MEMBERS ONLY

Market Research and Analysis - Part 2: Using Technical Indicators

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

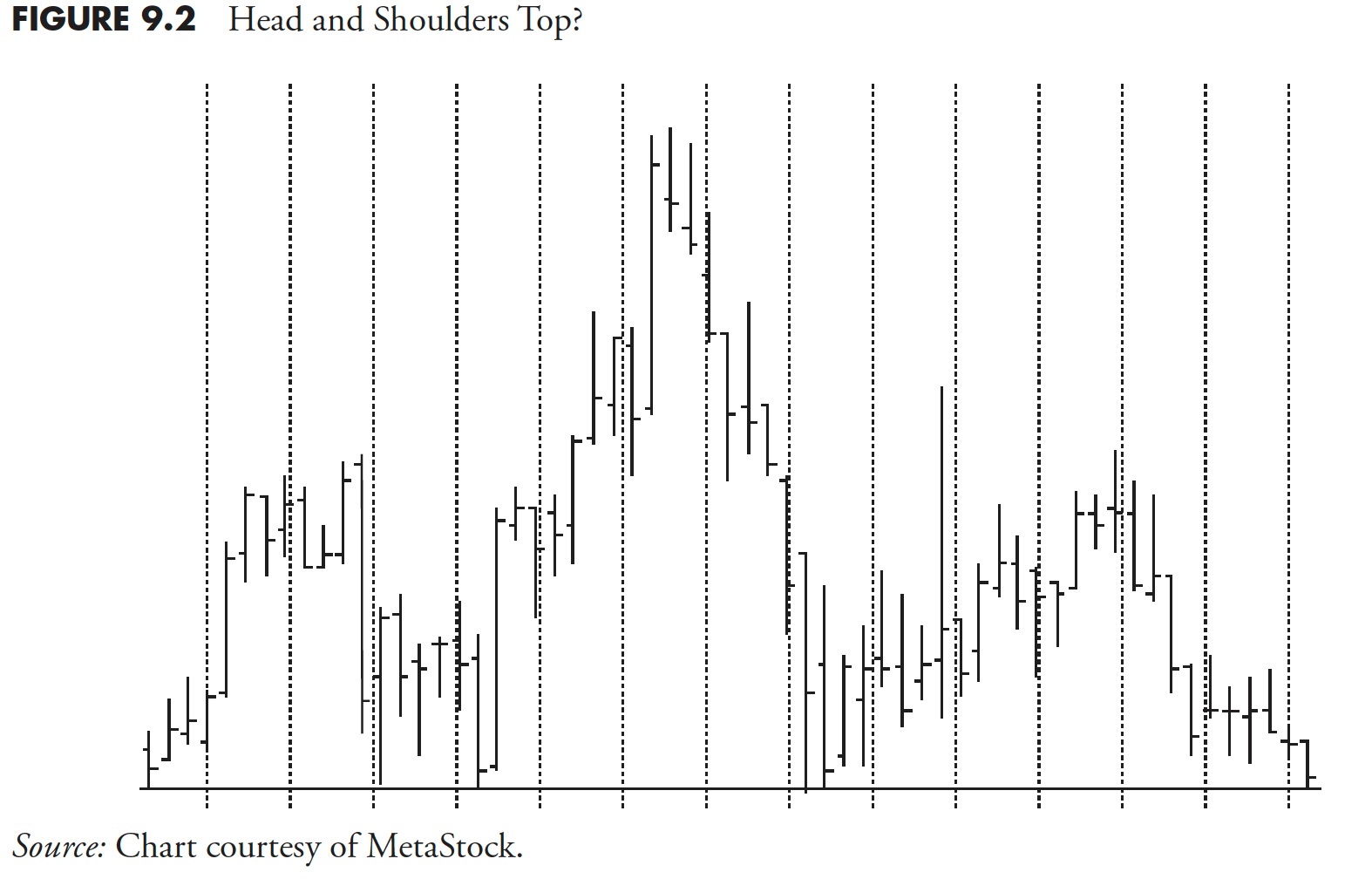

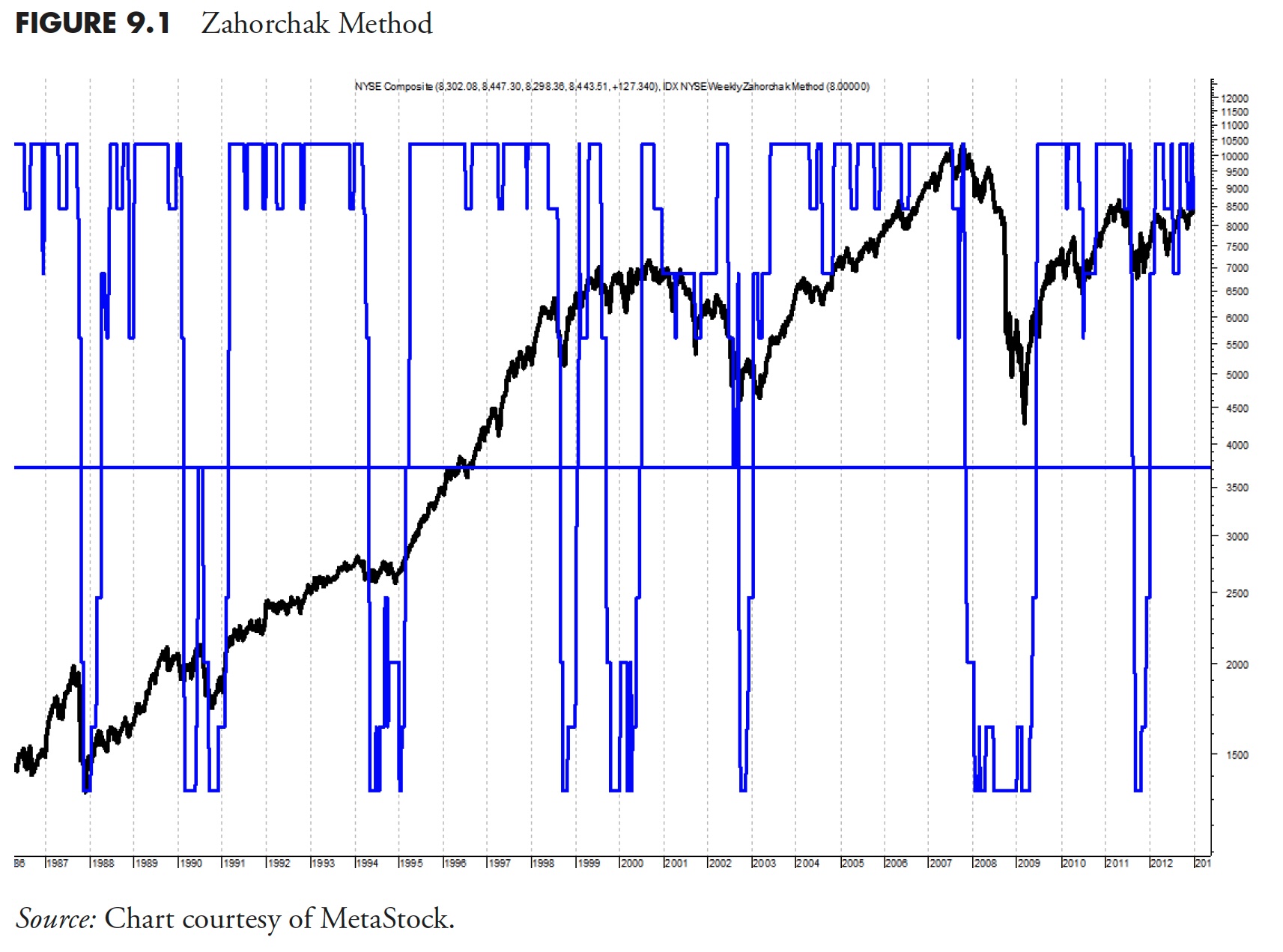

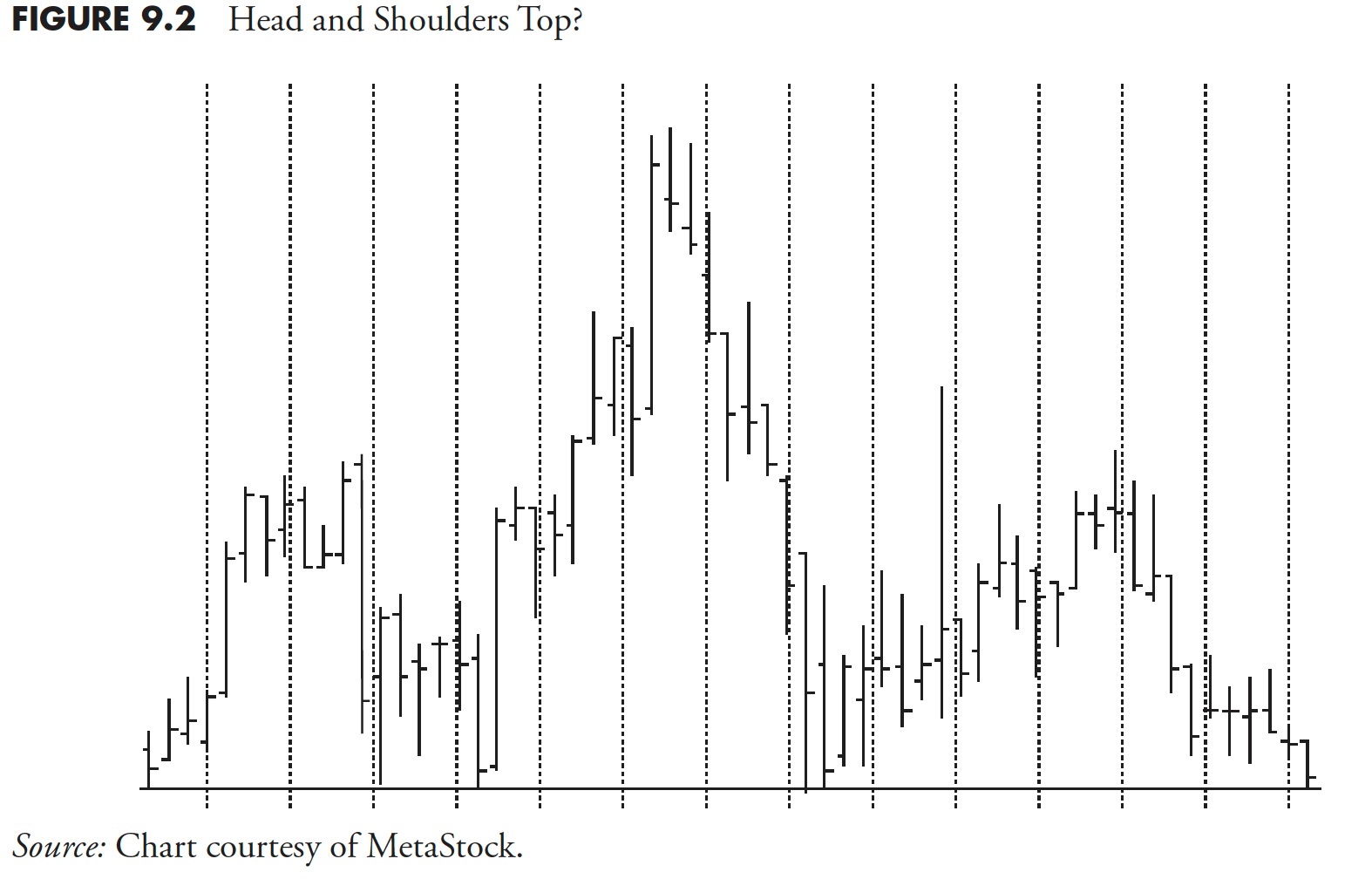

Note to the reader: This is the thirteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" March 19, 2024 Recording

by Larry Williams,

Veteran Investor and Author

It's March Madness in the stock market!

In this video, Larry begins by presenting his Trading Days of the Month (TDOM) for the rest of March, as well as the days to hold back on trading. He also presents what he dubs his "Machu Picchu" trade....

READ MORE

MEMBERS ONLY

MEM TV: Risk-Off Signals Possible Downside Ahead

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews investors' responses to the rise in interest rates after inflation numbers come in higher than expected. She also shares how riskier areas of the market sold off while cyclicals came into favor. Earnings reports continue to...

READ MORE

MEMBERS ONLY

Decisive Long-Term Breakout for Gold

by Carl Swenlin,

President and Founder, DecisionPoint.com

This month, the SPDR Gold Shares (GLD) broke out to new, all-time highs. That was a significant long-term move, which we will discuss when we get to the monthly chart.

Of more immediate interest is the fact that sentiment is still bearish, which bodes well for a continued advance. We...

READ MORE

MEMBERS ONLY

The Mighty Have Fallen! TSLA and NVDA On The Rocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave tracks the day's weaker session, with the S&P 500 and Nasdaq down slightly and the small cap S&P 600 down 1.6%. He covers energy stocks breaking higher on stronger crude oil prices,...

READ MORE

MEMBERS ONLY

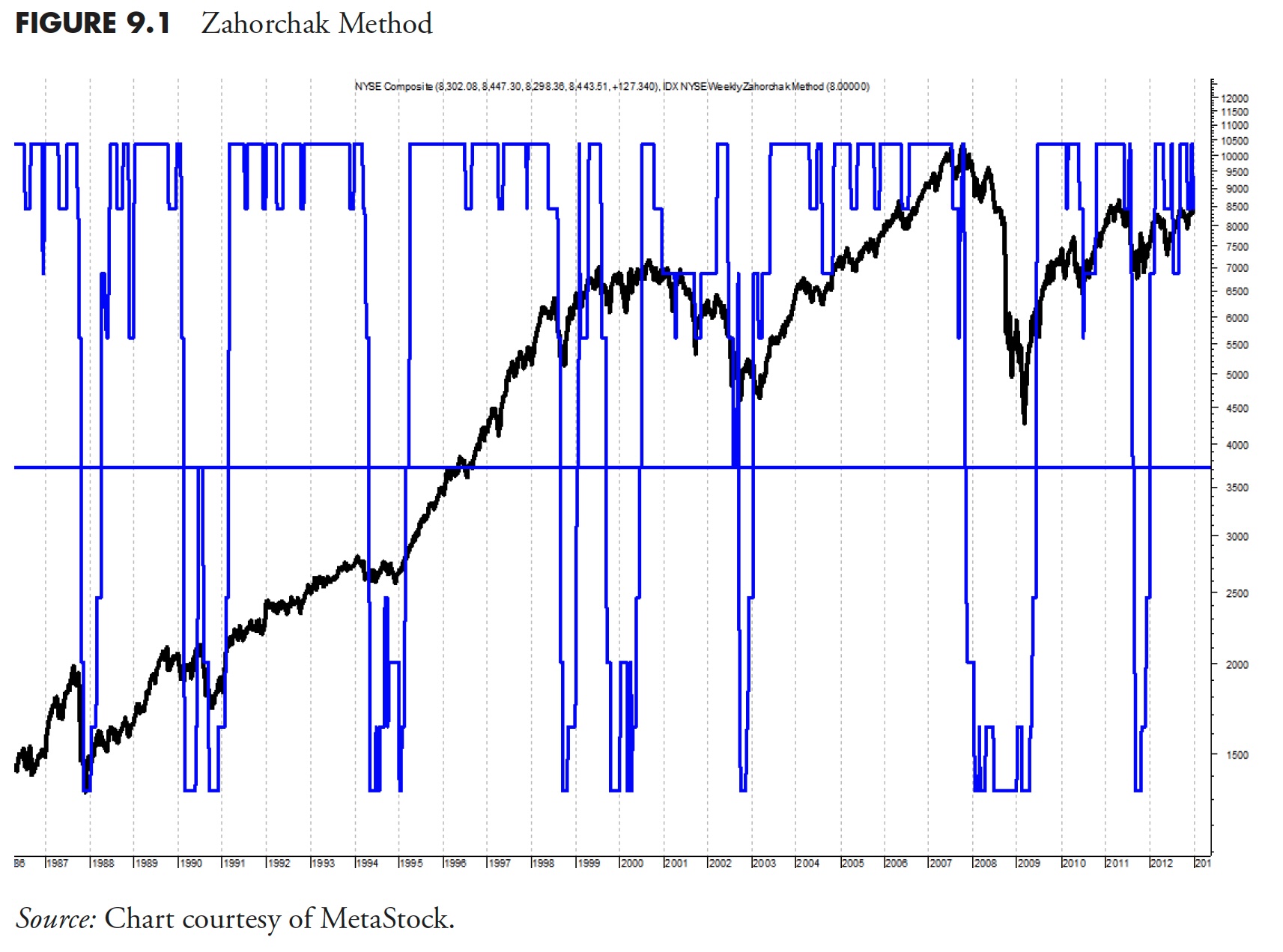

Market Research and Analysis - Part 1: Why Technical Analysis?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twelfth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

The Business Cycle is Edging its Way to a More Inflationary Stage

by Martin Pring,

President, Pring Research

Last week, I pointed out the inflationary consequences of the recent gold breakout, as gold market participants initially expect prices to firm up in the commodity pits and later the CPI itself. This week, we will take those thoughts a step further by relating swings in industrial commodity prices to...

READ MORE

MEMBERS ONLY

The Halftime Show: 100th and LAST Show!

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Pete presents the 100th and final edition ofStockCharts TV'sHalftime! This week, Pete shares some parting tips on what to look for when the trends change from defense, (risk off) to offense (risk on). He explains how he saw them coming and how the Chaikin Power Gauge did as...

READ MORE

MEMBERS ONLY

Everyone Has a Plan Until They Get Punched in the Face. Did Jerome Powell Just Get Punched in the Face?

by Martin Pring,

President, Pring Research

The title of this article may be exaggerated, but, last Friday, the probabilities for an upward reversal in the rate of inflation later this year went substantially higher. That's because the gold price, an inflationary bellwether, broke out from a 4-year trading range to a new all-time high....

READ MORE

MEMBERS ONLY

Three Intermarket Relationships That Say This Bull Market is Going Higher

by Martin Pring,

President, Pring Research

Absorbing the information gleaned from monthly charts for various asset classes or sectors can help gain some perspective. However, I find that an examination of the relationships between them can be equally rewarding, if not moreso. That's because they point out the nature of the current investment environment,...

READ MORE

MEMBERS ONLY

New Dow Theory CONFIRMS BULL Phase!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave continues his market recaps from Dubai, focusing on the impressive rally in small caps, continued strength in Bitcoin, and upside potential for crude oil and oil services stocks. He highlights one technology name in a persistent downtrend, but potentially...

READ MORE

MEMBERS ONLY

The False Flag of Fed Rate Cuts | Focus on Stocks: March 2024

by Larry Williams,

Veteran Investor and Author

Let's begin this month with a look at...

The False Flag of Fed Rate Cuts

Day after day, we hear how the Fed will embark on a series of rate cuts this year "because inflation has peaked" and is heading lower. The drop in inflation is...

READ MORE

MEMBERS ONLY

Emerging Markets Getting Closer to a Breakout

by Martin Pring,

President, Pring Research

Last November I asked the question "Are emerging markets about to emerge?"Using the iShares MSCI Emerging Markets ETF (EEM) as our benchmark, I concluded that more strength was needed in order to push the indicators into a bullish mode. In the intervening period, things have improved, but...

READ MORE

MEMBERS ONLY

The Halftime Show: Don't Box the Invisible Man -- EPS Reports

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

On this week's edition ofStockCharts TV'sHalftime, Pete takes a look at long-term trends. Semiconductors taking it on the chin. Inflation is still a problem. Bonds are selling off, and the Fed isn't cutting rates until, in Pete's opinion, the unemployment rate falls....

READ MORE

MEMBERS ONLY

Gold is at the Crossroad

by Martin Pring,

President, Pring Research

Last November and December, it looked as if gold had broken out from a multi-year inverse head-and-shoulders. Since then, the price has dropped below the breakout area, and the long-term KST has begun to roll over.

Just like takeoff and landing are the critical points for an aircraft, breakouts are...

READ MORE

MEMBERS ONLY

GNG TV: A STRONG Week for Equities and Internet Stocks SOAR!

by Alex Cole,

Co-founder, GoNoGo Charts®

On this week's edition of the GoNoGo Charts show from StockCharts TV, Alex takes a look at the market using the GoNoGo methodology as the S&P 500 digests the rally to all time highs. After using the GoNoGo Asset Map to look at the trends across...

READ MORE

MEMBERS ONLY

Home Prices and Stocks | Focus on Stocks: February 2024

by Larry Williams,

Veteran Investor and Author

Let's begin this month with a look at ...

Home Prices and Stocks

Most people have the majority of their money in homes and/or stocks. Thus, I thought that this month, I would take a look at what should be happening in the real estate market.

Let'...

READ MORE

MEMBERS ONLY

Gold is Making Waves within a Long-Term Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Gold is not the most exciting asset at the moment, but it is in a long-term uptrend and perhaps the strongest commodity out there. There are also signs that the January decline is ending as RSI hits a momentum support zone and a bullish continuation pattern forms. Note that GLD...

READ MORE

MEMBERS ONLY

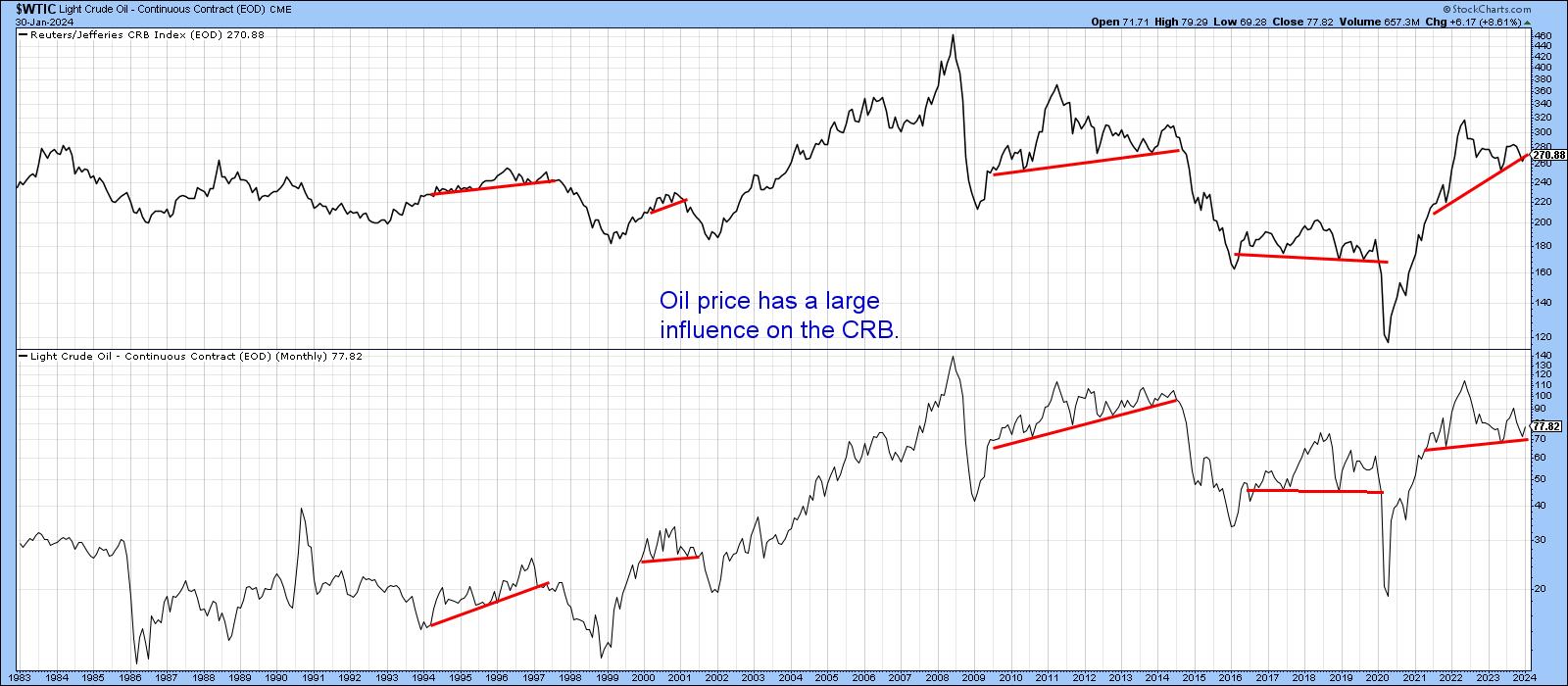

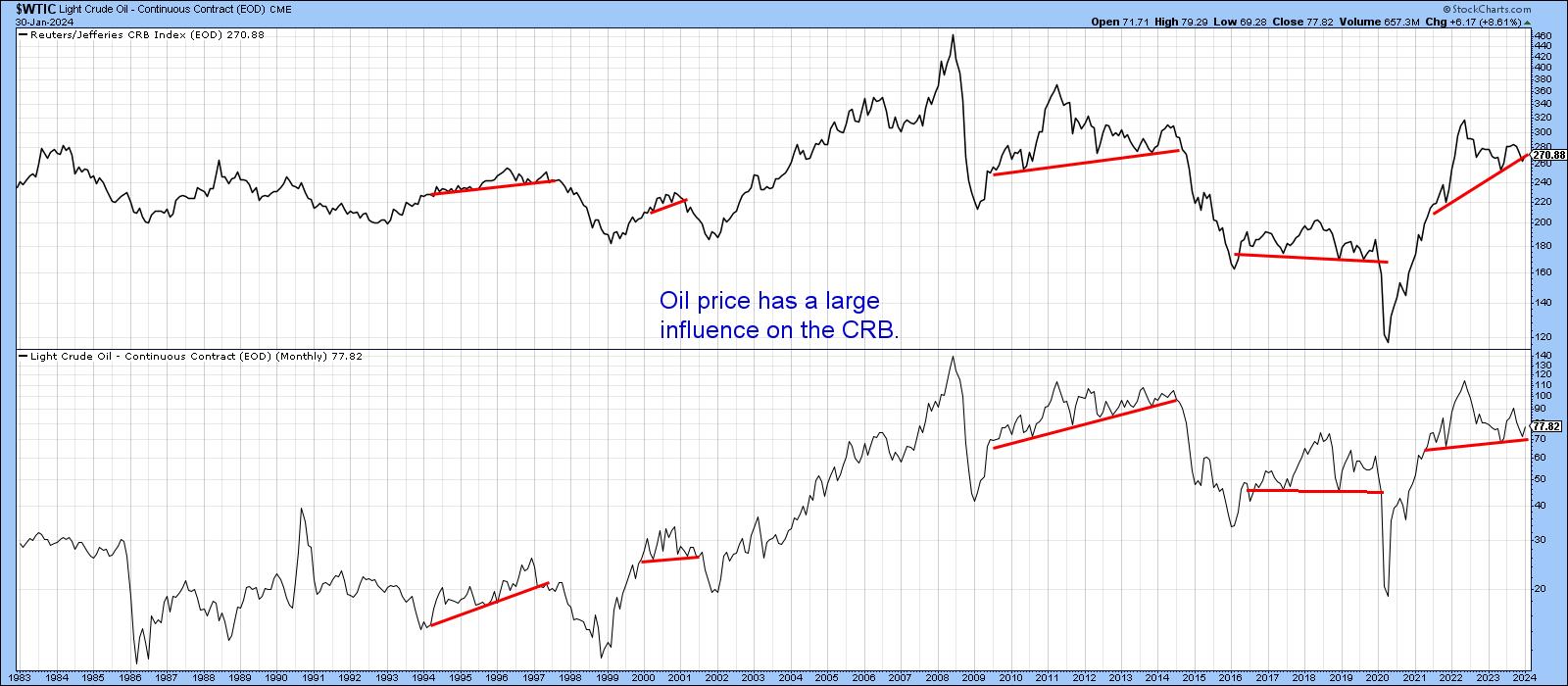

Is Oil Going Up or Down?

by Martin Pring,

President, Pring Research

Oil is not only an important commodity in and of itself, but is also one has a substantial influence on commodity indexes in general. Its weight in the CRB Composite is 23%; for energy in total, it is 39%. Chart 1 compares the oil price to the CRB Composite, where...

READ MORE

MEMBERS ONLY

Higher Gold Price Coming, But Investors Must Be Patient

For today, I am reprinting an interview I did for Kitco News with Neils Christensen, written by Neils.

(Kitco News) - The gold market remains in a solid holding pattern as it waits for some direction from the Federal Reserve, and one market strategist is warning potential precious metals investors...

READ MORE

MEMBERS ONLY

Will Catalysts Push Markets HIGHER or Drag Them LOWER?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave tracks the S&P 500 as it pushes to a new high above 4900, while the McClellan Oscillator rotates to a bullish reading. He breaks down earnings plays this week, including XOM, MSFT, and more.

This video originally...

READ MORE

MEMBERS ONLY

Inflation Fell to the Fed's Target -- Or is That a Moving Target?

On Friday, the market woke up to great news. Mission accomplished on inflation.

Yahoo Finance reported: "The Fed's preferred inflation measure — a 'core' Personal Consumption Expenditures index that excludes volatile food and energy prices — clocked in at 2.9% for the month of December, beating...

READ MORE

MEMBERS ONLY

Macro Model Gives Mixed Signals as NFLX LIGHTS UP!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest John Kosar, CMT of Asbury Research shares his proprietary Asbury Six macro model, which suggests caution based on weak fund flows and breadth conditions. Dave focuses in on crude oil and gold charts, and also reviews key earnings plays...

READ MORE

MEMBERS ONLY

Remember Those 3 Signs of Inflation to Watch?

As a follow-up to a daily I wrote earlier in January called "Super Cycles Do Not Just Fade Away",yesterday'sJanuary 23rd dailywas all about one of the three indicators that can get us prepared for more inflation.

On January 5th, sugar was still trading under 22...

READ MORE

MEMBERS ONLY

Time for Sweet Talk: Sugar Futures

The biggest mover so far in one month's time is sugar futures, up over 16%.

As I am a big follower of weather patterns and have predicted weather could be a huge factor on several crops this year, one major concern for sugar is that the current El...

READ MORE

MEMBERS ONLY

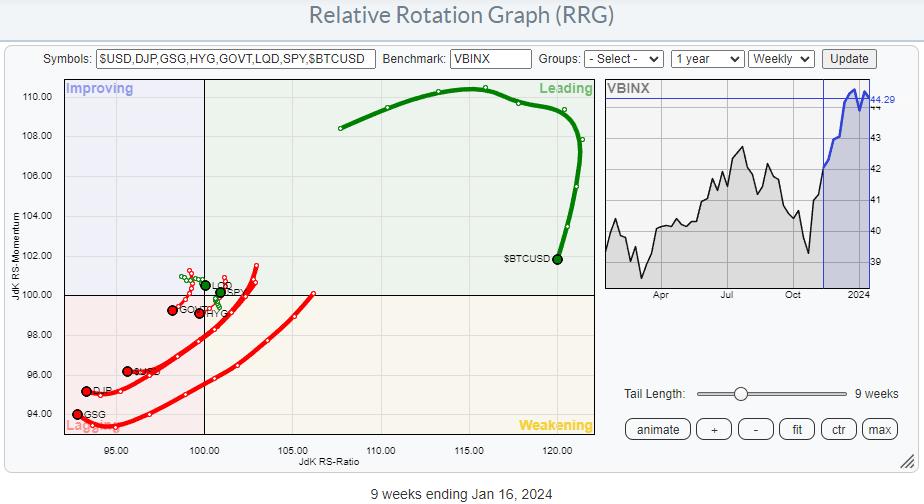

Watch Stocks Triumph in Latest Asset Allocation Battle

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

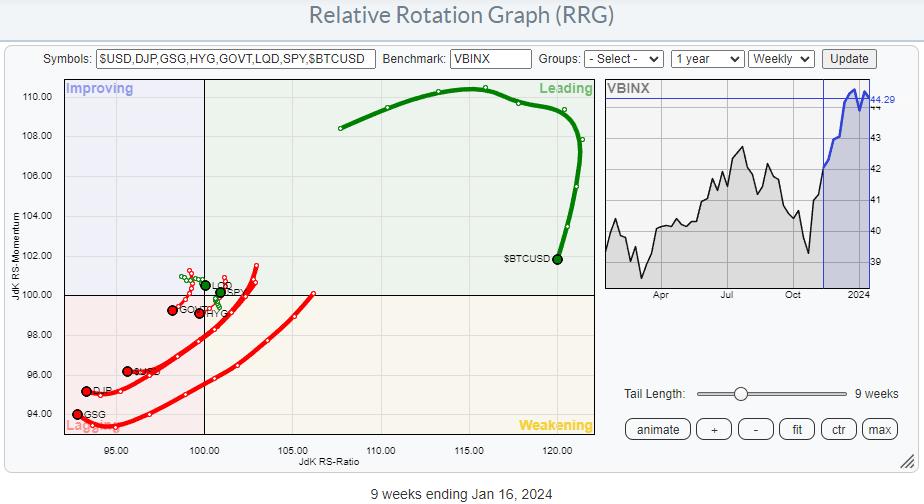

KEY TAKEAWAYS

* Commodities and USD rotating deep inside the lagging quadrant, indicating weak relative strength

* Bitcoin is in a strong relative uptrend vs all other asset classes, but going through a corrective phase

* Stocks are the clear winner in this asset allocation battle

The RRG above shows the rotation of...

READ MORE

MEMBERS ONLY

Has Rate Cut Anticipation Run Its Course?

by Carl Swenlin,

President and Founder, DecisionPoint.com

The Fed stopped raising rates in July, and, by mid-October, yields had peaked. Since then, yields have begun to decline in anticipation of the Fed beginning rate cuts this year. At this point, it appears that yields have found support and may possibly bounce, or begin moving sideways. This chart...

READ MORE

MEMBERS ONLY

Are Key Commodities Decoupling from Equities?

After a long weekend, the market action on January 16th held some surprises.

The Bullish Trends, or gainers, were the dollar and -- here is the surprise for some -- many different commodities. The Bearish Trends, or losers, were foreign currencies, long bonds, and (not shown on the chart) US...

READ MORE

MEMBERS ONLY

Buying Bitcoin ETFs is the Easy Part, But What Comes Next?

by Martin Pring,

President, Pring Research

Last week, eight new Bitcoin-based ETFs began trading courtesy of recent SEC approval. This launch was well anticipated, as the price had already run up in the hope that these new buyers would push it to an even higher level. The thought occurred to me that the situation is not...

READ MORE

MEMBERS ONLY

Stock Market Was Tentative This Week: S&P 500 Tested New High But Pulled Back

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market exhibited tentative behavior this week probably due to uncertainty about inflation and geopolitical developments

* S&P 500 index touched a high but pulled back to close slightly higher

* Crude oil prices broke above $75 but pulled back and is holding support at its 200-week...

READ MORE

MEMBERS ONLY

Drilling Down Into Gold and Silver

With the news on geopolitical escalation, soft versus hard landing, disinflation versus reinflation, growth versus value, and credit default versus available disposable income, gold and silver are even more interesting now.

Gold's behavior has been more of sell strength and buy weakness for some time. What has changed...

READ MORE

MEMBERS ONLY

Markets: Recap of This Week's Market Dailies

I began the week focused on bank earnings, which we will wake up to tomorrow. In that Daily, I wrote, "one can assume that bank stocks, which already started off the year extremely well, have potential to shine.

"However, we know that assumptions can be tricky. There are...

READ MORE

MEMBERS ONLY

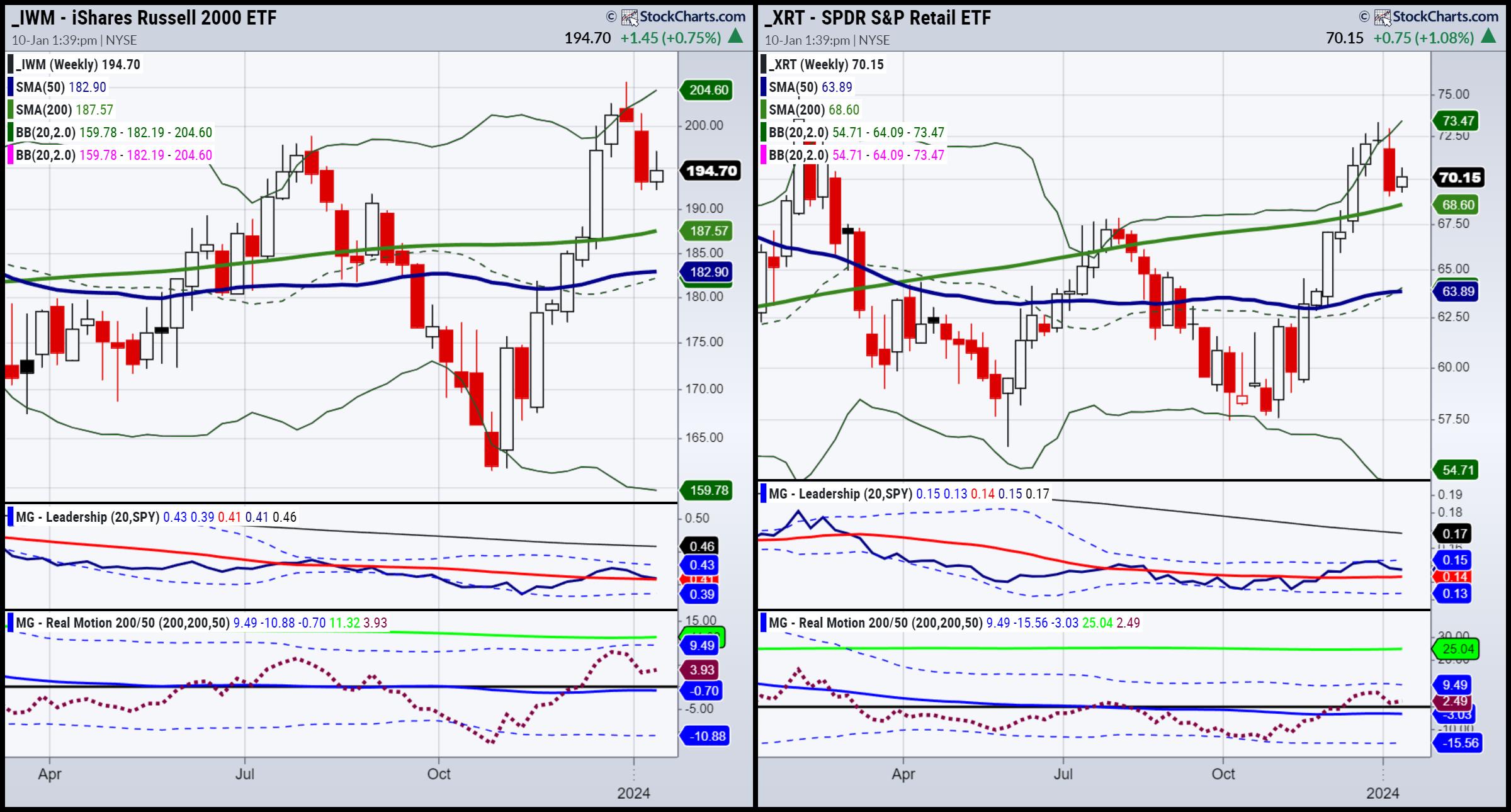

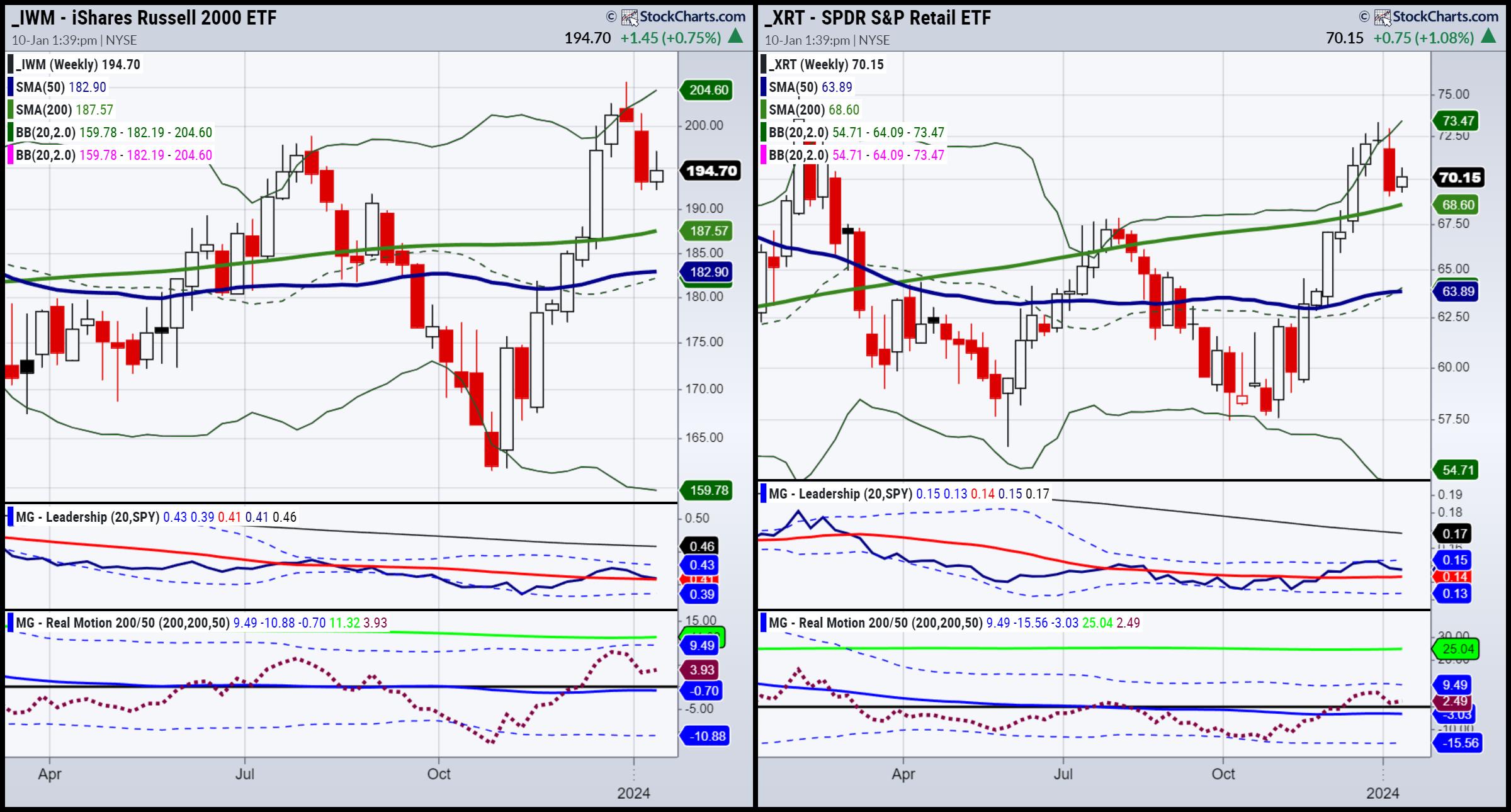

Markets: Week 1, Week 2 -- What's Next in Week 3?

Looking at the Economic Modern Family (weekly charts), all of them, to date, peaked in December. The Russell 2000, Regional Banks, Transportation and Retail, as far as index and sectors go, backed off the most from their peaks. Semiconductors are more sideways since the peak, as well as Biotech (which...

READ MORE

MEMBERS ONLY

The Halftime Show: Escape the Chaos - Discovering the Key to Tackling Market Uncertainty

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Uncertainty needs attention in order for it to make you second guess yourself. Instead, wait for trends to change, and then make changes. On this week's edition ofStockCharts TV'sHalftime, Pete Carmasino shares a broad market overview, starting with a divergence signal on the bullish percent of...

READ MORE

MEMBERS ONLY

Commodities Trade Analysis: Aluminum

As a main aluminum producer, Alcoa (AA) announced cost-cutting measures, along with plans to curtail production at one Western Australian Refinery. But that is just one facility, and the company plans to continue to operate its port facilities located alongside the refinery. Plus, it will continue to import raw materials...

READ MORE

MEMBERS ONLY

Super Cycles Do Not Just Fade Away

On inflation

I like this quote-

"Goods deflation likely transitory as downward pressure on goods demand and input costs are fading. 1H24 global core inflation likely to settle near 3%, which won't resolve the immaculate disinflation debate."

And this quote does not include the steep rise...

READ MORE

MEMBERS ONLY

Earnings for 2023 Q3 Show Market Still Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings are in for 2023 Q3, and here is our valuation analysis.

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

Guidelines for 2024 | Focus on Stocks: January 2024

by Larry Williams,

Veteran Investor and Author

Let's Get This Out of The Way Right Now

For the last 18 years, I've had a love affair with my annual forecast report. Until I began writing this letter, it was the only thing I did. Many of you purchased it last year, and some...

READ MORE

MEMBERS ONLY

STRONG Indicators for 2024!

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG points out how broadly supported the market has been this time around, and how he's seeing excellent setups on the higher time frames. He walks us through some of the action that is making him look forward...

READ MORE

MEMBERS ONLY

Intermediate-Term Participation Levels Are Very Overbought, and They Are Weak Long-Term

by Carl Swenlin,

President and Founder, DecisionPoint.com

When we discuss participation, we are referring to the more specific and accurate assessment of breadth available with the Golden Cross and Silver Cross Indexes. The venerable and widely-known Golden Cross is when the 50-day moving average of a price index crosses up through the 200-day moving average, which signals...

READ MORE