MEMBERS ONLY

Top Ten Charts to Watch for October 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As we near the end of what has been a fairly solid Q3 for the equity markets, we are left with the eternal question for investors: "What's next?"

We now have the Fed's first rate cut in the rearview mirror, with multiple rate cuts...

READ MORE

MEMBERS ONLY

This Week's "Sector to Watch" and "Industry Group to Watch"

by Erin Swenlin,

Vice President, DecisionPoint.com

On Friday mornings in our DP Diamonds subscriber-only trading room, the DecisionPoint Diamond Mine, I like to look for a "Sector to Watch" and an "Industry Group to Watch" within. These are for your watchlist and not necessarily ready for immediate investment. In the case of...

READ MORE

MEMBERS ONLY

Unlocking GDX's Short-Term Potential: How to Nail the Measured Move Strategy

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* VanEck Vectors Gold Miners ETF (GDX) broke above its recent highs, confirming a continued uptrend.

* GDX displayed a short-term trading setup that was apparent in its price chart.

* The "measured move" rule can exploit an obvious short-term trading opportunity in GDX.

A few weeks back, two...

READ MORE

MEMBERS ONLY

Opportunities in Industrials and Materials

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Negative divergence remains a distracting factor

* Defensive rotation still present

* Industrials and Materials on positive track toward leading RRG quadrant

Despite a backdrop of conflicting market signals, there are still sectors within the S&P 500 that are showing promising movements and potential opportunities for investors. Today,...

READ MORE

MEMBERS ONLY

SCTR Report: China Adds More Stimulus, FXI in Second Position

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* iShares China Large-Cap ETF (FXI) gains technical strength and has made it to second position in the StockCharts Technical Rank (SCTR).

* FXI could be in the early stages of a bull rally, so keep an eye on this ETF.

* Set your price target levels for entry and exit...

READ MORE

MEMBERS ONLY

China Stimulus Energizes Stocks, Commodities; Will The Energy Sink?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stocks, commodities, and crypto prices soared after China announced its stimulus package, but pulled back slightly after the news.

* Metal prices are still holding strong while oil prices pulled back.

* Escalating geopolitical tensions don't seem to be impacting the stock market much at the moment.

Tuesday&...

READ MORE

MEMBERS ONLY

How to Use the ADX Indicator (Trend Strength Explained)

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe presents an introduction to the Average Directional Index (ADX), sharing how it is calculated and how to use it. He highlights some of the strengths, and weaknesses, of this powerful indicator. He then analyzes Bitcoin, NVDA, and AVGO, and finishes up the show...

READ MORE

MEMBERS ONLY

How to Spot the Perfect Buying Opportunity in XLRE

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Investors began piling into real estate stocks over the last three months.

* XLRE is now just under 1% from its 52-week high, as indicated by the Distance From Highs indicator.

* With a potential dip on the horizon in XLRE, watch these levels to spot zones of opportunity from...

READ MORE

MEMBERS ONLY

Why the Stock Market is SO Confusing Right Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius assesses current rotations in asset classes and US sectors using Relative Rotation Graphs, finding a lot of contradictory behavior. Taking a step back, he focuses on the weekly timeframe to find some more meaningful trends and shy away from day-to-day noise. He then...

READ MORE

MEMBERS ONLY

The Dollar Index is Down, But Is It Out?

by Martin Pring,

President, Pring Research

The Dollar Index has been selling off sharply in the last few weeks and has now reached critical support in the form of the lower part of its recent trading range. The big question is whether it will break below the range or extend it in any way.

Chart 1...

READ MORE

MEMBERS ONLY

DP Trading Room: Analyzing Two New Stocks in SP500 (DELL, PLTR)

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's free DP Trading Room Carl reviews the charts of two new members to the SP500, Dell (DELL) and Palantir (PLTR). Are they poised to break out on this news?

Carl also discussed the inflation on housing prices to open the show. Before going over the signal...

READ MORE

MEMBERS ONLY

Equities Remain in Strong "Go" Trend, Powered by Financials

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Good morning and welcome to this week's Flight Path. Equities saw the "Go" trend remain strong with an uninterrupted week of strong blue "Go" bars. Treasury bond prices remained in the "Go" trend as well but we saw weaker aqua bars as...

READ MORE

MEMBERS ONLY

Bullish or Bearish? The Truth About Rate Cuts and Stock Performance

by David Keller,

President and Chief Strategist, Sierra Alpha Research

So the first Fed rate cut is behind us, and we are no longer in a "higher for longer" period, but in a new rate cut cycle which will most likely last well into 2025. So that's good news for stocks, right? Well, not necessarily.

The...

READ MORE

MEMBERS ONLY

Strategy After Rate Cuts: Best Areas to BUY!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the broader markets after last week's rate-cut induced rally. She also shares stocks that are breaking out of bases and poised to trade higher. The "nuclear renaissance" is also discussed, as well as stocks that will benefit the...

READ MORE

MEMBERS ONLY

Dow Jones in the Spotlight, Bonds Stabilize, Tech Plays Catch-Up

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Dow Jones Industrial Average closed at a new all-time high.

* Stock market indexes still have bullish momentum in spite of up and down movement.

* Bond prices could stabilize after digesting the interest rate cut.

The Federal Reserve's interest rate cut decision on Wednesdaywas like receiving...

READ MORE

MEMBERS ONLY

A Sector Rotation Dilemma ...

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Sector Rotation remains defensive

* S&P chart showing resemblence to late 2021

* Negative divergences still in play

First of all, I apologize for my absence this week. I caught something that looked like Covid, and felt like Covid, but it did not identify (pun intended) as Covid....

READ MORE

MEMBERS ONLY

Analyzing Investor Sentiment for Gold

by Carl Swenlin,

President and Founder, DecisionPoint.com

Sentiment indicators are contrarian, meaning that when the majority of investors are bullish on a market, it is bearish for that market. Most investors are aware of several sentiment indicators that relate to the stock market, but they may not be aware that there is a sentiment indicator for gold...

READ MORE

MEMBERS ONLY

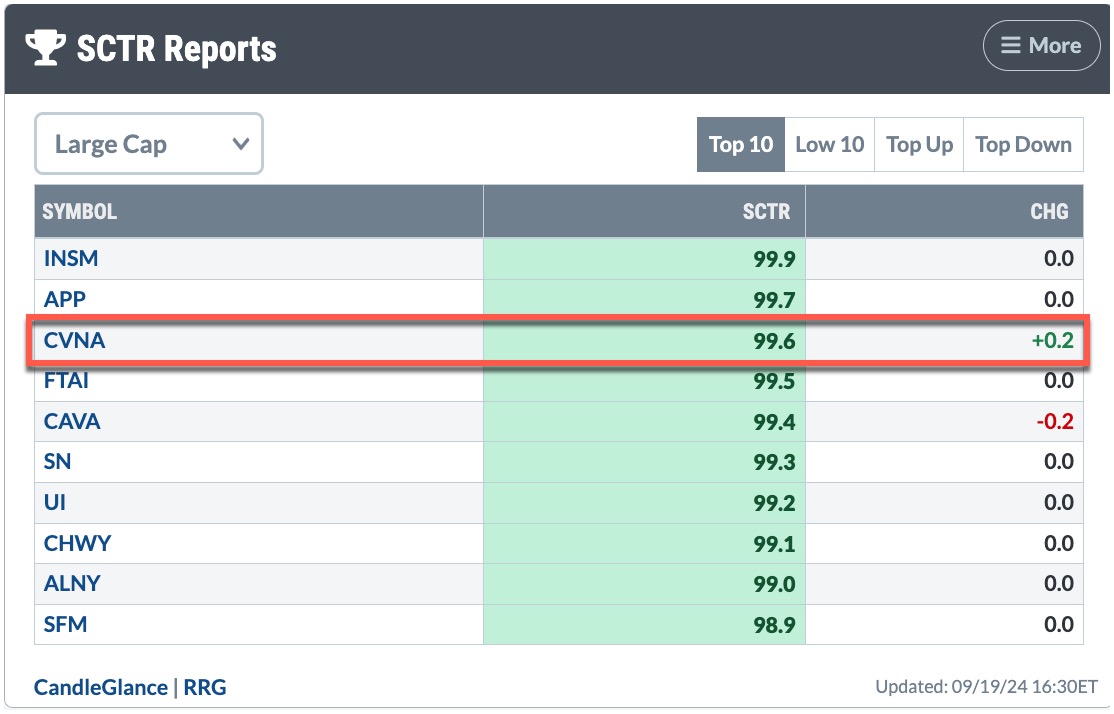

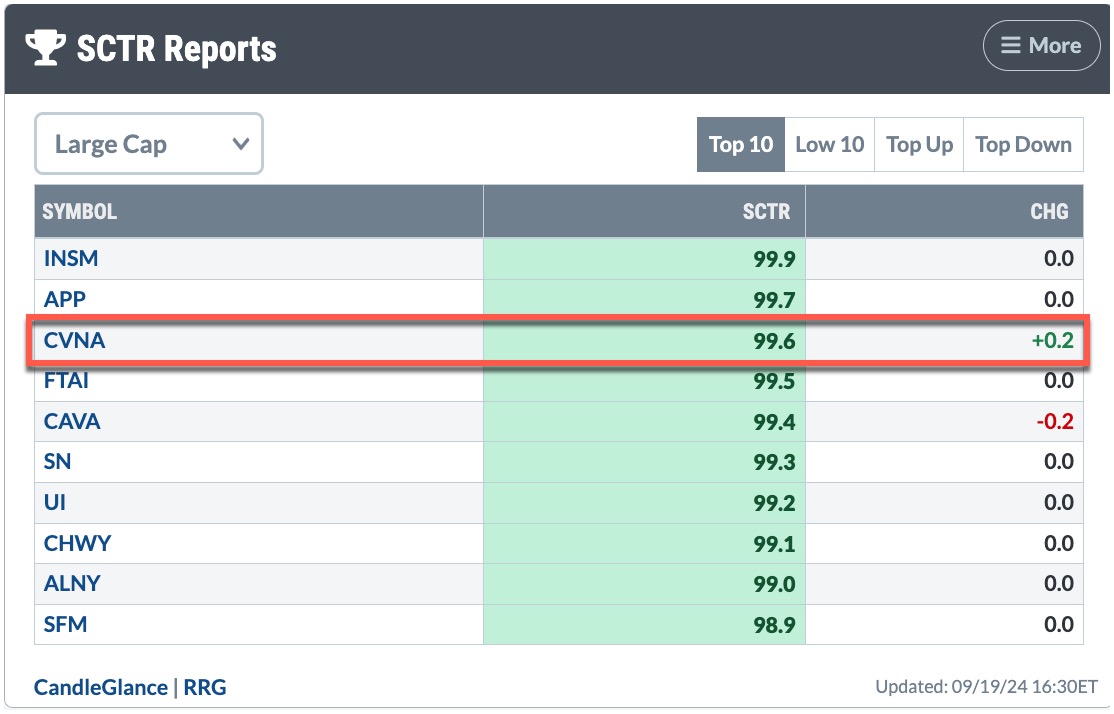

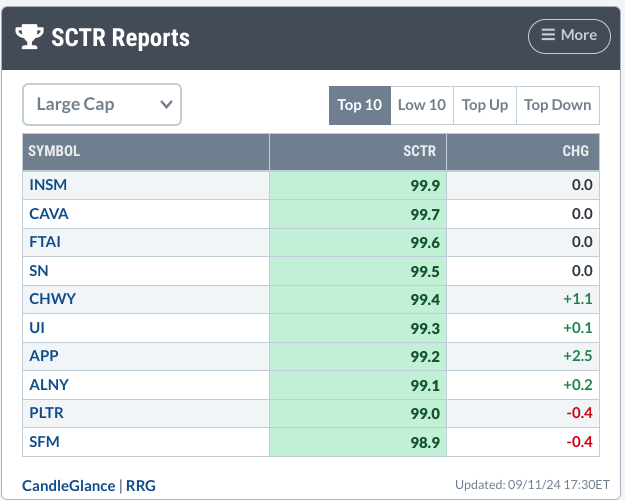

The SCTR Report: Carvana's Gain Makes It Worth a Revisit

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Carvana stock fell behind in its ranking during its August–September pullback, but it's now gaining momentum.

* From a weekly perspective, the uptrend in Carvana looks solid.

* Watch the Fibonacci retracement levels on the weekly chart to identify your entry and exit points.

On August 5,...

READ MORE

MEMBERS ONLY

This S&P 500 Rally is Defying the Experts – Here's What You Need to Know

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Wells Fargo analysts issued a warning about the current rally.

* Their last warning in November 2023 may have caused many investors to have missed out on a huge move.

* Analysts can be right or wrong, so it's important to watch key technical levels.

If you logged...

READ MORE

MEMBERS ONLY

The Fed Cut Discount Rate | Larry's "Family Gathering" September 19, 2024 Recording

by Larry Williams,

Veteran Investor and Author

Interest rates have been cut -- what now? Larry presents his thoughts in this edition of the Family Gathering video.

In this month's Family Gathering video, Larry begins with what he calls the "Fed Cut Discount Rate" and what it means. What does history make of...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Daylight Time (11am Pacific). Sign-in in begins 5 minutes prior. The show, which will include both a presentation from Larry and a viewer Q&A session, will be recorded and posted online for those...

READ MORE

MEMBERS ONLY

Stock Market Today: Fed Cuts Rates and Market Makes Last Minute U-Turn

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Fed cut interest rates by 50 basis points and shifts focus to the economy.

* Stock market rallied after the Fed's interest rate cut decision but closed lower.

* Treasury yields rose while bond prices fell.

The stock market received what it expected from the Federal Reserve—...

READ MORE

MEMBERS ONLY

The Secret to Perfecting SPY Entry Points? RSI!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe shows how to use RSI in multiple timeframes to identify the next buying opportunity in the SPY. Joe thinks this rally is important; he uses the ADX to distinguish between the strength in different indices. Joe demonstrates how he moves quickly around ACP,...

READ MORE

MEMBERS ONLY

SHOP Stock Ready to Surge: An Options Strategy to Take Advantage of the Big Move

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* SHOP stock pulled back to a support level and is showing a strong signal for an up move.

* SHOP's stock price has the potential to rise to $85.

* This call vertical spread options strategy could potentially result in a 238% return on investment.

Shopify (SHOP) continues...

READ MORE

MEMBERS ONLY

Investors Hesitant Ahead of Fed Meeting: How to Prepare

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Broader stock market indexes went above resistance levels, but retreated by the close.

* Small-cap stocks took the lead in Tuesday's trading.

* The Fed's decision on interest rates could make for a volatile trading day.

The broader stock market indexes are still in a holding...

READ MORE

MEMBERS ONLY

How High Can Gold Prices Go? The Tools You Need to Spot the Next Big Breakout!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Gold prices are soaring and are at an all-time high.

* Anticipated Fed rate cuts can send gold prices higher.

* There are two tools you can use to project gold price action in bullish and bearish scenarios.

As of Tuesday, the CME's FedWatch Tool gave a 67%...

READ MORE

MEMBERS ONLY

DP Trading Room: Tracking Gold Sentiment

by Erin Swenlin,

Vice President, DecisionPoint.com

As part of Carl's review of Gold charts, he explained how we use the close-ended fund, Sprott Physical Gold Trust (PHYS) to measure sentiment for Gold. Depending on how PHYS trades, it trades at a discount or premium based on the physical Gold that it holds. These discounts...

READ MORE

MEMBERS ONLY

Equity Markets Rebound As Discretionary Out-Performs

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Good morning and welcome to this week's Flight Path. Equities saw the "Go" trend return after a triplet of uncertain "Go Fish" bars. We saw blue "Go" bars from Wednesday on. Treasury bond prices remained in a strong "Go" trend...

READ MORE

MEMBERS ONLY

Can We Trust Last Week's BIG Rally?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

That's a great question, because we saw some very nice gains and we're now approaching all-time highs, especially on the Dow Jones ($INDU) and S&P 500 ($SPX). The more growth-oriented NASDAQ 100 ($NDX) has much more work to do. How much more strength is...

READ MORE

MEMBERS ONLY

An Indicator to Reduce Whipsaws and Ride Trends

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Whipsaws and losing trades are part of the process for trend-following strategies.

* These strategies are profitable because average profits far exceed average losses.

* Chartists can reduce whipsaws by adding signal thresholds to the 5/200 day SMA cross.

Whipsaws and losing trades are part of the process for...

READ MORE

MEMBERS ONLY

These Stocks are Just Beginning Their Move Higher!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the broader markets and highlights pockets of strength that are starting to trend higher. She also shares add-on plays to the move into home construction stocks, and shows key characteristics needed to confirm a downtrend reversal in select stocks.

This video originally...

READ MORE

MEMBERS ONLY

Here's My Most-Likely Scenario for QQQ

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While the S&P 500 finished the week once again testing new all-time highs around 5650, the Nasdaq 100 remains rangebound in a symmetrical triangle or "coil" pattern. While this pattern does not necessarily suggest a potential next move for the QQQ, it did lead me to...

READ MORE

MEMBERS ONLY

A Half Point Fed Rate Cut? The Stock Market Thinks So

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stocks make a strong recovery after last week's selloff.

* Large-, mid-, and small-cap stocks closed higher, with small caps the clear leader.

* Gold and silver prices surged on interest rate cut expectations.

This week's stock market action may have caught many investors by surprise....

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs NEXT WEEK - Thursday, September 19 at 2 PM EDT!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom on Thursday, September 19 at 2:00pm Eastern Daylight Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

A Déjà Vu in The Consumer Staples Sector Sends a Strong Warning Signal

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Tech bounce is judged as recovery within downtrend.

* XLP, XLF, and XLV are positioned for outperformance in coming weeks.

* The XLP chart is showing interesting characteristics which we have seen before

Tech Rallies, But Remains Inside the Lagging Quadrant

A quick look at the Relative Rotation Graph for...

READ MORE

MEMBERS ONLY

The SCTR Report: Insmed's Stock Hangs in the Balance—Here's What You Need to Know

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Insmed (INSM) has been near the top of the StockCharts SCTR report for weeks.

* Insmed's stock price has pulled back, but maintained its high SCTR score.

* Insmed could be posed for an upside move.

Numerous companies are making strides within their respective sectors, but, unless you...

READ MORE

MEMBERS ONLY

Stock Market Today: Are Big Tech Growth Stocks Back in the Spotlight?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stocks rebounded on Wednesday with wide trading ranges.

* Investors are rotating back into large-cap growth and momentum stocks.

* The Financial sector was hit hard by negative news from banks but made some recovery.

It was a massive turnaround day in the market on Wednesday—stocks sold off after...

READ MORE

MEMBERS ONLY

Pinpoint Strong Sectors BEFORE The Masses Notice

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe discusses why he is a bottom-up technical analyst. He explains the difference between top-down and bottom-up analysis and uses this to show the strongest sectors rotating to the upside right now; this approach will help give advance notice of which areas to focus...

READ MORE

MEMBERS ONLY

Why Stock Outperformance Might be ENDING!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius takes a look at rotations in an asset allocation RRG. He compares fixed-income-related asset classes, commodities, the US dollar, Bitcoin and stocks to a balanced portfolio of 60% stocks/40% bonds. The long-lasting outperformance of stocks seems to be coming to an end....

READ MORE

MEMBERS ONLY

Stock Market Today: Real Estate and Tech Lead, Energy Down

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The real estate sector gains ground as interest rate cuts loom.

* Technology stocks are showing slight gains, but not enough to shift momentum.

* Energy prices slide lower on weakened demand.

The Real Estate sector took the lead in Tuesday's trading, probably because interest rate cuts are...

READ MORE