MEMBERS ONLY

The Good, the Bad, and the Sideways

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As U.S. equity indexes hit new highs, not all stocks are keeping pace. Explore these three stocks that are at key technical junctures with charts that highlight trend shifts, risk levels, and actionable signals....

READ MORE

MEMBERS ONLY

My Go-To ADX Scan for Finding Breakout Stocks

by Joe Rabil,

President, Rabil Stock Research

Joe shares his go-to ADX stock scan! Follow along as Joe uses the StockCharts platform to uncover strong long-term uptrends paired with low short-term momentum — the kind of setup that often precedes powerful breakouts. He walks through his “Strong Monthly / Low Weekly” scan criteria, explains how to apply it across...

READ MORE

MEMBERS ONLY

Top 10 Charts to Watch August 2025!

by Grayson Roze,

Chief Strategist, StockCharts.com

Join Grayson Roze as he reveals his top 10 stock charts to watch this month including SFM, BSX, AFRM and SYF. From breakout strategies to moving average setups, he walks through technical analysis techniques using relative strength, momentum, and trend-following indicators. Viewers will also gain insight into key market trends...

READ MORE

MEMBERS ONLY

Top 10 Stock Charts for August 2025 You Need to Watch Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Join Dave as he shares ten actionable stock charts for August 2025 that he’s watching closely. From breakout setups to key reversals, David highlights tickers like Tesla, Meta, Caterpillar, Motorola, and Newmont Mining that show compelling technical patterns. He also walks through how to manage the full trading process...

READ MORE

MEMBERS ONLY

Markets Drop! But These Stocks Are Still Leading

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle breaks down this week’s market volatility and what it means for investors. She explains how inflation and employment data triggered technical breakdowns in key indexes, and discusses why volatility, relative strength, and leadership stocks (including MPWR, TER, and Cadence Design) should remain on your radar. Mary...

READ MORE

MEMBERS ONLY

Last Week’s Market Action Showed Signs of Exhaustion, Especially In This One Key Stock

by Martin Pring,

President, Pring Research

Explore how recent bearish weekly patterns in the S&P 500, Nasdaq, and Microsoft could signal an intermediate-term trend reversal. Learn why confirmation is key in technical analysis....

READ MORE

MEMBERS ONLY

Thursday's Stock Market Dive: Noise or a Warning? Let the Charts Decide

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Was Thursday's market dip a warning sign or just noise? Explore market trends, sentiment, and sector rotation, and learn how the StockCharts Market Summary page can help you stay one step ahead....

READ MORE

MEMBERS ONLY

Meta, Microsoft Blow Past Earnings — Are These Stock Next?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Tom recaps a pivotal week for the markets, as the Fed holds rates steady despite signs of softening economic growth. Tom breaks down the rare dissent among Fed governors, the market’s sharp reaction during Jerome Powell’s press conference, and the technical fallout across major indexes, especially small caps...

READ MORE

MEMBERS ONLY

3 Types of Breakouts To Upgrade Your Portfolio

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Use this StockCharts scan to identify three categories of stocks and ETFs that are making new three-month highs....

READ MORE

MEMBERS ONLY

Avoid This Common RSI Mistake (And What to Do Instead)

by Joe Rabil,

President, Rabil Stock Research

Master RSI strategies with Joe! Follow along as Joe shares his refined method using dual timeframes and a two-RSI approach; see how he uses RSI-20 as a trend filter and RSI-5 as an entry signal to avoid common mistakes and enhance trading precision. Joe breaks down real chart examples on...

READ MORE

MEMBERS ONLY

Before You Cast Away, Hook the Market's Key Trends on StockCharts

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Check these must-see StockCharts signals before you cast off for the summer and see whether August's market currents say "stay the course" or "make adjustments."...

READ MORE

MEMBERS ONLY

These Breakout Stocks Are Leading the Market Right Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Markets hit another all-time high as rotation accelerates into biotech, software, and alt-energy names. Follow along as Mary Ellen breaks down the top-performing sectors and ETFs, including key breakouts in Bloom Energy, DoorDash, and Deckers. She also highlights meme stocks' action, examines what international leadership in countries like Spain...

READ MORE

MEMBERS ONLY

Is It Time For a Comeback? 3 Stocks That Might Be Turning a Corner

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

Explore technical turnaround setups for UPS stock, UNH stock price trends, and why MRK stock may offer the best risk/reward for investors this earnings season....

READ MORE

MEMBERS ONLY

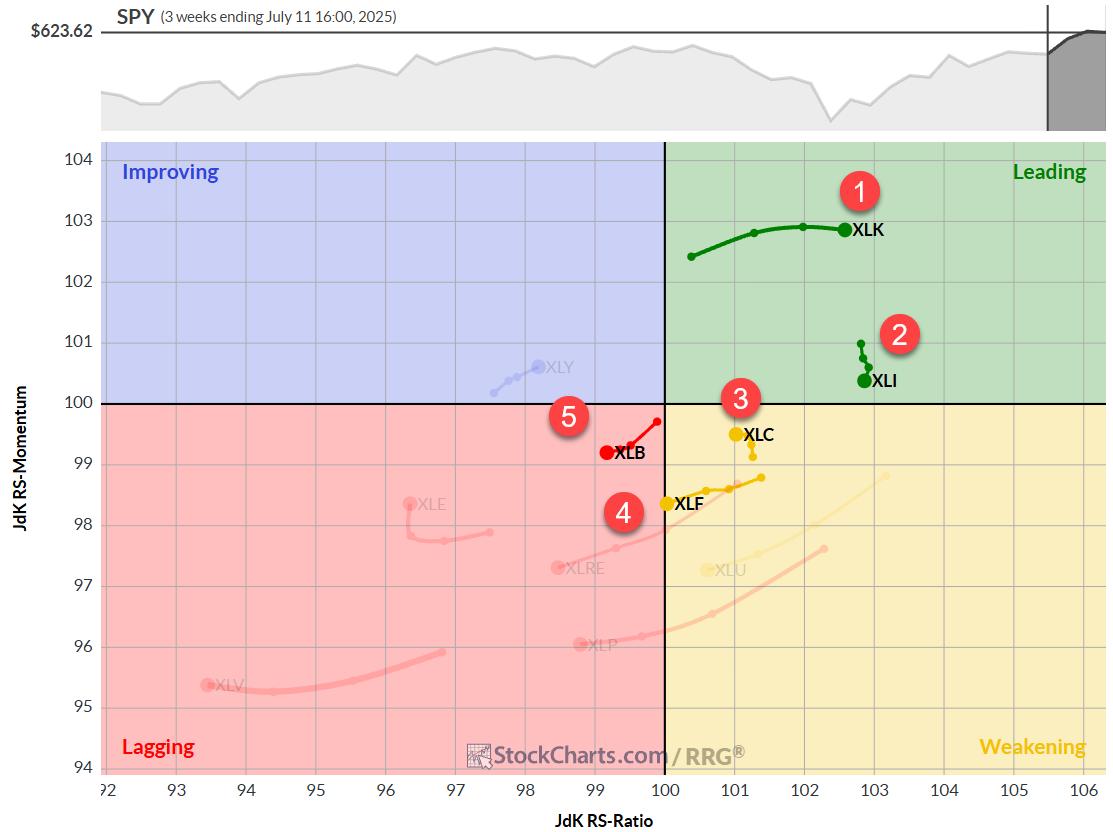

Using Relative Rotation Graphs to Visualize Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs or RRGs will help investors to keep an eye on relative trends that unfold within a universe. Among other things this will help to visualize sector rotation...

READ MORE

MEMBERS ONLY

Will SMCI Stock Soar in 2025? Here's What the Charts Say

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Discover why SMCI stock's steady breakout, key support levels, and AI-driven upside could reward patient investors....

READ MORE

MEMBERS ONLY

Momentum Leaders Are Rotating — Here's How to Find Them

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Is the market's next surge already underway? Find out with Tom Bowley's breakdown of where the money is flowing now and how you can get in front of it.

In this video, Tom covers key moves in the major indexes, revealing strength in transports, small caps,...

READ MORE

MEMBERS ONLY

Is META Breaking Out or Breaking Down?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The chart of Meta Platforms, Inc. (META) has completed a roundtrip from the February high around $740 to the April low at $480 – and all the way back again. Over the last couple weeks, META has pulled back from its retest of all-time highs, leaving investors to wonder what may...

READ MORE

MEMBERS ONLY

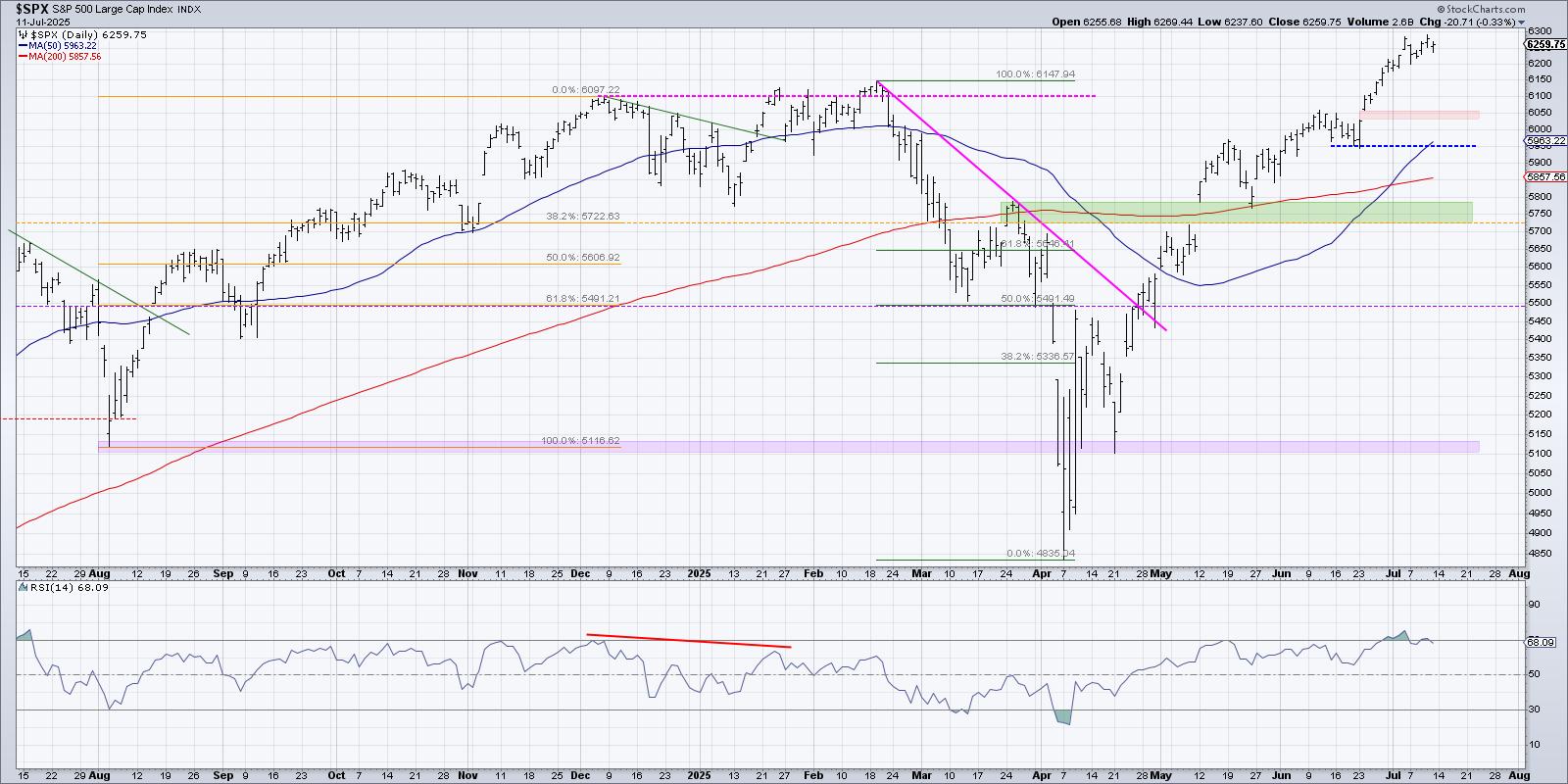

A Wild Ride For the History Books: 2025 Mid-Year Recap

by Grayson Roze,

Chief Strategist, StockCharts.com

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Markets don't usually hit record highs, then risk falling into bearish territory, and spring back to new highs within six months. But that's what happened in 2025.

In this special mid-year recap, Grayson Roze sits down with David Keller, CMT, to show how disciplined routines, price-based...

READ MORE

MEMBERS ONLY

Tech Taps the Brakes, Homebuilders Hit the Gas: See the Rotation on StockCharts Today

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Technology stocks cool before earnings, but the Nasdaq holds above a key moving average. See rotation, support, and key charts on StockCharts to stay ready....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Violates Short-Term Supports; Still Tentatively Devoid of Any Major Triggers

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Nifty traded in a broadly sideways and range-bound manner throughout the week, ending it with a modest decline. The Index oscillated within a narrow 276-point range, between 25144.60 on the higher end and 24918.65 on the lower end, before settling mildly lower. The India VIX declined by...

READ MORE

MEMBERS ONLY

The Real Drivers of This Market: AI, Semis & Robotics

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen spotlights the areas driving market momentum following Taiwan Semiconductor's record-breaking earnings report. She analyzes continued strength in semiconductors, utilities, industrials, and AI-driven sectors, plus highlights new leadership in robotics and innovation-focused ETFs like ARK. From there, Mary Ellen breaks down weakness in health...

READ MORE

MEMBERS ONLY

July Strength, Late-Summer Caution: 3 Charts to Watch

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

July seasonality is lifting the S&P 500 as breadth and bullish sentiment hold up. Discover which charts to watch before the choppier August to October stretch. ...

READ MORE

MEMBERS ONLY

Three Stocks in Focus: One Old Favorite, One Mag Name, and a Dow Comeback Story

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

This week, let's dive into three interesting stocks: a well-known Dow stalwart, a tech giant in a tug of war, and a former Dow member showing signs of revival. Whether you're looking for opportunity, caution, or something worth watching, there's a little something here...

READ MORE

MEMBERS ONLY

These HOT Industry Groups are Fueling This Secular Bull Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Join Tom as he covers key inflation data, earnings season highlights, and sector rotation trends. He breaks down recent price action in major indexes like the S&P 500 and Nasdaq, with a close look at the 20-day moving average as a support gauge. Tom spotlights standout industry groups...

READ MORE

MEMBERS ONLY

Three Bearish Candle Patterns Every Investor Should Know

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The shooting star pattern indicates a short-term rotation from accumulation to distribution.

* The bearish engulfing pattern suggests sellers have taken control, suggesting further weakness.

* The evening star pattern is a three-candle formation that illustrates an exhaustion of buying power.

There is no denying that the broad markets remain...

READ MORE

MEMBERS ONLY

RGTI Stock Surged 30% — Is This the Start of a Quantum Comeback?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

RGTI stock surged 30% in a breakout move. See why RGTI and other quantum computing stocks are back on traders' radar and what to watch next. ...

READ MORE

MEMBERS ONLY

30 Dow Stocks in 20 Minutes: Joe Rabil's Mid-Year Technical Check

by Joe Rabil,

President, Rabil Stock Research

This week, Joe analyzes all 30 Dow Jones Industrial Average stocks in a rapid-fire format, offering key technical takeaways and highlighting potential setups in the process. Using his multi-timeframe momentum and trend approach, Joe shows how institutional investors assess relative strength, chart structure, ADX signals, and support zones. From Boeing&...

READ MORE

MEMBERS ONLY

Tech Takes the Spotlight Again—Are You Watching These Stocks?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Tech stocks led by semiconductors pushed the Nasdaq to a record high. Learn why this sector is gaining momentum and how to track top stocks....

READ MORE

MEMBERS ONLY

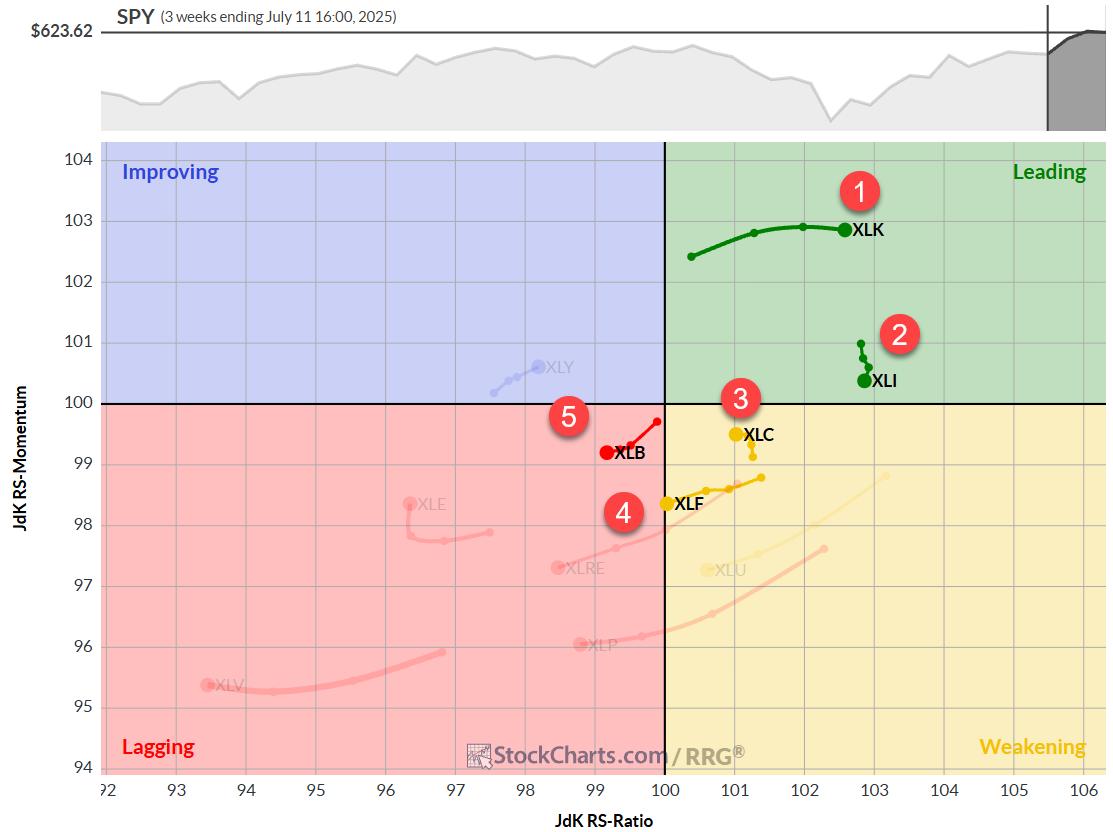

The Best Five Sectors, #27

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Materials sector climbs to #5 in rankings, displacing Utilities

* Technology maintains leadership, but Communication Services and Financials show weakness

* Daily RRG reveals potential for Materials, caution needed for Comm Services and Financials

* Portfolio drawdown continues, currently 8% behind S&P 500 YTD

After a relatively quiet week...

READ MORE

MEMBERS ONLY

Here's What's Fueling the Moves in Bitcoin, Gaming, and Metals

by Mary Ellen McGonagle,

President, MEM Investment Research

Is the market flashing early signs of a shift?

In this week's video, Mary Ellen McGonagle breaks down the subtle but telling moves happening under the surface. From strength in semiconductors, home builders, and energy to surging momentum in Bitcoin and silver, Mary Ellen highlights the sectors gaining...

READ MORE

MEMBERS ONLY

3 Stocks Seasoned Investors Should Watch

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

KEY TAKEAWAYS

* The Financial sector shows strong technical momentum potentially signifying continued growth.

* Goldman Sachs (GS) presents strong upside and potential entry opportunities on pullbacks.

* Johnson & Johnson (JNJ) is a stable, long-term holding with limited short-term excitement.

As we navigate the evolving stock market landscape, understanding key sectors and...

READ MORE

MEMBERS ONLY

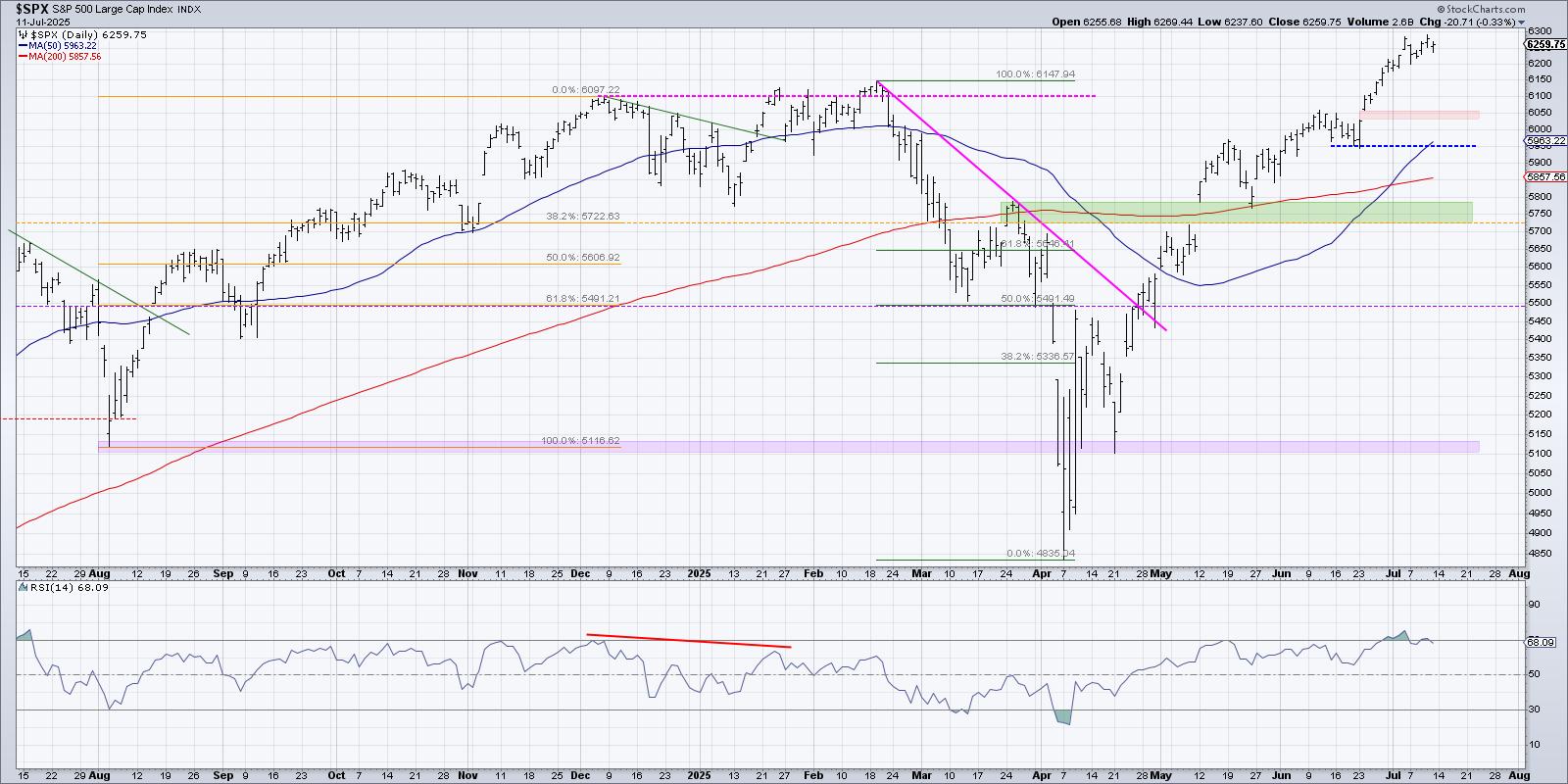

What Happens Next for the S&P 500? Pick Your Path!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The S&P continues to push higher, with the equity benchmark almost reaching 6300 this week for the first time in history. With so many potential macro headwinds still surrounding us, how can the market continue to reflect so much optimism? On the other hand, when will bulls wake...

READ MORE

MEMBERS ONLY

These 25 Stocks Drive the Market: Are You Watching Them?

by Grayson Roze,

Chief Strategist, StockCharts.com

If you're serious about trading or investing, establishing a weekly market routine is a must. But where do you begin?

In this eye-opening video, Grayson Roze, Chief Strategist at StockCharts, shares the method he uses every week to stay aligned with the market's biggest drivers — the...

READ MORE

MEMBERS ONLY

How to Find Compelling Charts in Every Sector

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Over a number of years working for a large money manager with a rich history of stock picking, I became more and more enamored with the benefits of scanning for constructive price charts regardless of the broad market conditions. Earlier in my career, as I was first learning technical analysis,...

READ MORE

MEMBERS ONLY

Breakout Watch: One Stock in Each Sector to Watch Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When sector performance shifts gears from one day to the next, it's best to be prepared with a handful of stocks from the each of the sectors.

In this hands-on video, David Keller, CMT, highlights his criteria for picking the top stocks in 10 of the 11 S&...

READ MORE

MEMBERS ONLY

Tariff Shock Spurs "Buy-the-Dip" Setups in Tesla and ON Semiconductor

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Just when we thought tariff talk had gone quiet, it's back on center stage. With the reciprocal tariff deadline landing this Wednesday, President Trump has mailed out notices that new duties will kick in on August 1. Countries such as Japan, South Korea, Malaysia, and Kazakhstan face a...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #26

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The past week has been relatively stable in terms of sector rankings, with no new entrants or exits from the top five. However, we're seeing some interesting shifts within the rankings that warrant closer examination. Let's dive into the details and see what the Relative Rotation...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Set To Stay In A Defined Range Unless These Levels Are Taken Out; Drags Support Higher

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After a strong move in the week before this one, the Nifty spent the last five sessions largely consolidating in a very defined range. The markets traded with a weak underlying bias and lost ground gradually over the past few days; however, the drawdown remained quite measured and within the...

READ MORE

MEMBERS ONLY

From Oversold to Opportunity: Small Caps on the Move

by Mary Ellen McGonagle,

President, MEM Investment Research

This holiday-shortened week was anything but short on action! The S&P 500 and Nasdaq Composite closed at record highs, but what is really driving the market?

In this essential recap, expert Mary Ellen McGonagle dives into the sectors and stocks making big moves. She'll reveal why...

READ MORE