MEMBERS ONLY

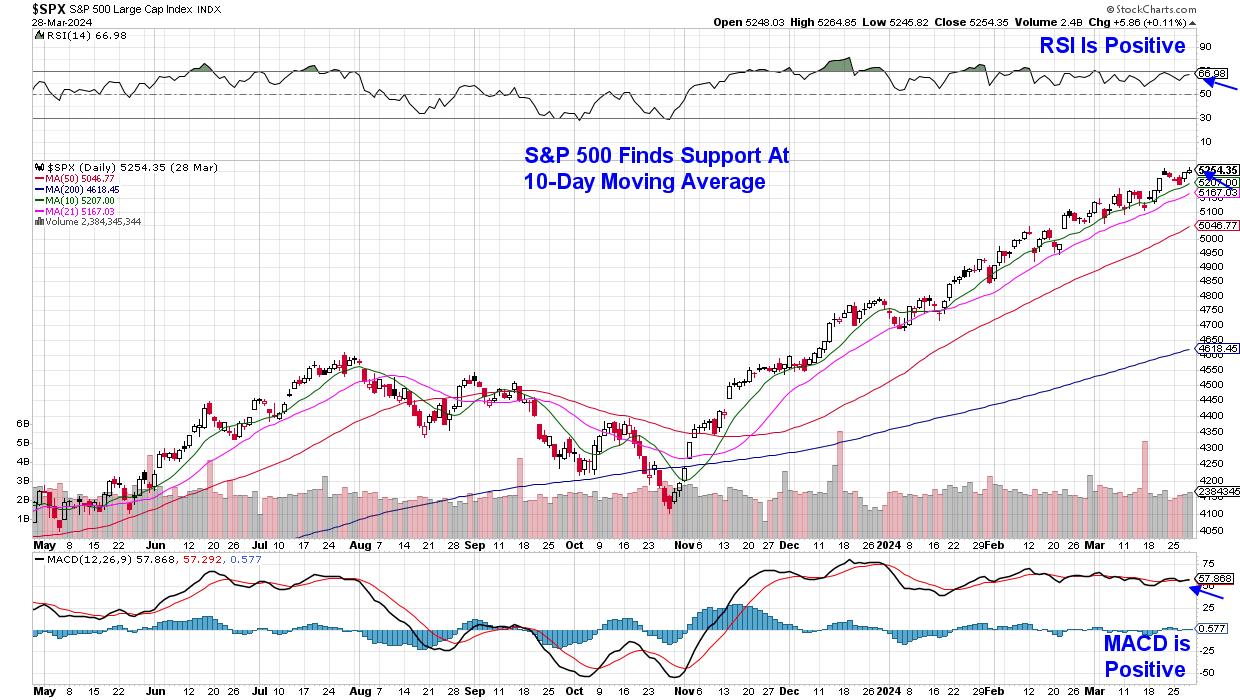

Master Market Entry with This RSI Strategy!

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use the RSI along with the MACD and ADX indicators. RSI is used as a timing tool when things are lined up. Joe goes through some of the key elements he looks for when...

READ MORE

MEMBERS ONLY

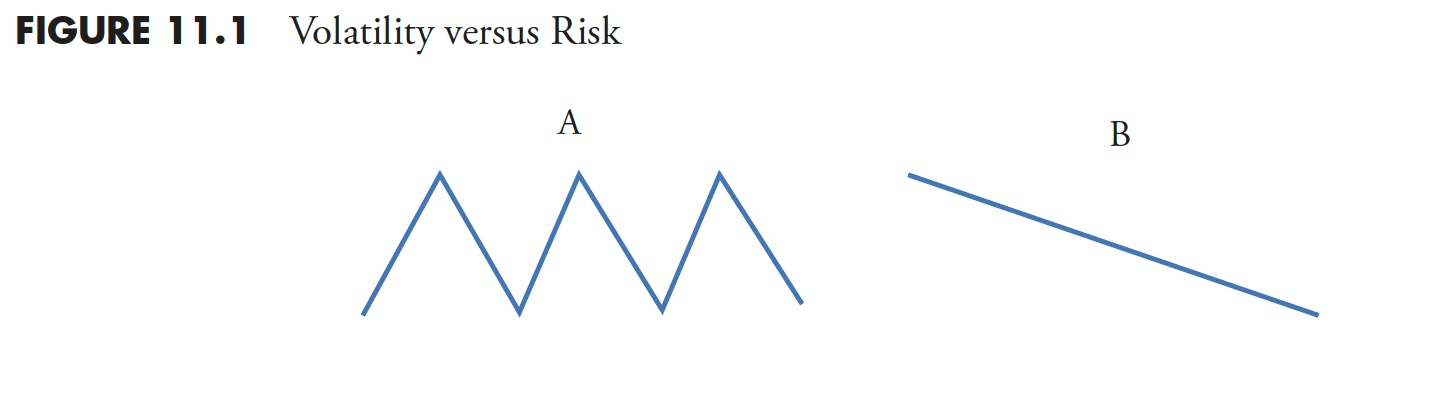

Market Research and Analysis - Part 5: Drawdown Analysis

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the sixteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

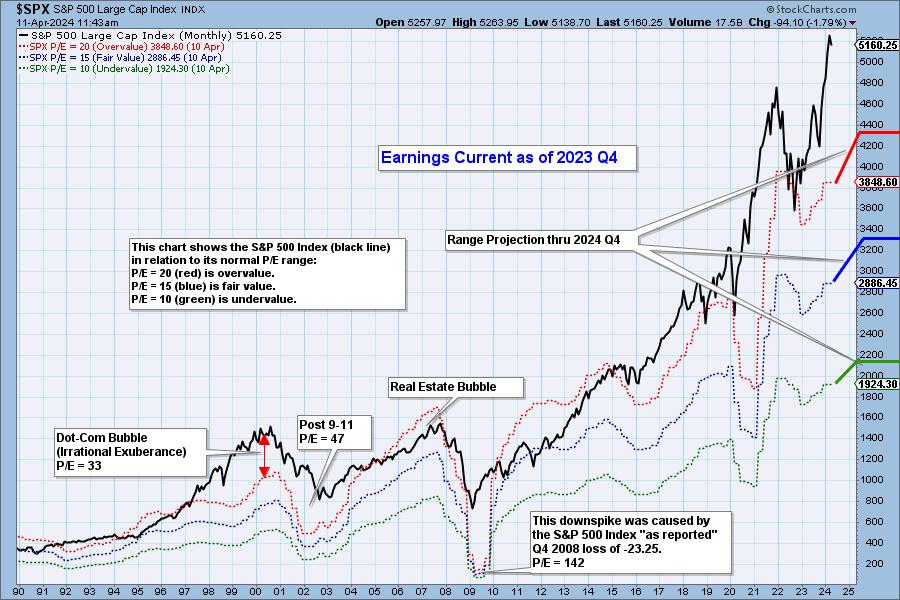

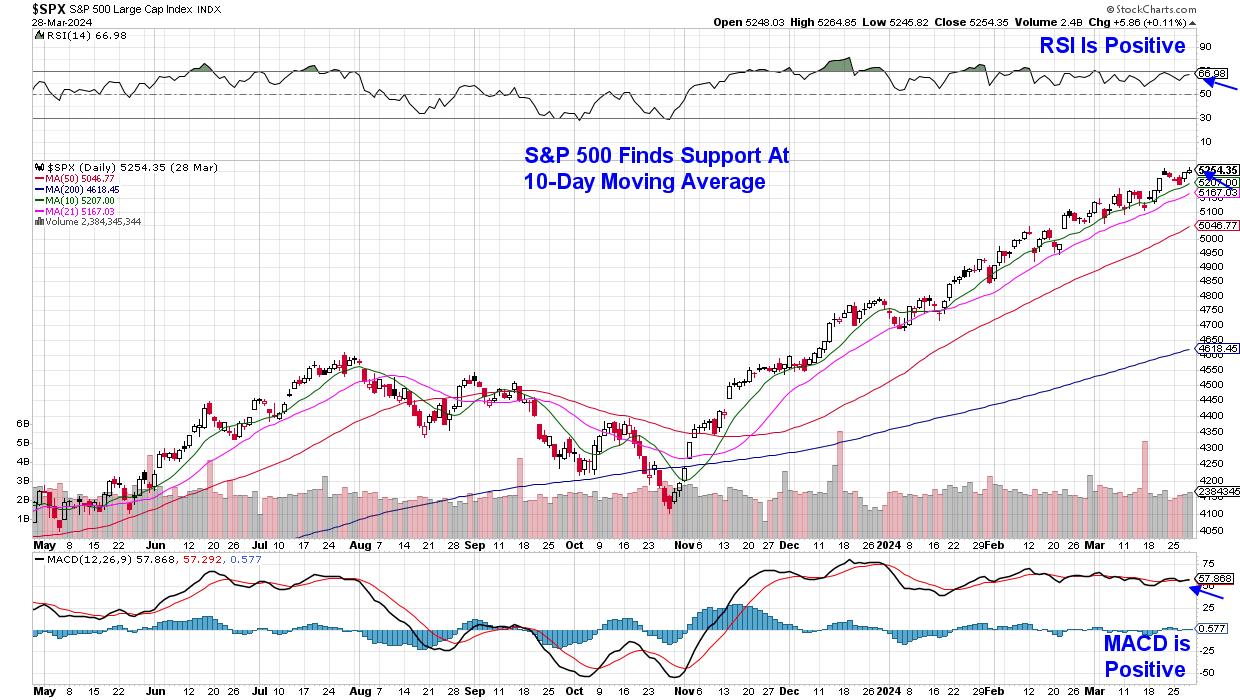

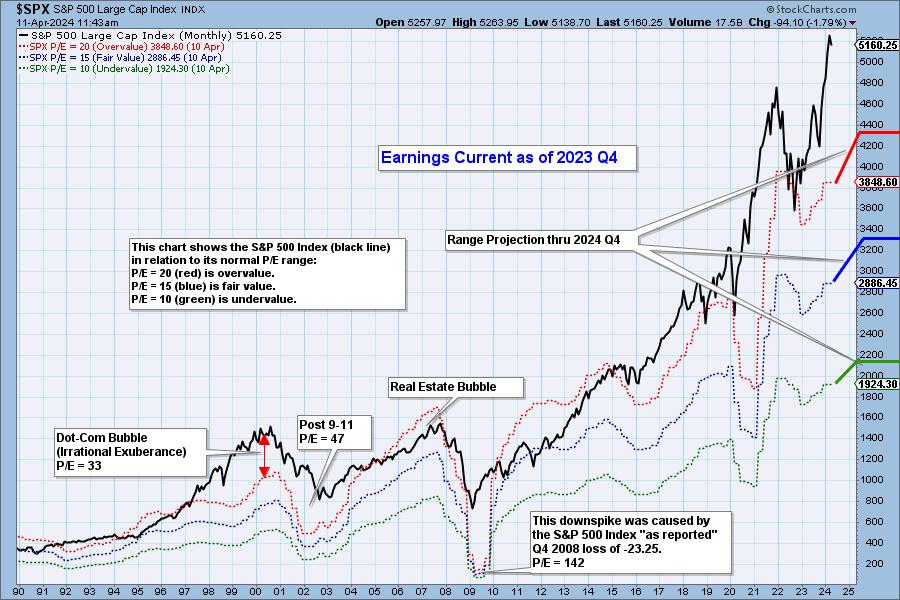

2023 Q4 Earnings Analysis and Projections Through 2024 Q4

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings are in for 2023 Q4, and here is our valuation analysis.

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

Is the Banking System on the Verge of Systemic Implosion? What to Look Out For

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* A few fringe economists are sounding the alarm on a looming series of banking collapses

* With bank holdings of government debt now underwater, some claim that banks are virtually insolvent as a result

* Whether any of this takes place, even partially, technical levels on the charts can help...

READ MORE

MEMBERS ONLY

This Sector is Breaking Up and Down Simultaneously

by Martin Pring,

President, Pring Research

This may seem like a contradiction, but it is possible for two different things to be true at the same time.

What I am referring to is the fact that the health care sector (XLV) recently broke out from a consolidation reverse head-and-shoulders pattern, as we can see from the...

READ MORE

MEMBERS ONLY

Despite Stable Markets, Breadth Says Danger

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave drops a market update, with a focus on Bitcoin's rebound above 70K, deteriorating short-term breadth conditions, and stocks still making new highs despite the market consolidation phase.

This video originally premiered on April 8, 2024. Watch on...

READ MORE

MEMBERS ONLY

2 Consolidating Stocks Ready To Resume Their Uptrends

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

My preference is to trade strong stocks that are simply consolidating and ridding themselves of weak hands, hopefully just in time to ride the next wave higher. Software ($DJUSSW) has been consolidating for the past couple months and appears poised to rebound from its latest 50-day SMA test:

Software is...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Continue Finding Resistance at Higher Levels; These Sectors May Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, it was categorically mentioned that, while the markets may attempt to inch higher, they may not form anything beyond minor incremental highs and could largely continue to stay under consolidation. In line with the analysis, the Nifty did form a new lifetime high, but eventually...

READ MORE

MEMBERS ONLY

MEM TV: Is It Safe To Reenter The Markets?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares what to be on the lookout for to tell if it's safe to put new money to work. She also shares the weakness in select sectors and which areas she suggests to underweight. Last up,...

READ MORE

MEMBERS ONLY

Double Top Forming in Growth vs. Value?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers questions from The Final Bar Mailbag. Today he talks about how to use the ADX indicator, how growth vs. value may have formed a double top pattern, how to use VWAP for intraday and historical analysis, and what...

READ MORE

MEMBERS ONLY

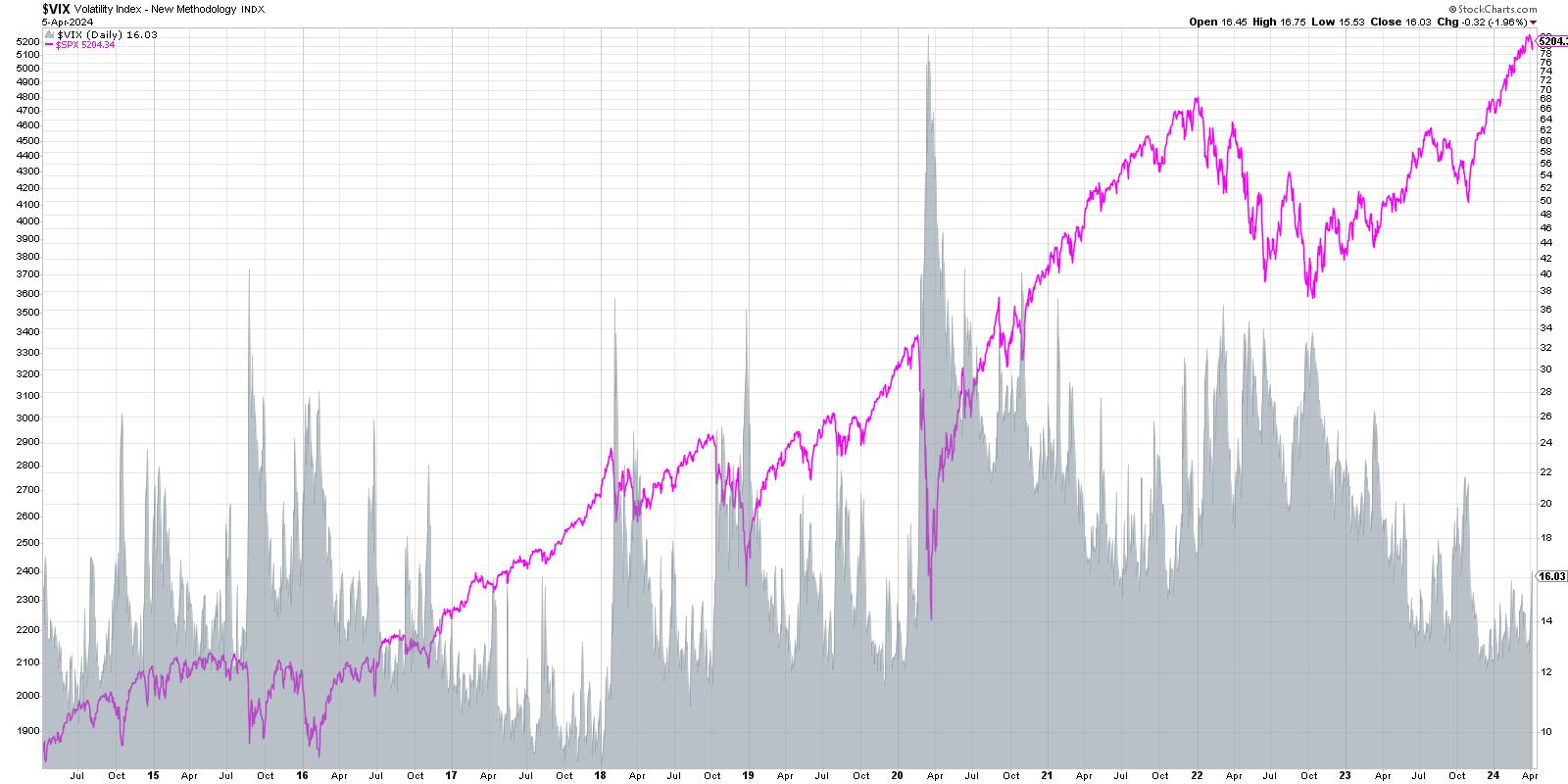

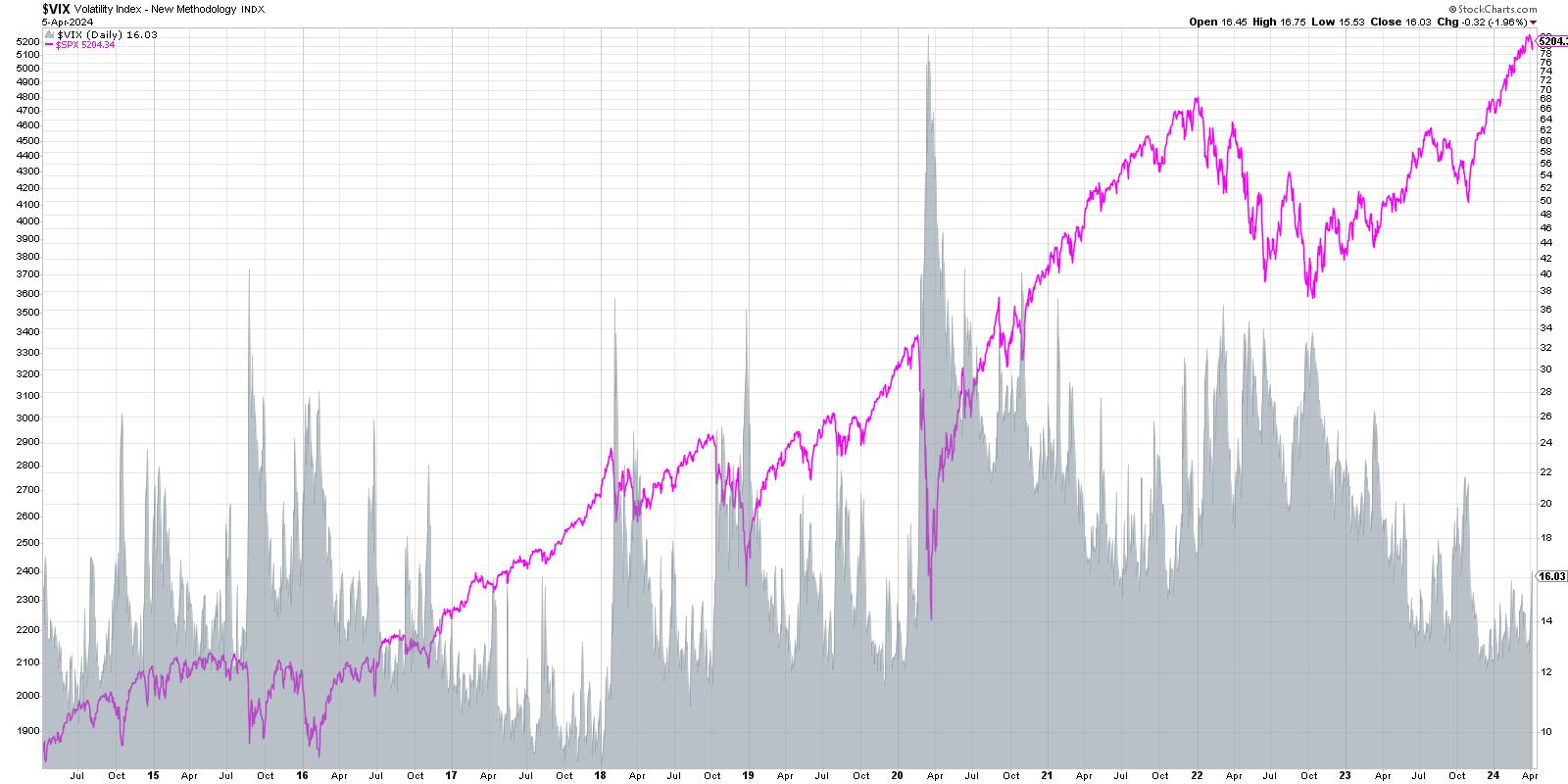

VIX Spikes Above 16 - Is This the End?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The VIX ended the week just above 16, bringing it to its highest level in 2024. What does this tell us about investor sentiment, and how does this compare to previous market cycles?

Let's take a quick tour of market history through the lens of the VIX, focusing...

READ MORE

MEMBERS ONLY

Jobs In the Spotlight: Stock Market Reverses Course After Massive Selloff

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* A stronger-than-expected jobs report sent the stock market higher

* Several stocks and ETFs hit new all-time highs today

* Commodity prices continue to rise

One day doesn't make a trend—that's one lesson we learned from this week's stock market action.

The March...

READ MORE

MEMBERS ONLY

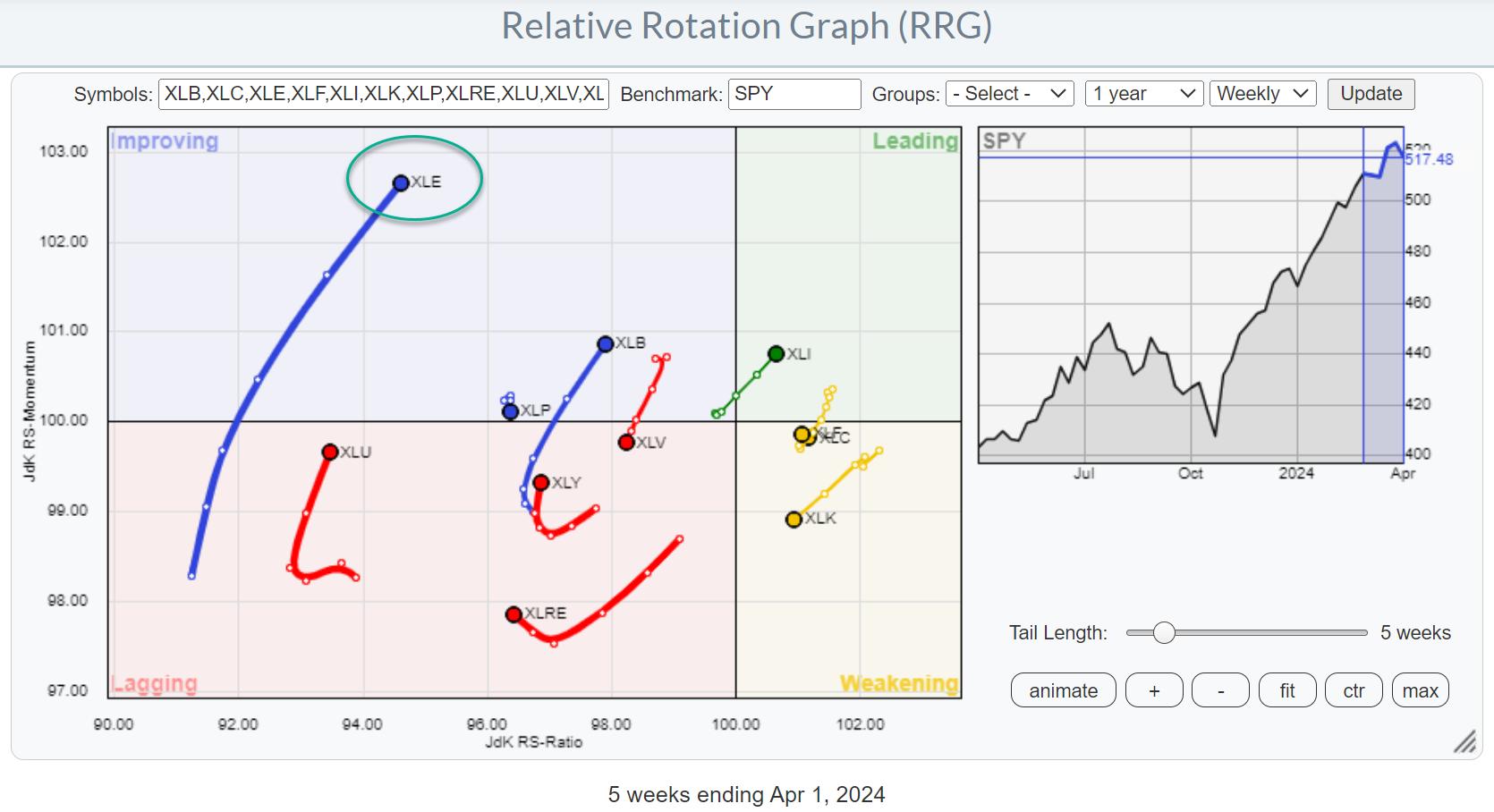

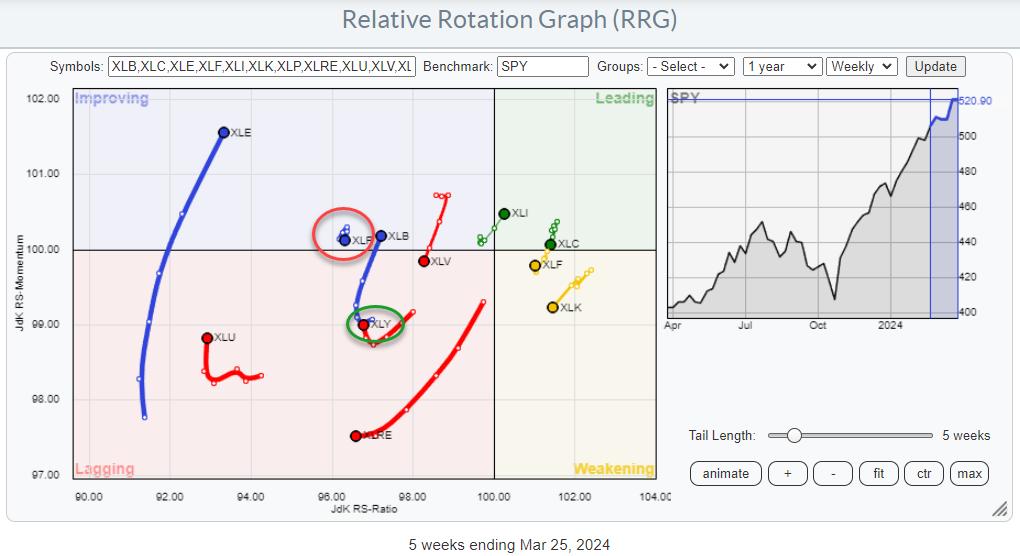

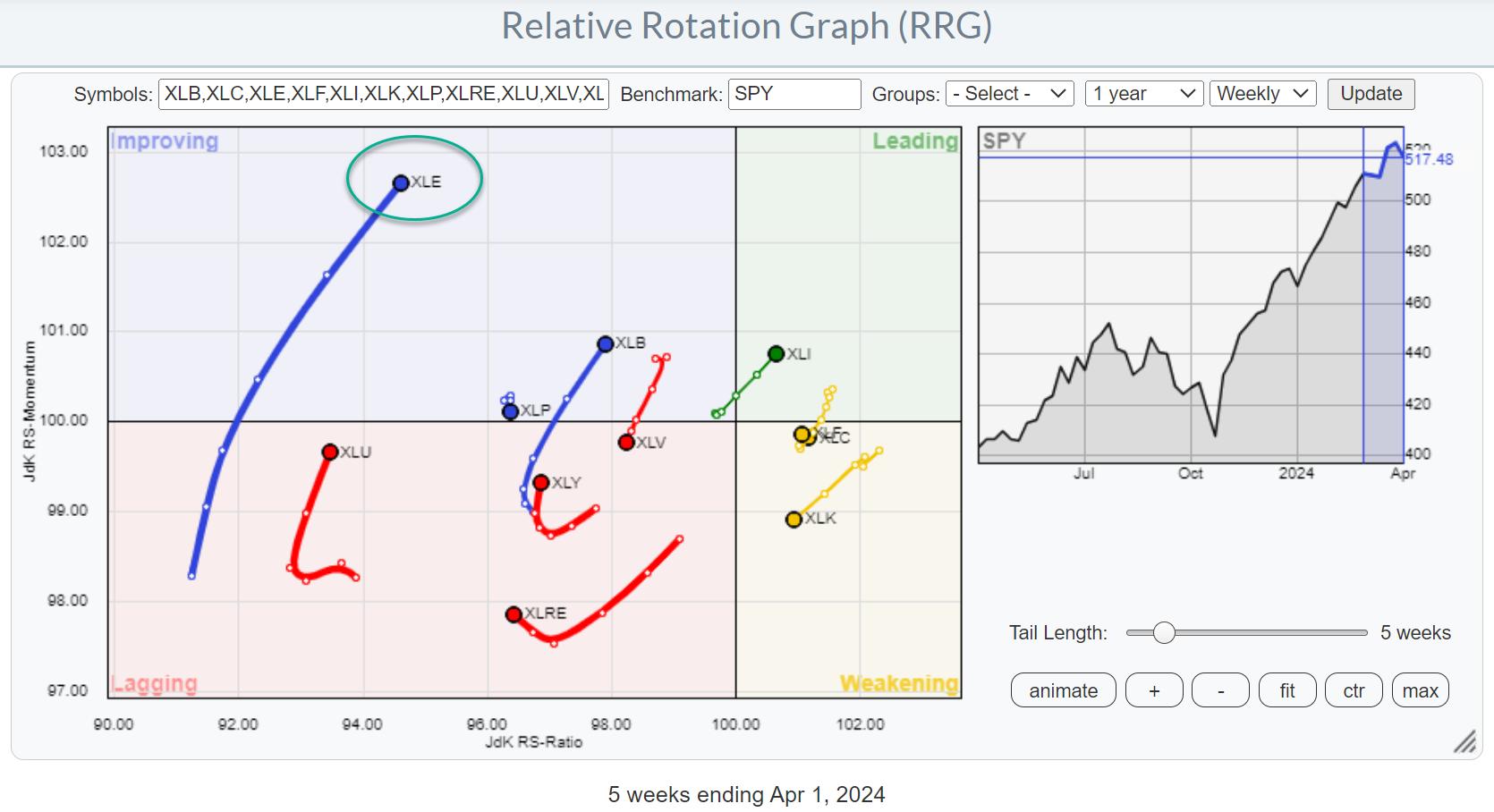

Energy is on Fire

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Energy sector is breaking higher on price chart

* XLE's RRG tail is continuing to pick up steam

* The exploration & production industry is leading inside the energy sector

Strong Rotation on the Weekly RRG

For a few weeks now, the improvement in the energy sector (XLE)...

READ MORE

MEMBERS ONLY

Trifecta of Trouble

by Bruce Fraser,

Industry-leading "Wyckoffian"

The Markup Phase of a Bull Market is glorious to behold and participate in. But they do ebb and flow. The bullish run in the major stock indexes has been persistent in 2024. We often discuss the quarter-end effect for stock index trends and the upward trend has persisted into...

READ MORE

MEMBERS ONLY

Silver's Surge: Can It Reach $50 an Ounce This Year?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Several analysts have grown exceedingly bullish on silver which has been undervalued for some time

* Price targets are now at the range of $35 to $50 an ounce

* The technical outlook presents a mixed picture, but there are a few key levels to watch if you're...

READ MORE

MEMBERS ONLY

Two Options Plays Amid Market Selloff

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Sean McLaughlin of All Star Charts. Sean shares his outlook for the Ark Innovation Fund (ARKK) and energy stocks (XLE) and how to employ options strategies to bet on particular outcomes. David tracks the afternoon selloff which created...

READ MORE

MEMBERS ONLY

Spot Big Reversals Using the ADX Indicator

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe demonstrates how to use the "Big Green Bar" candlestick pattern. This candlestick provides great confirmation on certain types of entry points, and can also be helpful for exits. Joe finishes up the show covering the...

READ MORE

MEMBERS ONLY

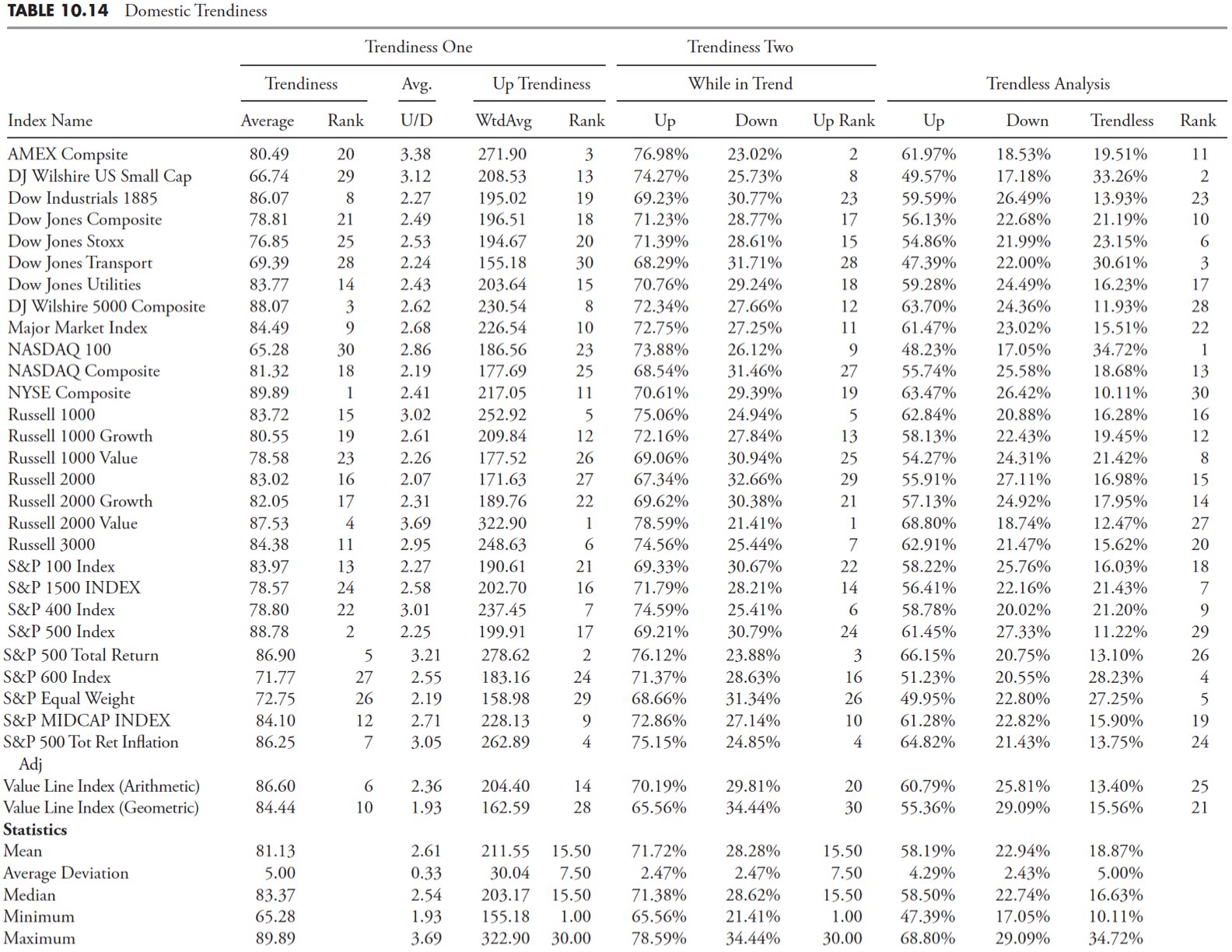

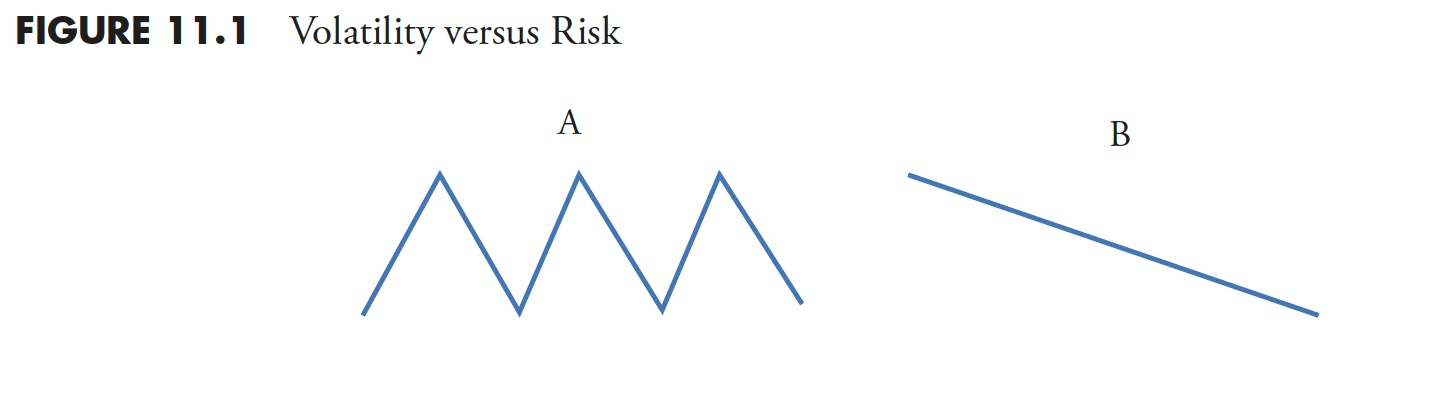

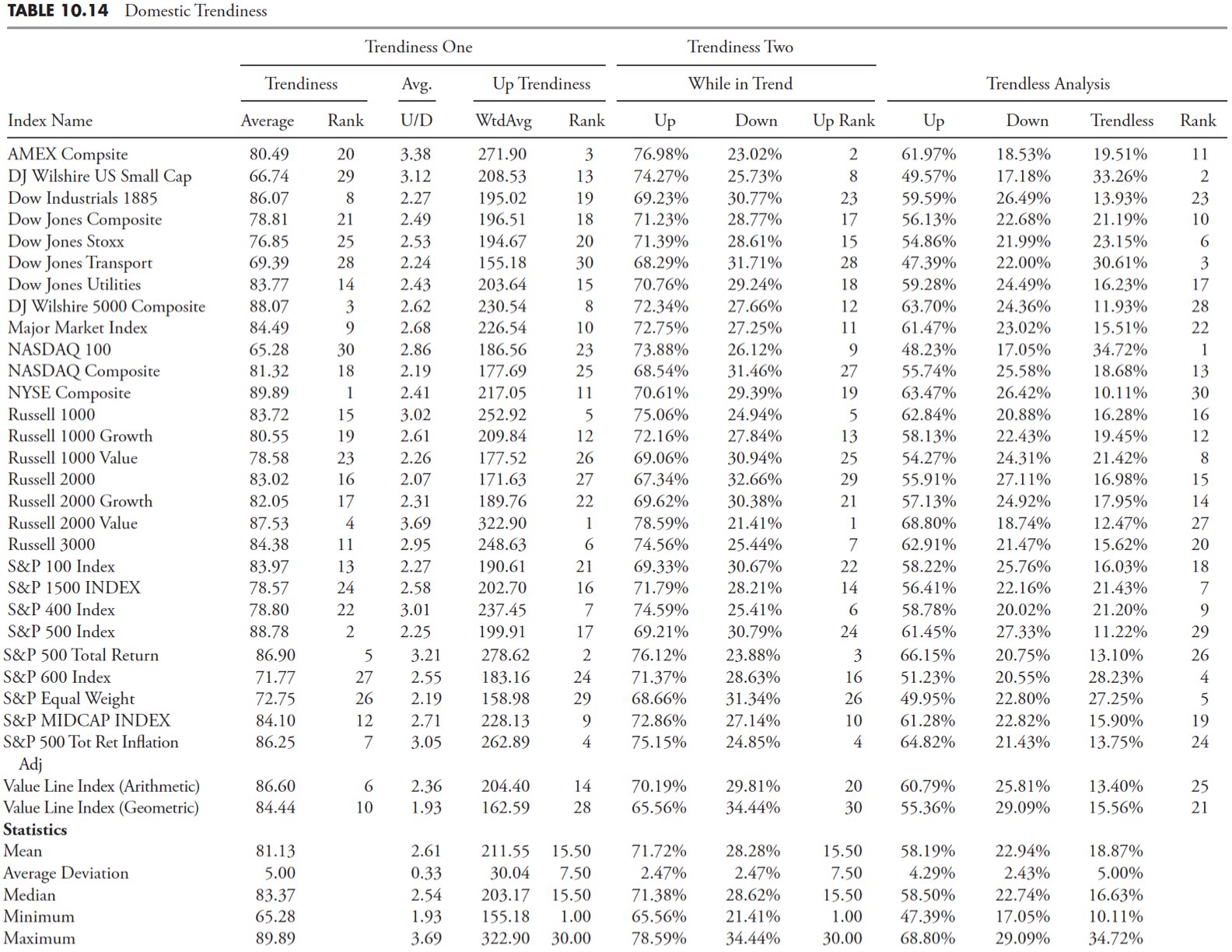

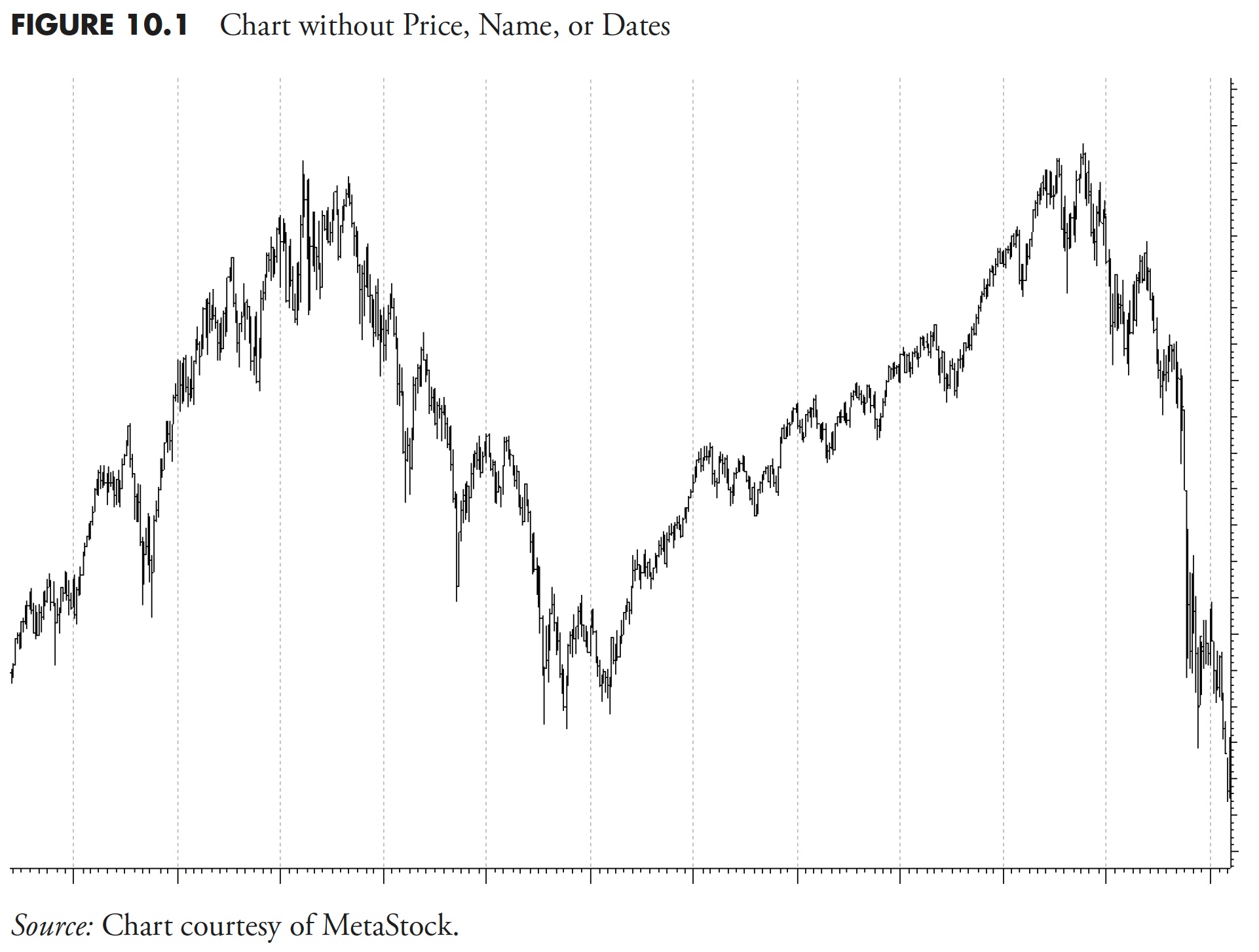

Market Research and Analysis - Part 4: Trend Analysis Continued

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the fifteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

The Stock Market's Tremendous Resilience: What This Means For Q2

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite remains unfazed about interest rates remaining higher for longer.

* Commodity prices such as oil, gold, and cocoa are rising, even though inflation seems to be cooling.

* The top S&P 500 sector performers indicate the...

READ MORE

MEMBERS ONLY

These Sectors are Poised to Lead in Q2

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Mish Schneider of MarketGauge as she walks through charts of the Swiss Franc, solar stocks, and uranium, with a focus on price momentum and multiple time frame analysis. Dave breaks down the S&P 500 sectors into...

READ MORE

MEMBERS ONLY

Top Two Sectors to Watch in April 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes guest Joe Rabil of Rabil Stock Research, who shares two sectors, Energy and Materials, where he sees upside potential given the recent upswing in commodity prices. Dave speaks to the developing pullback in growth leadership names and why...

READ MORE

MEMBERS ONLY

Should You be Concerned About These Four Stocks?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave and guest Julius de Kempenaer of RRG Research talk sector rotation, growth vs. value, offense vs. defense, and an outlook for the US equity markets as we begin Q2 2024. Dave also charts the strong breadth readings and low...

READ MORE

MEMBERS ONLY

DJT Has Closed Last Week's Gap, But is It Enough?

by Martin Pring,

President, Pring Research

Sometimes, simple indicators like bar or candlesticks operate just as the textbooks tell us they should. I don't normally follow individual stocks, but the hype surrounding last week's listing of Trump Media piqued my interest to see if the technical position squared with what the many...

READ MORE

MEMBERS ONLY

DP Trading Room: On-Balance Volume (OBV) Explained

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl and Erin cover the topic of On-Balance Volume (OBV) as a representation of volume trends. This came to their attention as they uncovered an OBV negative divergence on the SPY chart.

Carl completes a review of the weekly charts for the Magnificent 7 stocks, giving us a more...

READ MORE

MEMBERS ONLY

Business Confidence and Stocks | Focus on Stocks: April 2024

by Larry Williams,

Veteran Investor and Author

Here comes the answer to a very old question, "Do stocks lead the economy, does the economy lead the stock market, or is there something else?"

My work has shown numerous times that GDP is not a good predictor of the Dow Jones. Also, business inventories and a...

READ MORE

MEMBERS ONLY

Q1 Ends With A Small Cap Attack! One Small Cap Sector is EXPLODING Higher!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let's start off by reviewing a quarterly chart of the S&P 500 ($SPX), NASDAQ 100 ($NDX), and Russell 2000 (IWM) since this secular bull market began in early-April 2013 (44 quarters ago):

S&P 500:

NASDAQ 100:

Russell 2000:

When you look at these 3...

READ MORE

MEMBERS ONLY

Overbought Conditions Reflect Strength and Said Strength Drives Momentum Rotation Strategies

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Overbought is just another term for strong. RSI above 70 shows strong upside momentum, which his bullish. Stocks can become overbought (strong) and remain strong.

Momentum and trend strategies are off to a roaring start here in 2024. More often than not, these strategies buy leading stocks that...

READ MORE

MEMBERS ONLY

Core PCE Data Has Powell Pleased - May Set Tone For Q2

by Mary Ellen McGonagle,

President, MEM Investment Research

The Fed's preferred gauge of inflation was released today and, according to Fed chief Jerome Powell, "it was good," as there were no ugly surprises. This news could boost the markets, as sticky inflation data has had investors on edge amid interest rates that have remained...

READ MORE

MEMBERS ONLY

MEM TV: Small Cap STOCKS SHINE! 4 Names to Play the Strength

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what's shaping up in the broader markets after the Fed announced their rate cut plans. She also shares how to use ETFs to shape your investment decisions for the longer term. In addition, Mary Ellen...

READ MORE

MEMBERS ONLY

Which Magnificent 7 Stock Would You Pick for Q2?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

This article represents an exercise I like to call the "Single Stock Portfolio". In this scenario, you can only own one stock in your portfolio for the next three months, and you can pick any one of the following eight stocks. Which one would you select, and why?...

READ MORE

MEMBERS ONLY

Buy Breakout or Fade Divergence on Growth Stocks?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave presents a mailbag show discussing key technical analysis topics. He covers breakouts, the role of TSX, CCI signals, Gartner Group (IT) strategies, seasonal patterns, ATR use, NVDA Fibonacci retracements, and managing high-yield stocks like GLP. You don't...

READ MORE

MEMBERS ONLY

The Fourth Bitcoin Halving Is Upon Us: Is Now the Time to Go Long?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Bitcoin halving are often considered pivotal events for the cryptocurrency

* Bitcoin prices are rising, but momentum appears to be dwindling

* If Bitcoin stalls and reverse, there are a few potential support levels to watch

Bitcoin is about to undergo its fourth halving on April 19. For crypto enthusiasts,...

READ MORE

MEMBERS ONLY

These Breadth Charts PROVE How Strong This Bull Market Is

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson explains the importance of market breadth and shares some of the most crucial charts for understanding what's truly happening beneath the surface of the market. Using the Sample Chart Gallery, you'll see...

READ MORE

MEMBERS ONLY

How to Analyze Volume Trends on Multiple Time Frames

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave highlights charts breaking above resistance levels, including Gold Shares (GLD), Phillips 66 (PSX), Capital One Fence Corp (COF), Freeport-McMoRan (FCX), and DraftKings (DKNG). Dave also interviews Buff Dormeier of Kingsview Investment Management, who shows how he uses RSI, the...

READ MORE

MEMBERS ONLY

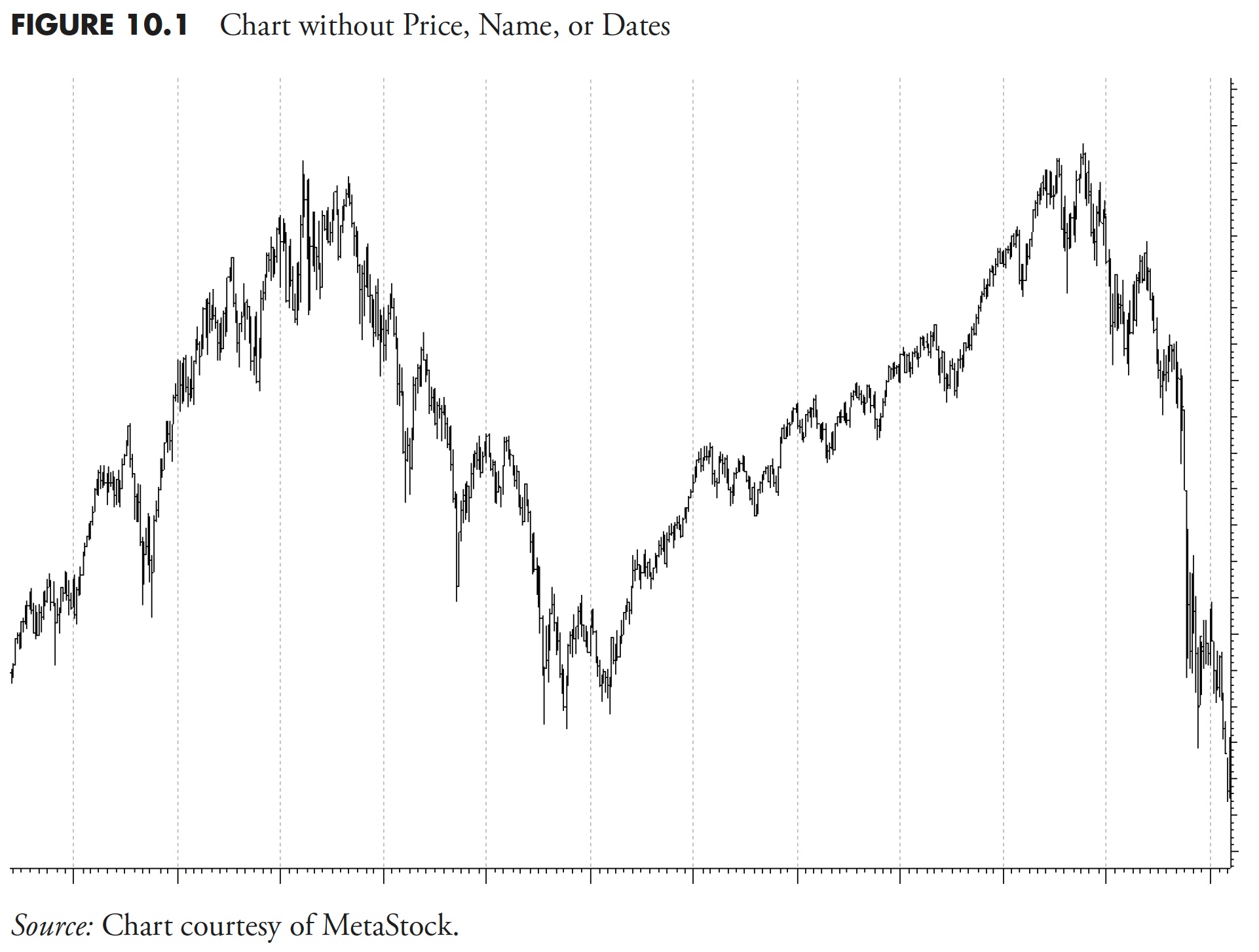

Market Research and Analysis - Part 3: Market Trend Analysis

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the fourteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

One Month of Positive Seasonality Remaining -- OBV Says, "Maybe Not."

by Carl Swenlin,

President and Founder, DecisionPoint.com

The late Yale Hirsch (Stock Trader's Almanac) has long been known for identifying the six-month periods of positive and negative seasonality in the stock market. The positive period is November through April, and the negative period is May through October. We are currently in a positive period, which...

READ MORE

MEMBERS ONLY

Return of the Meme Stock Frenzy: Is Now the Time to Shift Your Investment Focus?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Wednesday's broad stock market rally shows that investors are still willing to take chances in the stock market

* Even though the stock market rallied, Communication Services and Technology were the worst performing S&P 500 sectors on Wednesday

* Gold prices have been on a tear...

READ MORE

MEMBERS ONLY

S&P 7000 By End of 2024?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest David Hunter of Contrarian Macro Advisors shares his updated target for the S&P 500, and makes the case for a bullish melt-up phase for stocks, bonds, and gold. Dave Keller focuses in on the relative performance of...

READ MORE

MEMBERS ONLY

When These Levels Break, The S&P 500 is Going to Explode Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Consumer Discretionary Beating Staples

* Sectors Pushing Against Major Resistance Levels

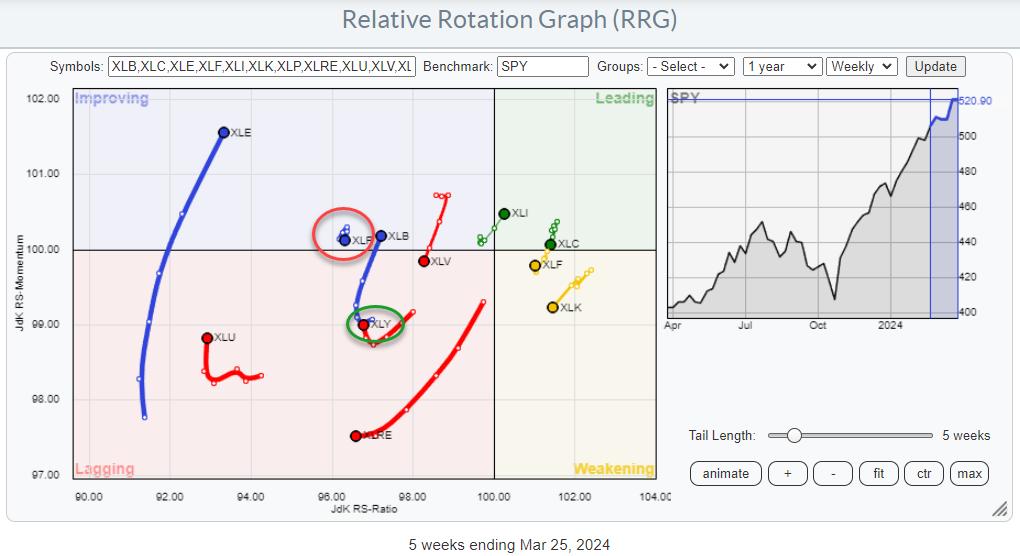

Summary

The Relative Rotation Graph for US Sectors for this week mainly shows a continuation of the rotations as they were underway last week.

XLB: This is moving from lagging into improving at a strong RRG-Heading, underscoring the...

READ MORE

MEMBERS ONLY

KRE's Impending Plunge: What This Emerging Crisis Means

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* KRE (the SPDR S&P Regional Banking ETF) is trading within a fairly wide uptrend channel

* Momentum in KRE appears to be waning which could uncover short-term trading opportunities

* Many regional banks can face increasing debt delinquencies and may be on the brink of collapse

Full disclosure:...

READ MORE