MEMBERS ONLY

The Top Candlestick Pattern For Entries

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe demonstrates how to use the "Big Green Bar" candlestick pattern. This candlestick provides great confirmation on certain types of entry points, and can also be helpful for exits. Joe finishes up the show covering the...

READ MORE

MEMBERS ONLY

Energy: A Long-Term Turnaround in Relative Strength is Brewing

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Energy sector showing relative strength in three timeframes

* The sector is nearing a heavy resistance area

* A long-term turnaround in relative strength appears to be underway

Energy Improving in Three Time Frames

Watching the sector rotation at the start of this week shows a continued improvement for the...

READ MORE

MEMBERS ONLY

What's the Downside Risk for QQQ?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* A bearish momentum divergence and declining Bullish Percent Index suggests rough waters ahead for the QQQ.

* The 50-day moving average and Chandelier Exit system can serve as trailing stops to lock in gains from the recent uptrend.

* If stops are broken, we can use Fibonacci Retracements to identify...

READ MORE

MEMBERS ONLY

The Mighty Have Fallen! TSLA and NVDA On The Rocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave tracks the day's weaker session, with the S&P 500 and Nasdaq down slightly and the small cap S&P 600 down 1.6%. He covers energy stocks breaking higher on stronger crude oil prices,...

READ MORE

MEMBERS ONLY

These Signals Will Improve Your Timing!

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use the MACD crossover signal and the Pinch play signal. There are times when one is better than the other, and he uses several examples to show this distinction. He discusses how the low...

READ MORE

MEMBERS ONLY

What Loss?! NVIDIA and ORACLE Rip Higher

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down today's market action direct from New York, tracking technology shares including NVDA and ORCL regaining lost ground after last Friday's losses. In a segment called Crypto Corner, he outlines two ways to apply...

READ MORE

MEMBERS ONLY

DP Trading Room: Semiconductors - SOXX v. SMH, They're Not the Same

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl and Erin explore the differences between two Semiconductor ETFs, SOXX and SMH. They are NOT the same. One offers far more upside potential than the other. Learn how to easily compare two ETFs or even two stocks using relative strength.

Carl covered the market in general with special attention...

READ MORE

MEMBERS ONLY

MEM TV: Growth Stocks Fade While These Areas Shine

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the broader markets amid last week's pullback. She also highlights sector rotation taking shape as Growth stocks pull back. With Bank stocks outperforming, she shares how to use StockCharts to uncover top candidates.

This video...

READ MORE

MEMBERS ONLY

The Halftime Show: 100th and LAST Show!

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Pete presents the 100th and final edition ofStockCharts TV'sHalftime! This week, Pete shares some parting tips on what to look for when the trends change from defense, (risk off) to offense (risk on). He explains how he saw them coming and how the Chaikin Power Gauge did as...

READ MORE

MEMBERS ONLY

Small Caps Breaking Out BULLISH

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave interviews Ari Wald, CFA CMT of Oppenheimer. He also covers Kroger, the iShares S&P 500 Value ETF, and Costco.

This video originally premiered on March 7, 2024. Watch on our dedicated Final Bar pageon StockCharts TV!

New...

READ MORE

MEMBERS ONLY

MEM TV: 3 Great WAYS to Play AMD Stock

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the move into Semiconductors and shares what that means for Technology. Diving in to volatility, she highlights 3 ways investors can take advantage of the moves in Advanced Micro Devices (AMD). She also highlights other bright spots...

READ MORE

MEMBERS ONLY

New Dow Theory CONFIRMS BULL Phase!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave continues his market recaps from Dubai, focusing on the impressive rally in small caps, continued strength in Bitcoin, and upside potential for crude oil and oil services stocks. He highlights one technology name in a persistent downtrend, but potentially...

READ MORE

MEMBERS ONLY

Flip the Script: Defense as Your New Offensive Playbook

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* March is a strong seasonal month for Utilities and Consumer Staples in relation to the broader market

* Utilities and Consumer Staples are defensive plays which, if timed correctly, can result in a positive market outcome

* The StockCharts Seasonality charts can help you identify sector plays that may not...

READ MORE

MEMBERS ONLY

MEM TV: Simple Way to Identify a Buy Point in NVDA

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what drove the markets to new highs and what areas are outperforming. She also shares how to identify a buy point in NVDA after its gap up following earnings, as well as how to determine when a...

READ MORE

MEMBERS ONLY

Is Energy About to Undergo a Strong Seasonal Sector Surge?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Combining fundamental forecasts with seasonality patterns offers a potent strategy for identifying tradable opportunities in specific sectors

* The Energy (XLE), Utilities (XLU), and Materials (XLB) sectors exhibit the strongest seasonal performance in the near-term

* Seasonality charts provide valuable insights, but checking overall stock market conditions and technical trading...

READ MORE

MEMBERS ONLY

NVDA SCREAMS BULL With Earnings Breakout

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave identifies key resistance levels for QQQ and HYG, along with a technical analysis downtrend checklist for charts in confirmed bear phases. Guest Larry Tentarelli of Blue Chip Daily Trend Report shares two stocks he's tracking along with...

READ MORE

MEMBERS ONLY

3 Unique RSI Techniques to Maximize Your Investments

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe dives into the world of technical analysis by sharing three unique ways to utilize the RSI indicator alongside MACD and ADX -- the Pullback Trade, Confirming a Breakout and 2nd Chance Entry. He then covers the symbol...

READ MORE

MEMBERS ONLY

Emerging Markets Getting Closer to a Breakout

by Martin Pring,

President, Pring Research

Last November I asked the question "Are emerging markets about to emerge?"Using the iShares MSCI Emerging Markets ETF (EEM) as our benchmark, I concluded that more strength was needed in order to push the indicators into a bullish mode. In the intervening period, things have improved, but...

READ MORE

MEMBERS ONLY

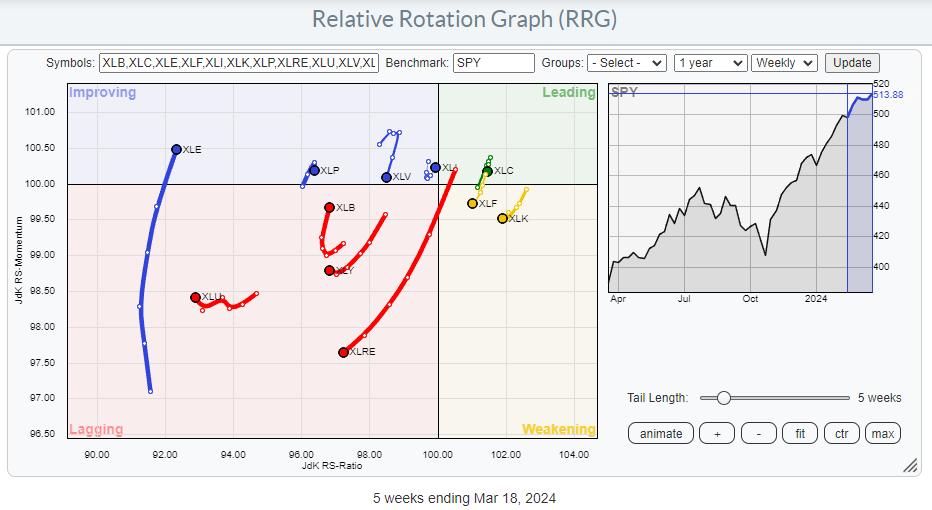

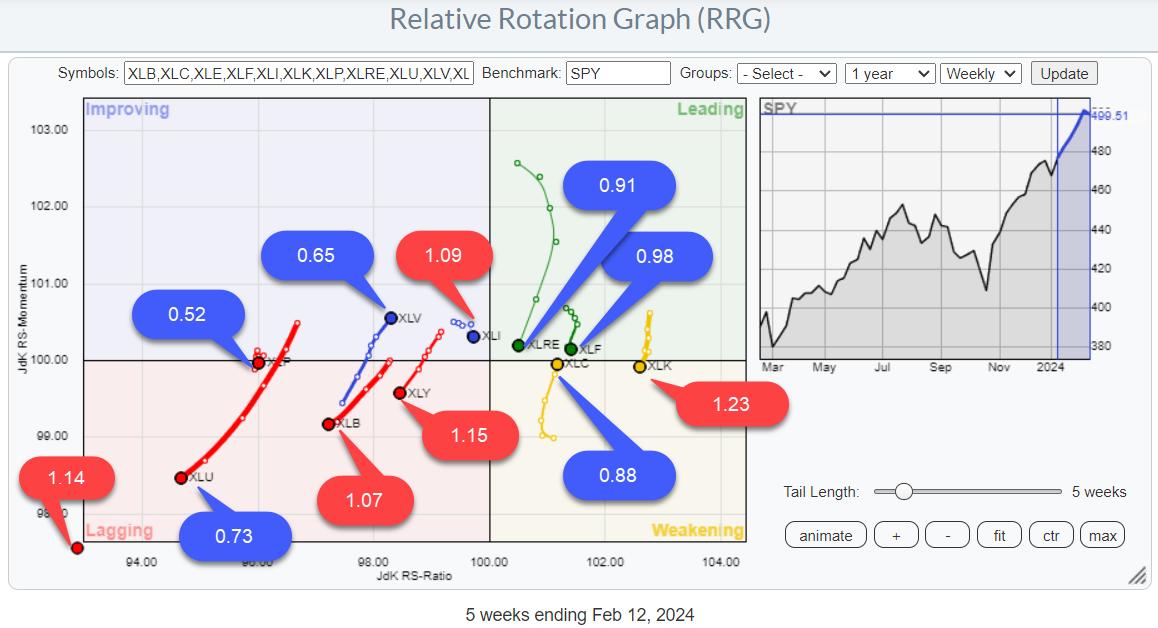

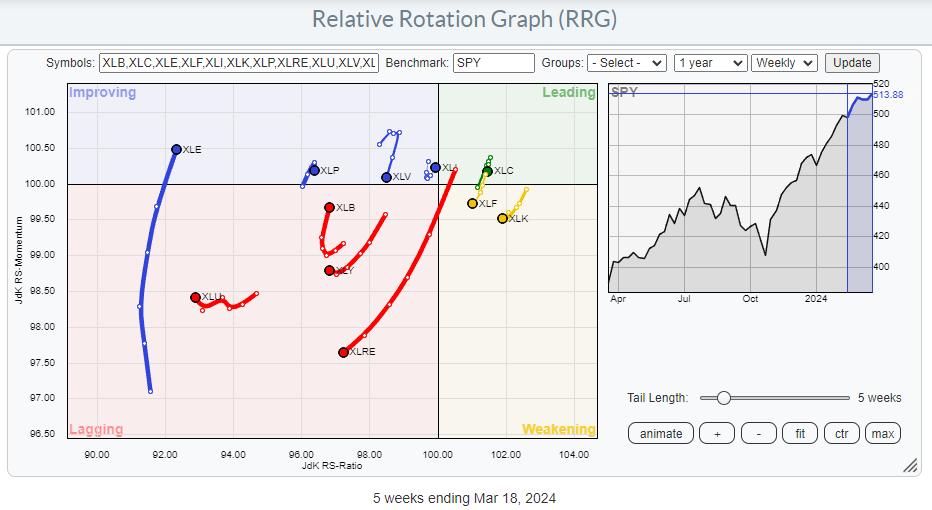

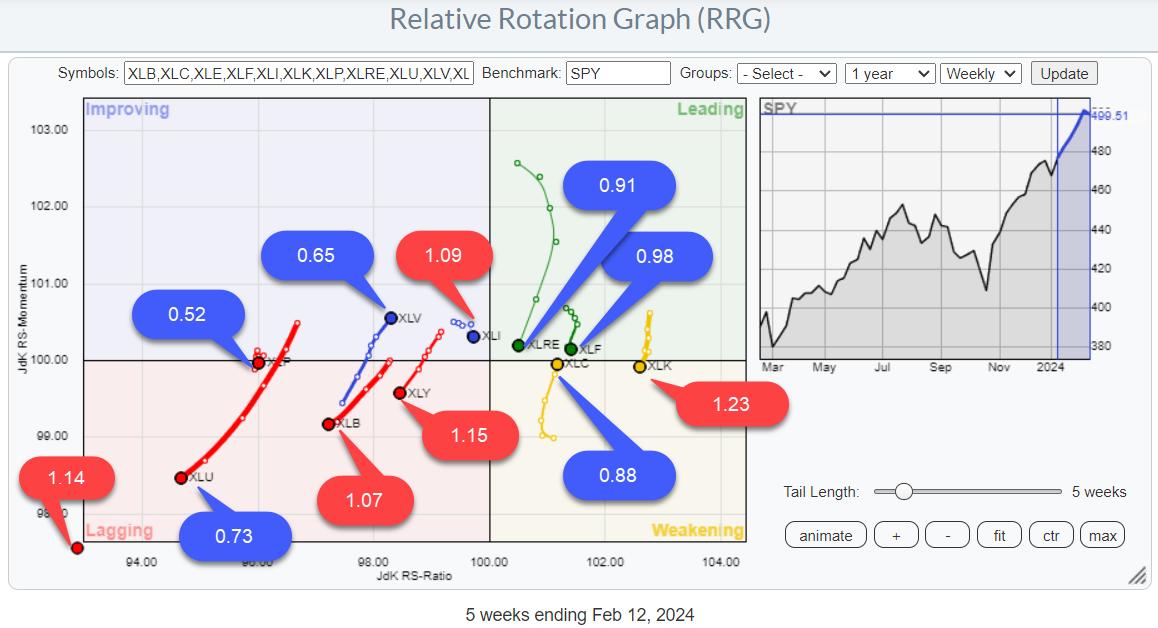

SPY Uptrend Intact, But Mixed Sector Rotation Signals Hesitation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Looking at Risk ON / OFF through BETA

* RRG shows mixed rotations

* SPY Uptrend intact with limited downside risk

BETA

One of the Risk ON/OFF metrics I like to keep an eye on is BETA.

From Investopedia:

—systematic risk—

I have updated my spreadsheet with last year'...

READ MORE

MEMBERS ONLY

MEM TV: Risk-On Trades Emerge Amid Big Tech Selloff

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the sloppy week for the markets, driven by the key economic data that was released. We saw interest rates rise, which had some other carry-on impact. While the S&P 500 saw a bit of a...

READ MORE

MEMBERS ONLY

The Halftime Show: Inflation Back in the Driver's Seat

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Yesterday, the market saw a massive selloff of over 2% at market lows for the SPY and the NDX. However, the rebound at the end of the day was promising, though not enough to change sentiment. What this means is that the selloff came from the hot CPI print, so...

READ MORE

MEMBERS ONLY

S&P 500 Plunges Below 5K!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shows how the S&P 500 is just barely holding trendline support as his short-term Market Trend Model threatens to turn bearish this week. Guest Sean McLaughlin of All Star Charts talks through how he's playing...

READ MORE

MEMBERS ONLY

Catch BIGGER GAINS by Fishing for Alpha

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave highlights breakouts in home builders and Bitcoin and reviews key names reporting earnings including ABNB, SHOP, and MAR. He also shares an equity scan he uses every week to identify the next potential breakout candidates. Stay tuned until the...

READ MORE

MEMBERS ONLY

MEM TV: Best Way To Participate in Stronger Areas of The Market

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews why the markets continue to hit new highs while also highlighting which areas are driving this strength. She then shares a low-risk, simple way to participate in the uptrend among these stronger areas.

This video originally premiered...

READ MORE

MEMBERS ONLY

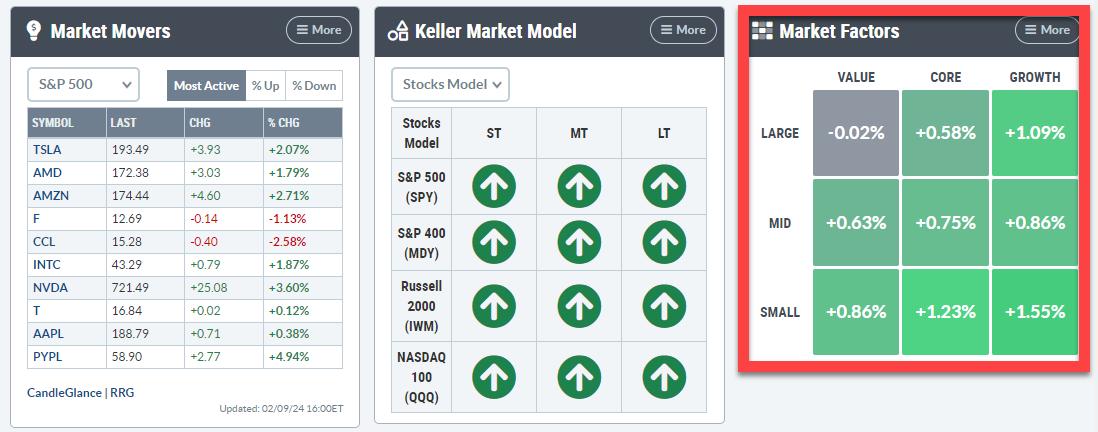

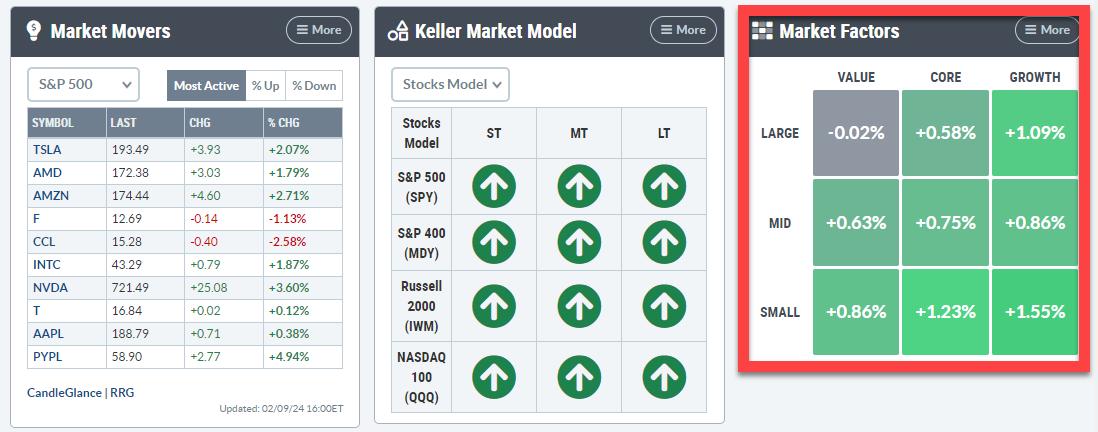

Visualizing the Market Factors Panel on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Bring the New Market Factors Panel to a Relative Rotation Graph

* Same approach using different index family shows a different image

With the release of the new Panels feature on the StockCharts dashboard, there are a lot of ways that users of RRG charts can take advantage! Let&...

READ MORE

MEMBERS ONLY

Your Questions, Answered! Price Gaps, Bull Flags, Inverse Patterns, and MORE

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave digs into The Final Bar Mailbag and answers questions on price patterns like bull flags, what price gaps actually represent on the chart, and why analyzing earnings trends could help you anticipate subsequent moves for stocks like META.

This...

READ MORE

MEMBERS ONLY

Master Momentum Using Price Swings and Fibonacci Grids

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe discusses how he uses the price swings and Fibonacci grid to determine the momentum of a trend without the use of indicators. He explains how indicators can lag at reversal points and why we need to lean...

READ MORE

MEMBERS ONLY

Market Breadth Divergence Says NO BULL!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave demonstrates how the market's recent upswing has left mid-caps and small-caps in the dust, with deteriorating breadth conditions suggesting an increased risk of downside for the S&P 500. He also unveils the latest enhancements to...

READ MORE

MEMBERS ONLY

Only a Fool Would Try to Call a Correction in a Bull Market, So Here Goes!

by Martin Pring,

President, Pring Research

The vast majority of the primary trend indicators are pointing to a bull market and have been doing so for the better part of a year. Chart 1, for instance, shows that NYSE Margin Debt, or rather its long-term KST, has only recently gone bullish. The vertical lines point out...

READ MORE

MEMBERS ONLY

MEM TV: Here's How to Trade Gaps Up After Earnings!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the market's recovery from Fed Chair Powell's comments on Wednesday, sharing exactly what drove the S&P 500 to new highs. She also reviews the sector rotation that's taking place,...

READ MORE

MEMBERS ONLY

Deciphering Gold's (GLD) Signals: Is Now the Time to Go Long on Gold?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The robust jobs data triggered a sell-off in the gold market, hampering expectations of an imminent rate cut

* Price projections for GLD in 2024 span a wide spectrum, below and above current prices because of fluctuating macroeconomic and geopolitical dynamics

* The Volume-by-Price indicator is especially useful in recognizing...

READ MORE

MEMBERS ONLY

The Halftime Show: Fed Stays Put, Bond Markets Rally!

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Uncertainty needs attention in order for it to make you second guess yourself. Instead, wait for trends to change, and then make changes. On this week's edition ofStockCharts TV'sHalftime, Pete Carmasino goes over some thoughts on interest rates and when the Fed will finally cut. He...

READ MORE

MEMBERS ONLY

Mastering MACD: The Fly-By Pattern

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe discusses key aspects to MACD when viewed as an oscillator rather than a momentum indicator. He also explains how to use MACD combination signals as well as combining with the ADX indicator. He then covers the symbol...

READ MORE

MEMBERS ONLY

Will Catalysts Push Markets HIGHER or Drag Them LOWER?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave tracks the S&P 500 as it pushes to a new high above 4900, while the McClellan Oscillator rotates to a bullish reading. He breaks down earnings plays this week, including XOM, MSFT, and more.

This video originally...

READ MORE

MEMBERS ONLY

MEM TV: Market Uptrend Endures Ahead of BIG Earnings Next Week!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews where the markets stand as we head into earnings from MSFT, GOOGL, AAPL and META. She also discusses how ETFs can help you refine your trading strategies and stock selection, then shares base breakouts and downtrend reversal...

READ MORE

MEMBERS ONLY

Is This a Breakout or a Pullback?

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG points out that the IWM is right in the middle of a range and he wants to hear from you as to which way you think it will go first. Beyond that, the overall picture of the market is...

READ MORE

MEMBERS ONLY

Inflation Fell to the Fed's Target -- Or is That a Moving Target?

On Friday, the market woke up to great news. Mission accomplished on inflation.

Yahoo Finance reported: "The Fed's preferred inflation measure — a 'core' Personal Consumption Expenditures index that excludes volatile food and energy prices — clocked in at 2.9% for the month of December, beating...

READ MORE

MEMBERS ONLY

Macro Model Gives Mixed Signals as NFLX LIGHTS UP!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest John Kosar, CMT of Asbury Research shares his proprietary Asbury Six macro model, which suggests caution based on weak fund flows and breadth conditions. Dave focuses in on crude oil and gold charts, and also reviews key earnings plays...

READ MORE

MEMBERS ONLY

Economic Modern Family Has Divisive Weekly Charts

Over the weekend, I covered the daily charts on the Economic Modern Family, featuring the Russell 2000 (IWM) and Retail (XRT). Both are lagging the benchmark and in the middle of their January trend calendar ranges.

As Semiconductors, NASDAQ, the Dow, and S&P 500 continue to post new...

READ MORE

MEMBERS ONLY

Small Caps Surge Higher As S&P 500 Stalls

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave observes the S&P 500 index pressing higher after achieving new all-time highs on Friday. While large caps have dominated small caps so far in January, days like today suggest small-cap strength as a potential emerging trend. He...

READ MORE