MEMBERS ONLY

Market Rotation and Cap-Weight Dynamics: A Closer Look

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Large cap growth stocks regaining favor as market faces pressure

* Cap-weighted sectors outperforming equal-weighted counterparts

* S&P 500 struggling to break above 610, suggesting potential trading range

* Exceptions in mega-cap dominated sectors (Communication Services, Technology, Consumer Discretionary)

With the market selling off into the close today, it&...

READ MORE

MEMBERS ONLY

Mega-Caps Weakening, More Trouble Ahead

by Erin Swenlin,

Vice President, DecisionPoint.com

The market declined heavily on Friday likely setting up for more downside ahead. We had already begun to notice that mega-cap stocks were beginning to weaken. You can see this on the relative strength line of the SPY versus equal-weight RSP. The relative strength line has been in decline. You&...

READ MORE

MEMBERS ONLY

Gold and Silver Are Crushing the S&P 500! Here's What You Need To Know Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Gold and silver are crushing the commodities markets and the S&P 500.

* Gold is hitting record highs, fueled by sentiment and speculation.

* Consider the key levels to watch for investment opportunities in gold and silver.

There's been a lot of wild speculation surrounding gold&...

READ MORE

MEMBERS ONLY

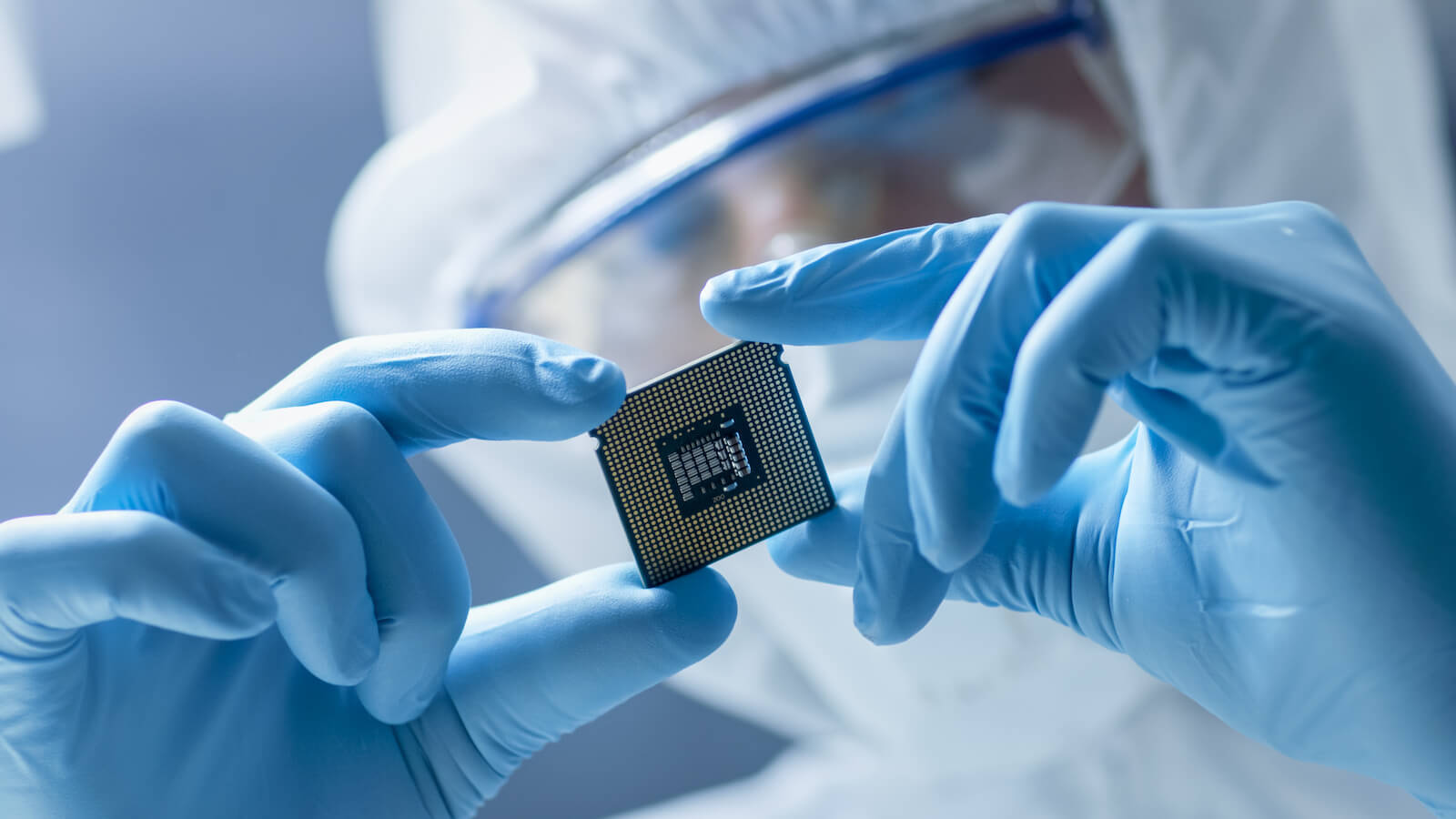

Unlocking the Secrets to Profitable Semiconductor Investments

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Semiconductor stocks are waking up from a long slumber.

* The StockCharts MarketCarpets tool can help identify the high performers.

* Analyze each chart to identify trends and support or resistance levels.

Disappointing guidance from Walmart (WMT) may have hurt the stock market on Thursday sending the broader indexes lower....

READ MORE

MEMBERS ONLY

Unleash the Power of BPI: The Key to Boosting Your Investment Returns

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

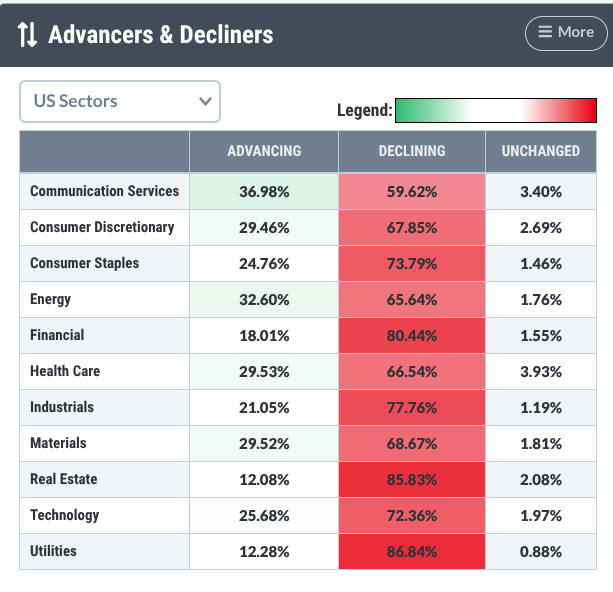

KEY TAKEAWAYS

* Market breadth is improving in some stock market sectors.

* Monitoring the Bullish Percent Index (BPI) can help you strategize your investments.

* The broader stock market indexes are still bullish.

On Wednesday, the Federal Reserve released minutes from its January 28–29 meeting. There weren't any surprises...

READ MORE

MEMBERS ONLY

If a Rising Tide Lifts All Boats, What Does It Mean for the Dollar?

by Martin Pring,

President, Pring Research

KEY TAKEAWAYS

* The US dollar is still in a bullish trend.

* An analysis of a secular trend, primary trend, and short-term trend support the dollar's bullish case.

* The Pring Dollar Diffusion indicator tends to lead the action of the US dollar and is indicating a bullish move ahead....

READ MORE

MEMBERS ONLY

Three Signs of the Bear and What May Come Next!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Bearish momentum divergences suggest potential exhaustion of the bulls and limited upside.

* Market breadth indicators have not confirmed recent highs, reflecting a lack of support outside the leading performers.

* Dow Theory non-confirmation, a pattern first identified by Charles Dow, shows that market indexes are not confirming one another....

READ MORE

MEMBERS ONLY

From Crash to Comeback: Is SMCI Stock the Hottest AI Asset Right Now?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* SMCI shot up 110% following a 1,167% plunge.

* While the company is projecting $40 billion in revenue by next year, many analysts aren't convinced (yet).

* The price action, however, tells its own story and is a few levels away from a buy and an uptrend....

READ MORE

MEMBERS ONLY

How To Grow Your Options Trading Account

by Tony Zhang,

Chief Strategist, OptionsPlay

Learn how to build your confidence in the markets with this high probability of success strategy and how to find the best opportunities every day to earn consistent income with the tools available at StockCharts.com.

This video premiered on February 18, 2025....

READ MORE

MEMBERS ONLY

The Best Five Sectors, #7

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

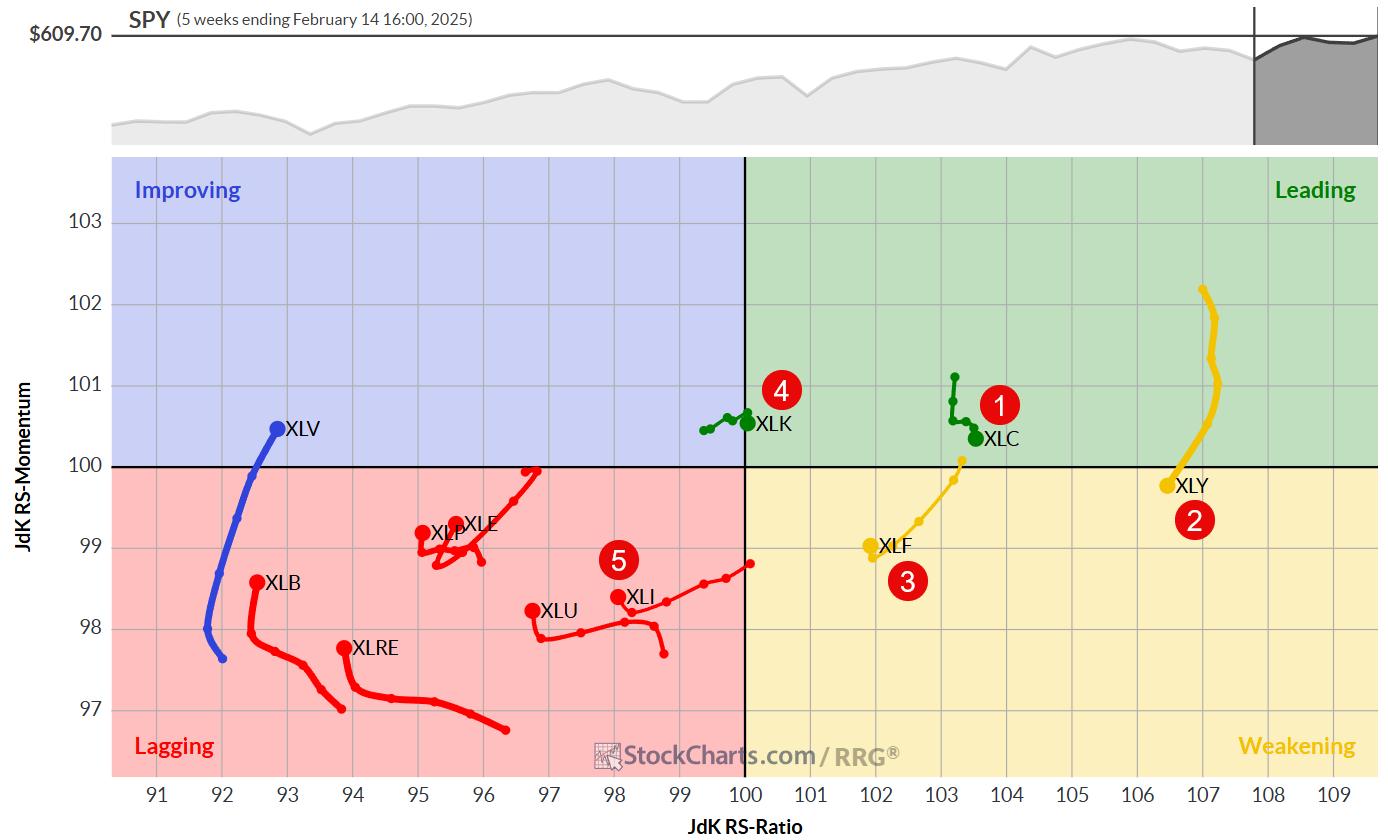

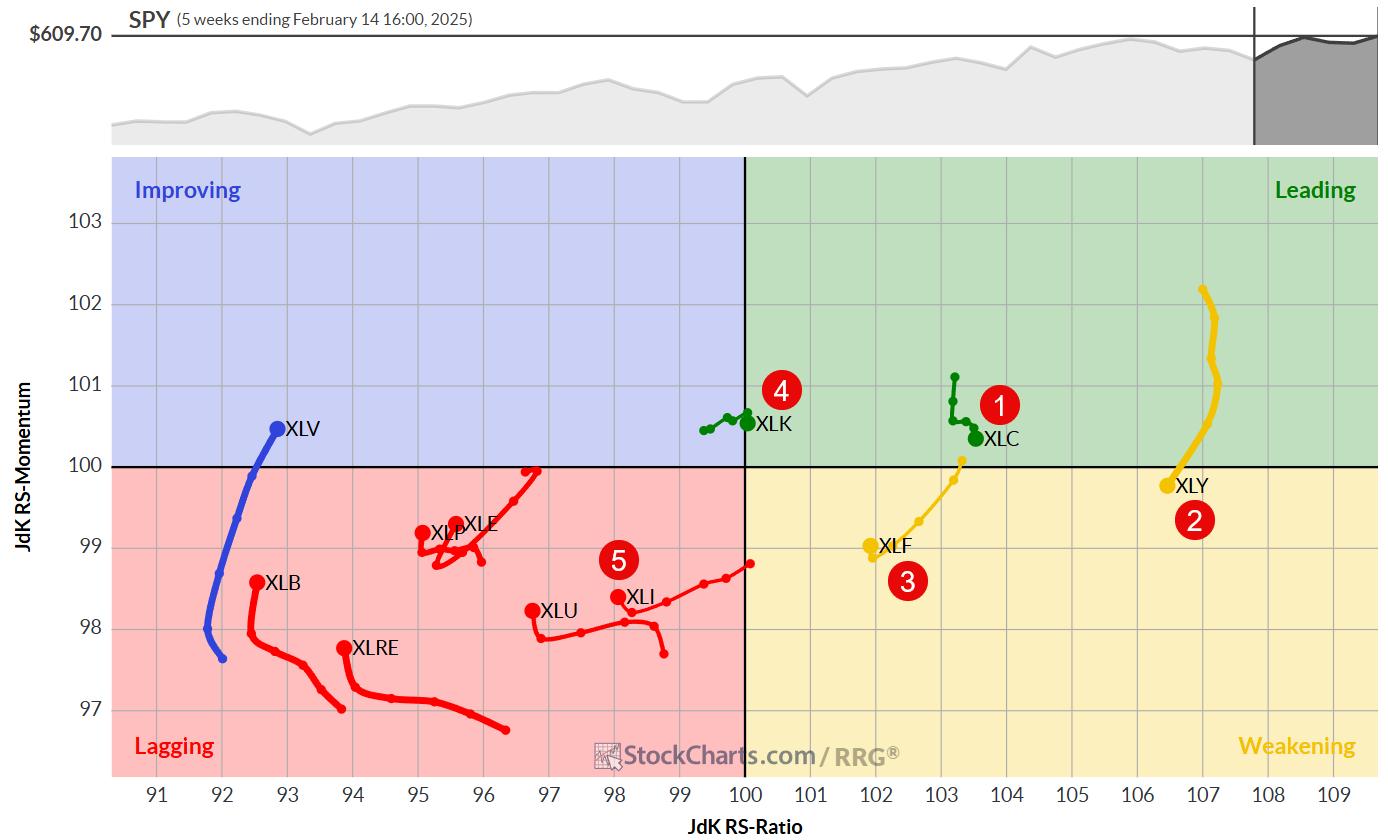

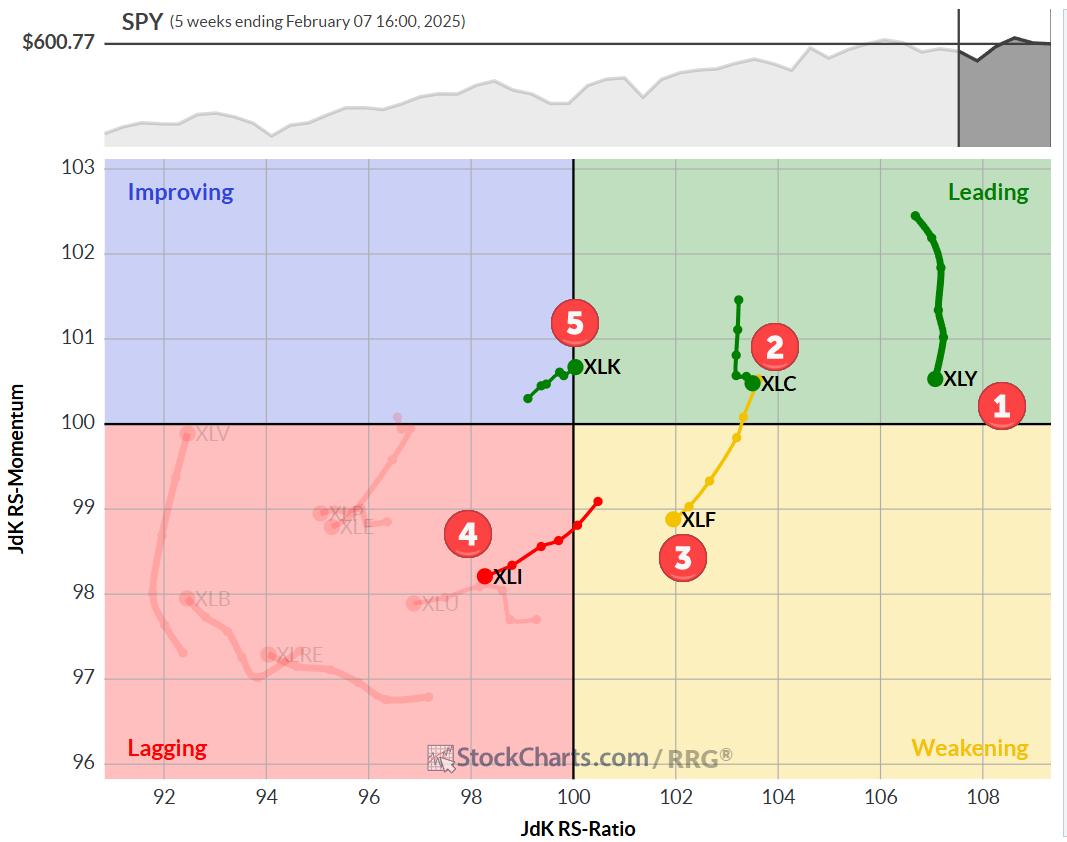

KEY TAKEAWAYS

* Communication services (XLC) claims the top spot, pushing consumer discretionary (XLY) to second place

* Technology (XLK) shows strength, moving up to fourth and displacing industrials (XLI)

* Industrials displaying weakness, at risk of dropping out of the top five

* RRG portfolio outperforming SPY benchmark by 69 basis points

Shifting...

READ MORE

MEMBERS ONLY

Here Are Two Great Earnings Reports This Past Quarter

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

For us at EarningsBeats.com, earnings season is the time to do our research to uncover the best stocks to trade over the next 90 days, or earnings cycle. We do this in various ways. Our flagship ChartList is our Strong Earnings ChartList (SECL), which honestly is nothing more than...

READ MORE

MEMBERS ONLY

This Is How I Crush The Benchmark S&P 500 In Any Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It was another mildly bullish week as our major indices climbed very close to new, fresh all-time highs. We also saw a return to growth stocks as we approached breakout levels, which is a good signal as far as rally sustainability goes. Despite this, there remain reasons to be cautious...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Tests Crucial Support; Violation Of This Level May Invite Incremental Weakness

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equity markets remained under pressure over the past five sessions, witnessing sustained weakness throughout the week. The Nifty50 faced resistance at key levels and struggled to find strong footing as it tested crucial support zones on two separate occasions. Market volatility surged significantly, with India VIX rising by...

READ MORE

MEMBERS ONLY

Stay Ahead of Tariffs: Essential Chart Analysis for Investment Security

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market has been trading sideways for an extended period.

* Tariffs, deregulation, inflation, and tax cuts are likely to occupy investors' minds for the next few years.

* Monitor the charts of the broader stock market, inflation expectations, and industries that are likely to benefit from the...

READ MORE

MEMBERS ONLY

Master Multiple Timeframe Analysis With This Simple Method

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* We can use the slope of moving averages, as well as a simple crossover technique, to define trends and identify trend changes.

* Our Market Trend Model uses exponential moving averages, as they are more sensitive to changes in market direction.

* Based on our Market Trend Model, the S&...

READ MORE

MEMBERS ONLY

Double Tops In Bitcoin and the Dollar

by Erin Swenlin,

Vice President, DecisionPoint.com

As part of the DP Alert, we cover Bitcoin and the Dollar every market day. We have been watching some bearish indications on both Bitcoin and the Dollar with the double top chart patterns.

On Bitcoin, price has been moving mostly sideways above support at 90,000. This happens to...

READ MORE

MEMBERS ONLY

Stash that Flash Right in the Trash

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Price represents a distillation of all news, events and rumors.

* Our job is to set biases aside and focus on price action.

* Chartists should focus on uptrends, relative strength and bullish setups.

The news cycle is in high gear lately, leading to some extra volatility. Traders reacting to...

READ MORE

MEMBERS ONLY

Market Chaos: How to Spot Bottoming Stocks Before the Rebound

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Markets plunged early Wednesday morning following a hotter-than-expected CPI report.

* The Real Estate sector was among those hit hardest.

* These stocks, filtered using a bearish New 52-Week Lows scan, display bottoming opportunities.

Not everyone likes to take a contrarian stance. Most people prefer to move with the market,...

READ MORE

MEMBERS ONLY

Intel's Rising SCTR Score: Why You Should Add This Stock to Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Intel stock has seen strong upside movement for four consecutive days.

* Intel's stock price is hitting its 200-day moving average resistance.

* If INTC stock breaks above its 200-day moving average and its next resistance level, considering accumulating INTC shares in your portfolio.

Intel's stock...

READ MORE

MEMBERS ONLY

Master Trades in Volatile Markets With This 4MA Strategy

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shows how the 4-day moving average can be useful especially in volatile markets. He explains the advantages of using it in conjunction with the 18-day MA to prevent buying at the wrong time and highlighting when good opportunities appear. He then goes through the...

READ MORE

MEMBERS ONLY

Bearish Divergences Plaguing Former Leadership Names

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* META and NFLX remain in strong uptrend phases, with limited drawdowns in 2025.

* Four of the Mag7 names can be classified as "broken charts", with recent breakdowns representing an important change of character.

* AMZN and GOOGL offer perhaps the most concerning short-term patterns, with bearish momentum...

READ MORE

MEMBERS ONLY

Are Trump's 25% Tariffs a Game-Changer for Steel Stocks? Here's What to Watch Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Trump's announced 25% tariffs on steel and aluminum imports are boosting domestic steel producers.

* STLD, NUE, and NEM jumped significantly relative to its peers.

* All three stocks may be approaching buy levels, but only under specific conditions.

On Monday morning, President Trump announced plans to impose...

READ MORE

MEMBERS ONLY

Why NVDA's Stock Price Shift Could Be Your Gain!

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* NVDA stock is staying within clear support and resistance levels.

* NVDA's stock price is approaching a position of strength.

* If NVDA's stock sees upside momentum, it may be time to accumulate positions.

Do you remember when NVDA stock had a very high StockCharts Technical...

READ MORE

MEMBERS ONLY

Are the Once High-Flying MAG 7 Stocks Just Mediocre Now?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave breaks down the formerly high-flying Mag 7 stocks into three distinct buckets. These include long & strong (META, NFLX & AMZN), broken down (TSLA, AAPL, MSFT & NVDA), and questionable (GOOGL). He also shows how GOOGL is not the only leading name featuring a bearish momentum...

READ MORE

MEMBERS ONLY

Dr Copper Could Be Close to a Major Breakout. What That Could Mean for the CPI

by Martin Pring,

President, Pring Research

The nickname "Dr. Copper" comes from its reputation as a reliable economic indicator. That's because it is used worldwide in a wide range of industries, including construction, electronics, and manufacturing. When demand for the red metal is high, it often signals that these industries are booming,...

READ MORE

MEMBERS ONLY

Stay on TOP of the AI Revolution!

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony highlights important moves in equities, then shares the OptionsPlay research report for bull/bear plays. Tony then spends time on NVDA, highlighting the importance of staying on top of the AI revolution. He also looks at key stocks like V, BA, META, and more.

This video...

READ MORE

MEMBERS ONLY

Three Technical Tools to Minimize Endowment Bias

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Have you ever held on too long to a winning position? You watch as that former top performer in your portfolio slows down, and then rotates lower, and then really begins to deteriorate, and you just watch it all happen without taking action?

If the answer is "yes"...

READ MORE

MEMBERS ONLY

DP Trading Room: Gold Hits Another All-Time High

by Erin Swenlin,

Vice President, DecisionPoint.com

The market rebounded to start trading on Monday, but indicators on Friday suggest internal weakness. Carl gives us his latest analysis on the market as well as taking a look at Gold which is making more all-time highs. Get Carl's perspective on the Gold rally.

Besides looking at...

READ MORE

MEMBERS ONLY

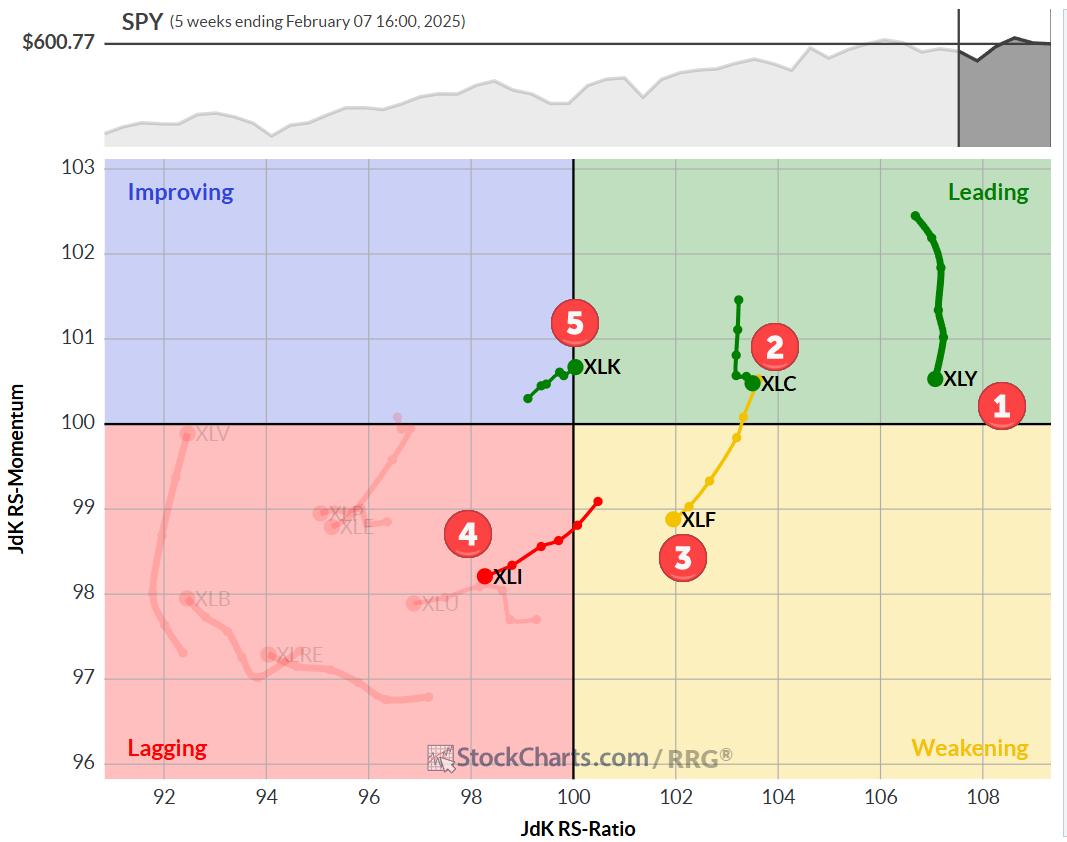

The Best Five Sectors, #6

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Top-5 remains unchanged

* Healthcare and Staples jump to higher positions

* Price and Relative trends remain strong for XLC and XLF

No Changes In Top-5

At the end of the week ending 2/7, there were no changes in the top-5, but there have been some significant shifts in...

READ MORE

MEMBERS ONLY

Here's a Group Ready To Set Sail

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Sometimes an industry group looks good technically, sometimes fundamentally, and then other times seasonally. But what happens when they all line up simultaneously? Well, we're about to find out with the travel & tourism group ($DJUSTT). On Friday, Expedia (EXPE, +17.27%) soared after reporting blowout quarterly results...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stares at Crucial Support; RRG Hints at Defensive & Risk-Off Setups

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In what can be called an indecisive week for the markets, the Nifty oscillated back and forth within a given range and ended the week on a flat note. Over the past five sessions, the Nifty largely remained within a defined range. While it continued resisting the crucial levels, it...

READ MORE

MEMBERS ONLY

Nasdaq DROPS on Weak AMZN, TSLA & GOOGL Earnings!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen reviews the market's flat momentum as uncertainty reemerges after weak AMZN, TSLA and GOOGL reports - PLUS more tariff talk from Trump. She also highlights the move into defensive sectors as growth stocks continue to struggle. Lastly, she shares the top stocks that...

READ MORE

MEMBERS ONLY

IT Breadth Momentum (ITBM) and IT Volume Momentum (ITVM) Top - Participation Draining

by Erin Swenlin,

Vice President, DecisionPoint.com

We are currently in a declining trend in the market and internals are telling us that this weakness will continue to be a problem. Our primary indicators in the short- and intermediate-term have topped with one exception. The Swenlin Trading Oscillators (STOs) started down on Thursday and the STO-B continued...

READ MORE

MEMBERS ONLY

Top 10 Charts to Watch for in February 2025

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While the major equity averages are certainly up year-to-date, we're detecting a growing number of signs of leadership rotation. As the Magnificent 7 stocks have begun to falter, with charts like Apple Inc. (AAPL) taking on a less-than-magnificent luster in February, we've identified ten key stocks...

READ MORE

MEMBERS ONLY

Bank SPDR Extends on Breakout - How to Find the Setup before the Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Pullbacks within uptrends provide opportunities to trade within an uptrend.

* Retracements, broken resistance and support mark setup zones.

* Strong breakouts should hold so we should mark re-evaluation levels accordingly.

The Finance sector is leading the market with a new high this week and the Bank SPDR (KBE) is...

READ MORE

MEMBERS ONLY

Hotel Stocks Spike: Why You Should Add These Stocks to Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Hilton's strong quarterly earnings sent hotel stocks surging.

* The StockCharts Technical Rank score indicates the hotel industry is technically strong.

* If hotel stocks continue to trend higher, consider adding these stocks to your portfolio.

When you think travel industry, airline and cruise line stocks are usually...

READ MORE

MEMBERS ONLY

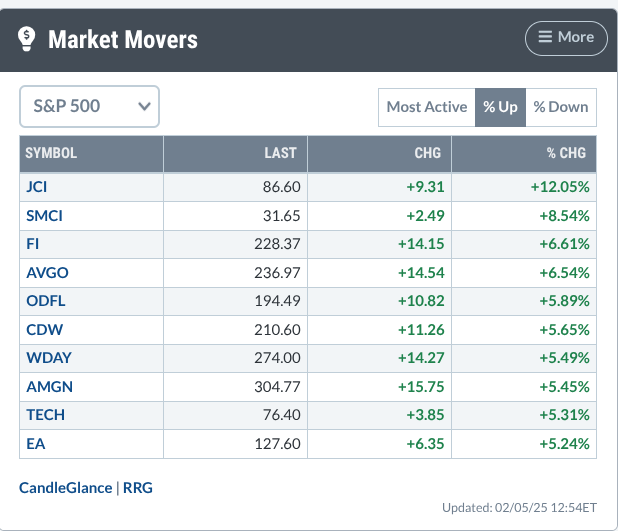

Missed Amgen's 5% Surge? Here's What You Need to Know Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Amgen's stock surged dramatically despite recent challenges.

* The stock has been underperforming its key industries and broader sector for over a year.

* Key support and resistance levels will determine whether Amgen's bullish reversal can be sustained.

On Wednesday morning, the markets wavered, with cautious...

READ MORE

MEMBERS ONLY

S&P 500 Sectors Play Musical Chairs: How To Win the Game With Options

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500 sectors keep shuffling from one day to the next.

* It's important to focus on the long-term trends in the S&P sectors by analyzing their respective using a unique indicator.

* Identify a stock within a sector that is likely to...

READ MORE

MEMBERS ONLY

The BEST Simple Moving Average Trading Strategy

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe presents a trading strategy using the simple moving average. Explaining what to watch and how it can tell you what timeframe to trade, he shares how to use it in multiple timeframes. Joe covers the QQQ and IWM and explains the levels to monitor...

READ MORE

MEMBERS ONLY

Three Behavioral Biases Impacting Your Portfolio Right Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave reveals three common behavioral biases, shows how they can negatively impact your portfolio returns, and describes how to use the StockCharts platform to minimize these biases in your investment process. He also shares specific examples, from gold to Pfizer to the S&P 500, and...

READ MORE