MEMBERS ONLY

A Simple Way to Clarify Price Structure

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows why having 2 versions of ACP running at the same time can be a nice advantage in situations where the price structure is not crystal clear. He also explains how to use price structure in conjunction...

READ MORE

MEMBERS ONLY

Three Indicators that Call Bear Market Bottoms Were AWOL at the October Lows

by Martin Pring,

President, Pring Research

To many, October represents the low for the 2022 bear market and what we are seeing today is the first leg of a new bull trend. After all, interest rates have probably peaked, inflation is dying, supply chain problems are over and so is the pandemic.

Looking Closely at the...

READ MORE

MEMBERS ONLY

Stock Market Indexes and Fibonacci Retracements: Will the Nasdaq Push Through This Key Level?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Smaller rate hikes were music to investors' ears. After two down days that looked like it could have stretched to three, the markets pulled a quick reversal and came roaring back after Fed Chairman Powell's speech at the Brookings Institution.

If you were following the markets on...

READ MORE

MEMBERS ONLY

Mish's Daily: The Next Stop on This Fierce Bear Market Rally: A Global Recession?

Determining whether we are in a risk-on or risk-off climate is challenging, especially after a fantastic day of gains in every major U.S. index.

We should be in a risk-on environment. The Chinese stock market even rose, with technology and electric vehicles leading, as investors hoped for a more...

READ MORE

MEMBERS ONLY

New Bull Market for the Dow Industrials?

by Carl Swenlin,

President and Founder, DecisionPoint.com

As of today, the Dow Jones Industrial Average has advanced to just over +20% from its October low, which by some standards means it has entered a new bull market. Does that mean that the worst is over and that the rest of the market will follow suit? Maybe.

A...

READ MORE

MEMBERS ONLY

Putting the Theory into Practice

by Dave Landry,

Founder, Sentive Trading, LLC

On this week's edition of Trading Simplified, Dave notes that, while there are plenty of books on trading filled with great setups, most are missing how to actually put the theory into action. With this in mind, Dave shows you two new mystery charts (and one that'...

READ MORE

MEMBERS ONLY

Sector Spotlight: Are Financials Ready to Push?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, wrapping up the month of November, I address the seasonality effects for stocks in general, as well as sectors. I then align these historical observations with the actual rotations as they are playing out on the Relative Rotation Graph, while...

READ MORE

MEMBERS ONLY

SPY Remains Under Pressure, But These Sectors are Improving

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

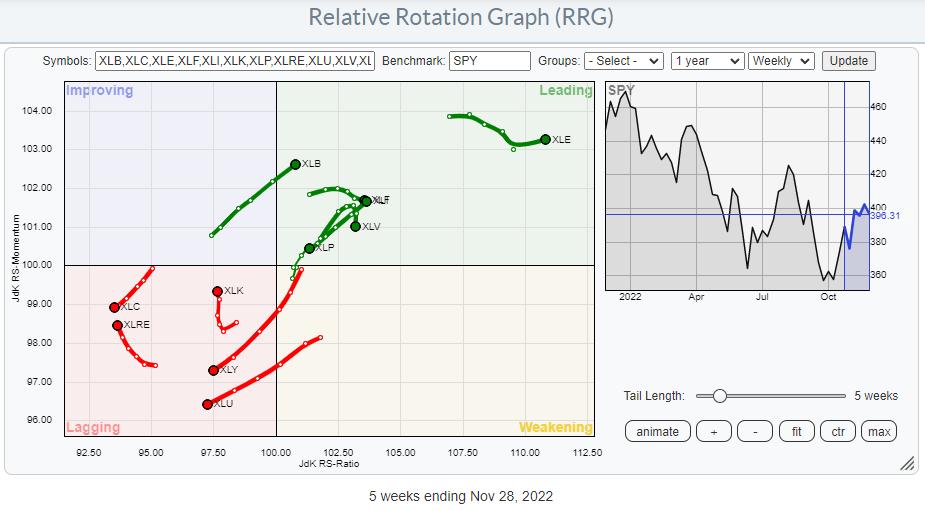

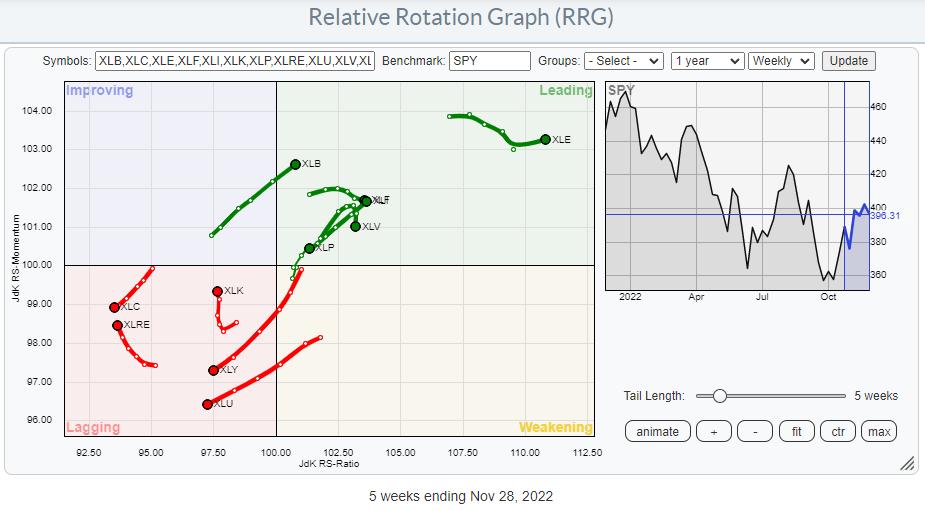

Relative Strength is Losing Its Concentration

Recent sector rotation shows a relative strength loss for two of the three defensive sectors. This is a move away from the trend we have seen for many months, where the defensive sectors were leading the market, sometimes even when the S&P...

READ MORE

MEMBERS ONLY

Peabody Energy Corp Leads the Energy Sector

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

A year or so ago, the thought of investing in coal companies may not have crossed your mind. Yet coal stocks seem to be playing a part in leading the Energy sector higher, at least for the short term.

One chart that looks particularly interesting today is Peabody Energy Corp....

READ MORE

MEMBERS ONLY

Mish's Daily: Will the Dow Jones Continue Higher? Will the Nasdaq Follow?

It's been a volatile few weeks in the markets, and it can be hard to tell if we're currently in a risk-on or risk-off environment. Have we seen the market lows for 2022, or will the market reverse lower before the end of the year?

The...

READ MORE

MEMBERS ONLY

Mish's Daily: Critical Intersections for Small Caps, Retail, Semis, and Long Bonds

The overall market is at a crucial intersection.

Let's take a deeper look at a few Modern Family members, focusing on semiconductors (SMH), long bonds (TLT), small caps (IWM), and retail (XRT). These sectors will be crucial to determining the market's trajectory for the rest of...

READ MORE

MEMBERS ONLY

DP Trading Room: How Falling Wedges Work

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl begins the Trading Room with a discussion on what falling wedge chart patterns are and why they have the expectation of an upside conclusion. Erin and Carl both review how exponential moving averages (EMAs) work and why they...

READ MORE

MEMBERS ONLY

Black Friday Data Trickling In: Which Retailer Is Winning?

by Mary Ellen McGonagle,

President, MEM Investment Research

Many economists have been predicting a flat holiday sales season in the U.S. due to a weaker economy brought on by higher inflation. So far, however, the long Thanksgiving weekend has been more buoyant than expected.

To begin, Black Friday sales broke $9 billion in sales, which is a...

READ MORE

MEMBERS ONLY

The Halftime Show: Cautiously Optimistic

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

On this week's edition of StockCharts TV'sHalftime, presented by Chaikin Analytics, Pete gives a run down of the current markets, which appear to be taking a break from their pretty good run over the last month. With industrials and materials still looking strong, he's...

READ MORE

MEMBERS ONLY

5 Things To Know Right Now; Our Fall Special Ends Today!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's been a long 2022 for many in the stock market as we've seen all-time highs in early January morph into one of the worst bear markets since 1950. While we've seen a significant decline in equity prices, the market environment now is much...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Approaches Lifetime High Point on Weak Breadth; These Three Sectors Look Promising

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, it was mentioned that the market has a resistance in the 18300-18400 level zone while it navigates the November month expiry of the derivative series. Quite on the expected lines, the NIFTY consolidated in the first half of the previous week; however, in the last...

READ MORE

MEMBERS ONLY

What to Expect from Granny Retail This Holiday Weekend

As the Thanksgiving holiday shopping weekend is here, we will be looking at Granny Retail XRT (SPDR S&P Retail ETF).

Investors and retailers are closely monitoring consumption over the holiday weekend. The National Retail Federation estimates that 166.3 million Americans will shop through Cyber Monday, up by...

READ MORE

MEMBERS ONLY

Here's How You Can Get 4 FREE MONTHS Of StockCharts Premium Membership On Monday, Nov. 28th

by Grayson Roze,

Chief Strategist, StockCharts.com

The countdown is on people! We're less than two days away from the BIGGEST sale of the year here at StockCharts.

For one day only this Cyber Monday, you can get up to 4 FREE MONTHS of StockCharts service when you sign up for a new account or...

READ MORE

MEMBERS ONLY

TG's Basic Chart Setups

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's educational edition of Moxie Indicator Minutes, TG goes over his basic chart setups, the indicators he uses, and some basic principles that he implements in his trading.

This video was originally broadcast on November 25, 2022. Click this link to watch on YouTube. You can...

READ MORE

MEMBERS ONLY

DOW HITS SEVEN-MONTH HIGH WHILE THE REST OF THE MARKET LAGS BEHIND -- HEALTHCARE HAS BECOME A MARKET LEADER

by John Murphy,

Chief Technical Analyst, StockCharts.com

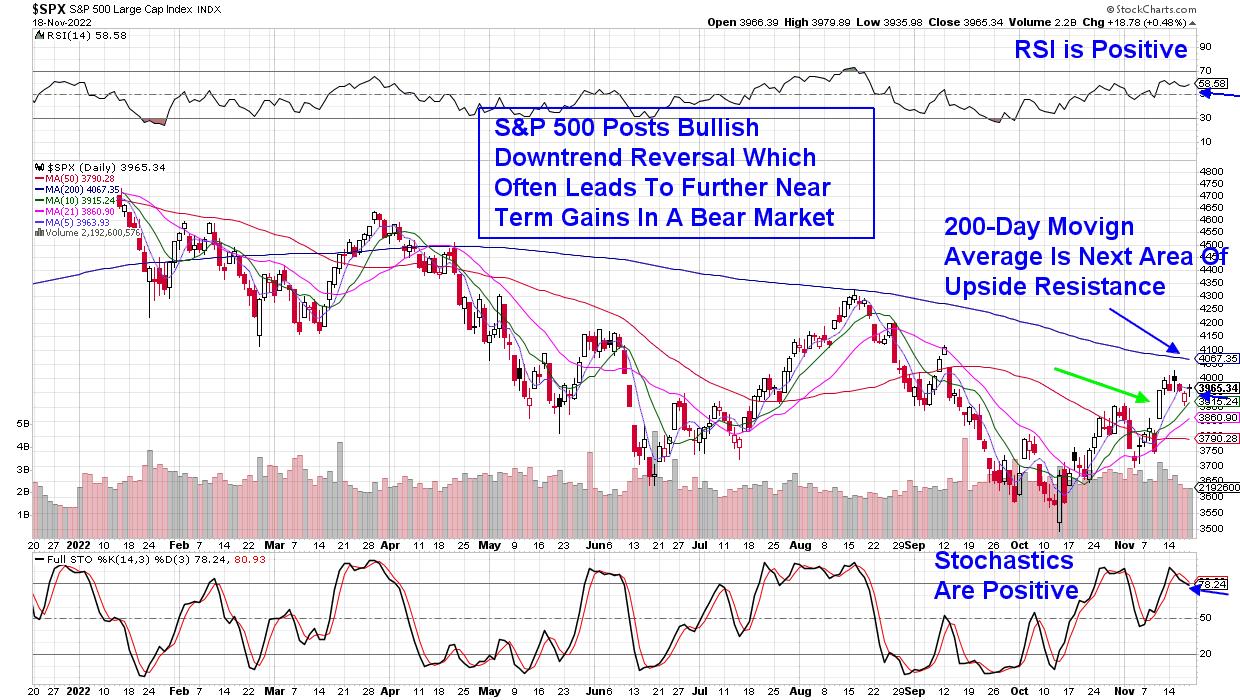

DOW CONTINUES TO LEAD... The market ended the Thanksgiving week with the Dow gaining ground on Friday while the S&P 500 and and Nasdaq ended the day lower. For the week, all three gained ground with the Dow in the lead and the Nasdaq turning in the weakest...

READ MORE

MEMBERS ONLY

Improve Your Portfolio Performance With This Improving Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm seeing more and more industry groups that have either broken out above August highs or on the verge of doing so. Meanwhile, I believe it's important to focus on individual stocks within these improving groups for possible trading candidates. I prefer sticking with leading stocks...

READ MORE

MEMBERS ONLY

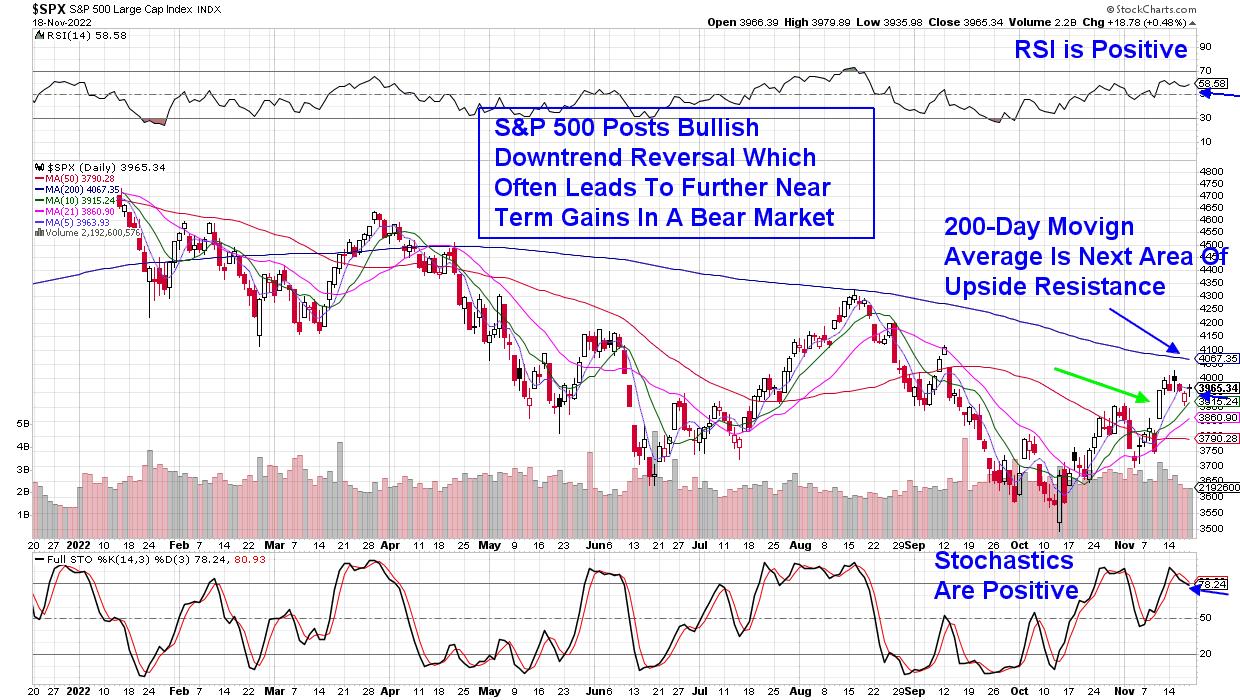

The S&P 500 Index Showing Its Holiday Spirit

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The higher lows in the S&P 500 Index are giving investors and traders some hope. Will the gains continue?

We're heading into the Thanksgiving holiday with a somewhat positive outlook from the stock markets. After a challenging year, with the markets reaching their all-time highs in...

READ MORE

MEMBERS ONLY

Industrials Sector Gets Golden Cross BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

Today the Industrial Select Sector SPDR (XLI) 50-day exponential moving average (EMA) crossed up through the 200-day EMA (Golden Cross), generating an LT Trend Model BUY signal. While this is an encouraging event, we note that most indicators on the chart below are overbought -- specifically, the PMO, Silver Cross...

READ MORE

MEMBERS ONLY

Dividends: Are Adjusted or Unadjusted Charts the Way To Go?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Hey Chartwatchers! Have you ever thought about how dividends may impact the price of your dividend-paying stocks or funds?

Dividends are like the cherry on the cake. They give you a little extra money for investing in a company. Not all stocks pay dividends, but for those that do, there...

READ MORE

MEMBERS ONLY

Big View Analytics: Consumer Discretionary vs. Consumer Staples

As the Thanksgiving holiday shopping season approaches, let's look at our Big View leading sector exchange-traded funds (ETFs) and the current tug-of-war between Consumer Discretionary (XLY) and Consumer Staples (XLP).

The chart displays the price spread between Consumer Discretionary (XLY) over Consumer Staples (XLP). Consumer Staples leads as...

READ MORE

MEMBERS ONLY

What Does the Wall-to-Wall Media Coverage of the FTX Collapse Mean?

by Martin Pring,

President, Pring Research

Last May, I wrote an article entitled "Bitcoin Bubble Finally Bursts", where I laid out the technical case for substantially lower prices. It was partially based on the fact that the 18-month ROC had peaked from a level in excess of 200%. My research, featuring 26 case studies...

READ MORE

MEMBERS ONLY

Sector Spotlight: AMZN & TSLA Causing Weak XLY Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I present a big sector special for the Consumer Discretionary sector. This follows a very brief review of Asset Classes and, more specifically, BTC, followed by a quick look at general sector rotation. For Consumer Discretionary, I highlight the difference...

READ MORE

MEMBERS ONLY

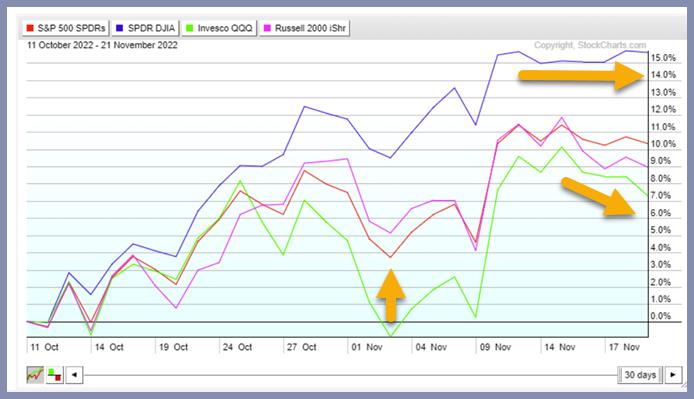

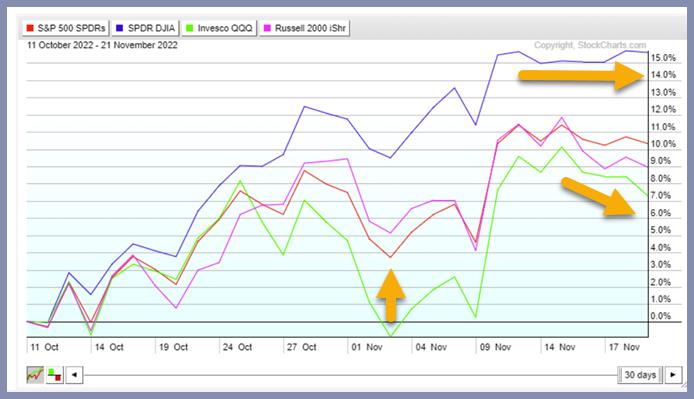

The Dow Jones Leads as Investors Prepare for Thanksgiving

The market had a relatively quiet day as investors look to the Thanksgiving holiday. Stocks did end lower on Monday, with the QQQs declining 1.1%. DIA lost 0.06% today. As seen in the chart above, starting from October 11, 2022, the Dow Jones (represented by DIA) outperformed the...

READ MORE

MEMBERS ONLY

DP Trading Room: Crypto Debacle

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl starts the show with a look at Bitcoin alongside the market overview. Erin finds two sectors with promise, as well as a review of the groups within. They finish with discussions on some viewer symbol requests!

This video...

READ MORE

MEMBERS ONLY

The Three Key Ingredients Of Stock Portfolio Construction

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I always stress the importance of combining technical and fundamental analysis. I practiced in public accounting for more than 20 years, with most of that time spent at a large, regional CPA firm in the Washington DC area. While I believe technical analysis is an absolute necessity to observe price/...

READ MORE

MEMBERS ONLY

Week Ahead: BankNifty at High Point & NIFTY Within Striking Distance; Stay with Stocks with Strong Relative Strength

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets navigated the past week quite on the analyzed lines; what we witnessed was a classical consolidation taking place. The NIFTY did not take any directional move throughout the week. Intermittent profit-taking bouts were seen; however, these phases saw the markets recovering from the lower levels. The NIFTY Bank...

READ MORE

MEMBERS ONLY

Thanksgiving Week is Historically Positive. Will This Year Deliver a Blockbuster or a Turkey?

by Mary Ellen McGonagle,

President, MEM Investment Research

The markets ended the week flat-to-down as investors digested remarks from Fed officials, who were intent on removing pivot hopes that followed soft CPI and PPI reports. Both inflation reports came in below expected, which was certainly encouraging. Mixed earnings reports from major retailers Walmart (WMT) and Target (TGT) also...

READ MORE

MEMBERS ONLY

VIX and UVXY Near Buy Points

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG explains that the market has been pulling back after the 2-day jump from CPI, which makes sense considering how vertical the move was and unsupported. Now, with the pullback, we have to determine if it is into support or...

READ MORE

MEMBERS ONLY

4 Crucial Dividend Features Every Investor Needs to Know About

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson dives into dividends, showing you how to adjust your charts to either include dividends, or to take the impact of those payments out and leave your chart unadjusted for dividends. Plus, Grayson presents other ways to...

READ MORE

MEMBERS ONLY

MEM TV: Earnings as the Driver

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, after a review of current markets and headline news, Mary Ellen takes a look at the continuing theme of stocks being driven higher by positive earnings reports. She closes the show with some "Thanksgiving" food-related stocks, as Consumer...

READ MORE

MEMBERS ONLY

The Risk On/Risk Off Gauge Just Flashed Red

It can take time to determine what financial news to trust and who to follow, with many conflicting market opinions and a 24-hour-driven news culture.That's one reason we use a rules-based methodology and quant modeling, combined with our proprietary trading indicators to help us make informed decisions...

READ MORE

MEMBERS ONLY

Mortgage Rates Drop Sharply - Time to Review XLRE

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

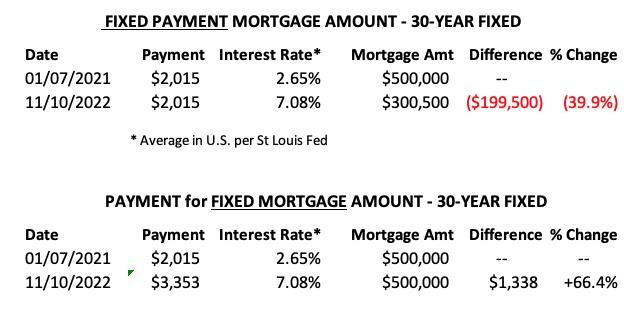

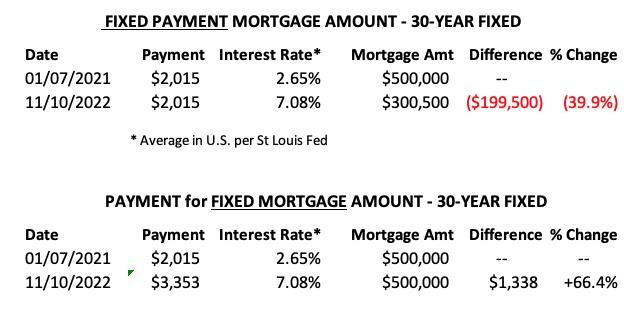

We watch the 30-Year Fixed Mortgage Interest Rate because, for the most part, people buy homes based upon the maximum monthly payment they can afford. As rates rise, a fixed monthly payment will carry a smaller mortgage amount. As buying power has been shrinking, home prices have come under pressure....

READ MORE

MEMBERS ONLY

Limited Upside Until This Chart Changes

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I was reviewing my weekly ChartList reports this afternoon and noticed this one, showing the top performing sectors for the week.

Only three of the 11 S&P 500 sectors were up on the week: Consumer Staples, Utilities and Health Care. Not exactly an offensive powerhouse on the top...

READ MORE

MEMBERS ONLY

The Pearls Of Wisdom I Took Away From ChartCon 2022: Part 2

by Gatis Roze,

Author, "Tensile Trading"

Gosh, I was pleased that so many of you emailed me with your own pearls of wisdom gleaned from ChartCon 2022. It shows once again that investors can look at the same chart and have vastly different takeaways. Likewise, they can attend the same investment conference and have a diverse...

READ MORE

MEMBERS ONLY

Trend-Followers Get the Whip, while Swing Traders Catch the Ride

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

2022 has been a tough market for trend-followers, but swing traders have been able to catch a few rides. Trend-followers are suffering because whipsaws are above average this year. A whipsaw occurs when an uptrend cannot extend after a bullish trend signal and the trade results in a loss.

Before...

READ MORE