MEMBERS ONLY

Week Ahead: NIFTY Defends This Crucial Support; Chase Rebounds Mindfully

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a truncated trading week, the Indian equities closed the week with gains thanks to a robust technical rebound that it witnessed on Friday. The Nifty continued to wear a corrective look for three days; on the last trading day of the week, the Index managed to get itself into...

READ MORE

MEMBERS ONLY

These Old-School Stocks Have Joined The AI Rally!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the broad-based rally that pushed the Equal-Weighted SPX to new highs. She also shared base breakouts and downtrend reversal candidates in the now hot Retail space, and takes a close look at 3 old school stocks that are seeing AI-related growth.

This...

READ MORE

MEMBERS ONLY

Financial Upswing: Understanding the Stock Market Rally and Yield Rise

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stock market indexes resumed their bullish trend.

* Small- and mid-cap stocks rose the most showing strong upside movement.

* Treasury yields rose higher on concerns of reinflation.

The afternoon turnaround seems to be more the norm than the exception. Thursday's stock market action followed the trend. What...

READ MORE

MEMBERS ONLY

AppLovin's 1,303% Rise: The Hidden Power of the SCTR Report

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* AppLovin has risen 1,303% since the SCTR Report first gave the green light on the stock.

* Other StockCharts indicators confirmed the opportunity when Wall Street insiders began quietly accumulating the stock.

* Key levels in AppLovin's price chart can guide you to enter a long position...

READ MORE

MEMBERS ONLY

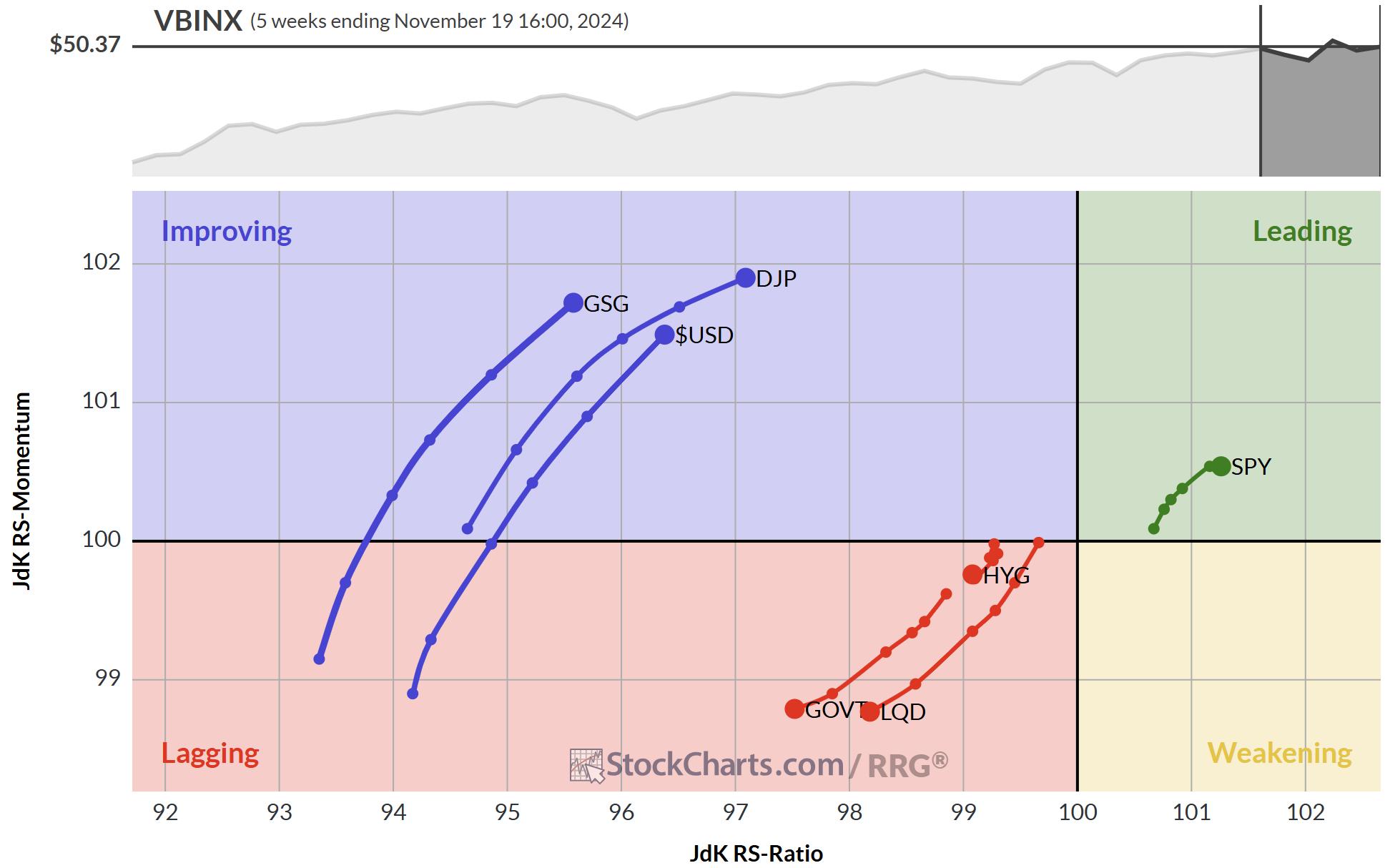

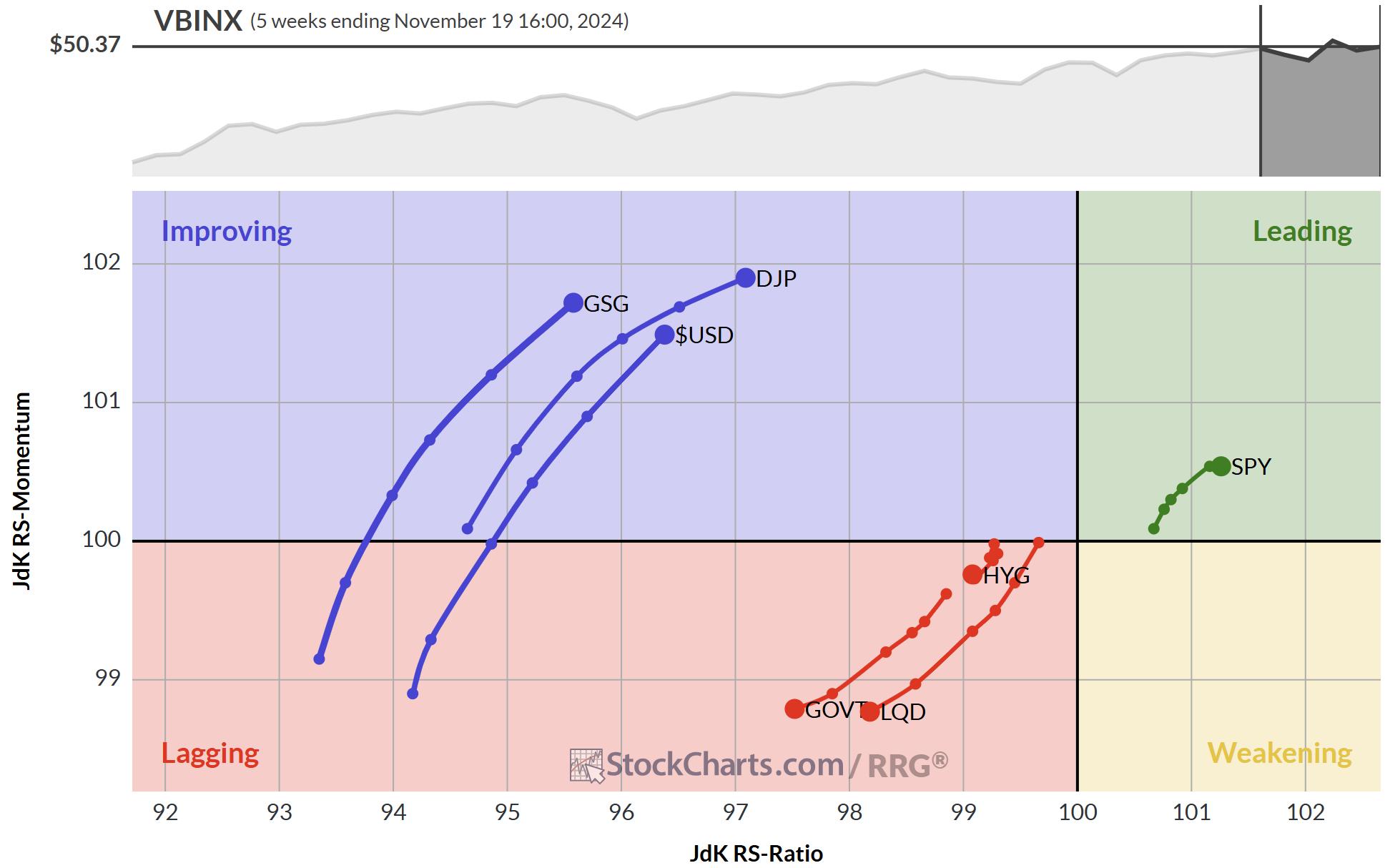

Is the USD Setting Up for a Perfect Rally?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Despite a lot of turmoil, SPY continues to show strong rotations on both weekly and daily RRGs.

* Rising yields have not damaged the stock rally yet.

* Stock/Bond ratio remains strongly in favor of stocks.

After the election, things have hardly settled in the world. New developments in...

READ MORE

MEMBERS ONLY

SCTR Report: The Palantir Trade Follow-Up—Transform Insights into Actions

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Palantir stock sold off significantly on Monday and may be ripe for a turnaround.

* The pullback in Palantir stock could be an opportunity to enter a long position.

* The chart of Palantir's stock price indicates increased buying pressure, but more upside momentum is needed to enter...

READ MORE

MEMBERS ONLY

Macro Market Outlook and Best Options Trade Ideas!

by Tony Zhang,

Chief Strategist, OptionsPlay

Join Tony as he walks you through a Macro Market outlook, where he shares his top bearish and bullish options trading ideas, These include Disney (DIS), Shopify (SHOP), Intel (INTC), Adobe (ADBE), and Apple (AAPL). He explores growth vs. value, current sector rotation, key earnings, and more.

This video premiered...

READ MORE

MEMBERS ONLY

Stocks: "...a PERMANENTLY high plateau"?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today we explore the bullish sentiment that has taken SPX valuations to the moon. There are many out there that believe we have hit a plateau on prices that will continue permanently. We talk about the quote: "Stock prices have reached 'what looks like a permanently high plateau,...

READ MORE

MEMBERS ONLY

Don't Miss These Breakouts Poised to Trade Higher!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reveals what took place last week and how the markets closed. She also revealed what drove price action, and what to be on the lookout for next week. In addition, she shares several stocks that broke out of powerful bases on bullish news....

READ MORE

MEMBERS ONLY

Tech Stocks Plunge: What This Means for Investors

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tech stocks, especially semiconductors, get hammered.

* Treasury yields continue to rally higher in response to Fed comments and strong economy.

* The US dollar rally confirms the strength of the US economy.

"The economy is not sending any signals that we need to be in a hurry to...

READ MORE

MEMBERS ONLY

Biotechs Fall Apart with Dark Cross Neutral Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

(This is an excerpt from the subscriber-only DP Weekly Wrap for Friday)

On Friday, the Biotechnology ETF (IBB) 20-day EMA crossed down through the 50-day EMA (Dark Cross) and above the 200-day EMA, generating an IT Trend Model NEUTRAL Signal. IBB recently switched to a BUY Signal on Friday November...

READ MORE

MEMBERS ONLY

Are the Magnificent 7 Still the Kings of Wall Street?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The Breakout Names have already broken to new all-time highs in Q4, but will they be able to hold those gains?

* The Consolidating Charts have failed to break to new highs, so it's all about watching key price support levels.

* The Wild Cards may be the...

READ MORE

MEMBERS ONLY

Spotting a Bullish Opportunity in Zscaler (ZS) with OptionsPlay Strategy Center

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* Zscaler was identified as a stock gearing up for a bullish trend in the OptionsPlay Strategy Center.

* Technical and fundamental analysis of Zscaler makes the stock an ideal candidate for a put vertical options trade.

As the cybersecurity landscape continues to evolve with increasing digital threats, Zscaler, Inc....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May See Mild Rebounds; Painful Mean Reversion May Continue

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian benchmark Nifty 50 extended its corrective decline. Over the past four sessions of a truncated week, the Nifty 50 index remained largely under selling pressure, and the markets continued with their process of mean-reversion. The volatility, though, did not show any major surge. The volatility gauge, IndiaVIX rose...

READ MORE

MEMBERS ONLY

The SCTR Report: Palantir Stock's Rise Makes It the Hottest AI Play

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Palantir stock's rise to the third place in the SCTR Report makes it a worthy candidate to add to your portfolio.

* The price surge in Palantir stock after its stellar earnings report may just be the beginning of a bullish move.

* Palantir is a stock that...

READ MORE

MEMBERS ONLY

Riding the Stock Market's Wave: How to Maximize Your Gains

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader US stock market indexes took a breather on Tuesday.

* Mega-cap Mag 7 stocks are back in the limelight.

* Investors are rotating into Technology and Communication Services sectors.

The post-election euphoria may have taken a breather on Tuesday, as the US stock market indexes closed lower. The...

READ MORE

MEMBERS ONLY

Is the Trump Rally Like the Reagan Rally?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl compares this week's Trump Rally with the rally we saw after Reagan was elected in 1980. There are similarities and differences. The Trump rally has lifted certain sectors of the market as well as Cryptocurrencies. While the Reagan rally had different catalysts.

The market continues to...

READ MORE

MEMBERS ONLY

Stock Market Hits Record Levels: Prepare for What Inflation Can Bring Next

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes hit milestone levels this week.

* Monitoring volatility in bonds could be a leading indicator in market action shifts.

* The US dollar can provide clues about future stock market action.

Another packed week for the stock market has come to a close. The broader...

READ MORE

MEMBERS ONLY

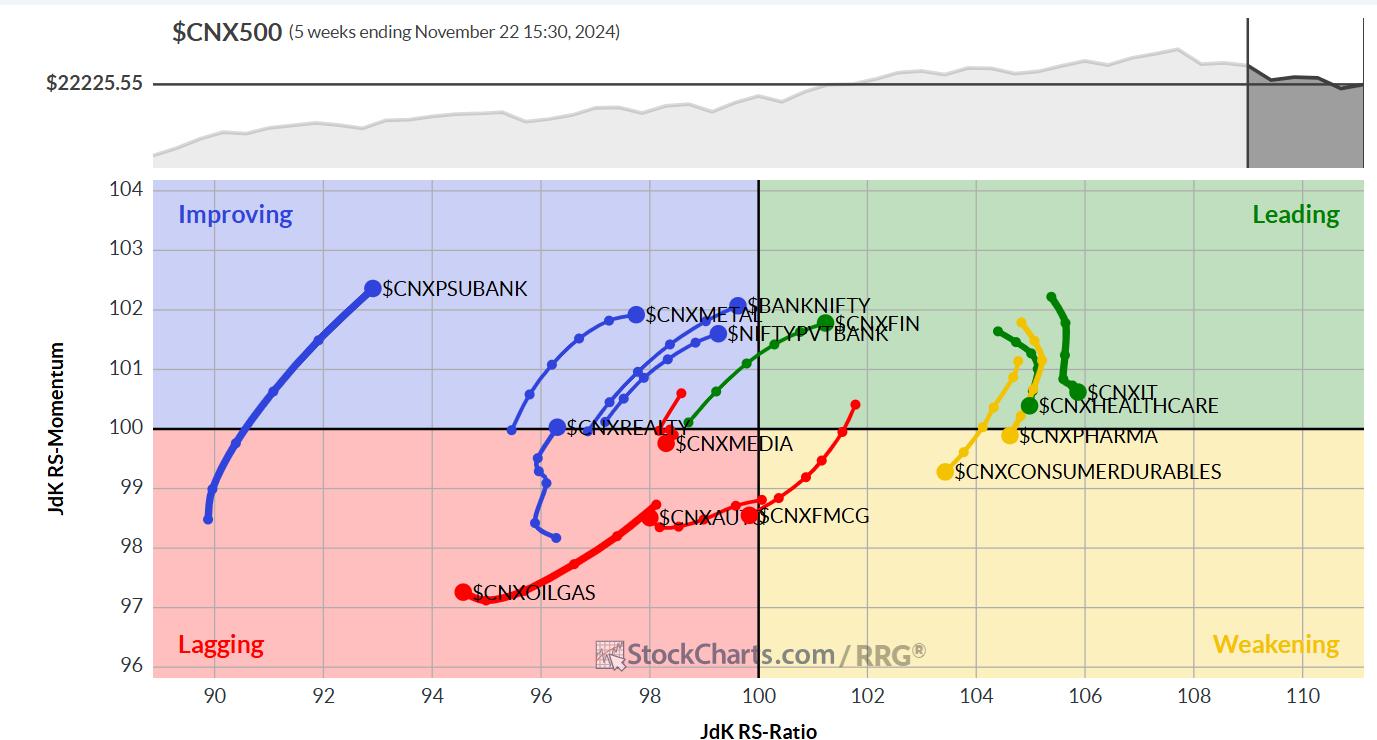

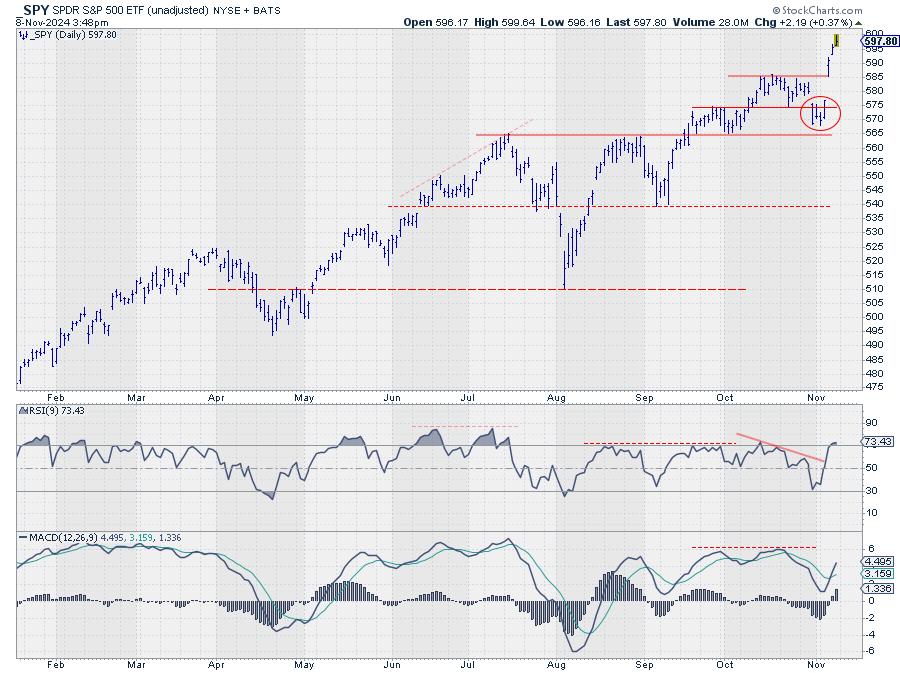

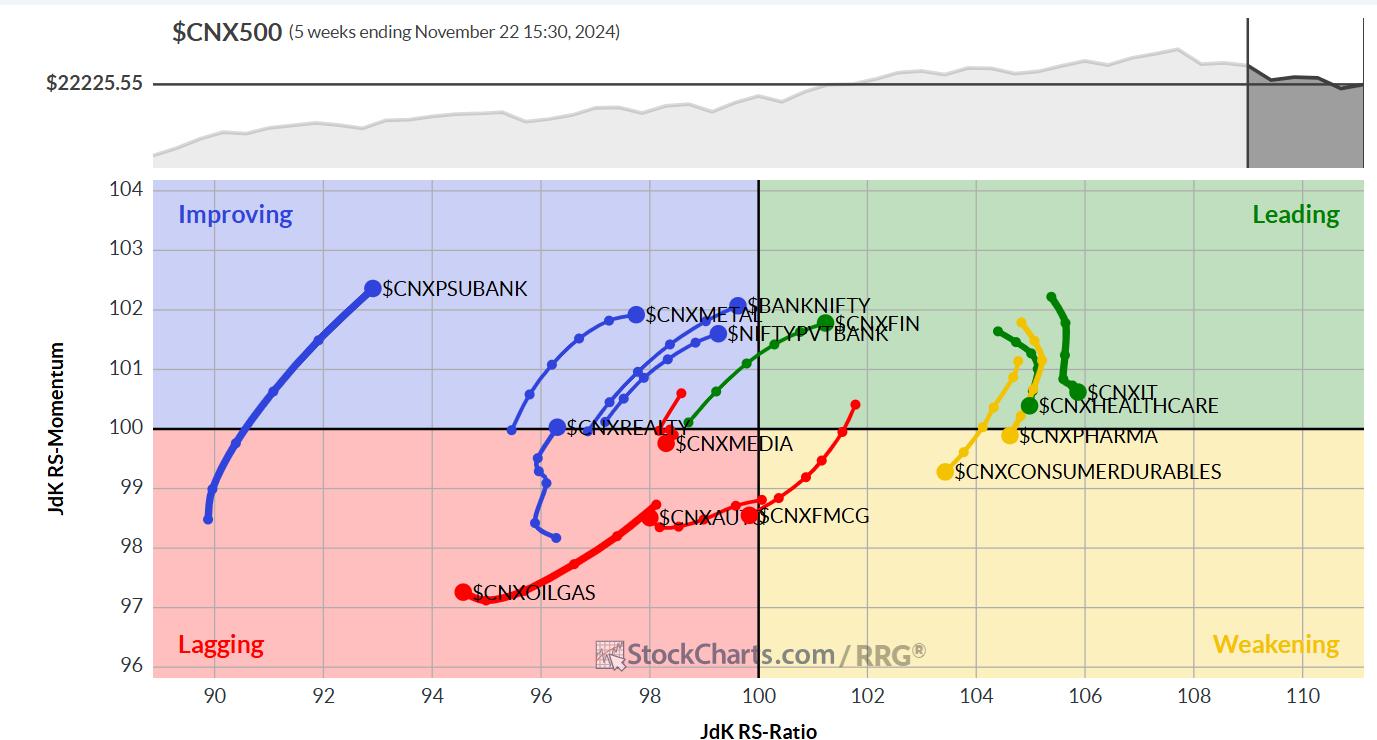

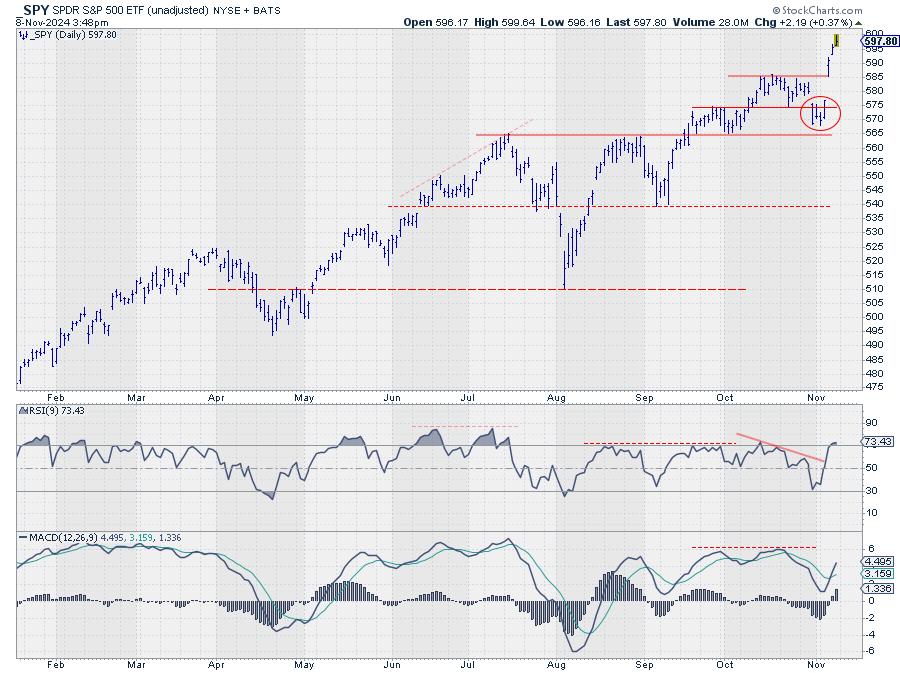

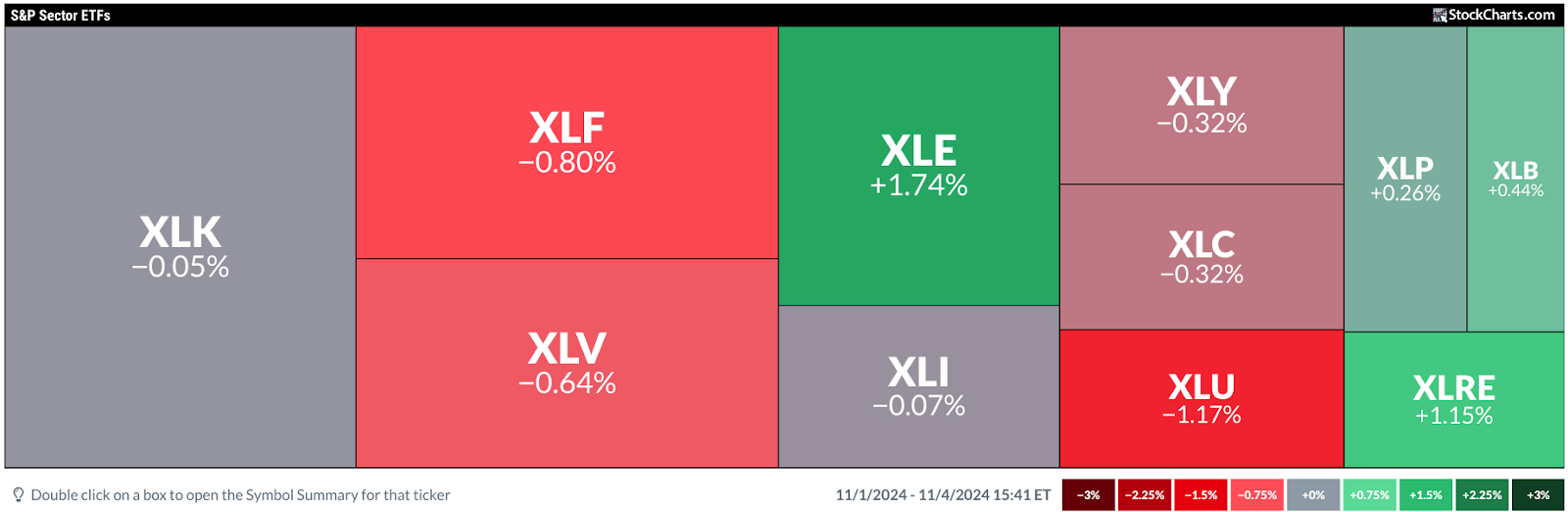

Three Sectors Leading SPY Back to Offense

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The market came out of defensive mode after the election.

* Old resistance at 585 is now support for SPY.

* XLC, XLY, and XLF are all showing strength.

First of all, for those of you looking for a new video this week, I have intentionally skipped it because I...

READ MORE

MEMBERS ONLY

Election Aftermath: Unleashing Profitable Small Cap Stocks

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Small cap stocks were the biggest gainers in post-election Wednesday.

* Financials was the top-performing sector in Wednesday's trading.

* Cryptocurrencies, US dollar, and Treasury yields rose in anticipation of an inflationary environment.

The risk-on sentiment has returned to the stock market. Stocks traded significantly higher ahead of...

READ MORE

MEMBERS ONLY

The SCTR Report: What Coinbase's Dramatic Price Surge Means For Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Coinbase made it to the top of the Top Up Large Cap stocks SCTR Report on the day after the US elections.

* The price surge in Coinbase stock could be the start of an upward move.

* Trading options on COIN provide an alternative to buying COIN stock.

Now...

READ MORE

MEMBERS ONLY

Stock Market Today: How to Scan for Post-Election Profit Opportunities

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Pre- and post-election jitters can cause market reactions and overreactions.

* The best thing you can do is get a bird's-eye view of opportunities that may unfold as the political fog clears.

* MarketCarpets is an effective tool to help you gauge market activity and spot high-probability trades....

READ MORE

MEMBERS ONLY

DP Trading Room: Six-Month Period of Favorable Seasonality Begins Now!

by Erin Swenlin,

Vice President, DecisionPoint.com

It's here! The SPY starts a period of favorable seasonality for the next six months. Carl takes us through his charts and explains favorable versus unfavorable periods of seasonality.

Carl covers our signal tables showing new weakness seeping in despite this period of favorable seasonality. The market looks...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May See Stable Start; Likely to Remain Under Selling Pressure at Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Nifty largely consolidated over the past five sessions, but did so with a bearish undertone. The Nifty traded in a defined range and closed the week with a modest gain. Importantly, the index also stayed below its crucial resistance points. The volatility also expanded; the IndiaVIX surged higher by...

READ MORE

MEMBERS ONLY

Election-Related Market Swings: How to Stay Ahead

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Markets bounced back after Thursday's selloff.

* Small-cap stocks are struggling to gain steam even though interest rates are likely to decline.

* Treasury yields continue to rise.

After yesterday's "trick," investors received a "treat" at the end of the trading week,...

READ MORE

MEMBERS ONLY

Top Ten Charts to Watch for November 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

With the Magnificent 7 stocks struggling to hold up through a tumultuous earnings season, what sort of opportunities are emerging on the charts going into November? Today, we'll break down some of the names we've included in our Top Ten Charts to Watch for November 2024....

READ MORE

MEMBERS ONLY

Market Rotation Fueled by Large-Cap Growth (Again)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Large-cap stocks are pushing the market higher.

* Large-cap growth is the only segment driving the market.

* AAPL, TSLA, NVDA, and AMD are having trouble pushing higher.

Following the recent market fluctuations, with a sharp decline and a subsequent rally, it's crucial to examine these movements'...

READ MORE

MEMBERS ONLY

Halloween Scare: The Stock Market Ends October on a Wicked Tone

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tepid earnings and negative news sends Tech stocks plunging.

* Economic data supports the narrative that the Fed will cut interest rates by 25 basis points in November.

* The long-term trend of the broader indexes are still bullish.

The Halloween effect caught up with the stock market! October 31...

READ MORE

MEMBERS ONLY

Homebuilding Rebound: How to Catch the Trend Early On

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Homebuilders are getting ready for a potential comeback in 2025.

* Many homebuilder stocks are exhibiting tepid-to-poor technical strength.

* When the homebuilding industry flips to the upside, there are undervalued names that could offer early investment opportunities.

Homebuyers are still on the sidelines, waiting for better mortgage rates, while...

READ MORE

MEMBERS ONLY

The SCTR Report: Learn How to Scan and Identify Winning Stocks

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Use the SCTR scan to help you find technically strong stocks.

* Filter scan results further using additional criteria such as trends and momentum indicators.

* Narrow your analysis further with additional criteria and add the most likely candidates to a watchlist.

When the stock market hesitates to move in...

READ MORE

MEMBERS ONLY

Cruise Or Soar? Carnival, Delta, and United Hit New Highs—Which One's Your Best Bet?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Carnival Corp occupies the top spot for new highs across different timeframes.

* Delta Air Lines and United Airlines, two other transportation companies, have also gained new highs.

* Compare Carnival Corp, Delta, and United stock price action and determine which might present a strong opportunity in the coming weeks....

READ MORE

MEMBERS ONLY

DP Trading Room: Magnificent Seven Earnings Preview

by Erin Swenlin,

Vice President, DecisionPoint.com

As part of today's coverage of the Magnificent Seven we remind you when the big mega-caps are reporting and give you are current perspective of each. We also cover all of the Magnificent Seven in the short and intermediate terms with daily and weekly charts.

Carl gives us...

READ MORE

MEMBERS ONLY

Two Indicators to Improve Your Edge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Trend and momentum are proven concepts we can use to improve our edge.

* Longer timeframes are better for trend-momentum

* CandleGlance charts make it easy to rank and sort for momentum.

There are no magic bullets, but we can improve our trading edge by starting our selection process with...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Violates Key Support Levels; Drags Resistance Lower

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The over-deviated markets continued to extend their losses for the fourth week in a row. The Nifty remained largely under sustained selling pressure over the past five days, barring a few feeble attempts to stage a technical rebound. The markets extended their downsides while giving up key supports on the...

READ MORE

MEMBERS ONLY

Election Season: Keep Calm and Optimize Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tech stocks gained some ground this week after better-than-expected earnings from Tesla.

* US Treasury yields continue to rise.

* Bullish momentum keeps gold prices rising higher.

Although earnings season is in full swing, trading volume has been relatively light this week. Perhaps investors are waiting for the stock market...

READ MORE

MEMBERS ONLY

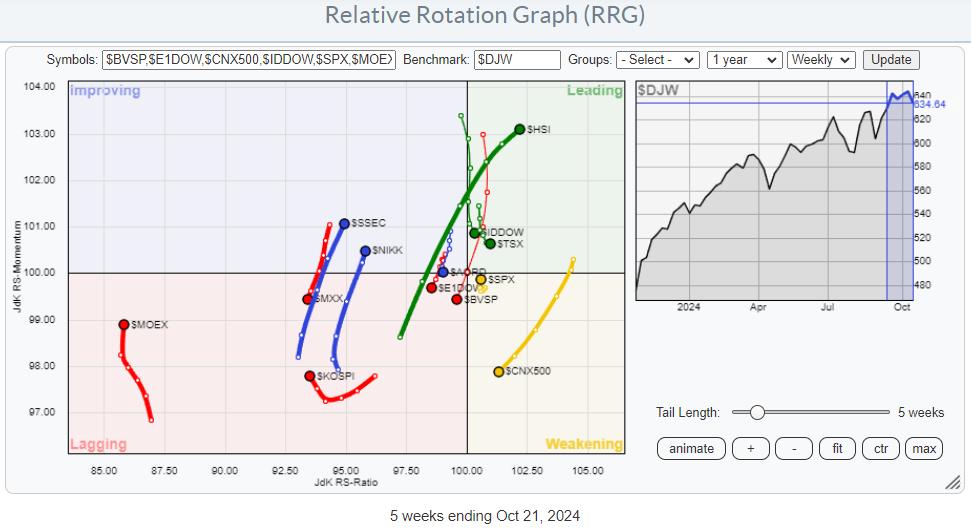

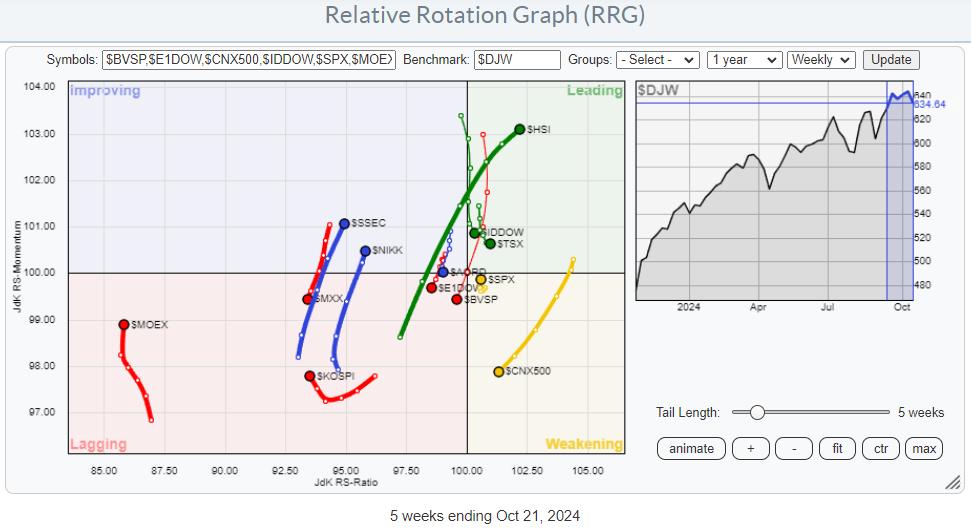

The US is Not the Only Stock Market in the World

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Asian stock markets showing strong relative trends.

* Meanwhile, India, Mexico, and Brazil are nosediving.

* Overall, the US is stull beating Europe.

The global stock market is a big place, and it extends far beyond the borders of the United States. While the US market is undeniably the largest...

READ MORE

MEMBERS ONLY

SCTR Report: Unlocking TSLA's Potential—What Every Investor Needs to Know Now

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* TSLA stock soared on upbeat Q3 earnings report.

* TSLA's stock price has broken above the upper Keltner Channel, indicating strength and the early stages of an uptrend.

* Adding a momentum indicator like the StochRSI to Tesla's stock analysis can help make smart trading decisions....

READ MORE

MEMBERS ONLY

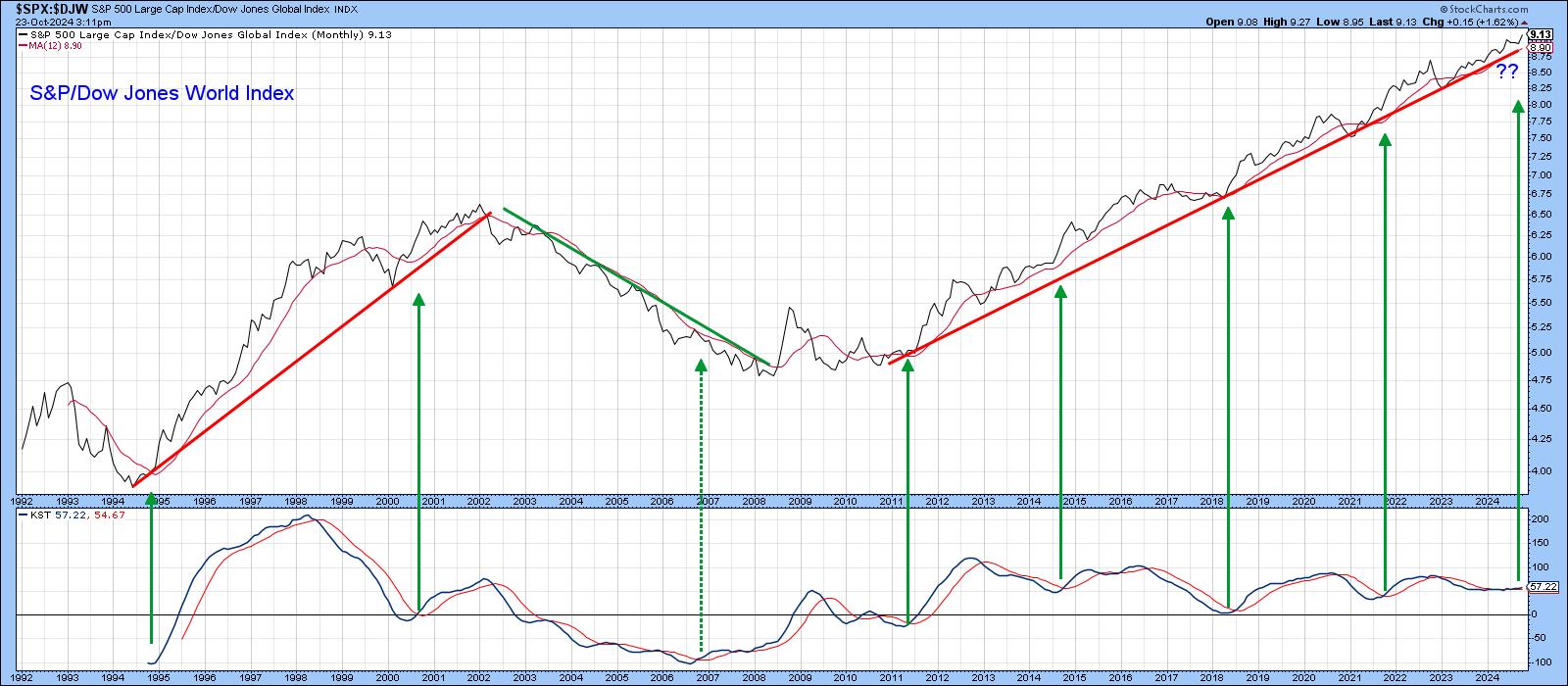

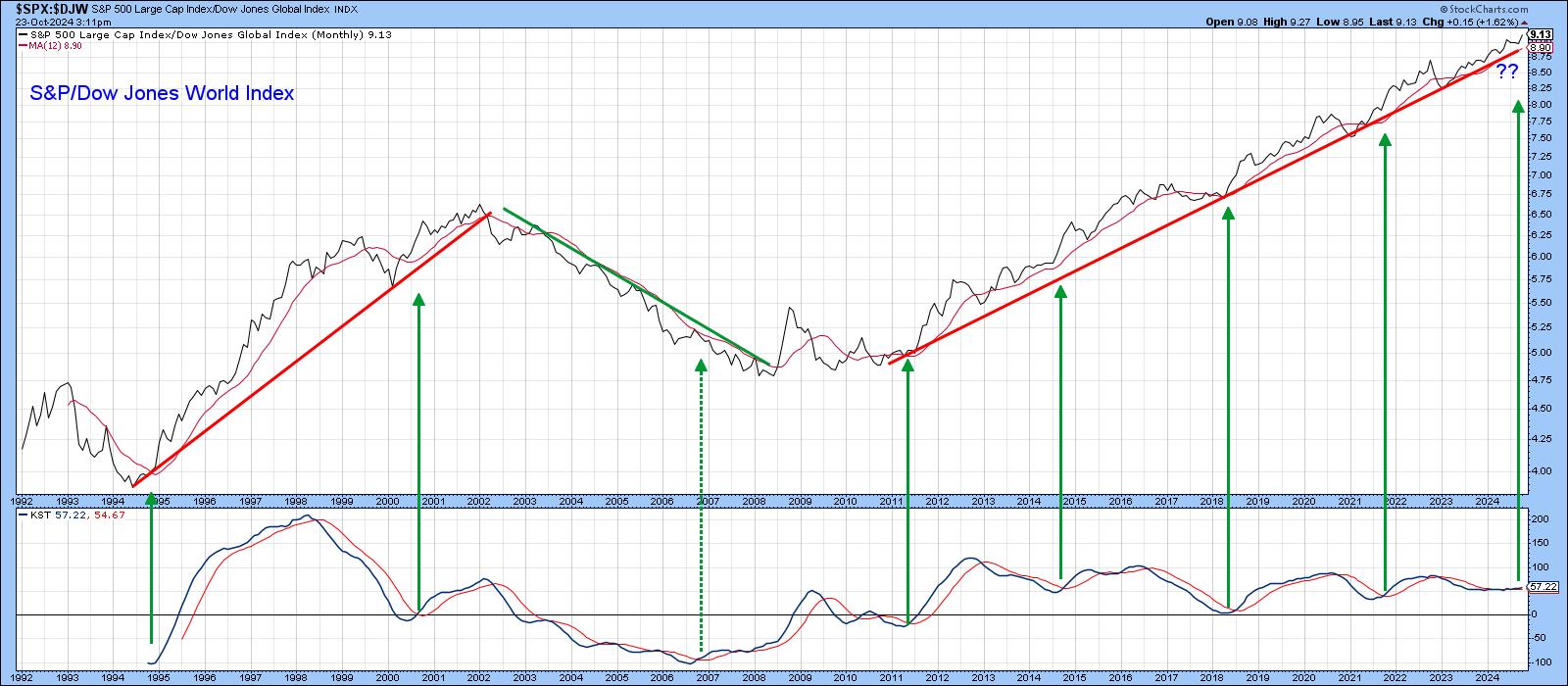

This Stock Market Will Likely Outperform the World Index, But Could Be Outshone by Something Completely Different

by Martin Pring,

President, Pring Research

Since 2011, the US stock market, represented by the S&P Composite, has outperformed the world. In the last couple of weeks or so, it has managed to break out from a trading range in its relationship with the rest of the world and looks headed even higher on...

READ MORE

MEMBERS ONLY

Unlock the Secret To Finding Strong Stocks in Weak Markets

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Predefined Scans is a tool you can use to find tradable opportunities in up and down markets.

* Coordinating your scans with the SCTR Report can increase your chances of finding strong stocks to trade.

* Applovin Corp has been on the radar for months, and its chart displays the...

READ MORE

MEMBERS ONLY

DP Trading Room: Which is Better? SP600 (IJR) or Russell 2000 (IWM)

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl explores which index is best...the SP600 (IJR) or Russell 2000 (IWM). He makes a comparison over time and reveals which tends to be the better performer. Which one should you use to analyze what is happening in small-caps?

Carl gives us his market outlook as prices pullback today....

READ MORE