MEMBERS ONLY

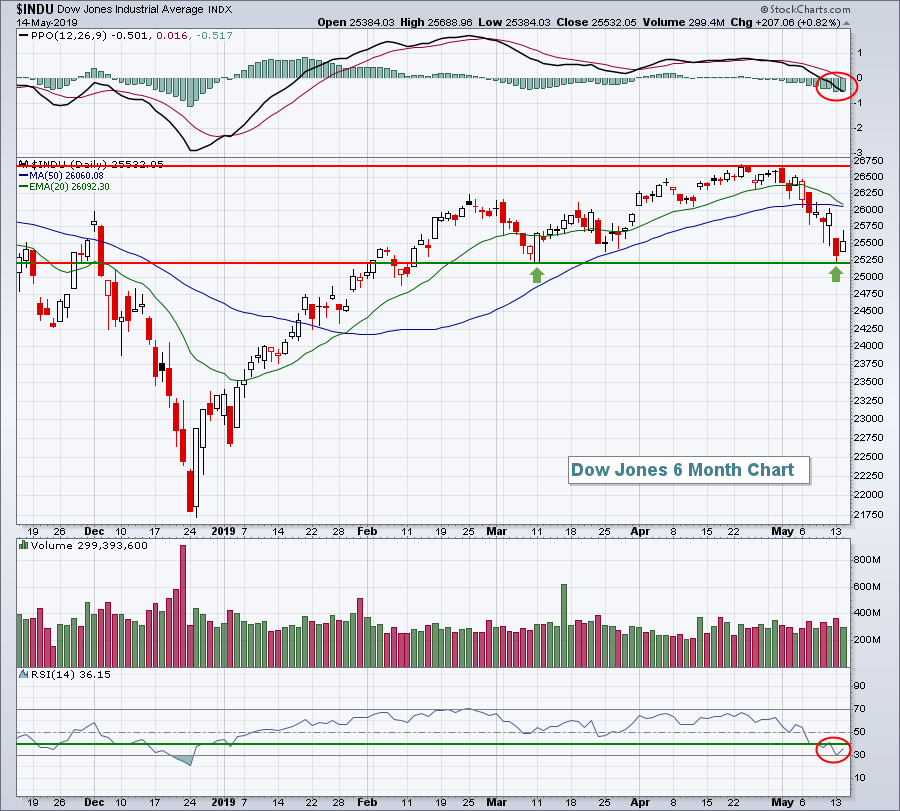

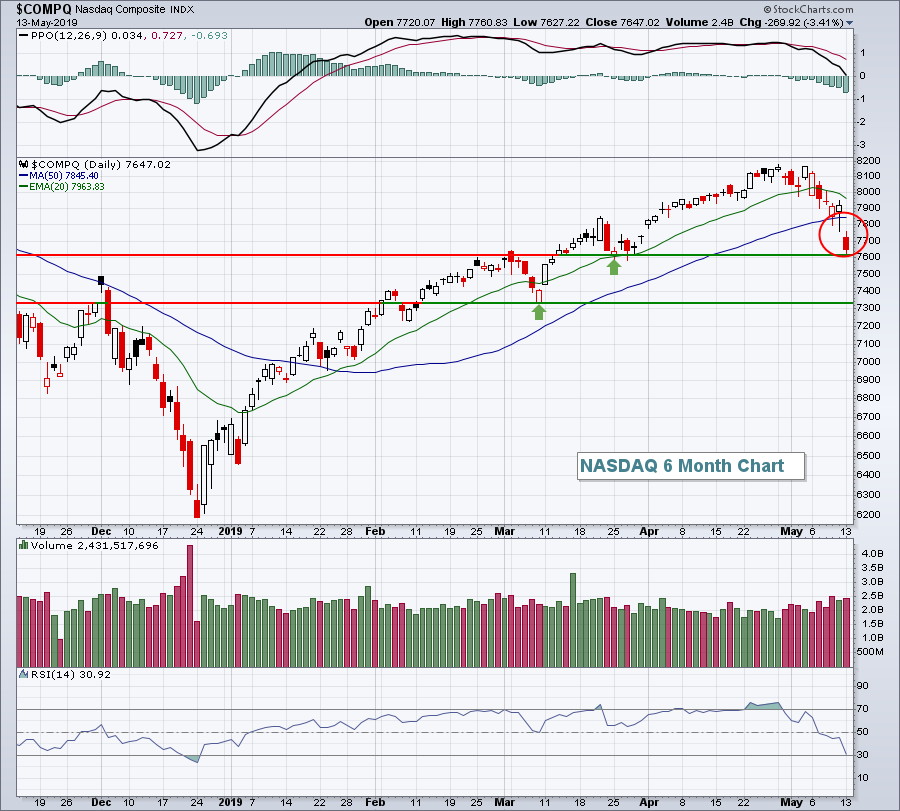

STOCK SELLING INTENSIFIES -- DOW TRADES BELOW ITS 200-DAY AVERAGE -- NASDAQ AND S&P 500 ARE DROPPING TOWARD THEIR 200-DAY LINES -- IF THEY DON'T HOLD, A TEST OF THEIR MARCH LOWS WOULD BE NEXT

by John Murphy,

Chief Technical Analyst, StockCharts.com

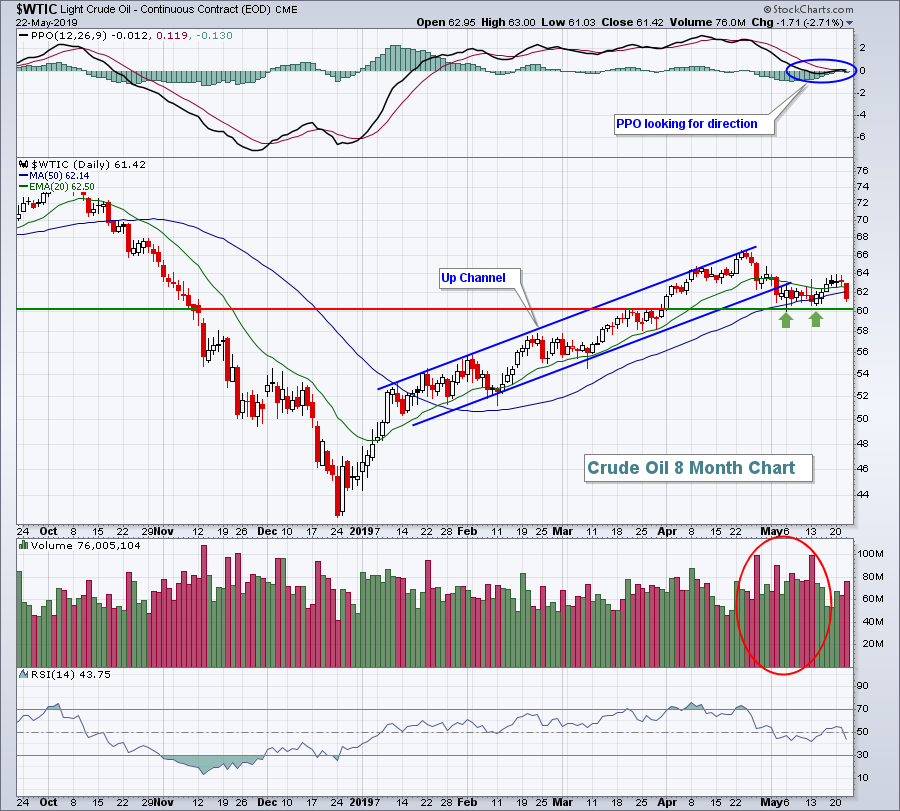

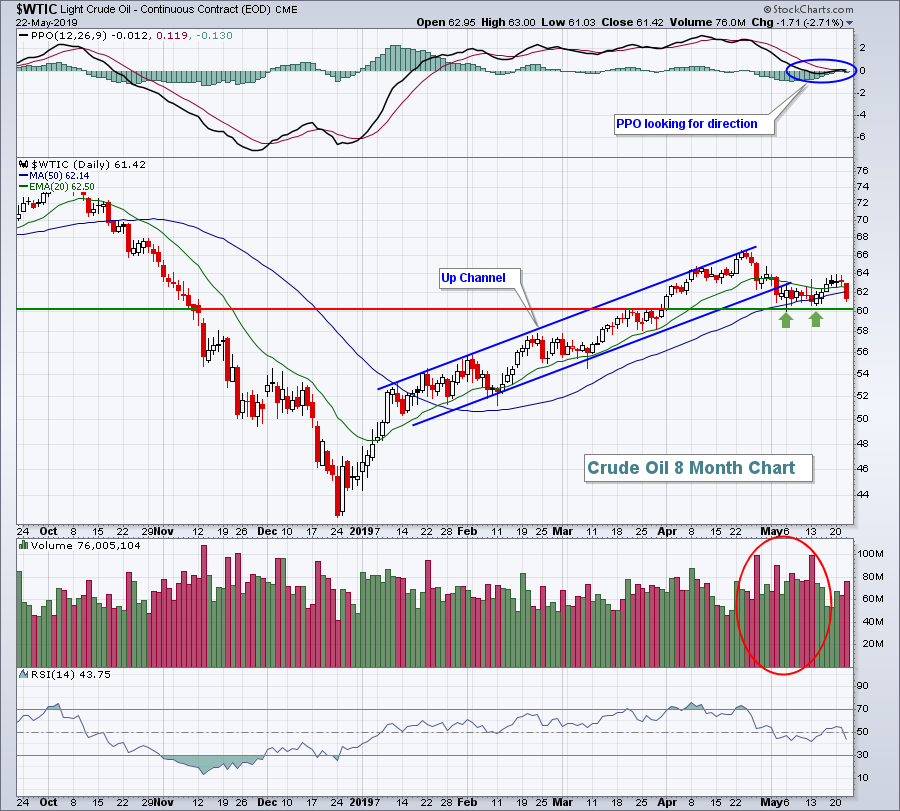

TRADE TENSIONS CONTINUE TO WEIGH ON STOCKS... Stocks are under heavy selling pressure today. Energy stocks are leading the market lower with a drop of more than -3%, while oil is dropping nearly twice as much. Technology, industrials, and financials are down -2% or more. As has been the case...

READ MORE

MEMBERS ONLY

Apparel Retailers Sink To Four Month Low

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 22, 2019

Our major indices finished with losses on Wednesday, despite strength in defensive sectors. The S&P 500 and Dow Jones held up best, falling just 0.28% and 0.39%, respectively. The primary reason is that more defensive stocks are represented on...

READ MORE

MEMBERS ONLY

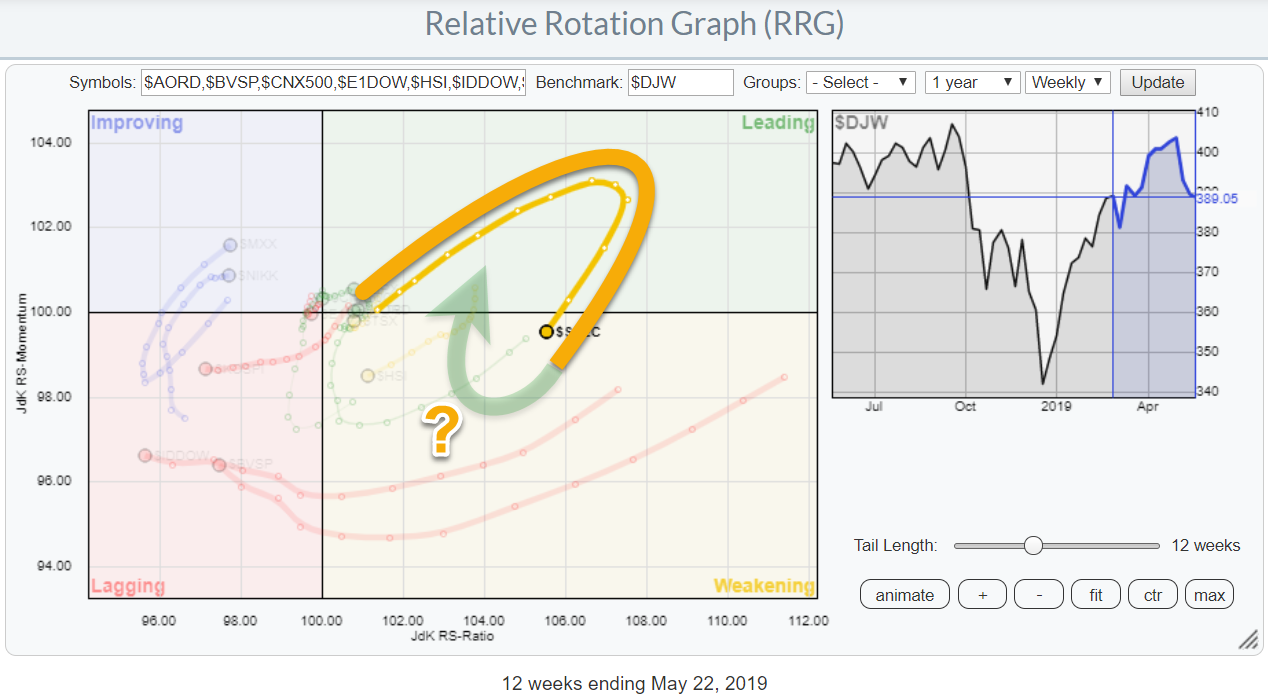

Is China About To Pick Up The Pace Again?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

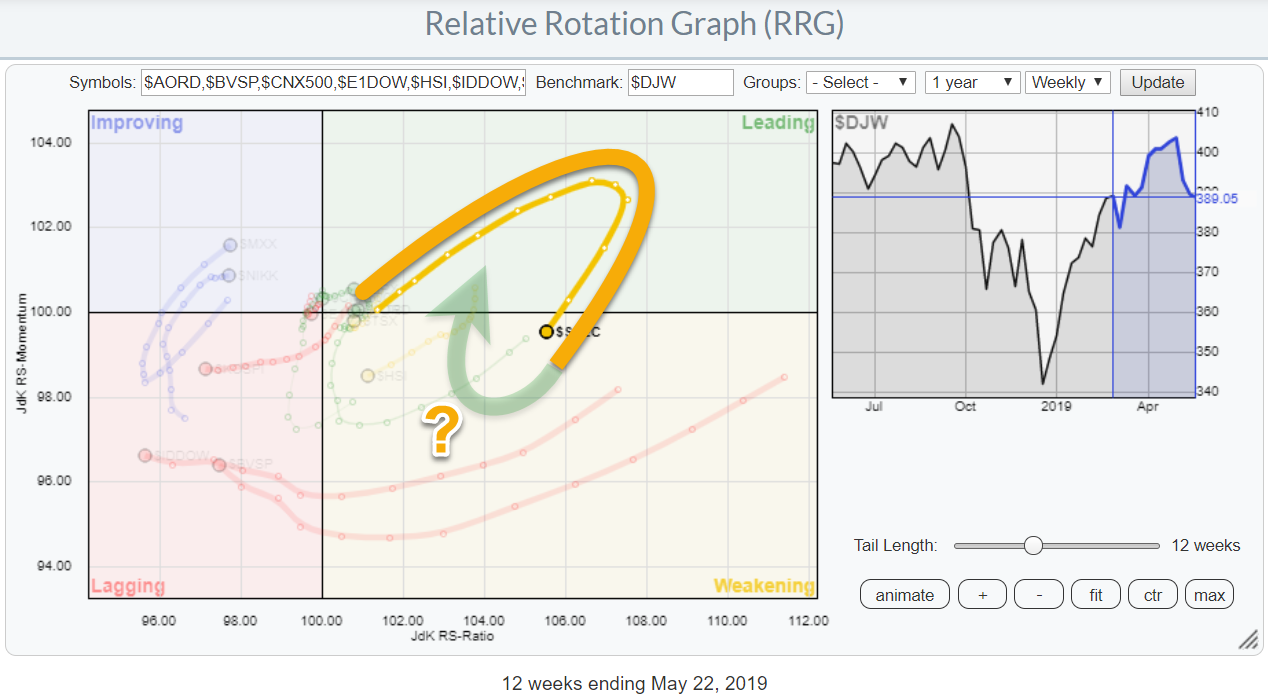

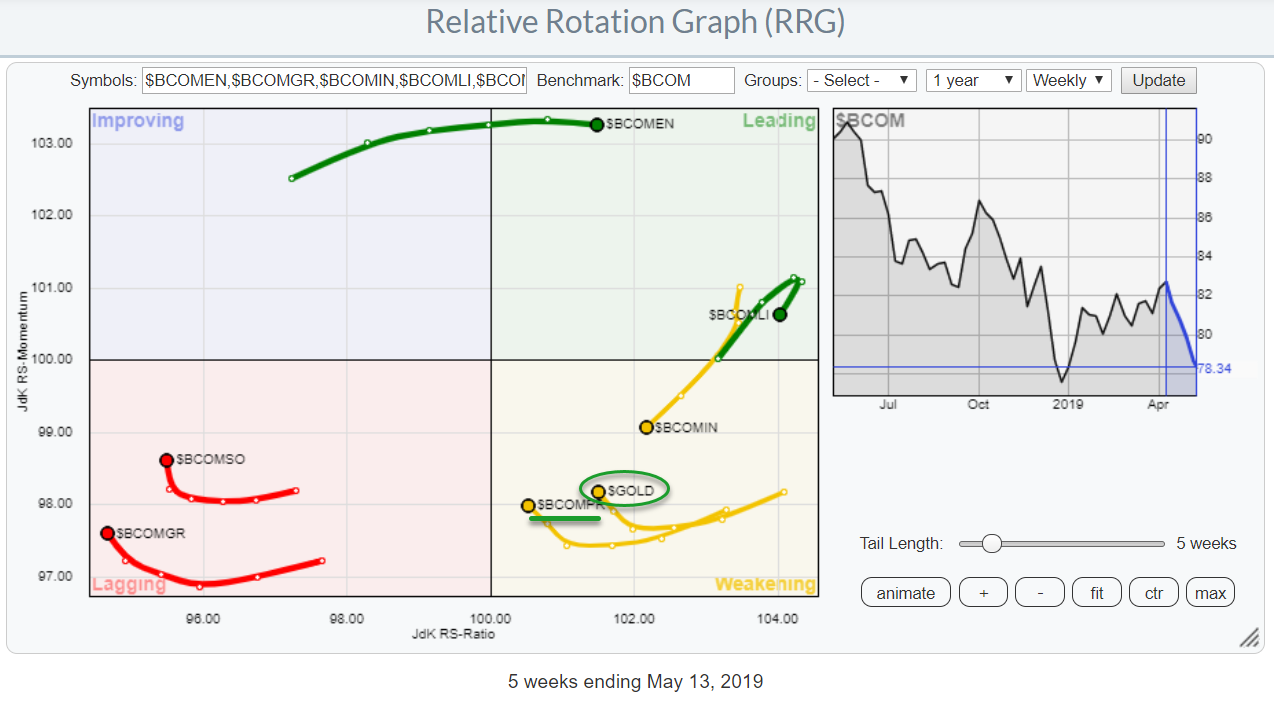

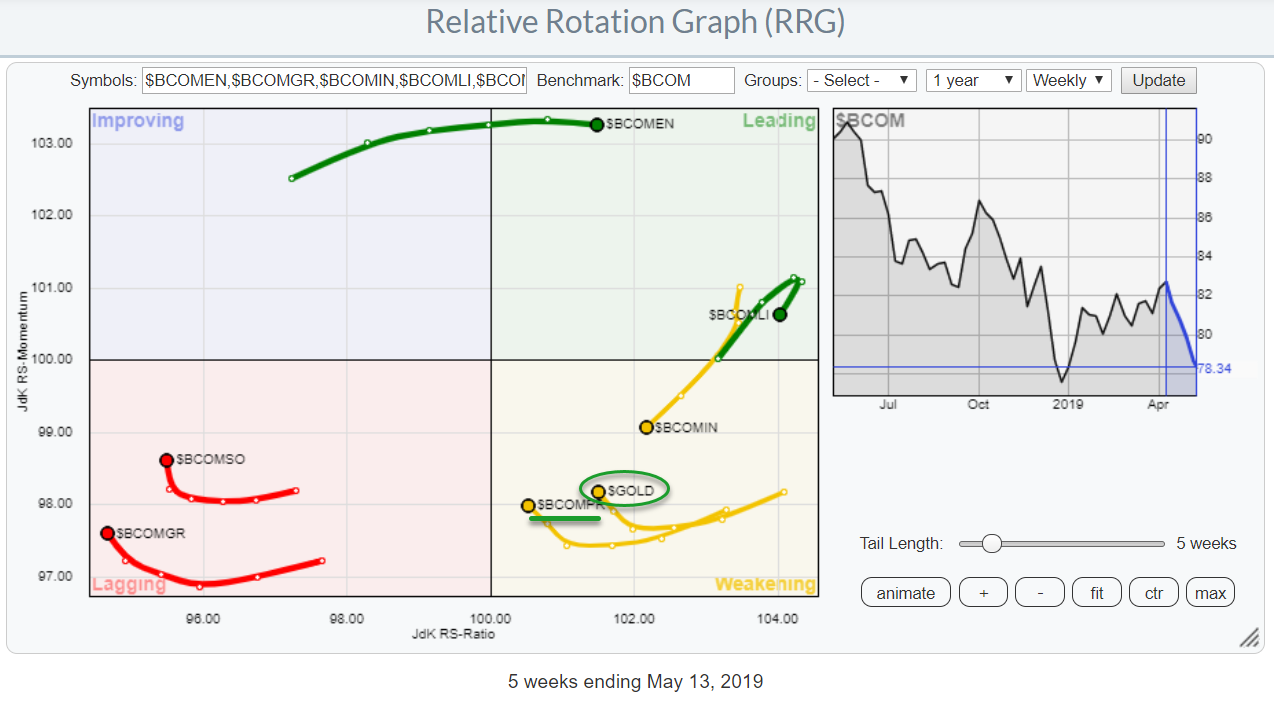

Yesterday, I wrote about the relationship of US stocks against other international stock markets in my regular RRG Charts article.

The Relative Rotation Graph that I use for these analyses is one of the pre-defined groups and is shown above.

While working on that article, I noted the long tail...

READ MORE

MEMBERS ONLY

DP Mid-Week Review: ST Indicators Top Too Soon - TLT Stalling at Resistance

by Erin Swenlin,

Vice President, DecisionPoint.com

No changes on the DecisionPoint Scoreboards. The short-term is still weak; our short-term Swenlin Trading Oscillators turned down this week after barely reaching positive territory. TLT rallied further but was unable to push past strong resistance at the March high.

The DP Mid-Week Review presents a mid-week assessment of the...

READ MORE

MEMBERS ONLY

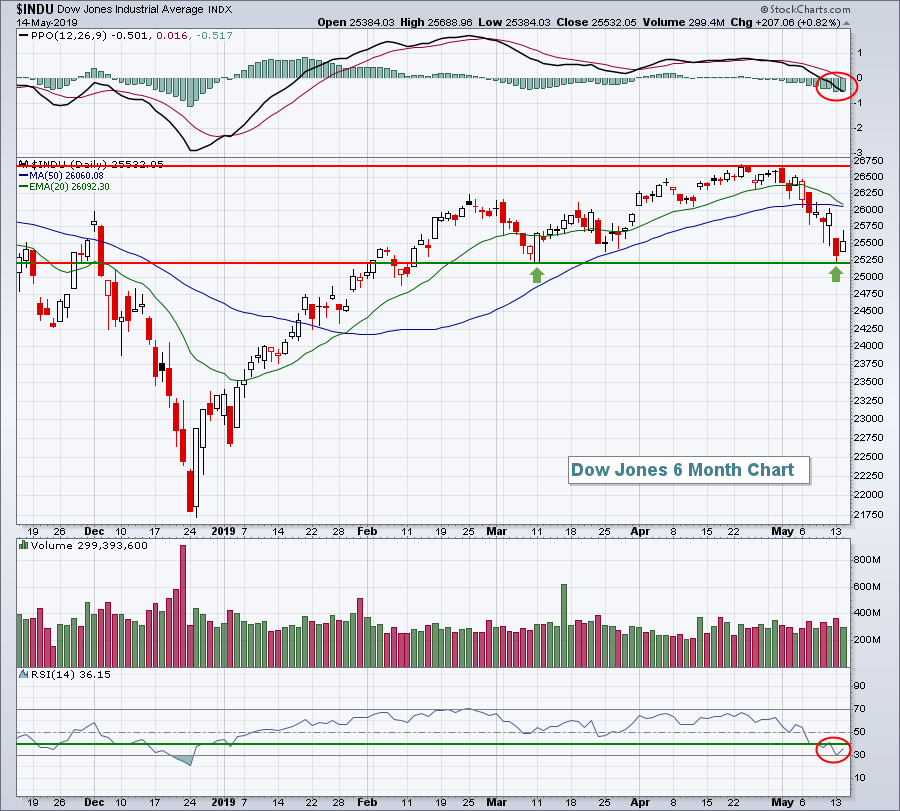

DOW TRANSPORTS FALL BELOW 200-DAY AVERAGE -- AMERICAN AIRLINES, FEDEX, AND JB HUNT ARE LEADING IT LOWER -- WHILE UTILITIES REACH NEW RECORD -- TECHS, INDUSTRIALS, AND CYCLICALS WEAKEN DURING MAY -- WHILE DEFENSIVE GROUPS TAKE LEADERSHIP ROLE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANSPORTS FALL BACK BELOW 200-DAY LINE... Transportation stocks are one of the weakest parts of the market today. Chart 1 shows the Dow Jones Transportation Average now trading below its 50- and 200-day moving averages. Not surprisingly, tranports are also showing relative weakness. The blue line in Chart 1...

READ MORE

MEMBERS ONLY

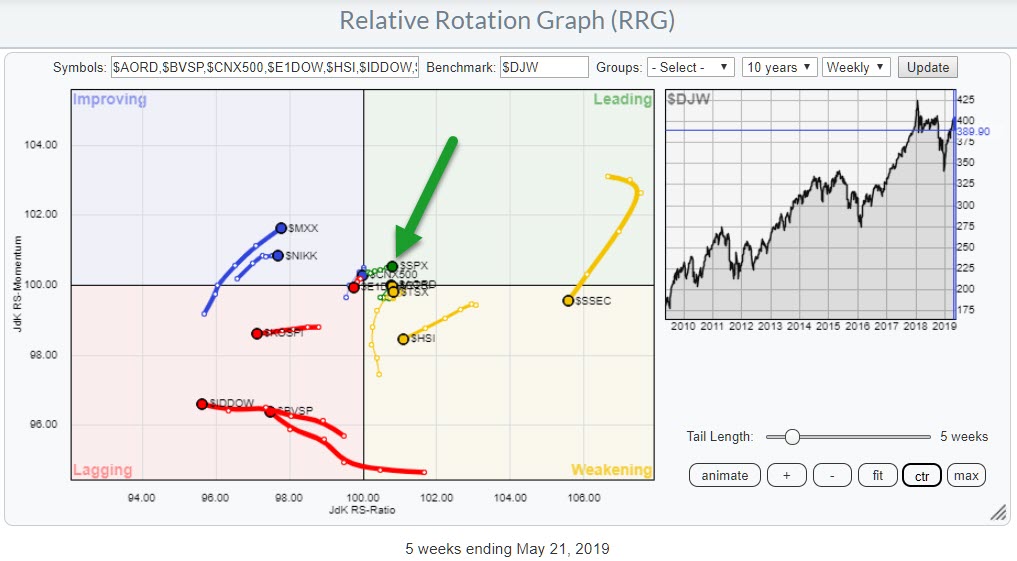

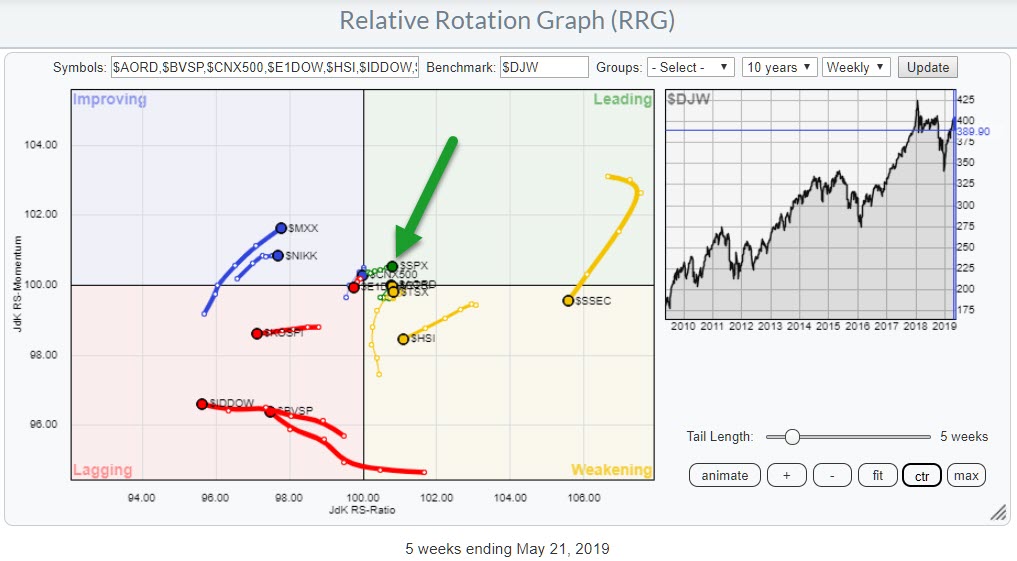

What Does It Mean When The US Starts Outperforming Other International Stock Markets?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Stock markets around the world are giving mixed signals. Returns over the last 5 weeks have varied from +4% in Australia to -10% in China. The Relative Rotation Graph above shows the relative trends that are currently in play among the various international stock market indexes.

For a pure, and...

READ MORE

MEMBERS ONLY

Discipline, Discipline, Discipline!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Discipline is the Key! You should look up the definition for both the noun and the verb.

Over the years I've stressed the importance of having discipline in any investment strategy, and that is certainly still the case. A couple of years ago, when the market was in...

READ MORE

MEMBERS ONLY

What's Wrong With Small Caps And Will June Seasonality Kick In?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 21, 2019

The U.S. stock market rebounded on Tuesday after a 90 day temporary license was granted by the U.S. Department of Commerce to Huawei, a Chinese multinational telecommunications equipment company. Technology stocks (XLK, +1.23%) were a primary beneficiary of this action...

READ MORE

MEMBERS ONLY

A Medical Device Stock with Strong Volume Trends

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

An existing uptrend and short-term breakout on high volume point to higher prices for Boston Scientific.

The chart below show BSX hitting a new high in early March and then falling rather sharply into mid April. A volume spike punctuates the plunge below 35 and this looks like a selling...

READ MORE

MEMBERS ONLY

Nail Biting Time For Equities, Green Shoots For Agricultural Commodities

by Martin Pring,

President, Pring Research

* Top or Consolidation for Equities?

* Agricultural Commodities Perking Up Following a Severe Sell-Off

* Grains Fully Supporting Price Action in the DBA

Top or Consolidation for Equities?

The S&P, like the other market averages, has been in a trading range since March. We will have to see how it...

READ MORE

MEMBERS ONLY

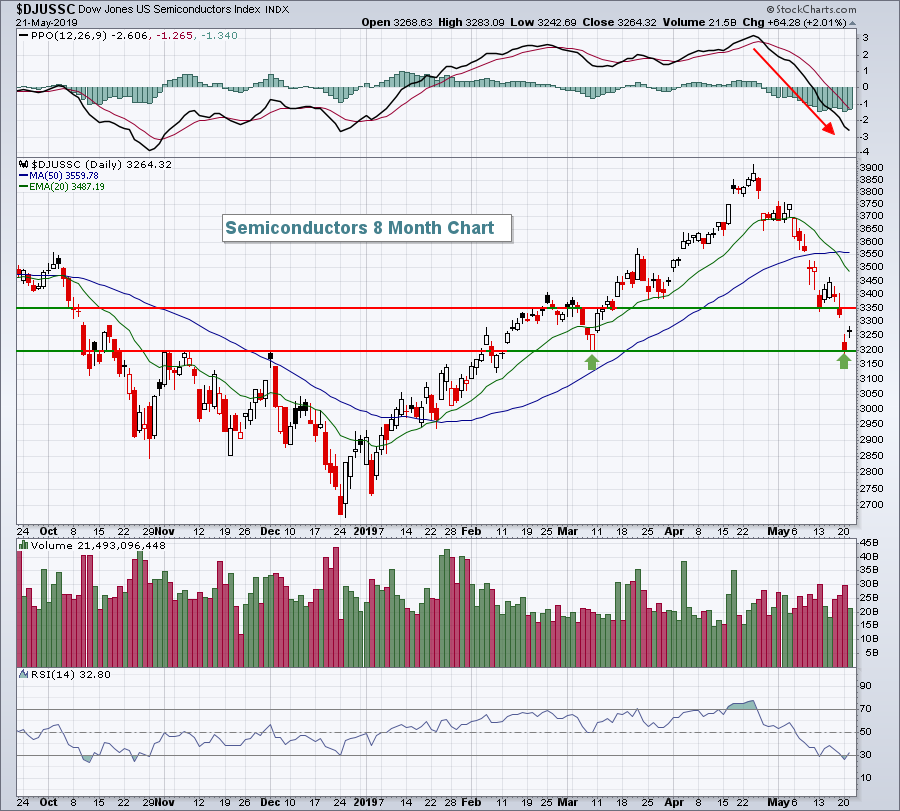

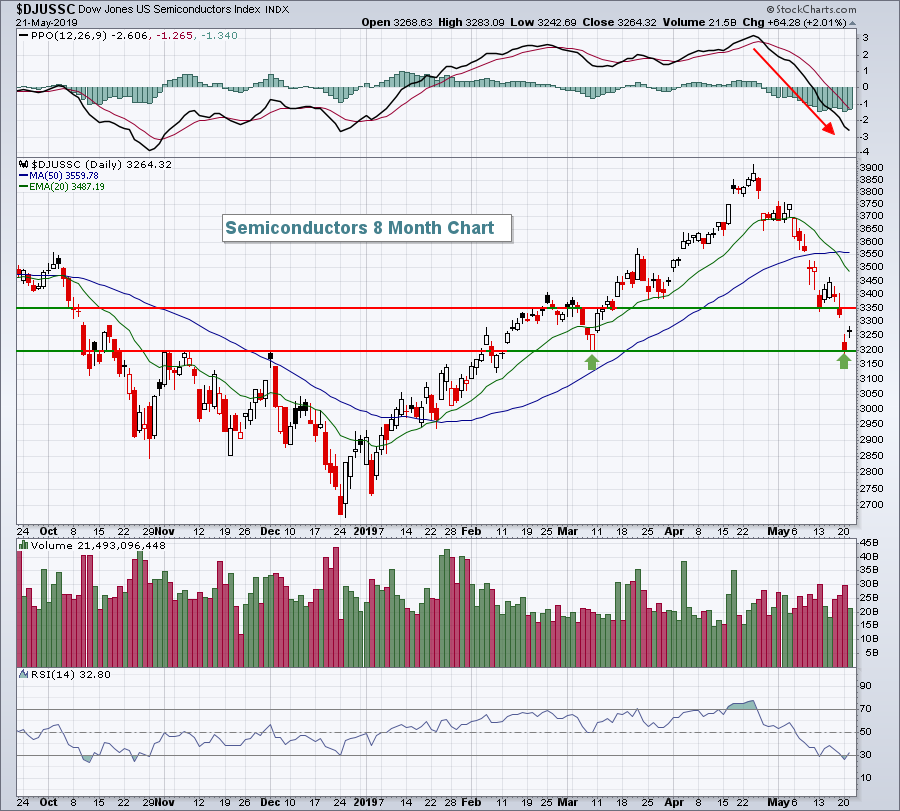

Semiconductors Take Another Big Hit, Support At Hand

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

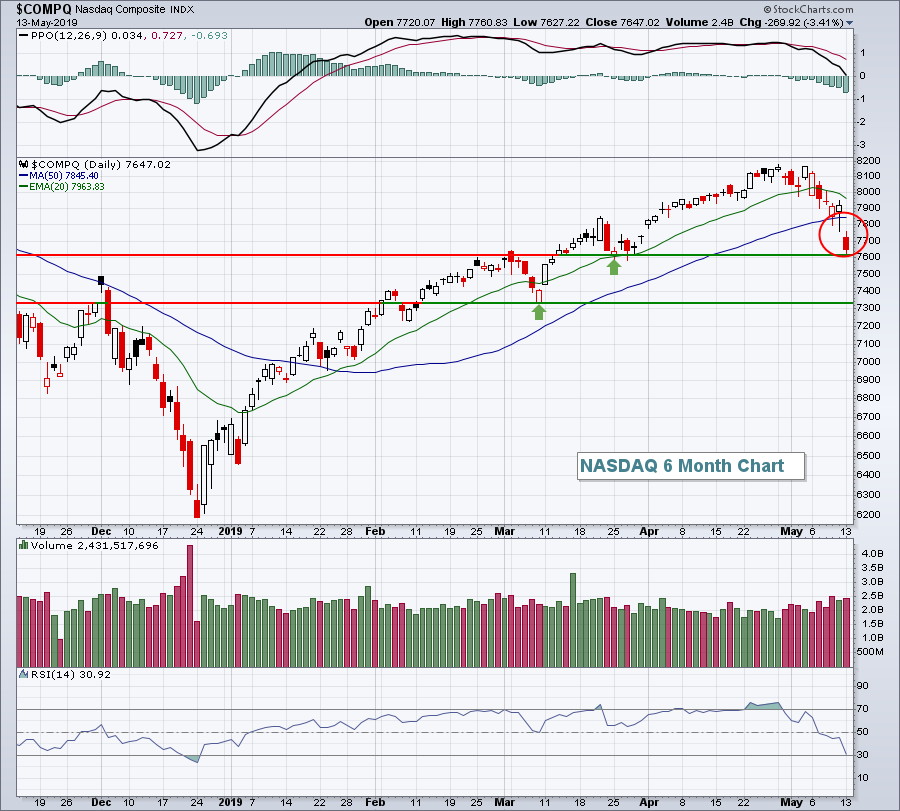

Market Recap for Monday, May 20, 2019

Monday marked another rough May trading day, especially for the NASDAQ, which dropped 1.46%. The other major indices fell, but to a much lesser extent. Technology (XLK, -1.74%) and communication services (XLC, -1.65%) were hardest hit as weakness in semiconductors...

READ MORE

MEMBERS ONLY

A Momentum Break for Ross Stores

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Ross Stores (ROST) recently bounced off its rising 200-day SMA with a bullish candlestick pattern and short-term RSI broke to its highest level of the month. It looks like the short-term pullback is ending and the bigger uptrend is resuming.

ROST plunged in November-December with a sharp decline below the...

READ MORE

MEMBERS ONLY

Financial Administration Relative Strength - When Will It End?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 17, 2019

Friday offered up a mixed bag. Our major indices were either higher or near the flat line with an hour left in the trading day. Then more discussion surfaced that US-China trade talks had stalled. That sent U.S. equities spiraling lower, especially...

READ MORE

MEMBERS ONLY

Special Weekly Note: Markets Set To Face A Volatile Week; Placed Differently Than In 2014

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equity markets witnessed one of their most volatile weeks in the recent past, oscillating back and forth in a relatively wider range before ending the week with a modest gain. After facing downward pressure in the initial days of the week, the NIFTY saw itself turning positive on...

READ MORE

MEMBERS ONLY

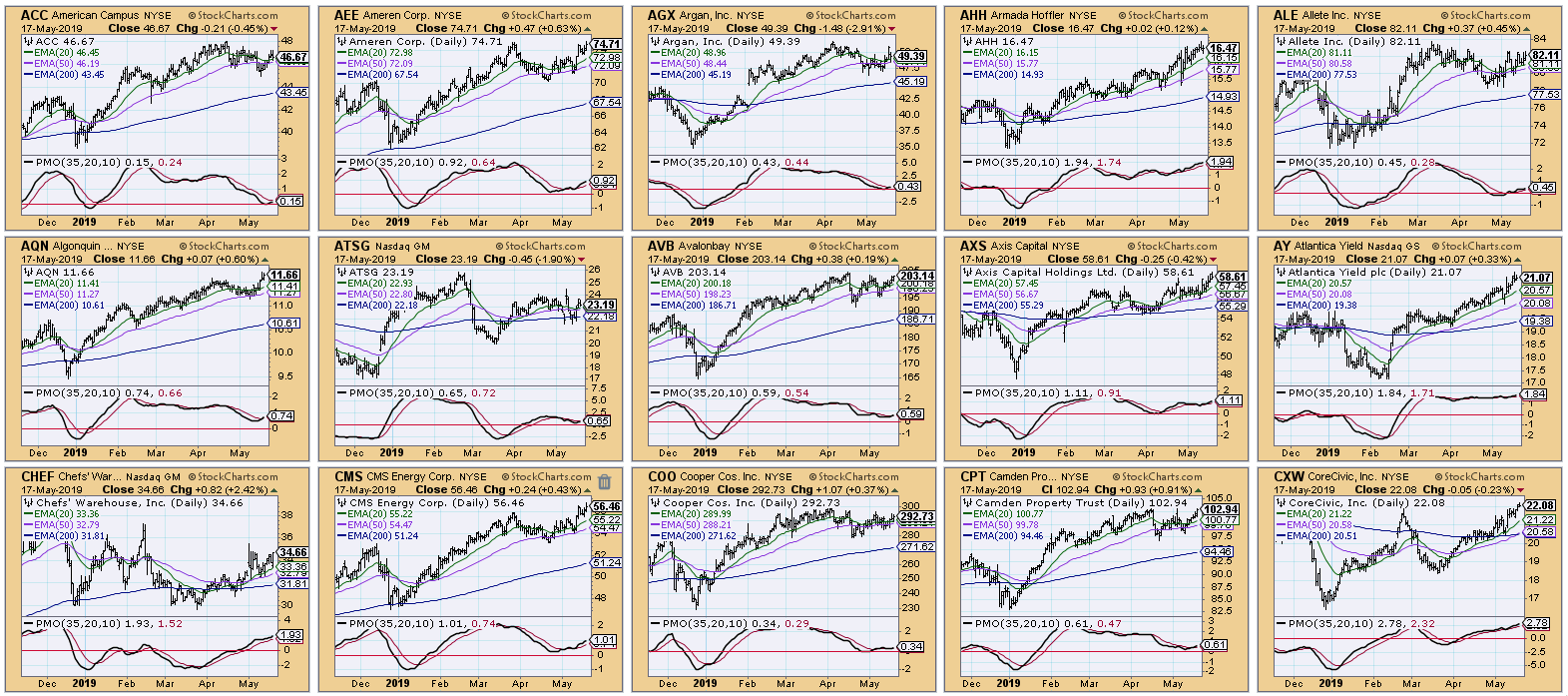

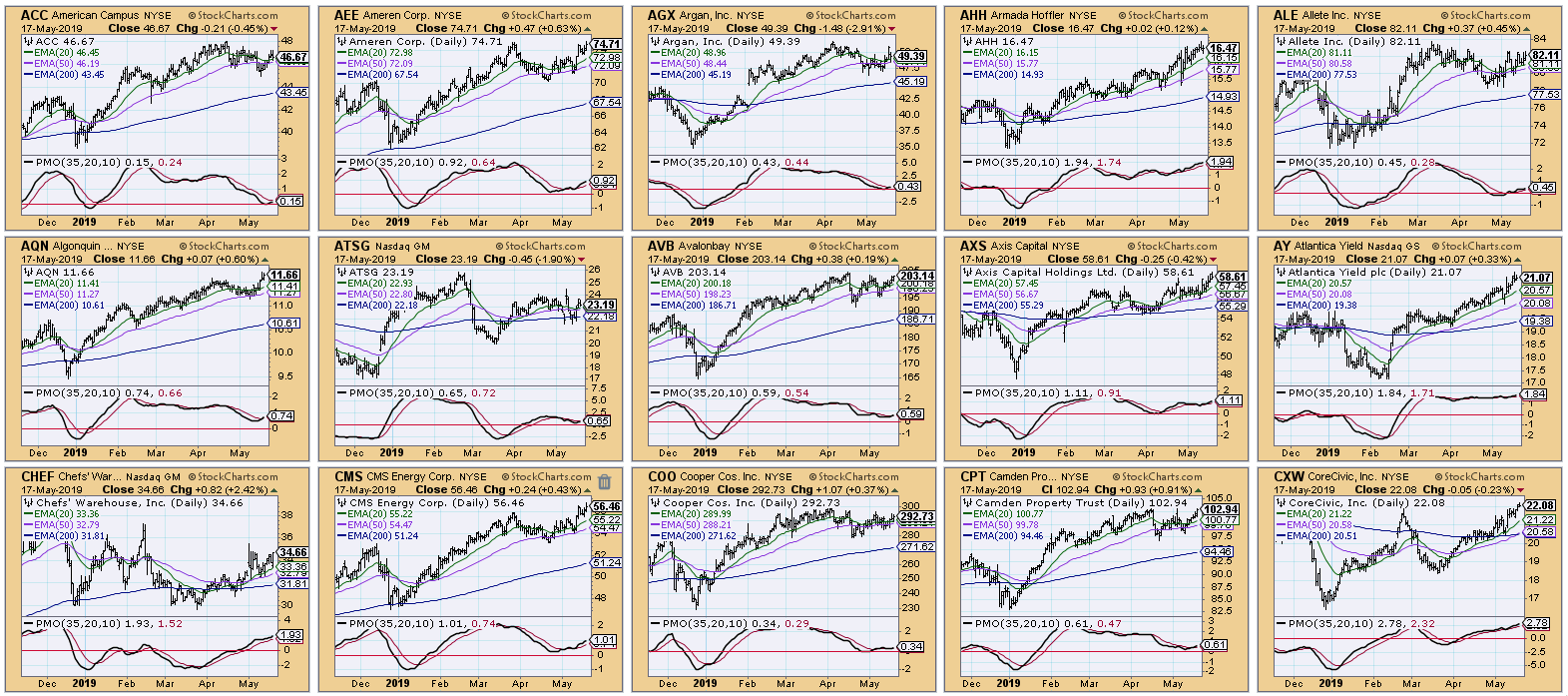

My New Favorite Scan - Excellent Results Using SCTR and Rising PMO

by Erin Swenlin,

Vice President, DecisionPoint.com

If you watch MarketWatchers LIVE regularly, you've probably heard about my new scan. I've found, especially when the market has a bearish bias, that my original Price Momentum Oscillator (PMO) scan wasn't producing any results. I consider this a caution flag before I get...

READ MORE

MEMBERS ONLY

Celebrating An Investor's Obituary

by Gatis Roze,

Author, "Tensile Trading"

I've begun writing my own obituary. No worries. I don’t have any incurable health issues to be concerned about. It's simply an exercise that I believe will have value and will be beneficial to my investment efforts. The catalyst for this rather unusual undertaking was...

READ MORE

MEMBERS ONLY

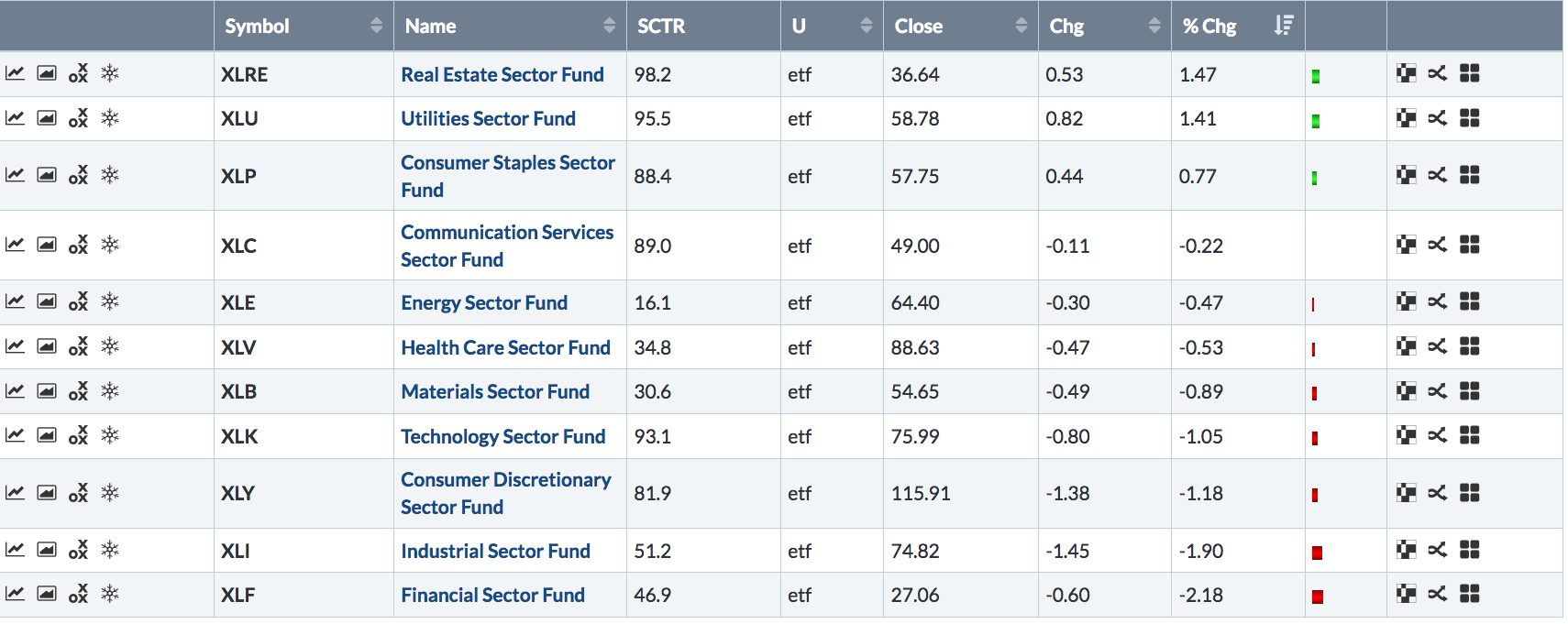

Weekly Sector Rankings Show a Defensive Market

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, May 17th at 4:49pm ET.

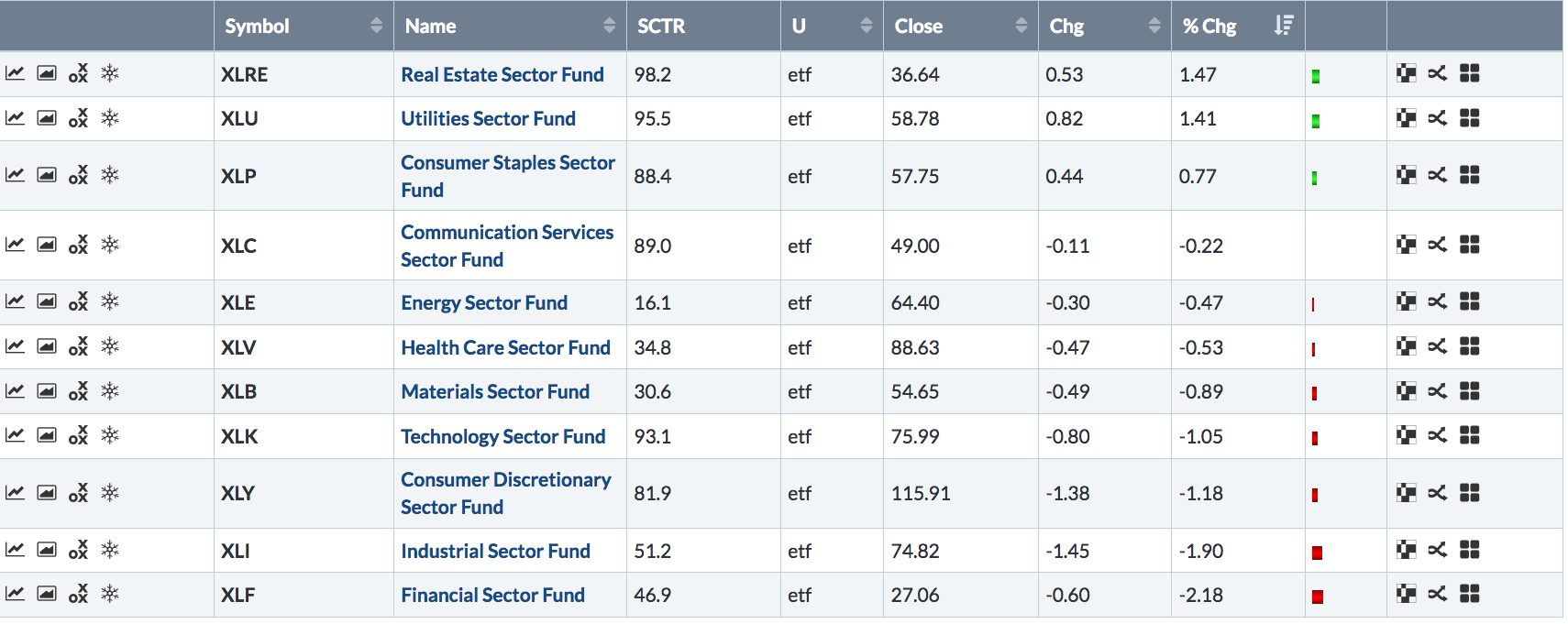

The table in Chart 1 plots the relative performance of the eleven market sectors for the week. And they show a generally defensive market. That can...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Double Top Scenario Still Fits

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I asserted that the market was in the process of forming a major double top. This week, in spite of some price action attempting to refute that assertion, the double top is still evolving. So far the rally attempt appears to have failed, and the thin volume says...

READ MORE

MEMBERS ONLY

WEEKLY SECTOR RANKINGS SHOW A DEFENSIVE MARKET -- SAFE HAVENS WERE MARKET LEADERS -- WHILE TRADE SENSITIVE GROUPS FELL THE MOST -- FINANCIALS WERE THE WEEK'S WORST PERFORMERS -- FALLING BOND YIELDS HAVE HURT BANKS WHILE BOOSTING HOMEBUILDERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEEKLY SECTOR RANKINGS SHOW DEFENSIVE MARKET ... The table in Chart 1 plots the relative performance of the eleven market sectors for the week. And they show a generally defensive market. That can be seen by the fact that REITs, utilities, and consumer staples are the three top sectors for the...

READ MORE

MEMBERS ONLY

A Bearish Failure Swing for the Russell 2000

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bearish failure swing is a bearish RSI signal from Welles Wilder, creator of RSI. Note that this signal is NOT the same as a bearish divergence, even though a bearish divergence is also possible at the same time.

A bearish failure swing has four parts: RSI moves above 70...

READ MORE

MEMBERS ONLY

Here's What a Double Looks Like

by John Hopkins,

President and Co-founder, EarningsBeats.com

Every trader dreams of owning a stock that doubles. If it can happen in just six months, even better. This has been the case for Twilio (TWLO), a stock featured during our Top 10 Stock Picks webinar in November of 2018 that has doubled in price since the November 20...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - Risk Aversion in the Air

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

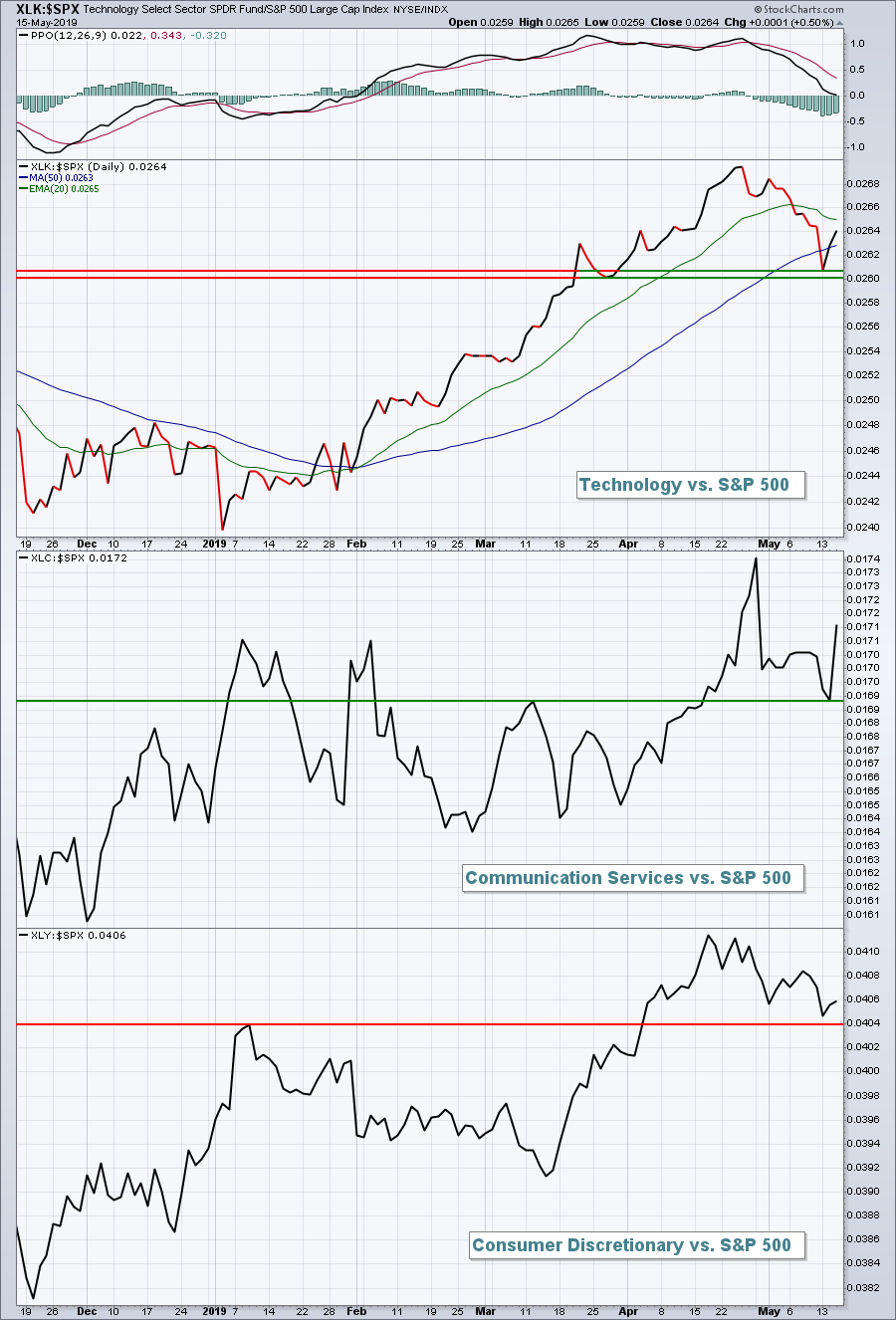

* Defensive Sectors Have Strongest Charts.

* Offensive Sectors Have Yet to Break Down.

* S&P 500 Gets a Bounce.

* A Bearish Failure Swing for the Russell 2000.

* Large-caps Lead New High List.

* Discretionary and Communication Sectors Take Hits.

* Housing versus Retail.

* Software versus Semis.

* Treasury Bonds Extend on Breakouts.

* Measuring...

READ MORE

MEMBERS ONLY

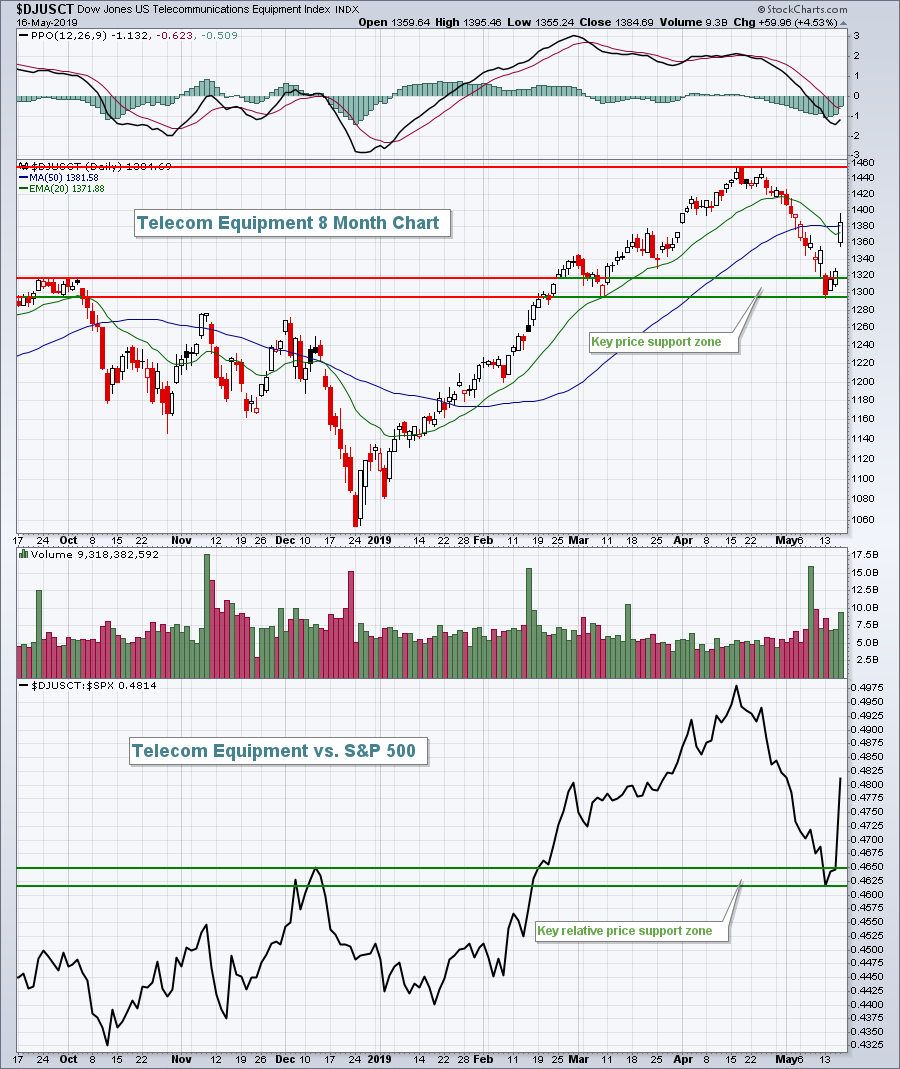

Cisco Earnings Drive Telecom Equipment Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

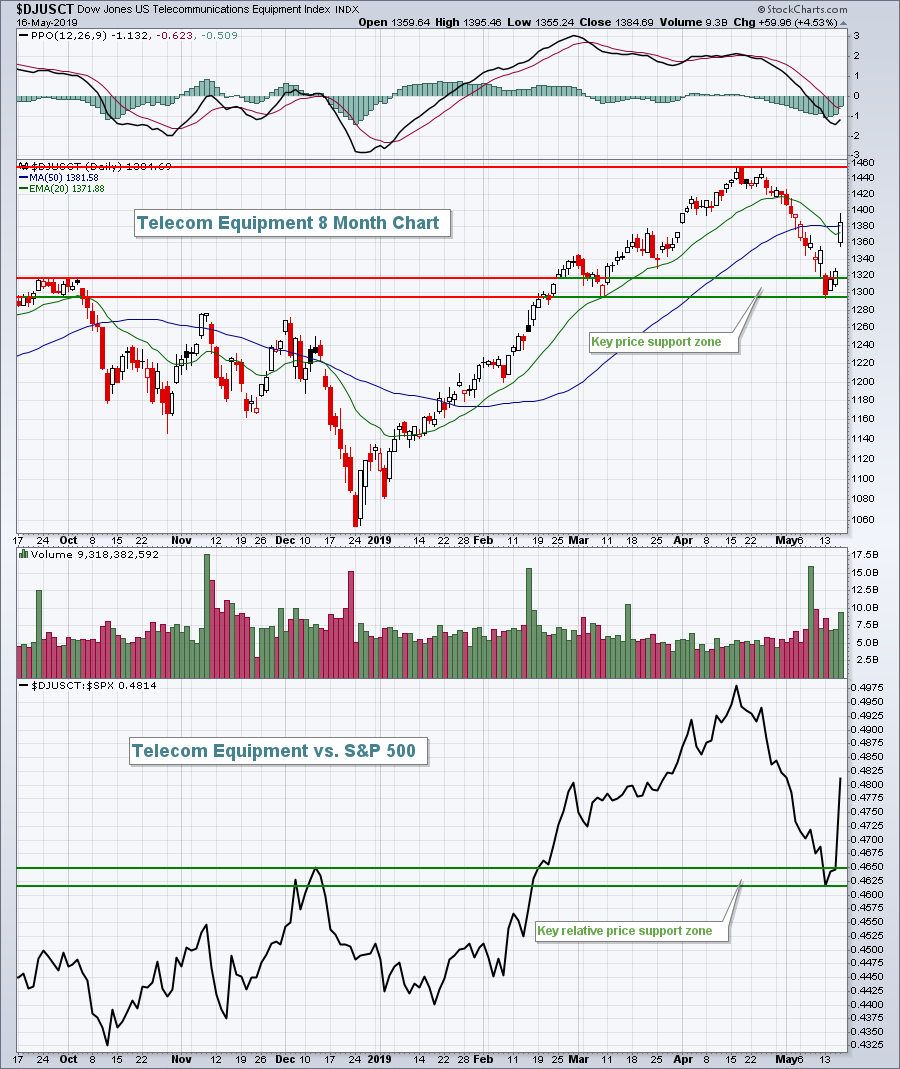

Market Recap for Thursday, May 16, 2019

Cisco Systems, Inc. (CSCO, +6.66%) reported its latest quarterly results after the bell on Wednesday, beating both revenue and EPS estimates, and provided a solid outlook. It was just what the telecom equipment group ($DJUSCT, +4.53%) needed after trending lower for...

READ MORE

MEMBERS ONLY

Things That Can Screw Up Your Investing!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I’ve written before about heuristics and cognitive biases in my Know Thyself series from a couple of years ago. Here I put together a list of them with short definitions and explanations. That space between your ears is generally a horrible investment decision maker.

Anchoring Bias – Too often investors...

READ MORE

MEMBERS ONLY

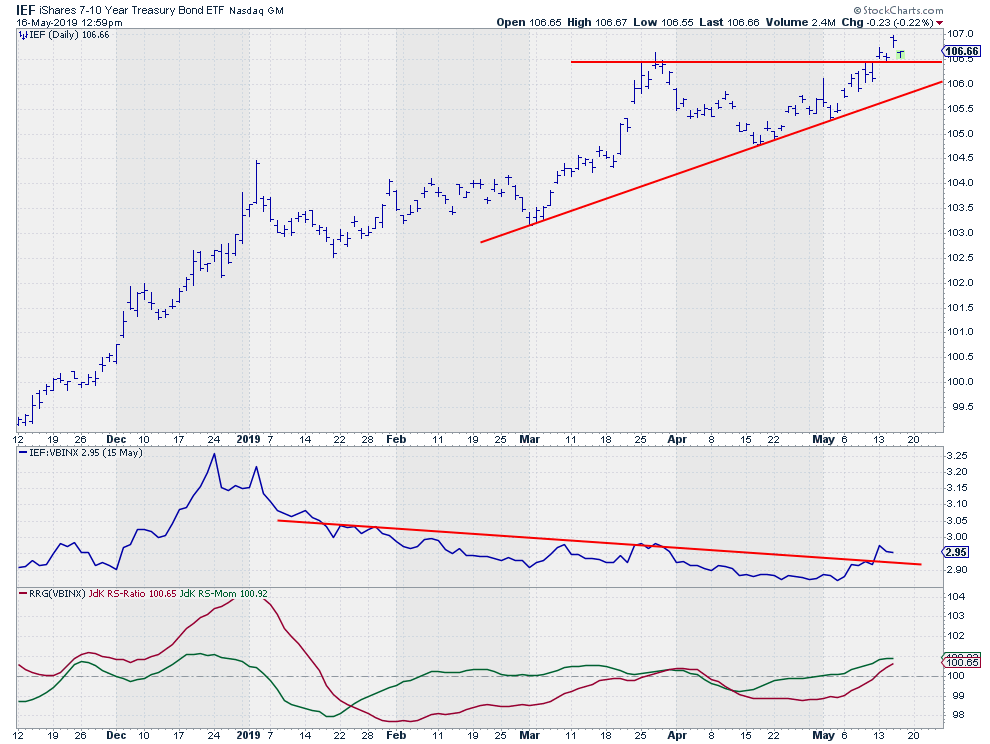

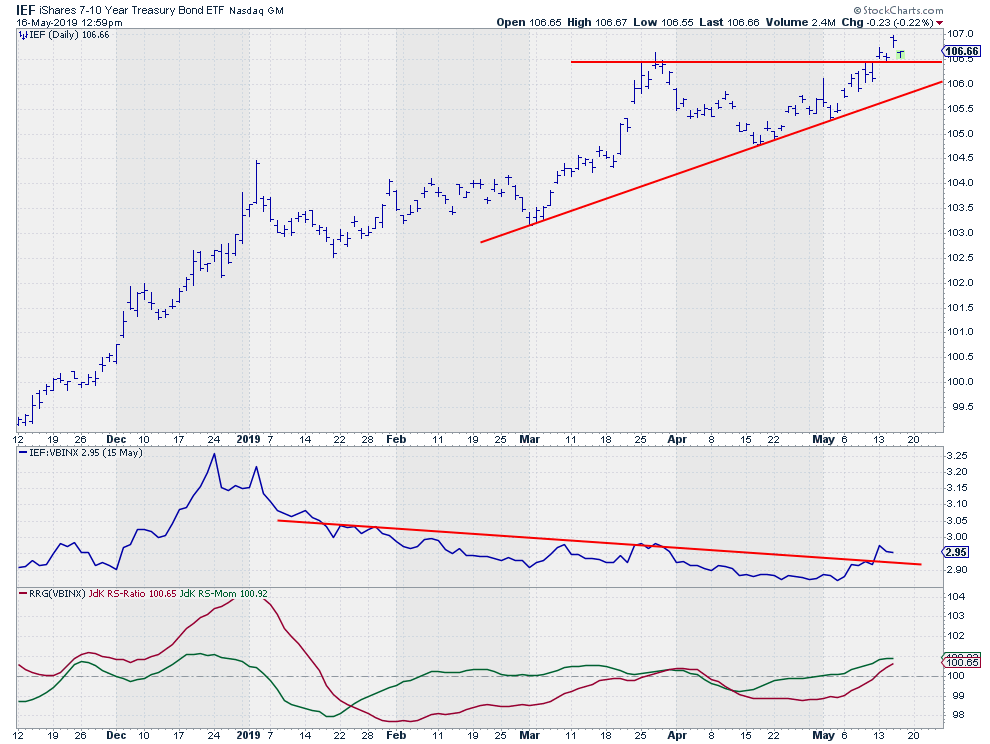

Will this break in IEF be able to hold up?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Browsing some Relative Rotation Graphs, the relationship between Stocks and Bonds once again drew my attention.

When I shifted to their respective charts, I decided that the current price action of IEF, as shown in the graph above, deserves our (or, at least, my) attention.

This ETF, which tracks the...

READ MORE

MEMBERS ONLY

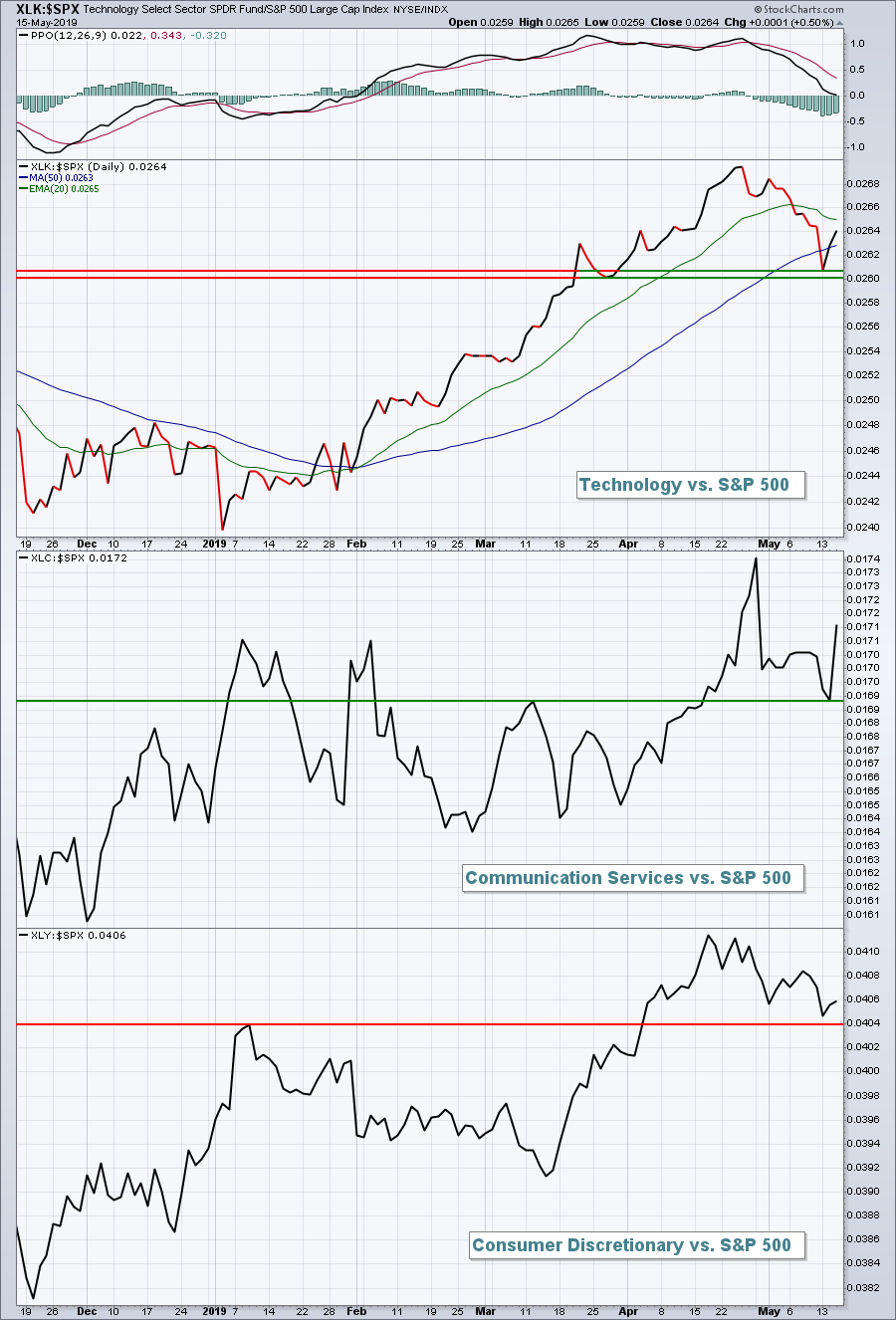

AMAZON.COM AND LENNAR LEAD CONSUMER DISCRETIONARY SECTOR HIGHER -- ADOBE AND CISCO LEAD TECHNOLOGY -- DRUG STOCKS BOOST HEALTHCARE -- MERCK IS LEADING -- NASDAQ AND S&P 500 REGAIN 50-DAY LINES AS ALL ELEVEN SECTORS GAIN GROUND

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR REGAINS 50-DAY LINE... Stocks are having another strong day today with all eleven market sectors in the red. Cyclical stocks are helping lead it higher. Chart 1 shows the Consumer Discretionary SPDR (XLY) trading back over its 50-day average (blue line). Two of its biggest gainers are...

READ MORE

MEMBERS ONLY

Is The 6 Week Relative Outperformance In Financials Over?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 15, 2019

Falling treasury yields put a lid on many industries within financials (XLF, -0.37%), while renewed strength in the U.S. Dollar Index ($USD) kept pressure on materials (XLB, -0.26%). Other than those two sectors, it was primarily a very bullish day....

READ MORE

MEMBERS ONLY

DP Alert Mid-Week: ST Indicators Rising Quickly, Not Necessarily Good - XLB ITTM Neutral Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

Short-term signals on the DecisionPoint Scoreboards below certainly reflect the market's weakness this month. It would seem that we are bouncing at a critical juncture. The Materials SPDR (XLB) collected an Intermediate-Term Trend Model Neutral signal, which you'll see on the DP Sector Scoreboard.

The DecisionPoint...

READ MORE

MEMBERS ONLY

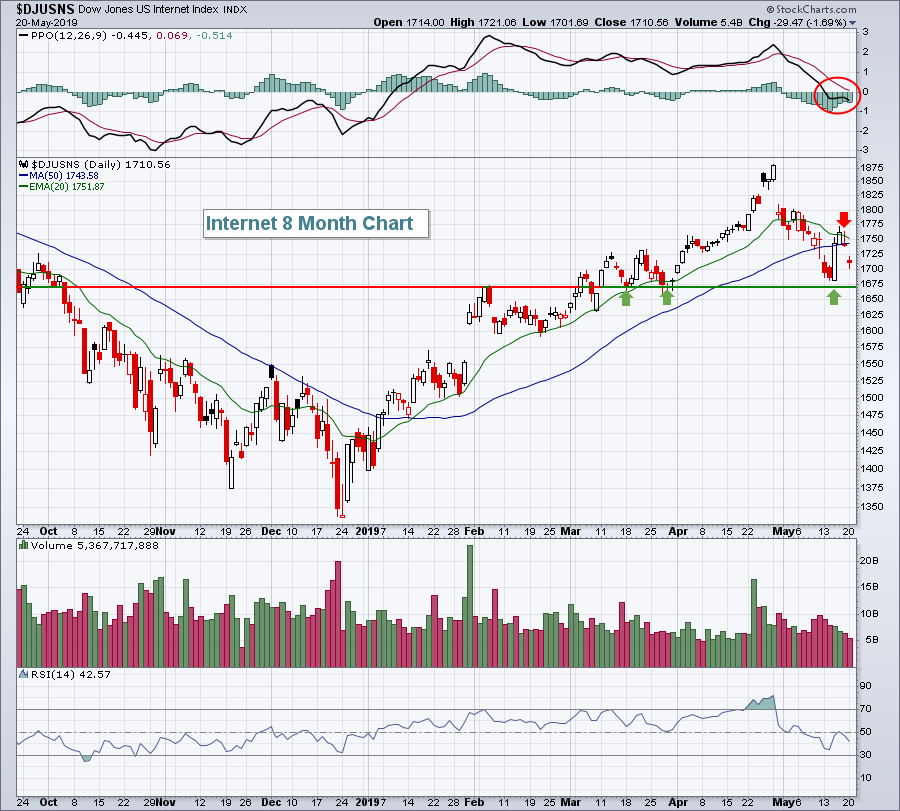

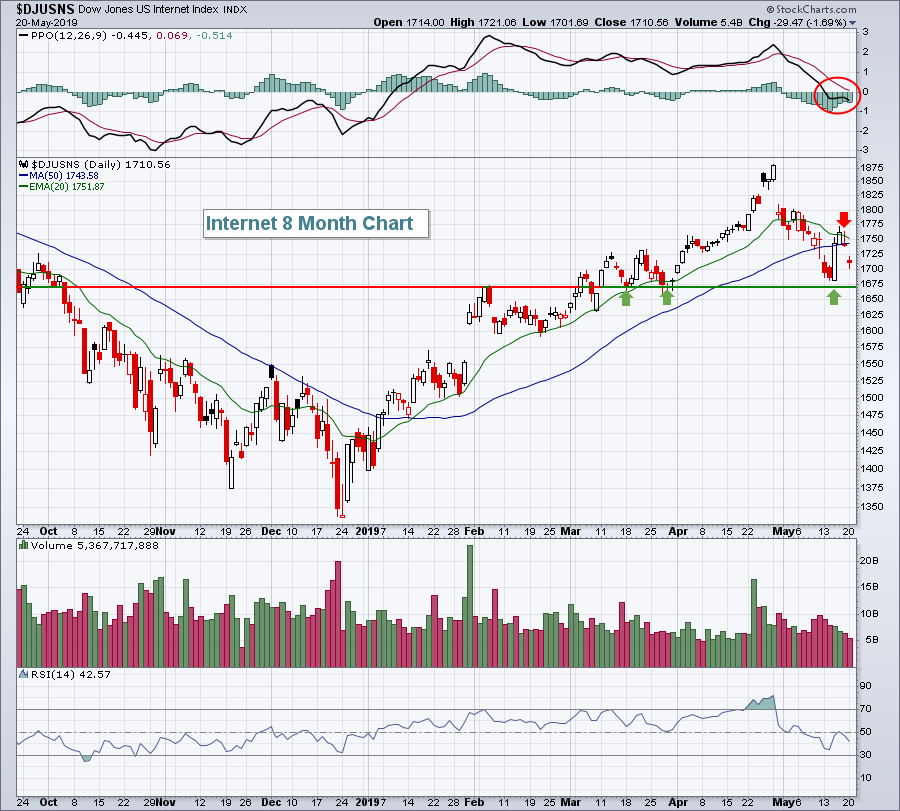

SEMICONDUCTOR ISHARES BOUNCE OFF CHART SUPPORT -- WITH APPLIED MATERIALS AND LAM RESEARCH IN THE LEAD -- INTERNET STOCKS LEAD COMMUNICATION SECTOR HIGHER -- FACEBOOK AND GOOGLE ARE HOLDING MOVING AVERAGE LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

SEMICONDUCTOR ISHARES BOUNCE OFF CHART SUPPORT... Technology stocks are helping lead today's stock rebound. With help from semiconductors. Chart 1 shows the PHLX Semiconductor iShares (SOXX) bouncing off potential chart support along its August/September highs near 190. Its 9-day RSI line (upper box) is also bouncing from...

READ MORE

MEMBERS ONLY

Boeing is Big

by Bruce Fraser,

Industry-leading "Wyckoffian"

The Dow Jones Industrial Average ($INDU) is the granddaddy of stock indexes. Charles Dow created the predecessor of this index in 1880s. The publication and distribution of this index was the forerunner of the Wall Street Journal. Eleven important leadership stocks composed this original stock index. The calculation was made...

READ MORE

MEMBERS ONLY

April Retail Sales Are Out, But Will It Help?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 14, 2019

We've seen little economic or earnings news of late and that's beginning to show in the randomness of the huge S&P 500 moves based on President Trump's tweets regarding US-China trade. Sometimes it's...

READ MORE

MEMBERS ONLY

Is GE for Real This time?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

General Electric (GE) is one of the worst performing stocks over the last two years, but the stock is perking up in 2019 and outperforming in May. The S&P 500 is down 3.8% so far this month and GE is up 1.5% after a big surge...

READ MORE

MEMBERS ONLY

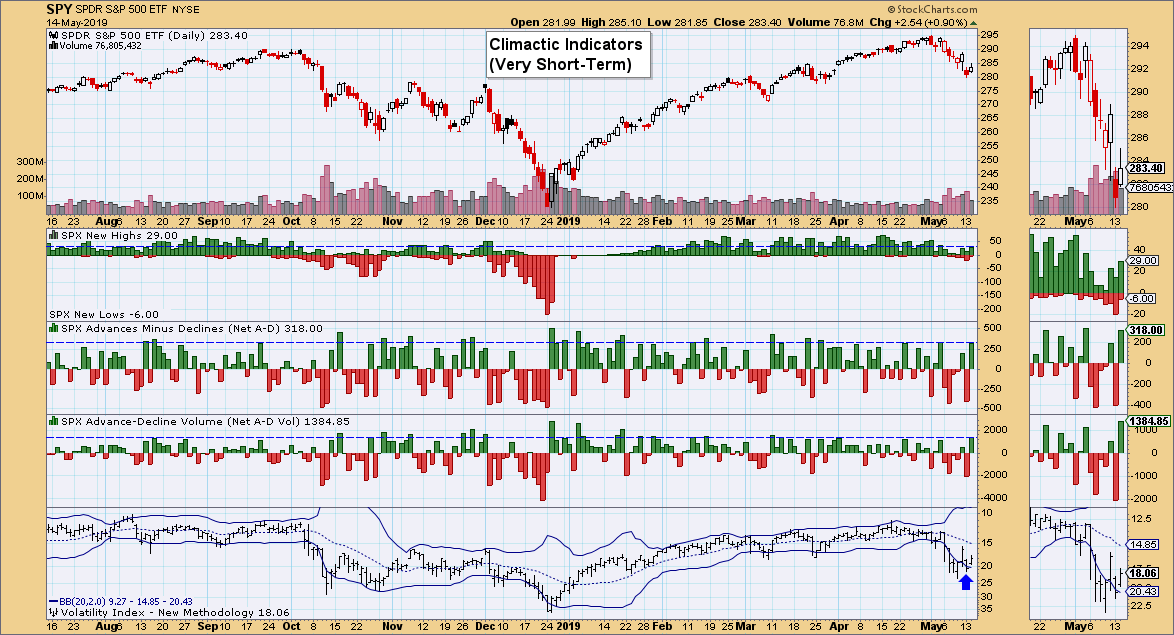

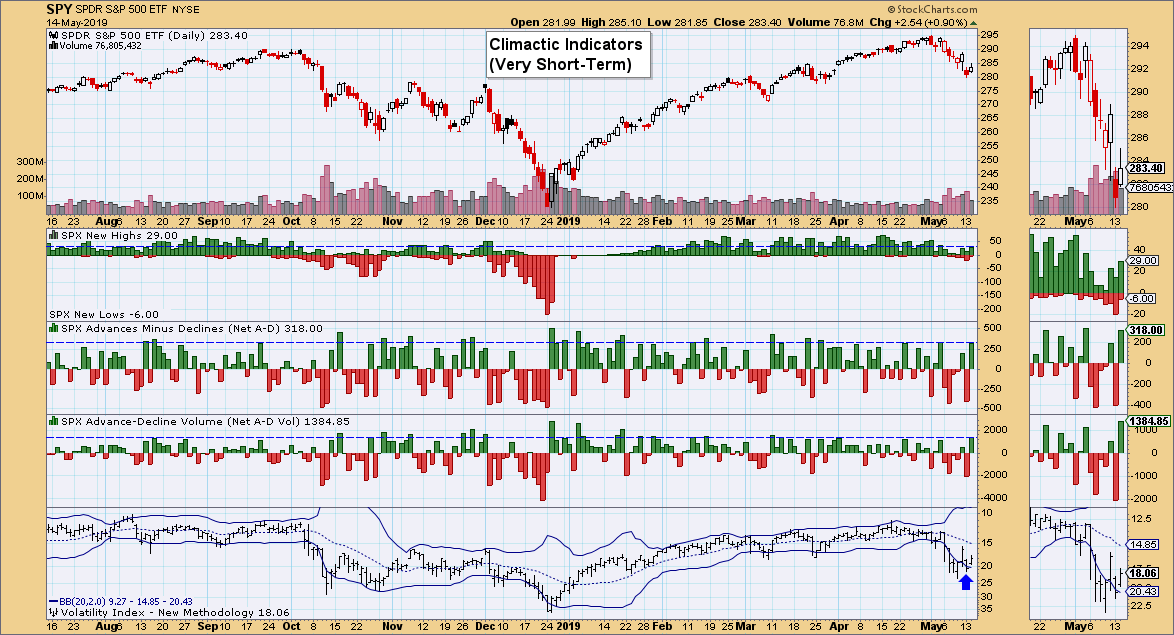

Climactic Indicators Suggest Possible Buying Initiation

by Erin Swenlin,

Vice President, DecisionPoint.com

At present, it appears that the DecisionPoint climactic indicator chart could be suggesting a possible buying initiation. This is tricky. With volatility so high right now, often what appears to be an initiation isn't always the case. Climactic readings can persist, as we've seen with the...

READ MORE

MEMBERS ONLY

Gold Pops As The Stock Market Drops

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After a struggle with resistance around its previous high of 2940, the S&P 500 index failed to break and started to come down off of its highs.

A lot of political and fundamental issues and news are influencing the behavior of market participants at the moment; this uncertainty...

READ MORE

MEMBERS ONLY

Seasonality Highlights An Average 36.3% Spring To Summer Gain For This Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, May 13, 2019

It was a very rough day on Wall Street yesterday. Mondays are historically the worst day of the week, but I doubt too many market participants were expecting the blood bath that we saw. Aggressive areas of the market were hit hardest, including...

READ MORE

MEMBERS ONLY

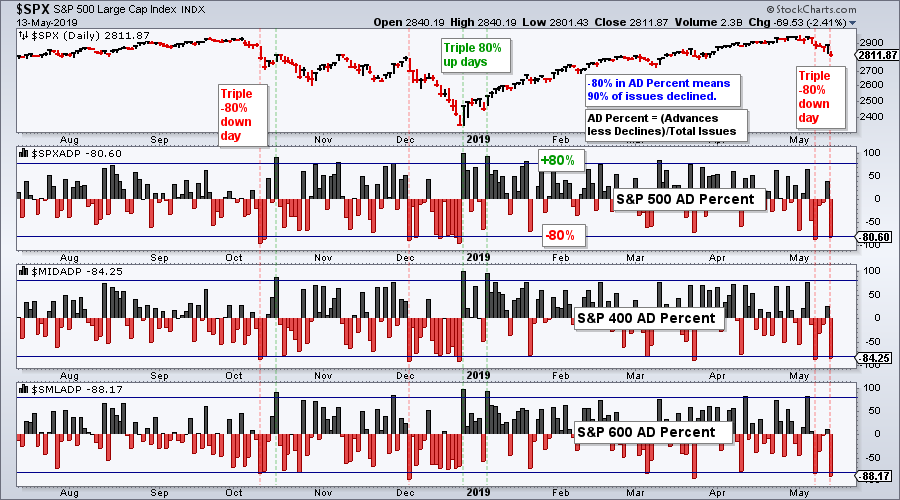

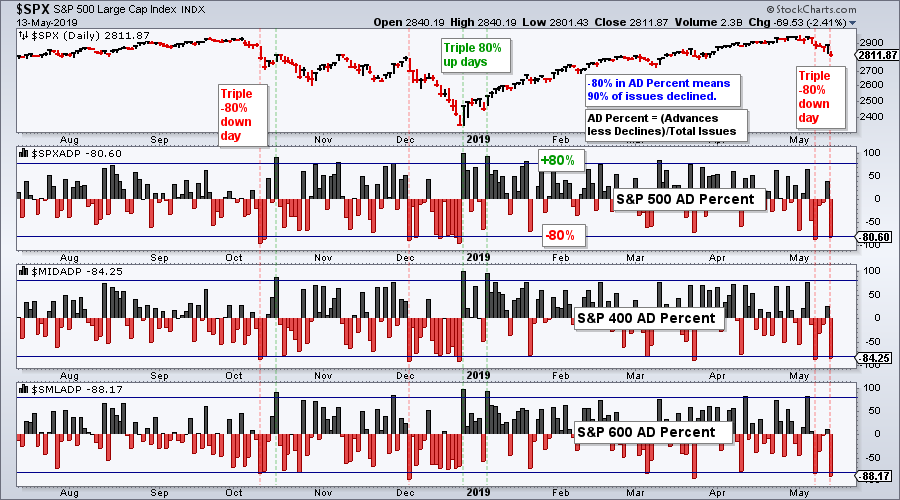

Four Steps Up and One Step Back - Another 90% Down Day - Breadth Update

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Triple 90% Down Volume Day.

* Breadth Table Update.

* Four Steps Up and One Step Back.

* SPY Hits Support and Becomes Oversold.

* Interest in Tariffs and Fed.

Triple 90% Down Volume Day

Stocks were hit with strong selling pressure again on Monday with the S&P 500 SPDR falling 2....

READ MORE

MEMBERS ONLY

Gold Breaks Out Against Stocks; What Does That Mean, Apart From The Obvious?

by Martin Pring,

President, Pring Research

* Gold Breaks Out against Stocks

* Gold Itself is about to Test Mega-Resistance

* When Gold Beats Stocks, that’s usually Bullish for Gold - and Bearish for Stocks

* Gold Leads Commodities

Gold Breaks Out against Stocks

Monday saw the gold/stock ratio break decisively above its 2019 downtrend line. The line...

READ MORE

MEMBERS ONLY

CHINESE RETALIATORY TARIFFS SEND GLOBAL STOCKS LOWER AGAIN -- TRADE-SENSITIVE ASSETS LEAD TODAY'S RETREAT WHILE SAFE HAVENS CONTINUE TO GAIN -- ARE DRUG STOCKS THAT DEFENSIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK SELLING CONTINUES ... Stock prices fell sharply again today and are continuing the trade-inspired selling that started last week. Retaliatory tariffs announced by China appear to be the main catalyst pushing global stocks lower. As a result, markets with the most exposure to trade tensions and Chinese tariffs are falling...

READ MORE

MEMBERS ONLY

5 Monday Stocks With Strong Reward To Risk Setups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 10, 2019

After another morning of very weak action in U.S. stocks, we saw another afternoon recovery on Friday as all of our major indices finished in positive territory. It certainly felt good, but the truth of the matter is that nothing has been...

READ MORE

MEMBERS ONLY

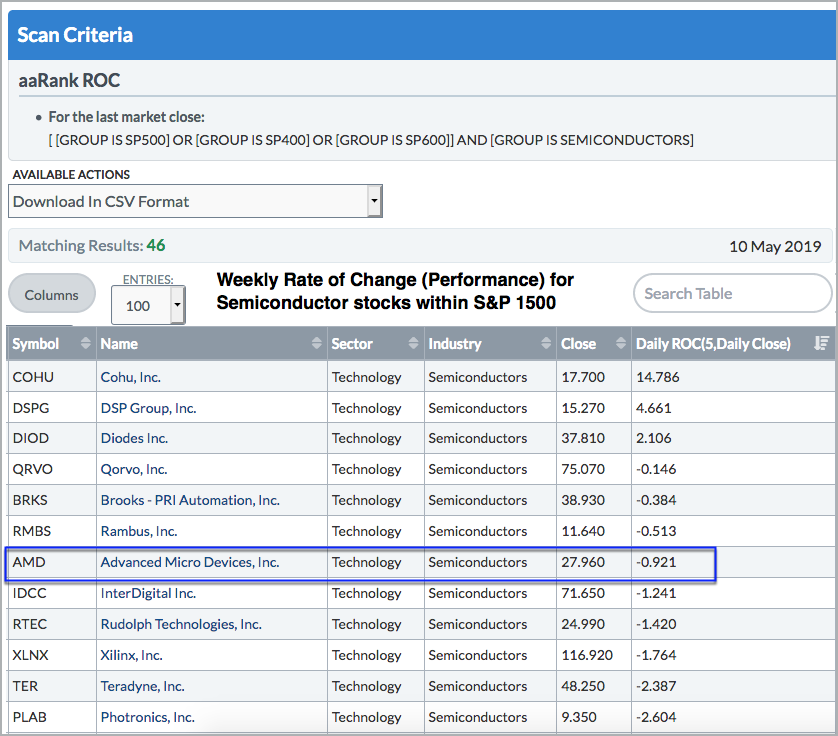

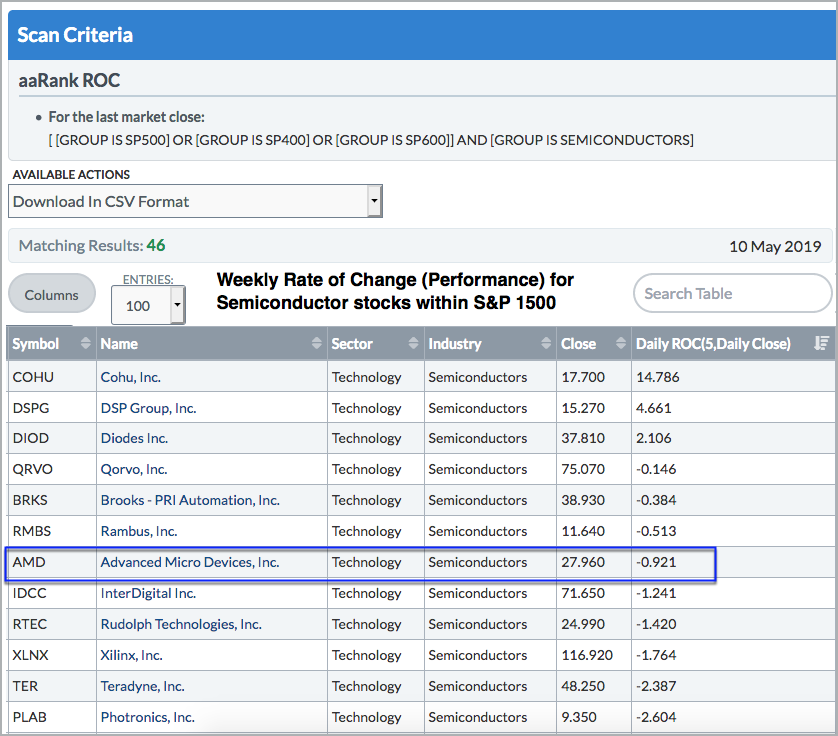

AMD Holds Up Well with Semiconductor Group

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 was down 2% last week and the Nasdaq fell 3%. Stocks that gained on the week showed relative and absolute strength. Stocks that fell less than 2% showed relative strength. The average semiconductor stock within the S&P 1500 was down 5% last week...

READ MORE