MEMBERS ONLY

From Tariffs to Tech: Where Smart Money's Moving Right Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Stay ahead of the market in under 30 minutes! In this video, Mary Ellen breaks down why the S&P 500 just broke out, which sectors are truly leading (industrials, technology & materials), and what next week's inflation data could mean for your portfolio.

This video originally...

READ MORE

MEMBERS ONLY

Silver's Surge is No Fluke—Here's the Strange Ratio Driving It

by Karl Montevirgen,

The StockCharts Insider

Silver just hit a 13-year high, breaking above a key resistance level that could ignite a major bull run. Some metals analysts now say a rally to $40 isn't a long shot, but a matter of time. So, are the odds finally shifting in favor of the bulls?...

READ MORE

MEMBERS ONLY

Strategic Chaos or Tactical Goldmine? What QQQ's Chart is Whispering Right Now

by Karl Montevirgen,

The StockCharts Insider

Despite the uncertainty prevailing in the markets, the Nasdaq 100 Index ($NDX) has proven resilient, perhaps more so than its peer benchmarks. The 90-day trade truce between the U.S. and China, initiated in May, boosted investor confidence. Yet that's now at risk amid mutual accusations of violations....

READ MORE

MEMBERS ONLY

S&P 500 Bullish Patterns: Are Higher Highs Ahead?

by Frank Cappelleri,

Founder & President, CappThesis, LLC

In this market update, Frank breaks down recent developments across the S&P 500, crypto markets, commodities, and international ETFs. He analyzes bullish and bearish chart patterns, identifies key RSI signals, and demonstrates how "Go No Go Charts" can support your technical analysis. You'll also...

READ MORE

MEMBERS ONLY

This Important Metal Could Be on the Verge of a Mega-Breakout

by Martin Pring,

President, Pring Research

Gold has been on a tear since 2022, leaving other metals in the dust. Nevertheless, it's important to remember that the yellow metal has a strong tendency to lead commodities in general, which implies the likelihood of inflationary pressures in the commodity pits going forward. The leads and...

READ MORE

MEMBERS ONLY

Hedge Market Volatility with These Dividend Aristocrats & Sector Leaders

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen highlights key areas of the stock market that gained strength last week, including Staples and Aerospace stocks. She also shares several Dividend Aristocrat stocks that can help stabilize your portfolio in times of market volatility.Whether you're seeking defensive plays or looking to...

READ MORE

MEMBERS ONLY

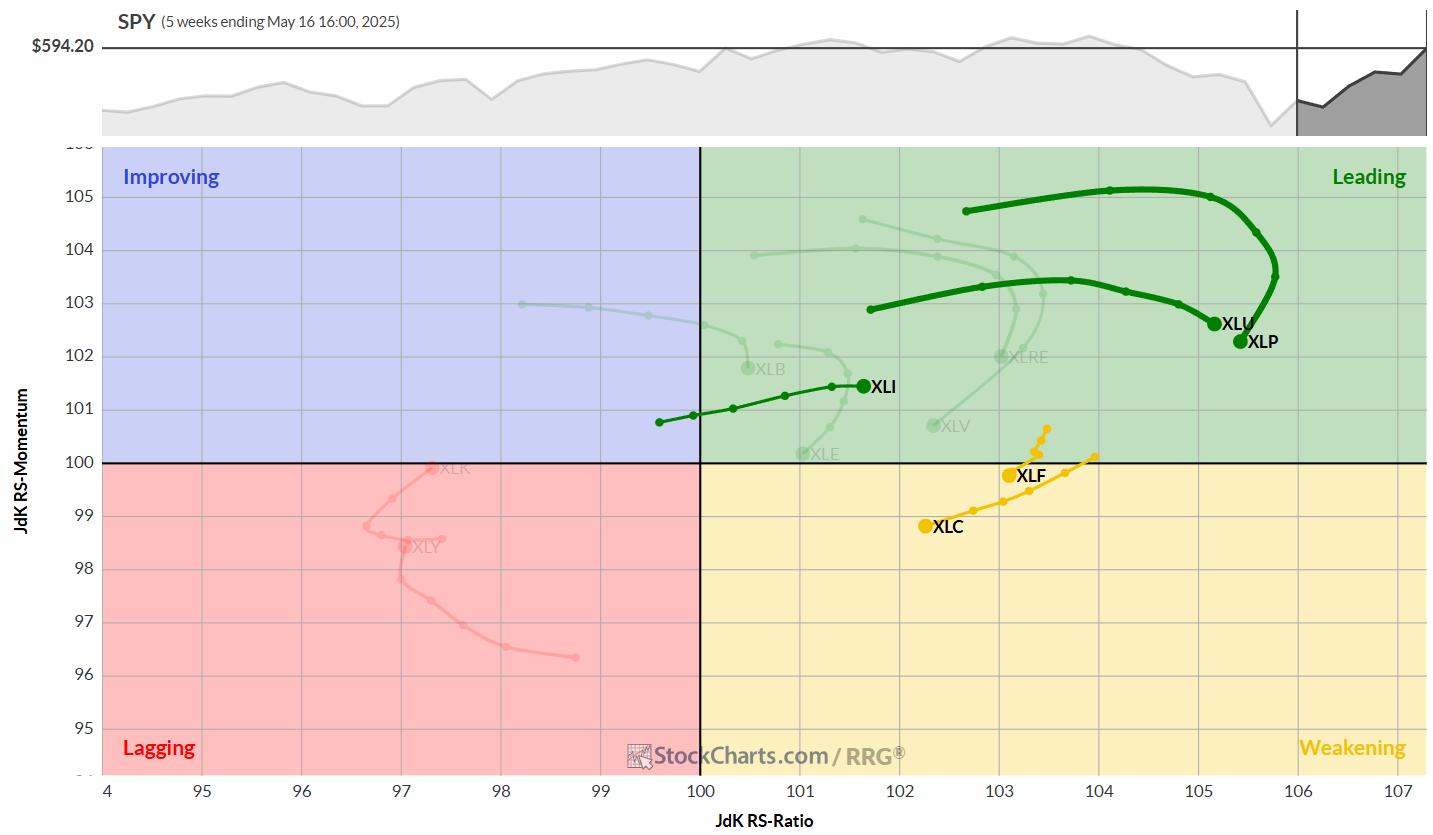

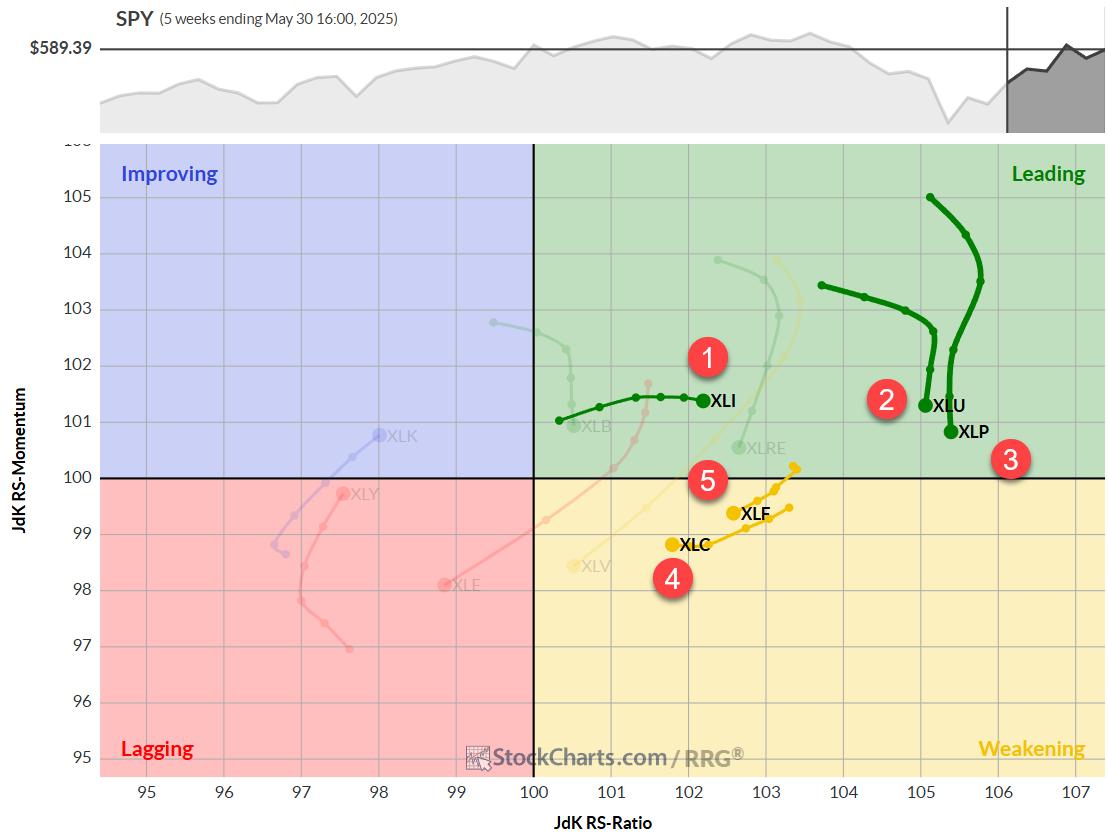

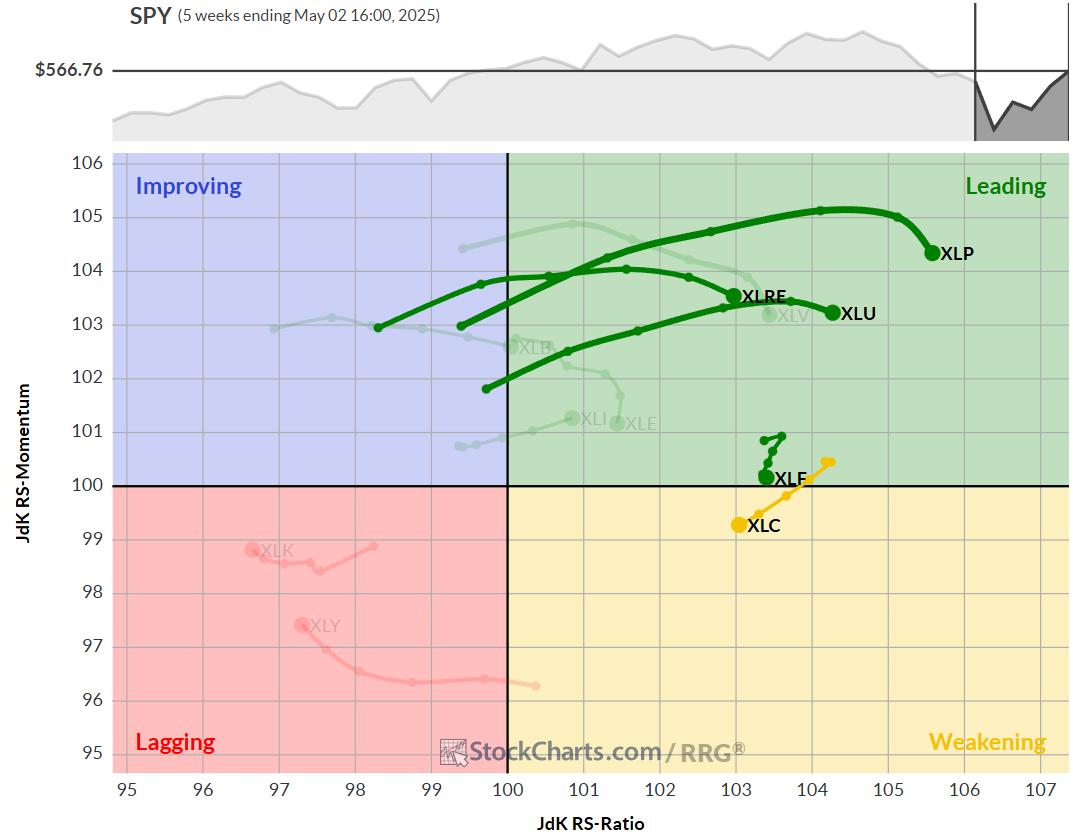

The Best Five Sectors, #21

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Staples and Tech Swap Positions Again

The weekly sector rotation continues to paint a picture of a market in flux, with defensive sectors gaining ground while cyclicals take a step back. This week's shifts underscore the ongoing volatility and lack of clear directional trade that's been...

READ MORE

MEMBERS ONLY

Leadership Rotation Could Confirm Corrective Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

There's no denying that the equity markets have taken on a decisively different look and feel in recent weeks.

We've compared the charts of the S&P 500 and Nasdaq 100, as well as leading growth stocks like Nvidia, to an airplane experiencing a "...

READ MORE

MEMBERS ONLY

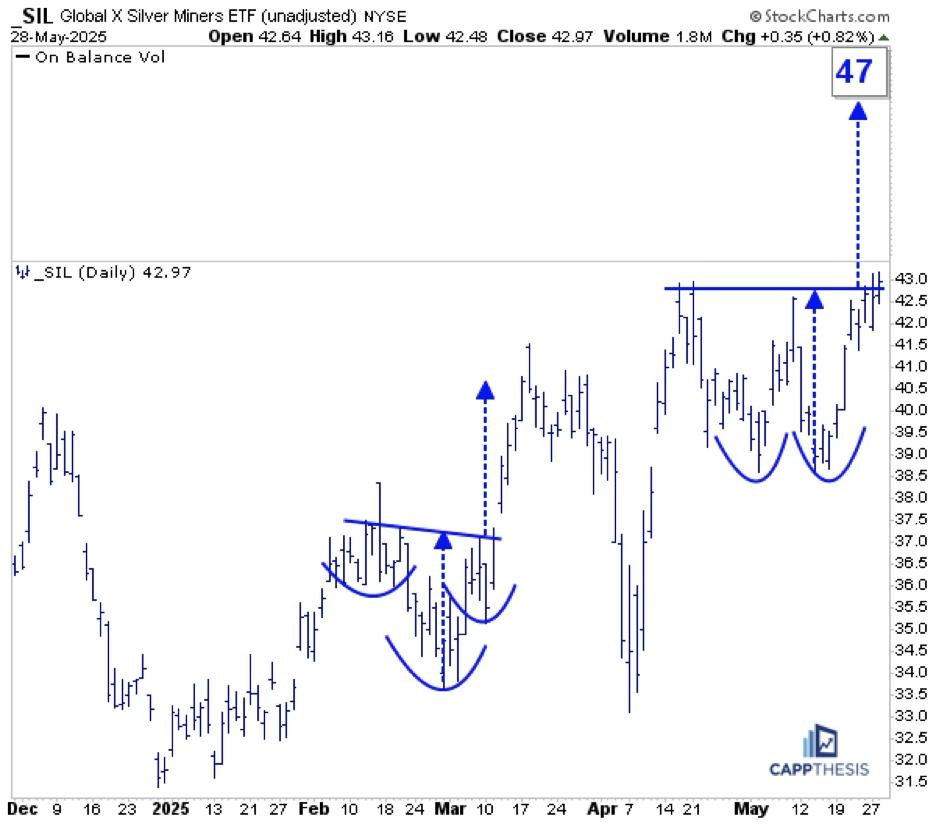

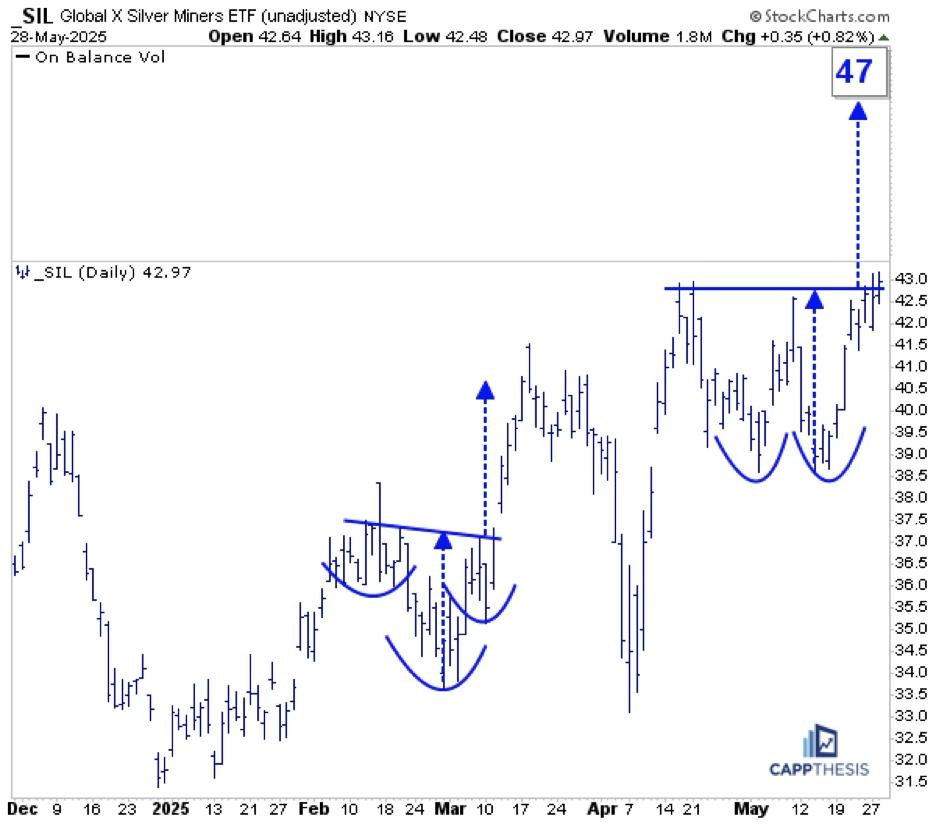

Analyzing SIL, USO, and NVDA: Could These Bullish Patterns Trigger?

by Frank Cappelleri,

Founder & President, CappThesis, LLC

SIL Silver Miners

SIL was among the leaders yesterday and now is close to triggering this double-bottom bullish pattern. Staying above the 43-mark would target 47. That's not a big move, but let's remember that SIL is sporting bullish formations on its longer-term charts, too.

SIL...

READ MORE

MEMBERS ONLY

Is It A Pullback? Or is More Downside Ahead?

by Mary Ellen McGonagle,

President, MEM Investment Research

Get the latest stock market update with Mary Ellen McGonagle. Learn key downside signals, how to manage pullbacks, and which earnings reports could impact the market next week.

In this week's episode, Mary Ellen reviews where the markets currently stand and what to watch for to signal further...

READ MORE

MEMBERS ONLY

Five Charts I Am Watching Closely

by Martin Pring,

President, Pring Research

Each week, I monitor numerous charts to see if they have the potential for an important breakout. I tend to look at longer-term ones, because they set the scene as to whether the primary trend is bullish or bearish. That's important information to have, as the magnitude and...

READ MORE

MEMBERS ONLY

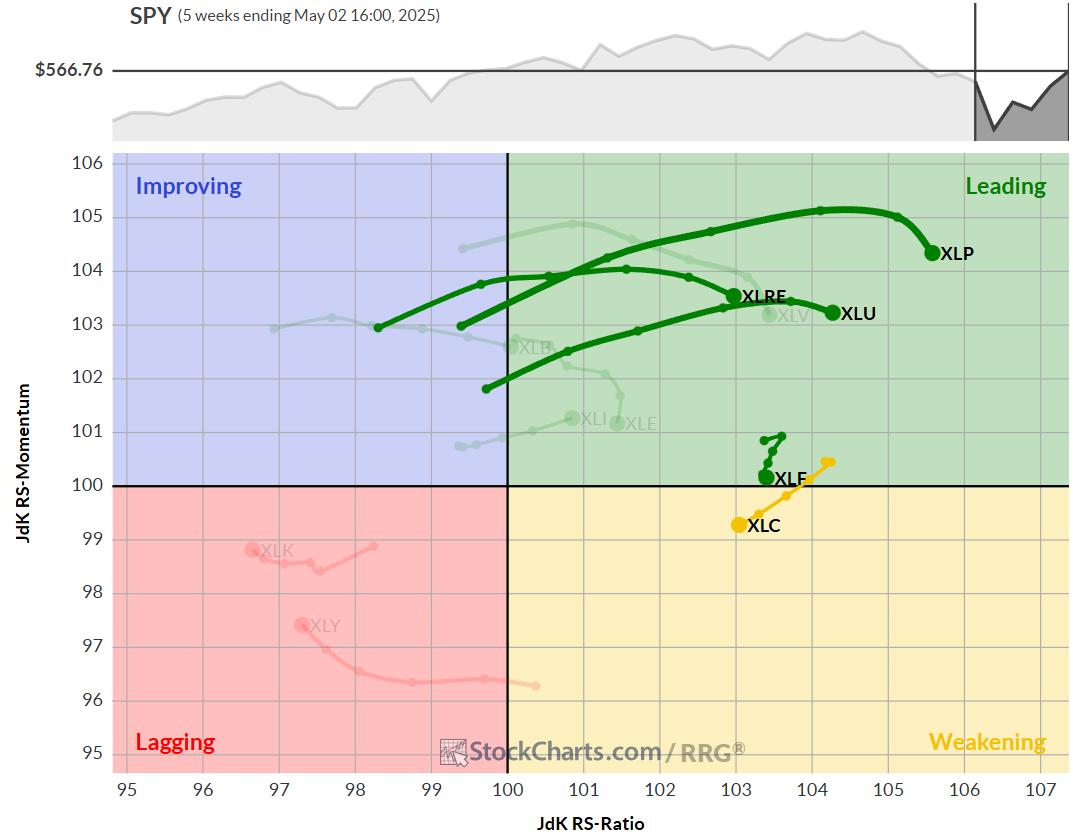

The Best Five Sectors, #20

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Technology Back in Top-5

Last week's market decline of 2-2.5% (depending on the index) has led to some notable shifts in sector performance and rankings.

This pullback, coming after a strong rally, is changing the order of highs and lows on the weekly chart -- a particularly...

READ MORE

MEMBERS ONLY

MACD + ADX: Spot the Pullbacks Worth Trading

by Joe Rabil,

President, Rabil Stock Research

In this video, Joe shares how to use MACD and ADX indicators to analyze stock pullbacks, focusing on the good while avoiding the weak setups. He explains how these indicators can complement one another. Joe then shows the Summary Page in ACP and how he uses it on a regular...

READ MORE

MEMBERS ONLY

S&P 500, Bitcoin & XLK: What the Charts Are Saying Now

by Frank Cappelleri,

Founder & President, CappThesis, LLC

In this video, Frank dives into some of his favorite features on StockCharts.com. He then dissects the S&P 500 and Bitcoin price action, before exploring the the XLK Technology ETF's explosive move off the lows. He also highlights a few recent trade ideas and setups...

READ MORE

MEMBERS ONLY

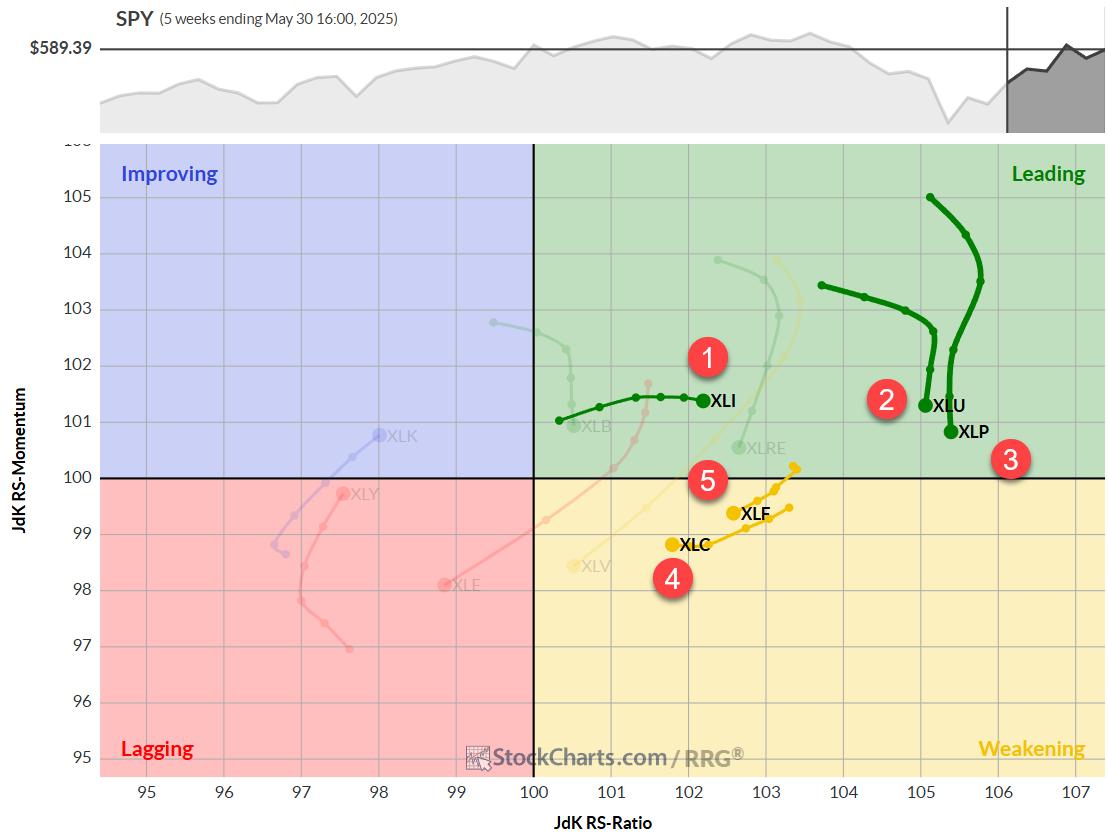

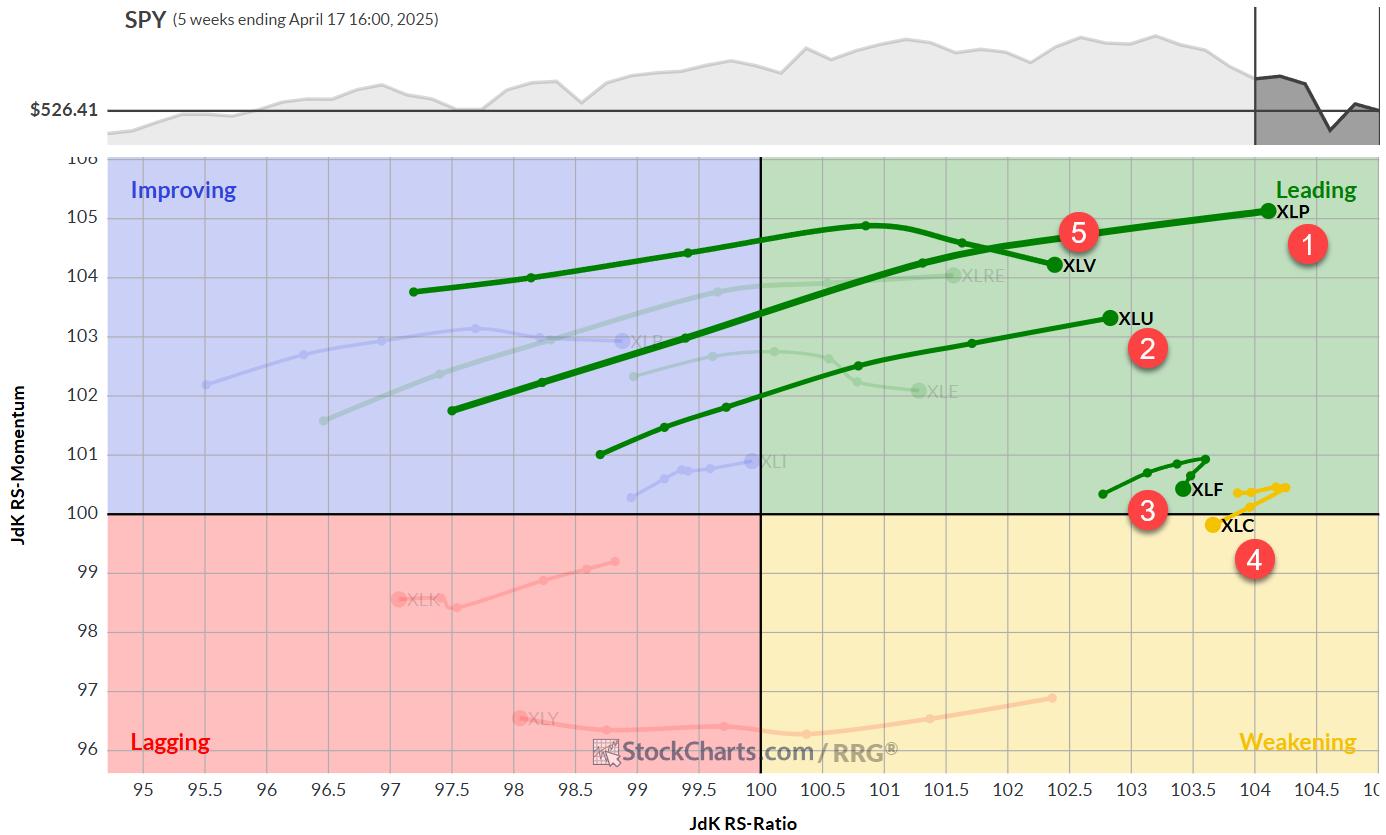

The Best Five Sectors, #19

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

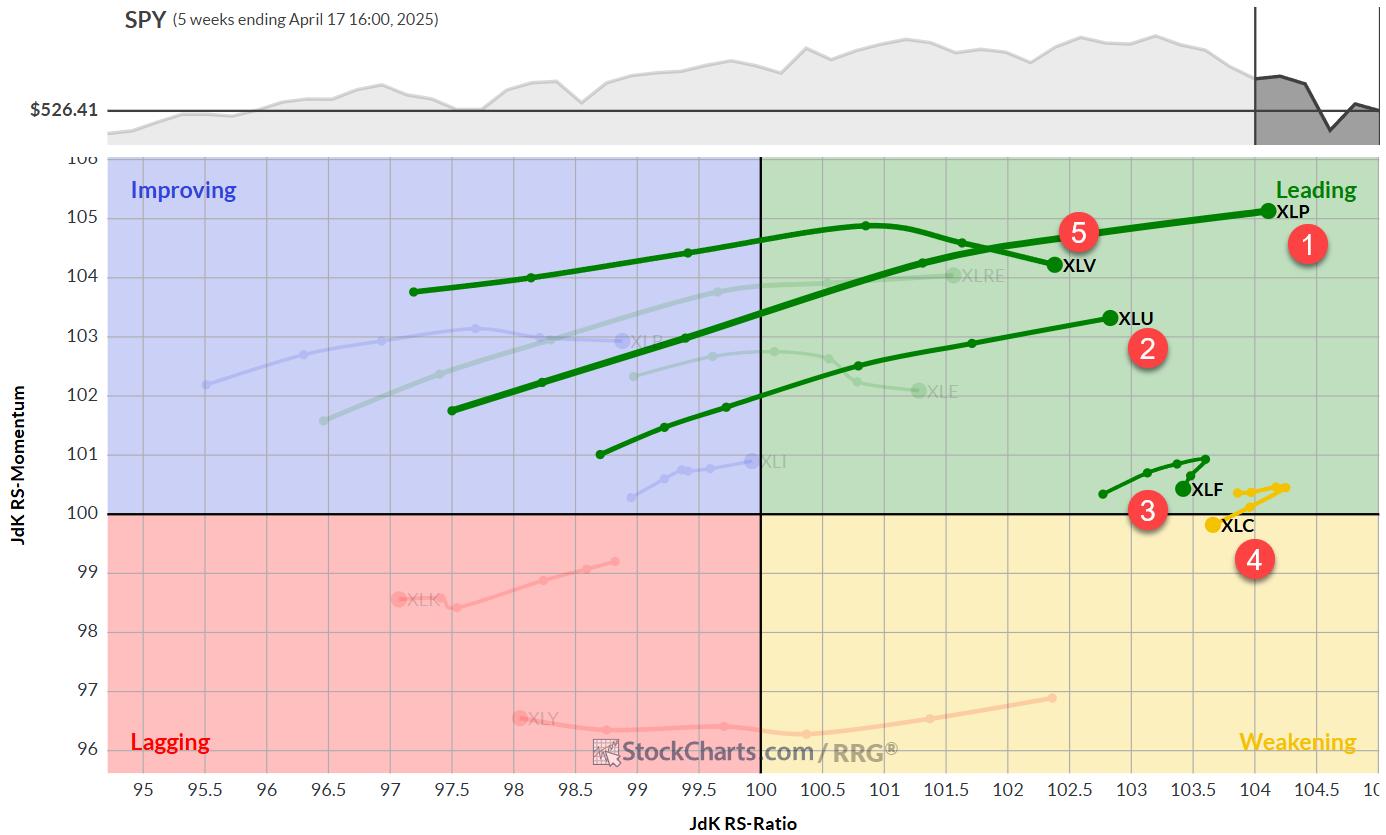

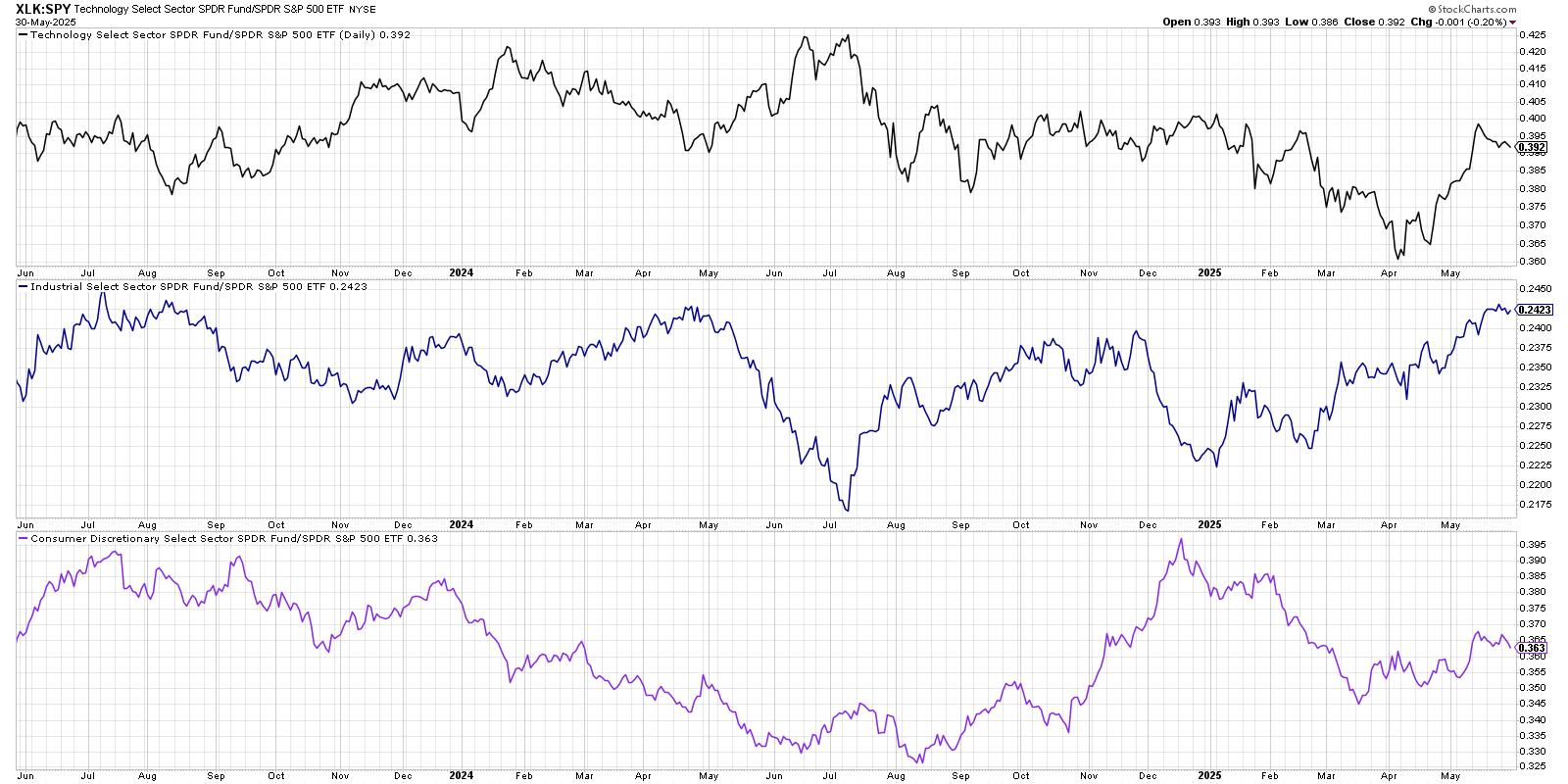

KEY TAKEAWAYS

* Industrials surge to #1 in sector ranking, replacing Real Estate in top 5

* Communication Services showing vulnerability, moving into weakening quadrant

* Utilities and Consumer Staples losing momentum but maintaining leading positions

* Portfolio maintains defensive positioning despite underperformance vs SPY

Sector Rotation Shakeup: Industrials Take the Lead

Another week...

READ MORE

MEMBERS ONLY

Emerging Stocks to Watch – Breakouts, Momentum & Upgrades!

by Mary Ellen McGonagle,

President, MEM Investment Research

Looking for breakout stocks and top market leaders? Follow along as Mary Ellen shares stock breakouts, analyst upgrades, and sector leadership trends to help you trade strong stocks in today's market.

In this week's episode, Mary Ellen reveals the stocks leading the market higher and explains...

READ MORE

MEMBERS ONLY

S&P 500 Now in Weakest Seasonal Period... Or Is It?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* "Sell in May" is less about weakness in the spring and more about weakness in the autumn months.

* Since the COVID low, the S&P 500 has usually been quite strong in May-June-July.

* We're watching the SPX 5750 level along with other indicators...

READ MORE

MEMBERS ONLY

The Stock Market's Comeback: Key Takeaways for Investors

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500, Nasdaq, and Dow Jones all broke above their 200-day moving averages and signaled renewed strength.

* AI stocks like NVDA and PLTR posted double-digit gains, highlighting continued momentum in AI-driven investing opportunities.

* Investors are rotating into offensive sectors like Technology and Consumer Discretionary.

If...

READ MORE

MEMBERS ONLY

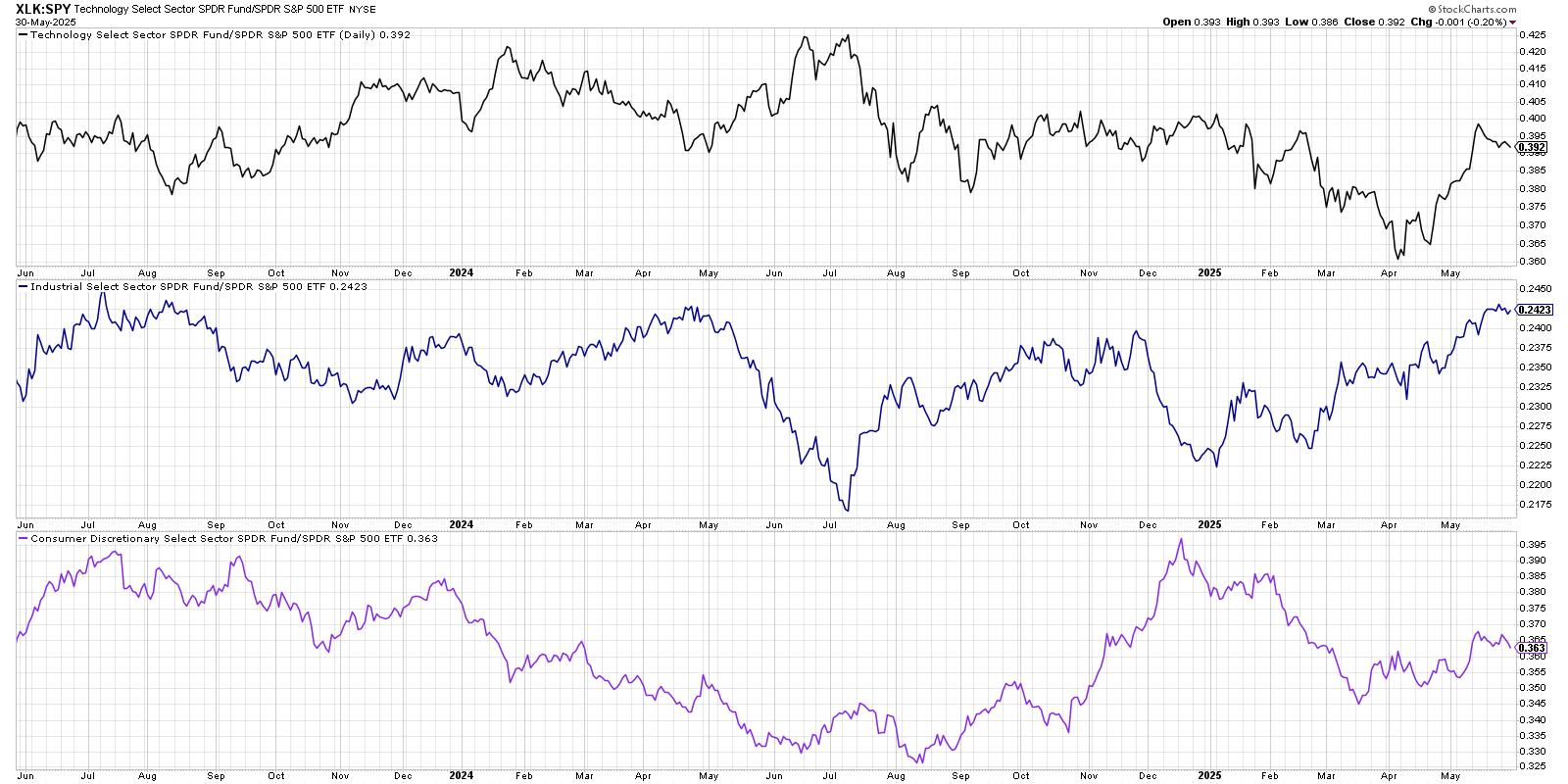

The S&P 500 Snapped Back Hard: Now What?

by Frank Cappelleri,

Founder & President, CappThesis, LLC

KEY TAKEAWAYS

* The S&P 500's 14-week RSI hit its lowest point since the 2008 financial crisis.

* Sector ETFs like XLK (Technology) and XLI (Industrials) are showing bullish patterns.

* While the stock market's rapid reversal is encouraging, historical trends show that pullbacks often follow oversold...

READ MORE

MEMBERS ONLY

How to Use Relative Strength in a Volatile Market

by Joe Rabil,

President, Rabil Stock Research

Want to know how to find strong stocks in a volatile market? In this video, Joe uses Relative Strength (RS), Fibonacci retracements, and technical analysis to spot top sectors and manage downside risk.

Follow along as Joe breaks down how to use the Relative Strength indicator to separate outperforming stocks...

READ MORE

MEMBERS ONLY

Tariff Tensions Ease, Nasdaq Soars — But is SMH the Emerging Leader?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The Nasdaq 100 leads with a strong show of breadth.

* Semiconductors are showing signs of recovery, despite lagging major indices.

* SMH's price action may be reaching a turning point.

For months, investors have been on edge over U.S.-China tariff tensions, bracing for everything from...

READ MORE

MEMBERS ONLY

Is It Time for Emerging Markets to Emerge?

by Martin Pring,

President, Pring Research

The US market has been recovering nicely since the April low, but it has actually been outperformed by the rest of the world this year so far. In that respect, Chart 1 shows that a major shift away from the US could well be in the cards.

It is evident...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #18

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* All 11 sectors changed positions, but the top-5 / bottom-6 composition remained the same.

* Utilities now strongest sector, despite overall market strength.

* Communication Services jumped from 5th to 2nd place.

* Portfolio still 3% behind the S&P 500 YTD, unchanged from last week.

Sector Shuffle: Same Players, New...

READ MORE

MEMBERS ONLY

Where the Market Goes Next: Key Resistance Levels + Top Bullish Stocks to Watch Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Want to know where the stock market is headed next? In this week's market update, Mary Ellen McGonagle analyzes key resistance levels and reveals what's fueling the current uptrend. She highlights top bullish setups among U.S. leadership stocks, plus global names showing strength.

This video...

READ MORE

MEMBERS ONLY

The V Reversal is Impressive, but is it Enough?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* SPY broke down in March, plunged into early April and surged into early May.

* This V bounce is impressive, but it is not enough to reverse the March breakdown.

* A significant increase in upside participation is needed to move from bear market to bull market.

Stocks plunged into...

READ MORE

MEMBERS ONLY

Fed Watch: Key Bullish Patterns in the S&P 500, Utilities, and Crypto

by Frank Cappelleri,

Founder & President, CappThesis, LLC

KEY TAKEAWAYS

* Bullish chart patterns, such as the inverse head-and-shoulders and cup with handle, are in play in the S&P 500.

* Utilities are breaking to new 50-day highs.

* Bitcoin and Ethereum continue to signal rising risk appetite.

The S&P 500 ($SPX) wrapped up Tuesday just below...

READ MORE

MEMBERS ONLY

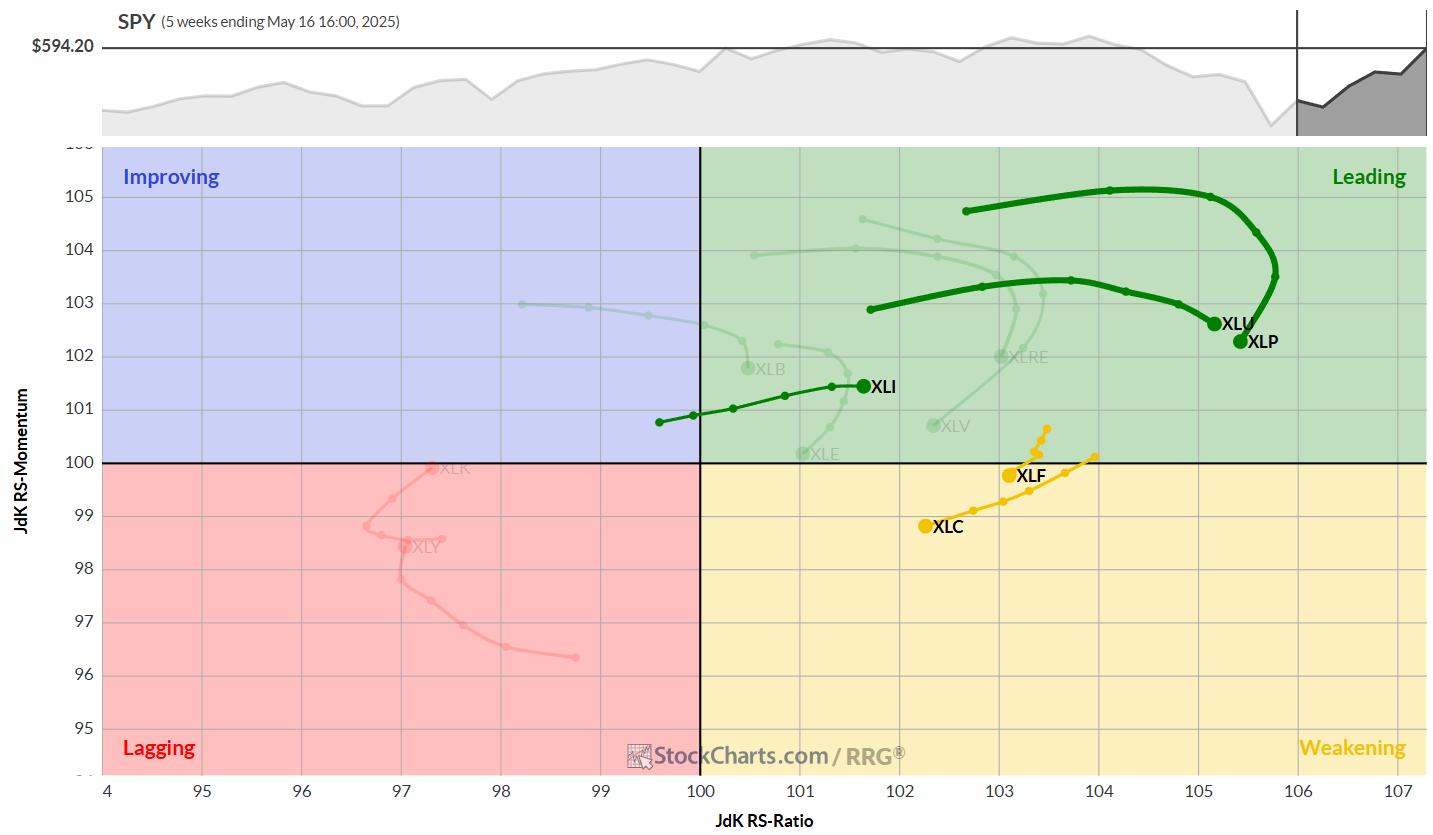

The Best Five Sectors, #18

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Top 5 sectors remain unchanged, with minor position shifts

* Leading sectors showing signs of losing momentum

* Daily RRG reveals top sectors in weakening quadrant

* Communication services at risk of dropping out of top 5

Communication Services Drops to #5

The composition of the top five sectors remains largely...

READ MORE

MEMBERS ONLY

Stock Market Wrap: Stocks Rebound as May Kicks Off with a Bang—What Investors Should Know

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* A strong jobs report sparked a stock market rally, with major indexes closing the week higher.

* Positive earnings from Microsoft and Meta Platforms took the Nasdaq Composite above its 50-day moving average.

* Financials, Industrials, and Technology were the leading sectors this week, with Financials showing technical strength.

We...

READ MORE

MEMBERS ONLY

If Non-US Equities Continue to Outperform the S&P, Will Europe or Asia Benefit Most?

by Martin Pring,

President, Pring Research

Since the tariff war first broke out, there have been widespread reports in the financial press telling us that investors have decided to cash in on their U.S. profits and move their capital abroad. The U.S., they tell us, is no longer regarded as a safe haven. Indeed,...

READ MORE

MEMBERS ONLY

Our Very Last Trading Room

by Erin Swenlin,

Vice President, DecisionPoint.com

Today, Carl and Erin made a big announcement! They are retiring at the end of June so today was the last free DecisionPoint Trading Room. It has been our pleasure educating you over the years and your participation in the trading room has been fantastic! Be sure and sign up...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #17

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Defensive sectors maintain dominance in top 5, despite strong market performance.

* Real Estate enters top 5, replacing Health Care; Consumer Staples, Utilities, and Financials remain stable in top 3 positions.

* Defensive positioning has put a dent in portfolio performance after strong week.

Real Estate and Healthcare Swapping Positions...

READ MORE

MEMBERS ONLY

Top Stock Areas After the Rally: What Smart Money Is Buying

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, after last week's sharp market rally, Mary Ellen breaks down where the markets stand now, which leading sectors are showing the most strength, and how to recognize if your stocks are entering a new uptrend. Get expert insights on market leadership, sector rotation, and key...

READ MORE

MEMBERS ONLY

Hidden Gems: Bullish Patterns Emerging in These Country ETFs

by Joe Rabil,

President, Rabil Stock Research

In this video, Joe highlights key technical setups in select country ETFs that are showing strength right now. He analyzes monthly and weekly MACD, ADX, and RSI trends that are signaling momentum shifts. Joe also reviews the critical level to watch on the S&P 500 (SPX), while breaking...

READ MORE

MEMBERS ONLY

$4,000 Gold? Analysts Eye New Highs on Inflation and Geopolitical Risk

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The price of gold is climbing on safe-haven demand, with key support levels mapped for potential entry.

* The U.S. dollar is sliding as speculation grows over whether its weakness is part of a larger strategy.

* Bitcoin is testing resistance and could rally further if safe-haven flows accelerate....

READ MORE

MEMBERS ONLY

DP Trading Room: Long-Term Outlook for Bonds

by Erin Swenlin,

Vice President, DecisionPoint.com

The market continued to slide lower today as the bear market continues to put downside pressure on stocks in general. Bonds and Yields are at an inflection point as more buyers enter the Bond market which is driving treasury yields higher. What is the long-term outlook for Bonds? Carl gives...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #16

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Consumer staples and utilities continue to lead sector rankings.

* Defensive sectors are showing strength in both weekly and daily RRGs.

* Health care struggling, but maintains position in top 5

* RRG portfolio slightly underperforming S&P 500 YTD, but gap narrowing.

Top 5 Remains Unchanged

The latest sector...

READ MORE

MEMBERS ONLY

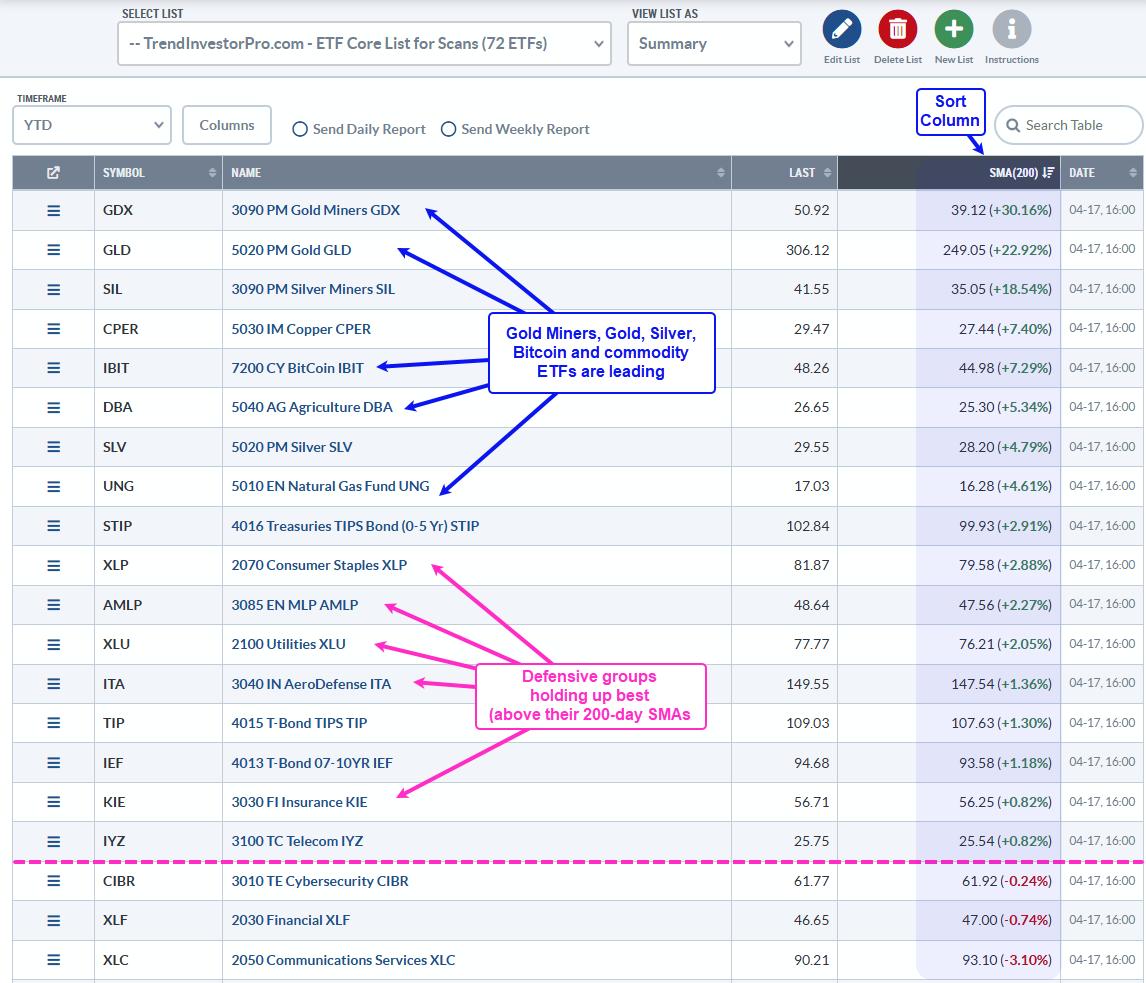

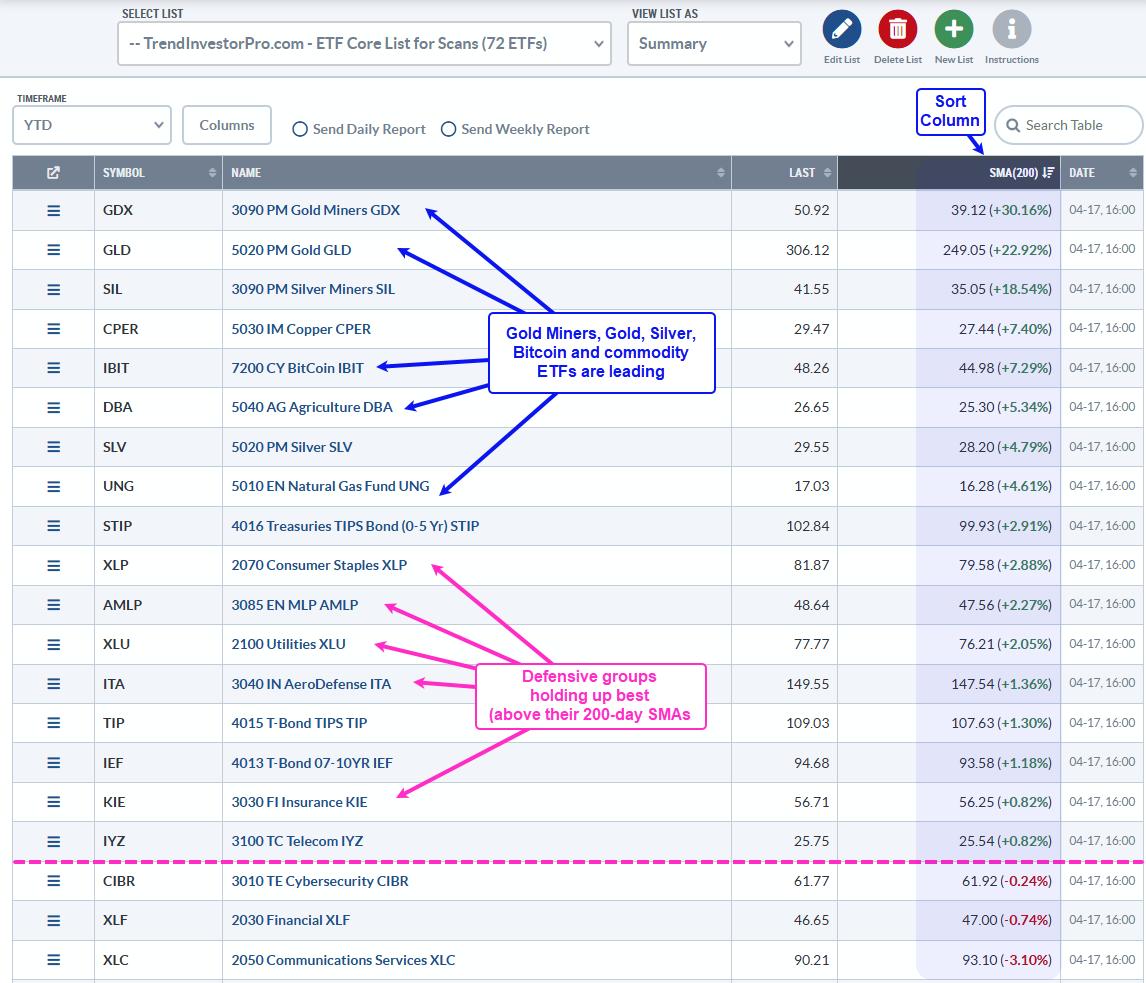

Equities? Fuhgeddaboudit! Alternative Assets are Leading

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* A simple ranking shows leadership in alterative assets and commodities.

* Stocks are not the place to be because the vast majority are below their 200-day SMAs.

* Bitcoin is holding up relatively well as it sets up with a classic corrective pattern.

Trading is all about the odds. Trade...

READ MORE

MEMBERS ONLY

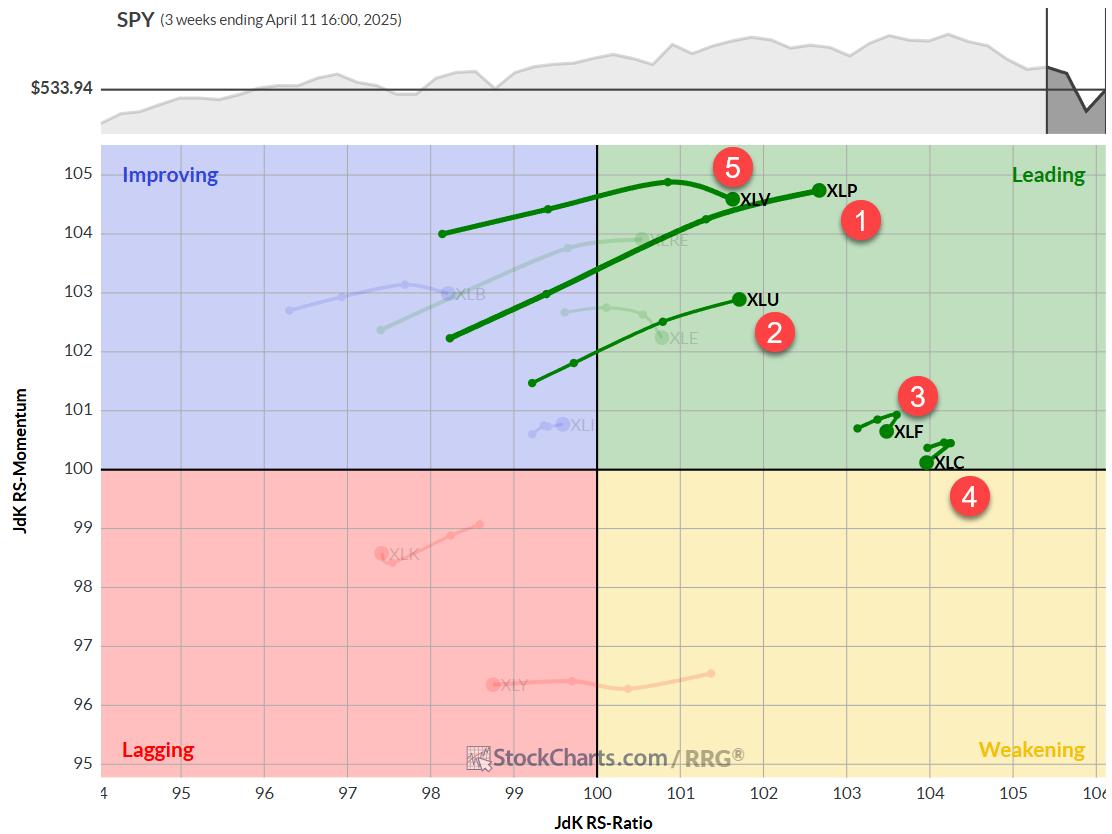

When in Doubt, Follow the Leadership

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The Consumer Discretionary sector has underperformed the Consumer Staples sector since February, indicating defensive positioning for investors.

* The Relative Rotation Graphs (RRG) show a clear rotation from "things you want" to "things you need" as investors fear weakening economic conditions.

* We remain focused on...

READ MORE

MEMBERS ONLY

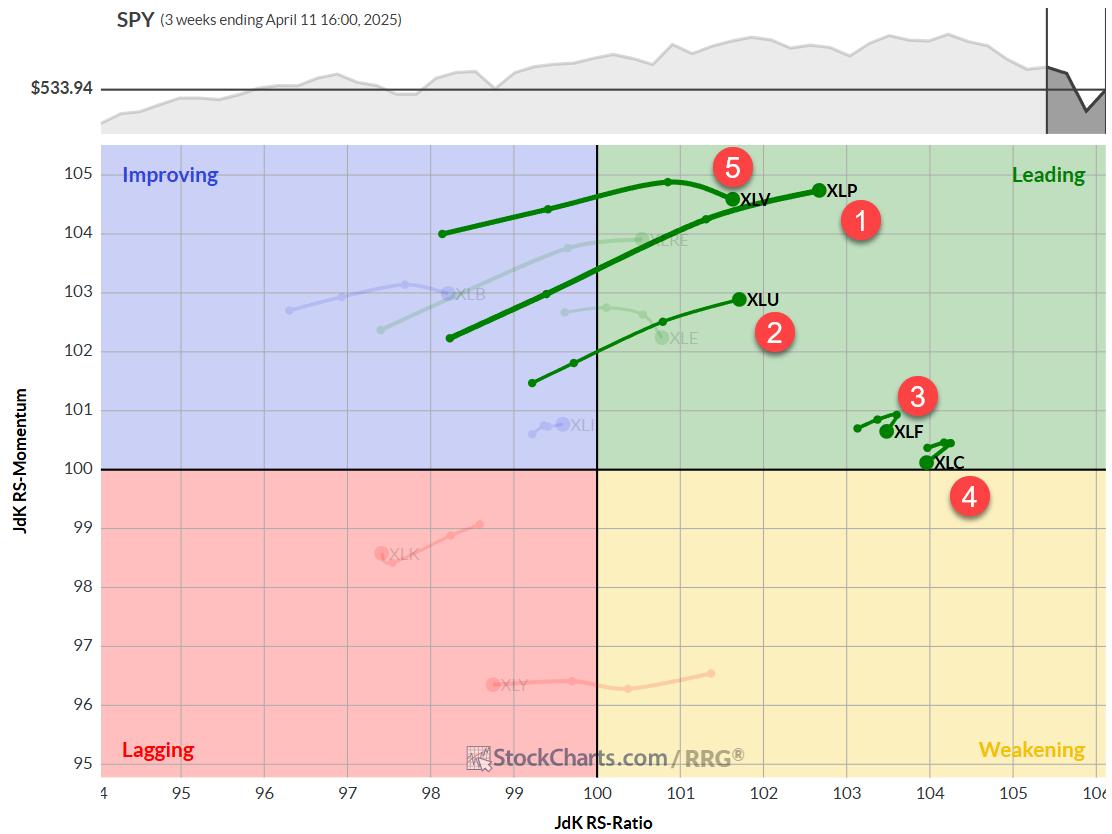

The Best Five Sectors, #15

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The entire top 5 has now changed positions.

* All defensive sectors are now in the top 5, while Healthcare has reentered.

* Portfolio is now lagging S&P 500.

Healthcare Re-Enters the Top 5

After a wild week in the markets, the sector ranking got quite a shake-up....

READ MORE

MEMBERS ONLY

Market Rally or Fakeout? How Politics and Earnings Are Driving Stocks

by Mary Ellen McGonagle,

President, MEM Investment Research

Stock market rally, sector rotation, and earnings movers dominate this week's analysis with Mary Ellen McGonagle. In this video, Mary Ellen reviews where the market stands after last week's bounce and explains how White House activity drove major price action.

Mary Ellen also highlights two top-performing...

READ MORE