MEMBERS ONLY

Two Currencies May Be About to Go Bullish for Commodities

by Martin Pring,

President, Pring Research

The Australian dollar and Canadian dollar may be getting ready to strengthen against the US dollar. Martin Pring analyzes these two commodity-based currencies and discusses which direction the two are likely to move....

READ MORE

MEMBERS ONLY

The US Dollar Index Hits a Critical Crossroad: Will It Reverse or Rally?

by Martin Pring,

President, Pring Research

The US Dollar Index has reached a key resistance level. Will it break through it and rally higher? Martin Pring provides his expert insight into the dollar's potential to rally....

READ MORE

MEMBERS ONLY

Market Pullback or Pause? Inside the November Dip and What Comes Next for Stocks

Intermarket relationships between stocks, bonds, the US dollar, and commodities are unsettled at the moment. What happens next? Here are the charts investors should be watching for clues....

READ MORE

MEMBERS ONLY

Fed Day Signals: Noise or the Start of Something Bigger?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The Fed delivered a rate cut and markets wobbled. Discover how stocks, bonds, and the dollar reacted and what investors should watch next. ...

READ MORE

MEMBERS ONLY

Wednesday May Have Been Turnaround Day for Some Markets

by Martin Pring,

President, Pring Research

Following the Fed's rate cut, the price action in several markets indicated a short-term reversal. Martin suggests monitoring these charts and their technical signals in the coming weeks....

READ MORE

MEMBERS ONLY

Will the Fed “Go Big”? Real Estate Stocks Quiet Amid Major Macro Shifts

The Fed is set to cut rates again as Treasury yields slide and stocks rally. But why are real estate stocks still lagging? And could a breakout above a key resistance level shape the 2026 cycle?...

READ MORE

MEMBERS ONLY

US Dollar at a Crossroads, Gold Primed for Action: Macro Moves to Watch

With high-impact US data and geopolitical risks on tap this week, traders must assess the US dollar. Here are some outcomes that could surface in the dollar and gold....

READ MORE

MEMBERS ONLY

Investors on the Move: A Visual Guide to the Stock Market

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Declining equities, bonds, and the US dollar is making Wall Street nervous.

* Investors will need to look at market price action through the lens of macro factors.

* View longer-term charts, keep an eye on bond prices, and watch the US dollar's price action.

Another interesting week...

READ MORE

MEMBERS ONLY

Are the Tariffs Bullish or Bearish for the US Dollar?

by Martin Pring,

President, Pring Research

Tariffs have been front and center of market attention, but one asset class that has been relatively subdued in its response has been the US Dollar Index. It has declined in recent weeks, but a review of the technical picture suggests that the sell-off is part of an overall corrective...

READ MORE

MEMBERS ONLY

Stock Market Momentum Slows Down: What This Means for Investors

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tuesday's stock market action was lackluster with not much movement in either direction.

* Lack of followthrough from the previous trading day's upside action shows uncertainty is still in the air.

* Keep an eye on the health of the overall U.S. economy by monitoring...

READ MORE

MEMBERS ONLY

Navigating Tariffs: Master the Charts to Outsmart Market Volatility

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tariffs have caused shifts in investor sentiment.

* Investors are rotating out of offensive sectors and into defensive sectors.

* The US dollar has weakened relative to the Canadian dollar and Mexican peso.

Tariffs have thrown the stock market into dizzying moves, moving up and/or down based on whatever...

READ MORE

MEMBERS ONLY

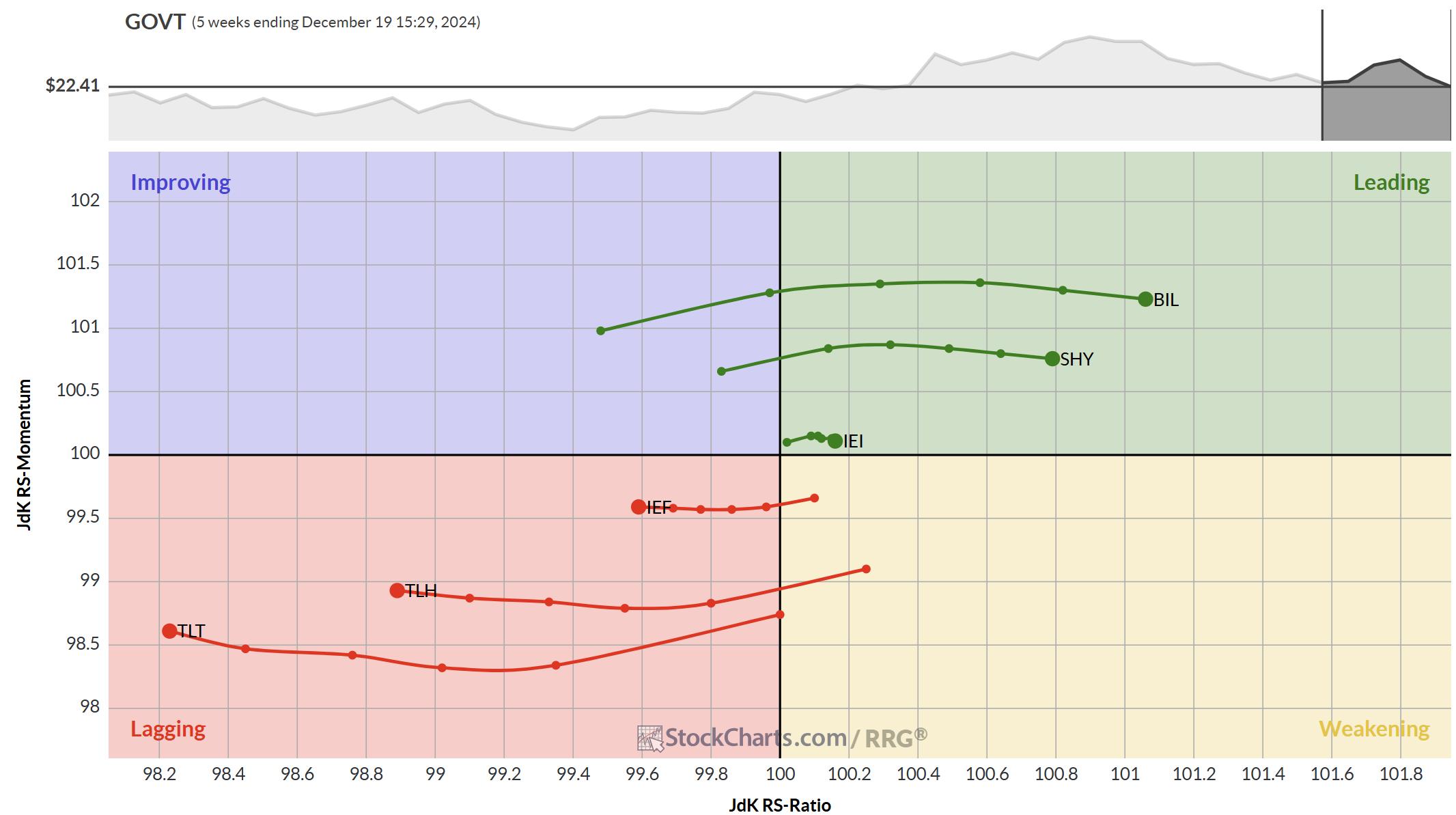

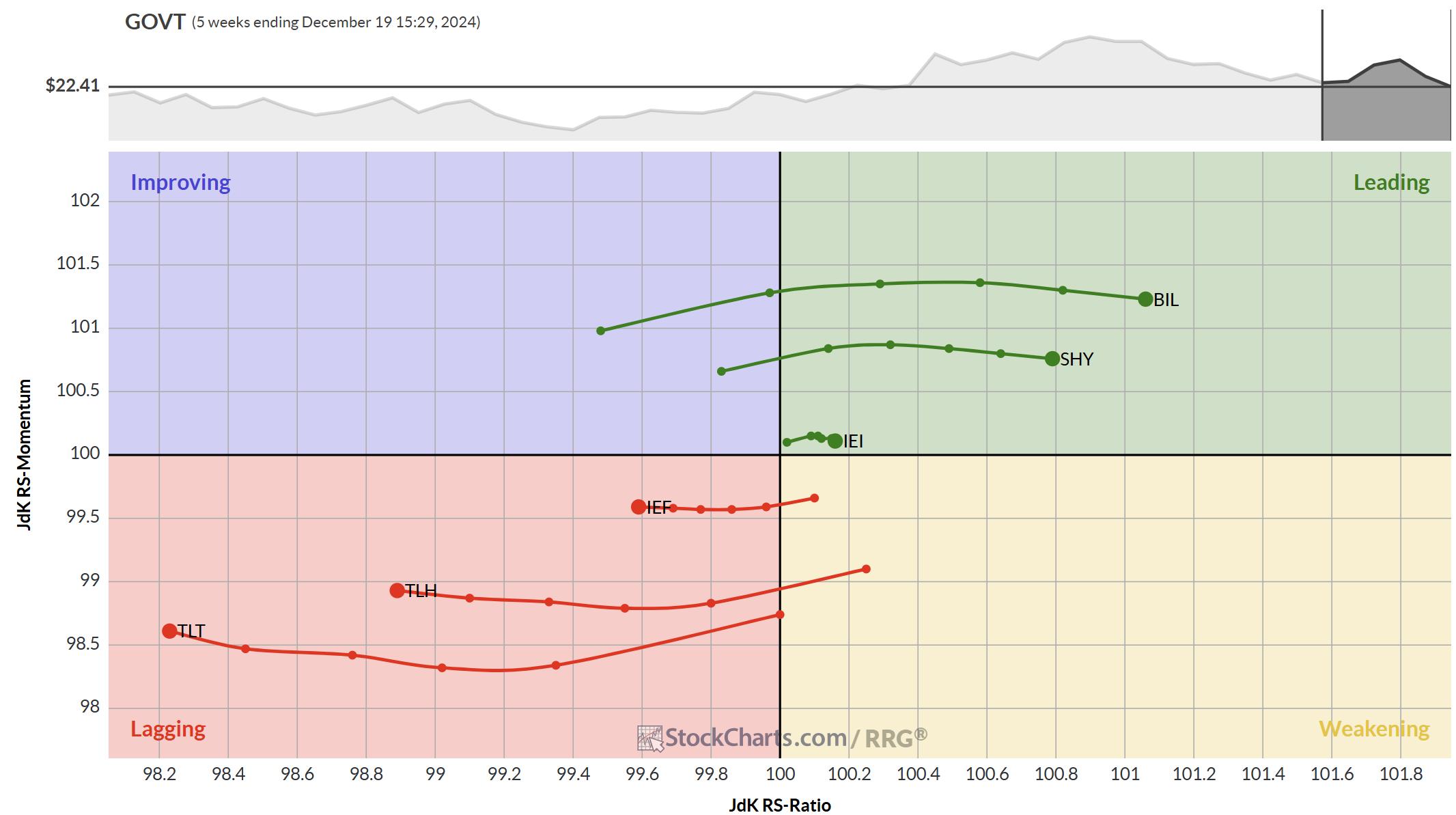

Three RRGs to Keep You on Track

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Track the Yield curve moving back to normal on RRG

* USD showing massive strength against all currencies

* Stock market drop not affecting sector rotation (yet)

The Yield Curve

The RRG above shows the rotations of the various maturities on the US-Yield Curve.

What we see at the moment...

READ MORE

MEMBERS ONLY

Stock Market Sell-Off: Is the Bull Market Over?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Broader stock market indexes got a bearish jolt on Wednesday.

* Gold, silver, and cryptocurrencies joined the equity selloff.

* Treasury yields and the US dollar jump higher.

Uncertainty in the stock market makes it difficult to make investment decisions. When investors sell off stocks, everyone follows without giving it...

READ MORE

MEMBERS ONLY

An All-Around Rally: Navigating Stocks, US Dollar, Gold, and Bitcoin Price Action

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Broader equity indexes ended the week on a positive note, with small- and mid-caps gaining momentum.

* Gold regained its bullish momentum, and the US dollar surged.

* Bitcoin skyrocketed and crossed the 10K level, but closed lower.

The last full trading week before the Thanksgiving holiday has ended on...

READ MORE

MEMBERS ONLY

Is the USD Setting Up for a Perfect Rally?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Despite a lot of turmoil, SPY continues to show strong rotations on both weekly and daily RRGs.

* Rising yields have not damaged the stock rally yet.

* Stock/Bond ratio remains strongly in favor of stocks.

After the election, things have hardly settled in the world. New developments in...

READ MORE

MEMBERS ONLY

Tech Stocks Plunge: What This Means for Investors

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tech stocks, especially semiconductors, get hammered.

* Treasury yields continue to rally higher in response to Fed comments and strong economy.

* The US dollar rally confirms the strength of the US economy.

"The economy is not sending any signals that we need to be in a hurry to...

READ MORE

MEMBERS ONLY

The Dollar's Technical Position is Crucial from a Short, Intermediate, Primary, and Secular Standpoint

by Martin Pring,

President, Pring Research

Chart 1 shows the Dollar Index has been in a trading range for the last couple of years and is now at resistance in the form of its upper part. The big question relates as to whether it can break to the upside, or if the resistance will once again...

READ MORE

MEMBERS ONLY

Stock Market Hits Record Levels: Prepare for What Inflation Can Bring Next

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes hit milestone levels this week.

* Monitoring volatility in bonds could be a leading indicator in market action shifts.

* The US dollar can provide clues about future stock market action.

Another packed week for the stock market has come to a close. The broader...

READ MORE

MEMBERS ONLY

Forex Secrets: How to Profit When EUR/USD Goes Nowhere

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The Euro has been trading sideways against the US dollar for the past two years.

* If you switch to a mean-reversion mindset, this may present quite a few attractive opportunities.

* You could trade ETFs such as FXE and UUP as an alternative to trading forex currency pairs.

For...

READ MORE

MEMBERS ONLY

Signal Scoreboard As Good As It Gets

by Carl Swenlin,

President and Founder, DecisionPoint.com

At DecisionPoint, we track intermediate-term and long-term BUY/SELL signals on twenty-six market, sector, and industry group indexes. The long-term BUY signals are based upon the famous Golden Cross, which is when the 50-day moving average crosses up through the 200-day moving average. (We use exponential moving averages -- EMAs....

READ MORE

MEMBERS ONLY

The Dollar Index is Down, But Is It Out?

by Martin Pring,

President, Pring Research

The Dollar Index has been selling off sharply in the last few weeks and has now reached critical support in the form of the lower part of its recent trading range. The big question is whether it will break below the range or extend it in any way.

Chart 1...

READ MORE

MEMBERS ONLY

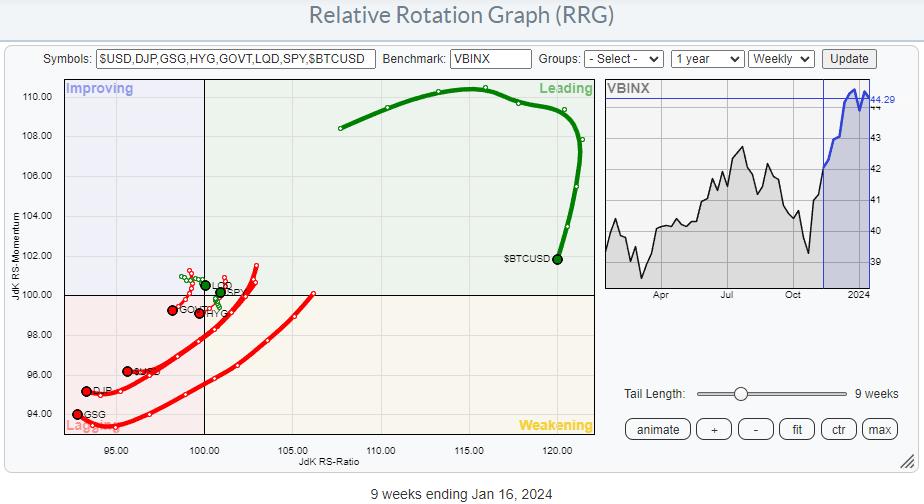

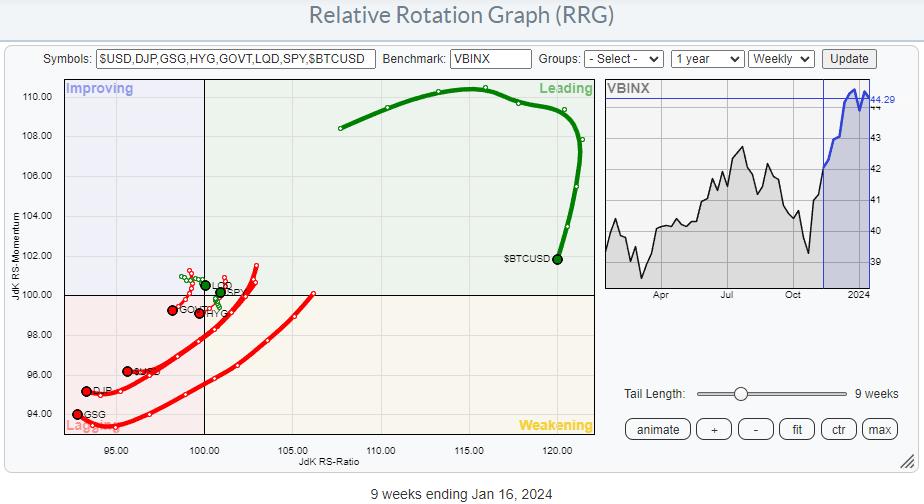

Why Stock Outperformance Might be ENDING!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius takes a look at rotations in an asset allocation RRG. He compares fixed-income-related asset classes, commodities, the US dollar, Bitcoin and stocks to a balanced portfolio of 60% stocks/40% bonds. The long-lasting outperformance of stocks seems to be coming to an end....

READ MORE

MEMBERS ONLY

A Deeper Dive into the Dollar | Focus on Stocks: September 2024

by Larry Williams,

Veteran Investor and Author

Let's get this out of the way...

In our last Family Gathering, I announced I am doing my best to retire. That means we will have our September Family Gathering, the October newsletter and mid-month Family Gathering. After that, "Focus on Stocks" is all over.

I...

READ MORE

MEMBERS ONLY

Is the Multi-Month Dollar Index Trading Range About to be Resolved?

by Martin Pring,

President, Pring Research

Last June, I wrote an articlewhose title was more or less the same as this one. At the time, the Index was bumping up against the top of a major trading range, and it looked very much as if it was about to experience an upside breakout. My conclusion was...

READ MORE

MEMBERS ONLY

This Market is On Track for a 45-Year Breakout

by Martin Pring,

President, Pring Research

It's not very often that any market experiences a 10-year breakout, let alone a 45-year one. That, however, is what Chart 1 says is about to materialize for the inflation-adjusted gold price.

Since the chart is based on monthly data, we will not know for sure until the...

READ MORE

MEMBERS ONLY

CrowdStrike: Did On-Balance Volume See the "Largest IT Outage In History" Coming?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Friday's CrowdStrike software disaster has been described as "the largest IT outage in history," and it brought home just how vulnerable the planet is to itty-bitty coding errors. We were busy publishing the DecisionPoint ALERT Weekly Wrap, so I didn't have a chance to...

READ MORE

MEMBERS ONLY

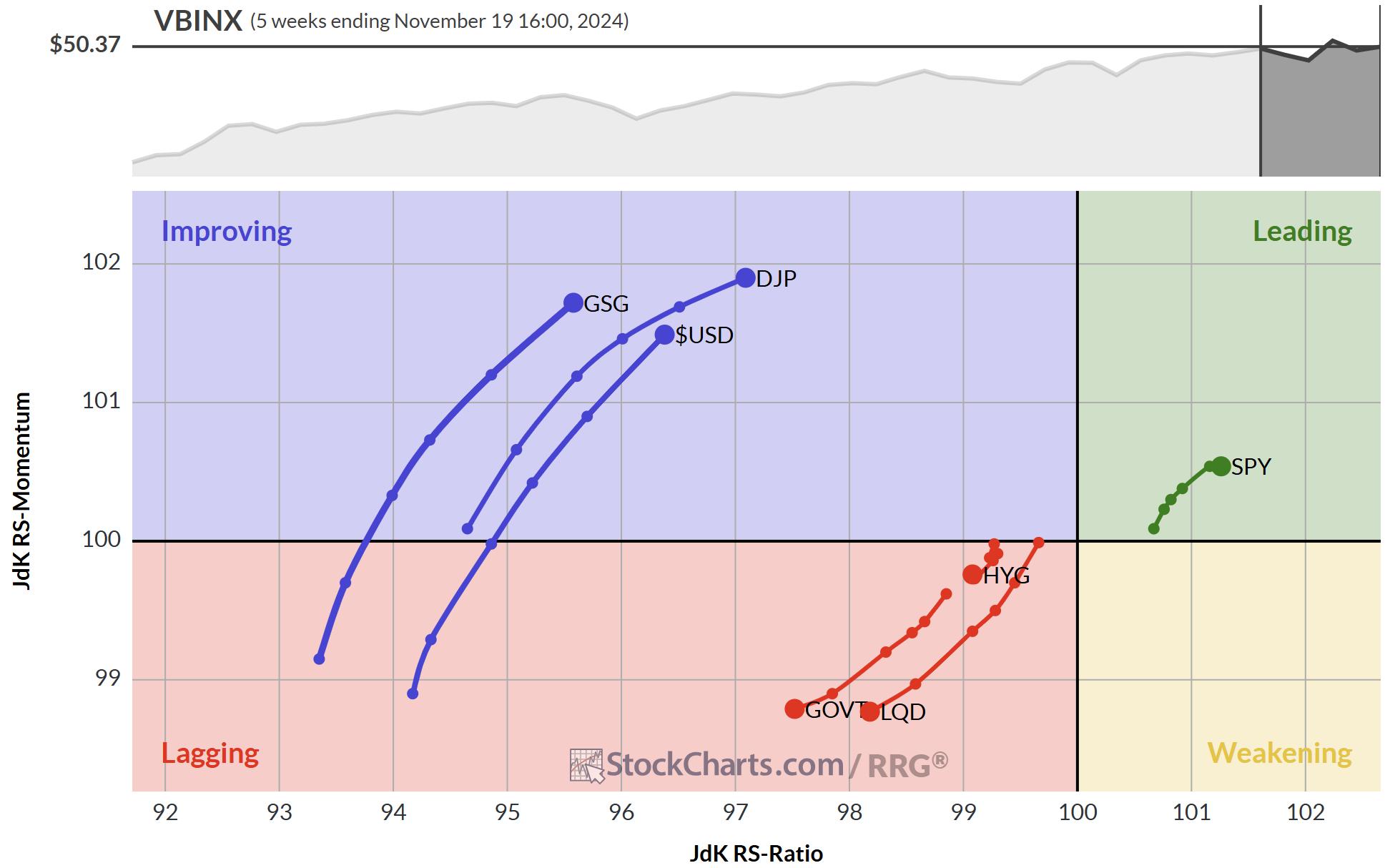

Why Stocks are STILL the BEST Investment

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius looks at the markets from an asset allocation perspective using various RRGs. Stocks are (still) beating bonds, while commodities are rotating out of favor and the USD is losing steam. BTC is jumping higher off support, and the Yield Curve is steepening against...

READ MORE

MEMBERS ONLY

They Say Three Steps and Stumble; This Market is Taking a Fourth

by Martin Pring,

President, Pring Research

The legendary technician Edson Gould had a rule that, after three discount rate hikes, the stock market would be likely to stumble. That doesn't apply to emerging markets, but it did make a catchy headline. What is relevant to the iShares MSCI Emerging Market ETF (EEM) is that,...

READ MORE

MEMBERS ONLY

Two Consumer Stocks Popping to New Swing Highs!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps Wednesday's late-stage rally for the S&P 500. He analyzes the charts of FDX, TSLA, RIVN, AMZN, and GLW, and reviews what a stronger US Dollar could mean for the SPX and Nasdaq.

See Dave&...

READ MORE

MEMBERS ONLY

Is This a Market Bubble - or Investor MANIA?

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe goes through the history of stock market bubbles, sharing what they look like, how they typically end, and how it relates to NVDA, MSFT, AAPL and GOOGL. Joe also covers the stock requests that came through this...

READ MORE

MEMBERS ONLY

Is the Eighteen-Month Dollar Index Trading Range About to be Resolved?

by Martin Pring,

President, Pring Research

Chart 1 shows that the Dollar Index has been in a trading range since the start of 2023. Its sheer size indicates the ultimate breakout could be followed by a sizeable move in either direction. It is also likely to have important implications for many different markets and asset classes....

READ MORE

MEMBERS ONLY

The Next Direction for Interest Rates Is...?

by Martin Pring,

President, Pring Research

In most cycles, central banks around the world raise and lower short-term interest rates in a rough synchronization. Last week, the European and Canadian central banks began lowering their rates, and the British are expected to follow suit this week. Most observers of the US expect the Federal Reserve to...

READ MORE

MEMBERS ONLY

It's Time to Take a Look at the Canadian and Australian Dollars and What They Imply for Inflation

by Martin Pring,

President, Pring Research

The Canadian and Aussie dollars have been confined between two converging trendlines since the beginning of the century, as we can see from Chart 1. The moment of truth appears to be close at hand, as both are approaching the apex of a giant potential symmetrical triangle.

One usually consistent...

READ MORE

MEMBERS ONLY

Failed Bearish Patterns are Bullish for S&P 500!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Frank Cappelleri, CMT CFA of CappThesis. Frank shares how the bull market phase has been marked by confirmed and completed bullish patterns and failed breakdowns after bearish patterns. Meanwhile, Dave discusses the rising interest rate environment, what it...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" May 16, 2024 Recording

by Larry Williams,

Veteran Investor and Author

Certainty is needed for a trader's actions. Good judgment comes from experience, and experience is gained from poor judgment. The key to improving your trading is to really, truly study the losing trades.

In this month's Family Gathering video, Larry presents PPI numbers for historical buy...

READ MORE

MEMBERS ONLY

Inflation Fell to the Fed's Target -- Or is That a Moving Target?

On Friday, the market woke up to great news. Mission accomplished on inflation.

Yahoo Finance reported: "The Fed's preferred inflation measure — a 'core' Personal Consumption Expenditures index that excludes volatile food and energy prices — clocked in at 2.9% for the month of December, beating...

READ MORE

MEMBERS ONLY

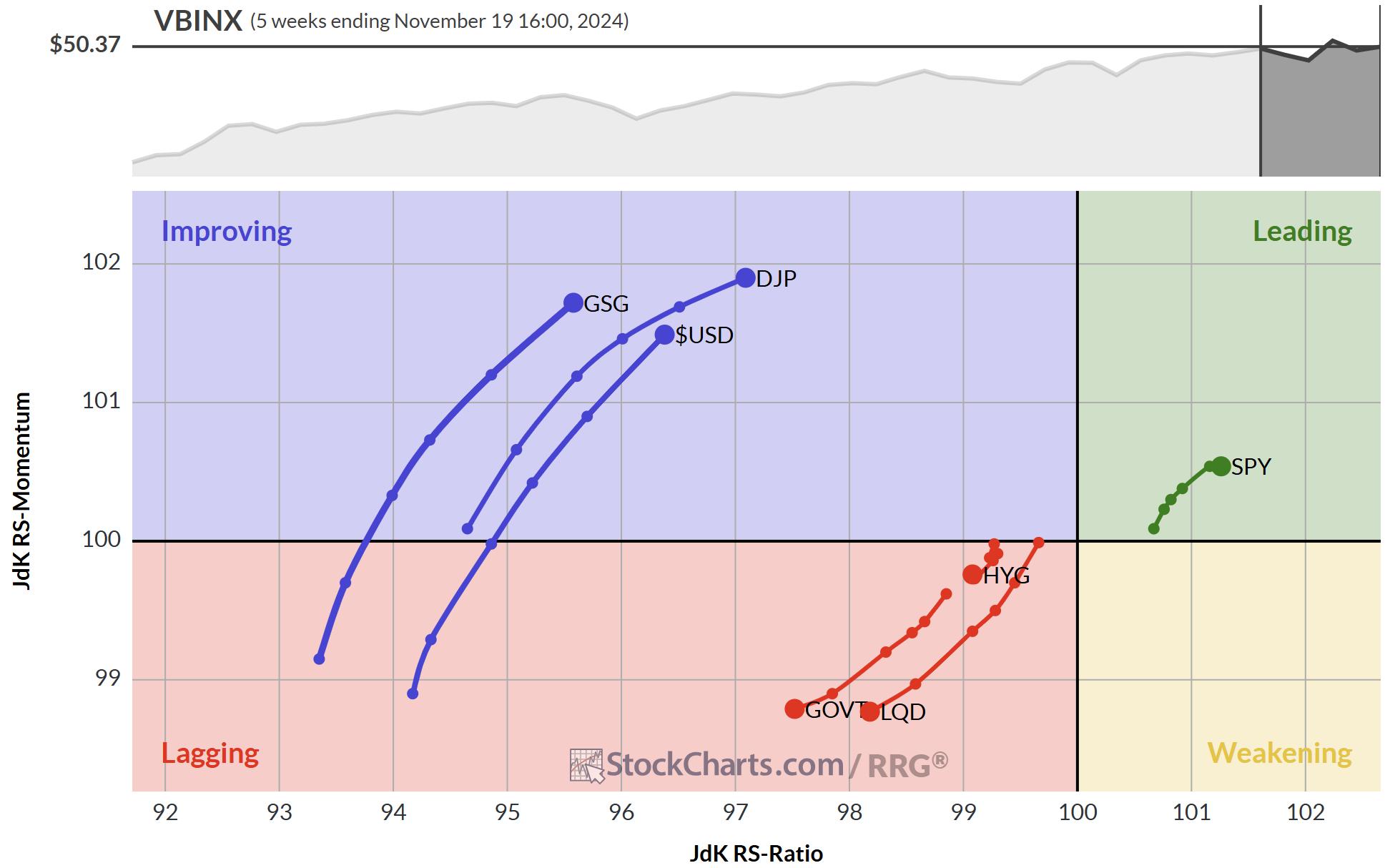

Watch Stocks Triumph in Latest Asset Allocation Battle

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Commodities and USD rotating deep inside the lagging quadrant, indicating weak relative strength

* Bitcoin is in a strong relative uptrend vs all other asset classes, but going through a corrective phase

* Stocks are the clear winner in this asset allocation battle

The RRG above shows the rotation of...

READ MORE

MEMBERS ONLY

USD Strength Accelerates After Completing Bearish Flag in EUR/USD

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* EUR/USD executes bearish flag formation

* Leaves rising trend channel by breaking rising support line as a result

After a rally from $1.045 to a high of $1.1140 from October to December 2023, the EUR/USD exchange rate has now executed a bearish flag formation, which...

READ MORE