MEMBERS ONLY

Is TECHNOLOGY now a defensive sector?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

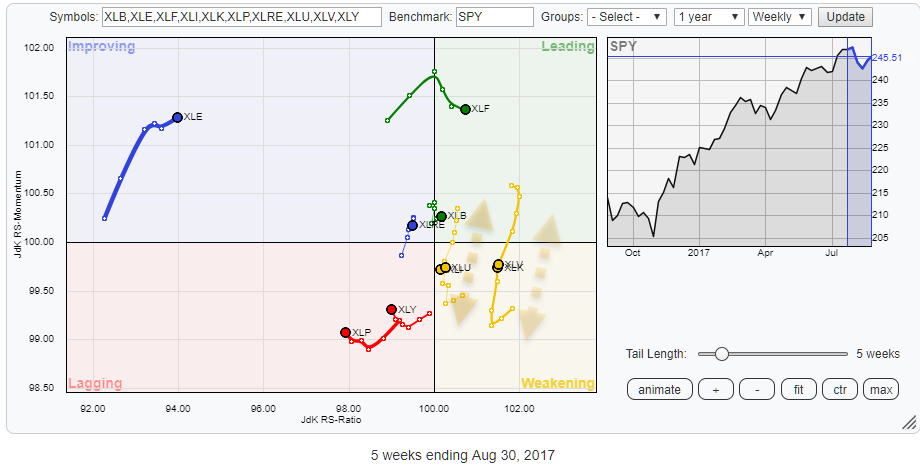

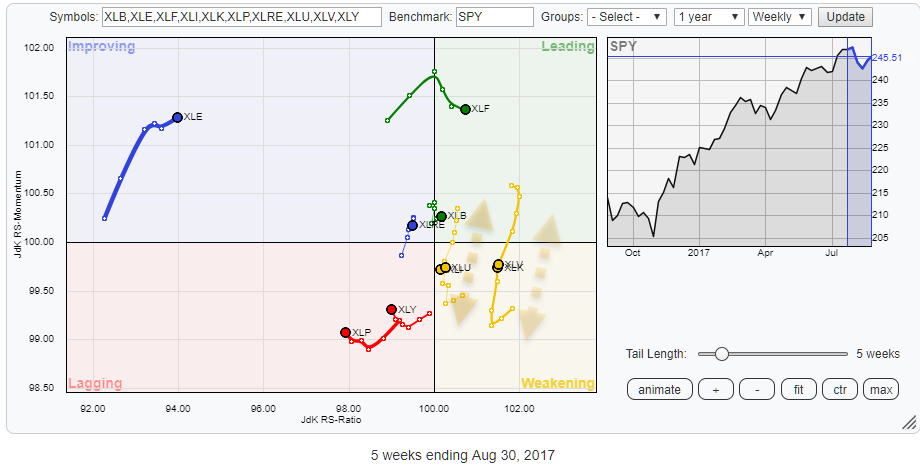

The Relative Rotation Graph above shows the US sector universe based on S&P 500 indices (ETFs).

Two sectors stand out on this chart. These are Energy (XLE) inside the improving quadrant but at low levels on the JdK RS-Ratio axis, and Financials (XLF) inside the Leading quadrant which...

READ MORE

MEMBERS ONLY

Biotechs And Semiconductors Lead The NASDAQ Charge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 30, 2017

The U.S. stock market benefited from a lot of the new and a little of the old on Wednesday as the Dow Jones U.S. Biotechnology Index ($DJUSBT) and the Dow Jones U.S. Semiconductors Index ($DJUSSC) posted solid gains to help...

READ MORE

MEMBERS ONLY

Meet the New Boss, Same as the Old Boss - Tech ETFs Still Leading - Plus 15 Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Meet the New Boss, Same as the Old Boss

.... Software Leads Tech with 52-week High

.... Flag Breakouts in Cloud and Internet ETFs

.... Networking and Cyber Security Join the Surge

.... Five Cyber Security Stocks (QLYS, PFPT, FTNT, PANW, FEYE)

.... SOXX Goes for Breakout as XSD Surges off Support

.... Five Semiconductor Stocks...

READ MORE

MEMBERS ONLY

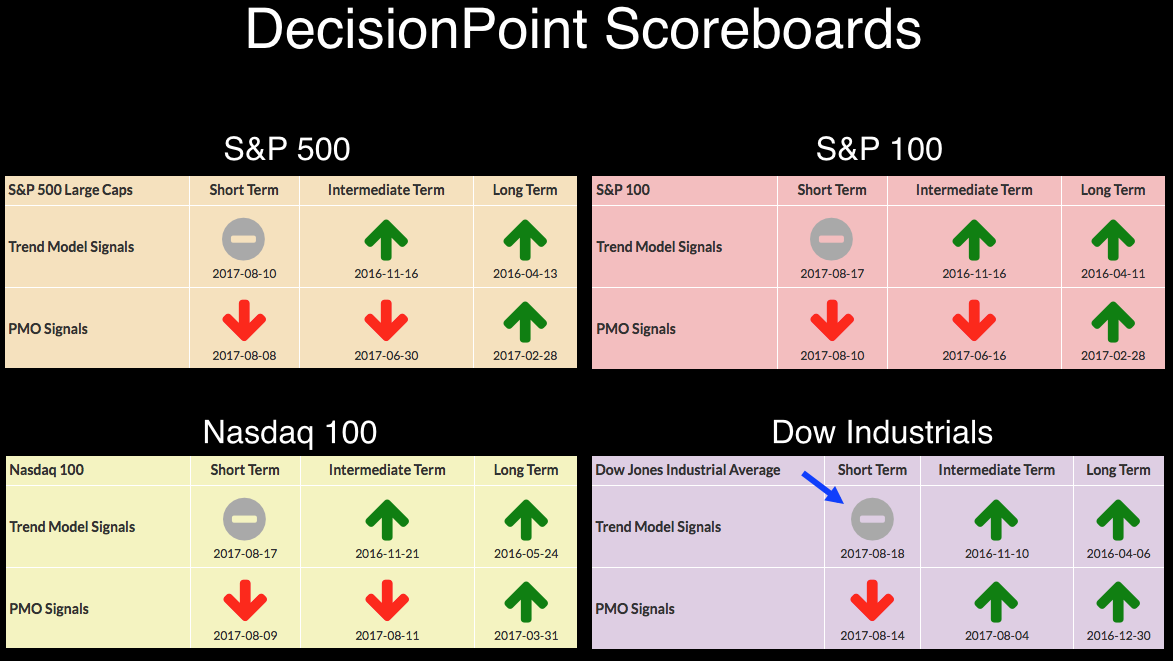

DP Alert: New STTM BUY Signals for Dow and NDX - IT Trend Model SELL Signal on USO

by Erin Swenlin,

Vice President, DecisionPoint.com

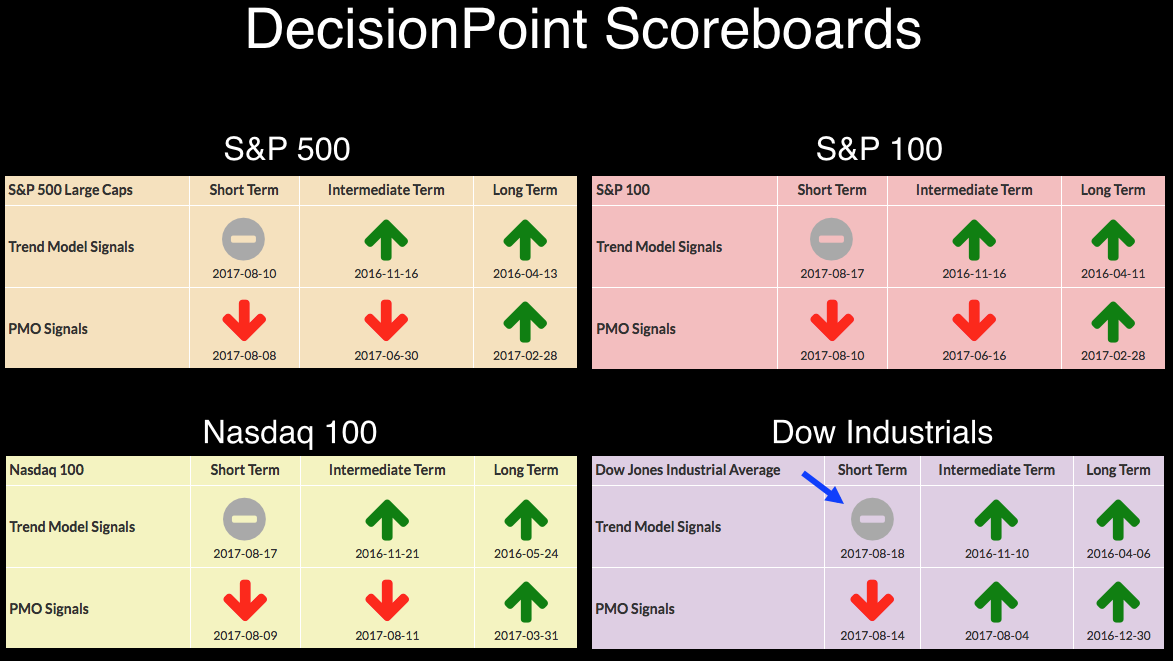

As you can see on the DecisionPoint Scoreboard summary, we had two new Short-Term Trend Model (STTM) BUY signals on the Dow and NDX. I've annotated the charts below the Scoreboards. Of particular note on those charts are the breakouts above the declining tops trendlines. The PMO on...

READ MORE

MEMBERS ONLY

Ebay Reverses Near Key Retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

EBAY shows signs that the correction is ending and the bigger uptrend is resuming. First, the long-term trend is up because the stock hit a 52-week high in July. The stock then corrected with a move back to a support zone around 34-34.5. Notice that broken resistance and the...

READ MORE

MEMBERS ONLY

Are We Trending Or Trendless? Watch Small Caps For Clues

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, August 29, 2017

At Tuesday's open, North Korea and its missile test were the talk of Wall Street. By the close, traders ignored the rising tensions and instead focused on the recent better-than-expected quarterly earnings and the low interest rate environment. U.S. equities...

READ MORE

MEMBERS ONLY

Is that PMO Overbought or Oversold?

by Erin Swenlin,

Vice President, DecisionPoint.com

First, thank you to all of the live MarketWatchers LIVE webinar viewers! You've been making writing my blog articles easy by posing excellent questions in the chat room during the live show. Today's question was how I determine if a Price Momentum Oscillator (PMO) is overbought...

READ MORE

MEMBERS ONLY

TWO-YEAR LOW IN THE DOLLAR CONTRIBUTES TO UPSIDE BREAKOUT IN GOLD -- GOLD IS OUTPERFORMING STOCKS FOR THE FIRST TIME SINCE 2011 -- BUT NOT ENOUGH TO POSE A SERIOUS THREAT TO STOCKS -- RISING EURO IS HURTING STOXX 50

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD ACHIEVES BULLISH BREAKOUT ... After trading sideways for the past five months, gold finally achieved a bullish breakout yesterday. Chart 1 shows the price of gold breaking the $1300 barrier which had turned back previous rallies in April and early June. Gold is adding to that gain today. The flight...

READ MORE

MEMBERS ONLY

Biotechs Surge To Lead The NASDAQ Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, August 28, 2017

The U.S. market was able to rally a bit in afternoon trading on Monday and most of our major indices finished in positive territory - the Dow Jones was the lone exception as that index of 30 conglomerates fell 5 points. Sectors...

READ MORE

MEMBERS ONLY

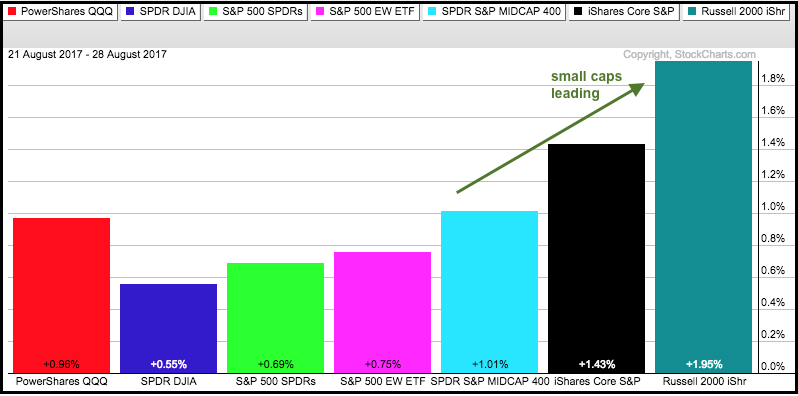

Measuring the Risk Appetite - 4 Inside Days and No Follow Thru - 6 Stock Charts

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

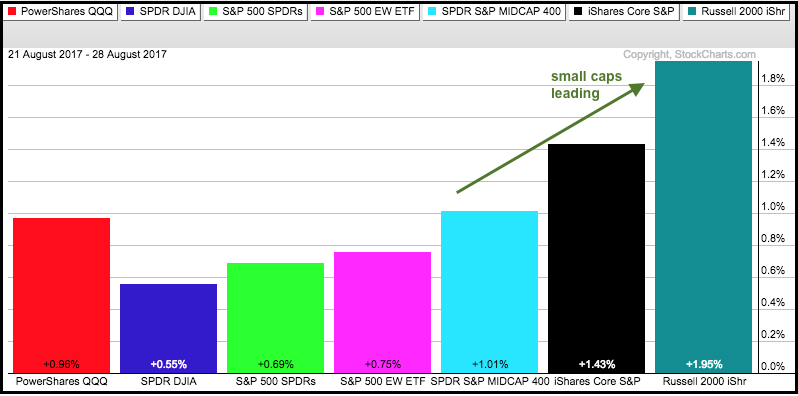

.... Small-caps Lead Five Day Bounce

.... Stocks are Underperforming Bonds in August

.... Four Inside Days and No Follow Thru

.... Chandelier Exit Falls for IJR

.... 10 Stocks and A Mixed Bag over the Past Week

.... Amazon and Google Tests Support as Facebook Corrects

.... Intel Lags in 2017

.... Discover Financial Breaks Wedge Line...

READ MORE

MEMBERS ONLY

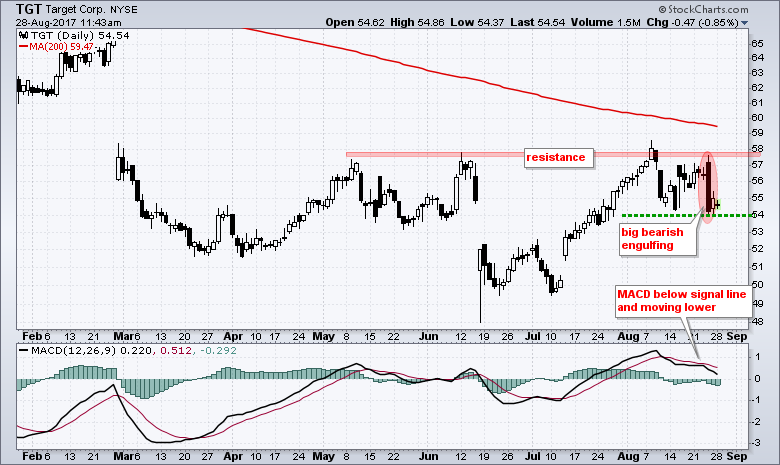

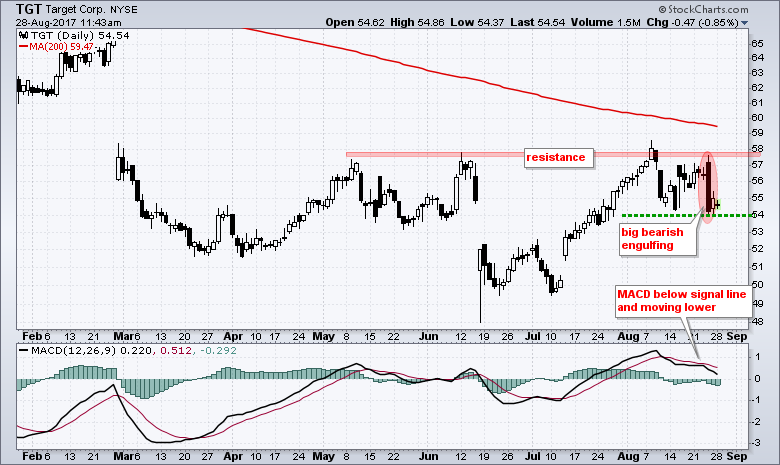

Target Reverses at Resistance with Big Engulfing Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Retail SPDR (XRT) is one of the worst performing industry group ETFs and Target (TGT) is one of the downside leaders. Even though the stock is up sharply since early July, it is down over 20% year-to-date and seriously lagging the broader market in 2017. Note that SPY is...

READ MORE

MEMBERS ONLY

Down Channels Are Firmly Established As We Approach September

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, August 25, 2017

Selling in the final hour on Friday contributed to bifurcated action where the NASDAQ tumbled into negative territory while the Dow Jones, S&P 500 and Russell 2000 all managed to hang onto meager gains. Our major indices remain in a downtrend...

READ MORE

MEMBERS ONLY

Balance Of Equity Power Continues To Shift Away From The US

by Martin Pring,

President, Pring Research

* Contrary opinion argues against being too bearish on US equities

* US equities are breaking down against the world

* Emerging markets are emerging

* Metals driving north

Contrary opinion argues against being too bearish on US equities

The majority of the shorter-term indicators monitoring trends lasting between 4-6 weeks argue for an...

READ MORE

MEMBERS ONLY

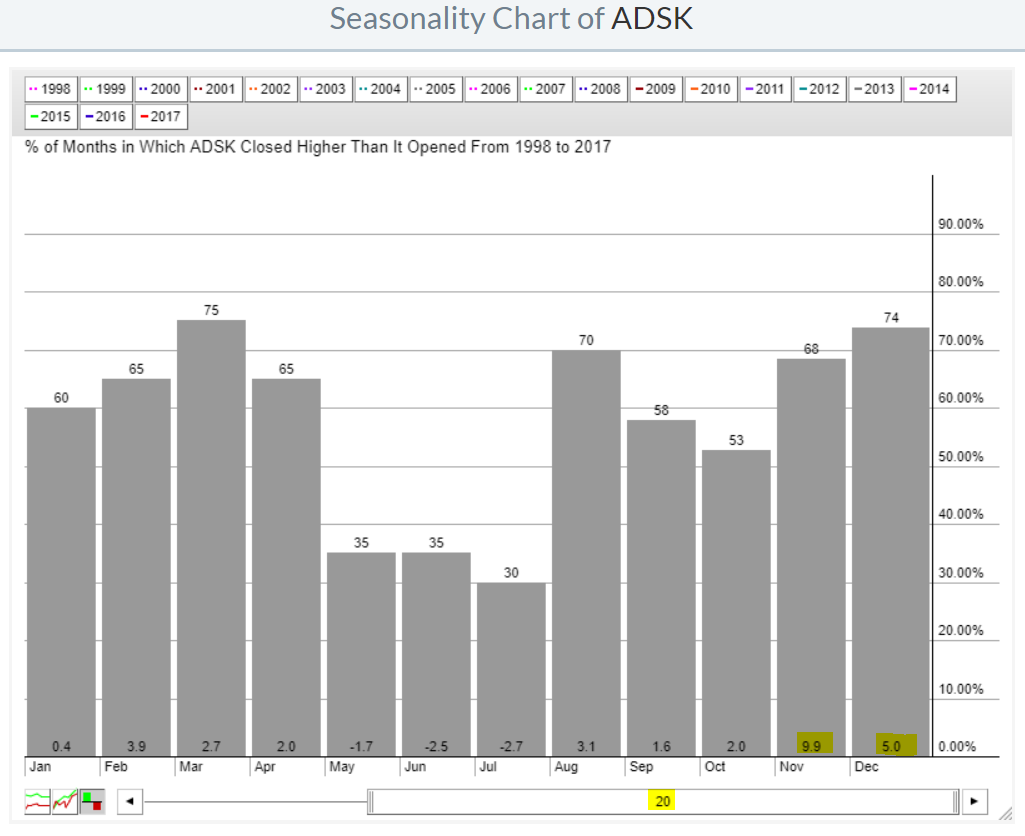

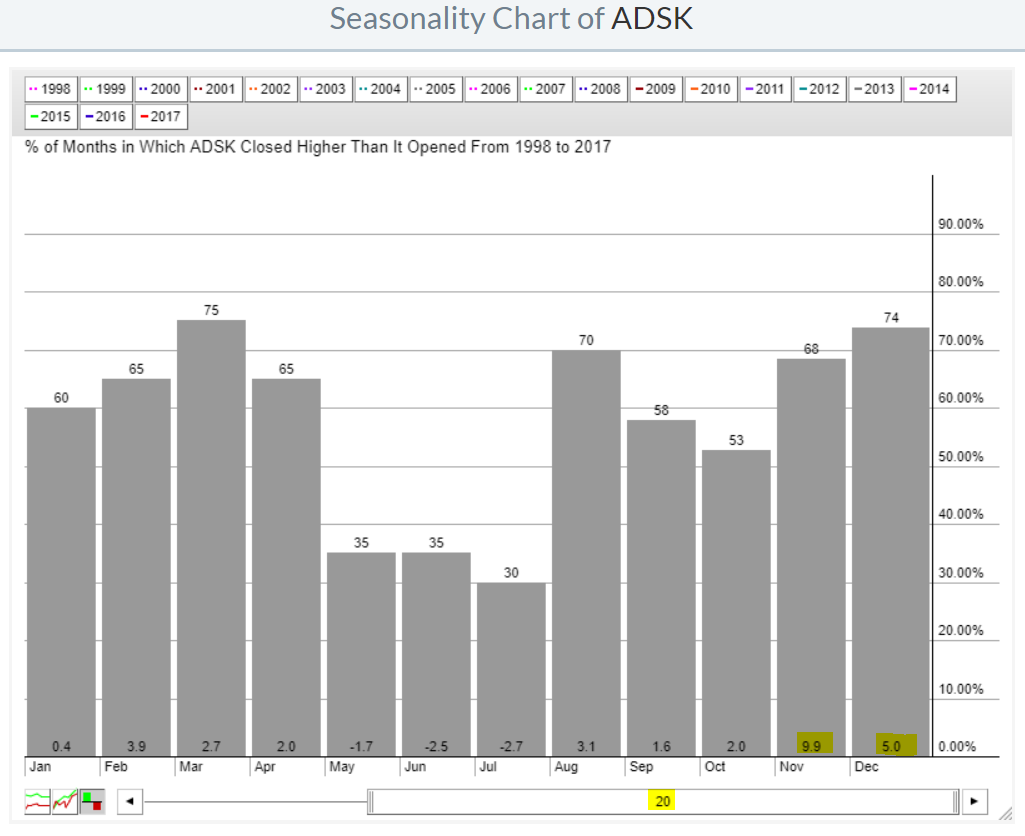

Autodesk (ADSK) Sends Buy Signal Technically, Fundamentally, And Seasonally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's rare when stocks line up bullishly from a technical perspective, in addition to both fundamental and seasonal perspectives as well. But that's exactly what I see when looking at Autodesk (ADSK). Let's start with fundamentals. ADSK just reported its latest quarterly earnings and...

READ MORE

MEMBERS ONLY

Transports Hit the Wall

by Bruce Fraser,

Industry-leading "Wyckoffian"

The ‘Dow Theory’ involves the study and comparison of the Dow Jones Industrial Average and the Dow Jones Transportation Average. When both averages are in ‘lockstep’ in a major uptrend, the market is said to be in a Bull Market. When both are in a downtrend, a bear market is...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Smaller-Cap Stocks Lagging

by Carl Swenlin,

President and Founder, DecisionPoint.com

While we usually focus on the large-cap market indexes, they often disguise what is happening with smaller-cap stocks. Recently I decided to delve into this question with a chart showing the relative strength of smaller-cap indexes. The first relative strength panel examines all S&P 500 stocks on an...

READ MORE

MEMBERS ONLY

Now Might Be a Good Time To Review 8 Previous Market Corrections ( I have been thru 6 of Them )

by Gatis Roze,

Author, "Tensile Trading"

Straight from the pages of my own trading journal. These are my charts from all the market corrections since 1981. Here’s why I want to share these with you.

The beauty of technical analysis is that it represents human emotions expressed by the buying and selling behavior of investors...

READ MORE

MEMBERS ONLY

Food And Broadline Retailers Crushed By Amazon.....Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Reminder

You can subscribe to my blog by scrolling to the bottom of the article, typing in your email address and clicking the green "Notify Me!" button. Once subscribed, my articles will be sent directly to your email as soon as Trading Places articles are published. Thanks!

Market...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (w/ Video) - When is Volatility a Problem? - Energy Stocks Buck Oil

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Volatile, but not that Volatile

.... When Does Volatility Become a Problem?

.... SPY and QQQ Correct with Flag Patterns

.... IJR Hits Prior Reversal Zone

.... Bull Flags working in XLI, XLV, XLF and XLB

.... XLY Toys with Double Top Support

.... EW Consumer Discretionary ETF Breaks Down

.... Consumer Staples Break Down

.... Bottom Fishing...

READ MORE

MEMBERS ONLY

Amazon To Cut Prices At Whole Foods, Prints Hammer On Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It was another round of selling for Whole Food Markets' (WFM) competitors as Amazon.com (AMZN) made headlines by announcing that prices would be cut at WFM stores. That spooked the likes of Costco (COST), Wal-Mart (WMT) and Target (TGT) as all three saw drops on very heavy volume....

READ MORE

MEMBERS ONLY

DP Alert: Dollar, Gold and Bonds All at a Decision Point

by Erin Swenlin,

Vice President, DecisionPoint.com

No changes to report on the DecisionPoint Scoreboards and based on the charts in the DecisionPoint ChartList (link at top of the DecisionPoint blog page), I only see the Intermediate-Term Trend Model signals nearing Neutral signals on the daily chart. 20-EMAs are steadily dropping toward negative crossovers the 50-EMAs.

The...

READ MORE

MEMBERS ONLY

Oil Exploration & Production Stocks Rebound But Key Resistance Approaching

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 23, 2017

Industrials (XLI, -0.94%) and consumer discretionary (XLY, -0.85%) led a move lower in U.S. stocks on Wednesday as we approach the gathering of global central bankers in Jackson Hole over the next few days. Energy (XLE, +0.43%) managed to...

READ MORE

MEMBERS ONLY

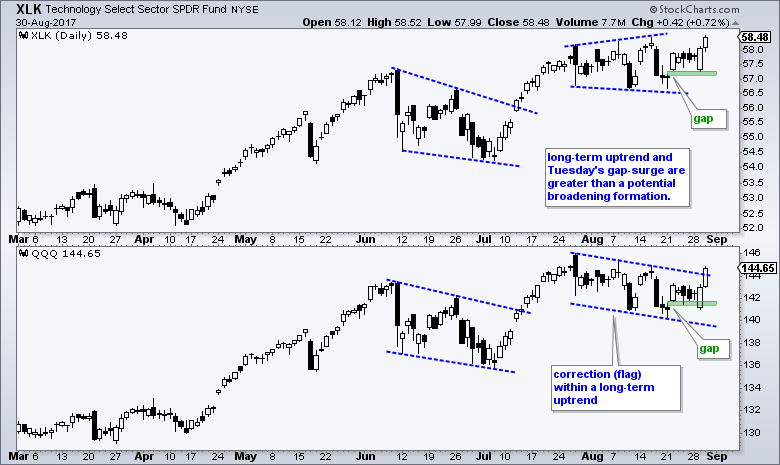

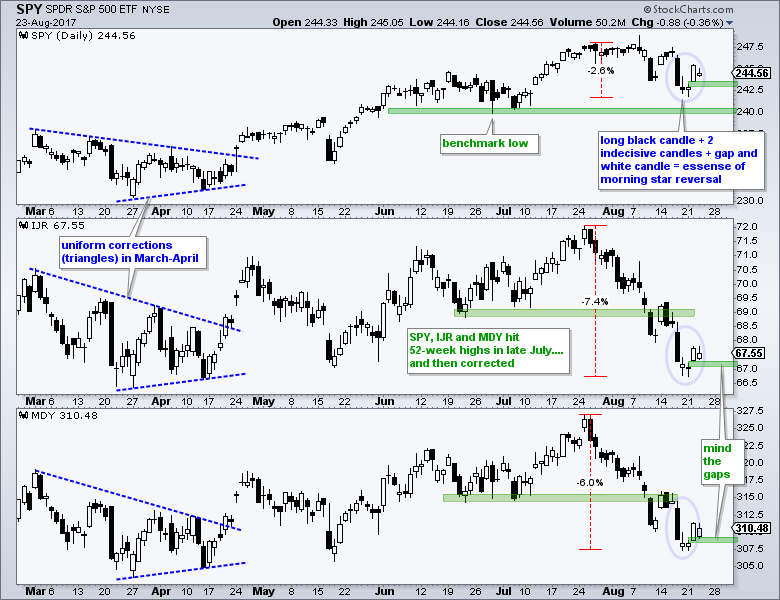

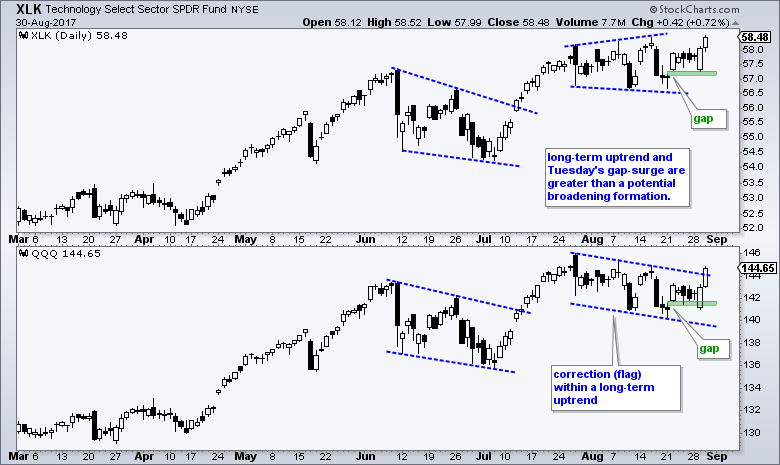

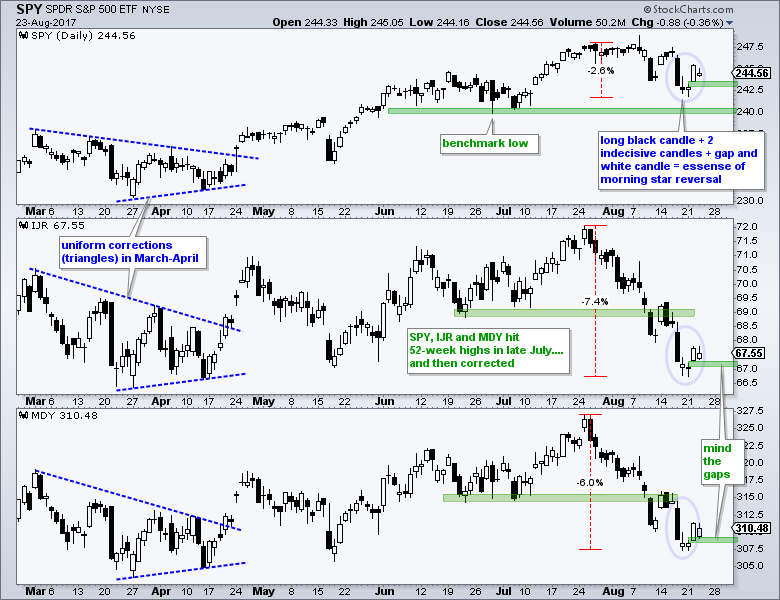

Minding the Gaps in QQQ and SPY - Plus Bullish Setups in Tech-related ETF and Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Minding the Gaps (SPY, MDY, IJR)

.... QQQ and XLK are Still Leading

.... Cloud Computer and Internet ETFs Form Flags

.... HACK Hits Potential Reversal Zone

.... SOXX Coils after New High

.... Biotech ETFs Firm in Potential Reversal Zones

.... XME Turns after Small Correction (plus SLX)

.... International Steel versus US Steel

.... Silver Goes...

READ MORE

MEMBERS ONLY

Determining the Health of the Market in the Intermediate and Long Terms

by Erin Swenlin,

Vice President, DecisionPoint.com

Today was my first day back on the MarketWatchers LIVE show (you'll find the recording under the "Webinars" tab) and it was so much fun to reconnect with all the fans in the chat room and on Twitter. During our "Mailbag" segment, I was...

READ MORE

MEMBERS ONLY

Is Housing Headed Towards The Basement?

by Martin Pring,

President, Pring Research

* Housing and housing stocks are vulnerable

* Equal weight ETF’s are becoming less equal

* Gold short-term vulnerable

Housing and housing stocks are vulnerable

New data for residential new single family home sales ($$HSNG1FAM) was released this morning and it is starting to look a little shaky. Chart 1 does not...

READ MORE

MEMBERS ONLY

Dow and DuPont Lead XLB, and Threaten to Take Over the Sector

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The sector SPDRs are weighted by market-cap and this means the biggest stocks carry the most weight. The Materials SPDR (XLB), for example, is dominated by Dow Chemical (11.86%) and DuPont (12%). These two behemoths are poised to merge and the combined company will clearly dominate XLB going forward....

READ MORE

MEMBERS ONLY

Combine Technicals And Seasonality And You Get? A Buy Signal On ULTA

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, August 22, 2017

All nine sectors advanced on Tuesday to lead a broad-based advance on Wall Street. The NASDAQ and Russell 2000 were the top performing indices, but the S&P 500 also saw a gain of nearly 1% and the Dow Jones bounced nearly...

READ MORE

MEMBERS ONLY

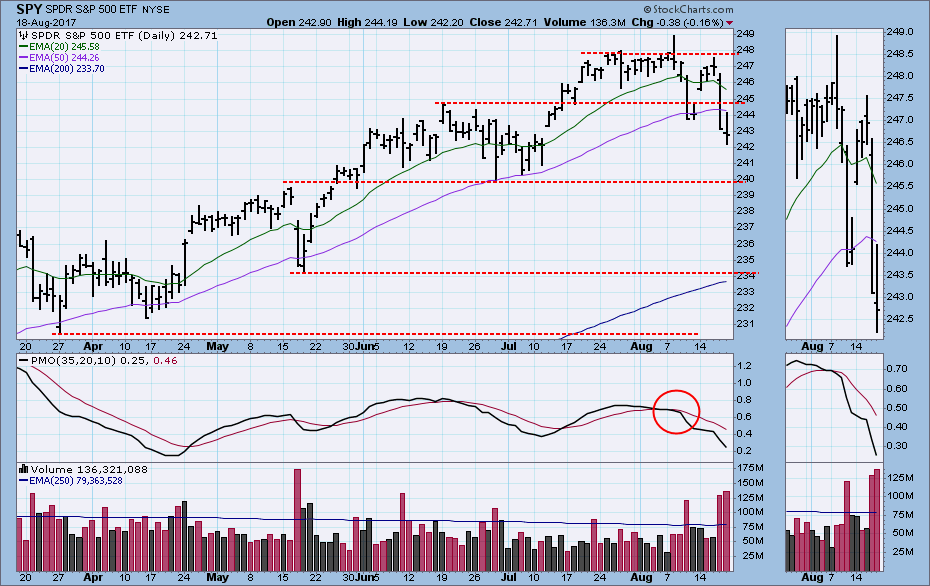

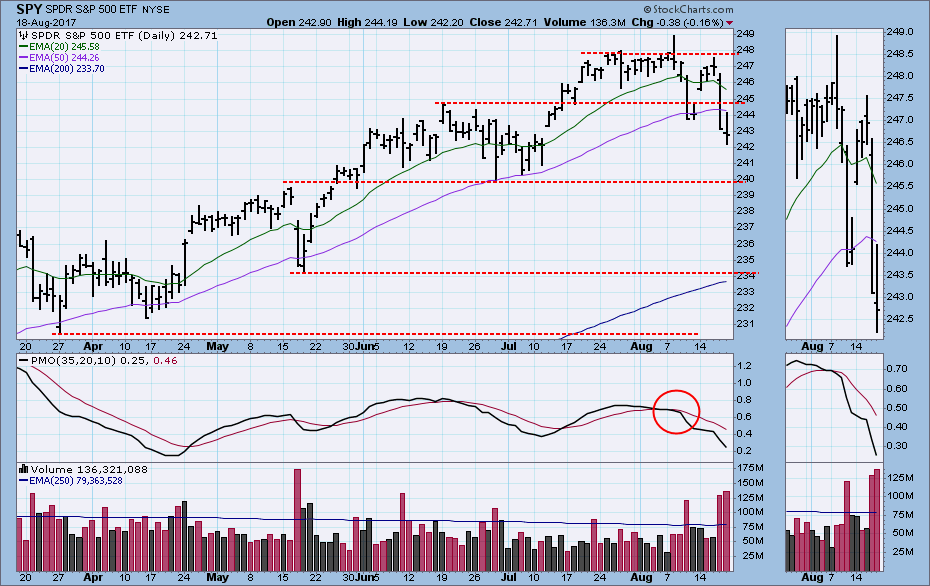

DP Alert: SPY Bounces Off Rising Bottoms Support - IT Indicators Reaching Near-Term Oversold Territory

by Erin Swenlin,

Vice President, DecisionPoint.com

After a wonderful wedding and honeymoon, I have finally returned! It took some time to review and update my annotations and I see that we've had quite a few signal changes while I was gone. The market has been meandering lower this month since I left and consequently...

READ MORE

MEMBERS ONLY

Technology Still Looks Most Vulnerable While Healthcare Remains Strong

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, August 21, 2017

Healthcare (XLV, +0.45%) led the market's advance on Monday's total solar eclipse day as money rotated into more defensive areas of the market. Utilities (XLU, +0.37%) and consumer staples (XLP, +0.36%) also benefited and this move...

READ MORE

MEMBERS ONLY

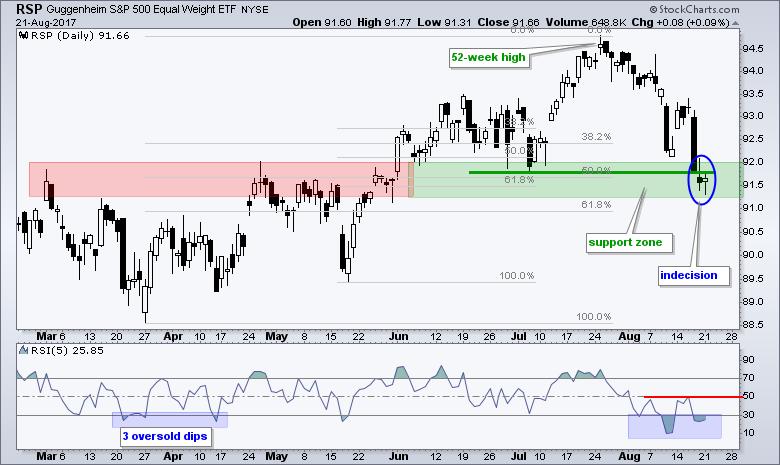

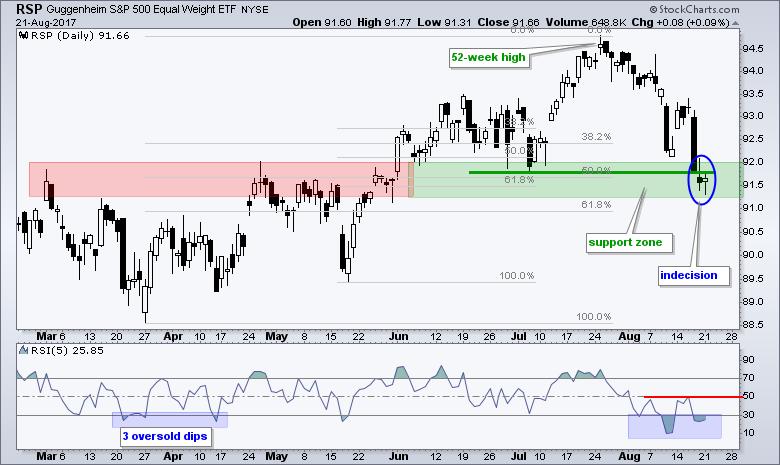

S&P 500, Five Percent and the 200-day SMA - Plus Scanning for Relative Strength within Sectors

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... EW S&P 500 ETF Stalls in Potential Reversal Zone

.... Checking the Chandelier Exit on IJR

.... S&P 500, Five Percent and the 200-day

.... Scanning for Short-term Relative Strength

.... Scanning within a Sector

.... Bottom Fishing for the Long-term

.... PKI Firms at a Key Retracement

.... Small-cap Breadth, Large-cap Leadership,...

READ MORE

MEMBERS ONLY

Newmont Holds Breakout Zone with a Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Newmont Mining (NEM) is one of the bigger gold players and its performance is tied to the price of gold, which is challenging resistance. Note that the Gold SPDR (GLD) has yet to break above its April-June highs, but Newmont is starting to outperform bullion with a break above these...

READ MORE

MEMBERS ONLY

Gold Tops 1300 And Reverses; Equities Close Out Rough Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, August 21, 2017

Late day selling killed the market's earlier attempt to rebound from Thursday's heavy losses. A market that finishes multiple days in a row weak is a market that requires a renewed buying effort. While we could see that at...

READ MORE

MEMBERS ONLY

AMC Might Entertain The Bulls This Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm mostly a short-term momentum trader that likes to follow the big picture trend. But it's hard to ignore stocks after they've been bludgeoned for a potential quick bounce, especially when you see a reversing candle on heavy volume. Enter AMC Entertainment Holdings (AMC)...

READ MORE

MEMBERS ONLY

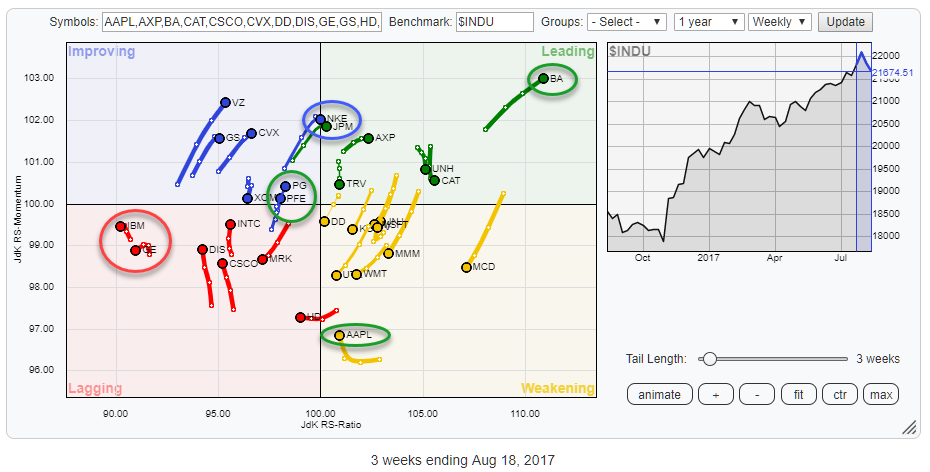

PG and PFE at similar location on RRG but one of them looks much stronger

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

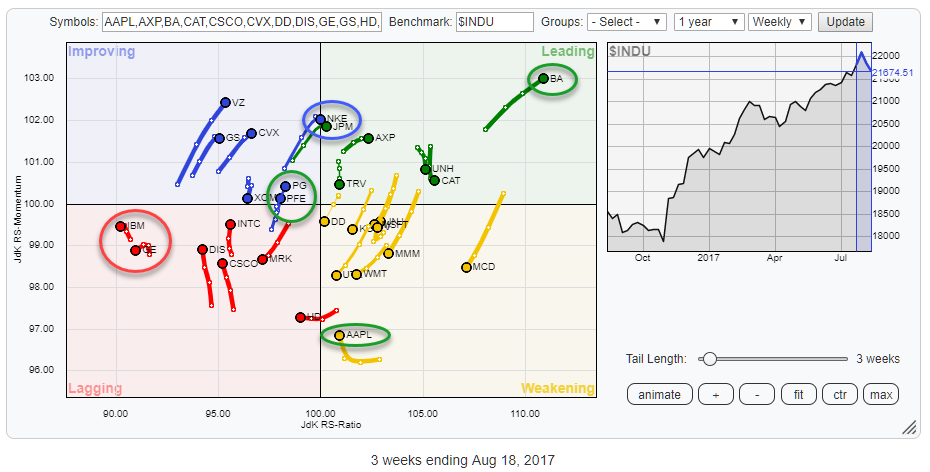

The Relative Rotation Graph above holds the 30 stocks that make up the Dow Jones Industrials Index and compares their relative rotation to $INDU.

From the first observation of this chart, a few tails/stocks catch the eye. First, there is BA in the top-right, leading, quadrant still powering further...

READ MORE

MEMBERS ONLY

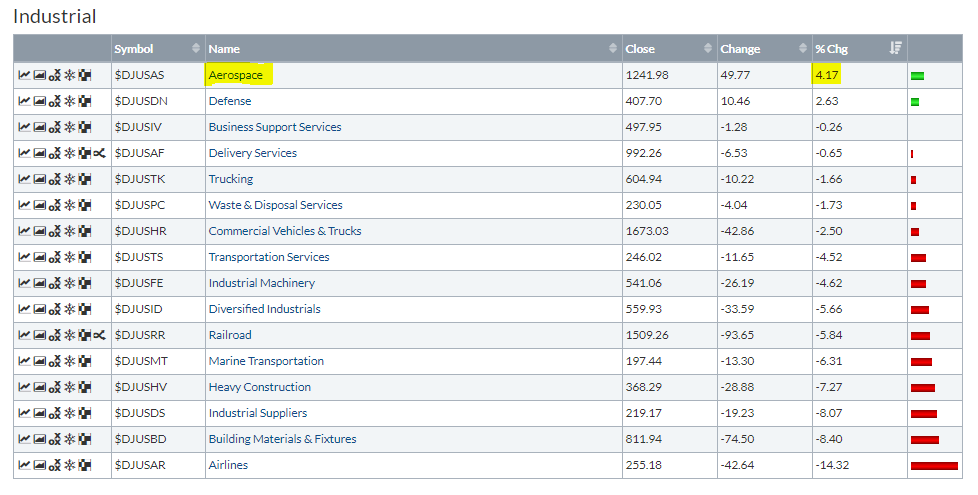

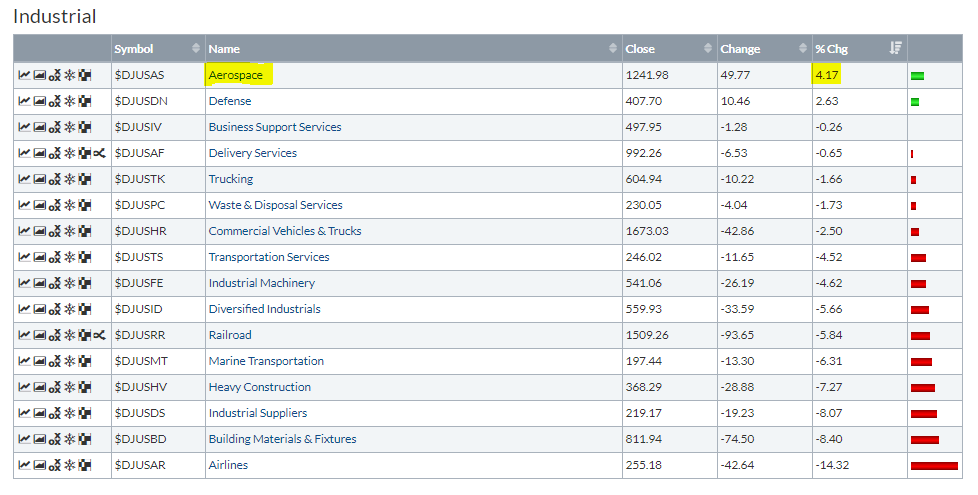

Aerospace Has Been Strong, But It's Relative Strength Momentum Is Weakening

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Bull markets are fueled by sector and industry group rotation. Throughout the bull market since 2009, we've seen each of the key aggressive sectors take their turn leading on a relative basis. Within each sector, we also see relative leadership and weakness among industry groups. For example, over...

READ MORE

MEMBERS ONLY

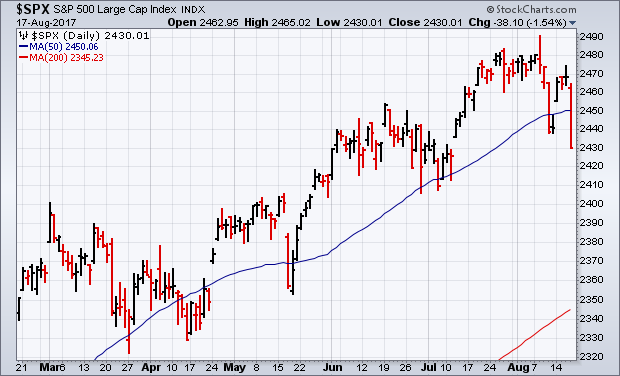

Stocks Have A Bad Day, August Is Living Up To Its Reputation

by John Murphy,

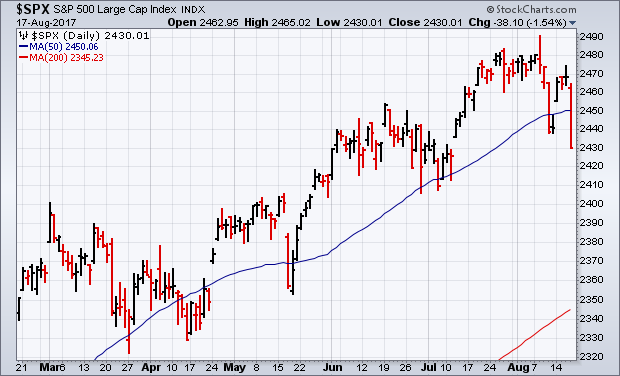

Chief Technical Analyst, StockCharts.com

S&P 500 FALLS TO SIX-WEEK LOW... Selling pressure resumed with a vengeance today. And a lot of support levels have been broken. Chart 1 shows the S&P 500 falling back below its 50-day average to the lowest level in more than a month. Volume was higher....

READ MORE

MEMBERS ONLY

With Earnings Season Winding Down Whats Next?

by John Hopkins,

President and Co-founder, EarningsBeats.com

As earnings season winds down traders are going to be looking for new reasons to be long the market. So far, according to Thompson's Reuters, 460 of the companies represented in the S&P 500 have reported earnings with almost 74% beating expectations. This is 10% above...

READ MORE

MEMBERS ONLY

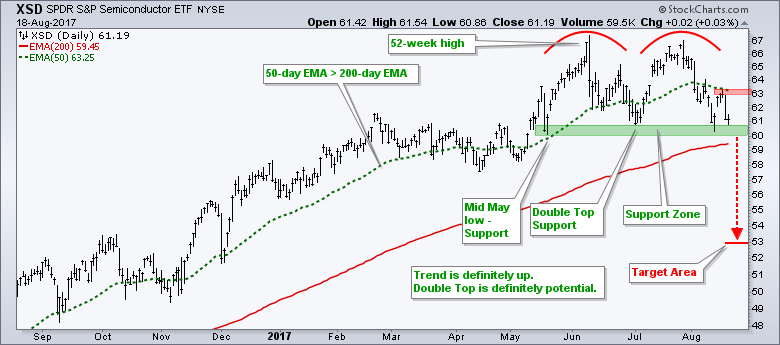

Two Potential Double Tops to Watch Going Forward

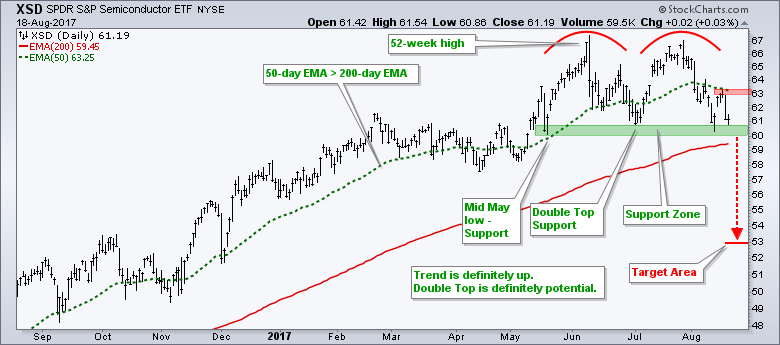

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Doubles Tops are forming in two key ETFs, the Semiconductor SPDR (XSD) and the Consumer Discretionary SPDR (XLY), and chartists should watch these important groups for clues on broad market direction in the coming week or two. First, let's talk about the Double Top. These patterns form with...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Failed Retest

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I wrote: "I would like for the correction to continue for a while, but honestly, we may have just hit bottom." Well, the market did make a bottom, but it was just for a short bounce prior to this week's failed retest of last...

READ MORE

MEMBERS ONLY

DP Bulletin: Dow Industrials ($INDU) Generates ST Trend Model NEUTRAL Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

Today the Dow Jones Industrial Average ($INDU) 5EMA crossed down through the 20EMA, changing a Short-Term Trend Model (STTM) BUY signal to NEUTRAL.

Recently we have been plagued by deluge of whipsaw signals on the other three major indexes we track here, but the Dow has been quite unambiguous, holding...

READ MORE