MEMBERS ONLY

S&P 4300 by End of February?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

We kicked off the new year of 2024 with an overheated stock market, excessively bullish breadth indicators, and euphoric sentiment levels. While the first week in January felt like a "wake-up call" pullback for awestruck bulls, this last week saw the S&P 500 push right back...

READ MORE

MEMBERS ONLY

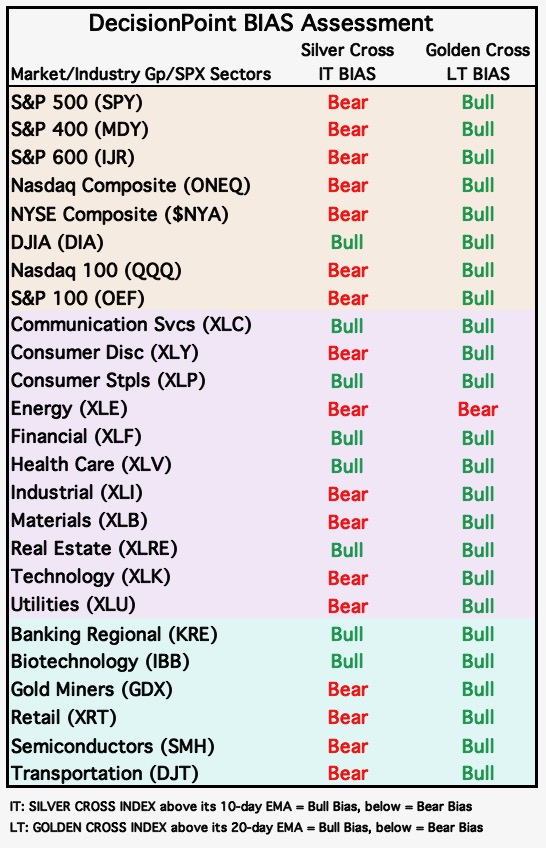

Dramatic Bearish Bias Shift on Major Market Indexes This Week

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

(This is an excerpt from the subscriber-only DecisionPoint Alert on DecisionPoint.com)

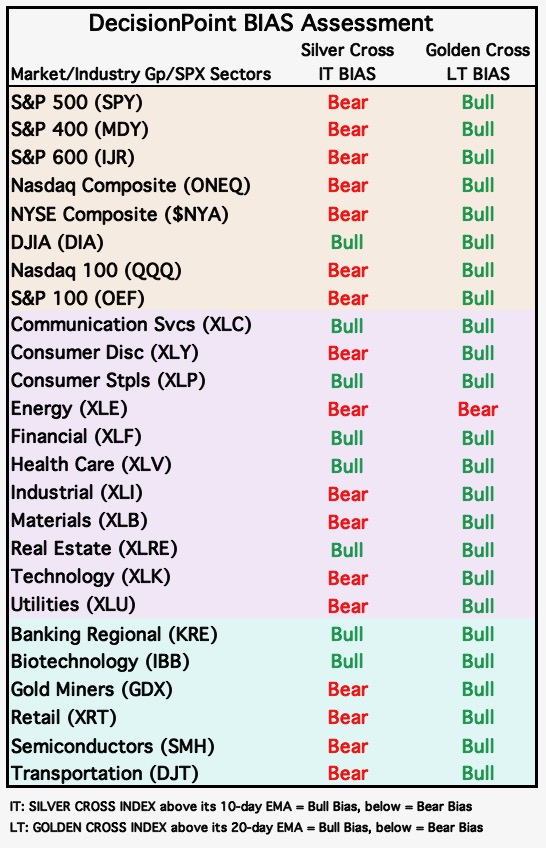

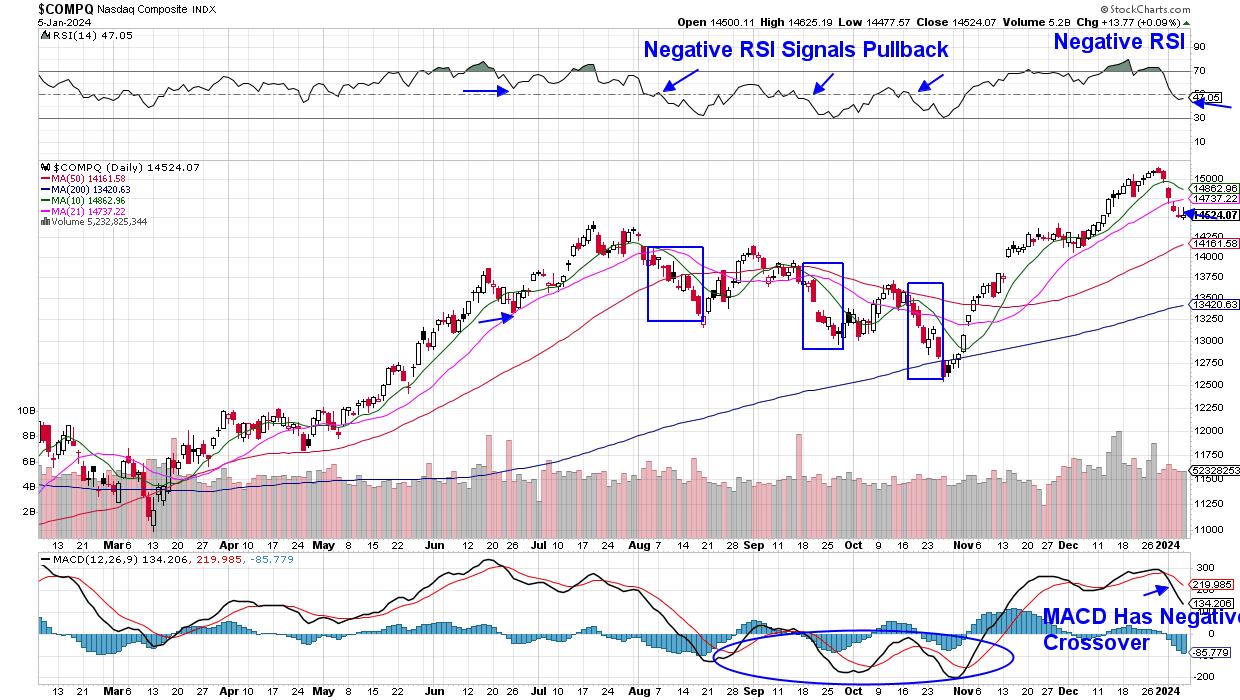

This week, the markets experienced a dramatic bias shift. We measure the Intermediate-Term Bias using our Silver Cross Index (SCI). The SCI measures how many stocks within an index, sector, or industry group hold "silver crosses"...

READ MORE

MEMBERS ONLY

Stock Market Was Tentative This Week: S&P 500 Tested New High But Pulled Back

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market exhibited tentative behavior this week probably due to uncertainty about inflation and geopolitical developments

* S&P 500 index touched a high but pulled back to close slightly higher

* Crude oil prices broke above $75 but pulled back and is holding support at its 200-week...

READ MORE

MEMBERS ONLY

Larry's First LIVE "Family Gathering" Webinar of 2024 Airs NEXT WEEK - Tuesday, January 16th at 2:00pm EST!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this coming Tuesday, January 16 at 2:00pm Eastern Standard Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current...

READ MORE

MEMBERS ONLY

Is the Market Ready for Another Dip?

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG points out how the market is still digesting the big move from the November/December run. It ran a huge sprint, and now needs to cycle down in order to create room for the next leg up. The internals...

READ MORE

MEMBERS ONLY

Drilling Down Into Gold and Silver

With the news on geopolitical escalation, soft versus hard landing, disinflation versus reinflation, growth versus value, and credit default versus available disposable income, gold and silver are even more interesting now.

Gold's behavior has been more of sell strength and buy weakness for some time. What has changed...

READ MORE

MEMBERS ONLY

GNG TV: Nothing "CRYPTIC" About These Go Trends!

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

As the SEC approved spot Bitcoin ETFs Wednesday, investors in a broad basket of cryptocurrencies witnessed strengthening Go trends and substantial advances in trends which took hold in October 2023. In this edition of the GoNoGo Charts show, Alex and Tyler review current trends across asset classes and sector groups....

READ MORE

MEMBERS ONLY

Your Questions Answered! Moving Averages, Chart Patterns, Inflation & More

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave presents a special all-mailbag episode, answering viewer questions on simple vs. exponential moving averages, the benefits of analyzing sector rotation, and a good first chart for beginners learning technical analysis.

This video originally premiered on January 12, 2024. Watch...

READ MORE

MEMBERS ONLY

XLV's Record Rally: The Must-Know Investment Move of the Year

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The Healthcare Select SPDR ETF XLV has seen a 16% rise from its October low and is showing upside momentum

* Seasonal patterns in XLV show that July and November are the strongest months in terms of returns and higher close rates

* Combining seasonality patterns and technical indicators shows...

READ MORE

MEMBERS ONLY

Common Lessons Amongst Corporate, Sports & Investment Portfolio Turnarounds!

by Gatis Roze,

Author, "Tensile Trading"

My many decades of business, investing, and sports experience has shown me time and time again that parallel lessons in all three arenas are remarkably worthy teachers. One essential lesson today (January 2024) is to not allow yourself to become a "legend in your own mind." Yes, you...

READ MORE

MEMBERS ONLY

From Selloff to Surge: Growth Stocks Rebound After CPI

by David Keller,

President and Chief Strategist, Sierra Alpha Research

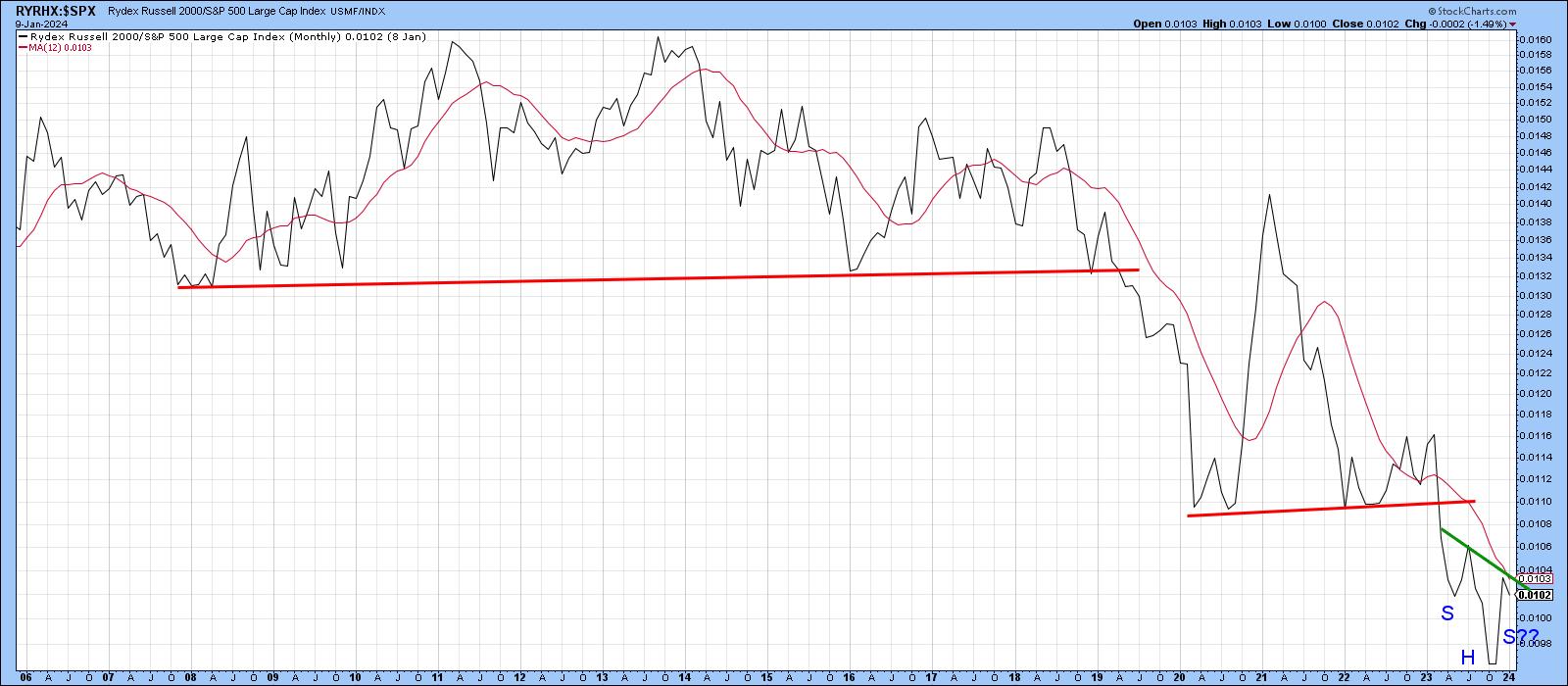

In this edition of StockCharts TV'sThe Final Bar, Dave highlights three leading growth stocks continuing to push to new swing highs. He also breaks down key market sentiment indicators, including the VIX, AAII survey, NAAIM Exposure Index, Rydex fund flows, and put/call ratios.

This video originally premiered...

READ MORE

MEMBERS ONLY

Markets: Recap of This Week's Market Dailies

I began the week focused on bank earnings, which we will wake up to tomorrow. In that Daily, I wrote, "one can assume that bank stocks, which already started off the year extremely well, have potential to shine.

"However, we know that assumptions can be tricky. There are...

READ MORE

MEMBERS ONLY

The Secret Behind My Moving Average "Buddy" System

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how the 18MA can be a powerful tool when used in conjunction with the 40MA line. First, Joe explains why he uses a 18MA instead of a 20MA, demonstrating how this MA line can act as...

READ MORE

MEMBERS ONLY

SPOT ETFs APPROVED!! The Technical Case for Bitcoin

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Adrian Zduńczyk, CMT of The Birb Nest discusses upside potential for Bitcoin and Ethereum based on expectations around new Bitcoin ETFs, as well as a bullish technical configuration. Dave highlights leading growth stocks, like META scoring new 52-week highs, as...

READ MORE

MEMBERS ONLY

Markets: Week 1, Week 2 -- What's Next in Week 3?

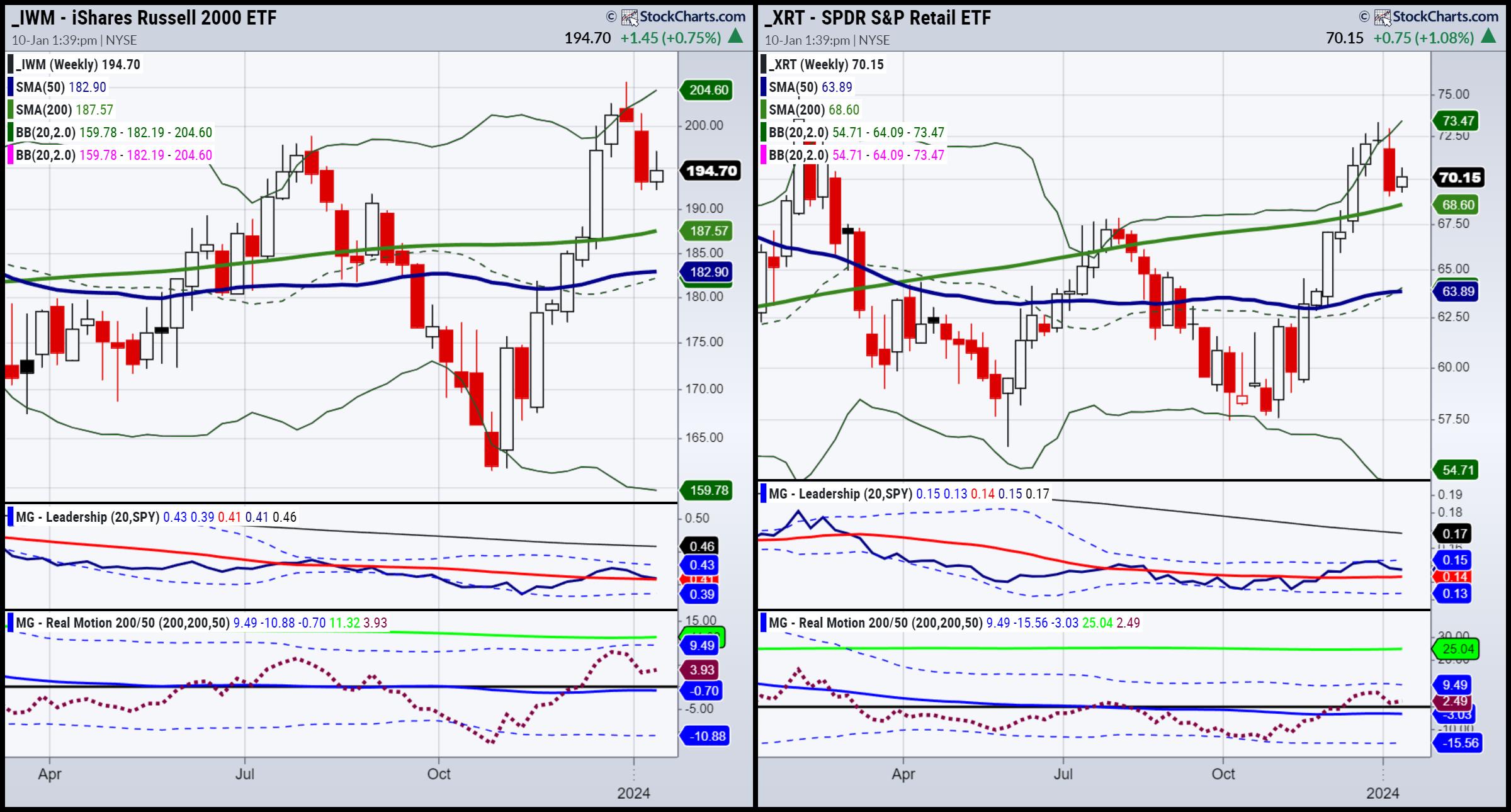

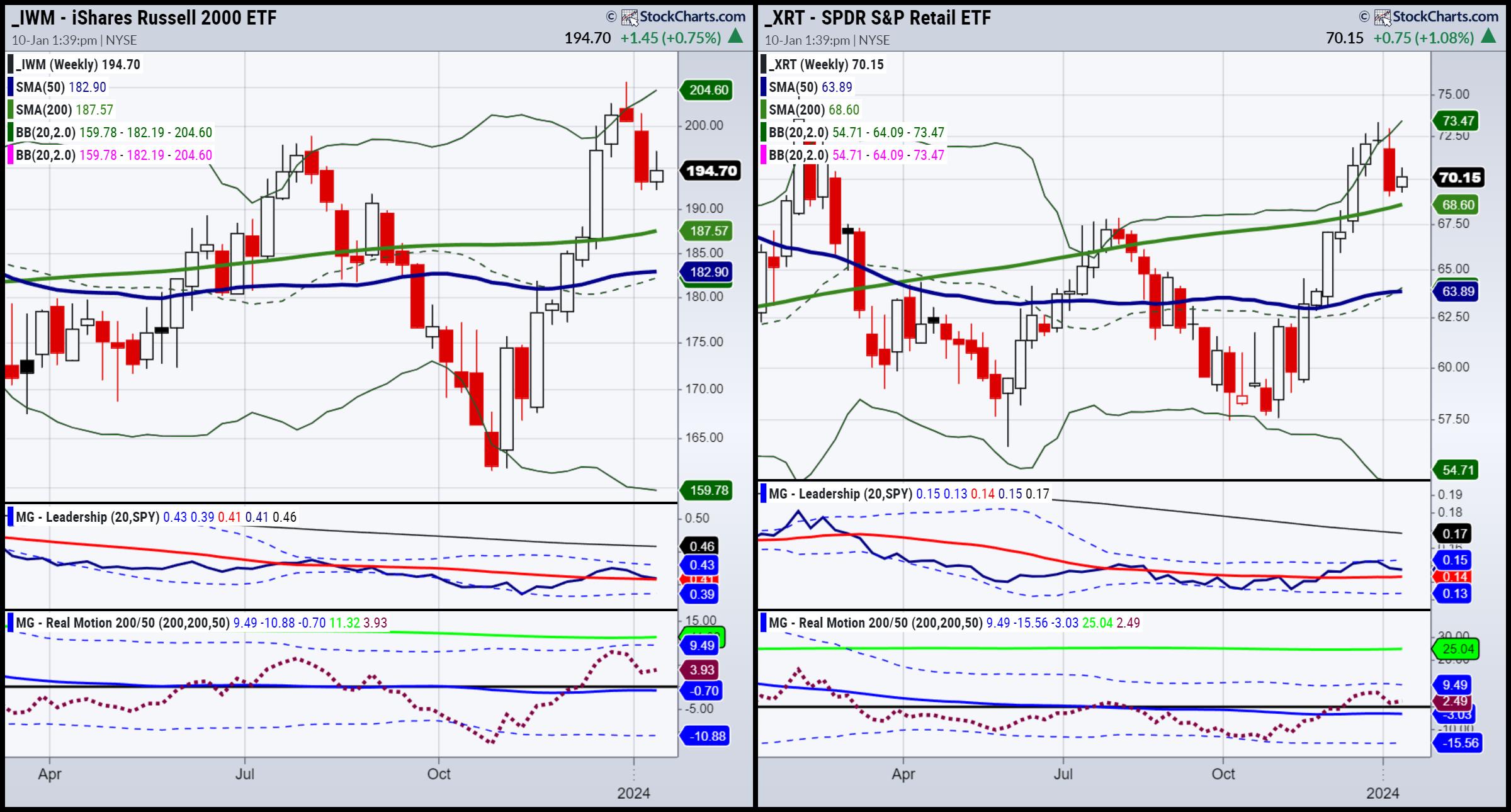

Looking at the Economic Modern Family (weekly charts), all of them, to date, peaked in December. The Russell 2000, Regional Banks, Transportation and Retail, as far as index and sectors go, backed off the most from their peaks. Semiconductors are more sideways since the peak, as well as Biotech (which...

READ MORE

MEMBERS ONLY

3 Health Care Stocks Flashing Promising Golden Cross: Why You Need to Watch Them

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Health Care sector has shown upside momentum in 2024

* It may be a good time to add some healthcare stocks to your portfolio

* The Bullish 50/200-day MA Crossovers scan in StockCharts filtered out three healthcare stocks that deserve attention

The Health Care sector started rallying in...

READ MORE

MEMBERS ONLY

The Halftime Show: Escape the Chaos - Discovering the Key to Tackling Market Uncertainty

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Uncertainty needs attention in order for it to make you second guess yourself. Instead, wait for trends to change, and then make changes. On this week's edition ofStockCharts TV'sHalftime, Pete Carmasino shares a broad market overview, starting with a divergence signal on the bullish percent of...

READ MORE

MEMBERS ONLY

Don't Miss Out! 2 Promising Sectors in Early 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Julius de Kempenaer of RRG Research talks stocks over bonds and highlights two sectors with upside potential based on improvements in their relative strength. Dave unveils a bearish momentum divergence for Netflix and reveals two technology stocks that could still...

READ MORE

MEMBERS ONLY

Commodities Trade Analysis: Aluminum

As a main aluminum producer, Alcoa (AA) announced cost-cutting measures, along with plans to curtail production at one Western Australian Refinery. But that is just one facility, and the company plans to continue to operate its port facilities located alongside the refinery. Plus, it will continue to import raw materials...

READ MORE

MEMBERS ONLY

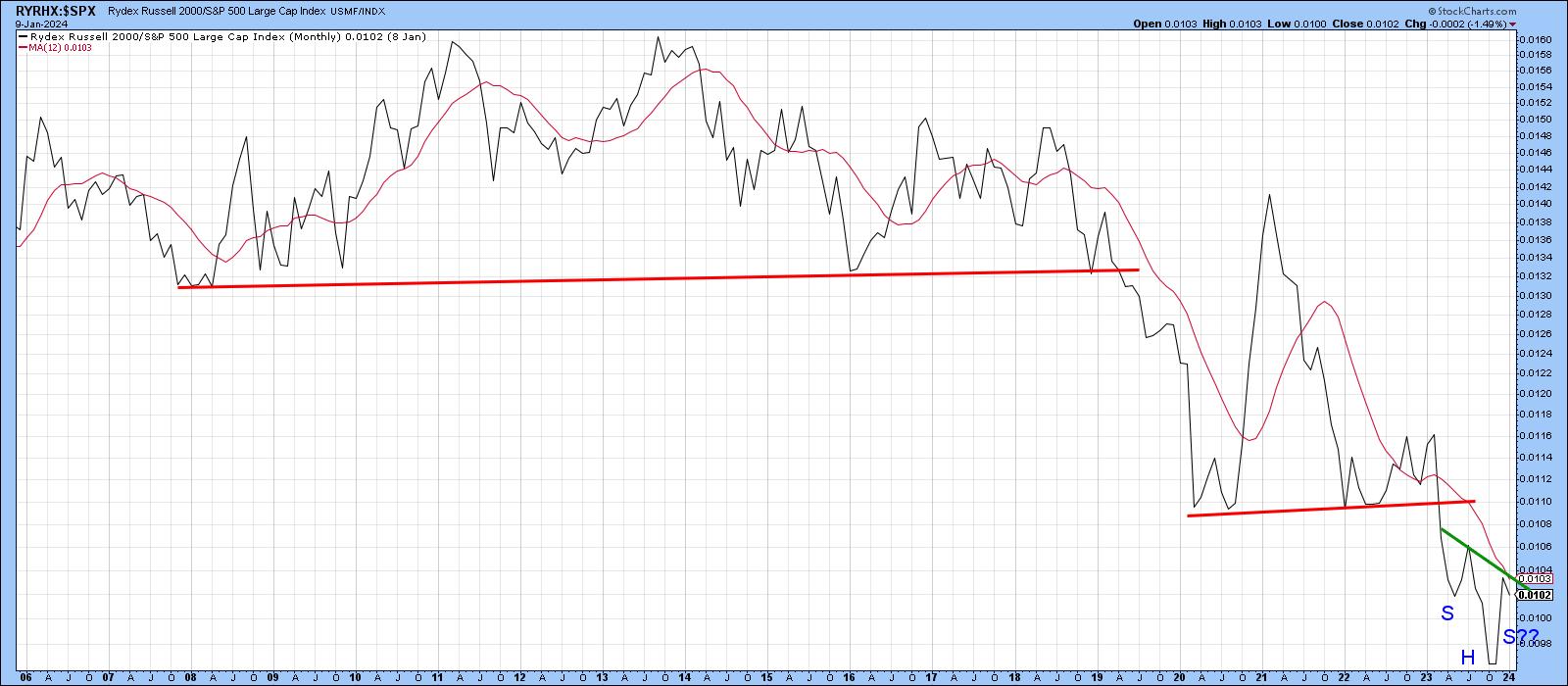

Is it Prime Time for Small Caps?

by Martin Pring,

President, Pring Research

A couple of weeks ago, I took note of the widespread interest in small caps amongst the technical community. I don't normally follow cap plays, but my contrary bones began to shake when I saw such acclaim at their recent performance following several false dawns in the last...

READ MORE

MEMBERS ONLY

Breakout Or Failed Breakout: It's Important To See The Difference

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Important days for stocks usually are associated with big volume, major support/resistance, and a test of leadership. As I look at Upwork, Inc. (UPWK), it's check, check, and check. Before I look at UPWK individually, let me show you what we typically see with internet stocks (which...

READ MORE

MEMBERS ONLY

January 2024: The Final Bar's Top 10 Must See Charts

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, Grayson Roze and Dave break down the trends for the top ten stocks and ETF charts for December 2023. They'll identify key levels and signals to watch for using technical analysis tools including moving averages, relative strength, RSI,...

READ MORE

MEMBERS ONLY

Bank Earnings Up -- Time to Look at Regional Banks ETF

Starting with the Jeffries Group on January 9th, by Friday, we will see Bank of America (BAC), JP Morgan (JPM), Wells Fargo (WFC), and Citigroup (C), as well as a few other banks, all report earnings.

In my 2024 Outlook and this Year of the Dragon, Raymond Lo writes, "...

READ MORE

MEMBERS ONLY

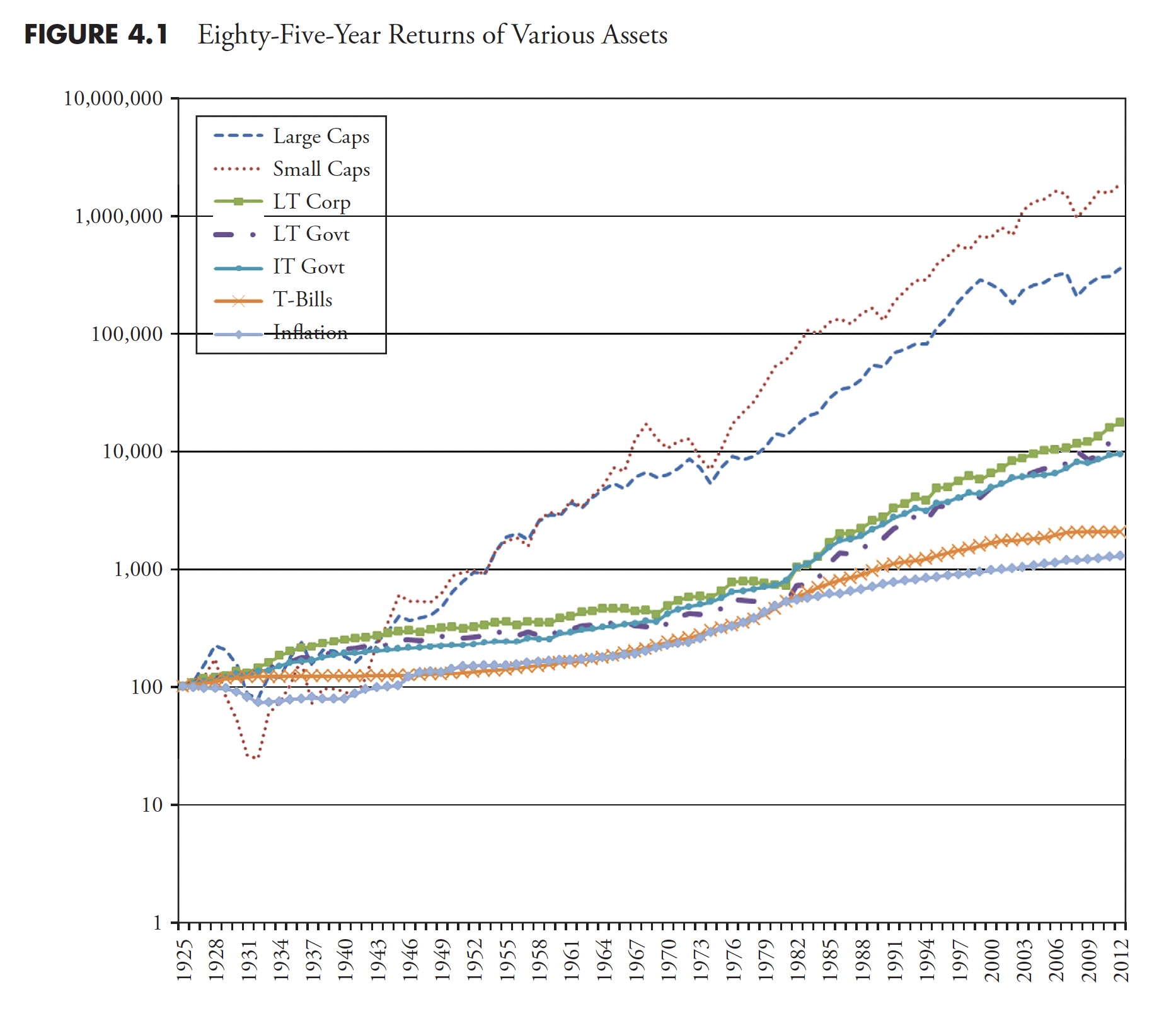

The Hoax of Modern Finance - Part 4: Misuse of Statistics and Other Controversial Practices

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

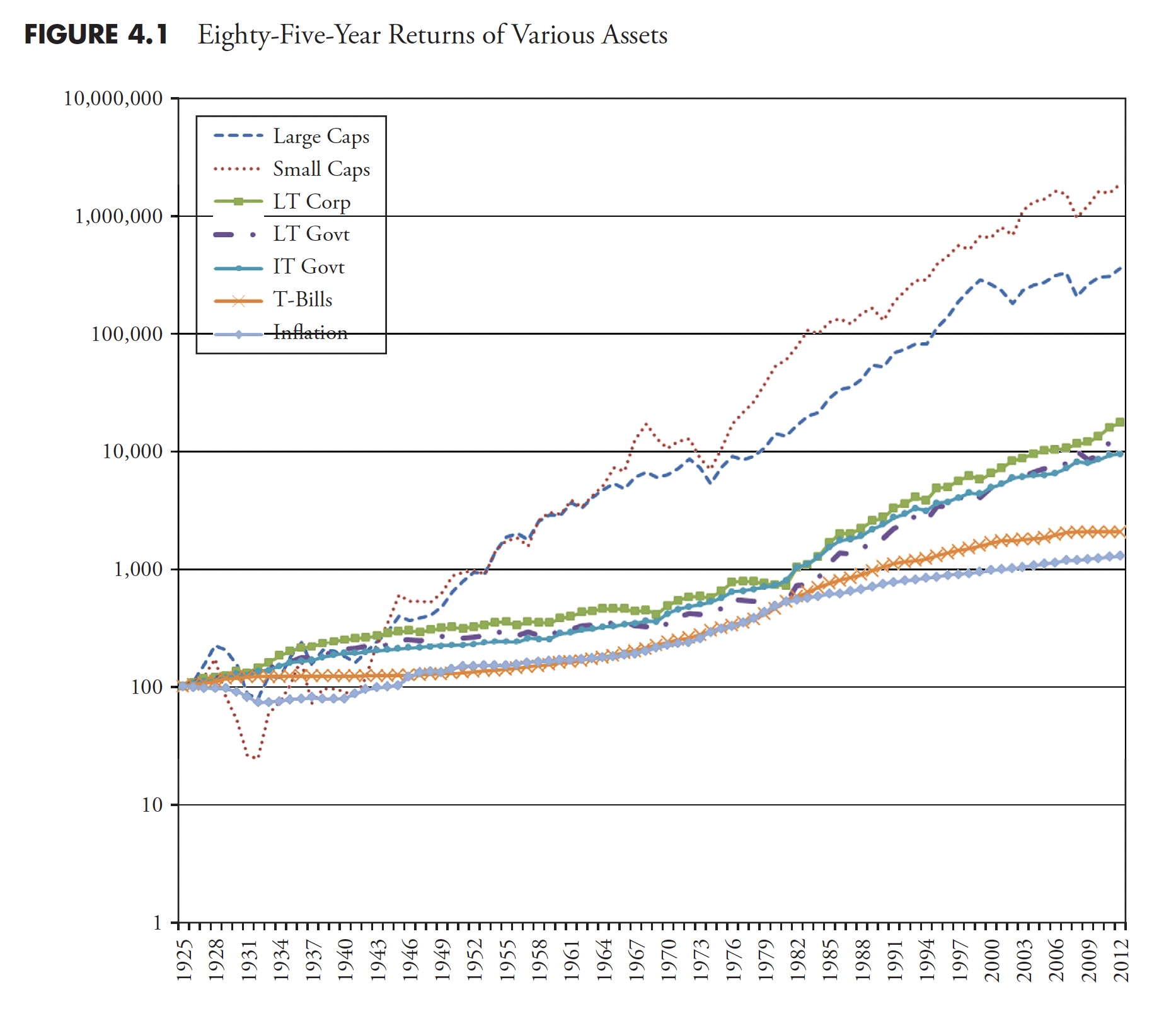

Note to the reader: This is the fourth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Putting a Mean-Reversion Strategy Into Practice

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Mean-reversion strategies typically buy stocks when they are oversold, which means catching the falling knife. These declines are often rather sharp, but the odds favor some sort of bounce after reaching an oversold extreme. While there are no guarantees, chartists can mitigate risk by insuring that the stock is still...

READ MORE

MEMBERS ONLY

Apple hits Support-Reversal Zone - What is it and Why Does it Matter?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Tech stocks were hit with selling pressure to start the year, but many are still in long-term trends and some are nearing support-reversal zones. In particular, Apple (AAPL) fell to a support-reversal zone and I am on alert for a bounce. Let's investigate.

First, the long-term trend is...

READ MORE

MEMBERS ONLY

Three Charts to Track Impending Doom

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* January through March is the weakest three-month period for stocks in an election year.

* The McClellan Oscillator turned bearish this week, suggesting at least a short-term pullback for stocks.

* The VIX remains low, but a push above 15 could indicate further downside, retracing the gains from Q4.

Okay,...

READ MORE

MEMBERS ONLY

MEM TV: Jobs Growth Reveals NEW Opportunities in These AREAS

by Mary Ellen McGonagle,

President, MEM Investment Research

Not a great start to the year! In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen takes a look at where the broader markets closed, and sees we're hovering around some rather critical areas. The sharp pullback in growth stocks drove last week's...

READ MORE

MEMBERS ONLY

Prepare for 2024: Martin Pring's Expert Insights on the Equity Market

by Martin Pring,

President, Pring Research

In this must-see once a year special, Martin breaks down his comprehensive equity market outlook for 2024, accompanied by Bruce Fraser.

Encompassing a secular (multi-business cycle) perspective of the forces that are likely to influence stocks and bonds over the coming years, Martin presents a look ahead at what'...

READ MORE

MEMBERS ONLY

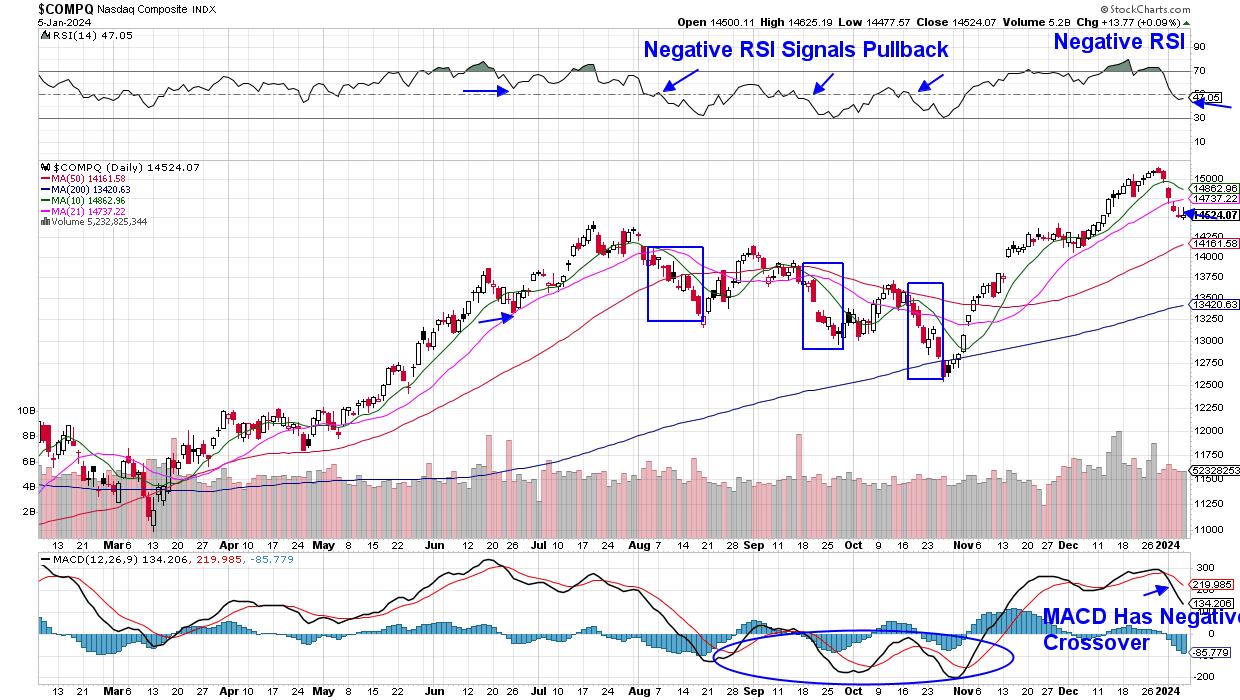

New Year Starts With a Bang as Leadership Areas Get Hit

by Mary Ellen McGonagle,

President, MEM Investment Research

Last week, Growth stocks came under selling pressure, with the Nasdaq falling over 3% amid sharp declines in most of the Magnificent Seven names. These weren't the only 2023 darlings that pulled back, as Semiconductor and Software stocks also underperformed. In turn, the Technology sector was the worst...

READ MORE

MEMBERS ONLY

Unlocking Growth: The Importance of Market Pullbacks

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG highlights the continuing market pullback that started right around the turn of the new year. This is very much expected, since the November/December run was so intense. Most tickers have become overextended and are in need of coming...

READ MORE

MEMBERS ONLY

Supercharge Your SUCCESS with The Ultimate List of Prebuilt Charts

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson kicks off the New Year by hooking you up with every chart you could ever need, and you don't have to create a single one yourself! In just a couple of clicks, you can...

READ MORE

MEMBERS ONLY

Hot Jobs Data Sends Stock Market Seesawing, Ending Nine-Week Winning Streak

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market indices closed higher for the day but ended the week lower

* The 10-year Treasury yield closed higher at 4.04%

* In spite of the pullback in equities, the stock market indices are still looking technically strong

You can't blame the market for taking...

READ MORE

MEMBERS ONLY

Super Cycles Do Not Just Fade Away

On inflation

I like this quote-

"Goods deflation likely transitory as downward pressure on goods demand and input costs are fading. 1H24 global core inflation likely to settle near 3%, which won't resolve the immaculate disinflation debate."

And this quote does not include the steep rise...

READ MORE

MEMBERS ONLY

Earnings for 2023 Q3 Show Market Still Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings are in for 2023 Q3, and here is our valuation analysis.

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

SPY Resting at Support, But Financials Showing Strength

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* SPY is testing, maybe breaking, short-term support

* Next support in 455 area

* Financials sector tails on daily and weekly RRG moving back in sync

* All banks inside the leading quadrant

HAPPY NEW YEAR!!! (I guess that is still allowed on day 5...)

Let's kick off the...

READ MORE

MEMBERS ONLY

Silver Cross Index is Topping on Broad Market Indexes

by Erin Swenlin,

Vice President, DecisionPoint.com

(Below is an excerpt from the subscriber-only DecisionPoint Alert on DecisionPoint.com for Thursday, 1/4):

Most are familiar with what a "golden cross" is, a 50-day MA moving above the 200-day MA. Today we will talk about a "silver cross". A "silver cross"...

READ MORE

MEMBERS ONLY

Growth Stocks Drop Again -- and That's Just the Beginning?!?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Jeff Huge, CMT of JWH Investments speaks to how extreme breadth conditions, sky-high valuations and overly bullish sentiment readings could indicate the beginning of a bear phase in 2024. Dave highlights two value sectors showing renewed signs of strength...

READ MORE

MEMBERS ONLY

GNG TV: Remaining Objective About Trading Rules is CRITICAL!

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, Alex and Tyler take a look at the GoNoGo Trend® conditions of several key areas of the market. The seasonal roadmap of 2023 may be overemphasized by many market commentators, and remaining objective about trading rules is critical in times like these....

READ MORE

MEMBERS ONLY

Add Happiness To Your Portfolio With a Sprinkle of Disney Stock

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Disney's stock price is showing signs of consolidation and may be worth watching for signs of a breakout

* The stock is at a critical support level and if the stock is able to hold this support, it could be positive for the stock

* A break above...

READ MORE