MEMBERS ONLY

DP Trading Room: Mortgage Rates are Falling - Watch Real Estate

by Erin Swenlin,

Vice President, DecisionPoint.com

Mortgage Rates fell quite a bit this past week and no one is really talking about it. One area that we will want to watch closely as rates fall is Real Estate (XLRE). This sector has already been moving in the right direction. It now has an opportunity to rally...

READ MORE

MEMBERS ONLY

CAUTION ADVISED Ahead of This Week's Inflation Data!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen dives into her broad market analysis, sharing what she needs to see before it's safe to get back in. She also shares her top candidates for once the markets turn positive, including META, LLY and NFLX. She finishes up by sharing...

READ MORE

MEMBERS ONLY

Financials Power Price Rally off Lows

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Good morning and welcome to this week's Flight Path. Equities remained in a "NoGo" trend this past week however after gapping lower on Monday, prices rallied until on Friday GoNoGo Trend painted a weaker pink bar. Treasury bond prices painted weaker aqua "Go" bars...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays Tentative As Defensive Setup Develops; Know These Levels Well

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The market extended its corrective move in the previous week; over the past five sessions, it has remained quite choppy and totally devoid of any definite directional bias. It absorbed a few global jerks and saw gaps on either side of its previous close on different occasions. While the level...

READ MORE

MEMBERS ONLY

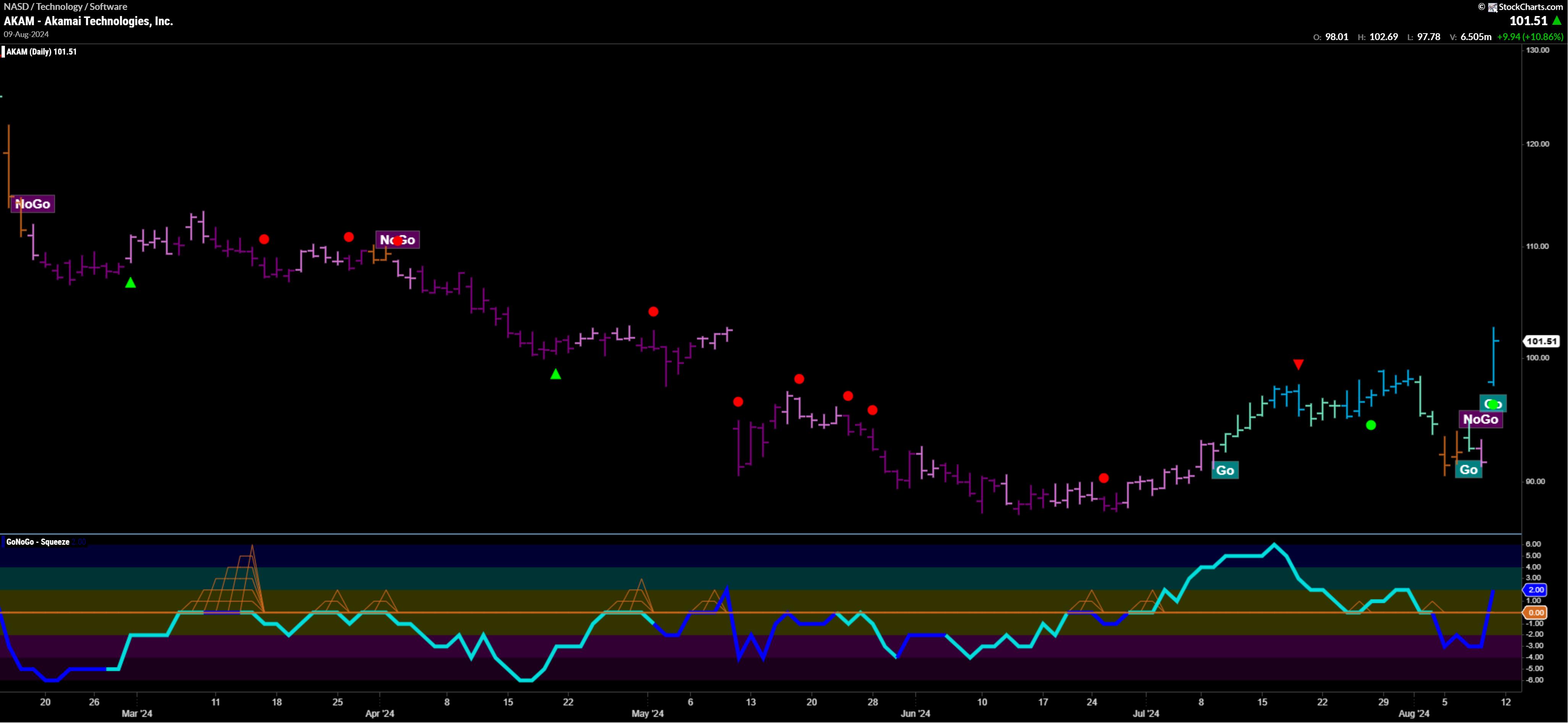

Top 5 Stocks in "Go" Trends | Fri Aug 9, 2024

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Scanning for breakouts on heavy volume

* Momentum confirmations of underlying trends

* Leading Equities in trend continuation

Top 5 Stocks in "Go" Trends

Trend Continuation on Rising Momentum

GoNoGo Charts® highlight low-risk opportunities for trend participation with intuitive icons directly in the price action. The resurgence of...

READ MORE

MEMBERS ONLY

Three Market Sentiment Indicators Confirm Bearish Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The VIX reaching 65 signals extreme volatility and elevated risk of market downside

* The AAII Survey is close to showing more bears than bulls, which would line up with previous corrections

* The NAAIM Exposure Index indicates that money managers were rotating to defensive positioning in early July

While...

READ MORE

MEMBERS ONLY

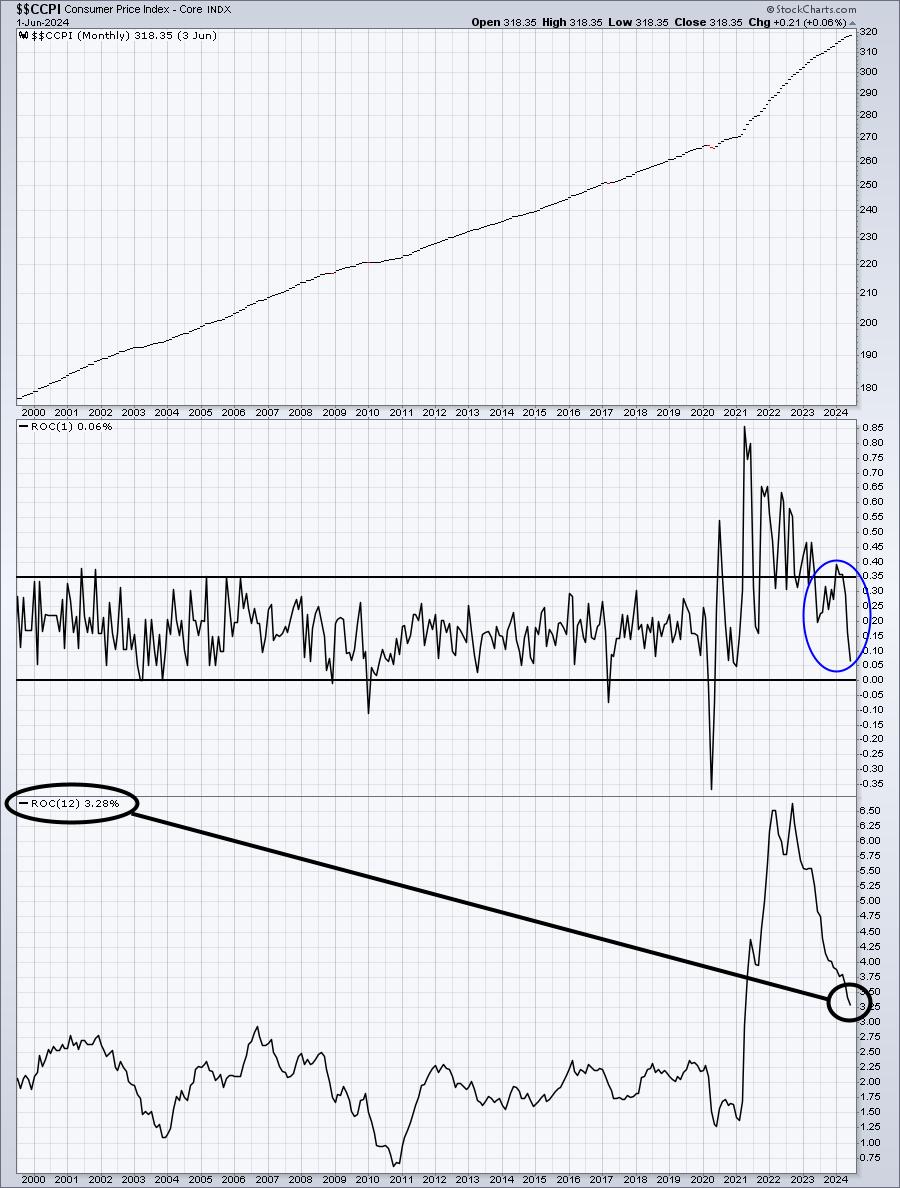

S&P 500 Teetering On 100-Day Moving Average Support

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market indexes end the week on a positive note after a scary Monday

* Volatility steps back slightly after a brief spike over 65

* Next week's consumer and producer inflation data could help set direction

A sigh of relief? The US stock market started the...

READ MORE

MEMBERS ONLY

How the PROS Time Entry Points

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave presents a special all-mailbag episode, answering viewer questions on optimizing entry points for long ideas, best practices for point & figure charts, and the relationship between gold and interest rates.

See Dave's chart showing Zweig Breadth Thrust...

READ MORE

MEMBERS ONLY

TLT Turns the Corner and Starts to Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Smoothing the signal thresholds help to reduce whipsaws.

* A new uptrend signaled for TLT as the 5-day exceeded the 200-day by more than 3%

* TLT also sports a classic breakout and continuation signal.

The 20+ Yr Treasury Bond ETF (TLT) is turning the corner as a long-term trend...

READ MORE

MEMBERS ONLY

Substantial Deterioration in Number of IT BUY Signals

by Carl Swenlin,

President and Founder, DecisionPoint.com

DecisionPoint tracks 26 market, sector, and industry group indexes, and we monitor moving average crossovers for those indexes to assess the bullish or bearish condition of those indexes. A Silver Cross BUY Signal is generated when the 20-day exponential moving average (EMA) of a price index crosses up through the...

READ MORE

MEMBERS ONLY

When Does This Selloff End?

by Larry Williams,

Veteran Investor and Author

In my last newsletter,I discussed cycle projections for the S&P 500, i.e., a rally and then down into a mid-September low. The recent price action in the stock market may have many of you wondering when to open long equity positions.

My cycle work suggests we...

READ MORE

MEMBERS ONLY

Will USO Soar to $83? Here Are the Key Levels to Watch!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Fundamental, technical, and seasonality factors suggest an upside move in WTI crude oil.

* Seasonality and other indicators suggest a swing trading opportunity in the United States Oil Fund (USO).

* Supply and geopolitical factors can quickly change the conditions of the market and the trade.

Oil prices are climbing...

READ MORE

MEMBERS ONLY

The Great Rotation: Not What You Think

by Martin Pring,

President, Pring Research

KEY TAKEAWAYS

* Small-cap stocks look like they have lost momentum.

* Market breadth in small-cap stocks appears to be weakening.

* The Utilities sector seems to be gaining momentum.

Just so we are on the same page, I looked up "Great Rotation" on Microsoft's Copilot and came away...

READ MORE

MEMBERS ONLY

QQQ: Critical Levels to Watch as Nasdaq Teeters on the Edge

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* QQQ has bounced off its 200-day moving average.

* An optimal entry point for QQQ would be the 50% to 61.8% Fibonacci retracement range.

* If QQQ drops below $350, it can mean further downside.

Just Another Manic Monday? On Monday, the Nasdaq plunged over 3%. With the S&...

READ MORE

MEMBERS ONLY

Not Much Good Takes Place When This Happens

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As a long-term stock trader, one development in the stock market takes me and many others to our collective knees. It's a Volatility Index ($VIX) that rises past 20. There has never been a bear market that's unfolded with a VIX that remains below 20. FEAR,...

READ MORE

MEMBERS ONLY

The SCTR Report: Carvana Stock Makes It To Top of the Podium Today

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Carvana stock takes the lead in the large-cap stocks SCTR Report

* CVNA stock has established an upside trend with higher lows and higher highs

* Carvana's stock price is holding above its 21-day exponential moving average

On a day when the S&P 500 ($SPX) drops...

READ MORE

MEMBERS ONLY

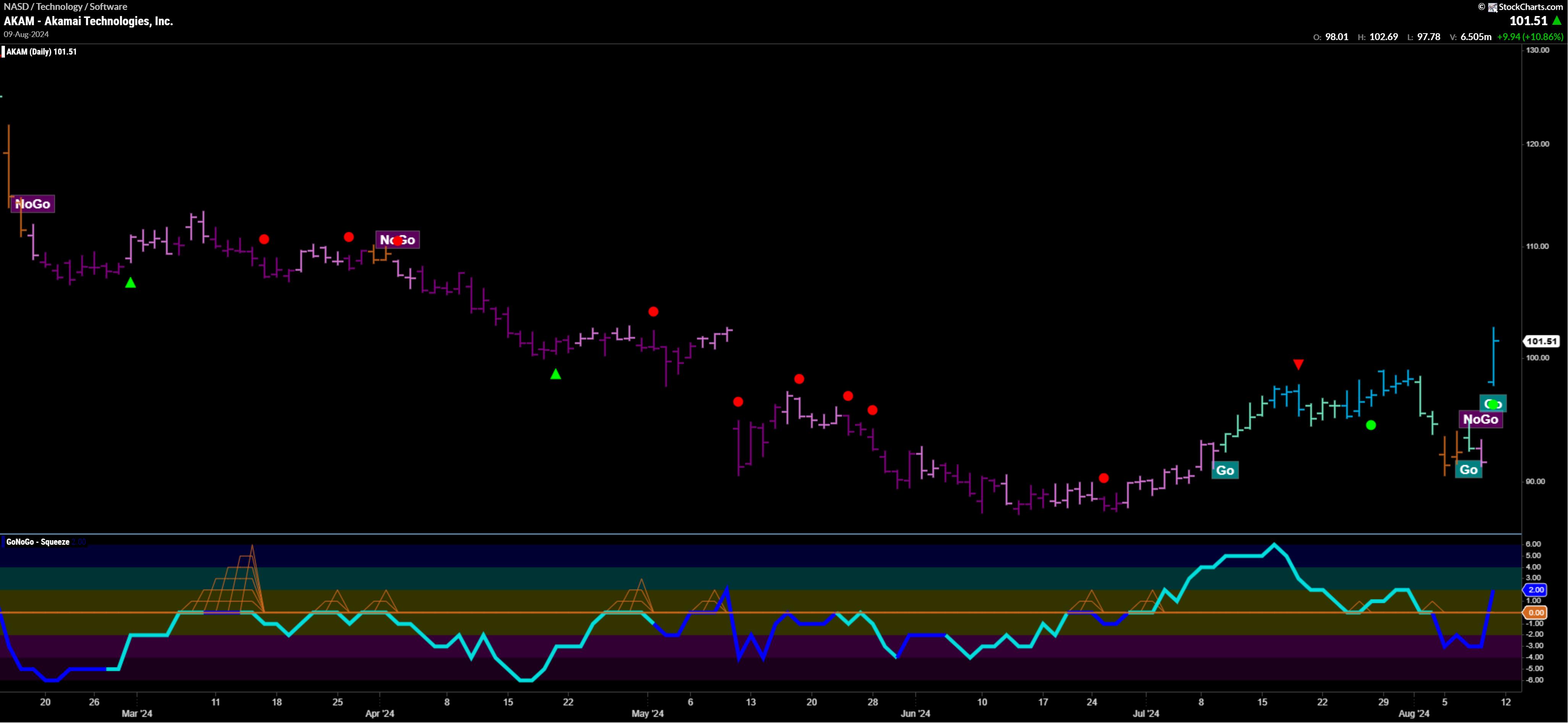

Stocks Get Defensive as Market Index Enters "NoGo"

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Good morning and welcome to this week's Flight Path. Equities could not hold onto "Go" colors any longer and we saw a strong purple "NoGo" bar as the trend changed on the last bar of the week. GoNoGo Trend painted strong blue "Go&...

READ MORE

MEMBERS ONLY

DP Trading Room: Bear Market Rules Apply

by Erin Swenlin,

Vice President, DecisionPoint.com

The market is dropping perilously right now and so it is time to review Bear Market Rules. Today Erin and Carl share their rules for trading during a bear market move. We aren't officially in a bear market and we may not get there, but there is likely...

READ MORE

MEMBERS ONLY

Who Let the DOG Out?

by Bruce Fraser,

Industry-leading "Wyckoffian"

In the classroom we would have students alter their view of charts they were evaluating to gain fresh perspective and possibly enhance their analysis. Students often had Ah-Ha moments after freshening their interpretation of a chart they had previously laid eyes on many times. Stock chart analysis heavily emphasizes the...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays Prone To Profit-Taking Bouts; Guard Profits and Stay Stock-Specific

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week turned out quite volatile for the markets as they not only marked a fresh lifetime high but also faced corrective pressure as well towards the end of the week. The markets maintained an upward momentum all through the week. It scaled the psychologically important 25000 level as...

READ MORE

MEMBERS ONLY

Recession Fears Top of Mind As Tech Stocks Selloff

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Weak manufacturing and jobs data sends investors into panic mode

* All broader stock market indexes fall over 2%

* Bond prices rise

The dog days of summer are here. And the stock market gives us a brutal reminder of this.

The first trading day of August began on a...

READ MORE

MEMBERS ONLY

It's Been a Long Time Mr Bear, Where Have You Been?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Some real damage for the markets

* Equal weight sector rotation paints a more realistic picture

* The BIG ROTATION into small caps has come to a halt

And then ..... all of a sudden..... things are heating up. Lots of (downside) market action in the past week.

Let's...

READ MORE

MEMBERS ONLY

This Breadth Indicator Points to More Downside and a Potential Opportunity

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Most stocks follow their underlying index or group.

* Oversold conditions in long-term uptrends are opportunities.

* Stocks can remain oversold so wait for an upward catalyst.

The broad market and the group are big drivers for stock performance. Recently, the Nasdaq 100 ETF (QQQ) led the market lower with...

READ MORE

MEMBERS ONLY

Small Caps Poised to Soar: Is Now the Time To Buy IWM?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Small caps saw an impressive surge in July, outpacing the S&P 500 in that month alone.

* IWM, a Russelll 2000 proxy, is only 8% away from its all-time highs, potentially signaling the start of a new bull market.

* As IWM pulls back (along with the rest...

READ MORE

MEMBERS ONLY

Unbelievable! The Fed Creating Its Own Nightmare And We're The Puppets

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This Fed has got to go. It's time. You've overstayed your welcome, Fed Chief Powell. I literally was just shaking my head after reading the changes to the Fed's policy statement. The changes were in the first two paragraphs, so let me jump right...

READ MORE

MEMBERS ONLY

Bonds To Get Beat Up? | Focus on Stocks: August 2024

by Larry Williams,

Veteran Investor and Author

It looks to me like it's time for the bond market to take a breather, if not have a pullback from now into late October.

We can sum it up with the cycle projections from Chart 1. I have highlighted, in red, the down leg of the 450-day...

READ MORE

MEMBERS ONLY

Semiconductors Are Down: Is Now the Time to Buy SMH?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* SMH has completed 100% of a measured move from the bottom of a double-top reversal.

* SMH has broken below several key levels based on various indicators.

* There are actionable levels in the SMH chart that traders can take advantage of if they materialize.

Nvidia (NVDA) was perhaps the...

READ MORE

MEMBERS ONLY

Big Tech Earnings, Fed Meeting, Jobs Report: Will They Add More Pressure to the Stock Market?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Investor sentiment has turned more bearish with a continuation of a selloff in big tech stocks.

* More earnings, an FOMC meeting, and jobs report are adding to investor uncertainty.

* Keep an eye on bond prices as the data starts to unravel.

Last week, there was a noticeable change...

READ MORE

MEMBERS ONLY

S&P 500 Equal Weight ETF Gains Strength

by Bruce Fraser,

Industry-leading "Wyckoffian"

The S&P 500 index ($SPX) is a capitalization-weighted stock index. Many lesser capitalization blue-chip stocks that compose these 500 companies have been performance laggards. Though smaller companies in the index, these corporations are among the bluest of the blue-chip stocks. These prestigious corporations have been overshadowed by the...

READ MORE

MEMBERS ONLY

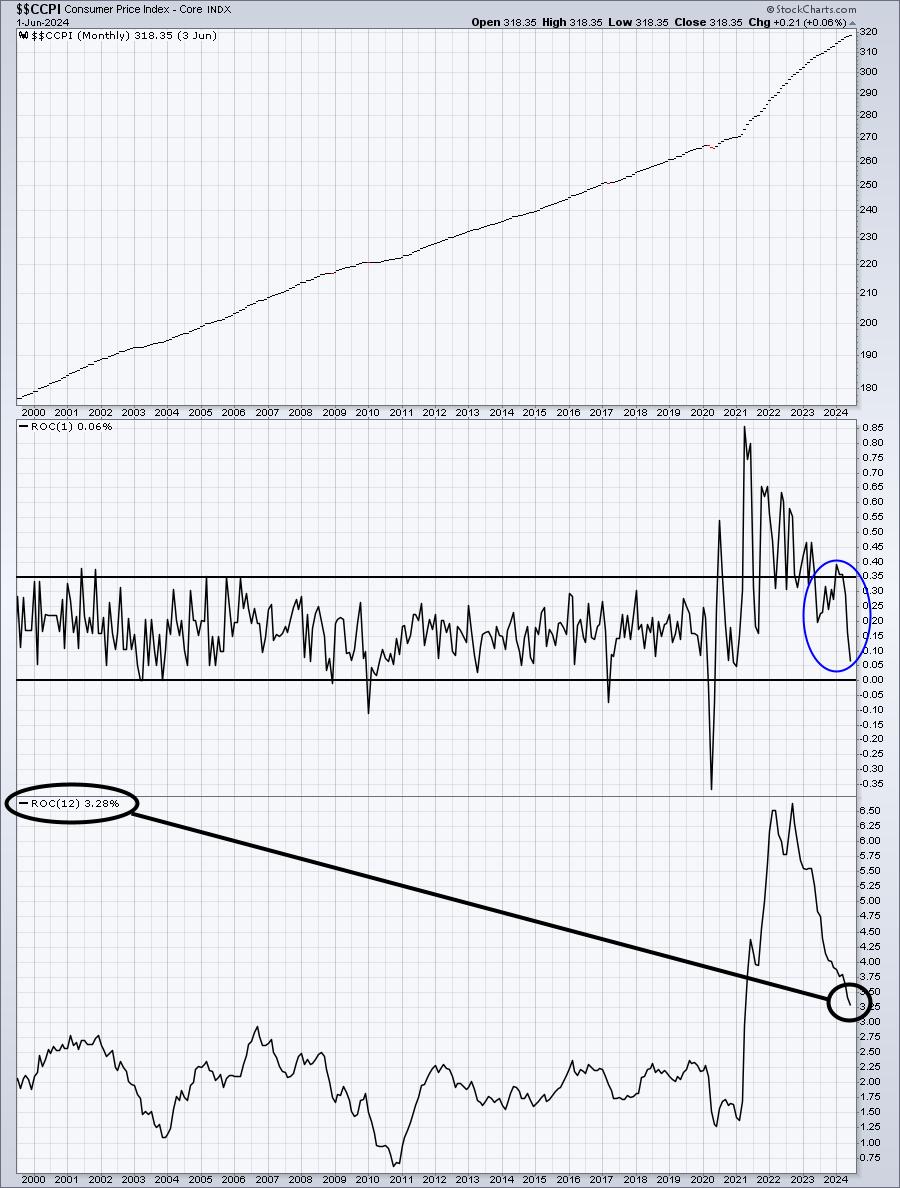

Is the Bond Market About To Make a Big Move?

by Martin Pring,

President, Pring Research

The bond market experienced a secular bear between 1981 and the spring of 2020. Chart 1 offers three reasons why it has since reversed and given way to a secular uptrend or possibly multi-year trading range.

The first piece of evidence comes from violating the multi-decade trendline. Second, the price...

READ MORE

MEMBERS ONLY

DP Trading Room: Spotlight on Mega-Cap Earnings

by Erin Swenlin,

Vice President, DecisionPoint.com

This week we have four Magnificent Seven stocks reporting earnings. We also take a look at McDonalds (MCD) and Ford (F) going into earnings. How are the chart technicals setup on the precipice of earnings? Carl and Erin give you there thoughts.

Carl reviews the DP Signal Tables to see...

READ MORE

MEMBERS ONLY

Equities Struggle As More Sectors Try To Keep the Trend Afloat

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Good morning, and welcome to this week's Flight Path.

Equities had another tough week last week, and we saw an amber "Go Fish" bar for the first time since this latest "Go" trend began. Encouragingly, GoNoGo Trend painted a weak aqua "Go"...

READ MORE

MEMBERS ONLY

Will the S&P 500 Break 5000 by September?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

This week saw the major equity averages continue a confirmed pullback phase, with some of the biggest gainers in the first half of 2024 logging some major losses. Is this one of the most buyable dips of the year? Or is this just the beginning of a protracted decline with...

READ MORE

MEMBERS ONLY

Recovery Rally In Stock Market Offers Hope: What You Need To Watch

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* After two days of massive selloffs, Friday's recovery offers some hope.

* Investors await earnings from mega-cap tech companies, economic data, and Fed meeting.

* Small caps continue to trend higher.

Major equity indexes rose on Friday after a selloff that hit the Technology sector especially hard. But...

READ MORE

MEMBERS ONLY

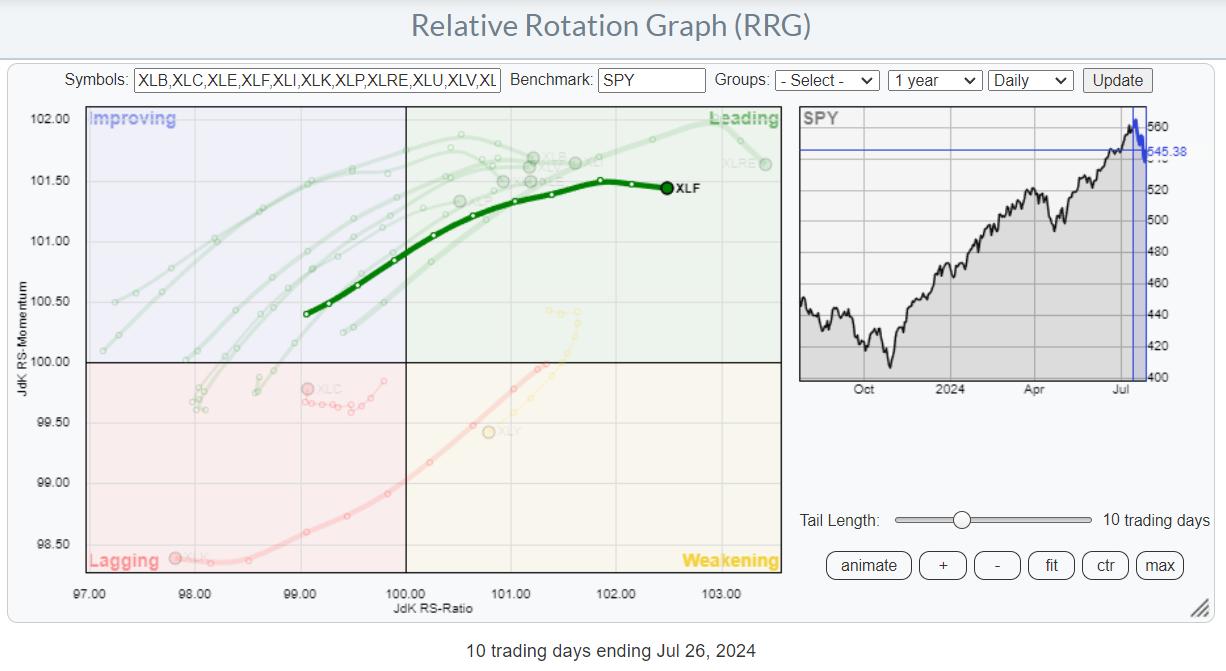

Flying Financials. Will It Be Enough?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

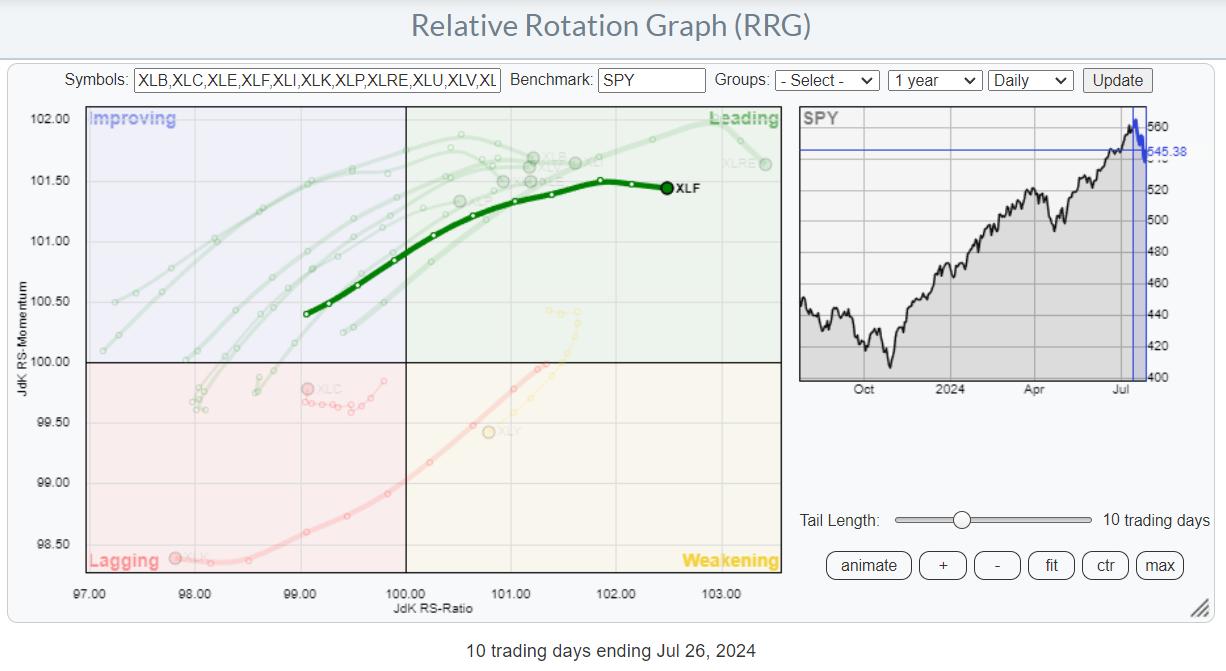

KEY TAKEAWAYS

* Strong Sector Rotation Out Of Technology

* Financials and Real Estate Lead

* Stock/Bond Ratio Triggers Sell Signal

Flying Financials

In the recent sector rotation, basically OUT of technology and INTO anything else, Financials and Real-Estate led the relative move.

On the RRG above, I have highlighted the (daily)...

READ MORE

MEMBERS ONLY

New Highs Coming or Will We Collapse? What Say You, Fed Chief Powell?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This will be one of the most interesting quarters in recent memory. The Fed has got to choose its poison. Do they stand pat once again next week, leaving rates "higher for longer" and awaiting more data? Or do they finally take the step that just about everyone...

READ MORE

MEMBERS ONLY

Nvidia Breaks the 50-day SMA: Is This a Threat or an Opportunity?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* The long-term trend provides perspective and sets the trading bias.

* The bias is bullish during long-term uptrends.

* Breaks below the 50-day SMA are viewed a opportunities, not threats.

After a big run this year, Nvidia (NVDA) fell over 15% from its high and broke its 50-day simple moving...

READ MORE

MEMBERS ONLY

Missed the Gilead Surge? Here's What You Need to Know About the Big Move

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* In June, Gilead Sciences saw a dramatic surge as positive results of a late-stage trial of its HIV drug had Wall Street buzzing.

* GILD was a "sentiment trade" that spiked too quickly for most technical and fundamental indicators to make heads or tails of the move....

READ MORE

MEMBERS ONLY

After the Tech Bloodbath: Ways to Strategize Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tech stocks took a dive on Wednesday but look like they are making up some of those losses prior to hitting the next support level.

* Expect volatility in the stock market in the coming weeks since it's earnings season and there's a Fed meeting...

READ MORE

MEMBERS ONLY

S&P 500 Breaks Key Trendline as Growth Stocks Plunge

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave previews earnings releases from TSLA and GOOGL, breaks down key levels to watch for SPOT, GE, and more, and analyzes the discrepancy between S&P 500 and Nasdaq breadth indicators.

See Dave's MarketCarpet featuring the Vanilla...

READ MORE