MEMBERS ONLY

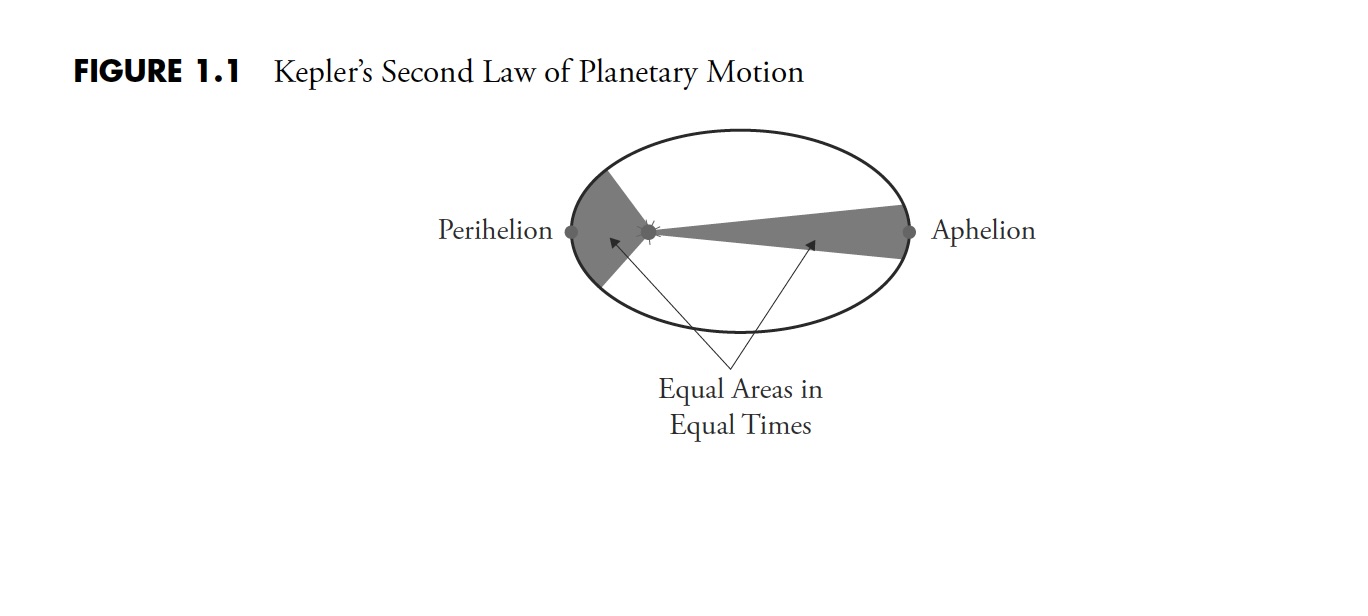

The Hoax of Modern Finance - Part 3: Fictions Told to Investors

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the third in a series of articles I'm publishing here taken from my book, "Investing with the Trend," in article form here on my blog. Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading...

READ MORE

MEMBERS ONLY

Mish's Outlook 2024 is Here -- Macro to Micro

Coming into 2023, we used the theme, "You can't hunt with the hounds and run with the rabbit." Those who stood back with the hounds, in search of a sure hit, were not only left behind, but missed the move higher as the rabbit got the...

READ MORE

MEMBERS ONLY

Top Five Charts of 2023 #3: Market Breadth Indicators

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In the third of a five-part special series on StockCharts TV'sThe Final Bar, Dave breaks down three market breadth indicators that tell the story of market conditions in 2023. By analyzing the S&P 500 Bullish Percent Index, the percentage of stocks above their 50-day moving average,...

READ MORE

MEMBERS ONLY

Costco's Record-Breaking Surge: Is It Time to Buy or Sell?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Costco experienced a significant rally driven by strong earnings and an upgraded analyst target of $700

* Despite COST's bullish prospects, the stock is overbought and is likely to pull back

* Setting price alerts at several support levels may be key to finding a strong long entry...

READ MORE

MEMBERS ONLY

What Would It Take for Emerging Markets to Emerge?

by Martin Pring,

President, Pring Research

Over the years, emerging markets as a group have experienced huge swings in relative performance. The latest one, which began in 2010, has been quite bearish. When such linear trends dominate the scene, reliable cyclical indicators, such as the long-term KST or monthly MACD, often give premature buy signals and...

READ MORE

MEMBERS ONLY

Top Five Charts of 2023 #2: Ten-Year Treasury Yield

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In the second of a five-part special series on StockCharts TV'sThe Final Bar, Dave takes a deep dive into the bond markets, talking rising rates, Fed rate hikes, value vs. growth, inverted yield curves, and what the bond markets in 2023 could tell us about potential future paths...

READ MORE

MEMBERS ONLY

DP Trading Room: Finally! Signs of Life in the Energy Sector

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, with Energy (XLE) finally showing signs of life, Carl and Erin dive into the sector to learn more about participation and new momentum. Carl discusses Total Returns on SPX, which are showing new all-time highs before the actual index....

READ MORE

MEMBERS ONLY

Top Five Charts of 2023 #1: S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In the first of a five-part special series on StockCharts TV'sThe Final Bar, Dave walks through the S&P 500 index quarter by quarter. From the strong rally phase in the 2nd quarter to the dramatic reversal at the October low, 2023 has provided a perfect case...

READ MORE

MEMBERS ONLY

Stock(ing) Stuffers That Could Be Loving the High 2024

Just for the fun of it, and since we did not include it in our Outlook 2024, I decided to have a look at what experts are saying concerning mushrooms, cannabis, and hemp. After all, recreational and medical alternatives as investments, have been huge underperformers, and are a bit of...

READ MORE

MEMBERS ONLY

Size (Matters) Over Style!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Growth and Value are moving together in an unusual rotation

* Money from large-cap stocks being distributed into mid- and small-cap segments

* Even all Mag7 names dropping in price is not enough to pull down benchmark indices

Something Strange is Going On

Or, at least, something unusual.

On the...

READ MORE

MEMBERS ONLY

Think Really Hard About Who You Want On Your Team

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm going to start this article a bit different than all the others I've written here at StockCharts.com and talk off topic for a paragraph or two.

I grew up in Maryland, quite close to Washington, DC, and was an avid Washington Redskins and Baltimore...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Overextended on Charts; Avoid Chasing Up Moves as Consolidation Look Imminent

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Continuing with the unabated upmove, the markets went on to post their fresh lifetime highs once again; NIFTY has ended on a fresh lifetime high on a closing basis as well. The rally this week was propelled by the Fed, which kept the interest rates unchanged. While this was widely...

READ MORE

MEMBERS ONLY

Extreme Breadth Readings Say Short-Term Bearish, Long-Term Bullish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

By late October, the market conditions were dire indeed. The S&P 500 had broken below its 200-day moving average for the first time since March. Only 10% of S&P 500 members remained above their 50-day moving average, meaning a full 90% were below this key short-term...

READ MORE

MEMBERS ONLY

The 2 Best Holiday Gifts You Can Give Your Kids!

by Gatis Roze,

Author, "Tensile Trading"

Let's begin with the bottom line.

As parents, our reason for being here on planet Earth is to pass on to our children the life skills they'll need to succeed. Everyone talks about leaving a better planet for our children; why don't we try...

READ MORE

MEMBERS ONLY

MEM TV: Don't Miss the Move Into These NEW Areas!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shows you what to be on the alert for, with the broader markets in an oversold position as we head into year-end. She also highlights which areas are poised to continue to trade higher, sharing some individual stocks...

READ MORE

MEMBERS ONLY

Larry Williams' 2024 Market Outlook

by Larry Williams,

Veteran Investor and Author

by David Keller,

President and Chief Strategist, Sierra Alpha Research

On this edition of StockCharts TV'sThe Final Bar, legendary trader and author Larry Williams joins Dave to share his lessons learned in 2023, his outlook for stocks in 2024, and which cycles he feels all investors should be following into the new year.

This video originally premiered on...

READ MORE

MEMBERS ONLY

Are We Seeing 2020 All Over Again!?

by TG Watkins,

Director of Stocks, Simpler Trading

The market exploded higher after already being on a winning streak for 5 weeks. While there are blow-off top vibes, there could be a lot of money able to come in from the sidelines to keep the market going. In this week's edition of Moxie Indicator Minutes, TG...

READ MORE

MEMBERS ONLY

How is the Economic Modern Family Liking Santa Now?

This is a great time to examine the weekly charts of the Economic Modern Family. We like that timeframe for now, with only a short number of trading days left. And there's lots of news constantly unfolding:

1. Rate cuts/no rate cuts

2. Middle East heating up...

READ MORE

MEMBERS ONLY

Momentum Madness and Nasdaq 100 Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks went on a tear the last seven weeks with Nasdaq 100 stocks leading the charge. The S&P MidCap 400 SPDR (MDY) and Russell 2000 ETF (IWM) gained more than QQQ over the last seven weeks, but QQQ is still the only major index ETF to exceed its...

READ MORE

MEMBERS ONLY

Small-Caps Rocket to the Upside, Leave Large-Caps in the Dust

by David Keller,

President and Chief Strategist, Sierra Alpha Research

On this edition of StockCharts TV'sThe Final Bar,Julius de Kempenaer of RRG Research points out that growth vs. value is now more of a small vs. large question, with small caps rocketing to the upside in December. Host David Keller, CMT recaps the top charts of the...

READ MORE

MEMBERS ONLY

GNG TV: S&P 500 Breakout -- Will the Rally Continue to All-Time Highs by Year End?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, as equities rally with speed from 4600 to 4700 this week, Alex and Tyler take a look across style boxes, cap scales, asset classes, and sectors, and review small-cap industrials that are part of the broadening leadership groups giving legs to this...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 2: Indicators, Terminology, and Noise

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: Over the next couple of weeks and months, I will be republishing the contents of my book, "Investing with the Trend," in article form here on my blog. I'm calling this series "The Hoax of Modern Finance" for reasons you...

READ MORE

MEMBERS ONLY

Find Aggressive Entry Opportunities & Tradeable Trends with Multi-Timeframe Charts

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use multiple timeframes to help when getting an aggressive entry in a stock. He starts by explaining the tradable trend, then shows how an aggressive opportunity develops. To close out the show, he analyzes...

READ MORE

MEMBERS ONLY

The Halftime Show: Crude Oil Back in the "White House Buy Zone"

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

On this week's edition ofStockCharts TV'sHalftime, Pete covers the major indexes and reviews the bullish percents of the S&P 500 and Nasdaq 100, before then taking a look at the NYSE FANG+ index. After that, he highlights the fact that crude oil is back...

READ MORE

MEMBERS ONLY

Energy Sector Finally Becoming Bullish?

by Carl Swenlin,

President and Founder, DecisionPoint.com

We publish this table daily to give an overview of the market, sector, and industry group indexes we follow. The Intermediate-Term Trend Model (ITTM) BUY Signals occur when the 20-day EMA crosses up through the 50-day EMA (Silver Cross). Long-Term Trend Model (LTTM) BUY Signals occur when the 50-day EMA...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" December 14, 2023 Recording

by Larry Williams,

Veteran Investor and Author

In this video, Larry presents his forecast for FANG stocks, including an analysis of the stock selloff for META. He then digs into the cycle of debt and why he's bothered about credit card writeoffs. After that, he examines the weekly economic index and GDP and how they...

READ MORE

MEMBERS ONLY

FED PIVOT ON RATES BOOSTS BONDS AND STOCKS -- GOLD AND ITS MINERS BENEFIT FROM FALLING RATES

by John Murphy,

Chief Technical Analyst, StockCharts.com

SPX RALLY BROADENS OUT... Two inflation reports this week showed consumer and producer price inflation cooling off. Then on Wednesday afternoon the Fed suggested that it may be ending its rate hikes, and might even lower rates three times in the coming year. That combination resulted in a big drop...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2:00 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Standard Time (11am Pacific). Sign-in in begins 5 minutes prior. The show will be recorded and posted online for those of you who cannot attend. Use the link below to join:

Link to Join Webinar:...

READ MORE

MEMBERS ONLY

Blow-Off Top?! Market Reacts to the FED Announcement

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Happy Fed Day on this edition of StockCharts TV'sThe Final Bar. There was quite a bit of movement leading into the FOMC announcement, with exceptional amounts of movement afterwards. Markets continued to push aggressively to the upside, with the S&P 500 closing the day out above...

READ MORE

MEMBERS ONLY

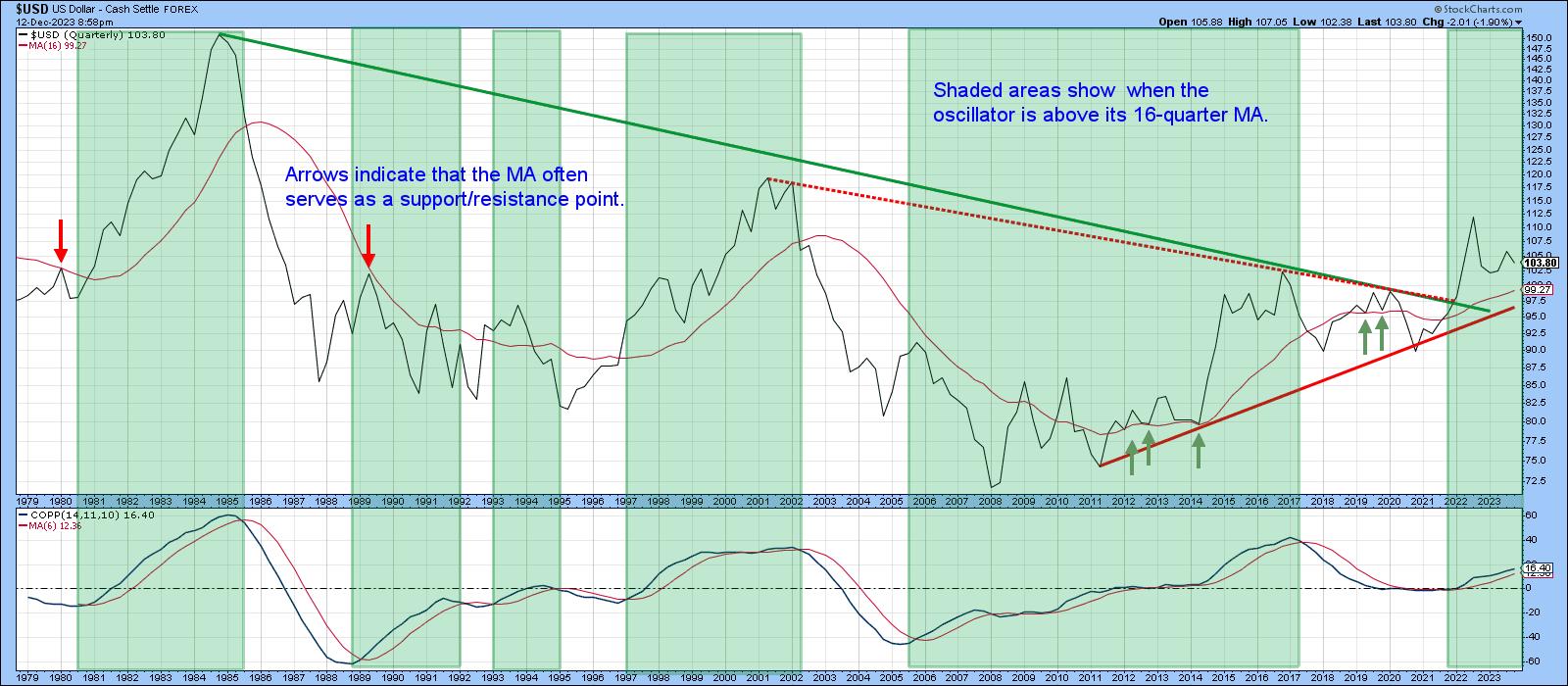

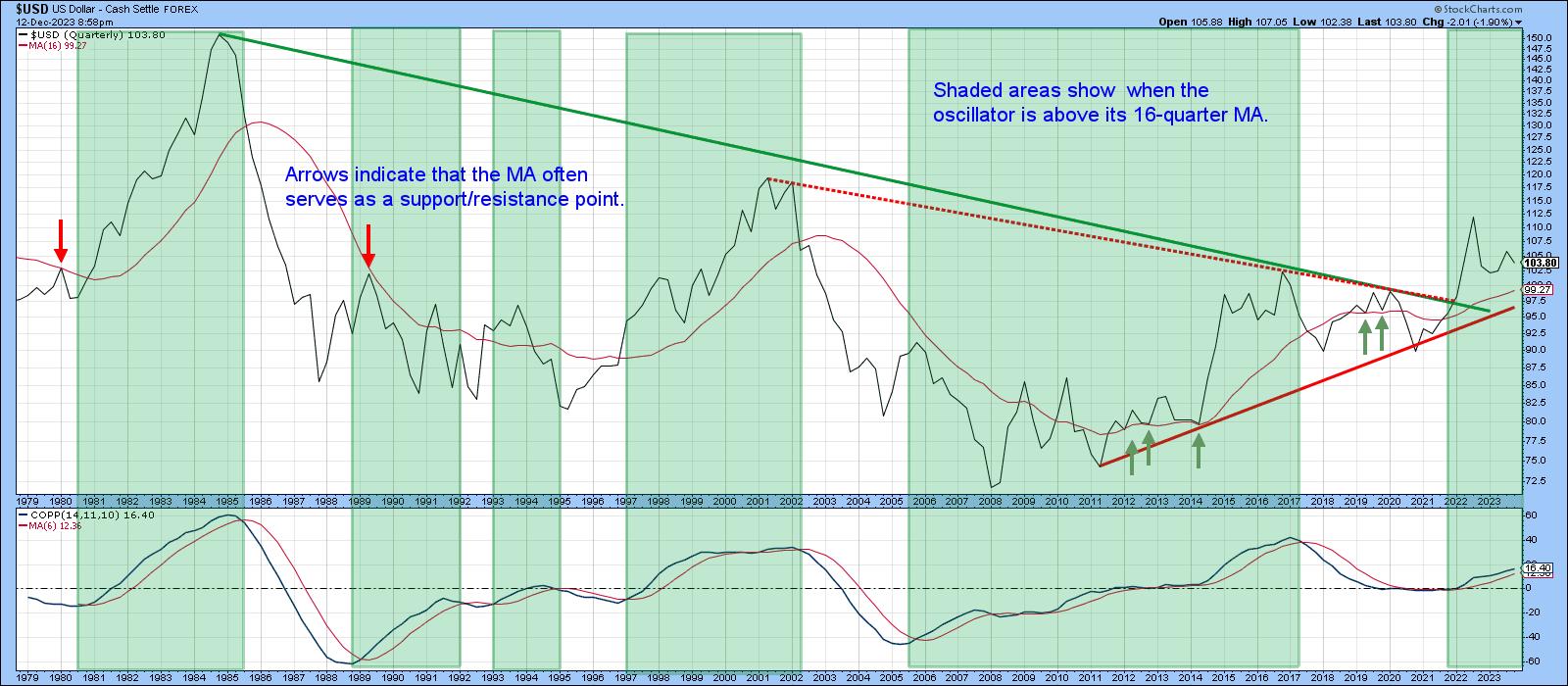

Maybe It's Time for a Santa Claus Rally... in the Dollar

by Martin Pring,

President, Pring Research

I like to start off my approach to any market by taking a look at the long-term trend. That's because a rising tide not only lifts all boats, but the direction of the long-term trend determines the characteristics of those below it. For example, if the primary trend...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 1: Introduction

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: Over the next couple of weeks and months, I will be republishing the contents of my book, "Investing with the Trend," in article form here on my blog. I'm calling this series "The Hoax of Modern Finance" for reasons you...

READ MORE

MEMBERS ONLY

This Industry Group Outperformed the S&P 500 by OVER 120% in 2023!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Joe Rabil of Rabil Stock Research shares his biggest takeaway from investing in 2023 and also conducts a deep dive in the Consumer Discretionary sector with a focus on four stocks: SIG, TSLA, RL, and ABNB. Meanwhile, Dave unveils...

READ MORE

MEMBERS ONLY

Sector Spotlight: Timeless Knowledge and Insights into Sector Rotation & Seasonality

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

For the 200th episode of StockCharts TV's Sector Spotlight, I inviteWall Street legend Sam Stovall for an entertaining discussion. Before that, I starts the show with a short look at current market rotations, highlighting the increasing relative weakness for the Energy Sector. I also note money rotating out...

READ MORE

MEMBERS ONLY

Larry's Final LIVE "Family Gathering" Webinar of 2023 Airs THIS WEEK - Thursday, December 14th at 2:00pm EST!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this Thursday, December 14 at 2:00pm Eastern Standard Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

Renewed UPTREND for Semis -- SMH and SOXX ETFs Breaking Out!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps the renewed uptrend for semis, with ETFs like SMH and SOXX breaking out despite a lack of participation from the largest semiconductor name, Nvidia (NVDA). He answers viewer questions on QQQ, Netflix (NFLX), Resmed (RMD), Avis Budget Group...

READ MORE

MEMBERS ONLY

Is Overbought Really Bearish?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 SPDR (SPY) surged over 10% since late October and exceeded the upper Bollinger Band (125,1). This means price is more than 1 standard deviation above the 125-day SMA. Surely, this means SPY is overbought. But is this actually bearish? Historical evidence suggests that this...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Faces An Imminent Consolidation; This Index May Finally Start To Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets continued their unabated upmove; following a strongly trending week, the Nifty not only ended at a fresh lifetime high point but also closed with gains for the sixth consecutive week. The markets piled up decent returns despite some signs of consolidation in the second half of the week....

READ MORE

MEMBERS ONLY

The Most Successful Base Pattern is Seeing a Pickup in Breakouts; Here Are Two Examples

by Mary Ellen McGonagle,

President, MEM Investment Research

Last week, the S&P 500 posted a modest 0.2% gain, which puts it within points of a 4-month base breakout at 4607. In addition to a breakout, a move above this level would put this Index above its July high, which is a key area of possible...

READ MORE

MEMBERS ONLY

Will the S&P 500 Push Above 4600 Before Year-End?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The S&P 500 index has stalled out at its July high around 4600, and overbought readings from RSI indicate a likely pullback.

* Breadth indicators have reached bullish extreme readings, confirming the long-term bullish, short-term bearish thesis.

* Individual stocks from both growth and value sectors are overbought...

READ MORE

MEMBERS ONLY

This Li'l Checkbox is KEY When Comparing Stocks & Charting Multiple Timeframes

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shares the secret to comparing symbols and making multi-timeframe analysis a breeze! Using the "Load Symbol Only" checkbox, he demonstrates how to review a list of symbols with different chart templates, all without having...

READ MORE