MEMBERS ONLY

Tesla Tests Key Support: Is This a Trade? Or an Investment?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Tesla is an outlier from the other Magnificent 7 stocks, remaining in a downtrend channel for the last six months.

* RSI oversold conditions, along with Fibonacci retracements, suggests a return to the upper end of the trend channel.

* TSLA shows a "confluence of resistance" above current...

READ MORE

MEMBERS ONLY

HUGE NEWS! Our Most Important Site-Wide Product Release EVER + A Tour!

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson pulls back the curtain on our latest site-wide product release - one of our biggest and most important EVER in the history of StockCharts. See new features in action like the all-new SharpCharts Workbench, totally redesigned...

READ MORE

MEMBERS ONLY

MEM TV: Here's How to Trade Gaps Up After Earnings!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the market's recovery from Fed Chair Powell's comments on Wednesday, sharing exactly what drove the S&P 500 to new highs. She also reviews the sector rotation that's taking place,...

READ MORE

MEMBERS ONLY

S&P 500, Dow Jones Hit All-Time Highs Again; Tech Stocks Back in the Spotlight

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500, Dow Jones Industrial Average, and Nasdaq 100 closed at all-time highs

* Tech stocks are back in focus as mega-tech companies wrap up their Q4 earnings

* Investors should take advantage of pullbacks if they want to add positions to their portfolios

What a week!...

READ MORE

MEMBERS ONLY

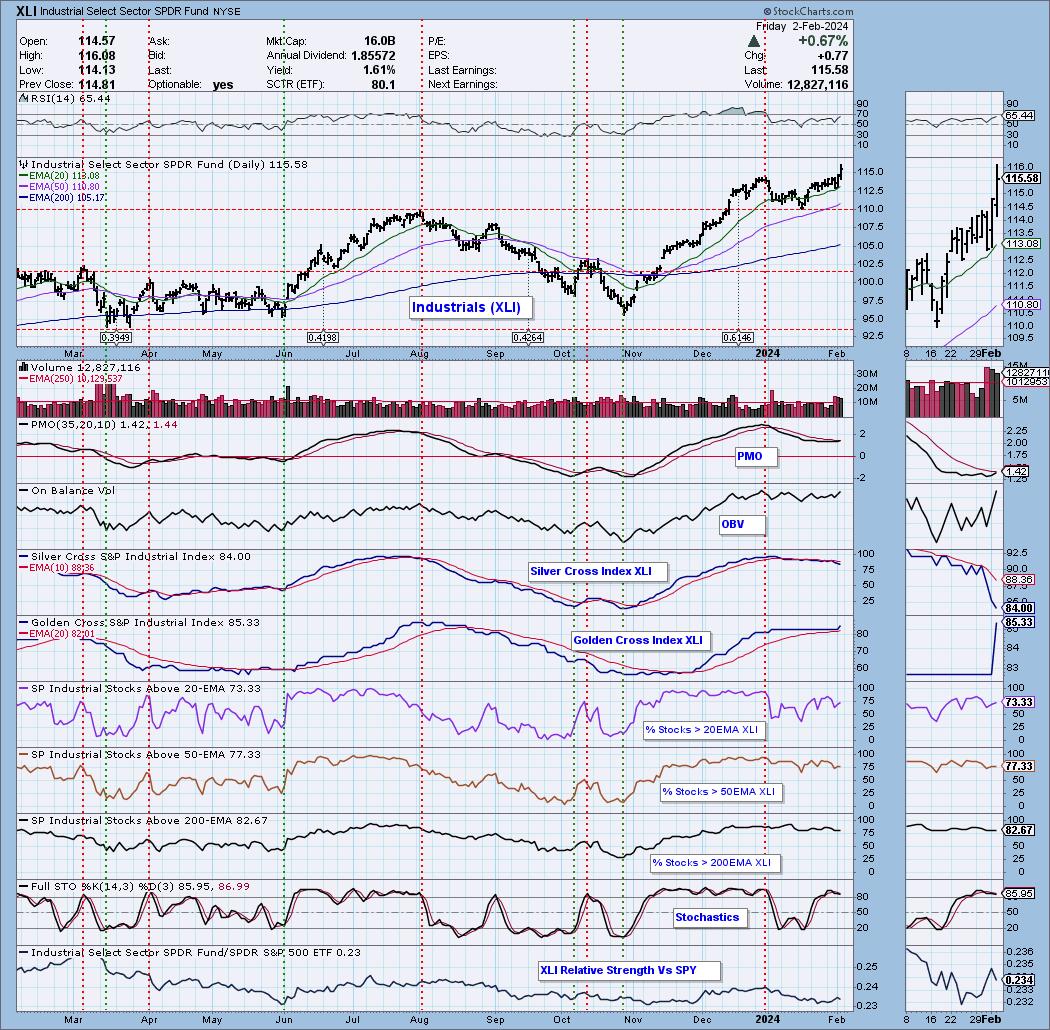

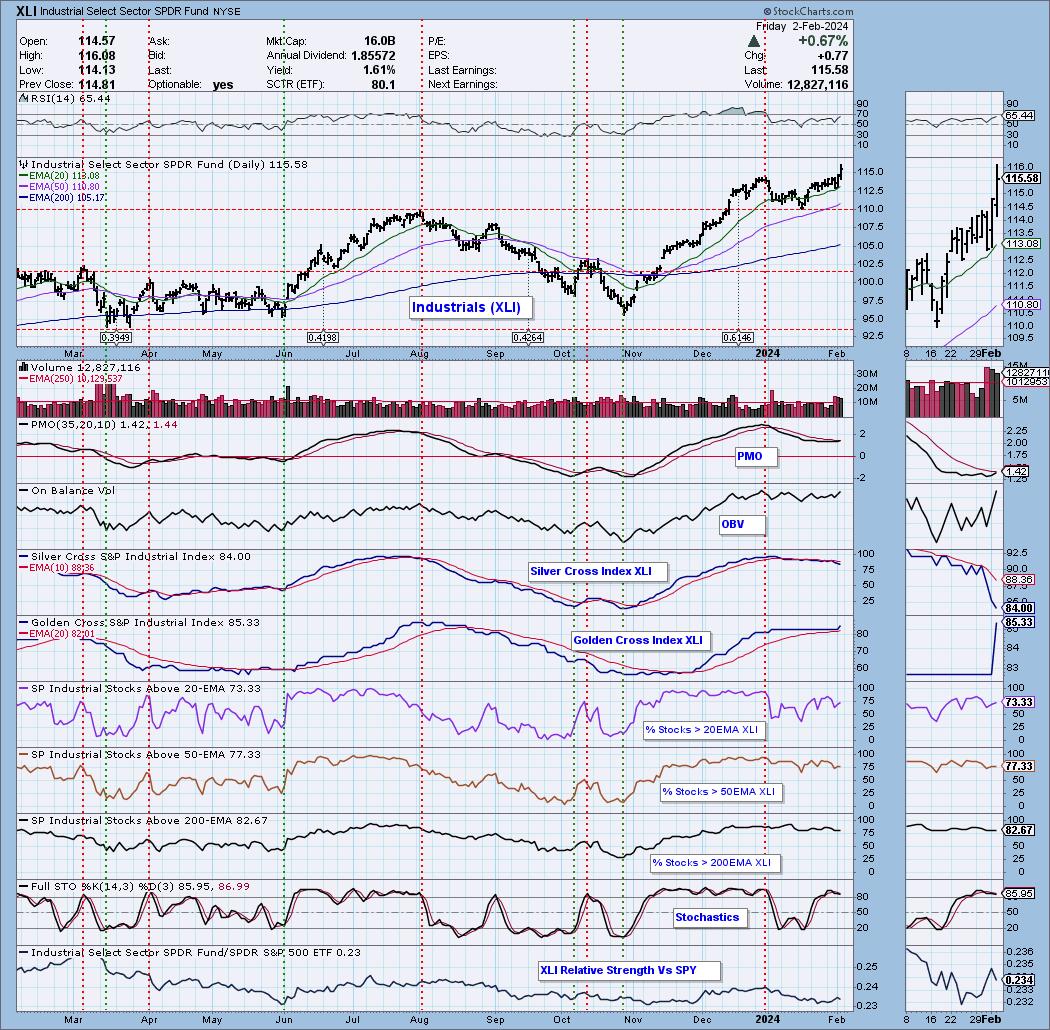

This Week's Sector & Industry Group to Watch

by Erin Swenlin,

Vice President, DecisionPoint.com

Before we get started today, I want to encourage you to subscribe to our new YouTube Channel for DecisionPoint. We post the recording of our weekly trading room there, and it is also full of educational videos that Erin has done over the years. Click on this LINK to subscribe...

READ MORE

MEMBERS ONLY

GNG TV: A STRONG Week for Equities and Internet Stocks SOAR!

by Alex Cole,

Co-founder, GoNoGo Charts®

On this week's edition of the GoNoGo Charts show from StockCharts TV, Alex takes a look at the market using the GoNoGo methodology as the S&P 500 digests the rally to all time highs. After using the GoNoGo Asset Map to look at the trends across...

READ MORE

MEMBERS ONLY

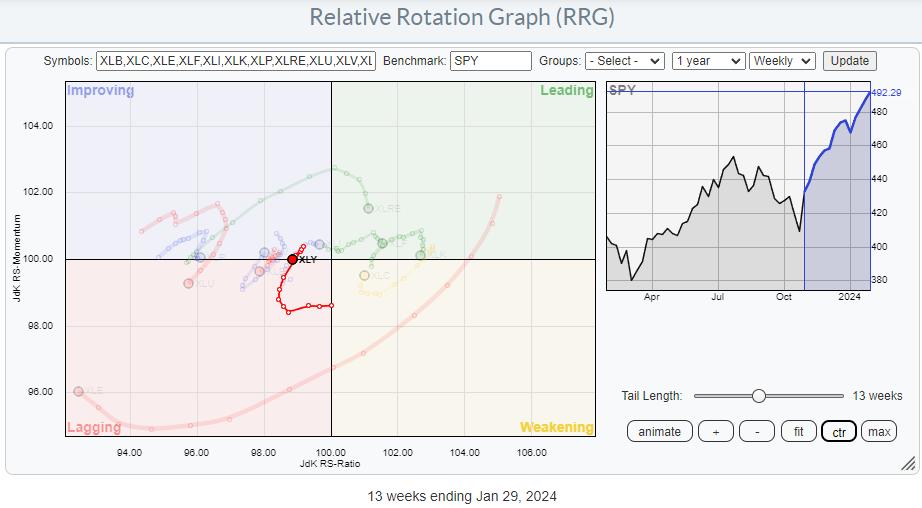

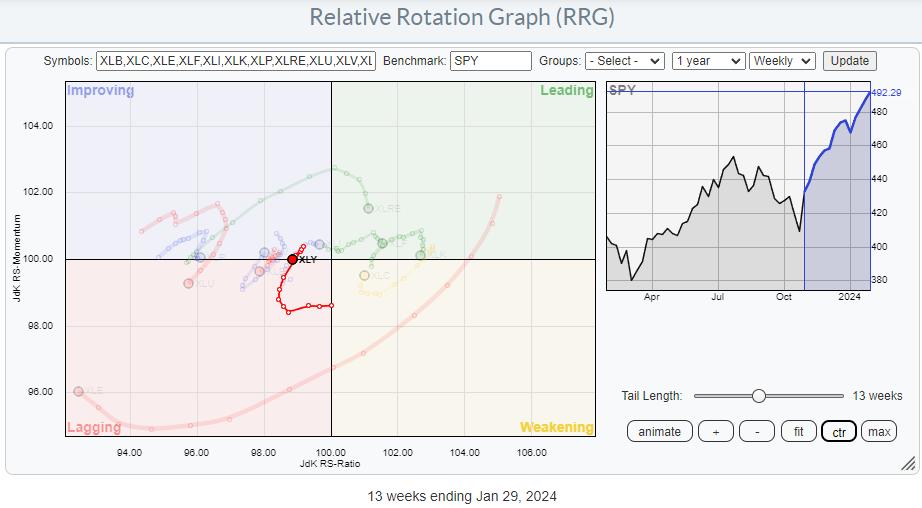

Discretionary vs. Discretionary, a Fierce Battle Under the Hood

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Not all is what it looks like inside the Consumer Discretionary Sector

* Using Cap-weighted vs. Equal-Weighted Sectors on RRG reveals underlying differences

* Mega-cap Stocks are dragging XLY down

* Using a Simple Scan Leads to four interesting charts

Cap-Weighted vs. Equal-Weighted

Sometimes, you need to look a little further....

READ MORE

MEMBERS ONLY

Deciphering Gold's (GLD) Signals: Is Now the Time to Go Long on Gold?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The robust jobs data triggered a sell-off in the gold market, hampering expectations of an imminent rate cut

* Price projections for GLD in 2024 span a wide spectrum, below and above current prices because of fluctuating macroeconomic and geopolitical dynamics

* The Volume-by-Price indicator is especially useful in recognizing...

READ MORE

MEMBERS ONLY

Top Ten Charts to Watch for February 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Grayson and Dave run through charts they feel present actionable opportunities based on their technical analysis setups. They'll cover breakout strategies, moving average techniques, relative strength, and much more. And you'll have ten new charts to...

READ MORE

MEMBERS ONLY

Bullish Buyers Return After Market Selloff

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Jay Woods, CMT of Freedom Capital Markets brings the energy of the NYSE floor to the show, relating today's market rebound to longer term themes for small caps and regional banks. Dave shares one breadth indicator recognizing broad...

READ MORE

MEMBERS ONLY

DR Horton Stock Plummets: Is Now the Time to Buy the Dip?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* DHI's stock plummeted after missing Wall Street's earnings expectations and soft guidance

* Technical indicators provide a clearer view for those looking to buy the dip

* You can use StockCharts seasonality charts to provide a big-picture context to your trading setup

The tight supply environment...

READ MORE

MEMBERS ONLY

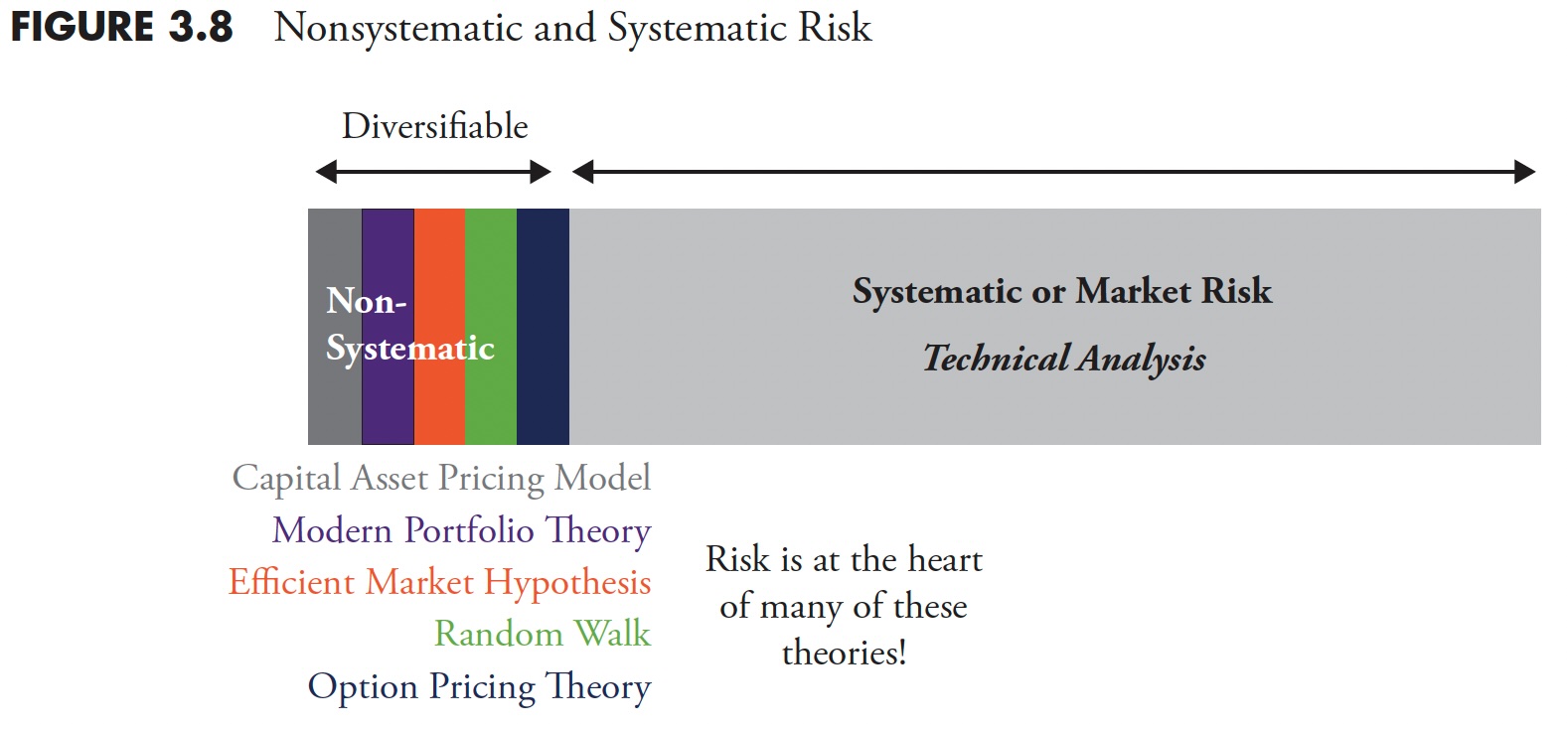

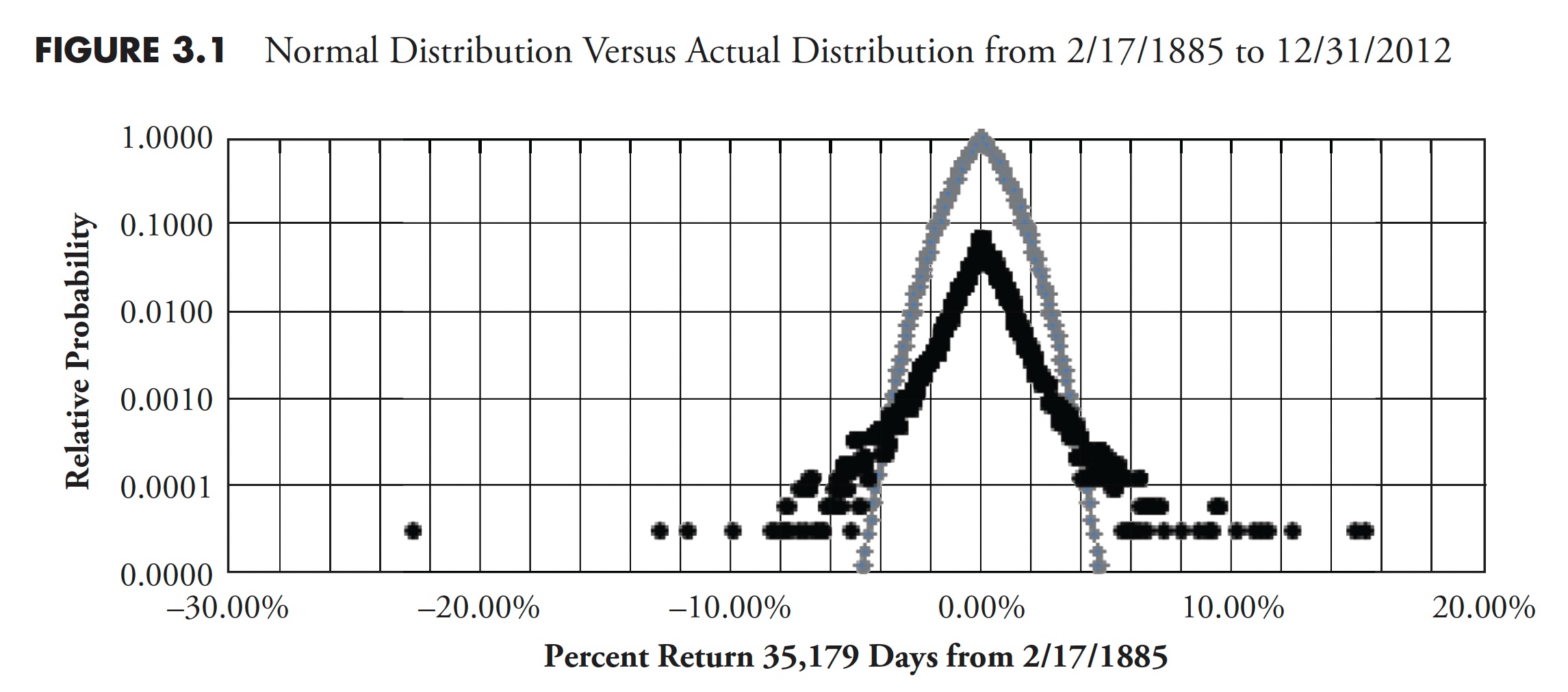

The Hoax of Modern Finance - Part 6: Is Volatility Risk?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the sixth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

The Halftime Show: Fed Stays Put, Bond Markets Rally!

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Uncertainty needs attention in order for it to make you second guess yourself. Instead, wait for trends to change, and then make changes. On this week's edition ofStockCharts TV'sHalftime, Pete Carmasino goes over some thoughts on interest rates and when the Fed will finally cut. He...

READ MORE

MEMBERS ONLY

Mastering MACD: The Fly-By Pattern

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe discusses key aspects to MACD when viewed as an oscillator rather than a momentum indicator. He also explains how to use MACD combination signals as well as combining with the ADX indicator. He then covers the symbol...

READ MORE

MEMBERS ONLY

Home Prices and Stocks | Focus on Stocks: February 2024

by Larry Williams,

Veteran Investor and Author

Let's begin this month with a look at ...

Home Prices and Stocks

Most people have the majority of their money in homes and/or stocks. Thus, I thought that this month, I would take a look at what should be happening in the real estate market.

Let'...

READ MORE

MEMBERS ONLY

S&P 500 Falls, Nears First Support Level -- How Much Lower Can It Go?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Fed leaves interest rates unchanged as expected, but investors weren't happy

* S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all close lower after Fed decision

* The 10-year Treasury yield falls to a three week low

Will the Fed cut interest rates at...

READ MORE

MEMBERS ONLY

Betting Against the Fed is RISKY!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Tony Dwyer of Canaccord Genuity shares insights on today's Fed meeting and what data he's following to anticipate rate cuts through 2024. Dave tracks mega cap growth stocks, including MSFT and GOOGL, which are in pullback...

READ MORE

MEMBERS ONLY

Post Tech Earnings & FOMC -- Give Retail Investors Credit

Although Microsoft and Alphabet, Inc. reported better-than-expected earnings after hours, and then with follow-up during the trading session, sellers came out to lock in gains or perhaps go short. After all, tech has done much of the market's heavy lifting to date. The earnings were already priced in....

READ MORE

MEMBERS ONLY

Gold is Making Waves within a Long-Term Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Gold is not the most exciting asset at the moment, but it is in a long-term uptrend and perhaps the strongest commodity out there. There are also signs that the January decline is ending as RSI hits a momentum support zone and a bullish continuation pattern forms. Note that GLD...

READ MORE

MEMBERS ONLY

Market Wisdom from the Godfather of Technical Analysis

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, legendary technical analyst Ralph Acampora, CMT visit StockCharts HQ to share lessons learned in the 1970s secular bear market, what he learned about simplicity from the late Alan Shaw, and how leadership rotation may be the theme for the coming...

READ MORE

MEMBERS ONLY

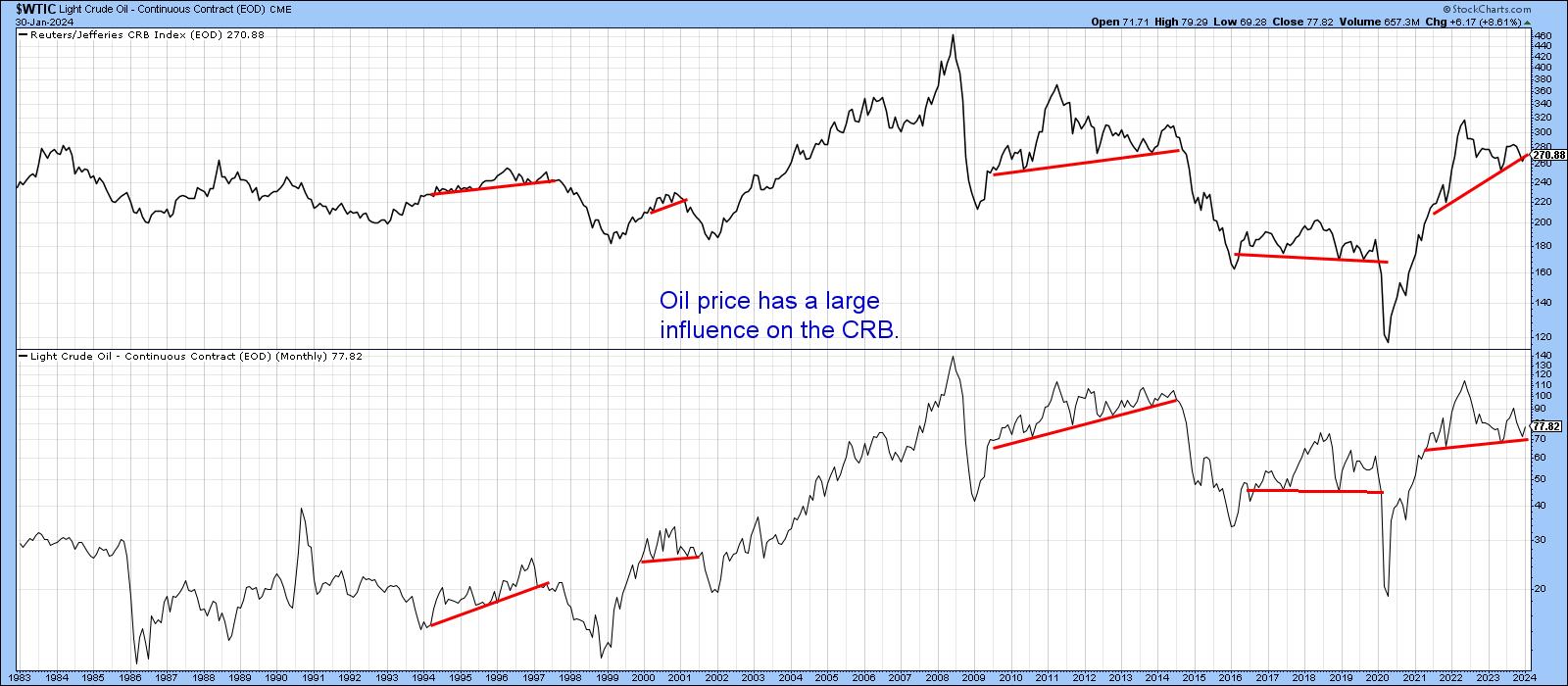

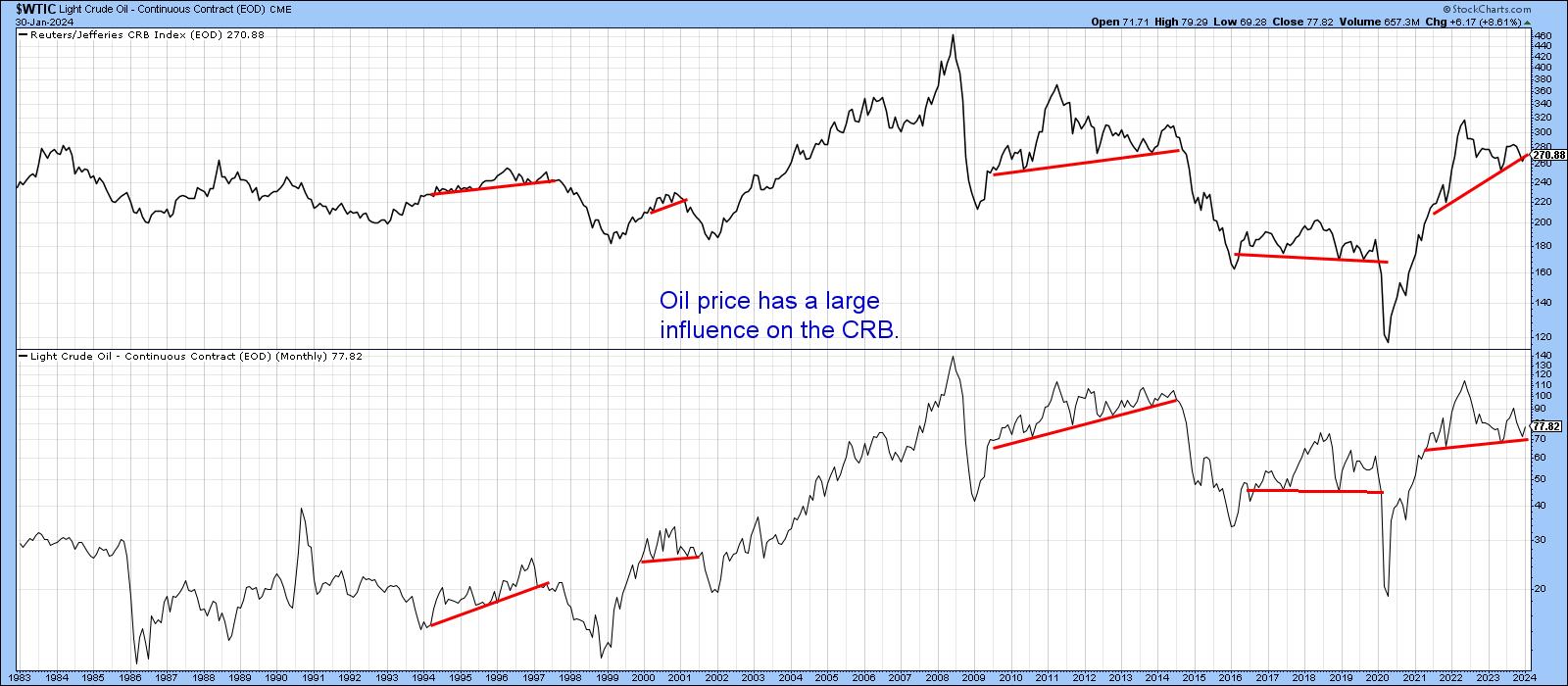

Is Oil Going Up or Down?

by Martin Pring,

President, Pring Research

Oil is not only an important commodity in and of itself, but is also one has a substantial influence on commodity indexes in general. Its weight in the CRB Composite is 23%; for energy in total, it is 39%. Chart 1 compares the oil price to the CRB Composite, where...

READ MORE

MEMBERS ONLY

Higher Gold Price Coming, But Investors Must Be Patient

For today, I am reprinting an interview I did for Kitco News with Neils Christensen, written by Neils.

(Kitco News) - The gold market remains in a solid holding pattern as it waits for some direction from the Federal Reserve, and one market strategist is warning potential precious metals investors...

READ MORE

MEMBERS ONLY

Sector Spotlight: The Market is Moving Higher, BUT Avoid Real Estate in February!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, after a quick look at asset class rotation and sector rotation for US stocks, I dive into a comparison of cap-weighted sectors vs. equal-weighted sectors and find a big difference for the Consumer Discretionary sector, which underscores and supports the...

READ MORE

MEMBERS ONLY

Will Catalysts Push Markets HIGHER or Drag Them LOWER?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave tracks the S&P 500 as it pushes to a new high above 4900, while the McClellan Oscillator rotates to a bullish reading. He breaks down earnings plays this week, including XOM, MSFT, and more.

This video originally...

READ MORE

MEMBERS ONLY

A Word and A Chart About and On Alibaba

Alibaba.com is one of the world's largest wholesale marketplaces.

To be honest, I had never gone to their website until today, even though we bought shares in BABA 2 weeks ago. So, in case you are like me and have not checked them out, they sell a...

READ MORE

MEMBERS ONLY

Earnings Preview: The Technical Temperature

by Erin Swenlin,

Vice President, DecisionPoint.com

KEY TAKEAWAYS

* Big Week in Earnings

* Magnificent 7 - Five Reporting (MSFT, GOOGL, META, AAPL and AMZN

* Other stocks we look at: PFE, SBUX, AMD, MA, BA, MET, MRK, XOM and CVX

* Even more coverage with viewer symbol requests

This is a big week for earnings so Carl and Erin...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May See Sharp Moves; Volatility May Spike Over The Coming Days

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week was reduced to just a short 3-day trading week as Monday was declared a special holiday while on Friday, the markets remained shut on account of Republic Day. Despite this, the markets remained extremely choppy and traded in a much wider range as they continued to decline...

READ MORE

MEMBERS ONLY

Magnificent 7 Stocks: Overheated or Just Getting Started?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

One of the key themes, if not THE theme, of 2023 was the dominance of the mega-cap growth trade. The Magnificent 7 stocks handily outperformed our equity benchmarks through the course of 2023, and, so far in 2024, it's been more of the same.

With Netflix (NFLX) gapping...

READ MORE

MEMBERS ONLY

MEM TV: Market Uptrend Endures Ahead of BIG Earnings Next Week!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews where the markets stand as we head into earnings from MSFT, GOOGL, AAPL and META. She also discusses how ETFs can help you refine your trading strategies and stock selection, then shares base breakouts and downtrend reversal...

READ MORE

MEMBERS ONLY

Is This a Breakout or a Pullback?

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG points out that the IWM is right in the middle of a range and he wants to hear from you as to which way you think it will go first. Beyond that, the overall picture of the market is...

READ MORE

MEMBERS ONLY

Stock Market Indexes Keep Setting New Highs: How Much Higher?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P notched new record highs in five consecutive trading sessions but snapped the winning streak on Friday

* Investors still are complacent, as indicated by the CBOE Volatility index

* The benchmark 10-year Treasury yield remains within a 4% to 4.2% range

In the first week...

READ MORE

MEMBERS ONLY

How to Avoid Huge Drawdowns from High-Flying Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave hosts an all-mailbag episode, answering viewer questions on the Relative Strength Index (RSI), how ETFs like QTEC have outperformed benchmarks including the Nasdaq 100, and how to avoid painful losses in leading names like NVDA, PANW, and ADBE.

This...

READ MORE

MEMBERS ONLY

Inflation Fell to the Fed's Target -- Or is That a Moving Target?

On Friday, the market woke up to great news. Mission accomplished on inflation.

Yahoo Finance reported: "The Fed's preferred inflation measure — a 'core' Personal Consumption Expenditures index that excludes volatile food and energy prices — clocked in at 2.9% for the month of December, beating...

READ MORE

MEMBERS ONLY

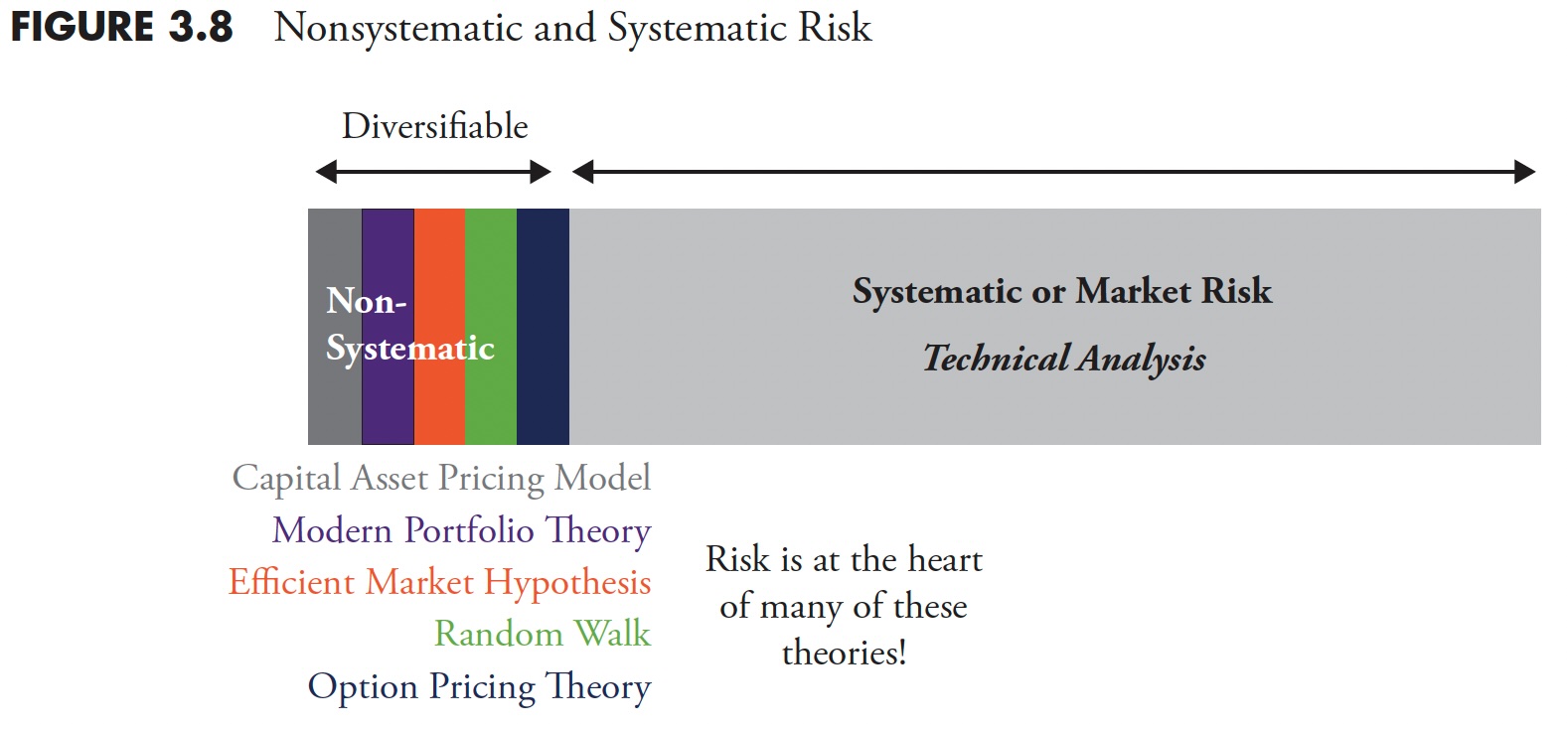

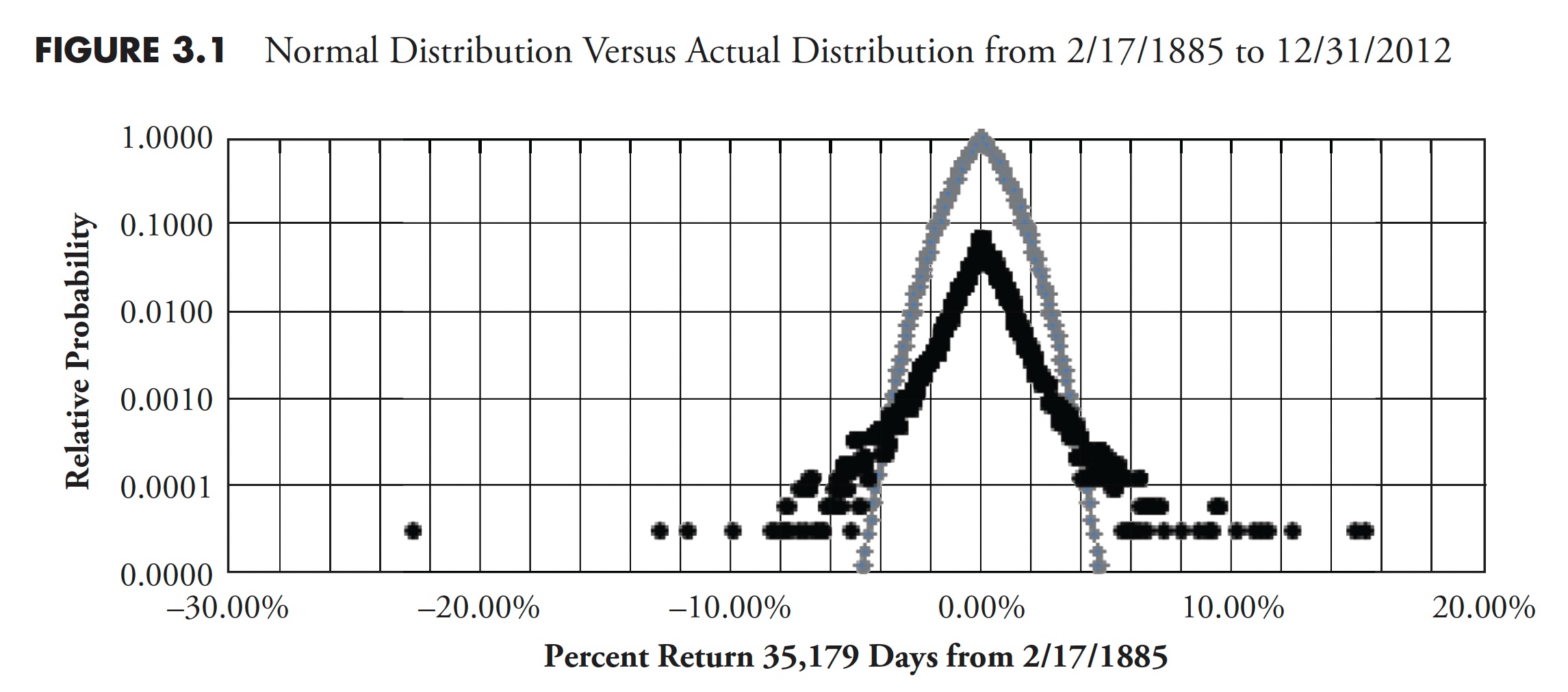

The Hoax of Modern Finance - Part 5: Flaws in Modern Financial Theory

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the fifth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

IBM Stock Shatters Expectations, Hitting a New All-Time High: A Buying Opportunity?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* IBM stock price hits a new 52-week high and moves above its upper Bollinger Band®

* IBM's share value could continue rising or pull back toward the middle Bollinger Band

* If IBM fills its post-earnings price gap it could present a more favorable entry point

As a...

READ MORE

MEMBERS ONLY

Value Stocks' Continued Strength Might Depend on One Area Of Transports

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I know all the talk continues to surround technology stocks (XLK), particularly semiconductors ($DJUSSC) and software ($DJUSSW). And why wouldn't it? These groups have been absolutely on fire since the end of the 2022 cyclical bear market. Rates remain low and many of these companies are seeing double...

READ MORE

MEMBERS ONLY

Unlocking the Power of Technical Indicators

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down the chart of Intel Corp (INTC) to demonstrate the benefits of three important technical indicators: Moving Averages, Relative Strength Index (RSI) and Relative Strength. He shares why a disciplined process of interpreting these indicators can help investors...

READ MORE

MEMBERS ONLY

SEC Greenlights Bitcoin ETFs: How This Major Move Could Skyrocket Coinbase Stock Price

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Coinbase stock price is correlated with Bitcoin's price

* COIN's price level is getting close to an entry point for bullish investors

* An ideal entry point for COIN would be after you see a strong reversal candle with increasing momentum

Are you feeling a bit...

READ MORE

MEMBERS ONLY

PRICE IS KING in Stock Trading!

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shares his five steps to becoming a better stock picker. He emphasizes the importance of starting with price and using technical analysis to identify potential outperforming stocks. From analyzing monthly and weekly charts to looking at momentum...

READ MORE

MEMBERS ONLY

Macro Model Gives Mixed Signals as NFLX LIGHTS UP!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest John Kosar, CMT of Asbury Research shares his proprietary Asbury Six macro model, which suggests caution based on weak fund flows and breadth conditions. Dave focuses in on crude oil and gold charts, and also reviews key earnings plays...

READ MORE