MEMBERS ONLY

The Market Breadth Indicator You Should Be Following

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps another strong day for stocks as the S&P 500 regains its 50-day moving average. He then identifies key levels to watch for PLTR, LCID, NFLX, NVDA, and AAPL, and breaks down the latest market breadth indicator...

READ MORE

MEMBERS ONLY

35 Years of Crude Oil Forecasting the Future | Focus on Stocks: May 2024

by Larry Williams,

Veteran Investor and Author

All You Need to Know About Crude Oil and the Future

Gold, black gold, is what Crude Oil has become. The entire world runs on energy. 98% of our cars and transportation, our lights, the device you are using to read this... virtually everything we can do is thanks to...

READ MORE

MEMBERS ONLY

Netflix Gets Island Reversal On Earnings

by Carl Swenlin,

President and Founder, DecisionPoint.com

Netflix (NFLX) earnings were released today, and the news was good. . . except for one little thing. They also suspiciously announced that, starting next year, they would no longer be reporting subscriber metrics. That's like General Motors saying that they will no longer report how many cars and trucks...

READ MORE

MEMBERS ONLY

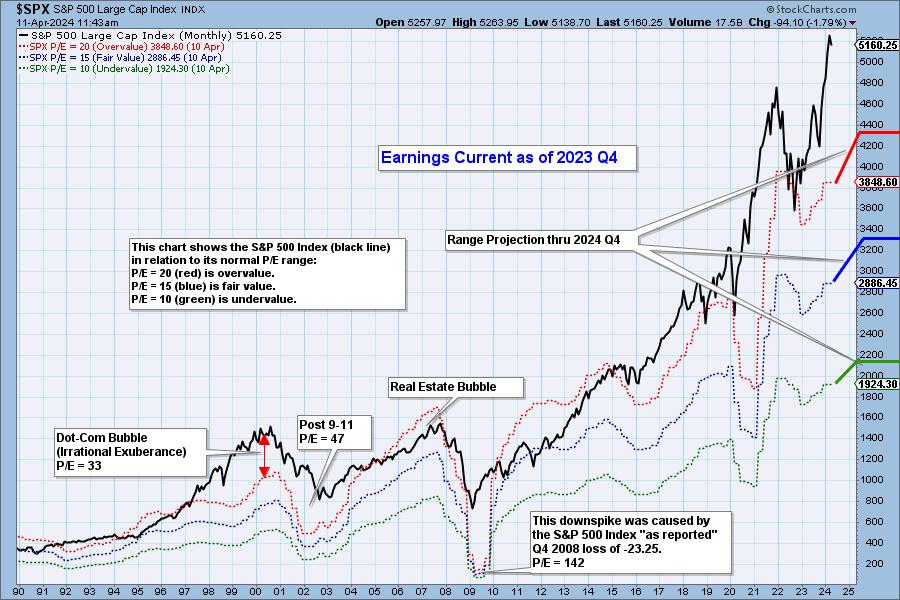

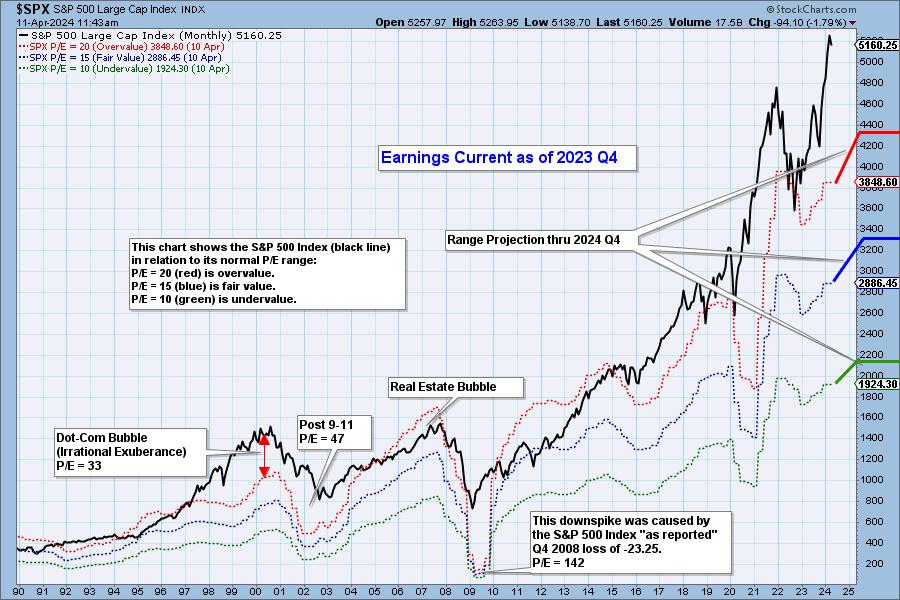

2023 Q4 Earnings Analysis and Projections Through 2024 Q4

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings are in for 2023 Q4, and here is our valuation analysis.

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

The Stock Market's Tremendous Resilience: What This Means For Q2

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite remains unfazed about interest rates remaining higher for longer.

* Commodity prices such as oil, gold, and cocoa are rising, even though inflation seems to be cooling.

* The top S&P 500 sector performers indicate the...

READ MORE

MEMBERS ONLY

Rates Look Set to Rise as TLT Resumes its Downtrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 20+ Yr Treasury Bond ETF (TLT) failed again at the falling 40-week SMA and looks poised to resume its bigger downtrend. Keep in mind that bonds and yields move in the opposite direction. A resumption of the downtrend in TLT translates into a resumption of the uptrend in the...

READ MORE

MEMBERS ONLY

The Business Cycle is Edging its Way to a More Inflationary Stage

by Martin Pring,

President, Pring Research

Last week, I pointed out the inflationary consequences of the recent gold breakout, as gold market participants initially expect prices to firm up in the commodity pits and later the CPI itself. This week, we will take those thoughts a step further by relating swings in industrial commodity prices to...

READ MORE

MEMBERS ONLY

Would You Rather Own AMZN or AAPL Stock?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shows how the Magnificent 7 has become much less of a comparable group of stocks, with TSLA, AAPL, and GOOGL all breaking down in recent weeks. He also tracks Bitcoin's retest of all-time highs and why high...

READ MORE

MEMBERS ONLY

Market In a "Wait and See" Mode: Awaiting Important Inflation Data

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Investors are anxiously awaiting the PCE data to get clues on when the Fed will start cutting interest rates

* Small cap stocks look like they want to break out of a range and join the bullish equity rally

* Bitcoin is having a strong week with three consecutive significant...

READ MORE

MEMBERS ONLY

The Halftime Show: Don't Box the Invisible Man -- EPS Reports

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

On this week's edition ofStockCharts TV'sHalftime, Pete takes a look at long-term trends. Semiconductors taking it on the chin. Inflation is still a problem. Bonds are selling off, and the Fed isn't cutting rates until, in Pete's opinion, the unemployment rate falls....

READ MORE

MEMBERS ONLY

Sector Spotlight: Stocks vs. Bonds -- Monthly Trends Revealed!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I review the monthly charts for January 2024, in combination with the Relative Rotation on the Monthly RRGs for asset classes and sectors. At asset class level, the preference for stocks over bonds remains clearly visible. Looking at the monthly...

READ MORE

MEMBERS ONLY

Three Things I WISH I'd Known About Trading

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave speaks to weakening short-term breadth conditions as the McClellan Oscillator rotates to a bearish level this week. Guest Dave Landry of DaveLandry.com drops some serious trader wisdom and also shares what he does first thing every morning to...

READ MORE

MEMBERS ONLY

S&P 500, Dow Jones Hit All-Time Highs Again; Tech Stocks Back in the Spotlight

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500, Dow Jones Industrial Average, and Nasdaq 100 closed at all-time highs

* Tech stocks are back in focus as mega-tech companies wrap up their Q4 earnings

* Investors should take advantage of pullbacks if they want to add positions to their portfolios

What a week!...

READ MORE

MEMBERS ONLY

GNG TV: A STRONG Week for Equities and Internet Stocks SOAR!

by Alex Cole,

Co-founder, GoNoGo Charts®

On this week's edition of the GoNoGo Charts show from StockCharts TV, Alex takes a look at the market using the GoNoGo methodology as the S&P 500 digests the rally to all time highs. After using the GoNoGo Asset Map to look at the trends across...

READ MORE

MEMBERS ONLY

Bullish Buyers Return After Market Selloff

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Jay Woods, CMT of Freedom Capital Markets brings the energy of the NYSE floor to the show, relating today's market rebound to longer term themes for small caps and regional banks. Dave shares one breadth indicator recognizing broad...

READ MORE

MEMBERS ONLY

The Halftime Show: Fed Stays Put, Bond Markets Rally!

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Uncertainty needs attention in order for it to make you second guess yourself. Instead, wait for trends to change, and then make changes. On this week's edition ofStockCharts TV'sHalftime, Pete Carmasino goes over some thoughts on interest rates and when the Fed will finally cut. He...

READ MORE

MEMBERS ONLY

S&P 500 Falls, Nears First Support Level -- How Much Lower Can It Go?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Fed leaves interest rates unchanged as expected, but investors weren't happy

* S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all close lower after Fed decision

* The 10-year Treasury yield falls to a three week low

Will the Fed cut interest rates at...

READ MORE

MEMBERS ONLY

S&P 500 Still SUPER Undervalued!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Ari Wald, CFA CMT of Oppenheimer lays out a bull case for the S&P 500 based on valuations and forward returns given strong breadth conditions. Dave reviews stocks reporting earnings this week, including LOGI, LMT, PG, DHI,...

READ MORE

MEMBERS ONLY

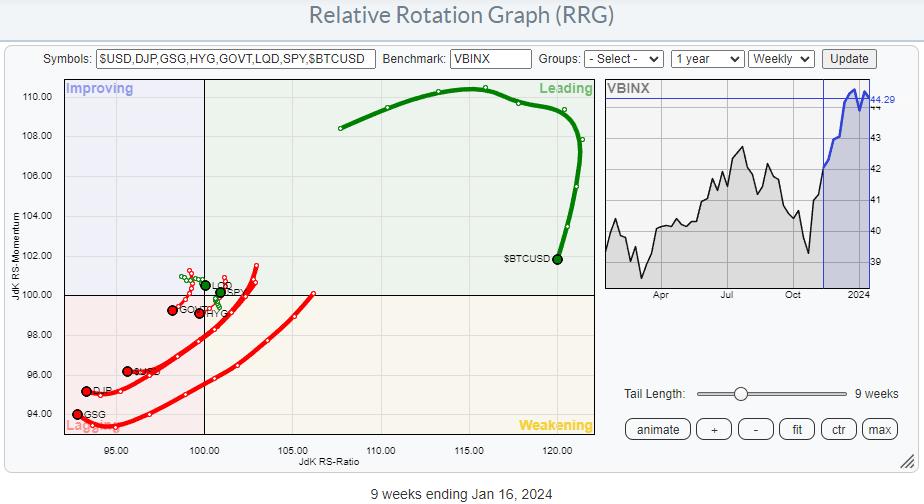

Watch Stocks Triumph in Latest Asset Allocation Battle

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

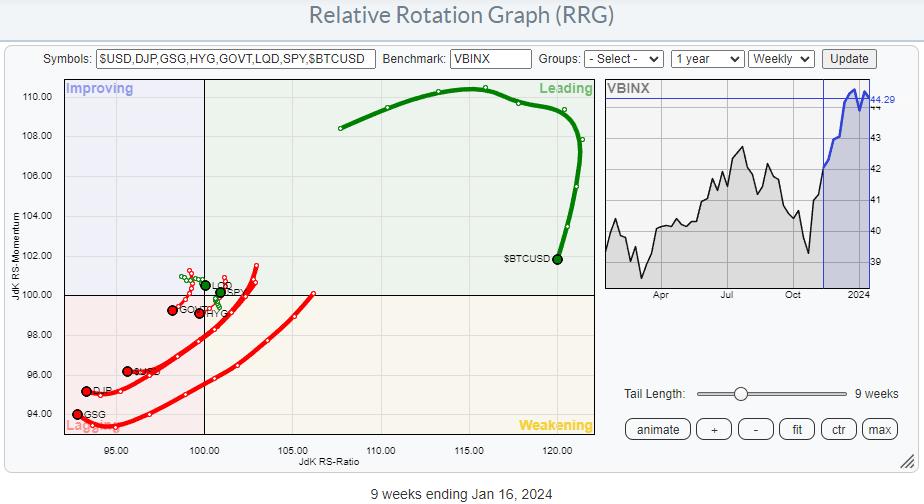

KEY TAKEAWAYS

* Commodities and USD rotating deep inside the lagging quadrant, indicating weak relative strength

* Bitcoin is in a strong relative uptrend vs all other asset classes, but going through a corrective phase

* Stocks are the clear winner in this asset allocation battle

The RRG above shows the rotation of...

READ MORE

MEMBERS ONLY

The Halftime Show: Escape the Chaos - Discovering the Key to Tackling Market Uncertainty

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Uncertainty needs attention in order for it to make you second guess yourself. Instead, wait for trends to change, and then make changes. On this week's edition ofStockCharts TV'sHalftime, Pete Carmasino shares a broad market overview, starting with a divergence signal on the bullish percent of...

READ MORE

MEMBERS ONLY

Don't Miss Out! 2 Promising Sectors in Early 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Julius de Kempenaer of RRG Research talks stocks over bonds and highlights two sectors with upside potential based on improvements in their relative strength. Dave unveils a bearish momentum divergence for Netflix and reveals two technology stocks that could still...

READ MORE

MEMBERS ONLY

MEM TV: Jobs Growth Reveals NEW Opportunities in These AREAS

by Mary Ellen McGonagle,

President, MEM Investment Research

Not a great start to the year! In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen takes a look at where the broader markets closed, and sees we're hovering around some rather critical areas. The sharp pullback in growth stocks drove last week's...

READ MORE

MEMBERS ONLY

Guidelines for 2024 | Focus on Stocks: January 2024

by Larry Williams,

Veteran Investor and Author

Let's Get This Out of The Way Right Now

For the last 18 years, I've had a love affair with my annual forecast report. Until I began writing this letter, it was the only thing I did. Many of you purchased it last year, and some...

READ MORE

MEMBERS ONLY

Investing in 2024: 3 Promising Opportunities To Watch

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market ended with a bang in 2023 in spite of inflationary fears

* Small caps and emerging markets are breaking out of a trading range so look for value plays in these asset groups

* Bitcoin has soared and the trend is likely to continue in 2024

The...

READ MORE

MEMBERS ONLY

Intermediate-Term Participation Levels Are Very Overbought, and They Are Weak Long-Term

by Carl Swenlin,

President and Founder, DecisionPoint.com

When we discuss participation, we are referring to the more specific and accurate assessment of breadth available with the Golden Cross and Silver Cross Indexes. The venerable and widely-known Golden Cross is when the 50-day moving average of a price index crosses up through the 200-day moving average, which signals...

READ MORE

MEMBERS ONLY

More from Mish's Outlook 2024 -- 17 Predictions

One area I cover in the Outlook 2024 is the teachings of Raymond Lo and how he sees the upcoming Year of the Dragon. Part of my comments on his analysis is based on this statement by Lo:

"Many has the misunderstanding that the Dragon is glamorous auspicious animal...

READ MORE

MEMBERS ONLY

MEM TV: Markets in Bullish Mode as We Head Toward Year-End

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, join Mary Ellen as she as she dives into the latest news and trends that are driving price action in the markets. From housing updates to consumer confidence and inflationary data, she breaks it all down and shows you how...

READ MORE

MEMBERS ONLY

Stock Market Delivered Huge Gift, Wipes Away Recession Fears

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Cooling inflation data sends the S&P 500 higher, which is a good start to the Santa Claus rally

* Investors should monitor small-cap stocks and bonds and consider adding them to investment portfolios

* Volatility is low but investors should continue monitoring the VIX to identify changes in...

READ MORE

MEMBERS ONLY

GNG TV: Buying Opportunity or Trend Reversal?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, Tyler and Alex dive into the current trends and momentum in the markets, in order to help navigate through the ever-changing landscape of stocks, bonds, commodities, and the dollar. Is the recent pullback in the S&P 500 is just a...

READ MORE

MEMBERS ONLY

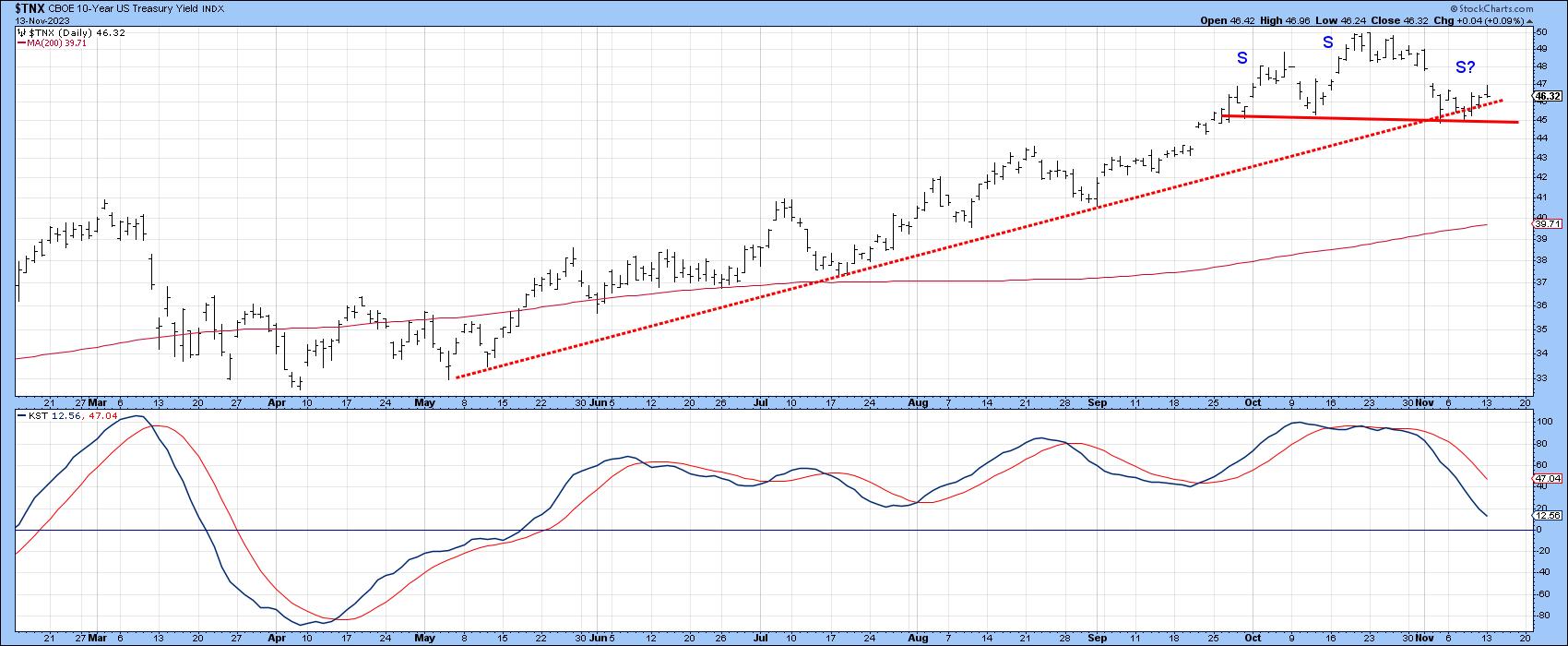

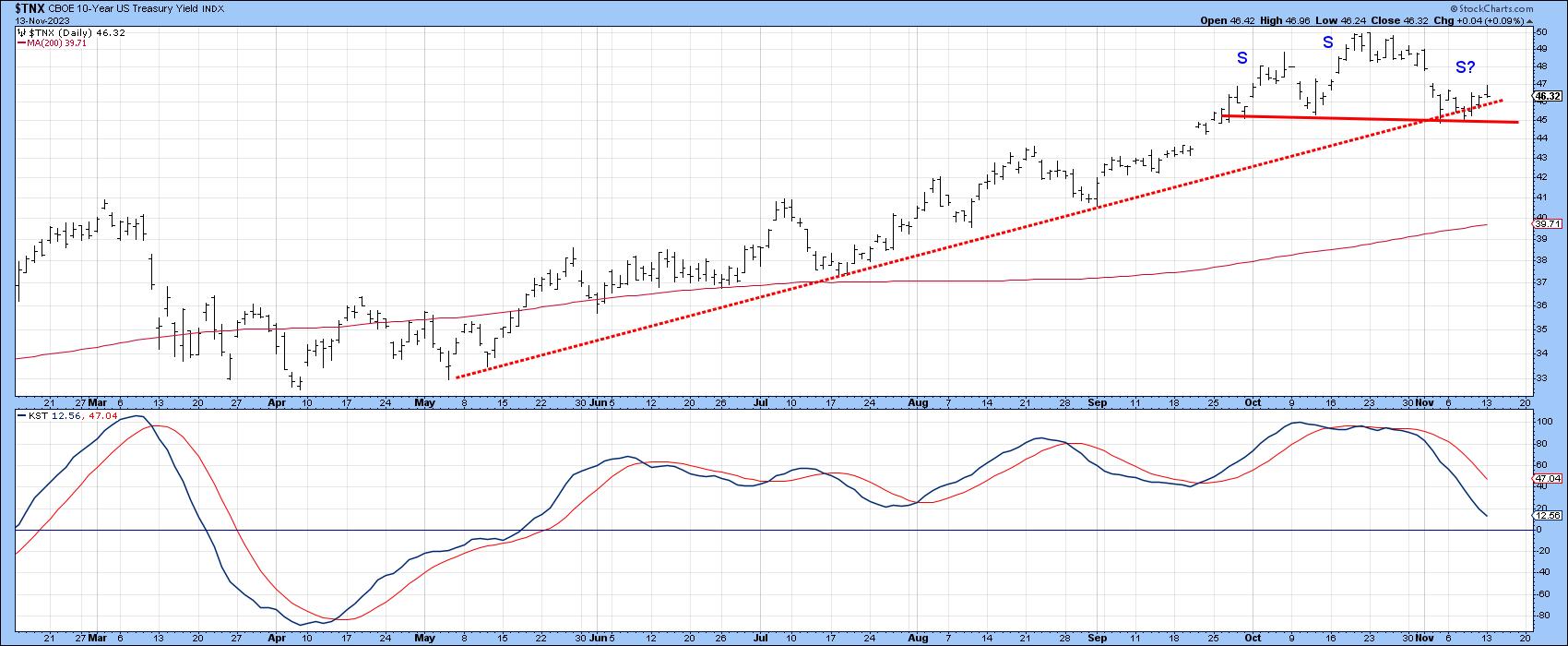

Top Five Charts of 2023 #2: Ten-Year Treasury Yield

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In the second of a five-part special series on StockCharts TV'sThe Final Bar, Dave takes a deep dive into the bond markets, talking rising rates, Fed rate hikes, value vs. growth, inverted yield curves, and what the bond markets in 2023 could tell us about potential future paths...

READ MORE

MEMBERS ONLY

DP Trading Room: Finally! Signs of Life in the Energy Sector

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, with Energy (XLE) finally showing signs of life, Carl and Erin dive into the sector to learn more about participation and new momentum. Carl discusses Total Returns on SPX, which are showing new all-time highs before the actual index....

READ MORE

MEMBERS ONLY

Energy Sector Finally Becoming Bullish?

by Carl Swenlin,

President and Founder, DecisionPoint.com

We publish this table daily to give an overview of the market, sector, and industry group indexes we follow. The Intermediate-Term Trend Model (ITTM) BUY Signals occur when the 20-day EMA crosses up through the 50-day EMA (Silver Cross). Long-Term Trend Model (LTTM) BUY Signals occur when the 50-day EMA...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" December 14, 2023 Recording

by Larry Williams,

Veteran Investor and Author

In this video, Larry presents his forecast for FANG stocks, including an analysis of the stock selloff for META. He then digs into the cycle of debt and why he's bothered about credit card writeoffs. After that, he examines the weekly economic index and GDP and how they...

READ MORE

MEMBERS ONLY

DP Trading Room: How Bad Data From Major Indexes Leads to Bad Analysis

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl discusses his recent epiphany regarding data derived from major indexes. Bad data will lead to bad analysis, so it's important to understand this concept for analyzing major indexes. He and Erin discuss the implications of Magnificent...

READ MORE

MEMBERS ONLY

Santa Comes to Wall Street | Focus on Stocks: December 2023

by Larry Williams,

Veteran Investor and Author

Santa Comes to Wall Street

Maybe St. Nick gets into the eggnog before he visits Wall Street each year, because the trading pattern has been a step up, then a stumble down before recovering at the end of the year. I first noticed this Up-Down-Up pattern back in the early...

READ MORE

MEMBERS ONLY

DP Trading Room: How To Time Your Trade Entries & Exits Like a Pro

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Erin flies solo today and gives everyone a refresher course on how to expertly time your entries and exits for trades, using the 5-minute candlestick chart. She covers the market in general, followed by analysis of sectors of interest...

READ MORE

MEMBERS ONLY

Wrong Data Gets Wrong Answers

by Carl Swenlin,

President and Founder, DecisionPoint.com

A recent article on the Business Insider site reported a set of Death Cross/Golden Cross signals on the Dow Jones Industrial Average ($INDU). Specifically, on November 13, the 50-day moving average crossed down through the 200-day moving average, commonly called a Death Cross. Two days later, the 50-day moving...

READ MORE

MEMBERS ONLY

These Three Intermarket Relationships are at Key Juncture Points

by Martin Pring,

President, Pring Research

We spend a lot of time analyzing sector rotation, but there are also other relationships that can offer useful insights to internal market dynamics. One aspect of this is the relationship between market averages.

NASDAQ vs. the DJIA

As an example, Chart 1 plots the relationship between the NASDAQ Composite...

READ MORE

MEMBERS ONLY

The Stock Market In 3 Charts: Market Breadth, Bonds, Sentiment

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stock market breadth is widening which is an indication that market internals are strong

* Falling treasury yields suggest that inflation expectations are declining

* Investors are more complacent than in October which is bullish for equities

Stocks are having a good November, which aligns with typical stock market behavior....

READ MORE

MEMBERS ONLY

Is It Time for Interest Rates to Fall?

by Martin Pring,

President, Pring Research

I last wrote about bonds and interest rates in August, as they were in the process of challenging their October 2022 highs. My conclusion at the time was that they were likely to go through, but that upside potential would be limited due to what seemed at the time to...

READ MORE