MEMBERS ONLY

Will the Test of Last October's High for Bond Yields be Successful?

by Martin Pring,

President, Pring Research

The 30-year yield reached its high point last October and has been rangebound since December. Chart 1 shows that it began to break out of that trading range in late July, but has yet to succeed in taking out the October high. The 14-day RSI is currently correcting from an...

READ MORE

MEMBERS ONLY

Big Tech, Big Troubles

by Carl Swenlin,

President and Founder, DecisionPoint.com

The seven mega-tech stocks, known to some as the Magnificent Seven, have had a magnificent advance since late last year, but now we're seeing some weakness, and it is likely that they will be under-performing for a while. Many have been affected by an emerging expectation of miracles...

READ MORE

MEMBERS ONLY

Dow Bounces Off Support: A New High in the Cards?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* DIA bounced off its 21-day exponential moving average

* The SCTR score is above 70 and market internals are looking positive

* Index ETFs can be a great way to get exposure to an index without owning individual stocks

If you look at the performance of the S&P...

READ MORE

MEMBERS ONLY

Market Breadth Indicators Signal Selling Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, David Keller, CMT tracks the initial selloff and subsequent recovery for the S&P 500 and Nasdaq, with bullish candle patterns popping up on charts like AAPL. He digs into market breadth indicators, which have signaled a likely rotation...

READ MORE

MEMBERS ONLY

July 6-Month Calendar Range Hits August Doldrums, Part 2

Today, we're continuing to look at the reset of the July 6-month calendar ranges in 4 of the Economic Modern FamilySectors.To remind you, the range is good until the next time it resets in January 2024.

Beginning with Transportation (IYT), as of last Friday, it has begun...

READ MORE

MEMBERS ONLY

Sector Spotlight: Risk to S&P as Technology Under Pressure

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I take a look at the rotations for asset classes and sectors. The current state of the rotations in asset classes shows Bitcoin and Commodities far away from the benchmark, which could provide ample opportunities to benefit from larger moves...

READ MORE

MEMBERS ONLY

RRG Finds Three Strong Stocks in Materials Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Materials Sector Steering Towards Leading Quadrant at Strong RRG Heading

* Twelve Stocks In the Materials Sector are at a North Eastern Trajectory

* PKG, WRK, and NUE look particularly interesting

Looking at the Relative Rotation Graph for US sectors, we can see the Materials sector pops up as potentially...

READ MORE

MEMBERS ONLY

A HUGE Double Top Pattern in the S&P 500?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, Dave sets the table for this week with a focus on FAANG stocks breaking down (MSFT, AAPL) vs. those still trending higher (META, GOOGL) as well as a potential rotation into financials XLF and energy XLE. He answers viewer questions...

READ MORE

MEMBERS ONLY

The July 6-Month Calendar Range Hits August Doldrums

It's summertime, and the living should be easy. Folks do tend to go away in August as the market tends to chop around on lower volume. This August proves to be no exception thus far.

What is interesting though, is looking at the reset of the July 6-month...

READ MORE

MEMBERS ONLY

DP Trading Room: Finding Pockets of Strength in Financials

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens by reviewing the "Magnificent 7+", a.k.a. the mega-cap darlings plus Tesla (TSLA). He discusses Apple (AAPL)'s demise and later discusses possible support levels. The bias is bearish in all three timeframes,...

READ MORE

MEMBERS ONLY

Week Ahead: Precariously Low Levels Of VIX Poses Continued Threat To NIFTY; RRG Shows Defensive Setup

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly technical note, it was mentioned about the vulnerability that the market faces due to extremely low levels of VIX. It was expected that such low levels of VIX had left the markets vulnerable to violent profit-taking bouts from higher levels. Precisely on these lines, the Indian...

READ MORE

MEMBERS ONLY

Power Charting TV: Stock Selection with the Wyckoff Market Report

by Bruce Fraser,

Industry-leading "Wyckoffian"

Being able to efficiently drill down from Sector to Industry Group to best Stock ideas is critical to an effective methodology. John Colucci guest hosts this episode of Power Charting to illustrate such a method and the scanning principles developed for the ‘Wyckoff Market Report'. Johni Scan (editor) does...

READ MORE

MEMBERS ONLY

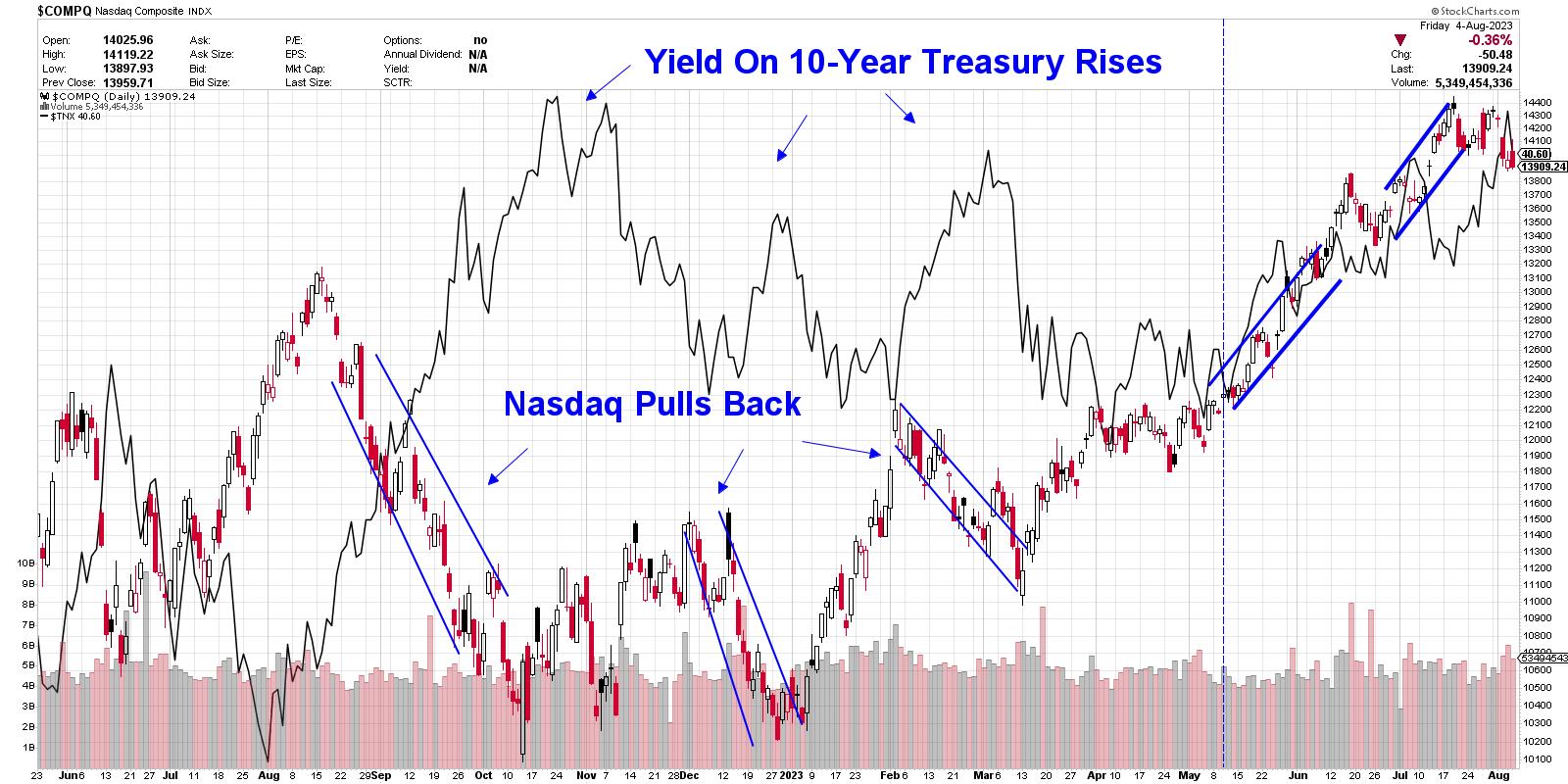

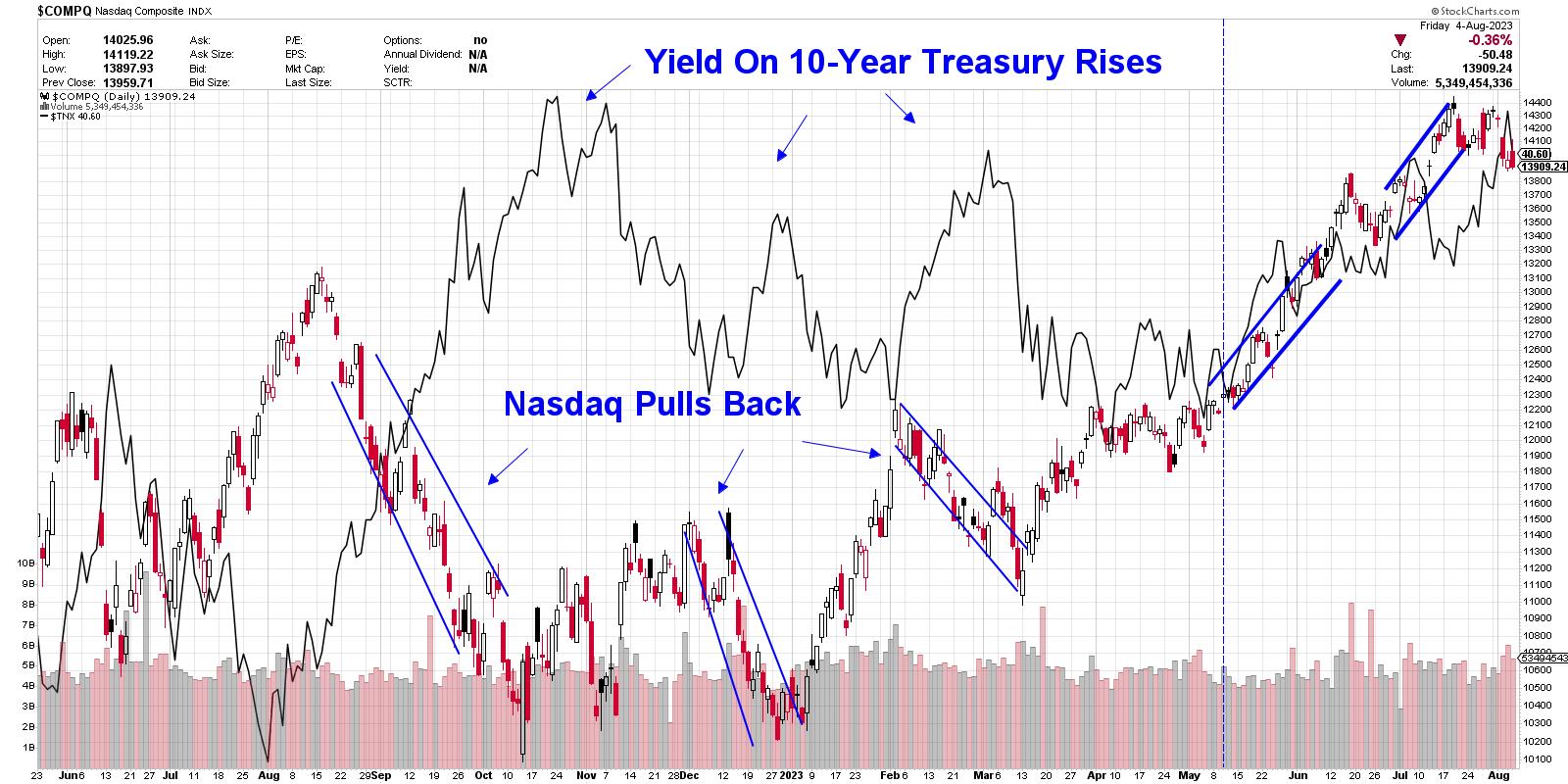

Tech Wreck Leads Markets Into a Downtrend -- Here's Where Key Support Lies

by Mary Ellen McGonagle,

President, MEM Investment Research

According to the Stock Trader's Almanac, August has been the weakest month for the Dow and the second-worst month for the S&P 500 since 1987. (September is the worst month). This seasonal weakness, coupled with over exuberance among investors, has set the markets up for at...

READ MORE

MEMBERS ONLY

MEM TV: Nasdaq & S&P Enter Downtrends After Tough Week

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what drove the markets lower, as well as key area of support for the broader market indices. She also shares areas that remain positive and why, and provides example stocks.

This video originally premiered August 4, 2023....

READ MORE

MEMBERS ONLY

Growth Stocks Begin Down a Slippery Slope

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Two key breadth indicators, the McClellan Oscillator and the Nasdaq 100 Bullish Percent Index, both registered bearish signals this week.

* While AMZN gapped higher on earnings and AAPL plunged lower, both stocks ended the week with bearish candle patterns.

* Investors can use Fibonacci Retracements along with moving averages...

READ MORE

MEMBERS ONLY

A Fresh Look at Precious Metals

We finished a very heavy week filled with all kinds of data:

1. Fitch downgrade

2. Earnings -- Amazon up, Apple down

3. Jobs report -- wages rising

4. Treasury Yields higher -- at October 2022 highs

5. Record temperatures around the globe, including winter in S. America

6. Oil...

READ MORE

MEMBERS ONLY

Tech Stocks Face BIG TIME Thrashing as Apple Disappoints

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, Dave tracks the bearish rotation for the technology sector as earnings misses for AAPL, PANW, FTNT, and others put downside pressure on the Nasdaq. He answers viewer questions on On Balance Volume, Chaikin Money Flow, and technical analysis techniques when...

READ MORE

MEMBERS ONLY

Oh Boy... Here Comes the Pullback!

by TG Watkins,

Director of Stocks, Simpler Trading

It's been at least a week in the making, but the pullback that TG thought was going to happen late last week showed up middle of this week, due to the Fitch downgrade of the US from AAA to AA+. On this week's edition of Moxie...

READ MORE

MEMBERS ONLY

Slower Job Growth, Treasury Yields, Earnings: Stock Market Looks For Support

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

It was quite a week in the stock market. The early part was relatively calm, but then things got a little hairy. You can thank the Fitch Ratings downgrade of US long-term debt from AAA to AA+ for the quick pivot in investor sentiment.

The reason for the downgrade: "...

READ MORE

MEMBERS ONLY

Larry Williams is LIVE! How to Access His Exclusive Newsletter + Webinar NOW

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson announces a brand new stock market service from Larry Williams called "Focus On Stocks".Available now for all StockCharts Members, Larry's newsletter brings you exclusive market insights from one of the most...

READ MORE

MEMBERS ONLY

ENERGY SECTOR IS BREAKING OUT TO THE UPSIDE -- RISING PRICES CARRY GOOD AND BAD NEWS

by John Murphy,

Chief Technical Analyst, StockCharts.com

UPSIDE ENERGY BREAKOUTS...Last week's message listed energy as the strongest market sector over the last week and month. That positive trend continued this past week with some upside breakouts taking place. Chart 1 shows the United States Oil Fund (USO) trading above its April high. WTIC hasn&...

READ MORE

MEMBERS ONLY

Caclulating the Risk of S&P 500 Downside Below October 2022 Low

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, guest Jeff Huge, CMT of JWH Investment Partners shares his Elliott Wave chart of the S&P 500, including a downside projection well below the October 2022 low. Host David Keller, CMT reveals another market breadth indicator registering a...

READ MORE

MEMBERS ONLY

GNG TV: Does a BIG Changing of the Guard Signal More Trouble for Tech Stocks?

by Alex Cole,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, Alex walks viewers through the markets from a trend perspective, using the lens of the GoNoGo charts. He then shows a few charts of crypto markets.

This video originally premiered on August 3, 2023. Click this linkto watch on YouTube.

Learn more...

READ MORE

MEMBERS ONLY

The Wisdom of Waiting for Your Pitch

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave shows his methodology in action with a trade that's "dead money?" He shows new mystery charts, updates some old ones, and emphasizes why money and position management is so crucial. He then continues his series on...

READ MORE

MEMBERS ONLY

The Halftime Show: Fitch Downgrade Sends TLT Closer to Target Set Months Ago

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

There is no way around the fact that as bonds fall, yields rise. Some say this is a non-event, while Pete says, "let the trends tell you what type of event this is." Mega-caps have pulled back, but two massive names are due to report tonight, Apple and...

READ MORE

MEMBERS ONLY

Why the MACD Pinch Play is So Valuable

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains why the MACD pinch play is so valuable. This pattern gives us plenty of important information about the stock and can be a great tool to identify stocks that are about to provide trading opportunities. Joe...

READ MORE

MEMBERS ONLY

Growth Stocks are PLUNGING Now? Blame Fitch Downgrade!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, guest Jay Woods, CMT of Freedom Capital Markets talks downside targets for the S&P 500 and Nasdaq 100, and also highlights one key sector with upside potential. Meanwhile, Dave reveals a huge sell signal from an important measure...

READ MORE

MEMBERS ONLY

Focus on Stocks: August 2023

by Larry Williams,

Veteran Investor and Author

Hi Gang.

Larry Williams here. Welcome to my new stock market service called "Focus On Stocks," which I'm creating in conjunction with my friends at StockCharts.com.

As a "Focus On Stocks" subscriber, you now have access to my latest market analysis. Be sure...

READ MORE

MEMBERS ONLY

Granddad Russell, Grandma Retail and Grand Debt

On August 1st, as many cheered the rise in GDP (partly because consumer spending is 70% of the GDP), another agency did not cheer at all.

With Government Debt to the GDP ratio super high, coupled with high interest rates, Fitch was not having it. They see this as a...

READ MORE

MEMBERS ONLY

Covered Calls: Dipping Your Toes In the Options World

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* When selecting an options contract for your covered call look at probabilities and days to expiration

* Know the best case scenario, worst case scenario, and the sweet spot when trading covered calls

* Understand the risks and rewards of covered calls

Have you considered renting a room in your...

READ MORE

MEMBERS ONLY

Will Rising Oil Prices Smack the S&P 500?

As the market and economy cheer the rise in GDP, we can thank consumer spending, 70% of GDP; services (what consumer pay for in aid, help or information), 45% of GDP; and government spending, about 19% of GDP.

Hence, one sector to watch carefully is retail, or our Granny XRT....

READ MORE

MEMBERS ONLY

Pay Attention to THIS! The Market is About to Skyrocket

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, guest Ari Wald, CFA CMT of Oppenheimer shows how overbought conditions have actually been a long-term bullish signal for the S&P 500 and Nasdaq. Dave highlights stocks reporting earnings today, including Eaton Corporation (ETN), Caterpillar (CAT), Stanley Black...

READ MORE

MEMBERS ONLY

Sector Spotlight: Industrials & Tech Headed to Uncharted Territory

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, on this first day of of August, I go over the completed monthly sector charts for July, looking for trends and support/resistance levels. I then wrap all of this up in a table, and finally talks the monthly Relative...

READ MORE

MEMBERS ONLY

CrowdStrike Shows Strength and Leadership with Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

CrowdStrike (CRWD) is separating itself from the rest of the pack with a breakout and nine month high.

The chart below shows CRWD with an uptrend working throughout 2023. The stock bottomed in January, advanced to the 140 area and hit resistance here in March-April (thick red line). The stock...

READ MORE

MEMBERS ONLY

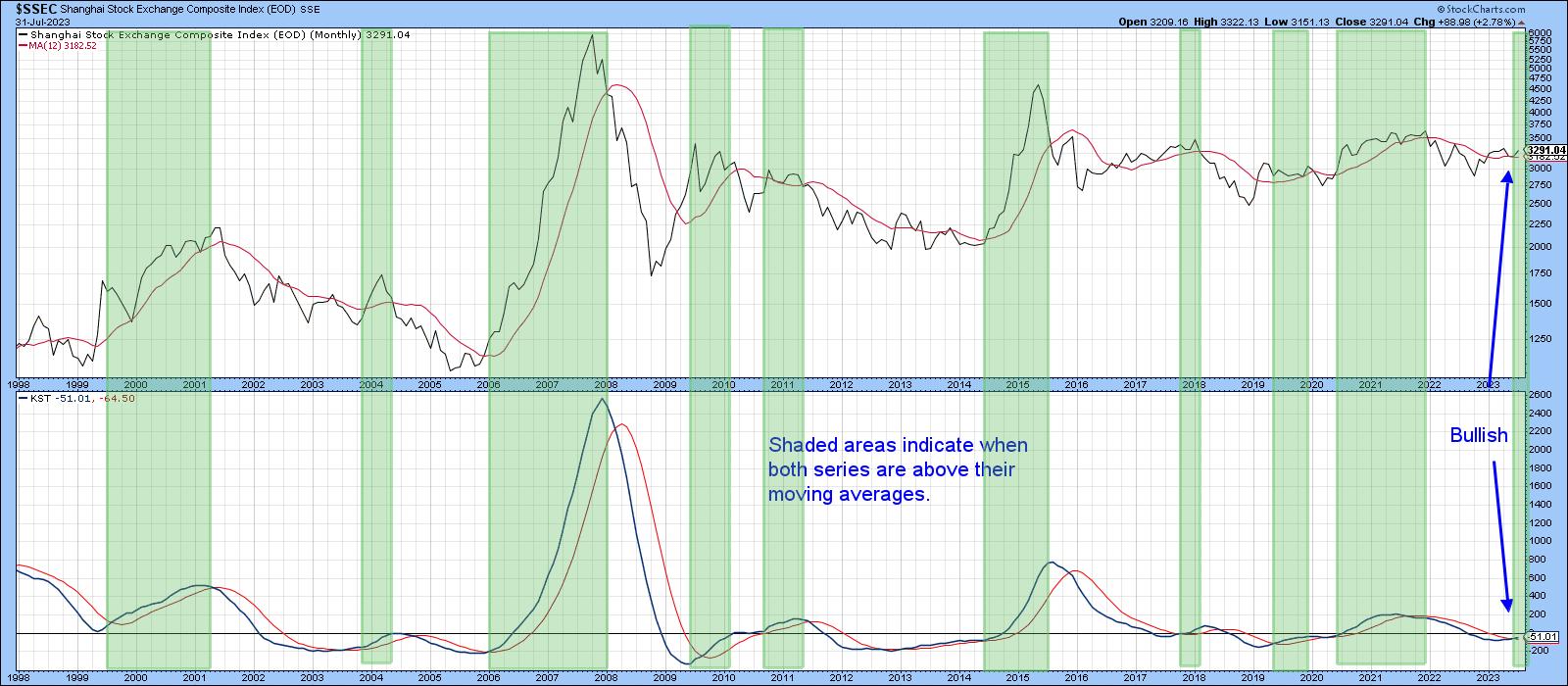

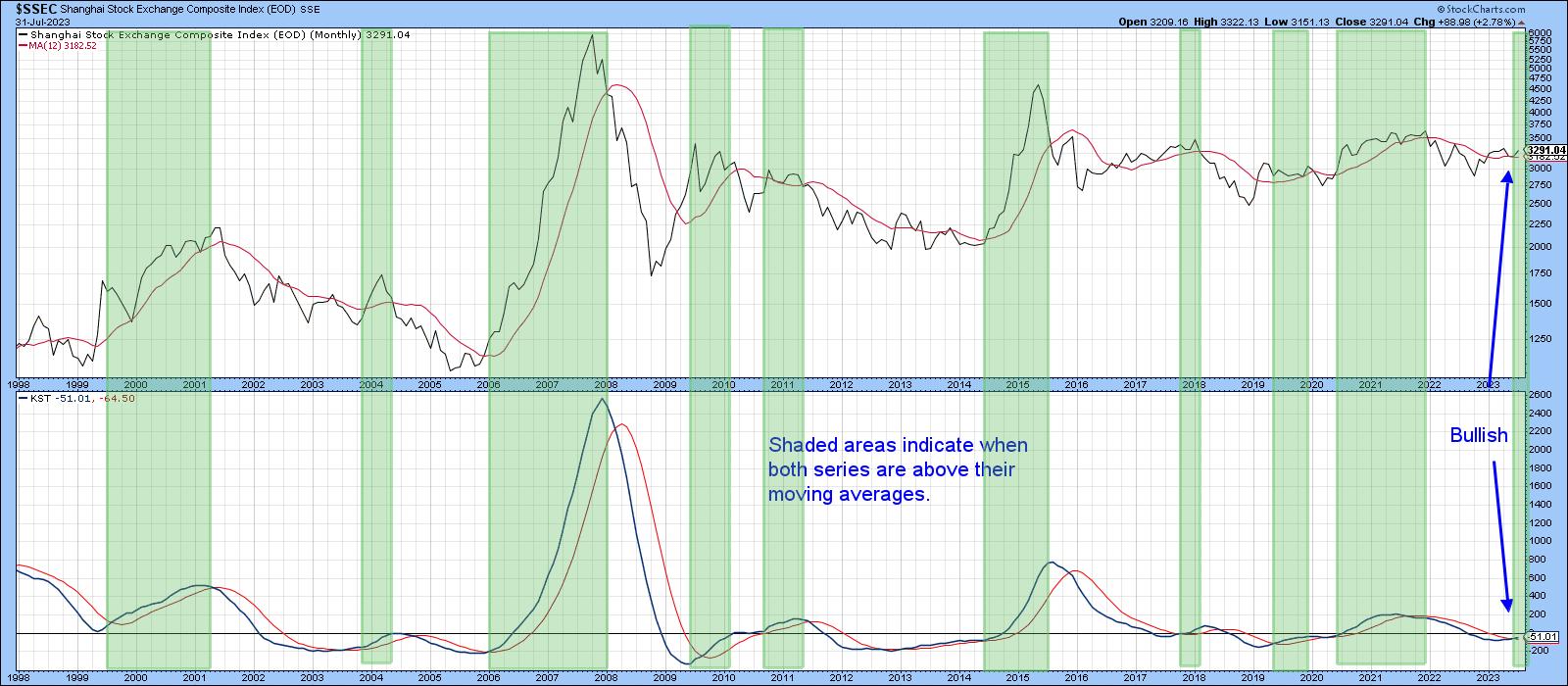

It's Time for These Chinese ETFs to Play Catch-Up

by Martin Pring,

President, Pring Research

There have recently been a lot of depressing stories concerning the state of the Chinese economy. Here are a spattering of headlines that appeared just today:

* China's Economic Recovery Weakens as Growth Concerns Linger (WSJ)

* China Manufacturing Keeps Shrinking, Weighing on Economic Recovery (Bloomberg)

* More Stimulus "Desperately...

READ MORE

MEMBERS ONLY

Breaking Down the Heavy Earnings Week

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, Dave breaks down a heavy earnings week featuring AAPL, AMZN, COIN, PYPL, COP, and others. Will this week illustrate the rotation from growth sectors like technology to value sectors like energy and materials? Dave also answers viewer questions on chart...

READ MORE

MEMBERS ONLY

What Does it Take to Build EV Charging Stations?

Headline over the weekend:

"GM, Other Big Automakers Form EV Charging Joint Venture"

Tesla (TSLA) is the dominant player in the EV space. As such, and with its supercharger network, several car companies have teamed up with Tesla for their charging stations.

To see more EV sales all...

READ MORE

MEMBERS ONLY

The Biggest Problem with Technical Analysis? Part 2: Trend Following!

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

This is the second video in a multi-part educational series from Tyler Wood, CMT and Alex Cole, co-founders of GoNoGo Charts®.

In this part, Alex and Tyler expand upon the concept of a rules-based approach to trend identification. This video offers real-time examples of trend-following concepts and covers multiple timeframes,...

READ MORE

MEMBERS ONLY

DP Trading Room: The "Magnificent 7" Mega-Caps

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl starts the program with an in-depth review of the "Magnificent 7" + Tesla (TSLA). These mega-cap stocks help us determine the temperature of the major indexes, and bias assessment suggests weakness under the surface in the short...

READ MORE

MEMBERS ONLY

Sector Spotlight: Energy & Tech's Opposite Seasonal Rotations

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, on this last day of July, I look at the expected seasonal patterns for the coming month of August and examine whether the current sector rotation, as seen on the Relative Rotation Graphs for any of the sectors, lines up...

READ MORE