MEMBERS ONLY

ALL-WORLD INDEX HITS NEW RECORD -- FOREIGN STOCKS CONTINUE TO RALLY -- ASIA LEADS EMERGING MARKETS HIGHER -- EUROPE ALSO LOOKS STRONG -- THAT INCLUDES IRELAND

by John Murphy,

Chief Technical Analyst, StockCharts.com

FTSE ALL-WORLD INDEX HITS NEW RECORD... Chart 1 shows the FTSE All-World Stock Index ($FAW) trading at a new record high. The FAW includes stocks from 47 developed and emerging markets. It just recently cleared its 2015 high which resumed its major uptrend. That's a positive sign because...

READ MORE

MEMBERS ONLY

Homebuilders Hot; DR Horton Forms Cup, Lennar Tests High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 16, 2017

Home construction ($DJUSHB) continued its torrid pace of recent gains, rising another 2% on Thursday. Since January 23rd, the DJUSHB has jumped roughly 20%. That's a great year by any measure, yet we're only talking the past two months...

READ MORE

MEMBERS ONLY

Investors Feeling Bearish = Good for the Market

by Erin Swenlin,

Vice President, DecisionPoint.com

I thought this "yin yang" symbol was actually a nice metaphor for sentiment. When we look at the sentiment numbers on a chart they are expressed as a percentage. For example, 31% are bullish, 39% are bearish, and the rest fall into the neutral category. It's...

READ MORE

MEMBERS ONLY

Fresh All-Time High For ORCL After Latest Earnings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Oracle Corp (ORCL) needed a solid earnings report last night after the closing bell to reach all-time highs and it delivered exactly that. ORCL posted both top line and bottom line (.63 vs .57) results that exceeded Wall Street consensus estimates and this morning's open cleared price resistance...

READ MORE

MEMBERS ONLY

Fed Hikes Rates, But No New Hike Expectations Revealed

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 15, 2017

The Federal Reserve's latest policy meeting has come and gone. As expected, the FOMC announcement at 2pm EST indicated that rates would be hiked another quarter point. But the real question was whether the Fed would turn more hawkish on future...

READ MORE

MEMBERS ONLY

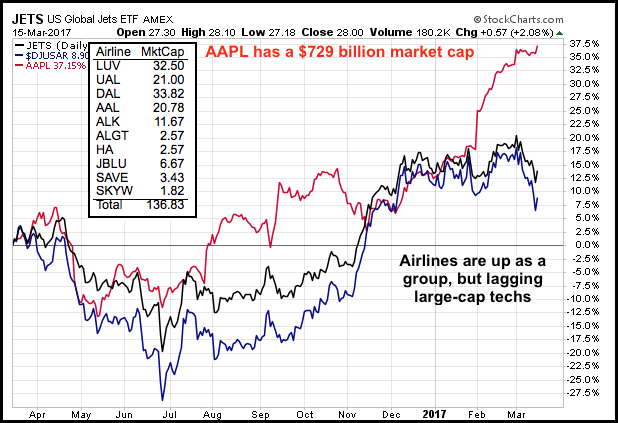

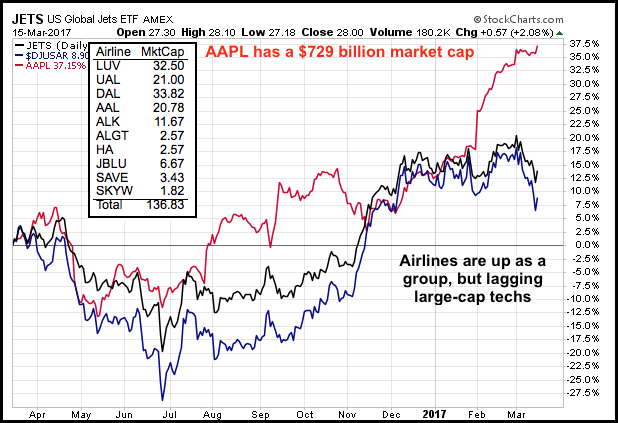

Airline ETF and Six Airline Stocks: Long-term Uptrend and Short-term Oversold - Plus Ford and Akamai

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... The Airline Group is Tiny, Really Tiny

.... Comparing the Airline Index with the Airline ETF

.... JETS Hits Oversold Zone

.... The Big Three (AAL, DAL, UAL)

.... Three Regional Carriers (HA, JBLU, SKYW)

.... Where to Find a List of Airline Stocks

.... Two More Charts with Bullish Setups (F and AKAM)

The Airline...

READ MORE

MEMBERS ONLY

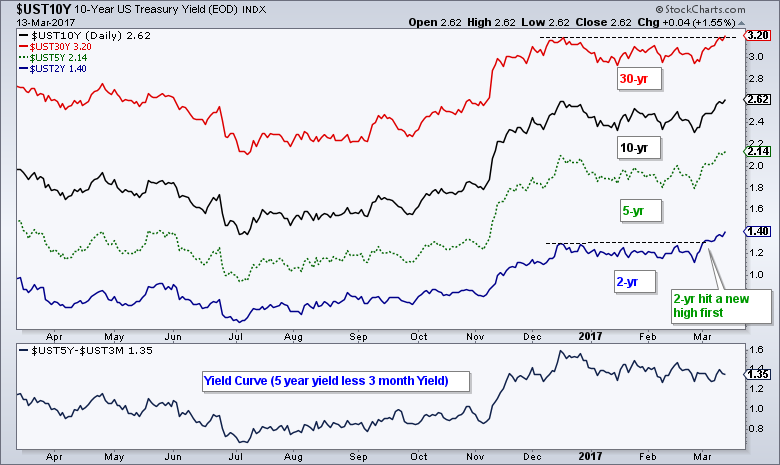

STOCKS AND BONDS RALLY ON FED ANNOUNCEMENT -- PULLBACK IN YIELDS BOOSTS REITS AND UTILITIES, WHILE BANKS LAG -- DOLLAR DROP BOOSTS GOLD -- STOCK INDEXES REACT POSITIVELY -- EMERGING MARKETS LEAD FOREIGN STOCK ETFS HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

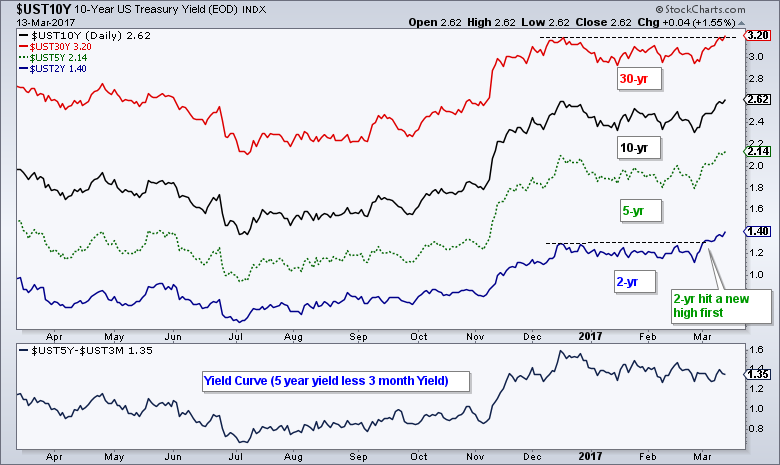

FED MOVE VIEWED AS DOVISH... The Fed hiked rates today as expected, with expectations for two more hikes this year. Judging from immediate market reactions, the Fed announcement is being viewed as somewhat dovish. For one thing, bond yields are dropping. Chart 1 shows the 10-Year Treasury Yield falling sharply....

READ MORE

MEMBERS ONLY

A High and Tight Pennant Takes Shape for Paychex

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Flags and pennants are continuation patterns, which means their bias depends on the direction of the prior move. A flag or pennant after a surge is a bullish continuation pattern that represents a rest within the uptrend. An upside break signals an end to this consolidation and a resumption of...

READ MORE

MEMBERS ONLY

Technology Showing Signs Of Slowing Momentum

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Webinar Announcement

Please join me at noon EST for my Bowley Briefing webinar. It'll be a special one hour format and I'll be joined by Erin Heim. Many of you may know Erin from all of her Decision Point work here at StockCharts.com. We&...

READ MORE

MEMBERS ONLY

Chart Spotlight on Pfizer, Inc. (PFE)

by Erin Swenlin,

Vice President, DecisionPoint.com

Chart Spotlights will be a regular addition to the DecisionPoint blog and have already been incorporated into the DecisionPoint Report webinars. The purpose of the Chart Spotlight is not to recommend a particular stock, it is a learning exercise. Many readers and viewers want to understand how to pull up...

READ MORE

MEMBERS ONLY

When Will Rising Rates Hit The Stock Market?

by Martin Pring,

President, Pring Research

* No consistent relationship between rates and equity prices

* Three step and a stumble

* Combining interest rate movements with equity trends

No consistent relationship between rates and equity prices

A lot of prognosticators have recently raised concerns that rising rates will soon affect equities in an adverse way. Last week at...

READ MORE

MEMBERS ONLY

SMALL CAPS AND TRANSPORTS CONTINUE TO WEAKEN -- ENERGY STOCKS CONTINUE TO DROP ON FALLING OIL PRICE -- COMMODITY SELLOFF WEAKENS INFLATION TRADE -- HIGH YIELD BONDS SELL OFF ON COMMODITY WEAKNESS

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAPS AND TRANSPORTS WEAKEN ... Bond yields are hitting multi-year highs in anticipation of a Fed rate hike tomorrow. Stocks remain in an uptrend, but weakness in some stock groups is sending short-term caution signals. Small caps and transports continue to weaken. So do energy shares along with falling oil...

READ MORE

MEMBERS ONLY

Bond Market Moves Ahead of the Fed - Plus MDY, JJC and 16 Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Bond Market Moves Ahead of the Fed

.... S&P MidCap SPDR Becomes Short-term Oversold

.... Copper ETN Pulls Back within Uptrend

.... Valero and Marathon (Refiners) Hold Up within XLE

.... Computer Associates, QQQ and New Highs

.... FFIV, PFPT and QLYS Bounce within Cyber-Security Group

.... Three Biotechs to Watch (CELG, ILMN, REGN)...

READ MORE

MEMBERS ONLY

Footwear Is Strengthening; Here's My Choice In The Space

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 13, 2017

There really was very little movement in our major indices or in our sectors on Monday - which for Monday isn't really a bad day. But my guess is that traders are a bit cautious ahead of what many perceive will...

READ MORE

MEMBERS ONLY

There are two Energy stocks inside $INDU.....

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

... And they both show very weak rotations on the Relative Rotation Graph of the DJ Industrials components.

XOM rotated negatively while inside the lagging quadrant and CVX just crossed over into the lowe-left part coming from weakening. These are the two names to avoid in this universe.

They are closely...

READ MORE

MEMBERS ONLY

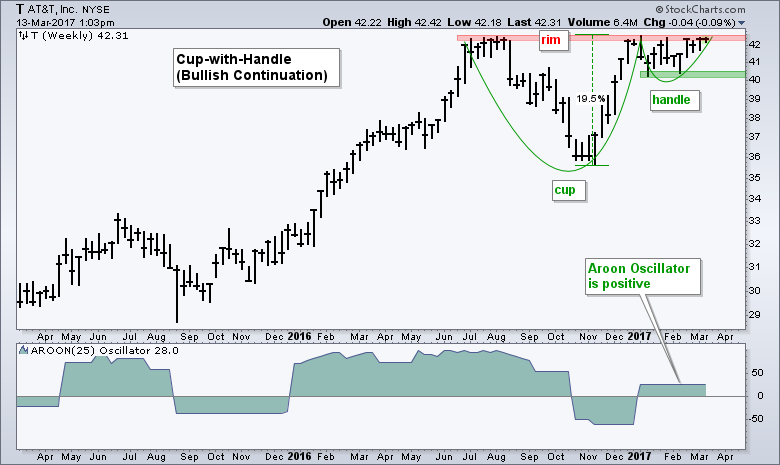

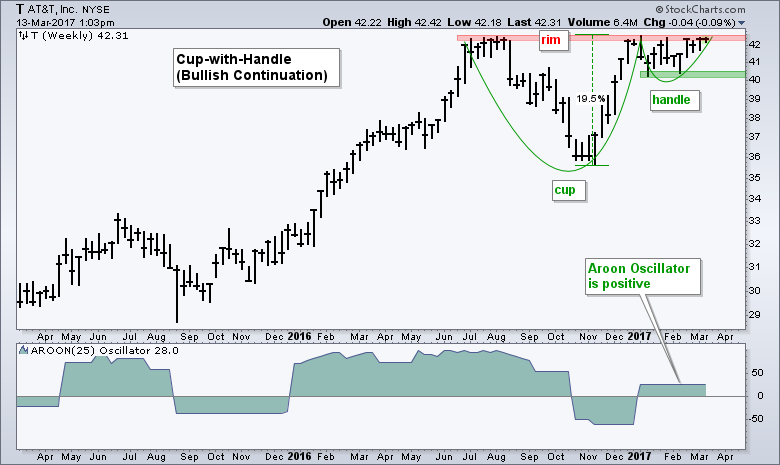

AT&T Forms a Classic Bullish Continuation Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The cup-with-handle is a bullish continuation pattern that forms as part of a bigger uptrend. There are three parts to this pattern. First, a cup forms as prices correct and rebound to form a "V" or "U" shape. Second, prices hit resistance at the prior high...

READ MORE

MEMBERS ONLY

Wall of Worry

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The “Wall of Worry” has been used for many decades to identify the period of time in the latter stages of a bullish run in the stock market, when all the naysayers start talking about a top. I have witnessed this often. As the bull ages, many start to think...

READ MORE

MEMBERS ONLY

Failure Of Treasury Yields Slow Financial Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 10, 2017

U.S. equities posted mostly strong results on Friday with a bit of relative strength from the more aggressive NASDAQ and Russell 2000. The NASDAQ 100 ($NDX) posted the best percentage gain of all, but keep in mind that the NDX does not...

READ MORE

MEMBERS ONLY

Heavy Construction Tests Support, Here's A Potential Winner

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones U.S. Heavy Construction Index ($DJUSHV) is currently testing its rising 20 week EMA and is near key support in its four month sideways consolidation range from 440-480. Friday's close was 447 and the weekly RSI is now at 43, typically a solid level on...

READ MORE

MEMBERS ONLY

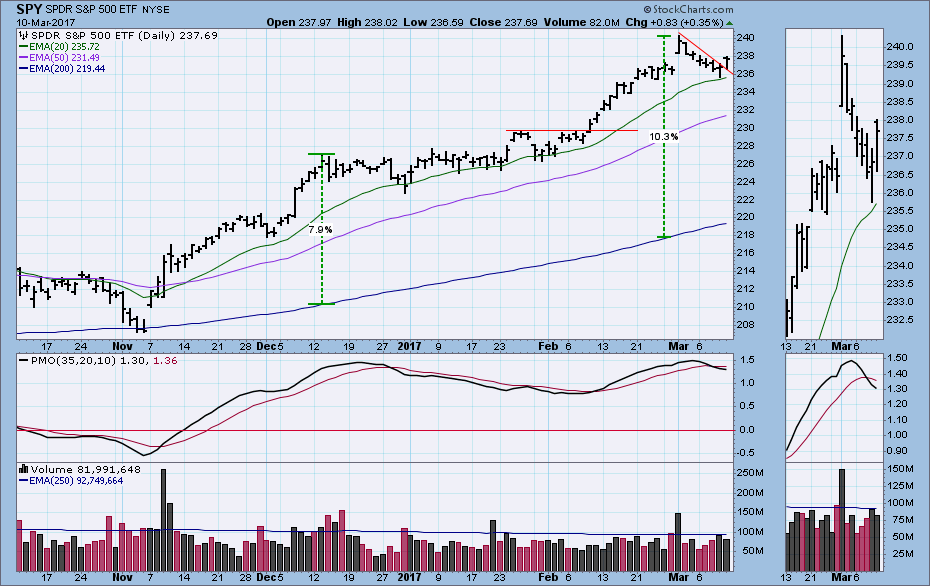

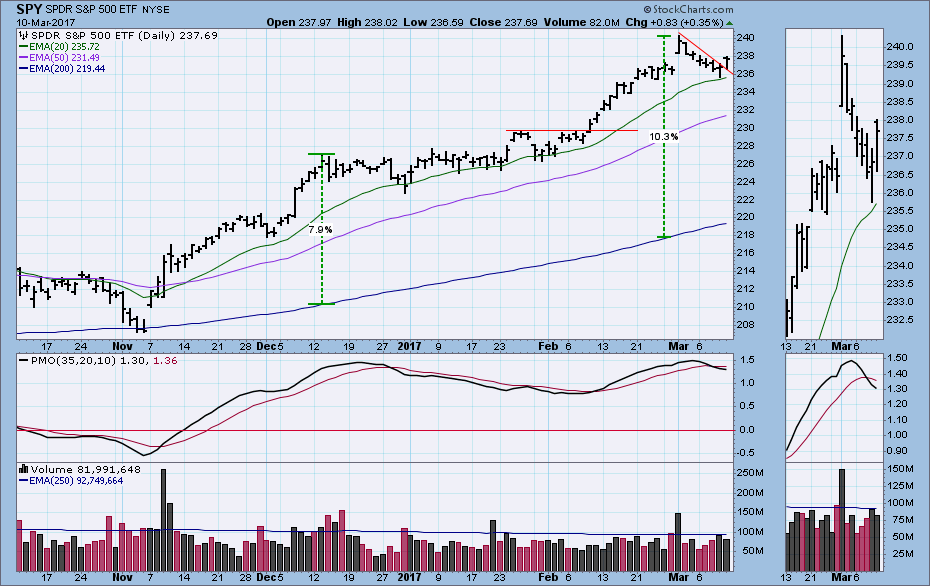

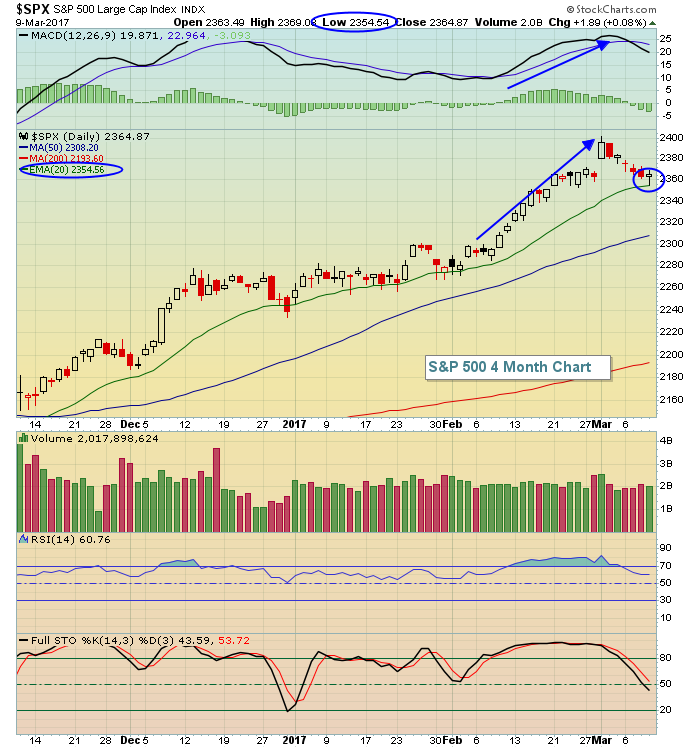

SPY: Short-Term Indicators Positive

by Carl Swenlin,

President and Founder, DecisionPoint.com

Trying to attribute every market up or down tick to news/fundamental events is a fool's errand, but every once in a while the connection between seems pretty obvious. The day after President Trump's address to congress, the market gapped up in response; however, it immediately...

READ MORE

MEMBERS ONLY

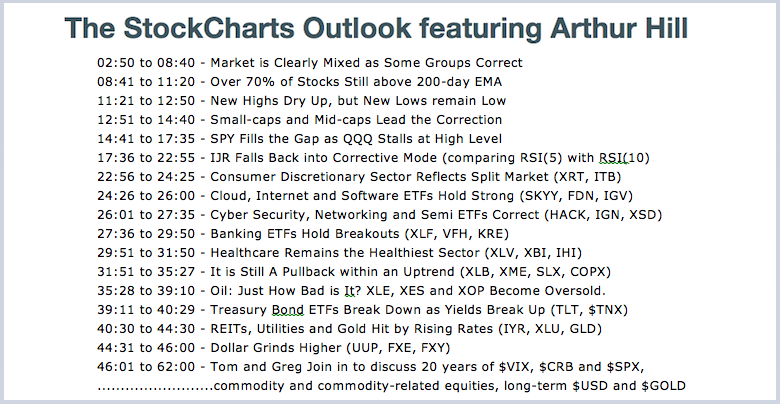

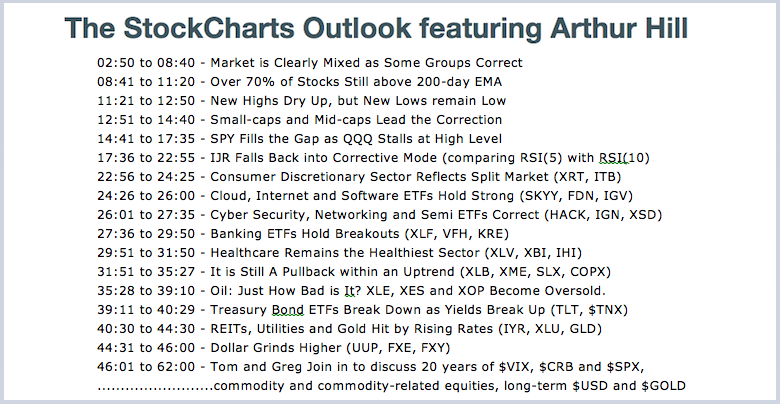

The StockCharts Outlook Webinar Recording with Arthur, Greg and Tom

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The image above shows the outline for the StockCharts Outlook webinar. Arthur added some color to the Weekly Market Review & Outlook by going over the each chart and expanding in some areas. Namely, the difference between RSI(5) and RSI(10), the bifurcation in the current market and a...

READ MORE

MEMBERS ONLY

NASDAQ 100 Index. A Current Case Study.

by Bruce Fraser,

Industry-leading "Wyckoffian"

Point and Figure charts are generated from price volatility, unlike a vertical (bar) chart, which is plotted as a function of time. This is particularly valuable to Wyckoffians who are always on the search for a Cause being built. Causes lead to Effects; Accumulation results in Markup and Distribution turns...

READ MORE

MEMBERS ONLY

Investor's Creed

by Gatis Roze,

Author, "Tensile Trading"

“An investor’s methodology is inseparable from his or her emotional discipline. Both must be defended and reinforced whenever either is threatened.” — Gatis Roze

My trading is guided by a collection of beliefs and principles that direct my trading routines, actions and ‘Investor Self’ behavior. Over the years, it’s...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - Looking at Performance Splits within the Market and Oversold ETFs - Webinar Link

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Market is Clearly Mixed as Some Groups Correct

.... Small-caps and Mid-caps Lead the Correction

.... New Highs Dry Up, but New Lows remain Low

.... Over 70% of Stocks Still above 200-day EMA

.... SPY Fills the Gap as QQQ Stalls at High Level

.... IJR Falls Back into Corrective Mode

.... Consumer Discretionary Sector...

READ MORE

MEMBERS ONLY

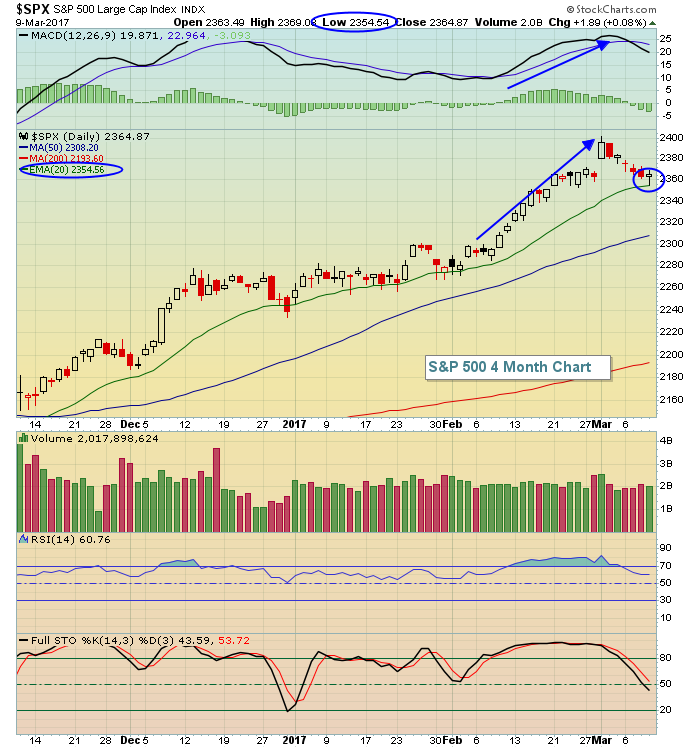

Weakening Aluminum, Steel And Gold Pressure Materials Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 9, 2017

The March 6th to 9th period once again produced not-so-good S&P 500 results. The S&P 500 did break its recent string of losses, gaining two points on Thursday. Technically, it bounced exactly where we would expect - off the...

READ MORE

MEMBERS ONLY

SystemTrader - Reducing Risk with a Portfolio Approach to Mean-Reversion Trading

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Failure for One Trader is Opportunity for Another

.... Mean-Reversion Trades and Setups for IJR

.... Backtesting Two Short-term Mean-Reversion Strategies

.... Completed Trade and Current Setup for MDY

.... Testing Five Major index ETFs

.... Trading a Portfolio to Reduce Risk

.... Equity Curve and Drawdown Chart

.... Conclusions

Failure for One Trader is Opportunity for...

READ MORE

MEMBERS ONLY

Record Crude Inventories Sink Oil, S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 8, 2017

The S&P 500 fell for a third consecutive day and it could have been five days in a row if not for a very small gain last Friday. The culprit yesterday was quite clearly the oil patch. The U.S. crude...

READ MORE

MEMBERS ONLY

INTEREST RATES CLIMB ALONG WITH THE DOLLAR -- INVESTMENT GRADE CORPORATES WEAKEN -- DROP IN JUNK BONDS MAY BE SHORT-TERM WARNING FOR STOCKS -- SMALL CAPS THREATEN 50-DAY LINE -- ENERGY SPDR PLUNGES ON FALLING CRUDE OIL

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS CONTINUE TO CLIMB... Chart 1 shows the 10-Year Treasury Yield (TNX) climbing to 2.55% which is the highest level this year. The 2-Year Treasury yield (most sensitive to a Fed rate hike) has climbed to 1.35% which is the highest level in seven years. Odds for...

READ MORE

MEMBERS ONLY

Is The Global Bull Market In Interest Rates Resuming?

by Martin Pring,

President, Pring Research

* The global picture

* Short-term rates

* Longer-term rates

* International rates

The Global Picture

When I talk about interest rates I am referring to a general advance that takes place at both ends of the yield spectrum. I make this reference because in many situations certain maturities and credit qualities do not...

READ MORE

MEMBERS ONLY

Microsoft Stalls within Uptrend as Stochastic Oscillator Starts to Turn

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It always piques my interest when a stock bucks the broader market. Note that SPY and QQQ closed lower the last two days and Microsoft (MSFT) closed higher. Even though it is only for two days, this little morsel of relative strength could foreshadow a bullish resolution to the current...

READ MORE

MEMBERS ONLY

Treasury Yield Shows Building Expectations For Next Rate Hike

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 7, 2017

Next Tuesday, another FOMC meeting begins with their policy decision announced next Wednesday. Expectations are that we'll see another quarter point rate hike. It's not a slam dunk and there are some who believe we should wait to see...

READ MORE

MEMBERS ONLY

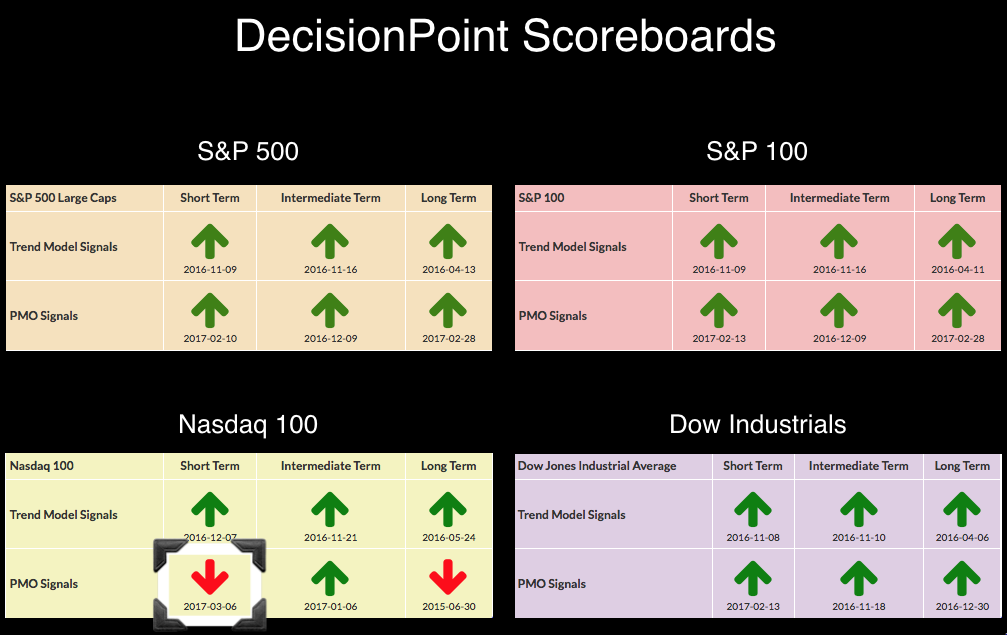

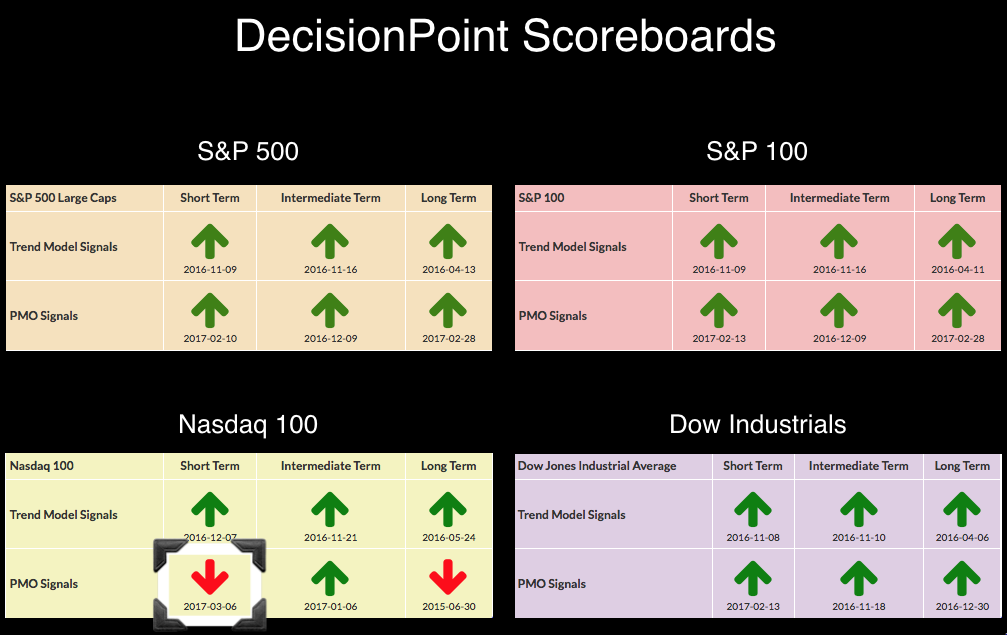

New NDX PMO SELL Signal Likely the First of Many

by Erin Swenlin,

Vice President, DecisionPoint.com

Many of you may have noticed yesterday's DecisionPoint Alert blog headline, "New PMO SELL Signal for the NDX". I had thought we'd make it to DP Scoreboards with all BUY signals, but the NDX refused to give up the Long-Term Price Momentum Oscillator (PMO)...

READ MORE

MEMBERS ONLY

Webinar Reminder 4:30pm EST Today

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I just wanted to send out a quick reminder about a webinar that I'll be conducting with EarningsBeats.com President and CEO John Hopkins. It starts in roughly an hour with the webinar doors opening as the stock market closes. I will be discussing trading strategies during earnings...

READ MORE

MEMBERS ONLY

HOMEBUILDING LEADERS ARE DR HORTON, LENNAR, AND PULTEGROUP -- HEALTH CARE INSURERS LED HIGHER BY HUMANA, CIGNA, AND UNITEDHEALTH GROUP -- BIOTECH AND DRUG ETFS MEET RESISTANCE -- HEALTHCARE SPDR TESTS OLD HIGHS -- BAXTER INTL RECOVERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DR HORTON, LENNAR, AND PULTE LOOK STRONG... Recent messages have shown bullish breakouts in a couple of ETFs tied to housing. The stronger of the two is the U.S. Home Construction iShares (ITB) which is the purest play on homebuilders. That's because its five biggest stocks are...

READ MORE

MEMBERS ONLY

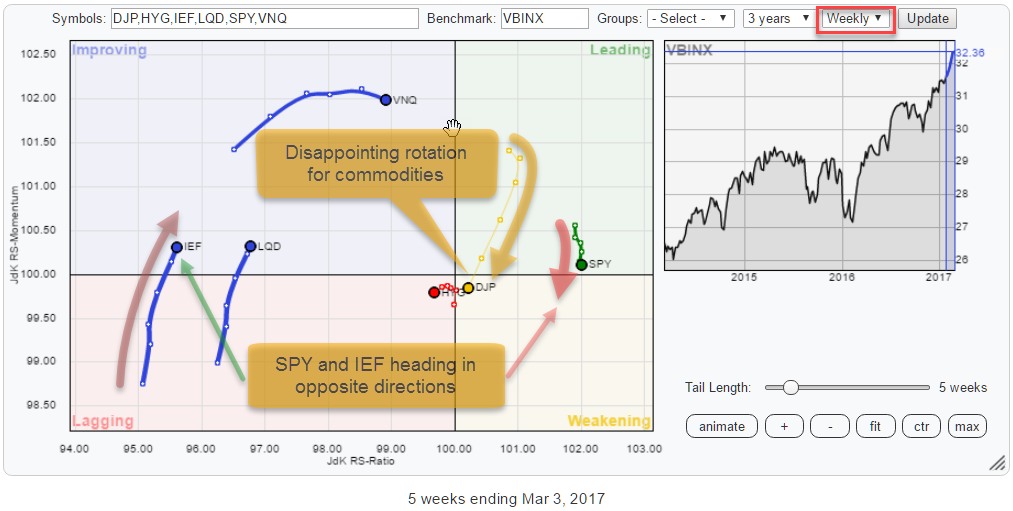

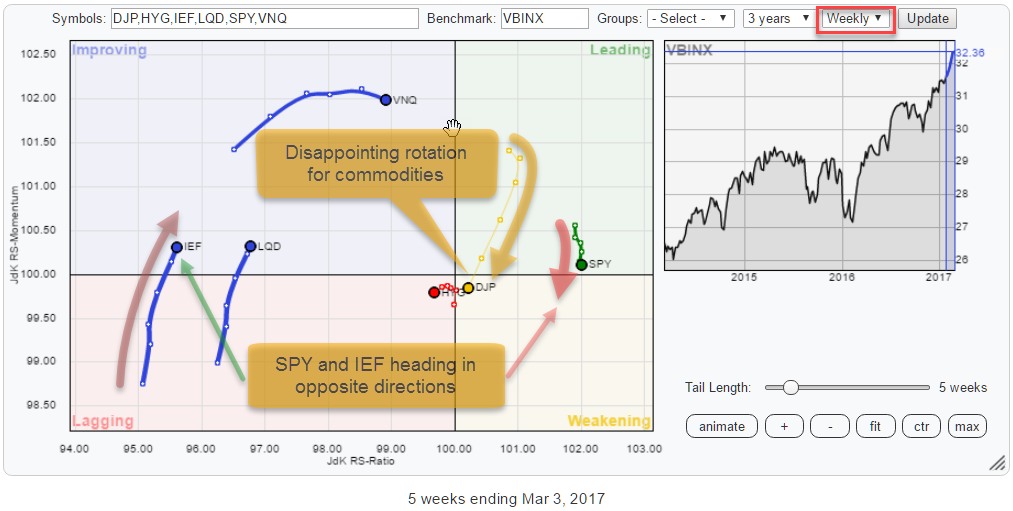

Double divergence building up in SPY:IEF ratio and commodities need another rotation through lagging.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Summary

* Opposite rotations for Equities and Bonds on both weekly and daily RRGs

* Rapid weakening of commodities over past six weeks

* Current positioning of SPY suggests some short-term weakness before resuming trend

* IEF in consolidation pattern after breaking long-term uptrend

* Double divergence in SPY:IEF ratio points to potential corrective...

READ MORE

MEMBERS ONLY

Evaluating The Technical Health Of Energy And Healthcare

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 6, 2017

U.S. equities experienced a little profit taking on Monday, nothing technically damaging, but all our major indices did finish lower. The only sector to escape damage was energy (XLE, +0.22%), while all the others declined. On a relative basis, the XLE...

READ MORE

MEMBERS ONLY

Small-Cap Breadth Deteriorates - Bonds Could Hold the Key for Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Small-cap Breadth Deteriorates

.... TLT Tests Support and 2-yr Yields Hits 52-week High

.... Mind the Gaps in these 4 Bank Stocks

.... Where to Check Earnings and News

.... 12 Stocks with Bullish Charts

.... PCN, CX, NUE, EOG, LNG, GE, ATI, JNPR, AKAM, T, EXPE, CAKE

Small-cap Breadth Deteriorates

Stocks declined for the,...

READ MORE

MEMBERS ONLY

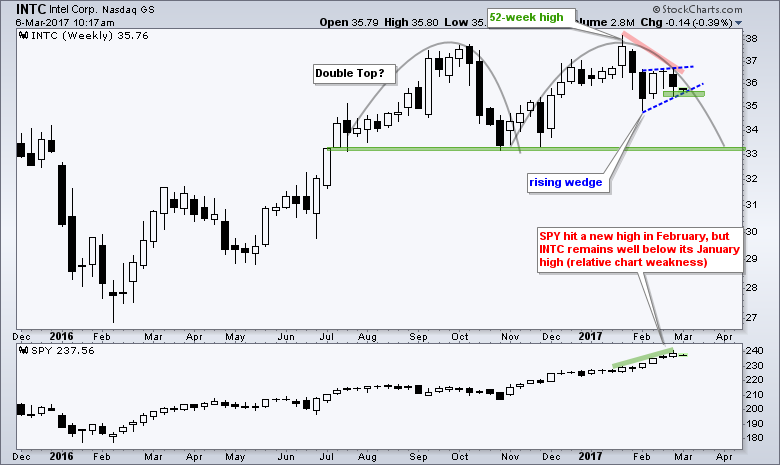

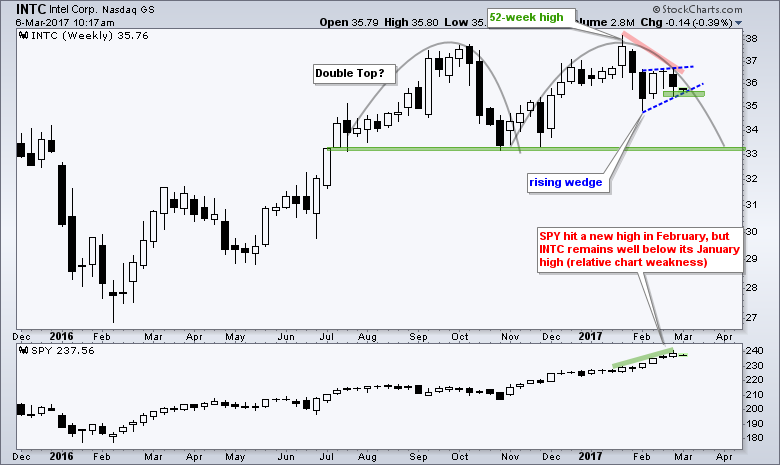

Intel Struggles as Bearish Patterns Take Shape

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Intel is not keeping pace with the broader market and chartists should watch the bearish wedge for signs of further weakness. There are two patterns at work on the price chart. First, INTC formed a rising wedge after a sharp decline and this looks like a short-term bearish continuation pattern....

READ MORE

MEMBERS ONLY

Sticking With Global Theme, China Stocks Look Bullish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 3, 2017

We saw bifurcated action on Friday with the Dow Jones, S&P 500 and NASDAQ all posting minor gains while the Russell 2000 fell slightly. Sector action behaved similarly as about half the sectors climbed fractionally while the rest finished in negative...

READ MORE

MEMBERS ONLY

GOLD: Slight Breakdown

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Friday gold broke below the rising trend line that forms the bottom of a rising wedge pattern. A breakdown was expected because that is the normal and highly reliable resolution of most rising wedge patterns. The minimum downside target is 1180, but downside estimates for rising wedge patterns are...

READ MORE