MEMBERS ONLY

GNG TV: Equities Turn "NoGo" as Weight of Macro Factors Takes Toll

by Alex Cole,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex takes a look at the major assets, noting that Equities have surrendered to a NoGo trend this week. Treasury rates rising, along with the dollar, could be acting as a headwind for stocks. Within the S&P...

READ MORE

MEMBERS ONLY

#1 Rule in Multiple Timeframes

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe discusses the first rule in multiple timeframe trading and analysis. He explains why the trend can be different on different timeframes and why the turning points on each timeframe are so important. He then covers the stock...

READ MORE

MEMBERS ONLY

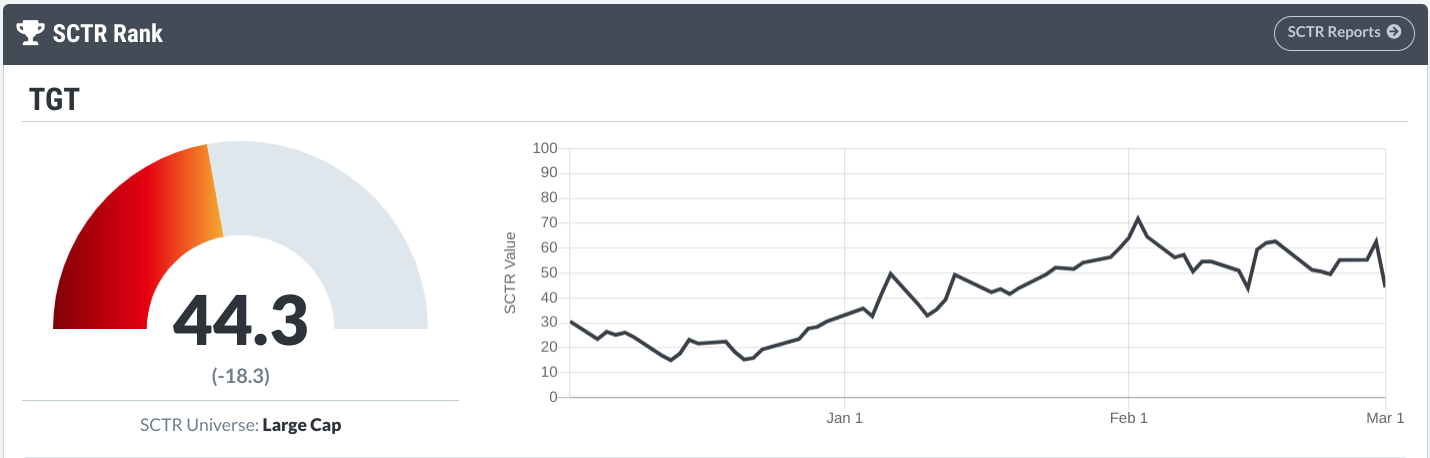

Target: Poised for an Explosive Breakout?

by Karl Montevirgen,

The StockCharts Insider

Target (TGT)'s stock has been bouncing back and forth within a wide eight-month trading range. This happened right after its -44% plunge between April and May last year. Since then, it's been stuck in a $45 range, forming an extremely long rectangle pattern.

Why's...

READ MORE

MEMBERS ONLY

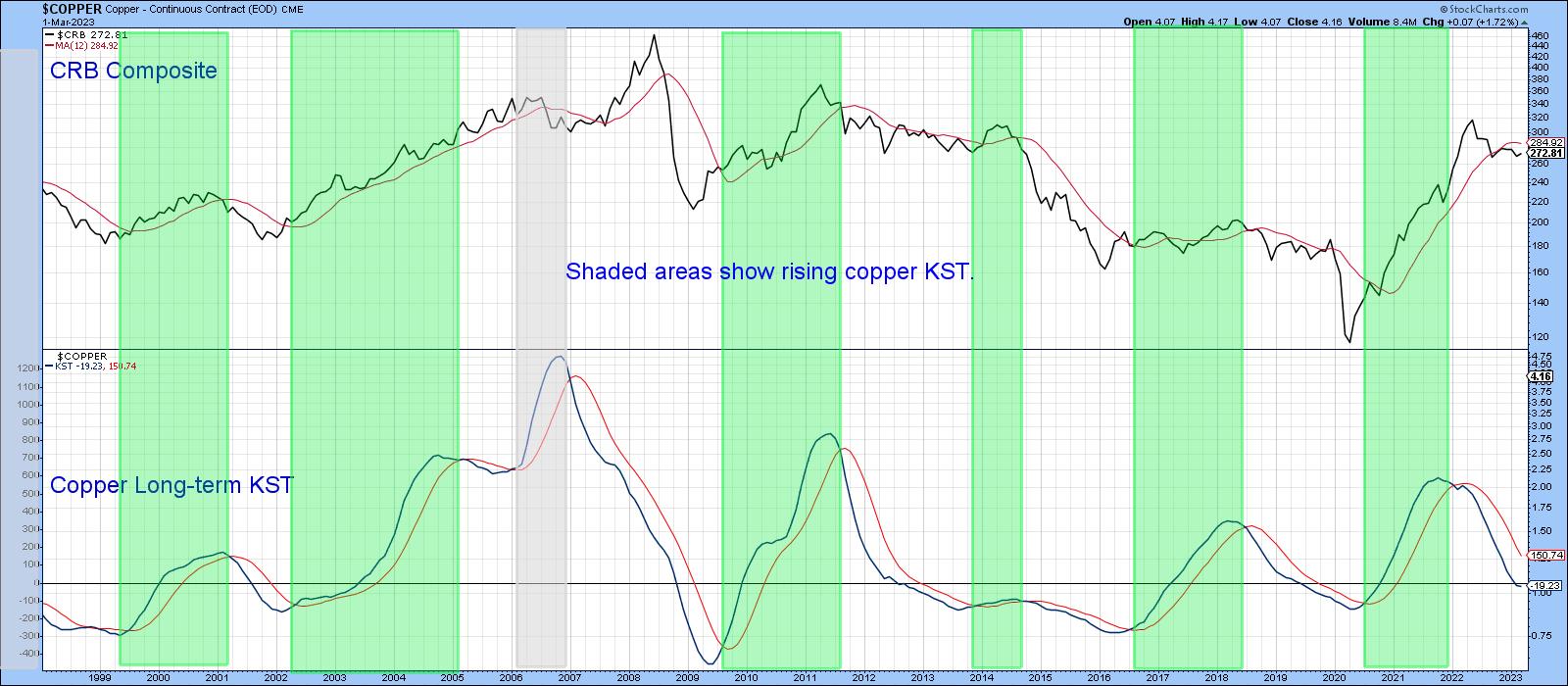

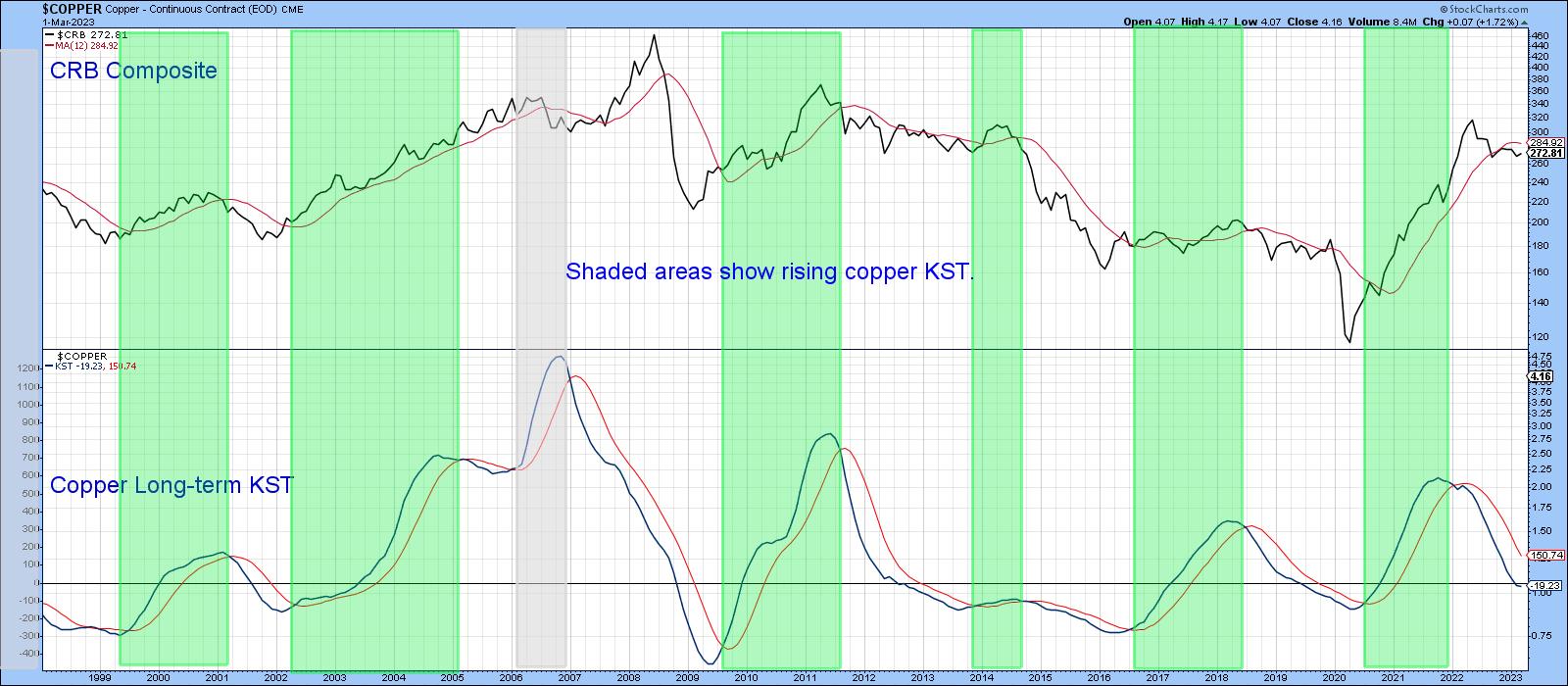

The Trend of This Metal Could Have Immense Consequences if It Breaks Out

by Martin Pring,

President, Pring Research

Commodity prices are an imperfect but useful forecaster of consumer price inflation. A key secular trend indicator that I use for industrial commodity prices went bullish last year. Since then, prices have corrected. However, it makes sense to take the pulse of the commodity markets from time to time, in...

READ MORE

MEMBERS ONLY

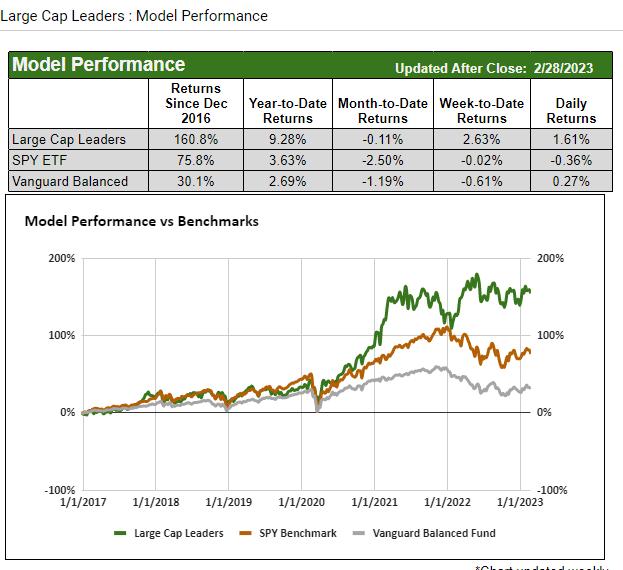

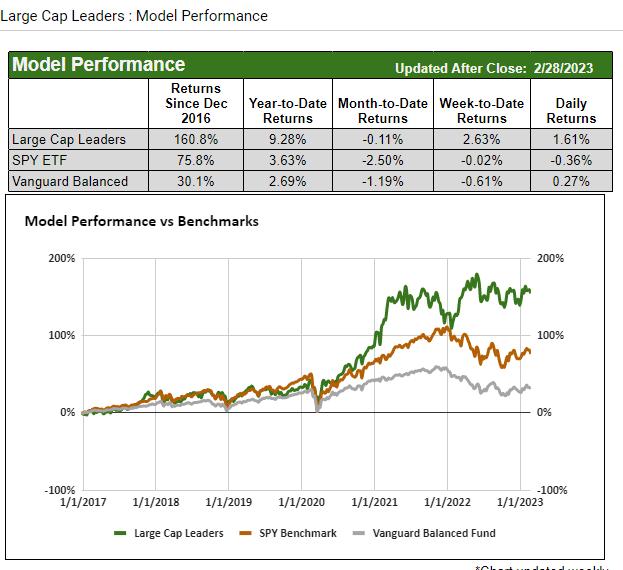

Industrial Metals Outperforming the S&P 500

Why are Large Cap Leadersleading?

While the major indices still try to sort out the next interest rate direction, soft, hard or no landing, and/or if inflation has peaked, a few stocks have dominated. Companies like Steel Dynamics (both holdings in the quant model) are in the manufacturing and...

READ MORE

MEMBERS ONLY

Stock Market Waiting Game: What You Should Be Watching

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

February, according to the Stock Trader's Almanac 2023, tends to be a weak month, especially in pre-election years. Now that February is behind us, does it mean the worst is over? Not necessarily. Each year comes with unique scenarios and challenges; this year, all else being equal, a...

READ MORE

MEMBERS ONLY

The War of Art (and Trading)

by Dave Landry,

Founder, Sentive Trading, LLC

If you trade, you must deal with bad times to get to the good. In this week's edition of Trading Simplified, Dave discusses how Steven Pressfield's "War Of Art" can help you to cope with these less-than-ideal conditions, and how you must continue to...

READ MORE

MEMBERS ONLY

Are We Staring at a Technical Rebound on This Metal Stock?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Metals and Commodities stocks have been relatively outperforming the broader markets for a couple of months now. This was the period when the US Dollar Index (DXY) underwent a strong corrective move after testing the highs of 114.77 in September. The retracement in the Dollar Index was a...

READ MORE

MEMBERS ONLY

A Breakout May Be in the Offing in This Engineering Stock

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equities have been quite jittery over the past couple of weeks. Broadly speaking, the headline index NIFTY50 ($NIFTY) has been oscillating between its 50-day moving average (MA) and 200-day MA during February. These MAs are placed at 17885 and 17302 respectively. Lately, the index has made strong attempts...

READ MORE

MEMBERS ONLY

NASDAQ New High/New Low Ratio and Risk

Stuck is a word we have used a lot lately.

Some common synonyms for stuck are jammed, trapped, put, pushed, and caught.

Nasdaq is stuck, jammed, or whichever word one wishes to use. And that's price. Traders are also trapped and caught, considering that the market breadth is...

READ MORE

MEMBERS ONLY

Sector Spotlight: Market Entering Period of Strong Seasonality

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I assess the current state of sector rotation, highlighting the ongoing rotation out of defense in favor of more offensive and economically-sensitive sectors. As it is the last Tuesday of the month, seasonality make ups a big part of the...

READ MORE

MEMBERS ONLY

Century Aluminum Pops Up as Bullish

The week is starting out exactly how we expect.

* The SPY and indices stuck in the trading range within a trading range.

* The latest economic data weak, hence causing buyers to return to the market, figuring bad news is good news.

* Four of the 6 Economic Modern Family members in...

READ MORE

MEMBERS ONLY

DP Trading Room: Not Too Late for Natural Gas

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl opens the trading room by discussing how the Silver Cross Index works and its superior representation of market participation. He also reviews the market and "S&P 10". Both he and Erin discuss Natural Gas...

READ MORE

MEMBERS ONLY

The Halftime Show: Soft Landing, No Landing, Fly By?

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

In this week's edition of StockCharts TV'sHalftime,with all of the talking heads and the "Wall Street" headlines throwing uncertainty into the mix (soft landing, no landing, and fly by, anyone?), Pete takes the time to find things that are more certain. He analyzes...

READ MORE

MEMBERS ONLY

Let The Charts Do The Talking

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We are provided constant reminders that important company information is reflected in the absolute and relative performance of the company's stock price. That may go against common sense in a few instances, especially when it comes to earnings. After all, the company is supposed to be delivering fresh...

READ MORE

MEMBERS ONLY

Oil, Energy, and Related Stocks of Interest

After the CORE PCE numbers came out on Friday, the market had the expected reaction of selling off in anticipation of a more aggressive Fed.

We find the reaction less than surprising. But what we do find more surprising is that the metals sank along with equities, although gold fell...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Draws Closer To Potential Support; RRG Charts Show Defensive Setup

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

It was a weak performance for the equity markets; after heading nowhere over the past two weeks despite staying volatile, the markets gave up some strength as they closed the week on a negative note. In the previous technical note, it was mentioned about the VIX, i.e., INDIAVIX was...

READ MORE

MEMBERS ONLY

Should we Continue Taking Trend Signals after Whipsaws?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The stock market has been a tough place for trend-following since January 2022, which is when the S&P 500 first triggered a bearish trend signal. The bearish signal in question is the humble 5/200 day SMA cross. There were whipsaws in the first quarter of 2022 and...

READ MORE

MEMBERS ONLY

Nothing Good Happens Below the 200-Day

by David Keller,

President and Chief Strategist, Sierra Alpha Research

One of my early mentors often remarked, "Nothing good happens below the 200-day."This was his way of recognizing that, while stocks can certainly pop higher from beaten down levels, you're more likely to experience sustained advances once the price is above the 200-day moving average....

READ MORE

MEMBERS ONLY

MEM TV: Negative Momentum Amid Rising Rates

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the markets' break below key support as inflation remains elevated. She also shares stocks from her watchlist that are trending higher amid a tough market.

This video was originally broadcast on February 24, 2023. Click on...

READ MORE

MEMBERS ONLY

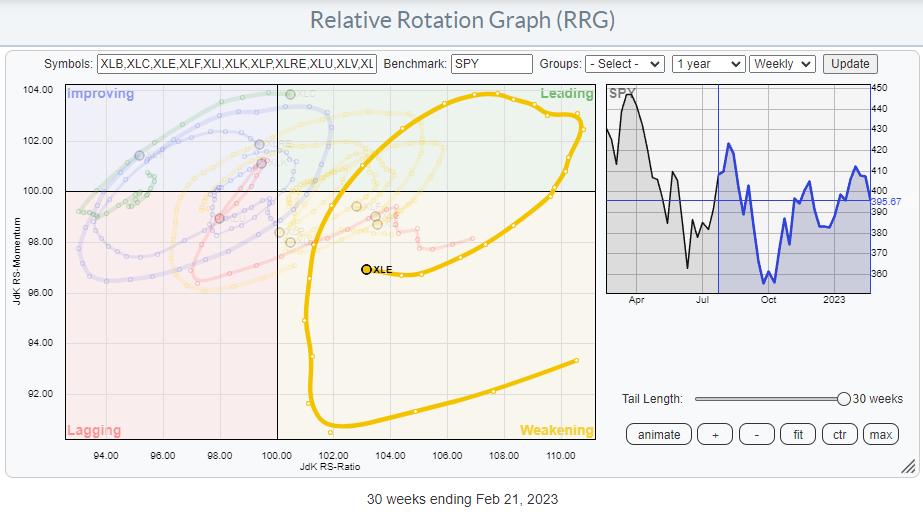

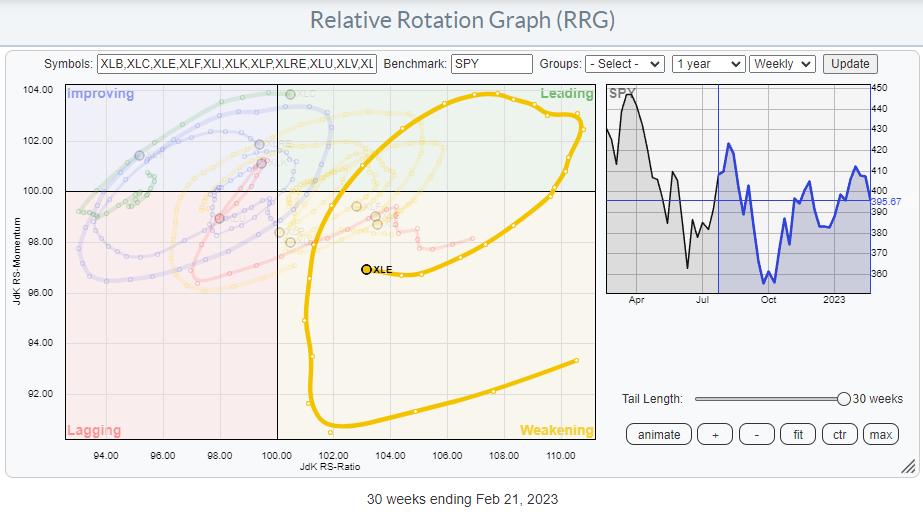

Looks Like a Major Shift in Leadership in the Energy Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Energy Sector Seems to be Coming Back to Life

On the Relative Rotation Graph (RRG), a long tail is visible starting in July 2022, traveling from weakening back up towards and into leading in October 2022. After another rotation through the leading quadrant, the tail for XLE crossed into...

READ MORE

MEMBERS ONLY

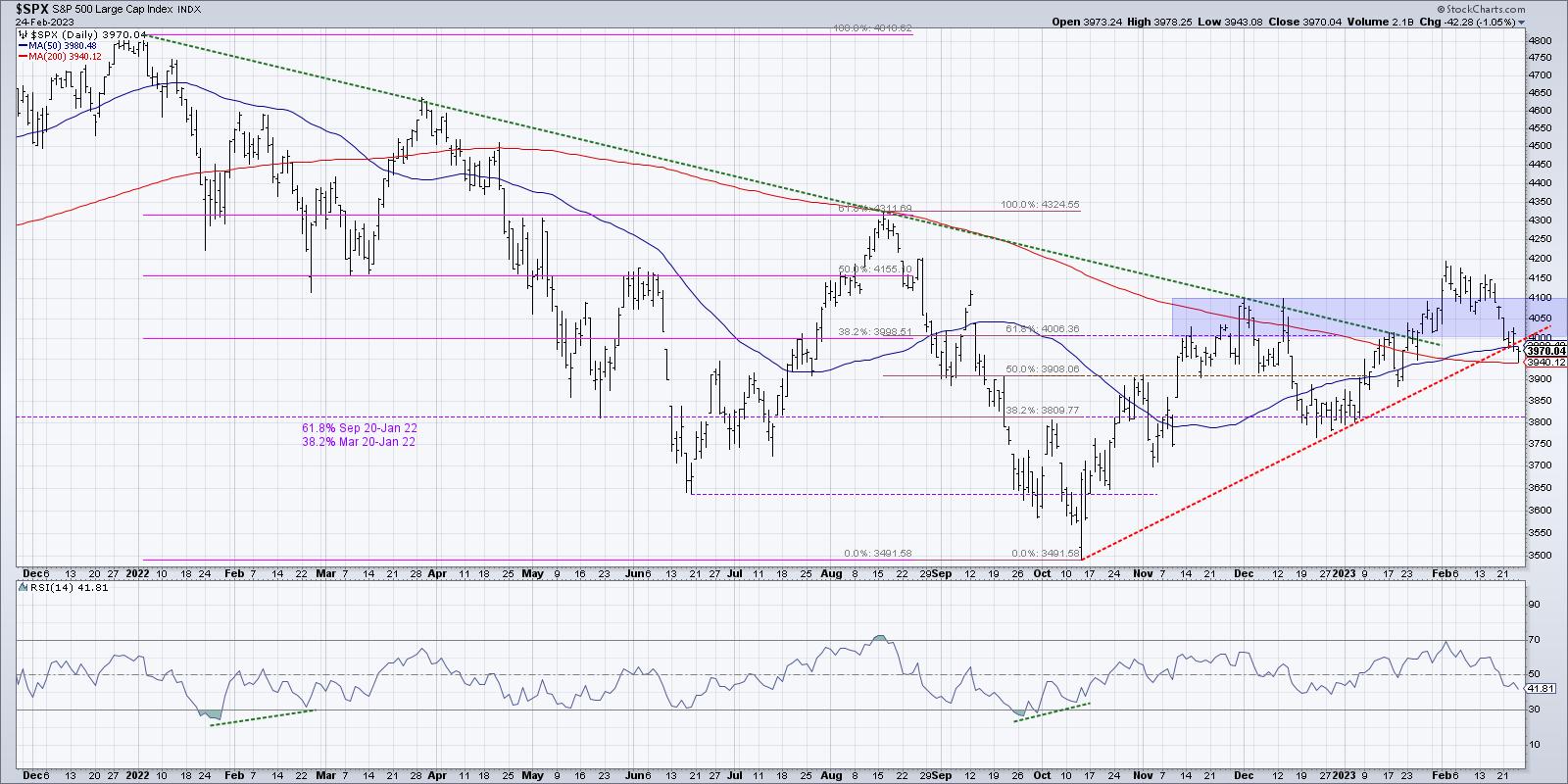

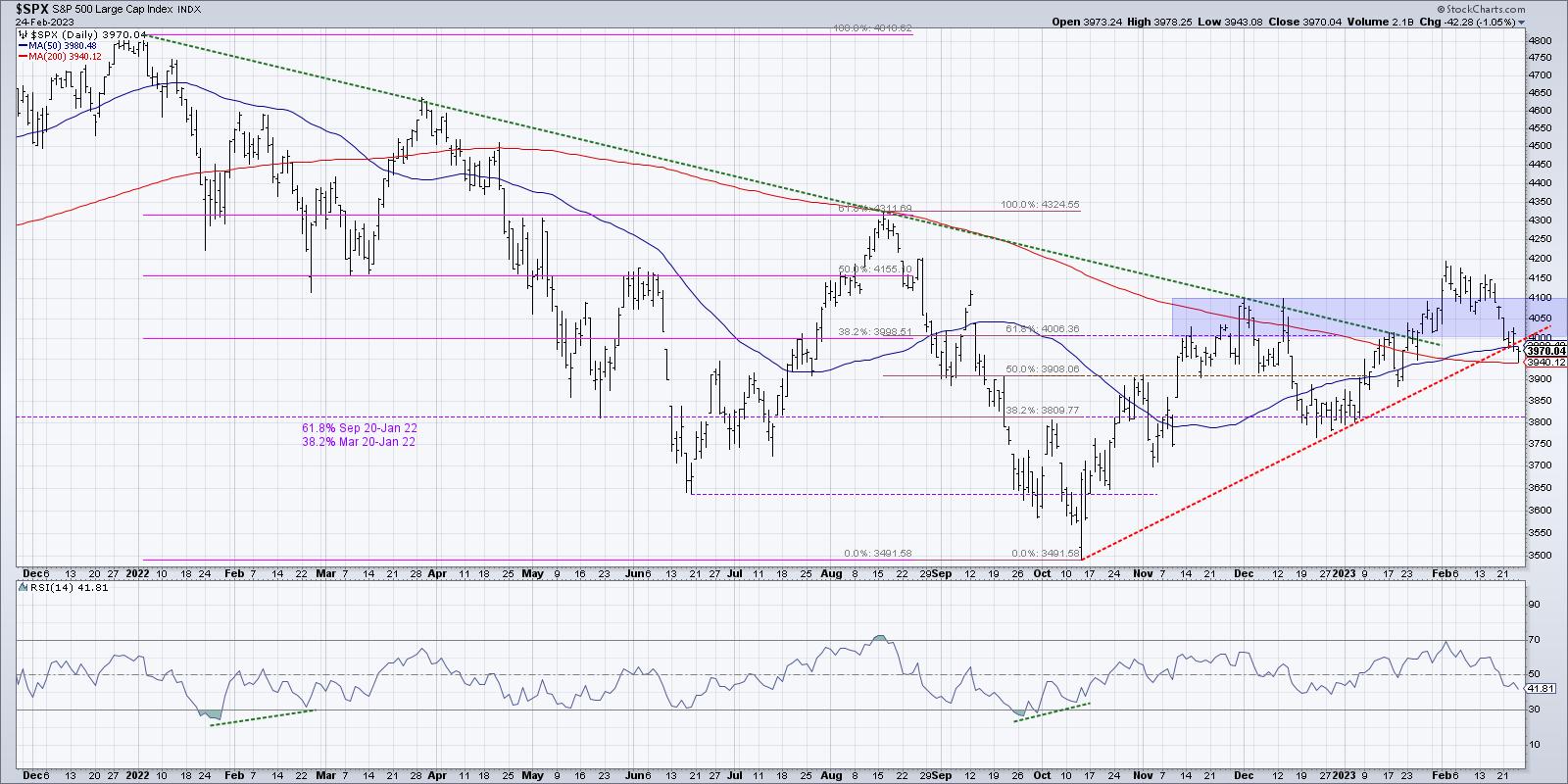

A Broad Market Bounceback or Bear Rally?

by Karl Montevirgen,

The StockCharts Insider

Driving into a dense fog of economic data can sometimes trigger something of an analytical spinout, where directionality and objects on the road are first felt, via gravity and impact, before they're seen. The January Personal Consumption Expenditure (PCE) report released this morning added another layer to this...

READ MORE

MEMBERS ONLY

Top 5 StockCharts Features to Use Every Day, Grouped n' Organized

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shows the best ways to organize your StockCharts experience, presenting the top 5 most important tools and features YOU need to be using on a daily basis!

This video was originally broadcast on February 24, 2023....

READ MORE

MEMBERS ONLY

Target Hit on SPY Pullback

by TG Watkins,

Director of Stocks, Simpler Trading

This week, the SPY pulled backed to the Daily 50-SMA, which was the target TG was looking for. Now it seems price is trying to hammer out a local bottom. Will it be enough? Will there be more downside? In this week's edition of Moxie Indicator Minutes, TG...

READ MORE

MEMBERS ONLY

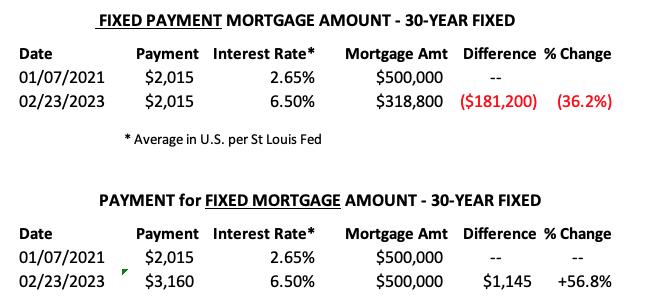

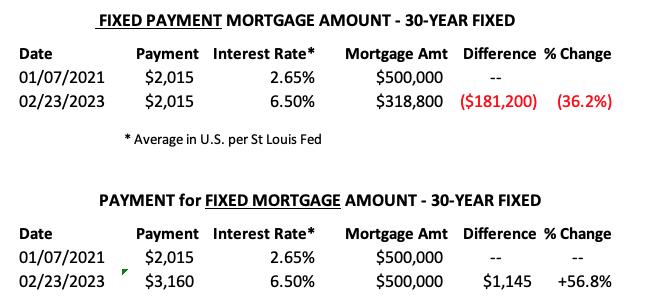

Mortgage Rates Continue Higher But Still Historically Low

by Carl Swenlin,

President and Founder, DecisionPoint.com

We watch the 30-Year Fixed Mortgage Interest Rate, because, for the most part, people buy homes based upon the maximum monthly payment they can afford. As rates rise, a fixed monthly payment will carry a smaller mortgage amount. As buying power has been shrinking, home prices have come under pressure....

READ MORE

MEMBERS ONLY

Hey Stock Market! Where Are You Heading?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

When the stock market can't decide which way it will go, investors have difficulty making decisions. But it doesn't have to be that way. You can up your investing game plan by following this road map.

CHARTWATCHERS KEY POINTS

* Looking at different asset types helps to...

READ MORE

MEMBERS ONLY

Sugar Prices Soar -- What Could It Mean?

What if sugar futures are really onto something?

What if they are relaying food shortages? More social disruption? The Start of Russian hoarding? Which leads to Geopolitical hell? And all the inflation theories that could still develop are staring us right in the face?

In the face of a rising...

READ MORE

MEMBERS ONLY

How to Use Emerging Relative Strength

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how he looks for signs of reversal in the relative strength vs. SPX. He explains how to look for emerging patterns that can be a leading indication of the price action. Instead of just looking for...

READ MORE

MEMBERS ONLY

STOCKS LOSE UPSIDE MOMENTUM -- RISING BOND YIELDS ARE BAD FOR STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW FAILS TEST OF AUGUST PEAK... The Dow Industrials led the three-month rally from their October low; and may be now leading the market lower. Chart 1 shows the Dow failing to clear a major resistance barrier at its August high and now falling back to the lowest level of...

READ MORE

MEMBERS ONLY

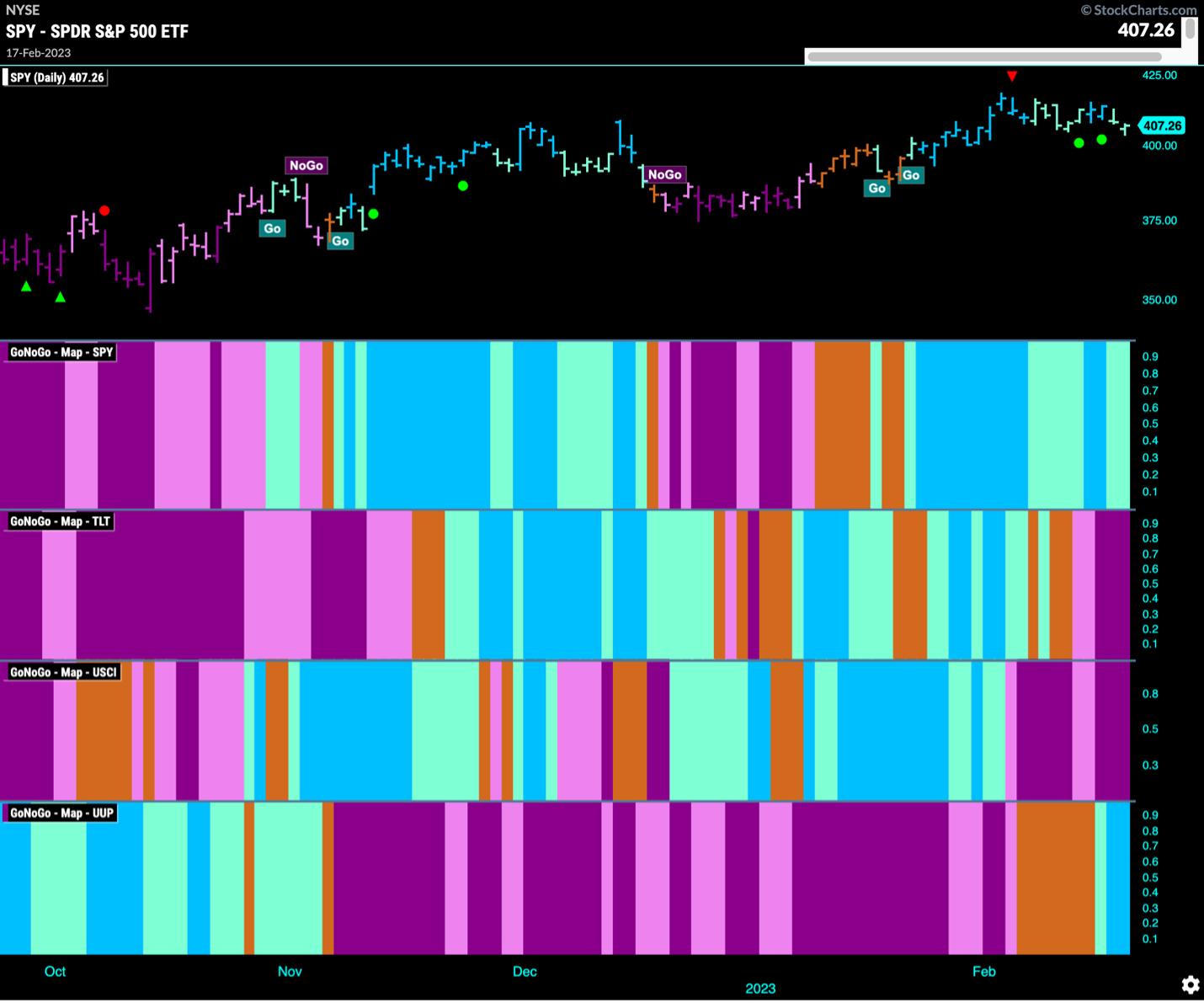

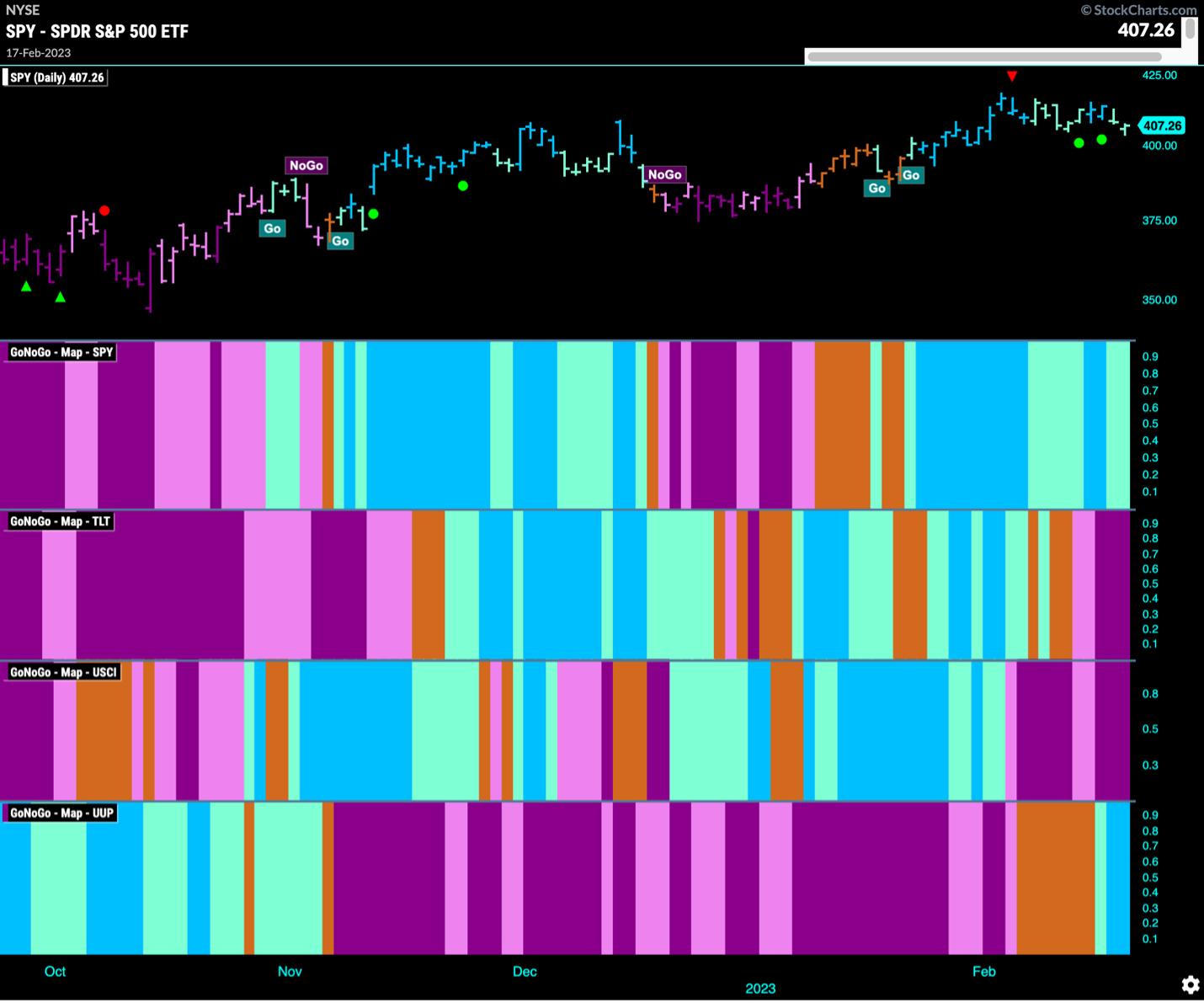

Stocks Tentatively In a Trend but Could Face Pressure

by Alex Cole,

Co-founder, GoNoGo Charts®

Equities are maintaining their "Go" trend status this week, but there could be weakness ahead. Treasury bonds and commodities are struggling while the US dollar finds its feet in a new trend.

Equities Continue To Pull Back From Recent High

Looking at the chart of iShares S&...

READ MORE

MEMBERS ONLY

Can Walmart Weather the Storm?

by Karl Montevirgen,

The StockCharts Insider

Walmart's (WMT) stock price jumped slightly over half a percent last Tuesday upon releasing its Q4 2022 earnings report. The retailer topped Wall Street's earnings and revenue estimates. And, despite expectations of a retail slowdown in the coming quarters, the company's guidance matched the...

READ MORE

MEMBERS ONLY

"No Landing"—Sugarcoated Words for Stagflation?

The above chart is from our MarketGauge product called Big View.

Risk Sentiment

Coming into the FOMC, the sentiment for risk is neutral. A week ago sentiment was 100% bullish. A month ago, it was neutral leaning towards bearish. Amazingly, the sentiment and the persistent trading range in the S&...

READ MORE

MEMBERS ONLY

Classic Short Setup in Tech

Akamai Technologies (AKAM) is a cloud computing company in the tech sector that deals with online security. Up until mid-2022, the trend was up.

Then, with the hawkish Fed, the trend changed, with AKAM eventually breaking the 23-month or two-year business cycle in May 2022. It just goes to show...

READ MORE

MEMBERS ONLY

These Four "Basket Cases" Have Great Looking Charts

by Martin Pring,

President, Pring Research

We are all aware of the investment principle that it's time to buy when the news is blackest. Even knowing this, it's always difficult to step up and click on that buy button, because the problems seem unsolvable. Moreover, how do we know for sure that...

READ MORE

MEMBERS ONLY

The Halftime Show: An In-Depth Overview of Chaikin Power Gauge Stock Ratings

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

In this week's edition of StockCharts TV'sHalftime,Pete breaks down the Chaikin Power Gauge Stock Rating System, shares what all of the ratings mean, and how you can use them to your advantage.

This video was originally broadcast on February 21, 2023. Click on the above...

READ MORE

MEMBERS ONLY

Ongoing Sector Rotation Out Of Defense Into Technology

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for US sectors continues to show a shift out of defensive sectors into more offensive and economically sensitive ones.

The improvement for XLC (communication services, XLY (consumer discretionary), and XLK (technology) continues and is visible inside the improving quadrant. All three tails are travelling at a...

READ MORE

MEMBERS ONLY

Sector Spotlight: This Sector is On Fire

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I look at the current state of sector rotation, highlighting the most important rotations from a positive as well as a negative perspective. After that, I zoom in on the Communication Services sector and highlight seven individual stocks; four worth...

READ MORE

MEMBERS ONLY

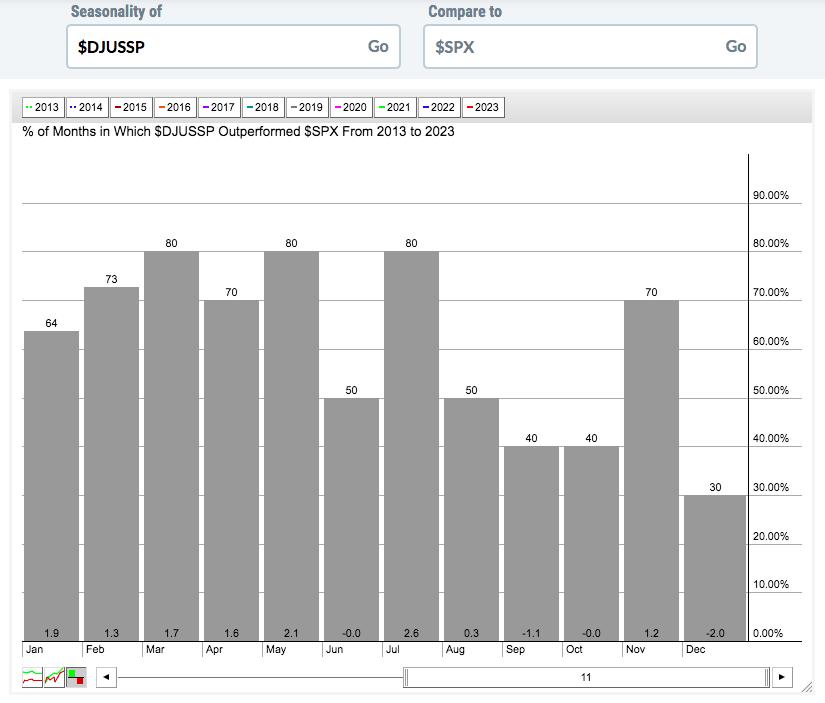

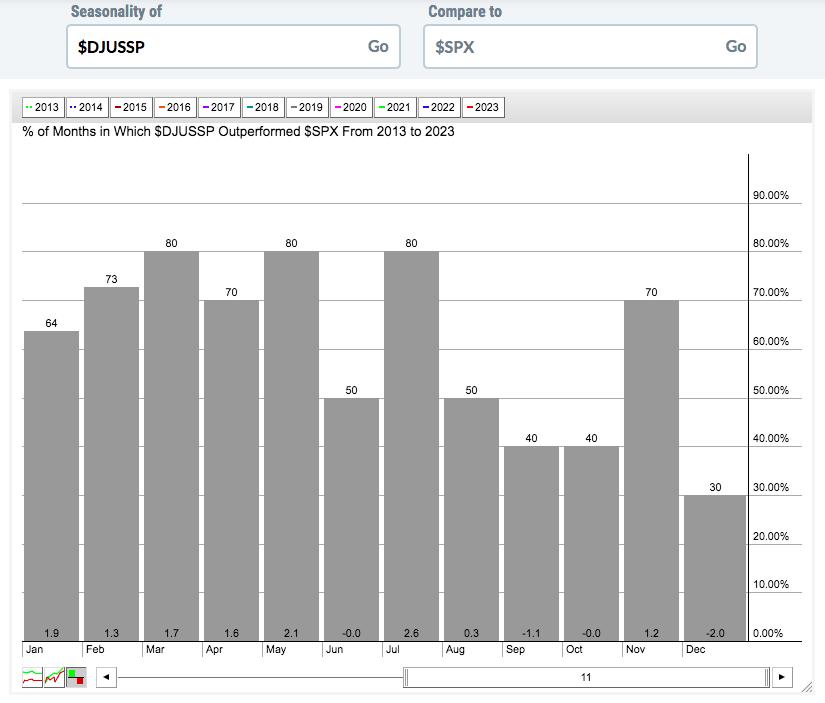

This Industry Group Loves the Next 3 Months

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Our research at EarningsBeats.com includes extensive seasonal studies, working off the seasonality tool here at StockCharts.com. We've recently ended the best historical period of the year, which runs from the close on October 27, 2022 through the close on January 18, 2023. But the bullishness doesn&...

READ MORE

MEMBERS ONLY

Comparing Gold to the S&P 500

This coming week is a big one. We have FOMC on tap, with some Fed members calling for .50 bps rate hike on the heels of the hot Producer Price Index and inflation. We have Gross Domestic Product on the heels of a strong retail sales number, and record amount...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Still Has Key Resistance Points to Deal With; This Sector Rolls Inside the Leading Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

It was the second week in a row that the markets did not make any major headway, staying directionless and ending with just modest gains. The previous days have seen volatility declining; the VIX remains at one of its lowest levels of the recent past. This week as well, there...

READ MORE