MEMBERS ONLY

Brace Yourselves, The Summertime Doldrums Have Arrived

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Reminder

If you'd like to receive my blog article each trading day, just as it's published, be sure to scroll down to the bottom of this article, type in your e-mail address and click the "Notify Me" button. It's FREE and you...

READ MORE

MEMBERS ONLY

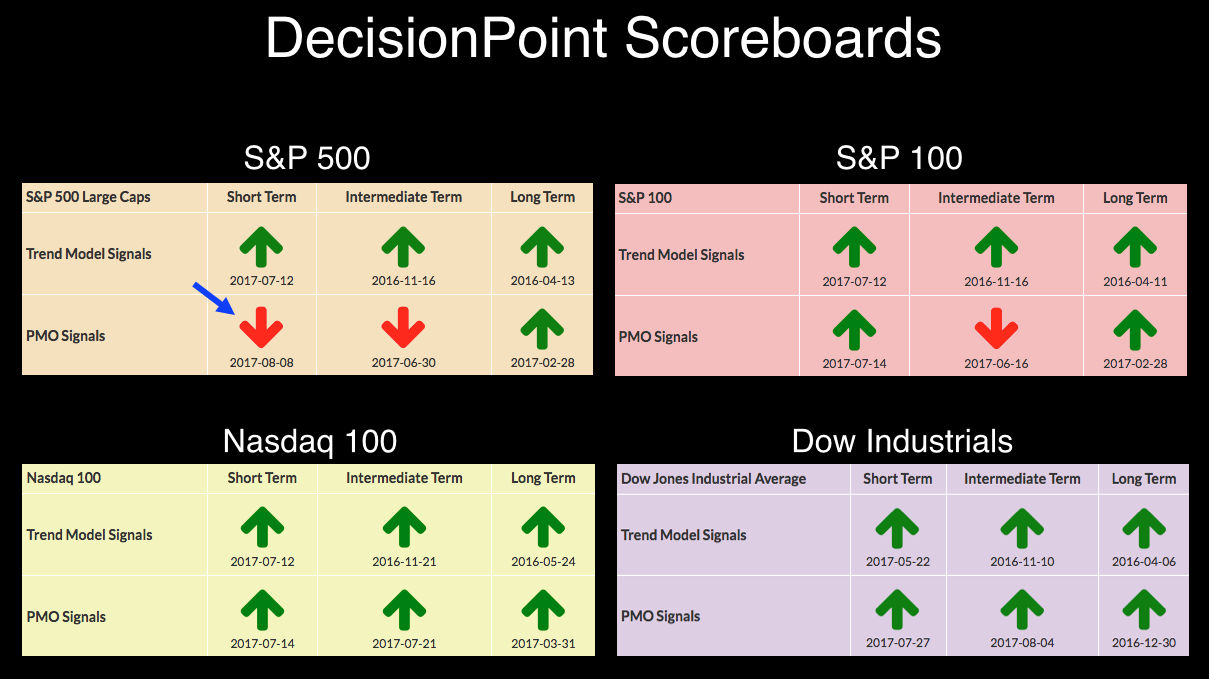

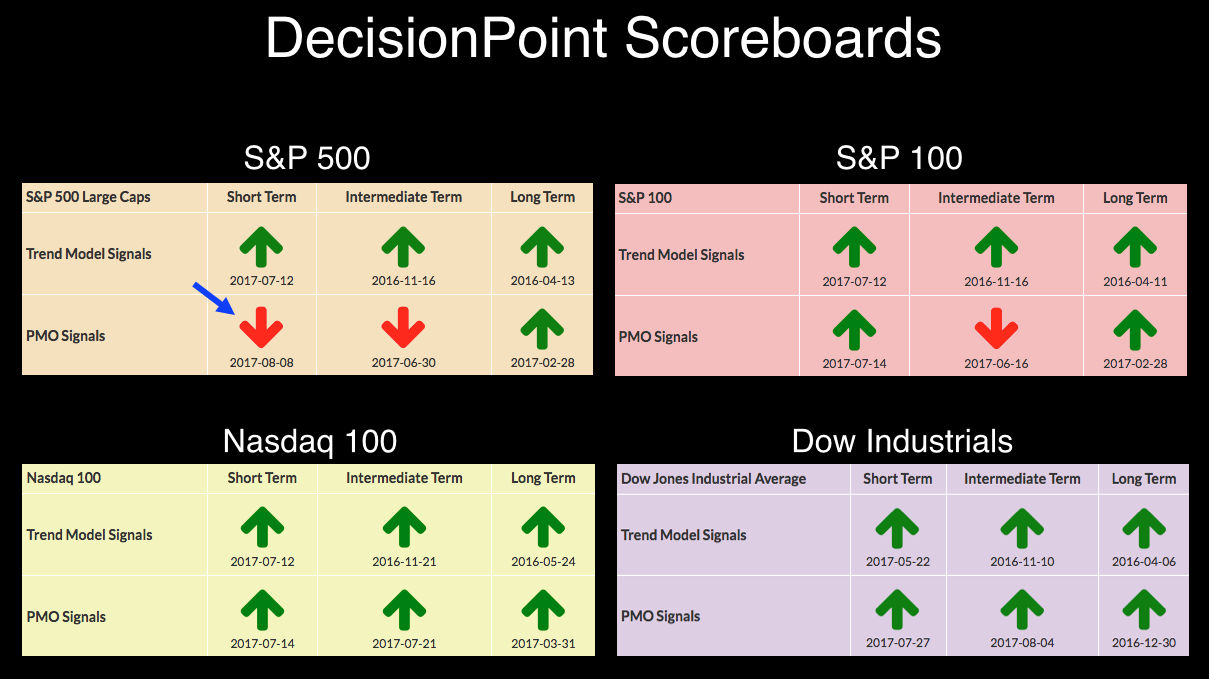

DP Bulletin: S&P 500 ($SPX) Generates ST PMO SELL Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

Today on the daily chart the $SPX PMO dropped below its signal line and generated a short-term PMO SELL signal. More notable, price opened and traded higher, but then it reversed and closed lower -- a key reversal day.

The line chart shows the modestly overbought PMO topping, then falling...

READ MORE

MEMBERS ONLY

Leadership Returns To NASDAQ 100; Watch This Key Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, August 7, 2017

There's nothing wrong with the Dow Jones moving to all-time highs for the ninth consecutive trading session. However, higher prices on the more aggressive NASDAQ and Russell 2000 show traders' appetite for riskier investments and it's that risk...

READ MORE

MEMBERS ONLY

Bear Market Preparedness

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Here is the scenario: You believe we are near a top in the market. I won’t bother to discuss what makes you think that, but if you do, then here is a sampling of things to consider. I was originally going to do this in an enumerated list, but...

READ MORE

MEMBERS ONLY

Another Mean-Reversion Setup for Small-caps and Mid-Caps - Oil and XES Break Up - Six Stock Setups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Another Mean-Reversion Setup for IJR and MDY

.... Crude and XES Get a Divorce

.... XES Tests June-July Lows

.... Interview with Tobias Levkovich

.... Lazard Hits Support after Pullback

.... Watts Water Technologies Turns Up

.... Analog Devices Consolidates within Uptrend

.... Qorvo Reveres Near Rising EMA

.... Two For the Road (CPSI and HLT) ....

Another Mean-Reversion...

READ MORE

MEMBERS ONLY

Erin's Hits: 5-EMA/PMO Scan Produces Interesting Short-Term Opportunities

by Erin Swenlin,

Vice President, DecisionPoint.com

** While Erin is away, we will be posting some of her "greatest hits" educational blogs. Some information may be dated **

With the market bottoming and taking a positive turn, I decided it might be a good time to review the results of one of my favorite and nicely...

READ MORE

MEMBERS ONLY

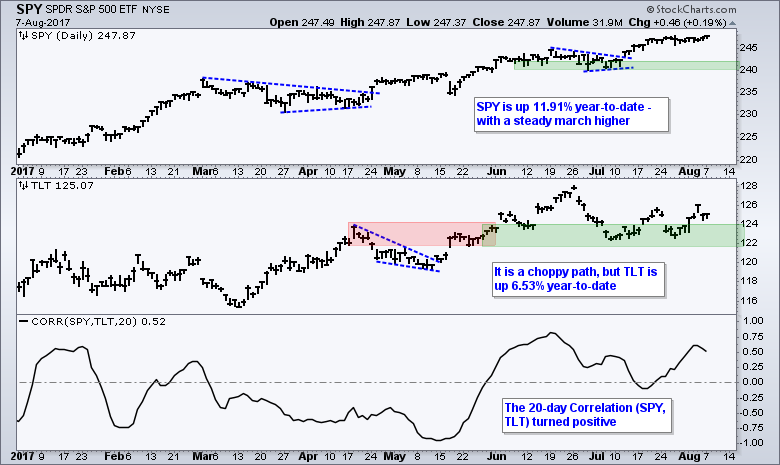

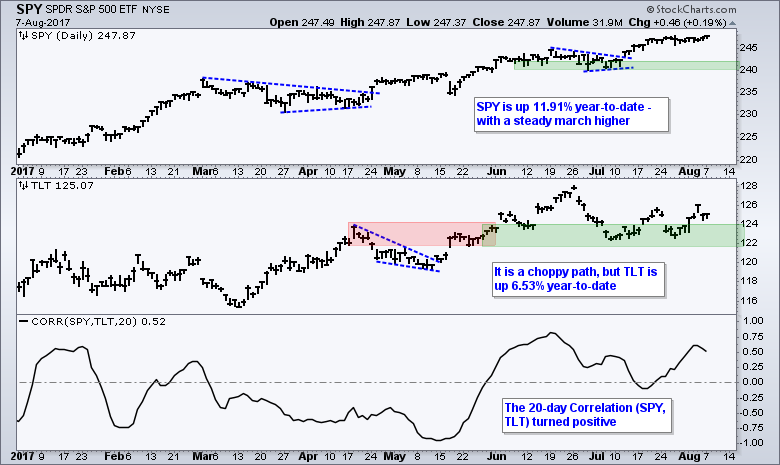

Correlation between Stocks and Bonds Turns Positive

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks and bonds are both having a good year with the S&P 500 SPDR (SPY) up 11.91% year-to-date and the 20+ YR T-Bond ETF (TLT) rising 6.53% since January. The advance in SPY has been much steadier than the choppy advance in TLT, but both sport...

READ MORE

MEMBERS ONLY

Solid Jobs And Treasury Selling Lifts U.S. Equities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I will be joining John Hopkins, President of EarningsBeats.com, for a special earnings-related webinar that begins at 4:15pm this afternoon, just after the market closes. I'll be providing several of my favorite stocks from the current parade of earnings so please join me and...

READ MORE

MEMBERS ONLY

Ferrari Flying But Does It Need A Pit Stop?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Fresh off yet another stellar quarterly earnings report, Ferrari's (RACE) stock price has hit the accelerator once again. Its ascent truly has been remarkable as RACE has gone from 31 to 111 in 3.2 seconds. Okay, the stock price hasn't really moved that fast, but...

READ MORE

MEMBERS ONLY

Dow 22,000 Mission Accomplished. Oh Yeah?

by Martin Pring,

President, Pring Research

* Bullish percent indicators are starting to deteriorate

* Short-term confidence may be turning

* Small caps getting smaller?

* Oversold Dollar Index bounces from support

Bullish Percent Index indicators are starting to deteriorate

This week we saw the financial media and President Trump glorify the fact that the DJIA had exceeded 22,000...

READ MORE

MEMBERS ONLY

The Table has Been Set - The Earnings Smorgasboard

by John Hopkins,

President and Co-founder, EarningsBeats.com

Everyone likes a good meal, especially an all you can eat buffet. And if you are a trader, you've just been served up an earnings smorgasboard.

So far, per Thomson Reuters, over 400 companies in the S&P have reported for Q2, 2017, with almost 73% beating...

READ MORE

MEMBERS ONLY

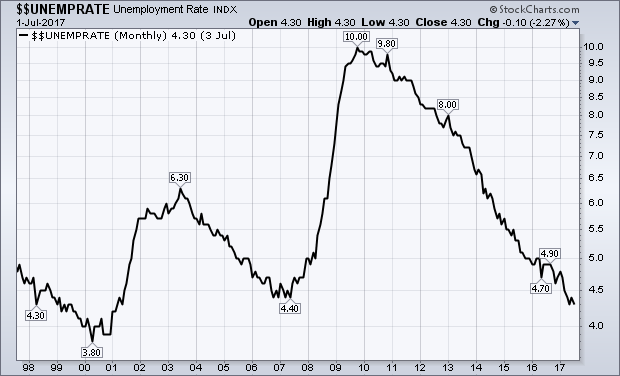

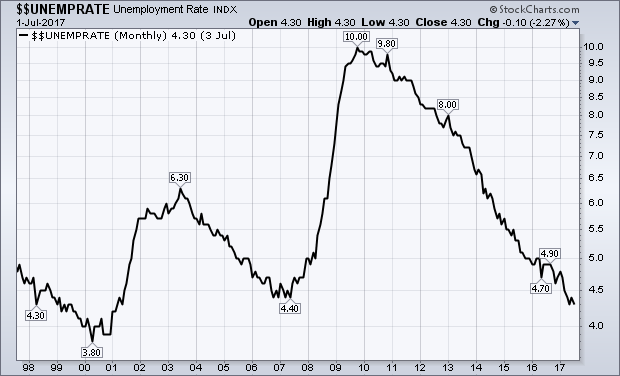

Friday's Strong Job Report May Not Be As Strong As It Looks

by John Murphy,

Chief Technical Analyst, StockCharts.com

IS THIS THE REAL UNEMPLOYMENT RATE? ... Friday's job report saw 209,000 new jobs added during July which was well above expectations. Hourly earnings also saw a July again of 0.3% which attracted the most attention. That, however, leaves the year over year rise in wages at...

READ MORE

MEMBERS ONLY

Searching For More Summertime Breakouts

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

A month ago, I posted an article looking at 3 NASDAQ 100 stocks that were looking to make technically significant breakouts. Sirius XM Holdings (SIRI) had a cup in play that, if broken, would measure to 5.90, or nearly 8%. It broke out on heavy volume and hit a...

READ MORE

MEMBERS ONLY

STOCKS END THE WEEK ON A STRONG NOTE WITH THE DOW STILL IN THE LEAD -- SMALL CAPS REBOUND AS TRANSPORTS HOLD 200-DAY LINE -- JUMP IN BOND YIELDS KEEPS FINANCIALS IN THE LEAD -- OVERSOLD DOLLAR BOUNCES OFF MAJOR CHART SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW HITS NEW RECORD WHILE NASDAQ HOLDS BACK ... The Dow Industrials continue to lead the market higher. Chart 1 shows the Dow ending the week at a new record. Its weekly gain of 1.2% led all other market indexes. Its 14-day RSI line, however, shows the Dow now in...

READ MORE

MEMBERS ONLY

An Ugly Price Relative, but a very Nice Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The price relative, or ratio chart, is handy for measuring relative performance, but it does not always reflect the trend for the underlying securities. For those unfamiliar, the RSP:SPY ratio measures the performance of the EW S&P 500 ETF (RSP) relative to the S&P 500...

READ MORE

MEMBERS ONLY

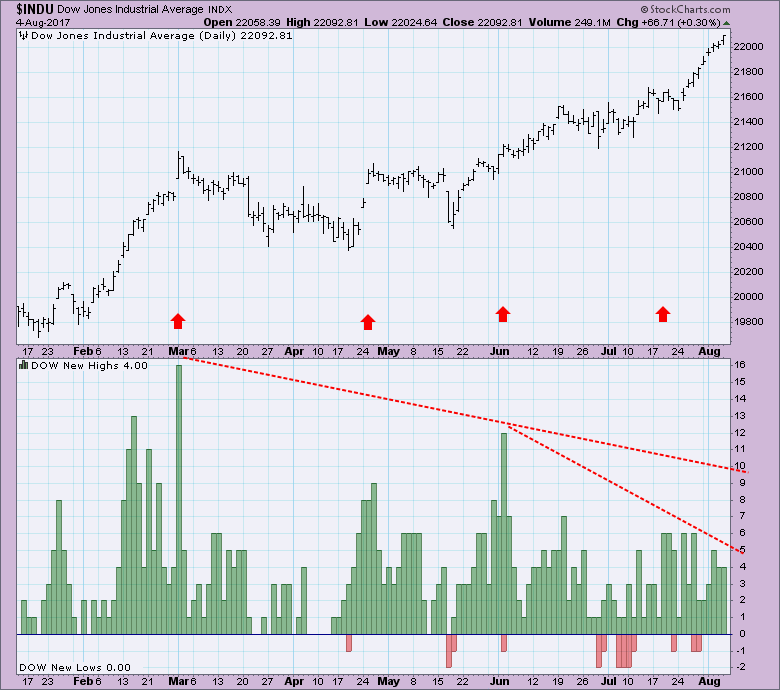

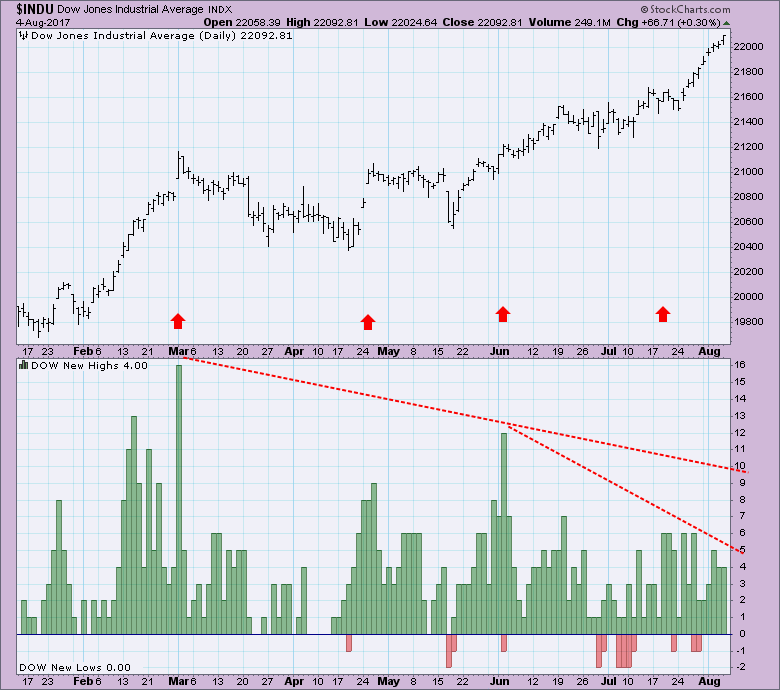

Watching Support Fade

by Carl Swenlin,

President and Founder, DecisionPoint.com

As the Dow Jones Industrial Average (DJIA) has been moving steadily to record highs, I have observed a persistent erosion of underlying support as expressed by 52-Week New Highs for the DJIA component stocks. The New High peak in March represents the highest level reached recently, and we can see...

READ MORE

MEMBERS ONLY

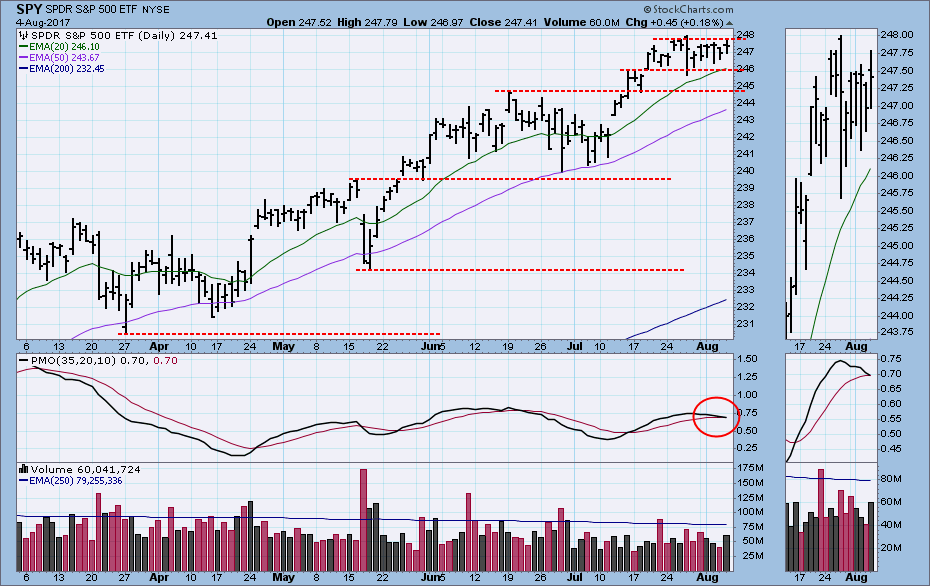

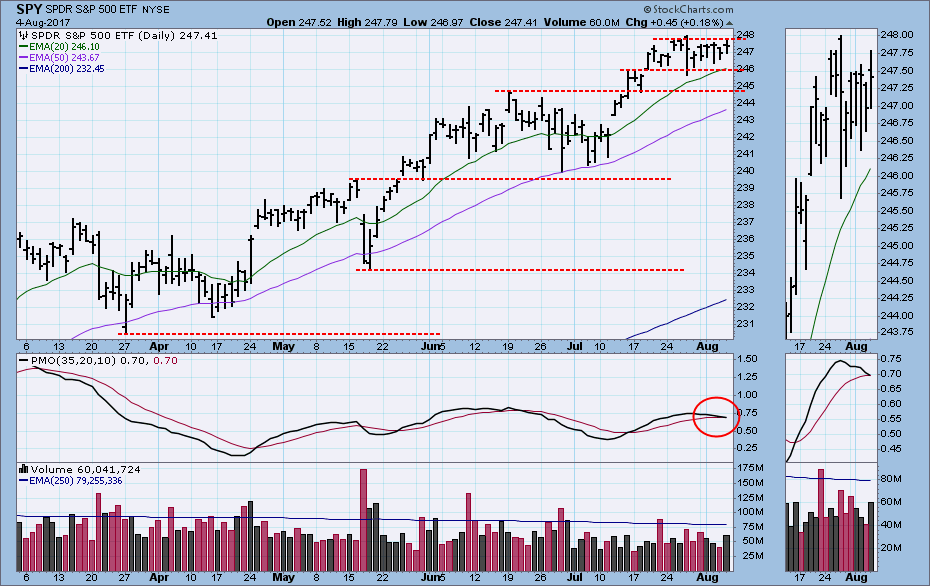

DP Weekly Wrap: Top Still Not Resolved

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week it looked as if the market was beginning to form a top, but that result still hasn't been realized. SPY continued to churn sideways, and the daily PMO came within a hair of crossing down through its signal line. There is still evidence that there is...

READ MORE

MEMBERS ONLY

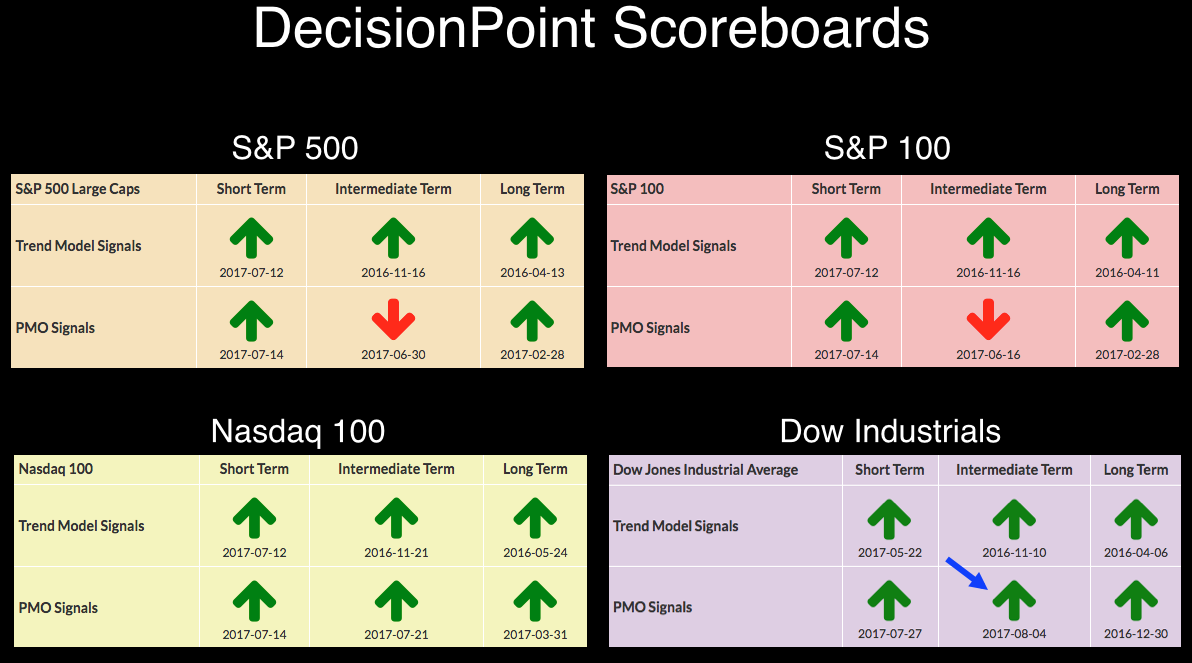

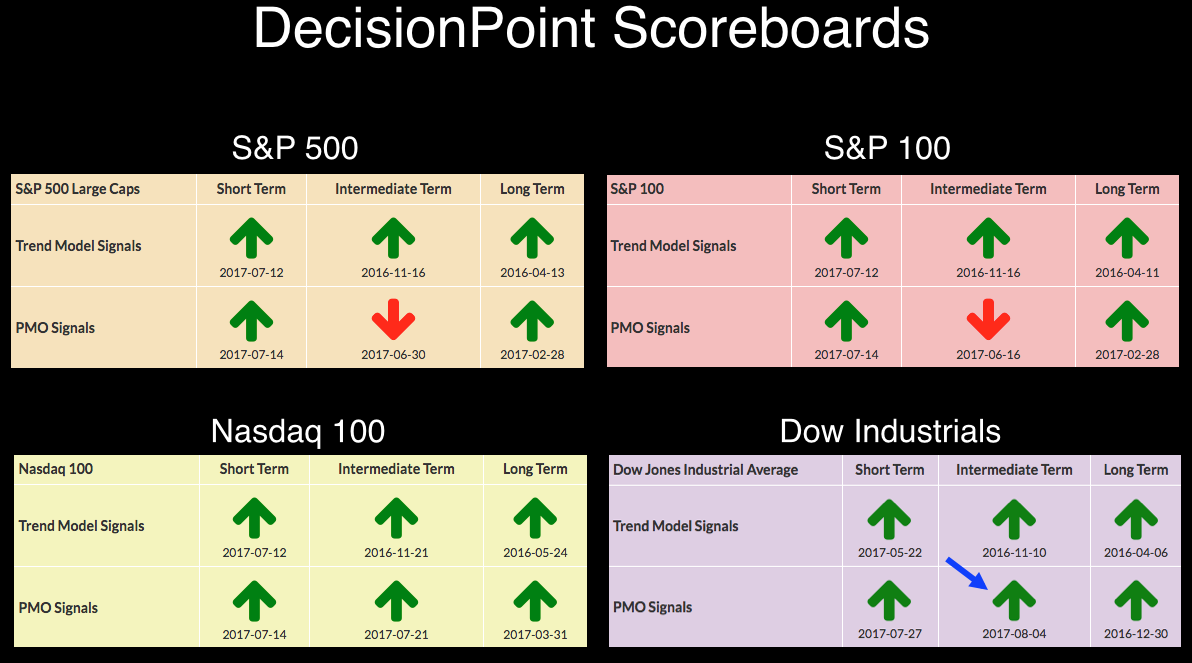

DP Bulletin: Dow Industrials ($INDU) Generate Weekly PMO BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

Today the weekly PMO for the Dow Jones Industrial Average ($INDU) crossed up through its signal line and generated a weekly PMO BUY signal.

We can see on the weekly chart that the PMO has been running flat well above the zero line since April, which indicates that price has...

READ MORE

MEMBERS ONLY

Get Inspired, Get Profitable, Get a Vacation

by Gatis Roze,

Author, "Tensile Trading"

It’s been my experience as a full-time trader over the decades that investing muscles need to take a vacation regularly. I’ve learned the hard way that vacations must be part of my money management routines. If I procrastinate and wait until I realize I need a vacation, the...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (w/ Video) - We've Seen this Movie Before

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Large-caps Continue to Lead

.... An Ugly Price Relative, but a Nice Uptrend

.... SPY and QQQ Stall Near All Time Highs

.... Small-caps: We Seen this Movie Before

.... Utes Outperform Bonds and Regionals Lag Badly

.... XLF Rises as 10-yr T-Yield Falls - KRE Lags

.... XLI Breaks Flag Resistance

.... XLP Breadth Weakens and...

READ MORE

MEMBERS ONLY

August Means Road Construction Ahead For Truckers; July Jobs Report On Deck

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, August 3, 2017

The Dow Jones was once again able to eke out a meager 9 point gain to establish yet another record closing high, but other indices were unable to keep up. The more aggressive Russell 2000 and NASDAQ fell by 0.54% and 0....

READ MORE

MEMBERS ONLY

Here's A High Reward To Risk Biotech Play

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

First, please understand that any time you trade a small biotech company, there are considerable risks attached. These types of stocks are certainly not for everyone. One size does not fit all. However, if you enjoy taking higher risk in an attempt to score high returns quickly, then take a...

READ MORE

MEMBERS ONLY

SystemTrader - Reworking the ChartCon Momentum Rotation Strategy - Cut your Profits and don't Worry about Stops

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

---- Reworking the Momentum-Rotation Strategy

---- Setting the Benchmark

---- System Ground Rules

---- Four Extra Filters

---- Consulting, Software and Data

---- Charts with Trading Signals

---- Rate-of-Change Ranking Results

---- Testing a Trailing Stop

---- Conclusions and Caveat Emptor

---- Scan Code ----

Reworking the Momentum-Rotation Strategy

I...

READ MORE

MEMBERS ONLY

AFTER FALLING DURING THE FIRST HALF OF THE YEAR, CRUDE OIL AND GASOLINE PRICES ROSE DURING JULY -- THAT SHOULD BOOST INFLATION NUMBERS FOR THAT MONTH -- THE FED SHOULD LIKE THAT

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY PRICES ROSE DURING JULY... A report on Tuesday covered economic conditions during the second quarter. One of the things it showed was continuing low inflation, which remains well below the Fed's target of 2%. One of the factors mentioned was falling energy prices. Naturally, the media reported...

READ MORE

MEMBERS ONLY

Consumer Relationship Still Pointing To Higher Prices

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 2, 2017

The action on Wednesday was quite boring once again, despite hundreds of companies reporting their quarterly results. The Dow Jones jumped another 52 points to a fresh record high - which it's been seeing daily - and it pierced 22000 for...

READ MORE

MEMBERS ONLY

Erin's Hits: PMO + CandleGlance = Smart Money

by Erin Swenlin,

Vice President, DecisionPoint.com

** While Erin is away, we will be posting some of her "greatest hits" educational blogs. Some information may be dated **

The definition of "Smart Money": Money bet or invested by people with expert knowledge. I won't claim expert knowledge, but the pursuit of getting...

READ MORE

MEMBERS ONLY

A FEW CRACKS ARE SHOWING IN THE STOCK UPTREND -- THE FIRST ONE IS DOW OUTPERFORMANCE -- THE SECOND IS TRANSPORTATION SELLING -- A THIRD IS SMALL CAP WEAKNESS -- AND STOCKS HAVE ENTERED A SEASONALLY A WEAK PERIOD BEWEEN AUGUST AND SEPTEMBER

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW OUTPERFORMANCE MAY NOT BE A SIGN OF MARKET STRENGTH... It seems everyone in the media has been transfixed on the Dow Industrials hitting 22K this week. And they cite that as proof that the stock rally is alive and well. That recent Dow strength, however, is coming from a...

READ MORE

MEMBERS ONLY

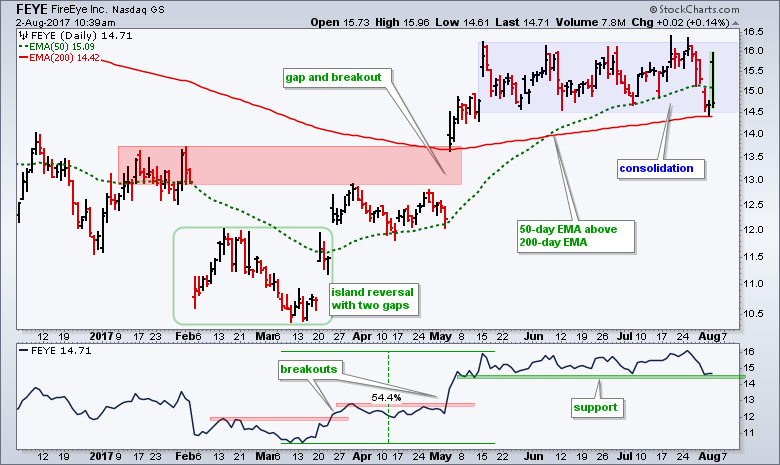

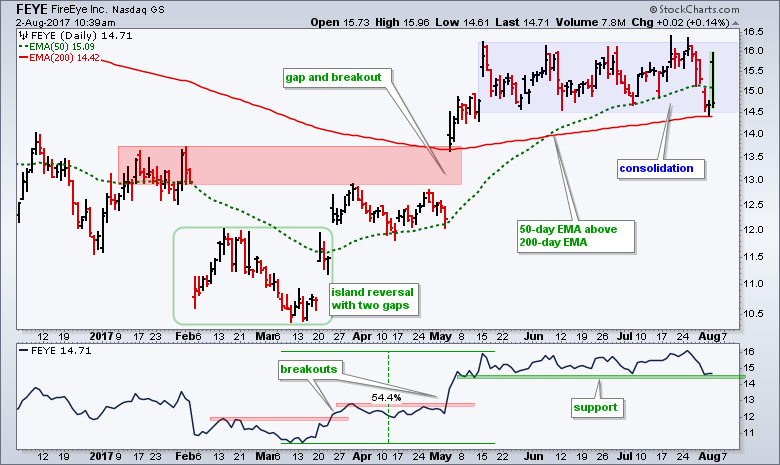

FireEye Battles Consolidation Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

FireEye reported earnings on Tuesday and surged on Wednesday morning with a strong open. The stock is trading well below the open now, but I wanted to highlight the bigger patterns at work. First, the long-term trend is up because the stock is above the 200-day EMA and the 50-day...

READ MORE

MEMBERS ONLY

It's Make Or Break Time For The Dollar And Gold

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, August 1, 2017

It was a rather boring day on Wall Street Tuesday, albeit a bullish one, as all of our major indices finished the day higher. Both the S&P 500 and NASDAQ tight-roped along key support/resistance levels as you can see below:...

READ MORE

MEMBERS ONLY

What Will You do When the Bear Arrives?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I would imagine there are many readers that are fairly new to market analysis and in particular, technical analysis. We have had 10 bear markets in the S&P 500 Index since 12/30/1927 and 15 bear markets in the Dow Jones Industrial Average since 2/17/1885....

READ MORE

MEMBERS ONLY

A Dollar for Your Thoughts

by Bruce Fraser,

Industry-leading "Wyckoffian"

The dollar has been sinking since the end of 2016. Recently there has been much attention and commentary from the financial community on the impact of this weakness. A falling dollar typically helps U.S. exporters by lowering the price of their goods in world markets. A lower dollar imports...

READ MORE

MEMBERS ONLY

Market Round Up Video Recording With Martin Pring 2017-08-01

by Martin Pring,

President, Pring Research

The Market Round Up Video Recording for August is available. Use the HD button for better clarity when viewing.

Market Round Up Live With Martin Pring 2017-08-01 from StockCharts.com on Vimeo.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the...

READ MORE

MEMBERS ONLY

DP Alert: New BUY Signal for Crude (USO)

by Carl Swenlin,

President and Founder, DecisionPoint.com

Today a new IT Trend Model (ITTM) BUY signal was generated by U.S. Oil Fund (USO), our surrogate for crude oil, when the 20EMA crossed up through the 50EMA. This looks like a case where the signal is a bit late in arriving due to the severe selling that...

READ MORE

MEMBERS ONLY

Financials Lead Dow Jones Rally; Costco Rebounds

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 31, 2017

The Dow Jones set another all-time high on Monday, rising another 60 points in its lone attempt to carry the bull market to new heights. All of our other major indices fell on Monday despite the renewed strength of financials (XLF, +0.72%...

READ MORE

MEMBERS ONLY

Oil Could Hit Resistance Soon - Equipment and Services ETF Lags - Plus XOM, CVS, GS, SCHW, L, TRV and BMY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Oil Could Hit Resistance Soon

.... Oil & Gas Equipment & Services SPDR Lags Crude

.... Chevron Leads as ExxonMobil Lags

.... Goldman Finds Support as Schwab Turns Up

.... Loews and Travellers Lead Insurance Industry

.... Bristol Meyers Fills Gap with Big Move ....

Oil Could Hit Resistance Soon

The rally in crude could run...

READ MORE

MEMBERS ONLY

Erin's Hits: Creating a Workflow ChartList

by Erin Swenlin,

Vice President, DecisionPoint.com

** While Erin is away, we will be posting some of her "greatest hits" educational blogs. Some information may be dated **

With the release of several DecisionPoint ChartPacks (to learn more about them and how to install them click here), many users have expressed that they are overwhelmed by...

READ MORE

MEMBERS ONLY

Has $GOLD Got What It Takes For A Major Rally?

by Martin Pring,

President, Pring Research

* The longer-term indicators very finely balanced

* The Gold/dollar ratio may be providing some leadership

* Gold shares may have something to say in the matter

The longer-term indicators very finely balanced

The price of Gold has been in a trading range since late 2013, and has traded even more narrowly...

READ MORE

MEMBERS ONLY

DP Alert: Gold Generates New BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

Gold generated a new IT Trend Model (ITTM) BUY signal as the 20EMA crossed up through the 50EMA. In the last year there have been six ITTM signal changes, and price has been running flat for six months, a configuration that facilitates even more whipsaw. There is, however, more to...

READ MORE

MEMBERS ONLY

Chevron Leads Energy Sector with Breakout $CVX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chevron appears to be ending its correction and resuming its bigger uptrend with a five-day surge and breakout. The stock surged to a 52-week high in December and then retraced 61.8% of the prior advance with a decline into April. The decline basically ended in April because the stock...

READ MORE

MEMBERS ONLY

Defense Stocks Bounce Off Price Support; Dow Jones Sets New Record

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 28, 2017

The U.S. stock market has been quite resilient and today wraps up a very strong July. On Friday, only the Dow Jones finished higher - and at a fresh new record high - while healthcare (XLV, +0.50%) and industrials (XLI, +0....

READ MORE