MEMBERS ONLY

Will Today's Earnings-Related Gap Higher Break Through Key Resistance?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, April 25, 2018

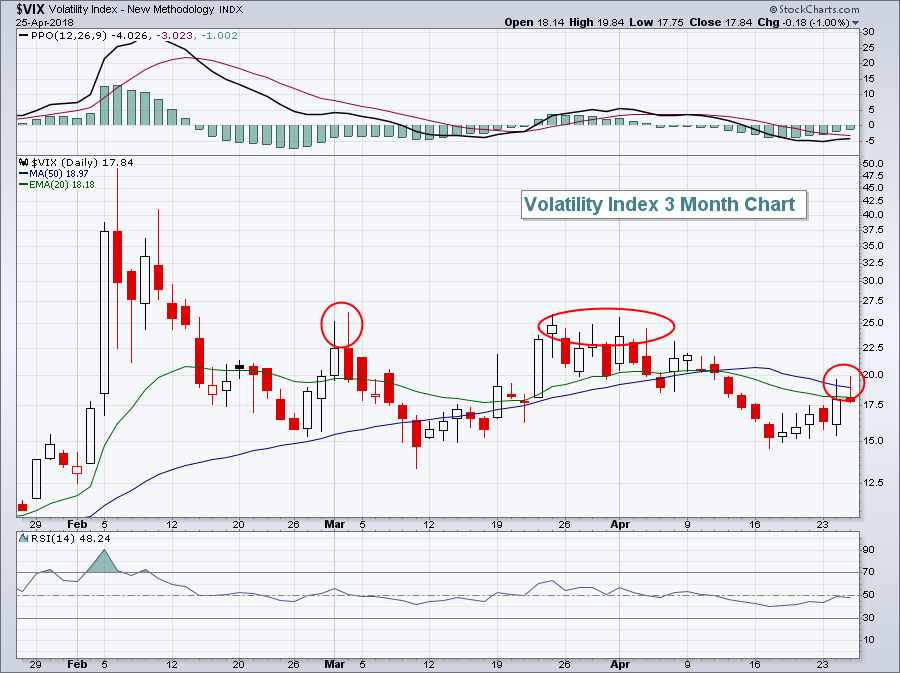

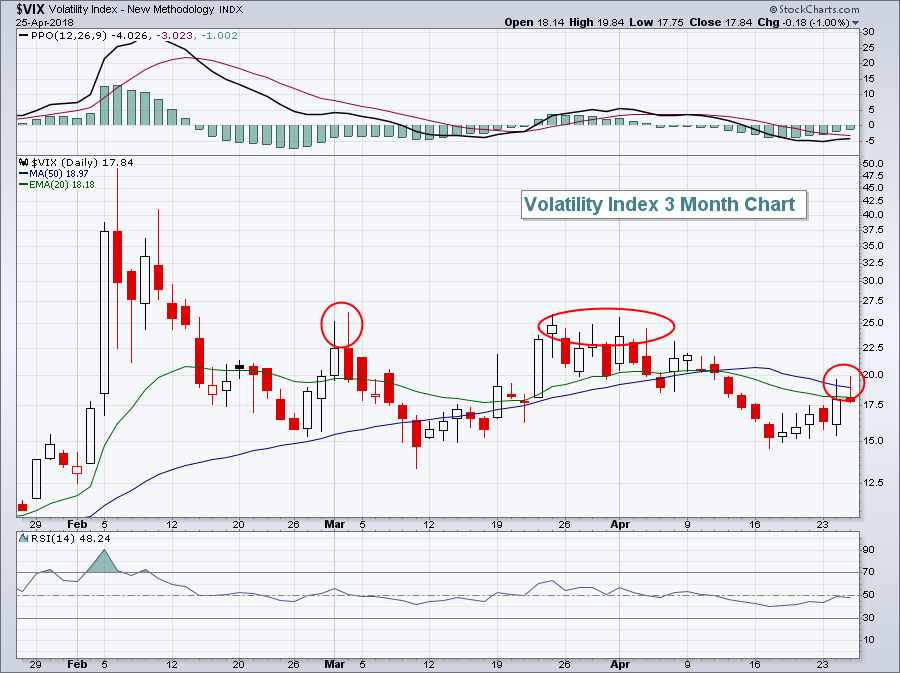

Wall Street was able to find equity buyers yesterday, despite the 10 year treasury yield's ($TNX) first close above 3.00% since 2014. The Volatility Index ($VIX) settled back down after approaching 20 for the second consecutive day. It has closed...

READ MORE

MEMBERS ONLY

Sector Splits Divide Broader Market - Plus Banks, Energy-Related ETFs, Telcos and Four Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* SPY Tests Upswing Support.

* Finance Sector Holds Up Best.

* Two Down and Three to Go.

* KRE Still Looking Positive.

* Bullish Continuation Patterns in Energy-Related ETFs.

* A Few Telcos Come Alive.

* Four Stocks to Watch.

SPY Tests Upswing Support...

I marked upswing support for the S&P 500 SPDR (SPY)...

READ MORE

MEMBERS ONLY

Who's Afraid Of The Big Bad 3%?

by Martin Pring,

President, Pring Research

* Technical position for yields still looks bullish

* International rates look higher

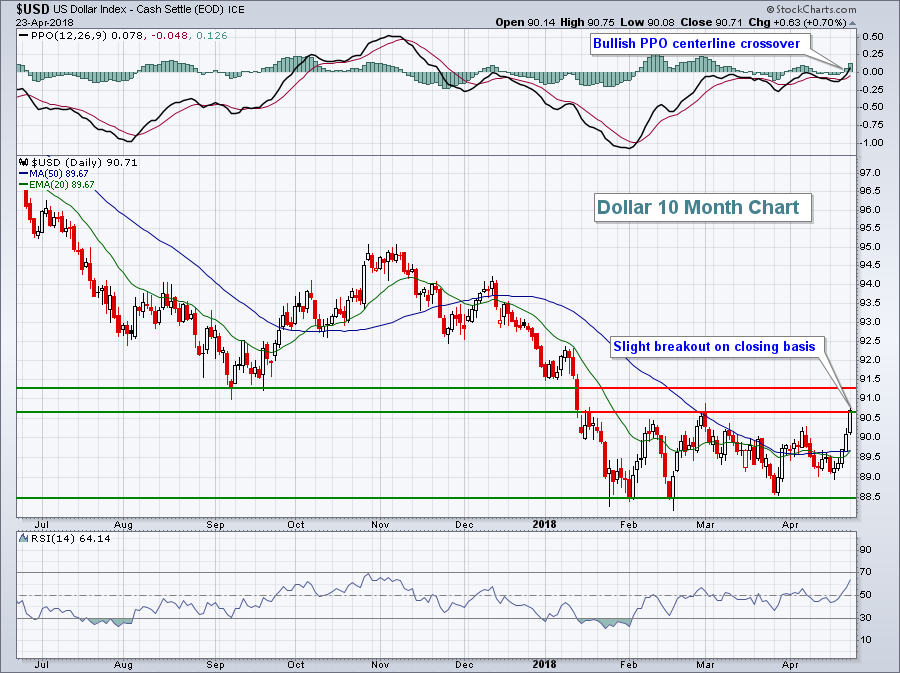

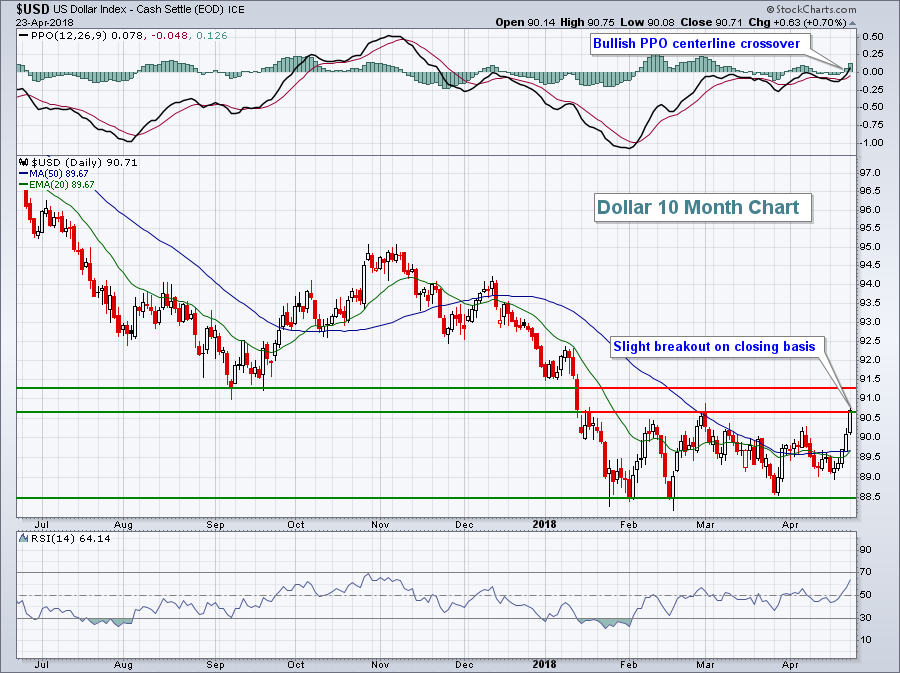

* Dollar breaks out, but will it hold?

* Finely balanced Gold picture needs some guidance from the Dollar

If you have punched up the symbol $TNX, you will know that the 10-year yield has recently hit 3%. Chances are that...

READ MORE

MEMBERS ONLY

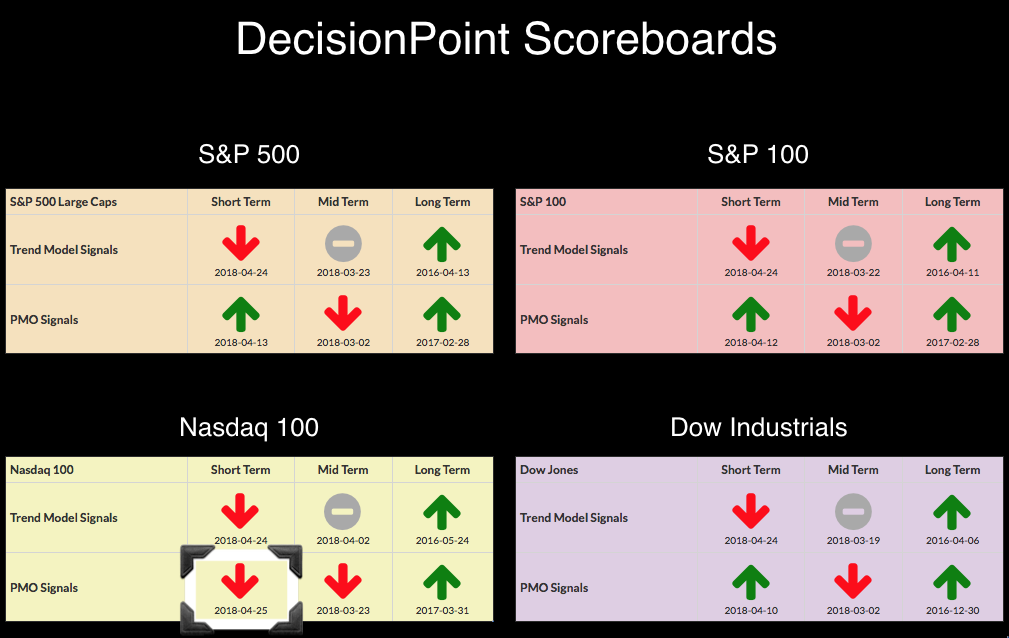

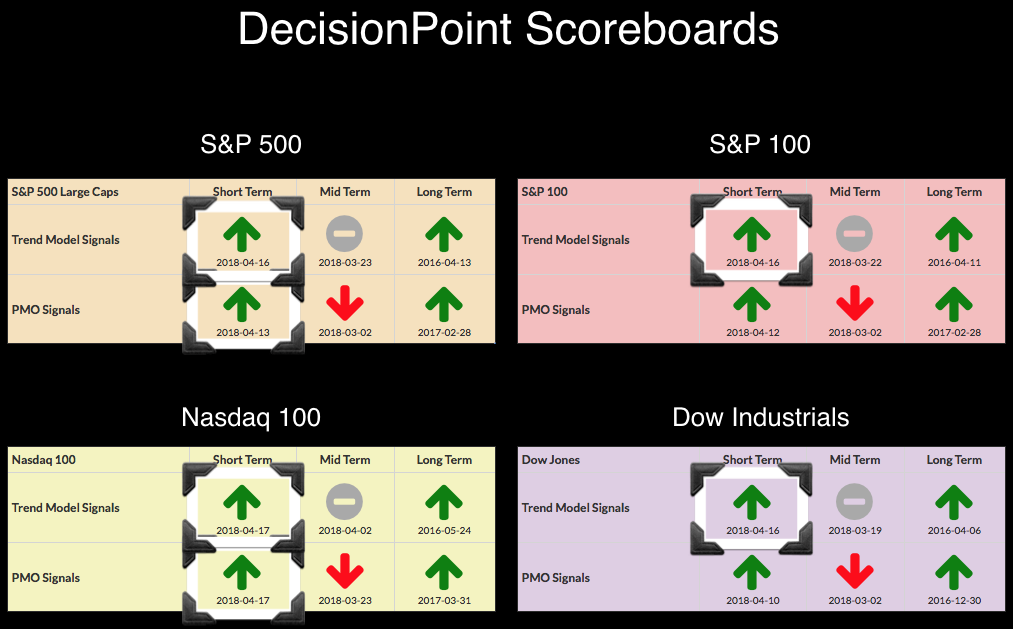

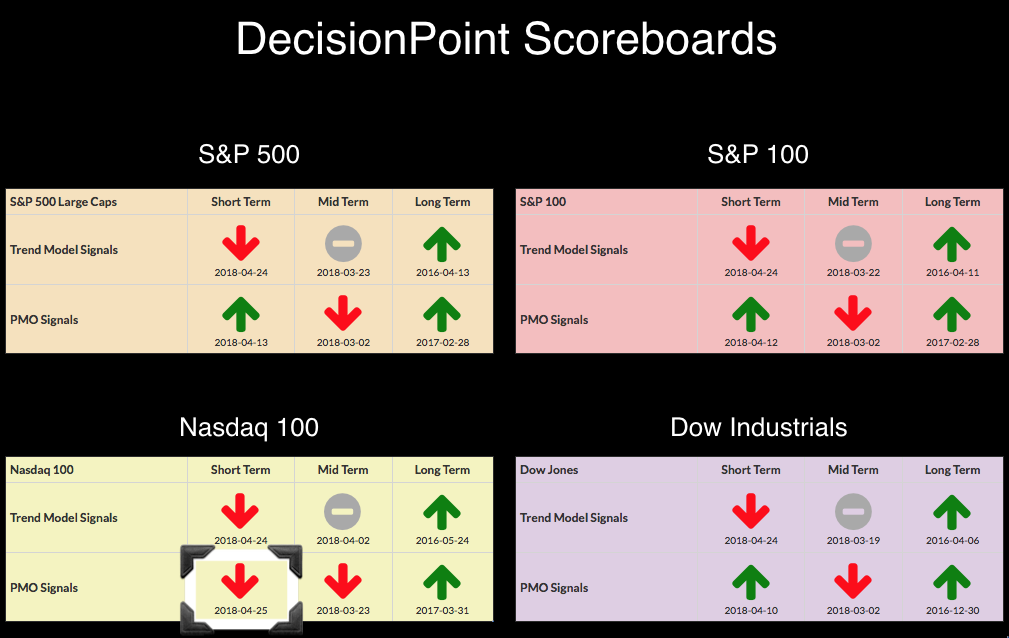

DP Bulletin #2: NDX Logs New PMO SELL Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

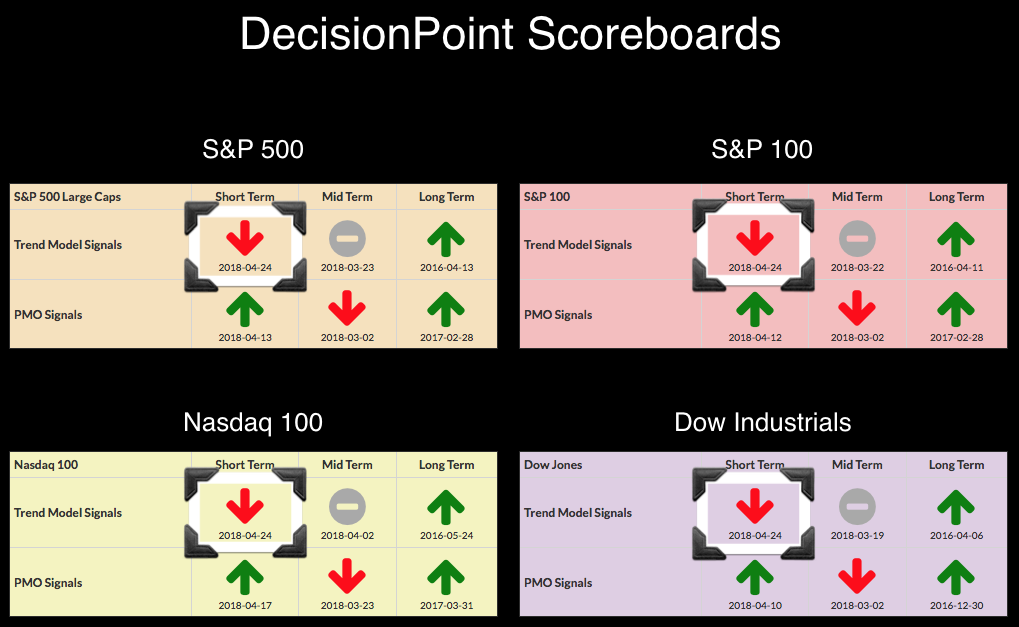

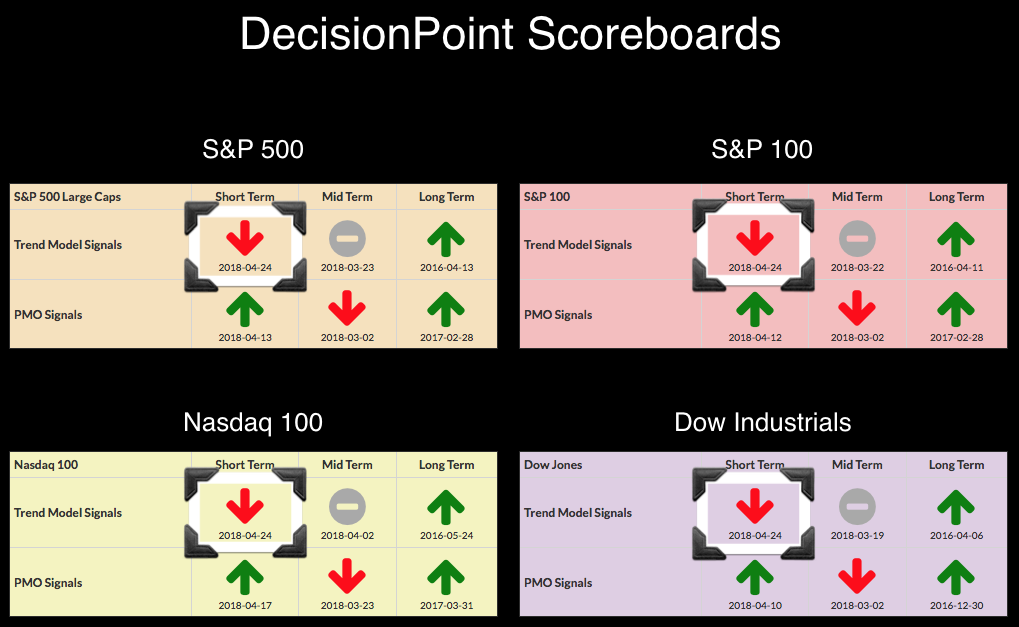

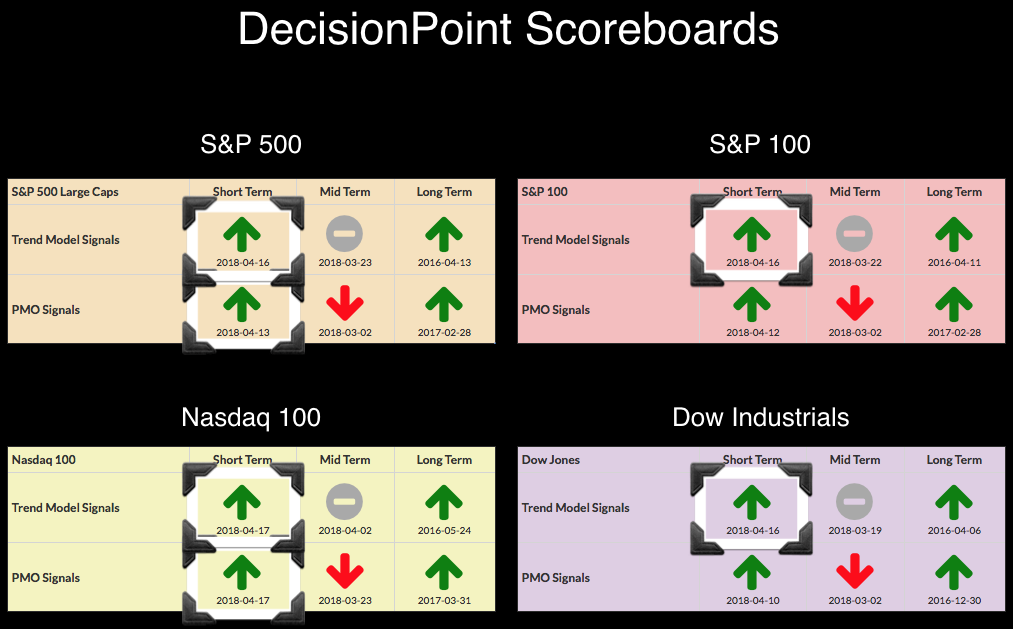

All four DecisionPoint Scoreboard indexes logged ST Trend Model SELL signals yesterday and now the NDX has added insult to injury with a new PMO SELL signal. This SELL signal was generated when the NDX Price Momentum Oscillator (PMO) crossed below its signal line.

Below is the daily chart for...

READ MORE

MEMBERS ONLY

QQQ: Breakdown, Mean-Reversion Opportunity or Both?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 ETF (QQQ) broke down with a sharp decline the last five days and this pushed RSI(5) below 30 for a short-term oversold reading. The breakdown is bearish, but it has also created a short-term mean-reversion opportunity.

I first introduced a mean-reversion trading system using RSI in...

READ MORE

MEMBERS ONLY

The Bears Are Making A Run For The Roses

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 24, 2018

Pre-market action on Tuesday was solid and that's just about where the bullishness ended. With the Kentucky Derby just around the corner, let me summarize Tuesday's action from the opening bell in different fashion: "And they're...

READ MORE

MEMBERS ONLY

DP Bulletin: ST Trend Model SELL Signals on NDX, Dow, SPX & OEX

by Erin Swenlin,

Vice President, DecisionPoint.com

This is a bulletin to let you know that the DecisionPoint Short-Term Trend Model has generated new SELL signals for all four indexes on the DecisionPoint Scoreboards. After the sizable decline to finish off today, the 5-EMAs all tumbled below the 20-EMAs. The 20-EMAs were below the 50-EMA so it...

READ MORE

MEMBERS ONLY

INDUSTRIALS, MATERIALS, AND TECHNOLOGY PULL MARKET LOWER AS TEN-YEAR TREASURY YIELD TOUCHES 3% -- MAJOR STOCK INDEXES ARE ALSO HEADING INTO ANOTHER TEST OF SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

SECTOR ETFS TAKE A BIG HIT ... The three stock ETFs shown below are leading the stock market sharply lower. Chart 1 shows the Industrial SPDR (XLI) losing more than 3% and once again threatening its 200-day average. Caterpillar (CAT) is one of its biggest losers with a drop of -6%...

READ MORE

MEMBERS ONLY

Dollar Makes Major Breakout; What That Means For Investment Allocation

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for April 23, 2018

A significant bullish breakout in the U.S. Dollar ($USD) occurred on Monday and the push higher is likely to just be beginning. Before I look at possible ramifications, let's look at the chart itself:

Monday's close was the USD&...

READ MORE

MEMBERS ONLY

Monitoring the Swings in SPY and the 5 Big Sectors - Plus KRE, GOOGL, NKE, UNH and BAC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* SPY Pulls Back within Channel.

* Monitoring Upswings in the Big Sectors.

* Regional Bank ETF Extends Short-term Bounce.

* Smelly SOXX.

* Google Holds the Gap.

* Nike Forms Flag within Triangle.

SPY Pulls Back within Channel...

There are three stages to a trend reversal. First, there is the bottom picking stage when momentum...

READ MORE

MEMBERS ONLY

Short-Term Swenlin Trading Oscillator Divergence Could be a Serious Warning Sign

by Erin Swenlin,

Vice President, DecisionPoint.com

There was one indicator that gave us a very good warning sign just prior to the Jan/Feb correction. The same warning sign is flashing right now. The Swenlin Trading Oscillators (STOs) have a breadth version and a volume version. When we see divergent tops on these indicators, bad things...

READ MORE

MEMBERS ONLY

Costco Breaks Triangle Line with Big Gap

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Costco (COST) is showing some upside leadership this year with a triangle breakout and challenge to the January high.

Long-term trend identification is important because it sets my bias going forward. My bias is bullish when the long-term trend is up and this means I favor bullish patterns over bearish...

READ MORE

MEMBERS ONLY

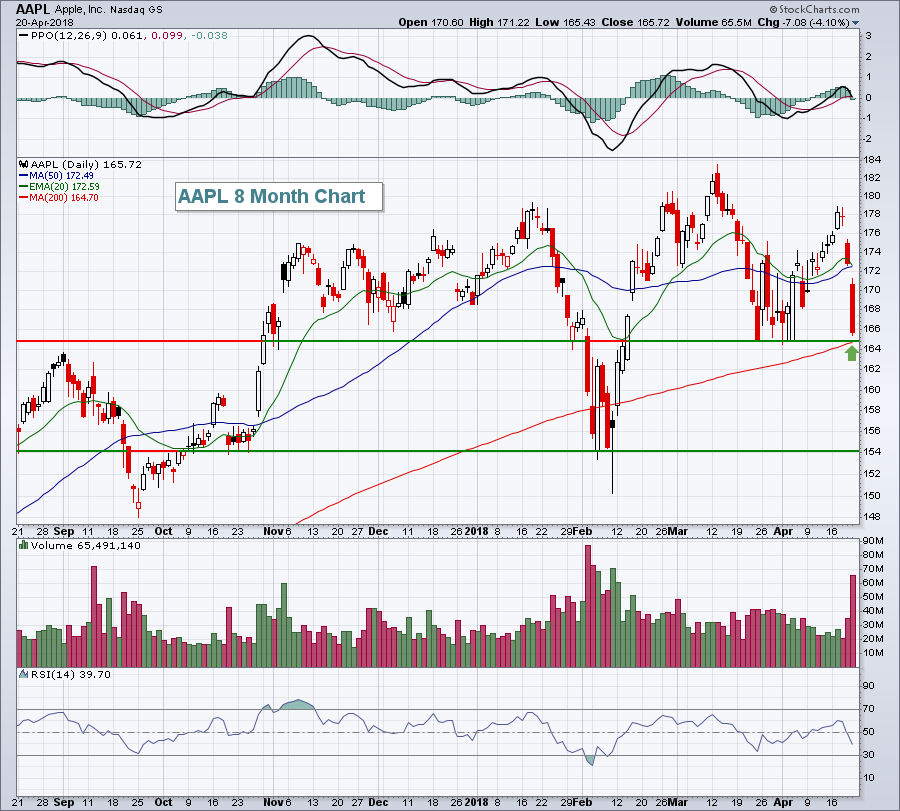

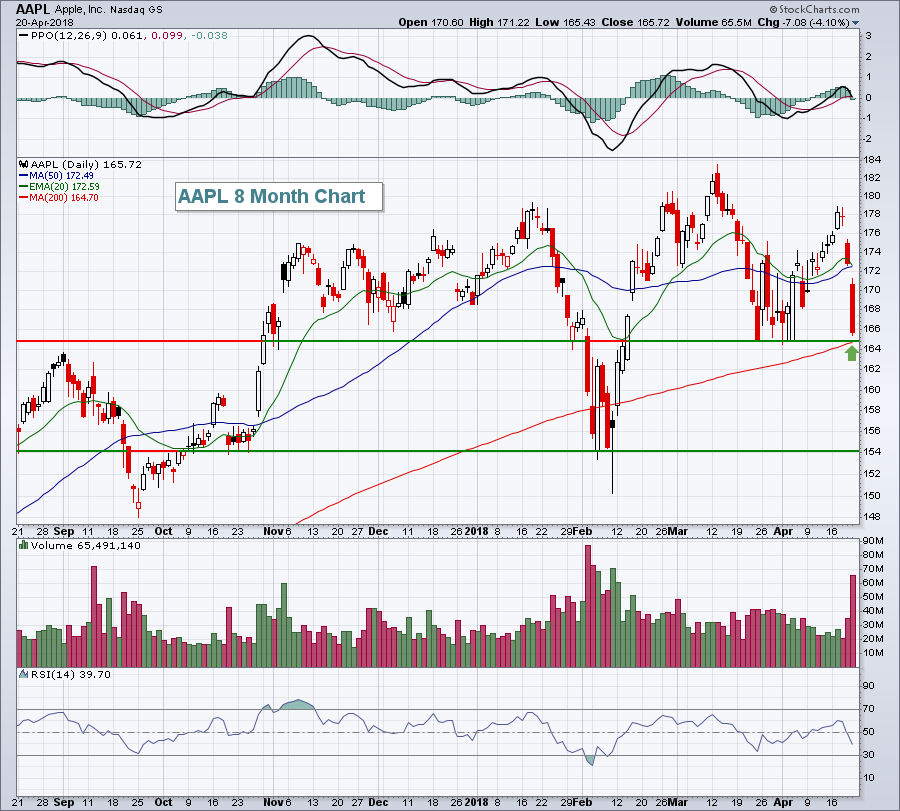

Two Bad Apples Don't Spoil The Whole Market Bunch

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 20, 2018

The big news on Friday was the bond market. The 10 year treasury yield ($TNX) closed just a tad above 2.95% and that was the highest close since late-2013/early-2014. The TNX has climbed another couple basis points in early action this...

READ MORE

MEMBERS ONLY

Article Summaries: 12/2017 - 4/2018

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Periodically I write an article that reviews the past few months of articles. Why on Earth would I do this? Primarily for two reasons. One is that many new readers are involved and often they do not go back and look at the past articles. Two is that my articles...

READ MORE

MEMBERS ONLY

Jumping the Creek. A Review.

by Bruce Fraser,

Industry-leading "Wyckoffian"

Let’s review the concept of the ‘Creek’. This is a nuanced Wyckoff principle, but once understood, it becomes a very powerful trading edge. Support and Resistance zones are typically understood to exert their influence at linear price levels. Horizontal lines are drawn on charts to represent these important levels....

READ MORE

MEMBERS ONLY

Bloomberg Commodity Index Testing Its 2018 High -- Upside Commodity Breakout Would Signal Higher Inflation -- Rising Commodity Prices Push Bond Yields Higher

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note:This article was originally published inJohn Murphy's Market Messageon Thursday, April 19th at12:11pmET

BLOOMBERG COMMODITY INDEX IS NEAR AN UPSIDE BREAKOUT... This week's surge in commodity prices is starting to attract a lot of attention. That's because rising commodity...

READ MORE

MEMBERS ONLY

Go Away In May? Not If You Own This NASDAQ 100 Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One of the most over used cliches in the stock market, in my opinion, is "go away in May". First of all, it's simply bad investment advice. Since 1950 on the S&P 500, the May 1st to July 17th period has produced annualized returns...

READ MORE

MEMBERS ONLY

Three Strike Trend Following with the PPO

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Percentage Price Oscillator (PPO) is mostly used as a momentum oscillator, but chartists can also use it to define the trend, even the long-term trend. Chartists interested in trend signals can simply ignore the wiggles and the signal line, and instead focus on zero line crossovers.

As noted in...

READ MORE

MEMBERS ONLY

Is The Breakout In The Dollar For Real?

by Martin Pring,

President, Pring Research

* The primary trend

* The short-term picture

* The Dollar, Copper and Gold

The Dollar Index showed some green shoots at the end of the week that might lead to greater things. That’s important in its own right, but since the dollar often moves inversely with commodities and gold its direction...

READ MORE

MEMBERS ONLY

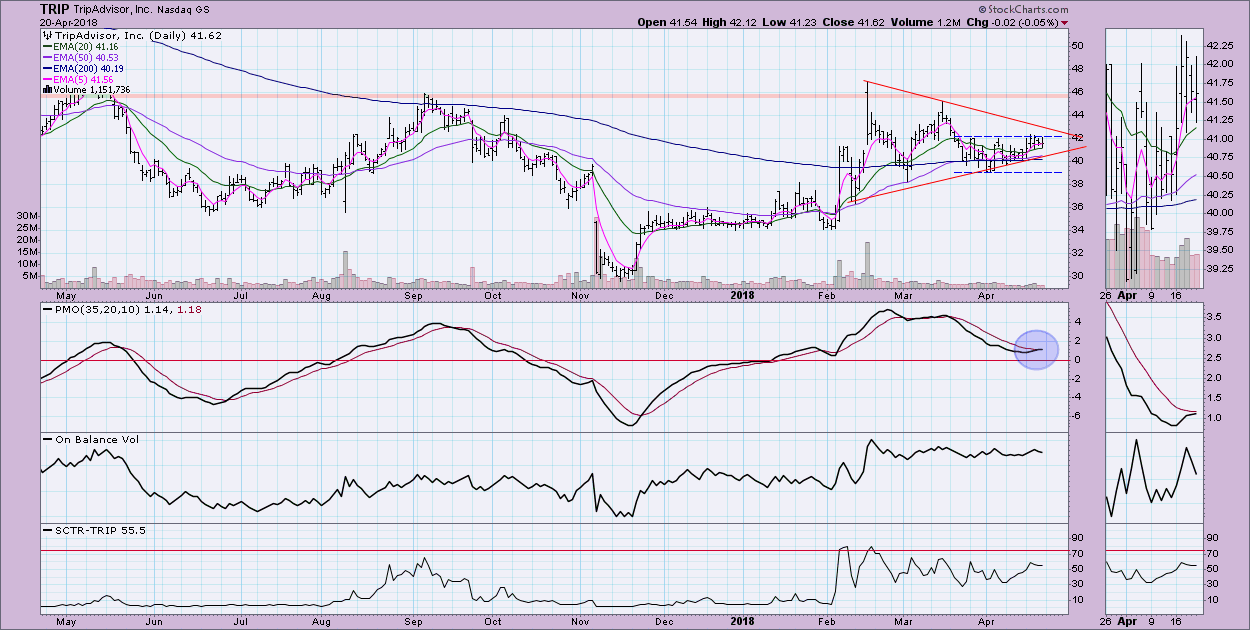

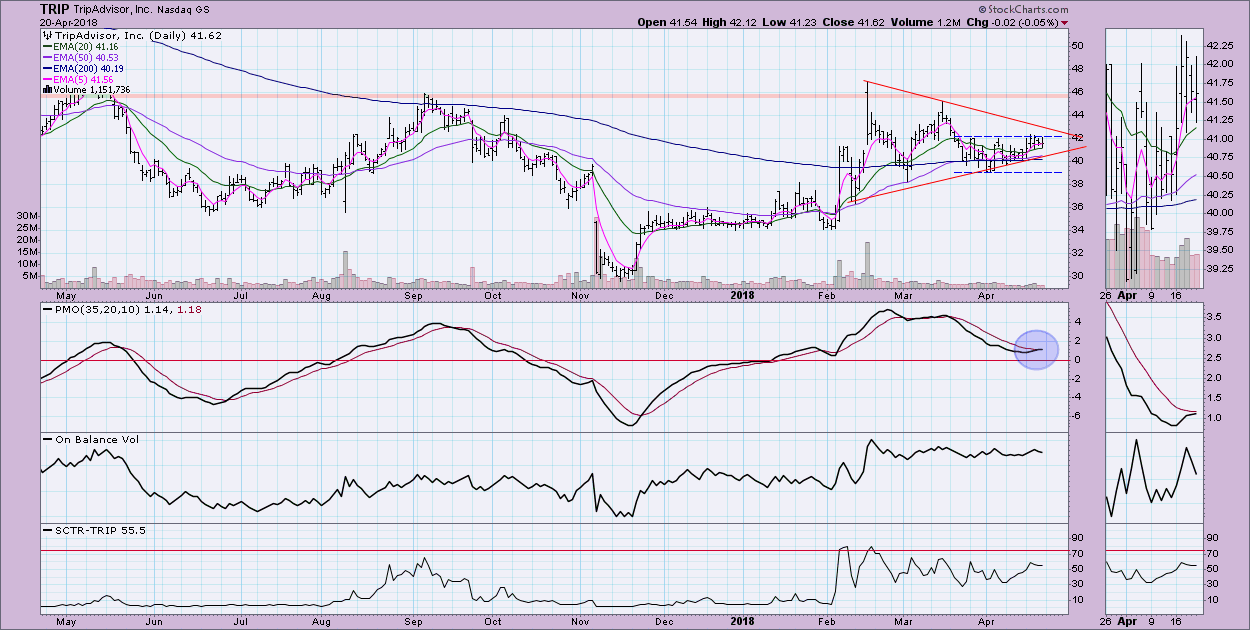

What a Trip! PMO Finds Two Travel & Tourism Stocks Poised To Take Off

by Erin Swenlin,

Vice President, DecisionPoint.com

This afternoon I ran one of my PMO scans (you'll find the link to my most popular scan in the link at the bottom of this article) and found two Travel & Tourism stocks that I found quite interesting. What I look for are Price Momentum Oscillator (PMO)...

READ MORE

MEMBERS ONLY

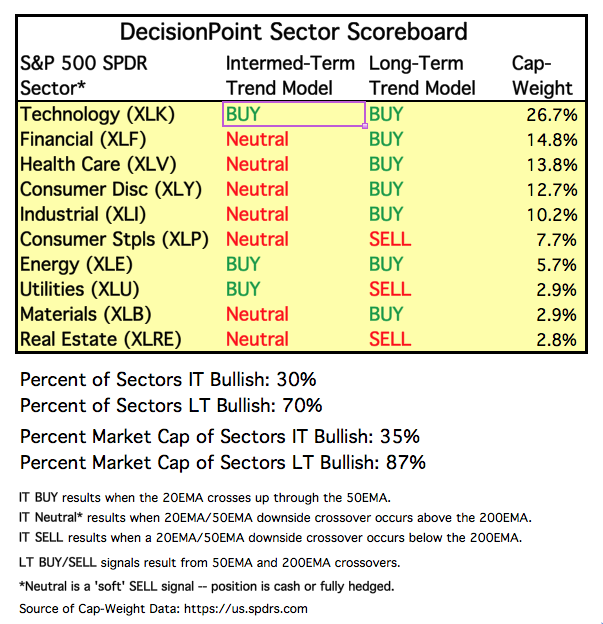

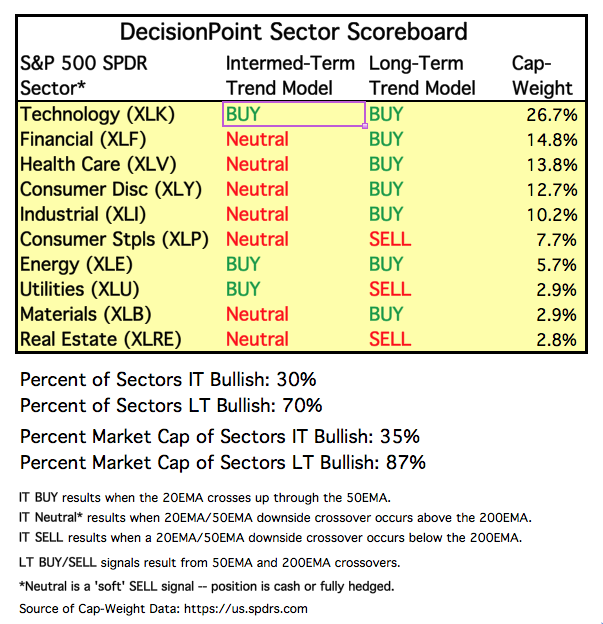

DP Weekly Wrap: Technology Whipsaw

by Carl Swenlin,

President and Founder, DecisionPoint.com

The technology sector (XLK) switched from NEUTRAL to BUY on Thursday, but reversed from BUY to NEUTRAL on Friday. The problem is that recent sideways price movement has squeezed the 20EMA and 50EMA very close together, and price movement above or below the EMAs can cause whipsaw signals. To review,...

READ MORE

MEMBERS ONLY

It's all About Reward to Risk

by John Hopkins,

President and Co-founder, EarningsBeats.com

Anytime we issue a trade alert to members at EarningsBeats it must carry a minimum reward to risk of at least 2 to 1. In fact we rarely consider getting involved in a trade unless the potential reward to risk is at least 3 to 1 or higher.

The concept...

READ MORE

MEMBERS ONLY

An Organized Process to Navigate the Markets - ChartPack Update #19 (Q1, 2018)

by Gatis Roze,

Author, "Tensile Trading"

In the 18 years I’ve been teaching investors to grow their wealth, I believe I can simplify it down to two basic prerequisites for success. Despite all the clatter, prattle and bluster that increasingly emanates from the financial industry, individual investors can multiply their probability of success many times...

READ MORE

MEMBERS ONLY

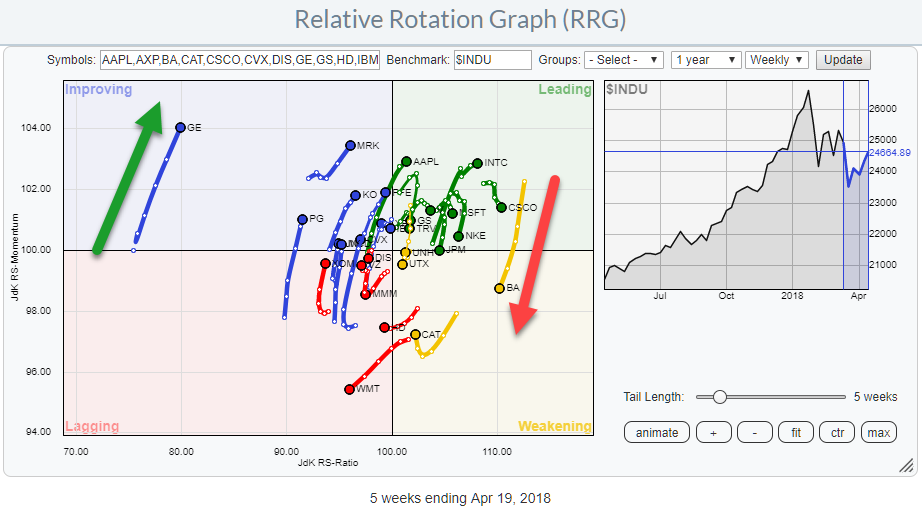

All eyes on the CAT

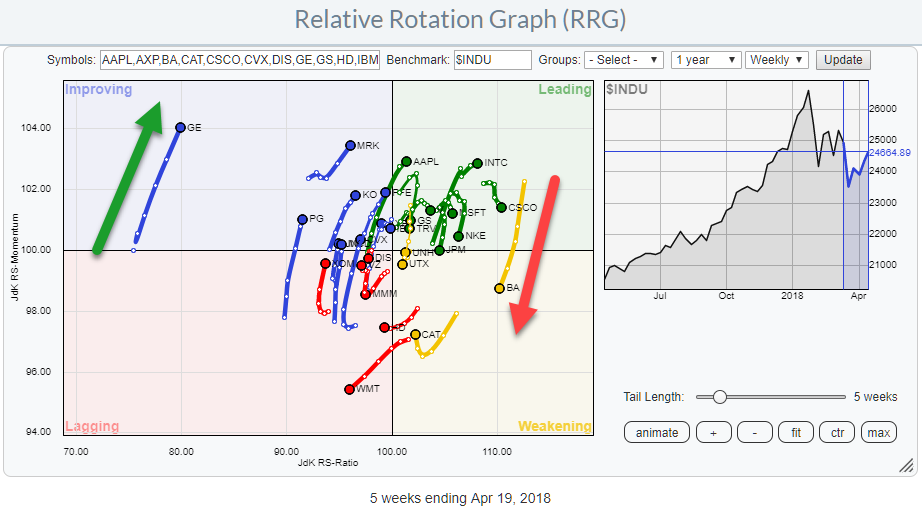

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Yesterday, Thursday 19th of April, it was my turn again to join Tom and Erin in their Market Watchers Live show again. By the way, I will be joining them every third Thursday of the month to talk about RRG and talk about market developments from an RRG point of...

READ MORE

MEMBERS ONLY

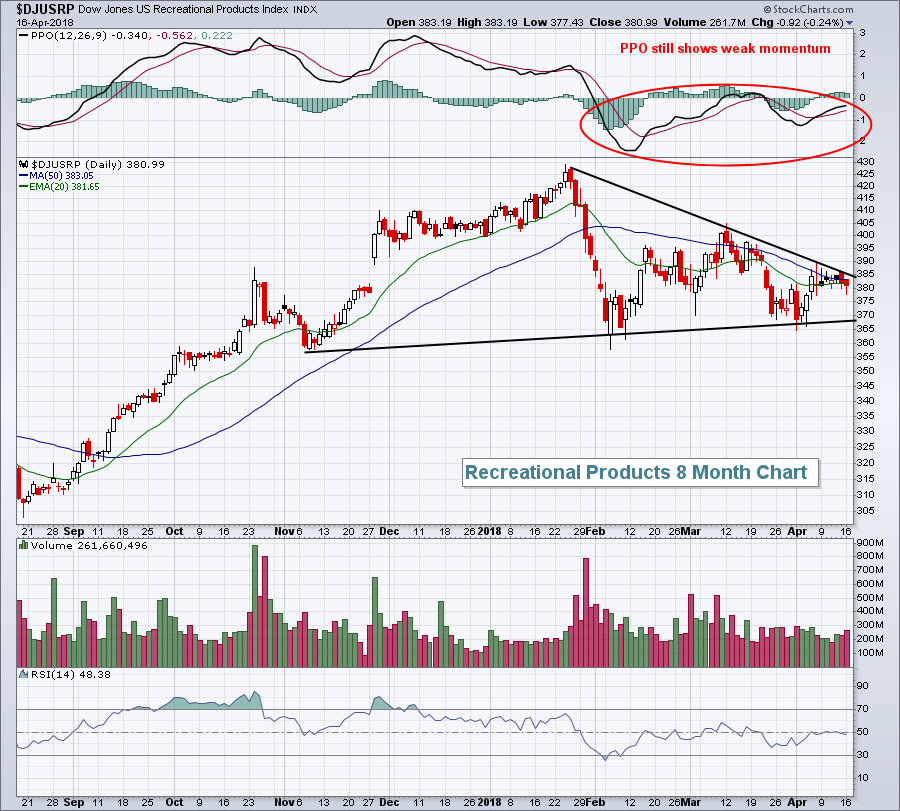

Weekly Market Review & Outlook - The Range Narrows

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* A Narrowing Range for the S&P 500.

* Monitoring the Upswing in SPY.

* Raff Regression Channel Explained.

* QQQ Weathers Semiconductor Weakness.

* IJR Challenges Rim Resistance.

* Big Wedge and Little Wedge in XLF.

* XLY, XLK and XLI Lead the Big Sectors.

* SOXX Fails to Hold Breakout.

* Notes from the Art&...

READ MORE

MEMBERS ONLY

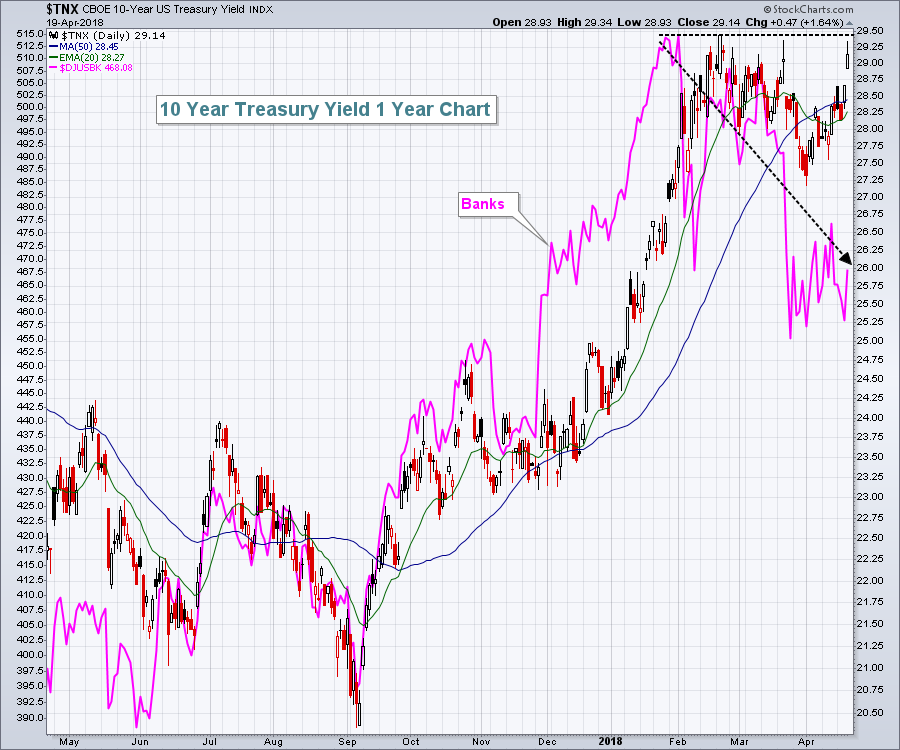

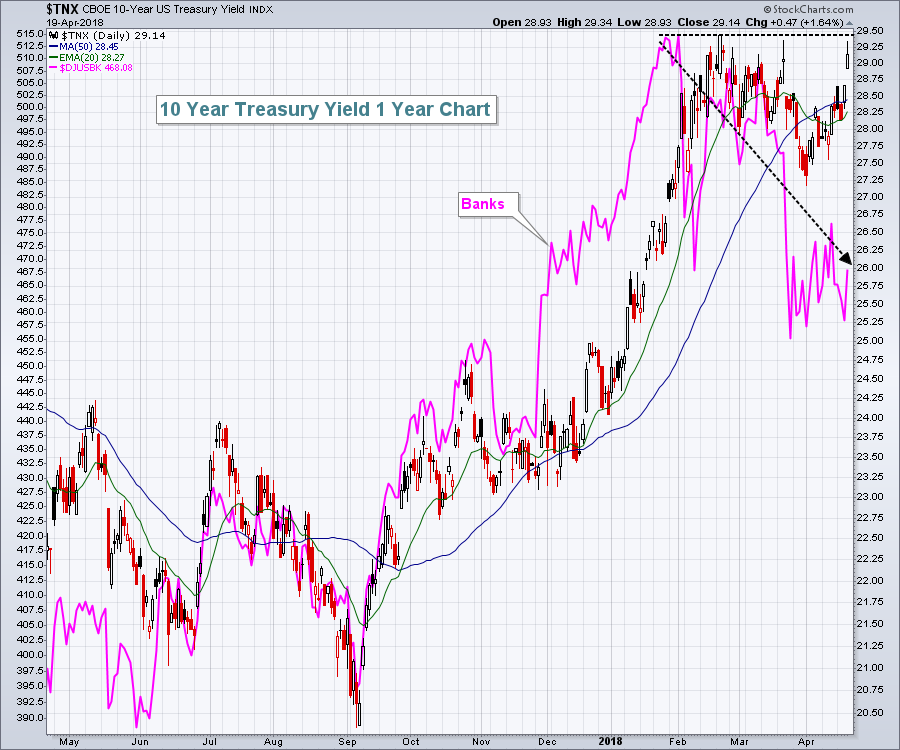

Treasury Yields Spike; TNX Threatens 4+ Year High, Banks Soar

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 19, 2018

The U.S. stock market has been solid throughout April thus far, so seeing a Thursday drop of 0.57% and 0.78% on the S&P 500 and NASDAQ, respectively, shouldn't be too alarming. And it wasn't....

READ MORE

MEMBERS ONLY

Tech Sector (XLK) Clicks to IT Trend Model BUY Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

As noted in the DecisionPoint Sector Scoreboard, a new IT Trend Model BUY signal was added. Before this BUY signal, there were only two sectors on IT BUY signals and they were in somewhat defensive areas of the market, Utilities and Energy. It is good news to see this BUY...

READ MORE

MEMBERS ONLY

BLOOMBERG COMMODITY INDEX IS TESTING ITS 2018 HIGH -- AN UPSIDE COMMODITY BREAKOUT WOULD SIGNAL HIGHER INFLATION -- RISING COMMODITY PRICES ARE PUSHING BOND YIELDS HIGHER -- TEN YEAR TREASURY YIELD MAY BE HEADING TO 3%

by John Murphy,

Chief Technical Analyst, StockCharts.com

BLOOMBERG COMMODITY INDEX IS NEAR AN UPSIDE BREAKOUT... This week's surge in commodity prices is starting to attract a lot of attention. That's because rising commodity prices are a leading indicator of inflation. Rising commodity prices have a lot of intermarket implications. For one thing, rising...

READ MORE

MEMBERS ONLY

Bifurcated Action Doesn't Hold Back Transports, Renewable Energy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, April 18, 2018

Our major indices showed signs of tiring on Wednesday as its seasonal pre-earnings run from April 1st to April 18th concluded. Five sectors managed to finish in positive territory, including the red-hot energy sector (XLE, +1.57%) and industrials (XLI, +1.04%). The...

READ MORE

MEMBERS ONLY

Finance and Banks Lag, but 10-yr Yield Breaks Out as Commodities Move Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* IJR Moves above Chandelier Exit.

* Finance Sector Underperforms.

* Regional Bank SPDR Forms Bear Flag.

* 10-yr Yield Breaks out of Flag.

* Yield Curve Sinks to Multi-year Lows.

* Bond Bounce May be Ending.

* Commodities are on the Move.

* Copper Bounces off Support (plus COPX).

* Gold Forms Bullish Cup-with-Handle.

The S&P...

READ MORE

MEMBERS ONLY

DP Alert: Will Dollar Ever Breakout? - Market Short-Term Overbought

by Erin Swenlin,

Vice President, DecisionPoint.com

This week the DP Scoreboards turned short-term bullish. Unfortunately, I suspect this breakout won't hold long if the short-term indicators continue to stretch into very overbought territory. Although the Scoreboards show intermediate-term neutral to bearish, the intermediate-term market indicators suggest we likely have seen the lows for the...

READ MORE

MEMBERS ONLY

Silver Surges out of Bollinger Band Squeeze

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Industrial metals surged on Wednesday with 2+ percent gains coming in silver, aluminum, palladium, copper and nickel. The Silver ETF (SLV), in particular, finally broke out of a two-month consolidation.

The chart below shows the Silver ETF (SLV) with Bollinger Bands in pink and BandWidth in the indicator window. Overall,...

READ MORE

MEMBERS ONLY

CSX AND UNITED AIRLINES LEAD TRANSPORTS HIGHER -- AND BOOST THE INDUSTRIAL SPDR -- FREEPORT MCMORAN LEADS MATERIALS HIGHER -- SIX-YEAR HIGH IN ALUMINUM PUSHES ALCOA TO NEW RECORD -- ENERGY AND METALS LEAD COMMODITIES SHARPLY HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTS NEAR UPSIDE BREAKOUT ... Monday's message showed the Dow Transports rising above their 50-day average to turn their trend higher. Chart 1 shows the Dow Transports on the verge of breaking through overhead resistance formed in late February and mid-March. While rails and truckers (and FedEx) were Monday&...

READ MORE

MEMBERS ONLY

Twitter Leads Internet Group Higher; Netflix Soars On Earnings Beat

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 17, 2018

Futures were solid heading into Tuesday's pre-market action as Netflix reported stellar Q1 results after the closing bell on Monday. Then, on Tuesday morning, home construction ($DJUSHB) received great news as both March housing starts and building permits easily exceeded expectations....

READ MORE

MEMBERS ONLY

Major Shakeup on DecisionPoint Scoreboards - Short-Term BUY Signals Everywhere

by Erin Swenlin,

Vice President, DecisionPoint.com

Since Friday, the DecisionPoint Scoreboards have been adding short-term buy signal after short-term buy signal. With today's breakouts from consolidation zones, I believe they are timely. You may be wondering what it would take to start seeing BUY signals in the intermediate term. The IT Trend Model signals...

READ MORE

MEMBERS ONLY

More Indicators Are Flashing The All Clear

by Martin Pring,

President, Pring Research

* Bearish engulfing pattern and outside day are cancelled

* Breath indicators are firming up

Bearish engulfing pattern and outside day are cancelled

Last week I wrote that many of the short-term indicators were flashing buy signals and that we should expect the US equity market to work its way higher. I...

READ MORE

MEMBERS ONLY

NASDAQ 100 LEADS MARKET HIGHER ALONG WITH THE TECHNOLOGY SECTOR -- TWITTER AND ALPHABET LEAD INTERNET STOCKS HIGHER -- INTEL AND MICROSOFT NEAR RECORD HIGHS -- THE DOW CLEARS 50-DAY LINE AND DOWN TRENDLINE -- ITS P&F CHART SHOWS AN UPTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ 100 LEADS MARKET HIGHER ... Stocks are having another good chart day. All major stock indexes are trading well above their 50-day averages. The Nasdaq market is in the lead. Chart 1 shows the PowerShares Nasdaq 100 (QQQ) gapping over its 50-day line today. The rising red line is a...

READ MORE

MEMBERS ONLY

Falling VIX Aiding Stocks; Watch This Resistance Zone On S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 16, 2018

Utilities (XLU, +1.37%) and materials (XLB, +1.34%) led rather odd market behavior on Monday. The good news is that all nine sectors finished higher. The bad news is that our most aggressive sectors struggled on a relative basis. Financials (XLF, +0....

READ MORE

MEMBERS ONLY

SPY Grinds Higher as Bullish Continuation Pattern Brews in Small-Cap ETF

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Small-caps Rise as Large-caps Grind.

* Cup-with-handle Evolves in IJR.

* Three Leading Small-Cap Sectors.

* XRT Holds Breakout.

* Providers and Devices Lead Healthcare.

* ITA Edges Above Short-term Resistance.

* Delta and Micron Correct within Uptrends.

Small-caps Rise as Large-caps Grind...

After a fairly dismal March, stocks moved higher this month with small-caps leading...

READ MORE

MEMBERS ONLY

Analog Devices Reverses Course at Key Retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Analog Devices (ADI) is a large semiconductor stock and a leader in the internet of things (IoT). The stock is in a long-term uptrend and recently broke short-term resistance to reverse a short-term pullback.

First and foremost, the long-term trend is up. The stock hit a 52-week high in January,...

READ MORE