MEMBERS ONLY

Two Indicators that are Acting Like It's 2020

by Erin Swenlin,

Vice President, DecisionPoint.com

We decided to take a look at our Silver Cross Index (SCI) and Golden Cross Index (GCI) across the broad markets. They were startling, to say the least. As we all debate whether this is the end of the Bear Market of 2022, these two indicators suggest it just might...

READ MORE

MEMBERS ONLY

MEM TV: What's Driving the Biggest Market Movers?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this special presentation courtesy of StockCharts TV'sThe MEM Edge, Mary Ellen reviews why select stocks are trading higher than the markets. She also highlights the rotation into Small Caps and shares ways to capitalize.

This video was originally broadcast on August 12, 2022. Click on the above...

READ MORE

MEMBERS ONLY

How Far Will the SPY Push?

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG goes through a few examples of how the market might continue before the 1-2 punch of a pullback and topping pattern. TG is seeing a ton of names that are in what he calls the Weekly Arch of the...

READ MORE

MEMBERS ONLY

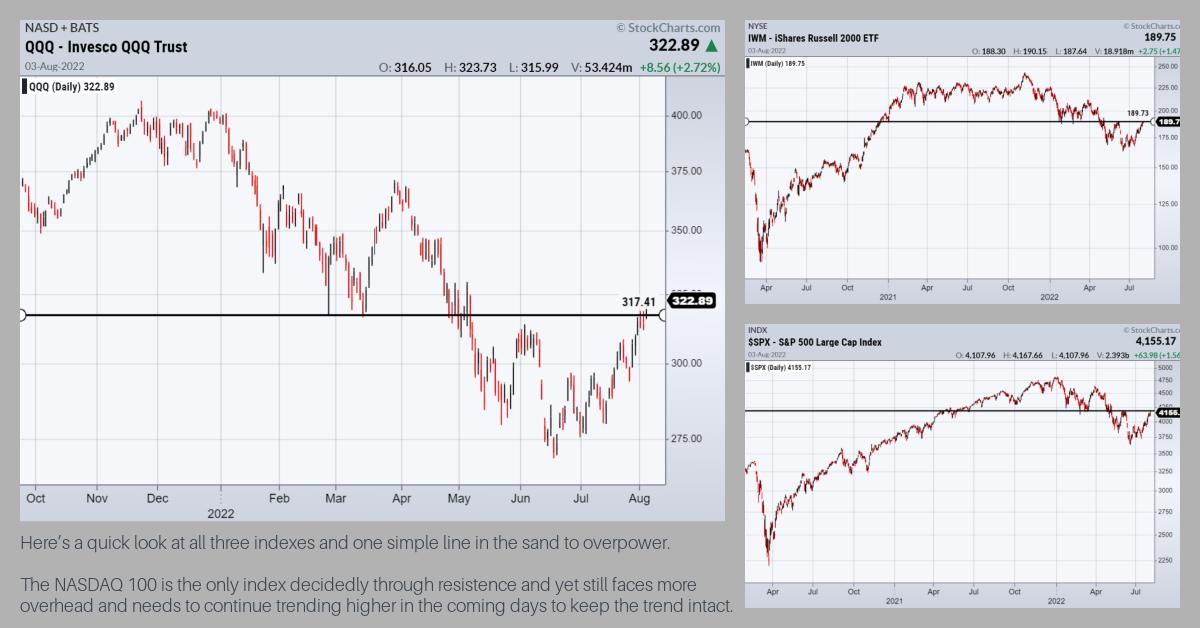

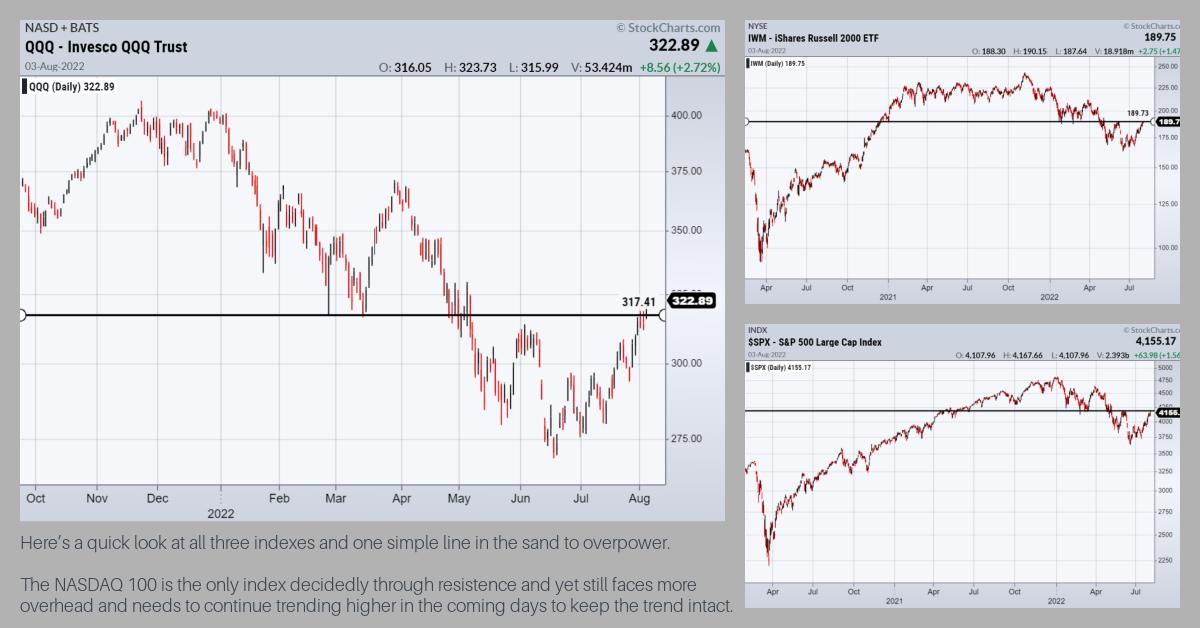

STOCK INDEXES CLEAR JUNE HIGH -- TEST OF 200-DAY AVERAGES MAY BE NEXT

by John Murphy,

Chief Technical Analyst, StockCharts.com

JUNE HIGHS CLEARED... Last week's message showed major stock indexes testing initial resistance at their June highs, and suggested that an upside penetration of that resistance could lead to a possible test of their 200-day moving averages. Those June highs have since been exceeded. Chart 1 shows the...

READ MORE

MEMBERS ONLY

Overbought and Staying Overbought

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 SPDR (SPY) is in the midst of a strong advance since mid July as it became "overbought" on July 20th and remains overbought. Today's article will show how to measure overbought and oversold levels using StochClose, which is a version of...

READ MORE

MEMBERS ONLY

Can the Stock Market Overcome This MAJOR Issue?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm a believer that Wall Street will eventually overcome all obstacles and move back to all-time highs. It's a big "wall of worry", but the bulls are up to the task. The cyclical bear market is over, and we've resumed the secular...

READ MORE

MEMBERS ONLY

GNG TV: Equities Rally Through Resistance, Dollar Now a "NoGo"

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

As US Equity indices broke through overhead supply, trend conditions strengthened to strong blue "Go" bars. In this week's edition of the GoNoGo Charts show, Alex and Tyler review the intermarket headwinds for risk assets including treasury rates ($TNX), the US Dollar index ($UUP) and high...

READ MORE

MEMBERS ONLY

What to Ask Before Each Trade

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe discusses some of the key aspects to trading psychology. He goes through a trade setup that has all the characteristics he is looking for, then explains the potential pitfalls on the mental side of trading. Joe talks...

READ MORE

MEMBERS ONLY

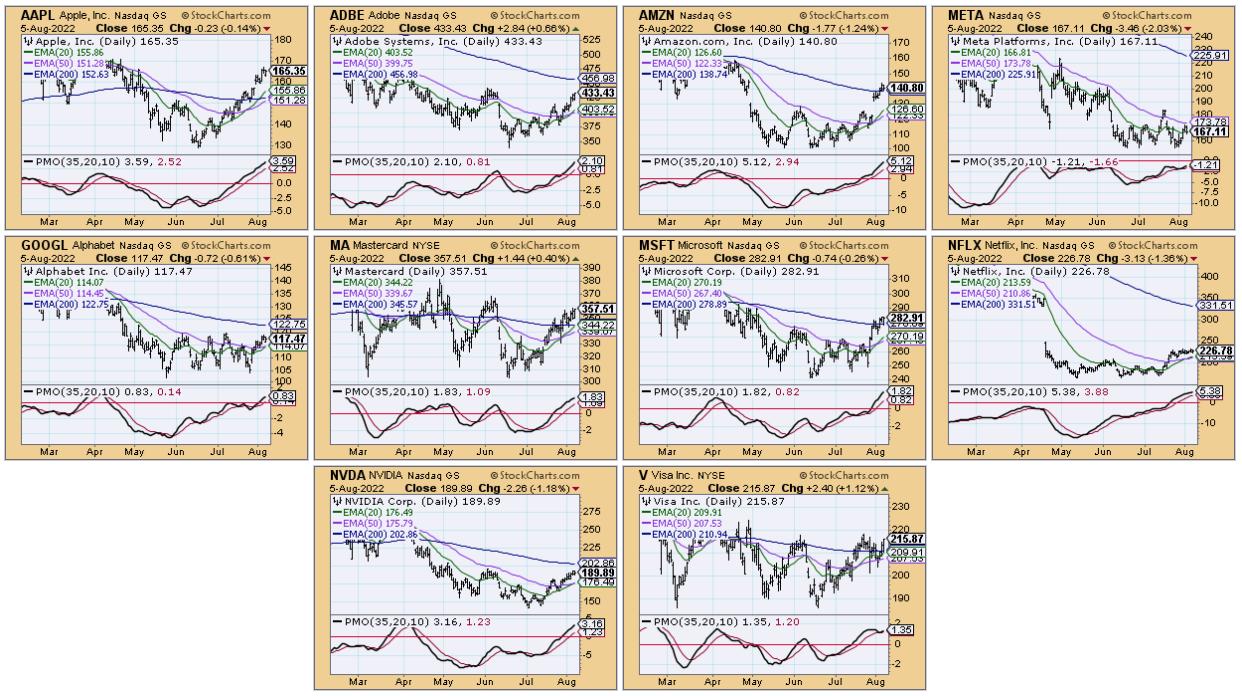

This One Would Make A Great Short Candidate

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

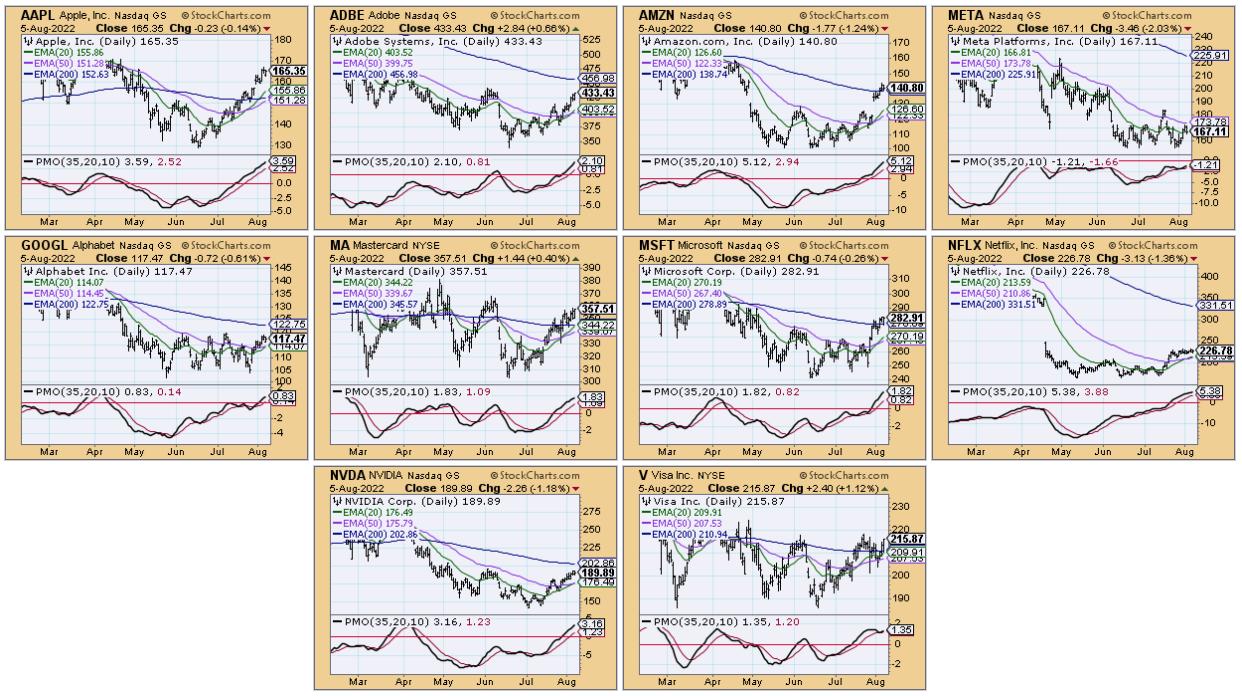

I'm very much in the bullish camp and have been for weeks now. However, there are isolated situations where I'd consider a short position. Netflix (NFLX) is on that list. I believe the reward-to-risk is set up beautifully right now on NFLX. Remember the horrid earnings...

READ MORE

MEMBERS ONLY

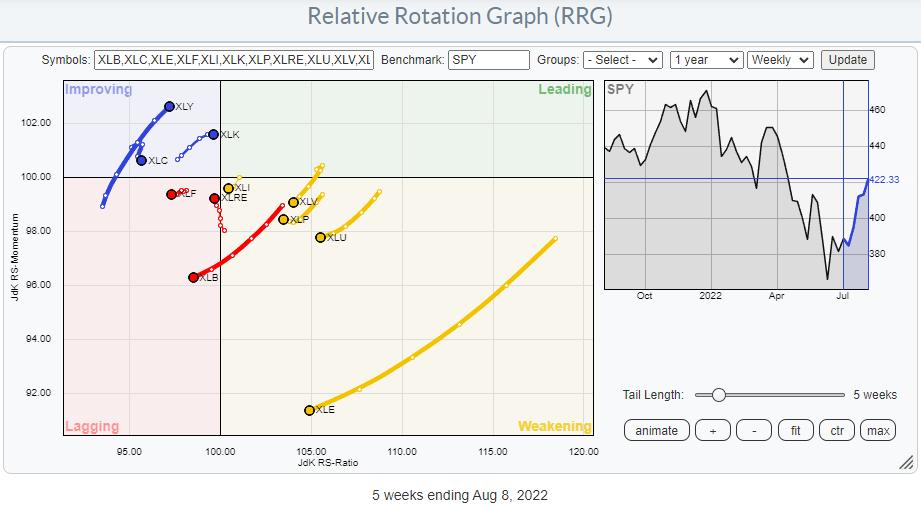

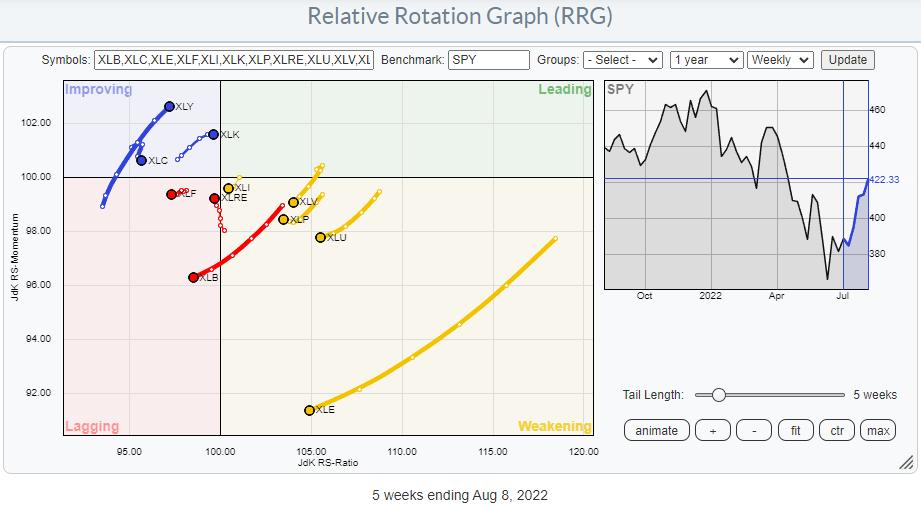

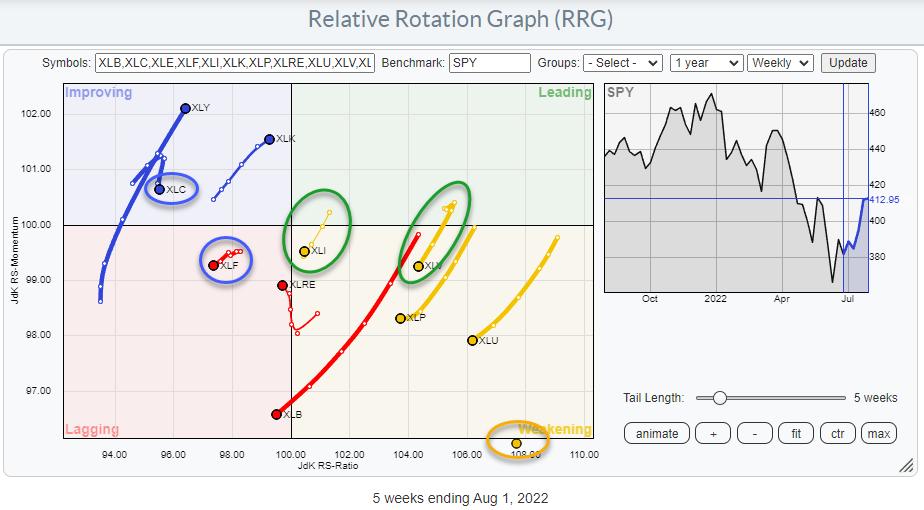

Only Two Sectors are Leading the Charge

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph for US sectors, there are only two sectors that are leading the market higher. Not surprisingly, these are growth-related sectors, specifically XLK and XLY, which together make up 40% of the market capitalization of the S&P 500 index.

In last Tuesday's...

READ MORE

MEMBERS ONLY

Good Inflation News is Helping Stocks Move Through Resistance -- But is It Enough?

by Martin Pring,

President, Pring Research

The summer rally has enabled several indexes to push through important resistance, but, since there was a lot of backing and filling at higher levels earlier this year, there are several places where even more resistance is apparent.

If you want to be bullish, for instance, take a look at...

READ MORE

MEMBERS ONLY

Learn From Dave's Trades

by Dave Landry,

Founder, Sentive Trading, LLC

On this week's edition of Trading Simplified, Dave continues his series of showing you his "next 100 trades." Even better, he shows why he picked them, how he managed the positions (which returned both good and bad results) and how he used discretion in an attempt...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sectors Kissing Resistance

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's edition of StockCharts TV's Sector Spotlight, I start with a look at Growth/Value and Size (Large-, Mid-, and Small-Cap) rotations. After that, I take an extensive look at the rotations of Offensive, Defensive and Sensitive sectors and their individual charts. The common...

READ MORE

MEMBERS ONLY

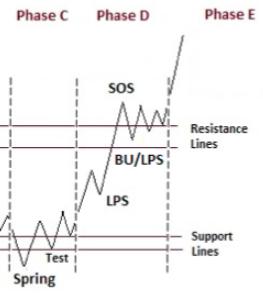

Special Note: This Bullish Reversal Pattern Might Really be a Continuation Pattern

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the discipline of Technical Analysis, there are patterns that can be classified as Reversal Patterns or Continuation Patterns. Where Reversal patterns tend to reverse the prior trend, Continuation patterns tend to resolve in the direction of the prior trend.

One such "Reversal Pattern" is the Inverted (or...

READ MORE

MEMBERS ONLY

DP Trading Room: Gold vs. Gold Miners & Silver

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl talks about the market conditions and trends, then dives into the metals and discusses possible entries. He explains how to use premium/discounts to determine sentiment for Gold and Silver, then covers yield inversions. Erin presents the sector...

READ MORE

MEMBERS ONLY

STOP Following The News And Focus On The Charts

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We're going higher. Sure, we'll have pullbacks along the way. Secular bull markets typically test their key moving averages like the 20-day EMA and/or 50-day SMA frequently, and I'll be looking for those in the weeks and months ahead. But it's...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY to See Ranged Consolidation Unless This Zone is Taken Out; RRG Shows These Sectors Doing Well

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In our previous technical commentary and forecast, we anticipated that this week may see some ranged consolidation. It was also expected that such consolidation may have ranged moves and some profit-taking bouts from the higher levels. However, the downsides were expected to stay limited. While dancing exactly to these tunes,...

READ MORE

MEMBERS ONLY

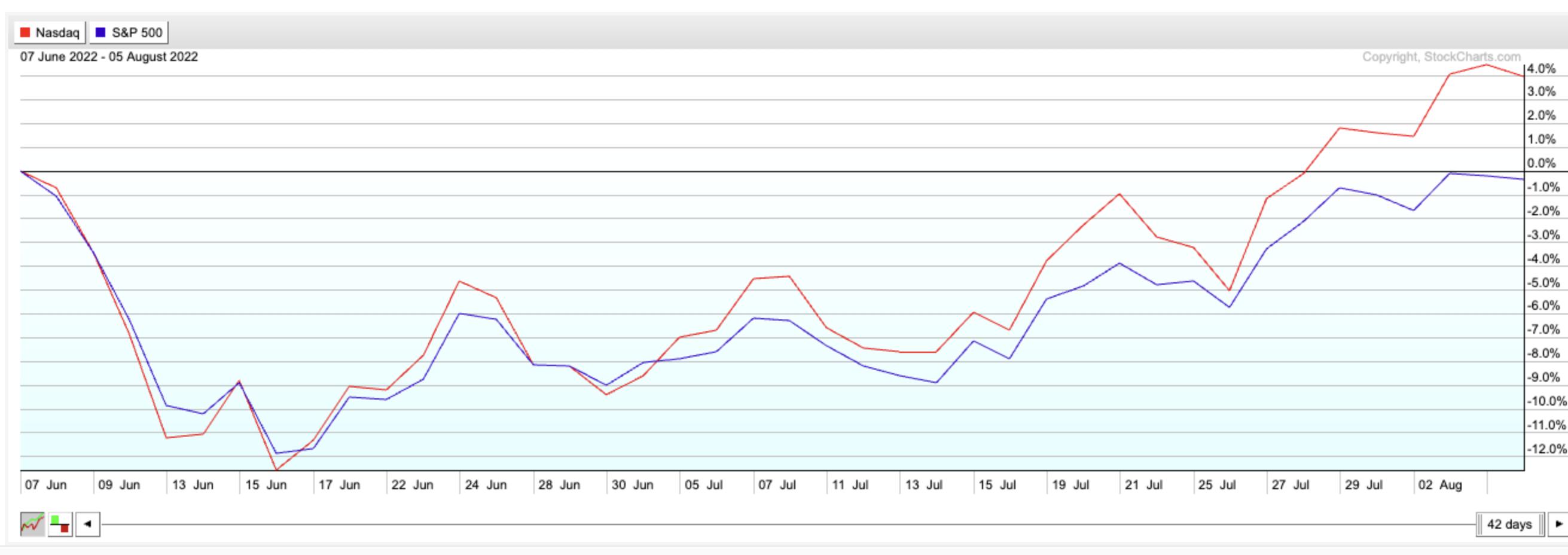

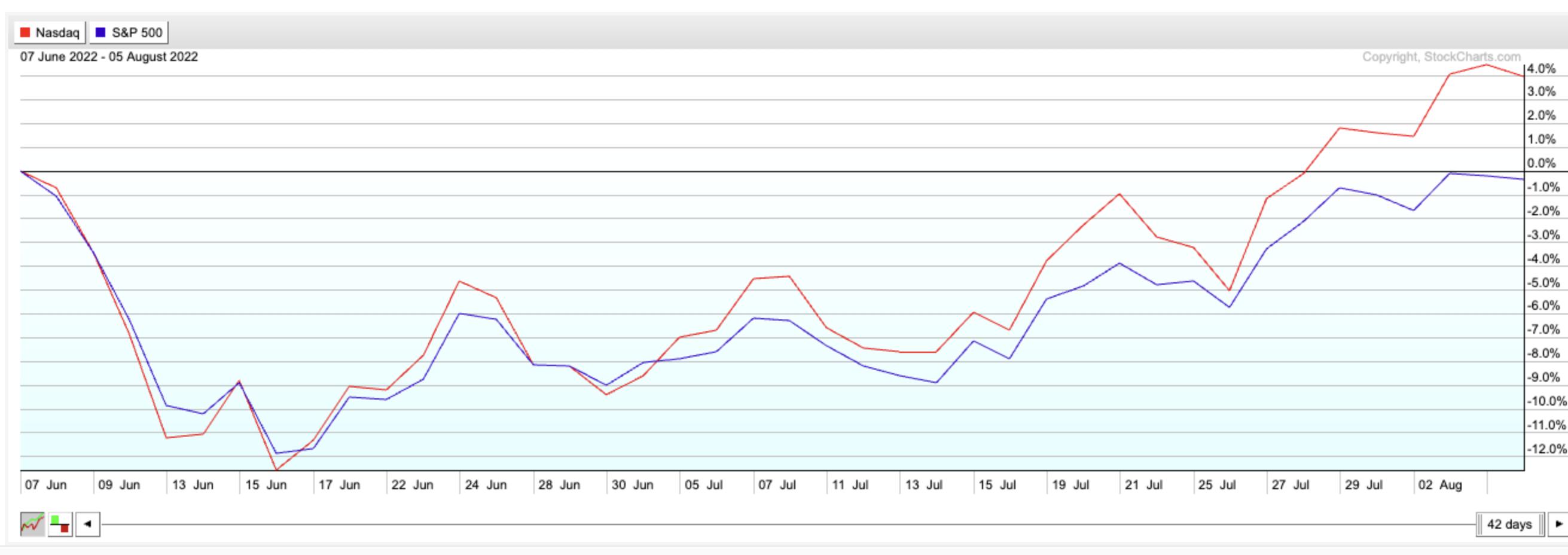

Growth Stocks Continue To Gain -- Will Their Strength Continue?

by Mary Ellen McGonagle,

President, MEM Investment Research

The bull market in stocks carried on last week, despite warnings from several Federal Reserve governors that the central bank is nowhere near being done cracking down on inflation. Growth stocks, in particular, continued their run, with the tech-heavy Nasdaq posting a 14.4% rally over the past 5 weeks...

READ MORE

MEMBERS ONLY

Why a Lower VIX is Bearish for Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While the VIX is often termed the "fear gauge" because of its inverse relationship to stocks, it's really more of a measure of volatility -- implied volatility, that is, which means it's looking at the S&P 500 options market, which then "...

READ MORE

MEMBERS ONLY

Climbing the Wall of Worry

by Erin Swenlin,

Vice President, DecisionPoint.com

This morning, I was at my parents' house, and my Dad chatted with me before I left. He said, in so many words, that I was probably a bit too bearish right now. It was likely in response to yesterday's free article (and DP Alert opening) about...

READ MORE

MEMBERS ONLY

MEM TV: Risk-On Area Moving Higher!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this special presentation courtesy of StockCharts TV'sThe MEM Edge, Mary Ellen reviews areas of growth and explains why they remain in a leadership position. She also reveals a more risky area of the markets that are on the move higher, and discusses how to trade stocks after...

READ MORE

MEMBERS ONLY

Stocks Hammering Out Bottoms

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG reviews the major indexes and large-cap stocks, which are in elevated areas that he's not comfortable putting new money to work on the long side. TG wants to see a pullback into support to see what the...

READ MORE

MEMBERS ONLY

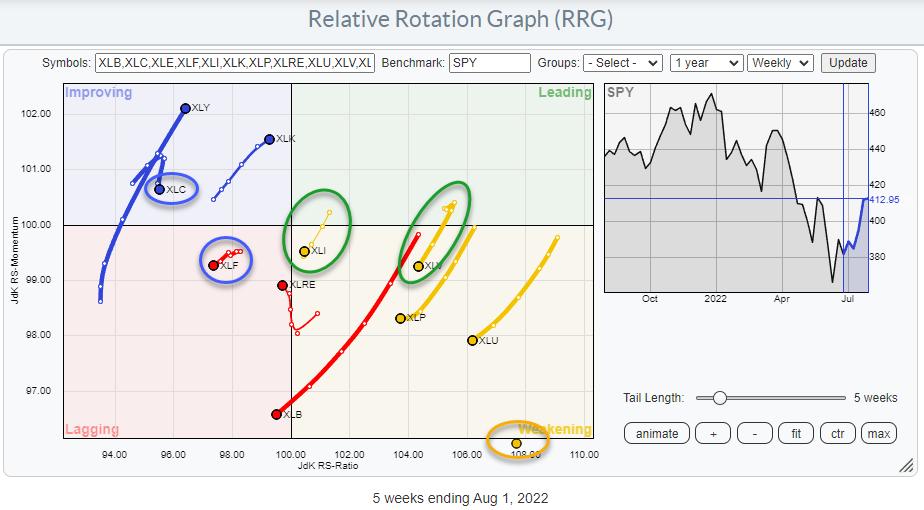

Disconnected EW Sector Rotation Offers Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

From time to time, I compare the rotations of the SPDR sectors that we usually use with their EW counterparts.

The first RRG below shows the rotations for the SPDR sector spiders (cap-weighted). The second RRG shows the rotations of the Equal Weight sectors. In both, the Energy sector is...

READ MORE

MEMBERS ONLY

A Theme Emerges within a Bear Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Composite Breadth Model at TrendInvestorPro has been bearish since April 11th and remains bearish, which suggests that the current bounce in SPY is a counter-trend advance within a bigger downtrend. Also note that the 5-day SMA for SPY is below the falling 200-day SMA and the Trend Composite is...

READ MORE

MEMBERS ONLY

DecisionPoint Primary Indicators are Diverging

by Erin Swenlin,

Vice President, DecisionPoint.com

We have two primary indicators in the short term (Swenlin Trading Oscillators (STOs)) and two primary indicators in the intermediate term (ITBM/ITVM). Of late, they have been diverging, with the short-term STOs moving lower and the intermediate-term ITBM/ITVM rising. We've included the chart below so you...

READ MORE

MEMBERS ONLY

GNG TV: "Go" Trend Reaches Resistance - Can it Continue?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex and Tyler talk about how the recent rally in risk assets has reached its first hurdle. They also explain that the strength of recent Go trends for the S&P 500, Growth sectors like Information Technology ($XLK)...

READ MORE

MEMBERS ONLY

How to Trade Gaps

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows the key criteria to determine if a gap is a buyable or sellable event. The concepts of contraction and expansion are important to recognize when a gap occurs. Joe discusses the location and the trend in...

READ MORE

MEMBERS ONLY

Mish's Daily: Don't Get Caught In The Market's Confusion

For the moment, the stock market continues to defy the notion that inflation or slower economic growth is hurting US businesses. Corporate earnings have slightly underperformed, but the stock market has continued on a trajectory upwards since the middle of July.

Technology (XLK) was today's best performing sector,...

READ MORE

MEMBERS ONLY

STOCK RALLY CONTINUES -- SOME POTENTIAL UPSIDE TARGETS -- NASDAQ TESTS DOWN TRENDLINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

INTERMEDIATE TERM RALLY CONTINUES... The stock rally that started in mid-June continues to gain ground which confirms that the market has put in an intermediate term bottom. The question is how far that intermediate rally can rally within the current downtrend. Hopefully, the charts shown below will help determine where...

READ MORE

MEMBERS ONLY

Following My Trades

by Dave Landry,

Founder, Sentive Trading, LLC

On this week's edition of Trading Simplified, Dave shows you his methodology in action by continuing to track his next "100 Trades." He explains how there will be setbacks along the way waiting for the mother-of-all trades. He also touches upon many trading traits that you&...

READ MORE

MEMBERS ONLY

Indexes Back to Their Breakdown Points; Should We Pop the Champagne If They Go Through?

by Martin Pring,

President, Pring Research

The rally since mid-June has taken several indexes back to their extended breakdown trendlines, which mark one demarcation point between bull and bear. Chart 1, for instance shows that the NASDAQ completed a top in May and then followed through with further weakness. By mid-June, the Index found a bottom...

READ MORE

MEMBERS ONLY

Mish's Daily: Ways to Profit in a Stagflationary World

Investing in an inflationary environment can be challenging. The markets have been volatile, but stocks have trended steadily higher with corporate earnings.

In stagflation, cash and bonds are usually below the rate of inflation, while certain stocks might not fare much better. It is important to invest into assets that...

READ MORE

MEMBERS ONLY

August Is Historically the Best Month for This Lagging Industry

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Since the mid-June market bottom, we've seen improvement in a large number of areas. Technology (XLK) has resumed its leadership role in a big way, as evidenced by the following relative breakout:

I believe this is just the beginning of the resumption of the secular bull market. If...

READ MORE

MEMBERS ONLY

Sector Spotlight: Downside Risk Beats Upside Potential

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's edition of StockCharts TV's Sector Spotlight, I start with a look at the current state of Sector Rotation in US stocks. (Normally, I review seasonal patterns in sectors every last Tuesday of the month, but, last week, that segment had to make place...

READ MORE

MEMBERS ONLY

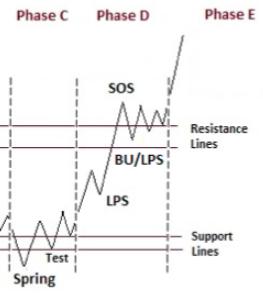

A Wyckoff Cause is Forming. What's Next?

by Bruce Fraser,

Industry-leading "Wyckoffian"

In May and June oversold conditions in the major stock indexes developed. Internal breadth and sentiment measures reached notable extremes. Keeping in mind the quarter-end effect, Wyckoffians were on the lookout for an acceleration of the downtrend into a ‘Selling Climax', which arrived in mid-June (quarter-end). Following a series...

READ MORE

MEMBERS ONLY

DP Trading Room: End of the Bear Market?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl takes questions from the audience on his opinions regarding Silver, Gold and what he's looking for as an end to the bear market. Meanwhile, Erin looks under the hood at leading sectors Technology and Consumer Discretionary,...

READ MORE

MEMBERS ONLY

Mish's Daily: Can Gold and Silver Hold Recent Gains?

As impressive as the global stock rally was last week, gold and silver's remarkable performance on Friday did not generate many financial headlines. Still, their one-day individual parabolic rise merits closer attention. Could this be a new trend? Or is it just a one-day wonder?

Using the Gold...

READ MORE

MEMBERS ONLY

Markets Ready to Rock & Roll!

by Larry Williams,

Veteran Investor and Author

Markets are getting ready to rock & roll to the upside! In this exclusive StockCharts TV special, Larry has a lot to show you and a lot of education to share. He digs into the three key reasons he's expecting a major rally: panic selling, important buying, and...

READ MORE

MEMBERS ONLY

TAN Follows Trend Composite Signal with Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Led by its top two components, Enphase (ENPH) and Solar Edge (SEDG), the Solar Energy ETF (TAN) followed a bullish signal from the Trend Composite with a big breakout to confirm a large bullish reversal pattern.

Let's start with the Trend Composite, which aggregates trend signals in five...

READ MORE

MEMBERS ONLY

Key Strategies To Improve Your Trading Performance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I love earnings season. New information abounds and the stock market is constantly trying to reprice thousands of securities based on this new data. It creates periods of temporary imbalances in supply and demand, which leads to a very inefficient market in the short-term. Put another way, we can make...

READ MORE