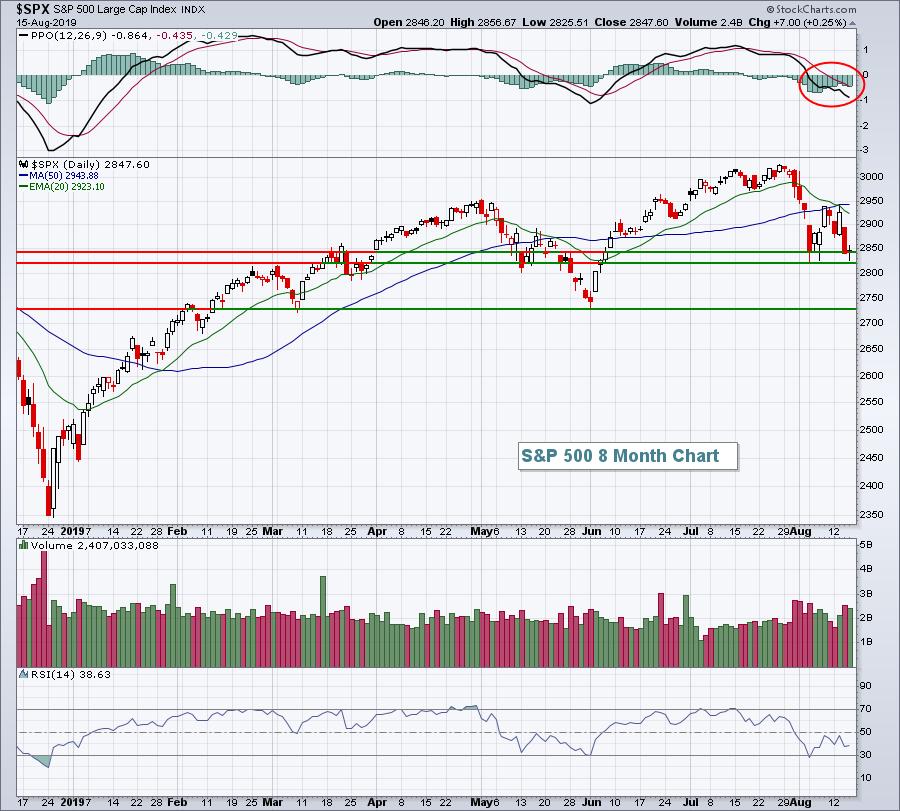

Starting To Shape Up Like An ABC Correction

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

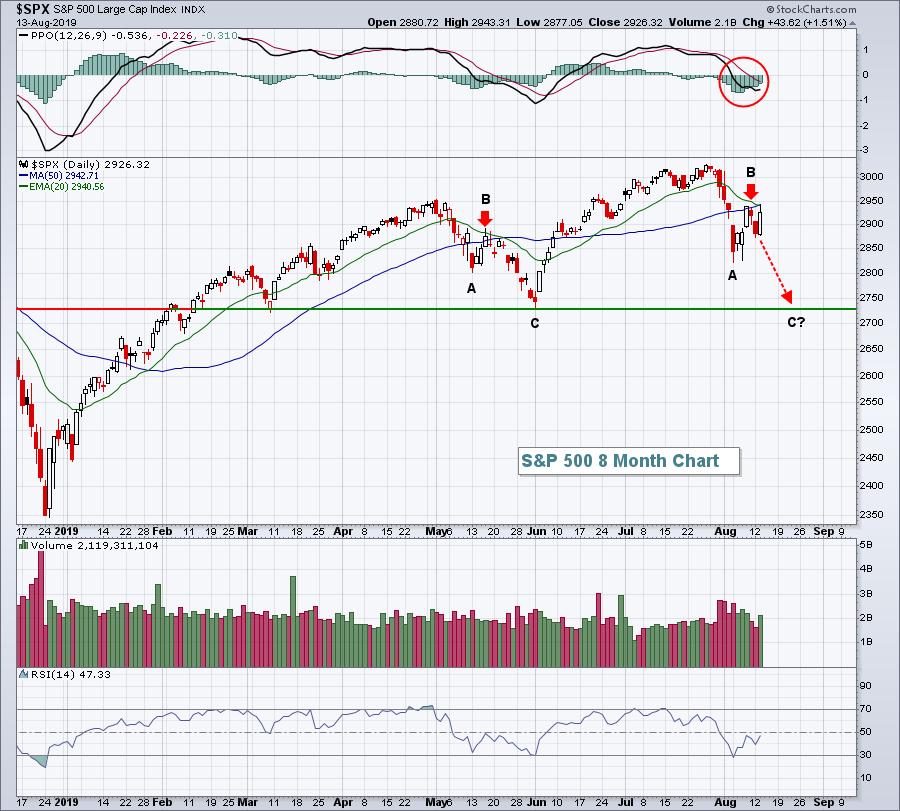

Market Recap for Monday, August 12, 2019

The flight to safety was clear on Monday. The 10 year treasury yield ($TNX) tumbled once again, falling 9 basis points to 1.63%, inching closer and closer to the historic TNX lows that were set in 2012 and 2016. The all-time low...

READ MORE

MEMBERS ONLY

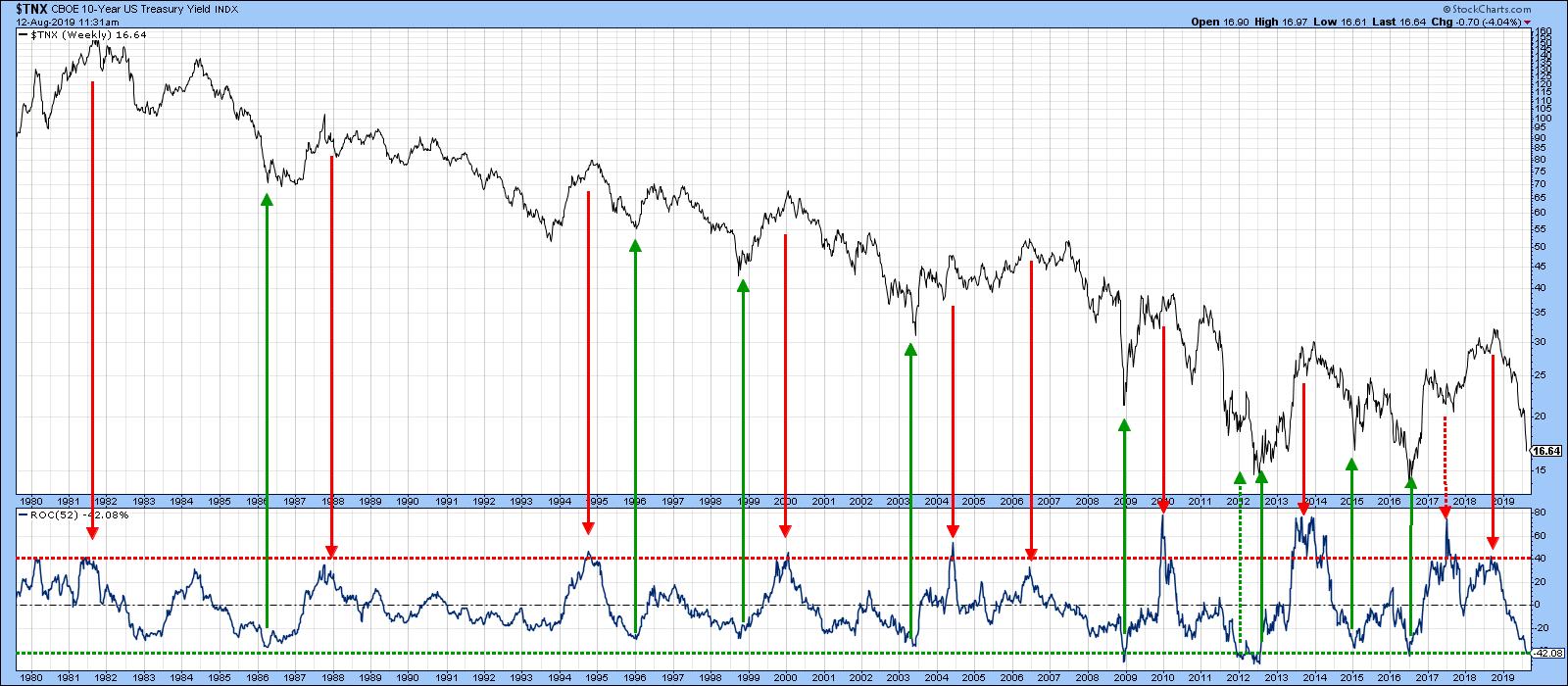

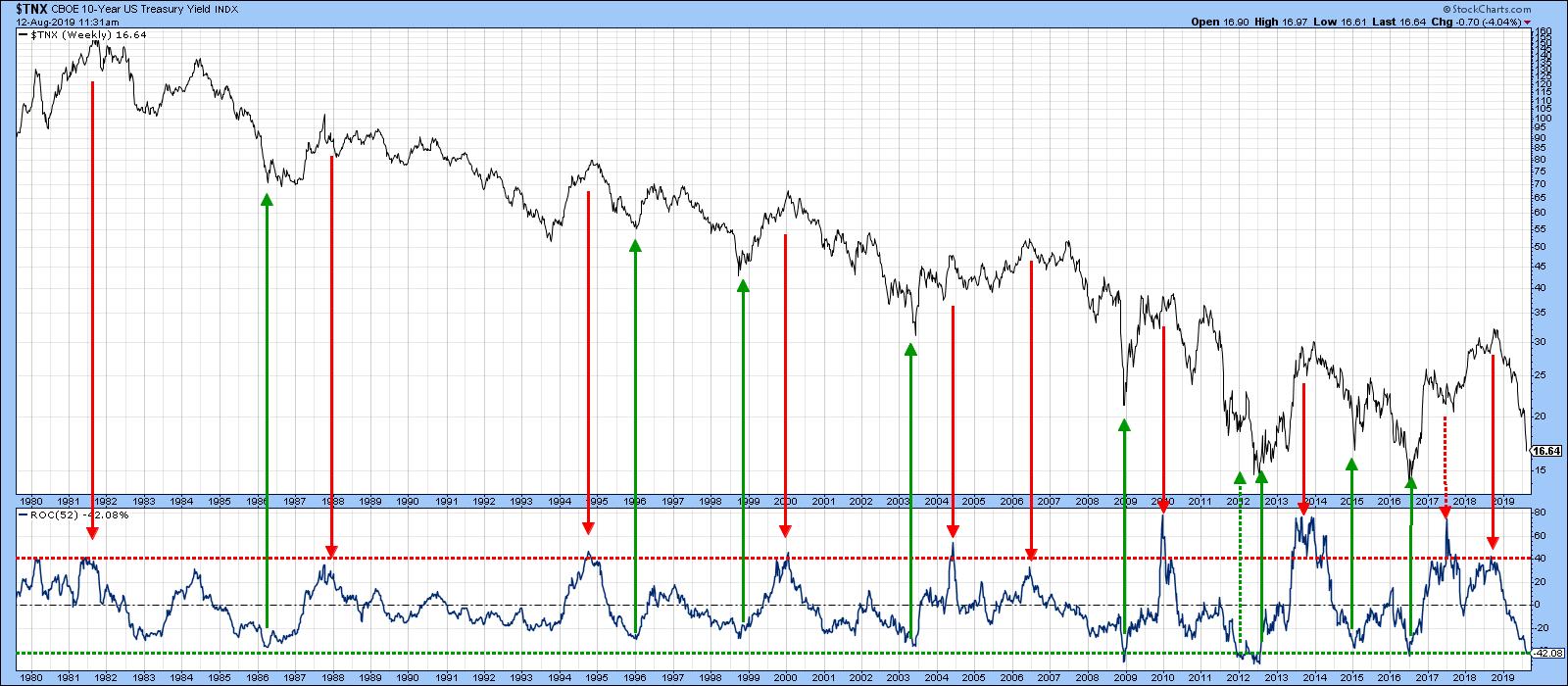

Thinking the Unthinkable - Bonds are Peaking

by Martin Pring,

President, Pring Research

* Long-Term Bond Oscillators Almost Fully Stretched

* Key Reversal Bars and Other Evidence Suggests Bonds are Exhausted on the Upside

* The Trend is Your Friend.... Until It Isn't

About a month ago, I wrote an article entitled "Bond Yields May Not Be Headed Lower After All". In...

READ MORE

MEMBERS ONLY

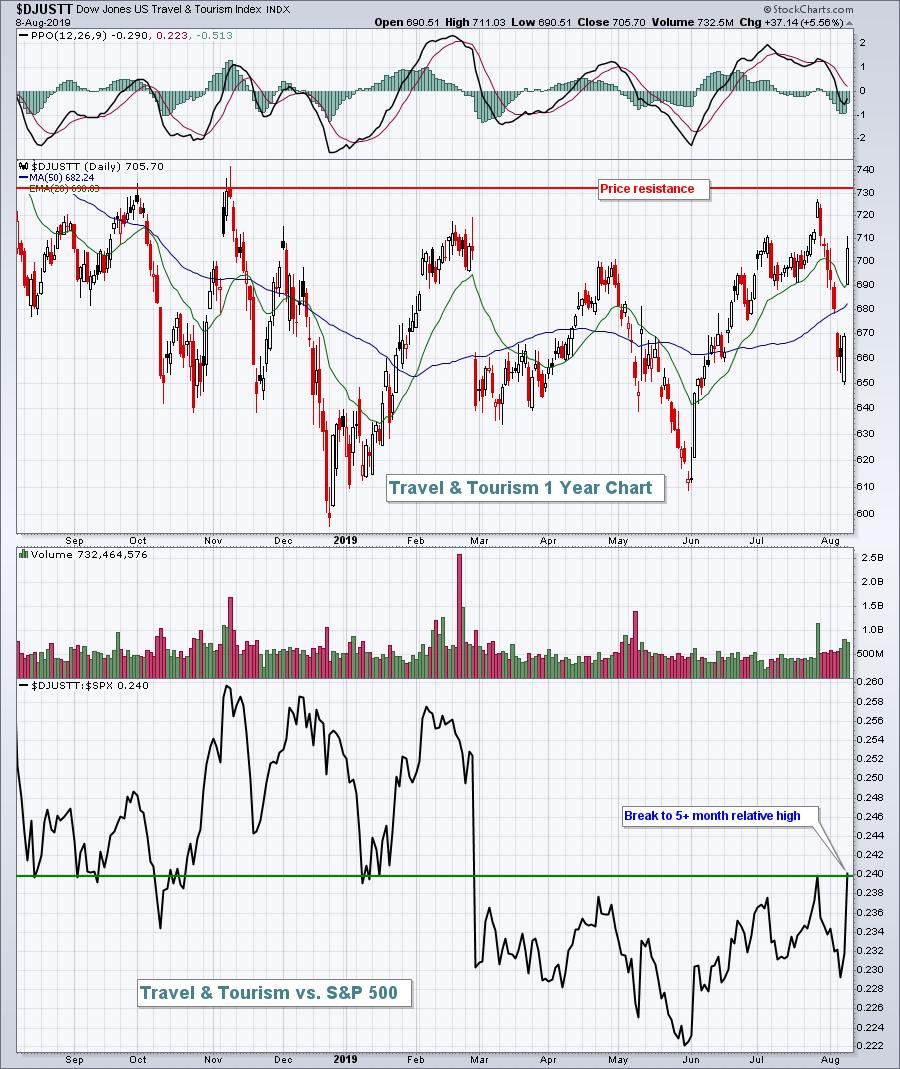

Energy Failing To Show Absolute Or Relative Strength....With One Exception

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

If you didn't have a chance to read my blog post from Saturday, "I'm Returning To My Roots At EarningsBeats.com", be sure to check it out. I'll be explaining a lot more about my decision and discussing my three...

READ MORE

MEMBERS ONLY

This Biotech Kept its Head while Others Lost Theirs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

If you can keep your head when all about you are losing theirs ....Rudyard Kipling

The line above comes from the Poem, "If" by Rudyard Kipling. We can rephrase this when looking at stocks over the last few weeks.

If a stock can hold above the late July...

READ MORE

MEMBERS ONLY

Week Ahead: Range-Bound Move Expected In The Truncated Week; These Sectors May Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After bouncing off its 100-Week MA in the previous week, the markets attempted to take a breather and stabilize during the past week. The NIFTY was able to bounce back once again from the 100-Week MA; this pullback was aided by the oversold nature of the markets on the short-term...

READ MORE

MEMBERS ONLY

I'm Returning To My Roots At EarningsBeats.com!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Wow, it's been a great ride here at StockCharts.com!

The ride's not completely over, but I'm making a big change (and with mixed emotions) as I leave my role as Sr. Technical Analyst at StockCharts.com, effective September 15, 2019, and return to...

READ MORE

MEMBERS ONLY

STOCKS END MODESTLY LOWER AFTER VOLATILE WEEK -- REITS AND UTILITIES WERE THE WEEK'S STRONGEST SECTORS -- ENERGY AND FINANCIALS THE WEAKEST -- MATERIALS ARE BEING LED HIGHER BY GOLD MINERS -- WHILE COPPER MINERS REMAIN WEAK

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS END MODESTLY LOWER AS BOND YIELDS WEAKEN...After a week of wild swings, stocks ended only modestly lower on the week. The devaluation of the Chinese yuan to the lowest level in more than a decade set the tone for a volatile week in financial markets. The 10-year Treasury...

READ MORE

MEMBERS ONLY

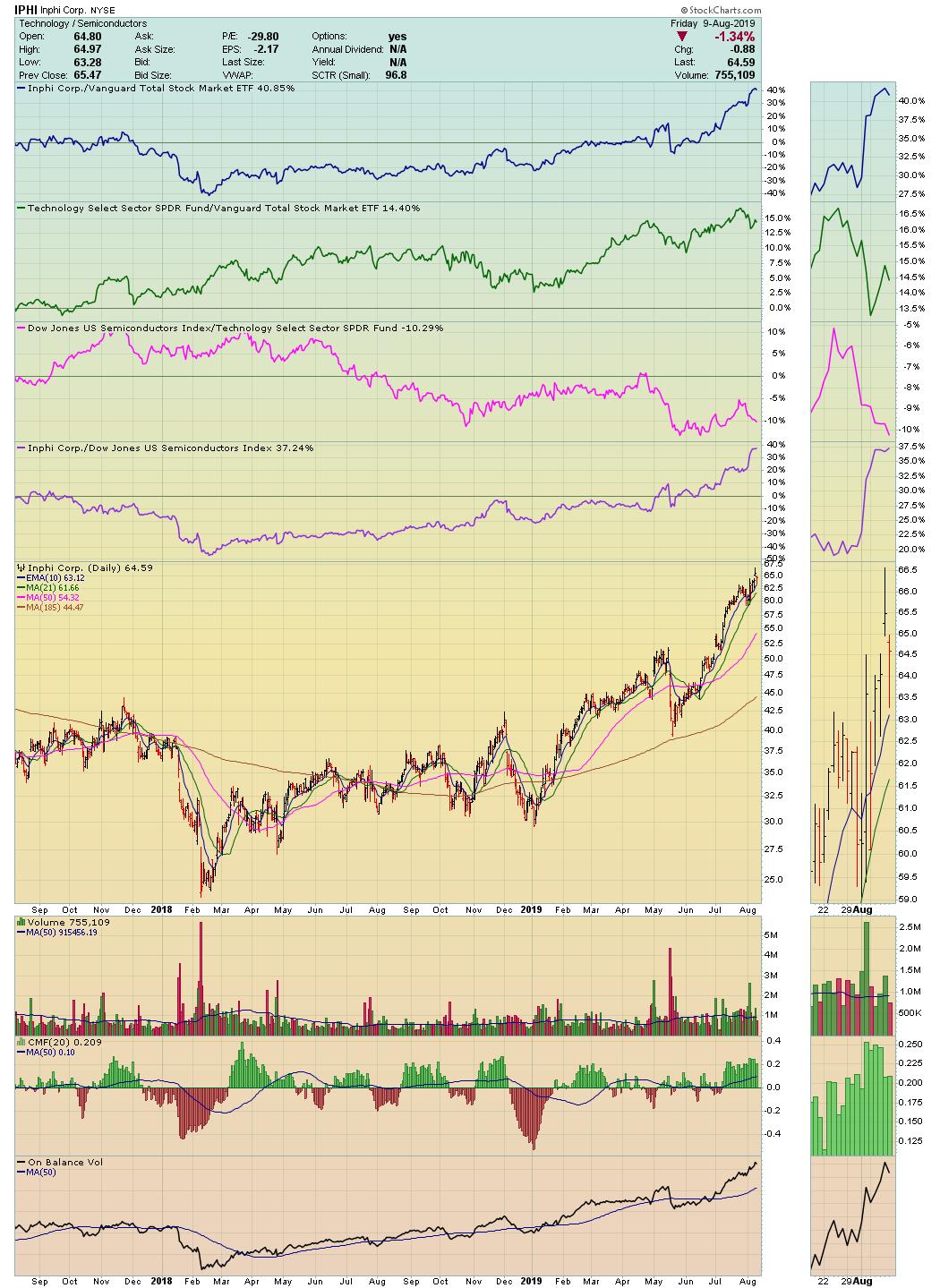

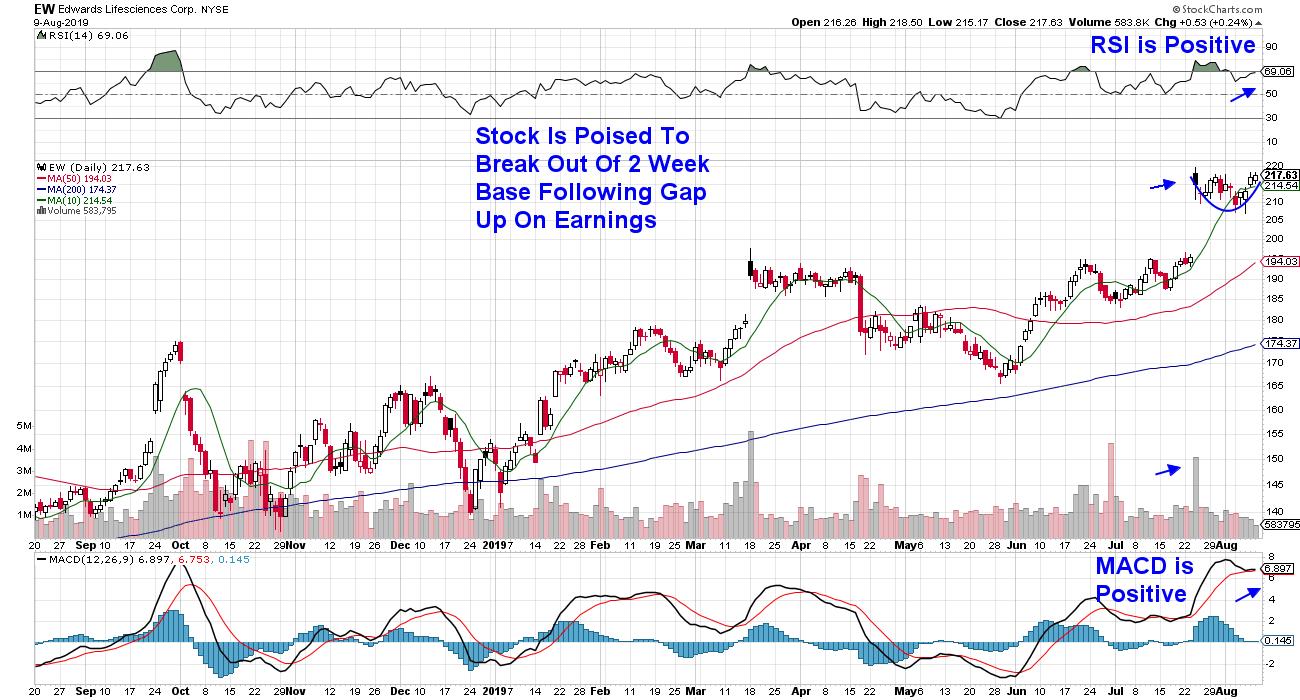

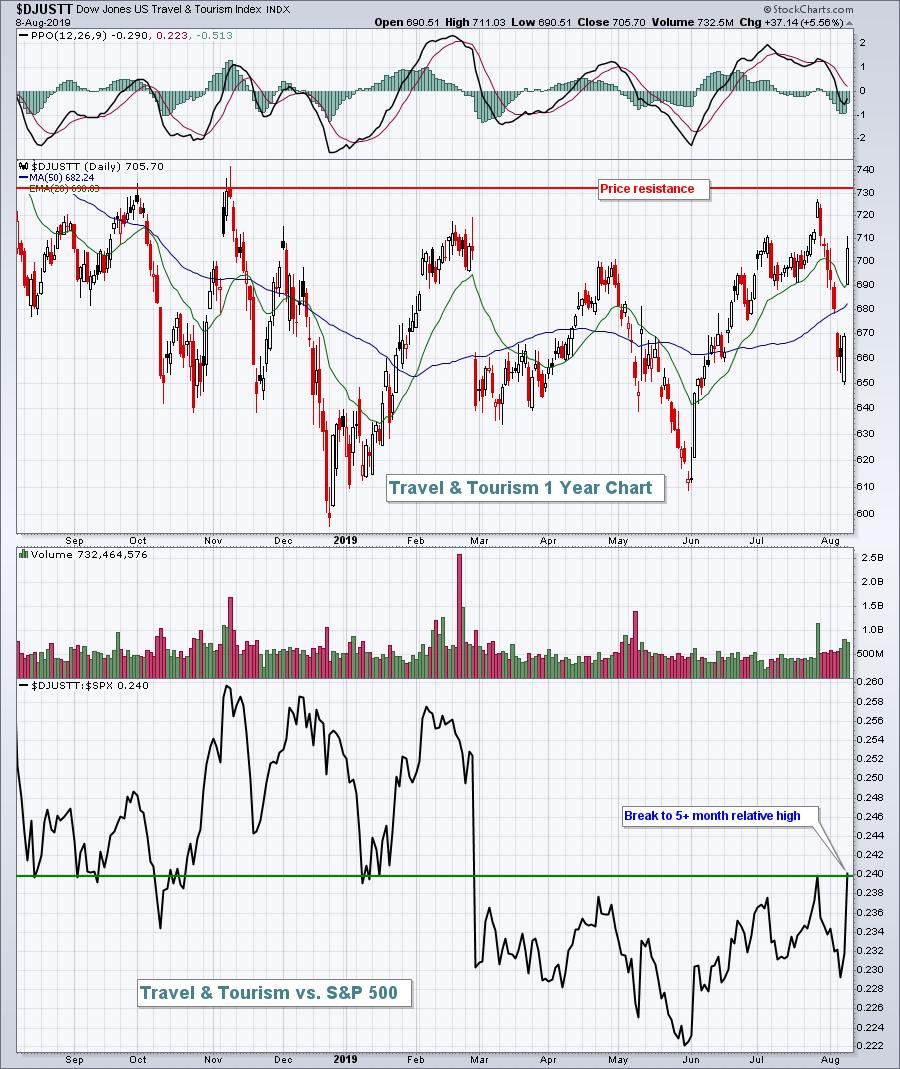

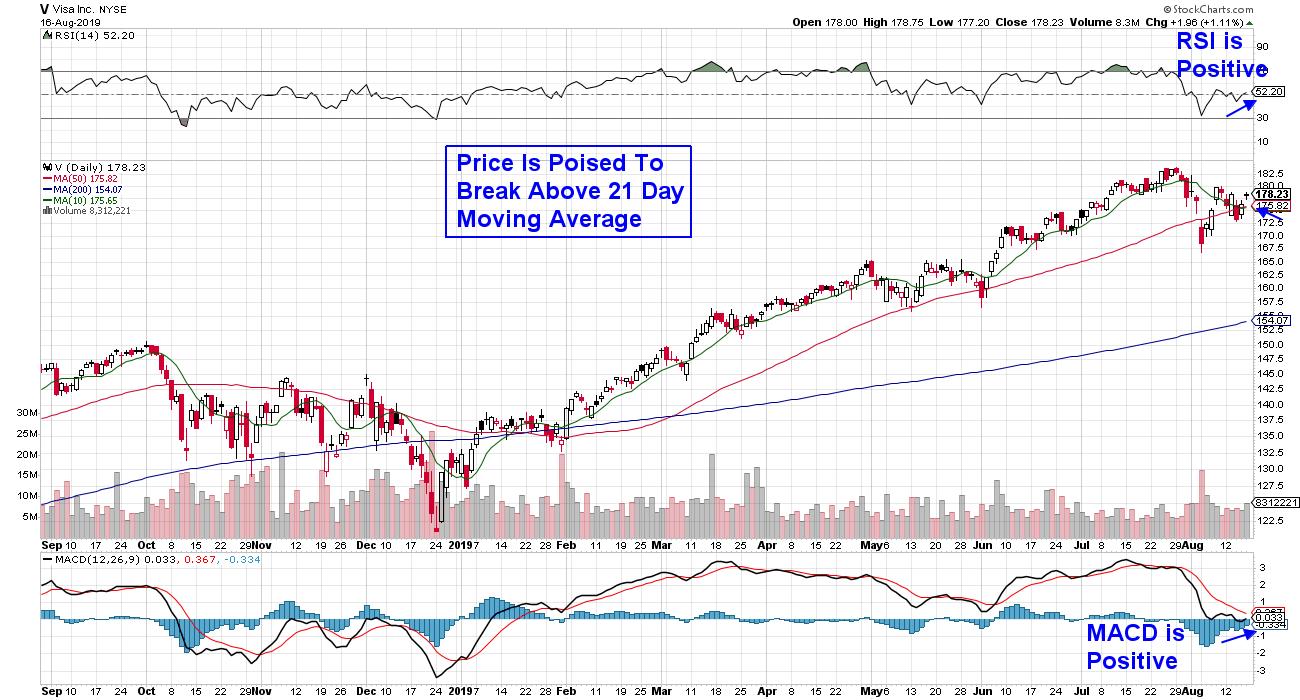

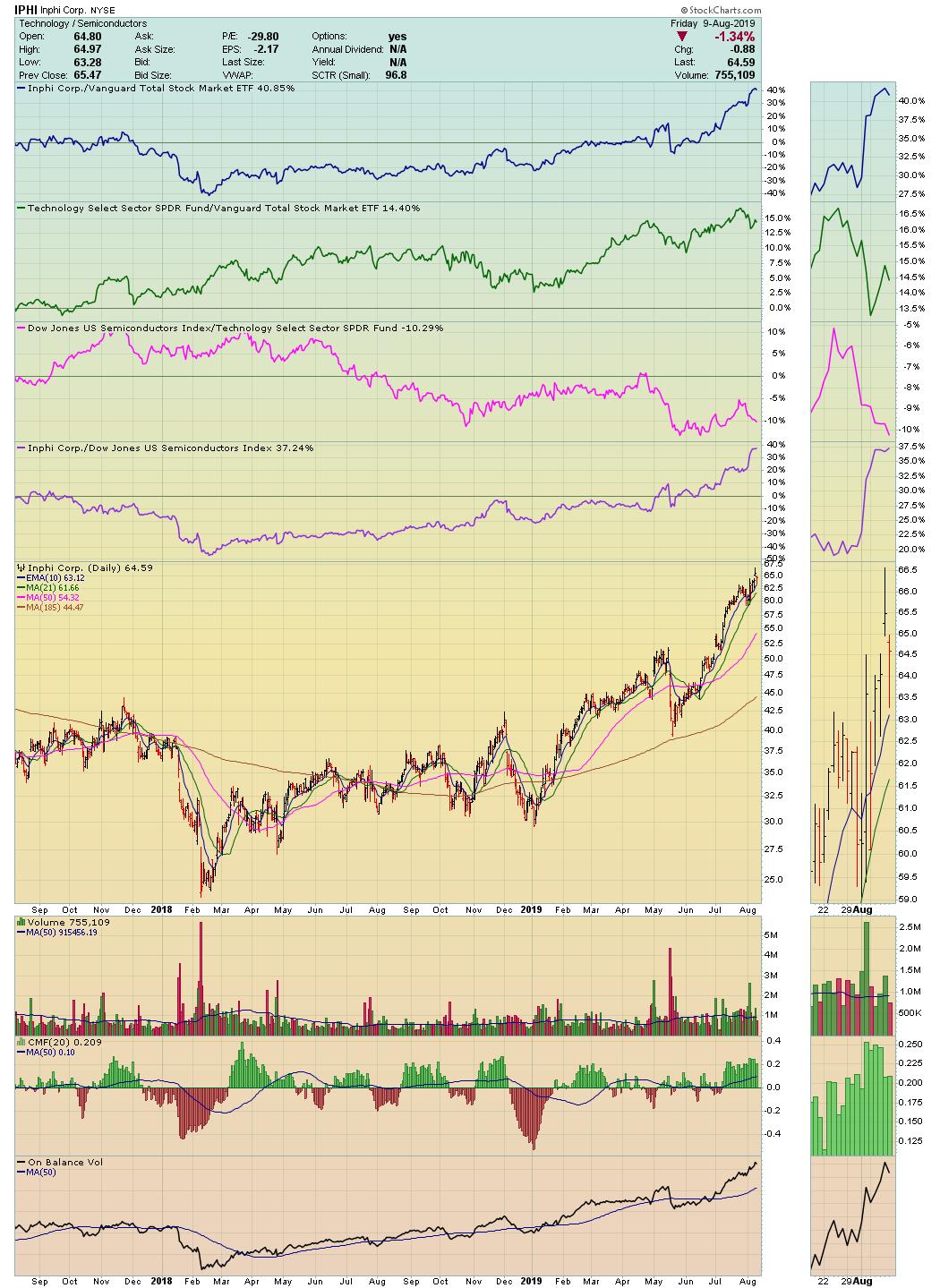

5 Best Industry Groups Not Named Software (And Stocks To Trade In Each)

by John Hopkins,

President and Co-founder, EarningsBeats.com

I know it's summer, and we generally think defensively during this time of year, but there are still very strong areas with tremendous momentum that you should be considering. I'll give you my top five industry groups with a stellar individual stock performer within each group....

READ MORE

MEMBERS ONLY

Achieve Clarity In A Nuanced Stock Market By Maximizing Relative Strength In Three Investing Arenas

by Gatis Roze,

Author, "Tensile Trading"

The stock market is indeed a nuanced creature. With that in mind, I'd like to show you how to use Relative Strength to understand what this creature is actually doing. You'll find that my suggested use of Relative Strength will keep your probability of success in...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Important New Look at an Old Indicator

by Carl Swenlin,

President and Founder, DecisionPoint.com

One thing that we technical analysts like to spot at price tops is an indicator flashing a negative divergence, which is an indicator that is trending downward while price continues to trend upward. Such divergences imply that internals are eroding under the rising price, and that a price correction could...

READ MORE

MEMBERS ONLY

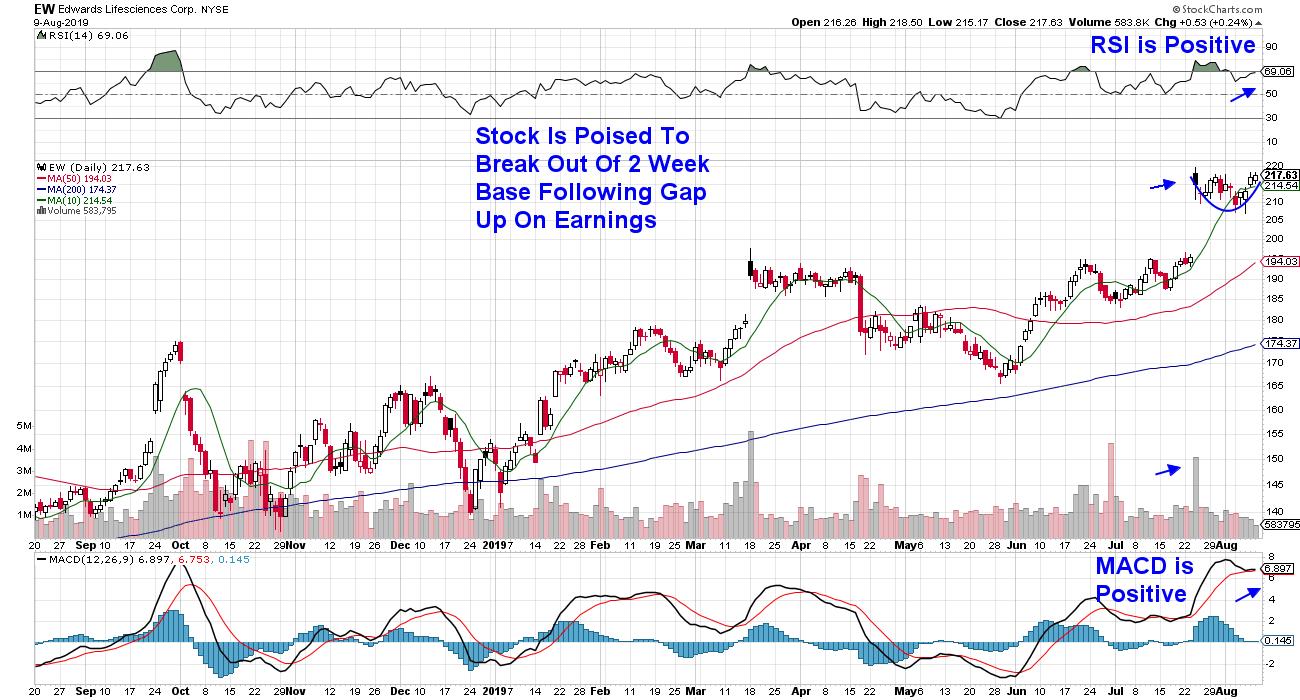

The Risk Is Real – 3 Stock Candidates That Can Offer Solace In A Chaotic Market

by Mary Ellen McGonagle,

President, MEM Investment Research

It was a wild week on Wall Street as the markets continued to gyrate in response to the latest trade related headlines. Those who went on vacation for the week may have been served best as a market that was down as much as 3.8% at one point, closed...

READ MORE

MEMBERS ONLY

Taking the Pulse of SPDR Sectors - Defensive Sectors Have a Healthy Heartbeat

by Erin Swenlin,

Vice President, DecisionPoint.com

John Murphy joined us on MarketWatchers LIVE on Thursday (8/8/19) and showed us some very interesting charts on the Sector SPDRs. The deterioration of nearly all of them prompted me to look at them using the Price Momentum Oscillator (PMO) in CandleGlance.

Let's start by looking...

READ MORE

MEMBERS ONLY

Finding Sectors and Stocks that Held Up During the Onslaught

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 hit a new high in late July and then got pummeled in early August with a sharp decline that broke the 50-day EMA. Moving averages like this can serve benchmark levels that chartists can use to compare performance. Stocks and ETFs that did not break...

READ MORE

MEMBERS ONLY

Transports Continue to Lag Behind the Dow Industrials

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, August 9th at 12:27pm ET.

I was asked during an interview on StockCharts TV yesterday whether I was concerned about the Dow Theory divergence between the Dow Industrials and the Dow...

READ MORE

MEMBERS ONLY

TRANSPORTS CONTINUE TO LAG BEHIND THE DOW INDUSTRIALS WHICH IS A DOW THEORY WARNING -- THE FACT THAT UTILITIES ARE THE STRONGEST OF THE THREE DOW AVERAGES MAY BE ANOTHER WARNING

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRADITIONAL DOW THEORY DIVERGENCE...I was asked during an interview on Stockcharts TV yesterday whether I was concerned about the Dow Theory divergence between the Dow Industrials and the Dow Transports. I responded that I was. But with an additional twist to that theory which is also giving a warning...

READ MORE

MEMBERS ONLY

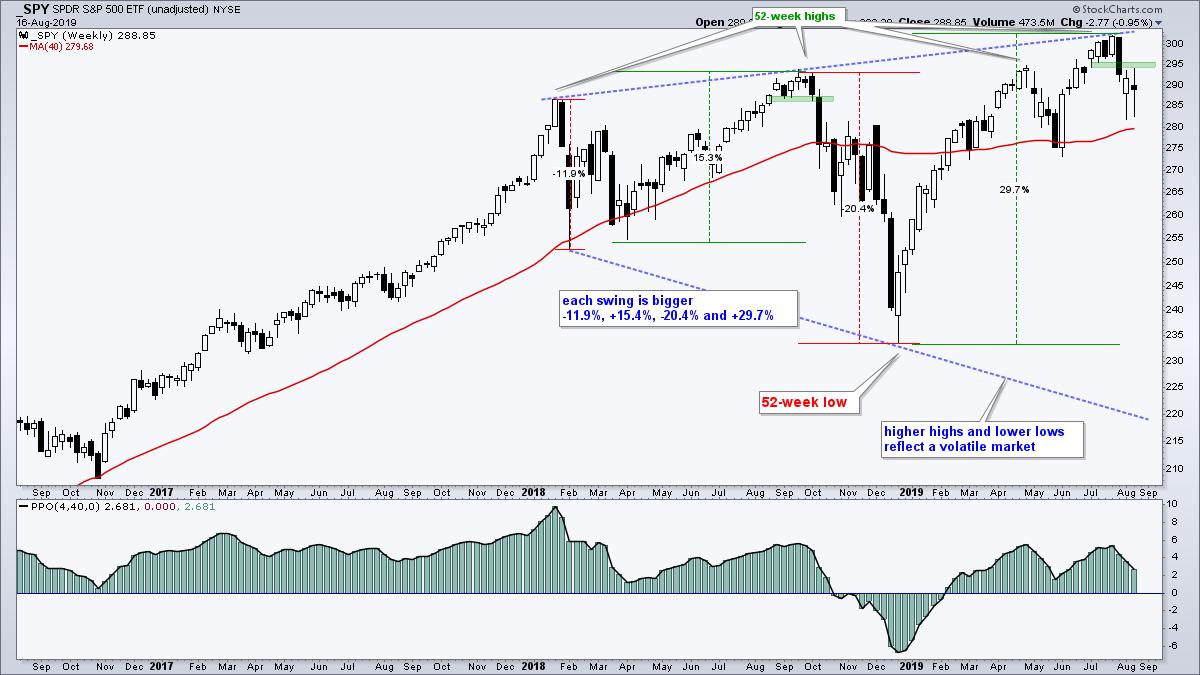

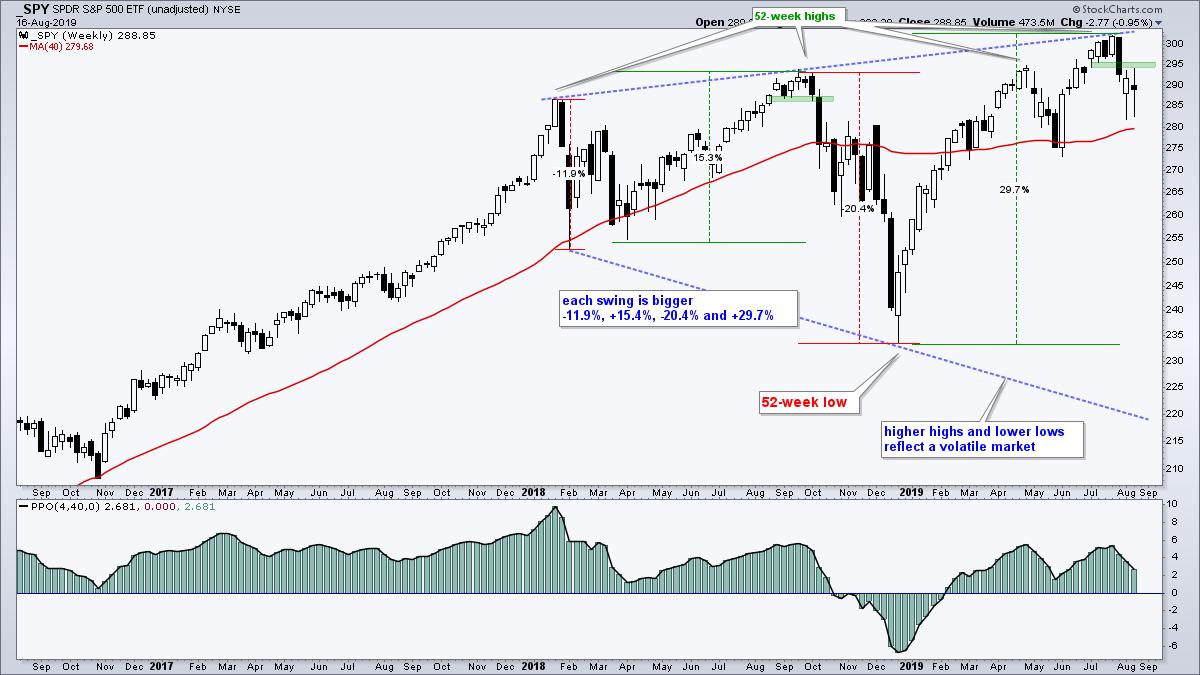

The State of the Stock Market (with video) - A Pick up in Volatility

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Volatility reared its ugly head this week with the S&P 500 falling around 6% in six days and then rebounding with a sharp three-day bounce. This is the biggest decline since the May-June correction, and the sharpest decline since early December. Looking back, the S&P 500...

READ MORE

MEMBERS ONLY

It's Make Or Break Time For Telecommunications Equipment Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, August 8, 2019

Thursday was a trend day for U.S. stocks, one in which the action was positive from start to finish. It's generally viewed bullishly and as a sign of accumulation. However, I don't know if I'd grow...

READ MORE