MEMBERS ONLY

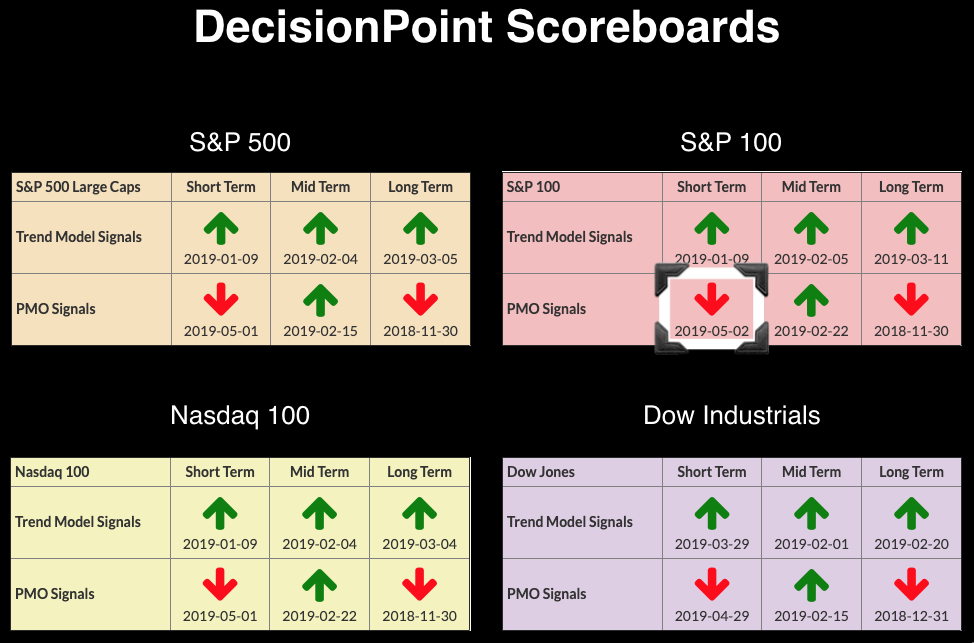

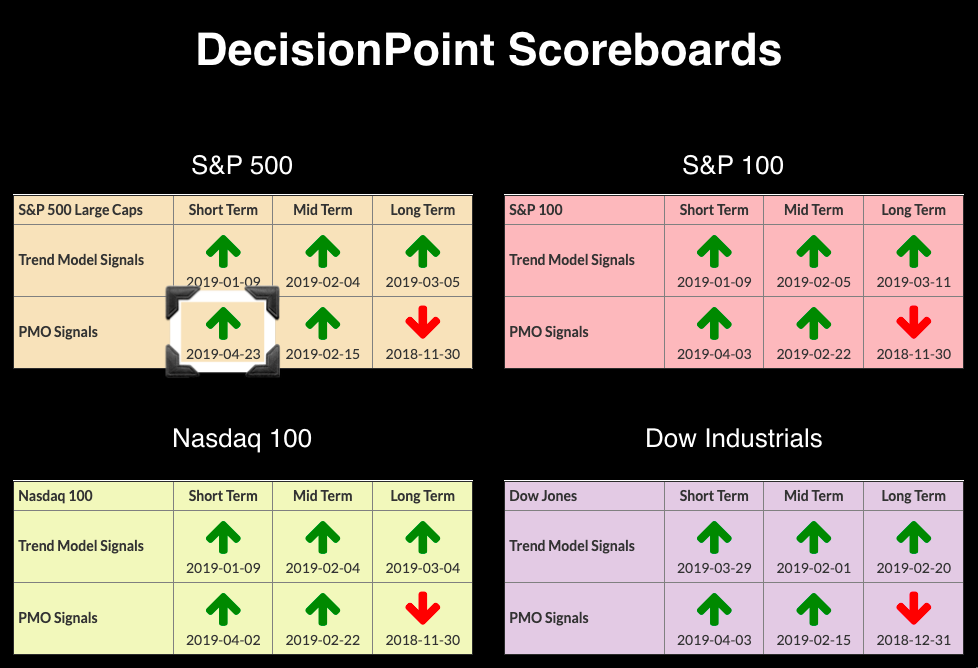

DP Bulletin: OEX Triggers ST PMO SELL Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

The OEX hopped on board the SELL signal train as its Price Momentum Oscillator (PMO) crossed below its signal line, which triggered its own Short-Term PMO SELL Signal.

A rising wedge was nearly executed today to the downside. The PMO was yanked below its signal line, which generated the SELL...

READ MORE

MEMBERS ONLY

Commodities: Down Now, Up Later?

by Martin Pring,

President, Pring Research

* Two Key Commodity Benchmarks Violated Trend Lines

* Commodity Sector ETFs Breaking as Well

* Longer-Term Picture May be Reversing

In early April, I tacked on a couple of commodity charts at the end of an article that commented on global equities breaking out. There, I noticed that some commodity indexes were...

READ MORE

MEMBERS ONLY

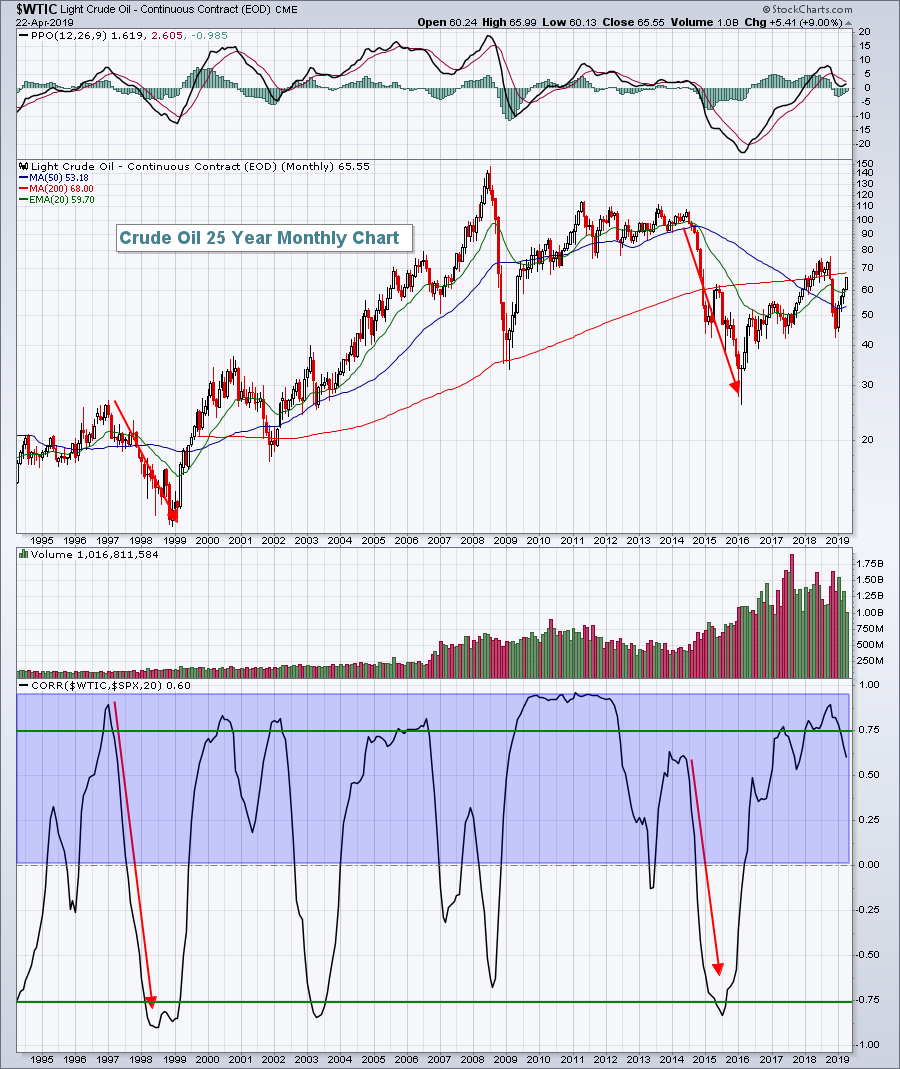

WEAK INFLATION ISN'T TRANSITORY -- COMMODITY PRICES HAVE BEEN FALLING FOR A DECADE -- A RISING DOLLAR IS ONE REASON WHY -- STOCKS REACT BADLY TO LESS DOVISH FED -- RISING BOND YIELDS BOOST THE DOLLAR -- CRUDE OIL LEADS COMMODITIES LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

COMMODITIES HAVE BEEN FALLING FOR A DECADE ... Yesterday's message suggested that weaker commodity prices should provide some comfort to the Fed since subdued inflation would allow the Fed to keep rates on hold and prolong the decade-long economic recovery. It turns out the Fed is more worried than...

READ MORE

MEMBERS ONLY

Market Roundup With Martin Pring

by Martin Pring,

President, Pring Research

Here is the link to this month's Market Roundup video. There are a significant number of long-term charts that are starting to turn higher suggesting, that the brief economic slowdown in late 2018 is behind us and we are starting the next major leg higher. Market Roundup with...

READ MORE

MEMBERS ONLY

Banks Vs. REITs Provide Bullish Clue

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 1, 2019

Fed Chair Jerome Powell ruined the bull market party on Wednesday afternoon, effectively suggesting that the Fed would not be lowering rates in response to low inflation data of late. The bond market has been screaming for a rate cut, not a hike,...

READ MORE

MEMBERS ONLY

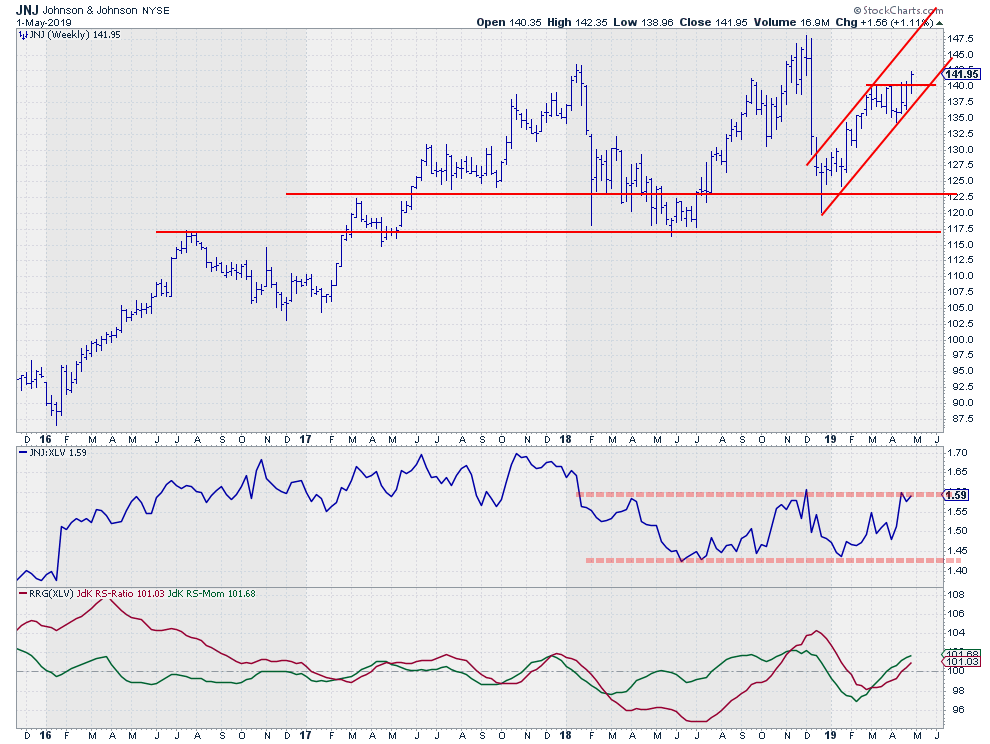

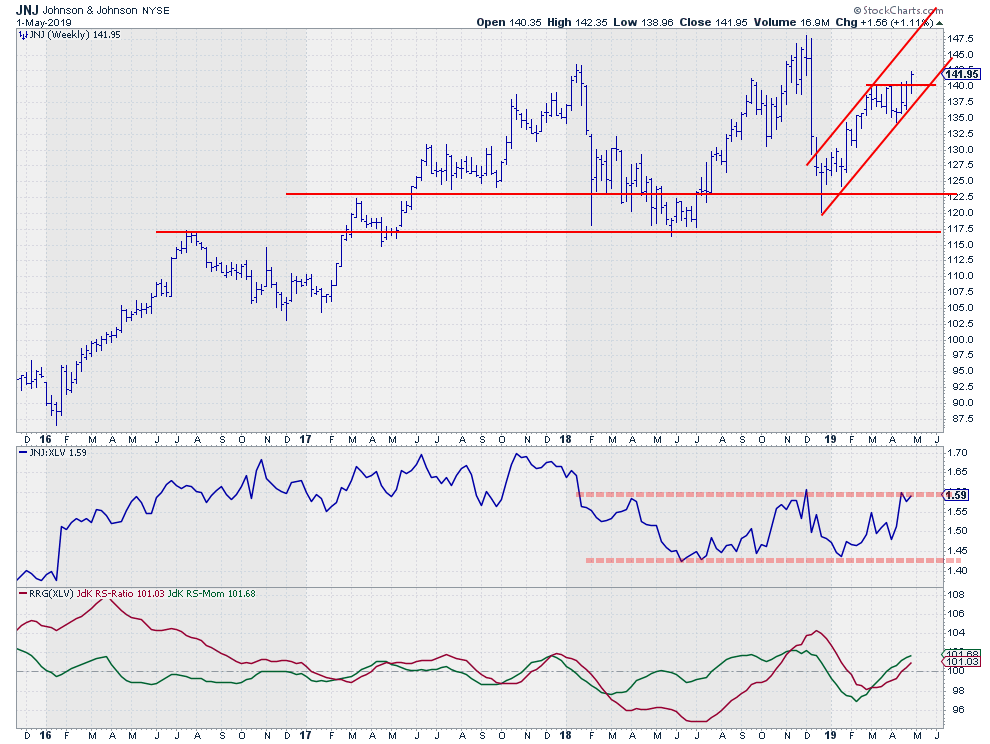

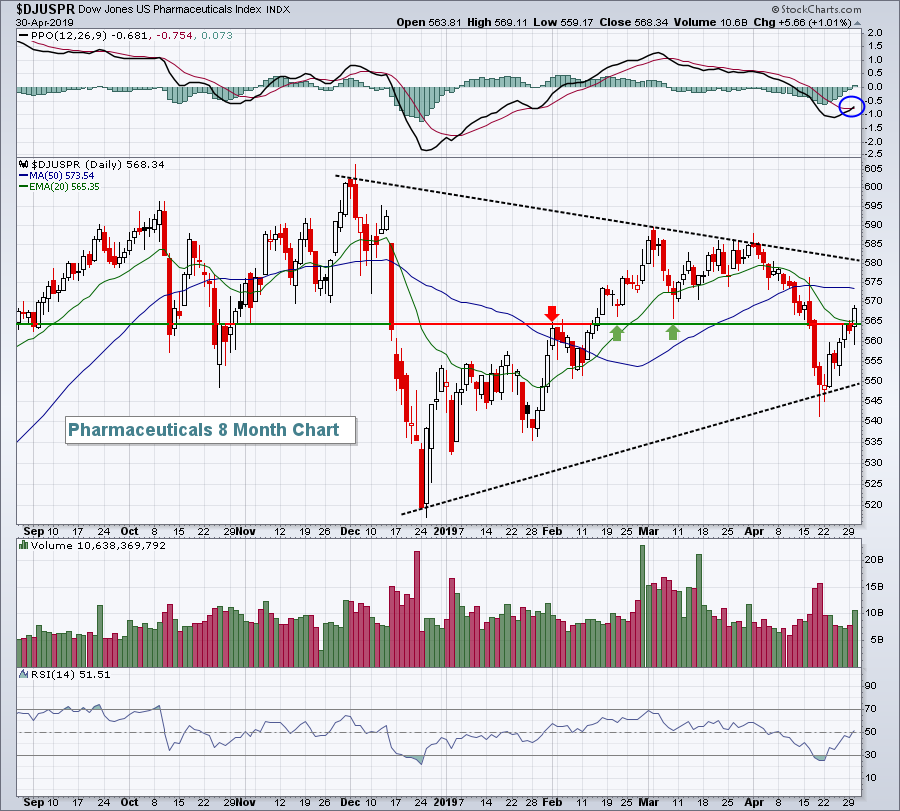

Will JNJ Be Able To Pull The Sector Back On Its Feet?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Healthcare sector is not in its best shape. On the Relative Rotation Graph for US sectors, XLV is deep down inside the lagging quadrant against SPY, without any signs of improvement at the moment. However, if you feel that this situation will not last forever and are gutsy enough...

READ MORE

MEMBERS ONLY

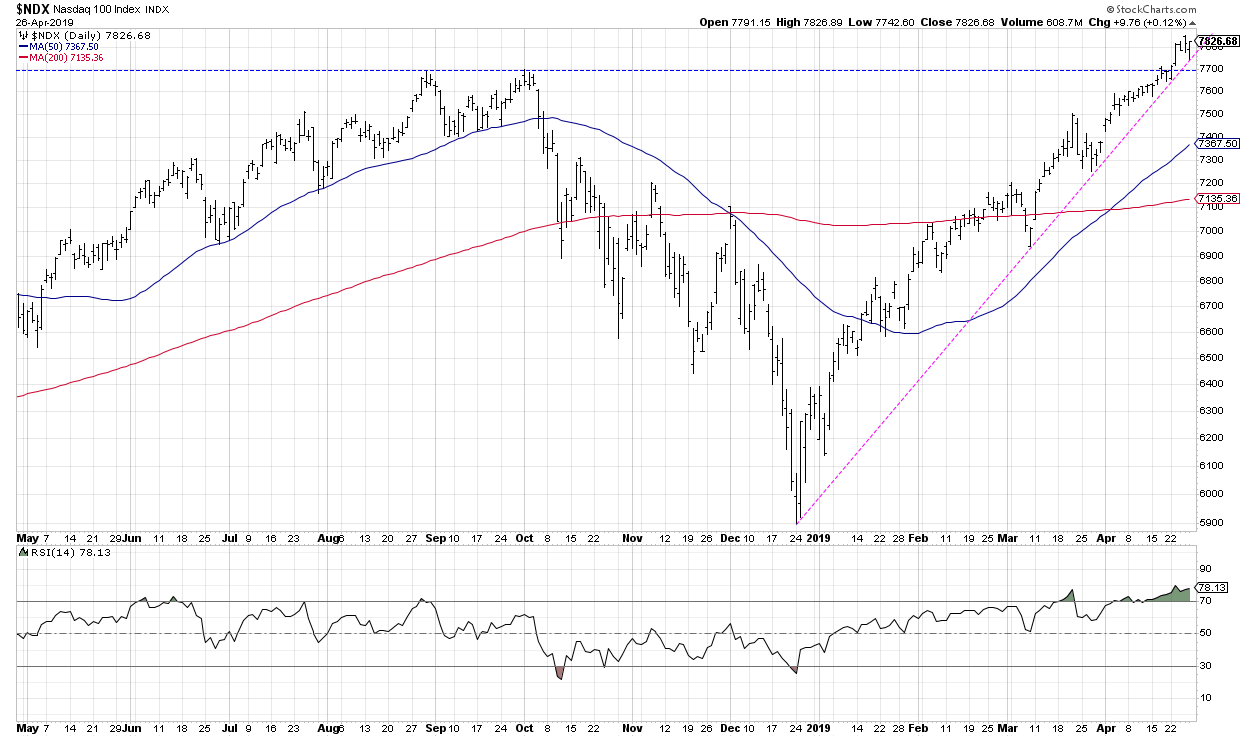

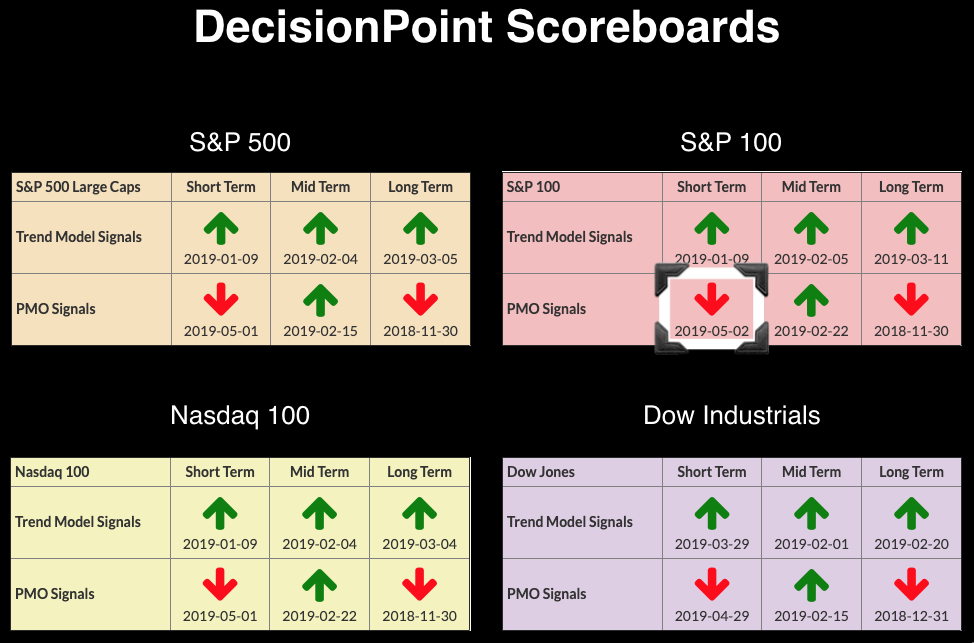

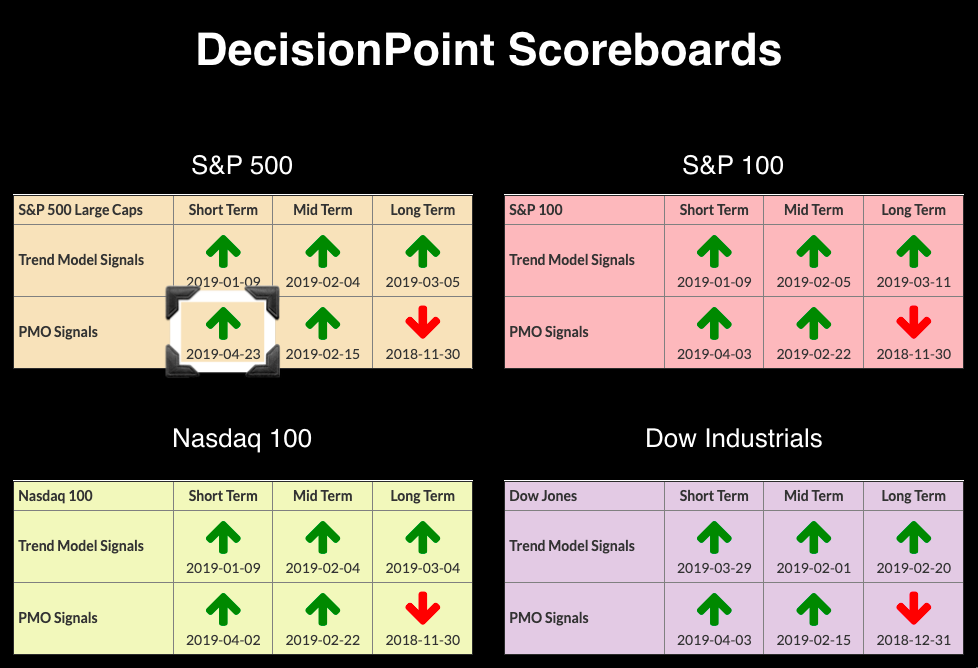

DP Alert: PMO SELL Signals on SPX & NDX - Gold Sentiment Very Bearish

by Erin Swenlin,

Vice President, DecisionPoint.com

The Dow flipped to a new PMO SELL signal on Monday; today, we saw the SPX and NDX join in. These are just more signs that the market is angling for a pullback or correction. We saw climactic readings on the VIX and breadth; additionally, the discounts on Sprott Physical...

READ MORE

MEMBERS ONLY

RECENT WEAKNESS IN COMMODITY MARKETS MAY BE GOOD NEWS FOR THE FED -- THE BLOOMBERG COMMODITY INDEX HAS WEAKENED ALONG WITH MOST COMMODITY GROUPS -- THE UPTREND IN OIL MAY ALSO BE WEAKENING -- ENERGY SPDR HAS ALREADY FALLEN BELOW ITS MOVING AVERAGE LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

COMMODITY PRICES WEAKEN ... One of the factors the Fed is now considering to help formulate its monetary policy for the rest of the year is the question of inflation. Rising inflation puts pressure on the Fed to raise rates. Flat or falling inflation allows the Fed to stick with its...

READ MORE

MEMBERS ONLY

Go Away In May? More Like "Time To Fly Is Mid-July"

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 30, 2019

Alphabet (GOOGL, -7.50%) set the stage for a rough day on the NASDAQ (-0.81%) as the internet giant posted quarterly results that didn't impress Wall Street. The small cap Russell 2000 lost 0.45%, losing ground vs. the benchmark...

READ MORE

MEMBERS ONLY

Junk Science; Junk Analysis!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I don’t think I have offended anyone in quite a while and feel I’m not doing my job if I don't try to periodically; so here goes!

Often a simple mathematical series of numbers can sometimes get misinterpreted (promoted) to be something magical. My personal favorite...

READ MORE

MEMBERS ONLY

Docusign Breaks from Consolidation Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Docusign (DOCU), a company that provides e-signature solutions, started trading on August 27th and surged over 30% on its IPO. The stock advanced another 65% after this initial gain and then fell back to the IPO price in October. Notice that the six month lockup period ended on October 24th...

READ MORE

MEMBERS ONLY

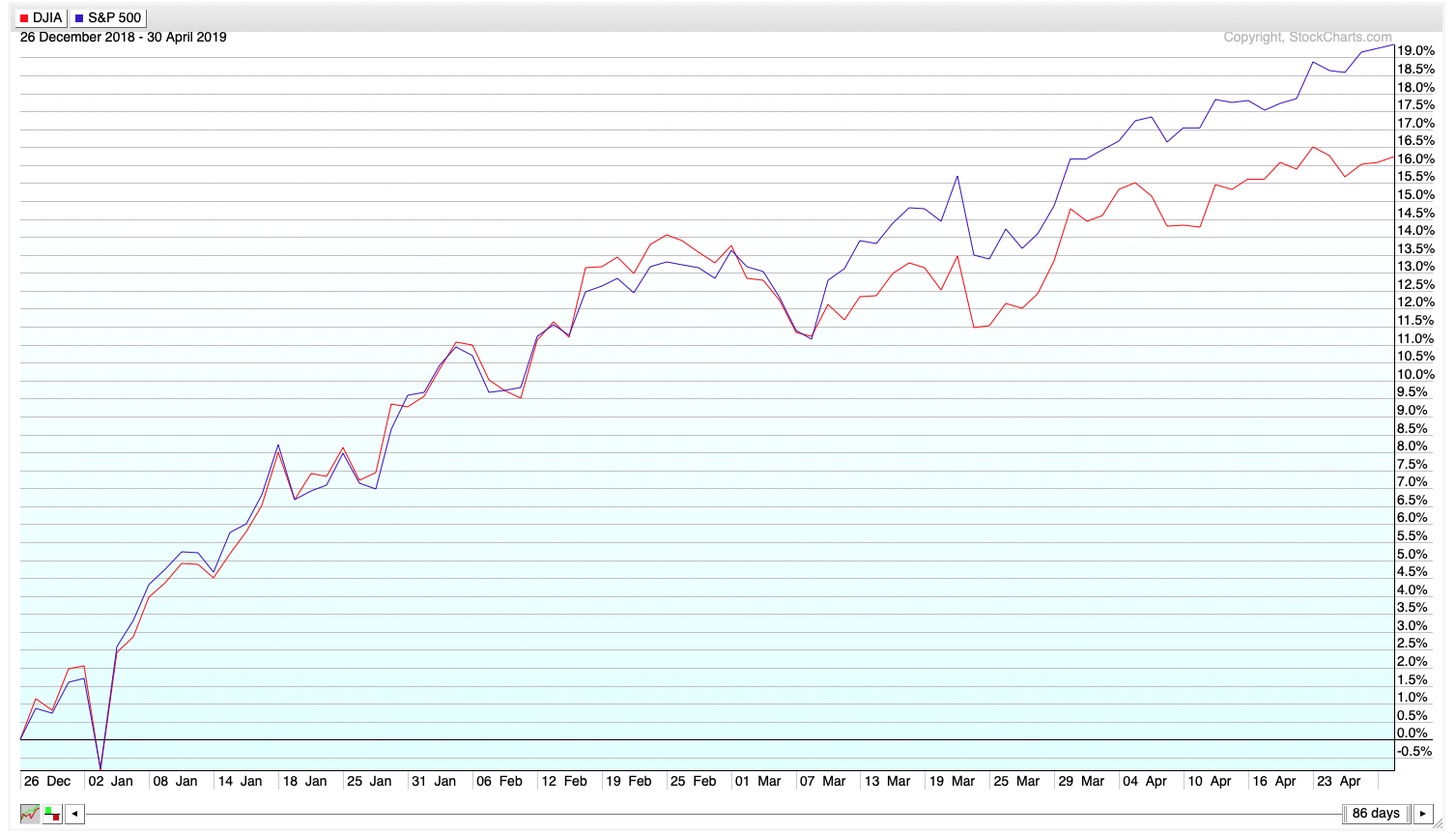

Dow Unable to Avoid Price Momentum Oscillator (PMO) SELL Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

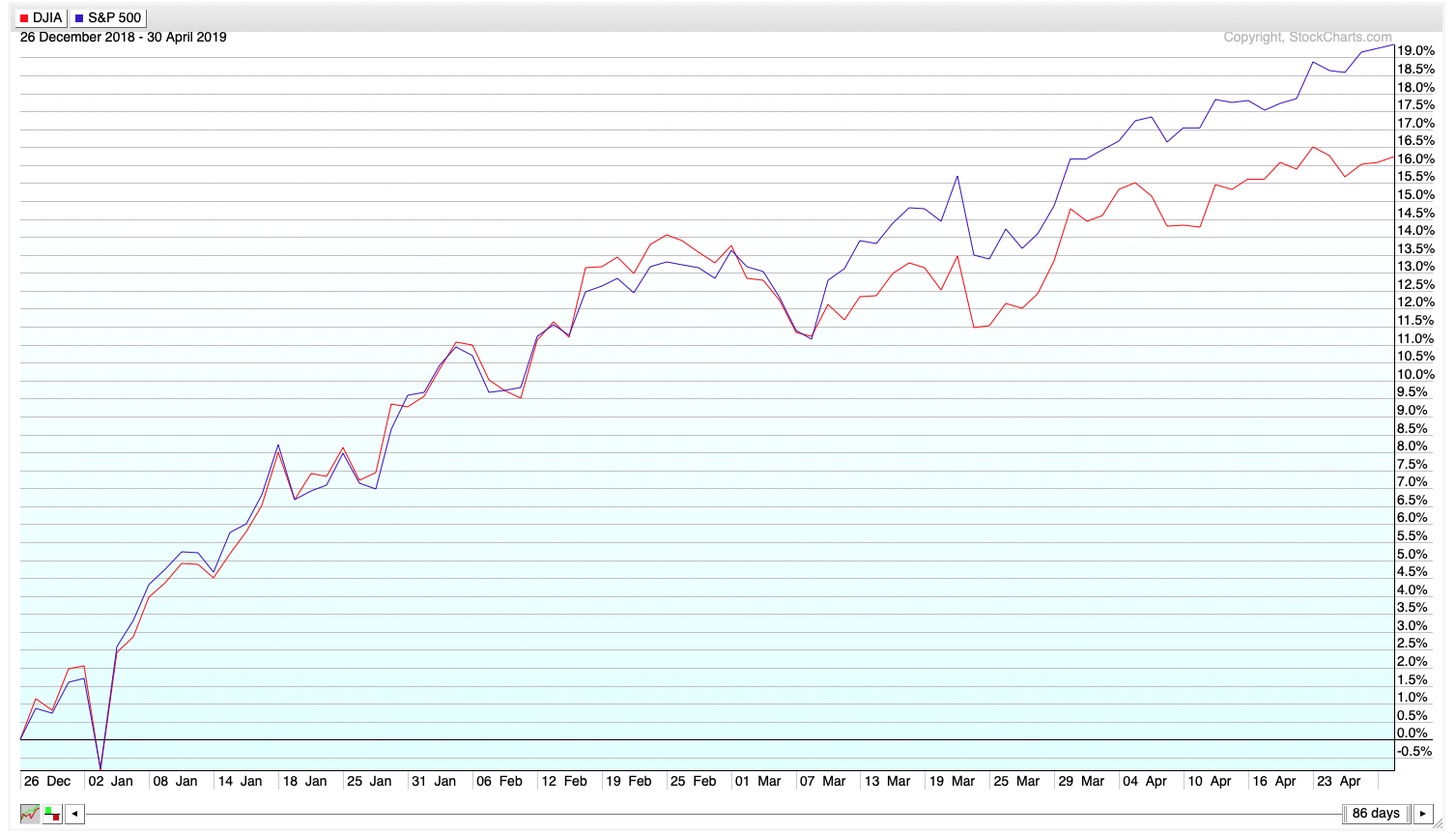

Since about the beginning of March, the SPX has been outperforming the Dow on an absolute basis. Looking at the December 26, 2018-April 30, 2019 PerfChart below,, the Dow is up just above 16%, which is certainly a win. However, the SPX, our benchmark, is up almost 20% from December...

READ MORE

MEMBERS ONLY

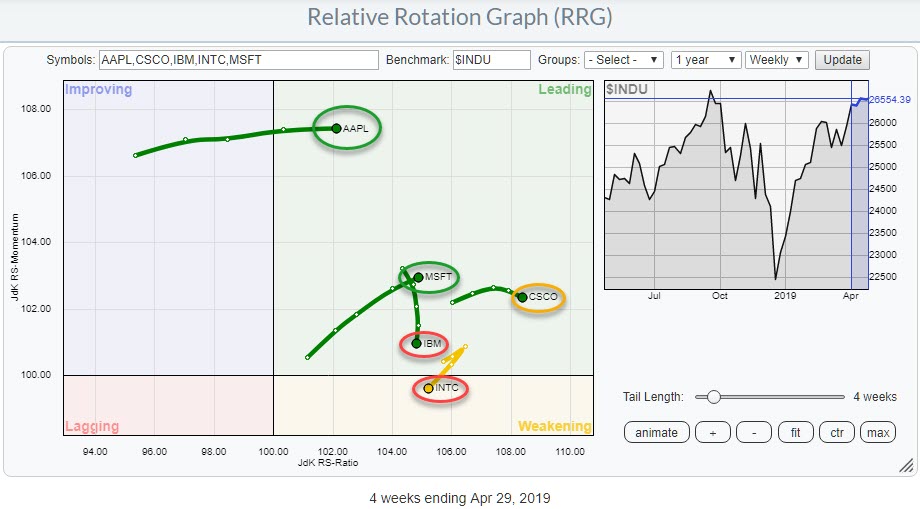

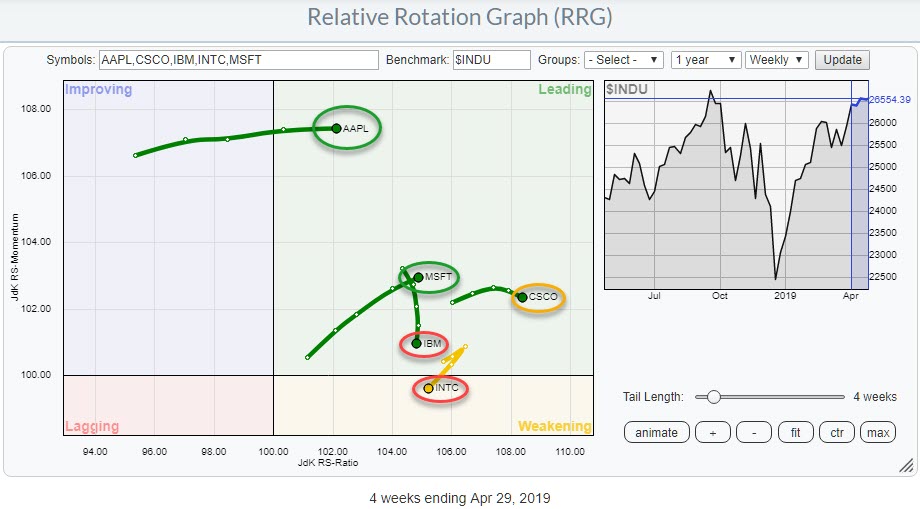

Mixed Rotations For Technology Stocks Inside The Dow - MSFT Comes Out On Top!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph shows the five technology stocks inside the DJ Industrials index, all of which are at the right-hand side of the RRG. This is not surprising, considering the strong rotation of the sector as a whole against the S&P 500 index.

Despite the strength of...

READ MORE

MEMBERS ONLY

Watch This Transportation Ratio Very, Very Closely

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 29, 2019

A bull market is comprised of a number of things, but two are wide participation and rotation of strength. We've been seeing both. Yesterday, it was financials (XLF, +1.01%) and communication services (XLC, +0.91%) that led the S&...

READ MORE

MEMBERS ONLY

Palo Alto Readies for its Next Move

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Palo Alto Networks (PANW) is a leading cyber-security stock that fits into the technology sector. Needless to say, the Technology SPDR (XLK) and the EW Technology ETF (RYT) are the leading sectors here in 2019. PANW took a break with a consolidation over the last eight weeks, and this could...

READ MORE

MEMBERS ONLY

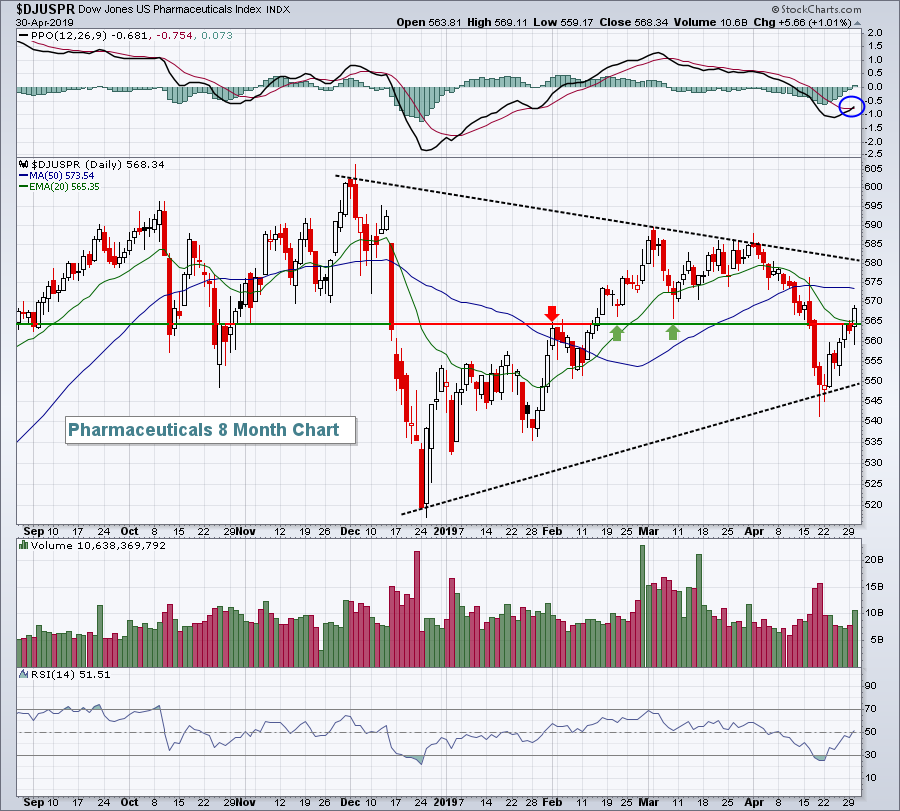

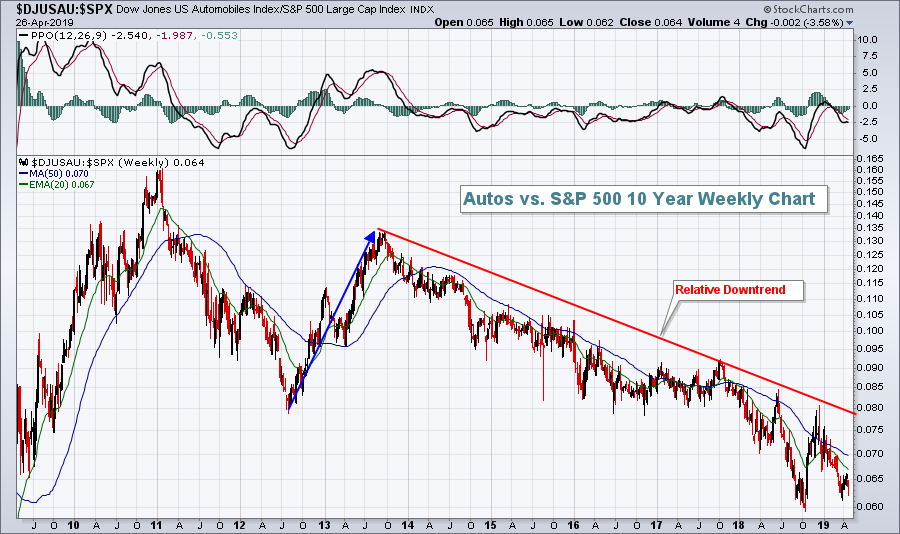

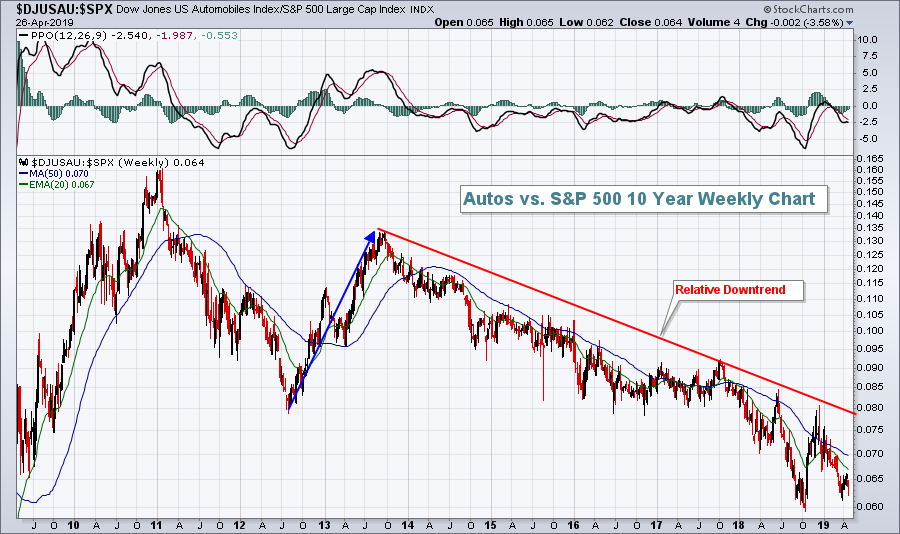

Ford Lifts Autos, Healthcare Advances, And Consumer Stocks Bullish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 26, 2019

When was the last time I suggested Ford Motor Co (F, +10.74%) was a catalyst for any bull market advance? Ummm, probably never. But F was exactly that on Friday as much better than expected earnings lifted the stock and the automobile...

READ MORE

MEMBERS ONLY

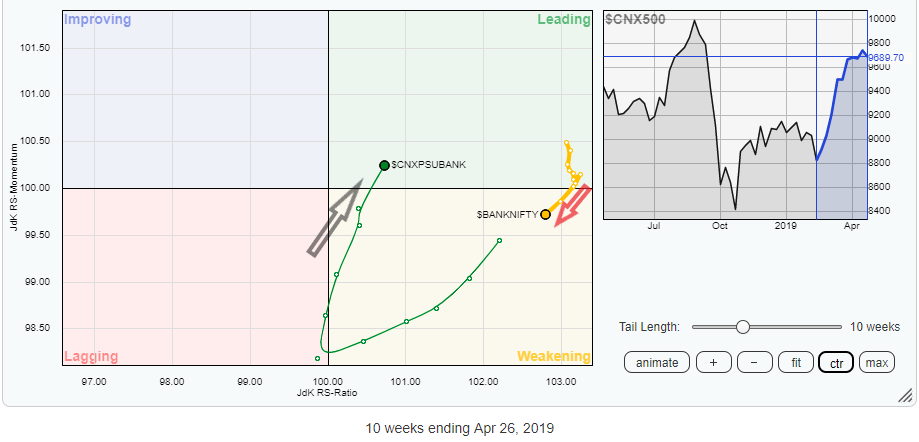

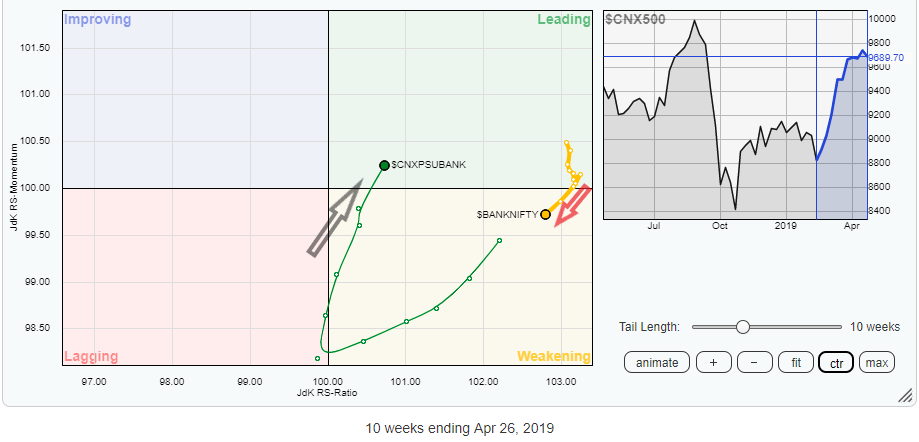

Are PSU Banks Likely to Outperform Private Banks? Answer Lies in the Relative Rotation Graph (RRG)

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

We head in to a month that is set to be among the most volatile and eventful as the market faces one of the most important domestic events – General Election Results.

The equity markets are currently hovering around their lifetime highs. On the one hand, they grapple with a not-so-favorable...

READ MORE

MEMBERS ONLY

Truncated Week May Offer Shallow But Volatile Moves; RRG Show These Sectors In Leading Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The past week remained as flat as it can get. In our previous weekly note, we had expected the week to remain volatile and the level of 11760 continuing to pose stiff resistance to any up-moves. Hewing very close to expected lines, the Indian equity markets remained volatile, headed nowhere,...

READ MORE

MEMBERS ONLY

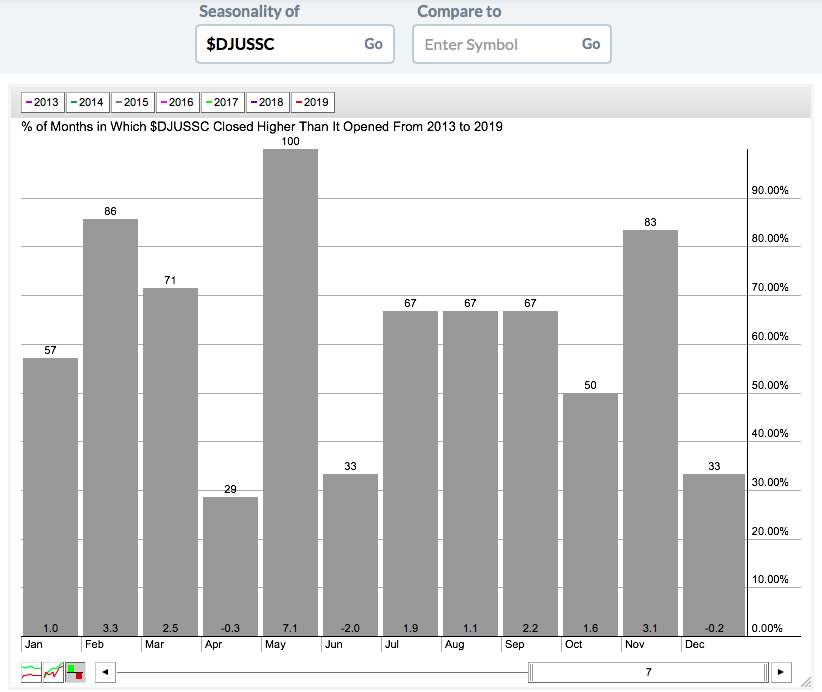

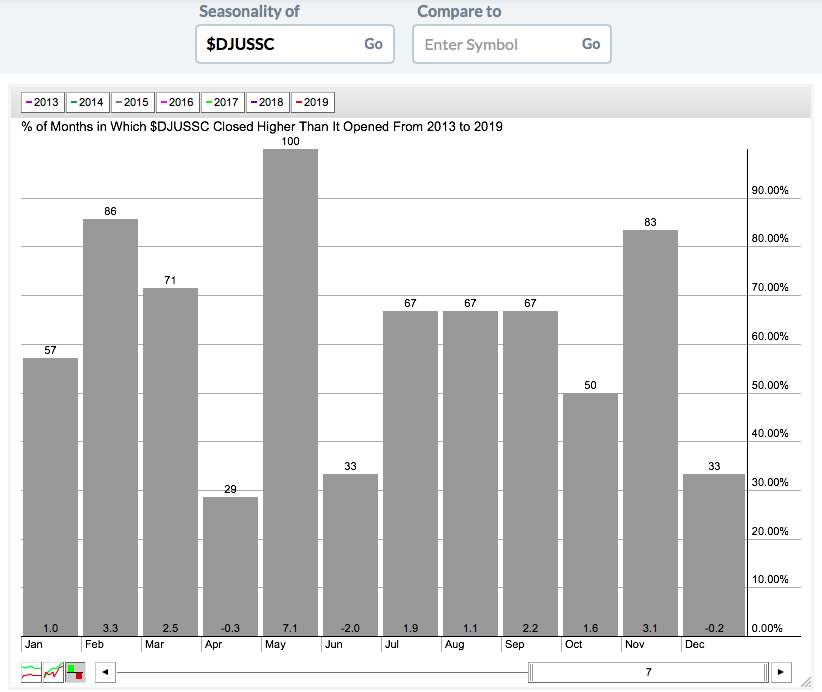

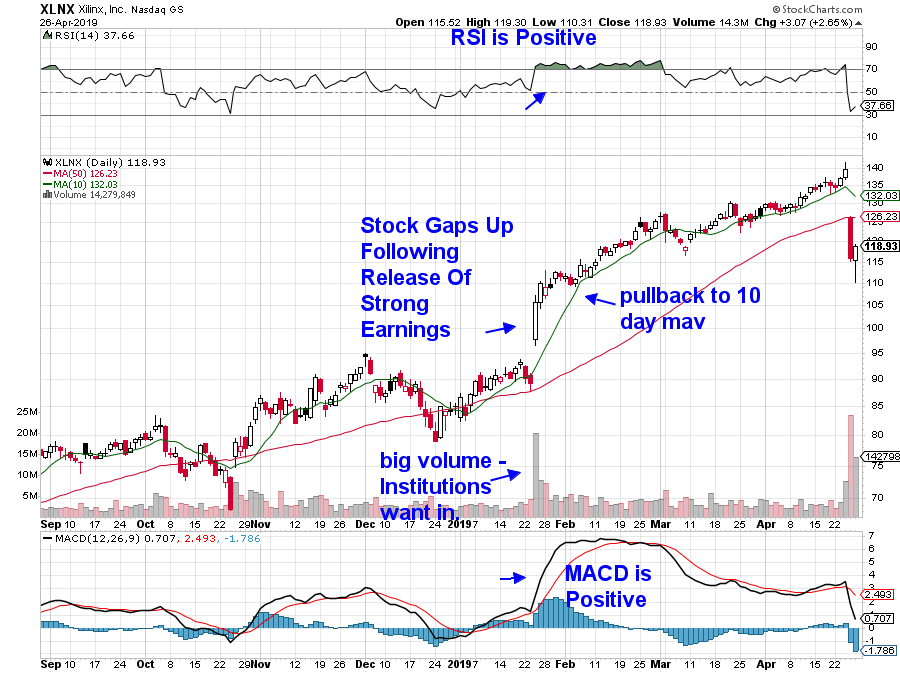

3 Reasons Why Semiconductors Are Poised To Lead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Okay, let's start with the short-term reason. Throughout much of this bull market, the month of May has been kind to semiconductors ($DJUSSC). In fact, the DJUSSC has advanced in each of the last 7 years during May. Check out this seasonal pattern:

Not only have semiconductors moved...

READ MORE

MEMBERS ONLY

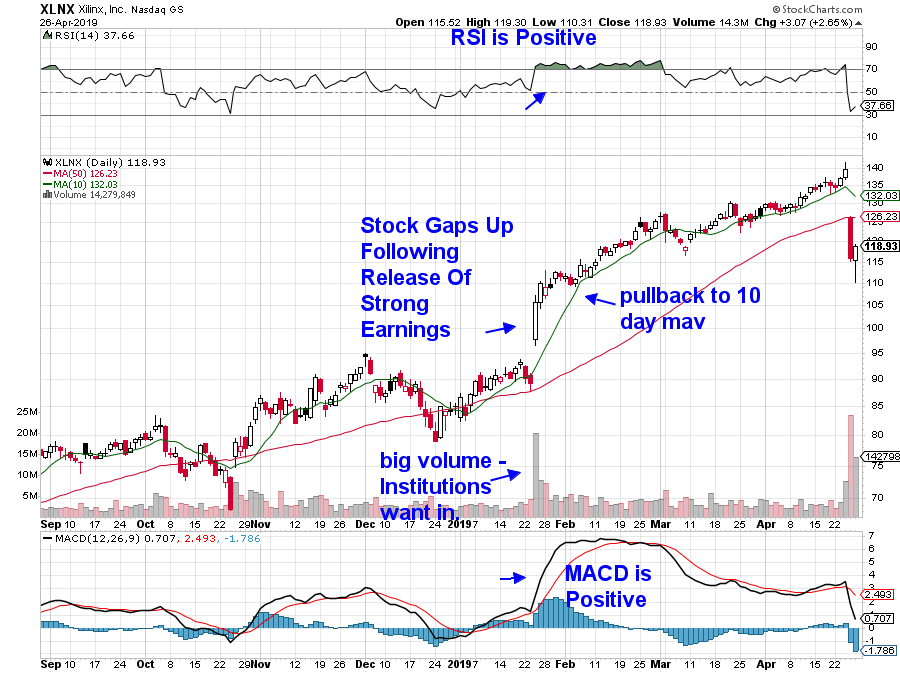

Successfully Trading Stocks After They Report Earnings

by Mary Ellen McGonagle,

President, MEM Investment Research

In my ChartWatchers article from two weeks ago, I provided insights into signals that your stock may be poised to report earnings above Wall Street estimates. Given that the markets are currently rewarding positively reporting companies with an average 2.1%+ boost in price* (and in many cases, much more)...

READ MORE

MEMBERS ONLY

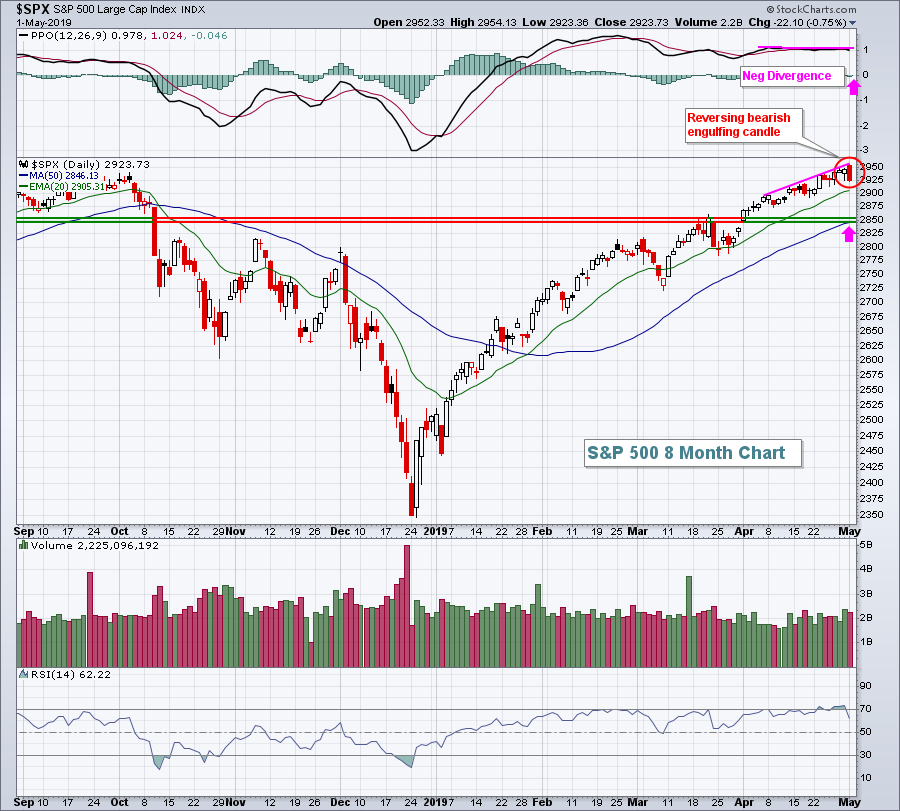

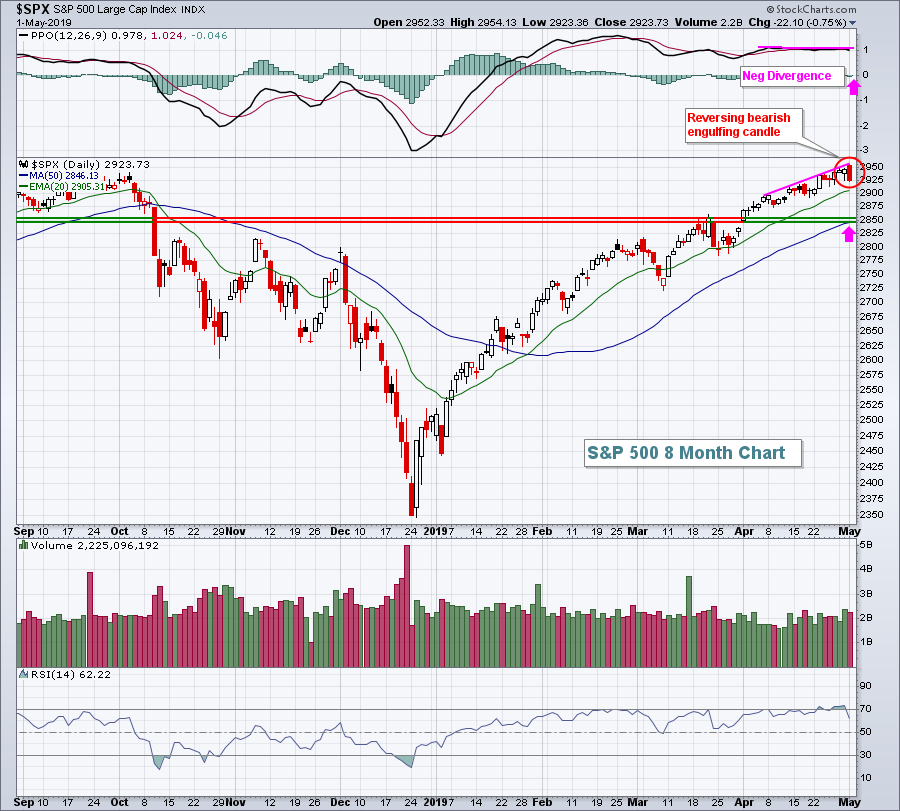

DP WEEKLY WRAP: Steady, Quiet Advance. What's Up?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Since the market gapped up on the first of April, it has been quietly moving higher, making marginal new, all-time highs. Volume has been a bit thin, particularly for SPY. I think that thin volume is a reflection of the low volatility, and of investors happy to sit quietly, not...

READ MORE

MEMBERS ONLY

Five Trendlines You Should Be Watching

by David Keller,

President and Chief Strategist, Sierra Alpha Research

My process is built around simplicity. I am of the firm belief that investors, as well as the financial industry as a whole, tend to unnecessarily complicate things. As a result, we are led to believe that we need to track an endless number of data points to have a...

READ MORE

MEMBERS ONLY

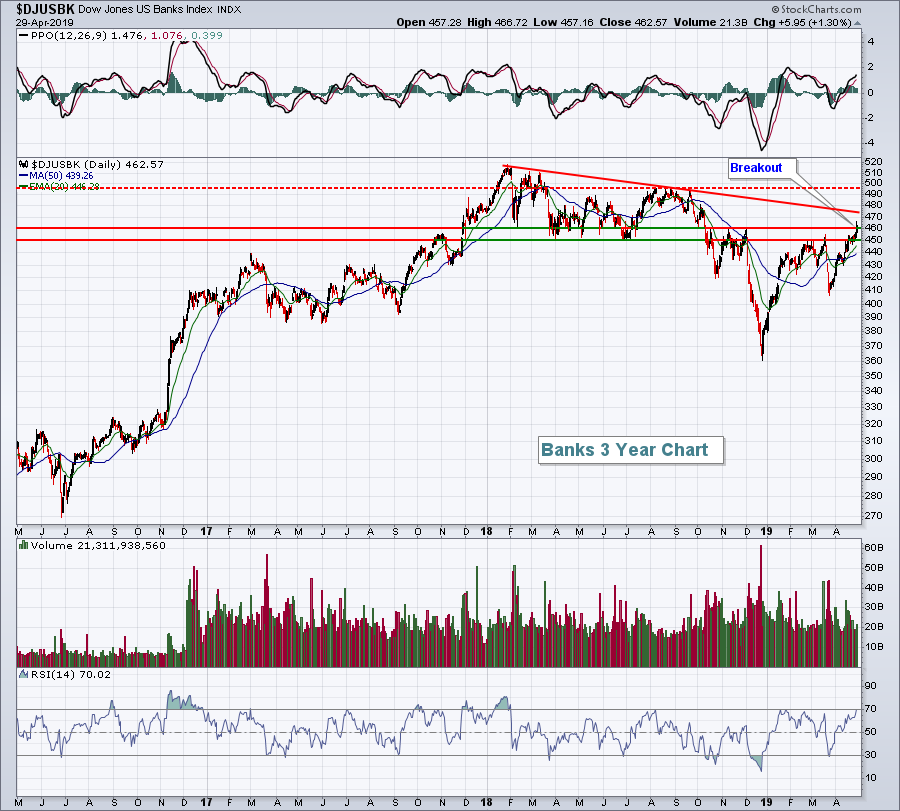

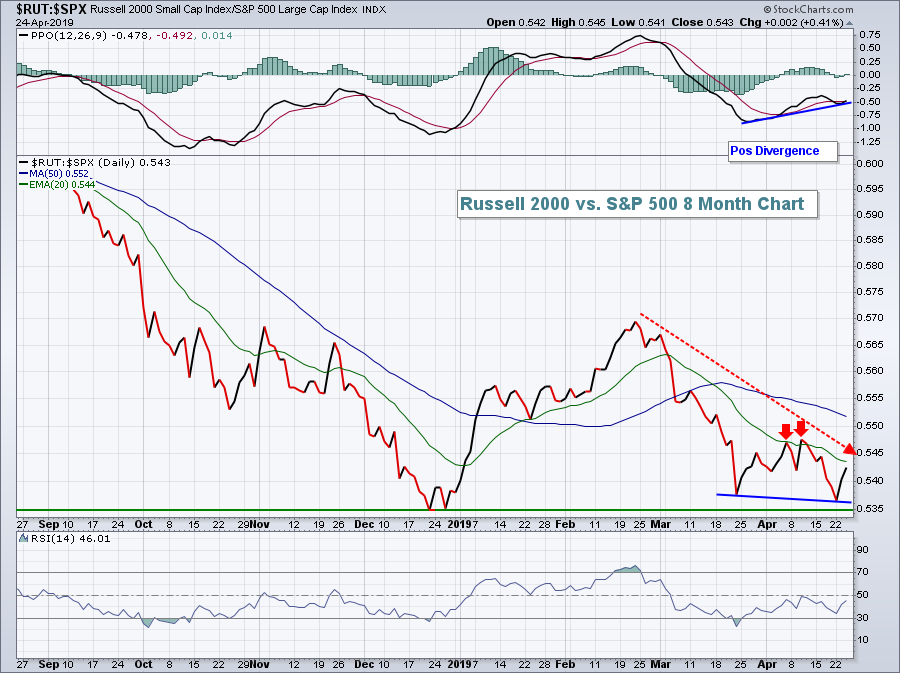

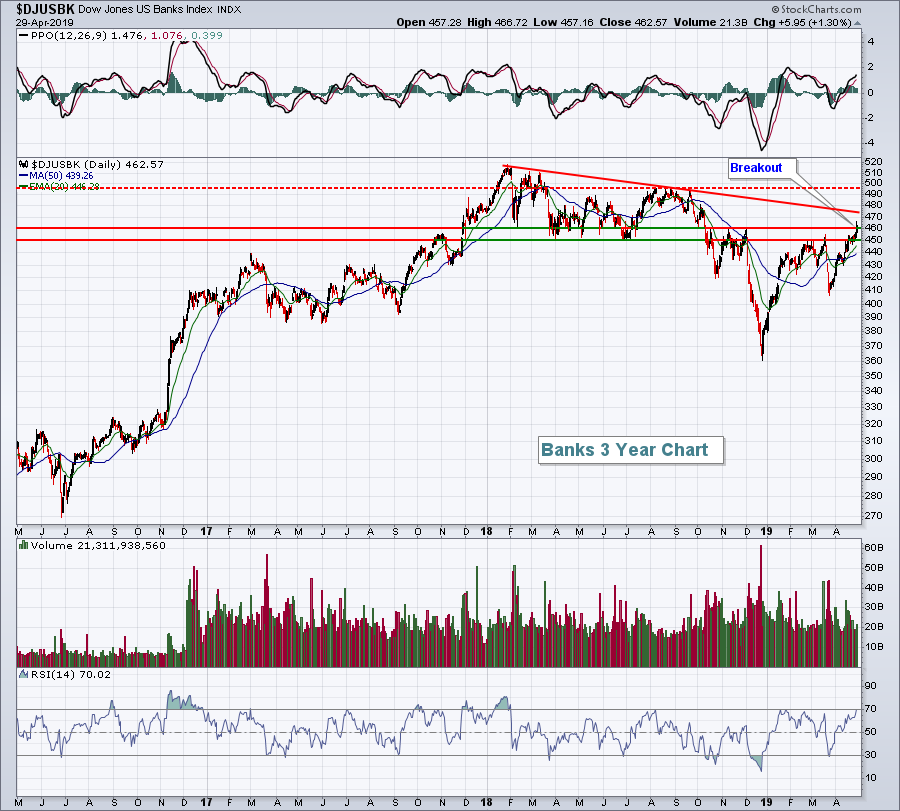

SMALL CAPS MAY BE GETTING A LIFT FROM RISING FINANCIAL SHARES -- FINANCIALS ARE THE BIGGEST SECTOR IN THE RUSSELL 2000 -- AND HAVE BEEN THIS MONTH'S STRONGEST SECTOR -- WHILE HEALTHCARE WEAKNESS MAY BE HOLDING SMALL CAPS BACK

by John Murphy,

Chief Technical Analyst, StockCharts.com

APRIL REBOUND IN FINANCIALS IS GIVING A BIG BOOST TO SMALL CAPS... I've been writing about the recent upturn in financial stocks and, to a lesser extent, small cap stocks. I also suggested that a stronger dollar might be helping smaller stocks. That's because a rising...

READ MORE

MEMBERS ONLY

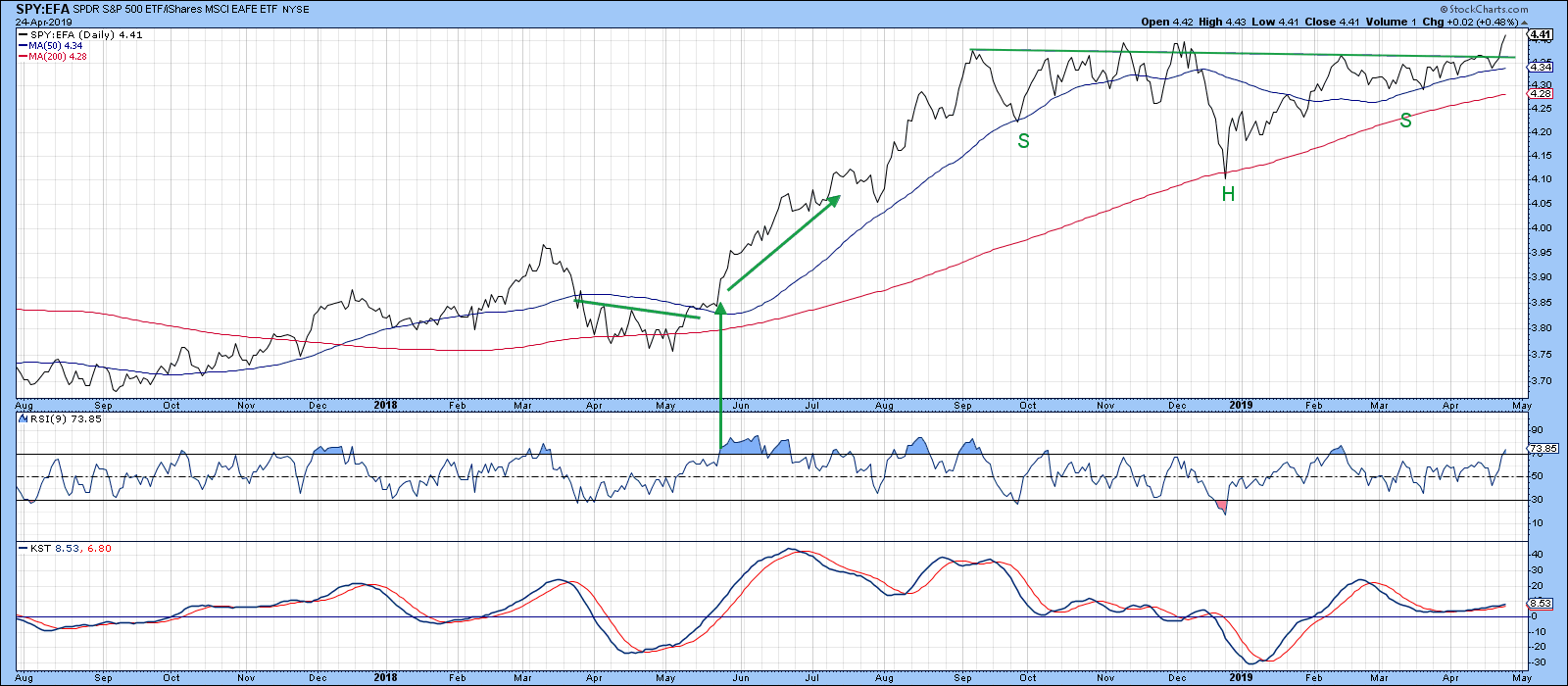

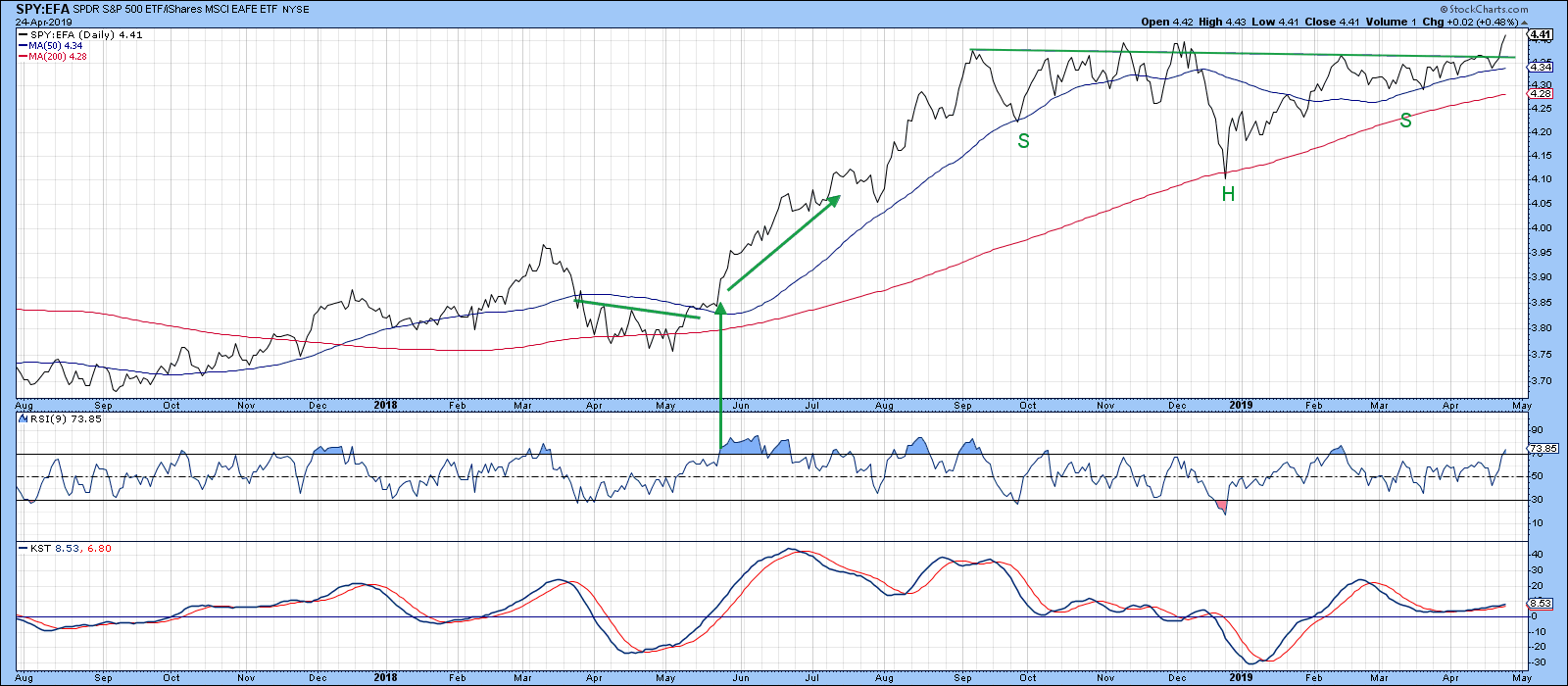

The SPY/EFA Ratio Completes an Inverse Head-and-Shoulders

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Wednesday, April 24th at 7:03pm ET.

Yesterday’s all-time new high in the S&P was well documented by the media, but what did not receive any attention was the fact...

READ MORE

MEMBERS ONLY

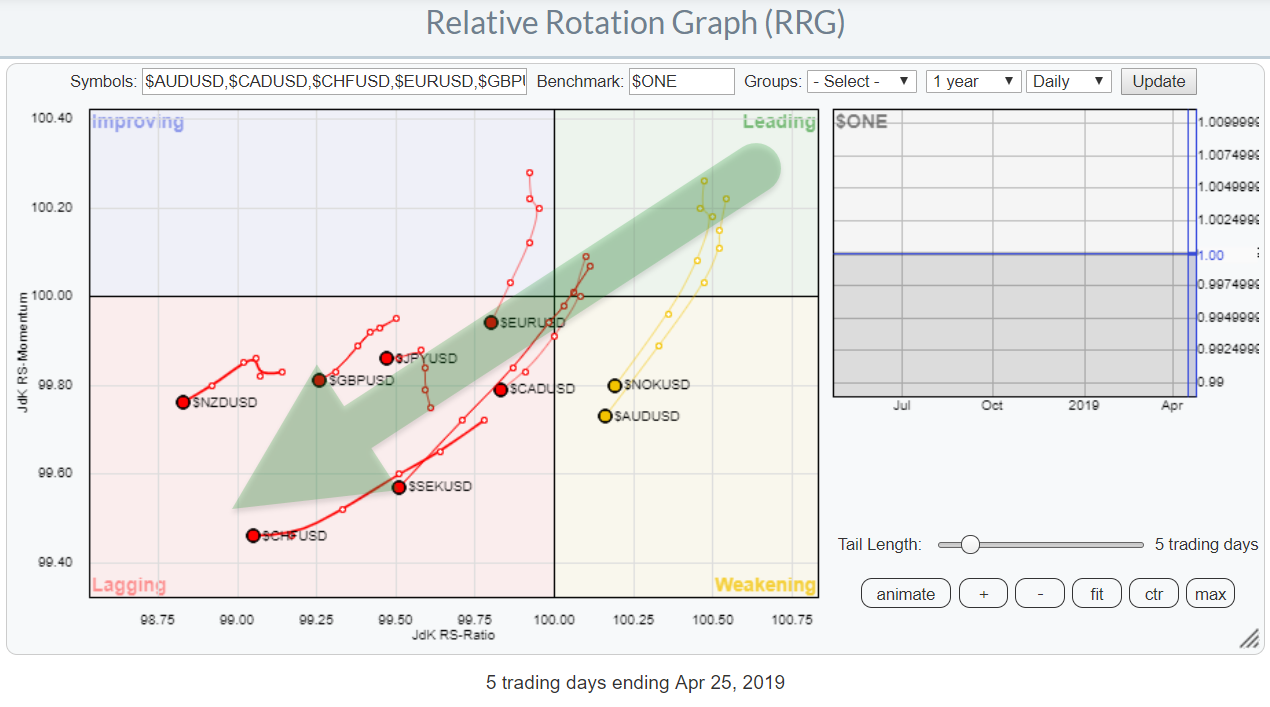

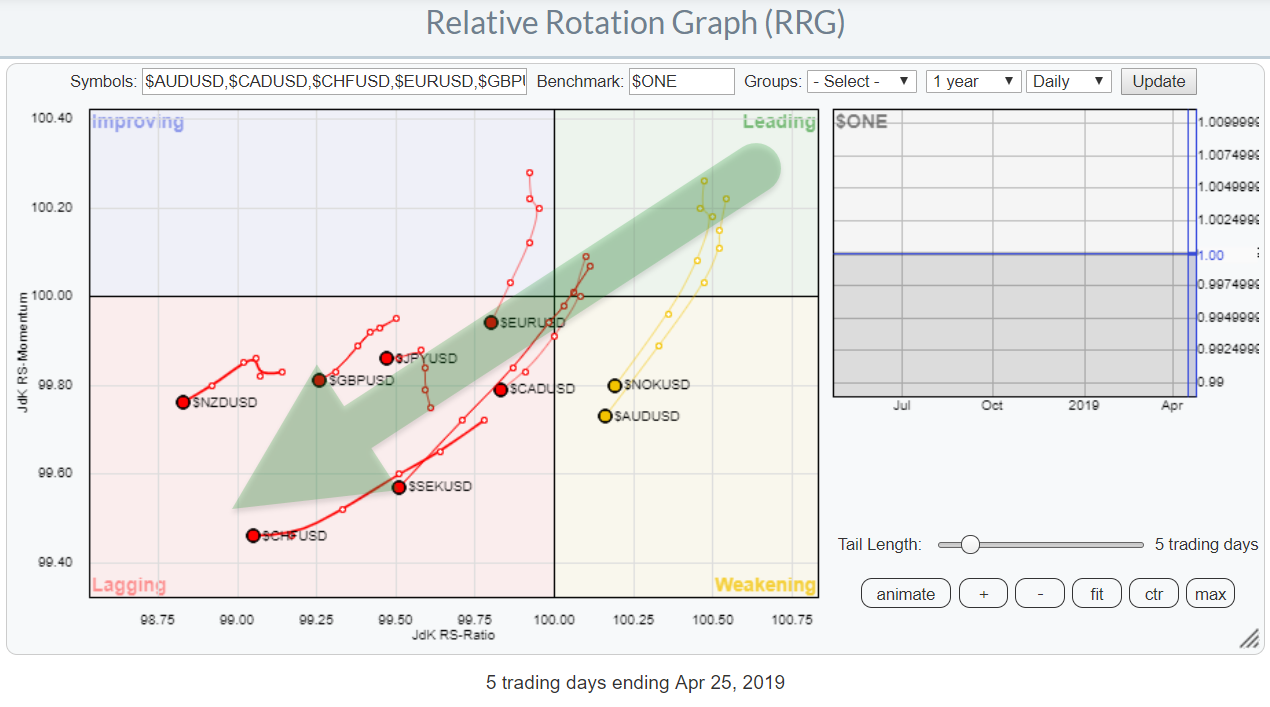

All Eyes On The Mighty Greenback! This Is How It Looks On A Relative Rotation Graph

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

A lot of eyeballs are watching the USD these days. Not surprisingly, as a lot (or most) people pay attention to the chart of the USD index ($USD), which compares the USD to a basket of other currencies. That chart now seems to be breaking out - to the UPside,...

READ MORE

MEMBERS ONLY

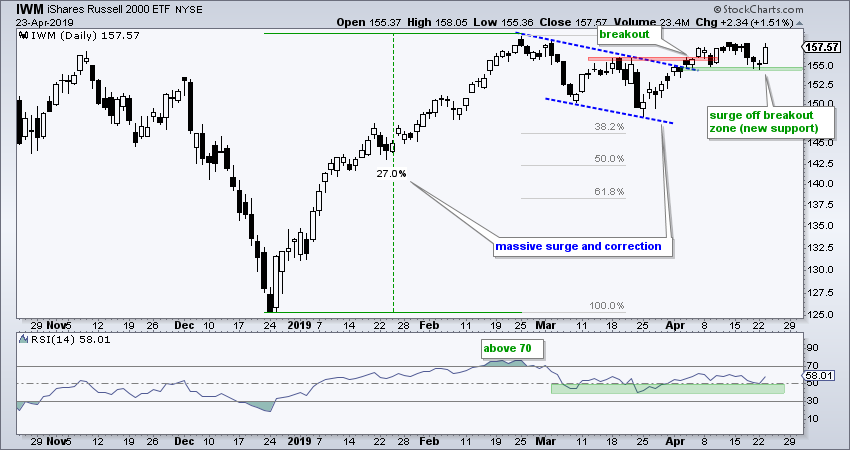

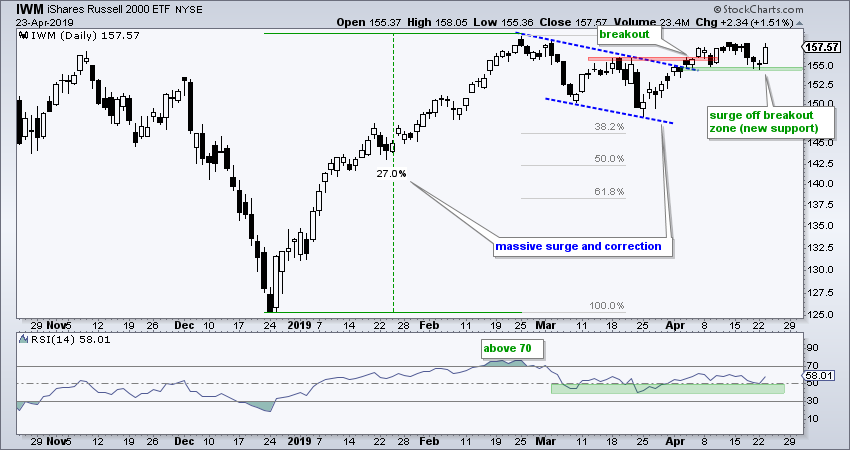

Weekly Market Review & Outlook - 3000 and then What?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* S&P 500 Reaches 2018 Highs.

* Watch the Immediate Uptrend.

* IWM Holds Flag Breakout.

* Small-caps Breadth Indicators Net Bearish.

* %Above 200-day EMA Hits Milestone for XLF.

* Utilities Correct within Bigger Uptrend.

* Stock Performance During Earnings Season.

* ChartList Updates.

* About the Art's Charts ChartList.

... S&P 500...

READ MORE

MEMBERS ONLY

Structuring A Sound Trade And Avoiding The Relative Bear Market In Materials

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 25, 2019

Strong earnings from Microsoft (MSFT, +3.31%) and Facebook (FB, +5.85%) lifted the NASDAQ to gains on Thursday, while broader market bearishness carried the other major indices to losses. 3M Co (MMM, -12.95%) was a disaster on the Dow Jones, which...

READ MORE

MEMBERS ONLY

MMM AND UPS WEIGH INDUSTRIALS DOWN -- AMERICAN EXPRESS BREAKS OUT TO NEW RECORD -- BANK INDEX TRIES TO CLEAR ITS 200-DAY LINE -- S&P 500 CONTINUES TO CHALLENGE ITS 2018 HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

INDUSTRIAL SPDR GAPS LOWER ... In a mixed market day, industrials are the weakest sector. Chart 1 shows the Industrial Sector SPDR (XLI) gapping lower today. That hasn't caused any serious chart damage with the XLI still trading well above its blue 50-day average. It is worth noting, however,...

READ MORE

MEMBERS ONLY

Industrials Set To Record All-Time Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

If you enjoy my daily blog articles, please subscribe (for FREE!) below. Simply scroll to the bottom of this article, type in your email address in the space provided and click the green "Subscribe" button. Once subscribed, my articles will be sent directly to the email address...

READ MORE

MEMBERS ONLY

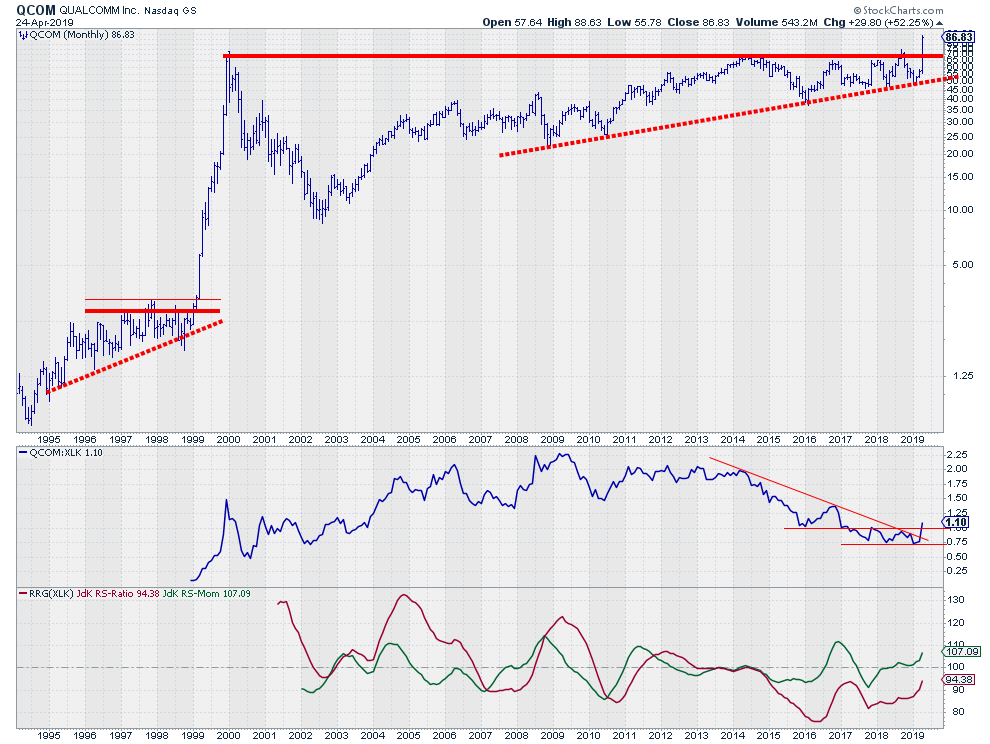

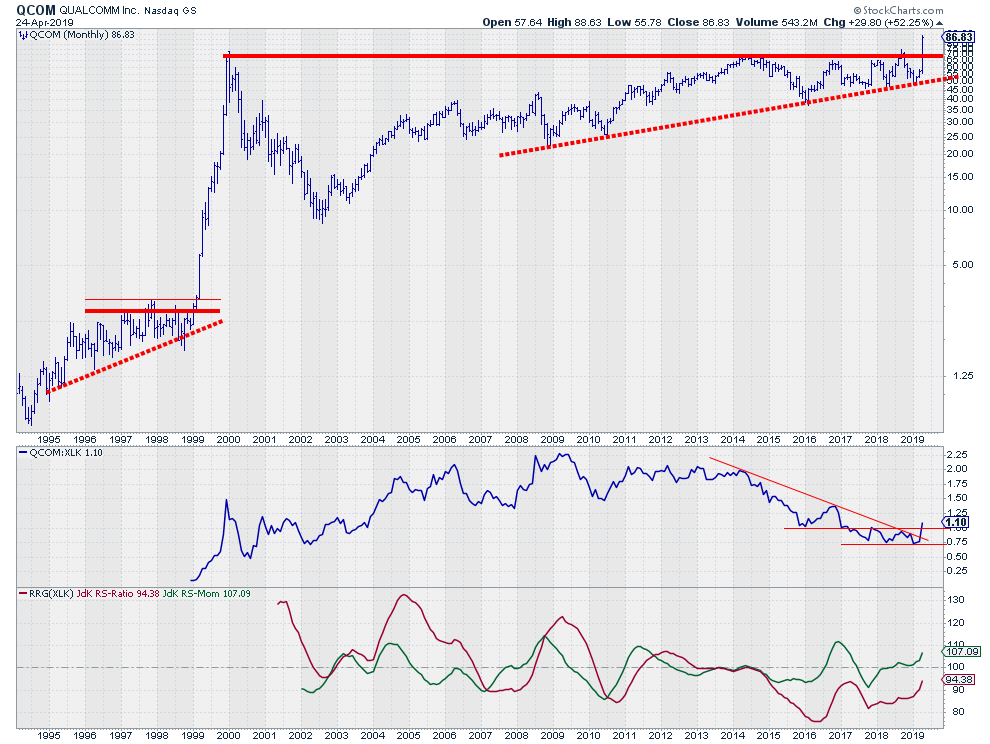

Party Like It's 1999 for QCOM

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Technology is doing very well on the Relative Rotation Graph for US sectors, with a rotation that is well inside the leading quadrant and pushing further into it. If we shift gears and look specifically at the RRG for the technology sector (against XLK), we can see there is one...

READ MORE

MEMBERS ONLY

US Equities Break Out Against The Rest Of The World

by Martin Pring,

President, Pring Research

* The SPY/EFA Ratio Completes an Inverse Head-and-Shoulders

* SPY/EFA Breakout also Bullish for the Dollar

* The Euro, Swiss Franc and Yen

* China Bucks the Flow

The SPY/EFA Ratio Completes an Inverse Head-and-Shoulders

Yesterday’s all-time new high in the S&P was well documented by the media,...

READ MORE

MEMBERS ONLY

DP Alert: Volume Indicators Wave a Caution Flag

by Erin Swenlin,

Vice President, DecisionPoint.com

Naturally, right after I wrote a very bullish article, the market decided to humble me somewhat with a reversal today. Yesterday, I mentioned that all-time high price resistance is generally very difficult to break above decisively (3+%). After publishing, though, Carl pointed out to me that volume on yesterday'...

READ MORE

MEMBERS ONLY

Can IWM Follow Through on Bounce? - ChartList Update

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Cup-with-handle Taking Shape in IWM.

* Bond ETFs Reach Potential Reversal Zone.

* Art's Charts ChartList Update (SMTC added).

Art's Charts featured IWM on Monday with a bullish chart and a lagging price. Even though IWM remains well below its September highs, the ETF broke out of a...

READ MORE

MEMBERS ONLY

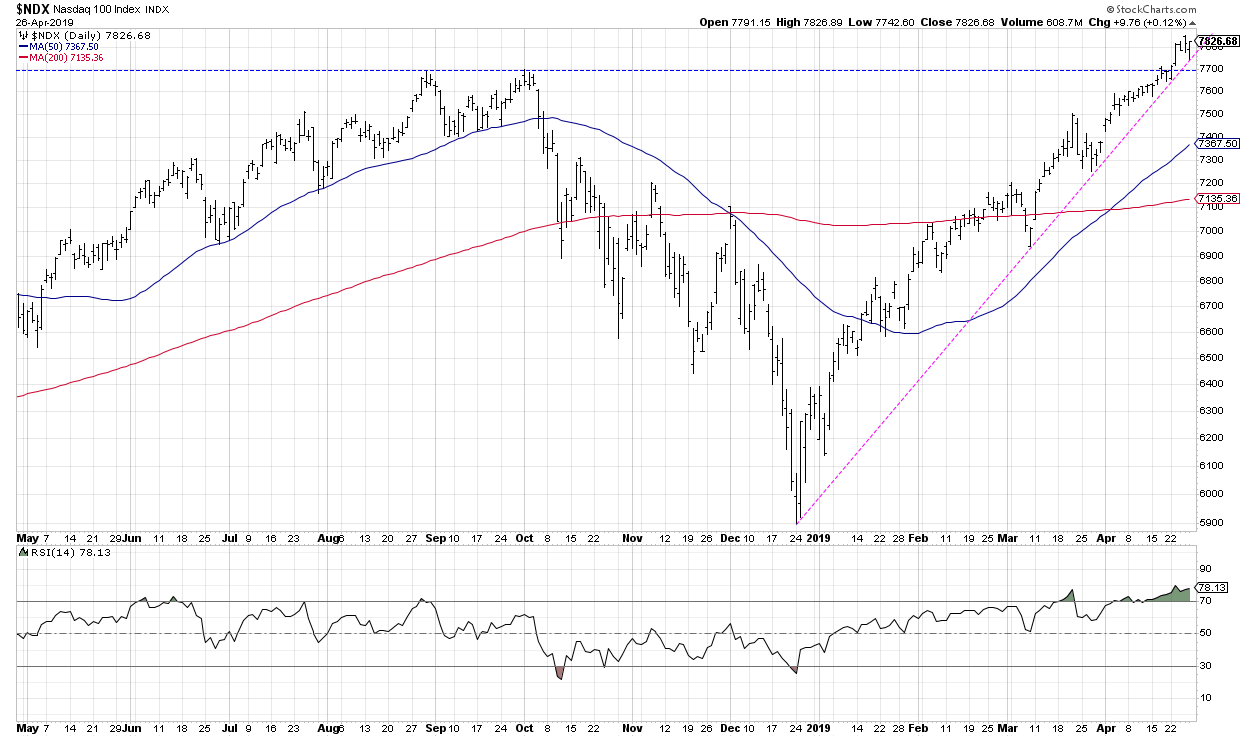

NASDAQ Breaks Out, Sets New All-Time High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 23, 2019

The small cap Russell 2000 led our major indices higher, gaining 1.61%, but the day clearly belonged to the NASDAQ, which not only climbed 1.32%, but broke to new all-time intraday and closing highs. The NASDAQ pierced the 8109.69 level...

READ MORE

MEMBERS ONLY

COUP Flies the Flag after Big Gain

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Coupa Software is one of the best performing stocks in 2019 with a 50% advance year-to-date. In addition, the stock is up over 80% from its late December low. Too far too fast you might say? Perhaps, but the stock digested its gains with a consolidation the last two months...

READ MORE

MEMBERS ONLY

SPX Whipsaw Signals on Buying Initiation - PMO SELL Yesterday, PMO BUY Today

by Erin Swenlin,

Vice President, DecisionPoint.com

I had a feeling we would see a whipsaw right after I switched the SPX Scoreboard to a Price Momentum Oscillator (PMO) SELL Signal. The margin was incredibly thin between the PMO and its signal line. With today's rally and the market making its way to a new...

READ MORE

MEMBERS ONLY

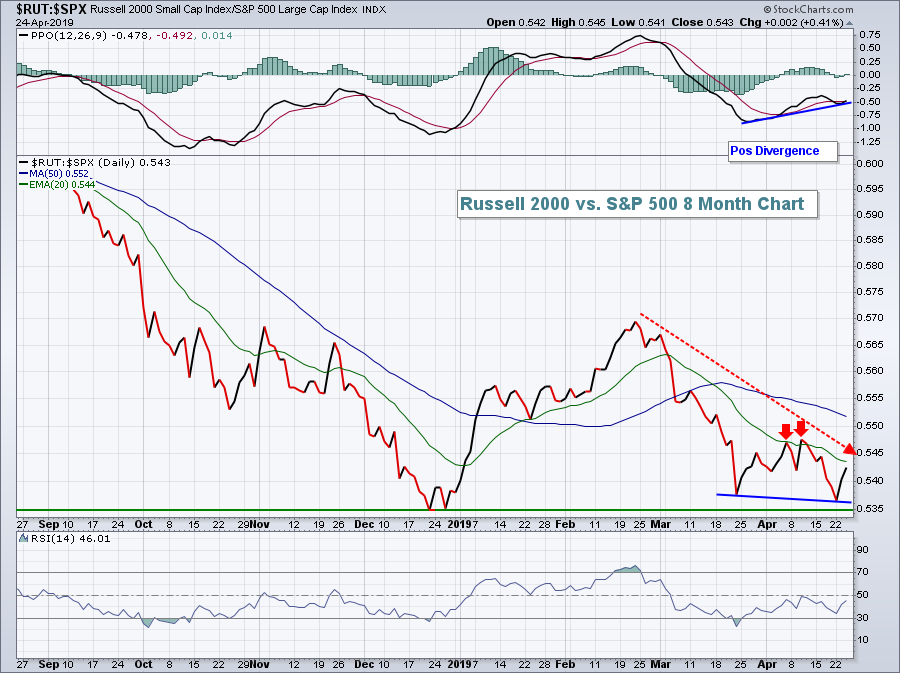

RUSSELL 2000 IS TRADING OVER ITS 200-DAY LINE -- A STRONGER DOLLAR MAY BE HELPING -- MAJOR U.S. STOCK INDEXES NEAR THEIR 2018 HIGHS -- CORPORATE BOND ISHARES ARE ALREADY IN NEW HIGH GROUND

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSELL 2000 TRADES ABOVE ITS 200-DAY AVERAGE... In the midst of a strong market day, small caps are showing a bigger percentage gain than large caps. Chart 1 shows the Russell 2000 Small Cap Index ($RUT) trading above its (red) 200-day moving average today. The RUT still needs to clear...

READ MORE

MEMBERS ONLY

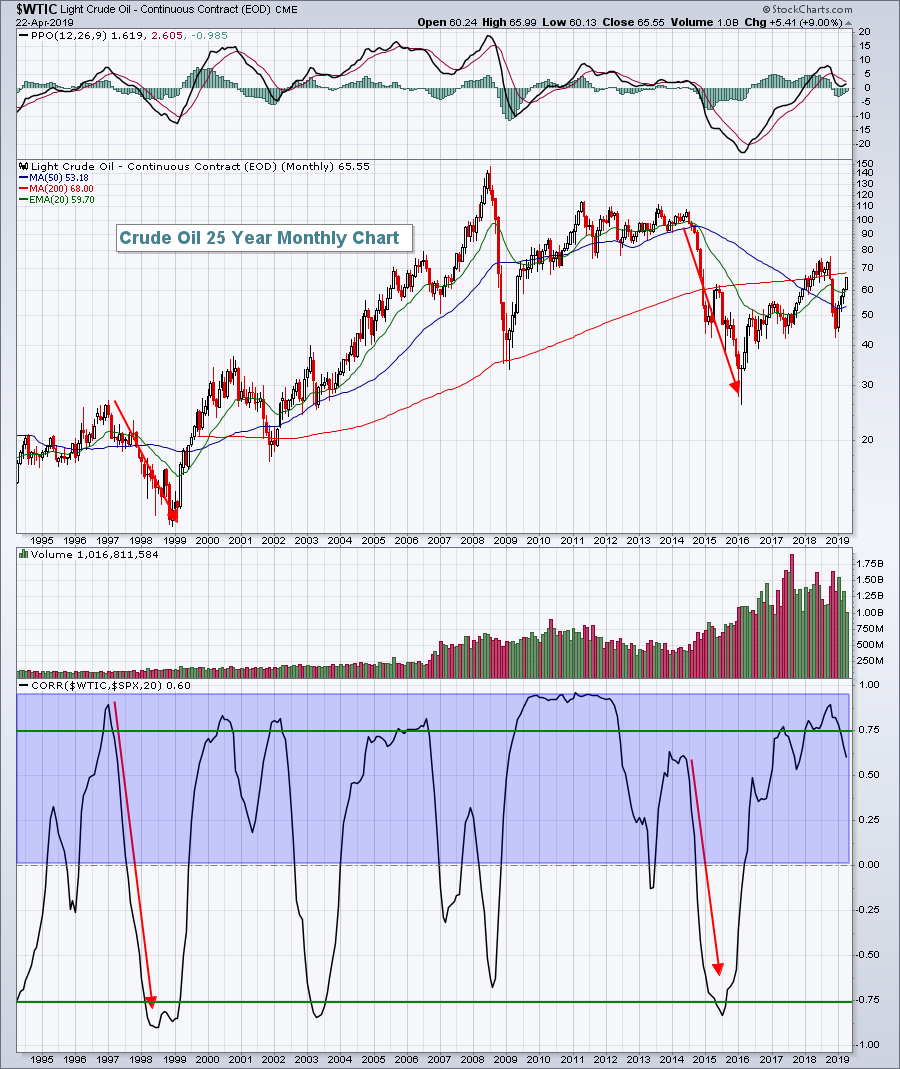

Crude Oil Surge Sends Energy Shares Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 22, 2019

I'm sure you've noticed it at the pump lately. Gas prices are rising. Yesterday, crude oil prices ($WTIC, +2.31%) jumped to their highest level of 2019 and closed above $65 per barrel for the first time since breaking...

READ MORE

MEMBERS ONLY

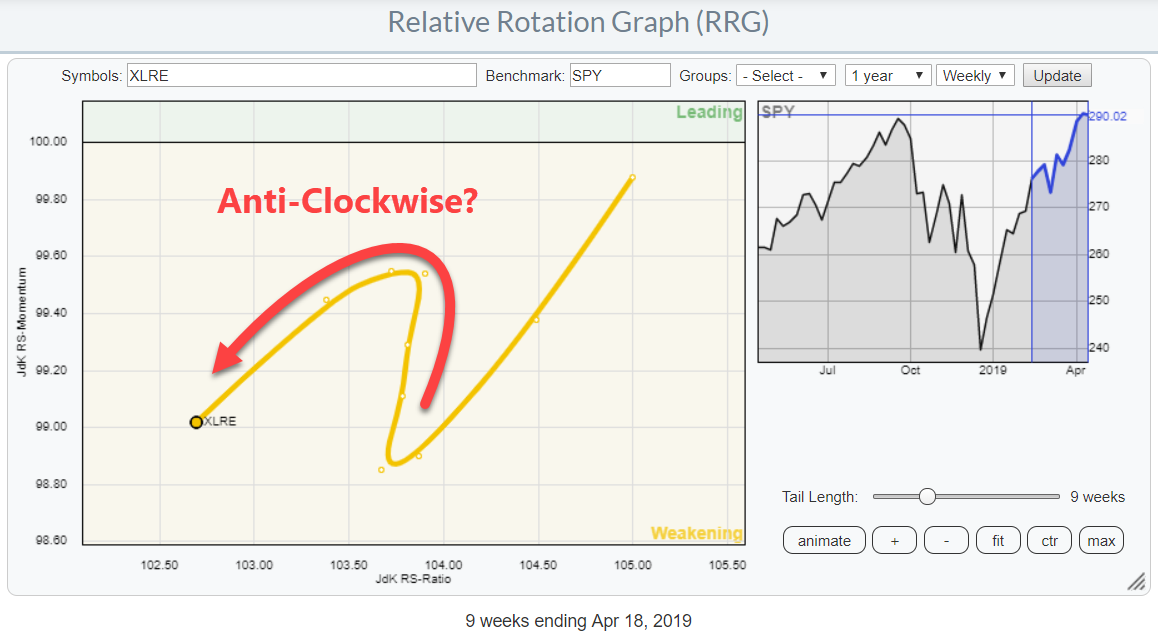

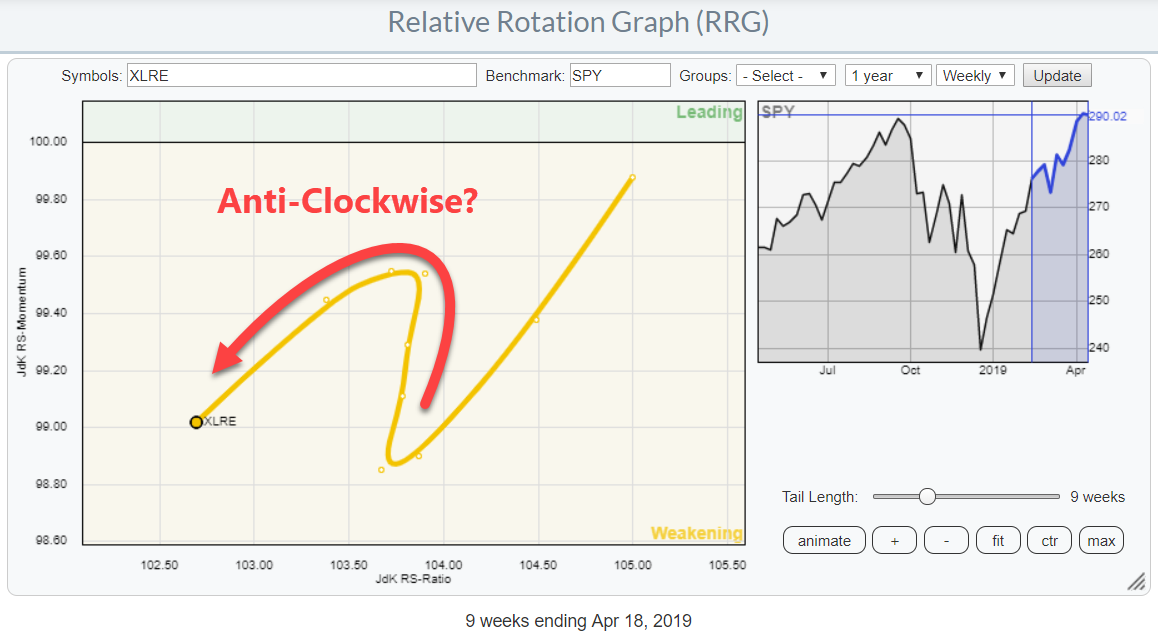

"Hooks" And One Sided Rotations On Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last Thursday, 18 April, was the third Thursday of the month, my regularly scheduled guest appearance on MarketWatchers LIVE. As Tom Bowley was enjoying a well-deserved day off, it was just me and Erin on duty.

It wasn't my first time co-hosting, but every time I fill in...

READ MORE

MEMBERS ONLY

Volatility and The World's Greatest Investor

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I've written before about the cost of volatility, both financially and emotionally, and in light of the volatility we saw in 2018, now is a good time to revisit that issue (while it is not an issue). In 2018, after many sizable down moves, then prices bounced up...

READ MORE