MEMBERS ONLY

When Uncle Utilities (XLU) Shows Up Drunk

Gosh, it's been a minute since we have looked at Utilities.

With rising interest rates, in March 2023, utilities fell near the October 2022 lows. Currently, XLU is changing phases from Bearish to Recuperation.

In my book, Plant Your Money Tree: A Guide to Growing Your Wealth,I...

READ MORE

MEMBERS ONLY

Sector Spotlight: Bonds & Financials Crucial for Promising S&P 500

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The first Tuesday of the month means monthly charts in this episode of StockCharts TV's Sector Spotlight. I start with an overview of long-term trends in asset classes, including a look at the USD and BTC and the relationship between stocks and bonds. I then move on to...

READ MORE

MEMBERS ONLY

DP Trading Room: Sector Deep Dive

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Erin presents a review of all of the sectors to find out where new momentum lies and where relative strength is -- you might be surprised. Carl gives us his take on the market, as well as the Dollar,...

READ MORE

MEMBERS ONLY

The Halftime Show: Screen Signals Momentum Breakouts

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

In this week's edition of StockCharts TV'sHalftime, Pete takes a look at the Q's and sectors this week. At the end of the quarter, we all know that tech has done well and, while the defensive side has tailed off, the quarter wasn'...

READ MORE

MEMBERS ONLY

Market Faces Key Test

by Martin Pring,

President, Pring Research

Global equities have risen for the last three weeks and now are at or just below key chart points. Chart 1, for instance, shows that the S&P 500 index ($SPX) is close to breaking above resistance in the form of its 2022–23 down trendline. In reality, that...

READ MORE

MEMBERS ONLY

The 4 Indices -- More to Prove in 2nd Quarter

Since the first quarter ended with very few instruments above the 23-month, we thought we would start the 2nd quarter by examining where the 4 indices are.

Over the weekend, the Market Outlookreminded us that "we would likely see a rangebound market, along with stagflation. With positive back-to-back quarterly...

READ MORE

MEMBERS ONLY

2022 Q4 Earnings Results: Market Becomes More Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E of 20 (red line), a fairly valued P/E of 15 (blue line), or an undervalued...

READ MORE

MEMBERS ONLY

BEWARE Leveraged ETFs: Invest With Caution

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The following was a special educational Daily Market Report that I sent to our EB.com members last week....

I always refer to EarningsBeats.com as a "Research, Guidance, and Education Platform", because that's truly what we strive to be. HERE IS WHAT WE ARE NOT...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Defends Key Supports; Upside May Stay Capped Here in This Short 3-Day Week

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets had a positive weekly closing; despite the truncated week with just four trading sessions, the NIFTY registered decent gains. Over the past several sessions, the markets were unable to take any major directional calls; however, this week saw the markets rebounding from the lower edge of the trading...

READ MORE

MEMBERS ONLY

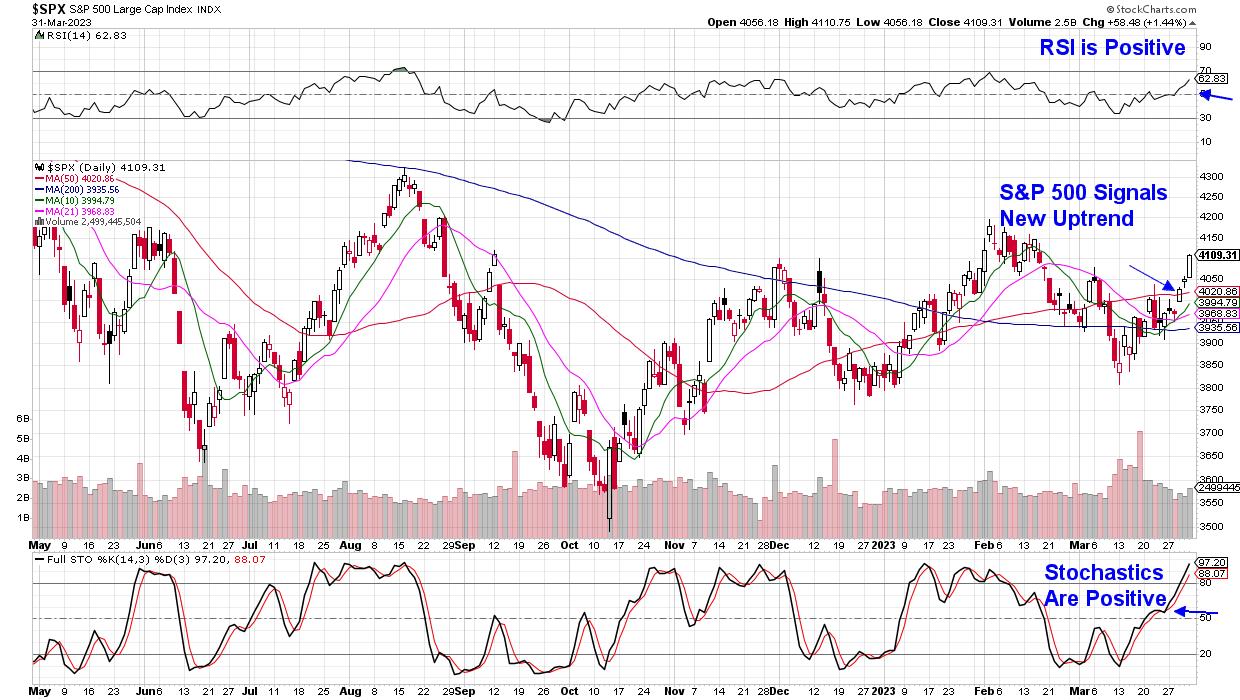

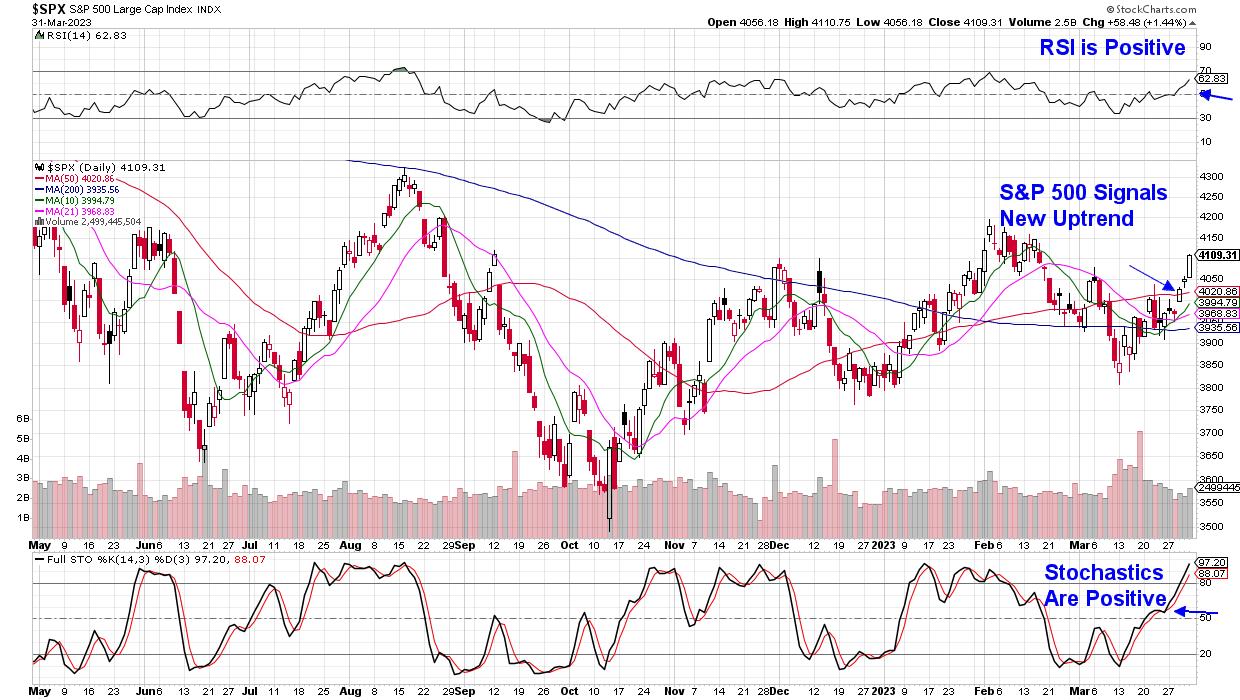

Market Flashes Green Light Amid Broad-Based Rally

by Mary Ellen McGonagle,

President, MEM Investment Research

Last week, the S&P 500 put in a bottom following Wednesday's rally of 1.4% on volume, which was greater than the prior day. Known by followers of William O'Neil's work as a "follow-through day", the price action occurred on...

READ MORE

MEMBERS ONLY

Three ETFs Showing Renewed Strength

by David Keller,

President and Chief Strategist, Sierra Alpha Research

With the first quarter of 2023 drawing to a close, what impresses me most about the equity markets are the improving breadth conditions. While the markets can move higher on strength from the MANAMANA stocks, sustained bull market phases usually need additional support from other stocks.

One could argue that...

READ MORE

MEMBERS ONLY

MEM TV: S&P 500 Puts in a Bottom!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen highlights the new uptrend in the S&P 500 and which areas are now reversing downtrends. She also reviews themes taking place in already-strong Software stocks.

This video was originally broadcast on March 31, 2023. Click on...

READ MORE

MEMBERS ONLY

A Quick Scan Tool for a Quick Swing Trade

by Karl Montevirgen,

The StockCharts Insider

There are times when technical merit alone can justify the case for a trade.

The reason for this is that many traders often stick with a familiar list or category of stocks, and for obvious reasons: to avoid trading a stock that you know very little about or to check...

READ MORE

MEMBERS ONLY

Top 2 Ways You Can Take Advantage of StockCharts Scans

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson kicks off a series of scanning-focused episodes by sharing two of his favorite ways to run and review your scan results. He demonstrates how the CandleGlance view for SharpCharts can help you quickly and easily narrow...

READ MORE

MEMBERS ONLY

1st Quarter -- QE Boosts Commodities and Stocks

Partial Look at the Models and Positions

On Friday, I was part of the Festival of Learning, sponsored by Real Vision, to help new and experienced traders.The topics that came up were in line with what everyone who trades wants more insights on:

* FOMO

* Position Sizing

* Risk Management

* Entries...

READ MORE

MEMBERS ONLY

When You See Amazon Turning Around, Beautiful Things Start to Happen

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

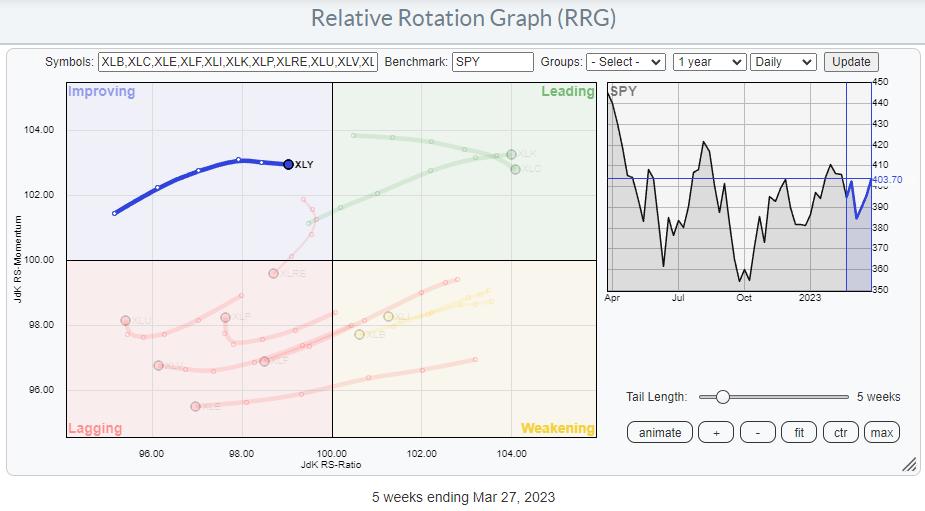

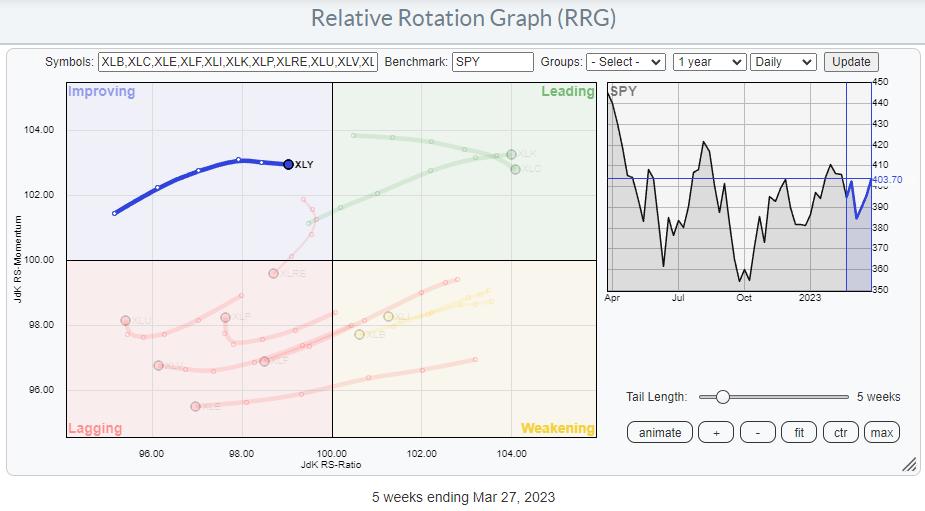

On the weekly RRG, the tail for XLY, Consumer Discretionary, is inside the improving quadrant and heading at an RRG-Heading of roughly 90 degrees. Not ideal; somewhere between 0-90 is stronger, as it indicates that the trend is still picking up speed, but not wrong either.

With only two sectors...

READ MORE

MEMBERS ONLY

Progress for the Bulls, But Will It Hold?

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG explains that, barring any crazy event, the SPX will close its second month over the Monthly 10-SMA. This moving average is his primary tool for assessing whether a longer-term trend is bullish or bearish. The SPY continues to hold...

READ MORE

MEMBERS ONLY

NASDAQ LEADS MARKET HIGHER --

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES HAVE A STRONG WEEK...Although the stock market's long-term trend may still be in doubt, stocks are ending the quarter on a strong note. Starting with the weakest, Chart 1 shows the Dow Industrials ending the quarter back above its 200-day moving average and in...

READ MORE

MEMBERS ONLY

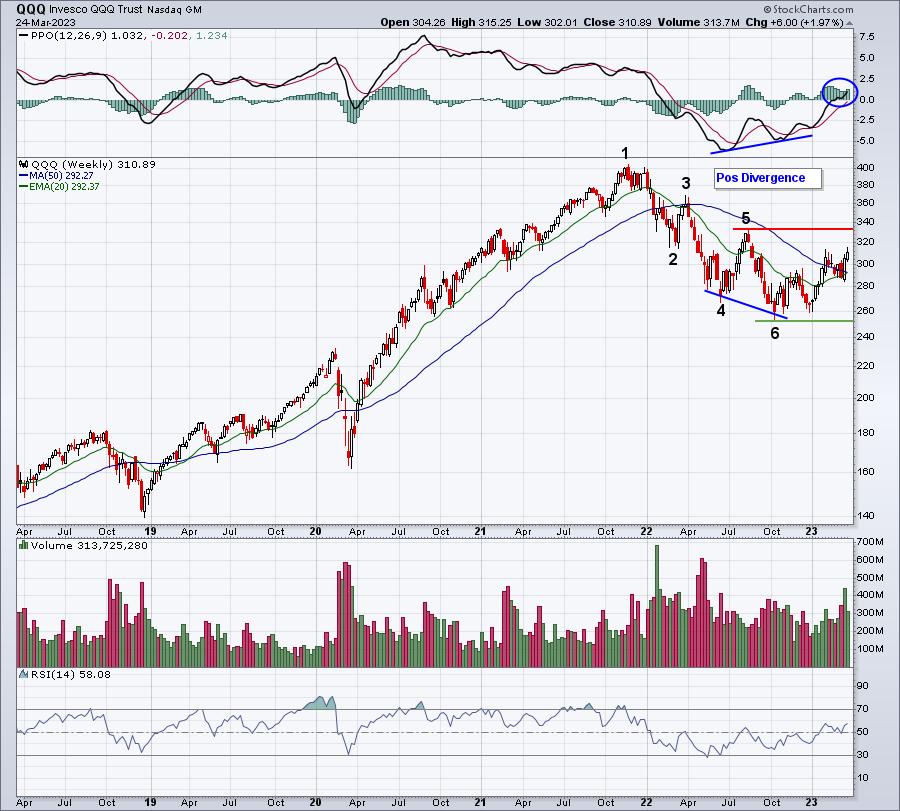

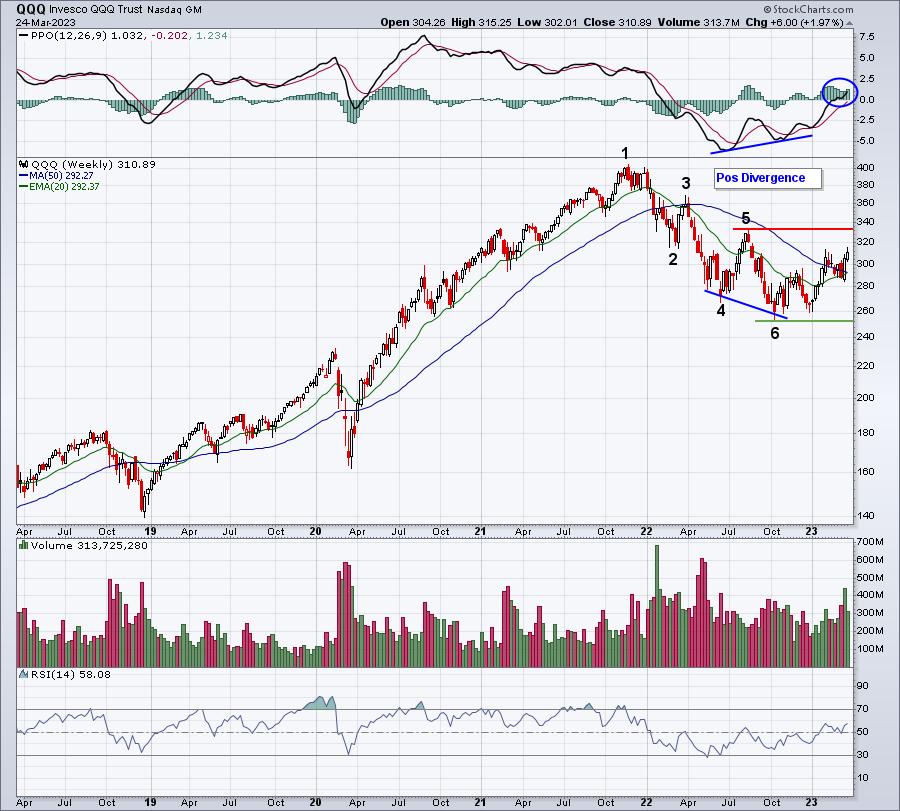

NASDAQ Breaks Out Again; 2 Stocks To Consider NOW

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

U.S. equities are wrapping up the first quarter in grand style. The QQQ, which tracks the NASDAQ 100, is zeroing in on a 20% gain for the quarter, as I write this. We saw a huge rally in January 2023 and strong Januarys usually suggest a strong year ahead....

READ MORE

MEMBERS ONLY

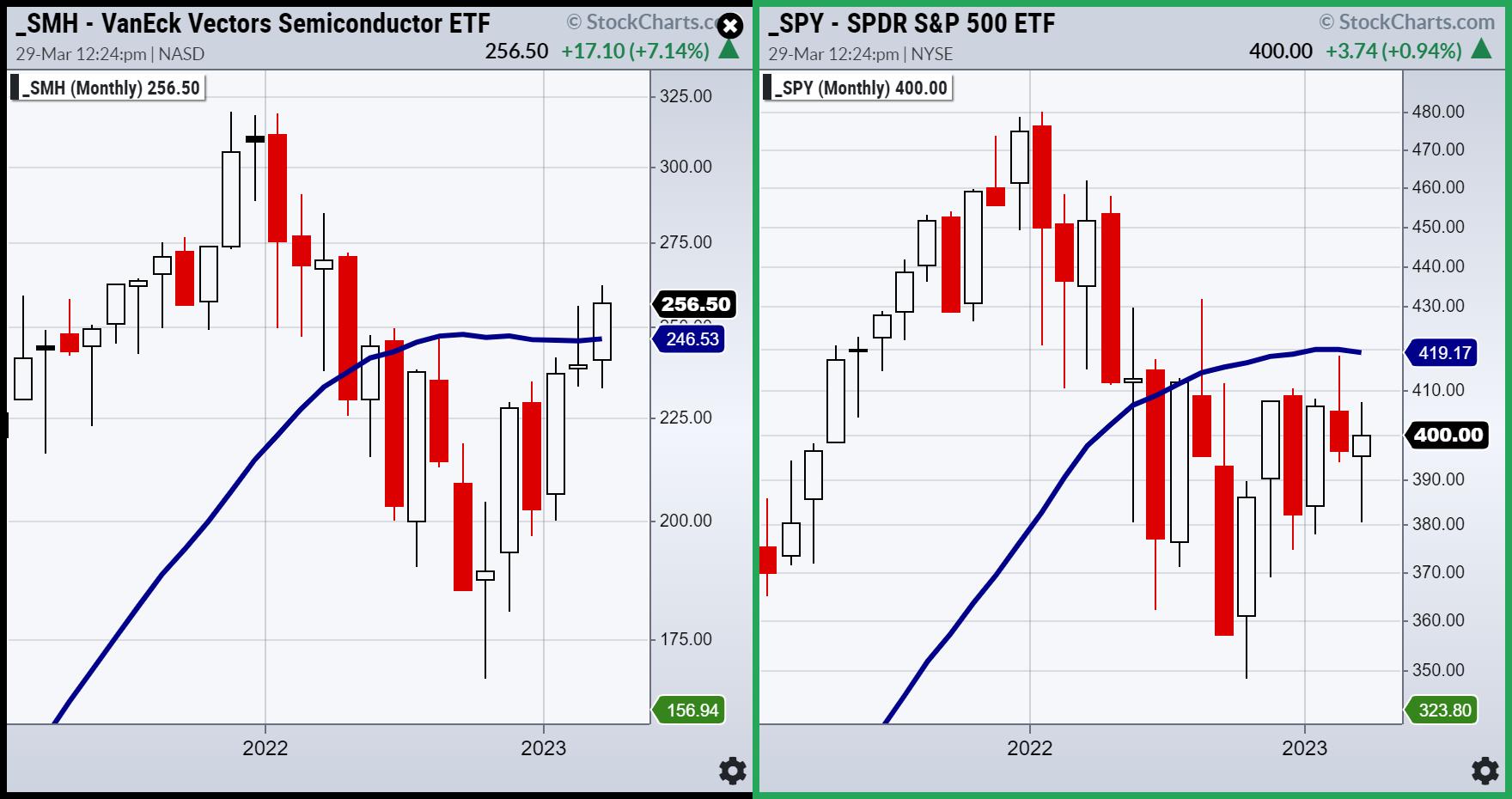

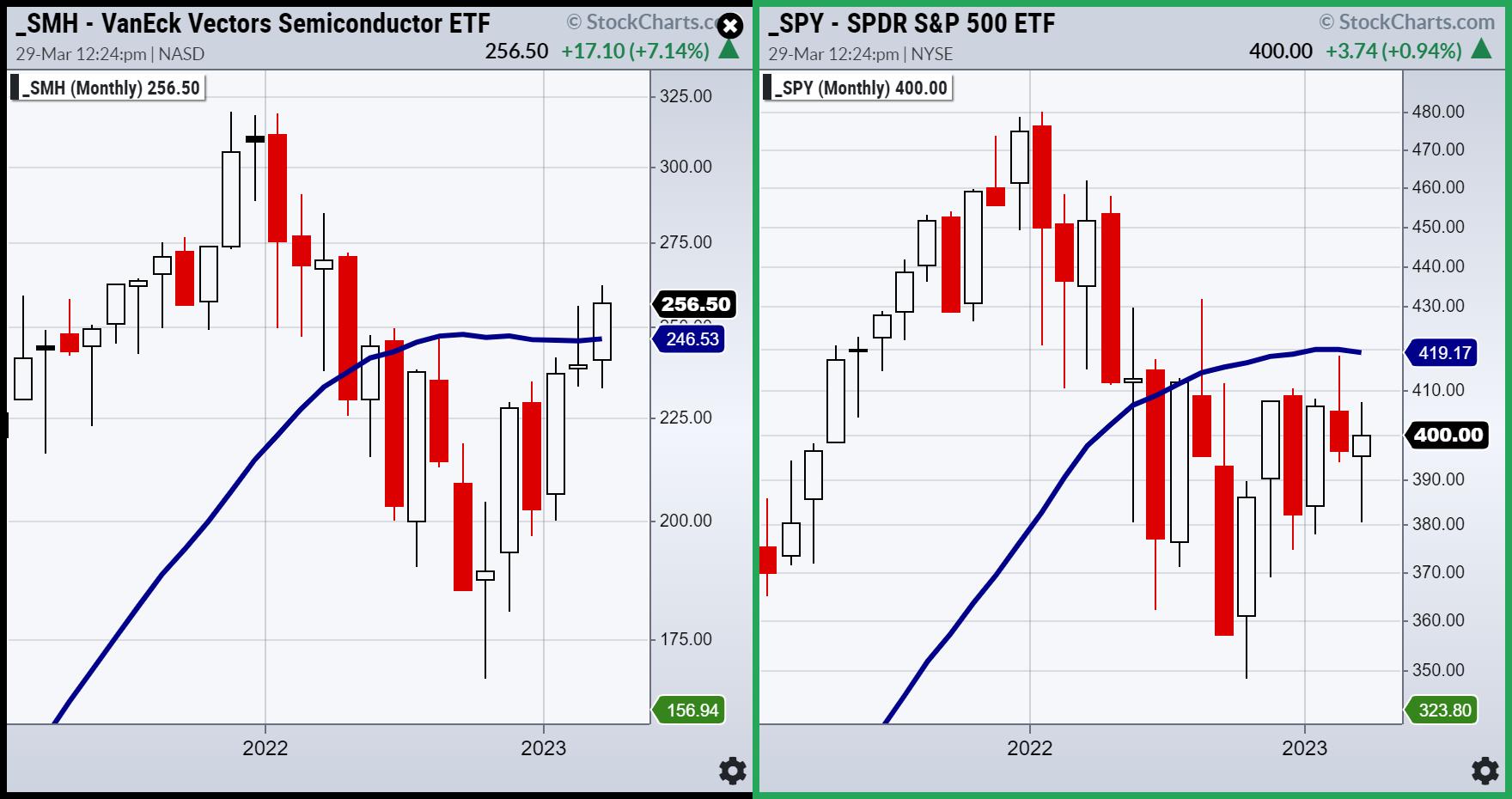

Are Semiconductors Ready for a Pullback?

by Carl Swenlin,

President and Founder, DecisionPoint.com

After a bear market decline of nearly -50%, the Semiconductor ETF (SMH) has rallied over +60% out of the October low. The long-term picture still looks promising, with the weekly PMO rising steeply above the zero line. But let's look in a shorter-term timeframe to see if there...

READ MORE

MEMBERS ONLY

GNG TV: Charts Telling the Story of the Markets

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, Alex and Tyler take a top-down approach to the technical market environment following the SVB collapse and the Fed's 25bps hike. They use a GoNoGo Cross Asset Heat Map to help understand the intermarket factors that could impact equity performance....

READ MORE

MEMBERS ONLY

NVDA at a Crossroads: Decoding the Signals From Atop a Cloud

by Karl Montevirgen,

The StockCharts Insider

This is a follow-up to a piece published a week ago on Nvidia's (NVDA) strong runfollowing its stellar earnings report. It follows NVDA's price action, but from another angle, using the lesser-usedIchimoku Cloudindicator.

Revisiting NVDA's Price Action

NVDA began outperforming its fellow semiconductor industry...

READ MORE

MEMBERS ONLY

The Best Form of MACD Divergence

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains the best form of MACD divergence, showing how to use multiple timeframes to increase your odds of success with this powerful MACD setup. Using Monthly, Weekly and Daily timeframes, he covers the setup and why it...

READ MORE

MEMBERS ONLY

Is Intel Now A Market Leader?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Well, it might be a little early to anoint Intel (INTC) a leader, but there's no denying a significant breakout in the chip stock above key price resistance. On November 15, 2022, INTC opened at 30.72, and the stock hasn't seen an open or close...

READ MORE

MEMBERS ONLY

The 23-Month Moving Average "Tell" for 1st Quarter

We have written lots of Dailys, not to mention talked a lot in media, about the significance of the 23-month moving average. Here are some past comments:

What has happened in the last 2 years? A bullish run in 2021 based on easy money. Inflation running hotter than most expected....

READ MORE

MEMBERS ONLY

Choppy Markets Require Patience

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave delves into why traders need patience, especially during less-than-ideal conditions. He discusses the fact that patience "gets used up" and why we must be vigilant not to give into temptations such as boredom, wants, needs, and other extraneous...

READ MORE

MEMBERS ONLY

Where's the Money Going? Watch Volume and Price Action

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

A driver who goes with the flow of traffic and adjusts to traffic conditions usually gets places in good time and safely. Similarly, a good trader who trades in sync with price action is likelier to make better trades and preserve more capital.

The key: Recognize price movement and take...

READ MORE

MEMBERS ONLY

Why Buy DBA: Agricultural Fund ETF?

Last week, I tweeted:

I believe the #commodities prices in food softs $DBA have bottomed. $GLD-well those who know me-that I pointed out bottomed months ago. $SLV now outperforming. That tells you something. Maybe even #oil. Get ready for the Commodities Super Cycle.

If you are not following me @marketminute...

READ MORE

MEMBERS ONLY

The Halftime Show: Bullish and Bearish Estimate Revisions

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

In this week's edition of StockCharts TV'sHalftime, Pete takes a look a sectors, then takes a deep dive into the historical bond picture, using TLT as an example. He focuses on using the Chaikin system to explore Bullish and Bearish estimate revisions as a cause of...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stocks Entering Year's Strongest Month

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, for this last Tuesday of the month, I take a look at seasonality as the S&P 500 enters the (historically speaking) strongest month of the year. Two sectors are showing meaningful odds for out-performance in April, and one...

READ MORE

MEMBERS ONLY

DP Trading Room: Negative Divergences Explained

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl starts off the trading room with a closer look at Regional Banks (KRE) and gives his opinion of not only the market, but the top ten capitalized stocks. Erin picks up with a discussion on how to find...

READ MORE

MEMBERS ONLY

GNG TV: Tech and Staples Leading Choppy S&P

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, Alex and Tyler take a top-down approach to the technical market environment following the SVB collapse and the Fed's 25bps hike. A GoNoGo Cross Asset Heat Map helps understand the intermarket factors that could impact equity performance. Treasury rates ($TNX)...

READ MORE

MEMBERS ONLY

Keeping Up with 3 Key Ratios in a Trading Range

Friday:

Monday:

Over the weekend, our Daily covered 3 key ratios to help decipher the market action and the prevailing macro theme for the economy.

We started with the one between long bonds (TLT) and the S&P 500 (SPY).

All last week, long bonds outperformed the SPY with...

READ MORE

MEMBERS ONLY

The NASDAQ Is Eyeing a Major Breakout Level

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Ultimately, breaking out above the August 2022 high represents the key level to reverse the downtrend that began in early-January 2022. I like to use longer-term charts to determine whether we're currently trending higher or lower, and right now the downtrend is firmly in place:

The numbers on...

READ MORE

MEMBERS ONLY

Don't Let a Good Banking Crisis Go to Waste

by Martin Pring,

President, Pring Research

Remember the wall-to-wall coverage concerning the FTX crypto collapse? It's a great example of why conventional wisdom and groupthink are usually wrong.

The prevailing hysteria had most traders brainwashed into expecting further crypto collapses and price drops. The simple fact is that, the market had been anticipating trouble...

READ MORE

MEMBERS ONLY

Week Ahead: A Shaky Start to the Week Likely; NIFTY Rests at Crucial Supports

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

It was a volatile, but largely quiet, week for the markets. Over the past five sessions, the markets were able to defend their opening lows and were trading flat until the last trading day of the week. The negative closing of the last trading day saw the markets ending in...

READ MORE

MEMBERS ONLY

MEM TV: Is it Time to Buy Bank Stocks?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the sharp decline in Banks and whether they're ready to reverse higher. She also discusses broader market conditions while highlighting key pockets of strength and stocks showing promise.

This video was originally broadcast on March...

READ MORE

MEMBERS ONLY

Art and Science: 3 Key Ratios in the Markets

One of the best questions I got asked this week was "How can you be long gold and long semiconductors at the same time?" And I have a simple answer for that.

We love to take a position based on the macro, which is why gold has been...

READ MORE

MEMBERS ONLY

Setting Up the Most Important Chart You'll See on StockCharts

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson discusses the most important chart on all of StockCharts – your default ChartStyle! In addition to a quick review of what a ChartStyle is, you'll learn how to save your favorite indicators, overlays and other...

READ MORE

MEMBERS ONLY

How To Confidently Trade the 2023 Stock Market

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

2022 was a challenging year for investors, and, so far, the stock market in 2023 has had its fair share of challenges. The fallout of some banks came as a surprise to many investors; how can retail traders improve their trading results in 2023 in light of such unexpected events?...

READ MORE