MEMBERS ONLY

VIX SPIKES! Is a Market Correction Coming?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shares a market update including key levels to watch for the S&P 500 index, what a VIX above 15 means for a possible market correction, the improvement in value-oriented sectors, and why DPZ may be the world&...

READ MORE

MEMBERS ONLY

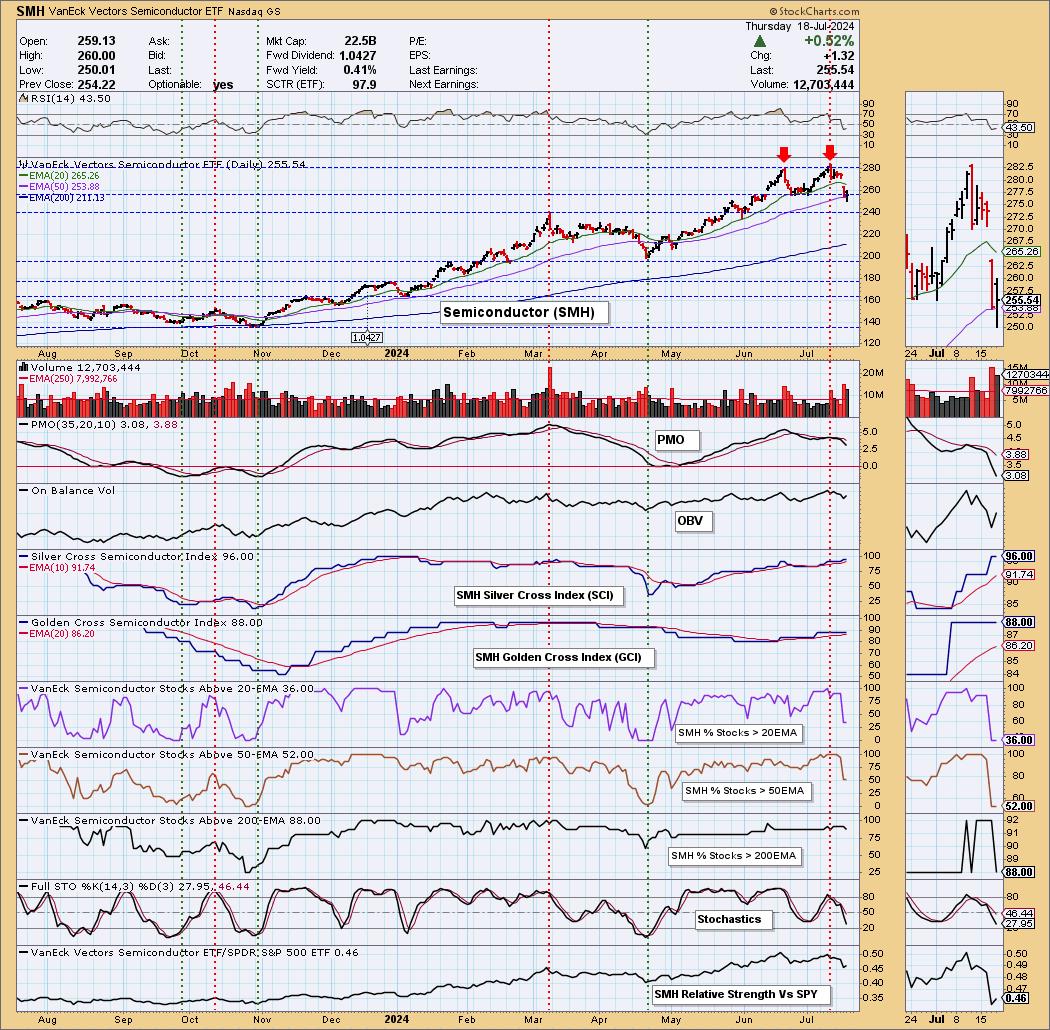

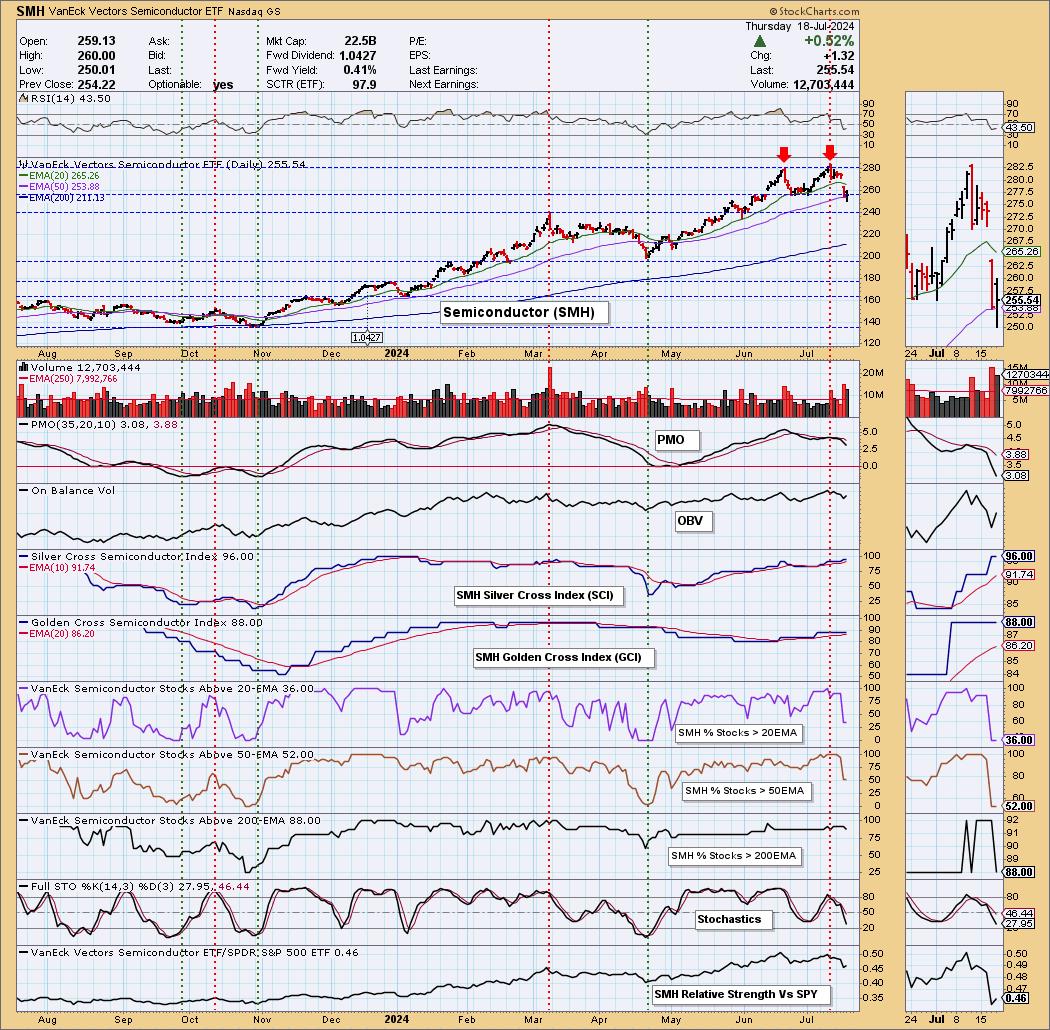

Double Top on Semiconductors (SMH)

by Erin Swenlin,

Vice President, DecisionPoint.com

(This is an excerpt from the subscriber-only DecisionPoint Alert)

We noticed a double top on the Semiconductor industry group (SMH) that looks very much like the NVIDIA (NVDA) chart. NVDA is clearly the bellwether for the group, and it appears all of the Semiconductors are feeling the pain. The downside...

READ MORE

MEMBERS ONLY

Will This Sector Rotation Be the Start of Something Bigger?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Technology is rotating out of favor

* Market Capitalization is a two-edged sword

* Negative divergences on Technology and S&P 500 charts are executing

Strong Rotations on Daily RRG

This daily RRG shows the sector rotation over the last five days. With only one more trading day to...

READ MORE

MEMBERS ONLY

Why Homebuilder Stocks are on Fire Right Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Homebuilder stocks are rallying on hopes of at least one (if not three) interest rate cuts in 2024

* The SPDR S&P Homebuilders ETF broke out above a short-term downward trend

* Though much depends on the interest rate environment, the charts of individual homebuilder stocks show support...

READ MORE

MEMBERS ONLY

Find Trades Using These POWERFUL MACD Combinations

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe shows how to use 2-3 specific MACD patterns on the monthly and weekly charts to set the stage for potential trading ideas. Joe then goes through the shifts in the Sector action and shows where the money is flowing. He covers the stock...

READ MORE

MEMBERS ONLY

Seasonal Sector Investing in the Fall: Top Sectors to Watch Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* One sector ETF is slightly outperforming the S&P 500 while the rest are underperforming the index.

* The performances of the four outperforming sector ETFs from September to December vary.

* Check the price action and fundamentals to see if both might agree with each sector's...

READ MORE

MEMBERS ONLY

Small Caps & Value Sectors are Booming (For Now)

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a strong Monday for value stocks, with the Financial and Energy sectors leading the S&P 500 and Nasdaq to new highs. He shares an update on the Hindenburg Omen, how Bitcoin has regained its 200-day moving...

READ MORE

MEMBERS ONLY

Is It Time To SELL Your Magnificent 7 Stocks?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the sharp rotation that took place in the markets after inflation data came in below estimates. She also highlights new areas of possible leadership as interest rates decline. Most importantly, she shares the best way to uncover leadership names that are in...

READ MORE

MEMBERS ONLY

Citi Predicts $3,000 Gold by 2025 — What You Need to Know

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* What the Fed does in the coming months could dramatically affect the direction of gold prices

* While seasonality suggests a shift from slump to strong performance for gold, it will likely coincide with the Fed's rate decisions in the coming months

* Goldman Sachs projects gold to...

READ MORE

MEMBERS ONLY

Simple RSI Trend Strategy: Entry BEFORE a Breakout!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe shows an RSI strategy that offered a few opportunities to get into AAPL before the big breakout. He then highlights what to watch for in TSLA, which may provide the same type of RSI setup sometime over the next week or so; this...

READ MORE

MEMBERS ONLY

They Say Three Steps and Stumble; This Market is Taking a Fourth

by Martin Pring,

President, Pring Research

The legendary technician Edson Gould had a rule that, after three discount rate hikes, the stock market would be likely to stumble. That doesn't apply to emerging markets, but it did make a catchy headline. What is relevant to the iShares MSCI Emerging Market ETF (EEM) is that,...

READ MORE

MEMBERS ONLY

One Rule to Drastically Improve Your Trading

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe uses a chart of AAPL to demonstrate how properly using a MACD and ADX indicator combo increases your chances of success. He analyzes 10-Year Yields, Bitcoin, Tesla, Datadog, and ServiceNow. Going through all the sectors, Joe explains...

READ MORE

MEMBERS ONLY

Technology Shares SOAR to New All-Time Highs

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, available to watch below, Dave recaps a shortened trading session marked by strength in the technology sector, potential breakouts in gold stocks, and key levels to watch as the S&P 500 index makes a new closing high on...

READ MORE

MEMBERS ONLY

Market Breadth is Narrowing - Should You Be Worried?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius assesses the long-term trends as they are playing out on the monthly S&P 500 sector charts. He takes a look into the future using the expected seasonal trends for the month of July. Markets are still going higher, but the path...

READ MORE

MEMBERS ONLY

S&P 500 Earnings Results Are In for 2024 Q1 and Market Is Still Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings are in for 2024 Q1, and here is our valuation analysis.

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

What to Expect This Month | Focus on Stocks: July 2024

by Larry Williams,

Veteran Investor and Author

Historically, July has seen stock prices move higher almost 80% of the time, cementing this in our trader's notebook as a time to stay home and trade. Others can vacation this month!

Chart 1 is my true seasonal pattern for the Dow for the last 124 years. It...

READ MORE

MEMBERS ONLY

Mastering GoNoGo Charting: Scanning Securities on StockCharts.com

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Scanning

* screening

* Idea Generation

* Market Breadth

Join Tyler Wood, CMT, in this insightful tutorial where he demonstrates how to effectively scan for GoNoGo conditions using StockCharts.com. GoNoGo Charts, a powerful method developed by Alex Cole and Tyler Wood, blend foundational tools in technical analysis into a powerful...

READ MORE

MEMBERS ONLY

Two Consumer Stocks Popping to New Swing Highs!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps Wednesday's late-stage rally for the S&P 500. He analyzes the charts of FDX, TSLA, RIVN, AMZN, and GLW, and reviews what a stronger US Dollar could mean for the SPX and Nasdaq.

See Dave&...

READ MORE

MEMBERS ONLY

Is This a Market Bubble - or Investor MANIA?

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe goes through the history of stock market bubbles, sharing what they look like, how they typically end, and how it relates to NVDA, MSFT, AAPL and GOOGL. Joe also covers the stock requests that came through this...

READ MORE

MEMBERS ONLY

Dow Transports Are Set for a Short-Term Rally, But Will It Be Enough?

by Martin Pring,

President, Pring Research

The Transportation Sector has been one of the weaker brethren of late. That's important, as this market average forms part of the Dow Theory, which many observers believe is currently signaling a bear market. However, back in January, I wrote a piece on the Dow Theorythat came to...

READ MORE

MEMBERS ONLY

Cruise Line Stocks Just Exploded! Here's What You Need to Know

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave highlights technical analysis takeaways for NVDA, ENPH, PNR, GLD, and Bitcoin. He also breaks down the sudden resurgence in stocks like CCL, the benefits of long-term trend analysis on the weekly chart of the Nasdaq 100 (QQQ), and how...

READ MORE

MEMBERS ONLY

Dow Stocks Outperform! Here's Why

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the broader markets, takes a close look at NVDA and other year-to-date winners that sold off last week, and shares top candidates in the Consumer Discretionary sector.

This video originally premiered June 21, 2024. You can watch it on our dedicated page...

READ MORE

MEMBERS ONLY

Why Technical Analysis Does NOT Work for Leveraged ETFs

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions on using technical indicators on leveraged and inverse ETFs like SOXL and SOXS, buying breakouts below the 200-day moving average, upside targets for gold, and whether the $USD is in a primary uptrend.

See Dave'...

READ MORE

MEMBERS ONLY

Bearish Engulfing Patterns Forming on NVDA & MU

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a day where technology shares struggles, with leading names like NVDA and MU dropping bearish engulfing patterns to indicate short-term distributions. He also addresses the ongoing divergence between large caps and small caps, the upside potential for energy...

READ MORE

MEMBERS ONLY

NVDA Wreaks Havoc on Technology Benchmark

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave celebrates Nvidia's rise to overtake Microsoft (MSFT) as the largest company by market cap, creating chaos in the Technology Sector ETF (XLK) with implications for Apple (AAPL). He points out that 10% of the S&P...

READ MORE

MEMBERS ONLY

Seasonality Suggests a Massive Energy Market Shift This Summer—Are You Ready?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Crude, Brent, gasoline, and natural gas tend to dip and peak in the summer months

* Although seasonality plays are attractive, they're not always reliable

* If you're looking to take advantage of seasonality trends, here are some technical levels to watch

We're heading...

READ MORE

MEMBERS ONLY

GET IN EARLY! These Tech Stocks Are Just Taking Off

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the overbought condition in the markets after last week's move to a new high in price. She highlights select areas that pushed the markets higher and covers NVDA, AAPL, and more. She also discusses the anatomy of a true downtrend...

READ MORE

MEMBERS ONLY

Breadth Thrust Can Validate a New Bull Phase for Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave describes how the "breadth thrust", popularized by legendary market strategist Martin Zweig, can help to validate a new bull phase for stocks. He answers viewer questions on pairs trades, running technical indicators like RSI on price ratios,...

READ MORE

MEMBERS ONLY

META, AMZN and MSFT On The Move! Here's How to Pinpoint Entry

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews what drove the markets to new highs. She highlights S&P 500 sectors, plus stocks that have reversed their downtrends, pointing out good entry points. Mary Ellen also takes a close look at why stocks did not respond to today'...

READ MORE

MEMBERS ONLY

Retail Stocks Caught in Limbo: Will RTH Break Free and Soar?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* VanEck Vectors Retail ETF (RTH) holds 70% discretionary and 30% staples retail stocks

* Retail stocks have been on a steady long-term uptrend over the last 10 years

* Traders are likely to accumulate or sell positions depending on the Fed's interest rate decisions

VanEck Vectors Retail ETF...

READ MORE

MEMBERS ONLY

3 Keys to Finding the Strongest Trends

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows the three keys he hunts for when identifying reversals and strong trends, giving a few examples and then showing one that is developing now. He then highlights similar techniques he uses while reviewing the Sectors. In...

READ MORE

MEMBERS ONLY

Tech Stocks Sell Off, But AI Shines!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the bullish close in the markets while highlighting areas to stay away from. She also shares why AI-related areas of Tech remain positive and what drove the Retail sector into a new uptrend. The potential downtrend reversal...

READ MORE

MEMBERS ONLY

MUST SEE! Top 10 Stock Picks For June 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, join Dave and Grayson as they run through top 10 charts to watch in June 2024! They'll cover breakout strategies, moving average techniques, relative strength, and much more. You don't want to miss these insights into...

READ MORE

MEMBERS ONLY

Failed Bearish Patterns are Bullish for S&P 500!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Frank Cappelleri, CMT CFA of CappThesis. Frank shares how the bull market phase has been marked by confirmed and completed bullish patterns and failed breakdowns after bearish patterns. Meanwhile, Dave discusses the rising interest rate environment, what it...

READ MORE

MEMBERS ONLY

This MUST SEE MACD Pattern is a Game Changer

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows a specific MACD pattern that, when it develops on the monthly chart, can give a great early warning sign. Joe gives several examples of this pattern during the lesson. He also shows two Scans that he...

READ MORE

MEMBERS ONLY

What Happens to GOOGL When This Negative Divergence Executes

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius takes a look at the differences in rotation between cap-weighted and equal-weighted sectors and sees a warning signal for GOOGL. He also examines the Communications Sector vs. the Equal-Weighted ETF.

This video was originally broadcast on May 28, 2024. Click anywhere on the...

READ MORE

MEMBERS ONLY

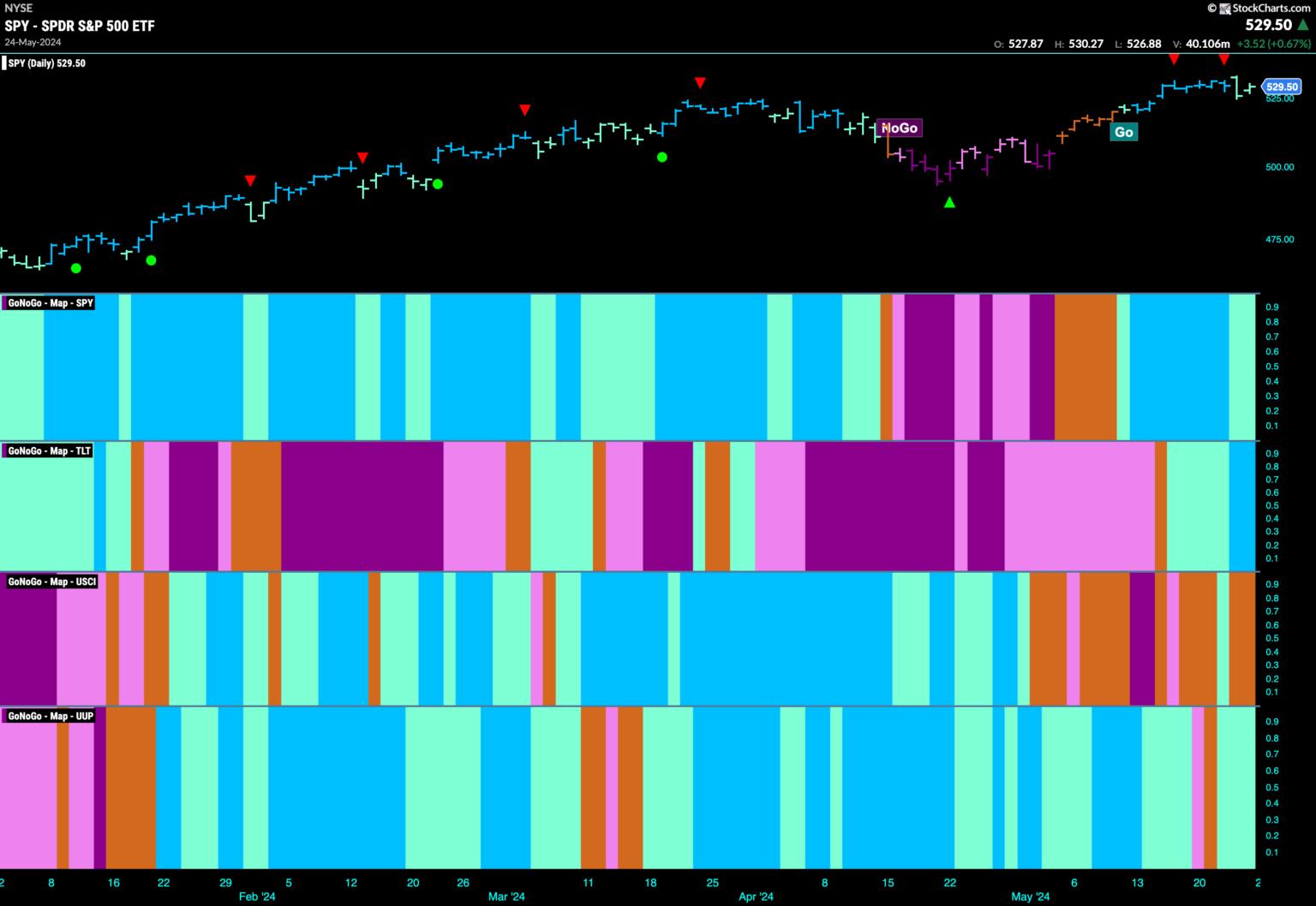

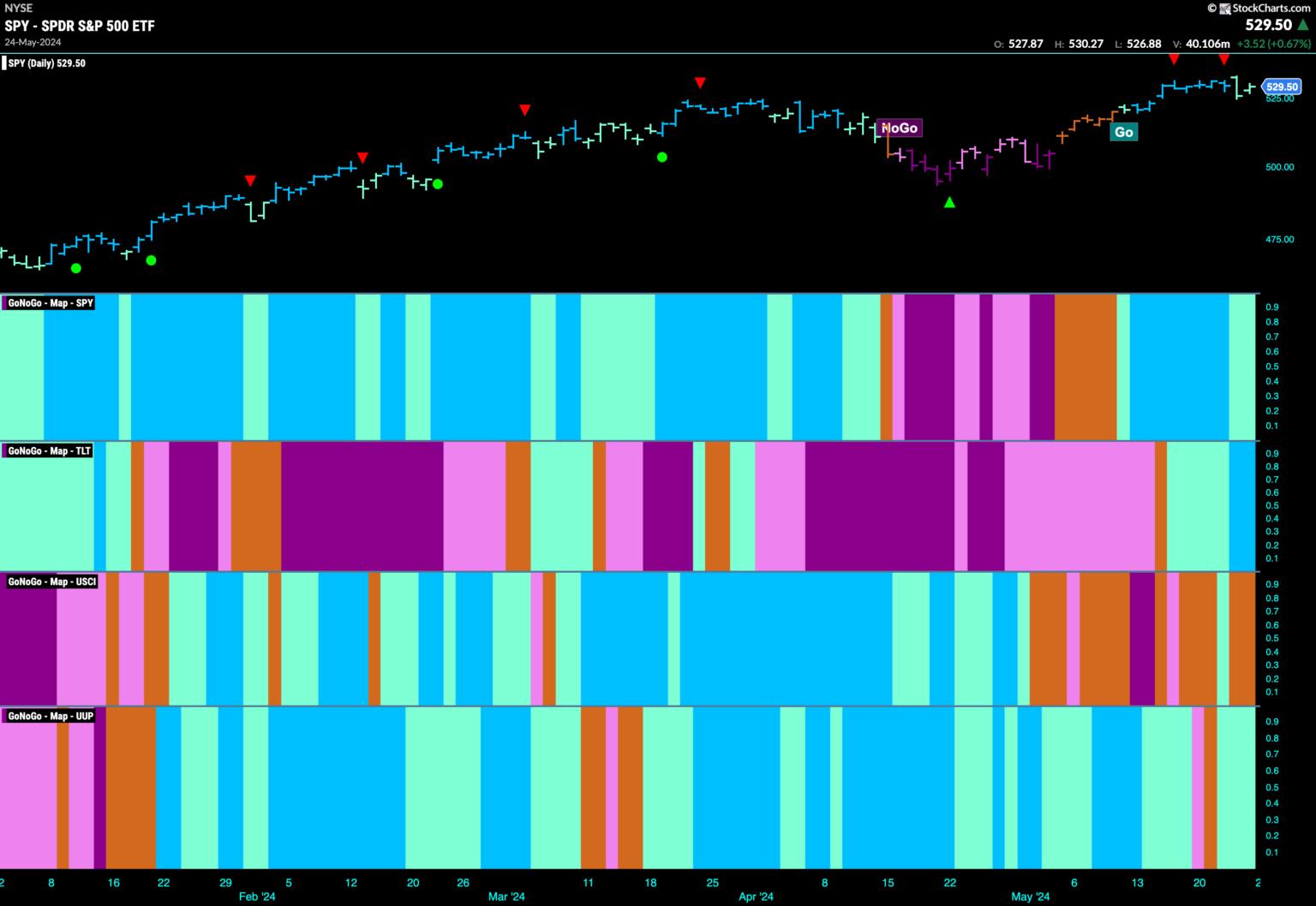

EQUITIES REMAIN IN "GO" TREND WITH SPARSE LEADERSHIP FROM TECH AND UTILITIES

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Relative Strength

* Market Trend

* Narrow Breadth

Good morning and welcome to this week's Flight Path. We saw some weakness this week as price pulled back a little from all time highs. Momentum cooled, we saw this in the form of Go Countertrend Correction Icons (red arrows)...

READ MORE

MEMBERS ONLY

MEM TV: How to Trade Nvidia After Its 15% Gain

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the broader markets and the rotation that's taking place amid a rise in interest rates. She also takes a close look at NVDA and shares how you should handle the stock after last week'...

READ MORE

MEMBERS ONLY

Surge in TSLA and Strong AMZN Not Enough

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Defensive sector rotation remains a concern.

* AMZN & TSLA are both strong, but XLY remains in relative downtrend.

* Large Cap Growth is the only segment on a strong RRG-Heading.

Concerns Remain

My concerns about current market developments, which I voiced in last week's article, are still...

READ MORE

MEMBERS ONLY

S&P 500 Downside Target 4800?!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Jeff Huge, CMT of JWH Investment Partners. David reflects on NVDA's gap higher, quick deterioration in market breadth indicators, and bearish candle patterns for ON and HOOD. Jeff shares his downside target for the S&...

READ MORE