MEMBERS ONLY

The Best Cybersecurity Stocks Showing Profitable Investment Opportunities

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Increasing demand for cybersecurity can give cybersecurity stocks a massive boost

* Four cybersecurity stocks showing technical strength are PANW, FTNT, CRWD, and ZS

* Keep an eye on the cybersecurity space, especially prior to the top companies' earnings announcement

Cybersecurity companies occupy a unique space. It can never...

READ MORE

MEMBERS ONLY

AMD Stock Projection: Price Could Soar Over 50%

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The StockCharts Technical Rank is indicating that AMD's stock price is strengthening

* A bull flag pattern and potential resistance levels can help to make a projection on AMD's stock price

* AMD stock's relative performance and momentum are improving, which means the stock...

READ MORE

MEMBERS ONLY

Breadth Indicators Illustrate Recent Dire Conditions

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Doug Ramsey, CFA CMT of The Leuthold Group talks small-cap underperformance and shares two breadth indicators illustrating the recently dire conditions. Host David Keller, CMT declares the 200-day moving average "the most important line in the sand for...

READ MORE

MEMBERS ONLY

A Closer Look at Long Bonds and The US Dollar

The next direction of the long bonds is crucial in determining the macro.

First, after a wrecking ball crash and ahead of the FOMC, we could surmise that a bottoming-like action defines the last several trading days. Our Real Motion indicator shows a mean reversion. The 10-day moving averages (cyan...

READ MORE

MEMBERS ONLY

The Halftime Show: Are Oversold Conditions Real? The Bullish Percent Says So

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

On this week's edition of StockCharts TV'sHalftime, Pete reviews the bullish percent index; with all the market talking about oversold conditions, the bullish percent makes that narrative make more sense. He then reviews the 20+ Year Treasury Bond ETF (TLT) and deciphers what is happening on...

READ MORE

MEMBERS ONLY

Trading the Swing within the Pattern: IGV Example

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists looking to get the jump on a bigger breakout can turn to the swings within a developing pattern. For example, a Symmetrical Triangle after an advance is a bullish continuation pattern. We can get the jump on a breakout by trading a downswing reversal within the pattern. Let'...

READ MORE

MEMBERS ONLY

Navigating Uncertain Times: Market Recap with Mish Schneider

In this special edition of StockCharts TV'sThe Final Bar, Mish Schneider, Chief Strategist at MarketGauge, takes over for Dave Keller to share her thoughts on the daily Market Recap during a day of uncertain news.

This video originally premiered on October 9, 2023. Watch on our dedicated Final...

READ MORE

MEMBERS ONLY

What We Will Use to Ascertain the Market's Next Moves

For consistency, here are the key go-tos during an uncertain time in the market:

1. The next direction of long bonds (TLT).

2. The next direction of the small caps and retail sectors (IWM, XRT).

3. The next direction of commodities, all of them, but particularly the agricultural ones, oil...

READ MORE

MEMBERS ONLY

DP Trading Room: Exponential vs. Simple -- This is the Moving Average We Use

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens the show with a discussion of the yield curve, followed by his coverage of the Magnificent 7+ and the market in general. Erin looks at the effect of war on the Energy sector, as well as a...

READ MORE

MEMBERS ONLY

RRG Shows Explosion In Growth Stocks Is Taunting The Fed

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One thing I repeatedly talk about is ignoring the talking heads and following the charts. If I had to provide a chart as the "poster child" for this, I might start with the following RRG chart:

We're downtrending, right? We're heading back to the...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Stay Vulnerable At Higher Levels; This Sectors Rolls Inside The Leading Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Despite the volatile moves during the four sessions of this week's shortened frame, we ended on a very flat note for the second time in a row. The trading range remained slightly wider compared to the previous week. Compared to the 274.55-point range in the week before,...

READ MORE

MEMBERS ONLY

Maximizing Profits: Three Stocks in Three Phases

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The accumulation phase is marked by higher highs and higher lows, as investors push the price onward and ever upward.

* Stocks in the distribution phase are trending lower, with the price usually below two downward-sloping moving averages.

* A symmetrical triangle or "coil" pattern is a telltale...

READ MORE

MEMBERS ONLY

Small-Caps and Retail Hold the Line in the Sand

I spent all of last week, in the media and in print, going over the importance of 2 key indicators. (See the media clips below.)

1. Our risk gauges on Big View, all of which kept flashing risk-on regardless of the doom-and-gloom and initial selloff in bonds and SPY.

2....

READ MORE

MEMBERS ONLY

MEM TV: Here's What To Do With Base Breakouts and Other Bullish Signals

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the bullish bias that's shaping up in the markets as high-growth areas begin to turn positive. She also provides insights into what's driving this price action, as well as what to be on...

READ MORE

MEMBERS ONLY

10 Crucial Charts Shaping The Markets in October 2023

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this special edition of StockCharts TV'sThe Final Bar, Dave breaks down the crucial charts shaping October 2023's financial landscape.

This video originally premiered on October 6, 2023. Watch on our dedicated Final Bar pageon StockCharts TV, or clickthis linkto watch on YouTube.

New episodes of...

READ MORE

MEMBERS ONLY

Stock Market Ends Week on Positive Note; Market Internals May Be Turning Bullish

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Strong September jobs report caused an initial shock but investors overcame it and the broader stock market indexes all closed higher

* Volatility remained below 20 during the trading day

* In addition to Technology and Communication Services, Financials may be showing bullish strength

September's strong labor market—...

READ MORE

MEMBERS ONLY

BOTH VERSIONS OF S&P 500 TRY TO HOLD SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

S$P 500 TESTS TRENDLINE SUPPORT AND 200-DAY AVERAGE... Last week's message suggested that the S&P 500 was headed for a test of its 200-day moving average (red line) and a rising trendline drawn under its October/March lows. Chart 1 shows that test taking place...

READ MORE

MEMBERS ONLY

Yields Soar on Strong Jobs Report

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

From a bullish perspective, I was hoping to see the "goldilocks" jobs report, one which still showed job growth, but came in below consensus estimates. The thought there is that the Fed would see that its rate-hiking campaign was working and the economy was slowing. Instead, we saw...

READ MORE

MEMBERS ONLY

The Halftime Show: What the Federal Reserve Doesn't Do, The Bond Market Does

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

The bond market is doing what the Federal Reserve hasn't -- raising rates. The fear is something is going to break.

On this week's edition of StockCharts TV'sHalftime, Pete reviews the TLT chart again, talking over the US 2-year yield less the US 10-year...

READ MORE

MEMBERS ONLY

GNG TV: Where You Can Find The "Health" in the Market!

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, Alex and Tyler take a familiar approach to the markets, starting at the top and working their way down. Going into the sectors, it is healthcare that is starting to outperform, and within that sector, healthcare providers are taking the lead. Single...

READ MORE

MEMBERS ONLY

The Top Three Indicators Pressuring Earnings Right Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Jesse Felder of The Felder Report shares his long-term charts comparing price and earnings, and reveals the two charts he's watching now to navigate a potential market bottom. Dave focuses on resilient strength in the semiconductor group and...

READ MORE

MEMBERS ONLY

The Most Important Moving Average to Boost Your Investing Success

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe discusses the importance of the 18-month MA line for investing. He shows how it can provide a bias for a stock or market for years, and how it reveals when to play counter to the trend. Joe...

READ MORE

MEMBERS ONLY

Earnings for 2023 Q2 Still Trending Up

by Carl Swenlin,

President and Founder, DecisionPoint.com

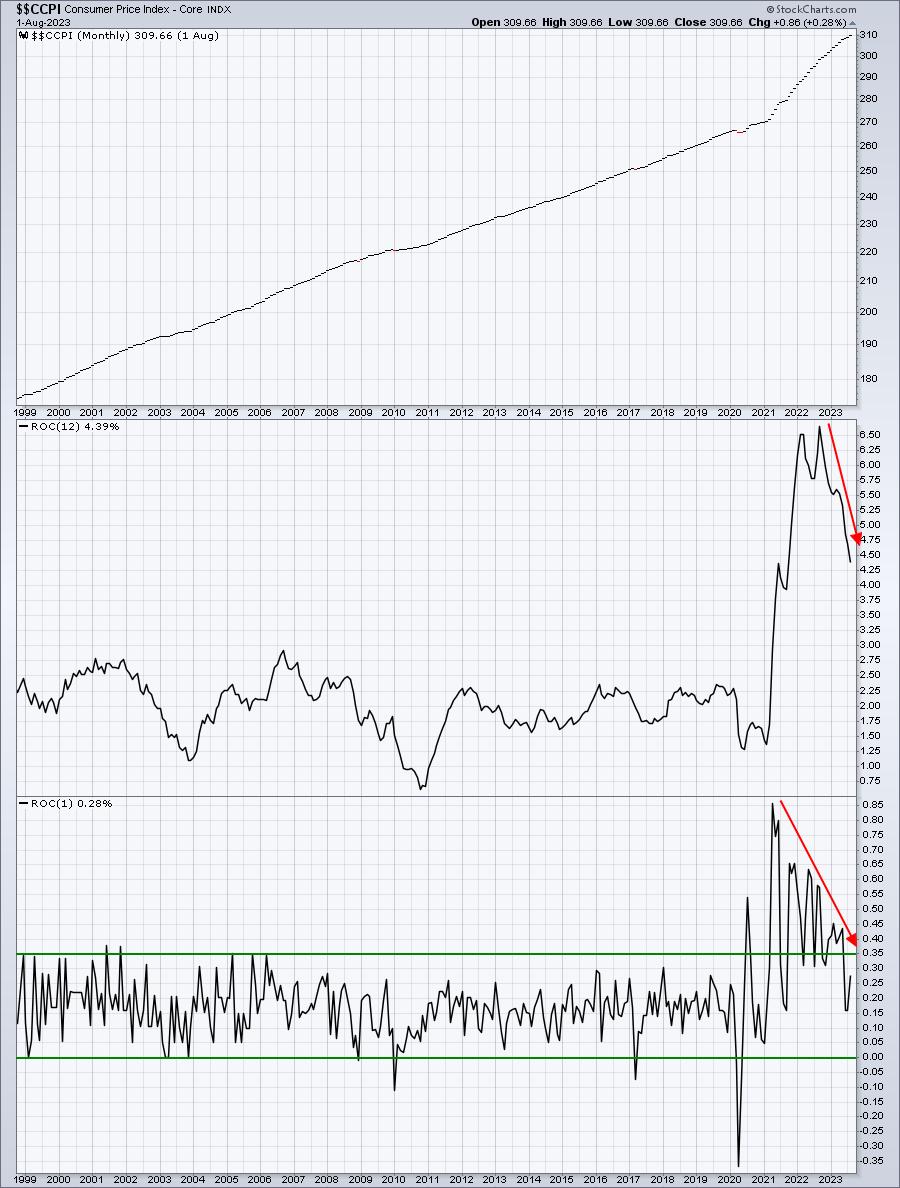

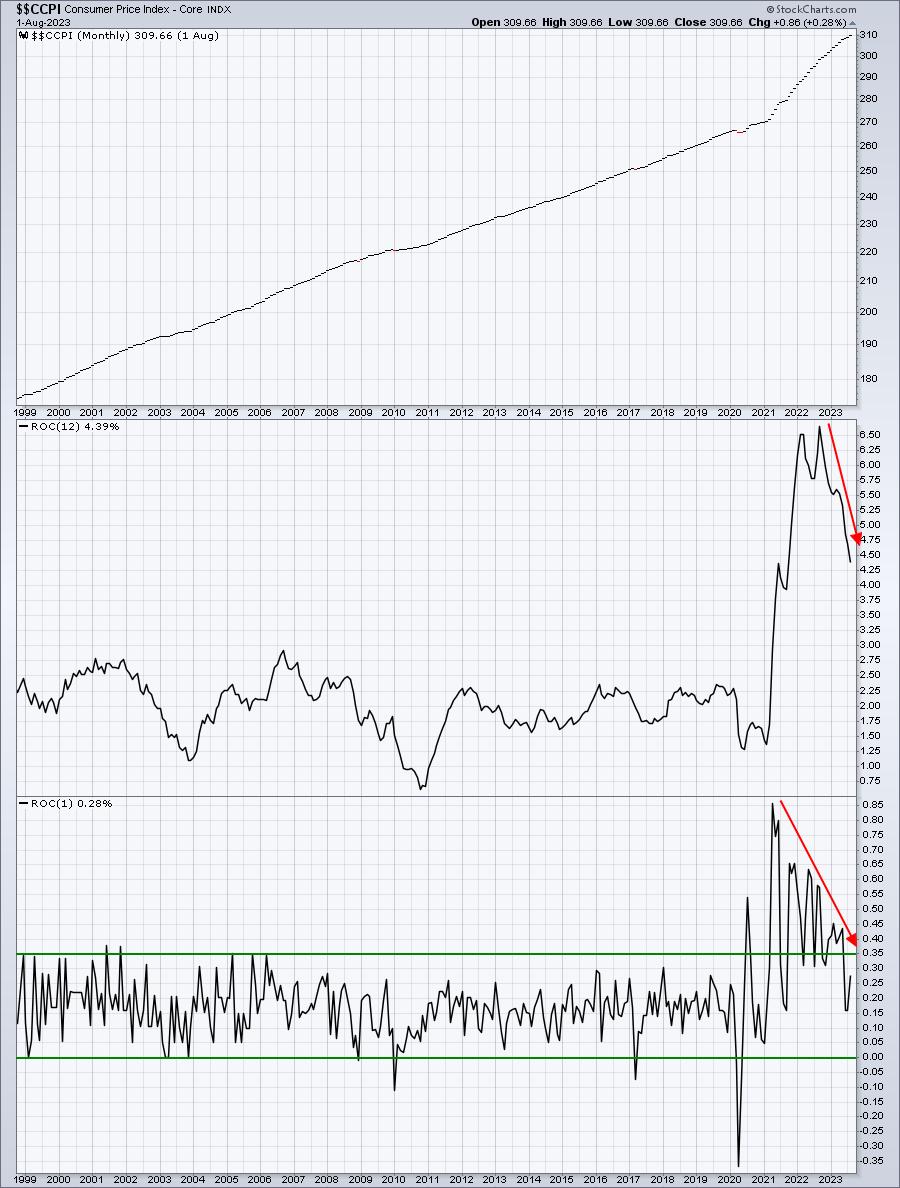

S&P 500 earnings are in for 2023 Q2, and here is our valuation analysis.

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

A Key Momentum Indicator Shifts from Bullish to Bearish for QQQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

QQQ remains well above the rising 200-day SMA, but clearly shifted from bullish to bearish over the last two months. Today's report/video will show this momentum shift and analyze the short-term continuation pattern taking shape.

The chart below shows QQQ trading well above the rising 200-day SMA....

READ MORE

MEMBERS ONLY

Watch Mish on Real Vision and More!

Yesterday, we covered the 80-month moving average in small caps and retail.

Today, I did several interviews -- some already out (BNN Bloomberg), others out soon (Financial Sense with Jim Pupluva), and the one that you'll find on YouTubelater today with Real Vision.

We chose this one to...

READ MORE

MEMBERS ONLY

How Market Breadth Indicators Can Lead You Out of Market Bottoms

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave digs out his market correction playbook and shares what market breadth indicators tend to do leading into and out of market bottoms. He also reveals the charts that can serve investors well in corrective phases, using relative strength as...

READ MORE

MEMBERS ONLY

10-Year Yield Spike Doesn't Mean Stock Market Will Plummet; You Need to See This Powerful Chart

by Karl Montevirgen,

The StockCharts Insider

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Rising yields have wreaked havoc on equities but it's not necessarily a cause for worry

* Growth stocks have performed well during high interest rate environments and are likely to do so again

* The Bullish Percent Index can signal when a turnaround will occur

The stock market...

READ MORE

MEMBERS ONLY

How to Not Just Survive But PROSPER During Market Downturns

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave shows his methodology in action by discussing his current portfolio and how he is seeing each position to its fruition. He then resumes his series on Jesse Livermore. This week, he explains how years of experience can give you intuition,...

READ MORE

MEMBERS ONLY

When the Dollar Stops Going Up, Will These Markets Stop Going Down?

by Martin Pring,

President, Pring Research

The Dollar Index

I last wrote an article on the dollar in August, The Dollar Index Goes to Missouri. In it, I pointed out that the Index had reached crucial resistance, which, if surpassed, would signal a new primary bull market and a likely fourth up leg to the secular...

READ MORE

MEMBERS ONLY

Time to Talk 6-7 Year Market Business Cycles

We began the year examining the 23-month moving averages in all the indices and major market sectors. It was pretty simple, really: buy anything that cleared the blue line (2-year business cycle), which we explained was a good reflection of a cycle within a cycle (6-7 year cycles are typical)...

READ MORE

MEMBERS ONLY

Here's a Scary Scenario for You: S&P 500 Downside to 2200?!?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Jeff Huge, CMT of JWH Investment Partners updates his Elliott Wave count for the S&P 500 and shares what the MOVE index can tell us about further upside potential for interest rates. Dave recaps the continued deterioration...

READ MORE

MEMBERS ONLY

Two Holding Up and Two Breaking Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The pockets of strength are shrinking as more stocks succumb to selling pressure. The Nasdaq 100 is the strongest of the major indexes, while the Finance sector is one of the weakest sectors. Today's report will highlight two leaders within the Nasdaq 100 and two laggards within the...

READ MORE

MEMBERS ONLY

Sector Rotation Makes Technology Line Up With Strong Seasonality Pattern

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Market is entering strongest period of the year

* Positive seasonal expectations for Technology and Financials

* Weaker outlook for Healthcare and Energy

* Current rotations for Tech and Healthcare are in line with seasonality

We are already in October .... How did that happen?

Also, I am writing this article while...

READ MORE

MEMBERS ONLY

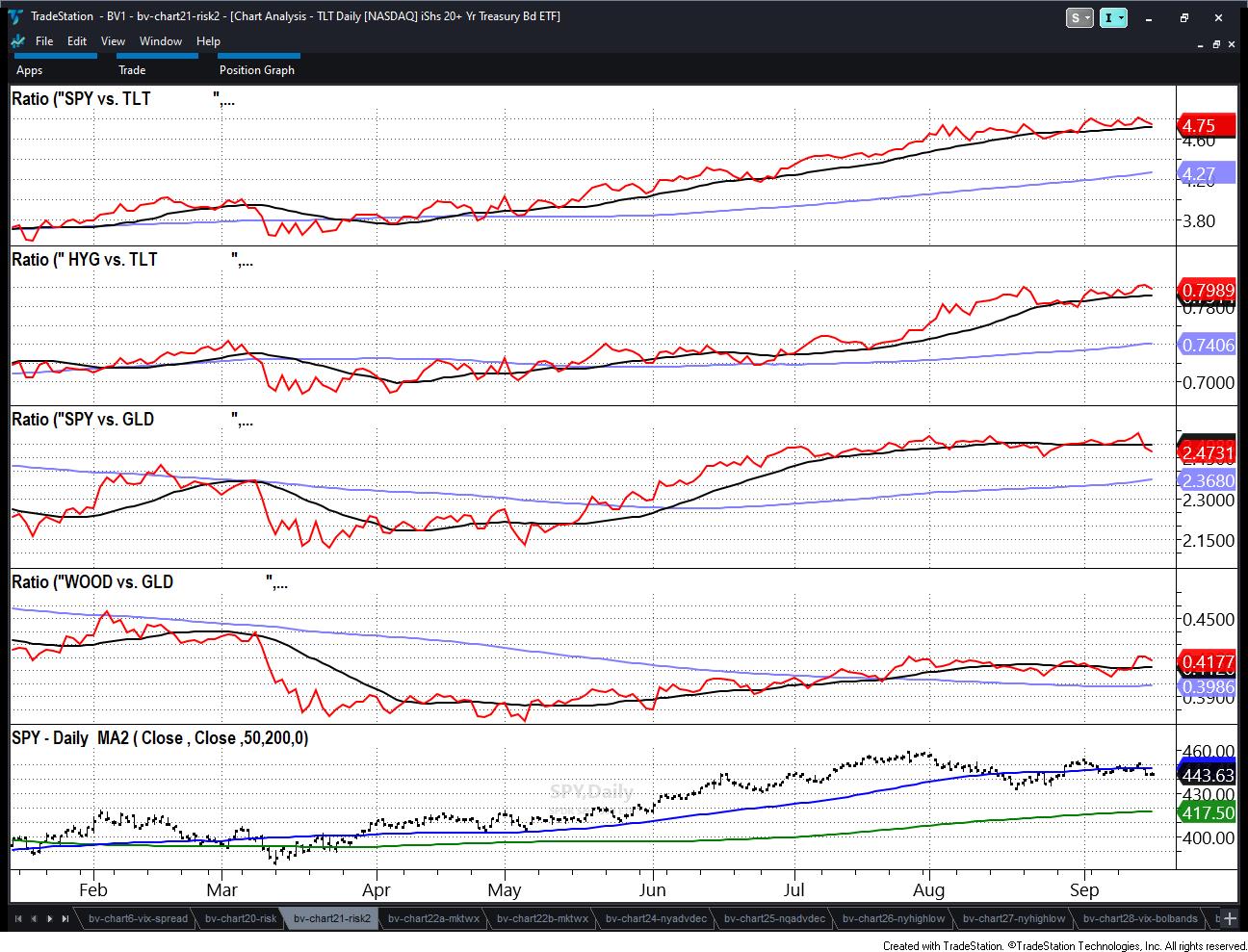

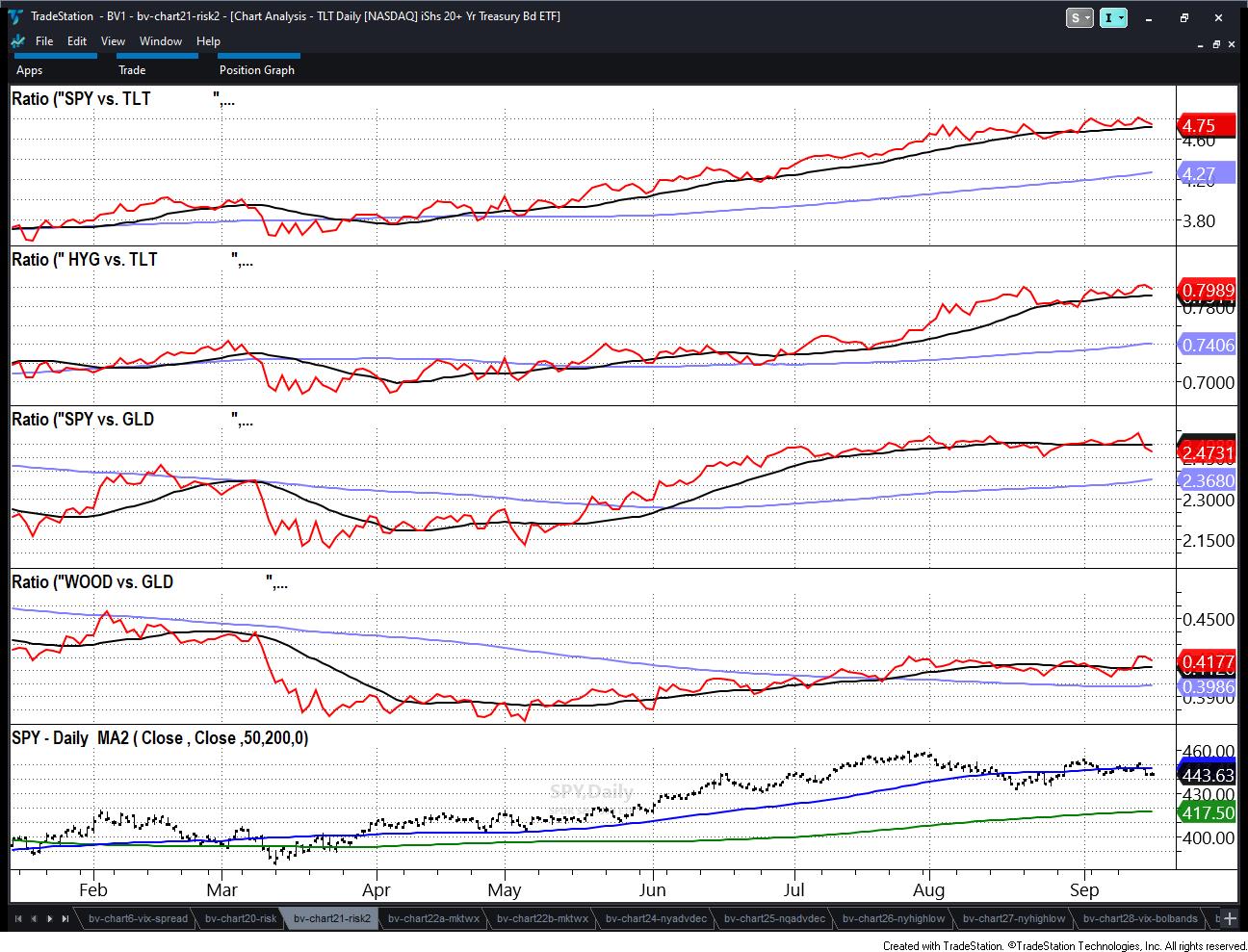

3 Key Relationships to Help Assess Market Direction

If you are finding yourself fluctuating between bullishness and bearishness, then congratulations! Hopefully, that also means you are waiting for certain signals to help you commit to one way or another.

Here are the signals we are waiting for before overly committing to a bias:

1. As we wrote over...

READ MORE

MEMBERS ONLY

Watch for These Signs of a Bottom As Market Breadth Conditions Crumble

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shows how market breadth conditions have continued to deteriorate to the point where signs of a bottom may emerge. He answers viewer questions on historical Fed cycles, under-performance of defensive sectors like utilities, and how to use technical analysis...

READ MORE

MEMBERS ONLY

DP Trading Room: This is the ONLY Sector Showing STRENGTH Right Now

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl, after a walkthrough of the Magnificent 7+ stocks, examines how, while it was clear that there's some strength to be had in the Nasdaq, one look at the Ultrashort for Dow 30 (SDOW) and an internal...

READ MORE

MEMBERS ONLY

Focus on Stocks: October 2023

by Larry Williams,

Veteran Investor and Author

First & Foremost

I want to personally thank you for subscribing to "Focus on Stocks". I will do all I can to earn the confidence you have placed in me. -- Larry Williams

Is it a Different World?

"I have to pay attention to the implications of...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Violates Important Levels; Stay Cautious and Selective in Approach

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Although the market stayed flat on a week-to-week basis, the past five trading sessions highlighted the possibility of the market continuing with its corrective retracement. In the previous technical note, it was categorically mentioned that the INDIAVIX had closed at a precariously low level, which had left us vulnerable to...

READ MORE

MEMBERS ONLY

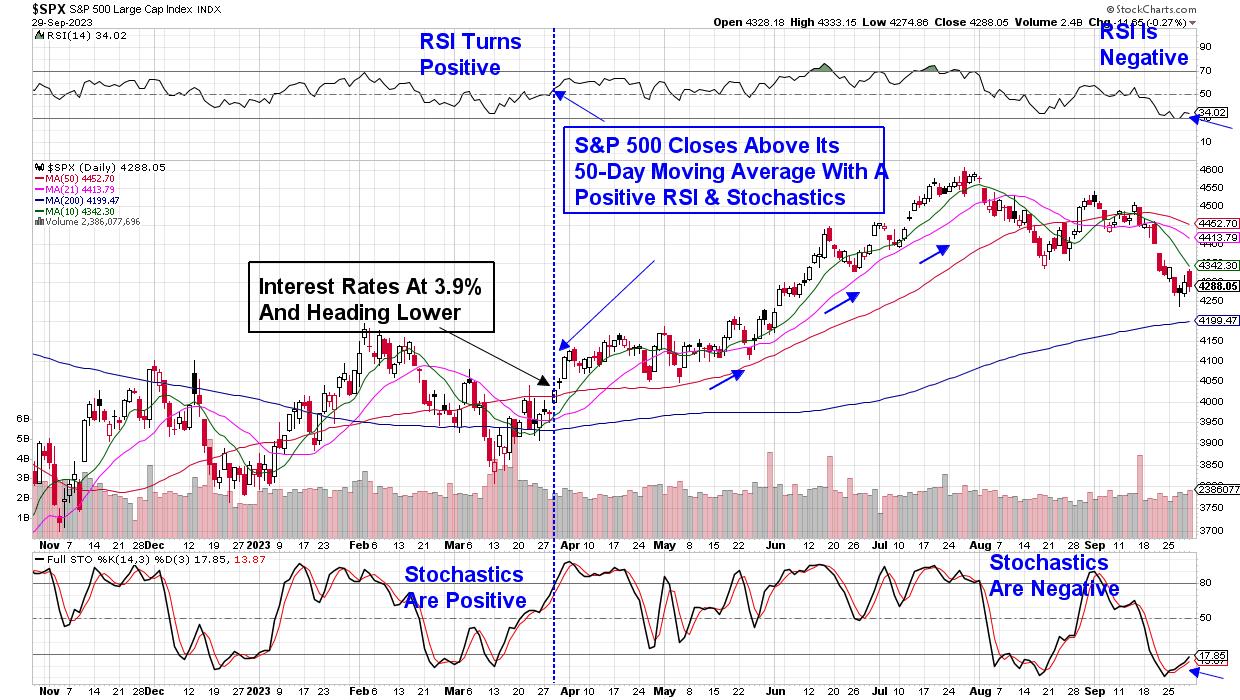

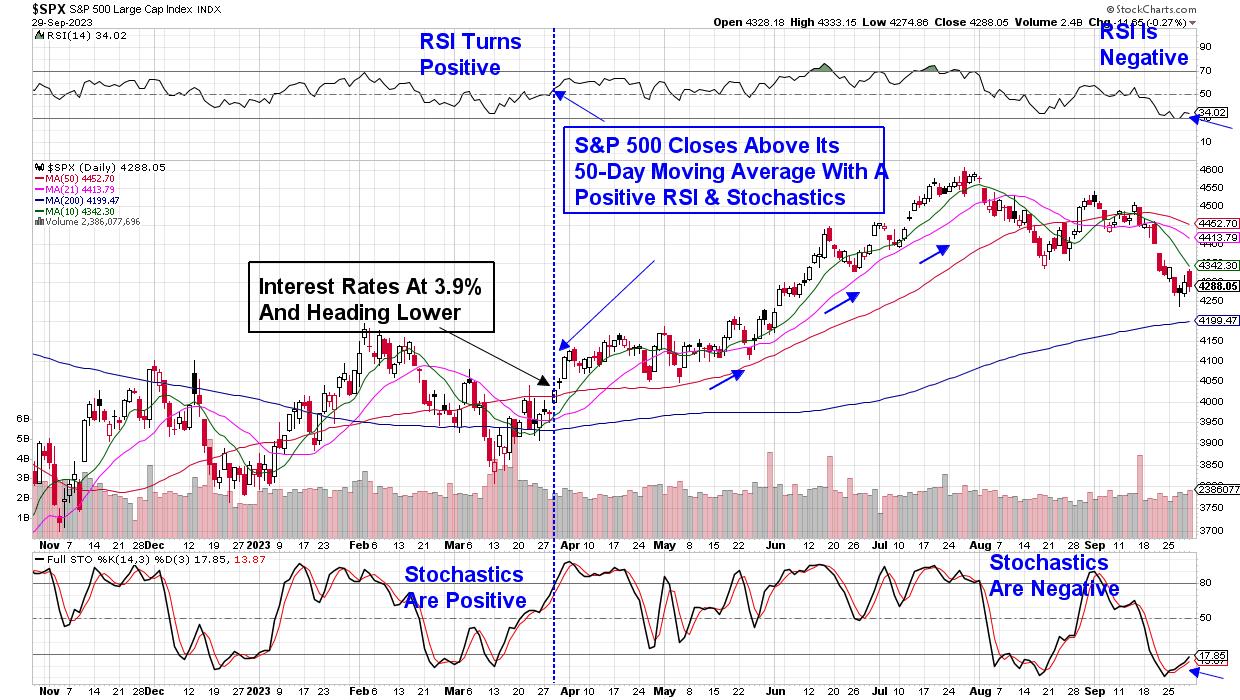

The Worst Month of the Year is Behind Us -- Here's What We Need to See for Better Times Ahead

by Mary Ellen McGonagle,

President, MEM Investment Research

The S&P 500 posted its worst month so far this year, with a 4.9% decline that's pushed the year-to-date returns for this benchmark index almost in half. With elevated interest rates that may be with us for a while, investors have pushed stocks lower, in...

READ MORE

MEMBERS ONLY

MEM TV: Here's Why the Nasdaq OUTPERFORMED Last Week

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews areas of the market that are bucking the downtrend pressure elsewhere, as those often go on to provide leadership once the markets turn. She also shares how to use ETFs to uncover rotation taking place beneath the...

READ MORE