MEMBERS ONLY

Don't Ignore This Unusual Event on the Market's March to New Highs

by Mary Ellen McGonagle,

President, MEM Investment Research

The S&P 500 gained 1.1% last week in a move that puts this Index at a record high. While this is exciting news for investors, those that owned some of last week's top performers are in even better spirits, as the average gain for the...

READ MORE

MEMBERS ONLY

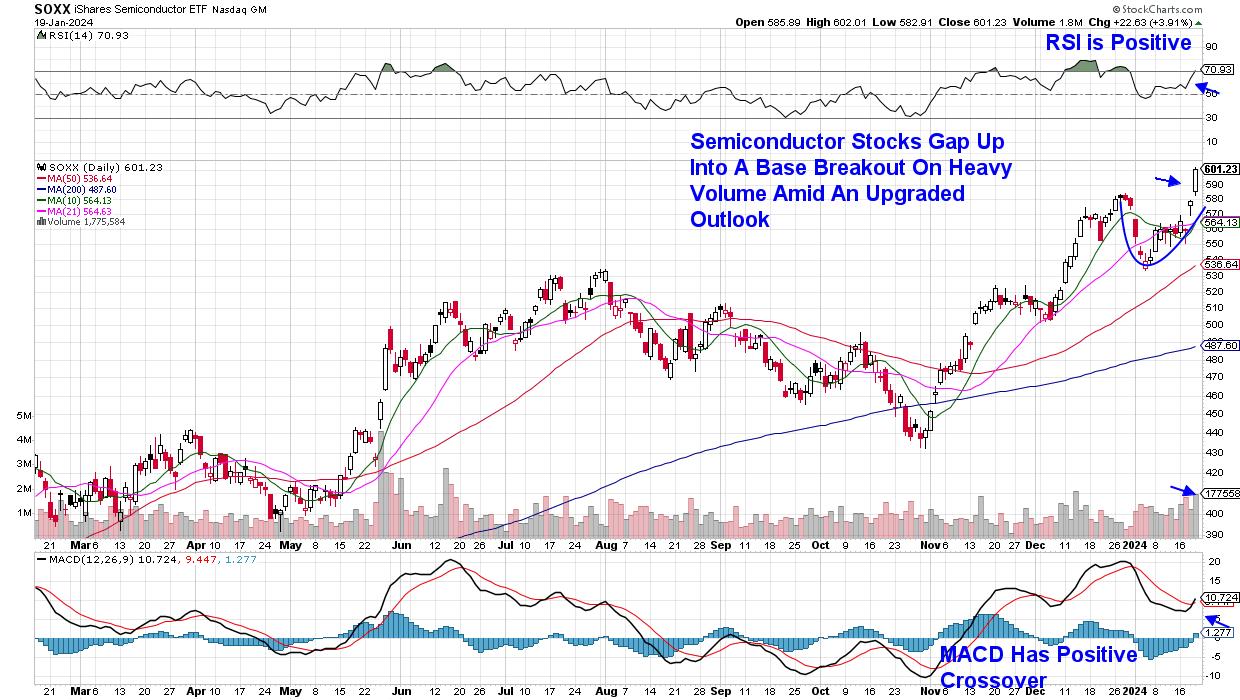

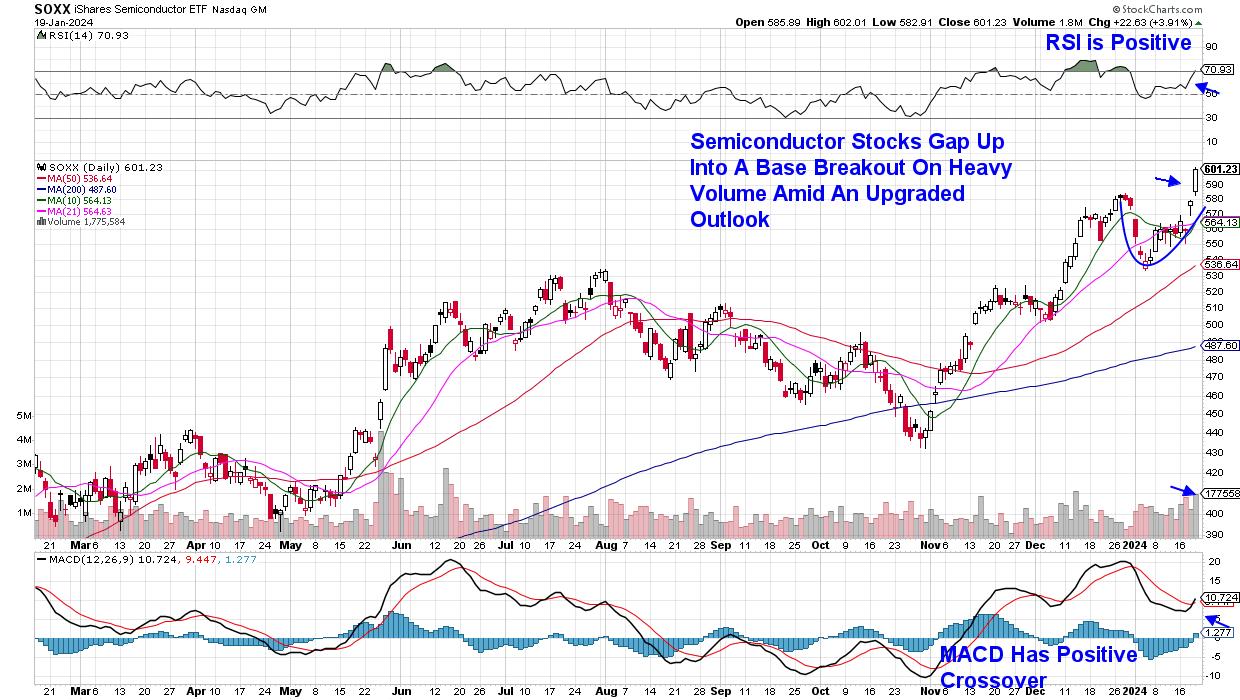

Tech and Semis Leading from the Dip

by TG Watkins,

Director of Stocks, Simpler Trading

The market was severely overbought going into the new year, so some steam was left off, which, as TG Watkins notes, we can see in the breadth readings. Now with notable names in the tech space leading and taking off, its time to get back in and see if the...

READ MORE

MEMBERS ONLY

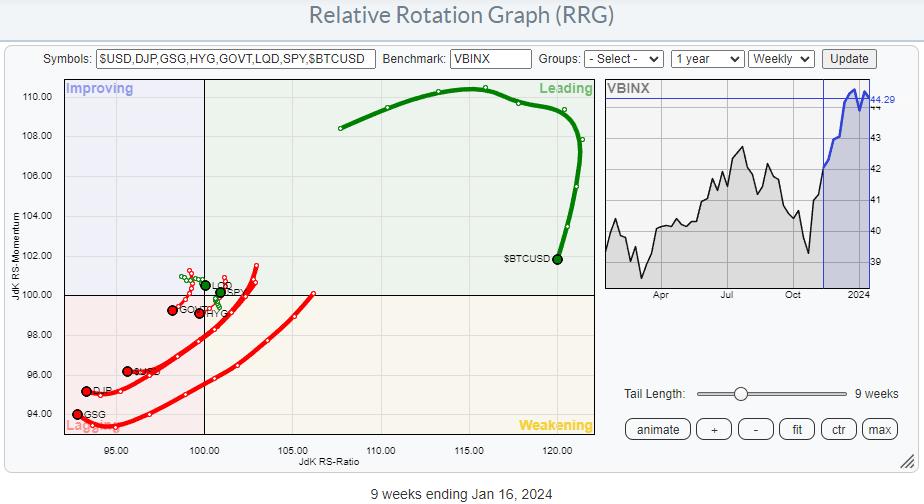

Watch Stocks Triumph in Latest Asset Allocation Battle

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

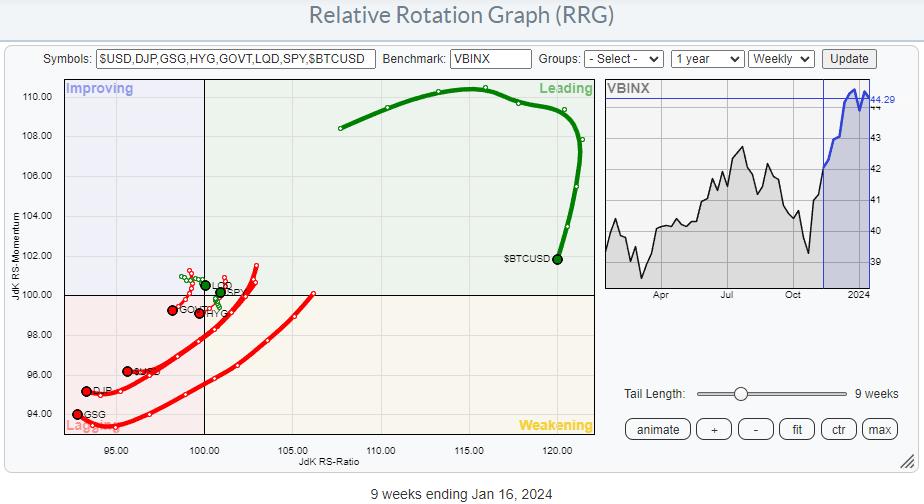

KEY TAKEAWAYS

* Commodities and USD rotating deep inside the lagging quadrant, indicating weak relative strength

* Bitcoin is in a strong relative uptrend vs all other asset classes, but going through a corrective phase

* Stocks are the clear winner in this asset allocation battle

The RRG above shows the rotation of...

READ MORE

MEMBERS ONLY

GNG TV: Active vs. Passive Investing

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

As the S&P 500 digests the rally to all time highs, Alex and Tyler take a look at GoNoGo Trend® conditions of several areas of the market on this edition of the GoNoGo Charts show. Amongst US equity indices, the Nasdaq and S&P offer more constructive...

READ MORE

MEMBERS ONLY

Utilities' Unique Seasonal Powers: The Best Months to Invest

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The Utilities sector has periods of cyclical outperformance

* Seasonality charts in StockCharts can identify which months Utilities are likely to outperform

* Analyzing a price chart of the XLU ETF can help time your entries so they coincide with seasonal patterns

The Utilities sector is known as a defensive...

READ MORE

MEMBERS ONLY

The Biggest Mistake Traders Make!

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains the number one mistake he sees traders make. He shows how both day traders and swing traders can get so laser-focused that they miss key components necessary for a successful trade; he then discusses why he...

READ MORE

MEMBERS ONLY

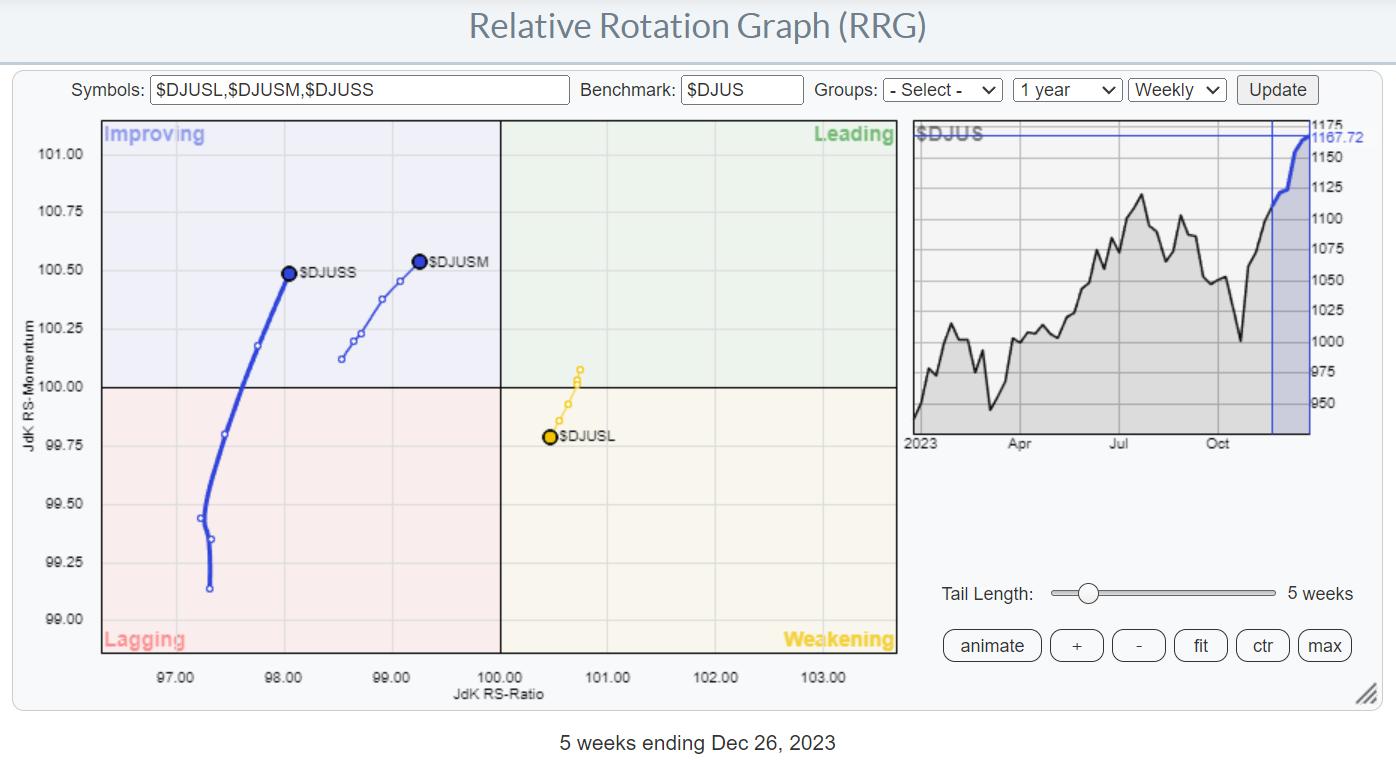

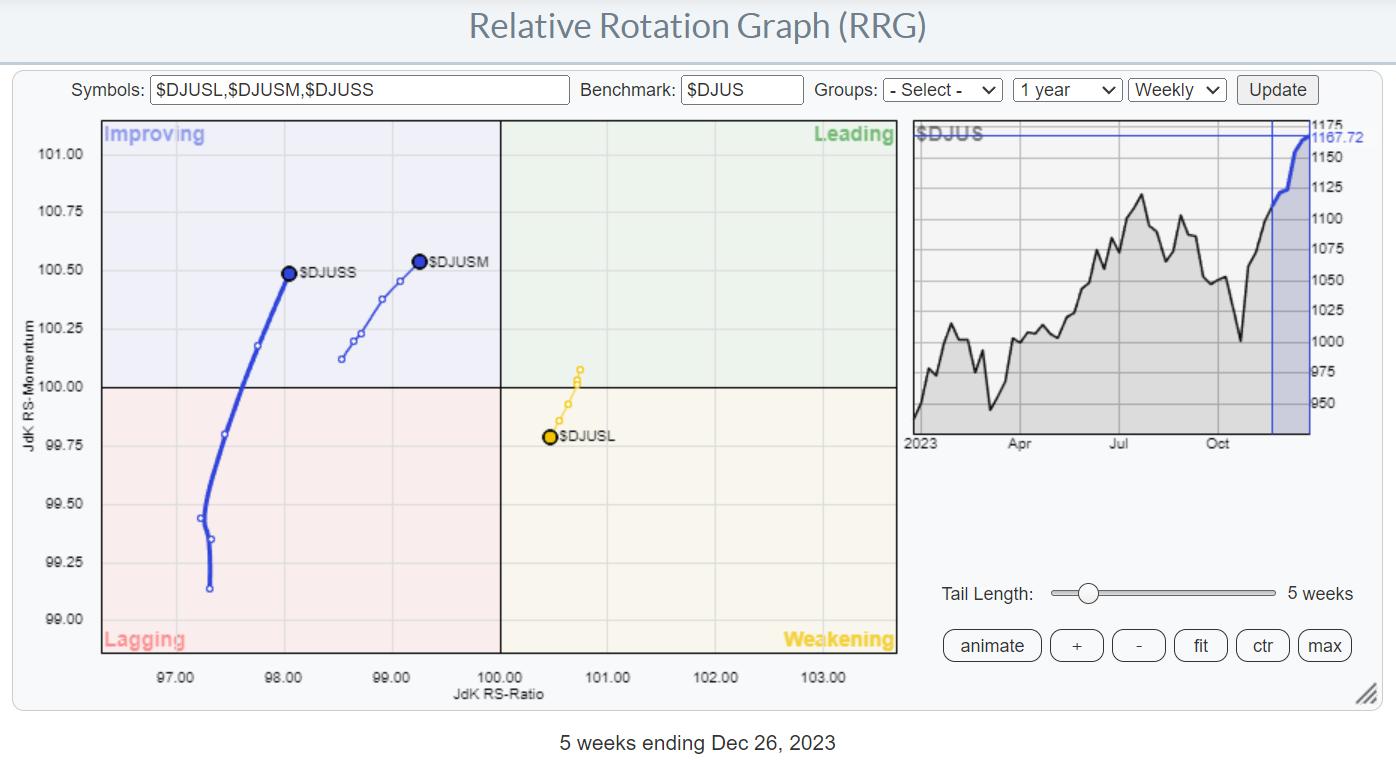

View The Large Cap - Small Cap Debate in a Direct Comparison on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Using RRG to see Large-Cap vs Small-Cap sector rotation

* The current strength for Small-Cap stocks vs Large-Caps is evident

At the end of last year, I wrote a blog article about the relationship between Large-Cap and Equal-Weight sectors. It involved plotting the ratios of the large-cap sector ETFs...

READ MORE

MEMBERS ONLY

Sector Spotlight: RRG Showing Strong Rotation For Stocks in All Time Frames

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Stocks Showing Relative Strength in All Time Frames on RRG

On this episode of StockCharts TV's Sector Spotlight, 2024's first episode, I dive into both Asset Class and Sector Rotation to set the stage for 2024. Today, I focus on a synchronized rotation of...

READ MORE

MEMBERS ONLY

MEM TV: The Easy Way to Uncover Stocks Poised to Outperform

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen takes a look at some of the items that drove price action last week. Growth stocks came roaring back for week two of 2024, which is great news for those that were believers last year. They can renew...

READ MORE

MEMBERS ONLY

Is the Market Ready for Another Dip?

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG points out how the market is still digesting the big move from the November/December run. It ran a huge sprint, and now needs to cycle down in order to create room for the next leg up. The internals...

READ MORE

MEMBERS ONLY

Drilling Down Into Gold and Silver

With the news on geopolitical escalation, soft versus hard landing, disinflation versus reinflation, growth versus value, and credit default versus available disposable income, gold and silver are even more interesting now.

Gold's behavior has been more of sell strength and buy weakness for some time. What has changed...

READ MORE

MEMBERS ONLY

GNG TV: Nothing "CRYPTIC" About These Go Trends!

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

As the SEC approved spot Bitcoin ETFs Wednesday, investors in a broad basket of cryptocurrencies witnessed strengthening Go trends and substantial advances in trends which took hold in October 2023. In this edition of the GoNoGo Charts show, Alex and Tyler review current trends across asset classes and sector groups....

READ MORE

MEMBERS ONLY

XLV's Record Rally: The Must-Know Investment Move of the Year

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The Healthcare Select SPDR ETF XLV has seen a 16% rise from its October low and is showing upside momentum

* Seasonal patterns in XLV show that July and November are the strongest months in terms of returns and higher close rates

* Combining seasonality patterns and technical indicators shows...

READ MORE

MEMBERS ONLY

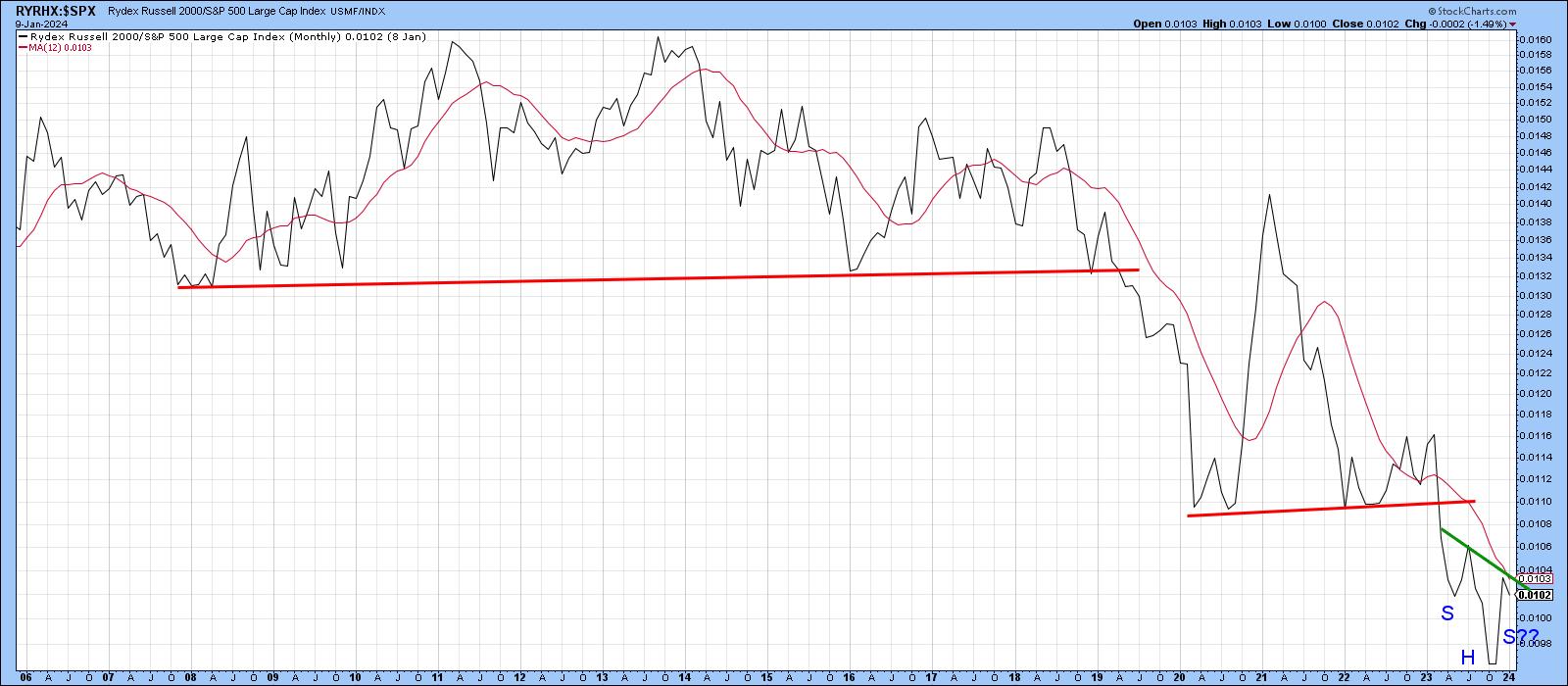

From Selloff to Surge: Growth Stocks Rebound After CPI

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave highlights three leading growth stocks continuing to push to new swing highs. He also breaks down key market sentiment indicators, including the VIX, AAII survey, NAAIM Exposure Index, Rydex fund flows, and put/call ratios.

This video originally premiered...

READ MORE

MEMBERS ONLY

Markets: Recap of This Week's Market Dailies

I began the week focused on bank earnings, which we will wake up to tomorrow. In that Daily, I wrote, "one can assume that bank stocks, which already started off the year extremely well, have potential to shine.

"However, we know that assumptions can be tricky. There are...

READ MORE

MEMBERS ONLY

The Secret Behind My Moving Average "Buddy" System

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how the 18MA can be a powerful tool when used in conjunction with the 40MA line. First, Joe explains why he uses a 18MA instead of a 20MA, demonstrating how this MA line can act as...

READ MORE

MEMBERS ONLY

SPOT ETFs APPROVED!! The Technical Case for Bitcoin

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Adrian Zduńczyk, CMT of The Birb Nest discusses upside potential for Bitcoin and Ethereum based on expectations around new Bitcoin ETFs, as well as a bullish technical configuration. Dave highlights leading growth stocks, like META scoring new 52-week highs, as...

READ MORE

MEMBERS ONLY

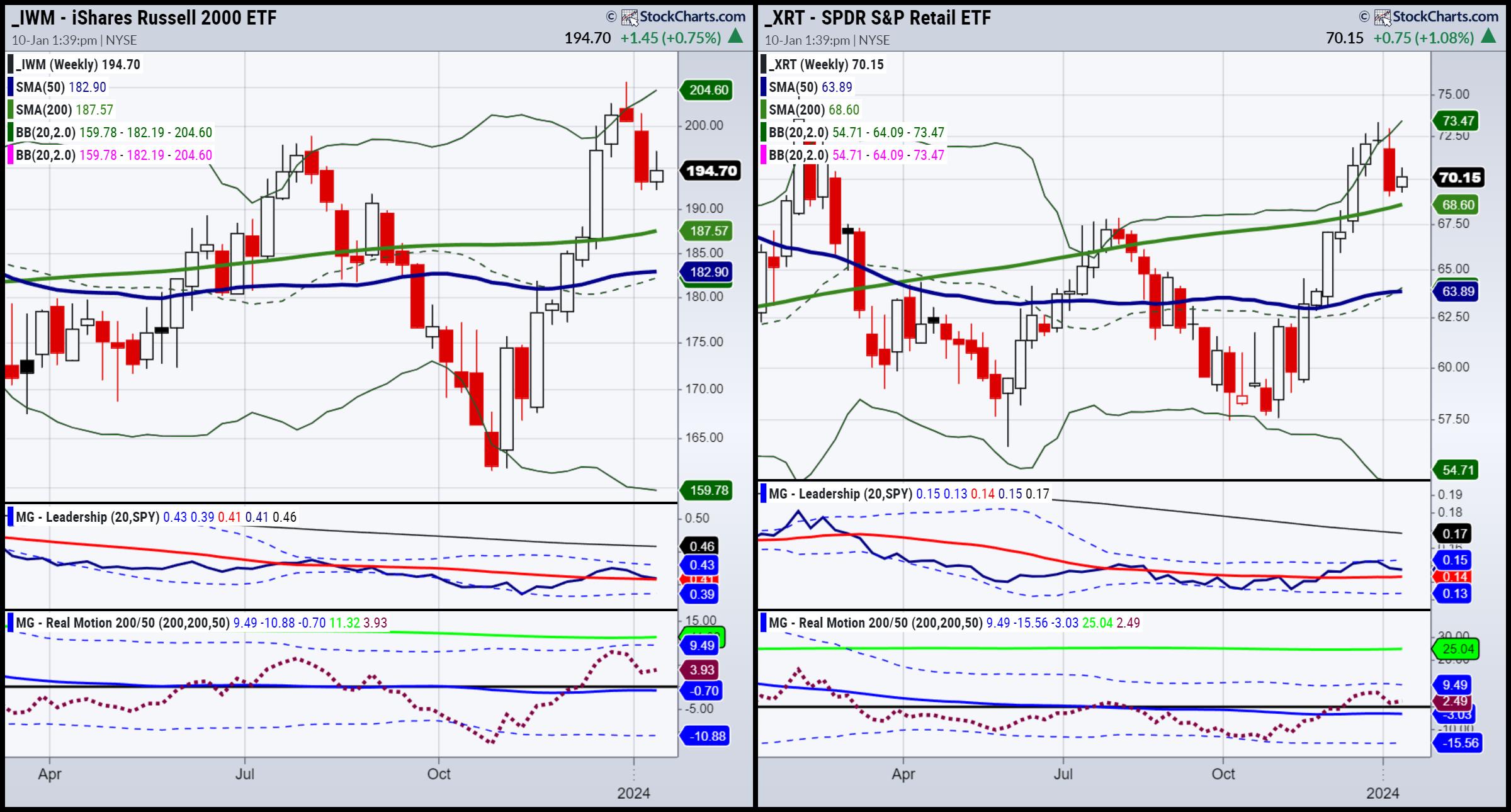

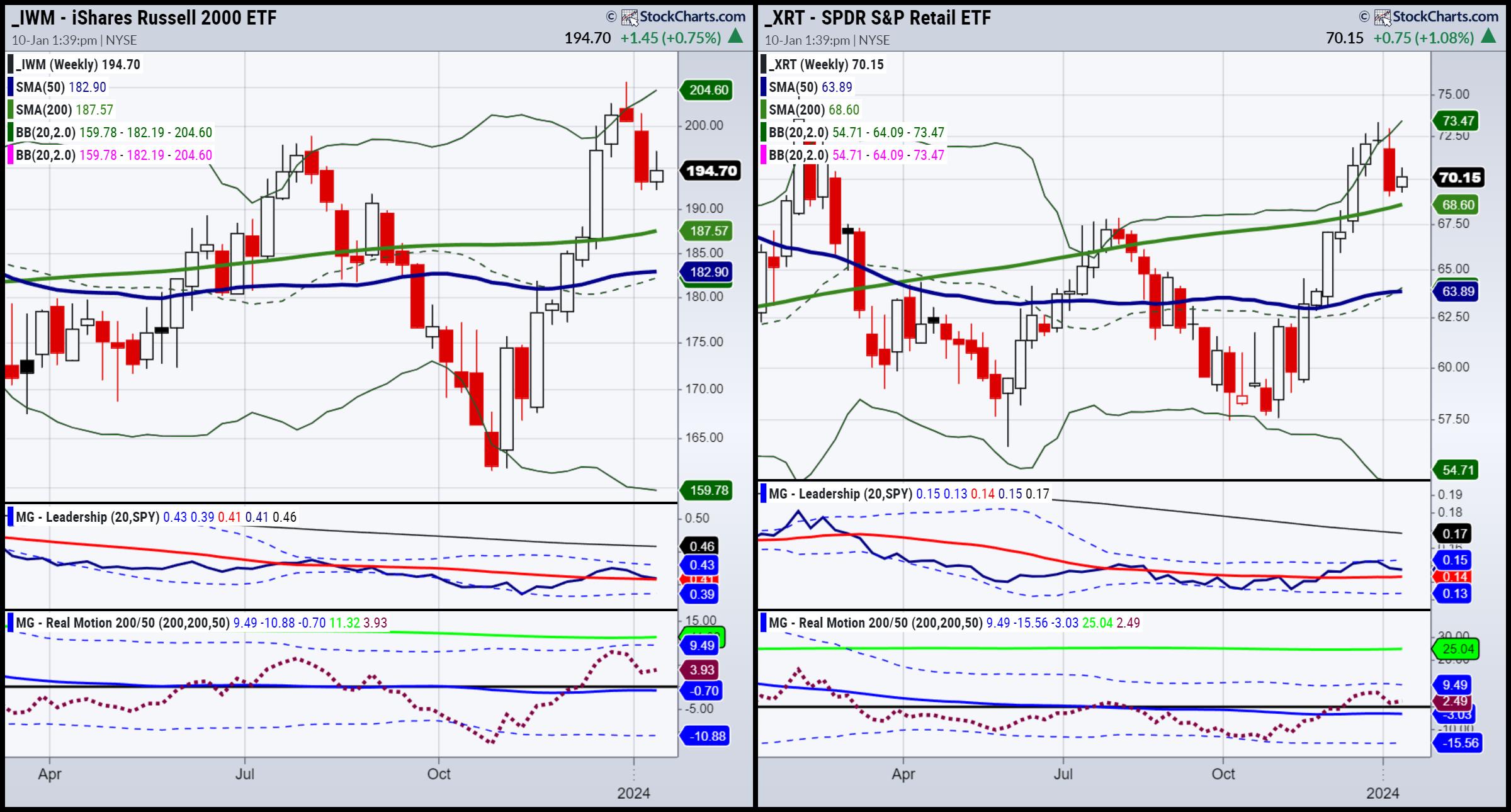

Markets: Week 1, Week 2 -- What's Next in Week 3?

Looking at the Economic Modern Family (weekly charts), all of them, to date, peaked in December. The Russell 2000, Regional Banks, Transportation and Retail, as far as index and sectors go, backed off the most from their peaks. Semiconductors are more sideways since the peak, as well as Biotech (which...

READ MORE

MEMBERS ONLY

The Halftime Show: Escape the Chaos - Discovering the Key to Tackling Market Uncertainty

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Uncertainty needs attention in order for it to make you second guess yourself. Instead, wait for trends to change, and then make changes. On this week's edition ofStockCharts TV'sHalftime, Pete Carmasino shares a broad market overview, starting with a divergence signal on the bullish percent of...

READ MORE

MEMBERS ONLY

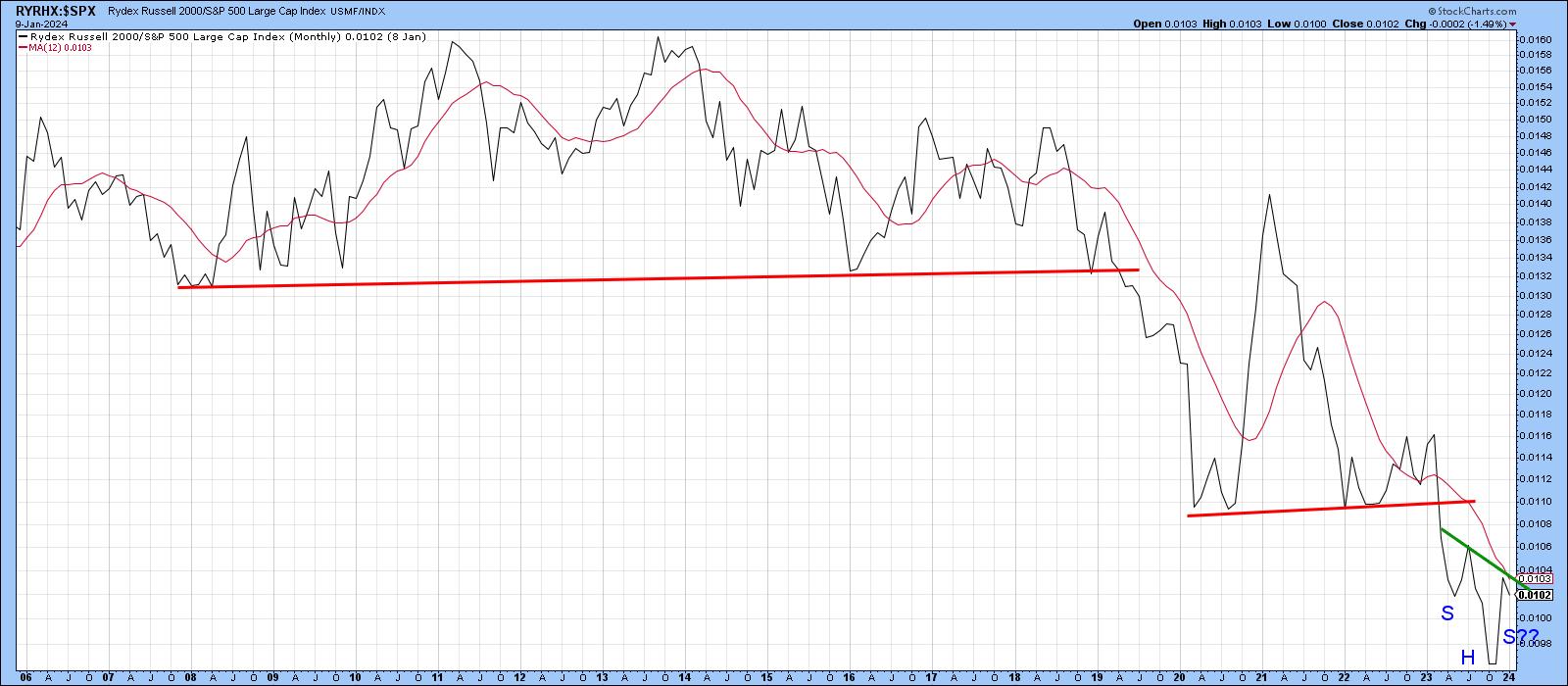

Is it Prime Time for Small Caps?

by Martin Pring,

President, Pring Research

A couple of weeks ago, I took note of the widespread interest in small caps amongst the technical community. I don't normally follow cap plays, but my contrary bones began to shake when I saw such acclaim at their recent performance following several false dawns in the last...

READ MORE

MEMBERS ONLY

January 2024: The Final Bar's Top 10 Must See Charts

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, Grayson Roze and Dave break down the trends for the top ten stocks and ETF charts for December 2023. They'll identify key levels and signals to watch for using technical analysis tools including moving averages, relative strength, RSI,...

READ MORE

MEMBERS ONLY

Bank Earnings Up -- Time to Look at Regional Banks ETF

Starting with the Jeffries Group on January 9th, by Friday, we will see Bank of America (BAC), JP Morgan (JPM), Wells Fargo (WFC), and Citigroup (C), as well as a few other banks, all report earnings.

In my 2024 Outlook and this Year of the Dragon, Raymond Lo writes, "...

READ MORE

MEMBERS ONLY

MEM TV: Jobs Growth Reveals NEW Opportunities in These AREAS

by Mary Ellen McGonagle,

President, MEM Investment Research

Not a great start to the year! In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen takes a look at where the broader markets closed, and sees we're hovering around some rather critical areas. The sharp pullback in growth stocks drove last week's...

READ MORE

MEMBERS ONLY

Prepare for 2024: Martin Pring's Expert Insights on the Equity Market

by Martin Pring,

President, Pring Research

In this must-see once a year special, Martin breaks down his comprehensive equity market outlook for 2024, accompanied by Bruce Fraser.

Encompassing a secular (multi-business cycle) perspective of the forces that are likely to influence stocks and bonds over the coming years, Martin presents a look ahead at what'...

READ MORE

MEMBERS ONLY

Unlocking Growth: The Importance of Market Pullbacks

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG highlights the continuing market pullback that started right around the turn of the new year. This is very much expected, since the November/December run was so intense. Most tickers have become overextended and are in need of coming...

READ MORE

MEMBERS ONLY

SPY Resting at Support, But Financials Showing Strength

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* SPY is testing, maybe breaking, short-term support

* Next support in 455 area

* Financials sector tails on daily and weekly RRG moving back in sync

* All banks inside the leading quadrant

HAPPY NEW YEAR!!! (I guess that is still allowed on day 5...)

Let's kick off the...

READ MORE

MEMBERS ONLY

Growth Stocks Drop Again -- and That's Just the Beginning?!?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Jeff Huge, CMT of JWH Investments speaks to how extreme breadth conditions, sky-high valuations and overly bullish sentiment readings could indicate the beginning of a bear phase in 2024. Dave highlights two value sectors showing renewed signs of strength...

READ MORE

MEMBERS ONLY

GNG TV: Remaining Objective About Trading Rules is CRITICAL!

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, Alex and Tyler take a look at the GoNoGo Trend® conditions of several key areas of the market. The seasonal roadmap of 2023 may be overemphasized by many market commentators, and remaining objective about trading rules is critical in times like these....

READ MORE

MEMBERS ONLY

January: NASDAQ Has the Best Odds of Gains, BUT...

"January provides us with a wealth of information that gets our year off to a good start, financially and emotionally.

"The data is specifically chosen to begin in 2009 because that is the bottom of the most significant bear market prior to the 2022 bear market, and 2009...

READ MORE

MEMBERS ONLY

Guidelines for 2024 | Focus on Stocks: January 2024

by Larry Williams,

Veteran Investor and Author

Let's Get This Out of The Way Right Now

For the last 18 years, I've had a love affair with my annual forecast report. Until I began writing this letter, it was the only thing I did. Many of you purchased it last year, and some...

READ MORE

MEMBERS ONLY

MEM TV: Don't Miss These! TOP Sector and Industry PICKS for 2024

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, join Mary Ellen as she as she dives into the latest news and trends that are driving price action in the markets. From housing updates to consumer confidence and inflationary data, she breaks it all down and shows you how...

READ MORE

MEMBERS ONLY

GNG TV: GO TRENDS Emerging Across the Globe!

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, as the S&P 500 continues trading at all-time highs on this final trading day of the year, Alex and Tyler take a look at GoNoGo Trend® conditions across asset classes, style boxes, and emerging markets indices. The conditions in the...

READ MORE

MEMBERS ONLY

Which Sectors Benefit Most From the Large- to Mid- & Small-Cap Rotation?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Money rotating away from large-cap stocks

* Re-distribution and new inflow to mid- and small-caps

* Majority of sectors show preference for equal weight ETFs over Cap-Weighted counterparts

I have used this Relative Rotation Graph regularly in the past few weeks to indicate the ongoing rotation out of large-cap stocks...

READ MORE

MEMBERS ONLY

Intermediate-Term Participation Levels Are Very Overbought, and They Are Weak Long-Term

by Carl Swenlin,

President and Founder, DecisionPoint.com

When we discuss participation, we are referring to the more specific and accurate assessment of breadth available with the Golden Cross and Silver Cross Indexes. The venerable and widely-known Golden Cross is when the 50-day moving average of a price index crosses up through the 200-day moving average, which signals...

READ MORE

MEMBERS ONLY

MEM TV: Markets in Bullish Mode as We Head Toward Year-End

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, join Mary Ellen as she as she dives into the latest news and trends that are driving price action in the markets. From housing updates to consumer confidence and inflationary data, she breaks it all down and shows you how...

READ MORE

MEMBERS ONLY

The Top Five Charts of 2023

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* 2023 was dominated by mega cap growth stocks, but the fourth quarter saw a potential change as other sectors experienced renewed vigor.

* Three breadth indicators provided great clarity to the up and down cycles over the course of the year, as extreme readings tended to coincide with major...

READ MORE

MEMBERS ONLY

More from Mish's Outlook 2024 -- S&P 500

A passage from the Outlook:

SPY's all-time high was made in January 2022 at $479.98.

For now, the chart looks clear. If SPY pushes over 460, we can expect more upside at least until we get near the ATHs.

Should those levels clear, then we are in...

READ MORE

MEMBERS ONLY

What Would It Take for Emerging Markets to Emerge?

by Martin Pring,

President, Pring Research

Over the years, emerging markets as a group have experienced huge swings in relative performance. The latest one, which began in 2010, has been quite bearish. When such linear trends dominate the scene, reliable cyclical indicators, such as the long-term KST or monthly MACD, often give premature buy signals and...

READ MORE

MEMBERS ONLY

Size (Matters) Over Style!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Growth and Value are moving together in an unusual rotation

* Money from large-cap stocks being distributed into mid- and small-cap segments

* Even all Mag7 names dropping in price is not enough to pull down benchmark indices

Something Strange is Going On

Or, at least, something unusual.

On the...

READ MORE

MEMBERS ONLY

The 2 Best Holiday Gifts You Can Give Your Kids!

by Gatis Roze,

Author, "Tensile Trading"

Let's begin with the bottom line.

As parents, our reason for being here on planet Earth is to pass on to our children the life skills they'll need to succeed. Everyone talks about leaving a better planet for our children; why don't we try...

READ MORE