MEMBERS ONLY

Can We Use Golf to Forecast Oil Prices?

by Martin Pring,

President, Pring Research

There used to be a rule of thumb on Wall Street that, whenever brokers upgraded to a new office after years of making do with smaller premises, it was the sign of market peak. Such behavior typically followed years of a bull market in which the investment houses had grown...

READ MORE

MEMBERS ONLY

It's Not Just About Small Caps; Look Here Too

Last week, I was listening to an analyst talking about small caps. He basically poo-poo'd their importance and therefore influence on the overall market conditions.

Now, this is our Granddad Russell (IWM) -- the representative of stuff made in the USA.

He went on to say that IWM...

READ MORE

MEMBERS ONLY

DP Trading Room: PMO Surge in Technology

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Erin, flying solo, dives right in to the market action with a focus on yields and bonds. The sector landscape looks very healthy, but Technology (XLK) saw a new PMO Surge (bottom above the signal line) accompanied by strong...

READ MORE

MEMBERS ONLY

The Halftime Show: Tech Anticipated the Inflation Slowdown

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

In this week's edition of StockCharts TV'sHalftime, Pete takes a look at some ratio charts, including defensive sectors. He highlights an indicator that seems to be playing out in the markets right now. Pete shares his belief that the tech indexes, including tech-heavy names, have moved...

READ MORE

MEMBERS ONLY

What Could Go Wrong This Week? Ummmm, A Lot!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I remain steadfastly bullish, but I do recognize reasons to be short-term cautious when I see them. I suppose the first question is, "what does it mean to be cautious." Well, I can only tell you what it means to me. While I still believe it makes sense...

READ MORE

MEMBERS ONLY

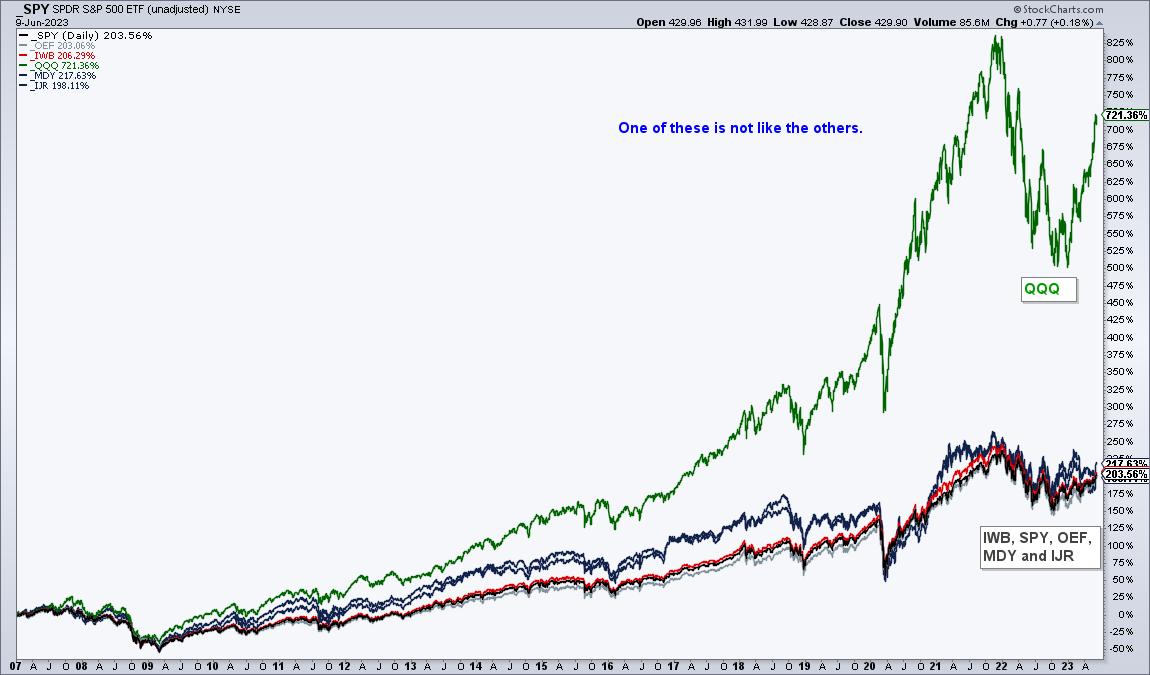

The Nasdaq 100 vs the Rest of the World

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

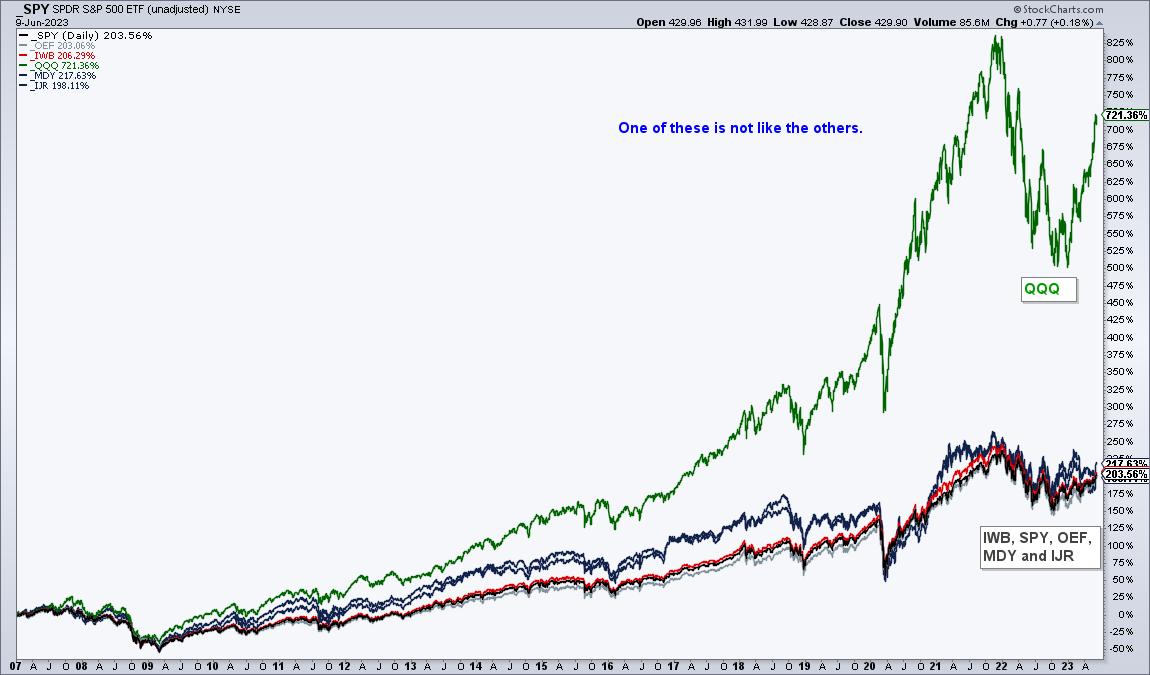

A long-term chart shows why the Nasdaq 100 is the place to be, or at least, "was" the place to be. Past performance does not guarantee future performance. The performance chart below shows the 16+ year percentage gain for QQQ and five other ETFs. These include the S&...

READ MORE

MEMBERS ONLY

Week Ahead: These Two Factors Delay Breakout for NIFTY; Stay Selective and Watch These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

This was the second week in a row where the markets delayed their breakout and continued to flirt with the key levels. This time, they continued to stay largely in a defined range and resist the key levels. The NIFTY50 index remained above the crucial supports; at the same time,...

READ MORE

MEMBERS ONLY

Down-and-Out Stocks Entering New Uptrends - These 8 Traits Will Help You Pick a Winner

by Mary Ellen McGonagle,

President, MEM Investment Research

The markets are seeing a continuation of last week's broadening out into areas beyond mega-cap FAANMG names. Most of the biggest gainers have been beaten-down stocks regaining their footing amid a move back into Cyclical areas of the market. The rally in these stocks began after last Friday&...

READ MORE

MEMBERS ONLY

Want More Market Insights and Trade Ideas? Try These Tools

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, we're going beyond the charts with, well... more charts! Grayson takes viewers on an action-packed tour of seven different StockCharts tools – Seasonality Charts, PerfCharts, CandleGlance, GalleryView, RRG Charts, MarketCarpets, and the Dynamic Yield Curve. These...

READ MORE

MEMBERS ONLY

MEM TV: New Uptrends Amid Sector Rotation!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the continued rotation into Cyclicals while sharing stocks that are in the beginning stages of new uptrends. She also shares how to use intraday charts to trade fast-moving AI-related stocks.

This video was originally broadcast on June...

READ MORE

MEMBERS ONLY

The Super Bullish to the Super Bearish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

One of my favorite parts of hosting a show on StockCharts TVis being able to interview analysts, traders, and money managers with all sorts of different backgrounds.

Recently, I was asked in our mailbag segment about why and how my guests can have very different takes on the markets at...

READ MORE

MEMBERS ONLY

Major Investing Themes Upcoming

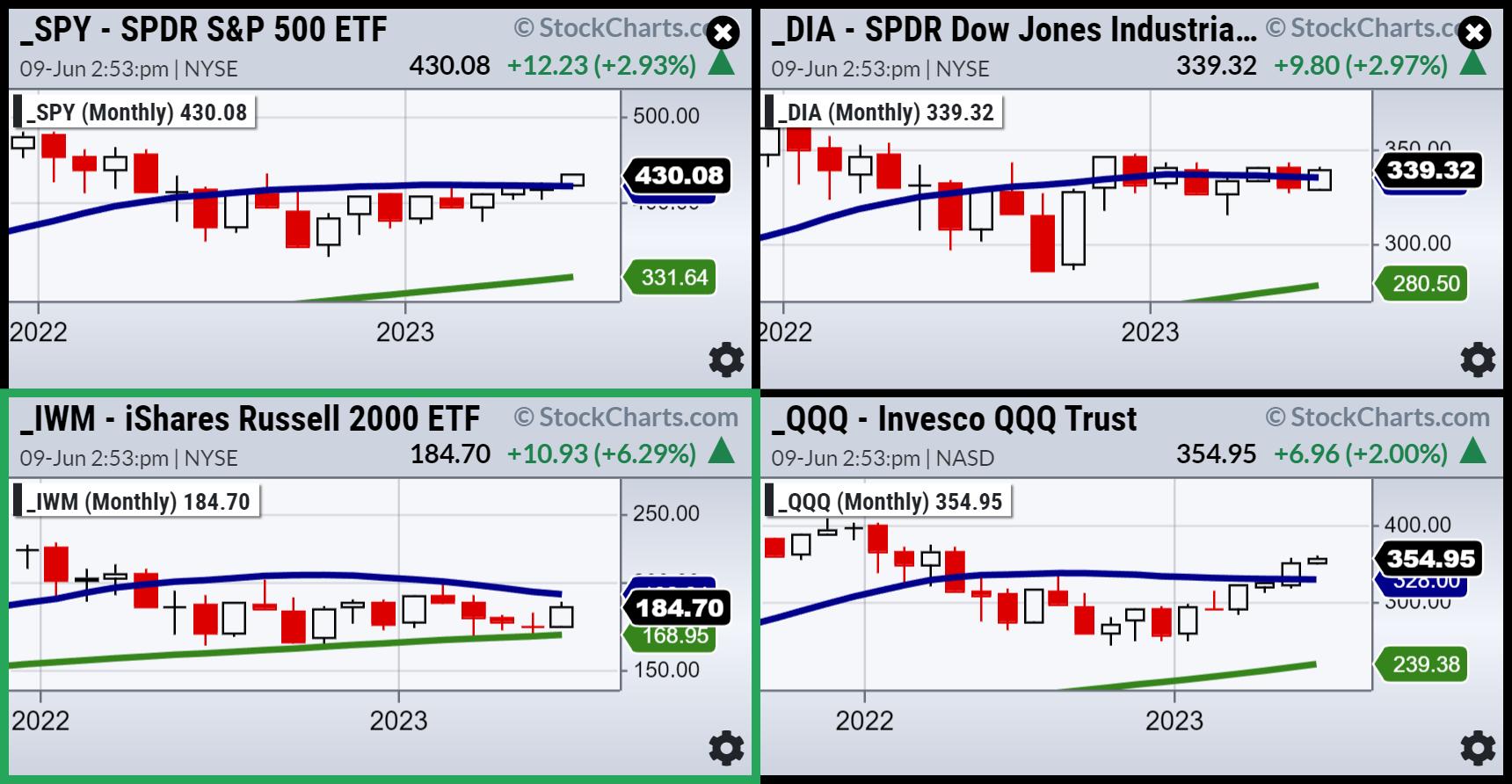

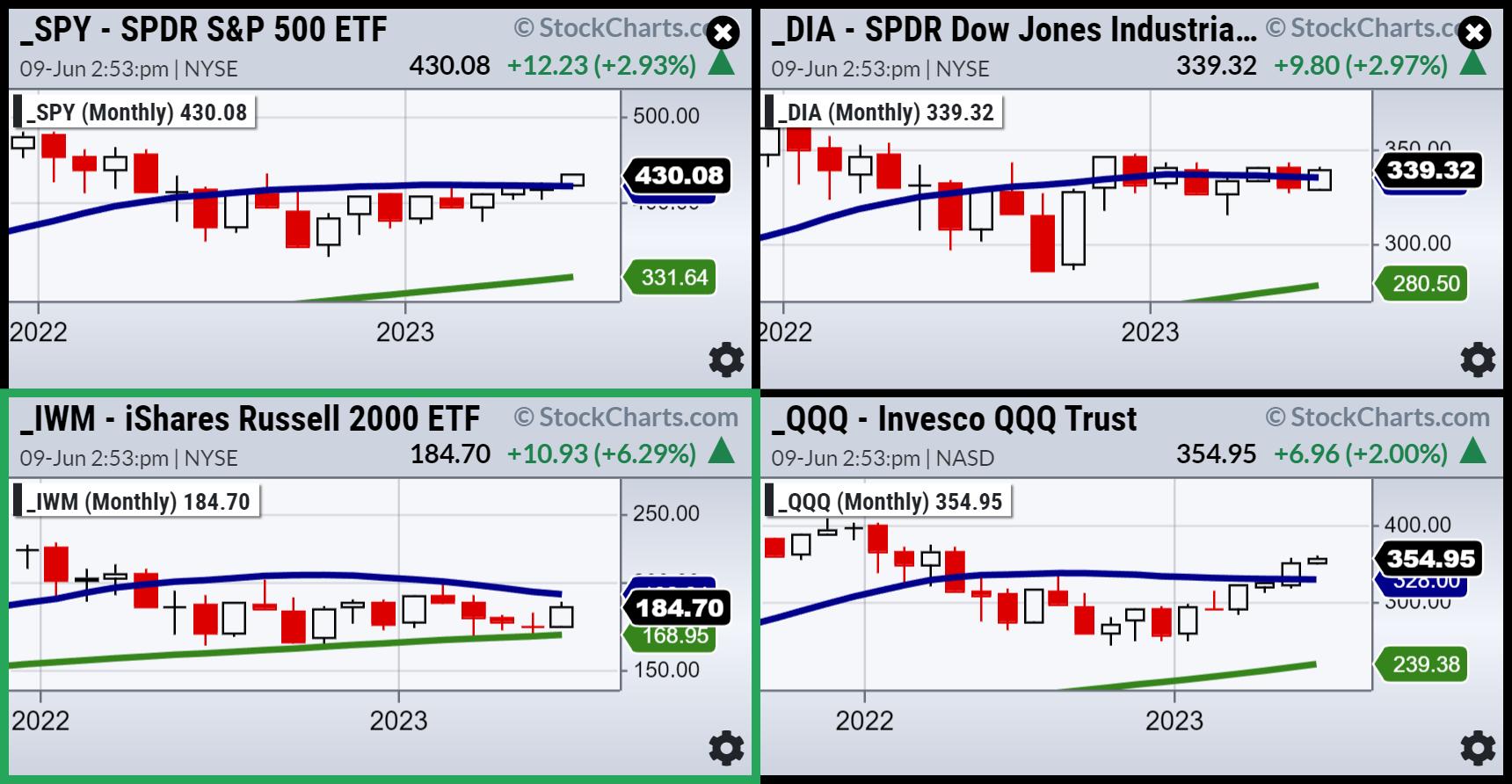

Looking at the monthly charts of the four major indices as we hit mid-June, all but the Russell 2000 are trading above their 23-month moving average. Thus far, this is in line with our prediction that, by the time IWM hits (if it does hit) 190-200 and the SPY hits...

READ MORE

MEMBERS ONLY

Is the Bull Market Back? Watch These Charts

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

What a week the market had!

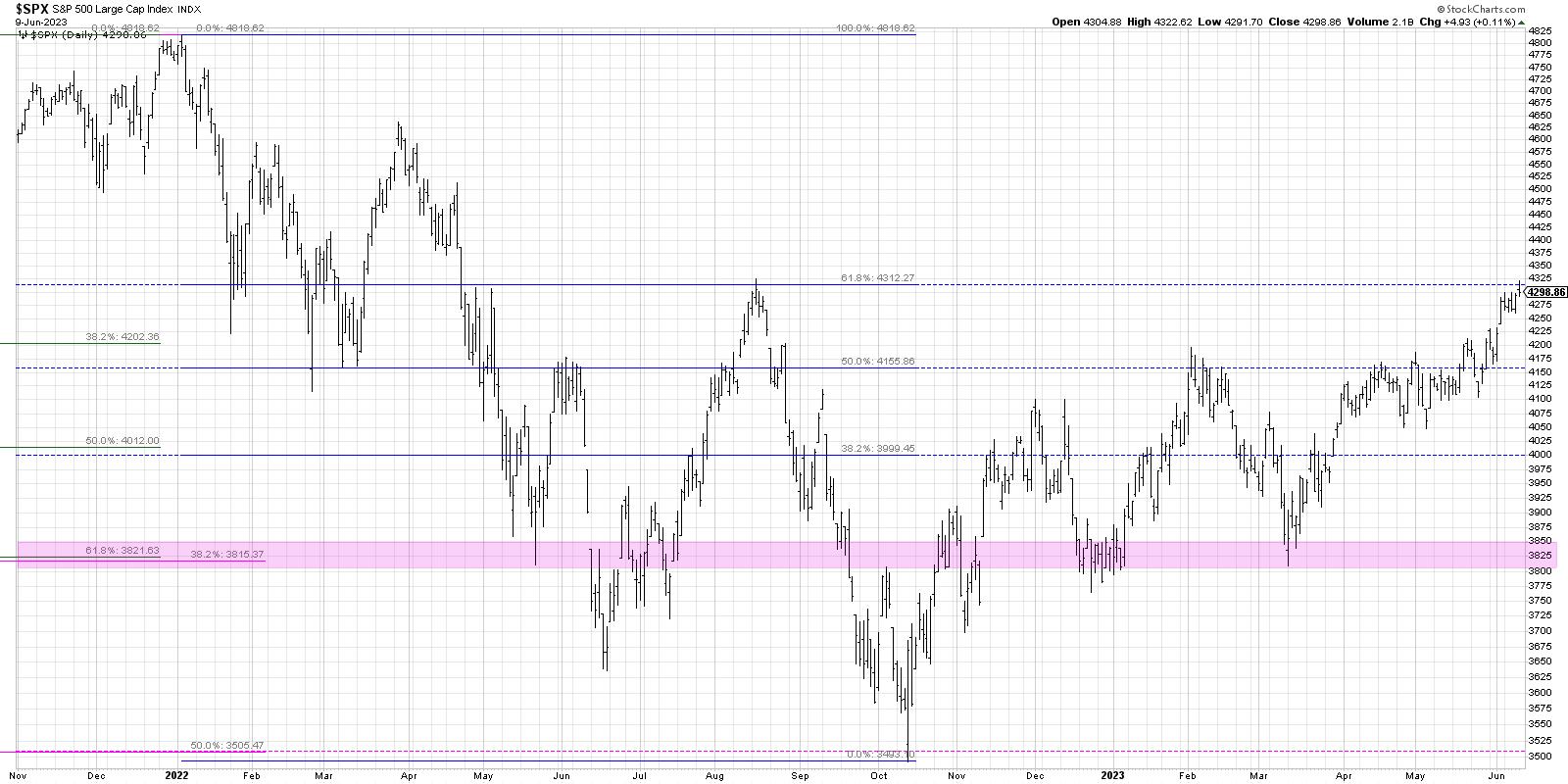

At the start, things looked positive for the S&P 500 index ($SPX). The index finally broke above the 4200 level, the debt ceiling issue was resolved, and the probability of a Fed interest rate pause was relatively high.

But on Wednesday, things...

READ MORE

MEMBERS ONLY

Friday Changed the Market's Character

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG discusses how the market has suddenly awoken, with more names are starting to breakout and participate in the long side after basing for a year. He takes a look at the overall conditions and how he sees the market...

READ MORE

MEMBERS ONLY

Ichimoku Cloud: Looking to the Past to Find Future Trades

by Karl Montevirgen,

The StockCharts Insider

Note: For the sake of brevity, this article will take a bullish and long-only approach. If you're interested in going short, you can apply this information, but in reverse.

How can you efficiently use the Ichimoku Kinko Hyo (aka Ichimoku Cloud) indicator to find trading opportunities, especially when...

READ MORE

MEMBERS ONLY

S&P 500 TESTING AUGUST HIGH -- SMALL CAPS TURN UP -- XLY ACHIEVES UPSIDE BREAKOUT -- SO DO TESLA AND FORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

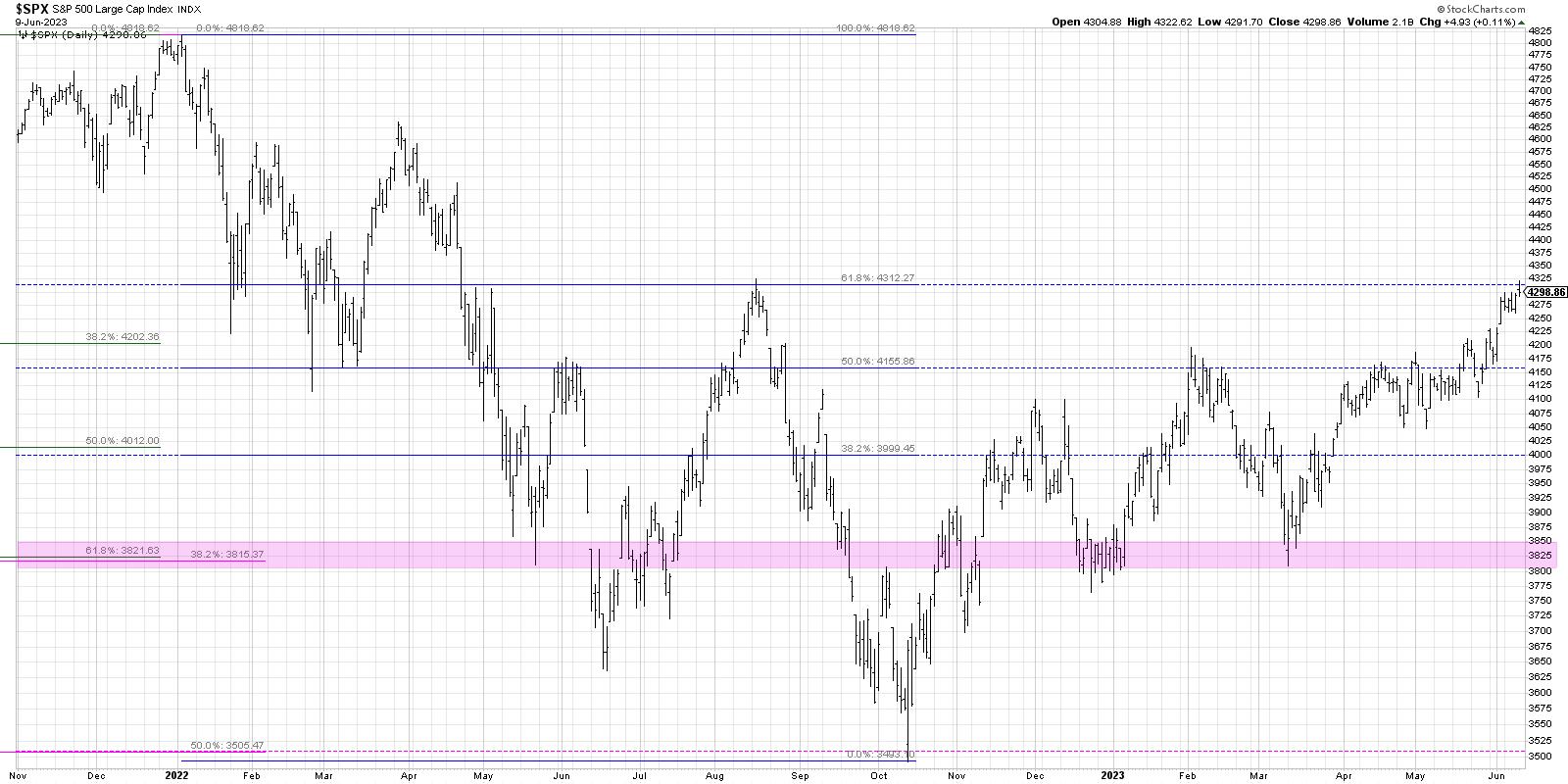

S&P 500 TESTS AUGUST HIGH...Chart 1 shows the S&P 500 Index in the process of testing important overhead resistance at its August high (flat line). A close above that barrier would be a positive sign. The SPX has now gained 20% from its October low....

READ MORE

MEMBERS ONLY

GNG TV: Small But Mighty -- "Go" Trend in Russell 2000

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, Alex and Tyler review the recent breakout from the downward-sloping trendline of the Russell 2000 (IWM) and "Go" trend conditions on the daily basis, and neutral trend conditions on the weekly chart. Picking out several individual equities in the small-cap...

READ MORE

MEMBERS ONLY

How to Use ADX to Find Tops

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how ADX can help us identify topping patterns. Tops can take place in the form of a climax or in the form of exhaustion or momentum loss, and Joe explains how ADX can help to see...

READ MORE

MEMBERS ONLY

Scanning for Bearish Engulfing Candlestick Patterns

by Karl Montevirgen,

The StockCharts Insider

It's tempting to think of Bearish Engulfing patterns as the negative counterpart to the Bullish Engulfing pattern because, technically, they sort of are. But the Bearish Engulfing pattern also presents a trading opportunity that's unique to the downside: Stocks tend to fall three times faster than...

READ MORE

MEMBERS ONLY

Vietnam and the U.S. Widening Trade Deficit

The US trade deficit widened to a six-month high and by the most in eight years. That means that we imported way more goods while our exports declined.

We don't like to use one economic stat as the end-all-be-all, but this strengthens our stagflation outlook. The dollar'...

READ MORE

MEMBERS ONLY

The Wisdom of Jesse Livermore, Part 7

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave shows his methodology in action with a recent "better-than-a-poke-in-the-eye" crypto trade and an open stock position where he's "free rolling", which is the secret to longer-term trading success. He then resumed his series on...

READ MORE

MEMBERS ONLY

These Areas are Pushing Equal-Weighted S&P 500 Higher

by Mary Ellen McGonagle,

President, MEM Investment Research

The equal-weighted S&P 500 index ($SPXEW) continues to advance above its key 50-day moving average, which it broke above following last Friday's broad-based rally in the markets. Friday's downtrend reversal took place after May's employment data delivered a positive report, with job...

READ MORE

MEMBERS ONLY

Is Gold About to Explode or Crash?

by Martin Pring,

President, Pring Research

The price of gold was recently trading at an all-time monthly closing high. Since then, it has backed off, raising the question of whether that was "the" top or whether the subsequent short-term price decline represents a healthy digestion of previous price gains, which will serve as a...

READ MORE

MEMBERS ONLY

Market Correction is Coming

by Larry Williams,

Veteran Investor and Author

"The farther backward you can look, the farther forward you can see." - Winston Churchill

In this exclusive StockCharts TV special, Larry is back to talk about a stock market correction ahead. There have not been any long term selling opportunities recently. However, right here & now, Larry...

READ MORE

MEMBERS ONLY

Zillow's New Strategy Looks Like a Winner; Is the Stock a Buy?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Zillow Group, Inc. (ZG) has faced a lot of headwinds in 2021. It pulled the plug on its home flipping segment, Zillow Offers, a big revenue generator. That hurt the company's bottom line, but, since then, Zillow Group has exhibited signs of turning around. It's made...

READ MORE

MEMBERS ONLY

Some Trading Pairs to Think About Right Now

It's just like the entire month of May, when folks were saying "Sell in May and go away"-- but not us. We were telling you that the Big ViewRisk Gauges were all pointing to risk on.

However, before that, on March 12, 2023, we also...

READ MORE

MEMBERS ONLY

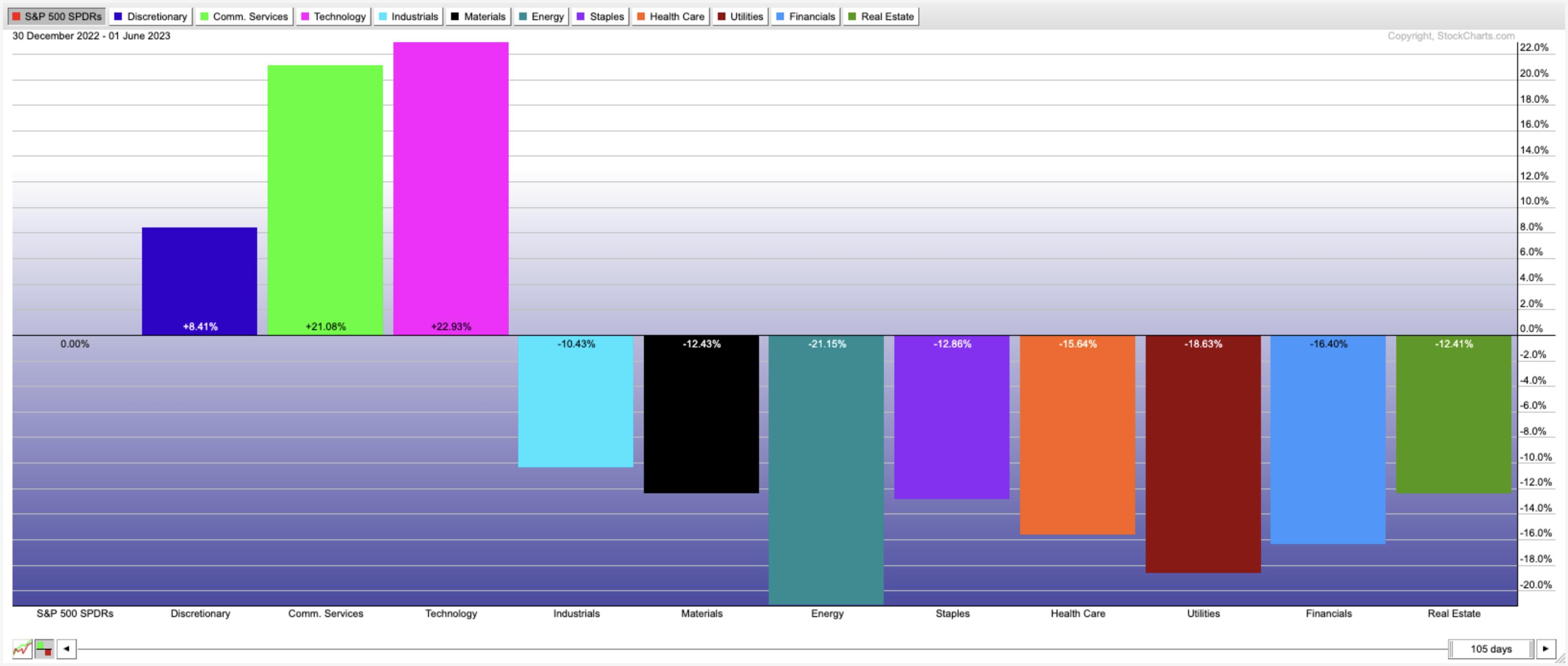

Sector Spotlight: May Was NOT a Good Month for Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, wrapping up the month of May, I look back at developments in May for Asset Classes and Sectors. Using Monthly Relative Rotation Graphs and monthly charts, I talk you through the good and the not-so-good parts of the markets, starting...

READ MORE

MEMBERS ONLY

DP Trading Room: Shareholders Should Come First

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens the trading room with a discussion of Target (TGT) and Anheuser-Busch (BUD) technicals and compares them to their industry groups. Shareholders can't be pleased. After an overview of the market as a whole, Erin follows...

READ MORE

MEMBERS ONLY

If It Weren't For These 7 Stocks...

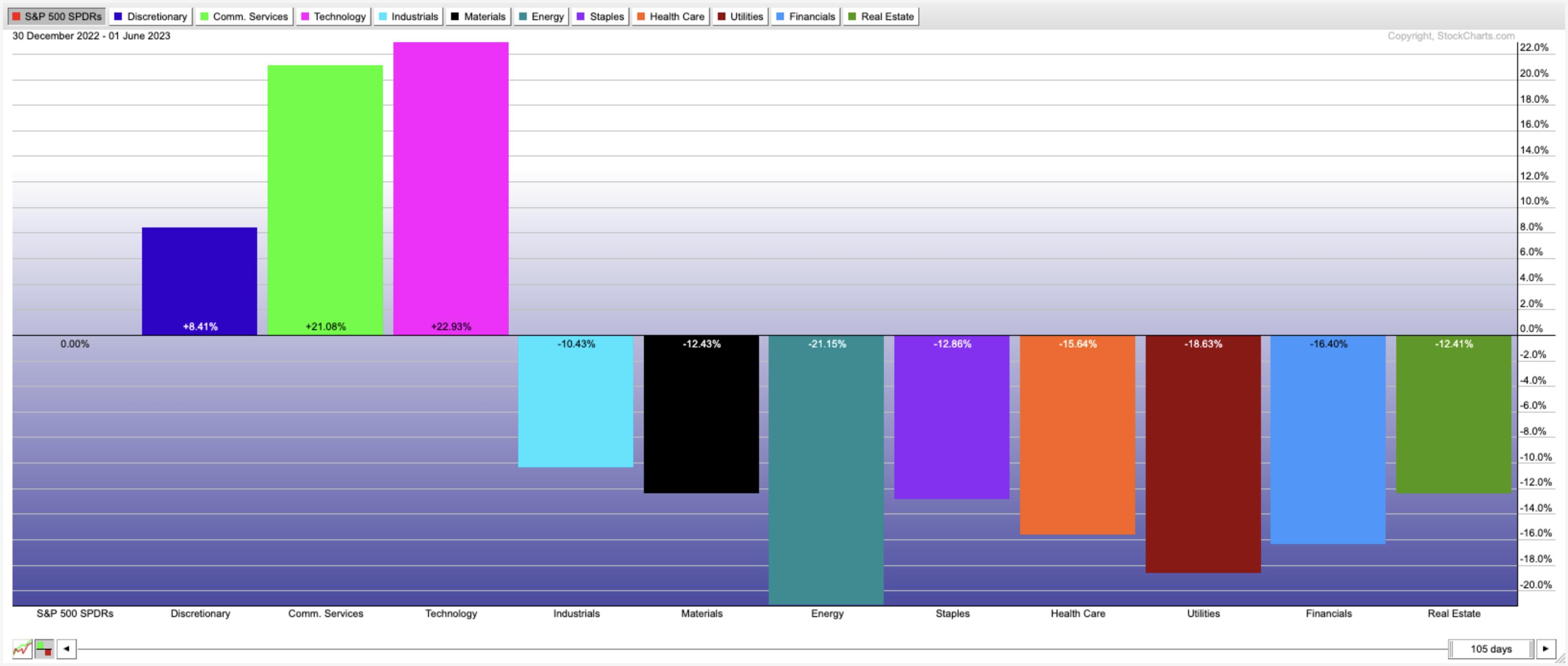

Apple, Nvidia, Meta, Alphabet, Microsoft, Amazon, and Tesla have now been penned as the "Magnificent 7." Only around 25% of the S&P 500 stocks have outperformed the benchmark, while these stocks continue to show massive leadership.

The Nasdaq is up around 15% year-to-date, outpacing the S&...

READ MORE

MEMBERS ONLY

QQQ Breaks Away from DIA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Trend-momentum strategies that trade stock-based ETFs should require two conditions before considering a position. First, broad market conditions should be bullish. This means being long stocks in bull markets and out of stocks in bear markets. Second, the trend for the ETF should be up. Employing these basic prerequisites can...

READ MORE

MEMBERS ONLY

Recent Manipulation in Small Caps Led To Friday's Big Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I wasn't expecting a huge 4% move in small caps on Friday, but I was looking for this group to start flexing its muscles. I've been telling our EarningsBeats.com members that small caps were poised for a big move to the upside. We've...

READ MORE

MEMBERS ONLY

Soft Landing? Retail Sector Gets up and Boogies

Last week, we asked, "Can the Retail ETF XRT hold here?"

We wrote that the Consumer Sector ETF had some words for you. To summarize:

1. The test of the 80-month MA (green and price 56.24) on the last day of the month of May is mad...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Sits at Cusp of a Breakout; Need to Stay Mindful of These Two Things

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After posting decent gains in the week before this one, NIFTY chose to consolidate this time just below the key breakout levels. In the last five sessions, the markets stayed devoid of any direction throughout, consolidating just below key resistance and breakout levels. However, given all this consolidation in the...

READ MORE

MEMBERS ONLY

The AUTOMATED Way to Find Strong Stocks Making New Highs

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson tours you through the chart annotation tools in both SharpCharts and ACP, our Advanced Charting Platform. Along the way, you'll see some helpful tips and tricks that will enhance your drawings and streamline your...

READ MORE

MEMBERS ONLY

Broad Market Rally a Turning Point

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

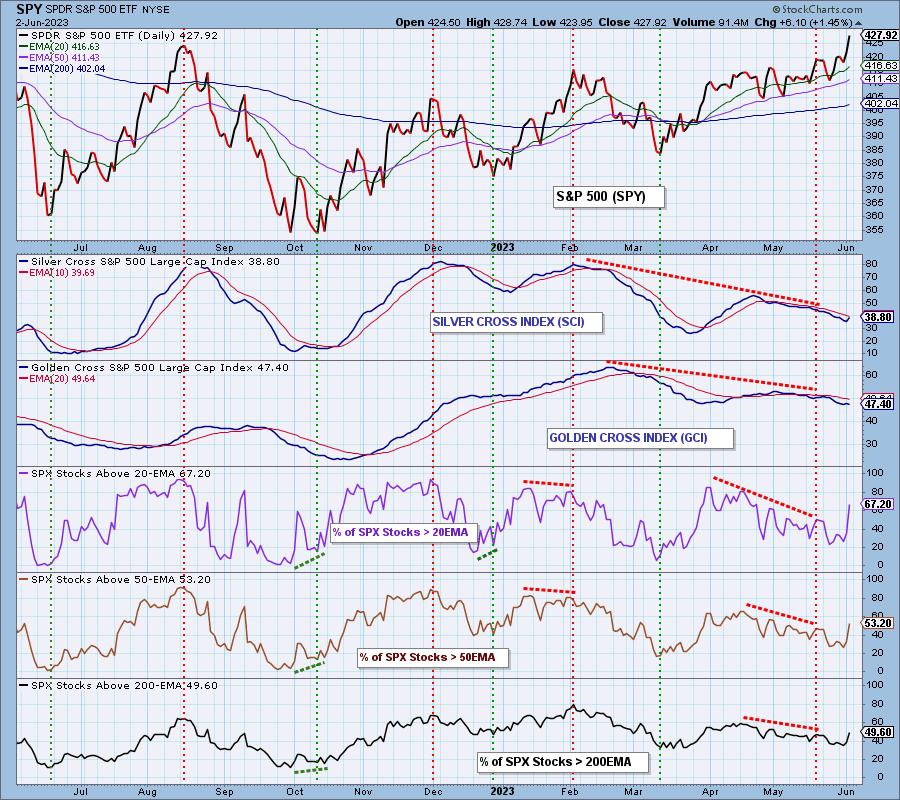

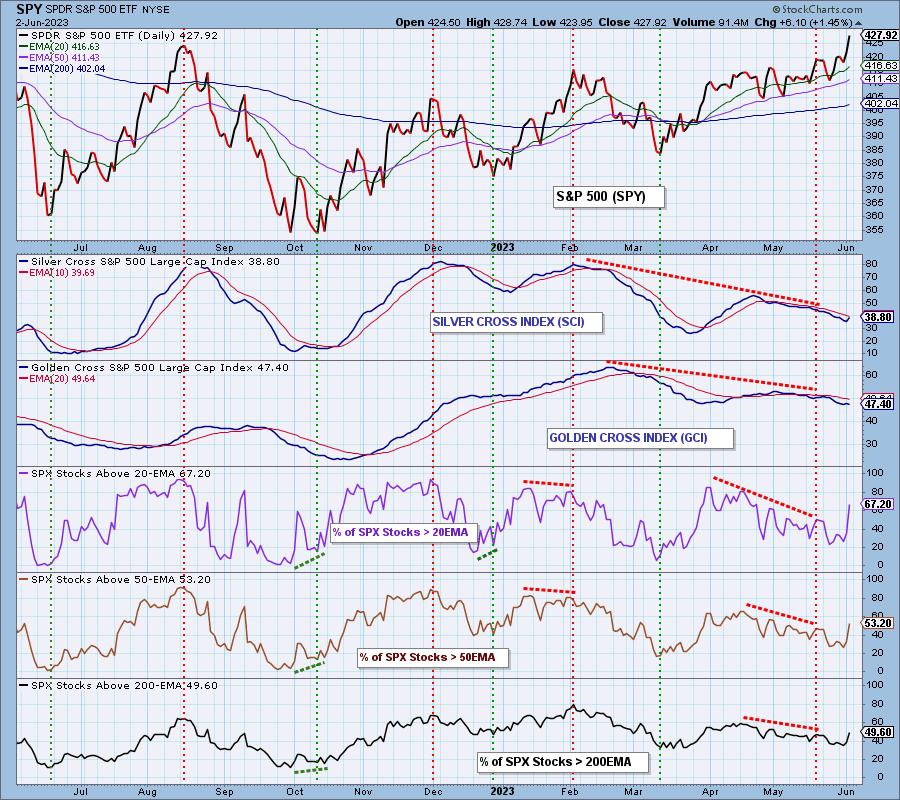

Today, we saw broadening of participation by comparing the percentage change of the cap-weighted version of the S&P 500, SPY (+1.50%), versus the equal-weighted, RSP (+2.25%), which shows that today's RSP advanced 52% more than SPY.

Our biggest beef with the SPY rally was...

READ MORE

MEMBERS ONLY

MEM TV: Broad-Based Rally Puts Markets in Bullish Position

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what's pushing the markets above resistance and how you can capitalize. She also highlights this week's rally in Bank stocks and whether the group is in an uptrend.

This video was originally broadcast...

READ MORE

MEMBERS ONLY

The Bull Case for Energy is Clear

by David Keller,

President and Chief Strategist, Sierra Alpha Research

What compels me to write a bold headline claiming one sector is obviously poised to break out to the upside?

As a trend follower, I have three goals every day: identify trends, follow those trends, and anticipate when those trends may reverse. Simple, right?

Energy has been the worst-performing sector...

READ MORE

MEMBERS ONLY

The AI Boom That Catapulted Tech's Impressive Weekly Outperformance

by Karl Montevirgen,

The StockCharts Insider

It's no surprise that the Technology sector was the most talked-about sector of the past several weeks. AI FOMO was everywhere on Wall Street as Nvidia (NVDA) and other AI stocks pulled ahead of their non-AI counterparts. In the end, Tech stocks, in general, kept the Nasdaq well...

READ MORE

MEMBERS ONLY

MARKET RALLY BROADENS OUT -- DOW LEADS FRIDAY RALLY -- CYCLICALS HAVE A STRONG WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW PLAYS CATCH-UP... A strong May jobs report and the passing of the debt ceiling bill have combined to give a big boost to stocks at week's end. The rally has been enough to push the Nasdaq to a new 52-week high and a ten-month high in the...

READ MORE

MEMBERS ONLY

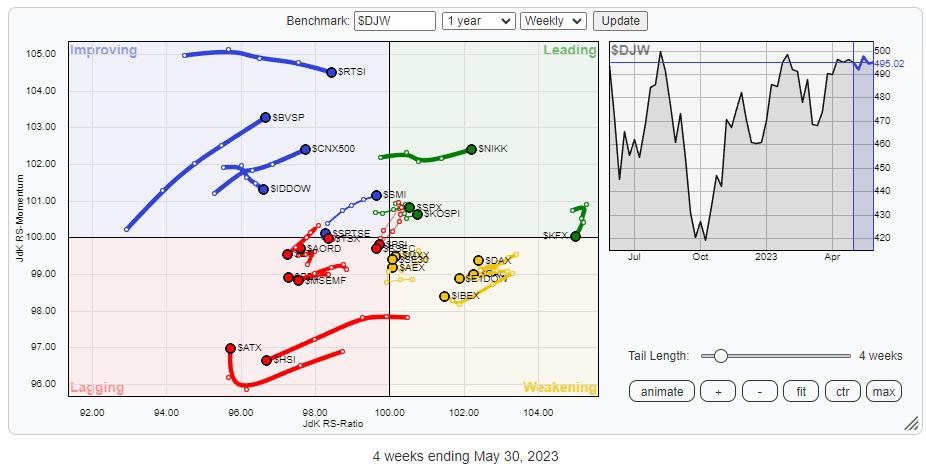

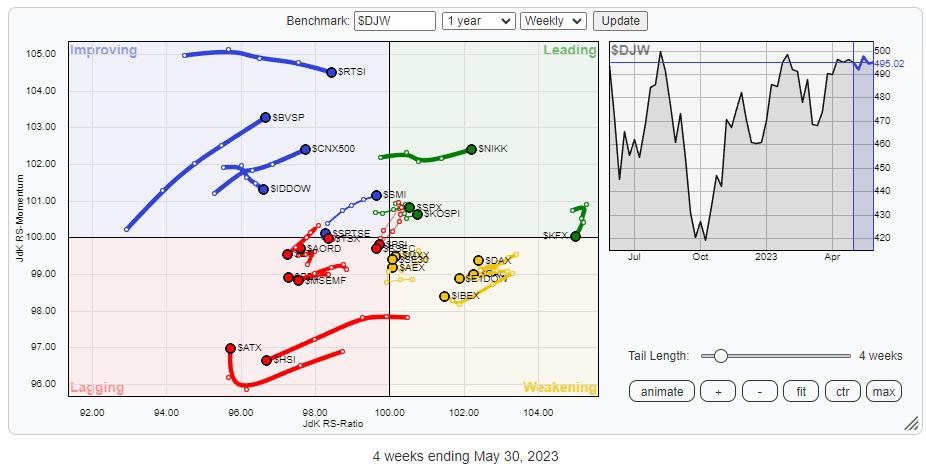

How To Benefit From a Big Rotation in Asian Markets

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

It's been a while since we discussed international stock markets.

Above is the Relative Rotation Graph that shows the rotation for a group of international stock market indices against $DJW, The Dow Jones Global Index. Looking at this, chart I see two big(ger) rotations that are probably...

READ MORE