MEMBERS ONLY

Northrop Grumman Awaiting Bullish Triangle Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Northrop Grumman (NOC) has risen ten fold since this bull market began in 2009 and its current bullish pattern suggests that this defense company is not ready to roll over just yet. It's been a struggle to clear 250 price resistance the past 6-7 months, but the rising...

READ MORE

MEMBERS ONLY

Dollar Index Triggers Some Long-term Sell Signals

by Martin Pring,

President, Pring Research

* Dollar Index experiences major trendline breaks and MA crossovers

* Dollar sympathy relationships confirm a weaker dollar

* Emerging currencies are emerging

* Some currencies remain in bear market against the dollar

Dollar Index experiences major trendline breaks and MA crossovers

This week, the US Dollar Index ($USD) violated several key benchmarks, leading...

READ MORE

MEMBERS ONLY

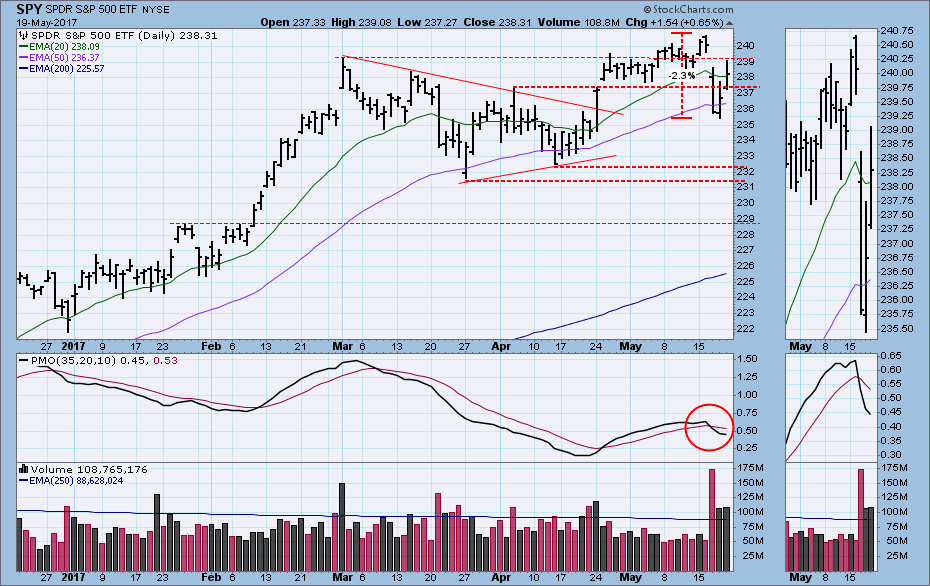

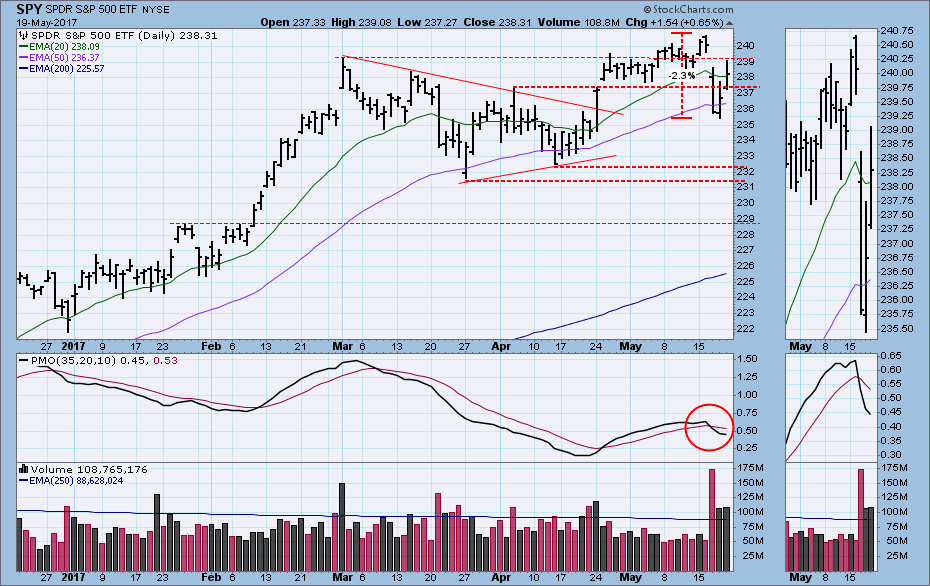

DecisionPoint Weekly Wrap -- Break and Bounce

by Carl Swenlin,

President and Founder, DecisionPoint.com

In our Conclusions section of the Weekly Wrap last week, I expressed my heightened level of caution due to the negative condition of our indicators. On Monday a nice rally to new, all-time highs gave me cause to doubt my assessment, but the rally stalled on Tuesday, and the bottom...

READ MORE

MEMBERS ONLY

Rising European Currencies Are Pushing the Dollar Lower

by John Murphy,

Chief Technical Analyst, StockCharts.com

While stocks were rebounding last week, the dollar wasn't. Chart 1 shows the Power Shares Dollar Index ETF (UUP) falling again Friday to the lowest level since November. It may seem surprising to see the dollar continuing to drop with bond yields bouncing along with stocks. The dollar...

READ MORE

MEMBERS ONLY

The New Nifty Fifty

by Bruce Fraser,

Industry-leading "Wyckoffian"

The ‘Nifty-Fifty’ era for stocks started in the 1960s and went into the early 1970s. These fifty or so stocks were consistent out-performers. Their earnings, sales and stock price growth stood apart from most other stocks. These stocks grew in value, year after year. They became known as ‘One Decision’...

READ MORE

MEMBERS ONLY

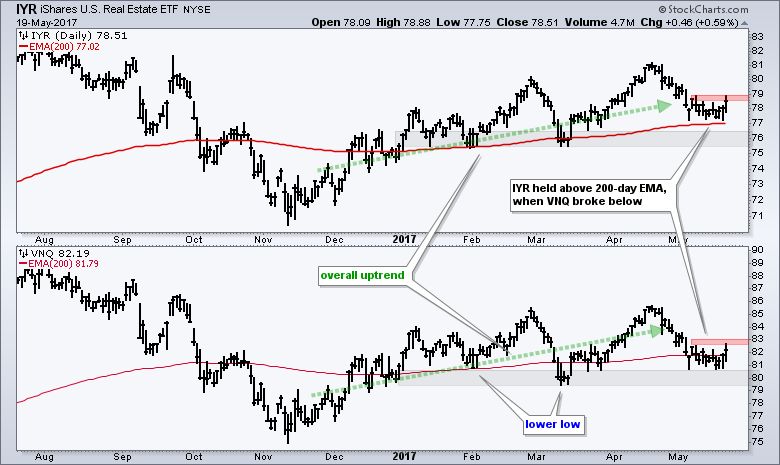

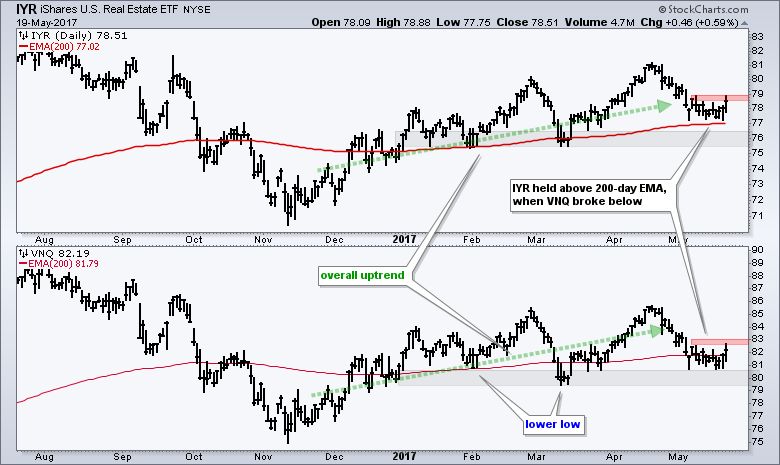

Broad REIT ETFs Hit Interesting Junctures, but Hotel and Retail REITs Weigh

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The REIT iShares (IYR) and the Vanguard REIT ETF (VNQ) are at interesting junctures because they corrected within an uptrend. Even though both are at potential reversal zones, chartists should be careful because retail REITs and hotel REITs are weak spots within the REIT universe. The chart below shows IYR...

READ MORE

MEMBERS ONLY

Video - Weekly Market Review & Outlook - Correction Evidence Builds

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The stock market has been in correction mode since early March when looking at the EW S&P 500 ETF (RSP) and S&P MidCap SPDR (MDY). Together, these two ETFs represent 900 stocks and cover the majority of the market, and they have been flat since March...

READ MORE

MEMBERS ONLY

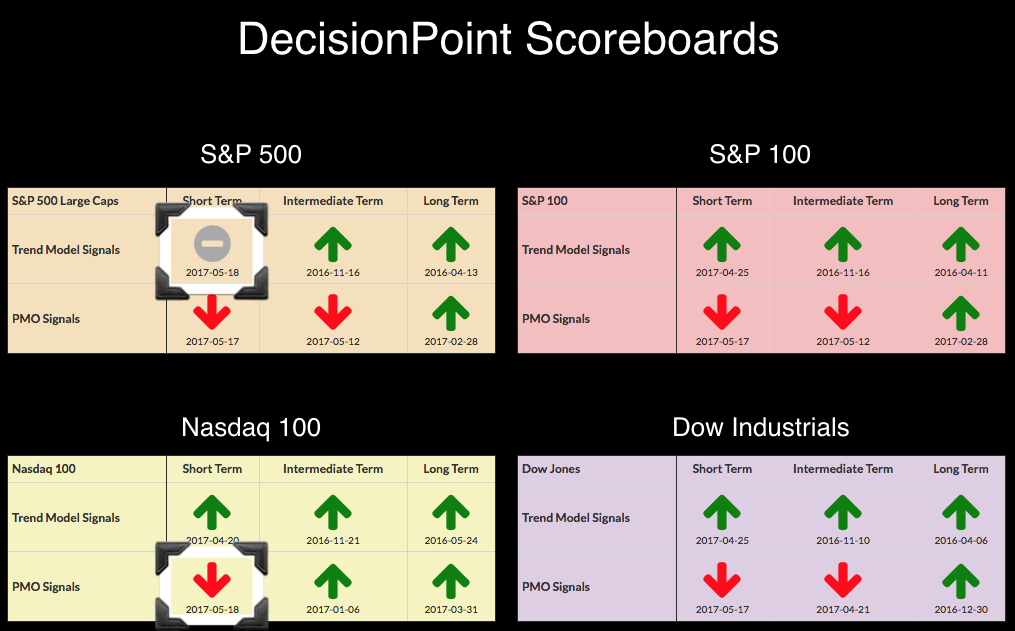

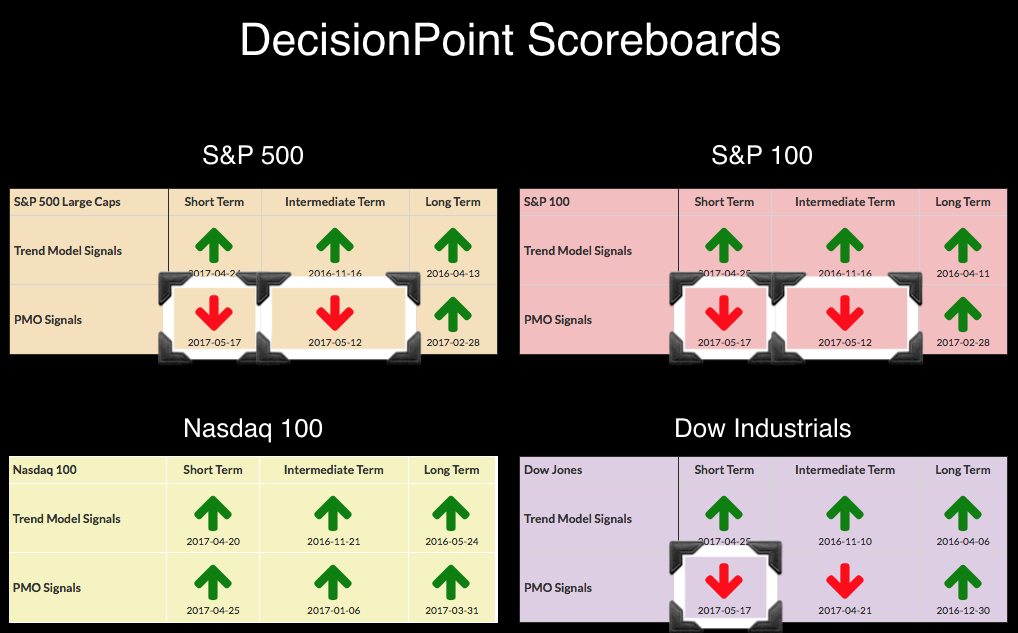

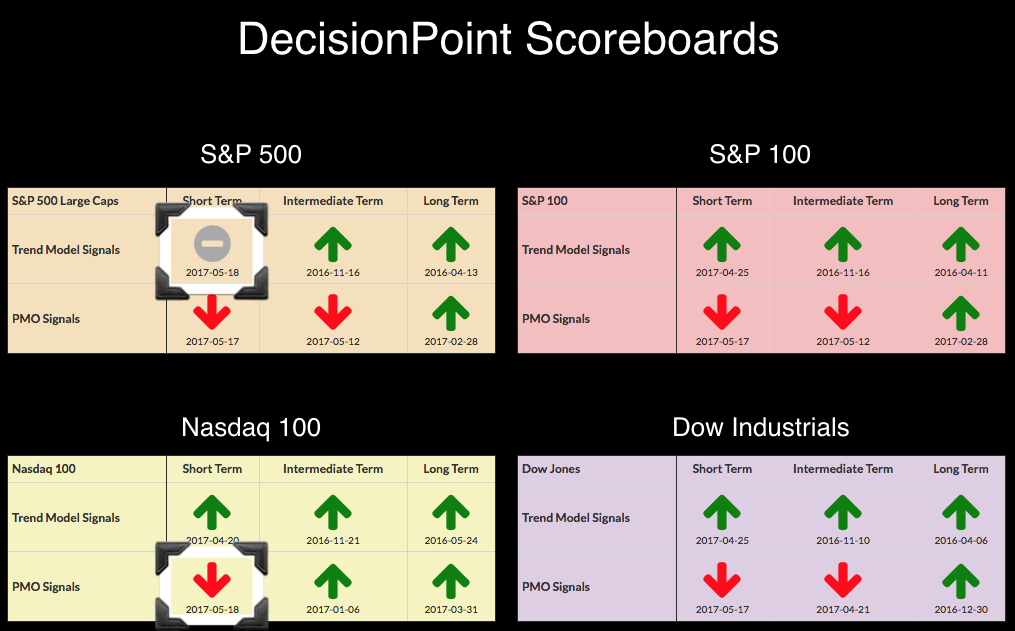

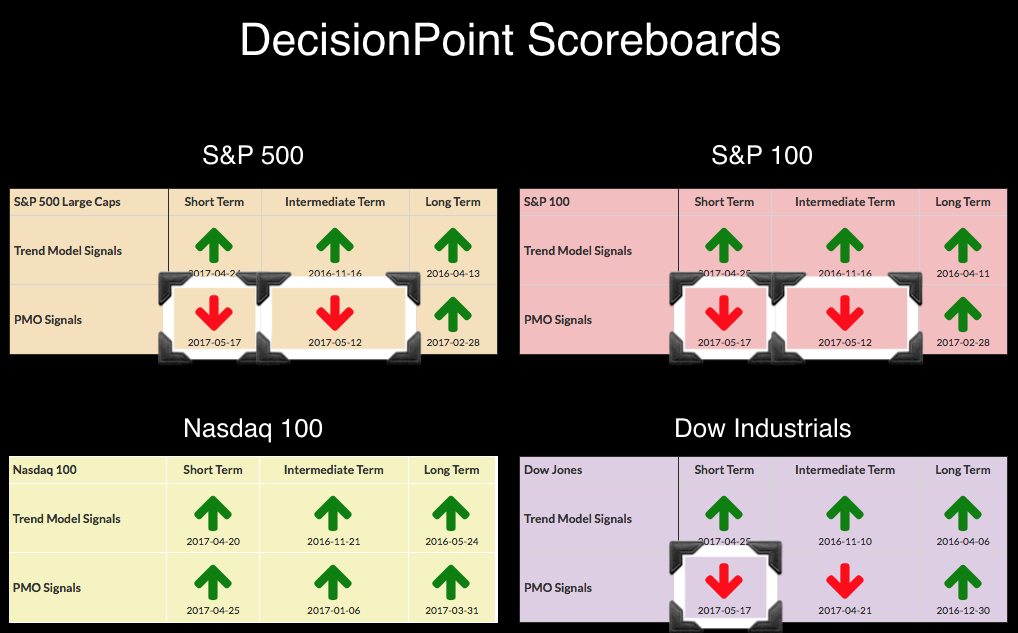

Bearish Signals Continue to Mount

by Erin Swenlin,

Vice President, DecisionPoint.com

It was a rough finish to the week and it has shaken up the DecisionPoint Scoreboards. Additionally, the Intermediate-Term Trend Model (ITTM) generated a Neutral signal on the equal-weight Financials ETF (RYF) and a weekly Price Momentum Oscillator (PMO) SELL signal popped on the equal-weight Consumer Discretionary ETF (RCD). Believe...

READ MORE

MEMBERS ONLY

RISING EUROPEAN CURRENCIES ARE PUSHING THE DOLLAR LOWER -- THE FALLING DOLLAR, HOWEVER, IS BOOSTING COMMODITIES -- BLOOMBERG COMMODITY INDEX IS BOUNCING OFF CHART SUPPORT -- FRIDAY'S REBOUND REPAIRS SOME DAMAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING EUROPEAN CURRENCIES ARE PUSHING THE DOLLAR LOWER... While stocks are rebounding today, the dollar isn't. Chart 1 shows the Power Shares Dollar Index ETF (UUP) falling again today to the lowest level since November. It may seem surprising to see the dollar continuing to drop with bond...

READ MORE

MEMBERS ONLY

When in Doubt, Sit it Out

by John Hopkins,

President and Co-founder, EarningsBeats.com

Anyone who trades the market on a regular basis knows how important it is to use whatever tools are available to make important decisions. This includes using charts to determine the strength/weakness of a specific stock, sector or index, zeroing in on key price and technical support/resistance levels...

READ MORE

MEMBERS ONLY

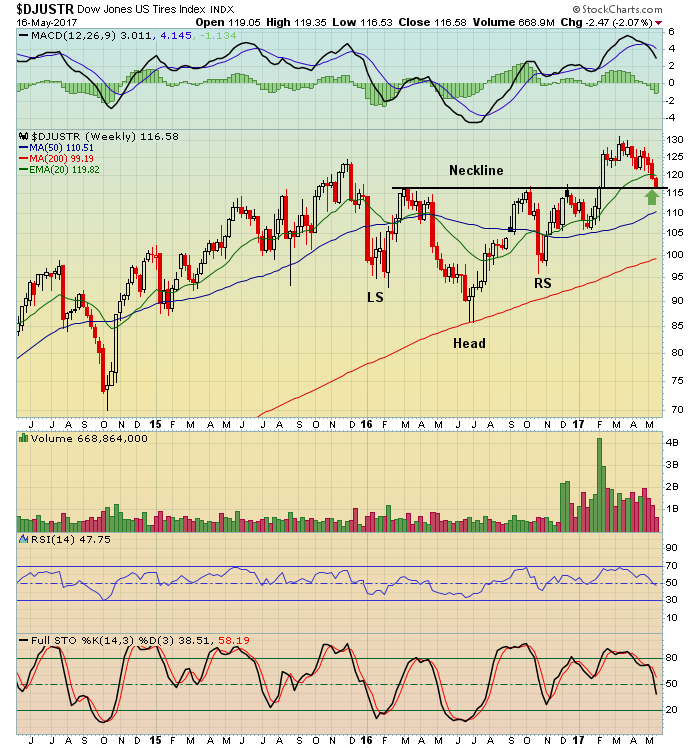

Are We Topping? Watch These Two Industry Groups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We saw the first significant selling pressure in months last week, especially on Wednesday. Financials (XLF) led the rout to the downside, but the sector did bounce back later in the week and, in the process, held key neckline price support within two key industry groups - banks ($DJUSBK) and...

READ MORE

MEMBERS ONLY

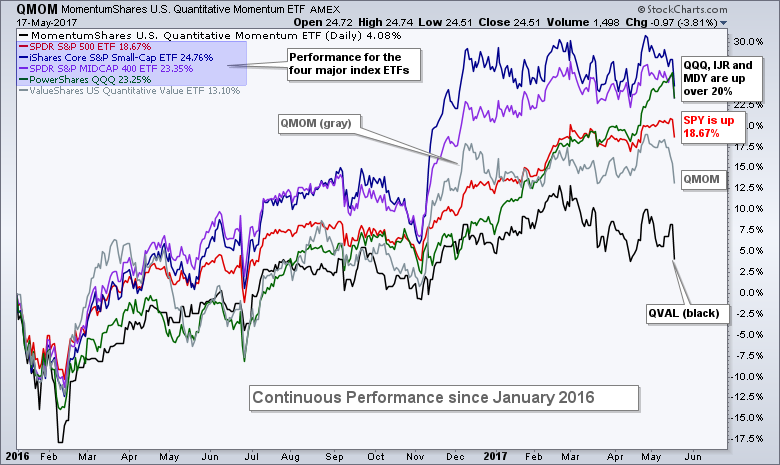

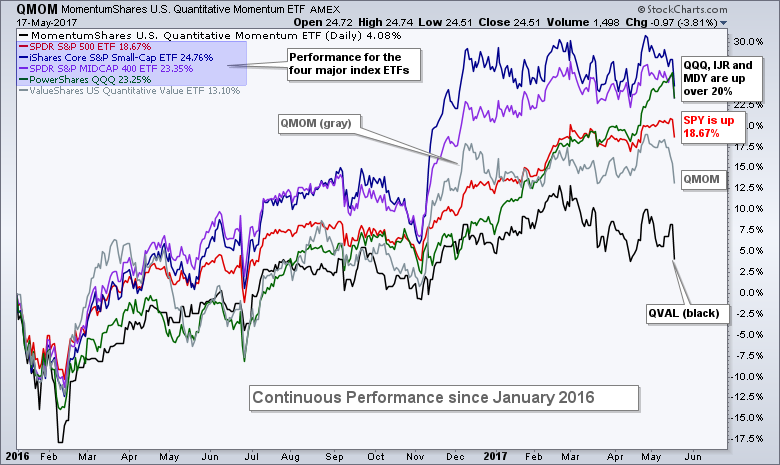

My 3-Prong Recipe for the Safe Growth & Outperformance of Your Portfolio

by Gatis Roze,

Author, "Tensile Trading"

There is a seismic generational displacement happening in the investment landscape. Many investors are shifting their assets into indexes and ETFs as they move away from stocks and mutual funds. Due to this shift, a number of investment firms are having to make enormous changes themselves in order to remain...

READ MORE

MEMBERS ONLY

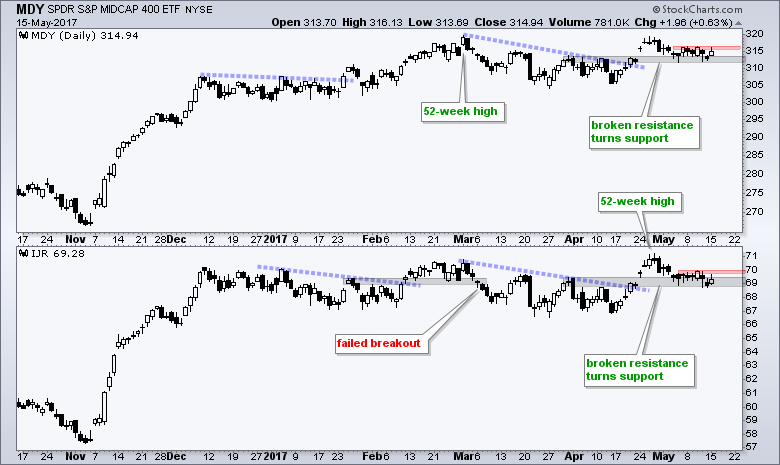

Weekly Market Review & Outlook - A Stealthy Correction

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... The Stealthy Looking Correction

.... AD Volume Lines Reflect Corrective Period

.... High-Low Lines Have Yet to Turn Down

.... Percent Above 200-day EMA Deteriorates Further

.... SPY Gaps Down like its September 2016

.... Setting a Correction Zone for QQQ

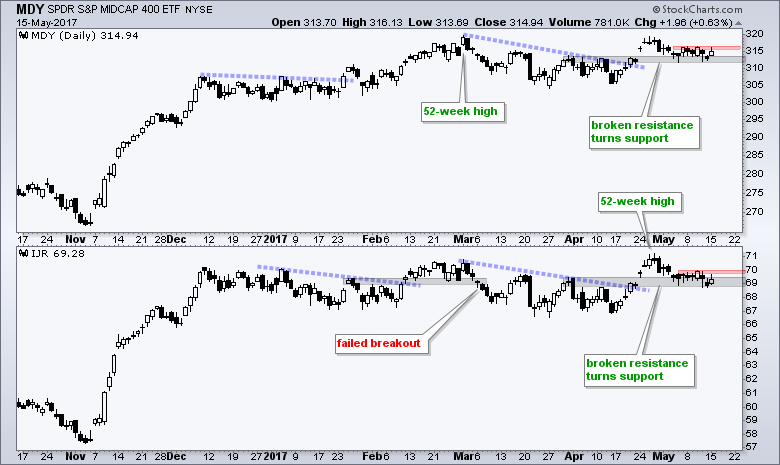

.... IJR: Breakout Failed, but Short-term Oversold

.... Finance and Industrials Gap Lower

.... Low Correlations are...

READ MORE

MEMBERS ONLY

Stocks Rebound, This Relative Ratio Will Be Important To Watch

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 18, 2017

Technology (XLK, +0.59%) and consumer discretionary (XLY, +0.58%) led the market's rally on Thursday after mobile telecom ($DJUSWC) managed to hang onto 20 week EMA support after a drubbing on Wednesday. The bad news is that there remains an...

READ MORE

MEMBERS ONLY

Two Important Areas To Watch- $VIX and Financials

by Martin Pring,

President, Pring Research

* 10-day ROC for the VIX may have a message for traders

* Close that gap on your way out

* Financials, a canary in the coal line for stocks in general

Last week I wrote about the $VIX and concluded that a low reading, such as we recently saw, usually precedes a...

READ MORE

MEMBERS ONLY

Caterpillar Tests Price Support, Nearly Fills Gap

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Caterpillar (CAT) was one of many beneficiaries of the latest quarterly earnings season. With its revenues and EPS topping Wall Street estimates, CAT surged higher on April 25 from its April 24 close of 96.81. The recent market weakness enabled CAT to pull back to test key price support...

READ MORE

MEMBERS ONLY

Major Indices Sell Off Hard, Lose Support; What's Next?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

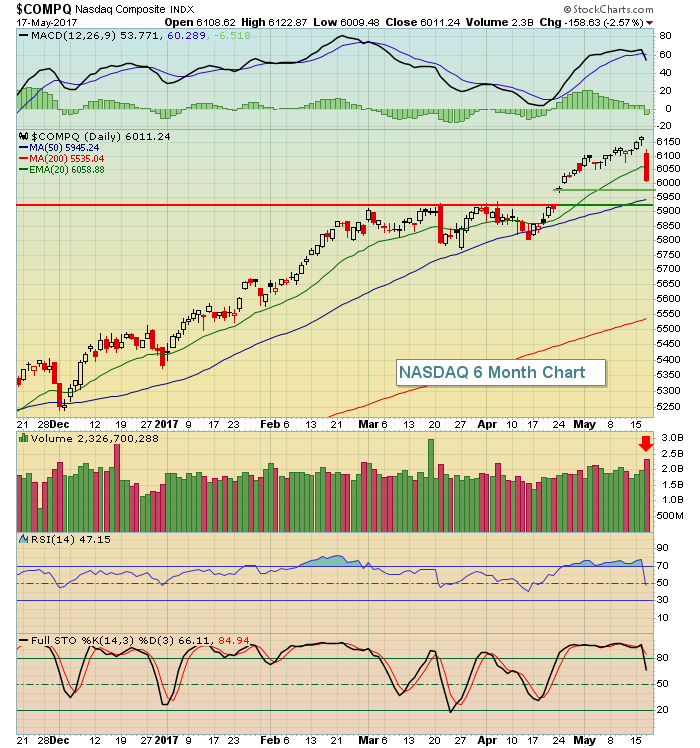

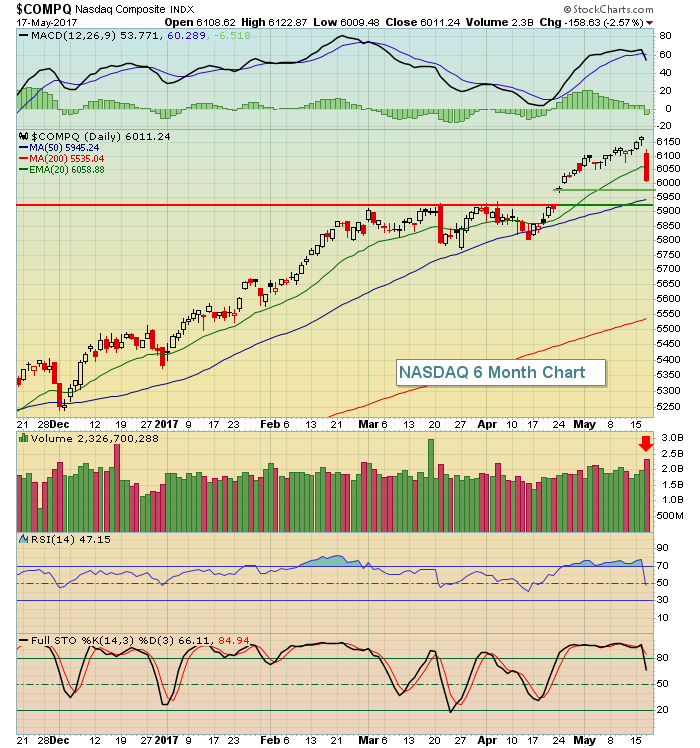

Market Recap for Wednesday, May 17, 2017

It was a brutal day of selling for U.S. equities. The selling began at the open and continued right through the close. The selling also cleared price support levels and that likely will result in further selling in the days and possibly...

READ MORE

MEMBERS ONLY

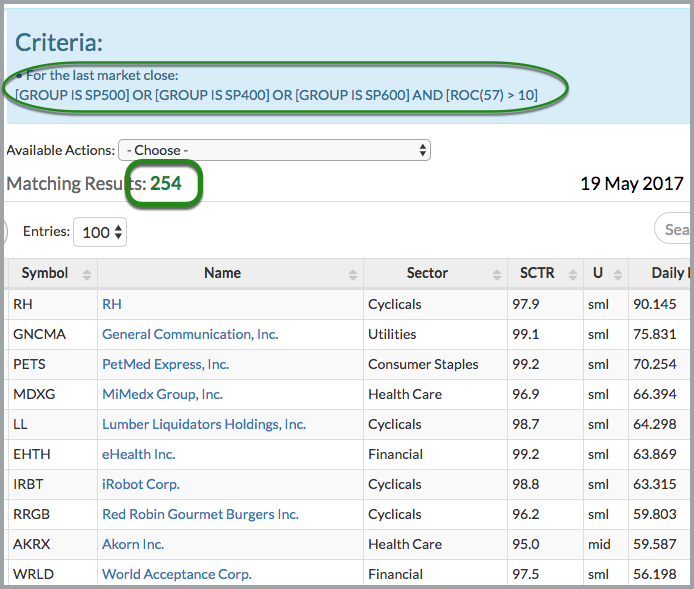

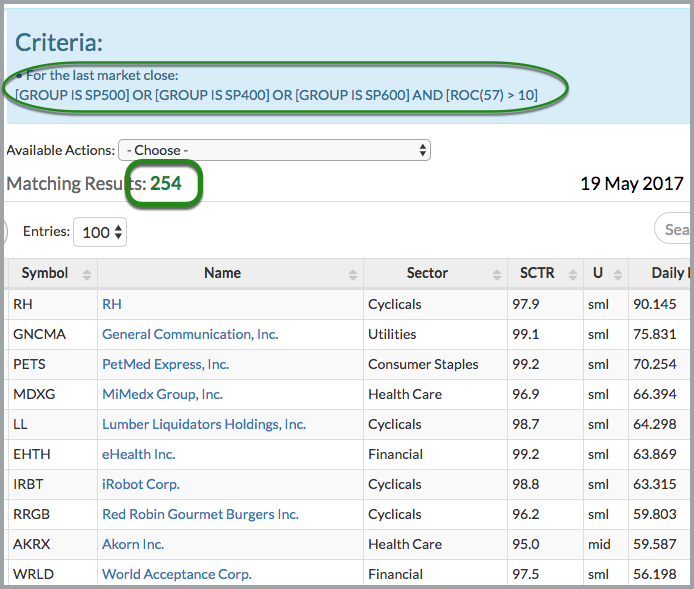

Setting Up a Stock-Picker's ChartList for a Possible Correction - S&P 500 Mimics September

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Passive versus Too Active

.... Using the Inspect Feature on SharpCharts

.... The Good, the Bad and the Neutral

.... Scan Code to Measure Performance

.... Building a Correction ChartList

.... S&P 500 Breadth, Momentum and Correction Target ....

The active versus passive debate has been raging for some time now. On one side...

READ MORE

MEMBERS ONLY

DP Scoreboards PMO SELL Signals Reflect Big Shift in Momentum

by Erin Swenlin,

Vice President, DecisionPoint.com

You'll likely notice the significant changes to the DP Scoreboards (which you can now find on your member homepage in the drop down in the "Market Movers" box!). A clear shift in momentum is taking place. Yesterday the short-term Price Momentum Oscillators (PMOs) were all rising...

READ MORE

MEMBERS ONLY

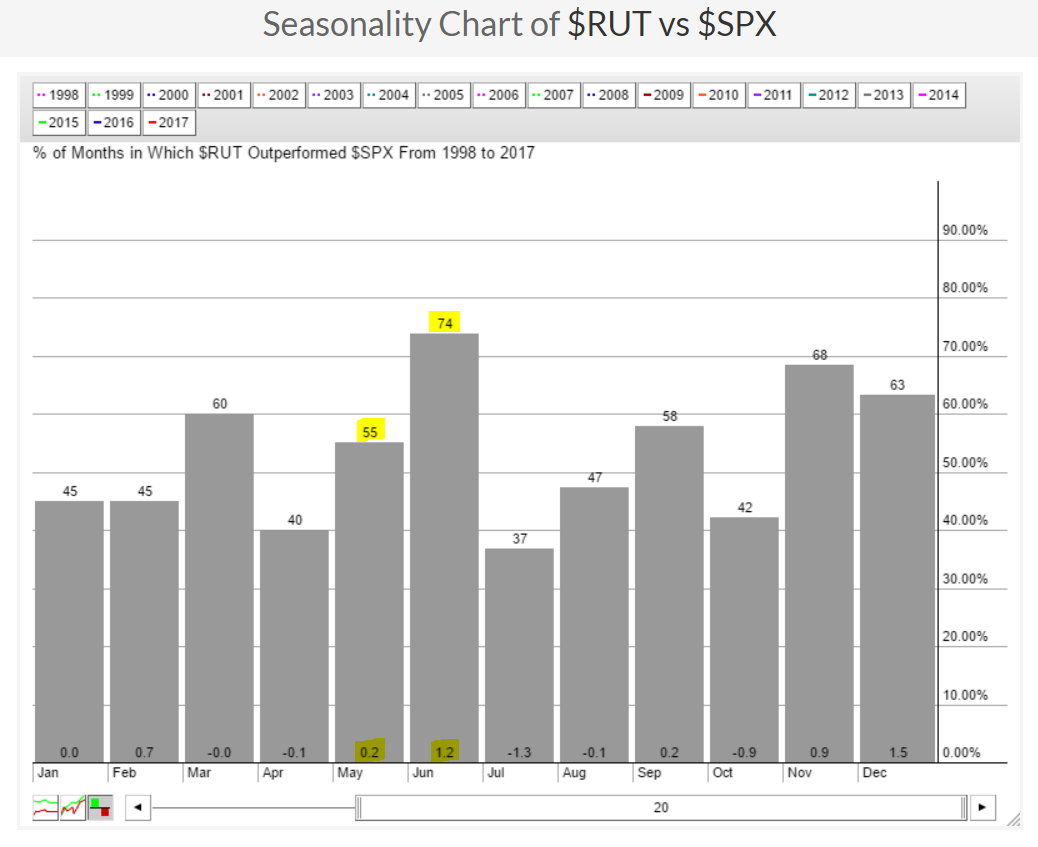

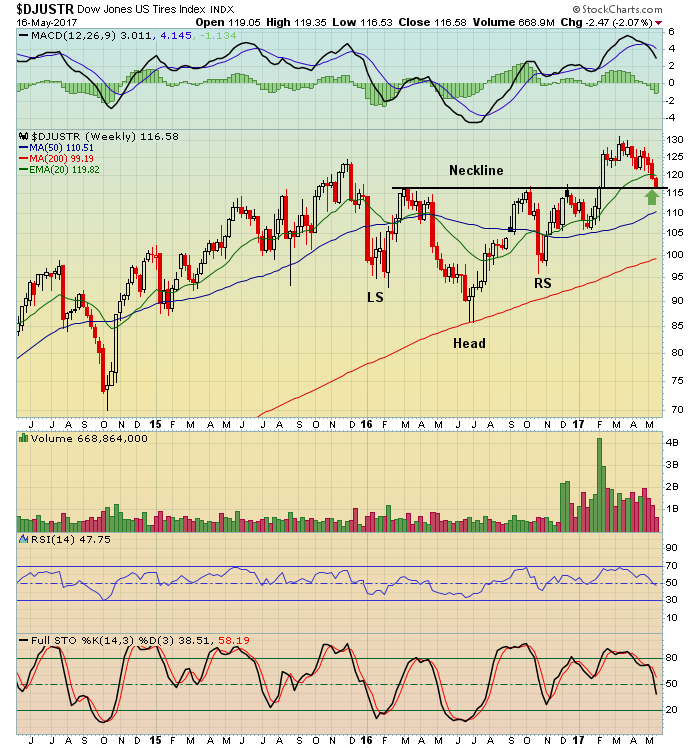

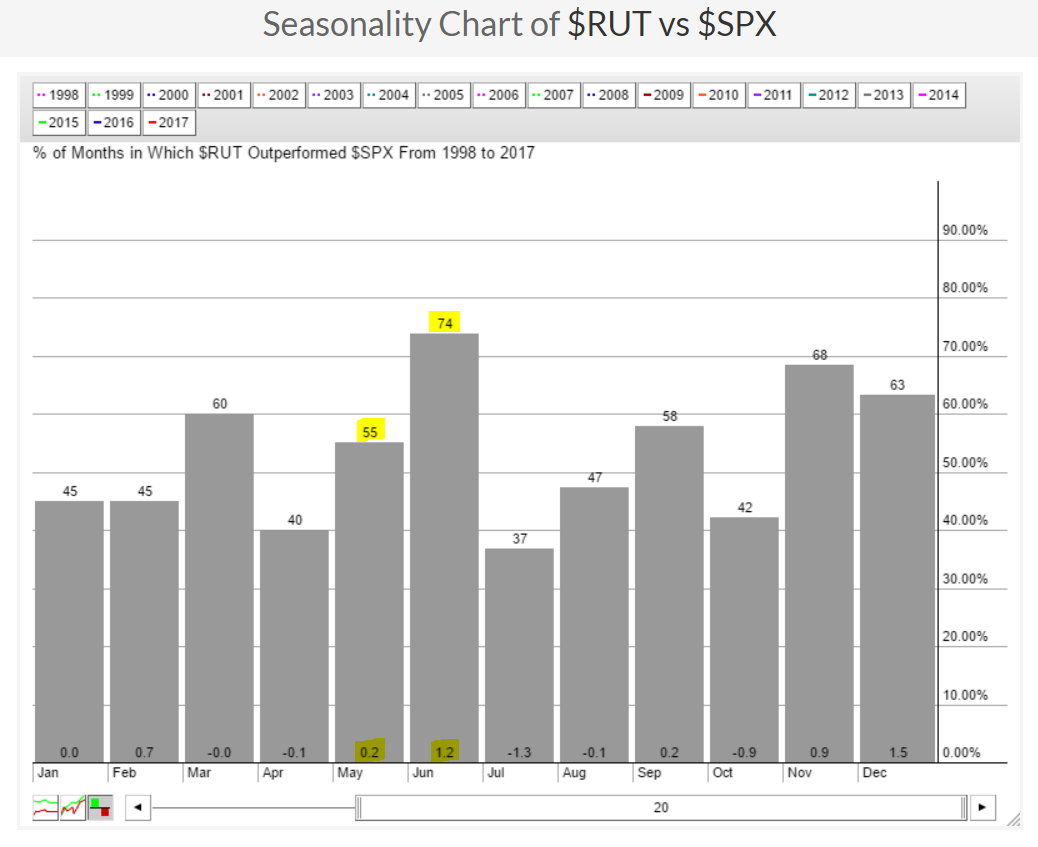

BIG DROPS IN BOND YIELDS AND DOLLAR SHOW LOSS OF CONFIDENCE -- FINANCIALS, SMALL CAPS, AND TRANSPORTS LEAD MARKET LOWER -- FALLING STOCK INDEXES ARE SUFFERING SHORT-TERM CHART DAMAGE -- TRADERS COULD BE SELLING IN MAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS CONTINUE TO DROP ... My Saturday message issued some short-term warnings for the market. Part of that warning came from falling bond yields which hinted that fixed income traders were turning more pessimistic. Another came from weak performances by banks, small caps, and transports which are leading the stock...

READ MORE

MEMBERS ONLY

Negative Divergences Weighing On Transports

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 16, 2017

Technology (XLK, +0.47%) and financials (XLF, +0.29%) were the two best performing sectors on Tuesday and the former was the primary reason that the NASDAQ was able to outperform on a day when the U.S. market was bifurcated. The Dow...

READ MORE

MEMBERS ONLY

Gold, Euro and Bonds: The Three Inter-market Amigos

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Gold SPDR (GLD), Euro ETF (FXE) and the 20+ YR T-Bond ETF (TLT) are all up year-to-date and showing positive correlation. This is not a big surprise because gold is negatively correlated to the Dollar and negatively correlated to the 10-yr T-Yield ($TNX). The Euro accounts for around 57%...

READ MORE

MEMBERS ONLY

DP Alert: PMO SELL Signal on Dollar - PMO BUY Signal on Oil

by Erin Swenlin,

Vice President, DecisionPoint.com

No changes to report on the DecisionPoint Scoreboards. They remain green in all timeframes (with the exception of the Dow IT PMO SELL signal). I suspect we will see some IT PMO SELL signals this Friday, barring a major rally. The OEX is currently configured for an IT PMO SELL...

READ MORE

MEMBERS ONLY

U.S. UNDERPERFORMS FOREIGN STOCKS -- DECADE OF U.S. LEADERSHIP MAY BE ENDING -- VANGUARD FOREIGN STOCK ETF HITS TEN-YEAR HIGH -- EUROZONE SHARES ALSO BREAK OUT -- UK ISHARES BENEFIT FROM STRONGER POUND -- RISING EMERGING CURRENCIES BENEFIT EM STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

U.S. STOCKS ARE GLOBAL UNDERACHIEVERS... Several of my previous messages have written about foreign stocks doing better than those in the U.S. this year. I'll come back to those foreign charts shortly. Chart 1, however, is designed to show how weak U.S. stocks have been...

READ MORE

MEMBERS ONLY

S&P 500 Sets Fresh Record High Close; Materials And Energy Lead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, May 15, 2017

It was another solid day for U.S. equities with index leadership coming from the small caps as the Russell 2000 posted a nice 0.81% rise while the other major indices were just below the +0.50% level. Monday marked only the...

READ MORE

MEMBERS ONLY

Will Bonds or Small-caps Turn Up First?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Will Bonds or Small-caps Turn Up First? (IJR, MDY, TLT, IEF)

.... Citigroup is Leading the Big Banks (XLF, JPM, BAC, MS, GS)

.... A Big ETF Provider and Two Brokers (BLK, SCHW, ETFC)

.... Three Railroads with Long-term Uptrends (UNP, NSC, KSU)

.... Three Big Utilities Go for Breakouts (AES, D, DUK, SO)...

READ MORE

MEMBERS ONLY

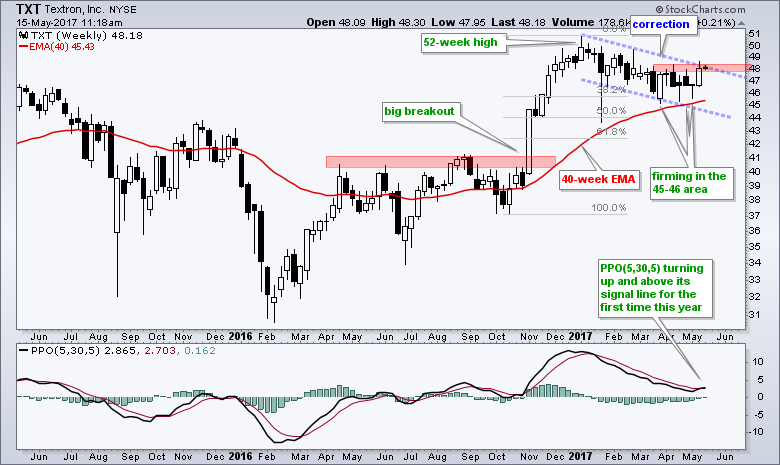

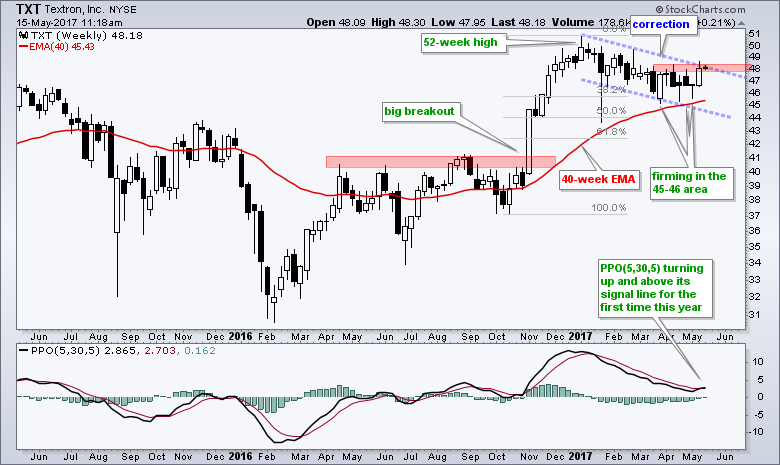

PPO Upturn Points to a Correction-ending Breakout for Textron

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Textron (TXT), which is part of the industrials sector and the defense-aerospace industry, surged to new highs after the election and then declined in 2017. I consider this a correction within a bigger uptrend because the decline retraced less than 50% of the prior advance and the stock remains above...

READ MORE

MEMBERS ONLY

You Need to Understand What Market Breadth Offers

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Early in writing these articles I talked a lot about market internals or market breadth. As a refresher, I’ll review the basics and then offer an opinion on why breadth is so important.

Breadth Components

Breadth components are readily available from newspapers, online sources, etc. and consist of daily...

READ MORE

MEMBERS ONLY

NASDAQ Leads Bifurcated U.S. Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

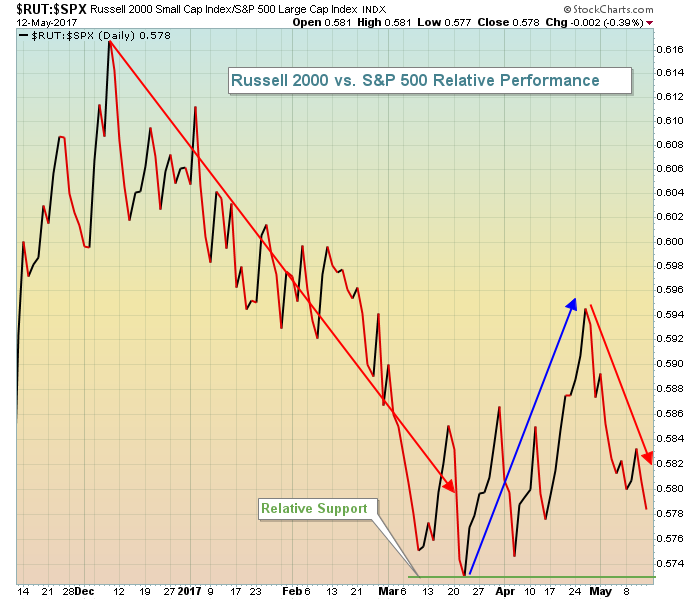

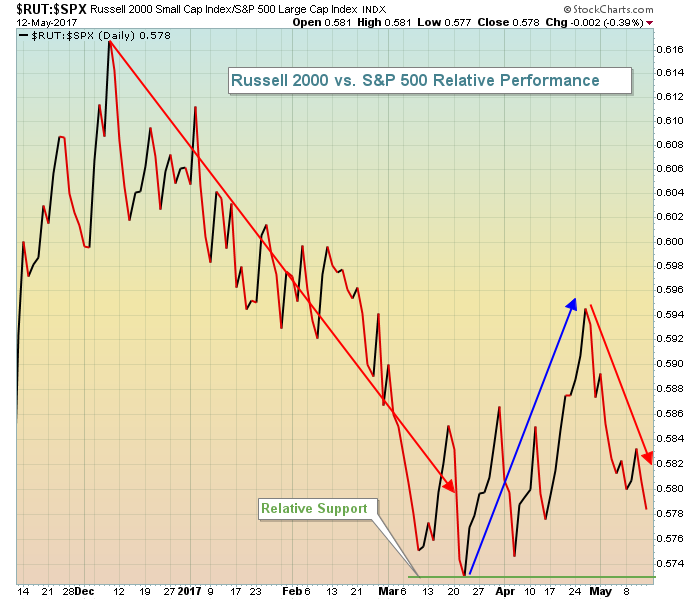

Market Recap for Friday, May 12, 2017

The NASDAQ finished higher on Friday, but that was not the case for the Dow Jones and S&P 500, which both finished fractionally lower. The Russell 2000 was hit hardest as this small cap index again threatened a short-term breakdown beneath...

READ MORE

MEMBERS ONLY

Chinese ETF's Are Playing Good Cop Bad Cop

by Martin Pring,

President, Pring Research

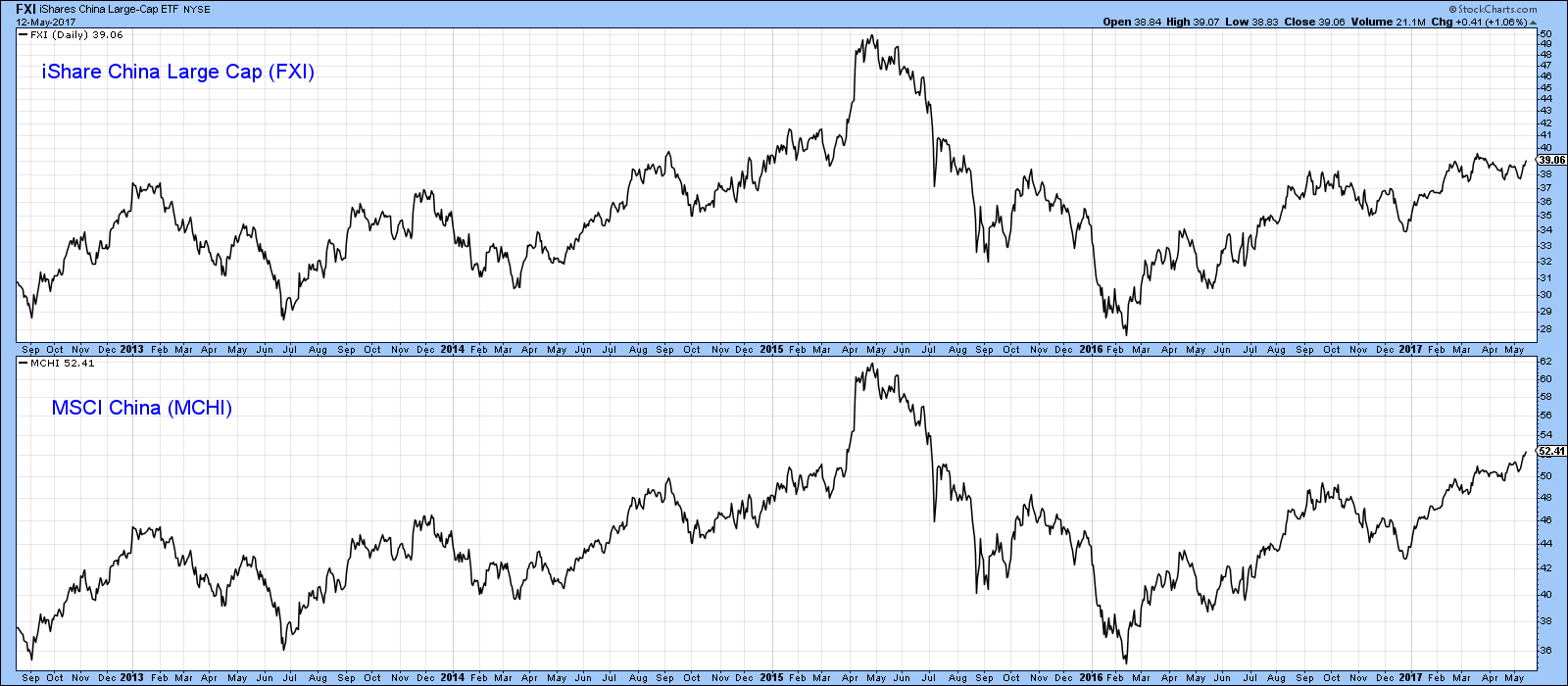

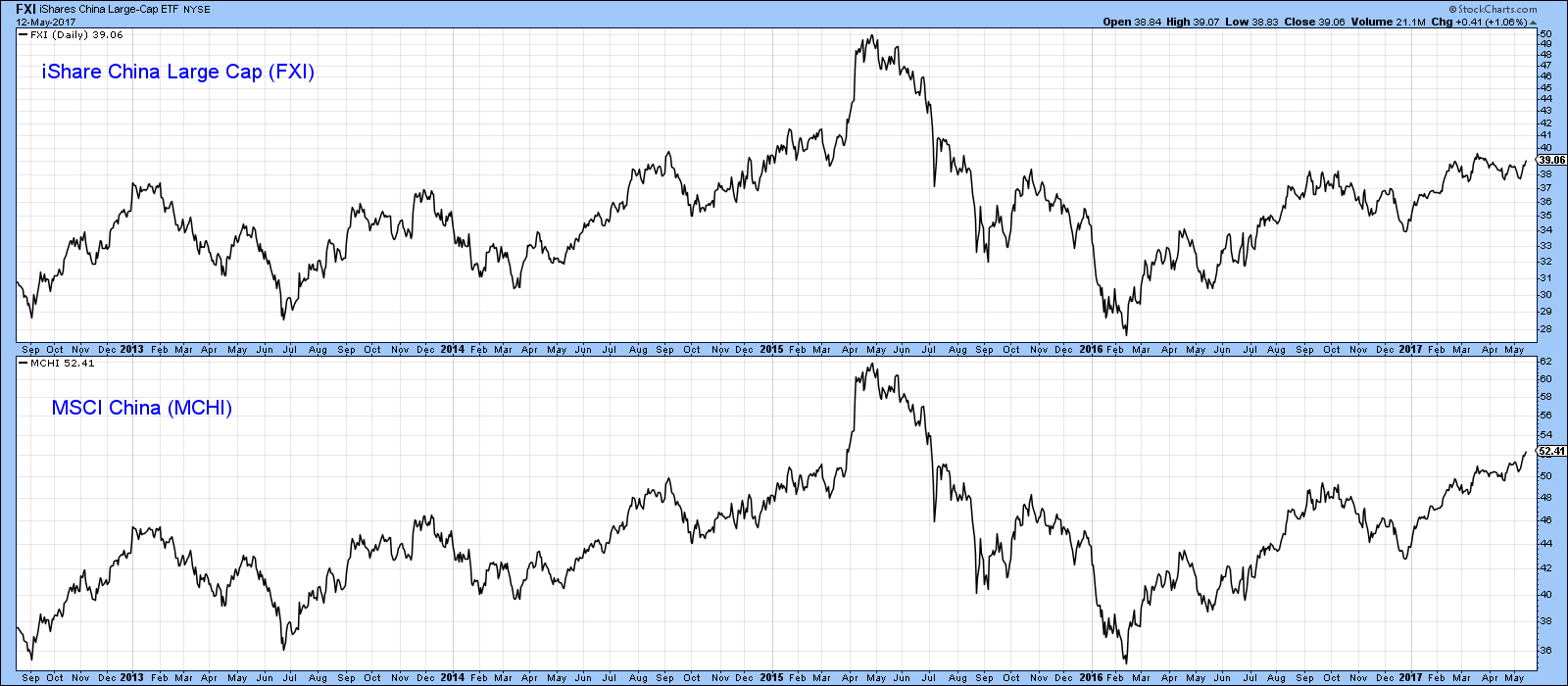

* Trying to replicate the Shanghai Composite with a Chinese ETF

* Global Update

Years ago, investing in China was a challenging proposition for US based investors. In recent years though, a number of ETF’s have been listed that embrace Chinese Indexes as well as specific sectors. The big daddy of...

READ MORE

MEMBERS ONLY

Breakout Watch: Can Intel Deliver The Goods?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Intel (INTC) has been trading in bullish sideways fashion since topping in October. The Dow Jones U.S. Semiconductor Index ($DJUSSC) has continued to rise and lead the benchmark S&P 500 on a relative basis - even while INTC consolidates. A breakout in Intel would measure to 42...

READ MORE

MEMBERS ONLY

DROP IN BOND YIELDS SENDS CAUTION SIGNAL -- THAT KEEPS BANKS ON THE DEFENSIVE -- SMALL CAPS AND TRANSPORTS ARE SHOWING RELATIVE WEAKNESS -- AMAZON RISE OFFSETS DEPARTMENT STORE LOSSES -- TECHNOLOGY SHARES LEAD TAIWAN MARKET TO SEVENTEEN YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS DROP ON FRIDAY... Some caution crept into financial markets near the end of the week. Part of that was reflected in Friday's sharp drop in bond yields. Chart 1 shows the 10-Year Treasury Yield falling back below its 50-day average in pretty decisive fashion. That was...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap -- Rally Stalls

by Carl Swenlin,

President and Founder, DecisionPoint.com

I thought that last week's breakout was the initiation of a new rally that would continue this week. But no. This week price moved back below the breakout level, but strangely this failure did not develop into a more serious breakdown either. Price just continued to churn sideways,...

READ MORE

MEMBERS ONLY

Pedaling Wyckoff

by Bruce Fraser,

Industry-leading "Wyckoffian"

Horizontal Point and Figure analysis is one of the great mysteries of technical analysis. Very few do this analysis, and even fewer do it correctly. An incorrect procedure leads to bad counts. But when it is done properly PnF is magical. We have spent much time here establishing proper counting...

READ MORE

MEMBERS ONLY

Video - Weekly Market Review & Outlook - Plotting the High-Low Line for Small-caps

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

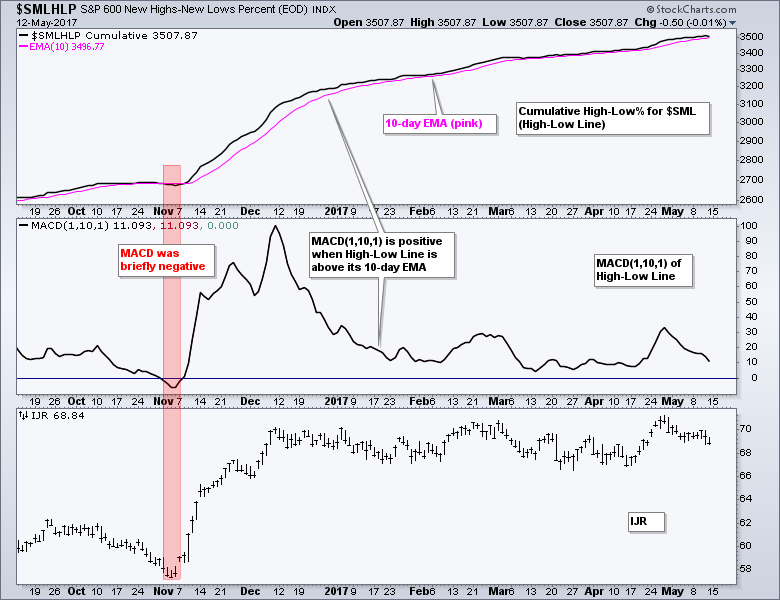

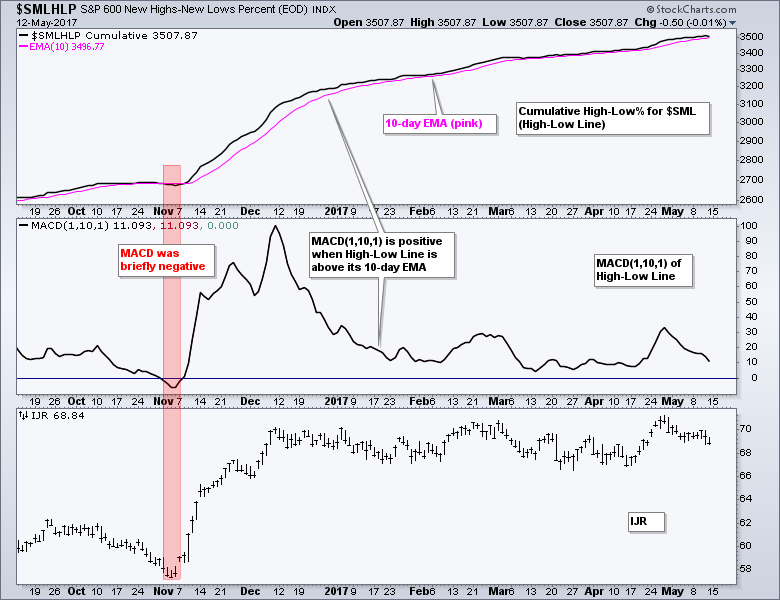

Small-Cap High-Low Line is Still Rising

The bulk of the evidence remains bullish for stocks, but small-caps and mid-caps continue to drag their feet. The chart below shows the cumulative High-Low Line for S&P SmallCap High-Low Percent ($SMLHLP) with the 10-day EMA (pink). Notice that the High-Low Line...

READ MORE

MEMBERS ONLY

This Investor's 5 Personal Passages

by Gatis Roze,

Author, "Tensile Trading"

I’d like to paraphrase a fishing analogy. Show someone how to invest by following a winning trading methodology and he/she will be happy for awhile. Teach someone how to think effectively about trading and he/she will be profitable for a lifetime.

All too often as investors, our...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - Mixed Breadth - Bond ETFs Hit Inflection Point

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Weekly Market Review & Outlook

.... On a Road to Nowhere ($VIX and $SPX)

.... High-Low Lines Continue to Rise

.... Deterioration in %Above 200-day Indicators

.... SPY Holds the Breakout and the Gaps

.... IJR and MDY Tests their Breakout Zones

.... Mind the Gap-Breakouts in XLI and XLF

.... Correlations with the 20+ YR T-Bond...

READ MORE

MEMBERS ONLY

Rotation Turns Defensive As S&P 500 Consolidation Continues

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 11, 2017

Consumer staples (XLP, +0.15%) and utilities (XLU, +0.14%) were beneficiaries of money rotating more defensively on Thursday. While the end result at the close wasn't bad overall (the Dow Jones and S&P 500 lost 0.11% and...

READ MORE

MEMBERS ONLY

DP Alert: New IT Trend Model NEUTRAL Signal for GOLD

by Erin Swenlin,

Vice President, DecisionPoint.com

No new changes to the DP Scoreboards to report...except that you can now find the DP Scoreboards on your member homepage! I'll be writing about how to quickly access it in tomorrow's blog. While everything remains green on most of the boards, I did note...

READ MORE

MEMBERS ONLY

When Does A Low VIX Reading Matter?

by Martin Pring,

President, Pring Research

* The VIX

* The Dollar Index

* The Euro

* Swiss Franc

* Japanese Yen

The VIX

Most of this piece is devoted to the dollar and some interesting looking currencies. However, I have been intrigued by a couple of articles and news stories recently appearing in the general purpose media. They have pointed...

READ MORE