MEMBERS ONLY

A Mean-Rervsion Opp in Gasoline - Inside Weeks for Gold - A Peak for REITs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Gasoline ETF Firms after Pullback

* Notes on RSI Parameters and Levels

* Three Inside Weeks for Gold

* Bollinger Contractions for GLD and GDX

* Dollar Gets Extended

* Unadjusted REIT SPDR Hits Reversal Zone

* Questions, Comments or Feedback?

... Gasoline ETF Firms after Pullback

The US Gasoline ETF ($UGA) has a mean-reversion setup working...

READ MORE

MEMBERS ONLY

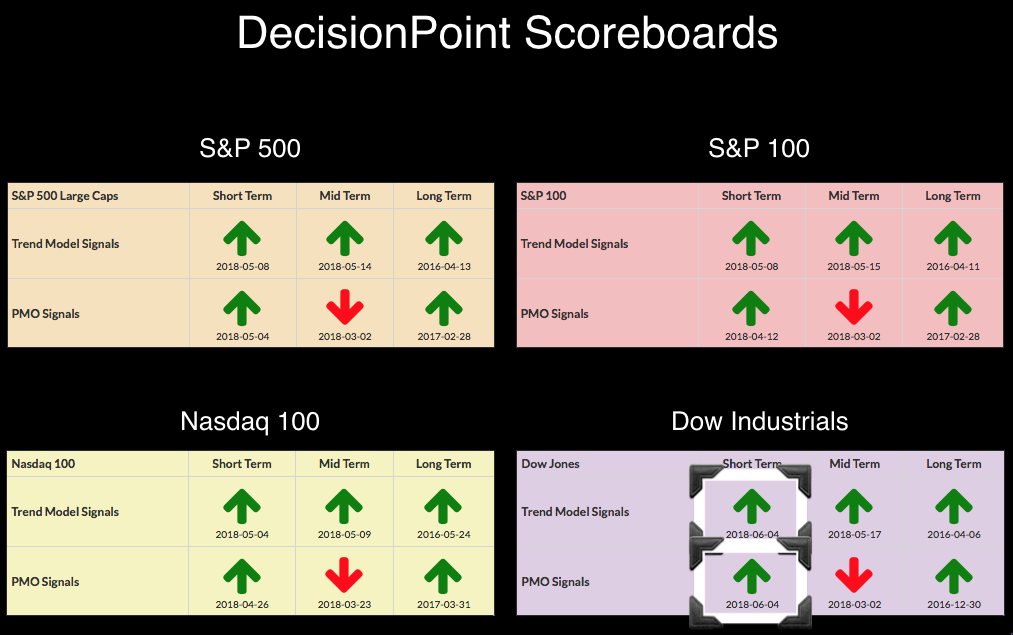

DP Alert: Short-Term Bearish Indicators - Gold Decouples from Dollar

by Erin Swenlin,

Vice President, DecisionPoint.com

The DecisionPoint Scoreboards remain bullish, except for intermediate-term PMO SELL signals. Those should be replaced by BUY signals soon as all four indexes have rising PMOs. In fact, the NDX already has the PMO positive crossover on its weekly chart, it just has to remain by the close on Friday...

READ MORE

MEMBERS ONLY

What Is The Gold Price Telling Us About The Stock Market?

by Martin Pring,

President, Pring Research

* Stocks are rising against gold and that’s bullish

* The long-term trend points to gold under-performing stocks

* Stock/Gold ratio breaks out from a right-angled broadening formation

The price of gold, over the short-term, typically rises and falls on global tensions or lack thereof. Longer-term trends though, are more influenced...

READ MORE

MEMBERS ONLY

Rockwell Automation: A Big Correction, but an Even Bigger Advance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Rockwell Automation reversed its downtrend with a big surge in May, worked off overbought conditions and looks poised to resume its uptrend.

The chart below shows ROK with a high-volume plunge in late April, a high-volume reversal day and a sharp recovery in early May. This recovery extended with high...

READ MORE

MEMBERS ONLY

Bull Market Resumption Awakens The Hibernating Industries; We're Going Higher Folks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 12, 2018

The Dow Jones lost one point yesterday, but our other key indices finished with gains, led higher by the NASDAQ (+0.57%) and small cap Russell 2000 (+0.46%). It was another boring day of bullish action with perhaps one slight negative -...

READ MORE

MEMBERS ONLY

Real Estate Sector SPDR (XLRE) Shows LT New Bullish Bias

by Erin Swenlin,

Vice President, DecisionPoint.com

I have alerts set on my ChartList of sector SPDRs that alert me to Trend Model and PMO signal changes (Check our Support area for directions on how to set these). Today the alarm triggered when the Real Estate SPDR (XLRE) had a Long-Term Trend Model BUY signal. An LT...

READ MORE

MEMBERS ONLY

Distribution

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

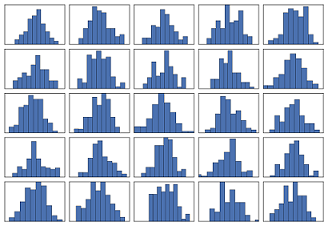

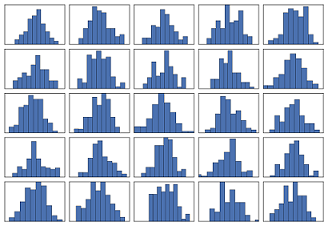

Distribution is the term often referred to as the topping process in the stock market. Before we go any further I want to say this loud and clear: I am not calling a top in the market. As you hopefully know by now I am just a humble trend follower....

READ MORE

MEMBERS ONLY

Technology sector rotating back to leading while Discretionary/Staples spread widens further

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

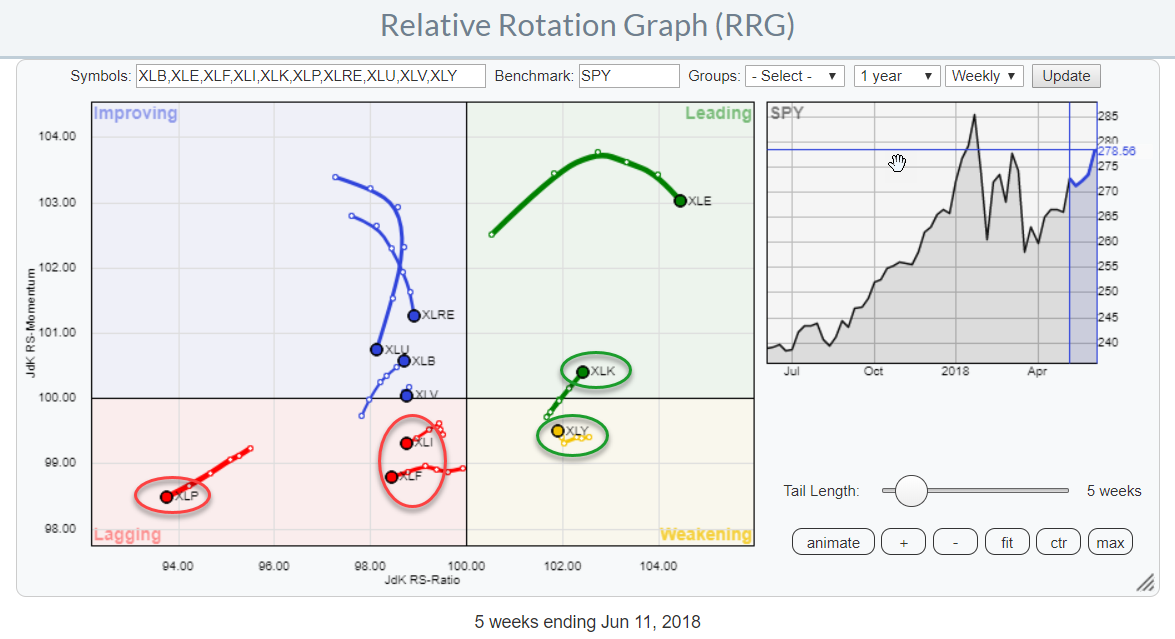

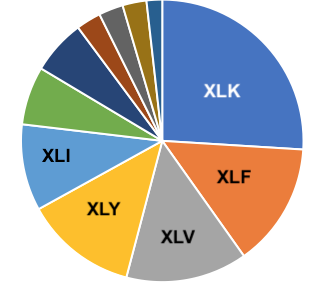

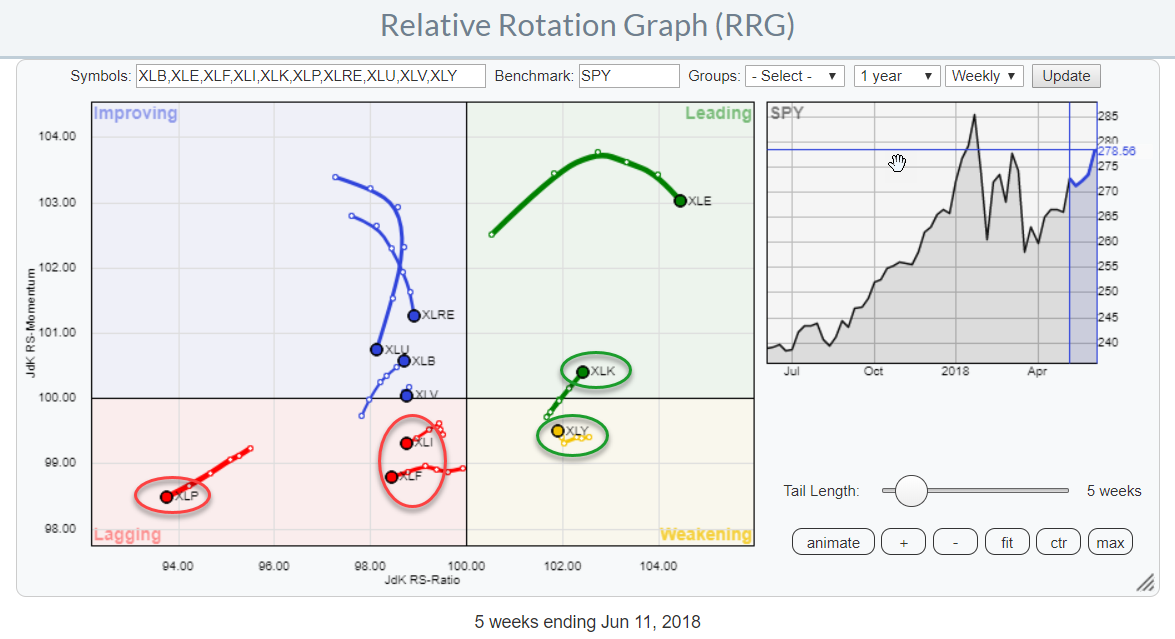

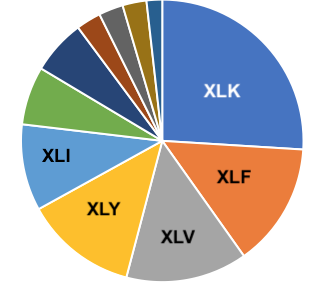

The Relative Rotation Graph shows the rotation of the ten S&P 500 sector ETFs (SPDR family) against the S&P 500 index ETF (SPY).

The rotation of the technology sector (XLK) back into the leading quadrant after a short period of rotation through the weakening quadrant is...

READ MORE

MEMBERS ONLY

On Trend Preview - Finance Sector and Big Banks Lag as Fed Looms

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

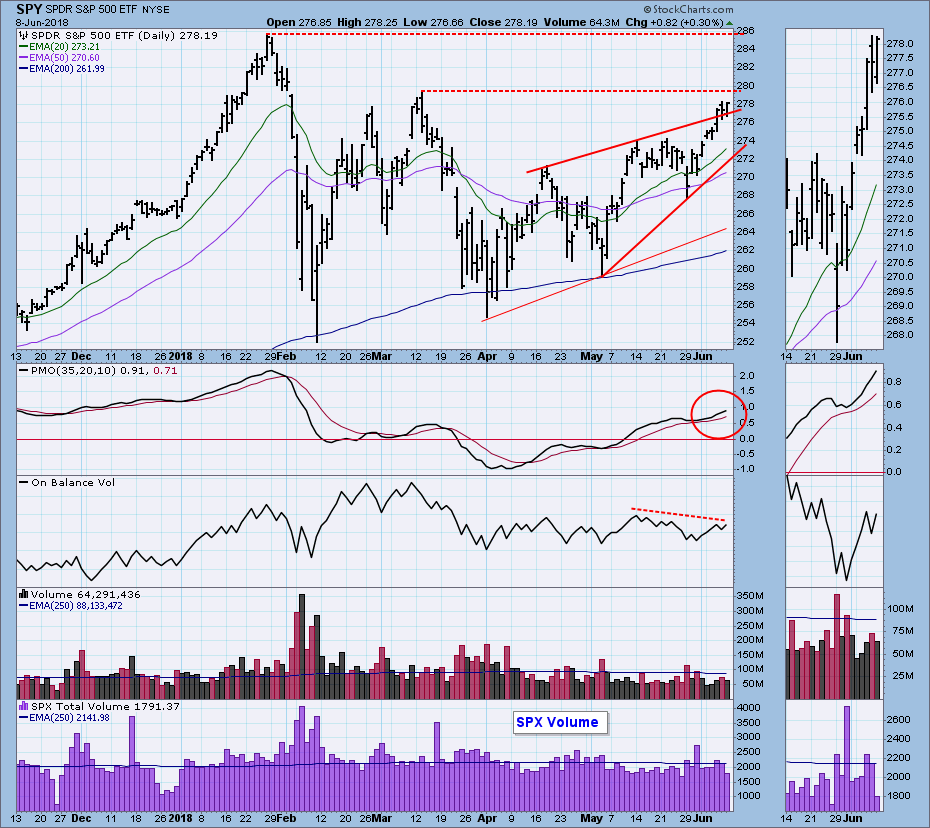

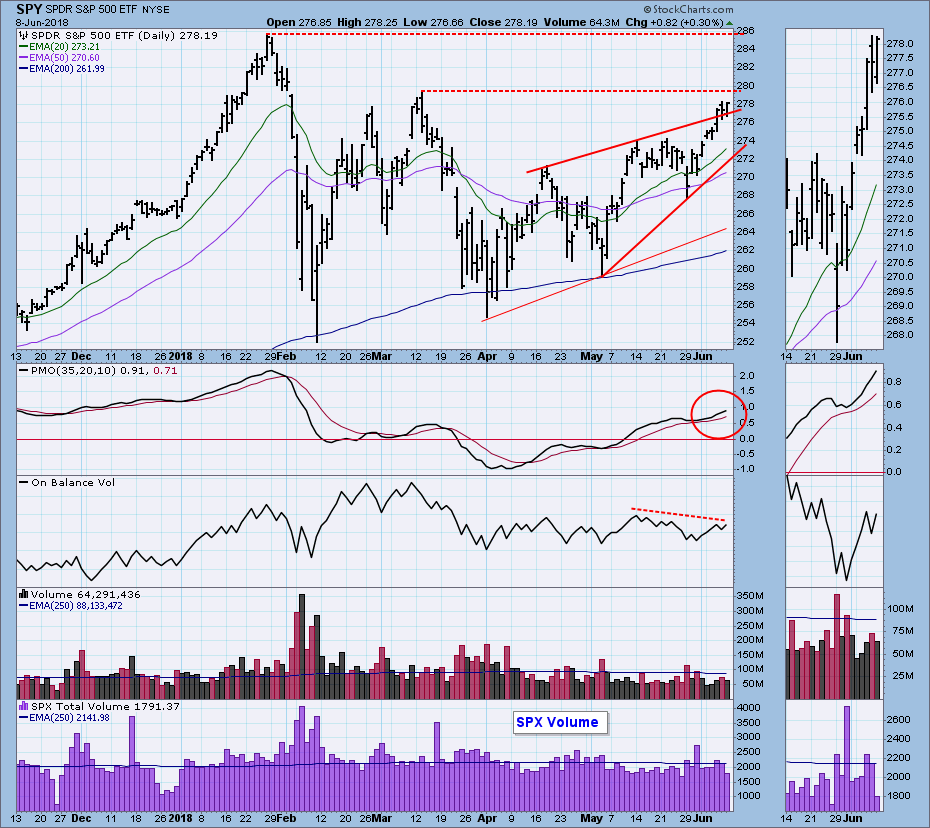

* Two Breakout Zones to Watch on SPY.

* On Trend Preview.

* TLT Affirms Resistance.

* Banks and Utilities Cue off Bond Market.

* Finance Sector and Big Banks Continue to Lag.

* Aetna Breaks Out of Bull Flag.

* Questions, Comments or Feedback?

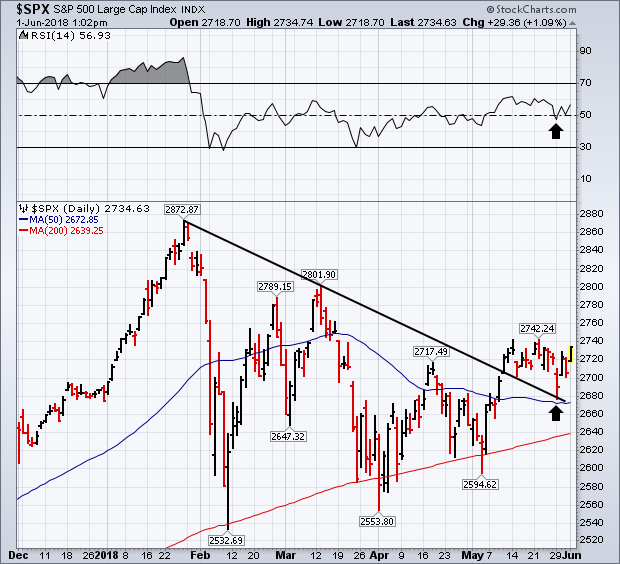

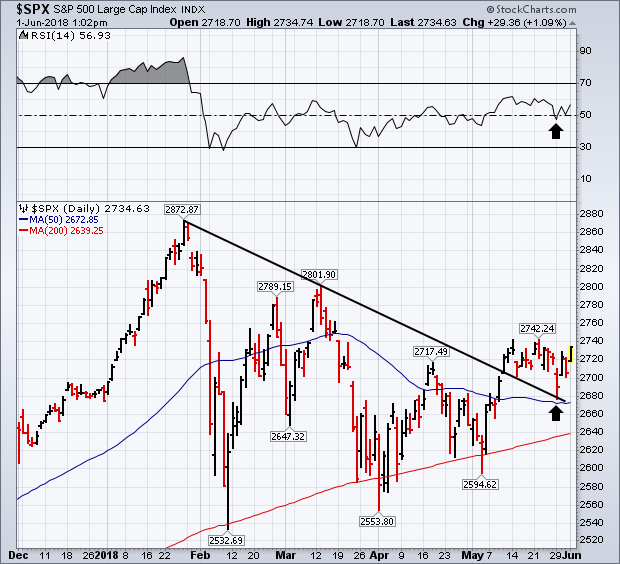

Two Zones to Watch on SPY

...The S&P 500 SPDR...

READ MORE

MEMBERS ONLY

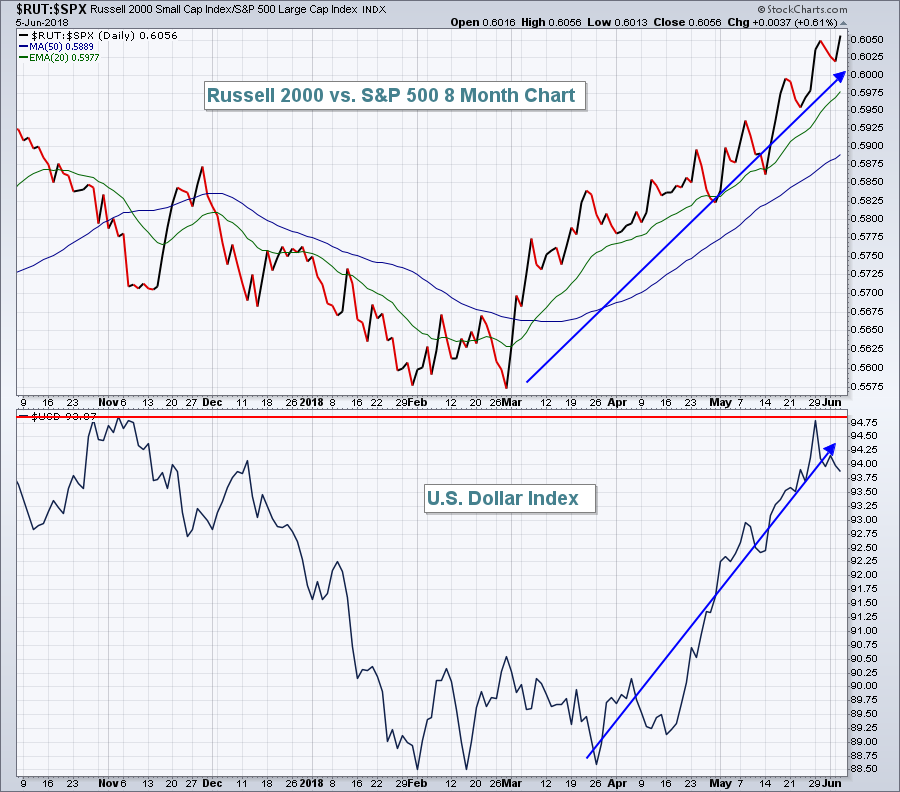

Expect Small Caps To Continue To Provide Leadership

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 11, 2018

U.S indices finished with across-the-board gains on Monday despite a final 30 minute selloff that saw the Dow Jones trim a 70 point gain down to just 5 points. Still, stocks managed to start the week with minor gains ahead of a...

READ MORE

MEMBERS ONLY

NYSE Breakout Is Supported By Eight Sectors

by Martin Pring,

President, Pring Research

* NYSE breakout

* Multi-sector breakouts

* Green shoots coming through for Europe and emerging markets

NYSE breakout

Monday’s action has seen the NYSE Composite, the $NYA complete a 4-month reverse head and shoulders pattern. If that breakout holds, and there are few grounds for suspecting that it won’t, it’s...

READ MORE

MEMBERS ONLY

DOW TRANSPORTS RESUME UPTREND -- WHILE UTILITIES CONTINUE TO WEAKEN -- TRANSPORTATION/UTILITIES RATIO RISES TO NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTS REACH FIVE-MONTH HIGH -- WHILE UTILITIES FALL ... The Dow Industrials exceeded their May high last week to reach the highest level in three months. And are higher again today. But today it's the transports' turn to lead the Dow family of stocks higher. Chart 1 shows...

READ MORE

MEMBERS ONLY

A Classic Continuation Pattern Takes Shape in Danaher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Danaher (DHR) is a conglomerate that is the 15th largest component (1.91%) of the Health Care SPDR (XLV) and the 5th largest component (5.43%) of the Medical Devices ETF (IHI). XLV broke out last week and IHI has been leading for some time. The stock is also looking...

READ MORE

MEMBERS ONLY

Wall Street Ends Week With Gains, Home Construction Leads

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 8, 2018

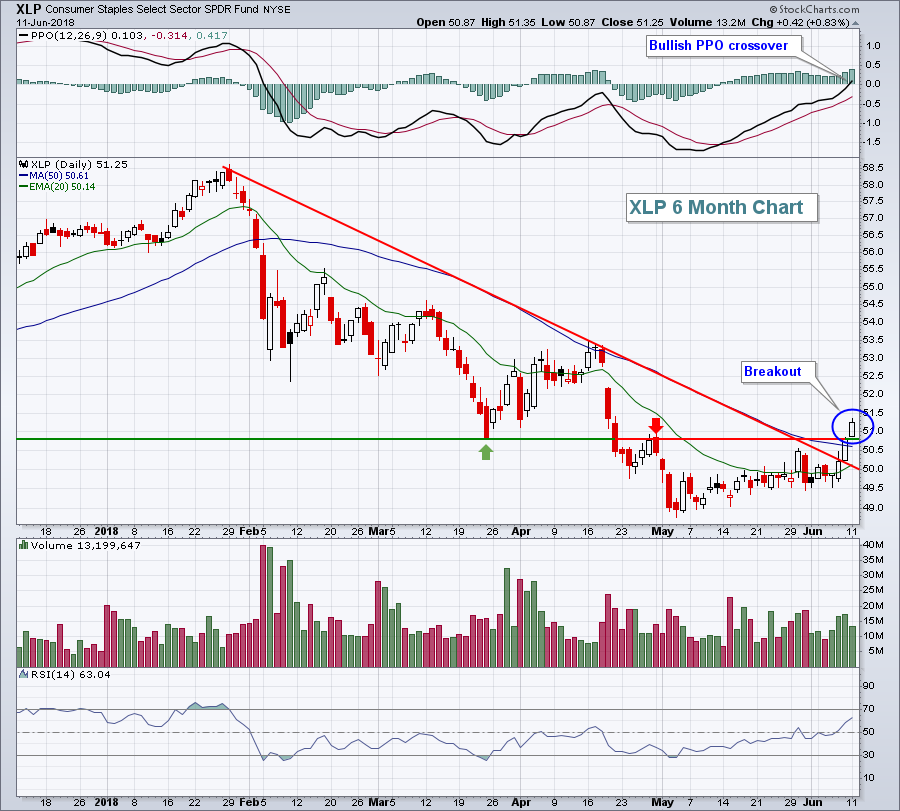

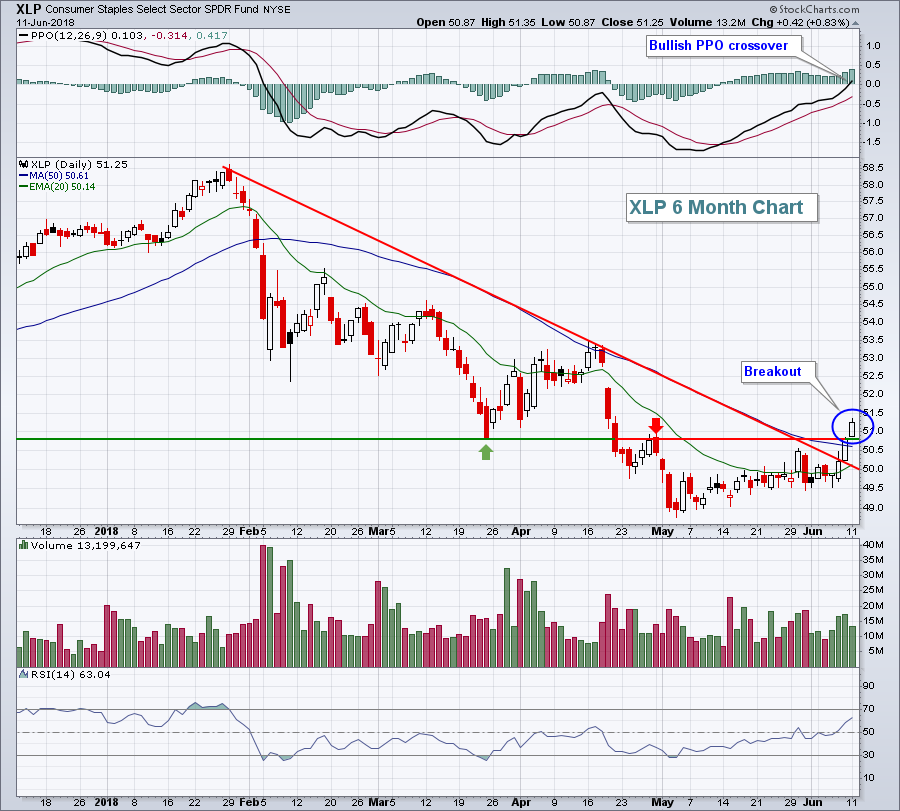

In a rare development, consumer staples (XLP, +1.23%) led Wall Street higher on Friday. Over the past three months, the XLP has fallen 5.78% and no other sector is close to consumer staples' ineptitude. The XLP has been the shunned...

READ MORE

MEMBERS ONLY

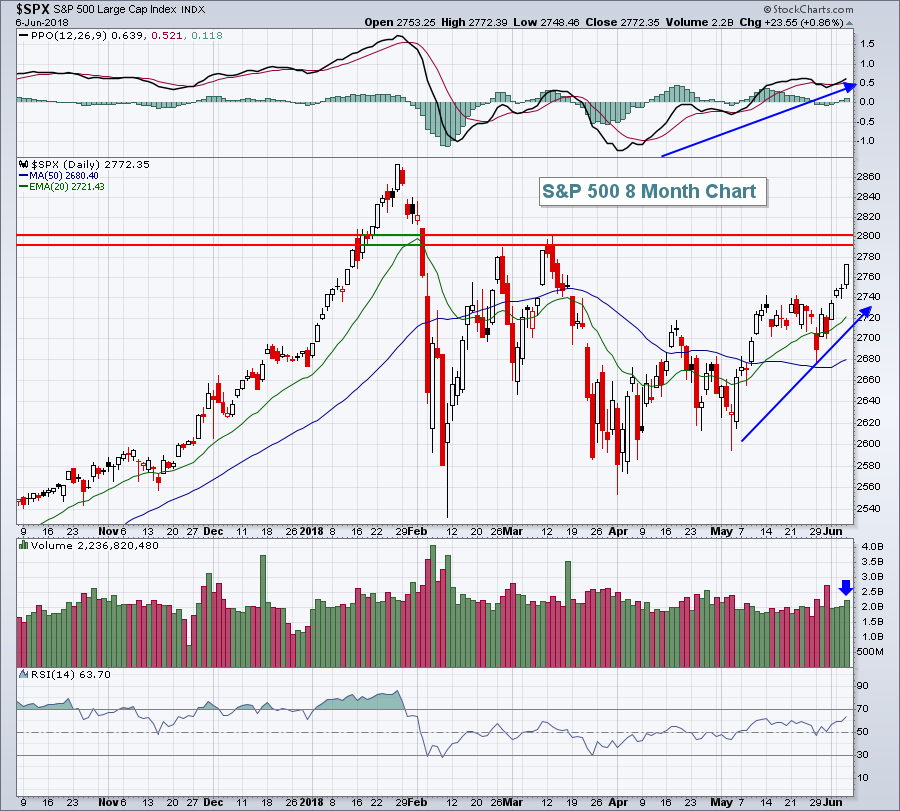

DP Weekly Wrap: Market Approaching Overhead Resistance

by Carl Swenlin,

President and Founder, DecisionPoint.com

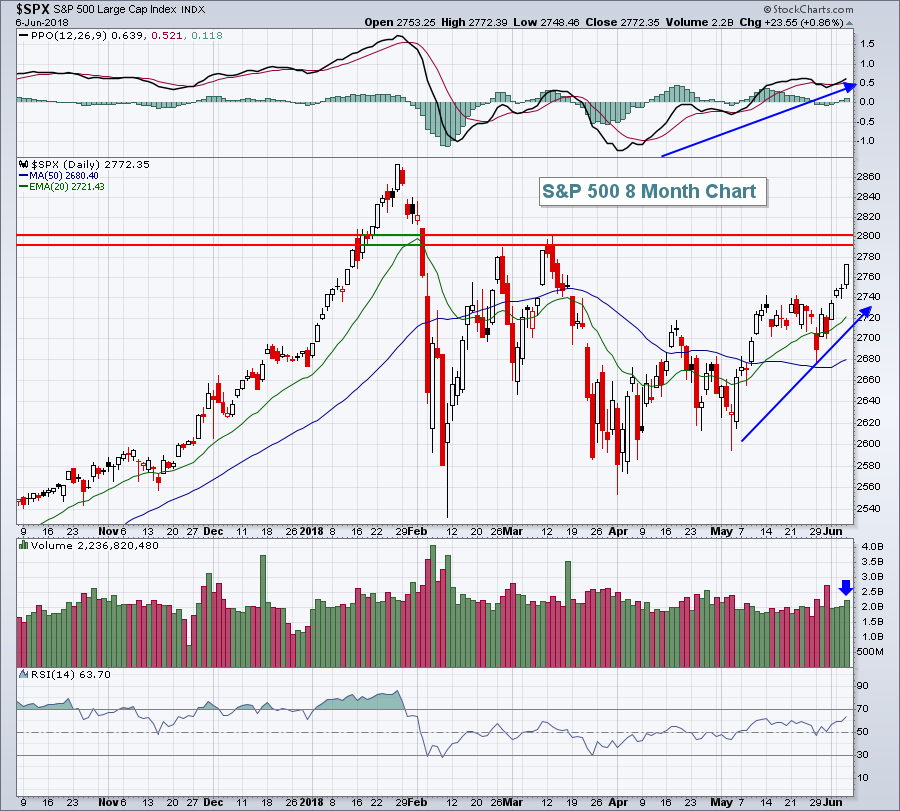

Rising wedge formations normally resolve downward, but sometimes they don't. While I was expecting the normal bearish resolution of the current rising wedge, the market wasn't having it, and it pressed higher for a breakout on Wednesday. There has been no follow through yet, but price...

READ MORE

MEMBERS ONLY

HEALTHCARE SPDR TURNS UP -- PHARMA IS LEADING -- PHARMACEUTICALS SPDR REACHES THREE-MONTH HIGH -- PHARMA LEADERS ARE ABBOTT LABS, LILLY, AND PFIZER -- ZOETIS HITS NEW RECORD -- SOME MONEY MAY BE ROTATING FROM TECHS INTO CHEAPER DRUG STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE SPDR TURNS UP... Last Friday's message suggested that the healthcare sector appeared to be basing. But it needed a close over its April/May highs to turn its trend from "sideways" to "up". Chart 1 shows the Health Care SPDR (XLV) exceeding those...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook (with Video) - Strong, but Getting Frothy

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Strong, but Getting Frothy.

* S&P 500 High-Low Percent Exceeds 10%.

* S&P 500 Extends Breakout.

* QQQ and IJR Hit New Highs.

* Two New Highs and Two Breakouts.

* Sector SPDRs Mask Strength Within.

* Setting Resistance for Treasury Bond ETFs.

* A Mean-Reversion Setup in Oil.

* Notes from the Art&...

READ MORE

MEMBERS ONLY

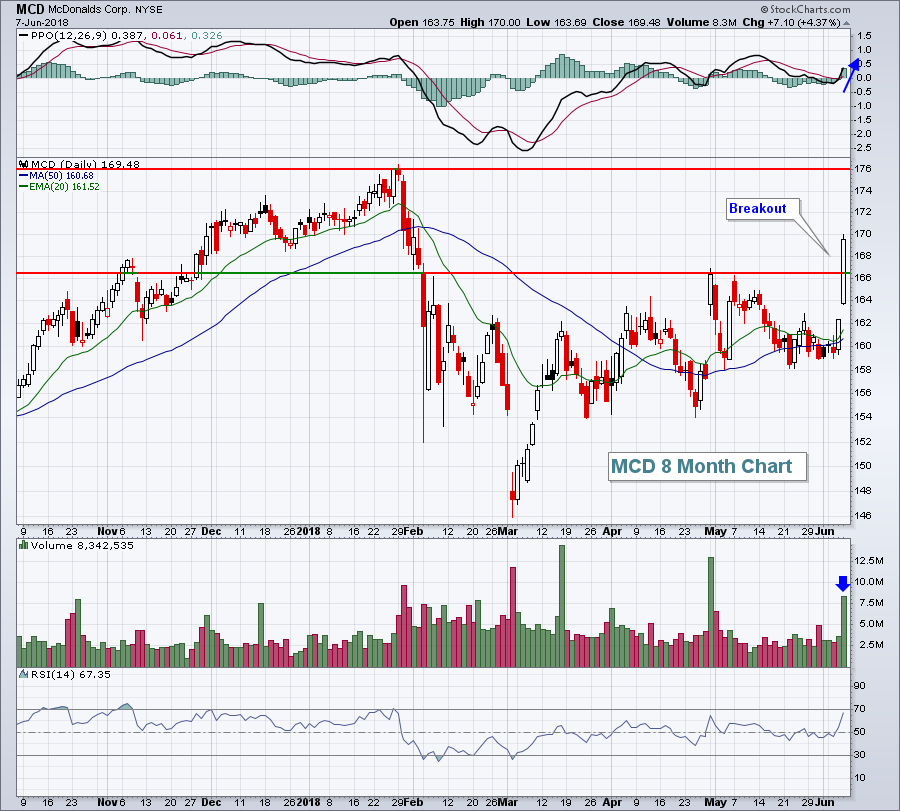

Dow Jones Leads Bifurcated Market; McDonalds Soars On Announced Layoffs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 7, 2018

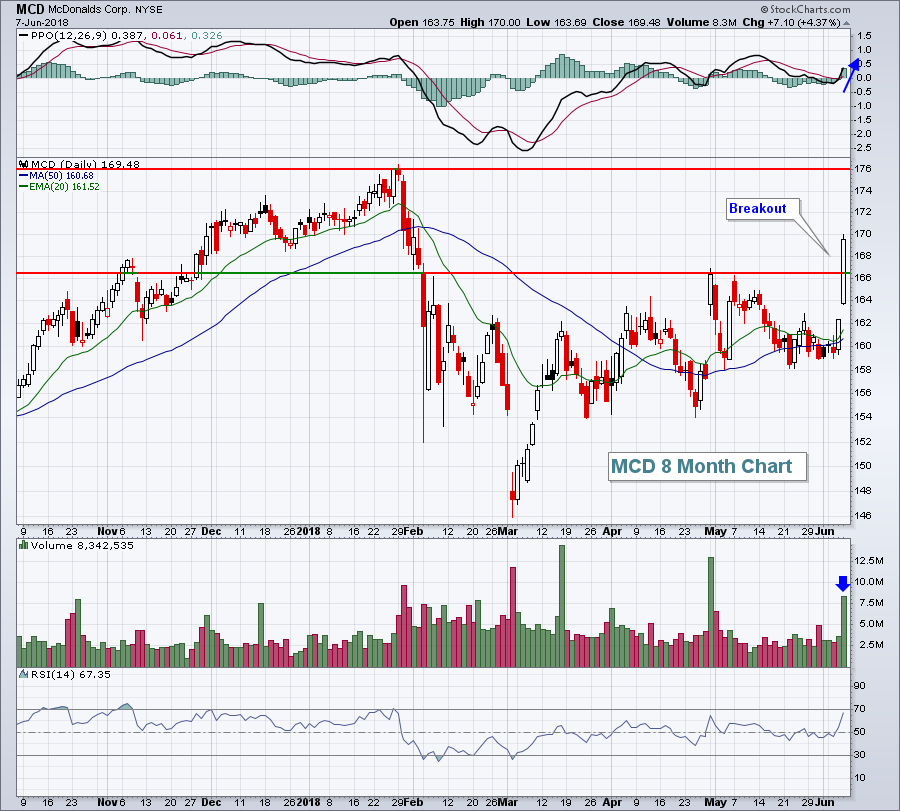

The Dow Jones gained 95 points, extending its recent rally, on the strength of McDonalds Corp (MCD) and Chevron Corp (CVX). MCD announced layoffs and Wall Street cheered the likely improvement to its bottom line by sending MCD higher by 4.37%:

MCD...

READ MORE

MEMBERS ONLY

EURO CONTINUES TO REBOUND FROM IMPORTANT CHART SUPPORT -- IT'S BEING SUPPORTED BY RISING EUROZONE BOND YIELDS -- A WEAKER DOLLAR MAY BE GIVING A BOOST TO COPPER AND OIL -- ENERGY IS DAY'S STRONGEST SECTOR

by John Murphy,

Chief Technical Analyst, StockCharts.com

EURO CONTINUES TO REBOUND FROM IMPORTANT CHART SUPPORT ... Global stocks fell on Tuesday May 29 on concerns that a new election in Italy might provide a threat to the eurozone. My message on the following day (May 30) wrote about global stocks starting to recover from that scare. Included in...

READ MORE

MEMBERS ONLY

Materials And Financials Lead Strong Rally; Tesla Breaks Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 6, 2018

It was another solid bull market rally on Wall Street on Wednesday, this time with the Dow Jones conglomerates leading the action. The Dow Jones Industrial Average gained 346 points, or 1.40%, topping 25,000 and closing at its highest level since...

READ MORE

MEMBERS ONLY

The Bull Market Broadens - XLI Breaks Out, Healthcare Perks Up and Financials Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* The Big Drivers in the S&P 500.

* Industrials SPDR Breaks Out of Massive Wedge.

* Boeing Leads XLI with New High.

* Healthcare Holds Support and Breaks Out.

* Blame J&J and Celgene.

* Pfizer, Merck and Amgen hold Breakouts.

* XLF Remains within Corrective Pattern.

* Questions, Comments or Feedback?

Large-caps...

READ MORE

MEMBERS ONLY

DP Alert: Indicators Bullish, But Beware Very Short-Term Buying Exhaustion

by Erin Swenlin,

Vice President, DecisionPoint.com

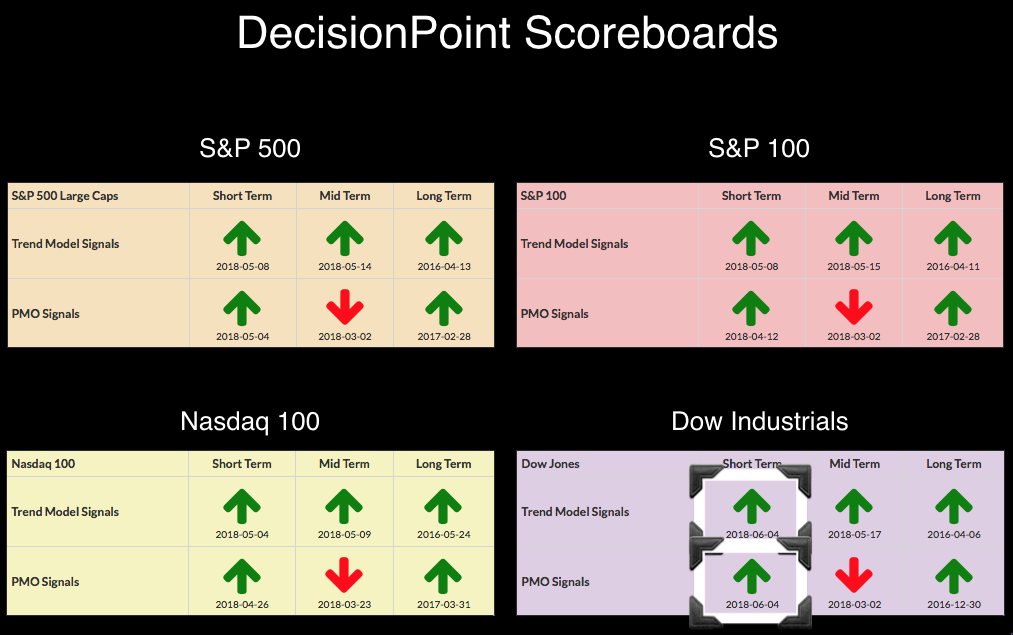

So far this week, we had only two signal changes. The Dow moved from ST Trend Model Neutral and ST PMO SELL back to BUY signals after only a few days. The only area of concern for these Scoreboards is the IT PMO SELL signals which are found on the...

READ MORE

MEMBERS ONLY

CONSUMER CYCLICALS SPDR TESTS JANUARY HIGH -- HEALTHCARE SPDR NEARS AN UPSIDE BREAKOUT -- FINANCIALS ARE BOUNCING OFF 200-DAY AVERAGE AND LEADING TODAY'S RALLY -- GROWTH STOCKS CONTINUE TO OUTPACE VALUE

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER CYCLICALS NEAR NEW RECORD ... My message from Thursday, May 24 wrote about consumer cyclical stocks continuing to show relative strength. That earlier message attributed that mostly to strong leadership from apparel retailers. That's been the story again this week with retailers continuing to rally. Chart 1 shows...

READ MORE

MEMBERS ONLY

Oil Hits Potential Reversal Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Oil fell rather sharply over the last two weeks, but the long-term trend is up and two technical indicators point to a bounce.

The chart below shows the USO Oil Fund (USO) in the top window, RSI for USO in the middle and the Light Crude Continuous Contract ($WTIC) in...

READ MORE

MEMBERS ONLY

Retail And Small Cap Industrials Helping To Feed This Bull Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 5, 2018

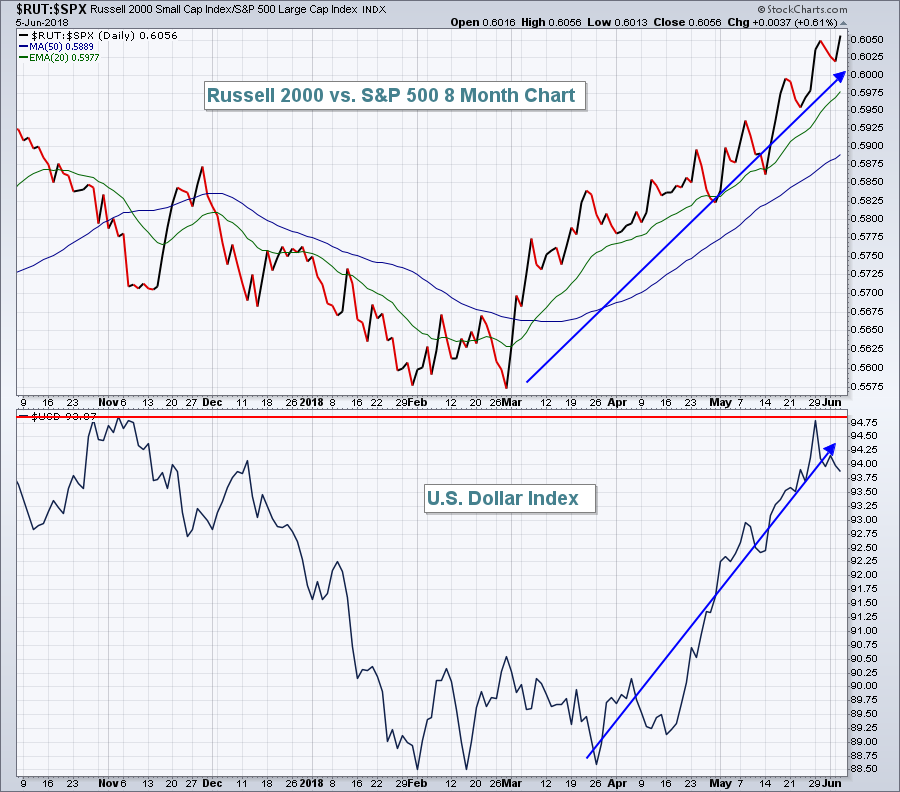

It's the perfect storm. Technology (XLK, +0.35%) sets another all-time high record close to lead the NASDAQ to the same. Strengthening economic conditions are creating a higher interest rate environment. That means money rotates from bonds to stocks. The dollar...

READ MORE

MEMBERS ONLY

Dow Whipsaws Back to Short-Term BUY Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

After yesterday's strong rally, the Dow managed to drop its bearish signals and collect two BUY signals in the short term. Today, the Dow was down slightly, but it didn't affect these signals which remained after the close. The indicators for the Dow are looking healthy...

READ MORE

MEMBERS ONLY

Consumer Stocks Roll; NASDAQ Breaks 7600

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 4, 2018

Consumer stocks - discretionary (XLY, +1.12%) and staples (XLP, +0.83%) - led Wall Street higher on Monday, especially the NASDAQ, which closed above 7600 for the first time in its history. The highest candle body on the NASDAQ, however, is at...

READ MORE

MEMBERS ONLY

On Trend Preview - AD Lines Hit New Highs, New Highs Expand in Two Key Sectors and Stocks to Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Expect Trends to Continue, Not Reverse.

* Broad Market AD Lines Record New Highs.

* 52-week Highs Expand in Two Key Sectors.

* Retail Propels Consumer Discretionary Sector.

* Copper and COPX Bounce off Support (plus PALL).

* Stocks to Watch.

This is a preview for today's show, On Trend. This show airs...

READ MORE

MEMBERS ONLY

Market Round Up June 2018

by Martin Pring,

President, Pring Research

Here is the link for the June 2018 Market Round Up.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

Equities At A Make-Or-Break Level What To Look Out For

by Martin Pring,

President, Pring Research

* CPI adjusted S&P is just above a long-term make-or-break point

* The rest of the world is at the brink

* US market looks stronger

CPI Adjusted S&P is just above a long-term make-or-break point

Last week I pointed out that US equities were experiencing a marginal upside...

READ MORE

MEMBERS ONLY

Strong Jobs Report Powers NASDAQ To Near Record Close

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 1, 2018

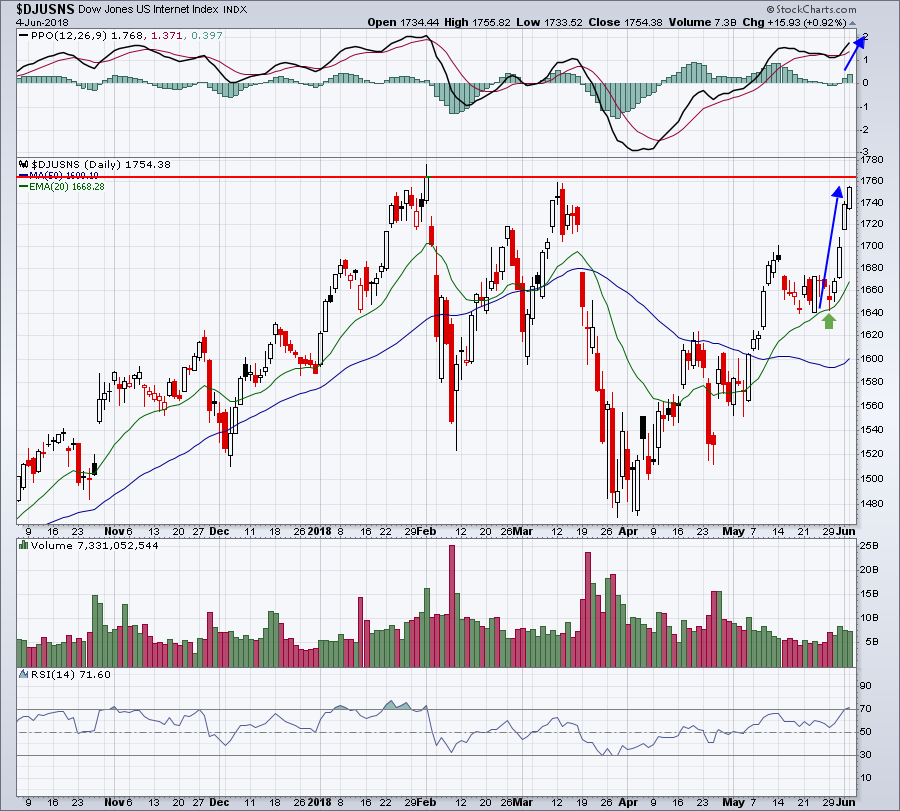

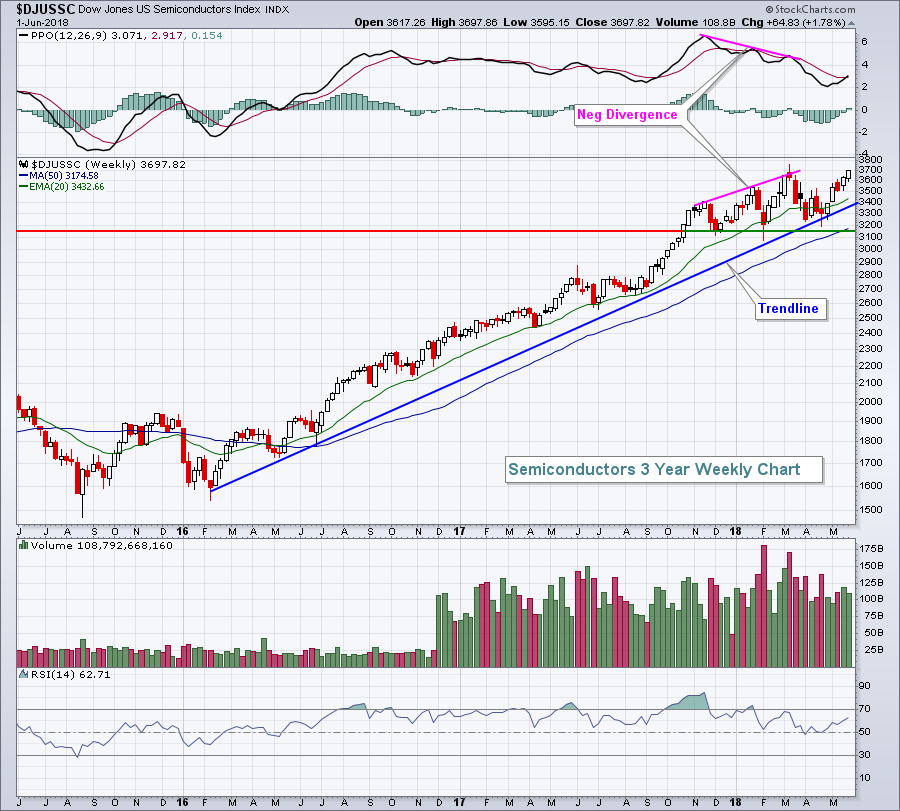

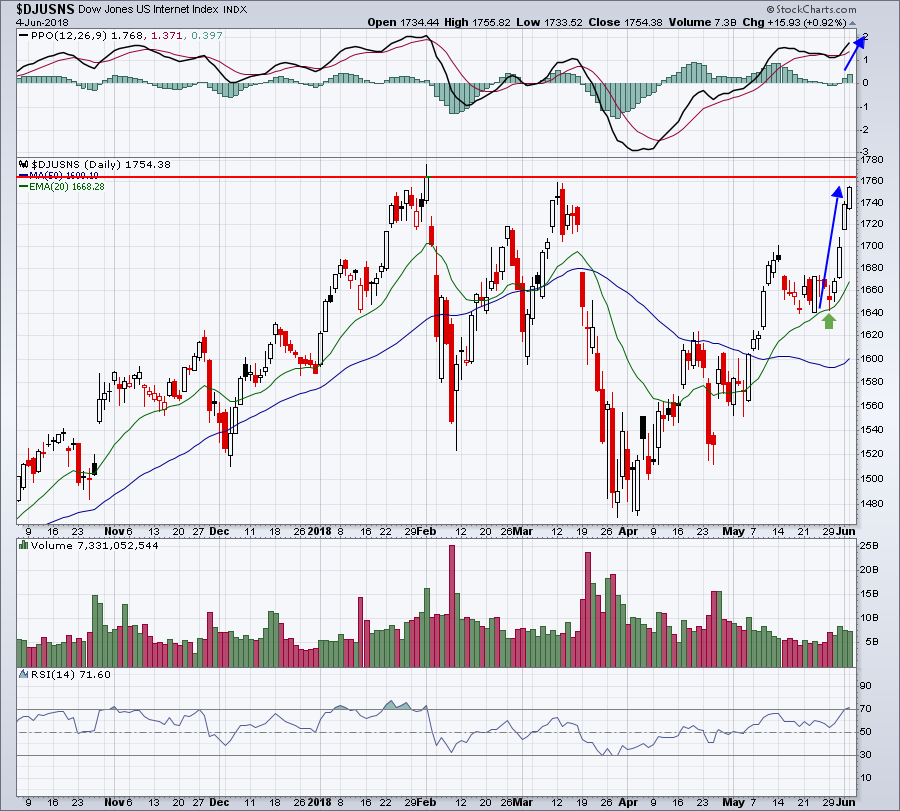

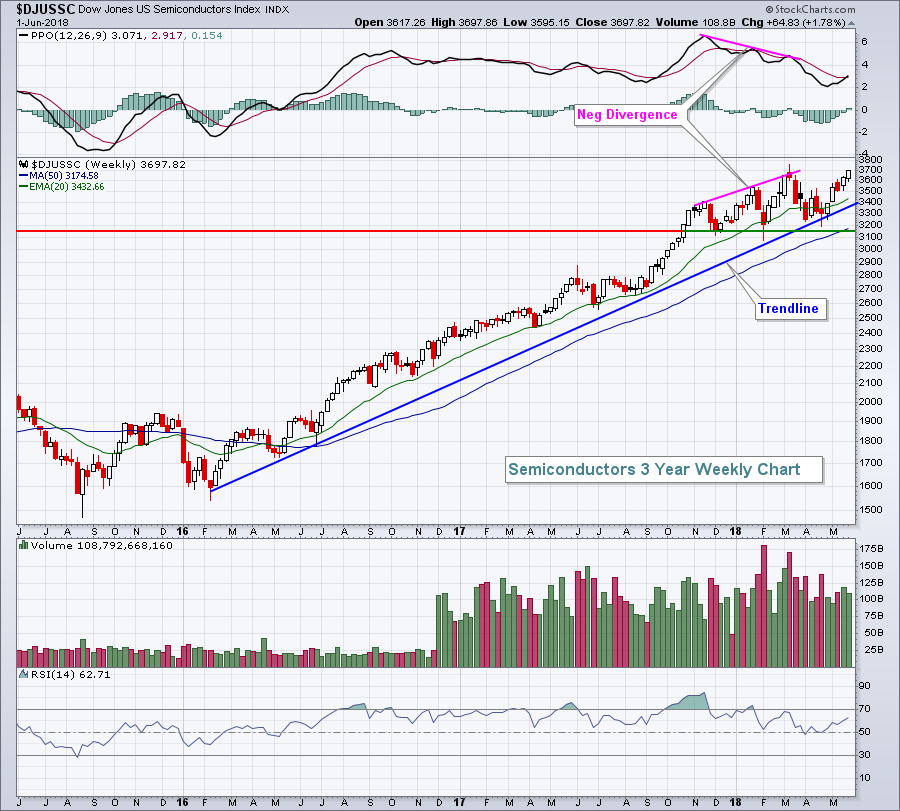

Technology (XLK, +1.70%) and materials (XLB, +1.53%) led Wall Street higher on Friday after the May nonfarm payrolls beat expectations, providing a lift for those anticipating further economic strength in the months ahead. Semiconductors ($DJUSSC, +2.42%) and internet stocks ($DJUSNS,...

READ MORE

MEMBERS ONLY

Apple Breakout Could Lift these Two Suppliers

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Apple (AAPL) broke out of a pennant formation with a surge on Friday and this breakout could bode well for Qorvo (QRVO) and Skyworks (SKWS).

The first chart shows Qorvo surging over 20% and then stalling with a contracting consolidation. This is a pennant and it is a bullish continuation...

READ MORE

MEMBERS ONLY

Two Key Sectors to Watch this Week - And Lots of Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Broad Strength in the Nasdaq 100.

* Nvdia and Netflix Lead the Top 10.

* Google Gets its Mojo Back.

* Lots of Bull Flags within XLI.

* Merck and Pfizer Break Out of Triangles.

* Questions, Comments or Feedback?

The Nasdaq 100 and big techs led the market higher in 2017 and they continue...

READ MORE

MEMBERS ONLY

BankRoll

by Bruce Fraser,

Industry-leading "Wyckoffian"

Bank stocks are telling an interesting tale. As Wyckoffians we interpret the story the market is telling through the action of the tape. Banks are at the hub of the wheel of the economy. These financial institutions continually inject or remove liquidity from the economy through their operations. It has...

READ MORE

MEMBERS ONLY

Strong Jobs Report Boosts Stocks, While S&P 500 Nears May High

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editors Note: This article was originally published in John Murphy's Market Message on Friday, June 1st at 1:19pm EST.

A stronger than expected jobs report for May is giving a boost to stocks today. So is the fact that European stocks are rising (as well as Italy&...

READ MORE

MEMBERS ONLY

Why We Emphasize Honoring Stops - A MUST Read

by John Hopkins,

President and Co-founder, EarningsBeats.com

At EarningsBeats we issue long/short trade alerts on companies that beat/miss earnings expectations. When we issue a trade alert we include entry price, target price and stop loss. Stop losses are based upon key technical or price support, so they matter.

We continuously emphasize the importance of honoring...

READ MORE

MEMBERS ONLY

The Stock Market Will Go Much Higher And Its Strength Will Be Shocking

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

While many market pundits seemed to grow very concerned about the 10 year treasury yield ($TNX) rising to 7 year highs at its recent 3.11% peak, I only grow nervous when the TNX falls. Why? Well, rising rates are typically a precursor to economic strength. The S&P...

READ MORE

MEMBERS ONLY

S&P 500 Gets Third Bullish Breadth Thrust

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There were eight breadth thrusts in the month of May and seven of these were bullish (>70%). In particular, there were three bullish breadth thrusts last week. These strong readings show broad participation and give the bulls the edge going forward.

Chartists can measure daily breadth by using the...

READ MORE

MEMBERS ONLY

Combining Relative Rotation Graphs and the "Turtle Soup" setup

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On Monday 21 and Tuesday 22 May I stepped in for Erin Swenlin and acted as the co-host to Tom Bowley in the Market Watchers Live show. Clearly, we talked a lot about RRGs but as MWL is not all about RRG I wanted to bring something different to the...

READ MORE

MEMBERS ONLY

Market Roundup Live May 2018

by Martin Pring,

President, Pring Research

This is the Market Roundup for May 2018.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE