MEMBERS ONLY

Finding Setups as Markets Wait for October CPI

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave identifies bullish and bearish momentum divergences as the equity and bond markets await the October CPI reading on Tuesday morning. He answers questions covering Brent crude oil prices, uranium stocks, inverse head and shoulders patterns, and upside potential for...

READ MORE

MEMBERS ONLY

Boeing Stock Takes Off: How to Profit From the Price Surge

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Boeing stock gapped on increased orders for its aircraft

* After a double bottom pattern on the weekly chart, Boeing's stock price looks to be recovering

* The stock could pull back or push through resistance and keep flying higher

After falling from August to October, Boeing stock...

READ MORE

MEMBERS ONLY

The Zweig Breadth Thrust Triggers, but the Indicator is Missing Something

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today's report features the Zweig Breadth Thrust, which was developed by the late, and great, Marty Zweig. Zweig appeared regularly on Wall Street Week, contributed to Barrons, published The Zweig Forecast and wrote Winning on Wall Street in 1986. Among other things, his timeless book shows us how...

READ MORE

MEMBERS ONLY

MEM TV: Will The Markets to Continue Trading Higher? This Needs to Happen First

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what drove the markets higher last week. She also shares what needs to take place in order for a sustained uptrend to materialize. Last up, she presents a review of the weaker areas as defensive stocks pull...

READ MORE

MEMBERS ONLY

Decoding Bear Markets, Divergences, & More! A Q&A with David Keller, CMT

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave dives deep into the world of market dynamics and technical analysis to answer YOUR burning questions! He talks topics like point and figure charts, moving averages, Nomura Holdings (NMR), Arthur J. Gallagher & Co. (AJG), and more!

This video...

READ MORE

MEMBERS ONLY

Moxie Indicator Alerts: Predicting Yesterday's Market Pullback!

by TG Watkins,

Director of Stocks, Simpler Trading

We had been patiently waiting for the action that happened yesterday, even though it was down. In this week's edition of Moxie Indicator Minutes, TG shows you real alerts from the Moxie Indicator Trading room that called the pullback before it happened, and presents how you too can...

READ MORE

MEMBERS ONLY

Stock Market Still Has Legs, Bitcoin Sees a Breakthrough Rally: Is the Market On the Mend?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market makes major gains with the S&P 500 and Nasdaq Composite closing above previous highs

* The 10-Year Treasury yield retested its 4.5% level and reversed to the upside

* Bitcoin rallied to close the week above 37,000

It was quite the week in...

READ MORE

MEMBERS ONLY

Top Ten Hidden Features of StockCharts, Features 6-10

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave takes a closer look at some key features on StockCharts and how to use them in new and improved ways, in order to gain a deeper understanding of market dynamics and price behavior. You might even stumble upon some...

READ MORE

MEMBERS ONLY

The Halftime Show: Don't Believe Everything the Analysts Say, It's Dangerous!

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

After TLT hit Pete's downside target, it had a violent move higher. On this week's edition ofStockCharts TV'sHalftime, Pete illustrates that the recent rally might be weakening.

A look at WTIC crude shows a pullback right on the level Pete uses as a pivot...

READ MORE

MEMBERS ONLY

This Relative Strength Signal Can Provide Early Warning Signs

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how to use comparative relative strength to identify important shifts in trend, sometimes well in advance of price. He explains what the line means, plus how to use it to provide early warning signals and for...

READ MORE

MEMBERS ONLY

Long-Term Bond Rally On the Way

by Carl Swenlin,

President and Founder, DecisionPoint.com

After making a major low in 1981, bonds entered a rising trend that lasted nearly 40 years. During that period, new rules and expectations were constructed and acquired that still influence decision making today -- which is unfortunate, because the game has changed.

In 2022, the long-term rising trend line...

READ MORE

MEMBERS ONLY

Stock Indexes Continue Winning Streak: Growth Stocks Still In the Lead

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500 and Nasdaq Composite continue their winning streak

* Crude oil continues to slide as it trades below its 200-day moving average

If there were one thing that was surprising about the stock market, it would be how quickly the charts changed in November. Equities...

READ MORE

MEMBERS ONLY

Top Ten Hidden Features of StockCharts, Features 1-5

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave takes a closer look at some key features on StockCharts and how to use them in new and improved ways, in order to gain a deeper understanding of market dynamics and price behavior. You might even stumble upon some...

READ MORE

MEMBERS ONLY

The Best Traders ALWAYS Cherry-Pick Their Setups

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave shows his methodology in action with two open trades, explaining why you must "cherry-pick" all setups and see subsequent positions through their fruition, even during less-than-ideal conditions. He also shows the recent TFM 10% sell signal and discusses...

READ MORE

MEMBERS ONLY

Sector Spotlight: Unleash The Power of Sector Analysis by Plotting Ratio Symbols on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I take a look at current sector rotation while comparing cap-weighted sectors with equal weight sectors, trying to find areas of the market where either one of these is dominating. I then demonstrate how to use ratio symbols on Relative...

READ MORE

MEMBERS ONLY

Why are Higher Interest Rates a Big Deal?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Mike Singleton of Invictus Research describes the impact of higher interest rates on consumer spending and growth stock valuations. Host David Keller, CMT charts the breakout for the QQQ and reviews stocks reporting earnings, including DKNG, UBER, and more....

READ MORE

MEMBERS ONLY

Market is UP After 10% Correction; Is a V Bottom in Place?

by TG Watkins,

Director of Stocks, Simpler Trading

The market has been signalling over-sold in multiple ways over the last 3 months, but we finally got a trigger, right around the 10% correction market plus FOMC. Powell was pretty neutral, but whatever it was, the market decided it liked it. So a V bottom appears to be in...

READ MORE

MEMBERS ONLY

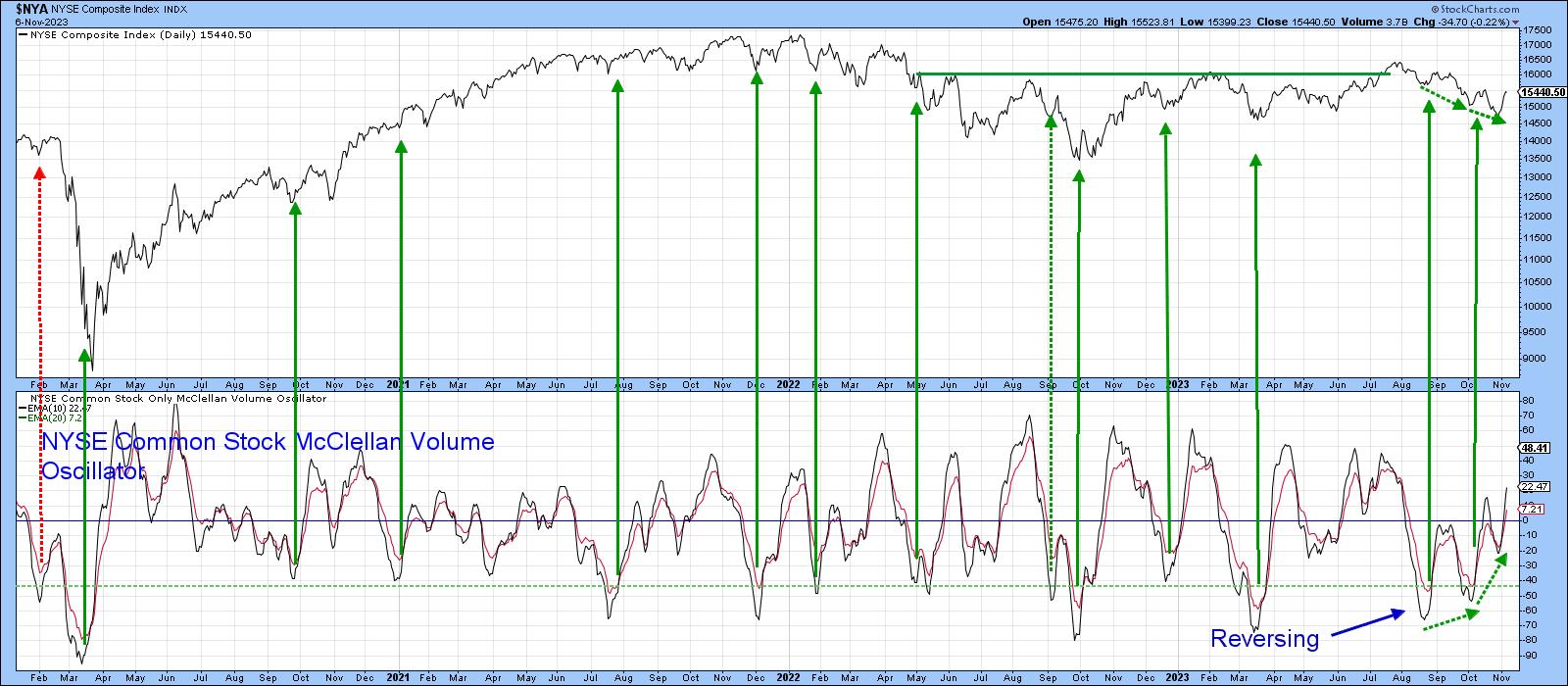

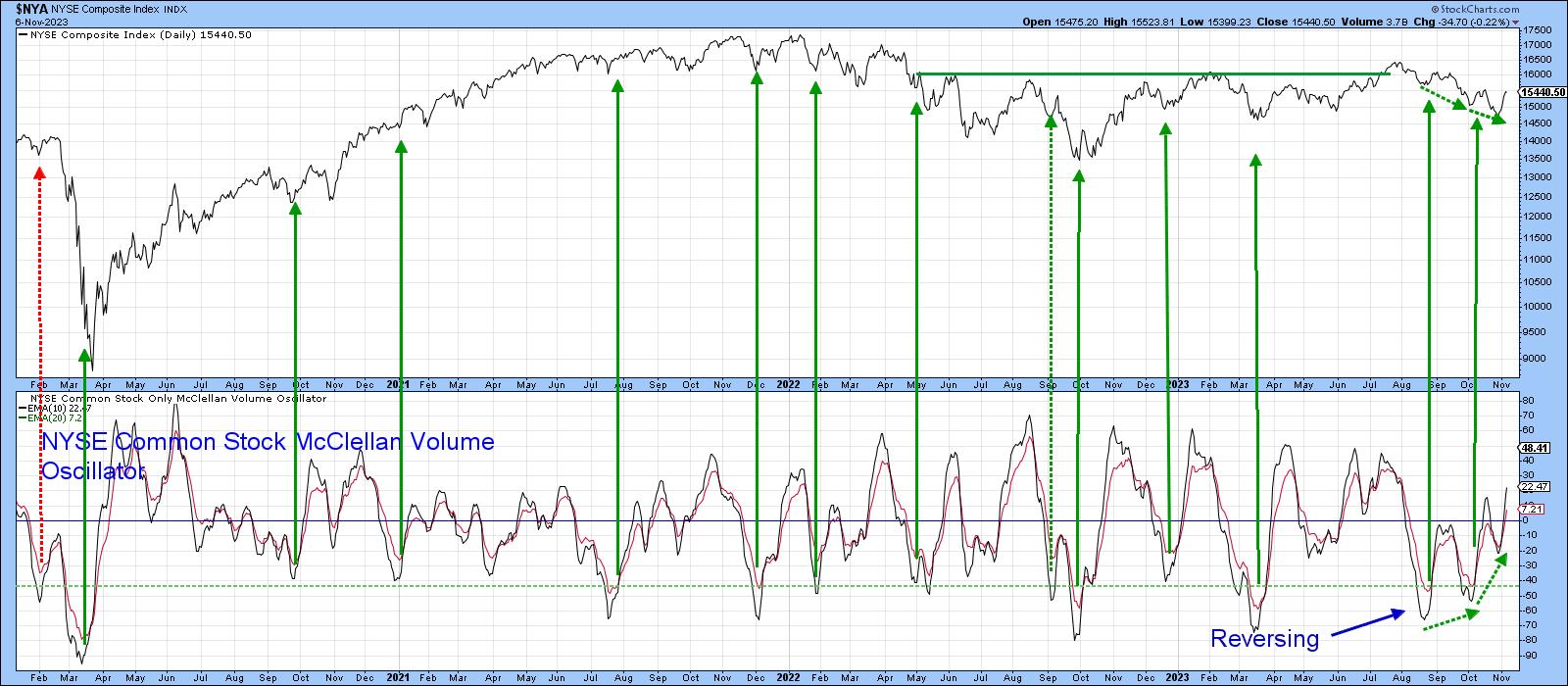

Benchmarks that Will Tell Us this Market Has Legs

by Martin Pring,

President, Pring Research

A couple of weeks ago, I wrote an upbeat article on the market, pointing out the fact that many short- and intermediate-term indicators were in a potentially bullish position at a time when stocks seemed impervious to bad news. I concluded "That does not mean the market will go...

READ MORE

MEMBERS ONLY

This Key Resistance Level is Crucial for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down the charts of the S&P 500 and Nasdaq 100 with a focus on the downtrend channel for the QQQ and key resistance at 4400 for the S&P 500. He answers viewer questions on...

READ MORE

MEMBERS ONLY

Skip the Noise and Focus on the Signal by Effectively Using the 200-day SMA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 is battling the 200-day SMA with four crosses over the last eleven days. We are also seeing a rise in volatility as this market benchmark plunged 5.86% in nine days (18-27 October) and then surged 5.85% the last five days. With such conditions,...

READ MORE

MEMBERS ONLY

Week Ahead: Broader Markets Set to Relatively Underperform; Watch These Nifty Levels Closely

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, during our analysis of the patterns of the NIFTY's weekly chart, it was mentioned that the Index has achieved a full throwback. This occurs when the instrument gives up the breakout gains entirely and retests the original breakout point which acts as a...

READ MORE

MEMBERS ONLY

New PMO Crossover BUY Signals Across All Major Indexes

by Erin Swenlin,

Vice President, DecisionPoint.com

Yesterday, the SPX (SPY), OEX (OEF) and Dow Industrials (DIA) all saw new PMO Crossover BUY Signals. Today, they were joined by the remainder of the major indexes. The market is clicking; now we need to determine how long this rally will stick around.

Seeing so many oversold PMO BUY...

READ MORE

MEMBERS ONLY

An Incredible Stock Market Rally Closes the Week on a Strong Note: The Best Week This Year, So Far

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite rally into the close

* Fed Chairman Jerome Powell's comments eased investor fears of further interest rate hikes

* Lower Treasury yields helped the banks, including regional banks

Five up days in a row for the...

READ MORE

MEMBERS ONLY

What Can the VIX Reveal To Us In November 2023?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Tim Hayes of Ned Davis Research shares an outlook for interest rates in 2024, and explains why a VIX over 28.5 could mean disaster for risk assets. Host David Keller, CMT updates charts of stocks reporting earnings including SBUX,...

READ MORE

MEMBERS ONLY

Start Trading Like a Pro with These RSI Divergence Signals!

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe presents a few examples in different timeframes of how to use the RSI indicator for divergences. He explains what to look for when finding counter trend plays, as well as divergence with the trend. Joe then analyses...

READ MORE

MEMBERS ONLY

Holiday Shopping Bonanza: Retail Stocks You Need to Watch

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Since holiday shopping season is here it could be a good time to add some retail stocks to your portfolio

* AMZN, WMT, COST, and TGT could be potential stocks to add to your portfolio as holiday shopping begins

* Set alerts for these stocks so you can enter at...

READ MORE

MEMBERS ONLY

Signs of Top in Rates As Fed Says NO CHANGE

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Katie Stockton, CMT of Fairlead Strategies shares her weekly charts of the S&P 500, VIX, and XLK and identifies three areas of opportunity through year-end 2023. Dave breaks down this week's Fed meeting from a technical...

READ MORE

MEMBERS ONLY

Focus on Stocks: November 2023

by Larry Williams,

Veteran Investor and Author

The Million Dollar Stock Market Bet

Warren Buffett proved his point in 2016 when he bet $1,000,000 that the S&P 500 Stock Index would outperform hedge funds. His bet was that active investment management by professionals would under-perform the returns of people who were passively investing....

READ MORE

MEMBERS ONLY

Arista Networks: A Profitable Tech Stock That Has Room to Surge

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* AI will need networks to support its development and growth and one stock that can benefit in this space is Arista Networks

* The stock is trading above its 50-day moving average and hit a new 52-week high

* The stock is outperforming the S&P 500 index and...

READ MORE

MEMBERS ONLY

Stock Market Hinges on the Ten Year Interest Rate

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Tony Dwyer of Canaccord Genuity breaks down four charts that speak to a potential tactical rally for the S&P 500, and explains why this market is still all about interest rates. Meanwhile, Dave charts the downtrend channel for...

READ MORE

MEMBERS ONLY

The Halftime Show: Harness The Strength of Power Gauge on ACP Platform

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

On this week's edition of StockCharts TV'sHalftime, Pete starts the show with a review of the Chaikin Power Gauge and demonstrates how to access to the tool on the ACP platform. Pete then reviews a few names that are moving big today, like Amgen (AMGN) and...

READ MORE

MEMBERS ONLY

Sector Spotlight: Seasonality is Dropping Big Bomb on Real Estate Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I address the seasonality patterns that are likely to affect stock market and sector performance in the coming month. November is one of the strongest months in the year based on seasonality, but the Real Estate Sector looks to be...

READ MORE

MEMBERS ONLY

Countertrend Rally in the Works for SPX? What the Charts Reveal

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave discusses implications for this week's earnings releases, the November Fed meeting, and geopolitical events. He answers live viewer questions on volume-based indicators, downside targets for the S&P 500 chart, possibilities for a countertrend rally for...

READ MORE

MEMBERS ONLY

MEM TV: Are the Magnificent Seven Ready to Rally?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews last week's negative price action in the markets while sharing key areas of possible support for the Nasdaq and S&P 500. She also highlights the relative strength in defensive areas of the market...

READ MORE

MEMBERS ONLY

My Downside Targets for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The S&P 500 has almost reached the minimum downside objective based on the head and shoulders topping pattern.

* SPX 3800 would mean represent a 38.2% retracement level of the March 2020 to January 2022 bull market phase.

If you've been fighting the mounting...

READ MORE

MEMBERS ONLY

Where to Find Stock Opportunities in Bear Territory

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, host Dave wraps a bearish week with a discussion on downtrend conditions, trendline resistance, deteriorating breadth, and finding opportunities in a bearish landscape. He answers viewer questions on inverted yield curves, recessionary periods, and leading vs. lagging technical indicators.

This...

READ MORE

MEMBERS ONLY

GNG TV: Charts Flash Warning Signs of Further Risk to the Downside

by Alex Cole,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, with US Equities delivering a streak of daily gains this week, Alex takes a top down approach to see what the GoNoGo Charts are saying about markets. With U.S. domestic equities in a "NoGo" trend, the charts warn that...

READ MORE

MEMBERS ONLY

The Halftime Show: Watch the Unemployment Rate - It Could Change Everything!

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

On this week's edition of StockCharts TV'sHalftime, Pete explains how his TLT call from 10/10 was spot-on! But that could all change based on the unemployment rate. Pete believes that rates will fallifthe unemployment rate spikes higher, likely to the 4.25-4.5% level. Until...

READ MORE

MEMBERS ONLY

Is the Bear Back?

by Carl Swenlin,

President and Founder, DecisionPoint.com

The S&P 500 (SPY) has fallen about 10 percent from the July top, and the last two weeks has been pretty rough, so should we be looking for the Bear to take charge again?

First, looking at a weekly chart, it is not clear that the Bear actually...

READ MORE

MEMBERS ONLY

Late-Hour Selloff Confirms Downtrend Phase!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Tom Bowley of EarningsBeats shares his chart of key ratios illustrating how growth still has held its ground relative to value stocks. Host David Keller, CMT focuses in on distribution in the last hour of trading and highlights one...

READ MORE