MEMBERS ONLY

Week Ahead: NIFTY Hovers Around Crucial Points; Keep Guarding Profits at Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets continued with their unabated up move in the week that went by and ended once again with net gains. While continuing with the advance, the Nifty 50 Index extended its move higher. However, as compared to the previous week, this time, the trading range got narrower as the...

READ MORE

MEMBERS ONLY

An Awesome Breakthrough in S&P 500 and Nasdaq: Will the Momentum Continue?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* S&P 500 and Nasdaq Composite close at record highs

* Equities, precious metals, and bonds all rise, but Bitcoin shows weakness

* Keep an eye on the Equal Weighted S&P 500 and Nasdaq breadth to get early insight into stock market direction.

If you were taking...

READ MORE

MEMBERS ONLY

Tesla Stock's Shocking Comeback: What You Need to Know Before July 23

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* TSLA's stock price surged 32% above its zone of congestion following its April 23 earnings report

* News of Tesla's dwindling inventories, plus expectations of a Fed rate cut before the end of the year (among other things), are fueling the stock's advance...

READ MORE

MEMBERS ONLY

Could AMZN's Stock Hit $3 Trillion Valuation? What You Need To Know

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* AMZN's stock price entered new all-time high territory, closing at $200.02; it could rise higher

* If AMZN's stock price dips, watch for key levels to enter a long position

* Amazons' next earnings report is expected to drop on August 1, 2024, which...

READ MORE

MEMBERS ONLY

Week Ahead: Nifty Creates Resistance In This Zone; Continue Guarding Profits At Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After consolidating in the week prior, the markets resumed their up move and have ended the present week on a strong note. The markets also navigated weekly derivatives expiry, showing some signs of fatigue and impending consolidation on the last trading day after rising for four trading sessions in a...

READ MORE

MEMBERS ONLY

Top 5 Stocks in "Go" Trends | Fri June 28, 2024

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Trend Continuation

* Breakouts

* Momentum Confirmation

* Bull Flags

Top 5 Stocks in "Go" Trends

Trend Continuation on Rising Momentum

GoNoGo Charts® highlight low-risk opportunities for trend participation with intuitive icons directly in the price action. The resurgence of momentum in the direction of the underlying price trend...

READ MORE

MEMBERS ONLY

Stock Market's Choppy Action Continues: Focus is on Jobs Report, Powell Speech

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market continued to move sideways as investors continue to be indecisive

* Speech from Fed Chair Powell and Fed meeting minutes could send the market in either direction

* Friday's jobs report could impact price action in the stock market

The stock market's theme...

READ MORE

MEMBERS ONLY

Mastering GoNoGo Charting: Scanning Securities on StockCharts.com

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Scanning

* screening

* Idea Generation

* Market Breadth

Join Tyler Wood, CMT, in this insightful tutorial where he demonstrates how to effectively scan for GoNoGo conditions using StockCharts.com. GoNoGo Charts, a powerful method developed by Alex Cole and Tyler Wood, blend foundational tools in technical analysis into a powerful...

READ MORE

MEMBERS ONLY

Can the S&P 500 Move Meaningfully Higher Without NVDA?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

2024 has been a year marked by exceptional returns for a relatively small number of high-flying growth stocks. In recent weeks, top performers like Nvidia (NVDA) have pulled back, and Super Micro Computer (SMCI) remains well below its all-time high from earlier this year. So can the major equity benchmarks...

READ MORE

MEMBERS ONLY

Can Nvidia's Stock Skyrocket Again? Key Levels to Watch Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* NVDA shares prices are falling, but it doesn't necessarily mean that the AI trend is at an end

* Expect near-term weakness in NVDA's stock price but keep in mind that longer-term prospects present a different picture

* Watch key support levels since ultra-bullish sentiment could...

READ MORE

MEMBERS ONLY

Why Investors are Betting Big on Berkshire Hathaway Class B Shares Right Now

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Berkshire Hathaway Class B shares are poised for an explosive breakout

* Fundamentally, BRK/B has been a consistent outperformer and is diversified among different sectors

* BRK/B is working its way through a symmetrical triangle formation and could breakout in either direction

Berkshire Hathaway needs no introduction. The...

READ MORE

MEMBERS ONLY

End of Quarter NASDAQ 100 Pile-On

by Bruce Fraser,

Industry-leading "Wyckoffian"

The NASDAQ 100 ($NDX) has been surging higher since October 2023 with the pace of advance accelerating in the second quarter of 2024. These 100 components are among the largest market capitalization NASDAQ Composite ($COMPQ) stocks. All of the ‘Magnificent-7' mega-caps are represented in this index. Now the second...

READ MORE

MEMBERS ONLY

DP Trading Room: Carl's Grab Bag! - Chipotle (CMG), NVDA, Bahnsen & Hussman

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl brings out his "Grab Bag" during today's free DecisionPoint Trading Room! He gives us a read on Chipotle's (CMG) 50:1 split. He talks about NVDA's strangle hold on the market and gives us homework to read recent articles from David...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Show Evident Signs of Fatigue; Guard Profits & Keep Looking for Relative Strength

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets consolidated throughout the past week, which was a shortened one, with Monday, June 17th being a holiday on account of Bakri Eid. The past five sessions saw the markets staying in a capped range throughout the day. Even when the Nifty kept marking incremental highs, the intraday trend...

READ MORE

MEMBERS ONLY

Gilead's Game-Changer: What You Need to Know About the Stock

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Gilead Sciences' stock price got a boost from positive results of a late-stage trial of its HIV drug

* While Gilead still needs to replicate its results and seek FDA approval, this may be a good time for traders and investors to get in early on a potentially...

READ MORE

MEMBERS ONLY

Price Pays... But For How Long?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The number of new 52-week highs is declining

* The percentages of stocks trading above 200-,50-, and 20-day Exp Moving Averages are declining

* Despiote narrowing breadth, the S&P continues higher

While the S&P 500 continues to move higher, the number of stocks participating to...

READ MORE

MEMBERS ONLY

DP Trading Room: Natural Gas (UNG) Bearish Again?

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl and Erin return to the trading room showing you the charts you need to see to start your week!

Carl covered the market trends and condition to start the program. He also covers Bitcoin, Dollar, Gold, Silver, Gold Miners, Bonds, Yields and Crude Oil.

Carl also gave us a...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Stay Tentative; Look For Stocks With Strong Relative Strength

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by was in stark contrast to the week before that, as the markets remained in an extremely narrow range before closing with modest gains. The markets demonstrated a peculiar feature over the past five sessions; on four out of five trading days, the Nifty 50 came...

READ MORE

MEMBERS ONLY

A Debit Spread in American Express to Add Long Exposure

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* American Express (AXP) has pulled back and is in oversold levels, which may present a buying opportunity

* AXP has upside potential and, to take advantage of it, you could trade an ITM debit spread

* A debit spread has a favorable risk to reward potential that can add long...

READ MORE

MEMBERS ONLY

How to Stop the "Wealth Destroyers" by Deploying Your Sell Methodology

by Gatis Roze,

Author, "Tensile Trading"

"We are in the business of making mistakes. Winners make small mistakes. Losers make big mistakes."

There are zillions of cliches that paraphrase what Ned Davis said. The umbrella axiom with your portfolio should be to cut your losers.

Nude investing is what I label an investor without...

READ MORE

MEMBERS ONLY

DP Trading Room: Equal-Weight Losing Against Cap-Weight SPY

by Erin Swenlin,

Vice President, DecisionPoint.com

Did you know that the equally-weighted RSP is seriously underperforming the cap-weighted SPY? It is losing considerable ground against the SPY and that suggests that if mega-caps fail, so will go the market. Carl shows us charts to prove his point.

Next up Carl covers the market in general followed...

READ MORE

MEMBERS ONLY

Week Ahead: Despite Pullback, Breadth Remains a Concern; Nifty Still Prone to Retracement

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets had an incredibly eventful week as they reacted to the exit polls and general election results. All happened in the same week; the Nifty saw itself forming a fresh lifetime high, and also came off close to 8% from its peak. A remarkable recovery also followed, which led...

READ MORE

MEMBERS ONLY

S&P 500 Still Bullish: This Is What You Should Watch For

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stock market unfazed by today's jobs data

* Yields rise, US dollar rises, and equities close the week relatively flat

* Market breadth continues to be strong, indicating the stock market is still chugging along

It was a bit of a seesaw week in the stock market, but,...

READ MORE

MEMBERS ONLY

Only One Pocket of Strength Left in US Stock Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Only Large-Cap Growth is on a positive RRG-Heading

* No segment, except LC Growth, has managed to take out its late March high

* $DJUSGL setting up for negative divergences

Breaking Down Into Growth / Value

Using Relative Rotation Graphs to help break down the US stock market into various segments...

READ MORE

MEMBERS ONLY

Will Spotify Smash Its All-Time High of $387?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Spotify's stock price has been trending higher for the last 16 months

* Spotify's stock price could reach its all-time high

* Analysts project Spotify's stock price to reach $400 in 2024 and $485 in 2025

Music streamer Spotify Technology (SPOT) isn't...

READ MORE

MEMBERS ONLY

DP Trading Room: Upside Initiation Climax (Should We Trust It?)

by Erin Swenlin,

Vice President, DecisionPoint.com

On today's DecisionPoint Trading Room episode Carl and Erin discuss Friday's "Upside Initiation Climax" and whether it can be trusted. With market follow through tepid, they discuss the implications of this very bullish signal.

Carl reveals his sentiment of the overall market and covers...

READ MORE

MEMBERS ONLY

Top 5 Stocks in "Go" Trends | Fri May 31, 2024

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Trend Continuation

* Breakouts

* Momentum Confirmation

* Bull Flags

Top 5 Stocks in "Go" Trends

Trend Continuation on Rising Momentum

GoNoGo Charts® highlight low-risk opportunities for trend participation with intuitive icons directly in the price action. The resurgence of momentum in the direction of the underlying price trend...

READ MORE

MEMBERS ONLY

Stock Market Shows Its Magic: An Exciting Finish

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market has wrapped the week on a positive note

* Consumer Staples stocks may start to show strength in the near future

* More macro data is on deck for next week

What a turnaround! Today's PCE data, which was in line with expectations, initially sent...

READ MORE

MEMBERS ONLY

Is Aflac Set to Surpass Analysts' Targets? Find Out Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Aflac stock soars, hitting a new all-time high

* Indicators suggest the stock is strong and could continue rising

* Aflac has the potential to outperform the S&P 500, the Financial sector, and the insurance industry

Boring and captivating rarely coexist, except for contrarians who can uncover the...

READ MORE

MEMBERS ONLY

Market Analysis: Top Stock Picks and Sector Insights

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

As we approach the highly anticipated results of India's general elections on Tuesday, June 4, market volatility is expected to be at its peak. Exit polls, scheduled for Saturday, June 1, will likely add to the market's uncertainty, causing significant fluctuations in the Nifty and BankNifty...

READ MORE

MEMBERS ONLY

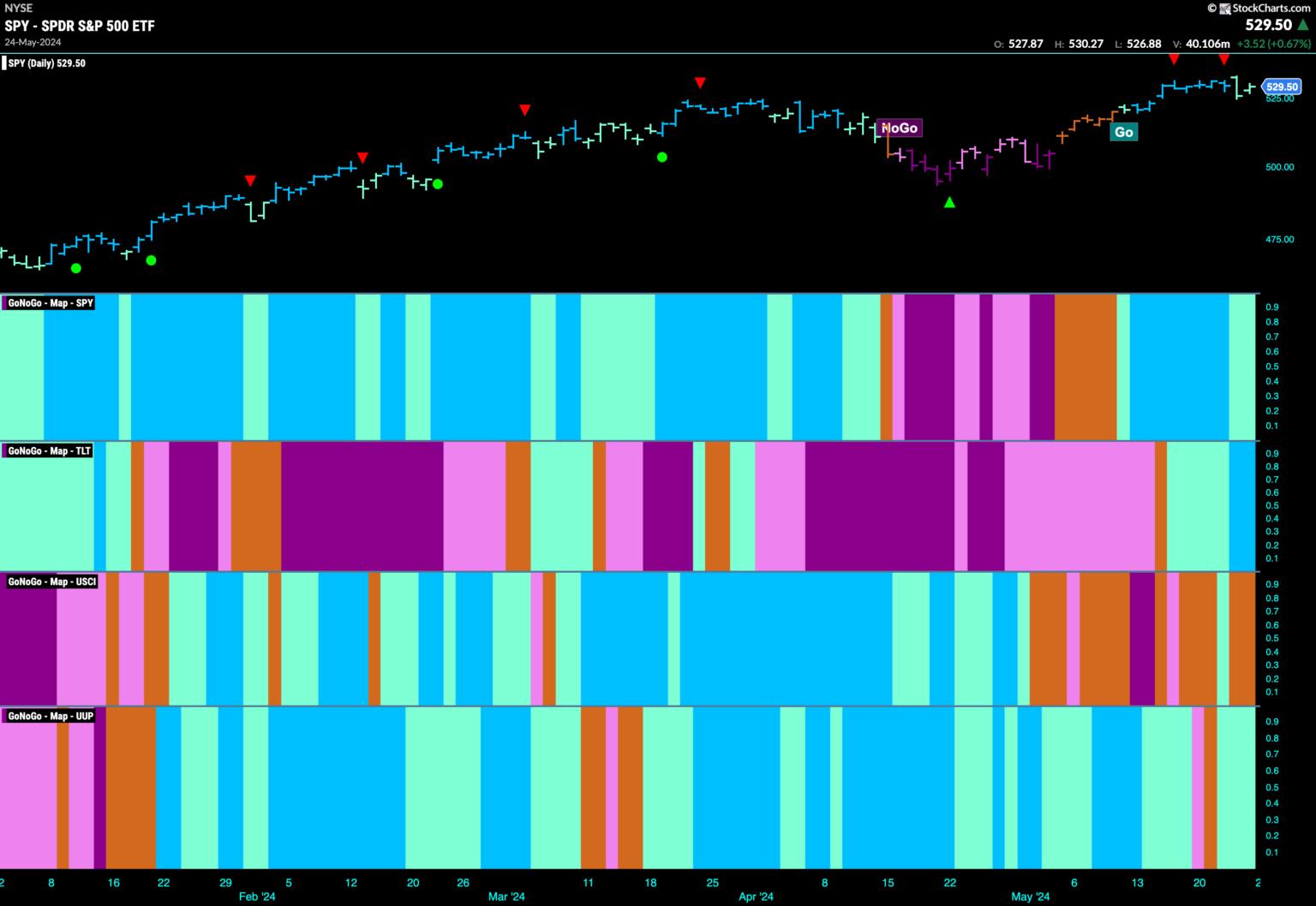

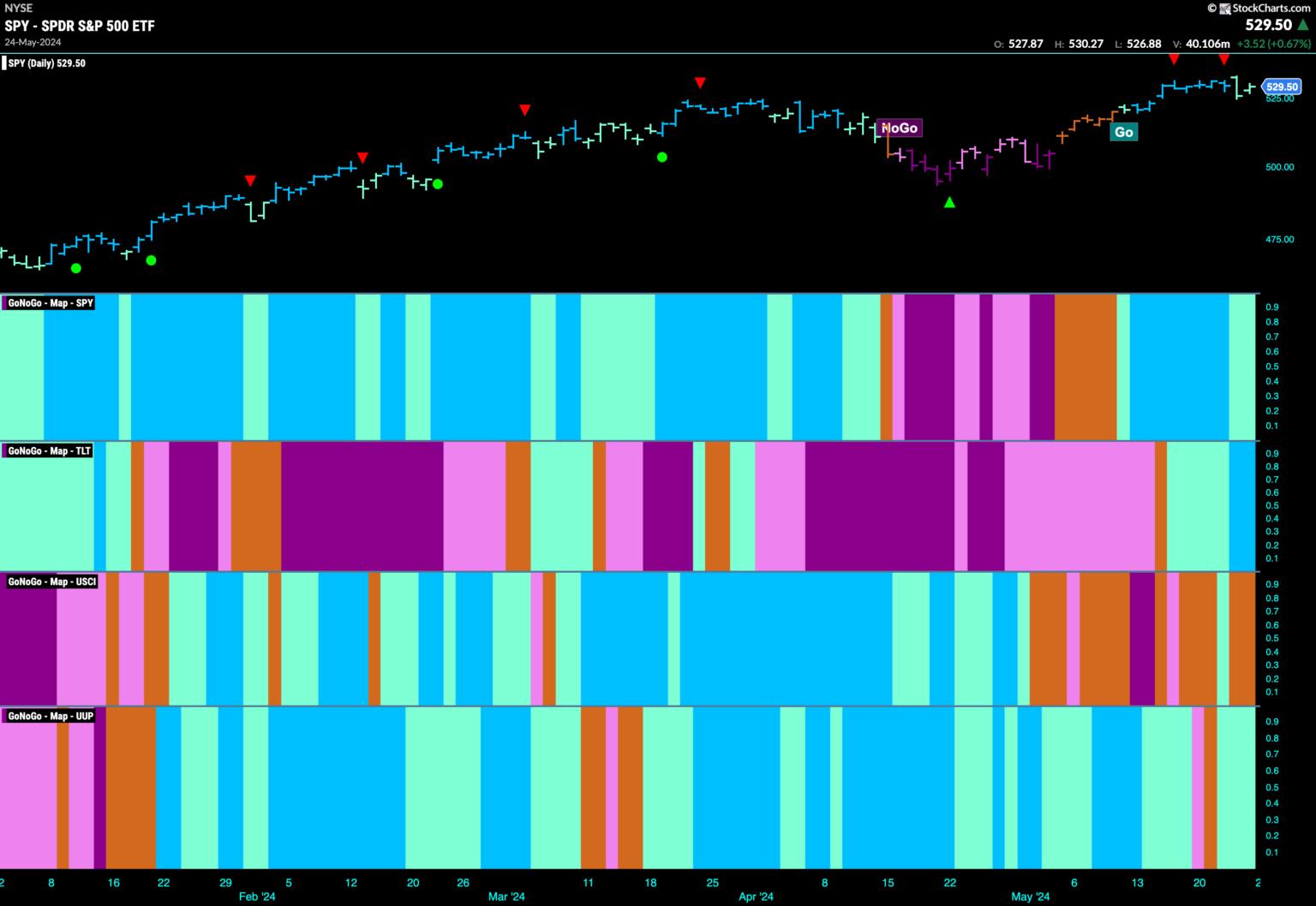

EQUITIES REMAIN IN "GO" TREND WITH SPARSE LEADERSHIP FROM TECH AND UTILITIES

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Relative Strength

* Market Trend

* Narrow Breadth

Good morning and welcome to this week's Flight Path. We saw some weakness this week as price pulled back a little from all time highs. Momentum cooled, we saw this in the form of Go Countertrend Correction Icons (red arrows)...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Set to Move Within This Volatile Range; Curtailing Leveraged Exposures is Recommended

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

It was a truncated day for the markets; over the past four trading sessions, the Indian equities continued to edge higher and ended on a fresh lifetime high. The volatility, too, remained at elevated levels. As mentioned in the previous technical note, the markets are building up ahead of the...

READ MORE

MEMBERS ONLY

Stock Market Ends Week on Optimistic Note, With a Few Surprises

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market started out slow, sold off, and then recovered some of those losses to end the week on an optimistic note.

* Market internals continue to be strong indicating that the stock market has a bullish bias.

* Several stocks made new highs including NVDA, FSLR, and DELL....

READ MORE

MEMBERS ONLY

Surge in TSLA and Strong AMZN Not Enough

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Defensive sector rotation remains a concern.

* AMZN & TSLA are both strong, but XLY remains in relative downtrend.

* Large Cap Growth is the only segment on a strong RRG-Heading.

Concerns Remain

My concerns about current market developments, which I voiced in last week's article, are still...

READ MORE

MEMBERS ONLY

Dow Theory Flashes Bear Signal

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Dow Theory is based on the foundational work of Charles Dow, considered the "Father of Technical Analysis." Many of the tools we employ to better analyze market structure and investor sentiment, from trend analysis to index construction, are derived from Dow's original essays from the early...

READ MORE

MEMBERS ONLY

Growth is Alive and Kicking for S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Mike Singleton of Invictus Research. David highlights a bearish momentum divergence for gold, and also illustrates how mid-cap and small-cap stocks have yet to make new highs in Q2. Mike paints a bullish picture for stocks based on...

READ MORE

MEMBERS ONLY

These Sectors are Showing Strength as S&P 500 Soars!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave is joined by special guest Julius de Kempenaer of RRG Research. Dave hits on the out-performance of traditionally defensive sectors and breaks down the charts of FSLR, NVDA, and more. Julius, meanwhile, is cautiously optimistic as the equity indexes...

READ MORE

MEMBERS ONLY

Capitalizing on Riot Platforms' Potential: A Sleeper Stock Ready to Soar?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* RIOT may be a beaten-down stock, but it has potential to rise higher

* A breakout above key the $12.65 price range on momentum could mean the stock price would move higher

* A potential resistance level is the $18.30 level

If you're not familiar, Riot...

READ MORE

MEMBERS ONLY

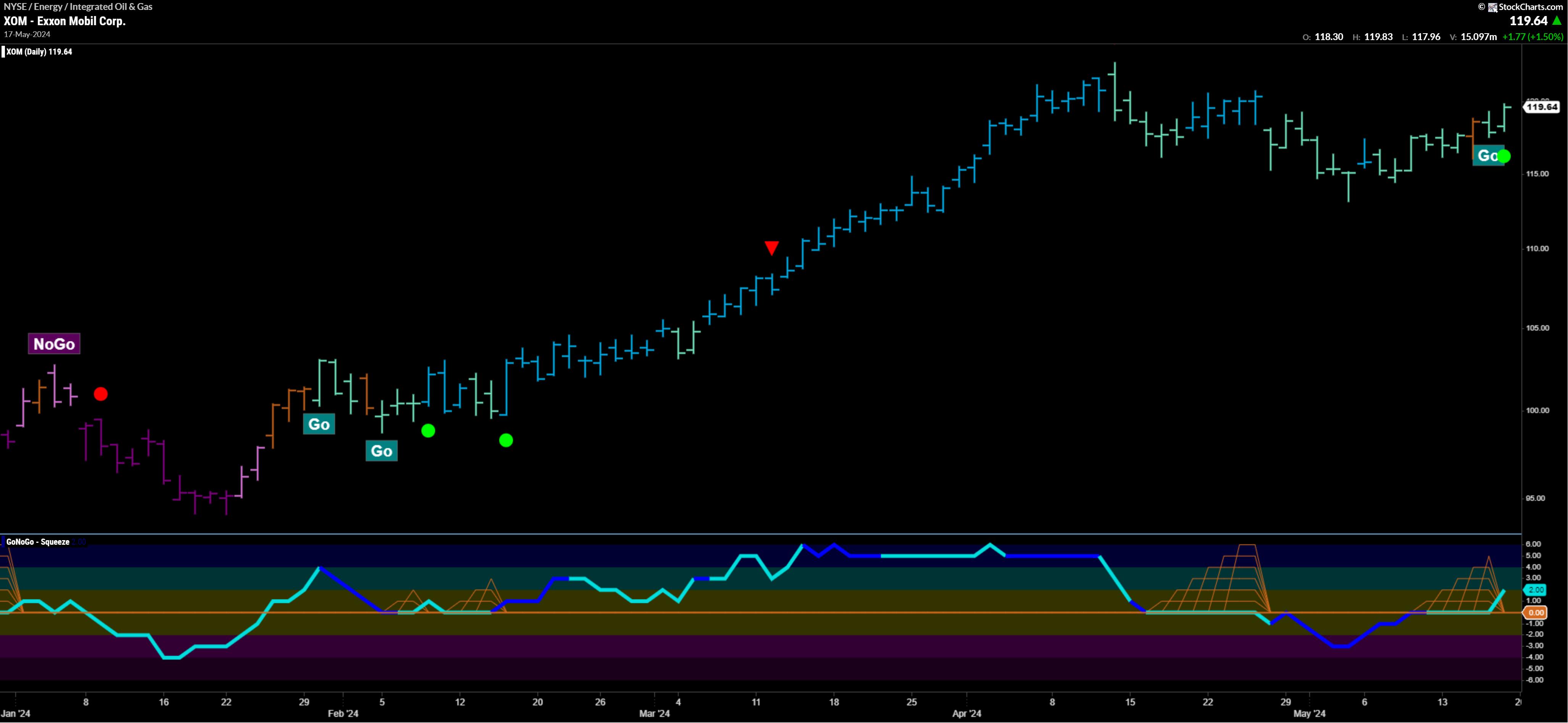

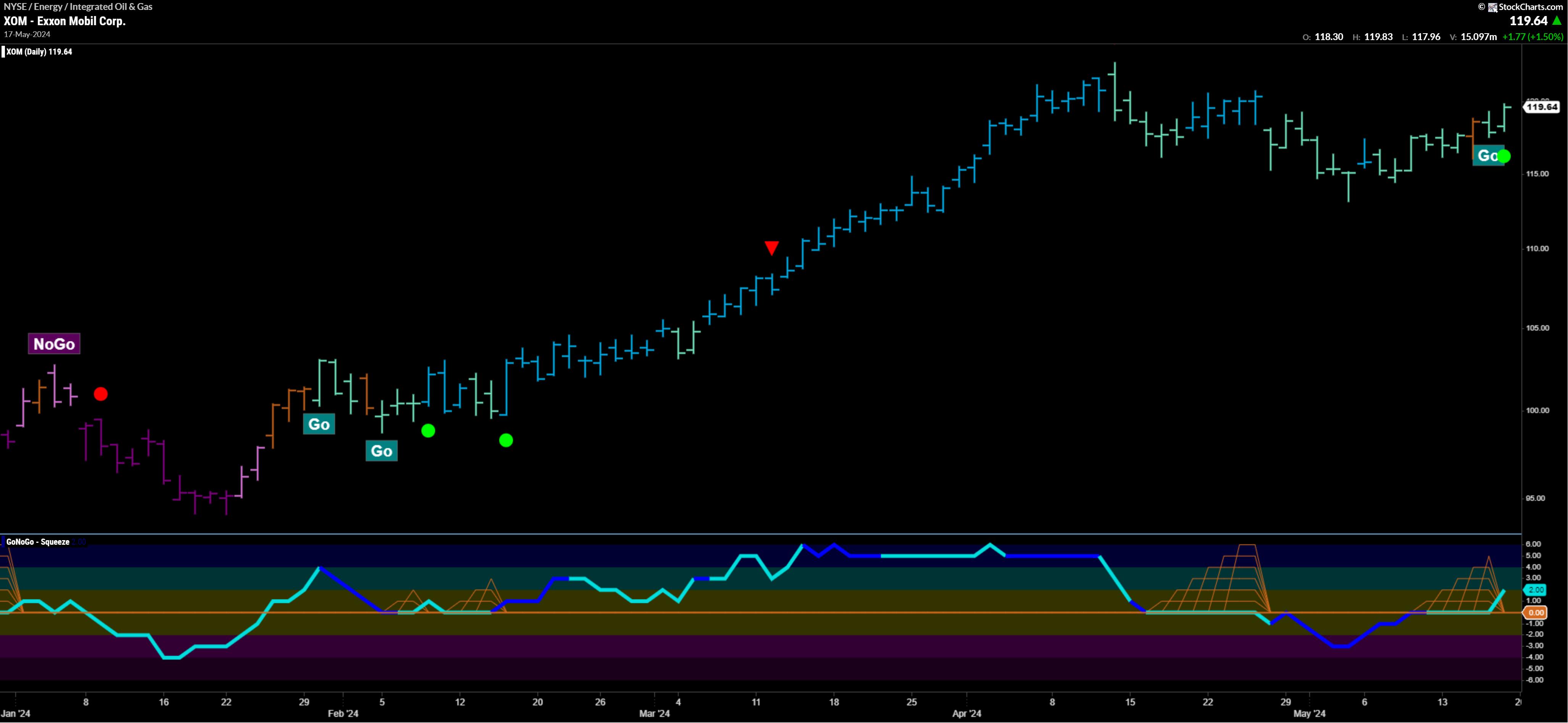

Top 5 Stocks in "Go" Trends | Fri May 17, 2024

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* trend continuation

* breakouts

* Momentum Confirmation

* Bull Flags

Top 5 Stocks in "Go" Trends

Trend Continuation on Rising Momentum

GoNoGo Charts® highlight low-risk opportunities for trend participation with intuitive icons directly in the price action. The resurgence of momentum in the direction of the underlying price trend...

READ MORE

MEMBERS ONLY

Thrilling Week for the Stock Market: Dow Jones Makes Strong Close Above 40,000 for the First Time

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Dow Jones Industrial Average closes above 40,000 for the first time

* Commodities such as silver, copper, and gold are moving higher

* Volatility remains low, indicating investors are complacent

It made it! The Dow Jones Industrial Average ($INDU) closed above 40,000 for the first time, another record...

READ MORE