MEMBERS ONLY

Trend-Followers Get the Whip, while Swing Traders Catch the Ride

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

2022 has been a tough market for trend-followers, but swing traders have been able to catch a few rides. Trend-followers are suffering because whipsaws are above average this year. A whipsaw occurs when an uptrend cannot extend after a bullish trend signal and the trade results in a loss.

Before...

READ MORE

MEMBERS ONLY

This Stock Trades At a 70% Discount In a Sector That Shows Strong Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

For weeks already, the rotation of the Industrial sector has been continuing its way deeper into the leading quadrant at a strong RRG-Heading.

For my appearance on the panel of The Pitch this month, I looked at the Relative Rotation Graph of US Sectors to identify three strong sectors where...

READ MORE

MEMBERS ONLY

Inverted Yield Curve and Recessions: An Odd Couple

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Read or listen to any financial media outlet and you're likely to hear the words "inverted yield curve." What does that mean and, more importantly, what does it mean for your investments?

The shape of the yield curve may not have made the top of your...

READ MORE

MEMBERS ONLY

DOW TESTS RESISTANCE NEAR AUGUST HIGH -- SPX AND QQQ LAG BEHIND -- 3 MONTH - 10 YEAR YIELD CURVE INVERTS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW LEADS WHILE SPX AND QQQ LAG BEHIND... The fourth quarter rally in stocks may be losing some upside momentum. That's especially true of the Dow. Chart 1 shows the Dow Industrials approaching formidable overhead resistance at their August highs. That may be hard to overcome. Charts 2...

READ MORE

MEMBERS ONLY

This Sector Is Poised at a Crucial Juncture

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After showing a great out-performance until the middle of 2022, this key sector index of the Indian markets is showing signs of slowing down. The technical structure of charts shows that, until a particular level is taken out, a potential top may be in place for this sector index. If...

READ MORE

MEMBERS ONLY

GNG TV: Intermarket Forces Assist Equity Rally

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex and Tyler review cross-asset relationships from a GoNoGo Trend Perspective. NoGo trends on the daily timeframe for USD and TNX provide tailwinds for risk assets. Multiple timeframe analysis reveals that the recent rotation to "risk-on" still...

READ MORE

MEMBERS ONLY

Stop Guessing!

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how his multiple time frame approach can be extremely helpful when determining whether to sell at resistance or buy at support. He shows how to use the smaller timeframe's momentum signs to help make...

READ MORE

MEMBERS ONLY

'Outrun the Bear' With This Indicator

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

This post is brought to you by our friends at Chaikin Analytics. Get Chaikin's free e-letter PowerFeed here.

Two campers are walking through the woods. Out of nowhere, a grizzly bear appears.

The first camper starts to run. The second camper shouts ahead to the first camper that...

READ MORE

MEMBERS ONLY

Learn What's Driving Retail Sales Growth

Today, the Commerce Department's retail sales report showed solid consumer spending. Yet robust retail sales data failed to boost the market.

Consumption accounts for approximately 70% of our economy. SPDR S&P Retail ETF (XRT), or Granny Retail, is a large, diversified ETF representing broad market consumption....

READ MORE

MEMBERS ONLY

GoNoGo Special: Embracing Volatility

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this special presentation from GoNoGo Charts, Alex and Tyler illustrate volatility compression in the lifecycle of a trade. See how they utilize this tool for entering trend continuations or reversals, with a view on the current market environment.

This video was originally broadcast on November 16, 2022. Click this...

READ MORE

MEMBERS ONLY

Retail Therapy Bodes Well for TJX Cos. (TJX)

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The economy may be slowing, but the cash registers keep on scanning. October retail sales were up 1.3%—a sign people are shopping and spending money. The increase in retail sales may not have been evident in Target's (TGT) earnings, but TJX Companies (TJX) saw its stock...

READ MORE

MEMBERS ONLY

Be Ready for the Next Bull Market, Part 2

by Dave Landry,

Founder, Sentive Trading, LLC

On this week's edition of Trading Simplified, Dave continues his discussion on getting ready for the next bull market. This week, he elaborates on trading emerging trends, with a focus on his First Thrust, Bowties, and First Kiss After Daylight setups. For his methodology in action, he shows...

READ MORE

MEMBERS ONLY

Building A Portfolio To CRUSH The S&P 500!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At EarningsBeats.com, we're one day away from the most exciting day of our quarter. I call it our Portfolio "Draft". I'll be announcing the 10 equal-weighted stocks that are included in each of our three portfolios - Model, Aggressive, and Income. We may...

READ MORE

MEMBERS ONLY

This Semiconductor ETF Might Signal a Chip Recovery

Semiconductors are an essential part of our daily lives, a geopolitical football of national security interests, and chips are increasingly in demand.

Meet Sister Semiconductor (SMH), also known in trading circles as the VanEck Semiconductor ETF (SMH). SMH potentially indicates new leadership in the beaten-down tech industry.

Today, institutional investment...

READ MORE

MEMBERS ONLY

Weakening Dollar Unleashes Non-U.S. Markets, or Does It?

by Martin Pring,

President, Pring Research

Last week, I wrote that the dollar and commodities were poised at inflection pointsand we should be on the lookout for an important move in both.

The U.S. Dollar Index ($USD) obliged with the completion of a head-and-shoulders top, as shown in chart 1. It's clearly overstretched...

READ MORE

MEMBERS ONLY

Inflation Show Signs of Cooling, Retail Earnings Encouraging

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Wash, rinse, repeat. We're seeing a scenario very similar to what we saw last Thursday, when the Consumer Price Index data was released. Today's Producer Price Index (PPI) also showed signs that inflation may be cooling. The softer-than-expected October PPI number was news that may further...

READ MORE

MEMBERS ONLY

The End is Near!

by Larry Williams,

Veteran Investor and Author

The end of this year is close, so this will probably be the last special for Larry for 2022. But is the year going to close in a good or bad way? In this exclusive StockCharts TV special, Larry explains why he thinks it will be in a good way....

READ MORE

MEMBERS ONLY

Sector Spotlight: RRG Shows Rotation from Discretionary to Energy

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This episode of StockCharts TV's Sector Spotlightis dedicated to a review of the current state of sector rotation in both asset classes and sectors. At Asset Class level, the rotations for the USD and its digital counterpart Bitcoin are worth a closer look as both are showing interesting...

READ MORE

MEMBERS ONLY

Now Is the Time To Add This Industry Group to Your Portfolio

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As the winter season approaches, I'm going to suggest that you consider buying into what might seem to be a warm weather industry—home construction ($DJUSHB). The "go away in May" theory applies very strongly to this cyclical group. Over the past 20 years, the average...

READ MORE

MEMBERS ONLY

U.S. Inflation to Remain a Pain in Granny Retail's Side

The retail sector soared after the CPI report last week, as represented above by Granny Retail, the lead shopper of Mish's Modern Family, SPDR S&P Retail ETF (XRT).

The latest Consumer Price Index (CPI) reading came in at 7.7% versus 7.9% showing 0.20%...

READ MORE

MEMBERS ONLY

DP Trading Room: Tesla or Bitcoin?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl opens today's trading room with a chart that begs the question, "Bitcoin or Tesla?" He and Erin then follow with a detailed market overview and determine which Dow stocks are the best right now....

READ MORE

MEMBERS ONLY

Halftime: Putting Interest Rates Into Perspective

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Lately, it seems like it's more of the same - treasuries are mostly weaker, interest rates rising, bond prices falling, tech running into headwinds. Rinse and repeat. On this week's edition of StockCharts TV'sHalftime, presented by Chaikin Analytics, Pete presents a high level overview...

READ MORE

MEMBERS ONLY

Walmart (WMT) and Target (TGT) Earnings: Who's Winning The Retail War?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Earnings season is quickly coming to a close, but it's just starting among the big retailers. On Tuesday, we'll get the latest earnings results from Walmart, Inc. (WMT), and that'll be followed by Target Corp's (TGT) quarterly earnings on Wednesday. Walmart and...

READ MORE

MEMBERS ONLY

Everything Has Changed and It's For The Better

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The stock market has been like a volcano, simply waiting to erupt. The hawkish Fed and stubbornly-high inflation have wreaked havoc on stocks in 2022, but market participants have been awaiting good news on the interest rate front and I believe they got it on Thursday. The October CPI was...

READ MORE

MEMBERS ONLY

How to Find the True Market Leaders

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged this week with the SPDR S&P 500 ETF (SPY) advancing over 5% and nearing its falling 200-day simple moving average (SMA). The big trend is still down because SPY recorded a 52-week low a month ago and a lower low from June to October. The ETF...

READ MORE

MEMBERS ONLY

Week Ahead: Protect Profits As NIFTY Continues To Surge; This Sector Generates Highest Alpha In Recent Times

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the truncated week that went by, the NIFTY 50 Index ($NIFTY) traded much on the analyzed lines. Despite staying volatile, it largely remained buoyant while it extended its move on the upside.

In the previous week's technical note, there was a categorical mention of the possibility of...

READ MORE

MEMBERS ONLY

All Indices Improved Their Market Phases This Week

The mid-terms are now somewhat behind us, and this week we saw the FTX crypto exchange file Chapter 11. Some investors worry that there might be more domino effects in the institutional crypto space. It is worth keeping an eye on.

Concerning the market, the mild CPI inflation numbers caused...

READ MORE

MEMBERS ONLY

The Bullish Case for Gold

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While gold has not done much in 2022 in terms of absolute returns, the SPDR Gold Shares (GLD) has indeed outperformed the SPDR S&P 500 (SPY) by about 11% year-to-date. Why has gold not done better as a safe haven? It's all about the U.S....

READ MORE

MEMBERS ONLY

MEM TV: Sharp Reversals and How to Capitalize

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares why Tech stocks are on the move and ways to capitalize on the strength. She also reviews how to use intraday and daily charts to time your entry and exits.

This video was originally broadcast on November...

READ MORE

MEMBERS ONLY

Watching Interest Rates? These Three Tools Are an Absolute Must

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson digs into the topic of the year -- interest rates! He shares three of the most powerful and important ways you can visualize interest rates on StockCharts. This episode walks you through how to visualize interest...

READ MORE

MEMBERS ONLY

Shopify Stock Is Getting Some Love

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

After hitting a high of around $176 in November 2021, the e-commerce platform Shopify, Inc. (SHOP) saw its stock price fall to a low of $23.63 within the span of a year. During the COVID-19 pandemic, SHOP attracted a lot of sellers, since many transitioned to offering their goods...

READ MORE

MEMBERS ONLY

What Happens After October Crashes? Here's What History Says.

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

This post is brought to you by our friends at Chaikin Analytics. Get Chaikin's free e-letter PowerFeedhere.

We've just got past Halloween. It may have been a joyous night for kids, especially if they got a lot of candy, but, if you've followed the...

READ MORE

MEMBERS ONLY

Markets Up from Cool CPI

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG shares how the CPI came in slightly cooler than expected and the market responded strongly. The questions he finds himself asking are "how far will it go?" and "for how long?" He is concerned that,...

READ MORE

MEMBERS ONLY

GNG TV: The Birth of a Bull -- Volatility Expands to the Upside

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, as yields pull back and the U.S. dollar accelerates into the NoGo trend, Alex and Tyler review the new Go trend in the S&P 500 Index ($SPX) daily chart. U.S. midterm elections are concluding and...

READ MORE

MEMBERS ONLY

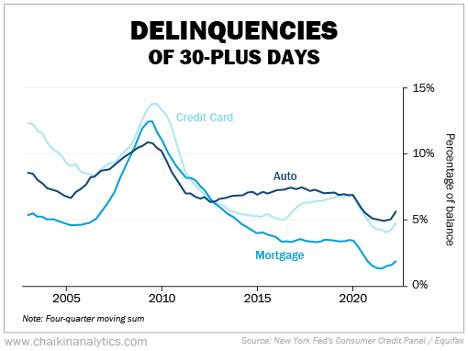

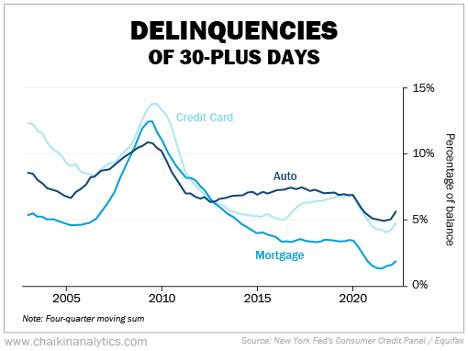

Inflation, Interest Rates, Debt Levels: The 'Trinity of Trouble' is Happening Right Now

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

This post is brought to you by our friends at Chaikin Analytics. Get Chaikin's free e-letter PowerFeed here.

Folks, a dangerous combination is brewing beneath the surface. It's what I like to call the "trinity of trouble."

When inflation and interest rates rise together,...

READ MORE

MEMBERS ONLY

Multiple Time Frame Method

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows when he would use an extra timeframe in his analysis. Usually, he discusses a 2-timeframe method, which works in most cases. However, for someone who wants to be more aggressive, Joe shows how to use 3-timeframes....

READ MORE

MEMBERS ONLY

STOCKS SURGE ON LOWER CPI FOR OCTOBER -- SHARP DROP IN BOND YIELDS BOOSTS HOMEBUILDERS -- HIGHER COMMODITY PRICES BOOST MATERIALS -- ASSET MANAGERS LEAD FINANCIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW LEADS STOCKS HIGHER... Annual inflation for October was a lower than expected reading of 7.7% which was the lowest since January. That softer reading raised hopes that inflation might be peaking and pushed stock and bond prices sharply higher. A big drop in bond yields and the dollar...

READ MORE

MEMBERS ONLY

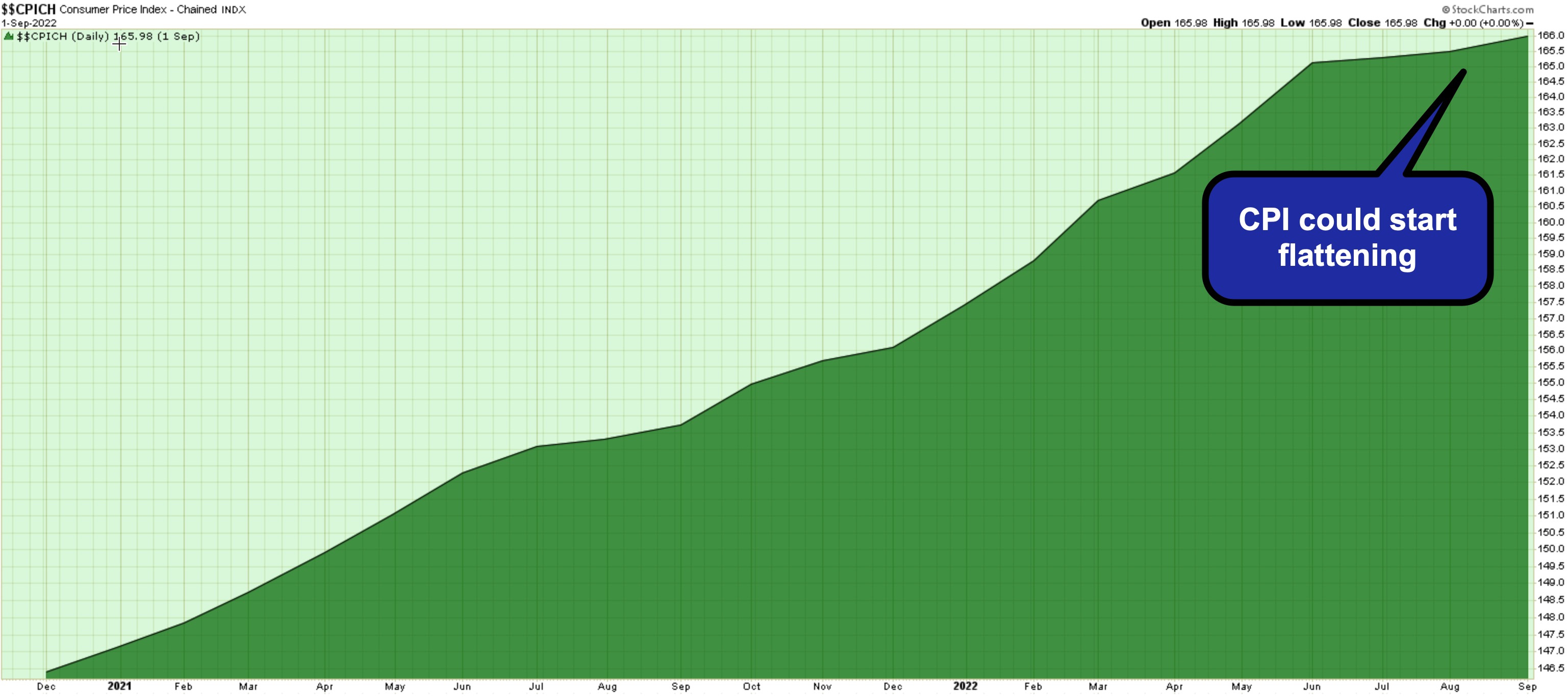

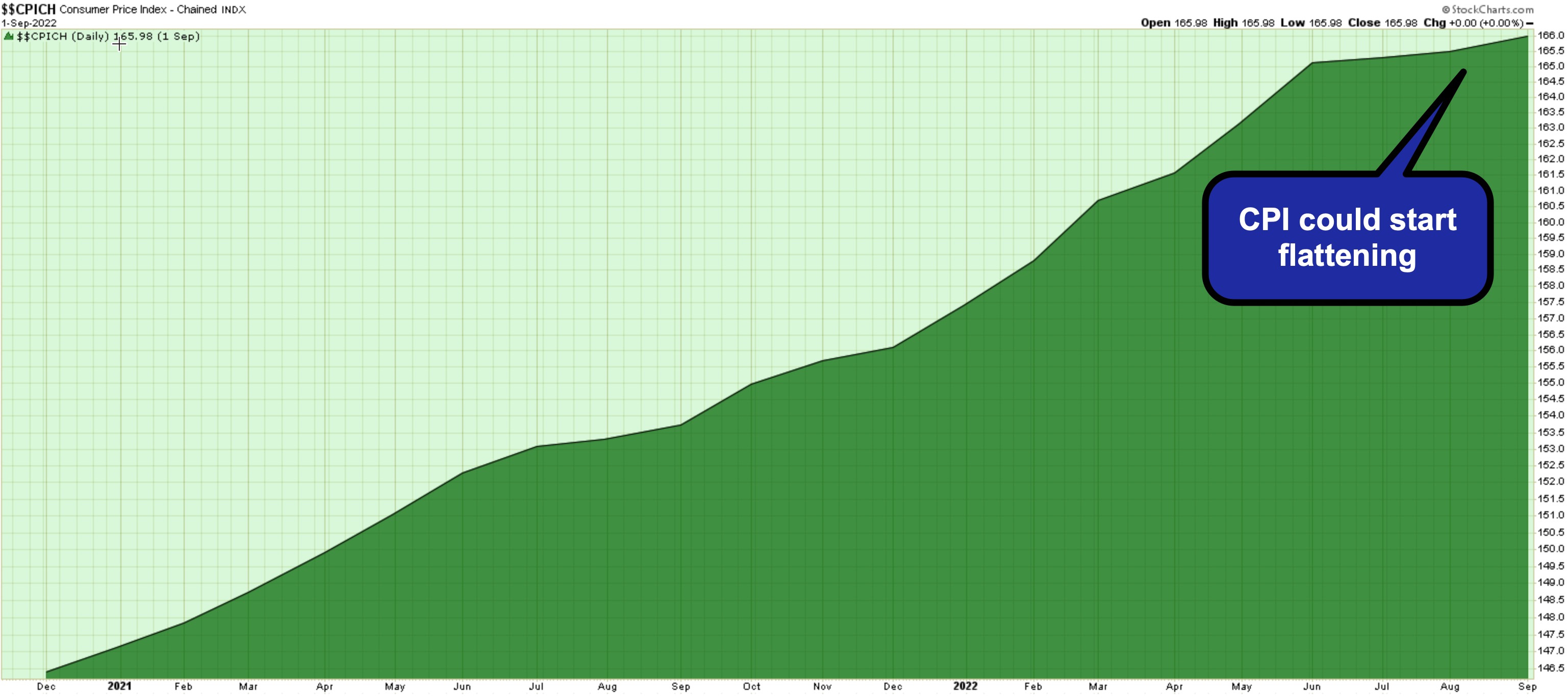

A Soft Inflation Number Sends Stock Markets Soaring

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The Consumer Price Index (CPI) report for October 2022 suggested that inflation could be cooling. This was welcome news for the stock market, given that the CPI has been steadily rising since December 2020. October CPI rose 0.4%, below the expected 0.6%, which brings the year-over-year increase to...

READ MORE

MEMBERS ONLY

What Investment Theme Will Lead the Market in 2023?

Market leaders are constantly evolving and staying up to date on the newest trends, and macro events can be challenging. Looking back at previous decades of market leadership provides insight into how market leaders change over time, and the impressive cumulative returns indicate potential future market leadership gains.

It may...

READ MORE

MEMBERS ONLY

Be Ready for the Next Bull Market

by Dave Landry,

Founder, Sentive Trading, LLC

On this week's edition of Trading Simplified, Dave shows his methodology in action with a freshly triggered setup--a stock that will become part of his "Next 100 Trades" segment. Dave then goes on to discuss how, while the best time to learn about avoiding bear markets...

READ MORE