MEMBERS ONLY

Top Ten Charts to Watch for February 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Grayson and Dave run through charts they feel present actionable opportunities based on their technical analysis setups. They'll cover breakout strategies, moving average techniques, relative strength, and much more. And you'll have ten new charts to...

READ MORE

MEMBERS ONLY

DR Horton Stock Plummets: Is Now the Time to Buy the Dip?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* DHI's stock plummeted after missing Wall Street's earnings expectations and soft guidance

* Technical indicators provide a clearer view for those looking to buy the dip

* You can use StockCharts seasonality charts to provide a big-picture context to your trading setup

The tight supply environment...

READ MORE

MEMBERS ONLY

Mastering MACD: The Fly-By Pattern

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe discusses key aspects to MACD when viewed as an oscillator rather than a momentum indicator. He also explains how to use MACD combination signals as well as combining with the ADX indicator. He then covers the symbol...

READ MORE

MEMBERS ONLY

Home Prices and Stocks | Focus on Stocks: February 2024

by Larry Williams,

Veteran Investor and Author

Let's begin this month with a look at ...

Home Prices and Stocks

Most people have the majority of their money in homes and/or stocks. Thus, I thought that this month, I would take a look at what should be happening in the real estate market.

Let'...

READ MORE

MEMBERS ONLY

S&P 500 Falls, Nears First Support Level -- How Much Lower Can It Go?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Fed leaves interest rates unchanged as expected, but investors weren't happy

* S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all close lower after Fed decision

* The 10-year Treasury yield falls to a three week low

Will the Fed cut interest rates at...

READ MORE

MEMBERS ONLY

Gold is Making Waves within a Long-Term Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Gold is not the most exciting asset at the moment, but it is in a long-term uptrend and perhaps the strongest commodity out there. There are also signs that the January decline is ending as RSI hits a momentum support zone and a bullish continuation pattern forms. Note that GLD...

READ MORE

MEMBERS ONLY

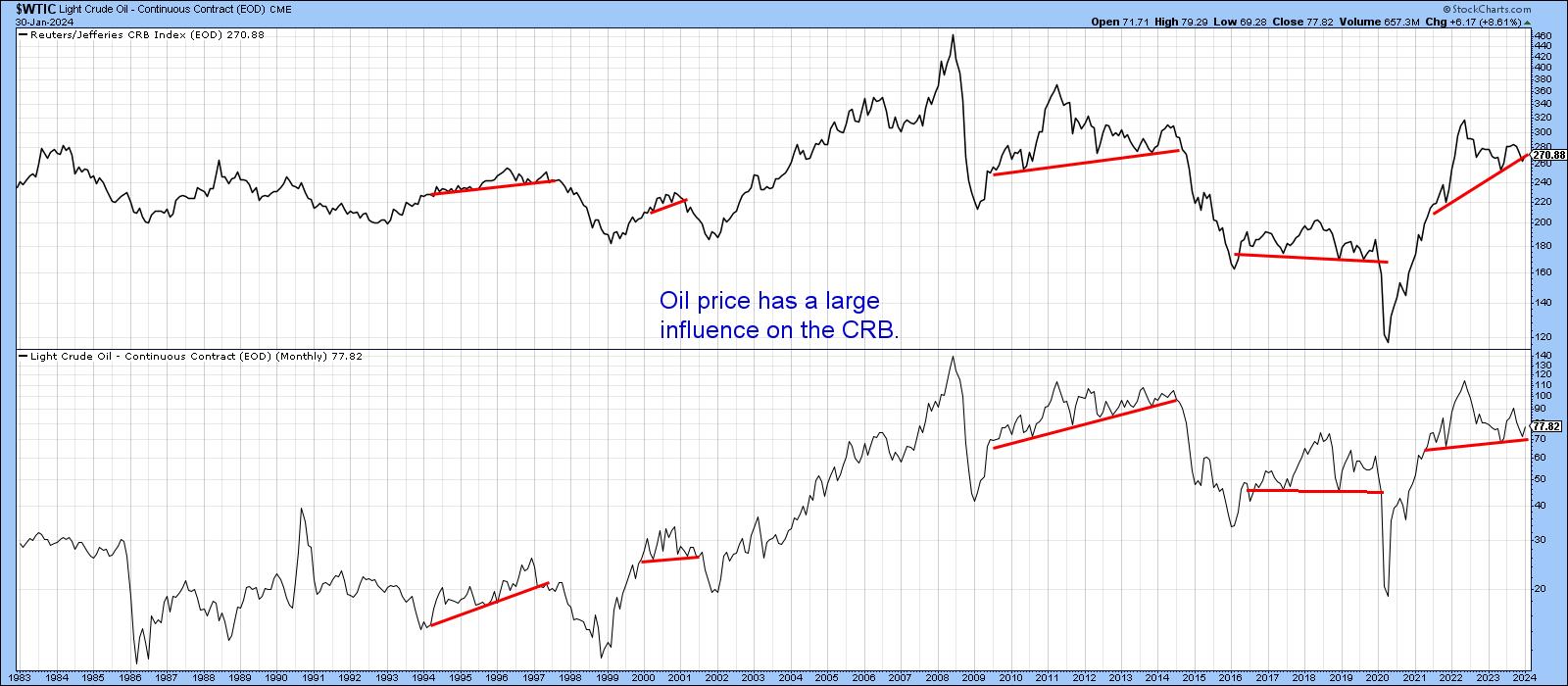

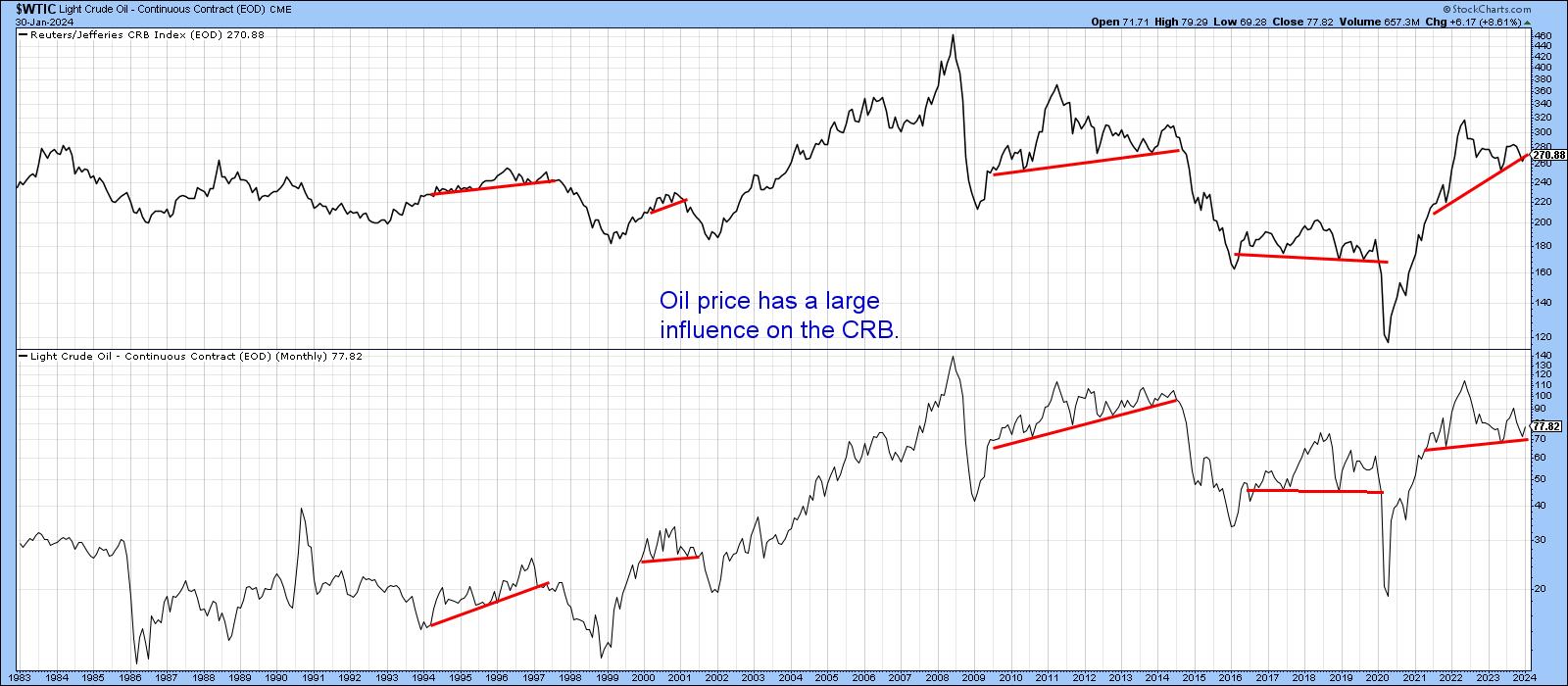

Is Oil Going Up or Down?

by Martin Pring,

President, Pring Research

Oil is not only an important commodity in and of itself, but is also one has a substantial influence on commodity indexes in general. Its weight in the CRB Composite is 23%; for energy in total, it is 39%. Chart 1 compares the oil price to the CRB Composite, where...

READ MORE

MEMBERS ONLY

Will Catalysts Push Markets HIGHER or Drag Them LOWER?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave tracks the S&P 500 as it pushes to a new high above 4900, while the McClellan Oscillator rotates to a bullish reading. He breaks down earnings plays this week, including XOM, MSFT, and more.

This video originally...

READ MORE

MEMBERS ONLY

A Word and A Chart About and On Alibaba

Alibaba.com is one of the world's largest wholesale marketplaces.

To be honest, I had never gone to their website until today, even though we bought shares in BABA 2 weeks ago. So, in case you are like me and have not checked them out, they sell a...

READ MORE

MEMBERS ONLY

Earnings Preview: The Technical Temperature

by Erin Swenlin,

Vice President, DecisionPoint.com

KEY TAKEAWAYS

* Big Week in Earnings

* Magnificent 7 - Five Reporting (MSFT, GOOGL, META, AAPL and AMZN

* Other stocks we look at: PFE, SBUX, AMD, MA, BA, MET, MRK, XOM and CVX

* Even more coverage with viewer symbol requests

This is a big week for earnings so Carl and Erin...

READ MORE

MEMBERS ONLY

Stock Market Indexes Keep Setting New Highs: How Much Higher?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P notched new record highs in five consecutive trading sessions but snapped the winning streak on Friday

* Investors still are complacent, as indicated by the CBOE Volatility index

* The benchmark 10-year Treasury yield remains within a 4% to 4.2% range

In the first week...

READ MORE

MEMBERS ONLY

How to Avoid Huge Drawdowns from High-Flying Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave hosts an all-mailbag episode, answering viewer questions on the Relative Strength Index (RSI), how ETFs like QTEC have outperformed benchmarks including the Nasdaq 100, and how to avoid painful losses in leading names like NVDA, PANW, and ADBE.

This...

READ MORE

MEMBERS ONLY

IBM Stock Shatters Expectations, Hitting a New All-Time High: A Buying Opportunity?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* IBM stock price hits a new 52-week high and moves above its upper Bollinger Band®

* IBM's share value could continue rising or pull back toward the middle Bollinger Band

* If IBM fills its post-earnings price gap it could present a more favorable entry point

As a...

READ MORE

MEMBERS ONLY

Unlocking the Power of Technical Indicators

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down the chart of Intel Corp (INTC) to demonstrate the benefits of three important technical indicators: Moving Averages, Relative Strength Index (RSI) and Relative Strength. He shares why a disciplined process of interpreting these indicators can help investors...

READ MORE

MEMBERS ONLY

SEC Greenlights Bitcoin ETFs: How This Major Move Could Skyrocket Coinbase Stock Price

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Coinbase stock price is correlated with Bitcoin's price

* COIN's price level is getting close to an entry point for bullish investors

* An ideal entry point for COIN would be after you see a strong reversal candle with increasing momentum

Are you feeling a bit...

READ MORE

MEMBERS ONLY

PRICE IS KING in Stock Trading!

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shares his five steps to becoming a better stock picker. He emphasizes the importance of starting with price and using technical analysis to identify potential outperforming stocks. From analyzing monthly and weekly charts to looking at momentum...

READ MORE

MEMBERS ONLY

Macro Model Gives Mixed Signals as NFLX LIGHTS UP!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest John Kosar, CMT of Asbury Research shares his proprietary Asbury Six macro model, which suggests caution based on weak fund flows and breadth conditions. Dave focuses in on crude oil and gold charts, and also reviews key earnings plays...

READ MORE

MEMBERS ONLY

What Does Dow Theory Say About This Market?

by Martin Pring,

President, Pring Research

Some tools in technical analysis are totally objective, such as a moving average crossover. It may be debatable whether it's a decisive signal or not, but a crossover is nevertheless a crossover. Dow Theory, on the other hand, is much more subjective and, therefore, open to interpretation. For...

READ MORE

MEMBERS ONLY

Remember Those 3 Signs of Inflation to Watch?

As a follow-up to a daily I wrote earlier in January called "Super Cycles Do Not Just Fade Away",yesterday'sJanuary 23rd dailywas all about one of the three indicators that can get us prepared for more inflation.

On January 5th, sugar was still trading under 22...

READ MORE

MEMBERS ONLY

AMD Stock Hits New 52-Week High: A Buying Opportunity?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* AMD stock price hits a new 52-week high and moves above its upper Bollinger Band®

* AMD's share value could continue rising or pull back and go below the middle Bollinger Band

* Watch volume, relative strength index, and money flow index to identify a slowing down in...

READ MORE

MEMBERS ONLY

Small Caps Surge Higher As S&P 500 Stalls

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave observes the S&P 500 index pressing higher after achieving new all-time highs on Friday. While large caps have dominated small caps so far in January, days like today suggest small-cap strength as a potential emerging trend. He...

READ MORE

MEMBERS ONLY

A Biotech Stock with a Breakout on the Weekly and a Classic Retracement on the Daily

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

This week's analysis will stick with the multiple timeframe approach. Today we are featuring a biotech stock with a channel breakout on the weekly chart and a classic retracement on the daily chart. Moreover, a larger bullish reversal pattern could be forming on the daily chart.

The weekly...

READ MORE

MEMBERS ONLY

Economic Modern Family's Engine Idles While Growth Goes Fast and Furious

Let's get right to it. The charts and our tools are telling.

To start, I always look at moving averages and phases. Then I look at Real Motion and momentum to see if there is a divergence to price. After that, I check out our Leadership indicator which...

READ MORE

MEMBERS ONLY

Viewer Questions: How Does the Fed Manipulate the Yield Curve?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave hosts a special all-mailbag edition, answering viewer questions on leading vs. lagging indicators, arithmetic vs. log scale charts, and how the Fed manipulates the yield curve. He digs into specific trading strategies using RSI, MACD, On Balance Volume, and...

READ MORE

MEMBERS ONLY

Technology Stocks Rise, but Market Internals Look Vulnerable

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Nasdaq Composite index rises 1.35% thanks to semiconductor stocks and an upgrade for Apple

* The Nasdaq Composite is trading close to its 52-week high, but market breadth isn't sharing the bullish sentiment

* Market breadth indicators, such as the advance-decline issues and percent above moving average,...

READ MORE

MEMBERS ONLY

Why SMALL CAPS MATTER in January 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest John Kolovos, CFA CMT of Macro Risk Advisors describes how the market is reacting to "good overbought" conditions in late 2023, and why the Russell 2000 small cap ETF may be the chart to watch in Q1...

READ MORE

MEMBERS ONLY

Utilities' Unique Seasonal Powers: The Best Months to Invest

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The Utilities sector has periods of cyclical outperformance

* Seasonality charts in StockCharts can identify which months Utilities are likely to outperform

* Analyzing a price chart of the XLU ETF can help time your entries so they coincide with seasonal patterns

The Utilities sector is known as a defensive...

READ MORE

MEMBERS ONLY

Has Rate Cut Anticipation Run Its Course?

by Carl Swenlin,

President and Founder, DecisionPoint.com

The Fed stopped raising rates in July, and, by mid-October, yields had peaked. Since then, yields have begun to decline in anticipation of the Fed beginning rate cuts this year. At this point, it appears that yields have found support and may possibly bounce, or begin moving sideways. This chart...

READ MORE

MEMBERS ONLY

The Case for a Tactical Stock Selloff

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Adam Turnquist of LPL Financial lays out the case for a tactical selloff for stocks, as well as why long-term indicators remain constructive in early 2024. Dave breaks down the bearish momentum divergence prevalent in the technology sector, and...

READ MORE

MEMBERS ONLY

Buying Bitcoin ETFs is the Easy Part, But What Comes Next?

by Martin Pring,

President, Pring Research

Last week, eight new Bitcoin-based ETFs began trading courtesy of recent SEC approval. This launch was well anticipated, as the price had already run up in the hope that these new buyers would push it to an even higher level. The thought occurred to me that the situation is not...

READ MORE

MEMBERS ONLY

View The Large Cap - Small Cap Debate in a Direct Comparison on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Using RRG to see Large-Cap vs Small-Cap sector rotation

* The current strength for Small-Cap stocks vs Large-Caps is evident

At the end of last year, I wrote a blog article about the relationship between Large-Cap and Equal-Weight sectors. It involved plotting the ratios of the large-cap sector ETFs...

READ MORE

MEMBERS ONLY

The Secret Sauce! Expert Investors Use This to Anticipate Market Moves

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shows you how to dig deeper into the markets like a true veteran chartist and put price history to work for you using Seasonality Charts. These simple, yet powerful historical charts let you see past price...

READ MORE

MEMBERS ONLY

S&P 4300 by End of February?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

We kicked off the new year of 2024 with an overheated stock market, excessively bullish breadth indicators, and euphoric sentiment levels. While the first week in January felt like a "wake-up call" pullback for awestruck bulls, this last week saw the S&P 500 push right back...

READ MORE

MEMBERS ONLY

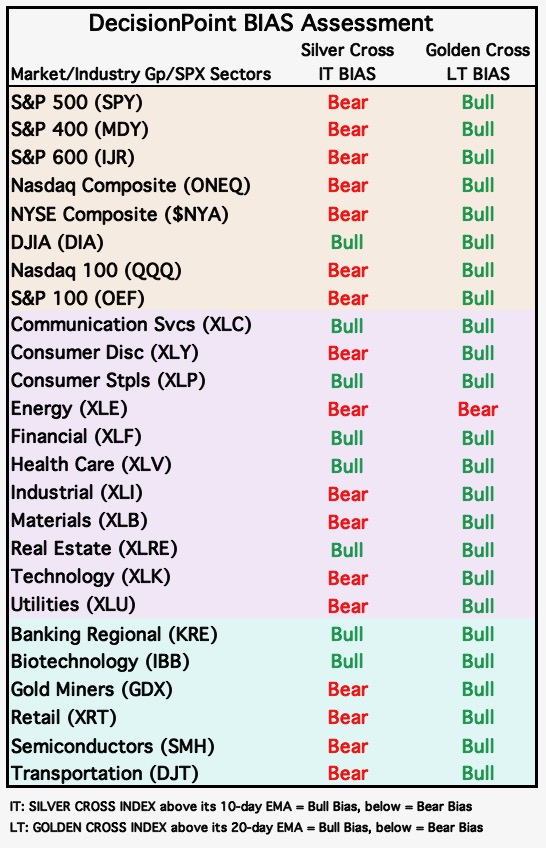

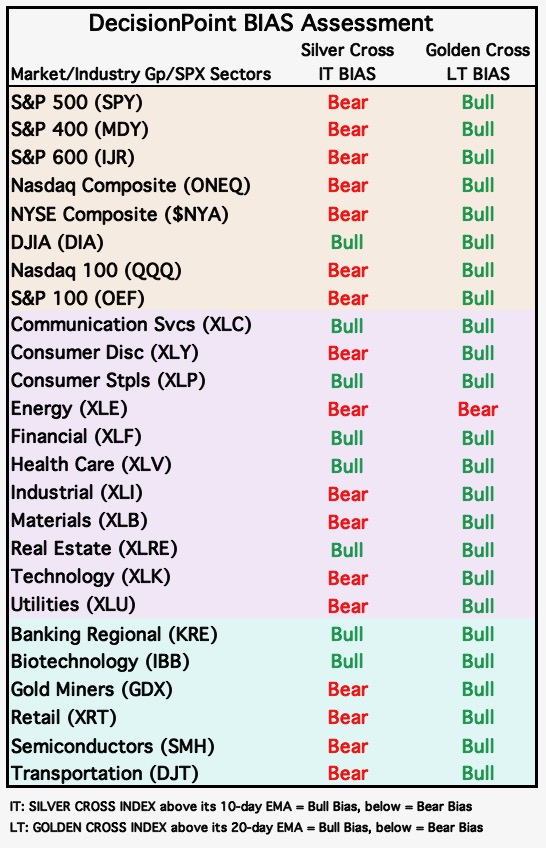

Dramatic Bearish Bias Shift on Major Market Indexes This Week

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

(This is an excerpt from the subscriber-only DecisionPoint Alert on DecisionPoint.com)

This week, the markets experienced a dramatic bias shift. We measure the Intermediate-Term Bias using our Silver Cross Index (SCI). The SCI measures how many stocks within an index, sector, or industry group hold "silver crosses"...

READ MORE

MEMBERS ONLY

Your Questions Answered! Moving Averages, Chart Patterns, Inflation & More

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave presents a special all-mailbag episode, answering viewer questions on simple vs. exponential moving averages, the benefits of analyzing sector rotation, and a good first chart for beginners learning technical analysis.

This video originally premiered on January 12, 2024. Watch...

READ MORE

MEMBERS ONLY

XLV's Record Rally: The Must-Know Investment Move of the Year

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The Healthcare Select SPDR ETF XLV has seen a 16% rise from its October low and is showing upside momentum

* Seasonal patterns in XLV show that July and November are the strongest months in terms of returns and higher close rates

* Combining seasonality patterns and technical indicators shows...

READ MORE

MEMBERS ONLY

From Selloff to Surge: Growth Stocks Rebound After CPI

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave highlights three leading growth stocks continuing to push to new swing highs. He also breaks down key market sentiment indicators, including the VIX, AAII survey, NAAIM Exposure Index, Rydex fund flows, and put/call ratios.

This video originally premiered...

READ MORE

MEMBERS ONLY

The Secret Behind My Moving Average "Buddy" System

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how the 18MA can be a powerful tool when used in conjunction with the 40MA line. First, Joe explains why he uses a 18MA instead of a 20MA, demonstrating how this MA line can act as...

READ MORE

MEMBERS ONLY

Commodities Trade Analysis: Aluminum

As a main aluminum producer, Alcoa (AA) announced cost-cutting measures, along with plans to curtail production at one Western Australian Refinery. But that is just one facility, and the company plans to continue to operate its port facilities located alongside the refinery. Plus, it will continue to import raw materials...

READ MORE

MEMBERS ONLY

January 2024: The Final Bar's Top 10 Must See Charts

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, Grayson Roze and Dave break down the trends for the top ten stocks and ETF charts for December 2023. They'll identify key levels and signals to watch for using technical analysis tools including moving averages, relative strength, RSI,...

READ MORE