MEMBERS ONLY

Market Round Up Video With Martin Pring 2017-06-02

by Martin Pring,

President, Pring Research

Here is the link to this months Market Round Up with Martin Pring for June 2017. Don't forget to use the HD button for better quality.

Market Round Up Live With Martin Pring 2017-06-02 from StockCharts.com on Vimeo.

Good luck and good trading,

Martin J. Pring...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook with Video - Participation is Broad Enough as New Highs Expand

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... New Highs Expand in Large-caps and Mid-caps

.... EW S&P 500 Reflects Broad Strength

.... SPY Hits another New High

.... QQQ Extends its "Overbought" Streak

.... Small-caps and Mid-caps Perk Up

.... New highs in XLY, XLK, XLI, XLV, XLU and XLP

.... Good Weekend Stocks Lead XLY to New High...

READ MORE

MEMBERS ONLY

Financials Rally To Lead U.S. Indices To New Records

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 1, 2017

U.S. equities had a very strong day on Thursday, with the small cap Russell 2000 leading the charge with a solid 1.89% gain. The move was also widely participated in, with all nine sectors finishing higher. Financials (XLF, +1.25%), a...

READ MORE

MEMBERS ONLY

DP Alert: Rally Pop! Internal Strength Prevails - S&P 600 (IJR) New ITTM BUY Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

Admittedly I was surprised that the market had just a brilliant day given the very bearish configuration of short-term market indicators. Apparently I should have paid more attention to the short-term buy signals that were produced over the past week or two. The rally brought the S&P 600...

READ MORE

MEMBERS ONLY

STAPLES AND CYCLICALS HIT NEW HIGHS TOGETHER -- BUT CYCLICALS STILL HAVE THE EDGE -- HEALTHCARE SPDR HITS NEW RECORD HIGH -- MIDCAPS MAY GIVE TRUER PICTURE OF STOCK MARKET --S&P 400 MID CAP INDEX IS CONSOLIDATING IN BULLISH TRIANGLE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STAPLES AND CYLICALS BOTH HIT NEW HIGHS... We can often get clues about stock market direction by watching shifting rotations among market sectors. In a strong market, stocks tied to the economy usually lead. In a correction, defensive stocks lead. But what are we to make of a situation where...

READ MORE

MEMBERS ONLY

Coal Facing Poor Technical Conditions And Historical Headwinds

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones U.S. Coal Index ($DJUSCL) spent 2016 bouncing from the ashes after a disastrous 2015 in which the DJUSCL lost 90% of its value. The "dead cat bounce" looks as though it may have ended as price action has rolled over and the weekly MACD...

READ MORE

MEMBERS ONLY

Autos Rise, Break Downtrend Line; Tesla Benefits

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 31, 2017

Utilities (XLU, +0.50%) and healthcare (XLV, +0.40%) led a defensive-oriented market on Wednesday with the latter nearing a significant bullish ascending triangle breakout. Materials (XLB, +0.30%) and consumer staples (XLP, +0.28%) also performed well. The aggressive sectors were mixed...

READ MORE

MEMBERS ONLY

Small-caps Rebound - Plus A Big Chemical Breakout, an Industrial Breakout, Four Tech Corrections and Two Big Pharmas Perk Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Small-caps Bounce Back from the Abyss

.... Lots of Winners and Losers Out There

.... A Big Chemical Stock Breaking Flag Resistance

.... An Industrial Stock Bouncing off Support

.... Four Tech Stocks with Small Corrections

.... Big Pharma Stocks Perk Up

.... Three Miscellaneous Stocks: FBHS, SYY and XRAY....

Small-caps Bounce Back from the Abyss...

READ MORE

MEMBERS ONLY

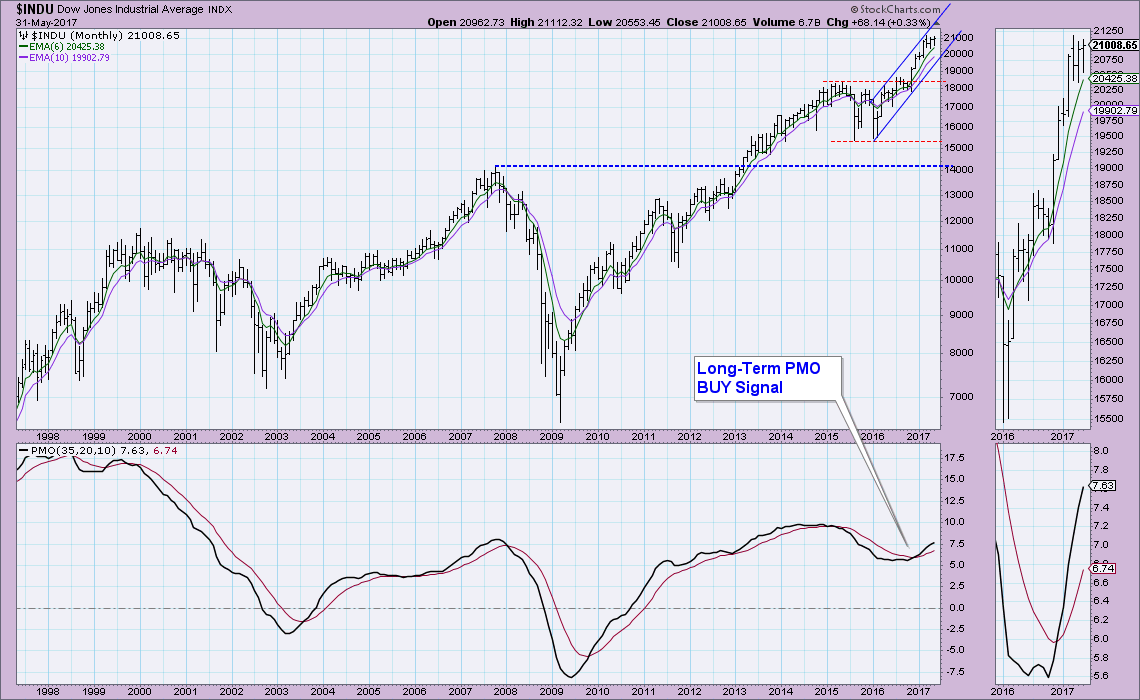

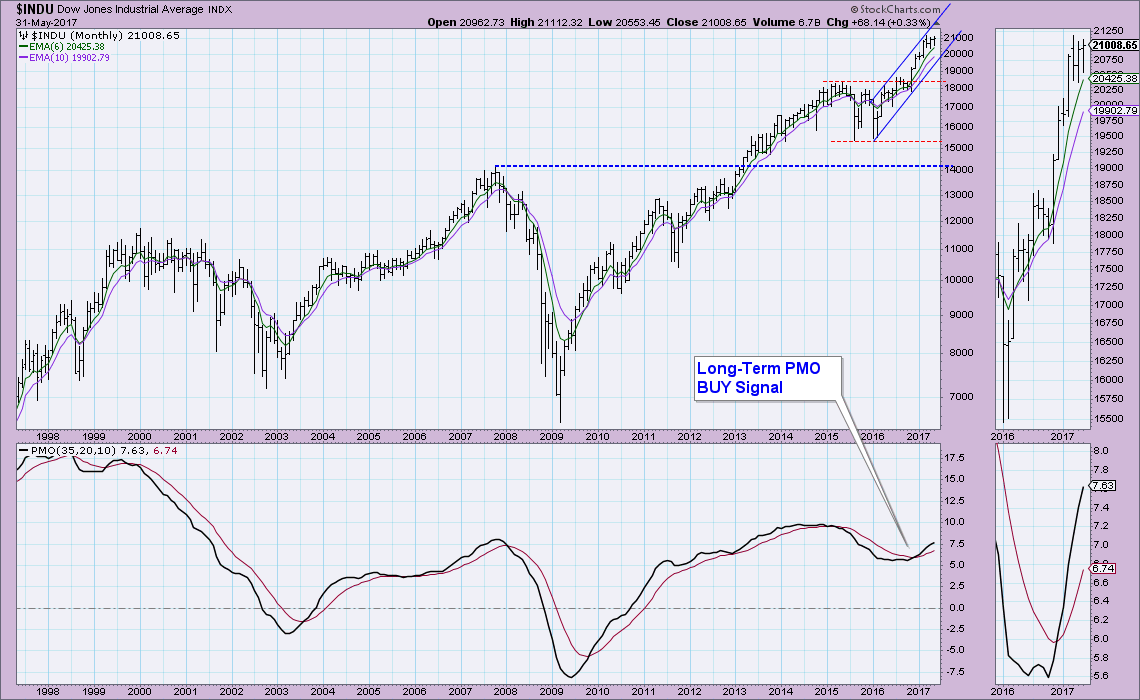

Monthly Chart Review - Large Caps, Small Caps, Big Four

by Erin Swenlin,

Vice President, DecisionPoint.com

It's the last day of the month and consequently time to review the monthly charts that have just gone final. There are some interesting configurations, especially on the Dollar and Bonds which I'll cover later in the blog. I'd like to start first with...

READ MORE

MEMBERS ONLY

FINANCIALS LEAD MARKET LOWER -- FALLING YIELD CURVE HURTS BANKS -- FALLING YIELDS, HOWEVER, PUSH UTILITIES TO NEW HIGHS -- SMALL CAPS CONTINUE TO UNDERFORM -- U.S. LARGE CAP STRENGTH MAY HAVE MORE TO DO WITH STRONGER FOREIGN MARKETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

FALLING BOND YIELD PUSHES YIELD CURVE LOWER... The divergence between falling Treasury bond yields and rising stock indexes may be starting to take its toll on the stock market. Major stock indexes are in the red today. The biggest selling, however, is coming from small caps and financials. At the...

READ MORE

MEMBERS ONLY

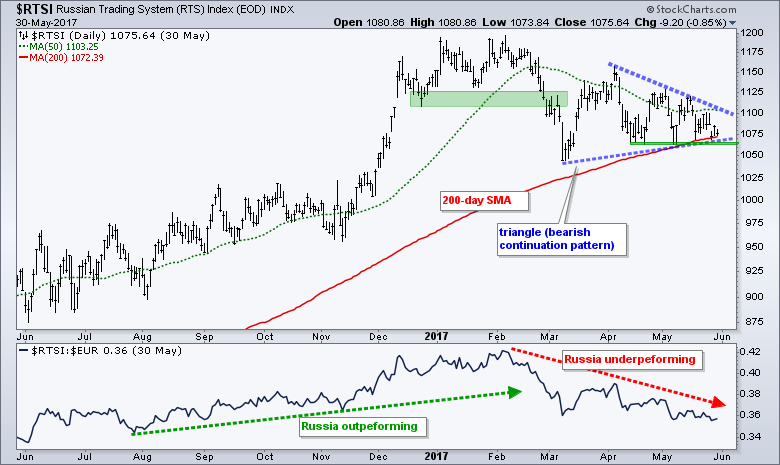

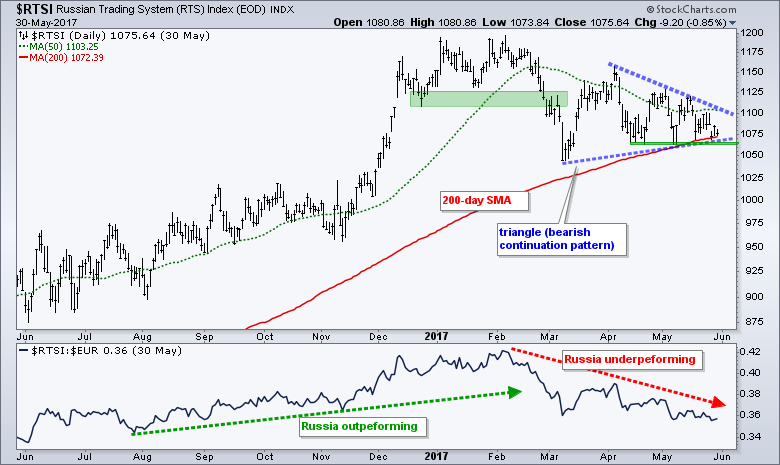

Russian Index Forms Bearish Continuation Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Russian Trading System Index ($RTSI) is struggling this year and down around 6.5% year-to-date. In contrast, the S&P 500 is up over 7% year-to-date and the Eurotop 100 ($EUR) is up around 6.5%. In addition to relative weakness, the index sports a bearish continuation pattern...

READ MORE

MEMBERS ONLY

Strength In Internet, Software And Semiconductors Leading Technology Group

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 30, 2017

Technology (XLK, +0.43%) remains the heart of this current bull market. The XLK was the sector leader on Tuesday, with utilities (XLU, +0.32%) a close second. Over the past week, utilities and consumer discretionary (XLY) hold a slight edge over technology....

READ MORE

MEMBERS ONLY

DP Alert: Market Pauses - Indicators Suggest a Bearish Week

by Erin Swenlin,

Vice President, DecisionPoint.com

No new changes to report today. Although we are seeing BUY signals on all of the DecisionPoint Scoreboards, the short-term picture is not that bullish according to our other market indicators.

The purpose of the DecisionPoint Alert Daily Update is to quickly review the day's action, internal condition,...

READ MORE

MEMBERS ONLY

Perhaps The Fed Won't Raise Rates After All?

by Martin Pring,

President, Pring Research

* Long-term background for bonds

* Bond Prices at a critical short-term juncture point

* Is the 5-year yield forming a massive top?

* Utilities moving in sympathy with bonds

* Interest sensitive REITS starting to improve

* Follow the commodities

Long-term background for bonds

A lot of people are betting that stronger economic data will...

READ MORE

MEMBERS ONLY

Dow Jones In Record High Territory Amid Signs Of Slowing Momentum

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 26, 2017

Friday's action was slightly bullish overall, but there was little difference between the best performing sectors and the worst performing sectors. Consumer stocks performed well with consumer staples (XLP, +0.37%) and consumer discretionary (XLY, +0.30%) leading all sectors. On...

READ MORE

MEMBERS ONLY

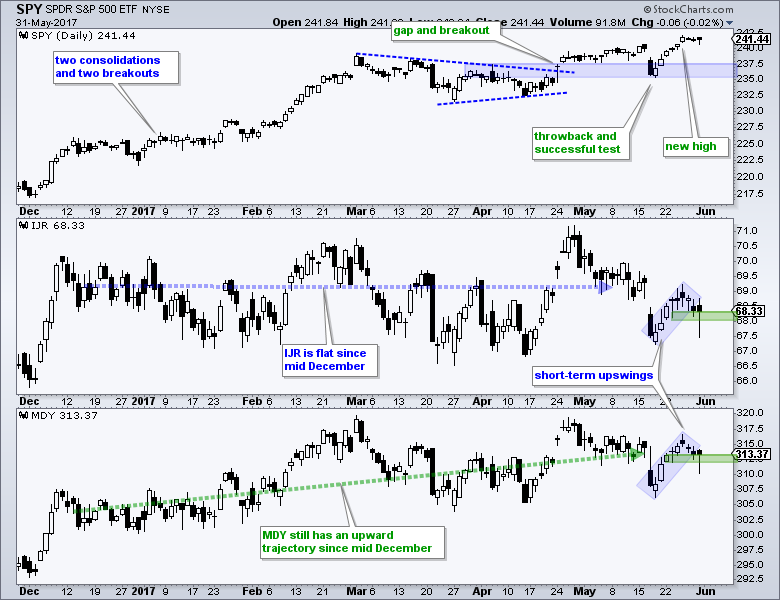

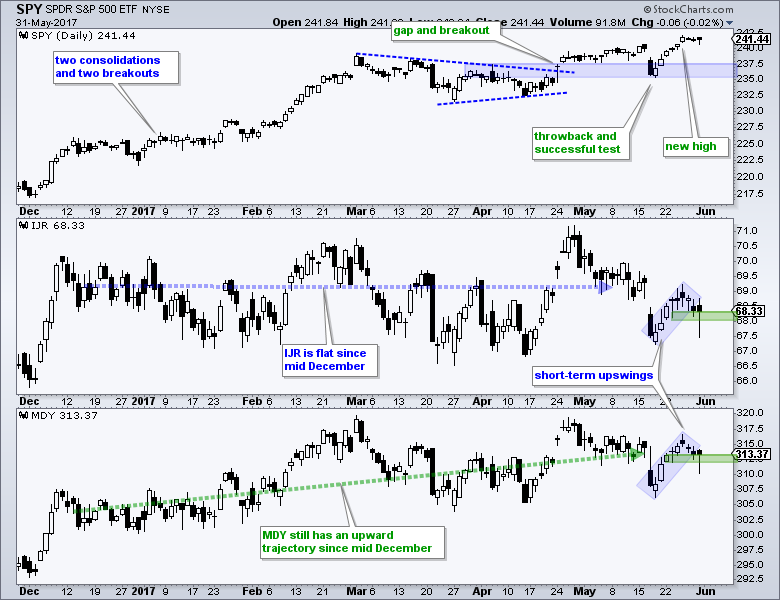

Mean-Reversion for IJR - Plus China, Asia, Aluminum, Railroads and Six Stocks to Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... IJR Mean-Reversion Trade in Play

.... Marking Upswing Support for MDY

.... Chinese Stocks Spring to Life

.... Asian Index ETFs Show Broad Strength

.... Finding Stocks within an Industry Group

.... Aluminum Stocks Look Poised for Upturn

.... Railroad Stocks Lead with Big Gains

.... Stocks to Watch: MON, FLIR, CY, PANW, PAYX, WWW ....

IJR Mean-Reversion...

READ MORE

MEMBERS ONLY

Infinera Breaks Descending Channel On Heavy Volume

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Infinera (INFN) gapped higher in February on massive volume, but has been falling in a descending channel ever since. Volume accelerated on Friday as INFN clearly broke this down channel. The reversal also is taking place after a key gap support level was filled and tested. Take a look at...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap -- Participation Fading

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I said that I was expecting the market to do a little more work on the downside before the bull market resumed, but the market had other ideas. Prices continued to rally, and on Thursday SPY broke to new, all-time highs. Volume expanded on that day, but it...

READ MORE

MEMBERS ONLY

Segmenting PnF Counts

by Bruce Fraser,

Industry-leading "Wyckoffian"

Wyckoffians often break up a large Point and Figure count into smaller count objectives. A large count objective usually requires a significant period of time to be fulfilled and pauses will occur along the way. Sometimes these pauses result in a period of Reaccumulation prior to moving on to higher...

READ MORE

MEMBERS ONLY

Charts I'm Stalking: Action Practice #16

by Gatis Roze,

Author, "Tensile Trading"

So you’ve heard about Exchange Traded Funds (ETFs). You’ve heard that they are cheap. You’ve heard that mutual fund managers cannot outperform ETFs. You’ve decided that a chunk of your nest egg should be in Healthcare. A friend suggested XPH because it holds stocks like Eli...

READ MORE

MEMBERS ONLY

GROWTH STOCKS ARE CARRYING MARKET HIGHER -- THAT'S MAINLY BIG TECHS -- VALUE STOCKS ARE LAGGING BEHIND -- THAT'S MAINLY FINANCIALS AND ENERGY -- % OF STOCKS ABOVE 50- AND 200-DAY AVERAGES NEED TO START CLIMBING

by John Murphy,

Chief Technical Analyst, StockCharts.com

GROWTH STOCKS ARE LEADING THIS YEAR'S STOCK RALLY... The S&P 500 and the Nasdaq hit new record highs yesterday, and the Dow isn't far behind. Large parts of the stock market, however, are lagging behind. That's not necessarily a good thing. The...

READ MORE

MEMBERS ONLY

Video - Weekly Market Review & Outlook - Still a Large-cap World

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Stocks Bounce without Biotechs

.... Breadth Remains Bullish, but Weakening

.... Nasdaq Stocks Support S&P 500

.... QQQ Hits Yet Another New High

.... Small-caps Not Feeling the Love

.... Sector Balance Clearly Bullish

.... %Above 200-day Ranking for Sectors

.... XLU, XLP, XLI and XLK Lead with Fresh Highs

.... TLT Holds Surge and Breakout...

READ MORE

MEMBERS ONLY

Specialty Retailers Rally Off Support, Lead U.S. Stocks To Record Close

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 25, 2017

Retailers led another U.S. market rally on Thursday and helped provide leadership for the consumer discretionary sector (XLY, +0.88%), which outperformed the benchmark S&P 500 for one of the few times over the past 2-3 weeks. There had been...

READ MORE

MEMBERS ONLY

DP Alert: New PMO BUY Signals on All Four Scoreboards Too Late? - LT Trend Model SELL on Dollar

by Erin Swenlin,

Vice President, DecisionPoint.com

As noted in the DP Scoreboard Summary below, all four major indexes triggered PMO BUY Signals today as the PMO crossed above its signal line. This certainly confirms the ST Trend Model BUY signals that appeared after yesterday's strong rally. You'll note in their charts below...

READ MORE

MEMBERS ONLY

Five Charts That Say Today's S&P Breakout Is For Real

by Martin Pring,

President, Pring Research

* Lots of supporting breakouts

* Confidence ratio on the verge of a major bullish breakout?

* Financials: trick or treat?

* The US is due for a bounce against the rest of the world

* Is it time to play the China card?

Lots of supporting breakouts

Last week I pointed out that the...

READ MORE

MEMBERS ONLY

Juniper Networks Trending Higher, Threatens Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Recently, competitor Cisco Systems (CSCO) broke out to a 15 year high. While Juniper Networks (JNPR) hasn't seen its price move to decade and a half highs, it is on the verge of breaking to a six year high amid very heavy volume. JNPR traded more than 25...

READ MORE

MEMBERS ONLY

AIRLINES ARE LEADING INDUSTRIAL SPDR TO NEW HIGHS -- AIRLINE LEADERS ARE UAL, SOUTHWEST, AND JETBLUE -- TRANSPORTATION AVERAGE ISHARES CLEAR 50-DAY LINE -- DOW INDUSTRIALS NEAR NEW RECORD -- S&P 500 IS ALREADY THERE

by John Murphy,

Chief Technical Analyst, StockCharts.com

INDUSTRIAL SPDR HITS NEW RECORD... Chart 1 shows the Industrial Select SPDR (XLK) trading in record territory today. Today's higher price action is pushing the XLI above a sideways trading pattern that's been in effect since the start of March. Its relative strength line (above chart)...

READ MORE

MEMBERS ONLY

SystemTrader - Trailing Stops versus Profit Targets for a Moving Average Crossover System

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Do stops really help?

.... Setting the Benchmark

.... System Ground Rules

.... Consulting, Software and Data

.... Testing Some Basic EMA Crossovers

.... Base System and Sample Charts

.... Trailing Stops, Profit Targets and Both

.... Backtest Results

.... Testing a Percent Profit Target

.... Conclusions and Caveat Emptor

.... Scan Code ....

Do stops really help?

We have all...

READ MORE

MEMBERS ONLY

S&P 500 Breaks To Another Fresh All-Time High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 24, 2017

Seven of nine sectors finished higher to lead the S&P 500 to a record high close on Wednesday. Materials (XLB, +0.67%) and utilities (XLU, +0.57%) led the advance as gold mining ($DJUSPM) and mining ($DJUSMG) both performed extremely well,...

READ MORE

MEMBERS ONLY

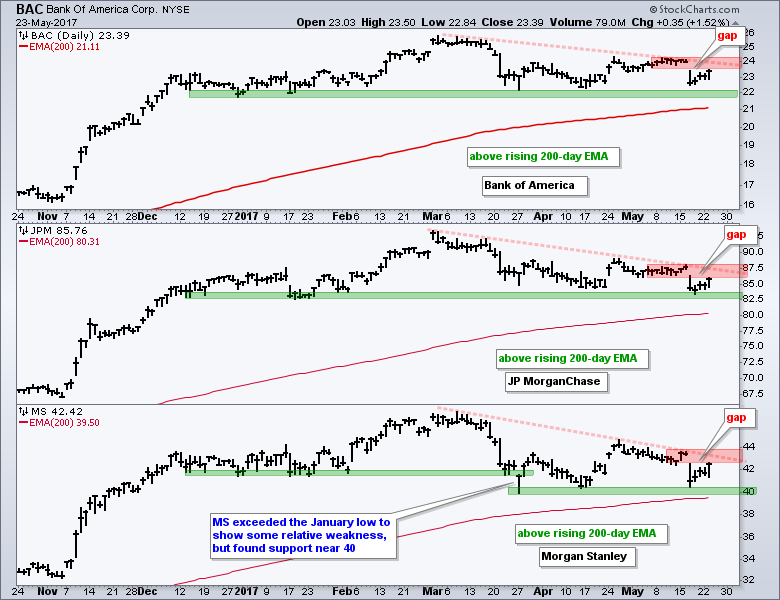

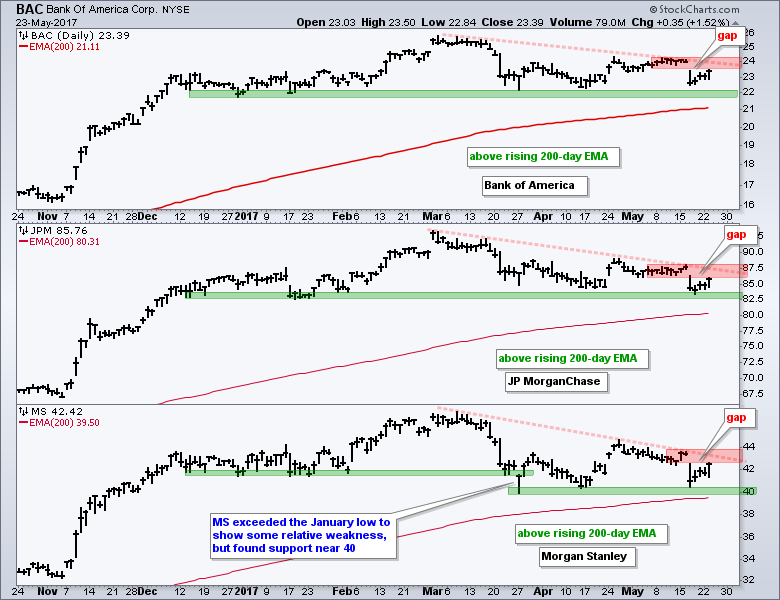

Minding Three Gaps for Three Big Banks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Banking stocks bounced on Tuesday as the 20+ YR T-Bond ETF (TLT) fell and the 10-yr T-Yield ($TNX) moved higher. These bounces reinforce the positive correlation with TLT and the negative correlation with $TNX. The chart below shows three big banks in long-term uptrends and six month stalls. Technically, Bank...

READ MORE

MEMBERS ONLY

Financials Lead As Banks Rally Amid Rising Treasury Yields

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 23, 2017

Eight of nine sectors finished in positive territory on Tuesday as only consumer discretionary (XLY, -0.38%) failed to do so. 18 of 23 industry groups within the discretionary sector finished lower, with retail and home construction stocks clearly the weakest links. After...

READ MORE

MEMBERS ONLY

DP Alert: STTM BUY Signals for Dow and OEX - Oil Shoots Higher

by Erin Swenlin,

Vice President, DecisionPoint.com

The market recovery since Wednesday has been remarkable. With this steady rally, last week's bearish signals are being erased. I did mention in yesterday's blog that ST Trend Model signals will whipsaw quite a bit but they do help us to characterize the market in the...

READ MORE

MEMBERS ONLY

Industrial Suppliers Continue Impressive Bounce Off Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, May 22, 2017

Utilities (XLU, +0.86%), technology (XLK, +0.80%) and industrials (XLI, +0.77%) were the sector leaders on Monday, aiding our major indices as they mostly have erased the big losses from last Wednesday. The XLI has been a leader of late and...

READ MORE

MEMBERS ONLY

Five Sectors Lead New High List - 10 Bullish Stock Setups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... XLF Lags as TLT Surges

.... A Classic Corrective Sequence for KRE

.... TLT Holds Breakout and Nears 200-day

.... T-bond Correlations in Play

.... Large-caps Continue to Lead New High List

.... Utilities and Staples Lead Sector New High List

.... Charts: MMC, CB, TRV, MDLZ, KHC, DPS, CMCSA, AAL, JBLU, MDT ....

XLF Lags as...

READ MORE

MEMBERS ONLY

Gold's New BUY Signals - SPX Triggers ST Trend Model BUY Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

I received some very important alerts this afternoon. Gold triggered a new IT Trend Model BUY signal as the 20-EMA crossed above the 50-EMA. In addition, Gold also saw a new PMO BUY signal; and, like the SPX, a new Short-Term Trend Model (STTM) BUY signal was triggered as the...

READ MORE

MEMBERS ONLY

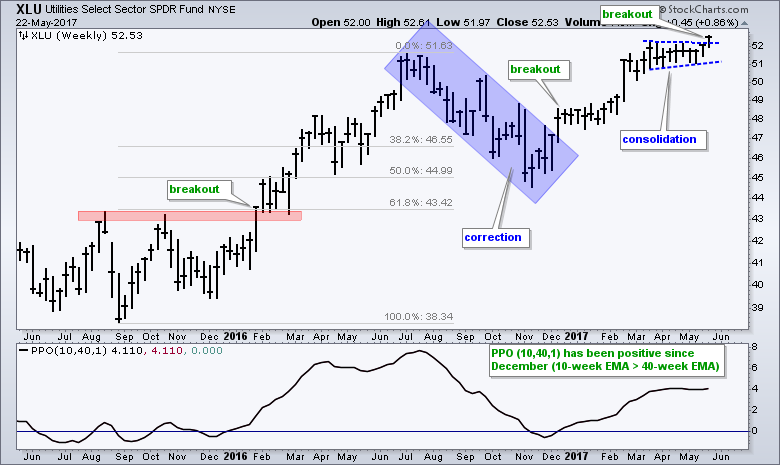

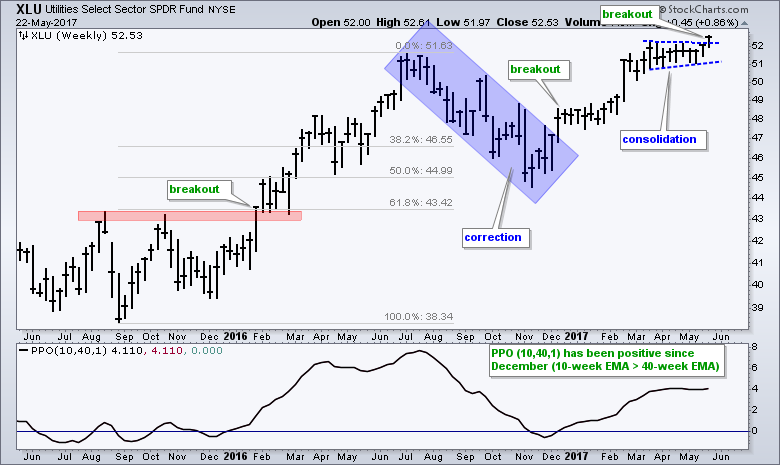

Utilities Take the Lead with a Triangle Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Utilities SPDR (XLU) is clearly one of the leading sectors in 2017 because it is trading at its highest level of the year. XLU, by the way, is the only sector SPDR that hit a year-to-date high on Monday. The chart shows XLU correcting into November 2016, breaking out...

READ MORE

MEMBERS ONLY

Will Technology (XLK) continue to lead the market higher?

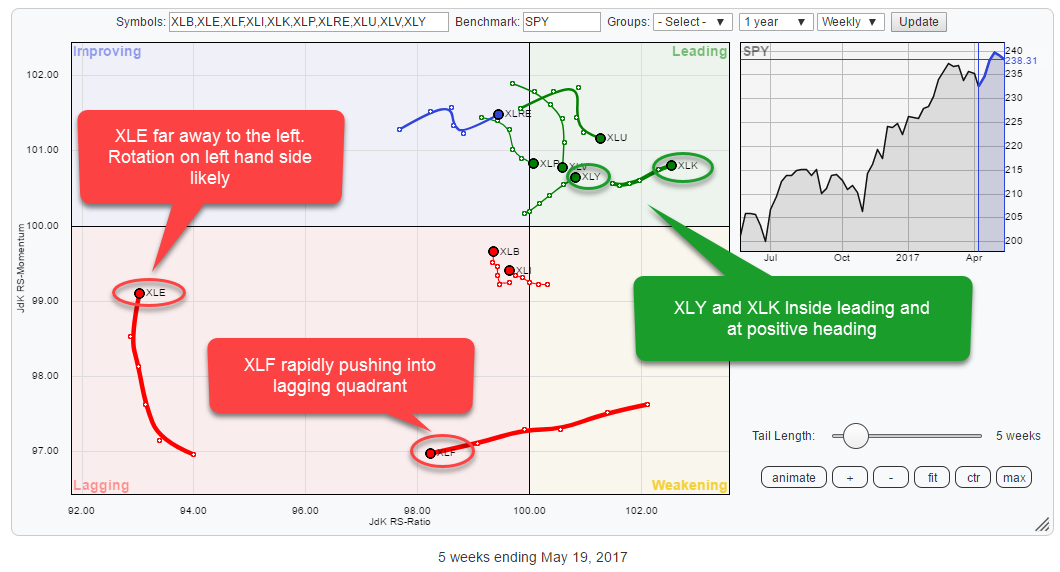

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

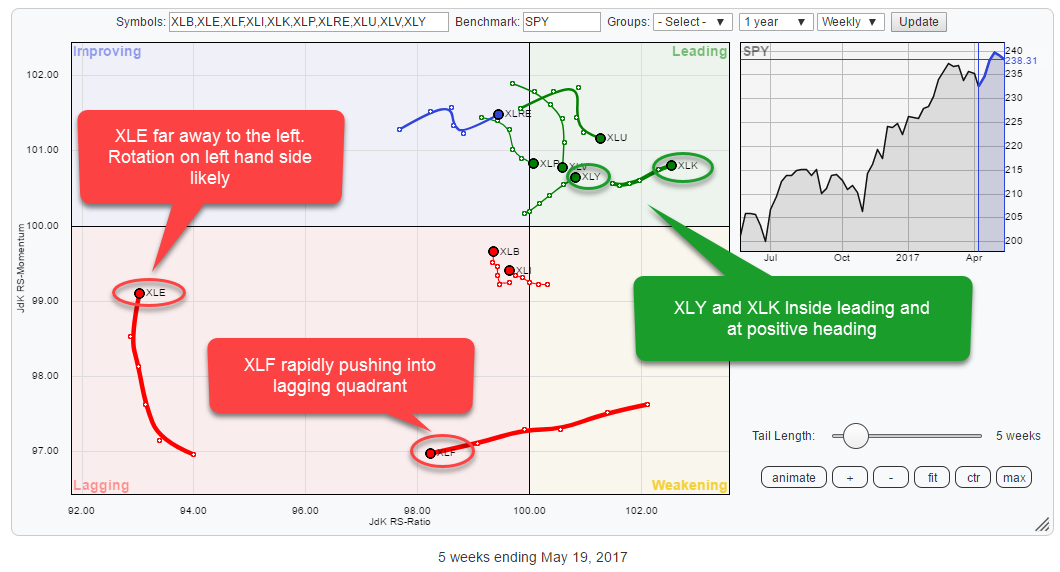

The Relative Rotation Graph for US sectors shows four sectors with rotational patterns that catch the eye and deserve a further investigation.

Inside the lagging quadrant, these are Energy (XLE) and Financials (XLF) and inside the leading quadrant, I am looking at Technology (XLK) and Consumer Discretionary (XLY).

The balance...

READ MORE

MEMBERS ONLY

A Reading List

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

In the 1970s there were very few books on technical analysis. Now there a many great books available in the field of technical analysis and finance. However, I’m going to keep these lists short and focused. These lists contains many other wonderful books on technical analysis, finance, and behavioral...

READ MORE

MEMBERS ONLY

Stocks Rebound On The Strength Of Industrials

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 19, 2017

Industrials (XLI, +1.32%) and energy (XLE, +1.23%) were the two clear leaders on Friday. The XLI represents one of the four aggressive sectors in the market so it's always nice to see strength there. Commercial vehicles ($DJUSHR) had a...

READ MORE

MEMBERS ONLY

Northrop Grumman Awaiting Bullish Triangle Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Northrop Grumman (NOC) has risen ten fold since this bull market began in 2009 and its current bullish pattern suggests that this defense company is not ready to roll over just yet. It's been a struggle to clear 250 price resistance the past 6-7 months, but the rising...

READ MORE