MEMBERS ONLY

Sector Spotlight: Seasonality Points to a Weak Start for 2023!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this year's first episode of StockCharts TV's Sector Spotlight, I address the expected seasonal performance for the stock market and the individual sectors. I locate one sector at high odds for outperforming the S&P 500 in January, as well as a sector with...

READ MORE

MEMBERS ONLY

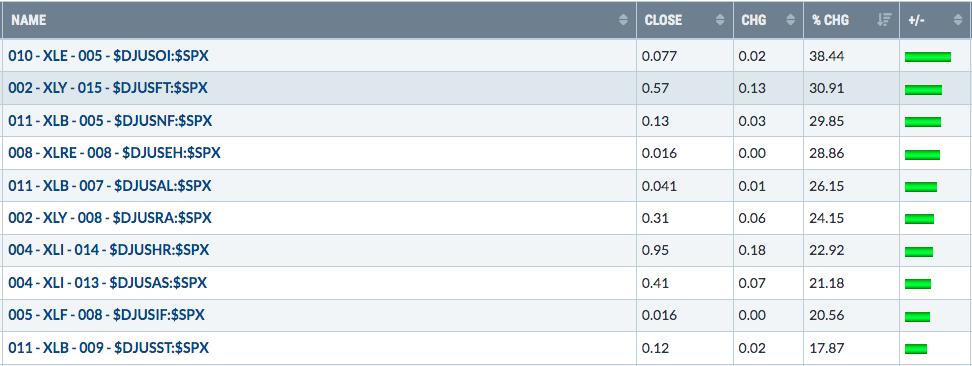

Top 10 Performing Industry Groups In Q4: Recap of 2022

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

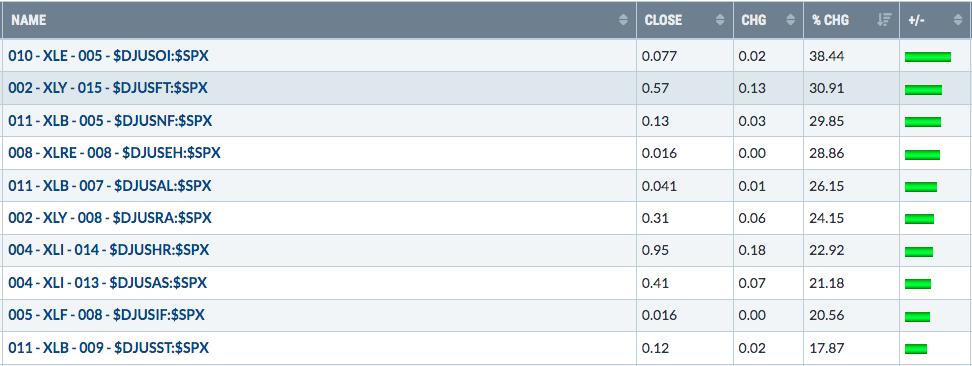

If you're looking for stocks that are momentum gainers, the best place to start is to find the leading industry groups. So which sectors were strong in 2022?

The first step is to identify the strong and/or strengthening industry groups. I keep an industry group relative strength...

READ MORE

MEMBERS ONLY

Is This Stock Setting Up As the Trade Of 2023?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There were times over the past few years that you probably wondered if Boeing (BA) would ever recover from its own miscues and the COVID-19 pandemic. Well, BA and its peer group, aerospace ($DJUSAS), were literally "flying" into the end of 2022. Check out the chart below.

If...

READ MORE

MEMBERS ONLY

My 2023 Stock Market Forecast

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

First of all, happy new year!!! I hope 2023 turns out to be a healthy and prosperous year for all!

As we look back on 2022, it was anything but that. We started the year on a very sour note and things went downhill from there - at least from...

READ MORE

MEMBERS ONLY

Week Ahead: Markets May Step into New Year On A Quiet Note; Staying Above This Zone Crucial

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

As the session on Friday ended, we not only ended the trading week, but also the month and the year. 2022 was choppy for the equities, to say the least. The markets had to navigate the weak trends, geopolitical tensions, inflation, fear of recession, and a slew of rate hikes...

READ MORE

MEMBERS ONLY

Money Is Pouring Into These 3 Industries Right Now

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

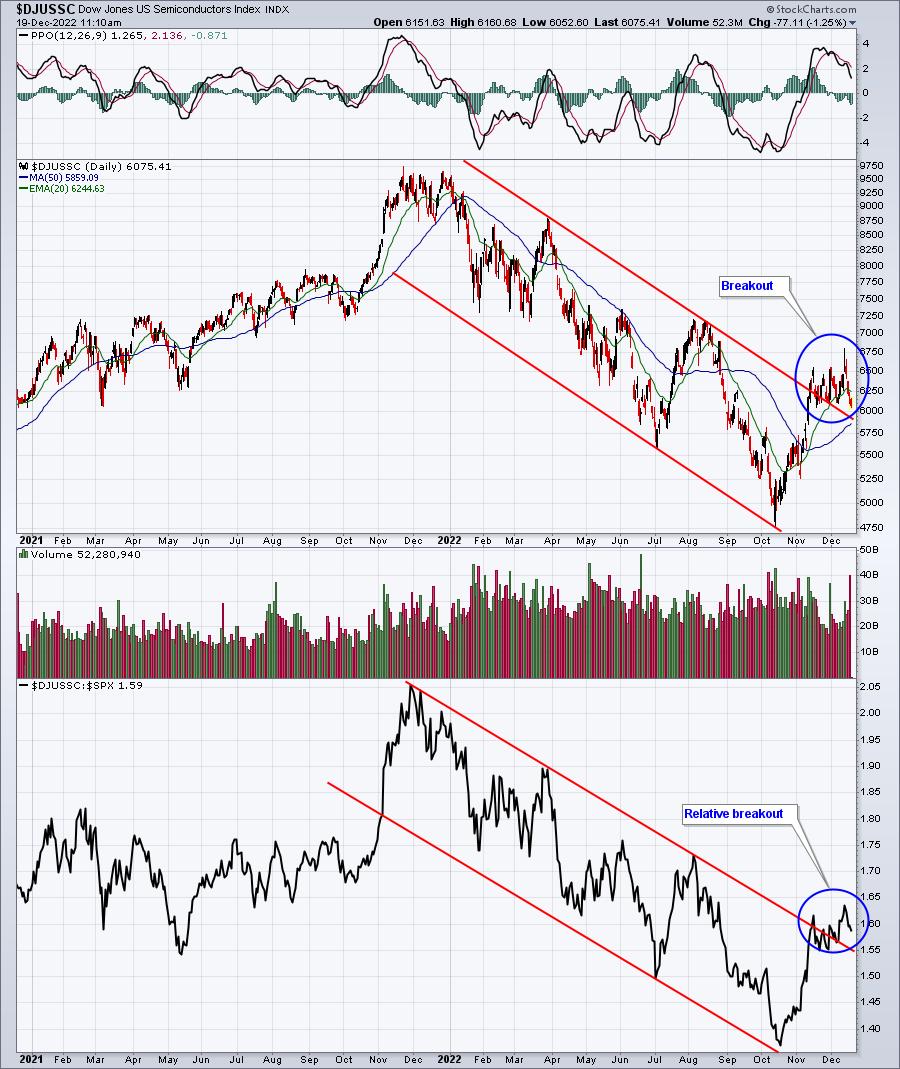

I've been watching critical areas like semiconductors ($DJUSSC), software ($DJUSSW), and internet ($DJUSNS) underperform vs. the S&P 500 throughout 2022. But the good news is that, since June, money rotating out of the three aforementioned aggressive sectors is finding a home in other industry groups. That&...

READ MORE

MEMBERS ONLY

Top 5 New Features And Chart Enhancements In ACP

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson's digging into more new features that just rolled out across the site, highlighting his top 5 favorites that have been added to ACP. He'll cover the new annotation features, indicator actions, right-click...

READ MORE

MEMBERS ONLY

Looking Back at The Biggest Rotation of 2022

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

I have been quiet on the video and blog side of things over the past weeks. Still, just before you pop the champagne for a grand New Year's eve celebration, I want to take the opportunity to look back at maybe the most important or dominant rotation that...

READ MORE

MEMBERS ONLY

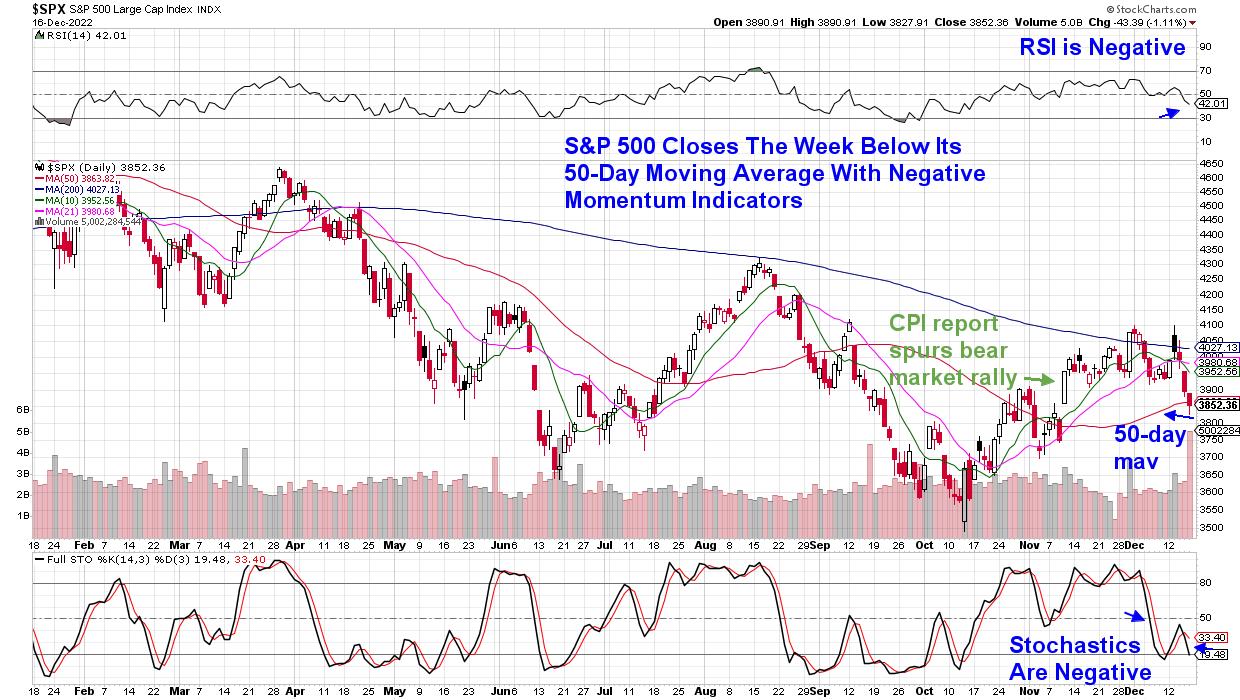

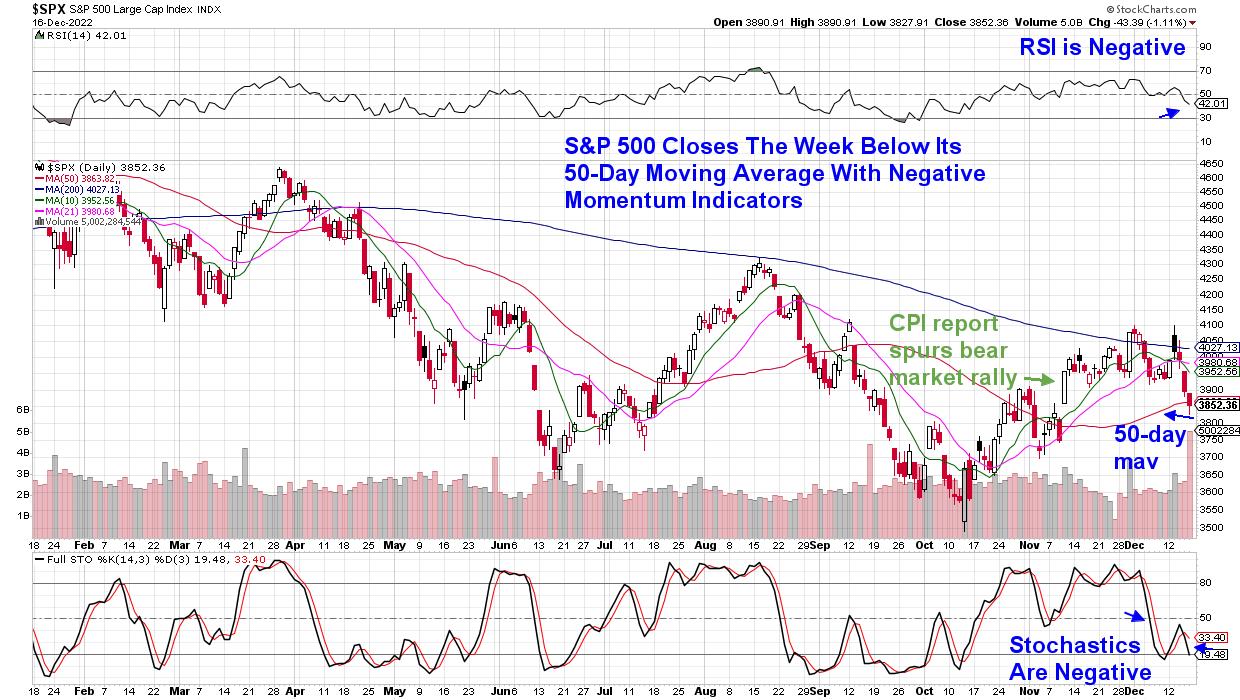

STOCKS END WEAK DECEMBER UNDER PRESSURE: NASDAQ HAS REACHED ITS AUTUMN LOW; SECTOR RANKING REMAINS DEFENSIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS END YEAR UNDER PRESSURE...

Little has changed since the last message written a couple of weeks ago. At that point, major stock indexes had failed a test of overhead resistance levels and were starting to weaken. They've weakened even further since then. Chart 1 shows the Dow...

READ MORE

MEMBERS ONLY

Top 5 New Year's Resolutions Every Stock Trader Should Make

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

As the year ends, it's time to think about your New Year's resolutions. But how can you make them last longer than a few weeks? Here's one approach traders and investors can try.

The ball has dropped, the champagne has popped, and you'...

READ MORE

MEMBERS ONLY

Put/Call Ratio is Telling Bears to Watch Out!

by Carl Swenlin,

President and Founder, DecisionPoint.com

If you're tuned in to the financial media, you may have heard that the put/call ratio is at an extreme. I don't usually pay a lot of attention to this indicator, as it's hard to interpret, but when I looked at it this...

READ MORE

MEMBERS ONLY

This Is The Chart To Watch

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

According to Fidelity.com, Apple, Inc. (AAPL) represents 12.95% and 6.51% of the QQQ and SPY, respectively. The QQQ and SPY are exchange-traded funds that track the NASDAQ 100 and S&P 500 Index respectively. That's a very large weighting, so it would seem to...

READ MORE

MEMBERS ONLY

Weekend Daily: Tips for Trading Profitably in a Bear Market

Many investors have had a rough year.

2022 has been characterized by turbulence in financial markets. The Nasdaq Composite, S&P 500 Index, and Russell 2000 are all in bear market territory, while the Dow Jones is the only U.S. index down less than 10% YTD. The performance...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Drags Its Resistance Lower; Watch PSE, Energy Along With These Sectors For Resilience

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past few days, the levels of 18600 on NIFTY have assumed a lot of importance as the index had staged a breakout above this point but ended up slipping below this level following a full throwback. In the previous editions of weekly technical notes, it has been mentioned...

READ MORE

MEMBERS ONLY

My Worst Call of the Year

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When I worked on the institutional buyside, we had the opportunity to hear from lots of brokers, strategists, and analysts in the industry. And I was thrilled to have some of the top technical analysts around coming through to talk charts with us. One of my favorite questions to ask...

READ MORE

MEMBERS ONLY

MEM TV: Market Outlook Into the New Year

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews some of the key events driving price action as we head into the New Year. She also highlights the impact of last week's rise in interest rates, as well as key areas of support for...

READ MORE

MEMBERS ONLY

Will Santa Show Up on Wall Street? He Just Might.

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Warning! Inclement weather at the North Pole might impact Santa's trip to Wall Street.

As the end of the year approaches, you're likely to hear the term 'Santa Claus rally" come up often. But what exactly is it, and how can traders and investors...

READ MORE

MEMBERS ONLY

Top 5 Charts Every Trader Needs to Watch in 2023

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

What will the stock market look like in 2023? It's hard to tell, but these five charts could elevate your market awareness by a few notches.

Forecasting stock price movement is never easy, not even for the most experienced stock investor. As an investor or trader, the closest...

READ MORE

MEMBERS ONLY

Crude Oil (USO) Garners PMO BUY Signal - 20+ Bonds (TLT) Triggers PMO SELL Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

Reminder: Prices go up for new DecisionPoint.com subscriptions in January. Details are below the article.

Crude Oil has been in a short-term declining trend since the beginning of November. Big picture, it is in a large trading range. After spending so much time being beat down, crude is finally...

READ MORE

MEMBERS ONLY

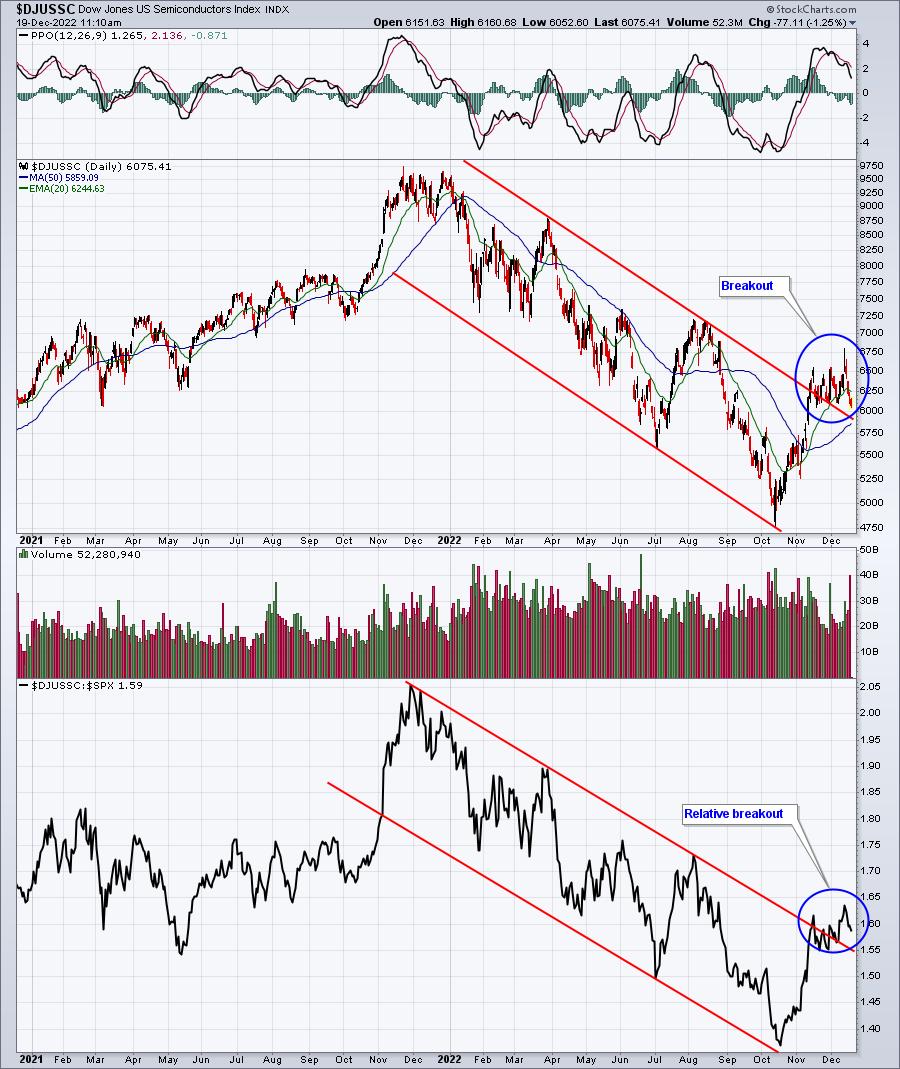

Mish's Daily: Sister Semiconductors—A Gauge of High-Tech Industries

Even the biggest Grinches on Wall Street might need to rethink their outlook for the final trading days of 2023, as U.S. stocks rallied on surprising consumer confidence numbers and strong earnings from Nike (NKE) and FedEx (FDX). This is cause for some holiday cheer, signaling that good financial...

READ MORE

MEMBERS ONLY

Investor Lessons from the World Cup in Qatar

by Gatis Roze,

Author, "Tensile Trading"

Excellence that we investors can learn from and utilize in our trades is all around us. I encourage you to harness that energy. Here's how to use it to motivate yourself to become better as a trader and investor.

As I watched the World Cup Soccer matches in...

READ MORE

MEMBERS ONLY

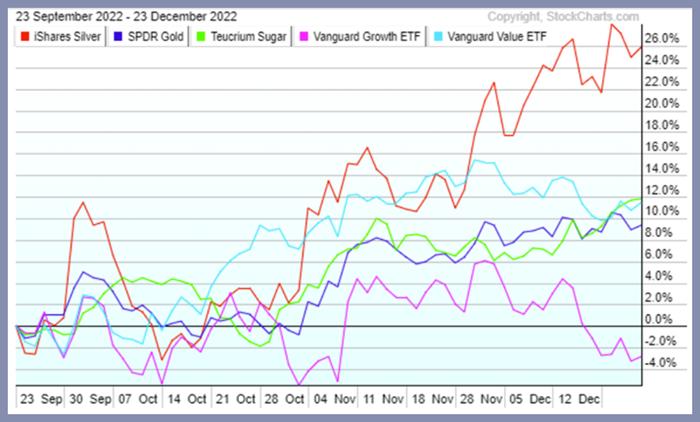

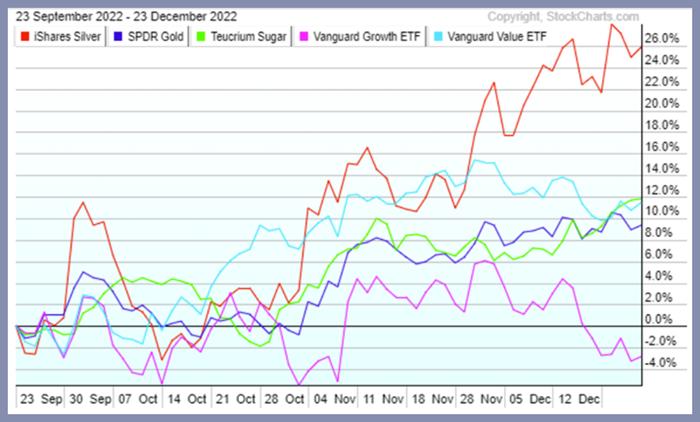

Mish's Daily: Don't Miss Out on the Next Gold Rush

Gold always has been and will always be a controversial asset within investment circles. Its proponents can't agree on why it deserves a place in portfolios or how much to allocate to gold in various risk-based portfolio models.

But gold can be used as insurance against macroeconomic tail...

READ MORE

MEMBERS ONLY

Mish's Daily: Is the Santa Claus Rally Over?

Bond prices plummeted, yields increased, and U.S. indexes fell again Monday.

The major U.S. indexes have fallen for the past two weeks, and, on Monday, most markets closed near their lows. The S&P 500 Index, represented by the SPDR S&P 500 ETF (SPY) above,...

READ MORE

MEMBERS ONLY

Santa Comes Up Empty-Handed

by Martin Pring,

President, Pring Research

Statistically speaking, the last half of December is the best seasonal period of the year, part of which serves as what is popularly known as the Santa Claus rally. The first half of the month also has a slight edge to the upside, though that has not worked out so...

READ MORE

MEMBERS ONLY

DP Trading Room: Silver Cross Index Warning Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl reignites his discussion on watershed events, showing us how the Hunt Brothers' attempt to corner the market in Silver also raised Gold prices to historic levels. Of course, we know how this ended... not well for investors...

READ MORE

MEMBERS ONLY

The Halftime Show: Yet Another Sell-Off

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Coming to the end of the year on this week's edition of StockCharts TV'sHalftime (presented by Chaikin Analytics), Pete's focus is primarily on the market and the mechanics of the market in general. Another sell off is in progress today, as the indices and...

READ MORE

MEMBERS ONLY

Will This Major Support Level Hold?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Semiconductors hold the key to a major market advance, in my opinion, as they're a critical part of the NASDAQ 100 ($NDX). There are 16 semiconductor companies in the NDX, including NVIDIA (NVDA), Advanced Micro Devices (AMD), Texas Instruments (TXN), Applied Materials (AMAT), QUALCOMM, Inc. (QCOM), and Intel...

READ MORE

MEMBERS ONLY

Small Cap Stocks: Is This Group Friend or Foe?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Since the S&P 500 Index ($SPX) broke out above price resistance that was established in 2000 and 2007, the secular bull market rally has been led by the Nasdaq 100's influence. If you compare relative performance (to the benchmark S&P 500 Index), small caps...

READ MORE

MEMBERS ONLY

The Markets Are Oversold : Will This Provide a Window For Santa?

by Mary Ellen McGonagle,

President, MEM Investment Research

Statistics show that December has the highest probability of a positive return over every other month of the year, and by a fair margin. Using data from 1926 to 2020, the odds of a positive return for U.S. large-cap stocks are 77.9%.

However, the markets will have some...

READ MORE

MEMBERS ONLY

Weekend Daily: Wall Street Banks Favored Over Main Street's Regional Banks

The SPDR S&P Regional Banking ETF (KRE) is a key member of Mish's Modern Family. Why? Because KRE measures the health the U.S. financial system and the overall economic activity of rural America.

Regional banks have performed relatively well compared to larger, more prominent banking...

READ MORE

MEMBERS ONLY

MEM TV: S&P 500 Breaks Key Support!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews where the next area of possible support is for the markets, as well as what to be on the lookout for going into next week's normally bullish period. She also highlights price action in Value...

READ MORE

MEMBERS ONLY

The End of Another Bear Market Rally?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Charts give you a window into the collective psychological state of investors. Are people excited or panicky? Euphoric or despondent? Optimistic or pessimistic? All of that is embedded in price action if you know how to analyze the trends.

As the market rallied strongly off the October lows, fueled by...

READ MORE

MEMBERS ONLY

How to Benefit From a Two-Stock Wrecking Ball

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

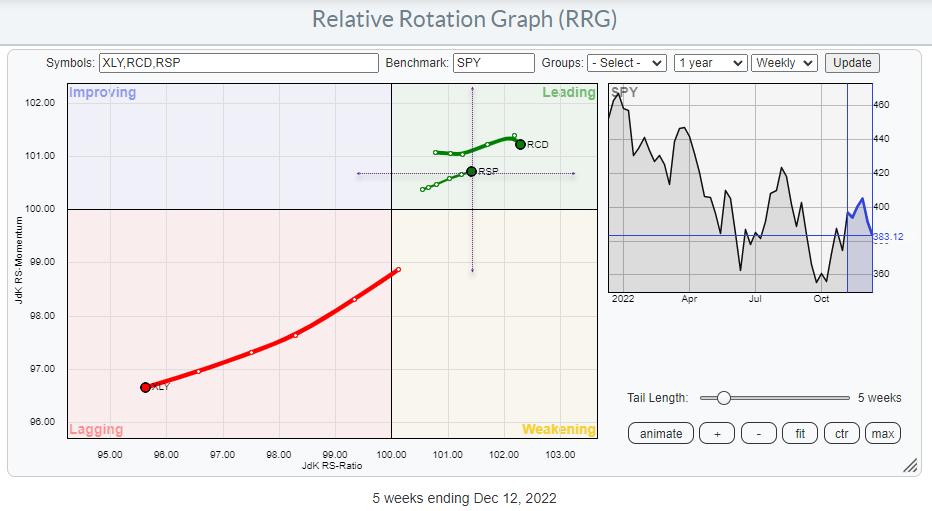

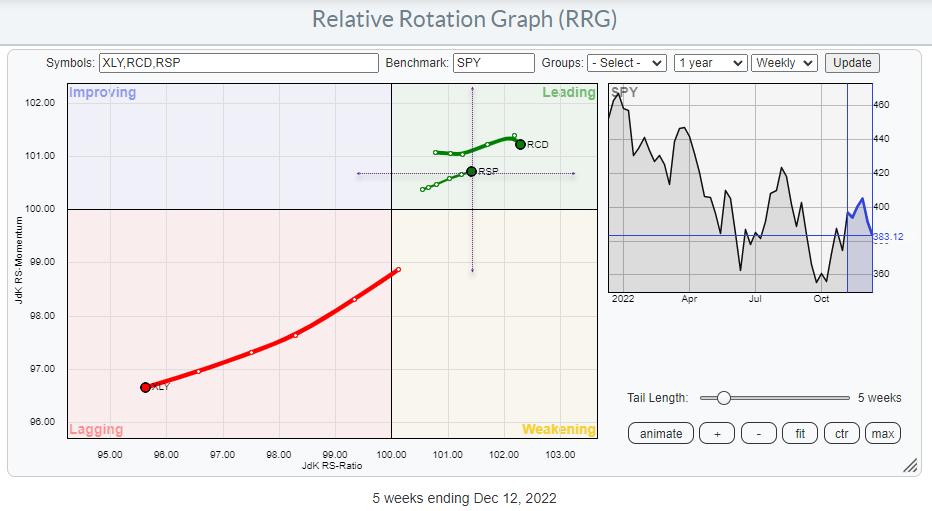

The Relative Rotation Graph above shows an intriguing picture.

Opposite Rotations

Last week in Sector Spotlight, I discussed the opposite rotations for XLY and its equal-weight counterpart RSP vs. their respective benchmarks (SPY and RSP). When you bring up the Relative Rotation Graphs for cap-weighted S&P sectors alongside...

READ MORE

MEMBERS ONLY

Has the Market Priced in All the Bad News?

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG shares how there are two narratives out there for the future direction of the market, discussing both of them. Which one is true is what we are all debating and what the market is also trying to figure out....

READ MORE

MEMBERS ONLY

It's Like Déjà Vu, All Over Again for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The SPDR S&P 500 exchange-traded fund (SPY) surged from mid-October to early December, but this advance was considered a counter-trend bounce within a bigger downtrend. And this week, SPY reversed its short-term uptrend and the bearish technical setup was similar to the last two reversals.

First and foremost,...

READ MORE

MEMBERS ONLY

GNG TV: US Equity "Go" Trend Wobbles

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex and Tyler review markets following the recent 50-basis-point hike from Fed Chairman Jerome Powell. While the relief rally in the S&P 500 has retained its "Go" trend conditions, early warning signs from GoNoGo Oscillator...

READ MORE

MEMBERS ONLY

Using MACD to Pinpoint Reversals

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how to use MACD to look for reversal signals. By using two timeframes, an investor can identify when momentum is shifting in one of them. Then, you can use the lower timeframe to point the timing....

READ MORE

MEMBERS ONLY

Stocks Fall Sharply at Key Resistance Levels: Year End Rally May Have Run Its Course

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES ARE FAILING AT OVERHEAD RESISTANCE LEVELS...

The year-end stock market rally appears to have run its course. A more hawkish Fed on Wednesday suggesting that rates will be higher for longer started the stock selling. This mornings's economic reports for November showed a drop in retail...

READ MORE

MEMBERS ONLY

Short-Term Traders: Beware of This Flaw In Leveraged ETFs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've written many articles and discussed several times that it's unwise to buy and hold leveraged exchange-traded funds (ETFs) unless you're at a major support level or you catch an uptrend. Buying and holding through volatile periods results in erosion. In other words, if...

READ MORE

MEMBERS ONLY

Here's A Chart That's Flashing a Major Buy Signal During This Selloff

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

You've probably heard the adage, "Don't judge a book by its cover?" Well, it's tempting to say that when you look at the possible Fed-induced selloff in the stock market. While we're seeing a lot of negativity, let's...

READ MORE