MEMBERS ONLY

MEM TV: Don't Miss the Move Into These NEW Areas!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shows you what to be on the alert for, with the broader markets in an oversold position as we head into year-end. She also highlights which areas are poised to continue to trade higher, sharing some individual stocks...

READ MORE

MEMBERS ONLY

Are We Seeing 2020 All Over Again!?

by TG Watkins,

Director of Stocks, Simpler Trading

The market exploded higher after already being on a winning streak for 5 weeks. While there are blow-off top vibes, there could be a lot of money able to come in from the sidelines to keep the market going. In this week's edition of Moxie Indicator Minutes, TG...

READ MORE

MEMBERS ONLY

How is the Economic Modern Family Liking Santa Now?

This is a great time to examine the weekly charts of the Economic Modern Family. We like that timeframe for now, with only a short number of trading days left. And there's lots of news constantly unfolding:

1. Rate cuts/no rate cuts

2. Middle East heating up...

READ MORE

MEMBERS ONLY

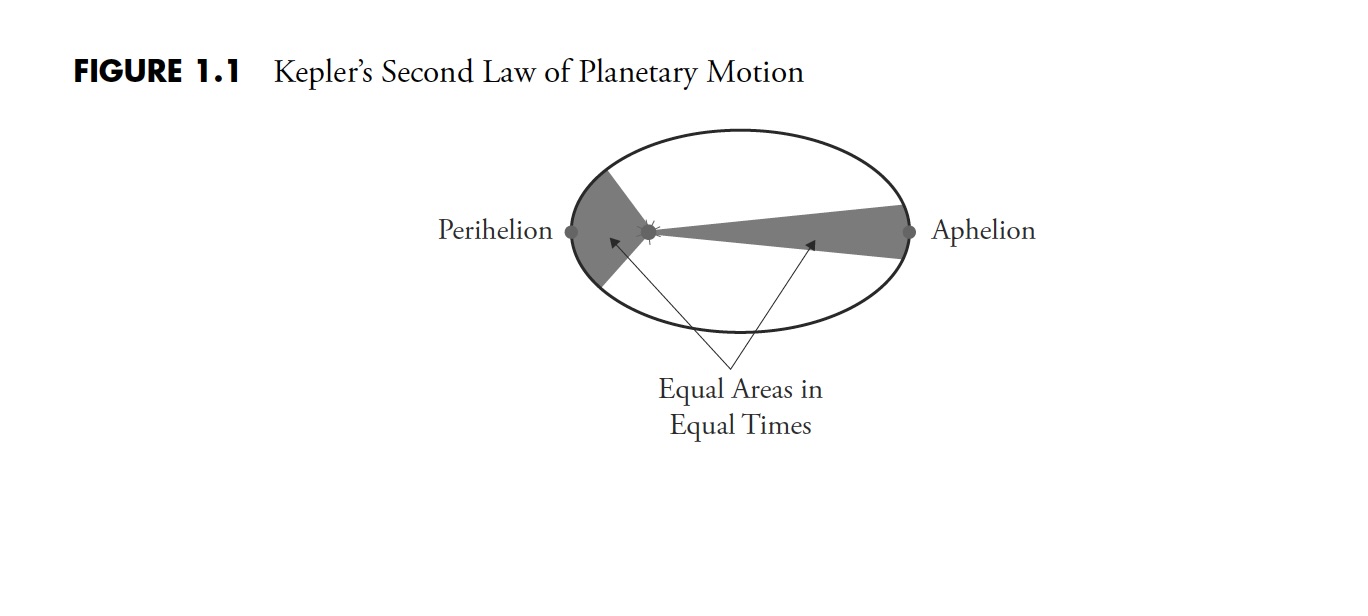

The Hoax of Modern Finance - Part 2: Indicators, Terminology, and Noise

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: Over the next couple of weeks and months, I will be republishing the contents of my book, "Investing with the Trend," in article form here on my blog. I'm calling this series "The Hoax of Modern Finance" for reasons you...

READ MORE

MEMBERS ONLY

Find Aggressive Entry Opportunities & Tradeable Trends with Multi-Timeframe Charts

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use multiple timeframes to help when getting an aggressive entry in a stock. He starts by explaining the tradable trend, then shows how an aggressive opportunity develops. To close out the show, he analyzes...

READ MORE

MEMBERS ONLY

The Halftime Show: Crude Oil Back in the "White House Buy Zone"

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

On this week's edition ofStockCharts TV'sHalftime, Pete covers the major indexes and reviews the bullish percents of the S&P 500 and Nasdaq 100, before then taking a look at the NYSE FANG+ index. After that, he highlights the fact that crude oil is back...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 1: Introduction

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: Over the next couple of weeks and months, I will be republishing the contents of my book, "Investing with the Trend," in article form here on my blog. I'm calling this series "The Hoax of Modern Finance" for reasons you...

READ MORE

MEMBERS ONLY

Renewed UPTREND for Semis -- SMH and SOXX ETFs Breaking Out!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps the renewed uptrend for semis, with ETFs like SMH and SOXX breaking out despite a lack of participation from the largest semiconductor name, Nvidia (NVDA). He answers viewer questions on QQQ, Netflix (NFLX), Resmed (RMD), Avis Budget Group...

READ MORE

MEMBERS ONLY

MEM TV: Here's Why Growth Stocks Outperformed Last Week!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews last week's muted price action in the markets, which occurred despite impactful economic data. She also highlights where the broader markets are headed and best ways to participate in the select areas that are outperforming...

READ MORE

MEMBERS ONLY

Small-Caps Take Pole Position In Overbought Market

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG notes that the market is finally letting some steam out which is what we want since we need this to present fresher opportunities for us to buy. TG presents some great examples of how to use and read the...

READ MORE

MEMBERS ONLY

Lift Off! Aerospace and Defense Stocks Showing Multi-Year Breakout

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Jeff Huge, CMT of JWH Investment Partners highlights one industry within the Industrial sector showing a multi-year breakout, and lays out the bull case for gold in 2024. Dave reviews travel and tourism charts, speaks to the strength in...

READ MORE

MEMBERS ONLY

GNG TV: What Lies Ahead For End-of-the-Year Equities?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, Alex and Tyler take a top-down approach to the markets as they apply the GoNoGo suite of tools to all the major asset classes. Starting with a look at macro factors effecting equity investors, they discuss the technical analysis from trend, momentum,...

READ MORE

MEMBERS ONLY

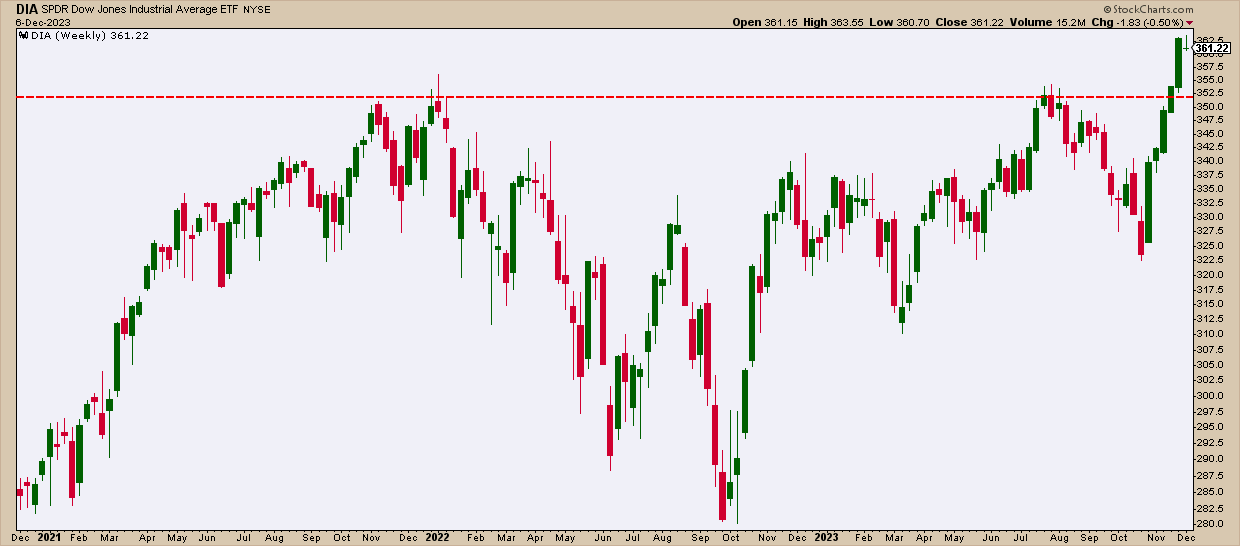

Santa Claus Rally Alert: Predicting a 70% Chance of Surge in the Dow Jones This December!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* December has seen the Dow Jones Industrial Average rally 7 out of 10 times in December since 1896.

* DIA is seeing support at its former resistance level of $352.

* DIA has pulled back from "overbought" highs, which looks favorable for market engagement.

It's that...

READ MORE

MEMBERS ONLY

45% of Market Capitalization In S&P 500 Showing Strong Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* RRG showing very distinct opposite rotations

* Once Sector Inside Leading and Two Sectors Inside Improving and Pushing toward Leading

* Energy Sector At Risk of Completing a Massive Double Top Formation

Usually, I would do this week's Sector Spotlight on the completed monthly charts for November. But...

READ MORE

MEMBERS ONLY

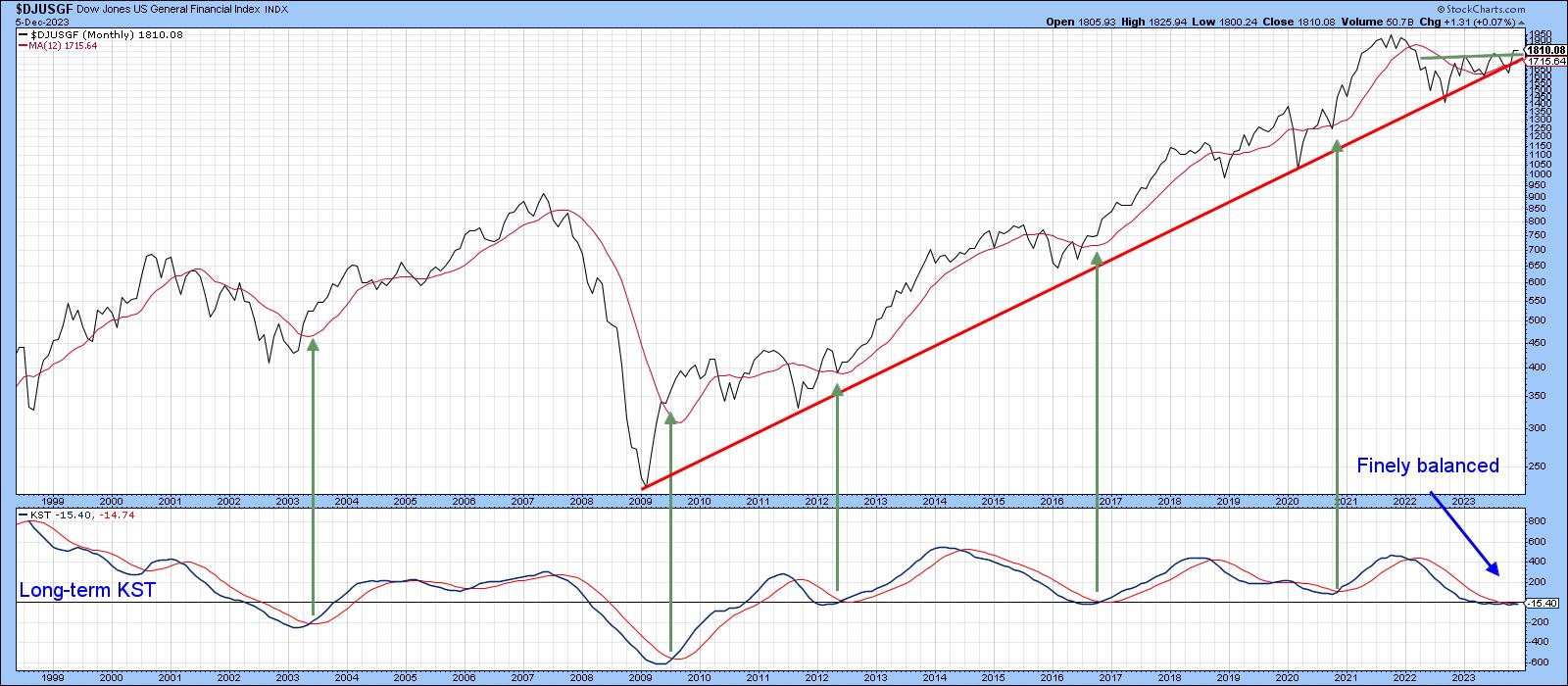

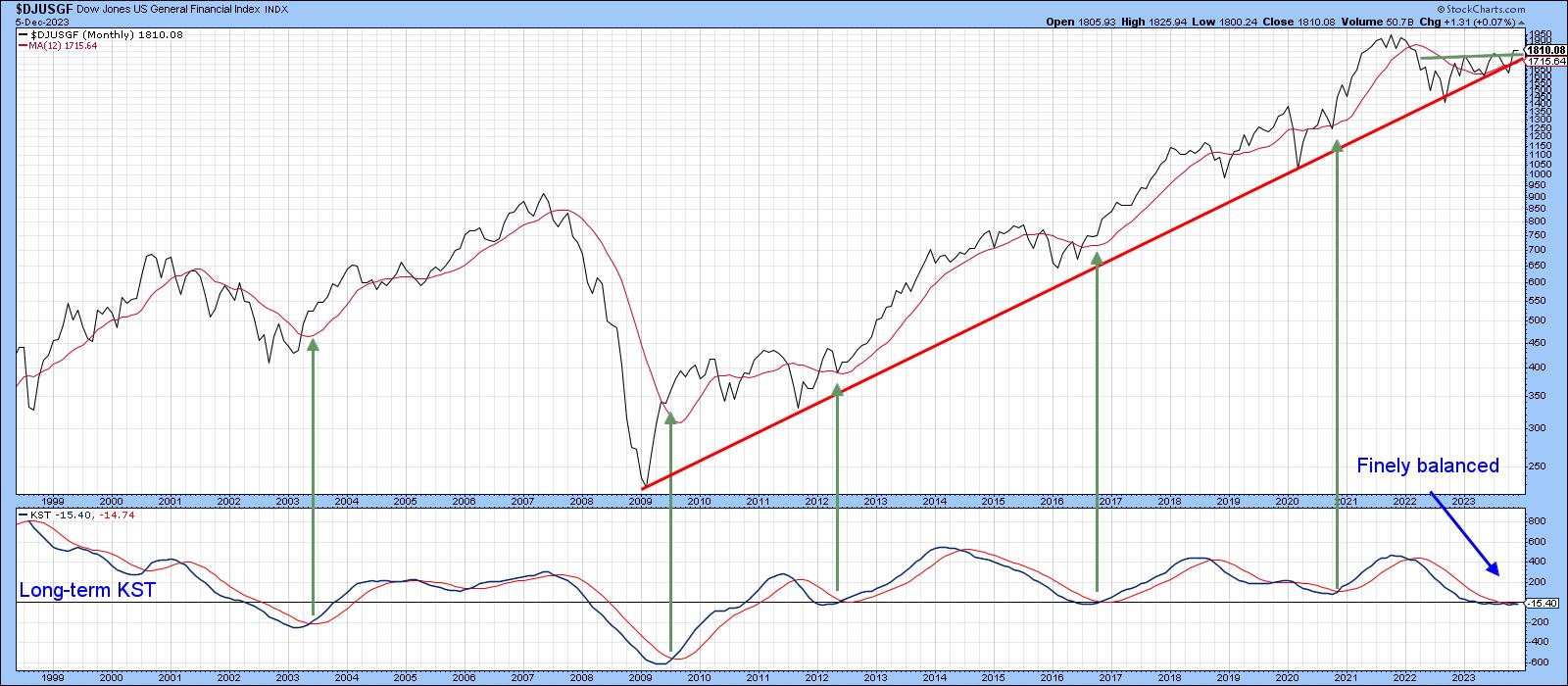

Are Financials Ready to Extend their Leadership?

by Martin Pring,

President, Pring Research

Technology (XLK) and Communications Services (XLC) have been the leaders since the bull market began in October of last year. However, they may need to look over their shoulders, as financials have been creeping up since the October 27 intermediate low. The short answer to the question posed by the...

READ MORE

MEMBERS ONLY

Is Every Stock on the Planet Overbought?!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, host David Keller, CMT shows how mega-cap growth stocks like NFLX and GOOGL have pulled back from overbought conditions, and reviews how other market segments like gold and small caps are experiencing a similar pattern of upside exhaustion. He takes...

READ MORE

MEMBERS ONLY

Fresh Trade Opportunities as Market Eases Up on the Reins!

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG notes that the market is finally letting some steam out which is what we want since we need this to present fresher opportunities for us to buy. TG presents some great examples of how to use and read the...

READ MORE

MEMBERS ONLY

Unlock the Secrets of Five Candlestick Patterns

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe presents 5 specific candlestick patterns and how to use them. He explains how the location of these candles have an impact on their importance, and also discusses how a higher timeframe candle can help with trades on...

READ MORE

MEMBERS ONLY

Santa Comes to Wall Street | Focus on Stocks: December 2023

by Larry Williams,

Veteran Investor and Author

Santa Comes to Wall Street

Maybe St. Nick gets into the eggnog before he visits Wall Street each year, because the trading pattern has been a step up, then a stumble down before recovering at the end of the year. I first noticed this Up-Down-Up pattern back in the early...

READ MORE

MEMBERS ONLY

The Halftime Show: Are Rate Cuts on the Horizon? Watch the Jobless Claims

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

As Pete has said several times on theHalftimeshow before, the Fed will likely cut rates when the unemployment rate ticks higher. Year-to-date the unemployment rate is up 14% from its lows in January and even Christopher Waller, an economist and member of the Fed Board of Governors, mentioned the possibility...

READ MORE

MEMBERS ONLY

Three Markets That are Right At Significant Breakout Points

by Martin Pring,

President, Pring Research

A lot of the time, I write articles that focus on markets or technical situations that should be monitored for a potential turn. This one is no different, except to say that these markets are not close to breakout points, but right at them. In short, it's fish-or-cut-bait...

READ MORE

MEMBERS ONLY

Economic Modern Family -- Home for the Holidays, Part 2

Over the weekend, I covered small caps, retail, semiconductors and transportation. The conclusion was that "If you put these four charts all together, we get a reunion that is filled with the makings of a family breakdown. While Granny XRT and Sister Semiconductors SMH give us investors reasons to...

READ MORE

MEMBERS ONLY

Market Secrets Revealed! Final Bar Mailbag -- US Dollar, S&P 500 ETF, Fibonacci Pivots

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave devotes the show to the Mailbag. He answers viewer questions about the impact of the US Dollar on the stock market, why he uses the S&P 500 ETF rather than the S&P Index for relative...

READ MORE

MEMBERS ONLY

Economic Modern Family -- Home for the Holidays

In the 1995 film, Home for the Holidays, family reunions are explored using both drama and comedy. The film illustrates how we outsiders looking in never really know the love and the madness that goes on inside any one family's home during Thanksgiving.

Happily, our Economic Modern Family...

READ MORE

MEMBERS ONLY

A NEW ERA of Growth Leadership?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Mary Ann Bartels of Sanctuary Wealth describes how falling interest rates could pave the way for another leadership by mega-cap growth stocks, including semiconductors. Host David Keller, CMT breaks down two market breadth indicators to watch into December and...

READ MORE

MEMBERS ONLY

Check These Out: Buyable Pullbacks Under the Surface!

by TG Watkins,

Director of Stocks, Simpler Trading

In the previous episode, TG explained that we needed to wait for the right opportunities to buy pullbacks from when the market shot up. The mega-caps and the major indexes did one small day of pulling back, but underneath that, many individual stocks have pulled back and come into buyable...

READ MORE

MEMBERS ONLY

Cap-Weighted Leadership Is Unhealthy

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

Below is a reprint of an article written Thursday in the subscriber-only DecisionPoint Alert:

One of the things we keep track of is the performance of the S&P 500 Index (SPY), which is cap-weighted, versus the S&P 500 Equal Weight Index (RSP). In a healthy bull...

READ MORE

MEMBERS ONLY

MEM TV: Easy Way To Uncover Best Candidates for These Markets

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reveals areas of the market that are reversing lengthy downtrends and the best way to participate. She also highlights where the strength is in the markets as the uptrend remains firmly in place.

This video originally premiered November...

READ MORE

MEMBERS ONLY

Recap and Action Plan: Small Caps, Beans, Oil

Since we came back from vacation, I've written 3 Dailys. The first of these was on the Economic Modern Family and how it opened its loving arms to the bulls.

I was particularly keen on small caps or the Russell 2000 (IWM). I wrote, "Beginning with Granddad...

READ MORE

MEMBERS ONLY

Stock Market Welcomes Us Home in a Big Way

The Economic Modern Family has opened its loving arms to the bulls and to us after our 2 weeks away.

Beginning with Granddad Russell 2000 (IWM), Monday began with a gap up over the 50-DMA (blue). We will watch for a phase change confirmation. Furthermore, the monthly chart shows IWM...

READ MORE

MEMBERS ONLY

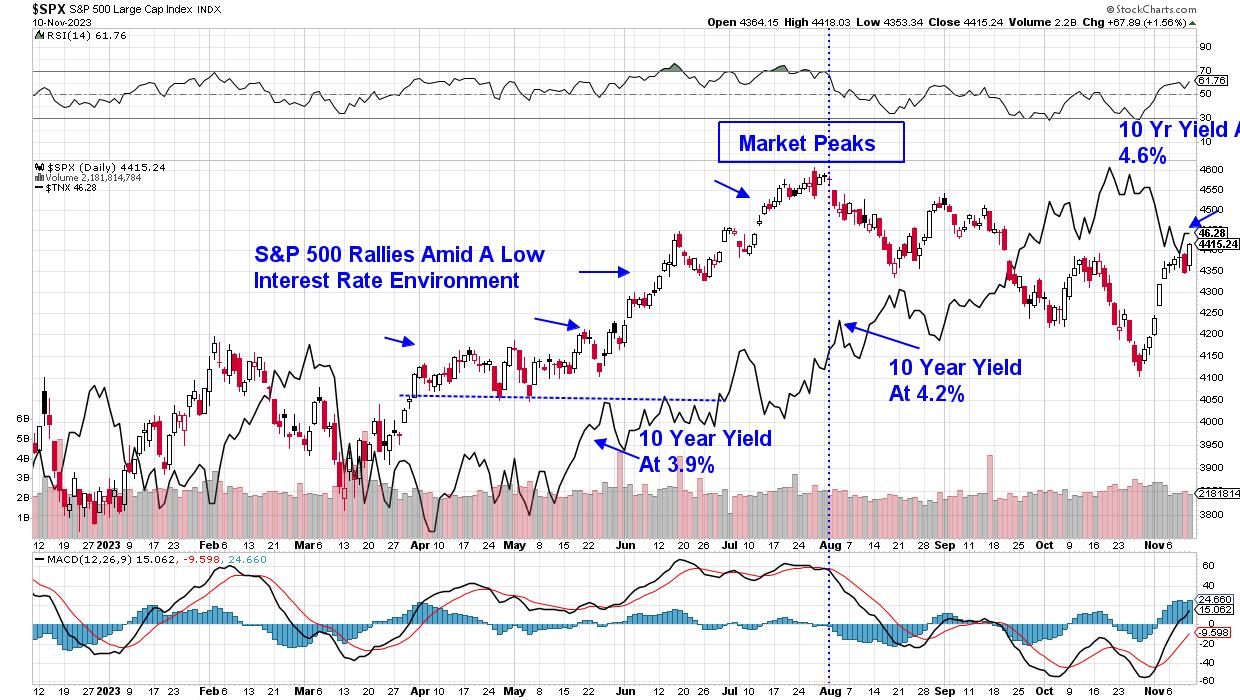

A Supercharged Stock Market Rally: Catch These Stocks Before They Get Away

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Cooling CPI data sends equities roaring higher

* The 10-year Treasury yield fell below 4.5%, a critical support level

* Small-cap stocks were clearly the biggest winners today

October's unchanged headline US CPI and lower-than-expected core CPI were reasons for investors to celebrate. The broader stock market...

READ MORE

MEMBERS ONLY

Finding Setups as Markets Wait for October CPI

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave identifies bullish and bearish momentum divergences as the equity and bond markets await the October CPI reading on Tuesday morning. He answers questions covering Brent crude oil prices, uranium stocks, inverse head and shoulders patterns, and upside potential for...

READ MORE

MEMBERS ONLY

DP Trading Room: Is Your Portfolio OUTDATED? The Truth About The 60/40 Mix

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens the show with a discussion about the typical 60/40 Portfolio (60% US Stocks/40% US Bonds) and whether it will continue to serve you well given the decline in Bonds. Is this portfolio blend obsolete? Both...

READ MORE

MEMBERS ONLY

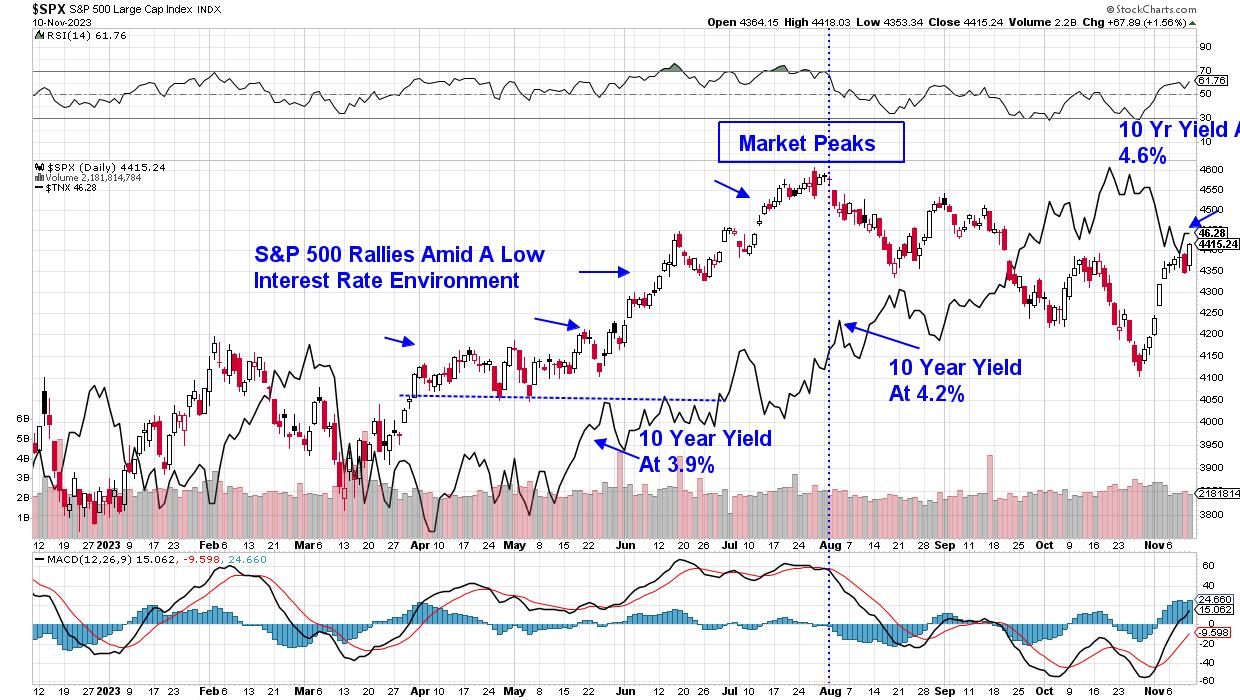

Focused Market Leadership Ahead Of Core Inflation Data - Here's What Investors Need To Look Out For

by Mary Ellen McGonagle,

President, MEM Investment Research

On Friday, the Nasdaq Composite posted its best day in more than five months, with a 2% rally that pushed this Index further into an uptrend. The S&P 500 had a good day as well, with all eleven sectors advancing higher. The sharp gain in the Nasdaq was...

READ MORE

MEMBERS ONLY

Moxie Indicator Alerts: Predicting Yesterday's Market Pullback!

by TG Watkins,

Director of Stocks, Simpler Trading

We had been patiently waiting for the action that happened yesterday, even though it was down. In this week's edition of Moxie Indicator Minutes, TG shows you real alerts from the Moxie Indicator Trading room that called the pullback before it happened, and presents how you too can...

READ MORE

MEMBERS ONLY

Stock Market Still Has Legs, Bitcoin Sees a Breakthrough Rally: Is the Market On the Mend?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market makes major gains with the S&P 500 and Nasdaq Composite closing above previous highs

* The 10-Year Treasury yield retested its 4.5% level and reversed to the upside

* Bitcoin rallied to close the week above 37,000

It was quite the week in...

READ MORE

MEMBERS ONLY

This Relative Strength Signal Can Provide Early Warning Signs

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how to use comparative relative strength to identify important shifts in trend, sometimes well in advance of price. He explains what the line means, plus how to use it to provide early warning signals and for...

READ MORE

MEMBERS ONLY

Market is UP After 10% Correction; Is a V Bottom in Place?

by TG Watkins,

Director of Stocks, Simpler Trading

The market has been signalling over-sold in multiple ways over the last 3 months, but we finally got a trigger, right around the 10% correction market plus FOMC. Powell was pretty neutral, but whatever it was, the market decided it liked it. So a V bottom appears to be in...

READ MORE

MEMBERS ONLY

This Country ETF Rallies Sharply After War Breaks Out

by Martin Pring,

President, Pring Research

Understandably, most Middle Eastern country ETFs have performed poorly since the war broke out, but there is one noticeable exception, which I will get to later.

Israel

First, as might be expected, the iShares Israel ETF (EIS) has moved lower and completed what looks to be a massive top. The...

READ MORE

MEMBERS ONLY

Focus on Stocks: November 2023

by Larry Williams,

Veteran Investor and Author

The Million Dollar Stock Market Bet

Warren Buffett proved his point in 2016 when he bet $1,000,000 that the S&P 500 Stock Index would outperform hedge funds. His bet was that active investment management by professionals would under-perform the returns of people who were passively investing....

READ MORE