MEMBERS ONLY

NVDA is Not the Only Semiconductor Stock Out There

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

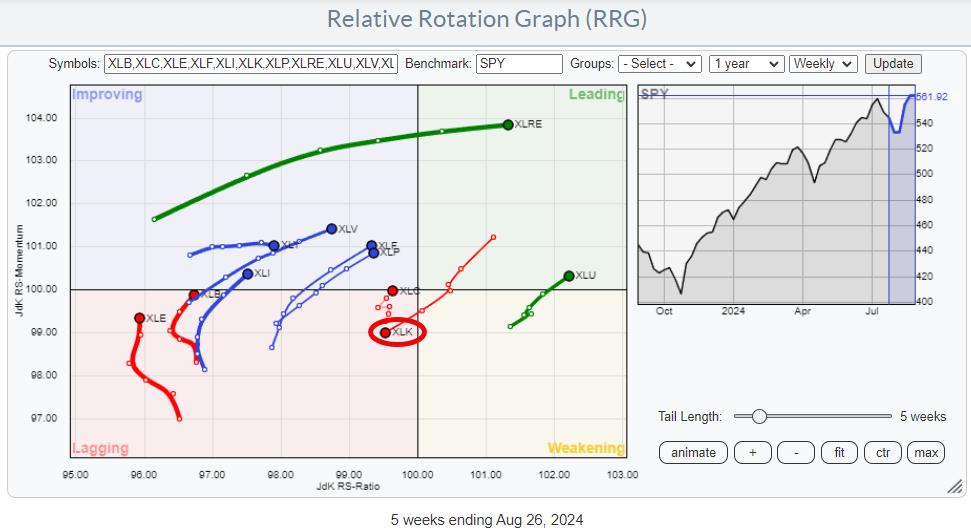

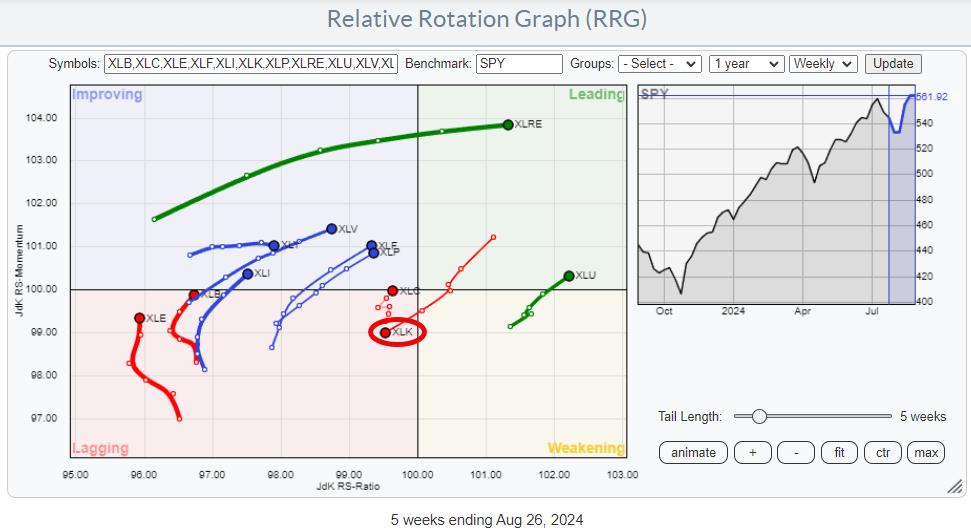

* SPY is pushing against resistance.

* The technology sector is out of favor, and semiconductors are a drag for it.

* NVDA is big, but it is not the only semiconductor stock.

It's All Still Relative

The weekly Relative Rotation Graph, as it looks toward the close of...

READ MORE

MEMBERS ONLY

MarketCarpet Report: Stock Market Remains Resilient With Dow Notching a Record Close

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Dow Jones Industrial Average closed at a record high in a thin trading day.

* The Financial sector continues to lead.

* Overall, the stock market remains healthy with low volatility.

The thin trading ahead of Labor Day weekend is here. Despite that, on Thursday, the Dow Jones Industrial...

READ MORE

MEMBERS ONLY

Stock Market Today: NVDA Reports, Tech Lags, Financials Take the Lead

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

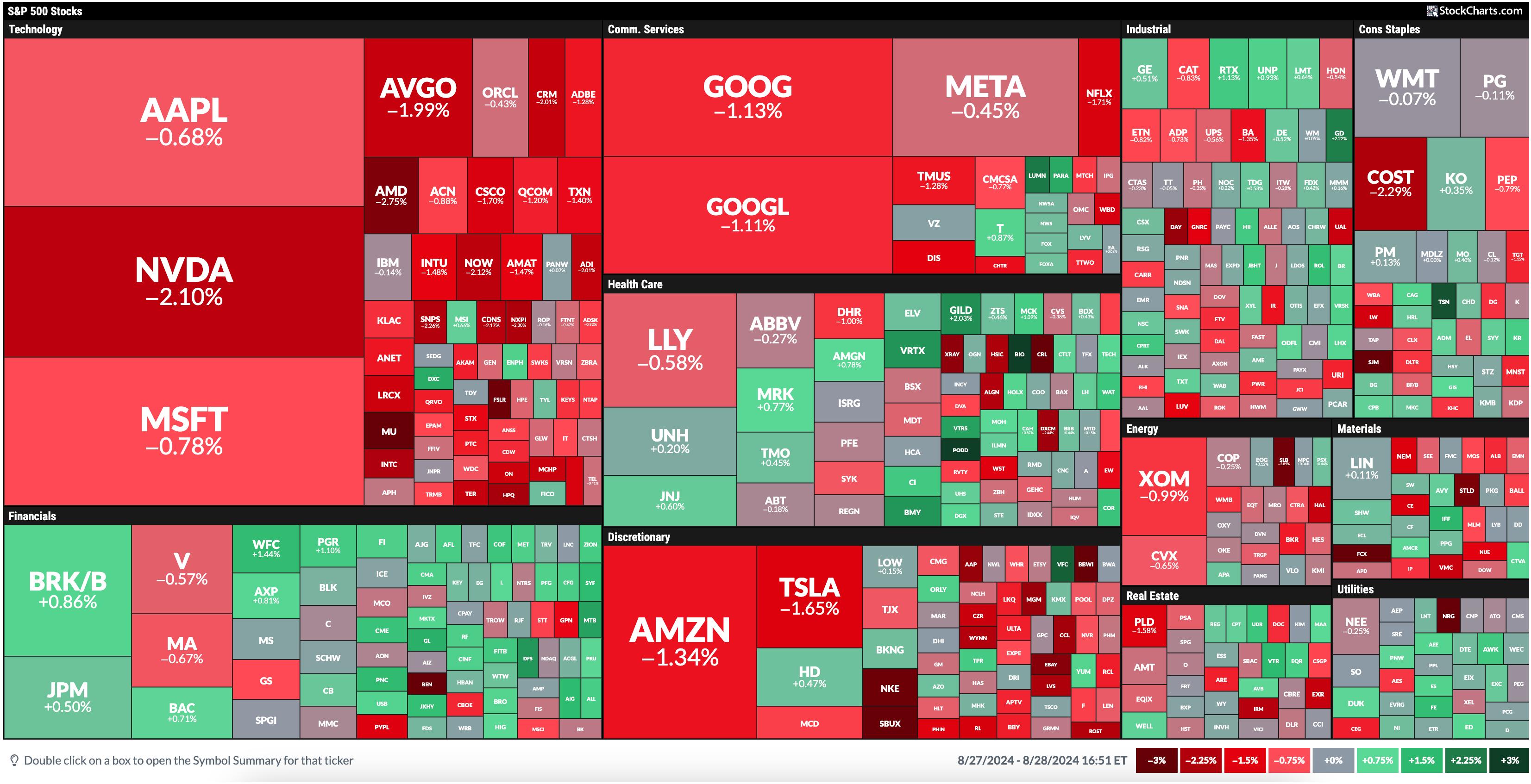

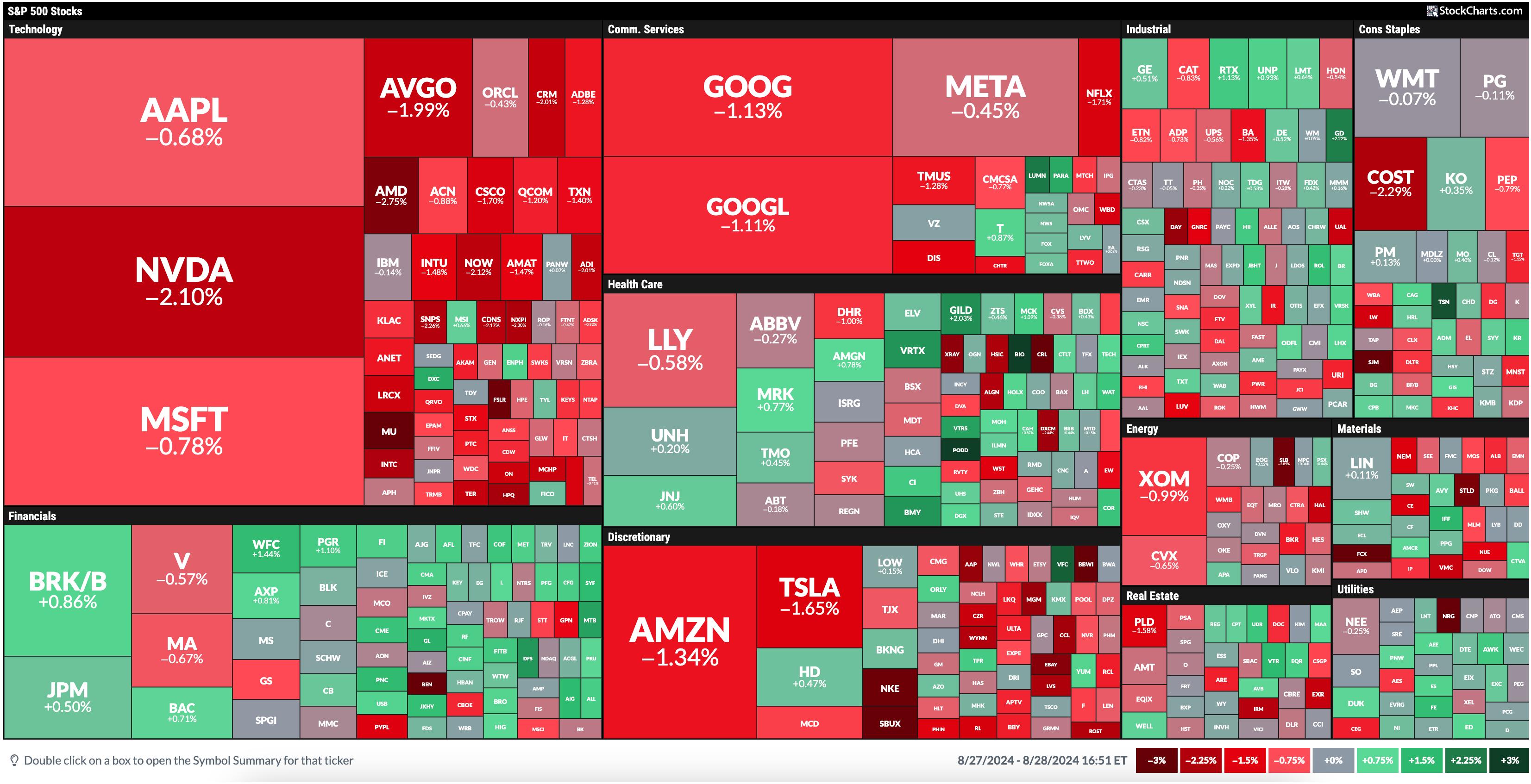

* The leading sector today was the Financials, followed by Health Care and Utilities.

* Technology stocks sold off significantly and was the worst sector performer.

* With interest rate cuts expected in the next FOMC meeting, financial stocks have the potential to rise further.

Today's MarketCarpet was a...

READ MORE

MEMBERS ONLY

An Investment Routine for Spotting Buy-The-Dip Opportunities

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The first step when deciding which stocks to invest in, should be to monitor the broader market

* After getting an idea of the overall market, drill down to the different sectors

* The last step is to zero in on the industry and identify the stocks that are moving...

READ MORE

MEMBERS ONLY

DP Trading Room: NVDA Going Into Earnings - Hold or Sell?

by Erin Swenlin,

Vice President, DecisionPoint.com

It is a big week for earnings and NVIDIA (NVDA) is at the top of the list! Erin gives you her view on whether to hold into earnings based on the technicals of the chart. She also reviewed other stocks reporting on Wednesday: CRM, CRWD, HPQ and OKTA.

Carl talks...

READ MORE

MEMBERS ONLY

PayPal Stock Price Breaks Out: How to Take Advantage of the Price Rise

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* PayPal broke out from its two-year consolidation and triggered a new bullish signal

* The next upside target for the bullish trend in PYPL is around the $90 level

* The call vertical options strategy can be used to capitalize on the upside breakout in PYPL

Earlier this year, in...

READ MORE

MEMBERS ONLY

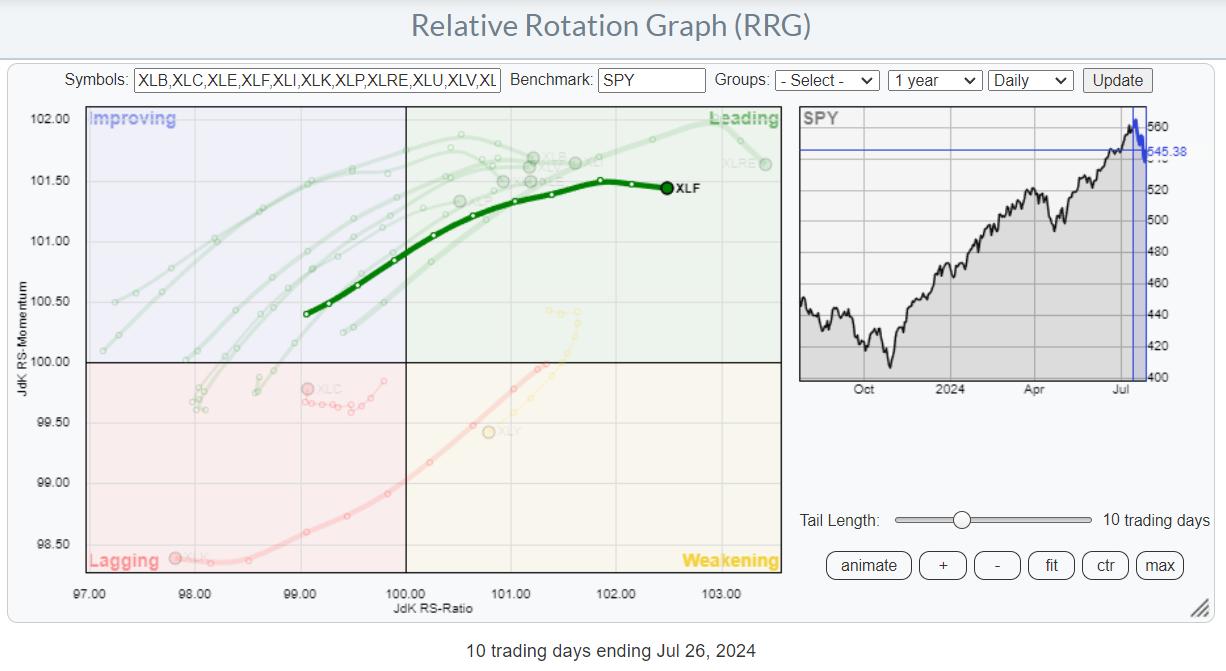

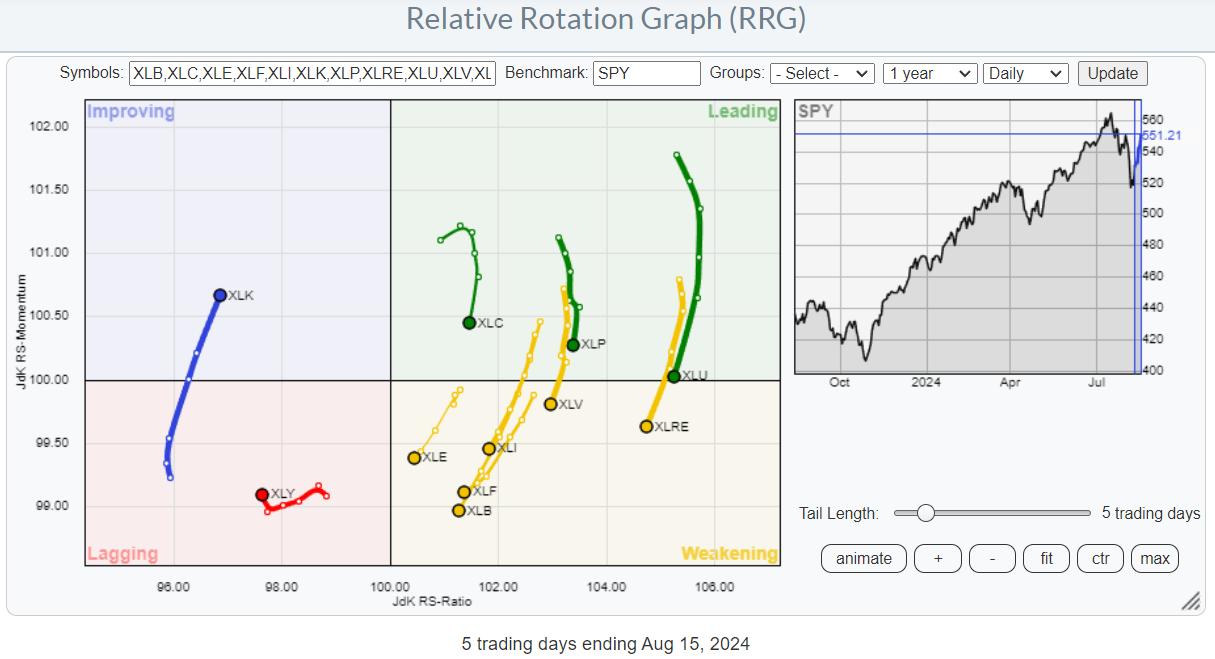

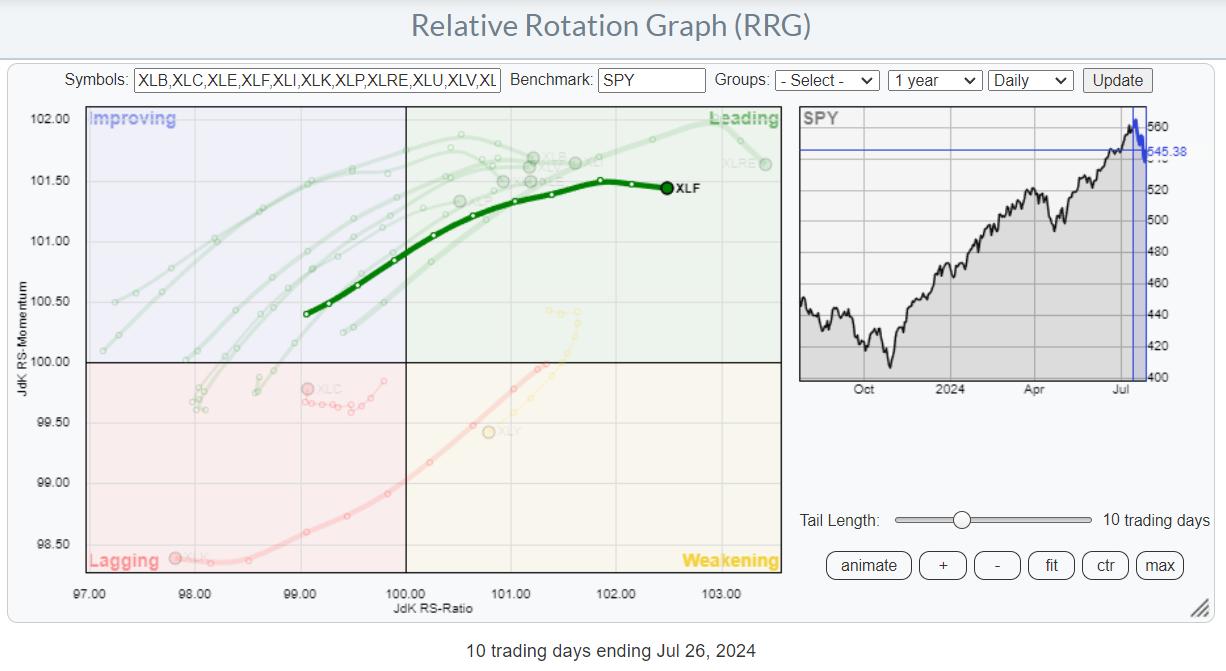

RRG-Velocity Jumping on XLF Tail

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

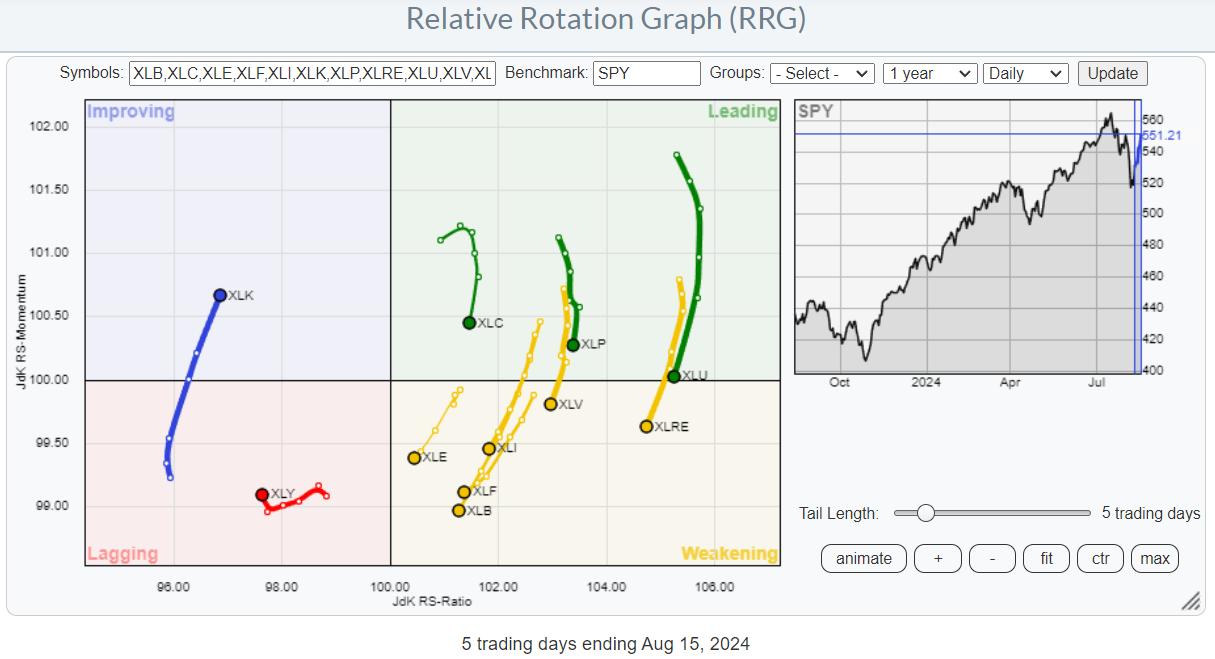

KEY TAKEAWAYS

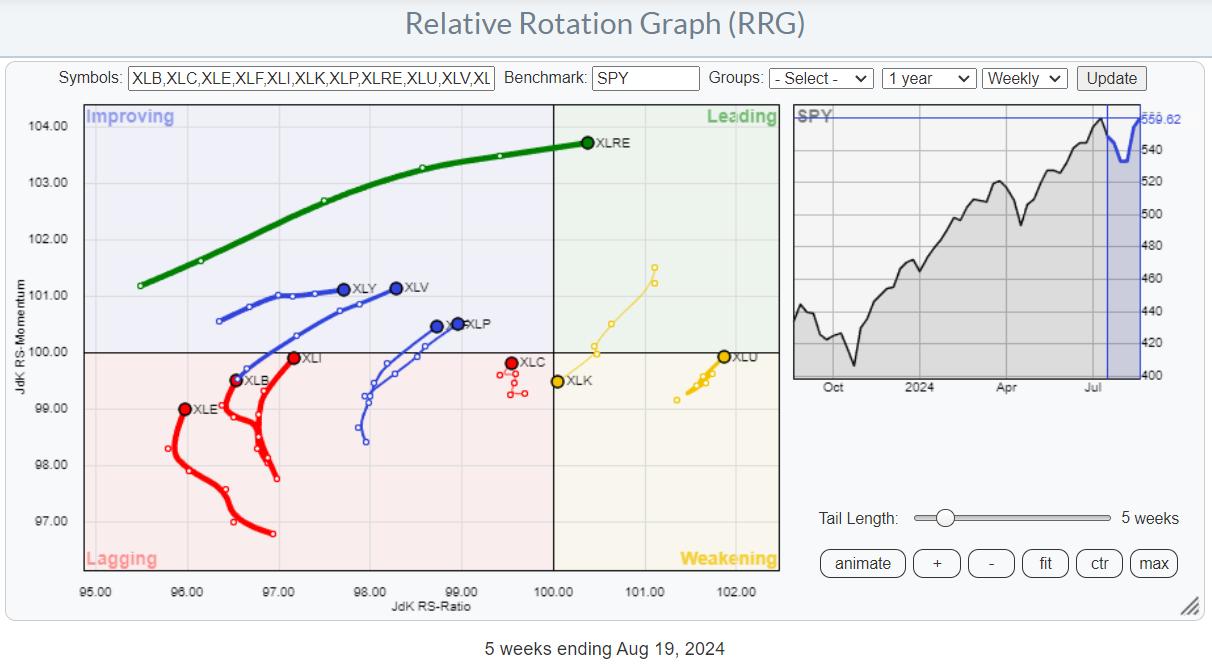

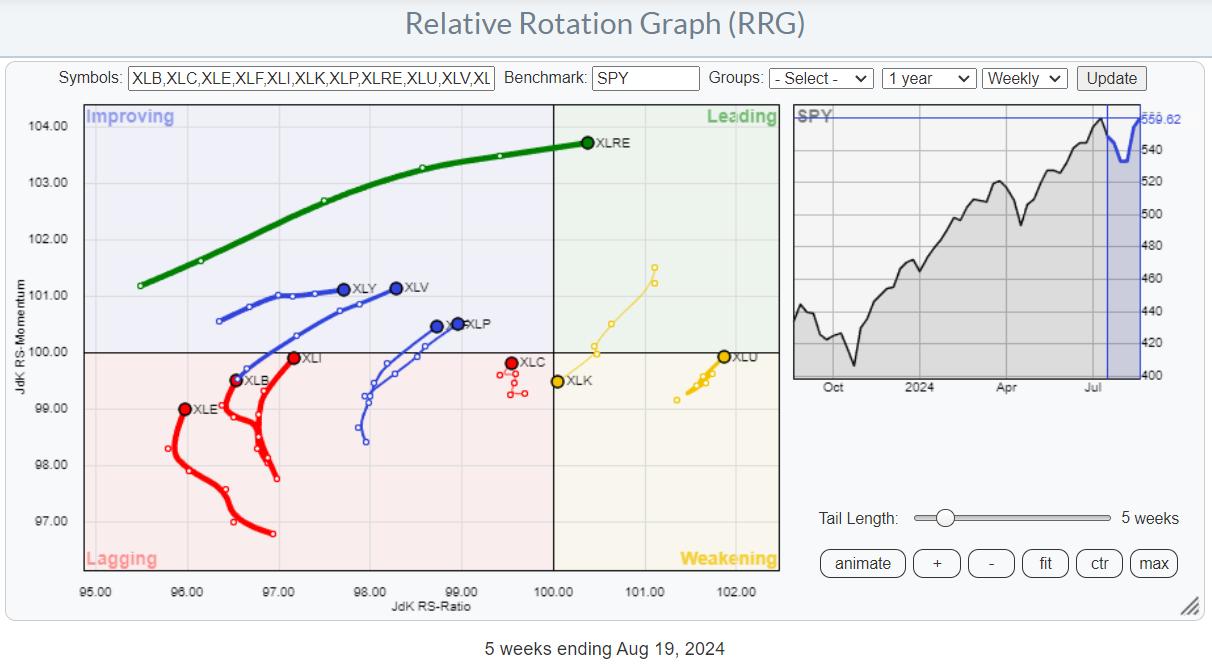

* Sector rotation out of technology

* All other sectors are picking up relative strength

* Real-Estate, Utilities, and Financials showing strong rotations

On the weekly Relative Rotation Graph, the rotation still favors almost every sector over Technology. I discussed the opposite rotations between weekly and daily RRGs in last week&...

READ MORE

MEMBERS ONLY

The SCTR Report: Workday Rises on Strong Earnings Results and Rising Technical Strength

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Workday, Inc. stock rose higher on strong earnings and guidance

* If Workday stock rises with strong momentum and technical strength, the stock has potential to make for a favorable intermediate-term position trade

* Learn how to set an alert for WDAY stock price to cross a specific threshold

When...

READ MORE

MEMBERS ONLY

Is Peloton Stock the Next Big Turnaround? What You Need to Know Before It's Too Late

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Peloton shares jumped over 38% on Thursday following an earnings surprise

* Having fallen 97% from its record peak, Peleton could present investors with a ground-level market opportunity

* With the breakout well underway, here are the actionable levels to watch as Peloton stock surges ahead or dips back down...

READ MORE

MEMBERS ONLY

What Does This Mean for the S&P 500 Rally?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius looks at the conflicting rotations in both asset classes and equity sectors. The weekly rotations differ significantly from their daily counterparts. What does it mean for the current rally in the S&P 500, and what does it mean for the relationship...

READ MORE

MEMBERS ONLY

DP Trading Room: Potential Housing Crash?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl and Erin discuss the potential of a housing crash as more evidence is coming in that many haven't thought of. Private Equity firms have become very involved in the housing market, buying up properties on high amounts of leverage. What happens when it's time...

READ MORE

MEMBERS ONLY

The SCTR Report: Dell Is Gaining Strength. Here's Why the Stock Is a Strong Buy

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Dell stock is rising from its lows and is worth putting on your radar

* Dell stock is seeing technical improvement but needs more momentum

* There are clear entry and exit points on the daily chart of Dell

When the general market is recovering from a pullback, there can...

READ MORE

MEMBERS ONLY

Strength Off the Lows, But Concerns Remain

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Rotation to large-cap growth is back

* And so is the narrow foundation/breadth supporting this rally

* Weekly and daily $SPX charts need to get in line

Stronger than Expected

The recent rally out of the August 5th low is definitely stronger than I had anticipated. I was watching...

READ MORE

MEMBERS ONLY

Mag 7 Stocks in the Spotlight as Stock Market Recovers

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Cooling inflation data added some optimism in the market although trading volume was low

* The broader stock market indexes are seeing some daylight as they pop their heads out after being underwater

* The Mag 7 stocks are showing strength, which means there could be some buying opportunities soon...

READ MORE

MEMBERS ONLY

SBUX Stock Price Skyrockets: Is Now the Time to Buy?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Starbucks' stock price saw a massive jump and SCTR score on Tuesday

* Much of SBUX's stock price movement is sentiment-driven, so the price spike could be short-lived

* StockCharts SCTR tool identified SBUX as a strong stock, and a more thorough analysis can determine if the...

READ MORE

MEMBERS ONLY

DP Trading Room: Mortgage Rates are Falling - Watch Real Estate

by Erin Swenlin,

Vice President, DecisionPoint.com

Mortgage Rates fell quite a bit this past week and no one is really talking about it. One area that we will want to watch closely as rates fall is Real Estate (XLRE). This sector has already been moving in the right direction. It now has an opportunity to rally...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays Tentative As Defensive Setup Develops; Know These Levels Well

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The market extended its corrective move in the previous week; over the past five sessions, it has remained quite choppy and totally devoid of any definite directional bias. It absorbed a few global jerks and saw gaps on either side of its previous close on different occasions. While the level...

READ MORE

MEMBERS ONLY

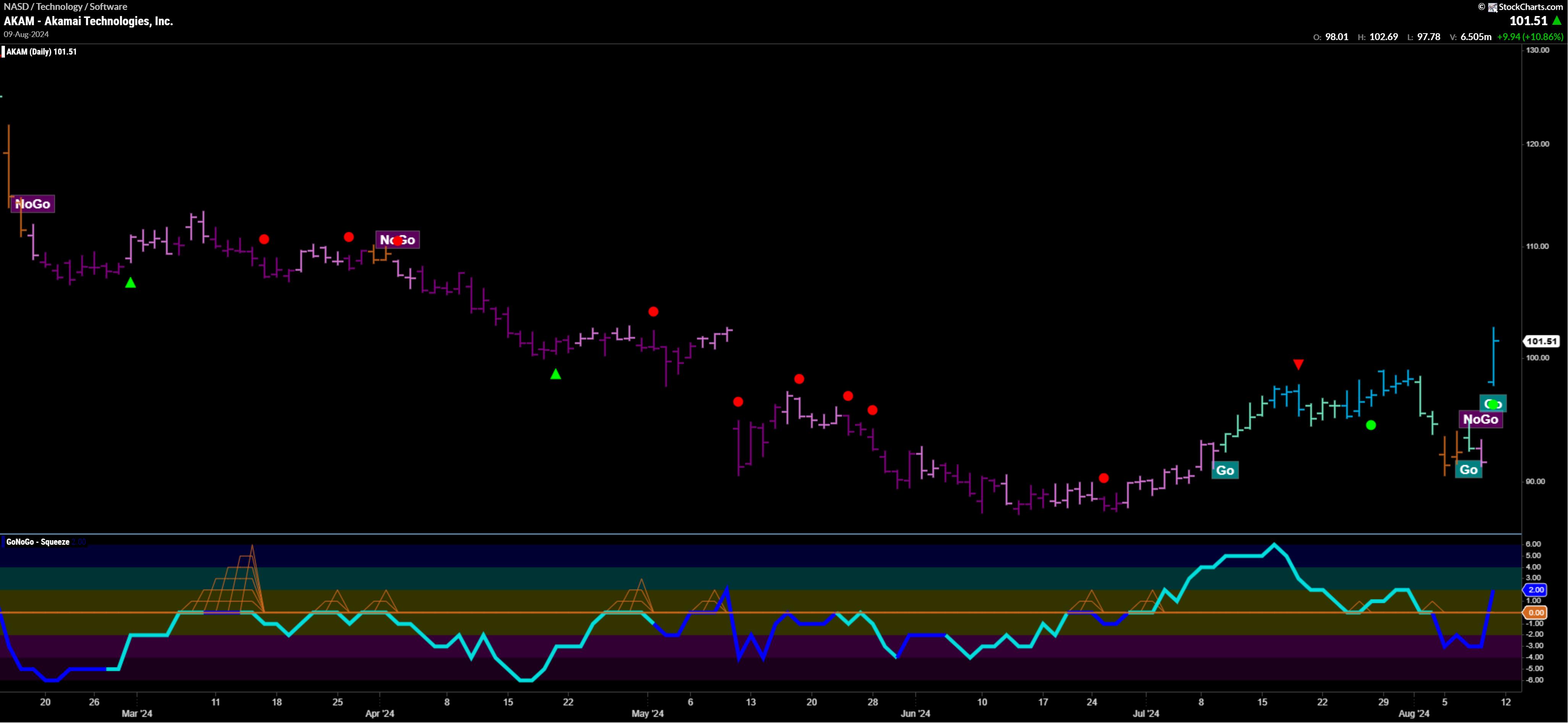

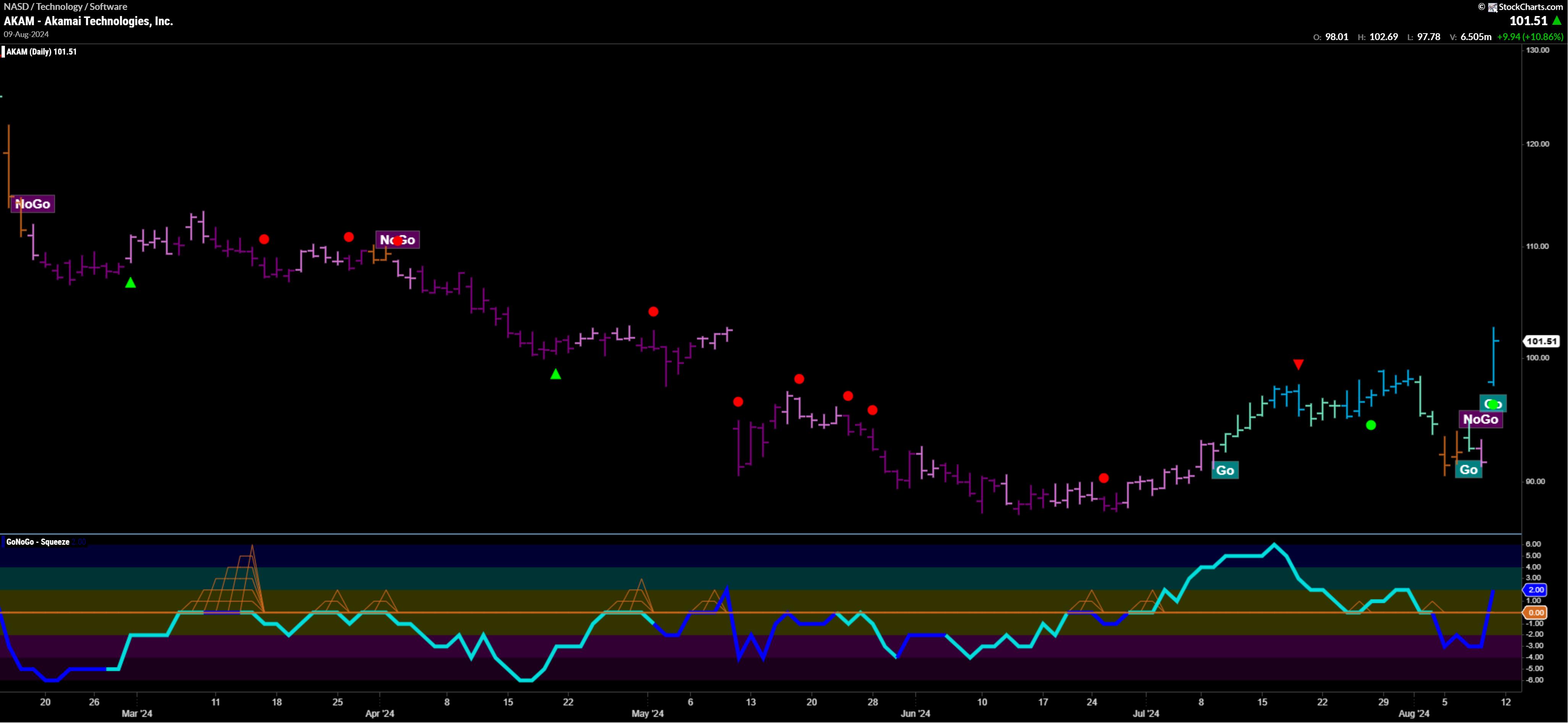

Top 5 Stocks in "Go" Trends | Fri Aug 9, 2024

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Scanning for breakouts on heavy volume

* Momentum confirmations of underlying trends

* Leading Equities in trend continuation

Top 5 Stocks in "Go" Trends

Trend Continuation on Rising Momentum

GoNoGo Charts® highlight low-risk opportunities for trend participation with intuitive icons directly in the price action. The resurgence of...

READ MORE

MEMBERS ONLY

When Does This Selloff End?

by Larry Williams,

Veteran Investor and Author

In my last newsletter,I discussed cycle projections for the S&P 500, i.e., a rally and then down into a mid-September low. The recent price action in the stock market may have many of you wondering when to open long equity positions.

My cycle work suggests we...

READ MORE

MEMBERS ONLY

The SCTR Report: Carvana Stock Makes It To Top of the Podium Today

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Carvana stock takes the lead in the large-cap stocks SCTR Report

* CVNA stock has established an upside trend with higher lows and higher highs

* Carvana's stock price is holding above its 21-day exponential moving average

On a day when the S&P 500 ($SPX) drops...

READ MORE

MEMBERS ONLY

DP Trading Room: Bear Market Rules Apply

by Erin Swenlin,

Vice President, DecisionPoint.com

The market is dropping perilously right now and so it is time to review Bear Market Rules. Today Erin and Carl share their rules for trading during a bear market move. We aren't officially in a bear market and we may not get there, but there is likely...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays Prone To Profit-Taking Bouts; Guard Profits and Stay Stock-Specific

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week turned out quite volatile for the markets as they not only marked a fresh lifetime high but also faced corrective pressure as well towards the end of the week. The markets maintained an upward momentum all through the week. It scaled the psychologically important 25000 level as...

READ MORE

MEMBERS ONLY

Recession Fears Top of Mind As Tech Stocks Selloff

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Weak manufacturing and jobs data sends investors into panic mode

* All broader stock market indexes fall over 2%

* Bond prices rise

The dog days of summer are here. And the stock market gives us a brutal reminder of this.

The first trading day of August began on a...

READ MORE

MEMBERS ONLY

It's Been a Long Time Mr Bear, Where Have You Been?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Some real damage for the markets

* Equal weight sector rotation paints a more realistic picture

* The BIG ROTATION into small caps has come to a halt

And then ..... all of a sudden..... things are heating up. Lots of (downside) market action in the past week.

Let's...

READ MORE

MEMBERS ONLY

Small Caps Poised to Soar: Is Now the Time To Buy IWM?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Small caps saw an impressive surge in July, outpacing the S&P 500 in that month alone.

* IWM, a Russelll 2000 proxy, is only 8% away from its all-time highs, potentially signaling the start of a new bull market.

* As IWM pulls back (along with the rest...

READ MORE

MEMBERS ONLY

DP Trading Room: Spotlight on Mega-Cap Earnings

by Erin Swenlin,

Vice President, DecisionPoint.com

This week we have four Magnificent Seven stocks reporting earnings. We also take a look at McDonalds (MCD) and Ford (F) going into earnings. How are the chart technicals setup on the precipice of earnings? Carl and Erin give you there thoughts.

Carl reviews the DP Signal Tables to see...

READ MORE

MEMBERS ONLY

Will the S&P 500 Break 5000 by September?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

This week saw the major equity averages continue a confirmed pullback phase, with some of the biggest gainers in the first half of 2024 logging some major losses. Is this one of the most buyable dips of the year? Or is this just the beginning of a protracted decline with...

READ MORE

MEMBERS ONLY

Recovery Rally In Stock Market Offers Hope: What You Need To Watch

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* After two days of massive selloffs, Friday's recovery offers some hope.

* Investors await earnings from mega-cap tech companies, economic data, and Fed meeting.

* Small caps continue to trend higher.

Major equity indexes rose on Friday after a selloff that hit the Technology sector especially hard. But...

READ MORE

MEMBERS ONLY

Flying Financials. Will It Be Enough?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Strong Sector Rotation Out Of Technology

* Financials and Real Estate Lead

* Stock/Bond Ratio Triggers Sell Signal

Flying Financials

In the recent sector rotation, basically OUT of technology and INTO anything else, Financials and Real-Estate led the relative move.

On the RRG above, I have highlighted the (daily)...

READ MORE

MEMBERS ONLY

Missed the Gilead Surge? Here's What You Need to Know About the Big Move

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* In June, Gilead Sciences saw a dramatic surge as positive results of a late-stage trial of its HIV drug had Wall Street buzzing.

* GILD was a "sentiment trade" that spiked too quickly for most technical and fundamental indicators to make heads or tails of the move....

READ MORE

MEMBERS ONLY

CrowdStrike's Epic Fail: Here are the Critical Trading Levels to Watch Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Following the CrowdStrike debacle, the stock is as much a technical trade as it is a news-driven trade

* Crowdstrike's stock price has entered a potential buying zone, but potential lawsuits may be a headwind

* Crowdstrike could be a buying opportunity but watch momentum, buying levels, and...

READ MORE

MEMBERS ONLY

DP Trading Room: Behind the Scenes: CrowdStrike (CRWD)

by Erin Swenlin,

Vice President, DecisionPoint.com

Friday was a bad day for CrowdStrike Holdings (CRWD) as a bug was pushed out that disrupted Windows machines worldwide. The trouble for CRWD is the follow-up lawsuits etc that will likely plague the stock for some time to come. You'll be shocked to see the warning signs...

READ MORE

MEMBERS ONLY

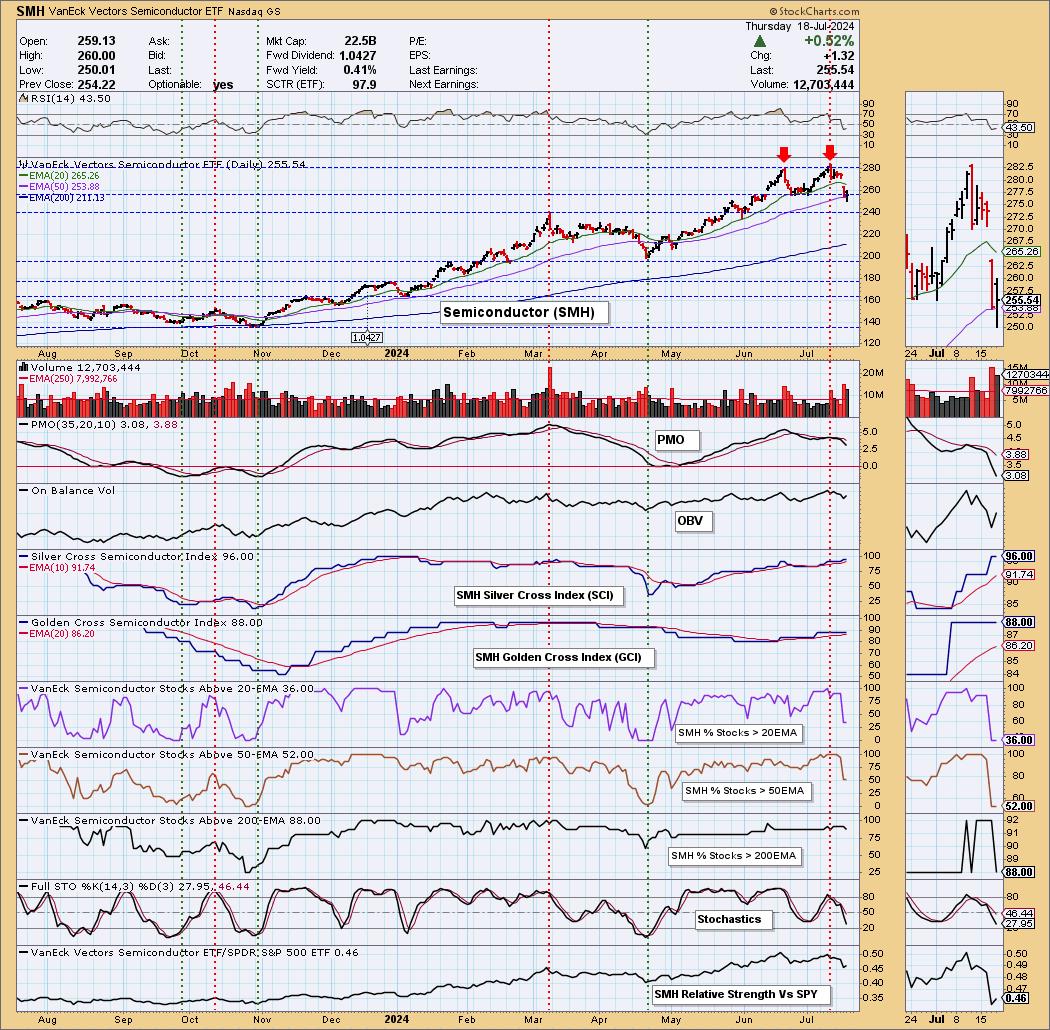

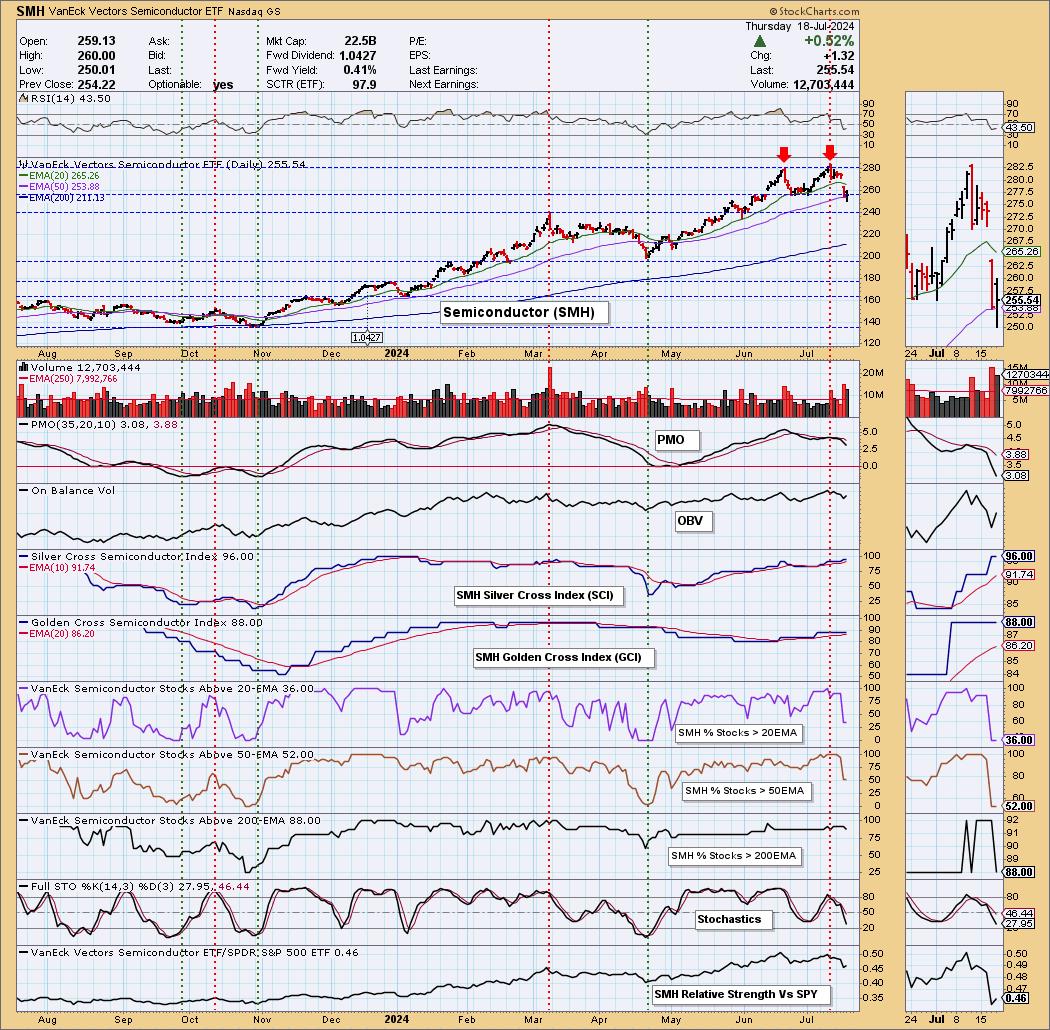

Important Market Breadth Indicators to Watch: Making Sense of Three Consecutive Down Days

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Three consecutive declining days in the stock market increases risk appetite

* Semiconductors were the catalyst for the selloff and trading below two support levels

* Keep an eye on market breadth indicators to get indications of whether the stock market is correcting or if the selloff will be longer-term...

READ MORE

MEMBERS ONLY

Double Top on Semiconductors (SMH)

by Erin Swenlin,

Vice President, DecisionPoint.com

(This is an excerpt from the subscriber-only DecisionPoint Alert)

We noticed a double top on the Semiconductor industry group (SMH) that looks very much like the NVIDIA (NVDA) chart. NVDA is clearly the bellwether for the group, and it appears all of the Semiconductors are feeling the pain. The downside...

READ MORE

MEMBERS ONLY

Why Homebuilder Stocks are on Fire Right Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Homebuilder stocks are rallying on hopes of at least one (if not three) interest rate cuts in 2024

* The SPDR S&P Homebuilders ETF broke out above a short-term downward trend

* Though much depends on the interest rate environment, the charts of individual homebuilder stocks show support...

READ MORE

MEMBERS ONLY

Carvana Stock Is Picking Up Speed. Is Now the Time To Buy?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Carvana stock hit a new 52-week high and has potential to move higher

* The weekly chart of Carvana's stock price shows the trend is up and has more upside potential

* Carvana's stock chart shows the relative strength index is just approaching overbought territory, indicating...

READ MORE

MEMBERS ONLY

DP Trading Room: PMO Sort on Earnings Darlings

by Erin Swenlin,

Vice President, DecisionPoint.com

Earnings are coming into focus and today Erin looks at the big earnings stocks to find out which look the best going into earnings. She took the list of stocks and sorted them by the Price Momentum Oscillator (PMO) which put the strongest stocks at the top of the list....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Remains Significantly Deviated From Mean; Stay Vigilant at Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

It was the sixth week in a row that saw the Nifty 50 index ending with gains. Over the past few days, the markets largely experienced trending days as they continued inching higher despite the intraday moves staying ranged. The Nifty also continued forming its new lifetime highs; the current...

READ MORE

MEMBERS ONLY

Stock Market Makes Spectacular Run, and It's Not From the Popular Magnificent Seven

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stock market sees rally in areas aside from the Magnificent Seven stocks

* Small-cap stocks had an impressive performance in the last two trading days of the week

* The stock market continues to show its bullish strength as we enter earnings season

What a strange trip it's...

READ MORE

MEMBERS ONLY

DP Trading Room: These Banks are Bullish Going Into Earnings

by Erin Swenlin,

Vice President, DecisionPoint.com

Earnings season is kicking off and Carl and Erin spotlight the banks that will be reporting on Friday. The setups aren't good for all of these banks, but some are set up nicely going into their earnings calls. Earnings are always tricky as good earnings can still result...

READ MORE