MEMBERS ONLY

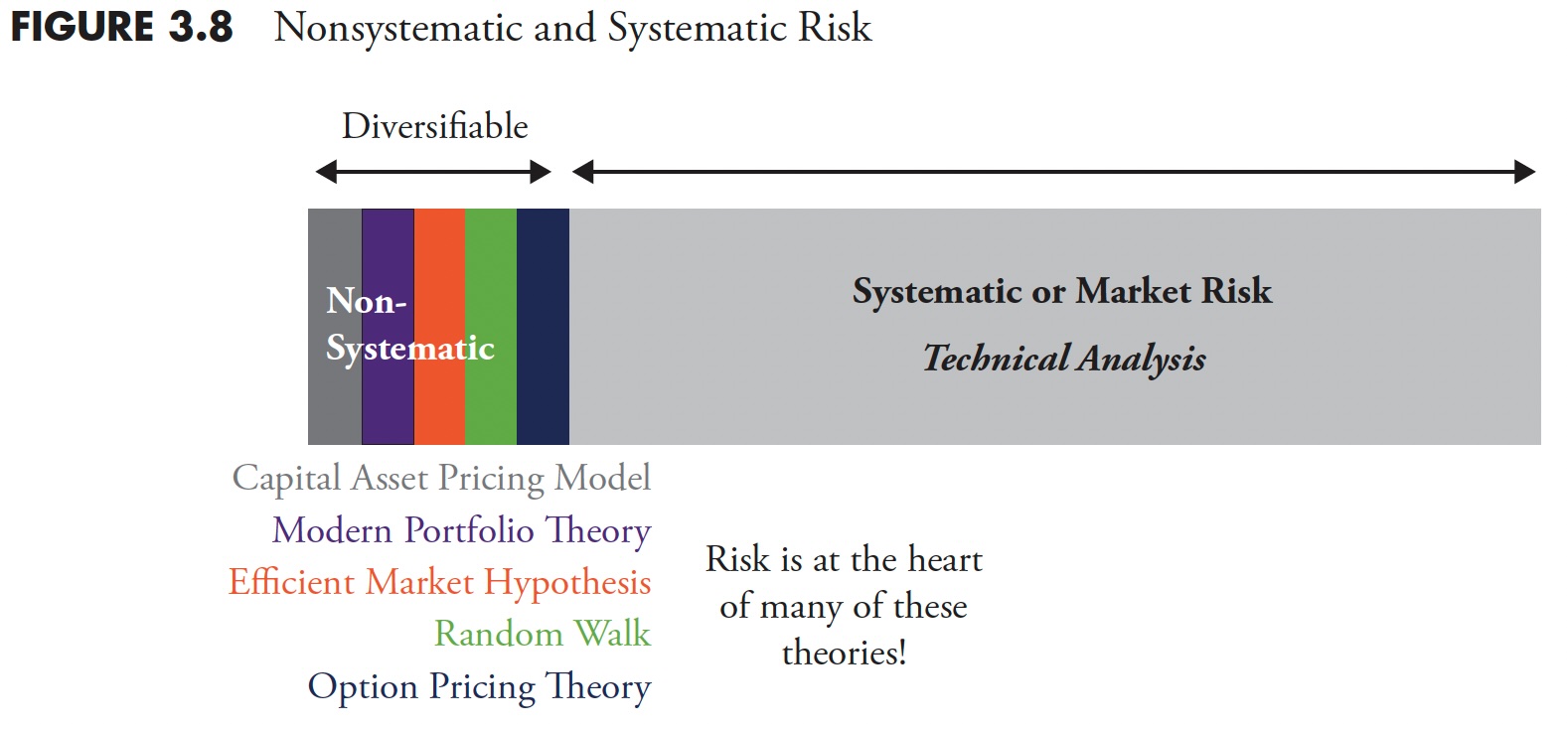

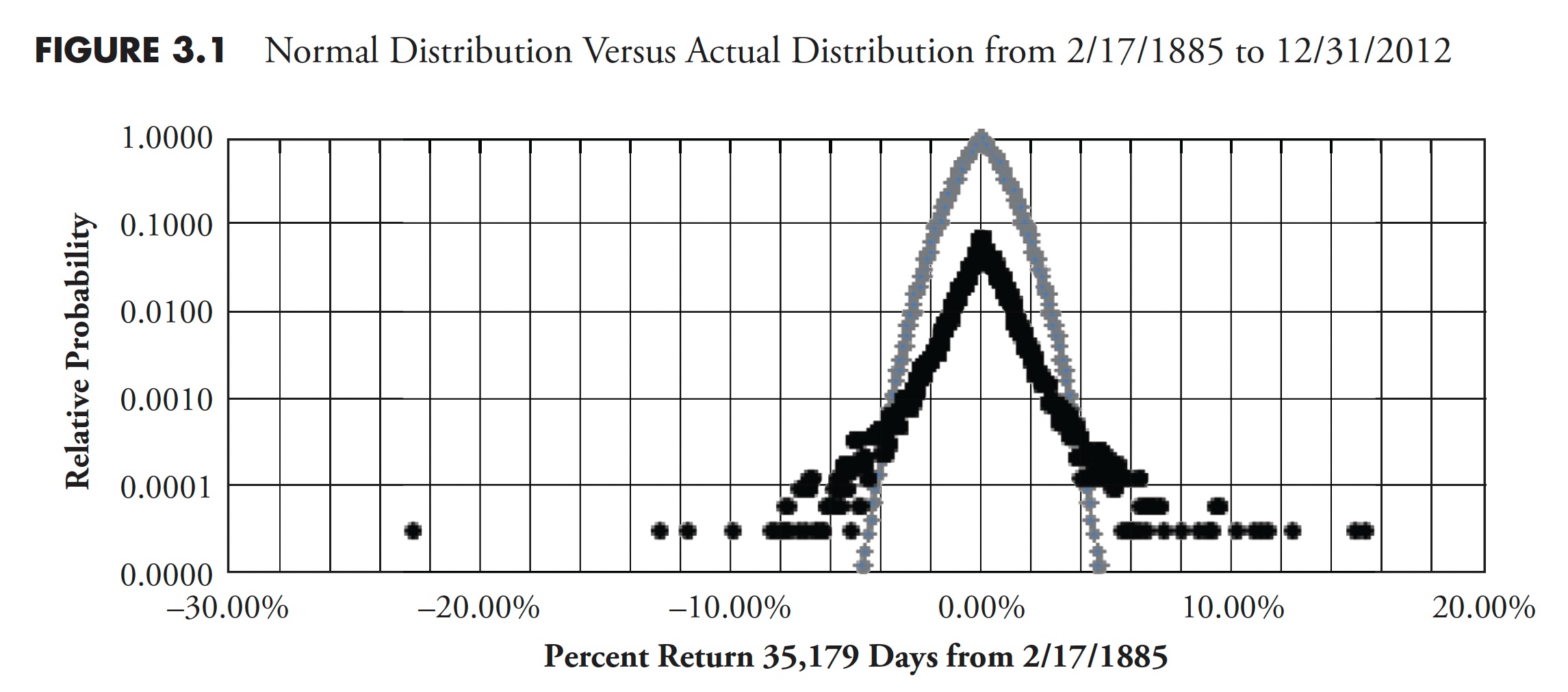

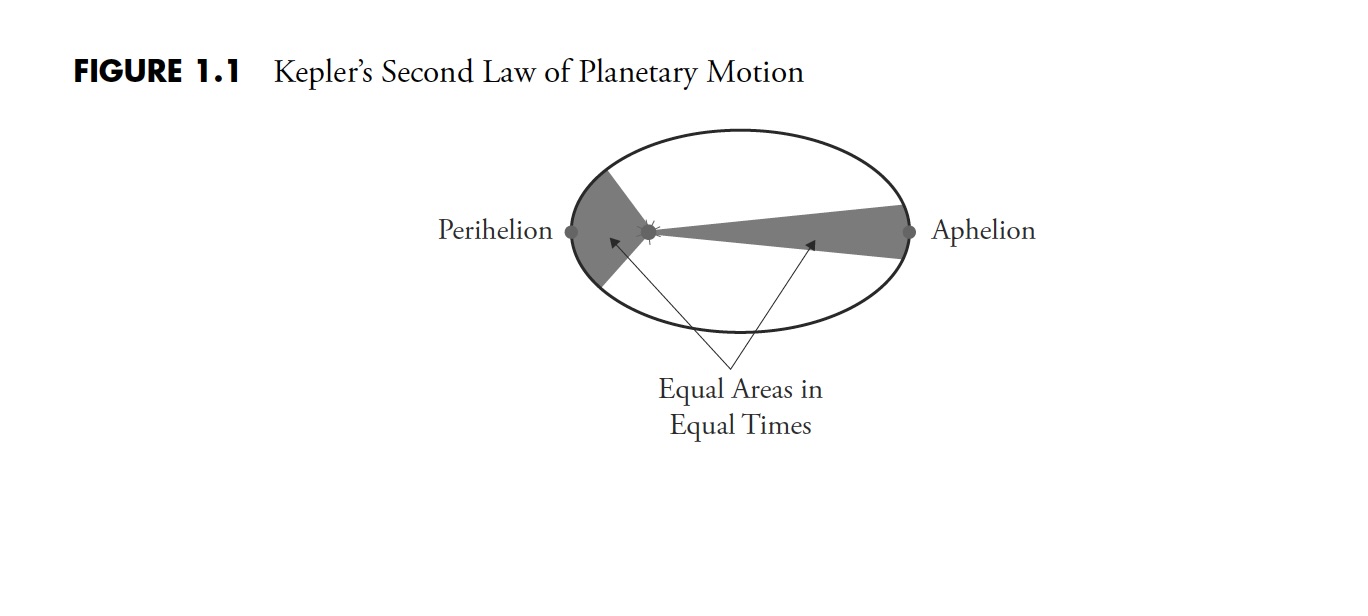

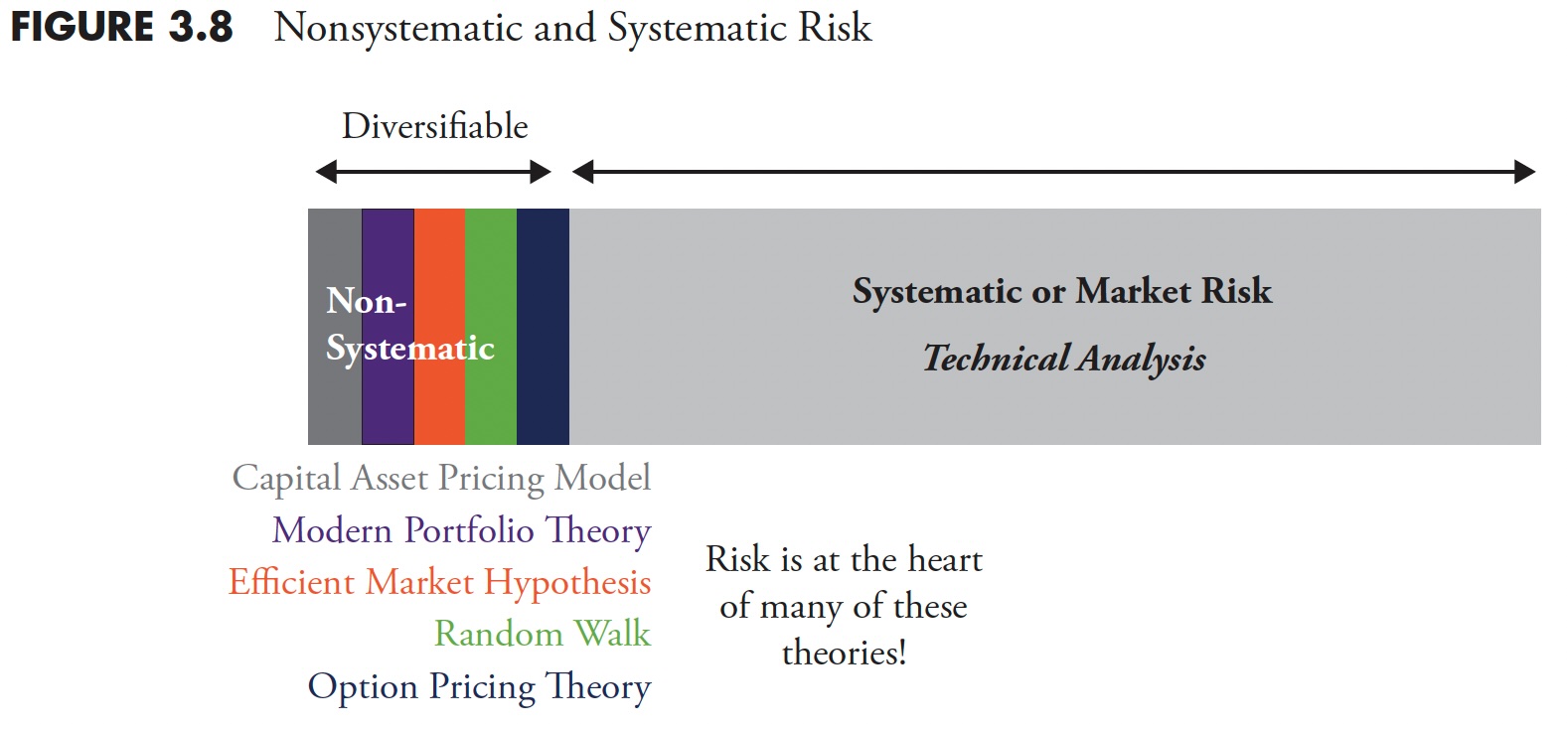

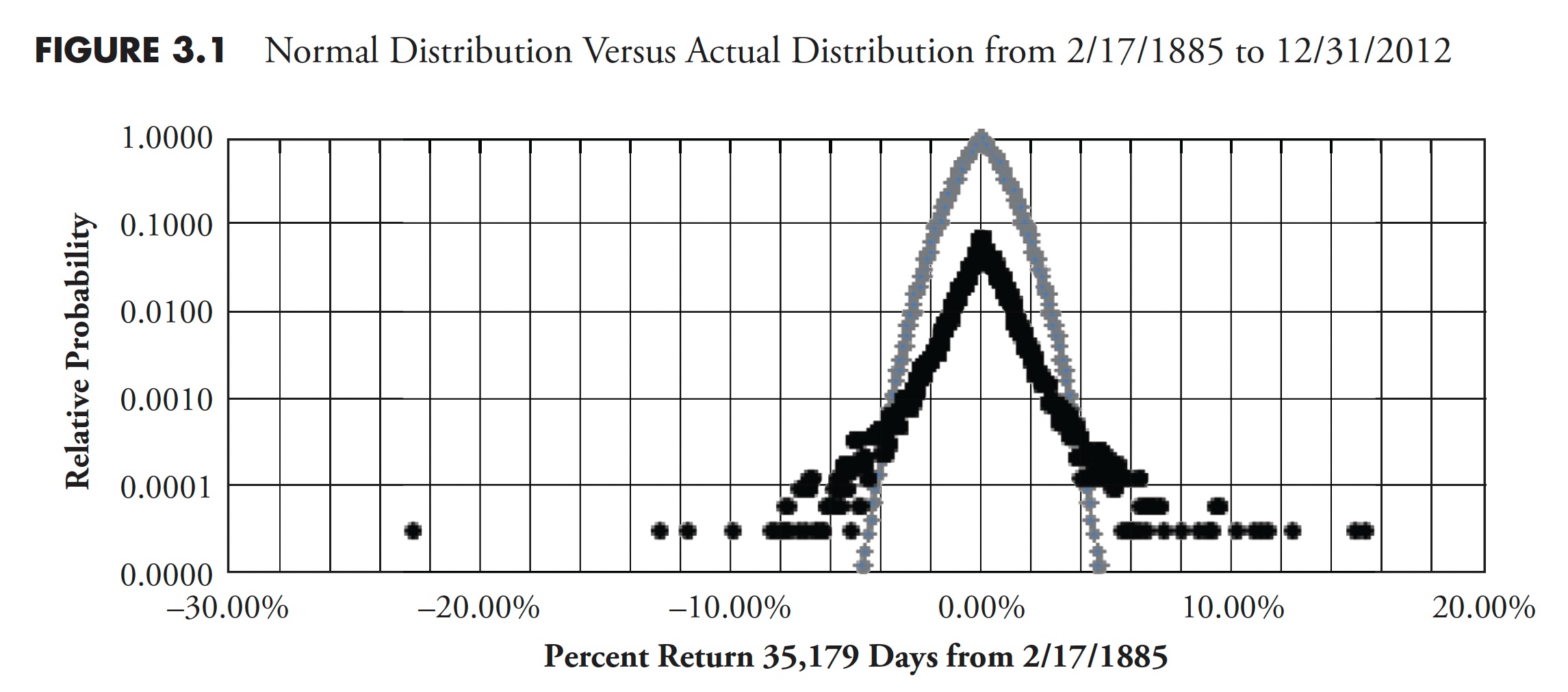

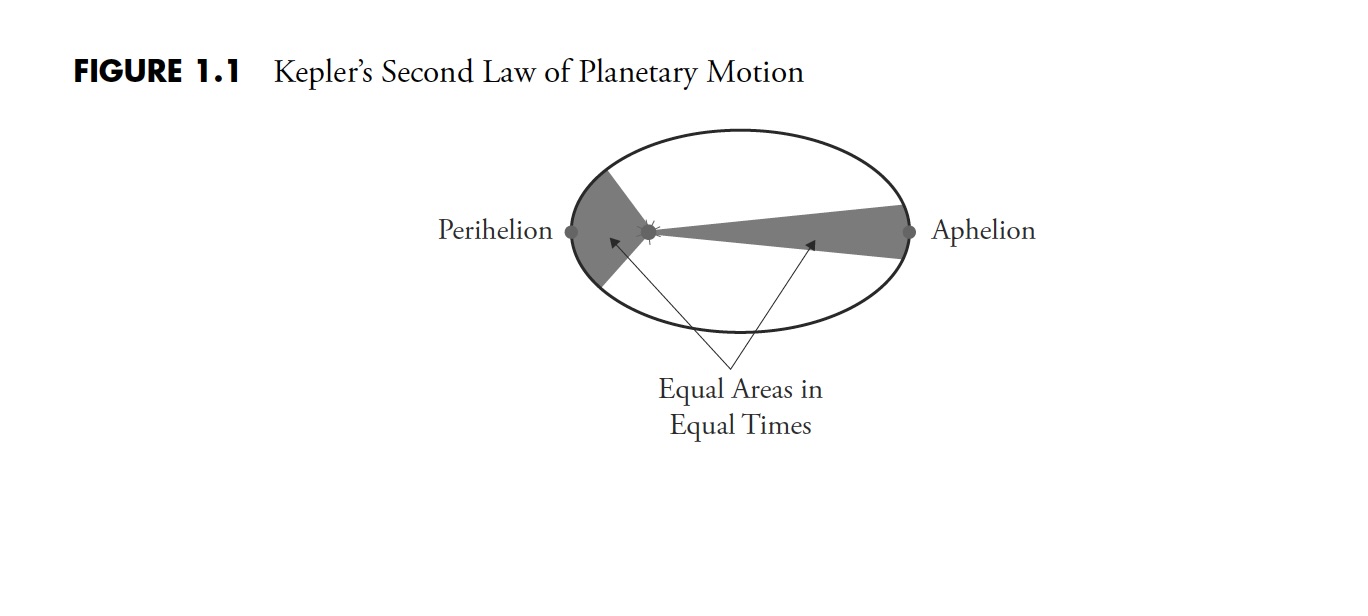

The Hoax of Modern Finance - Part 6: Is Volatility Risk?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the sixth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Earnings Preview: The Technical Temperature

by Erin Swenlin,

Vice President, DecisionPoint.com

KEY TAKEAWAYS

* Big Week in Earnings

* Magnificent 7 - Five Reporting (MSFT, GOOGL, META, AAPL and AMZN

* Other stocks we look at: PFE, SBUX, AMD, MA, BA, MET, MRK, XOM and CVX

* Even more coverage with viewer symbol requests

This is a big week for earnings so Carl and Erin...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May See Sharp Moves; Volatility May Spike Over The Coming Days

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week was reduced to just a short 3-day trading week as Monday was declared a special holiday while on Friday, the markets remained shut on account of Republic Day. Despite this, the markets remained extremely choppy and traded in a much wider range as they continued to decline...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 5: Flaws in Modern Financial Theory

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the fifth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

IBM Stock Shatters Expectations, Hitting a New All-Time High: A Buying Opportunity?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* IBM stock price hits a new 52-week high and moves above its upper Bollinger Band®

* IBM's share value could continue rising or pull back toward the middle Bollinger Band

* If IBM fills its post-earnings price gap it could present a more favorable entry point

As a...

READ MORE

MEMBERS ONLY

AMD Stock Hits New 52-Week High: A Buying Opportunity?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* AMD stock price hits a new 52-week high and moves above its upper Bollinger Band®

* AMD's share value could continue rising or pull back and go below the middle Bollinger Band

* Watch volume, relative strength index, and money flow index to identify a slowing down in...

READ MORE

MEMBERS ONLY

Dow Jones and S&P 500 Close At Record High -- Time to Add Tech Stocks To Your Portfolio?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Dow Jones Industrial Average and S&P 500 close at record highs

* Technology stocks are back in the spotlight, with the Nasdaq 100 closing up 1.95%

* Keep an eye on momentum and volatility as earnings reports continue to pour in

Tech stocks are striking back after...

READ MORE

MEMBERS ONLY

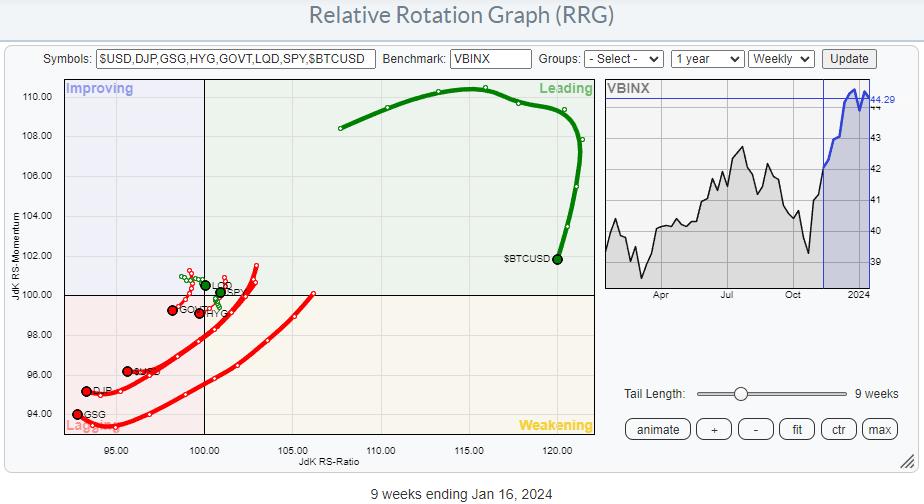

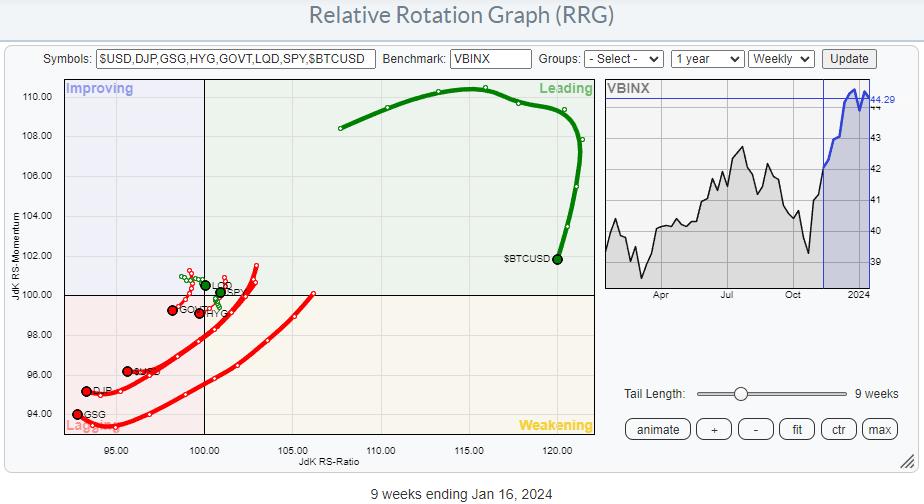

Watch Stocks Triumph in Latest Asset Allocation Battle

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Commodities and USD rotating deep inside the lagging quadrant, indicating weak relative strength

* Bitcoin is in a strong relative uptrend vs all other asset classes, but going through a corrective phase

* Stocks are the clear winner in this asset allocation battle

The RRG above shows the rotation of...

READ MORE

MEMBERS ONLY

Technology Stocks Rise, but Market Internals Look Vulnerable

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Nasdaq Composite index rises 1.35% thanks to semiconductor stocks and an upgrade for Apple

* The Nasdaq Composite is trading close to its 52-week high, but market breadth isn't sharing the bullish sentiment

* Market breadth indicators, such as the advance-decline issues and percent above moving average,...

READ MORE

MEMBERS ONLY

GNG TV: Active vs. Passive Investing

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

As the S&P 500 digests the rally to all time highs, Alex and Tyler take a look at GoNoGo Trend® conditions of several areas of the market on this edition of the GoNoGo Charts show. Amongst US equity indices, the Nasdaq and S&P offer more constructive...

READ MORE

MEMBERS ONLY

Are Key Commodities Decoupling from Equities?

After a long weekend, the market action on January 16th held some surprises.

The Bullish Trends, or gainers, were the dollar and -- here is the surprise for some -- many different commodities. The Bearish Trends, or losers, were foreign currencies, long bonds, and (not shown on the chart) US...

READ MORE

MEMBERS ONLY

View The Large Cap - Small Cap Debate in a Direct Comparison on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Using RRG to see Large-Cap vs Small-Cap sector rotation

* The current strength for Small-Cap stocks vs Large-Caps is evident

At the end of last year, I wrote a blog article about the relationship between Large-Cap and Equal-Weight sectors. It involved plotting the ratios of the large-cap sector ETFs...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY In Uncharted Territory; Adopt This Simple Approach Towards Markets

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After consolidating for most of the week, the markets extended their upmove and ended at yet another record lifetime high. In the past four out of five sessions, the markets were seen consolidating and staying under limited corrective retracement. However, they did find themselves taking support at the short-term 20-Day...

READ MORE

MEMBERS ONLY

Using Two Timeframes to Increase the Odds - Starting with the Strategic View

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists looking to increase their odds should consider two timeframes for their analysis. The longer timeframe sets the strategic tone, while the shorter timeframe defines the trading tactics. Strategically, I am interested in stocks with long-term uptrends. Tactically, I am looking for bullish continuation patterns to trade after a correction....

READ MORE

MEMBERS ONLY

Stock Market Was Tentative This Week: S&P 500 Tested New High But Pulled Back

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market exhibited tentative behavior this week probably due to uncertainty about inflation and geopolitical developments

* S&P 500 index touched a high but pulled back to close slightly higher

* Crude oil prices broke above $75 but pulled back and is holding support at its 200-week...

READ MORE

MEMBERS ONLY

3 Health Care Stocks Flashing Promising Golden Cross: Why You Need to Watch Them

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Health Care sector has shown upside momentum in 2024

* It may be a good time to add some healthcare stocks to your portfolio

* The Bullish 50/200-day MA Crossovers scan in StockCharts filtered out three healthcare stocks that deserve attention

The Health Care sector started rallying in...

READ MORE

MEMBERS ONLY

Putting a Mean-Reversion Strategy Into Practice

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Mean-reversion strategies typically buy stocks when they are oversold, which means catching the falling knife. These declines are often rather sharp, but the odds favor some sort of bounce after reaching an oversold extreme. While there are no guarantees, chartists can mitigate risk by insuring that the stock is still...

READ MORE

MEMBERS ONLY

SPY Resting at Support, But Financials Showing Strength

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* SPY is testing, maybe breaking, short-term support

* Next support in 455 area

* Financials sector tails on daily and weekly RRG moving back in sync

* All banks inside the leading quadrant

HAPPY NEW YEAR!!! (I guess that is still allowed on day 5...)

Let's kick off the...

READ MORE

MEMBERS ONLY

Add Happiness To Your Portfolio With a Sprinkle of Disney Stock

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Disney's stock price is showing signs of consolidation and may be worth watching for signs of a breakout

* The stock is at a critical support level and if the stock is able to hold this support, it could be positive for the stock

* A break above...

READ MORE

MEMBERS ONLY

Sprouts Farmers Market: A Hidden Gem on the Corner of Wall and Main Street?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Sprouts Farmers Market has been riding a relatively steady uptrend channel over the last year

* More dominant on Main Street than Wall Street, its earnings have been yielded positive surprises almost every quarter since 2019

* Look for SFM stock to pull back to its 50-day SMA

Most traders...

READ MORE

MEMBERS ONLY

MRNA Stock Gets an Upgrade: When is the Best Time To Buy?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* MRNA stock surges on the potential of widening its vaccine offerings

* Moderna's stock price has crossed above its upper Bollinger Band and is showing technical strength

* Look for MRNA's stock price to move above its 50-week moving average

Last year's vaccine sales...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely To Ring In The New Year In This Way

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The equity markets have ended the year on a very strong note.

As the week comes to a close, we not only end the month, but also the year. On a monthly basis, the NIFTY has had a stellar run this December, having gained 1598 points (+7.94%). On a...

READ MORE

MEMBERS ONLY

Investing in 2024: 3 Promising Opportunities To Watch

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market ended with a bang in 2023 in spite of inflationary fears

* Small caps and emerging markets are breaking out of a trading range so look for value plays in these asset groups

* Bitcoin has soared and the trend is likely to continue in 2024

The...

READ MORE

MEMBERS ONLY

This Stock is up a Startling 90% This Year: Last Time This Happened Was in 2003

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Intel stock is up over 90% in 2023 and could see further growth in 2024

* The stock crossed above its upper Bollinger Band and is now pulling back

* Any signs of a reversal followed by price action that confirms the uptrend is resuming will be an ideal entry...

READ MORE

MEMBERS ONLY

Is FedEx's Long-Term Uptrend in Jeopardy? Here's What to Watch.

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* A drop in global demand contributed to FedEx's quarterly earnings miss which caused the stock price to fall

* FedEx's stock price action reveals the critical price levels to watch for entry points

* Set technical price alerts at key support and resistance levels to closely...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Takes Breather After Seven Weeks of Gains; What to Expect Next?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, it was categorically mentioned that, given the unabated upmove, the markets have risen near-vertically. This has caused the indices to deviate greatly from their mean, making them overextended and prone to violent profit-taking bouts. While weekly, the markets have just consolidated, but on the daily...

READ MORE

MEMBERS ONLY

Stock Market Delivered Huge Gift, Wipes Away Recession Fears

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Cooling inflation data sends the S&P 500 higher, which is a good start to the Santa Claus rally

* Investors should monitor small-cap stocks and bonds and consider adding them to investment portfolios

* Volatility is low but investors should continue monitoring the VIX to identify changes in...

READ MORE

MEMBERS ONLY

Profit From the AI Wave Now: One Stock With Lots of Upside Potential

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* An earnings beat and strong guidance was enough to send shares of Micron Technology higher

* Micron Technology hit a new 52-week high and the stock has room for more upside

* Identify your entry and exit price targets to trade this stock

Yesterday's stock market selloff was...

READ MORE

MEMBERS ONLY

Costco's Record-Breaking Surge: Is It Time to Buy or Sell?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Costco experienced a significant rally driven by strong earnings and an upgraded analyst target of $700

* Despite COST's bullish prospects, the stock is overbought and is likely to pull back

* Setting price alerts at several support levels may be key to finding a strong long entry...

READ MORE

MEMBERS ONLY

Size (Matters) Over Style!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Growth and Value are moving together in an unusual rotation

* Money from large-cap stocks being distributed into mid- and small-cap segments

* Even all Mag7 names dropping in price is not enough to pull down benchmark indices

Something Strange is Going On

Or, at least, something unusual.

On the...

READ MORE

MEMBERS ONLY

Momentum Madness and Nasdaq 100 Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks went on a tear the last seven weeks with Nasdaq 100 stocks leading the charge. The S&P MidCap 400 SPDR (MDY) and Russell 2000 ETF (IWM) gained more than QQQ over the last seven weeks, but QQQ is still the only major index ETF to exceed its...

READ MORE

MEMBERS ONLY

GNG TV: S&P 500 Breakout -- Will the Rally Continue to All-Time Highs by Year End?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, as equities rally with speed from 4600 to 4700 this week, Alex and Tyler take a look across style boxes, cap scales, asset classes, and sectors, and review small-cap industrials that are part of the broadening leadership groups giving legs to this...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 2: Indicators, Terminology, and Noise

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: Over the next couple of weeks and months, I will be republishing the contents of my book, "Investing with the Trend," in article form here on my blog. I'm calling this series "The Hoax of Modern Finance" for reasons you...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 1: Introduction

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: Over the next couple of weeks and months, I will be republishing the contents of my book, "Investing with the Trend," in article form here on my blog. I'm calling this series "The Hoax of Modern Finance" for reasons you...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Faces An Imminent Consolidation; This Index May Finally Start To Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets continued their unabated upmove; following a strongly trending week, the Nifty not only ended at a fresh lifetime high point but also closed with gains for the sixth consecutive week. The markets piled up decent returns despite some signs of consolidation in the second half of the week....

READ MORE

MEMBERS ONLY

45% of Market Capitalization In S&P 500 Showing Strong Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* RRG showing very distinct opposite rotations

* Once Sector Inside Leading and Two Sectors Inside Improving and Pushing toward Leading

* Energy Sector At Risk of Completing a Massive Double Top Formation

Usually, I would do this week's Sector Spotlight on the completed monthly charts for November. But...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stares At Scaling New Highs; These Sectors May Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Following a strong consolidation in the week before this one, the markets finally staged a decisive rally over the past four sessions of the truncated week. The benchmark index NIFTY50 surged in all four sessions; it went on to move past the previous lifetime high of 20222.45 and managed...

READ MORE

MEMBERS ONLY

Emerging Markets vs. U.S. Markets

While December 1st brought out the bulls in nearly EVERYTHING, one area caught our attention.

In December 2019, I saw a similar chart showing an unsustainable ratio between equities and commodities, which started me on the notion that something had to give. Now that I see this chart, with emerging...

READ MORE

MEMBERS ONLY

SNAP's Stock Price Snaps Out Above Bollinger Band -- Could This Be a Profitable Opportunity?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Snap Inc.'s stock (SNAP) price exceeded its upper Bollinger Band. But what does this mean for the stock's price move?

To start, a move above a Bollinger Band isn't necessarily a signal to buy. It's more of an indication of strength, and...

READ MORE

MEMBERS ONLY

MSFT Stock At Record High: Is Now the Time to Buy Before It Skyrockets Further?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* MSFT stock price surges past its 52-week high but. pulls back, closing just shy of $379

* Investors should watch for dips and resistance-turned-support levels for long entries

* Microsoft's massive investment in OpenAI could help push the stock price higher

While Microsoft's (MSFT) Azure contends...

READ MORE